|

시장보고서

상품코드

1854905

매니지드 네트워크 서비스 시장(-2030년) : 유형별(매니지드 LAN, 매니지드 Wi-Fi, 매니지드 WAN, 매니지드 VPN, 네트워크 모니터링, 매니지드 NFV, 매니지드 네트워크 보안), 산업별(BFSI, IT 및 통신, 제조), 지역별Managed Network Services Market by Type (Managed LAN, Managed Wi-Fi, Managed WAN, Managed VPN, Network Monitoring, Managed NFV, Managed Network Security), Vertical (BFSI, IT & Telecom, Manufacturing), and Region - Global Forecast to 2030 |

||||||

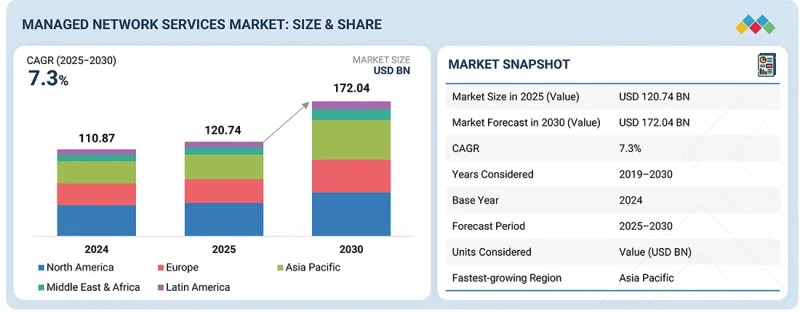

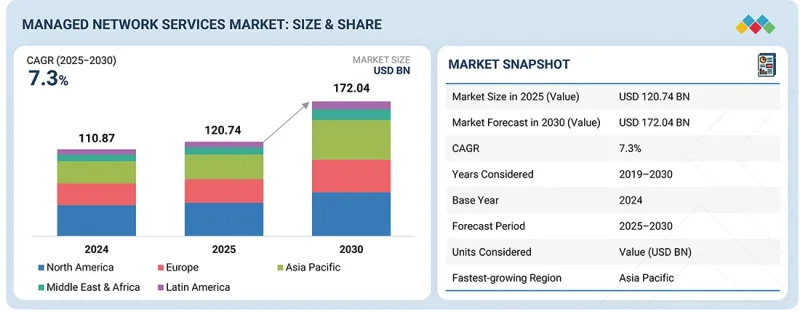

매니지드 네트워크 서비스 시장 규모는 2025년 1,207억 4,000만 달러에서 예측 기간 동안 CAGR 7.3%로 증가하여 2030년에는 1,720억 4,000만 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2019-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(달러) |

| 부문 | 유형, 매니지드 네트워크 보안, 산업, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

기업들은 세계 연결성, 하이브리드 업무, 클라우드 트랜스포메이션의 복잡성에 대응하기 위해 점점 더 많은 기업들이 매니지드 네트워크 서비스를 활용하고 있습니다. 현재 시장은 성능 관리, 보안, 자동화를 통합한 종합적인 솔루션을 제공하는 서비스 제공업체들이 주도하고 있습니다.

산업 전반에 걸쳐 디지털 생태계가 확장됨에 따라, 기업들은 확장성이 높고 상시 가동되는 네트워크를 신뢰할 수 있는 파트너에게 위탁하는 움직임을 강화하고 있습니다. 유연한 서비스 모델과 성과 기반 요금제를 제공하는 공급자의 채택이 증가하고 있습니다. 매니지드 네트워크 서비스는 연결성, 클라우드 통합, 사이버 보안을 통합한 민첩한 운영을 실현하는 주요 원동력으로 부상하고 있으며, 향후 지능형 예측 및 적응형 네트워크 관리에 초점을 맞출 것으로 보입니다.

"유형별로는 관리형 WAN 부문이 예측 기간 동안 가장 큰 규모를 나타낼 것으로 예상됩니다."

기업들은 복잡하고 분산된 네트워크 구조를 단순화하고 애플리케이션의 안정적인 성능을 보장하기 위해 관리형 WAN 서비스로 빠르게 전환하고 있습니다. 하이브리드 업무의 확산, SaaS 도입, 세계화가 진행되면서 안전하고 클라우드에 최적화된 연결을 제공하는 매니지드 WAN 공급자의 중요성이 커지고 있습니다.

현재 관리형 WAN 서비스에는 동적 트래픽 제어, 실시간 분석, 정책 기반 자동화가 포함되어 있어 기업의 증가하는 성능 요구 사항을 충족하고 있습니다. 이 기술은 AI 워크로드, 엣지 컴퓨팅, IoT 생태계를 지탱하는 기둥 역할을 하며, 차세대 디지털 기업의 기반으로서 전 세계적으로 필수적인 역할을 할 것으로 예상됩니다.

"의료 부문이 예측 기간 동안 가장 빠른 성장률을 기록할 것으로 예상됩니다."

매니지드 네트워크 서비스는 병원, 진료소, 원격의료 시설 등을 연결하는 안전하고 고성능의 연결성을 제공함으로써 의료 서비스의 방식을 변화시키고 있습니다. Cleveland Clinic과 Verizon은 2023년 Ericsson과 협력하여 오하이오 주 멘토 병원에 5G 지원 네트워크를 도입하여 첨단 임상 워크플로우와 원격의료를 실현합니다. 이 사례는 매니지드 프라이빗 네트워크가 저지연 애플리케이션과 의료 현장의 디지털 연계를 지원하고 있음을 보여줍니다.

의료 분야의 시장 확대는 전자 의료 기록의 디지털화, 커넥티드 의료기기의 보급, 상시 가동이 요구되는 미션 크리티컬한 의료 운영 등에 의해 촉진되고 있습니다. 또한, 병원이 스마트 인프라와 AI 진단을 도입하면서 복잡한 의료 환경에서의 데이터 무결성, 실시간 모니터링, 통합 네트워크 거버넌스 등의 요구가 매니지드 서비스 수요를 더욱 증가시키고 있습니다.

"아시아태평양이 가장 빠르게 성장하는 반면, 북미는 예측 기간 동안 가장 큰 시장을 유지할 것으로 예상됩니다."

아시아태평양 시장은 클라우드 도입 급증, 원격 운영 확대, 정부 주도의 디지털 전환 프로젝트로 인해 급성장하고 있습니다. 기업들은 효율성 향상, 가시성 확보, 분산 환경의 보안 강화를 위해 네트워크 관리를 외부에 위탁하는 움직임을 강화하고 있습니다. 2024년 싱텔은 아시아태평양 전역에 매니지드 네트워크 및 사이버 보안 서비스를 확대하여 네트워크 인텔리전스, 매니지드 SD-WAN, 지속적인 모니터링을 결합한 서비스를 제공하게 됩니다.

이러한 움직임은 점점 더 복잡해지는 디지털 환경에서 엔드투엔드 연결성과 보호 기능을 제공할 수 있는 신뢰할 수 있는 파트너에 대한 수요 증가를 상징합니다. 또한, IoT 도입과 데이터센터 연결이 증가함에 따라 확장성, 유연성, AI 기반 모델에 대한 요구가 증가하고 있습니다. 매니지드 네트워크 서비스는 혁신, 보안, 운영 탄력성의 균형을 추구하는 기업에게 필수적인 존재가 될 전망입니다.

한편, 북미는 시장에서 가장 큰 점유율을 차지하고 있습니다. 네트워크의 복잡성을 단순화하고 내결함성을 향상시키려는 기업들의 움직임에 따라 빠르게 성장하고 있습니다. 멀티 클라우드 환경과 인력 분산으로 인해 기업들은 네트워크 성능, 가시성, 사이버 보안을 통합하는 매니지드 솔루션을 우선시하고 있습니다.

통신사업자들은 AI 및 소프트웨어 정의 기술(SDN)에 대한 투자를 강화하여 대규모에서도 민첩하고 예측 가능한 운영을 실현하고 있습니다. 북미는 매니지드 서비스에 인텔리전스, 자동화, 정책 기반 오케스트레이션을 통합하는 분야에서 세계를 선도하고 있습니다. 또한, 기업들은 성과 기반 계약을 채택하고, 자체 운영팀을 확대하지 않고도 성능, 보안, 안정성에 대한 실제 측정된 결과를 요구하는 경향이 증가하고 있습니다.

세계의 매니지드 네트워크 서비스 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술·특허 동향, 법·규제 환경, 사례 분석, 시장 규모 추정 및 예측, 각종 부문별·지역별·주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요와 업계 동향

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 매니지드 네트워크 서비스 시장 : 간단한 역사

- 밸류체인 분석

- 생태계 분석

- 사례 연구 분석

- Porter's Five Forces 모델

- 주요 이해관계자와 구입 기준

- 특허 분석

- 고객의 사업에 영향을 미치는 동향/혼란

- 가격 분석

- 기술 분석

- 규제 상황

- 2025-2026년의 주요 회의와 이벤트

- 기술 로드맵

- 베스트 프랙티스

- 현재 비즈니스 모델과 신흥 비즈니스 모델

- 매니지드 네트워크 서비스 시장에서 사용되는 툴, 프레임워크, 기술

- 투자와 자금 조달 시나리오

- AI/생성형 AI의 영향

- 2025년 미국 관세의 영향

제6장 매니지드 네트워크 서비스 시장 : 유형별

- 매니지드 LAN

- 매니지드 Wi-Fi

- 매니지드 VPN

- 매니지드 WAN

- 네트워크 모니터링

- 매니지드 NFV

- 매니지드 네트워크 보안

제7장 매니지드 네트워크 서비스 시장 : 매니지드 네트워크 보안별

- 매니지드 방화벽

- 매니지드 IDS/IPS

- 기타

제8장 매니지드 네트워크 서비스 시장 : 산업별

- 은행, 금융 서비스, 보험

- 소매·E-Commerce

- IT·통신

- 제조

- 정부

- 교육

- 의료

- 미디어 및 엔터테인먼트

- 기타

제9장 매니지드 네트워크 서비스 시장 : 지역별

- 북미

- 북미 : 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽 : 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양 : 거시경제 전망

- 중국

- 일본

- 인도

- 호주와 뉴질랜드

- 한국

- 싱가포르

- 기타

- 중동 및 아프리카

- 중동 및 아프리카 : 거시경제 전망

- 중동

- 아프리카

- 라틴아메리카

- 라틴아메리카 : 거시경제 전망

- 브라질

- 멕시코

- 기타

제10장 경쟁 구도

- 주요 진출 기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 브랜드/제품 비교

- 기업 평가와 재무 지표

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 경쟁 시나리오

제11장 기업 개요

- 주요 기업

- CISCO

- AT&T

- VERIZON

- NTT

- DEUTSCHE TELEKOM

- VODAFONE

- ORANGE

- ERICSSON

- HUAWEI

- TELEFONICA

- 기타 기업

- LUMEN TECHNOLOGIES

- FUJITSU

- TATA COMMUNICATIONS

- TELSTRA

- COLT TECHNOLOGY SERVICES

- NOKIA

- SINGTEL

- GTT COMMUNICATIONS

- SIFY TECHNOLOGIES

- DXC TECHNOLOGY

- WIPRO

- COMARCH

- COMMSCOPE

- SME/스타트업

- ALKIRA

- FLEXIWAN

- BIGLEAF NETWORKS

- GRAPHIANT

- KENTIK

- OMAN DATA PARK

- KUBUS

- EIL GLOBAL

- SYSTAL TECHNOLOGY SOLUTIONS

- METTEL

제12장 인접 시장과 관련 시장

제13장 부록

KSM 25.11.06The managed network services market is estimated to be USD 120.74 billion in 2025 to USD 172.04 billion by 2030, at a CAGR of 7.3%, during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By Type, Managed Network Security, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Enterprises are increasingly turning to managed network services as they navigate the complexity of global connectivity, hybrid work, and cloud transformation. The market is gaining traction as providers deliver comprehensive solutions that integrate performance management, security, and automation.

The rise of digital ecosystems across industries has pushed demand for scalable, always-on networks managed by trusted partners. Providers offering flexible service models and outcome-based pricing are witnessing growing adoption. Managed network services will emerge as key drivers of agile operations, bridging connectivity, cloud integration, and cybersecurity into a unified service experience. The emphasis will shift toward intelligent, predictive, and adaptive network management.

Managed network services face various restraints and challenges that slow adoption and complicate operations. Integrating and modernizing legacy on-premises infrastructure with cloud-native SD-WAN and SASE architecture is technically and financially demanding, while multi-cloud and edge deployments create fragmentation that makes consistent visibility, quality of service, and policy enforcement difficult. Security and data privacy compliance across jurisdictions adds legal and operational overhead, and rising telemetry volumes strain monitoring, analytics, and storage.

"Managed WAN segment is expected to contribute to the largest market size during the forecast period"

Enterprises are rapidly transitioning to managed WAN services to simplify their complex, distributed network infrastructures and ensure consistent application performance. The rise of hybrid work, SaaS adoption, and global operations is driving the need for managed WAN providers that can deliver secure, cloud-optimized connectivity.

Managed WAN offerings now include dynamic traffic steering, real-time analytics, and policy-based automation, helping enterprises meet growing performance expectations. Managed WAN is expected to play a crucial role in supporting AI-driven workloads, edge computing, and IoT ecosystems, establishing them as the backbone of modern digital enterprise operations worldwide.

"Healthcare segment among types is expected to register the fastest growth rate during the forecast period"

Managed network services are transforming healthcare delivery by providing secure, high-performance connectivity across hospitals, clinics, and remote care facilities. In 2023, the Cleveland Clinic and Verizon, in partnership with Ericsson, deployed a 5G-enabled network to support advanced clinical workflows and telemedicine services at the Mentor Hospital in Ohio. This demonstrates how managed private networks are supporting low-latency applications and digital collaboration in patient care.

Market expansion is being fueled by the growing digitization of health records, wider use of connected medical devices, and the need for continuous uptime in mission-critical healthcare operations. As hospitals pursue smart infrastructure and AI-driven diagnostics, demand for managed services will be driven by requirements for data integrity, real-time monitoring, and unified network governance in complex healthcare environments.

"Asia Pacific is expected to be the fastest-growing region, while North America will hold the largest market during the forecast period"

The managed network services market in the Asia Pacific is expanding rapidly, fueled by strong enterprise cloud adoption, the rise of remote operations, and government-led digital transformation projects. Companies are outsourcing network management to improve efficiency, enhance visibility, and secure distributed environments. In 2024, Singtel expanded its managed network and cybersecurity services across the Asia Pacific region, combining network intelligence, managed SD WAN, and continuous monitoring for enterprise customers.

This reflects the growing need for trusted partners who can deliver end-to-end connectivity and protection in a complex digital landscape. With the rise of IoT deployments and data center interconnections, regional growth will be shaped by the demand for scalable, flexible, and AI-driven service models. During the forecast period, the managed network services are expected to be essential for enterprises seeking to balance innovation, security, and operational resilience in an increasingly interconnected economy.

The North America region is expected to be the largest region in the managed network services market. It is growing rapidly as enterprises seek to simplify network complexity and improve resilience. With multi-cloud environments and distributed workforces, companies are prioritizing managed solutions that integrate network performance, visibility, and cybersecurity.

Providers are investing heavily in AI and software-defined capabilities to deliver agility and predictability at scale. North America will lead in embedding intelligence, automation, and policy-driven orchestration into managed services. Enterprises will increasingly adopt outcome-based contracts, expecting providers to deliver measurable performance, security, and reliability without expanding in-house operational teams.

Breakdown of primary interviews

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The breakdown of the primary interviews is as follows:

- By Company Type: Tier 1 - 20%, Tier 2 - 10%, and Tier 3 - 70%

- By Designation: C-level - 9%, Directors - 18%, and Others - 73%

- By Region: North America - 55%, Europe - 9%, Asia Pacific - 36%

The major players in the managed network services market are Cisco (US), AT&T (US), Verizon (US), NTT Data (Japan), Deutsche Telekom (Germany), Huawei (China), Orange (France), Vodafone (UK), Ericsson (Sweden), Telefonica (Spain), Singtel (Singapore), Telstra (Australia), Lumen Technologies (US), Fujitsu (Japan), Tata Communications (India), Colt Technology Services (UK), Nokia (Finland), GTT Communications (US), Sify Technologies (India), DXC Technology (US), Wipro (India), Comarch (Poland), Commscope (US), Alkira (US), Kentik (US), flexiWAN (Israel), Bigleaf Networks (US), Graphiant (US), Oman Data Park (Oman), Kubus (UK), EIL Global (Australia), Systal Technology Solutions (Scotland), and MetTel (US). These players have adopted various growth strategies, such as partnerships, agreements, and collaborations, product launches, product enhancements, and acquisitions, to expand their footprint in the managed network services market.

Research Coverage

The market study covers the managed network services market size across different segments. It aims at estimating the market size and the growth potential across various segments, including Usage Scenario (Further-enhanced Mobile Broadband (FEMBB), Extremely Reliable And Low-latency Communications (ERLLC), Long-distance and High-mobility Communications (LDHMC), Ultra-massive Machine Type Communications (UMMTC), Extremely Low-power Communications (ELPC)), Enterprise Application (Holographic Communications, Tactile/Haptic Internet, Fully Automated Driving, Industry 5.0, Internet Of Bio-Nano-Things, Other Enterprise Applications (Deep-sea Sightseeing and Space Travel)), Communication Infrastructure (Cellular, Broaband, Fixed), Vertical (Consumer and Enterprise (Manufacturing, Healthcare & Life Sciences, Automotive, Media & Entertainment, Aerospace & Defense, Other Enterprises [Retail & Ecommerce, Energy & Utilities, Education])), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global managed network services market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide stakeholders with insights into the market's pulse, as well as information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (technological advancements, deliver extreme performance and highly advanced use cases, growing metaverse traction), restraints (high initial cost, limited spectrum availability, regulatory and standardization challenges, terahertz (THz) frequency challenges and energy efficiency concerns), opportunities (transformative applications, global connectivity, detailed sensing and high-precision positioning technologies offered by 6g networks), and challenges (security and privacy, ethical and social implications, environmental concerns) influencing the growth of the managed network services market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and new product & service launches in the managed network services market

- Market Development: Comprehensive information about lucrative markets and analyzes the managed network services market across various regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the managed network services market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Cisco (US), AT&T (US), Verizon (US), NTT Data (Japan), Deutsche Telekom (Germany), Huawei (China), Orange (France), Vodafone (UK), Ericsson (Sweden), Telefonica (Spain), Singtel (Singapore), Telstra (Australia), Lumen Technologies (US), Fujitsu (Japan), Tata Communications (India), Colt Technology Services (UK), Nokia (Finland), GTT Communications (US), Sify Technologies (India), DXC Technology (US), Wipro (India), Comarch (Poland), Commscope (US), Alkira (US), Kentik (US), flexiWAN (Israel), Bigleaf Networks (US), Graphiant (US), Oman Data Park (Oman), Kubus (UK), EIL Global (Australia), Systal Technology Solutions (Scotland), and MetTel (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR MARKET PLAYERS IN MANAGED NETWORK SECURITY MARKET

- 4.2 NORTH AMERICA: MANAGED NETWORK SERVICES MARKET, BY TYPE & COUNTRY

- 4.3 MANAGED NETWORK SERVICES MARKET, BY TYPE

- 4.4 MANAGED NETWORK SERVICES MARKET, BY VERTICAL

- 4.5 MANAGED NETWORK SERVICES MARKET, BY MANAGED NETWORK SECURITY

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Outsourcing of IT expertise by small and medium-sized businesses

- 5.2.1.2 Technological advancements impacting enterprise networks

- 5.2.1.3 Capital and operational expenditure savings associated with managed network services

- 5.2.2 RESTRAINTS

- 5.2.2.1 Privacy and security concerns in outsourcing network management

- 5.2.2.2 Increasing regulations and compliance issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Exponential growth in global IP traffic and cloud traffic

- 5.2.3.2 Ability to provide value-added services above and beyond core network infrastructure

- 5.2.3.3 Increasing demand for managed network services among small and medium-sized enterprises

- 5.2.4 CHALLENGES

- 5.2.4.1 Establishing clear expectations and requirements

- 5.2.4.2 Navigating customer support depending on MSP response times

- 5.2.4.3 Challenges associated with marketing and sales efforts

- 5.2.1 DRIVERS

- 5.3 MANAGED NETWORK SERVICES MARKET: BRIEF HISTORY

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 CASE STUDY 1: NORTH AMERICAN FOOD MANUFACTURER UPGRADES ITS NETWORK FOR BUSINESS GROWTH WITH KYNDRYL

- 5.6.2 CASE STUDY 2: COMMUNICATIONS COSTS REDUCED TO AN INDUSTRY LOW OF ABOUT 1% OF OPERATING BUDGET WITH NTT

- 5.6.3 CASE STUDY 3: EVOLUTION OF ENTERPRISE DATA MANAGEMENT IN HEALTH

- 5.6.4 CASE STUDY 4: SINGLE-PROVIDER MANAGED NETWORK FOR IMPROVING CHECKOUT RELIABILITY, GUEST WI-FI, AND CENTRALIZING OPERATIONS

- 5.7 PORTER'S FIVE FORCES MODEL

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF BUYERS

- 5.7.4 BARGAINING POWER OF SUPPLIERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 BUYING CRITERIA

- 5.9 PATENT ANALYSIS

- 5.9.1 METHODOLOGY

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE OF SERVICE TYPES, BY KEY PLAYER, 2024

- 5.11.2 INDICATIVE PRICING ANALYSIS, BY TYPE, 2024

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Software-defined networking (SDN)

- 5.12.1.2 Network functions virtualization (NFV)

- 5.12.1.3 Artificial intelligence (AI) and machine learning (ML)

- 5.12.1.4 Security automation and orchestration (SAO)

- 5.12.2 ADJACENT TECHNOLOGIES

- 5.12.2.1 Cloud computing

- 5.12.2.2 Internet of Things (IoT)

- 5.12.2.3 Edge computing

- 5.12.2.4 Blockchain

- 5.12.3 COMPLEMENTARY TECHNOLOGIES

- 5.12.3.1 Big data analytics

- 5.12.3.2 Cybersecurity automation tools

- 5.12.3.3 Collaboration platforms

- 5.12.1 KEY TECHNOLOGIES

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 KEY REGULATIONS

- 5.13.2.1 North America

- 5.13.2.1.1 US

- 5.13.2.2 Europe

- 5.13.2.3 Asia Pacific

- 5.13.2.3.1 India

- 5.13.2.4 Middle East & Africa

- 5.13.2.4.1 UAE

- 5.13.2.5 Latin America

- 5.13.2.5.1 Brazil

- 5.13.2.5.2 Mexico

- 5.13.2.1 North America

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 TECHNOLOGY ROADMAP FOR MANAGED NETWORK SERVICES MARKET

- 5.15.1 SHORT-TERM ROADMAP (2025-2027)

- 5.15.2 MID-TERM ROADMAP (2027-2029)

- 5.15.3 LONG-TERM ROADMAP (2029-2030)

- 5.16 BEST PRACTICES IN MANAGED NETWORK SERVICES MARKET

- 5.17 CURRENT AND EMERGING BUSINESS MODELS

- 5.18 TOOLS, FRAMEWORKS, AND TECHNIQUES USED IN MANAGED NETWORK SERVICES MARKET

- 5.19 INVESTMENT AND FUNDING SCENARIO

- 5.20 IMPACT OF AI/GENERATIVE AI ON MANAGED NETWORK SERVICES MARKET

- 5.21 IMPACT OF 2025 US TARIFF - MANAGED NETWORK SERVICES MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON COUNTRY/REGION

- 5.21.4.1 US

- 5.21.4.2 Europe

- 5.21.4.3 Asia Pacific

- 5.21.5 IMPACT ON MANAGED NETWORK SERVICES MARKET END USE

6 MANAGED NETWORK SERVICES MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.1.1 MANAGED NETWORK SERVICES MARKET, BY TYPE: DRIVERS

- 6.2 MANAGED LAN

- 6.2.1 GROWTH OF HYBRID/REMOTE WORK TO REQUIRE SECURE LAN ACCESS

- 6.3 MANAGED WI-FI

- 6.3.1 EXPLOSIVE GROWTH IN SMARTPHONES, TABLETS, AND IOT DEVICES TO BOOST DEMAND FOR WIRELESS NETWORK INFRASTRUCTURE

- 6.4 MANAGED VPN

- 6.4.1 GLOBALIZATION OF BUSINESS TO FUEL NEED FOR ENCRYPTED LINKS BETWEEN GEO DISTRIBUTED SITES

- 6.5 MANAGED WAN

- 6.5.1 RAPID GROWTH OF CLOUD APPS AND STREAMING SERVICES TO REQUIRE HIGH BANDWIDTH LINKS

- 6.6 NETWORK MONITORING

- 6.6.1 DEMAND FOR REAL-TIME PERFORMANCE DATA AND SLA COMPLIANCE TO ENSURE ZERO NETWORK OUTAGES

- 6.7 MANAGED NFV

- 6.7.1 SHIFT TO CLOUD NATIVE TELECOM AND ENTERPRISE NETWORKS TO RELY ON VIRTUALIZED FUNCTIONS

- 6.8 MANAGED NETWORK SECURITY

- 6.8.1 LACK OF IN-HOUSE SECURITY EXPERTISE TO MANAGE FIREWALLS/IDS EFFECTIVELY

7 MANAGED NETWORK SERVICES MARKET, BY MANAGED NETWORK SECURITY

- 7.1 INTRODUCTION

- 7.1.1 MANAGED NETWORK SECURITY: MARKET DRIVERS

- 7.2 MANAGED FIREWALL

- 7.2.1 RAPID INCREASE IN CYBER ATTACKS AND SOPHISTICATED THREATS TO DRIVE DEMAND

- 7.3 MANAGED IDS/IPS

- 7.3.1 ANALYZING NETWORK TRAFFIC TO IDENTIFY PATTERNS INDICATIVE OF A CYBERATTACK

- 7.4 OTHER MANAGED NETWORK SECURITY

8 MANAGED NETWORK SERVICES MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.1.1 VERTICALS: MANAGED NETWORK SERVICES MARKET DRIVERS

- 8.2 BANKING, FINANCIAL SERVICES, & INSURANCE

- 8.2.1 ULTRA-LOW LATENCY REQUIREMENTS AND PROTECTION OF SENSITIVE CLIENT DATA TO BOOST DEMAND

- 8.2.2 USE CASES

- 8.2.2.1 Secure SD-WAN for branch connectivity

- 8.2.2.2 Managed firewalls and intrusion detection systems

- 8.2.2.3 Disaster recovery and business continuity planning

- 8.3 RETAIL & ECOMMERCE

- 8.3.1 NEED FOR ROBUST NETWORK AND CUSTOMER EXPERIENCE IMPROVEMENTS TO SUPPORT ADOPTION

- 8.3.2 USE CASES

- 8.3.2.1 Managed Wi-Fi for enhanced customer experience

- 8.3.2.2 Secure VPNs for remote point-of-sale systems

- 8.3.2.3 Network monitoring for inventory management

- 8.4 IT & TELECOM

- 8.4.1 CUSTOMER SATURATION, SLOW INNOVATION, AND OTHER CHALLENGES TO DRIVE USERS TOWARD OUTSOURCING

- 8.4.2 USE CASES

- 8.4.2.1 Managed network infrastructure for data centers

- 8.4.2.2 SD-WAN for optimized application delivery

- 8.4.2.3 Managed security services for client networks

- 8.5 MANUFACTURING

- 8.5.1 ENHANCED PRODUCT LIFE CYCLE, INNOVATION, AND COST REDUCTION BENEFITS TO BOOST ADOPTION

- 8.5.2 USE CASES

- 8.5.2.1 Industrial IoT network management

- 8.5.2.2 Secure remote access for operational technology

- 8.5.2.3 Network segmentation for enhanced security

- 8.6 GOVERNMENT

- 8.6.1 RISING DATA GENERATION AND CONCERNS OVER SECURITY BREACHES TO FUEL NEED FOR DISASTER RECOVERY NETWORKS

- 8.6.2 USE CASES

- 8.6.2.1 Secure managed networks for public services

- 8.6.2.2 Emergency communication network services

- 8.6.2.3 Data encryption and compliance management

- 8.7 EDUCATION

- 8.7.1 DIGITAL MEDIA TO OFFER PERSONALIZED ELEARNING CONTENT

- 8.7.2 USE CASES

- 8.7.2.1 Campus-wide managed Wi-Fi

- 8.7.2.2 Secure remote learning platforms

- 8.7.2.3 Network monitoring for academic research

- 8.8 HEALTHCARE

- 8.8.1 GREATER EFFICIENCY AND REDUCED OPERATING COSTS TO DRIVE HEALTHCARE CUSTOMERS TOWARD MANAGED NETWORK SERVICES

- 8.8.2 USE CASES

- 8.8.2.1 Managed networks for telemedicine services

- 8.8.2.2 Secure data transmission for electronic health records

- 8.8.2.3 Network redundancy for critical medical equipment

- 8.9 MEDIA & ENTERTAINMENT

- 8.9.1 SHIFTING CONSUMPTION TRENDS TO DRIVE MEDIA HOUSES TOWARD DIGITAL DISTRIBUTION AND HIGH-SPEED CONNECTIVITY

- 8.9.2 USE CASES

- 8.9.2.1 High-bandwidth managed networks for content distribution

- 8.9.2.2 Managed Wi-Fi for live events

- 8.10 OTHER VERTICALS

9 MANAGED NETWORK SERVICES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Adoption of emerging technologies to boost managed network outsourcing

- 9.2.3 CANADA

- 9.2.3.1 Rural broadband expansion to fuel demand for managed network services

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 UK

- 9.3.2.1 Developing networking infrastructure and high number of mobile subscribers to drive market

- 9.3.3 GERMANY

- 9.3.3.1 Demand for secure, low-latency connectivity to boost adoption of managed offerings

- 9.3.4 FRANCE

- 9.3.4.1 Smart city projects to fuel adoption of centralized managed network platforms

- 9.3.5 ITALY

- 9.3.5.1 SME digitalization to accelerate demand for managed connectivity

- 9.3.6 SPAIN

- 9.3.6.1 Tourism and hospitality digitization to increase requirement of resilient networks

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Massive 5G enterprise rollouts to fuel demand for managed services

- 9.4.3 JAPAN

- 9.4.3.1 Significant investment in AI infrastructure to boost demand for high-performance computing and data center operations

- 9.4.4 INDIA

- 9.4.4.1 Rapid digital adoption to drive demand for pressure-scalable managed network solution

- 9.4.5 AUSTRALIA & NEW ZEALAND

- 9.4.5.1 Remote connectivity and cloud adoption to boost managed services

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Hyperconnected consumer market to boost demand for low-latency networks

- 9.4.7 SINGAPORE

- 9.4.7.1 Surge in regional data hubs to boost demand for secure managed networking

- 9.4.8 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 MIDDLE EAST

- 9.5.2.1 Energy sector digitization and mega projects to fuel demand for managed networks

- 9.5.2.2 KSA

- 9.5.2.2.1 National cloud and giga projects to drive demand for managed networks

- 9.5.2.3 UAE

- 9.5.2.3.1 Smart city and EXPO legacy to boost demand for network services

- 9.5.2.4 KUWAIT

- 9.5.2.4.1 Strategic moves by regional operators to alter secure managed connectivity

- 9.5.2.5 Bahrain

- 9.5.2.5.1 Financial services growth to increase demand for managed security

- 9.5.2.6 Rest of Middle East

- 9.5.3 AFRICA

- 9.5.3.1 SME digital transformation to drive adoption managed services

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Urbanization and mobile growth to push adoption of managed networking services

- 9.6.3 MEXICO

- 9.6.3.1 Nearshoring manufacturing expansion to drive resilient network services

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 10.3 REVENUE ANALYSIS, 2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.6 COMPANY VALUATION AND FINANCIAL METRICS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Type footprint

- 10.7.5.4 Managed network security footprint

- 10.7.5.5 Vertical footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 CISCO

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches and enhancements

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 AT&T

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 VERIZON

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches and enhancements

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 NTT

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches and enhancements

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 DEUTSCHE TELEKOM

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches and enhancements

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 VODAFONE

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches and enhancements

- 11.1.6.3.2 Deals

- 11.1.7 ORANGE

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches and enhancements

- 11.1.7.3.2 Deals

- 11.1.8 ERICSSON

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.9 HUAWEI

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.10 TELEFONICA

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.1 CISCO

- 11.2 OTHER PLAYERS

- 11.2.1 LUMEN TECHNOLOGIES

- 11.2.2 FUJITSU

- 11.2.3 TATA COMMUNICATIONS

- 11.2.4 TELSTRA

- 11.2.5 COLT TECHNOLOGY SERVICES

- 11.2.6 NOKIA

- 11.2.7 SINGTEL

- 11.2.8 GTT COMMUNICATIONS

- 11.2.9 SIFY TECHNOLOGIES

- 11.2.10 DXC TECHNOLOGY

- 11.2.11 WIPRO

- 11.2.12 COMARCH

- 11.2.13 COMMSCOPE

- 11.3 SMES/STARTUPS

- 11.3.1 ALKIRA

- 11.3.2 FLEXIWAN

- 11.3.3 BIGLEAF NETWORKS

- 11.3.4 GRAPHIANT

- 11.3.5 KENTIK

- 11.3.6 OMAN DATA PARK

- 11.3.7 KUBUS

- 11.3.8 EIL GLOBAL

- 11.3.9 SYSTAL TECHNOLOGY SOLUTIONS

- 11.3.10 METTEL

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 MANAGED SERVICES MARKET - GLOBAL FORECAST TO 2029

- 12.2.1 MARKET DEFINITION

- 12.3 NETWORK-AS-A-SERVICE MARKET

- 12.3.1 MARKET DEFINITION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS