|

시장보고서

상품코드

1840917

수술용 이미징 시장 : 제품별, 용도별, 최종 사용자별, 지역별 예측(-2030년)Surgical Imaging Market by Product (Surgical Navigation Software, System), Brand (Azurion, StealthStation, Ingenia, Nexaris), Application (MIS, Endoscopy, CVD, OB/GYN, Ortho, Neuro), End User-Global Forecast to 2030 |

||||||

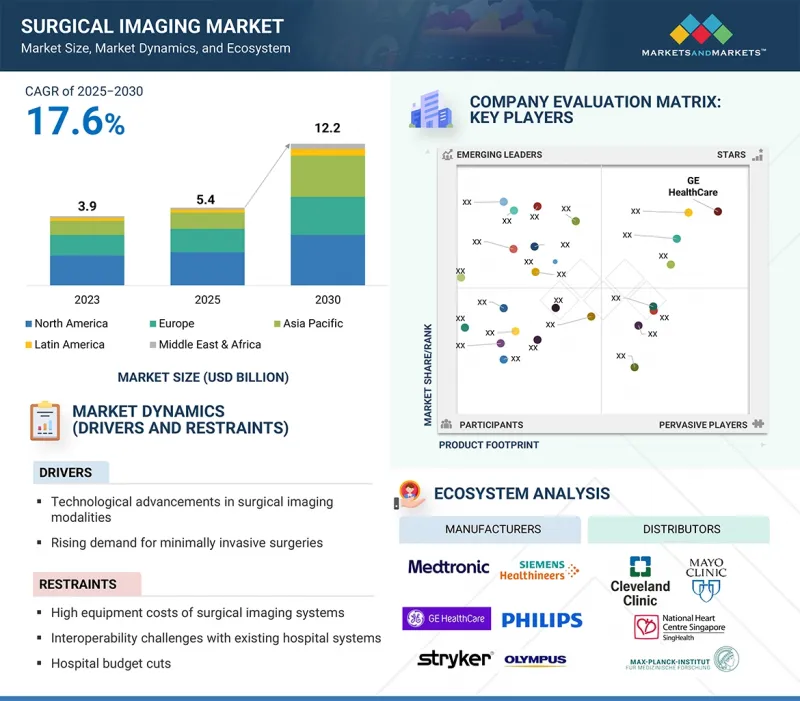

수술용 이미징 시장 규모는 2025년에 540만 달러로 평가되었고, 2030년에는 1,220만 달러에 이를 것으로 예상되며, 예측 기간 중 CAGR은 17.6%를 나타낼 것으로 전망되고 있습니다.

이 배경에는 첨단 수술 중 영상 처리 기술의 사용 증가, 수술 내비게이션을 위한 AI 주도형 이미지 분석 및 증강현실의 통합, 병원 및 외래수술센터(ASC)에서 하이브리드 수술실의 설치 확대가 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 제품별, 용도별, 최종 사용자별, 지역별 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 라틴아메리카, 중동 및 아프리카 |

외과 수술의 정확성 향상, 수술 시간 단축, 환자 결과 개선에 대한 요구가 더욱 높아지고 있는 것 외에, 지원적인 상환 정책, 화상 처리 소프트웨어 및 연결 솔루션의 기술 혁신이 진행되고 있는 것도 수요를 뒷받침하고 있습니다.

용도별로는 무릎이나 고관절의 치환술, 척주측만증의 교정, 복잡한 수술 등 다양한 정형외과나 근골격계의 수술에 있어서 정확하고 실시간 영상처리에 대한 수요가 높기 때문에 정형외과·근골격계 외과분야가 2024년에 수술용 이미징 시장에서 가장 큰 점유율을 차지했습니다. C암 시스템, 3D 이미지, 수술 중 CT와 같은 첨단 기술을 통해 외과의사는 임플란트의 정확한 위치 결정, 뼈 정렬 확인, 수술 결과 평가를 즉시 수행할 수 있으므로 합병증 및 재수술 위험을 줄일 수 있습니다. 스포츠 부상, 교통사고, 노화에 따른 변성질환 등으로 인한 정형외과 수술 증가가 이 분야에서 수술용 이미지 솔루션의 채용을 더욱 강화하고 있습니다.

북미 시장은 2024년 수술용 이미징 시장을 선도했습니다. 이 리더십은 이 지역의 고급 의료 인프라, 차세대 수술 중 영상 기술의 높은 채용률, AI를 활용한 시각화 및 데이터 관리 시스템의 강력한 통합 등의 요인 때문입니다. 미국과 캐나다의 병원에서는 복잡한 수술이 증가하고 있으며, 실시간 이미지를 갖춘 하이브리드 수술실이 급성장하고 있는 것도 이 지위를 더욱 견고하게 하고 있습니다. 호의적인 상환 정책, 최상급 의료기술 기업 집적, 외과 기술 혁신에 대한 지속적인 투자도 북미 시장 리더십을 지원합니다.

본 보고서에서는 세계의 수술용 이미징 시장에 대해 조사했으며, 제품별, 용도별, 최종 사용자별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 고객사업에 영향을 주는 동향/파괴적 변화

- 업계 동향

- 가격 분석

- 밸류체인 분석

- 공급망 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 기술 분석

- 특허 분석

- 무역 분석

- 주요 컨퍼런스 및 행사(2025-2026년)

- 사례 연구 분석

- 관세 및 규제 상황

- 상환 시나리오 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 미충족 수요 분석

- 비즈니스 모델

- AI/생성형 AI가 수술용 이미징 시장에 미치는 영향

- 미국 관세의 영향 - 개요(2025년)

제6장 수술용 이미징 시장(제품별)

- 서론

- C암

- CT 스캐너

- 초음파 시스템

- 통합 MR-OR 시스템

- 수술 내비게이션 소프트웨어

- 액세서리

제7장 수술용 이미징 시장(용도별)

- 서론

- 시술 유형

- 저침습 수술

- 복강경 수술

- 내시경 검사

- 기타

- 수술 유형

- 일반 외과

- 심혈관 외과

- 산부인과 수술

- 정형외과 및 근골격계 수술

- 신경외과

- 비뇨기과 수술

- 기타

제8장 수술용 이미징 시장(최종 사용자별)

- 서론

- 병원 및 외과 센터

- 전문 클리닉

- 외래수술센터(ASC)

- 기타

제9장 수술용 이미징 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 일본

- 중국

- 인도

- 한국

- 호주

- 기타

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 기타

제10장 경쟁 구도

- 개요

- 주요 진입기업의 전략/강점

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업평가와 재무지표

- 브랜드/제품 비교

- 경쟁 시나리오

제11장 기업 프로파일

- 주요 진출기업

- GE HEALTHCARE

- SIEMENS HEALTHINEERS AG

- KONINKLIJKE PHILIPS NV

- SHIMADZU CORPORATION

- FUJIFILM HOLDINGS CORPORATION

- ZIEHM IMAGING GMBH

- HOLOGIC, INC.

- SMITH NEPHEW

- MEDTRONIC

- STRYKER

- CANON MEDICAL SYSTEMS CORPORATION

- OLYMPUS CORPORATION

- NOVANTA INC.

- GLOBUS MEDICAL

- SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- SONY ELECTRONICS INC.

- UNITED IMAGING HEALTHCARE CO., LTD.

- BARCO

- AUXEIN

- BRAINLAB SE

- 기타 기업

- TRIVITRON HEALTHCARE

- RGS HEALTHCARE

- GEMSS HEALTHCARE CO., LTD.

- SKANRAY TECHNOLOGIES LIMITED

- NANJING PERLOVE MEDICAL EQUIPMENT CO., LTD.

- ARTHREX, INC.

제12장 부록

KTH 25.10.22The surgical imaging market was valued at USD 5.4 million in 2025 and is estimated to reach USD 12.2 million by 2030, registering a CAGR of 17.6% during the forecast period. This is due to the increased use of advanced intraoperative imaging technologies, integration of AI-driven image analysis and augmented reality for surgical navigation, and the expanding installation of hybrid operating rooms in hospitals and outpatient surgical centers.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Brand, Application, End User, Region |

| Regions covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

The demand is further boosted by the need for greater surgical precision, shorter procedure times, and better patient outcomes, along with supportive reimbursement policies and ongoing innovations in imaging software and connectivity solutions.

"The orthopedic & musculoskeletal surgery segment is estimated to hold the largest share of the surgical imaging market in 2024."

By application, the orthopedic & musculoskeletal surgery segment is expected to hold the largest share of the surgical imaging market in 2024 due to the high demand for precise, real-time imaging across various orthopedic and musculoskeletal procedures, including knee and hip replacements, scoliosis correction, and complex surgeries. Advanced technologies such as C-arm systems, 3D imaging, and intraoperative CT allow surgeons to accurately position implants, verify bone alignment, and evaluate surgical outcomes immediately, thereby reducing the risk of complications or needing revisions. The increasing number of orthopedic surgeries, driven by sports injuries, traffic accidents, and age-related degenerative conditions, has further boosted the adoption of surgical imaging solutions in this field segment.

"North America accounts for the largest market share in the surgical imaging market in 2024."

The North American market led the surgical imaging market in 2024. This leadership is driven by factors such as the region's advanced healthcare infrastructure, high adoption of next-generation intraoperative imaging technologies, and strong integration of AI-powered visualization and data management systems. The growing number of complex surgical procedures in US and Canadian hospitals, along with the rapid growth of hybrid operating rooms equipped with real-time imaging, has further solidified this position. Favorable reimbursement policies, a high concentration of top medical technology companies, and ongoing investments in surgical innovation also support North America's market leadership.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the surgical imaging marketplace.

The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1 (48%), Tier 2 (36%), and Tier 3 (16%)

- By Designation - Directors (15%), Managers (10%), and Others (75%)

- By Region - North America (39%), Europe (31%), the Asia Pacific (21%), and Latin America (6%), and the Middle East & Africa (3%)

Key Players in the Surgical Imaging Market

Prominent players in the surgical imaging market include GE HealthCare (US), Siemens Healthineers AG(Germany), Koninklijke Philips N.V. (Netherlands), Shimadzu Corporation (Japan), Fujifilm Holdings Corporation (Japan), Ziehm Imaging GmbH (Germany), Hologic, Inc. (US), Smith & Nephew (UK), Medtronic (Ireland), United Imaging Healthcare Co. Ltd. (China), Canon Inc. (Japan), Stryker (US), Olympus Corporation (Japan), Novanta Inc. (US), Global Medical (US), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), Sony Electronics Inc. (Japan), Barco (Belgium), Brainlab SE (UK), Auxein (US), Trivitron Healthcare (India), RGS Healthcare (US), GEMSS HEALTHCARE Co., Ltd. (South Korea), Skanray Technologies Limited (India), Nanjing Perlove Medical Equipment Co., Ltd. (China), Arthrex, Inc. (Florida).

Players adopted both organic and inorganic growth strategies, such as product launches and improvements, investments, partnerships, collaborations, joint ventures, funding, acquisitions, expansions, agreements, contracts, and alliances, to increase their offerings, address unmet customer needs, boost profitability, and expand their presence in the global market.

The study features a detailed competitive analysis of major players in the surgical imaging market, including their company profiles, recent updates, and primary market strategies.

Research Coverage

- The report studies the surgical imaging market based on product, brand, application, end user, and region.

- The report analyzes factors (such as drivers, restraints, opportunities, and challenges) affecting the market growth.

- The report evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders.

- The report studies micro-markets with respect to their growth trends, prospects, and contributions to the total surgical imaging market.

- The report forecasts the revenue of market segments with respect to five major regions.

Reasons to Buy the Report

The report can help established firms as well as new entrants/smaller firms gauge the pulse of the market, which, in turn, would help them garner a greater share. Firms purchasing the report could use one or a combination of the five strategies mentioned below.

This report provides insights into the following pointers:

- Analysis of key drivers (technological advancements in surgical imaging modalities, rising demand for minimally invasive surgeries, technological transition to flat-panel detectors and hybrid ORs, expanding applications across surgical specialties), restraints (high equipment costs of surgical imaging systems, interoperability challenges with existing hospital systems, hospital cost cut), opportunities (increasing number of surgical procedures conducted in ambulatory surgical centers, development of hybrid operating rooms, growing demand for data-integrated imaging systems), and challenges (shortage of skilled workforce, imaging obese patients, hospital budget cuts) influencing the industry macrodynamics of surgical imaging market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the surgical imaging market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of surgical imaging across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the surgical imaging market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the surgical imaging market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS AND REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.5.1 METHODOLOGY-RELATED LIMITATIONS

- 1.5.2 SCOPE-RELATED LIMITATIONS

- 1.6 MARKET STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.2 PRIMARY DATA SOURCES

- 2.1.2.1 List of key primary stakeholders interviewed

- 2.1.2.2 Insights from primary experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET ESTIMATION METHODOLOGY

- 2.2.1 APPROACH 1: COMPANY REVENUE ESTIMATION APPROACH

- 2.2.2 APPROACH 2: CUSTOMER-BASED MARKET ESTIMATION

- 2.2.3 PRIMARY RESEARCH VALIDATION

- 2.3 GROWTH RATE ASSUMPTIONS

- 2.4 DATA TRIANGULATION AND MARKET BREAKDOWN

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SURGICAL IMAGING MARKET

- 4.2 ASIA PACIFIC: SURGICAL IMAGING MARKET, BY PRODUCT

- 4.3 SURGICAL IMAGING MARKET, BY KEY COUNTRY/REGION

- 4.4 REGIONAL MIX: SURGICAL IMAGING MARKET

- 4.5 SURGICAL IMAGING MARKET: DEVELOPED VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Technological advancements in surgical imaging modalities

- 5.2.1.2 Rising demand for minimally invasive surgeries

- 5.2.1.3 Technological transition to flat-panel detectors and hybrid operating rooms

- 5.2.1.4 Expanding applications across surgical specialties

- 5.2.2 RESTRAINTS

- 5.2.2.1 High equipment costs of surgical imaging systems

- 5.2.2.2 Interoperability challenges with existing hospital systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing number of surgical procedures conducted in ASCs (ambulatory surgical centers)

- 5.2.3.2 Development of hybrid operating rooms (ORs)

- 5.2.3.3 Growing demand for data-integrated imaging systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled workforce

- 5.2.4.2 Imaging obese patients

- 5.2.4.3 Hospital budget cuts

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 INDUSTRY TRENDS

- 5.4.1 INTEGRATION OF ARTIFICIAL INTELLIGENCE AND ADVANCED ANALYTICS

- 5.4.2 AUGMENTED REALITY (AR) AND VIRTUAL REALITY (VR) IN SURGERY

- 5.4.3 GROWTH OF HYBRID OPERATING ROOMS AND MULTIMODAL IMAGING

- 5.4.4 COMPACT, MOBILE, AND LOW-DOSE IMAGING TECHNOLOGIES

- 5.4.5 INTEGRATION WITH SURGICAL ROBOTICS AND ADVANCED 3D/4D IMAGING

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF SURGICAL IMAGING PRODUCTS, BY TYPE

- 5.5.2 AVERAGE SELLING PRICE OF SURGICAL IMAGING PRODUCTS, BY KEY PLAYER

- 5.5.3 PRICING MODELS

- 5.6 VALUE CHAIN ANALYSIS

- 5.6.1 RESEARCH & DEVELOPMENT

- 5.6.2 MANUFACTURING & ASSEMBLY

- 5.6.3 DISTRIBUTION, MARKETING & SALES, AND POST-SALES SERVICES

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.7.1 PROMINENT COMPANIES

- 5.7.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.7.3 END USERS

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Intraoperative imaging systems

- 5.10.1.2 Image-guided surgery and navigation systems

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Radiopharmaceutical development and theranostics

- 5.10.2.2 Advanced computing and big data analytics

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Endoscopic & laparoscopic imaging systems

- 5.10.3.2 AI/Image analytics solutions

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA FOR SURGICAL IMAGING PRODUCTS (HS CODE 9022)

- 5.12.2 EXPORT DATA FOR SURGICAL IMAGING PRODUCTS (HS CODE 9022)

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 ADVANCING ENDOSCOPIC SINUS AND SKULL BASE SURGERY WITH SURGICAL NAVIGATION AT GMCH-32

- 5.14.2 PRECISION MAXILLOFACIAL SURGERY THROUGH BRAINLAB'S INTRAOPERATIVE NAVIGATION AND CT INTEGRATION

- 5.14.3 AI-POWERED REAL-TIME TUMOR MARGIN DETECTION IN SKULL BASE SURGERY WITH STIMULATED RAMAN HISTOLOGY

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 TARIFF DATA FOR HS CODE 9022

- 5.15.2 REGULATORY LANDSCAPE

- 5.15.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.4 REGULATORY TRENDS

- 5.15.4.1 North America

- 5.15.4.1.1 US

- 5.15.4.1.2 Canada

- 5.15.4.1 North America

- 5.15.5 EUROPE

- 5.15.6 ASIA PACIFIC

- 5.15.6.1 Japan

- 5.15.6.2 China

- 5.15.6.3 India

- 5.15.6.4 Middle East (GCC Region)

- 5.15.6.4.1 UAE

- 5.15.6.4.2 Saudi Arabia

- 5.15.6.5 Africa

- 5.16 REIMBURSEMENT SCENARIO ANALYSIS

- 5.17 PORTER'S FIVE FORCES ANALYSIS

- 5.17.1 BARGAINING POWER OF SUPPLIERS

- 5.17.2 BARGAINING POWER OF BUYERS

- 5.17.3 THREAT OF NEW ENTRANTS

- 5.17.4 THREAT OF SUBSTITUTES

- 5.17.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.18 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.18.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.18.2 BUYING CRITERIA

- 5.19 UNMET NEEDS ANALYSIS

- 5.19.1 CURRENT UNMET NEEDS

- 5.19.2 END-USER EXPECTATIONS

- 5.20 BUSINESS MODEL

- 5.20.1 CAPITAL EQUIPMENT SALES MODEL

- 5.20.2 SUBSCRIPTION AND SAAS MODEL

- 5.20.3 PAY-PER-USE/TRANSACTION-BASED MODEL

- 5.20.4 MANAGED SERVICES MODEL

- 5.20.5 VALUE-BASED/OUTCOME-DRIVEN MODEL

- 5.20.6 HYBRID MODEL (BUNDLED HARDWARE + DIGITAL SERVICES)

- 5.21 IMPACT OF AI/GEN AI ON SURGICAL IMAGING MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 MARKET POTENTIAL OF AI/GEN AI IN SURGICAL IMAGING MARKET

- 5.21.3 CASE STUDIES RELATED TO AI/GEN AI IMPLEMENTATION

- 5.21.3.1 AI-assisted intraoperative imaging for enhanced detection of peritoneal metastases

- 5.21.4 IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.21.4.1 Surgical navigation & visualization software

- 5.21.4.2 Operating room integration platforms

- 5.21.4.3 Intraoperative imaging systems (CT, MRI, fluoroscopy, ultrasound)

- 5.21.5 USER READINESS AND IMPACT ASSESSMENT

- 5.21.5.1 User readiness

- 5.21.5.1.1 User A: Hospitals

- 5.21.5.1.2 User B: Ambulatory surgical clinics (ASCs)

- 5.21.5.2 Impact assessment

- 5.21.5.2.1 User A: Hospitals

- 5.21.5.2.1.1 Implementation

- 5.21.5.2.1.2 Impact

- 5.21.5.2.2 User B: Ambulatory surgical clinics (ASCs)

- 5.21.5.2.2.1 Implementation

- 5.21.5.2.2.2 Impact

- 5.21.5.2.1 User A: Hospitals

- 5.21.5.1 User readiness

- 5.22 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.22.1 INTRODUCTION

- 5.22.2 KEY TARIFF RATES

- 5.22.3 PRICE IMPACT ANALYSIS

- 5.22.4 IMPACT ON COUNTRY/REGION

- 5.22.4.1 US

- 5.22.4.2 EUROPE

- 5.22.4.3 ASIA PACIFIC

- 5.22.5 IMPACT ON END-USE INDUSTRIES

- 5.22.6 CONCLUSION

6 SURGICAL IMAGING MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 C-ARMS

- 6.2.1 C-ARMS ENHANCING SURGICAL OUTCOMES THROUGH REAL-TIME FLUOROSCOPIC IMAGING TO DRIVE MARKET

- 6.3 CT SCANNERS

- 6.3.1 ENHANCED OPERATIVE CARE WITH HIGH-ACCURACY INTRAOPERATIVE IMAGING TO DRIVE ADOPTION OF CT SCANNERS

- 6.4 ULTRASOUND SYSTEMS

- 6.4.1 ULTRASOUND ADVANCING SURGICAL PRECISION THROUGH REAL-TIME INTRAOPERATIVE IMAGING TO DRIVE SEGMENTAL GROWTH

- 6.5 INTEGRATED MR-OR SYSTEMS

- 6.5.1 INTEGRATED MR OR SYSTEMS DRIVING SURGICAL ACCURACY THROUGH REAL-TIME SOFT TISSUE IMAGING

- 6.6 SURGICAL NAVIGATION SOFTWARE

- 6.6.1 GROWING USE OF SURGICAL NAVIGATION SOFTWARE DRIVING OPERATIVE PRECISION WITH REAL-TIME GUIDANCE

- 6.7 ACCESSORIES

- 6.7.1 INCREASING ADOPTION OF SURGICAL IMAGING ACCESSORIES TO DRIVE ENHANCED VISUALIZATION AND WORKFLOW EFFICIENCY

7 SURGICAL IMAGING MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 PROCEDURE TYPE

- 7.2.1 MINIMALLY INVASIVE SURGERY

- 7.2.1.1 Rising adoption of minimally invasive techniques driving precision and faster recovery in surgical imaging

- 7.2.2 LAPAROSCOPY

- 7.2.2.1 Enhanced precision and faster recovery driving increased adoption of laparoscopic imaging

- 7.2.3 ENDOSCOPY

- 7.2.3.1 Real-time internal visualization driving growth in endoscopic imaging

- 7.2.4 OTHER PROCEDURES

- 7.2.1 MINIMALLY INVASIVE SURGERY

- 7.3 SURGERY TYPE

- 7.3.1 GENERAL SURGERY

- 7.3.1.1 Enhanced visualization transforming general surgical procedures to fuel growth

- 7.3.2 CARDIOVASCULAR SURGERY

- 7.3.2.1 Advanced imaging techniques enhancing cardiovascular interventions to fuel growth

- 7.3.3 OB/GYN SURGERY

- 7.3.3.1 Growing use of imaging-guided precision driving improved surgical outcomes in OB/GYN procedures

- 7.3.4 ORTHOPEDIC & MUSCULOSKELETAL SURGERY

- 7.3.4.1 Adoption of imaging solutions driving optimized implant placement and bone alignment

- 7.3.5 NEUROSURGERY

- 7.3.5.1 High-precision imaging navigating complex neural procedures to drive market

- 7.3.6 UROLOGY SURGERY

- 7.3.6.1 Imaging-guided precision improving outcomes in urological surgeries to drive demand

- 7.3.7 OTHER SURGERIES

- 7.3.1 GENERAL SURGERY

8 SURGICAL IMAGING MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS & SURGICAL CENTERS

- 8.2.1 RISING SURGICAL VOLUMES IN HOSPITALS AND SURGICAL CENTERS TO DRIVE MARKET

- 8.3 SPECIALTY CLINICS

- 8.3.1 SPECIALTY CLINICS DRIVING SURGICAL IMAGING ADOPTION THROUGH PRECISION AND EFFICIENCY

- 8.4 AMBULATORY SURGICAL CENTERS

- 8.4.1 AMBULATORY SURGICAL CENTERS DRIVING SURGICAL IMAGING ADOPTION FOR EFFICIENT OUTPATIENT CARE

- 8.5 OTHER END USERS

9 SURGICAL IMAGING MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Advancements in AI and augmented reality integration in surgery to drive market

- 9.2.3 CANADA

- 9.2.3.1 Collaborations between national AI institutes and health systems to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Precision-driven imaging and expanding hospital capacity to drive regional growth

- 9.3.3 UK

- 9.3.3.1 NHS-led integration of surgical imaging and skilled workforce strength to drive regional growth

- 9.3.4 FRANCE

- 9.3.4.1 Steady growth in radiology workforce supporting imaging expansion

- 9.3.5 ITALY

- 9.3.5.1 Balancing imaging modernization with workforce shortages

- 9.3.6 SPAIN

- 9.3.6.1 Expanding surgical imaging access with focus on regional equity

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 JAPAN

- 9.4.2.1 Enhancing surgical outcomes with innovative imaging technologies

- 9.4.3 CHINA

- 9.4.3.1 Strong network of grade-A tertiary hospitals driving advanced imaging adoption

- 9.4.4 INDIA

- 9.4.4.1 Government initiatives and private hospital collaborations to fuel growth

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Rising aging population driving demand for precision surgical imaging

- 9.4.6 AUSTRALIA

- 9.4.6.1 Strengthening surgical imaging capabilities for minimally invasive procedures

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Government and private investment in surgical infrastructure to drive market

- 9.5.3 MEXICO

- 9.5.3.1 Accelerating minimally invasive and AI-enabled surgical imaging to drive market

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Rising healthcare demand and innovation driving surgical imaging advancements

- 9.6.3 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SURGICAL IMAGING MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Product footprint

- 10.5.5.4 Application (procedure type) footprint

- 10.5.5.5 Application (surgery type) footprint

- 10.5.5.6 End-user footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of emerging players/startups

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 GE HEALTHCARE

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches & approvals

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 SIEMENS HEALTHINEERS AG

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Other developments

- 11.1.2.3.4 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 KONINKLIJKE PHILIPS N.V.

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches & approvals

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 SHIMADZU CORPORATION

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches & approvals

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 FUJIFILM HOLDINGS CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches & approvals

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 ZIEHM IMAGING GMBH

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches & approvals

- 11.1.6.3.2 Deals

- 11.1.7 HOLOGIC, INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.8 SMITH+NEPHEW

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches & approvals

- 11.1.8.3.2 Deals

- 11.1.9 MEDTRONIC

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches & approvals

- 11.1.9.3.2 Deals

- 11.1.10 STRYKER

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches & approvals

- 11.1.10.3.2 Deals

- 11.1.11 CANON MEDICAL SYSTEMS CORPORATION

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches & approvals

- 11.1.11.3.2 Deals

- 11.1.12 OLYMPUS CORPORATION

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 PRODUCT LAUNCHES AND APPROVALS

- 11.1.12.3.2 Deals

- 11.1.12.3.3 Expansions

- 11.1.13 NOVANTA INC.

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Deals

- 11.1.14 GLOBUS MEDICAL

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product launches & approvals

- 11.1.14.3.2 Deals

- 11.1.15 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Product launches & approvals

- 11.1.16 SONY ELECTRONICS INC.

- 11.1.16.1 Business overview

- 11.1.16.2 Products offered

- 11.1.16.3 Recent developments

- 11.1.16.3.1 Product launches & approvals

- 11.1.16.3.2 Deals

- 11.1.17 UNITED IMAGING HEALTHCARE CO., LTD.

- 11.1.17.1 Business overview

- 11.1.17.2 Products offered

- 11.1.17.3 Recent developments

- 11.1.17.3.1 Product launches & approvals

- 11.1.18 BARCO

- 11.1.18.1 Business overview

- 11.1.18.2 Products offered

- 11.1.18.3 Recent developments

- 11.1.18.3.1 Product launches & approvals

- 11.1.18.3.2 Deals

- 11.1.19 AUXEIN

- 11.1.19.1 Business overview

- 11.1.19.2 Products offered

- 11.1.19.3 Recent developments

- 11.1.19.3.1 Product launches & approvals

- 11.1.20 BRAINLAB SE

- 11.1.20.1 Business overview

- 11.1.20.2 Products offered

- 11.1.20.3 Recent developments

- 11.1.20.3.1 Deals

- 11.1.1 GE HEALTHCARE

- 11.2 OTHER PLAYERS

- 11.2.1 TRIVITRON HEALTHCARE

- 11.2.2 RGS HEALTHCARE

- 11.2.3 GEMSS HEALTHCARE CO., LTD.

- 11.2.4 SKANRAY TECHNOLOGIES LIMITED

- 11.2.5 NANJING PERLOVE MEDICAL EQUIPMENT CO., LTD.

- 11.2.6 ARTHREX, INC.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS