|

시장보고서

상품코드

1856027

통합 방공 미사일 방어 시장 : 시스템별, 구성요소별, 사정거리별, 최종사용자별, 지역별 - 예측(-2030년)Integrated Air and Missile Defense Market by System (Missile Defense, Anti-Aircraft, C-UAS, C-RAM, Counter-Hypersonics), by Component (Weapon Systems, Radars & Sensors, C2), by Range (SHORAD, MRAD, LRAD) by End-User and Region - Global Forecast to 2030 |

||||||

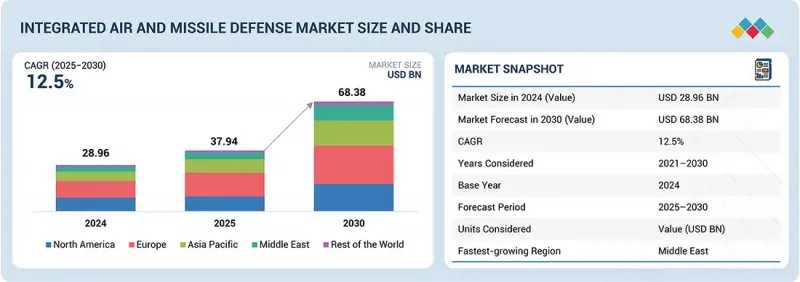

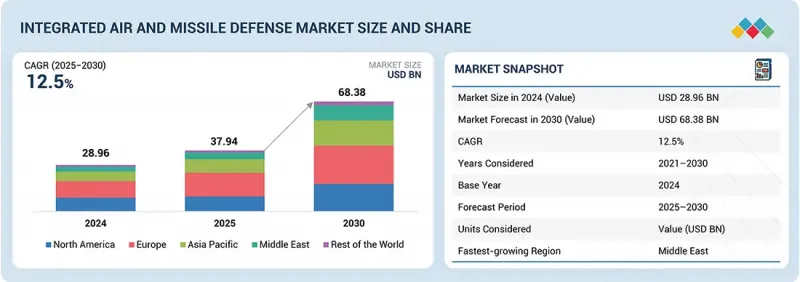

통합 방공 미사일 방어 시장 규모는 2025년에 379억 4,000만 달러, 2030년에는 683억 8,000만 달러에 달할 것으로 추정되며, CAGR은 12.5%로 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문별 | 시스템별, 구성요소별, 사정거리별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

새로운 위협에 대응하기 위해 레이더, 요격 미사일, 명령 및 제어 시스템으로 구성된 강력한 시스템에 대한 요구가 성장을 주도하고 있습니다. 군사 현대화 계획의 진전과 적대적인 지역을 통한 안전하고 빠른 데이터 및 전력 전송의 필요성이 확장을 이끄는 주요 요인으로 꼽히고 있습니다. C4ISR 인터넷 조달, 전자전 시스템, 다층 방어 전략 내 무인 시스템도 대용량 소형 솔루션의 속도를 가속화하고 있습니다. 전 세계적으로 방위비 지출이 증가함에 따라 자율 및 AI 지원 전투 관리 시스템 지출과 함께 다영역 IAMD 임무에서 고성능을 유지하기 위한 견고하고 소형화된 솔루션에 대한 필요성이 증가하고 있습니다.

미사일 방어 시스템 분야는 탄도미사일, 순항 미사일, 극초음속 미사일의 위협에 대응하는 데 중요한 역할을 담당하고 있어 통합 방공 미사일 방어 시장에서 가장 큰 비중을 차지할 것으로 추정됩니다. 각국은 미사일 요격 미사일의 대규모 조달, 다층 방어 아키텍처, 레거시 시스템의 현대화를 우선순위에 두고 있습니다. 국방 예산의 증가와 국경을 초월한 위협의 증가는 미사일 방어 시스템이 국가 안보 전략의 근간이 될 수 있도록 보장하며, 전 세계적으로 압도적인 시장 점유율을 주도하고 있습니다.

공군 부문은 첨단 미사일과 UAV의 위협으로부터 영공을 보호해야 할 필요성이 증가함에 따라 통합 대공 미사일 방어 시장에서 가장 빠르게 성장하는 부문이 되고 있습니다. 현대 공군은 작전 준비태세를 강화하기 위해 공중조기경보시스템, 장거리 요격미사일, 차세대 레이더 네트워크를 우선순위에 두고 있습니다. 전투기 일체형 미사일 방어 솔루션의 조달 증가와 다층적 공중 방어 아키텍처의 확대는 이 분야의 세계 급격한 성장에 박차를 가하고 있습니다.

아시아태평양은 국방 예산의 증가, 영토 분쟁, 군대의 급속한 현대화로 인해 통합 대공 미사일 방어 시장에서 두 번째로 빠르게 성장하는 시장이 될 것으로 추정됩니다. 인도, 중국, 일본, 한국 등의 국가들은 탄도미사일과 순항 미사일의 위협 증가에 대응하기 위해 다층 미사일 방어 시스템에 많은 투자를 하고 있습니다. 지역 협력 관계와 독자적인 개발 프로그램은 이 지역의 강력한 성장 궤도를 더욱 강화하고 있습니다.

세계의 통합 방공 미사일 방어 시장에 대해 조사했으며, 시스템별, 구성요소별, 사거리별, 최종사용자별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

- 다영역 위협에 대한 대항의 전략적 격차

- 통합 방공 미사일 방어 유효성 확보에서 인프라의 역할

- 운영상 우위성을 위한 계층화 통합 방공 미사일 아키텍처

- 변혁적 기술의 도입

제5장 시장 개요

- 소개

- 시장 역학

- 가격 분석

- 부품표

- 운영 데이터

- 투자와 자금 조달 시나리오

- 총소유비용

- 주요 이해관계자와 구입 기준

- 기술 분석

- 기술 로드맵

- 특허 분석

- 기술 동향

- AI의 영향

제6장 업계 동향

- 생태계 분석

- 밸류체인 분석

- 규제 상황

- 2025년 미국 관세

- 무역 분석

- 사례 연구 분석

- 주요 회의와 이벤트

- 거시경제 전망

- 메가트렌드의 영향

제7장 통합 방공 미사일 방어 시장(시스템별)

- 소개

- 미사일 방어 시스템

- 대공 시스템

- 대 무인항공기 시스템

- 대 로켓포 및 박격포 시스템

- 대 극초음속 방위 시스템

- 통합 다위협 시스템

제8장 통합 방공 미사일 방어 시장(구성요소별)

- 소개

- 무기 시스템

- 사격 통제 시스템

- 레이더와 센서

- 런처

- 커맨드 & 컨트롤

- 시스템 통합

제9장 통합 방공 미사일 방어 시장(사정거리별)

- 소개

- 단거리(SHORAD)

- 중거리(MRAD)

- 장거리(LRAD)

제10장 통합 방공 미사일 방어 시장(최종사용자별)

- 소개

- 육군

- 해군

- 공군

제11장 통합 방공 미사일 방어 시장(지역별)

- 소개

- 북미

- PESTLE 분석

- 미국

- 캐나다

- 유럽

- PESTLE 분석

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 폴란드

- 기타

- 아시아태평양

- PESTLE 분석

- 중국

- 일본

- 인도

- 한국

- 호주

- 싱가포르

- 기타

- 중동

- PESTLE 분석

- GCC

- 이스라엘

- 튀르키예

- 기타

- 기타 지역

- PESTLE 분석

- 라틴아메리카

- 아프리카

제12장 경쟁 구도

- 소개

- 주요 진출 기업의 전략/강점, 2020-2024년

- 매출 분석, 2021-2024년

- 시장 점유율 분석, 2024년

- 브랜드/제품 비교

- 기업 평가와 재무 지표

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제13장 기업 개요

- 주요 진출 기업

- RTX

- LOCKHEED MARTIN CORPORATION

- MBDA

- NORTHROP GRUMMAN

- IAI

- THALES

- RHEINMETALL AG

- RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

- KONGSBERG

- HANWHA GROUP

- ASELSAN A.S.

- DIEHL STIFTUNG & CO. KG

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- LIG NEX1

- HENSOLDT AG

- 기타 기업

- ALMAZ-ANTEY

- CHINA AEROSPACE SCIENCE AND TECHNOLOGY CORPORATION

- BHARAT DYNAMICS LIMITED

- BHARAT ELECTRONICS LIMITED

- SAAB AB

- ELBIT SYSTEMS LTD.

- LEONARDO DRS

- EDGE GROUP PJSC

- INDRA SISTEMAS, S.A.

- ROKETSAN

제14장 부록

KSM 25.11.10The integrated air & missile defense market is estimated in terms of market size to be USD 37.94 billion in 2025 and USD 68.38 billion by 2030, at a CAGR of 12.5%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By System, Component, Range, End-user, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The need for rugged systems consisting of radars, interceptors, and command-and-control systems for addressing emerging threats is bolstering growth. Advancing military modernization programs and the need for secure, high-speed data and power transmission via hostile territory top the list of the expansion-driving factors. C4ISR net procurements, electronic warfare systems, and unmanned systems within multi-layer defense strategies also accelerate the pace for high-capacity, small solutions. Advancing defense spending globally, along with autonomous and AI-capable battle management system spending, is reinforcing the need for rugged and miniaturized solutions for maintaining high performance across multi-domain IAMD missions.

"The missile defense systems segment is projected to account for the largest market share in the integrated air and missile defense market during the forecast period."

The missile defense systems segment is estimated to account for the greatest share of the integrated air & missile defense market because of its critical role in countering ballistic, cruise, and hypersonic missile threats. Nations are prioritizing large-scale procurement of missile interceptors, multi-layered defense architectures, and modernization of legacy systems. Growing defense budgets, combined with heightened cross-border threats, ensure missile defense systems remain the backbone of national security strategies, driving their dominant market share globally.

"The air force segment is set to be the fastest segment in the integrated air & missile defense market during the forecast period."

The air force segment is becoming the fastest-growing segment in the integrated air & missile defense market because of the increasing need to safeguard airspace against advanced missile and UAV threats. Modern air forces are prioritizing airborne early warning systems, long-range interceptors, and next-generation radar networks to enhance operational readiness. Rising procurement of fighter-integrated missile defense solutions and expansion of multi-layered aerial defense architectures are fueling the rapid growth of this segment worldwide.

"The Asia Pacific is projected to be the second-fastest-growing market in the integrated air & missile defense market."

Asia Pacific is estimated to be the second-fastest-growing market in the integrated air & missile defense market, driven by rising defense budgets, territorial disputes, and the rapid modernization of armed forces. Countries such as India, China, Japan, and South Korea are heavily investing in multi-layered missile defense systems to counter growing threats from ballistic and cruise missiles. Regional collaborations and indigenous development programs further reinforce the region's strong growth trajectory.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%; Tier 2 - 45%; and Tier 3 - 20%

- By Designation: C Level - 35%; Directors - 25%; and Others - 40%

- By Region: North America - 40%; Europe - 25%; Asia Pacific - 15%; Middle East - 10%; Rest of the World - 10%

RTX (US), Lockheed Martin Corporation (US), MBDA (France), Northrop Grumman (US), and IAI (Israel) are some of the leading players operating in the integrated air & missile defense market.

Research Coverage

The study covers the integrated air and missile defense market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different segments based on system, component, deployment, range, end user, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report:

This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall integrated air and missile defense market and its subsegments. The report covers the entire ecosystem of the integrated air and missile defense market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key growth drivers, including the rising threat from asymmetric warfare and missile proliferation, the increasing requirement for maritime and airspace security, and heightened defense spending on layered air and missile defense architectures; expanding modernization programs across the armed forces are also reinforcing investments in advanced IAMD capabilities

- Product Development: In-depth analysis of product innovation/development by companies across various regions

- Market Development: Comprehensive information about lucrative markets-the report analyzes the integrated air and missile defense market across varied regions

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in the integrated air & missile defense market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like market RTX (US), Lockheed Martin Corporation (US), MBDA (France), Northrop Grumman (US), and IAI (Israel), among others, in the integrated air and missile defense market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 DEMAND-SIDE INDICATORS

- 2.2.2 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 3.3 HIGH-GROWTH SEGMENT AND EMERGING FRONTIERS

- 3.4 GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 STRATEGIC GAPS IN COUNTERING MULTI-DOMAIN THREATS

- 4.1.1 AIRBORNE THREATS

- 4.1.2 MISSILE THREATS

- 4.1.3 INDIRECT FIRE THREATS

- 4.2 ROLE OF INFRASTRUCTURE IN ENSURING INTEGRATED AIR AND MISSILE DEFENSE EFFECTIVENESS

- 4.2.1 MOBILE INFRASTRUCTURE

- 4.2.2 FIXED INFRASTRUCTURE

- 4.2.3 TRAINING CENTERS

- 4.2.4 TESTING RANGES

- 4.2.5 MAINTENANCE AND LOGISTICS

- 4.2.6 COMMUNICATION NETWORKS

- 4.3 LAYERED INTEGRATED AIR AND MISSILE DEFENSE ARCHITECTURE FOR OPERATIONAL SUPERIORITY

- 4.3.1 SENSOR LAYER

- 4.3.2 C2 LAYER

- 4.3.3 SHOOTER LAYER

- 4.4 ADOPTION OF TRANSFORMATIVE TECHNOLOGIES

- 4.4.1 KINETIC-KILL EFFECTORS

- 4.4.2 DIRECTED ENERGY WEAPONS

- 4.4.3 ELECTRONIC WARFARE AND CYBER DEFENSE

- 4.4.4 ARTIFICIAL INTELLIGENCE AND DATA FUSION

- 4.4.5 SPACE AND CYBER INTEGRATION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Demand for standardized IAMD architectures across allied and coalition forces

- 5.2.1.2 Emergence of hypersonic glide vehicles, sleath missiles, and re-entry vehicles

- 5.2.1.3 Rapid adoption of multi-tiered architectures combining short, medium, and long-range defense systems

- 5.2.1.4 Heightened geopolitical conflicts

- 5.2.2 RESTRAINTS

- 5.2.2.1 Restrictions on transferring sensitive BMC4I technologies

- 5.2.2.2 Resistance to replacing standalone systems with fully integrated networks

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of terrestrial, airborne, and space-based assets into a unified architecture

- 5.2.3.2 Untapped potential for shared IAMD frameworks across neighboring states

- 5.2.3.3 Recurring revenues from upgrades, digital twin deployments, and modular battle management enhancements

- 5.2.3.4 Recapitalization programs for national-level integrated defense networks

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical barriers in harmonizing data from dissimilar radar bands and sensors

- 5.2.4.2 Vulnerability of centralized C2 nodes to cyber intrusion or electronic attack

- 5.2.4.3 Preference for visible kinetic platforms over investments in command, control, and integration infrastructure

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE OF INTEGRATED AIR AND MISSILE DEFENSE SYSTEMS OFFERED BY KEY PLAYERS

- 5.3.1.1 Short-range IAMD programs

- 5.3.1.2 Medium-range IAMD programs

- 5.3.1.3 Long-range IAMD programs

- 5.3.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.3.1 AVERAGE SELLING PRICE OF INTEGRATED AIR AND MISSILE DEFENSE SYSTEMS OFFERED BY KEY PLAYERS

- 5.4 BILL OF MATERIALS

- 5.4.1 INTERCEPTORS

- 5.4.2 LAUNCHERS

- 5.4.3 SENSORS

- 5.4.4 C2/BATTLE MANAGEMENT

- 5.4.5 INFRASTRUCTURE AND SITE SUPPORT

- 5.4.6 SERVICES AND LIFECYCLE SUPPORT

- 5.5 OPERATIONAL DATA

- 5.5.1 INSTALLED BASE OF INTEGRATED AIR AND MISSILE DEFENSE, BY REGION, 2021-2024

- 5.5.2 INSTALLED BASE OF INTEGRATED AIR AND MISSILE DEFENSE, BY REGION, 2025-2030

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TOTAL COST OF OWNERSHIP

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 BUYING CRITERIA

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Real-time use of AI/ML to process radar, EO/IR, satellite, and SIGINT data into fire-control quality tracks

- 5.9.1.2 New seekers, propulsion, and kill-vehicle technologies designed to track and neutralize maneuvering hypersonic threats

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Jamming, spoofing, and deception systems that contest adversary missile seekers and radars

- 5.9.2.2 High-altitude drones extending reach and persistence of IAMD systens

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 High-energy lasers and high-power microwaves for low-cost interception of UAVs, rockets, and cruise missiles

- 5.9.3.2 Infrared and EO satellites providing global coverage for missile launches

- 5.9.1 KEY TECHNOLOGIES

- 5.10 TECHNOLOGY ROADMAP

- 5.11 PATENT ANALYSIS

- 5.12 TECHNOLOGY TRENDS

- 5.12.1 RESILIENT COMMUNICATION AND MULTI-DOMAIN DATA LINKS

- 5.12.2 MULTI-MISSION INTERCEPTORS

- 5.12.3 HYPERSONIC DEFENSE TESTBEDS AND SIMULATION PLATFORMS

- 5.12.4 ENERGY STORAGE AND POWER MANAGEMENT FOR DIRECTED ENERGY SYSTEMS

- 5.13 IMPACT OF AI

- 5.13.1 SYSTEM-LEVEL IMPACT

- 5.13.1.1 Real-time multi-sensor fusion

- 5.13.1.2 Automated threat prioritization and engagement management

- 5.13.1.3 Accelerated decision loops

- 5.13.1.4 Adaptive battle management

- 5.13.2 SUBSYSTEM-LEVEL IMPACT

- 5.13.2.1 AI in radars and sensors

- 5.13.2.2 AI in C2 nodes

- 5.13.2.3 AI in interceptors and kill vehicles

- 5.13.1 SYSTEM-LEVEL IMPACT

6 INDUSTRY TRENDS

- 6.1 ECOSYSTEM ANALYSIS

- 6.1.1 PROMINENT COMPANIES

- 6.1.2 PRIVATE AND SMALL ENTERPRISES

- 6.1.3 END USERS

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH AND DEVELOPMENT

- 6.2.2 RAW MATERIAL

- 6.2.3 SUBSYSTEM/PRODUCT MANUFACTURING

- 6.2.4 ASSEMBLY AND INTEGRATION

- 6.2.5 POST-SALES SERVICE

- 6.3 REGULATORY LANDSCAPE

- 6.3.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.3.2 KEY REGULATIONS

- 6.3.2.1 North America

- 6.3.2.2 Europe

- 6.3.2.3 Asia Pacific

- 6.3.2.4 Middle East

- 6.3.2.5 Rest of the World

- 6.4 2025 US TARIFF

- 6.4.1 INTRODUCTION

- 6.4.2 KEY TARIFF RATES

- 6.4.3 PRICE IMPACT ANALYSIS

- 6.4.4 IMPACT ON COUNTRY/REGION

- 6.4.4.1 US

- 6.4.4.2 Europe

- 6.4.4.3 Asia Pacific

- 6.4.5 IMPACT ON END-USE INDUSTRIES

- 6.4.5.1 Military

- 6.5 TRADE ANALYSIS

- 6.5.1 IMPORT SCENARIO (HS CODE 9306)

- 6.5.2 EXPORT SCENARIO (HS CODE 9306)

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 DEPLOYMENT OF PATRIOT PAC-3 IN UKRAINE

- 6.6.2 ADOPTION OF NASAMS FOR NATO'S EASTERN FLANK

- 6.6.3 INTEGRATION OF S-400 AMID INDO-PAK TENSIONS

- 6.7 KEY CONFERENCES AND EVENTS

- 6.8 MACROECONOMIC OUTLOOK

- 6.8.1 NORTH AMERICA

- 6.8.2 EUROPE

- 6.8.3 ASIA PACIFIC

- 6.8.4 MIDDLE EAST

- 6.8.5 REST OF THE WORLD

- 6.9 IMPACT OF MEGATRENDS

- 6.9.1 AI-PREDICTIVE MAINTENANCE AND DIGITAL TWINS

- 6.9.2 QUANTUM-ENHANCED SENSING

- 6.9.3 CYBER-HARDENING AND ZERO-TRUST SECURITY ARCHITECTURES

7 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY SYSTEM

- 7.1 INTRODUCTION

- 7.2 MISSILE DEFENSE SYSTEMS

- 7.2.1 EXPANDING BALLISTIC AND CRUISE MISSILE THREATS TO DRIVE MARKET

- 7.2.2 USE CASE: PATRIOT PAC-3 MSE BY RTX AND LOCKHEED MARTIN CORPORATION

- 7.3 ANTI-AIRCRAFT SYSTEMS

- 7.3.1 INTEGRATION OF AI-ASSISTED TARGET RECOGNITION TO COUNTER AERIAL THREATS TO DRIVE MARKET

- 7.3.2 USE CASE: IRIS-T SLM BY DIEHL DEFENCE

- 7.4 COUNTER-UNMANNED AERIAL SYSTEMS

- 7.4.1 GROWING PROLIFERATION OF DRONES AND LOITERING MUNITIONS TO DRIVE MARKET

- 7.4.2 USE CASE: DRONEGUN MKIII BY DRONESHIELD

- 7.5 COUNTER-ROCKET ARTILLERY AND MORTAR SYSTEMS

- 7.5.1 INCREASING INDIRECT FIRE THREATS TO DRIVE MARKET

- 7.5.2 USE CASE: IRON DOME BY RAFAEL ADVANCED DEFENSE SYSTEMS

- 7.6 COUNTER-HYPERSONIC DEFENSE SYSTEMS

- 7.6.1 ONGOING DEVELOPMENT OF HYPERSONIC WEAPONS TO DRIVE MARKET

- 7.6.2 USE CASE: GLIDE PHASE INTERCEPTOR BY RTX AND NORTHROP GRUMMAN

- 7.7 INTEGRATED MULTI-THREAT SYSTEMS

- 7.7.1 RISING HYBRID AND MULTI-DOMAIN THREATS TO DRIVE MARKET

- 7.7.2 USE CASE: BARAK-MX SYSTEM BY ISRAEL AEROSPACE INDUSTRIES

8 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 WEAPON SYSTEMS

- 8.2.1 DIVERSITY OF MISSILE, DRONE, AND ARTILLERY THREATS TO DRIVE MARKET

- 8.2.2 INTERCEPTORS

- 8.2.3 DIRECTED ENERGY WEAPONS

- 8.2.4 CLOSE-IN WEAPON SYSTEMS & GUNS

- 8.2.5 MAN-PORTABLE AIR DEFENSE SYSTEMS

- 8.3 FIRE CONTROL SYSTEMS

- 8.3.1 NEED FOR RAPID MULTI-TARGET ENGAGEMENTS TO DRIVE MARKET

- 8.3.2 ENGAGEMENT OPERATION CENTERS

- 8.3.3 TARGET ACQUISITION & TRACKING SYSTEMS

- 8.4 RADARS & SENSORS

- 8.4.1 INCREASED STEALTH AND HYPERSONIC CHALLENGES TO DRIVE MARKET

- 8.4.2 EARLY WARNING RADARS

- 8.4.3 FIRE CONTROL RADARS

- 8.4.4 EO/IR & SPACE SENSORS

- 8.4.5 ELINT

- 8.5 LAUNCHERS

- 8.5.1 ELEVATED DEMAND FOR SURVIVABILITY AND MODULARITY TO DRIVE MARKET

- 8.5.2 MOBILE LAUNCHERS

- 8.5.3 VERTICAL LAUNCHING SYSTEMS

- 8.6 COMMAND & CONTROL

- 8.6.1 EXTENSIVE USE IN HYBRID AND COALITION WARFARE TO DRIVE MARKET

- 8.6.2 CENTRALIZED COMMAND & CONTROL

- 8.6.3 INTEGRATED BATTLE MANAGEMENT SYSTEMS

- 8.7 SYSTEM INTEGRATION

- 8.7.1 GROWING MULTINATIONAL OPERATIONS AND SATURATION THREATS TO DRIVE MARKET

- 8.7.2 COALITION INTEROPERABILITY SOFTWARE

- 8.7.3 DATA FUSION SYSTEMS

9 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY RANGE

- 9.1 INTRODUCTION

- 9.2 SHORT RANGE (SHORAD)

- 9.2.1 RISE OF DRONES AND LOW-FLYING AIRCRAFT TO DRIVE MARKET

- 9.2.2 USE CASE: PANTSIR-S1 BY KBP INSTRUMENT DESIGN BUREAU

- 9.3 MEDIUM RANGE (MRAD)

- 9.3.1 REGIONAL SECURITY TENSIONS TO DRIVE MARKET

- 9.3.2 USE CASE: NASAMS BY KONGSBERG

- 9.4 LONG RANGE (LRAD)

- 9.4.1 EXPANSION OF LONG-RANGE STRIKE CAPABILITIES TO DRIVE MARKET

- 9.4.2 THEATER MISSILE DEFENSE (TMD)

- 9.4.3 GROUND-BASED MIDCOURSE DEFENSE (GMD)

- 9.4.4 USE CASE: THAAD BY LOCKHEED MARTIN CORPORATION

10 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 ARMY

- 10.2.1 EMPHASIS ON GROUND-BASED MISSILE DEFENSE AND MODERNIZATION TO DRIVE MARKET

- 10.2.2 KEY PROGRAMS PROCURED BY ARMY

- 10.2.2.1 Patriot PAC-3 MSE

- 10.2.2.2 THAAD

- 10.2.2.3 GMD-GBI

- 10.2.2.4 NGI for GMD

- 10.2.2.5 KM-SAM Cheongung-II

- 10.2.2.6 DE M-SHORAD

- 10.2.2.7 IFPC-HPM

- 10.2.2.8 LD-2000

- 10.2.2.9 MANTIS

- 10.2.2.10 Skynex

- 10.2.2.11 Korkut

- 10.2.2.12 FIM-92 Stinger

- 10.2.2.13 Piorun

- 10.2.2.14 Mistral 3

- 10.2.2.15 Starstreak

- 10.2.2.16 QW-series

- 10.2.2.17 KP-SAM Shingung

- 10.2.2.18 Sungur

- 10.2.2.19 Igla-S and advancing DRDO VSHORAD

- 10.3 NAVY

- 10.3.1 NAVAL FOCUS ON INTEGRATED FLEET PROTECTION AND MODULAR MISSILE DEFENSE TO DRIVE MARKET

- 10.3.2 KEY PROGRAMS PROCURED BY NAVY

- 10.3.2.1 SM-3

- 10.3.2.2 Sea Viper

- 10.3.2.3 CAMM/CAMM-ER

- 10.3.2.4 Barak-8

- 10.3.2.5 SM-6

- 10.3.2.6 HELIOS

- 10.3.2.7 ODIN

- 10.3.2.8 Phalanx CIWS

- 10.3.2.9 Goalkeeper CIWS

- 10.3.2.10 Type 730 CIWS

- 10.3.2.11 Type 1130 CIWS

- 10.3.2.12 Millennium Gun

- 10.4 AIR FORCE

- 10.4.1 NEED FOR REAL-TIME SITUATIONAL AWARENESS AND NETWORKED COMMAND INTEGRATION TO DRIVE MARKET

- 10.4.2 KEY PROGRAMS PROCURED BY AIR FORCE

- 10.4.2.1 Arrow-3

- 10.4.2.2 David's Sling

- 10.4.2.3 Iron Dome

- 10.4.2.4 S-400

- 10.4.2.5 AIM-120 AMRAAM

- 10.4.2.6 DN-3

- 10.4.2.7 HQ-20

- 10.4.2.8 Iron Beam

11 INTEGRATED AIR AND MISSILE DEFENSE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 PESTLE ANALYSIS

- 11.2.2 US

- 11.2.2.1 Comprehensive modernization programs and sustained procurement to drive market

- 11.2.3 CANADA

- 11.2.3.1 Need to counter evolving threats to drive market

- 11.3 EUROPE

- 11.3.1 PESTLE ANALYSIS

- 11.3.2 UK

- 11.3.2.1 Domestic defense modernization strategy to drive market

- 11.3.3 GERMANY

- 11.3.3.1 ESSI leadership and expanded IRIS-T SLM procurement to drive market

- 11.3.4 FRANCE

- 11.3.4.1 Defense upgrade programs and strong maritime capabilities to drive market

- 11.3.5 ITALY

- 11.3.5.1 Commitment to multinational defense to drive market

- 11.3.6 SPAIN

- 11.3.6.1 Patriot modernization and Aegis-equipped frigate expansion to drive market

- 11.3.7 POLAND

- 11.3.7.1 Expanding IAMD capabilities through WISLA and NAREW to drive market

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 PESTLE ANALYSIS

- 11.4.2 CHINA

- 11.4.2.1 Focus on military modernization as part of PLA reforms to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Rising threats from North Korea's ballistic missile program and China's missile arsenal to drive market

- 11.4.4 INDIA

- 11.4.4.1 Development of indigenous ballistic missile defense systems to drive market

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Regional security challenges to drive market

- 11.4.6 AUSTRALIA

- 11.4.6.1 Strong push toward layered air defense and advanced radar integration to drive market

- 11.4.7 SINGAPORE

- 11.4.7.1 Aster 30 upgrade and allied partnerships to drive market

- 11.4.8 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST

- 11.5.1 PESTLE ANALYSIS

- 11.5.2 GCC

- 11.5.2.1 UAE

- 11.5.2.1.1 THAAD, PAC-3, and EDGE programs to drive market

- 11.5.2.2 Saudi Arabia

- 11.5.2.2.1 Repeated threats from ballistic and cruise missiles to drive market

- 11.5.2.1 UAE

- 11.5.3 ISRAEL

- 11.5.3.1 Iron Dome, David's Sling, and Arrow expansion to drive market

- 11.5.4 TURKEY

- 11.5.4.1 Indigenous development and NATO cooperation to drive market

- 11.5.5 REST OF MIDDLE EAST

- 11.6 REST OF THE WORLD

- 11.6.1 PESTLE ANALYSIS

- 11.6.2 LATIN AMERICA

- 11.6.2.1 Selective procurement of NASAMS, Spyder, and Indigenous Radar Programs to drive market

- 11.6.3 AFRICA

- 11.6.3.1 Advanced system procurements in Algeria and Morocco to drive market

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 12.3 REVENUE ANALYSIS, 2021-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 System footprint

- 12.7.5.4 Component footprint

- 12.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.8.5.1 List of start-ups/SMEs

- 12.8.5.2 Competitive benchmarking of start-ups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 DEALS

- 12.9.2 OTHERS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 RTX

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Others

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 LOCKHEED MARTIN CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Others

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 MBDA

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 NORTHROP GRUMMAN

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Others

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 IAI

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Others

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 THALES

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Others

- 13.1.7 RHEINMETALL AG

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Others

- 13.1.8 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Others

- 13.1.9 KONGSBERG

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Others

- 13.1.10 HANWHA GROUP

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 ASELSAN A.S.

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.12 DIEHL STIFTUNG & CO. KG

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.13 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Deals

- 13.1.14 LIG NEX1

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Others

- 13.1.15 HENSOLDT AG

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Deals

- 13.1.15.3.2 Others

- 13.1.1 RTX

- 13.2 OTHER PLAYERS

- 13.2.1 ALMAZ-ANTEY

- 13.2.2 CHINA AEROSPACE SCIENCE AND TECHNOLOGY CORPORATION

- 13.2.3 BHARAT DYNAMICS LIMITED

- 13.2.4 BHARAT ELECTRONICS LIMITED

- 13.2.5 SAAB AB

- 13.2.6 ELBIT SYSTEMS LTD.

- 13.2.7 LEONARDO DRS

- 13.2.8 EDGE GROUP PJSC

- 13.2.9 INDRA SISTEMAS, S.A.

- 13.2.10 ROKETSAN

14 APPENDIX

- 14.1 LONG LIST OF COMPANIES

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS