|

시장보고서

상품코드

1856920

환자 안전 및 위험 소프트웨어 시장 : 기능별, 전개 모드별, 최종사용자별, 지역별 - 예측(-2030년)Patient Safety and Risk Software Market by Function (Incident Reporting, Compliance, Clinical Safety, Claims Management), End User, Deployment, and Region - Global Forecasts to 2030 |

||||||

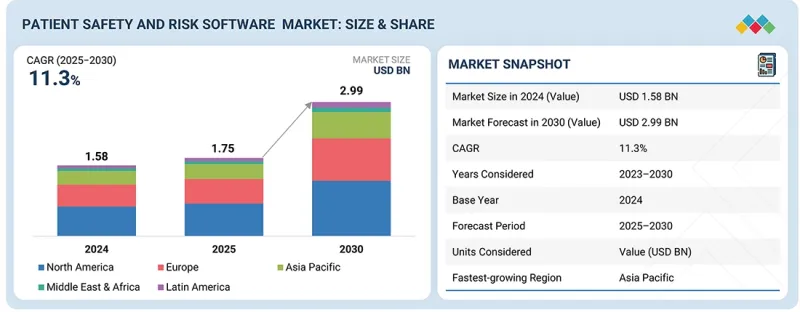

세계의 환자 안전 및 위험 소프트웨어 시장 규모는 2025년 17억 5,000만 달러에서 2030년에는 29억 9,000만 달러에 이를 것으로 예측되어 예측 기간 중 연평균 복합 성장률(CAGR)은 11.36%와 높다고 보여지고 있습니다.

환자 안전 및 위험 소프트웨어 시장은 의료 실수를 최소화하고 의료의 질을 향상시키는 것을 목표로 전 세계 의료 시스템에서 중요한 우선순위로 떠오르고 있습니다. 부작용 발생률 증가, 의료 서비스 제공의 복잡성 증가, 가치 기반 치료 모델로의 전환이 이 시장의 성장을 가속하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 기능별, 전개 모드별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

FDA, EMA, The Joint Commission 등의 규제 프레임워크는 엄격한 보고, 모니터링, 컴플라이언스를 의무화하고 있으며, 의료기관과 생명과학 기업들은 첨단 PSRM 솔루션을 도입해야 하는 상황에 직면해 있습니다. 동시에 미국 보건복지부의 환자안전 프로그램, EU의 약물감시 규제 등 정부 차원의 노력도 도입을 가속화하고 있습니다. 그러나 높은 도입 비용, 세계 표준화 부족, 레거시 시스템과의 통합 문제, 안전사고의 과소보고 등의 장벽이 여전히 보급을 제한하고 있습니다.

컴플라이언스 및 거버넌스 분야는 예측 기간 동안 가장 빠르게 성장하는 분야로, 규제 요건을 충족하고 헬스케어 업무의 투명성을 유지하는 것이 중요해졌기 때문입니다. 표준화된 보고 및 감사 추적의 필요성과 함께 규제 기관의 감시가 강화됨에 따라, 헬스케어 조직은 고급 컴플라이언스 관리 솔루션을 채택하고 있습니다. 이러한 도구는 품질 기준, 데이터 보호 규정, 환자 안전 프로토콜을 준수하도록 보장함으로써 헬스케어 생태계 전반의 위험 감소와 업무 효율화를 지원합니다.

클라우드 기반 부문은 디지털 헬스 기술 채택 증가와 유연하고 확장 가능한 배포 모델로의 전환에 힘입어 가장 빠르게 성장하고 있는 부문입니다. 클라우드 솔루션은 헬스케어 환경 전반에 걸쳐 원활한 데이터 액세스, 상호운용성, 실시간 협업을 제공하여 보다 신속한 의사결정과 환자 안전 결과를 개선할 수 있도록 지원합니다. 또한, 초기 비용 절감, IT 인프라 요구 사항 감소, 높은 수준의 암호화 및 컴플라이언스 조치로 인한 데이터 보안 강화는 이 시장에서 클라우드 기반 플랫폼의 채택을 더욱 가속화하고 있습니다.

아시아태평양은 전례 없는 헬스케어 디지털화, 정부 이니셔티브, 대규모 기술 투자로 인해 환자 안전 및 위험 소프트웨어 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 예를 들어, 중국의 스마트 병원 프로그램은 2025년까지 1,000개 이상의 공공 병원을 통합 IT 솔루션으로 업그레이드하는 것을 목표로 하고 있습니다. 의료사고 증가, 의료 인프라의 확대, 인도, 중국, 동남아시아 등 신흥국 전반의 EHR/EMR 통합 추진으로 인해 EHR/EMR 통합이 더욱 확산되고 있습니다. 이 지역의 의약품 및 의료기기 분야가 확대되고 환자 수가 증가함에 따라 효율적인 위험 관리 및 안전 솔루션에 대한 수요가 증가하고 있습니다.

세계의 환자안전 및 위험 소프트웨어 시장에 대해 조사했으며, 기능별, 전개 모드별, 최종사용자별, 지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 업계 동향

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 기술 분석

- 특허 분석

- 2025년-2027년 주요 컨퍼런스 및 이벤트

- 사례 연구 분석

- 규제 상황

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 최종사용자 분석

- 비즈니스 모델

- AI/생성형 AI가 환자 안전 및 위험 소프트웨어 시장에 미치는 영향

- 2025년 미국 관세의 영향

제6장 환자 안전 및 위험 소프트웨어 시장(기능별)

- 서론

- 위험 및 안전 관리

- 컴플라이언스 및 거버넌스

- 임상 안전 관리

- 재무 및 법적 위험 처리

제7장 환자 안전 및 위험 소프트웨어 시장(전개 모드별)

- 서론

- On-Premise 전개

- 클라우드 기반 전개

- 하이브리드 전개

제8장 환자 안전과 위험 소프트웨어 시장(최종사용자별)

- 서론

- 의료 제공자

- 제약 기업 및 바이오테크놀러지 기업

- 의료비 지불자

- 의료 기술 기업

- 기타

제9장 환자 안전 및 위험 소프트웨어 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 남아프리카공화국

- 기타

제10장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점

- 매출 점유율 분석, 2020년-2024년

- 시장 점유율 분석, 2024년

- 브랜드/소프트웨어 비교

- 기업 평가와 재무 지표

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제11장 기업 개요

- 주요 시장 진출기업

- RISKONNECT, INC.

- ORIGAMI RISK LLC

- RLDATIX

- HEALTH CATALYST

- SYMPLR

- CLARITY GROUP, INC.

- PERFORMANCE HEALTH PARTNERS

- MORCARE

- RISKQUAL TECHNOLOGIES, INC.

- PRISTA CORPORATION

- SAFEQUAL

- IQVIA

- INOVALON

- NAVEX GLOBAL, INC.

- CENSINET

- AMERICAN DATA NETWORK

- ARVENTA

- COMPLIANCEQUEST

- RADAR HEALTHCARE INC

- PASCAL METRICS INC.

- 기타 기업

- OMNIGO

- LOGICMANAGER, INC.

- DEXUR

- HEALTHCARE GRC PTE LTD.

- NOSOTECH INC.

제12장 부록

LSH 25.11.10The global patient safety and risk software market is projected to reach USD 2.99 billion by 2030 from USD 1.75 billion in 2025, at a high CAGR of 11.36% during the forecast period. The patient safety and risk software market is emerging as a critical priority for healthcare systems worldwide, aimed at minimizing medical errors and improving the quality of care. Its growth is being driven by rising incidences of adverse events, increasing complexity of healthcare delivery, and the push toward value-based care models.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Function, Deployment, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Regulatory frameworks from bodies such as the FDA, EMA, and The Joint Commission mandate strict reporting, monitoring, and compliance, compelling providers and life sciences companies to adopt advanced PSRM solutions. At the same time, government initiatives, such as the US Department of Health and Human Services' patient safety programs and the EU's pharmacovigilance regulations, are accelerating adoption. However, barriers such as high implementation costs, lack of global standardization, integration challenges with legacy systems, and underreporting of safety events continue to limit widespread adoption.

Compliance & governance under the function segment is expected to register the fastest growth during the forecast period.

The compliance & governance segment is the fastest-growing segment during the forecast period, driven by the rising emphasis on meeting regulatory requirements and maintaining transparency in healthcare operations. Increasing scrutiny from regulatory bodies, coupled with the need for standardized reporting and audit trails, is encouraging healthcare organizations to adopt advanced compliance management solutions. These tools help ensure adherence to quality standards, data protection regulations, and patient safety protocols, thereby supporting risk mitigation and operational efficiency across the healthcare ecosystem.

The cloud-based deployment segment is projected to register the fastest growth during the forecast period.

The cloud-based segment is the fastest-growing segment, driven by the rising adoption of digital health technologies and the shift toward flexible, scalable deployment models. Cloud solutions offer seamless data access, interoperability, and real-time collaboration across healthcare settings, enabling faster decision-making and improved patient safety outcomes. Additionally, lower upfront costs, reduced IT infrastructure requirements, and enhanced data security through advanced encryption and compliance measures are further accelerating the adoption of cloud-based platforms in this market.

Asia Pacific is expected to witness the highest growth rate during the forecast period.

The Asia Pacific region is positioned to register the highest CAGR in the patient safety and risk software market, driven by unprecedented healthcare digitization, government initiatives, and substantial technology investments. For example, the smart hospital program in China aims to upgrade over 1,000 public hospitals by 2025 with integrated IT solutions. The growing burden of medical errors, expansion of healthcare infrastructure, and the push for EHR/EMR integration across emerging economies such as India, China, and Southeast Asia are further fueling adoption. The expanding pharmaceutical and medical device sectors in the region, coupled with a rising patient population, are creating strong demand for efficient risk management and safety solutions.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the authentication and brand protection marketplace. The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1: 31%, Tier 2: 28%, and Tier 3: 41%

- By Designation - C Level: 31%, Director Level: 25%, and Others: 44%

- By Region - North America: 32%, Europe: 32%, Asia Pacific: 26%, Middle East & Africa: 5%, Latin America: 5%

Key Players

The key players operating in the patient safety and risk software market include Riskonnect, Inc. (US), Origami Risk LLC (US), RLDatix (US), Health Catalyst (US), symplr (US), Clarity Group, Inc. (US), Performance Health Partners (US), MorCare, LLC (US), RiskQual Technologies, Inc. (US), Prista Corporation (US), IQVIA Inc. (US), Inovalon (US), NAVEX Global, Inc. (US), Censinet (US), American Data Network (US), Arventa Pty Ltd (Australia), ComplianceQuest (US), Radar Healthcare Inc (UK), Pascal Metrics Inc. (US), and SafeQual Health (US)

Research Coverage

The report analyzes the patient safety and risk software market and estimate the market size and future growth potential of various market segments, based on function, deployment mode, end user, and region. The report also provides a competitive analysis of the key players operating in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a higher share of the market. Firms purchasing the report could use one or a combination of the following strategies to strengthen their positions in the market.

This report provides insights into:

- Analysis of key drivers (rising patient safety incidents, increasing prioritization of patient safety, escalating healthcare costs and shift toward value-based care models, increasing adoption of digital health technologies), restraints (high implementation and maintenance costs, resistance to adoption and perceived complexity of patient safety and risk software, data privacy and interoperability challenges), opportunities (growing adoption of AI, predictive analytics, and automation, increasing adoption of patient safety and risk software into MedTech and pharma safety domains, integration of patient safety and risk software with population health and real-world evidence platforms), challenges (lack of global standardization in safety reporting, complex integration with legacy systems, limited awareness and underreporting of safety incidents)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and solution launches in the patient safety and risk software market.

- Market Development: Comprehensive information on the lucrative emerging markets, function, deployment mode, end user, and region

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the patient safety and risk software market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the patient safety & risk software market such as Riskonnect, Inc. (US), Origami Risk LLC (US), RLDatix (US), symplr (US), and Radar Healthcare Inc (UK)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Insights from primary experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.4.1 MARKET SIZING ASSUMPTIONS

- 2.4.2 OVERALL STUDY ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.5.1 METHODOLOGY-RELATED LIMITATIONS

- 2.5.2 SCOPE-RELATED LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 PATIENT SAFETY AND RISK SOFTWARE MARKET OVERVIEW

- 4.2 PATIENT SAFETY AND RISK SOFTWARE MARKET, BY END USER AND REGION

- 4.3 PATIENT SAFETY AND RISK SOFTWARE MARKET: GEOGRAPHIC SNAPSHOT

- 4.4 PATIENT SAFETY AND RISK SOFTWARE MARKET: DEVELOPED MARKETS VS. EMERGING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising patient safety incidents

- 5.2.1.2 Increasing prioritization of patient safety

- 5.2.1.3 Escalating healthcare costs and shift toward value-based care models

- 5.2.1.4 Increasing adoption of digital health technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High implementation and maintenance costs

- 5.2.2.2 Resistance to adoption and perceived complexity of patient safety and risk software

- 5.2.2.3 Data privacy and interoperability challenges

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of AI, predictive analytics, and automation

- 5.2.3.2 Increasing adoption of patient safety and risk solutions into MedTech and pharma safety domains

- 5.2.3.3 Integration of patient safety and risk software with population health and real-world evidence platforms

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of global standardization in safety reporting

- 5.2.4.2 Complex integration with legacy systems

- 5.2.4.3 Limited awareness and underreporting of safety events

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 MOBILE HEALTH PLATFORMS

- 5.3.2 CLOUD-BASED ALARM MANAGEMENT SOLUTION

- 5.3.3 IOT-ENABLED SOLUTIONS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING ANALYSIS, BY KEY PLAYER

- 5.5.2 INDICATIVE PRICING ANALYSIS, BY REGION

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 AI-powered risk scoring

- 5.9.1.2 Automated root cause analysis

- 5.9.1.3 Real-time safety dashboards

- 5.9.1.4 Mobile incident reporting apps

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Cloud SaaS platforms

- 5.9.2.2 Blockchain

- 5.9.3 COMPLEMENTARY TECHNOLOGIES

- 5.9.3.1 EHR/EMR integration

- 5.9.3.2 Claims and billing systems

- 5.9.3.3 Credentialing systems

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.10.1 PATENT PUBLICATION TREND

- 5.10.2 LIST OF PATENTS

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2027

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 ADOPTION OF VIRTUAL OBSERVATION SOLUTION TO REDUCE FALL RATES IN PATIENTS

- 5.12.2 UTILIZATION OF ENTERPRISE RISK MANAGEMENT SYSTEM FOR ENHANCED PATIENT SAFETY

- 5.12.3 USE OF COMPREHENSIVE HEALTHCARE RISK MANAGEMENT SOFTWARE FOR IMPROVED REGULATORY COMPLIANCE

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 BARGAINING POWER OF SUPPLIERS

- 5.14.2 BARGAINING POWER OF BUYERS

- 5.14.3 THREAT OF NEW ENTRANTS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 END-USER ANALYSIS

- 5.16.1 UNMET NEEDS

- 5.16.2 END-USER EXPECTATIONS

- 5.17 BUSINESS MODEL

- 5.17.1 SUBSCRIPTION LICENSING

- 5.17.2 MODULAR PLATFORM APPROACH

- 5.17.3 IMPLEMENTATION AND INTEGRATION FEES

- 5.17.4 VALUE-ADDED SERVICES

- 5.17.5 MARKETPLACE INTEGRATION AND REGIONAL PRICING

- 5.18 IMPACT OF AI/GEN AI ON PATIENT SAFETY AND RISK SOFTWARE MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 TOP USE CASES AND MARKET POTENTIAL

- 5.18.3 KEY USE CASES

- 5.18.4 CASE STUDY ON AI/GENERATIVE AI IMPLEMENTATION

- 5.18.4.1 Use of AI-powered data extraction platform with risk management software

- 5.18.5 INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.18.5.1 Pharmacovigilance and drug safety monitoring

- 5.18.5.2 Healthcare information exchange

- 5.18.5.3 Quality improvement software

- 5.18.5.4 Healthcare GRC

- 5.18.6 USER READINESS AND IMPACT ASSESSMENT

- 5.18.6.1 Healthcare providers

- 5.18.6.2 Pharmaceutical & biotechnology companies

- 5.19 IMPACT OF 2025 US TARIFF

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.4.1 US

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END-USE INDUSTRIES

6 PATIENT SAFETY AND RISK SOFTWARE MARKET, BY FUNCTION

- 6.1 INTRODUCTION

- 6.2 RISK & SAFETY MANAGEMENT

- 6.2.1 INCIDENT REPORTING SYSTEMS

- 6.2.1.1 Need for real-time reporting and automated workflows to support growth

- 6.2.2 EVENT MANAGEMENT & ROOT CAUSE ANALYSIS SOFTWARE

- 6.2.2.1 Ability to analyze incident patterns and implement risk mitigation to promote growth

- 6.2.3 PATIENT LEARNING SYSTEMS

- 6.2.3.1 Increasing focus on improving patient safety to foster growth

- 6.2.1 INCIDENT REPORTING SYSTEMS

- 6.3 COMPLIANCE & GOVERNANCE

- 6.3.1 RISK/COMPLIANCE MONITORING AND ANALYTICS SOFTWARE

- 6.3.1.1 Evolving need for continuous surveillance of organizational activities to aid growth

- 6.3.2 GOVERNANCE, RISK, AND COMPLIANCE PLATFORMS

- 6.3.2.1 Growing shift from reactive compliance management to proactive risk prevention to boost market

- 6.3.1 RISK/COMPLIANCE MONITORING AND ANALYTICS SOFTWARE

- 6.4 CLINICAL SAFETY CONTROLS

- 6.4.1 MEDICATION SAFETY & PHARMACY-LEVEL CONTROL SOFTWARE

- 6.4.1.1 Need to prevent medication errors to contribute to growth

- 6.4.2 INFECTION CONTROL SYSTEMS

- 6.4.2.1 Rise in proactive surveillance, rapid intervention, and continuous monitoring to expedite growth

- 6.4.1 MEDICATION SAFETY & PHARMACY-LEVEL CONTROL SOFTWARE

- 6.5 FINANCIAL & LEGAL RISK HANDLING

- 6.5.1 CLAIMS MANAGEMENT SOLUTIONS

- 6.5.1.1 Need to leverage data-driven claims management to minimize costs to favor growth

- 6.5.2 REVENUE INTEGRITY & RISK MANAGEMENT SOLUTIONS

- 6.5.2.1 Growing focus on minimizing financial and legal risks to propel market

- 6.5.1 CLAIMS MANAGEMENT SOLUTIONS

7 PATIENT SAFETY AND RISK SOFTWARE MARKET, BY DEPLOYMENT MODE

- 7.1 INTRODUCTION

- 7.2 ON-PREMISE DEPLOYMENT

- 7.2.1 HIGHER CONTROL, SECURITY, AND CUSTOMIZATION TO BOLSTER GROWTH

- 7.3 CLOUD-BASED DEPLOYMENT

- 7.3.1 NEED TO REDUCE IT OVERHEAD AND ENABLE FASTER INNOVATION TO SPUR GROWTH

- 7.4 HYBRID DEPLOYMENT

- 7.4.1 ABILITY TO SUPPORT REAL-TIME INCIDENT REPORTING, ROOT CAUSE ANALYSIS, AND COMPLIANCE MONITORING TO DRIVE MARKET

8 PATIENT SAFETY AND RISK SOFTWARE MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HEALTHCARE PROVIDERS

- 8.2.1 HOSPITALS

- 8.2.1.1 Rising demand for high-quality care and patient safety to accelerate growth

- 8.2.2 CLINICS

- 8.2.2.1 Increasing demand for quality care in outpatient and ambulatory settings to facilitate growth

- 8.2.3 AMBULATORY CARE CENTERS

- 8.2.3.1 Growing shift toward outpatient and value-based care models to drive market

- 8.2.4 LONG-TERM CARE CENTERS

- 8.2.4.1 Increasing focus on elderly care and patients with chronic conditions to aid growth

- 8.2.5 PHARMACIES

- 8.2.5.1 Enhanced medical safety and regulatory compliance to augment growth

- 8.2.6 OTHER HEALTHCARE PROVIDERS

- 8.2.1 HOSPITALS

- 8.3 PHARMACEUTICAL & BIOTECH COMPANIES

- 8.3.1 NEED TO MAINTAIN PRODUCT QUALITY, REGULATORY COMPLIANCE, AND PHARMACOVIGILANCE TO ENCOURAGE GROWTH

- 8.4 HEALTHCARE PAYERS

- 8.4.1 INCREASING ADOPTION OF PATIENT SAFETY AND RISK SOFTWARE FOR ENHANCED QUALITY ACROSS HEALTHCARE ECOSYSTEM TO AID GROWTH

- 8.5 MEDTECH COMPANIES

- 8.5.1 GROWING RISK OF DATA INTEGRITY AND CYBERSECURITY TO FUEL MARKET

- 8.6 OTHER END USERS

9 PATIENT SAFETY AND RISK SOFTWARE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Increasing initiatives for improving patient and healthcare workforce safety to aid growth

- 9.2.3 CANADA

- 9.2.3.1 Rise in patient safety improvement programs to contribute to growth

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Targeted government policies and push toward modernizing healthcare delivery to propel market

- 9.3.3 UK

- 9.3.3.1 Growing initiatives on improving patient outcomes and reducing medical errors to drive market

- 9.3.4 FRANCE

- 9.3.4.1 Increasing use of integrated digital platforms in hospitals to expedite growth

- 9.3.5 ITALY

- 9.3.5.1 Favorable national legislation and regional healthcare policies to promote growth

- 9.3.6 SPAIN

- 9.3.6.1 Rising commitment toward enhanced healthcare quality and culture of safety to aid growth

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Increasing deployment of critical incident reporting systems and EHR-linked safety modules to fuel market

- 9.4.3 JAPAN

- 9.4.3.1 Growing focus on supporting error reporting, root cause analysis, and clinical protocols to boost market

- 9.4.4 INDIA

- 9.4.4.1 Strong public-private sector initiatives to support growth

- 9.4.5 AUSTRALIA

- 9.4.5.1 Increasing emphasis on quality improvement across public and private hospitals to spur growth

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Innovation-driven healthcare ecosystem to facilitate growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Increasing focus on reducing adverse events and hospital-acquired infections to encourage growth

- 9.5.3 MEXICO

- 9.5.3.1 Expanding healthcare digitization and national policies promoting patient safety to drive market

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Saudi Arabia

- 9.6.2.1.1 Increasing modernization efforts in healthcare to accelerate growth

- 9.6.2.2 UAE

- 9.6.2.2.1 Evolving digital health landscape to favor growth

- 9.6.2.3 Rest of GCC countries

- 9.6.2.1 Saudi Arabia

- 9.6.3 SOUTH AFRICA

- 9.6.3.1 Increasing awareness about patient safety in public and private healthcare sectors to boost market

- 9.6.4 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PATIENT SAFETY AND RISK SOFTWARE MARKET

- 10.3 REVENUE SHARE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 BRAND/SOFTWARE COMPARISON

- 10.6 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6.1 COMPANY VALUATION

- 10.6.2 FINANCIAL METRICS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Deployment mode footprint

- 10.7.5.4 Function footprint

- 10.7.5.5 End-user footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 SOLUTION LAUNCHES AND ENHANCEMENTS

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 RISKONNECT, INC.

- 11.1.1.1 Business overview

- 11.1.1.2 Solutions offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Solution launches and enhancements

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 ORIGAMI RISK LLC

- 11.1.2.1 Business overview

- 11.1.2.2 Solutions offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Solution launches and enhancements

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 RLDATIX

- 11.1.3.1 Business overview

- 11.1.3.2 Solutions offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Solution launches and enhancements

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 HEALTH CATALYST

- 11.1.4.1 Business overview

- 11.1.4.2 Solutions offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Solution launches and enhancements

- 11.1.4.3.2 Deals

- 11.1.5 SYMPLR

- 11.1.5.1 Business overview

- 11.1.5.2 Solutions offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Solution launches and enhancements

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 CLARITY GROUP, INC.

- 11.1.6.1 Business overview

- 11.1.6.2 Solutions offered

- 11.1.7 PERFORMANCE HEALTH PARTNERS

- 11.1.7.1 Business overview

- 11.1.7.2 Solutions offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.8 MORCARE

- 11.1.8.1 Business overview

- 11.1.8.2 Solutions offered

- 11.1.9 RISKQUAL TECHNOLOGIES, INC.

- 11.1.9.1 Business overview

- 11.1.9.2 Solutions offered

- 11.1.10 PRISTA CORPORATION

- 11.1.10.1 Business overview

- 11.1.10.2 Solutions offered

- 11.1.11 SAFEQUAL

- 11.1.11.1 Business overview

- 11.1.11.2 Solutions offered

- 11.1.12 IQVIA

- 11.1.12.1 Business overview

- 11.1.12.2 Solutions offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Solution launches and enhancements

- 11.1.12.3.2 Deals

- 11.1.13 INOVALON

- 11.1.13.1 Business overview

- 11.1.13.2 Solutions offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Solution launches and enhancements

- 11.1.14 NAVEX GLOBAL, INC.

- 11.1.14.1 Business overview

- 11.1.14.2 Solutions offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Solution launches and enhancements

- 11.1.14.3.2 Deals

- 11.1.14.3.3 Expansions

- 11.1.15 CENSINET

- 11.1.15.1 Business overview

- 11.1.15.2 Solutions offered

- 11.1.15.3 Recent developments

- 11.1.15.3.1 Solution launches and enhancements

- 11.1.16 AMERICAN DATA NETWORK

- 11.1.16.1 Business overview

- 11.1.16.2 Solutions offered

- 11.1.17 ARVENTA

- 11.1.17.1 Business overview

- 11.1.17.2 Solutions offered

- 11.1.18 COMPLIANCEQUEST

- 11.1.18.1 Business overview

- 11.1.18.2 Solutions offered

- 11.1.18.3 Recent developments

- 11.1.18.3.1 Solution launches and enhancements

- 11.1.18.3.2 Deals

- 11.1.19 RADAR HEALTHCARE INC

- 11.1.19.1 Business overview

- 11.1.19.2 Solutions offered

- 11.1.20 PASCAL METRICS INC.

- 11.1.20.1 Business overview

- 11.1.20.2 Solutions offered

- 11.1.1 RISKONNECT, INC.

- 11.2 OTHER PLAYERS

- 11.2.1 OMNIGO

- 11.2.2 LOGICMANAGER, INC.

- 11.2.3 DEXUR

- 11.2.4 HEALTHCARE GRC PTE LTD.

- 11.2.5 NOSOTECH INC.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS