|

시장보고서

상품코드

1840079

수소 충전소 시장 : 공급 유형별, 스테이션 유형별, 스테이션 사이즈별, 압력별, 솔루션별, 지역별 예측 및 동향(-2035년)Hydrogen Fueling Station Market by Supply Type (On-site, Off-site (Gas, Liquid)), Station Type (Fixed, Mobile), Station Size (Small, Mid-sized, Large), Pressure (High, Low), Solution (EPC, Components), Region - Global Forecast & Trends to 2035 |

||||||

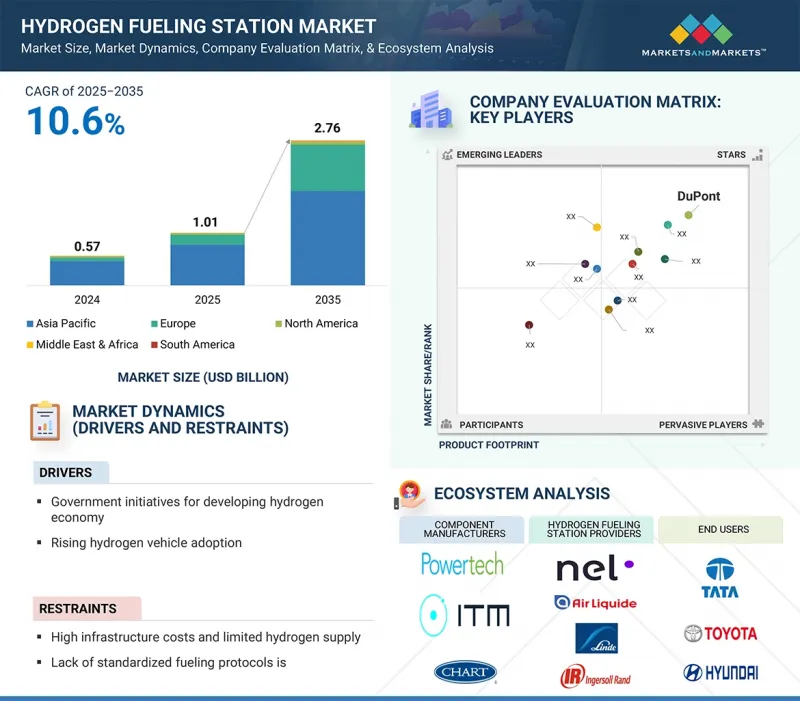

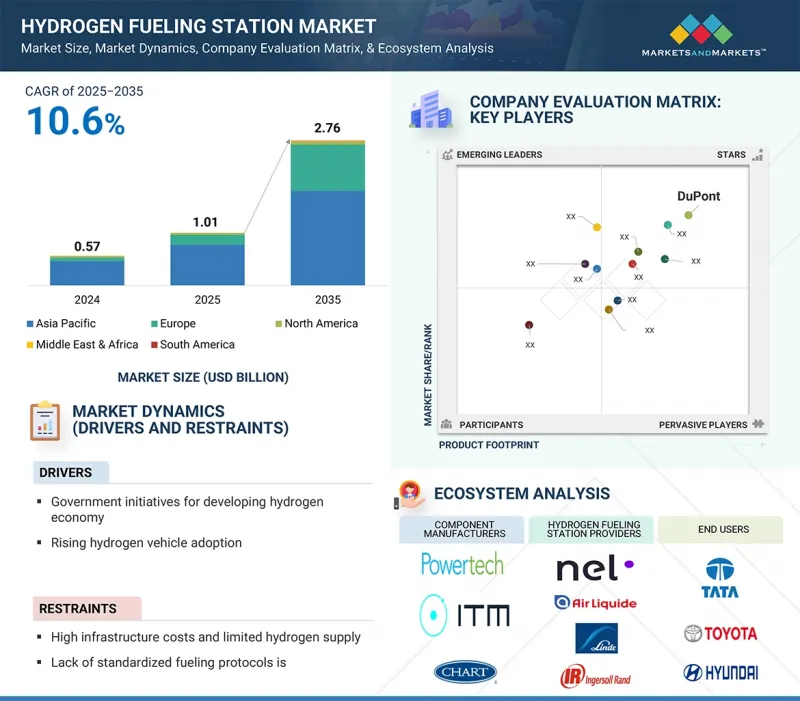

수소 충전소 시장 규모는 2025년 10억 1,000만 달러에서 2035년에는 27억 6,000만 달러로 성장하며, 예측 기간 중 CAGR은 10.6%를 나타낼 것으로 전망되고 있습니다.

이 시장을 견인하고 있는 것은 환경 문제에 대한 관심과 배출 가스에 관한 엄격한 규제에 의해 제로 방출 차량의 채용이 증가하고 있다는 것입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2035년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2035년 |

| 대상 대수 | 금액(100만 달러) 및 테이블 |

| 부문별 | 공급 유형별, 스테이션 유형별, 스테이션 사이즈별, 압력별, 솔루션별, 지역별 |

| 대상 지역 | 유럽, 아시아태평양, 북미, 남미, 중동 및 아프리카 |

수소 연료전지 차량을 포함한 제로 방출 차량은 꼬리 파이프에서 오염 물질을 배출하지 않으므로 도시의 대기 오염을 줄이고 기후 목표를 달성하기 위한 노력에서 실현 가능한 옵션이 되었습니다. 제로 배출 차량 시장의 확대는 수소 보급 스테이션과 같은 지원 인프라 수요를 직접 증가시킵니다. 시장 확대의 원동력은 청정 에너지원으로서 수소를 지지하는 규제 정책입니다.

중형 스테이션에서는 최적의 리소스 사용과 다운타임 감소로 운영 효율성을 높일 수 있습니다. 중형 스테이션은 소형 스테이션의 사용 부족과 대형 스테이션의 과부하의 균형을 맞추어 보다 안정적인 성능을 보장합니다. 중간 규모 스테이션에 필요한 기술은 대규모 스테이션보다 성숙하고 널리 사용할 수 있습니다. 이 기술적 성숙은 개발 위험을 줄이고 중형 인프라에 대한 투자를 촉진합니다. 게다가, 중형 스테이션은 중간 정도 수요가 높은 지역을 타겟팅함으로써 시장에 침투하기 쉽습니다. 그 크기는 많은 장소에 배포하는 데 필요한 다양성을 제공하고 고객에 대한 접근성을 높입니다. 게다가 수소연료전지차산업의 확대가 예측되는 가운데 중형 스테이션의 건설, 유지보수, 운영은 전반적인 경제성이 우수합니다.

EPC 기업은 설계부터 완성까지 프로젝트 관리를 위한 엔드 투 엔드 턴키 솔루션을 제공합니다. 기본적으로 이것은 엔드 투 엔드 솔루션이며 프로젝트의 복잡성에서 벗어나기 때문에 투자자와 개발자의 대부분이 매우 매력적이라고 느낍니다. 또한 EPC 기업은 대규모 인프라 프로젝트에서 확실한 전문 지식과 풍부한 경험을 가지고 있으며 업계 표준을 준수하는 고품질의 건설을 보장합니다. 또한 EPC 기업은 프로젝트 단계를 중복하고 리소스를 관리함으로써 프로젝트 기간을 단축할 수 있습니다. 프로젝트 완료까지의 기간이 단축되면 경쟁적으로 유리하게 됩니다. 또한 EPC 기업이 업계 규정 및 규정 준수 요구 사항을 충분히 이해하면 복잡한 규제 환경을 성공적으로 처리할 수 있습니다.

유럽은 강력한 정책 지원, 대규모 투자, 야심찬 제로 방출 이동성 목표에 힘입어 수소 연료 스테이션(HRS) 시장이 급성장하는 태세를 갖추고 있습니다. 이 지역은 확립된 수소 전략의 혜택을 받고 있으며, 유럽 연합(EU)과 일부 회원국들은 연료전지 차량의 도입을 가능하게 하기 위해 대규모 HRS 네트워크의 확장을 약속합니다. 독일, 프랑스, 네덜란드, 영국 등의 비공개 회사는 관민 일체가 된 대규모 이니셔티브로 주도하고 있으며, 자동차 제조업체와 에너지 기업은 주요 운송 경로를 따라 대용량 스테이션을 배치하기 위해 협력하고 있습니다. 대형 운송의 탈탄소화와 재생가능한 수소 제조의 통합을 위한 개발 증가가 이 지역의 HRS 개발을 더욱 가속화하고 있습니다. 또한 유럽에서는 대형 용도에 대응하기 위한 인프라 정비가 진행되고 있습니다. 2023년에는 신설 스테이션의 92%가 승용차와 버스나 트럭과 같은 대형차 모두에 급유할 수 있게 되어, 모든 스테이션의 40% 근처가 이러한 용도를 서포트했습니다.

Air Liquide(프랑스), Linde PLC(아일랜드), Air Products and Chemicals, Inc.(미국), Nel(노르웨이), MAXIMATOR Hydrogen GmbH(독일), HYDROGEN REFUELING SOLUTIONS SA(프랑스), Iwatani Corporation(일본), Ingersoll Rand(미국), Chart Industries 중국 MOBILITY(독일), PDC Machines(미국), sera GmbH(독일), Hydrogenious LOHC technology(독일), Powertech Labs Inc.(캐나다), Resato Hydrogen Technology(네덜란드), Galileo Technologies SA(아르헨티나), Nikola Corporation(미국), Humble Hydrogen(영국), atawey(프랑스), OneH2(미국), China Petrochemical Corporation(중국), VIRYA ENERGY(벨기에), NUVERA FUEL CELLS, LLC(미국), ANGI Energy Systems, Inc. 등이 이 시장에서 주요 진출기업이 되고 있습니다. 이 연구는 수소 충전소 시장에서 이러한 주요 기업 프로파일, 최근 동향, 주요 시장 전략 등 상세한 경쟁 분석을 제공합니다.

본 보고서에서는 수소 시장을 공급 유형별(온사이트, 오프사이트(가스, 액체)), 스테이션 유형별(고정식, 이동식), 스테이션 사이즈별(소형, 중형, 대형), 압력별(고압, 저압), 솔루션별(EPC, 구성 요소), 지역별(북미, 유럽, 아시아태평양, 중동 및 아프리카, 남미)에 정의, 기술, 예측했습니다. 이 보고서의 조사 범위는 수소 연료 스테이션 시장 성장에 영향을 미치는 촉진요인, 시장 성장 억제요인, 과제, 기회 등 주요 요인에 대한 자세한 정보를 다룹니다. 주요 업계 진출 기업의 철저한 분석을 통해 사업 개요, 솔루션, 서비스, 계약, 파트너십, 협정, 확대, 합작 투자, 제휴, 인수 등 주요 전략, 수소 연료 스테이션 시장과 관련된 최근 동향에 대한 인사이트력을 제공합니다. 이 보고서는 수소 충전소 시장 생태계에서 향후 신흥 기업의 경쟁 분석을 다룹니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 고객사업에 영향을 주는 동향/파괴적 변화

- 공급망 분석

- 생태계 분석

- 시장 매핑

- 기술 분석

- 특허 분석

- 규제 상황

- 주요 컨퍼런스 및 행사(2025-2026년)

- 무역 분석

- 가격 분석

- 사례 연구 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 투자 및 자금조달 시나리오

- 충전 프로토콜

- AI/생성형 AI가 수소 충전소 시장에 미치는 영향

- 미국 관세가 수소 충전소 시장에 미치는 영향(2025년)

제6장 수소 충전소 시장(솔루션별)

- 서론

- EPC

- 구성 요소

제7장 수소 충전소 시장(압력별)

- 서론

- 높음

- 낮음

제8장 수소 충전소 시장(스테이션 사이즈별)

- 서론

- 소형

- 중형

- 대형

제9장 수소 충전소 시장(스테이션 유형별)

- 서론

- 고정식

- 이동식

제10장 수소 충전소 시장(공급 유형별)

- 서론

- 현장

- 오프사이트

제11장 수소 충전소 시장(지역별)

- 서론

- 아시아태평양

- 중국

- 일본

- 한국

- 뉴질랜드

- 호주

- 기타

- 유럽

- 독일

- 프랑스

- 네덜란드

- 스위스

- 영국

- 기타

- 북미

- 미국

- 캐나다

- 중동 및 아프리카

- GCC

- 기타

- 남미

- 브라질

- 기타

제12장 경쟁 구도

- 개요

- 주요 참가 기업의 전략/강점(2020-2025년)

- 시장 점유율 분석(2024년)

- 수익 분석(2020-2024년)

- 기업 평가 및 재무 매트릭스

- 브랜드 비교

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제13장 기업 프로파일

- 주요 진출기업

- LINDE PLC

- AIR LIQUIDE

- AIR PRODUCTS AND CHEMICALS, INC.

- NEL

- MAXIMATOR HYDROGEN GMBH

- CHART INDUSTRIES

- HYDROGEN REFUELING SOLUTIONS SA

- IWATANI CORPORATION

- INGERSOLL RAND

- PERIC HYDROGEN TECHNOLOGIES CO., LTD

- H2 MOBILITY

- PDC MACHINES

- SERA GMBH

- HYDROGENIOUS LOHC TECHNOLOGIES

- POWERTECH LABS

- RESATO HYDROGEN TECHNOLOGY

- 기타 기업

- GALILEO TECHNOLOGIES

- NIKOLA CORPORATION

- HUMBLE HYDROGEN

- ATAWEY

- ONEH2

- CHINA PETROCHEMICAL CORPORATION

- VIRYA ENERGY

- NUVERA FUEL CELLS, LLC

- ANGI ENERGY SYSTEMS, INC.

제14장 부록

KTH 25.10.22The hydrogen fueling stations market is expected to grow from USD 1.01 billion in 2025 to USD 2.76 billion by 2035, at a CAGR of 10.6% during the forecast period. The market is driven by the increasing adoption of zero-emission vehicles due to environmental concerns and stringent regulations on emissions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2035 |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Units Considered | Value (USD Million) and Volume (Units) |

| Segments | By Station Size, Pressure, Station Type, Solution, Supply Type, and Region |

| Regions covered | Europe, Asia Pacific, North America, South America, and Middle East & Africa |

Zero-emission vehicles, including hydrogen fuel cell vehicles, do not emit any pollutants from their tailpipes, thereby making them a feasible option in the effort to decrease urban air pollution and meet climate goals. A growing zero-emission vehicles market directly increases the demand for supporting infrastructures like hydrogen refueling stations. Market expansion is driven by regulatory policies that favor hydrogen as a clean energy source.

"Mid-sized station segment to register highest growth from 2025 to 2030"

In medium-sized stations, operational efficiency can be higher due to optimized usage of resources and reduced downtime. They somehow balance the underutilization of small stations and the possible overburdening of large ones, thus assuring more stable performance. The technology required for medium-sized stations is more mature and widely available than that for large stations. This technological maturity reduces the development risks and encourages investment in mid-sized infrastructure. Further, mid-sized stations have a better way of infiltrating markets by targeting areas of moderate to high demand. Their size offers the versatility needed for deployment in many locations, increasing accessibility to customers. Additionally, the projected expansion of the hydrogen fuel cell vehicle industry is well served by the overall economic feasibility of mid-sized stations in terms of building, maintenance, and operation.

"EPC, by solution, to be the fastest-growing segment during forecast period"

EPC companies provide end-to-end turnkey solutions for the management of projects right from design to completion. Basically, this is an end-to-end solution that most of the investors and developers find very attractive as it relieves them of the complexity of the project. In addition, EPC companies come with sound expertise and vast experience in large-scale infrastructure projects, assuring high-quality execution of works with conformity to industry standards. Besides, the duration of a project can be reduced by EPC companies through overlapping project phases and by the management of resources. The faster project completion times offer competitive advantages. Moreover, the complex regulatory environment is better negotiated when EPC firms are fully aware of the industry's regulations and compliance requirements.

"Europe to be fastest-growing hydrogen fueling stations market"

Europe is poised to be the fastest-growing hydrogen fueling station (HRS) market, driven by strong policy support, large-scale investments, and ambitious zero-emission mobility targets. The region benefits from a well-established hydrogen strategy, with the European Union and several member states committing to extensive HRS network expansion to enable fuel cell vehicle adoption. Countries such as Germany, France, the Netherlands, and the UK are leading with significant public-private initiatives, while automotive manufacturers and energy companies collaborate to deploy high-capacity stations along major transport corridors. Growing focus on decarbonizing heavy-duty transport and integrating renewable hydrogen production further accelerates HRS development across the region. Additionally, Europe is increasingly adapting its infrastructure to serve heavy-duty applications. In 2023, 92% of newly built stations were capable of refueling both passenger cars and heavy vehicles like buses and trucks, and nearly 40% of all stations now support such use, up from just 27% in 2019.

In-depth interviews were conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 57%, Tier 2 - 29%, and Tier 3 - 14%

By Designation: C-Level Executives - 35%, Directors - 20%, and Others - 45%

By Region: North America - 20%, Europe - 15%, Asia Pacific - 30%, Middle East & Africa - 25%, and South America - 10%

Note: The tiers of the companies are defined based on their total revenues as of 2024. Tier 1: > USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: < USD 500 million. Others include sales managers, engineers, and regional managers.

Air Liquide (France), Linde PLC (Ireland), Air Products and Chemicals, Inc. (US), Nel (Norway), MAXIMATOR Hydrogen GmbH (Germany), HYDROGEN REFUELING SOLUTIONS SA (France), Iwatani Corporation (Japan), Ingersoll Rand (US), Chart Industries (US), PERIC Hydrogen Technologies Co., Ltd. (China), H2 MOBILITY (Germany), PDC Machines (US), sera GmbH (Germany), Hydrogenious LOHC technology (Germany), Powertech Labs Inc. (Canada), Resato Hydrogen Technology (Netherlands), Galileo Technologies S.A. (Argentina), Nikola Corporation (US), Humble Hydrogen (UK), atawey (France), OneH2 (US), China Petrochemical Corporation (China), VIRYA ENERGY (Belgium), NUVERA FUEL CELLS, LLC (US), and ANGI Energy Systems, Inc. (US) are some of the key players in the hydrogen fueling station market. The study includes an in-depth competitive analysis of these key players in the hydrogen fueling station market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

The report defines, describes, and forecasts the hydrogen market by supply type (on-site, off-site [gas, liquid]), station type (fixed, mobile), station size (small, mid-sized, large), pressure (high, low), solution (EPC, components), and region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the hydrogen fueling station market. A thorough analysis of the key industry players has provided insights into their business overview, solutions, and services; key strategies such as contracts, partnerships, agreements, expansion, Joint ventures, collaborations, and acquisitions; and recent developments associated with the hydrogen fueling station market. This report covers the competitive analysis of upcoming startups in the hydrogen fueling station market ecosystem.

Key Benefits of Buying the Report

- The report includes the analysis of key drivers (Increasing private-public investments in deploying hydrogen fueling stations, Growing adoption of FCEVs across multiple transportation modes), restraints (Requirement for substantial initial investment, Underdeveloped hydrogen infrastructure), opportunities (Government initiatives to accelerate deployment of hydrogen fueling stations, Increasing focus on building hydrogen-based economy) and challenges (Risks associated with launching hydrogen networks for FCVs.

- Product Development/Innovation: Hydrogen fueling station market participants are driving advancements across the value chain-covering supply methods, station size, station configuration, and dispensing pressure-to boost efficiency, lower costs, and enable broader deployment. In station design, innovations such as modular and scalable layouts, advanced cooling systems, and high-throughput dispensers are improving fueling speed, reliability, and user experience. In storage and compression, companies are integrating new materials for high-pressure tanks, cryogenic systems, and solid-state storage to enhance safety, energy density, and operational flexibility. Digital tools, including AI-based station management, predictive maintenance, real-time monitoring, and smart grid integration, are increasingly adopted to optimize performance, reduce downtime, and support a growing hydrogen mobility ecosystem.

- Market Development: In March 2023, Chart Industries and GenH2 partnered to deliver distributed, small-scale hydrogen liquefaction technologies globally. Chart will supply key system components-such as storage vessels, heat exchangers, and other modular equipment-for GenH2's flagship 1,000 kg/day hydrogen liquefier, including the mobile LS20 trailer-based system. This report provides a detailed analysis of hydrogen fueling station solution provider strategies critical for project success, providing stakeholders with actionable insights into trends and opportunities for growth in the hydrogen fueling station market.

- Market Diversification: The report offers a comprehensive analysis of the strategies employed by hydrogen fueling station solution providers to facilitate market diversification. It outlines innovative products and operating models, as well as new partnership frameworks across various regions, underpinned by technology-driven business lines. The findings emphasize opportunities for expansion beyond traditional operations, identifying geographical areas and customer segments that are currently served but remain underserved and are suitable for strategic entry.

- Competitive Assessment: The report provides in-depth assessment of market shares, growth strategies, and service offerings of leading players such as Linde PLC (Ireland), Air Liquide (France), Air Products and Chemicals, Inc. (US), H2 MOBILITY (Germany), PDC Machines (US), sera GmbH (Germany), Hydrogenious LOHC technology (Germany), Powertech Labs Inc. (Canada), Resato Hydrogen Technology (Netherlands), Galileo Technologies S.A. (Argentina), Nikola Corporation (US), Humble Hydrogen (UK), atawey (France), and OneH2 (US), among others, in the hydrogen fueling station market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.2 SECONDARY AND PRIMARY RESEARCH

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of key secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 List of primary interview participants

- 2.2.2.2 Key primary insights

- 2.2.2.3 Breakdown of primaries

- 2.2.2.4 Key data from primary sources

- 2.2.1 SECONDARY DATA

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DEMAND-SIDE ANALYSIS

- 2.5.1 DEMAND-SIDE ASSUMPTIONS

- 2.5.2 DEMAND-SIDE CALCULATIONS

- 2.6 SUPPLY-SIDE ANALYSIS

- 2.6.1 SUPPLY-SIDE ASSUMPTIONS

- 2.6.2 SUPPLY-SIDE CALCULATIONS

- 2.7 FORECAST

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HYDROGEN FUELING STATION MARKET

- 4.2 HYDROGEN FUELING STATION MARKET, BY REGION

- 4.3 HYDROGEN FUELING STATION MARKET, BY SUPPLY TYPE

- 4.4 HYDROGEN FUELING STATION MARKET, BY PRESSURE

- 4.5 HYDROGEN FUELING STATION MARKET, BY STATION SIZE

- 4.6 HYDROGEN FUELING STATION MARKET, BY SOLUTION

- 4.7 HYDROGEN FUELING STATION MARKET, BY STATION TYPE

- 4.8 HYDROGEN FUELING STATION MARKET IN ASIA PACIFIC, BY PRESSURE AND COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing investment in zero-emission charging infrastructure

- 5.2.1.2 Rising popularity of fuel cell vehicles

- 5.2.2 RESTRAINTS

- 5.2.2.1 Requirement for substantial initial investments

- 5.2.2.2 Underdeveloped hydrogen infrastructure

- 5.2.2.3 High installation and maintenance costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Government initiatives to accelerate deployment of hydrogen fueling stations

- 5.2.3.2 Increasing focus on building hydrogen-based economy

- 5.2.4 CHALLENGES

- 5.2.4.1 Competitive pressure due to rapid development of battery electric vehicle charging infrastructure

- 5.2.4.2 High flammability of hydrogen

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 MARKET MAPPING

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Gaseous hydrogen systems

- 5.7.1.2 On-site hydrogen generation

- 5.7.1.3 Liquid hydrogen systems

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Subcooled liquid hydrogen (sLH2)

- 5.7.2.2 Cryo-compressed hydrogen (CcH2)

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 REGULATIONS

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 TRADE ANALYSIS

- 5.11.1 EXPORT SCENARIO (HS CODE 280410)

- 5.11.2 IMPORT SCENARIO (HS CODE 280410)

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE TREND OF HYDROGEN FUELING STATION INSTALLATIONS, BY REGION, 2020-2024

- 5.12.2 PRICING RANGE OF HYDROGEN FUELING STATIONS, BY SUPPLY TYPE AND SOLUTION, 2024

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 AUDUBON ASSISTS SHELL IN OPERATING HYDROGEN REFUELING STATIONS FOR LIGHT- AND HEAVY-DUTY VEHICLES

- 5.13.2 EMERSON PROVIDES TESCOM PRODUCTS TO AUTOMOTIVE COMPANY TO EFFICIENTLY MANAGE FUEL FLOW CONTROL

- 5.13.3 TECHNO-ECONOMIC OPTIMIZATION CONTRIBUTES TO COST-EFFECTIVE AND RELIABLE HYDROGEN REFUELING INFRASTRUCTURE

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF SUBSTITUTES

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF NEW ENTRANTS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 FILLING PROTOCOLS

- 5.17.1 SLOW FILL

- 5.17.2 FAST FILL

- 5.18 IMPACT OF AI/GEN AI ON HYDROGEN FUELING STATION MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 IMPACT OF AI/GEN AI ON SUPPLY CHAIN, BY SOLUTION AND REGION

- 5.19 IMPACT OF 2025 US TARIFF ON HYDROGEN FUELING STATION MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRIES/REGIONS

- 5.19.4.1 US

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON SOLUTIONS

6 HYDROGEN FUELING STATION MARKET, BY SOLUTION

- 6.1 INTRODUCTION

- 6.2 EPC

- 6.2.1 SITE ENGINEERING & DESIGN

- 6.2.1.1 Ability to ensure safe, efficient, and compliant infrastructure development to expedite segmental growth

- 6.2.2 PERMITTING

- 6.2.2.1 Minimized regulatory delays and reduced operational risks to foster segmental growth

- 6.2.3 CONSTRUCTION

- 6.2.3.1 Ability to reduce project timelines, control costs, and ensure adherence to safety and quality standards to drive market

- 6.2.4 COMMISSIONING

- 6.2.4.1 Need for timely service availability for end users to contribute to segmental growth

- 6.2.5 PROJECT MANAGEMENT & GENERAL OVERHEAD

- 6.2.5.1 Optimized project management and efficient fueling station delivery attributes to fuel segmental growth

- 6.2.1 SITE ENGINEERING & DESIGN

- 6.3 COMPONENTS

- 6.3.1 HYDROGEN INLETS

- 6.3.1.1 Proper design and maintenance attributes to fuel segmental growth

- 6.3.2 COMPRESSORS

- 6.3.2.1 Emergence as simple hydrogen storage and distribution network to contribute to segmental growth

- 6.3.3 HYDRAULIC POWER UNITS & CONTROLS

- 6.3.3.1 Focus on delivering required power from fuel cells to bolster segmental growth

- 6.3.4 DISPENSING CHILLER SYSTEMS

- 6.3.4.1 Rapid advances in cooling technology to expedite segmental growth

- 6.3.5 STORAGE UNITS

- 6.3.5.1 Ability to regulate pressure and coordinate with dispensers and vehicles to drive market

- 6.3.6 DISPENSERS

- 6.3.6.1 High emphasis on precise pressure and regulated flow to accelerate segmental growth

- 6.3.7 OTHER COMPONENTS

- 6.3.1 HYDROGEN INLETS

7 HYDROGEN FUELING STATION MARKET, BY PRESSURE

- 7.1 INTRODUCTION

- 7.2 HIGH

- 7.2.1 GOVERNMENT INCENTIVES AND FUNDING PROGRAMS RELATED TO ZERO-EMISSION MOBILITY TO FUEL SEGMENTAL GROWTH

- 7.3 LOW

- 7.3.1 STRONG FOCUS ON DECARBONIZING PUBLIC AND COMMERCIAL TRANSPORTATION TO BOOST SEGMENTAL GROWTH

8 HYDROGEN FUELING STATION MARKET, BY STATION SIZE

- 8.1 INTRODUCTION

- 8.2 SMALL-SIZED

- 8.2.1 COST-EFFICIENCY AND SCALABILITY TO BOOST ADOPTION

- 8.3 MID-SIZED

- 8.3.1 APPLICATION SCOPE IN URBAN AND SEMI-URBAN AREAS TO FOSTER SEGMENTAL GROWTH

- 8.4 LARGE-SIZED

- 8.4.1 FOCUS ON ADVANCING HYDROGEN INFRASTRUCTURE TO AUGMENT SEGMENTAL GROWTH

9 HYDROGEN FUELING STATION MARKET, BY STATION TYPE

- 9.1 INTRODUCTION

- 9.2 FIXED

- 9.2.1 LARGE-SCALE PROJECTS ON HYDROGEN MOBILITY TO FOSTER SEGMENTAL GROWTH

- 9.3 MOBILE

- 9.3.1 HIGH DEMAND FOR FLEXIBLE, COST-EFFECTIVE, AND PORTABLE SOLUTIONS TO AUGMENT SEGMENTAL GROWTH

10 HYDROGEN FUELING STATION MARKET, BY SUPPLY TYPE

- 10.1 INTRODUCTION

- 10.2 ON-SITE

- 10.2.1 INCREASING INVESTMENT IN GREEN HYDROGEN TO DRIVE MARKET

- 10.2.2 ELECTROLYSIS

- 10.2.3 STEAM METHANE REFORMING (SMR)

- 10.3 OFF-SITE

- 10.3.1 WIDER ADOPTION OF COMPRESSED HYDROGEN GAS TO AUGMENT SEGMENTAL GROWTH

- 10.3.2 GAS

- 10.3.3 LIQUID

- 10.3.3.1 Subcooled liquid hydrogen (sLH2)

- 10.3.3.2 Cryo-compressed hydrogen (CcH2)

11 HYDROGEN FUELING STATION MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Growing network of refueling stations for hydrogen vehicles and buses for logistics applications to fuel market expansion

- 11.2.2 JAPAN

- 11.2.2.1 Ambitious hydrogen strategy, infrastructure expansion, and carbon-neutral goals drive market

- 11.2.3 SOUTH KOREA

- 11.2.3.1 Rising emphasis on expanding clean transportation infrastructure to accelerate market growth

- 11.2.4 NEW ZEALAND

- 11.2.4.1 Increasing investment in low-emission heavy vehicles to boost market growth

- 11.2.5 AUSTRALIA

- 11.2.5.1 Growing focus on developing flexible and mobile refueling solutions to foster market growth

- 11.2.6 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Rising consumption of clean fuel with minimal carbon emissions to expedite market growth

- 11.3.2 FRANCE

- 11.3.2.1 Increasing investment in green hydrogen production and advanced refueling technologies to drive market

- 11.3.3 NETHERLANDS

- 11.3.3.1 Mounting demand for zero-carbon energy in industries to accelerate market growth

- 11.3.4 SWITZERLAND

- 11.3.4.1 Strong commitment to sustainability and emissions reduction to bolster market growth

- 11.3.5 UK

- 11.3.5.1 Large-scale adoption of hydrogen-powered vehicles to accelerate market expansion

- 11.3.6 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 NORTH AMERICA

- 11.4.1 US

- 11.4.1.1 Strong focus on building clean mobility infrastructure to bolster market growth

- 11.4.2 CANADA

- 11.4.2.1 Rapid transition toward zero-emission technologies to accelerate market growth

- 11.4.1 US

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.5.1.1 UAE

- 11.5.1.1.1 Increasing use of hydrogen for electricity generation to boost market growth

- 11.5.1.2 Saudi Arabia

- 11.5.1.2.1 Growing emphasis on integrating hydrogen fuel cell vehicles into public transportation to drive market

- 11.5.1.1 UAE

- 11.5.2 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Increasing allocation of funds to boost hydrogen production to contribute to market growth

- 11.6.2 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2020-2024

- 12.5 COMPANY VALUATION AND FINANCIAL MATRIX

- 12.6 BRAND COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Pressure footprint

- 12.7.5.4 Station size footprint

- 12.7.5.5 Station type footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 LINDE PLC

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 AIR LIQUIDE

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.3.3 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 AIR PRODUCTS AND CHEMICALS, INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.3.3 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 NEL

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Expansions

- 13.1.4.3.3 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 MAXIMATOR HYDROGEN GMBH

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Expansions

- 13.1.5.3.3 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 CHART INDUSTRIES

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.3.2 Other developments

- 13.1.6.4 MnM view

- 13.1.6.4.1 Key strengths/Right to win

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses/Competitive threats

- 13.1.7 HYDROGEN REFUELING SOLUTIONS SA

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.3.2 Expansions

- 13.1.8 IWATANI CORPORATION

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Expansions

- 13.1.9 INGERSOLL RAND

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Other developments

- 13.1.10 PERIC HYDROGEN TECHNOLOGIES CO., LTD

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.11 H2 MOBILITY

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.3.2 Expansions

- 13.1.12 PDC MACHINES

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.13 SERA GMBH

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.14 HYDROGENIOUS LOHC TECHNOLOGIES

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Deals

- 13.1.14.3.2 Other developments

- 13.1.15 POWERTECH LABS

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Product launches

- 13.1.15.3.2 Expansions

- 13.1.16 RESATO HYDROGEN TECHNOLOGY

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Deals

- 13.1.16.3.2 Expansions

- 13.1.1 LINDE PLC

- 13.2 OTHER PLAYERS

- 13.2.1 GALILEO TECHNOLOGIES

- 13.2.2 NIKOLA CORPORATION

- 13.2.3 HUMBLE HYDROGEN

- 13.2.4 ATAWEY

- 13.2.5 ONEH2

- 13.2.6 CHINA PETROCHEMICAL CORPORATION

- 13.2.7 VIRYA ENERGY

- 13.2.8 NUVERA FUEL CELLS, LLC

- 13.2.9 ANGI ENERGY SYSTEMS, INC.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS