|

시장보고서

상품코드

1858522

일회용 바이오프로세싱 시장 예측(-2030년) : 제품 유형별, 용도별, 워크플로우별, 분자 유형별Single-use Bioprocessing Market by Product (Equipment, Consumables ), Application, Workflow, Molecule Type - Global Forecast to 2030 |

||||||

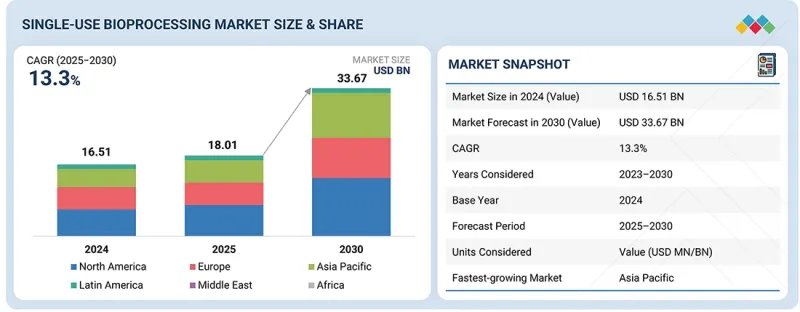

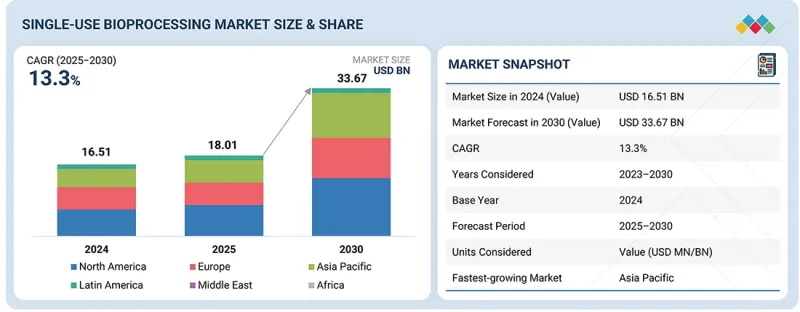

세계의 일회용 바이오프로세싱 시장 규모는 2025년에 180억 1,000만 달러, 2030년까지 336억 7,000만 달러로 예측되며, 2025-2030년에 CAGR로 13.3%의 성장이 전망됩니다.

시장의 성장은 개발제조수탁기관(CDMO) 및 제조수탁기관(CMO) 사이에서 일회용 기술 채택이 증가하고 있으며, 기존 스테인리스 시스템에 비해 일회용 시스템에 필요한 장비 투자가 줄어들고 있기 때문인 것으로 판단됩니다. 또한 생산성 향상과 교차 오염 위험 감소가 시장을 크게 견인하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제품, 용도, 워크플로우, 분자 유형, 최종사용자 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

기존의 스테인리스강 시스템은 종종 시간이 많이 소요되는 세척과 배치 간 검증이 필요하며, 이는 상당한 다운타임과 리소스 할당으로 이어집니다. 반면 일회용 시스템은 일회용 부품을 사용하여 대규모 세척 처리의 필요성을 없애고 합리적인 접근 방식을 제공합니다. 이 기능을 통해 제조업체는 제품 교체 및 공정 전환을 가속화하여 장비 가동률과 전체 생산 처리량을 극대화할 수 있습니다.

"업스트림 바이오프로세스 부문이 예측 기간 중 가장 높은 CAGR을 나타낼 것으로 예측됩니다."

워크플로우에 따라 일회용 바이오프로세싱 시장은 업스트림 바이오프로세스와 다운스트림 바이오프로세스로 구분됩니다. 2024년, 일회용 바이오프로세싱 시장에서 가장 큰 점유율을 차지한 것은 업스트림 바이오프로세싱 부문입니다. 이는 세포주 발효를 위한 일련의 준비 과정을 포함하며, 관류 및 페드배치와 같은 다양한 방법으로 수행될 수 있습니다. 이 생명공학 공정은 미생물의 적절한 보관, 세포 분리, 최종 수확까지의 배양 등 여러 단계를 포함합니다. 또한 이 부문의 성장은 바이오의약품의 제형화에 일회용 바이오프로세싱의 활용이 확대되고 있기 때문인 것으로 보입니다.

"제약 및 생명공학 기업 부문이 2024년 가장 큰 점유율을 차지했습니다."

2024년 세계 일회용 바이오프로세싱 시장에서 제약 및 생명공학 기업 부문이 최종사용자별로 가장 큰 점유율을 차지할 것으로 예측됩니다. 일회용 장비는 제품/배치 교차 오염의 위험을 줄이고, 제품 무결성을 높이고, 가동 중지 시간을 줄이고, 세척 비용을 줄이고, 시설 설치 비용을 줄이고, 제조 공간을 줄이고, 시설의 유연성과 적응성을 향상시킵니다. 이러한 장점으로 인해 제약 및 바이오 제약 기업에서 일회용 바이오프로세싱 제품의 채택이 증가하고 있습니다. 북미와 유럽과 같은 선진국 시장에서 일회용 바이오프로세싱 장비와 소모품이 널리 사용되고 있다는 점이 시장 성장을 지원하고 있습니다.

"미국이 2024년 북미 일회용 바이오프로세싱 시장을 독식했습니다."

미국은 세계 최대 바이오의약품 시장이며, 바이오의약품 연구/투자의 선두주자입니다. 일회용 바이오프로세싱 제품에 대한 수요는 바이오의약품에 대한 관심이 높아지고 의료 산업에서 안전하고 고품질의 제품에 대한 요구가 증가함에 따라 향후 수년간 확대될 것으로 예측됩니다. 의료 인프라 개선, 정부의 강력한 바이오테크놀러지 연구 및 첨단 제조 지원, 혁신적인 바이오프로세스 기술에 대한 민간 자금 지원으로 연구개발 측면에서 매우 발전된 시장으로 성장하고 있습니다. 이는 연구에 사용되는 혁신적인 첨단 기술 개발에 도움이 되고 있습니다. 제약기업은 생물제제 및 바이오시밀러 개발에 적극적으로 참여하고 있으며, 납기가 짧고 설치비용이 낮으며 에너지 효율이 높은 일회용 바이오프로세싱의 사용이 증가하고 있습니다. 이러한 요인들이 국내 일회용 바이오프로세싱 시장의 성장을 지원하고 있습니다.

세계의 일회용 바이오프로세싱 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 제공하고 있습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 중요 인사이트

- 세계의 일회용 바이오프로세스 시장 스냅숏

- 북미의 일회용 바이오프로세스 시장 : 용도별, 국가별(2024년)

- 일회용 바이오프로세스 시장 : 지역적 성장 기회

- 미충족 요구와 화이트 스페이스

- 상호접속된 시장과 부문 횡단적인 기회

- 새로운 비즈니스 모델과 에코시스템의 변화

- 성장 기회의 전략적 분석

- 지속가능성에 대한 영향과 규제 정책 구상

- VC/사모펀드 투자의 동향과 스타트업의 상황

제5장 시장 개요

- 서론

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

제6장 산업 동향

- 고객 비즈니스에 영향을 미치는 동향/혼란

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 구매 프로세스에서 주요 이해관계자

- 주요 구입 기준

- 채택 장벽과 내부 과제

- 가격결정 분석

- 일회용 바이오프로세스 제품의 가격결정 분석 : 주요 기업별(2024년)

- 일회용 바이오리액터의 가격 분석 : 지역별(2024년)

- 밸류체인 분석

- 에코시스템 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 특허 분석

- 일회용 바이오프로세스 특허의 주요출원자/소유주(기업)(2014-2024년)

- 특허 참고 리스트

- 주요 컨퍼런스와 이벤트(2025-2026년)

- 규제 분석

- 규제기관, 정부기관, 기타 조직

- 규제 구조

- 지속가능성 구상

- 투자와 자금조달 시나리오

- 무역 분석

- HS 코드 902720과 842129의 수입 데이터(2020-2024년)

- HS 코드 902720과 842129의 수출 데이터(2020-2024년)

- 성공 사례와 실세계에서의 이용

- SARTORIUS : 일회용 기술에 의한 상업 바이오제조

- THERMO SCIENTIFIC HYPERFORMA 일회용 발효조에 의한 백신의 혁신

- 기술/제품 로드맵

- 향후 응용

- 세포·유전자 치료 제조에서의 일회용 시스템

- 연속 바이오프로세싱과의 통합

- 맞춤형 의료용 첨단 일회용 바이오리액터

- 고객 상황

- 성장 기회의 전략적 분석

- 다양한 최종 용도 산업으로부터의 미충족 요구

- 일회용 바이오프로세스 시장에 대한 AI/생성형 AI의 영향

- 주요 사용 사례와 시장의 장래성

- 일회용 바이오프로세스 시장에서 AI 도입의 사례 연구

- 일회용 바이오프로세스의 베스트 프랙티스

- 일회용 바이오프로세스 시장에 대한 2025년 미국 관세의 영향

- 서론

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종 용도 산업에 대한 영향

제7장 일회용 바이오프로세스 시장 : 제품별

- 서론

- 기기

- 일회용 바이오리액터

- 일회용 여과 시스템

- 일회용 혼합 시스템

- 일회용 크로마토그래피 시스템

- 기타 일회용 기기

- 소모품

- 일회용 백·용기

- 일회용 필터

- 일회용 어셈블리

- 일회용 크로마토그래피 컬럼

- 일회용 센서

- 기타 일회용 소모품

제8장 일회용 바이오프로세스 시장 : 용도별

- 서론

- 여과

- 세포배양

- 혼합

- 정제

- 보관·이송

- 기타 용도

제9장 일회용 바이오프로세스 시장 : 워크플로우별

- 서론

- 업스트림 바이오프로세스

- 다운스트림 바이오프로세스

제10장 일회용 바이오프로세스 시장 : 분자 유형별

- 서론

- 모노클로널 항체

- 백신

- 치료용 단백질·펩티드

- 세포·유전자 치료

제11장 일회용 바이오프로세스 시장 : 최종사용자별

- 서론

- 제약·바이오테크놀러지 기업

- CRO·CMO

- 기타 최종사용자

제12장 일회용 바이오프로세스 시장 : 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 한국

- 일본

- 인도

- 호주

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동

- 중동의 거시경제 전망

- GCC 국가

- 기타 중동

- 아프리카

제13장 경쟁 구도

- 서론

- 주요 참여 기업의 전략/강점

- 매출 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업의 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제14장 기업 개요

- 서론

- 주요 기업

- SARTORIUS AG

- DANAHER CORPORATION

- THERMO FISHER SCIENTIFIC INC.

- MERCK KGAA

- AVANTOR, INC.

- SOLVENTUM

- REPLIGEN CORPORATION

- ENTEGRIS

- GETINGE

- PARKER HANNIFIN CORP.

- ALFA LAVAL

- SAINT-GOBAIN

- EPPENDORF SE

- CORNING INCORPORATED

- EATON

- METTLER TOLEDO

- PORVAIR

- LONZA

- 기타 기업

- ABEC

- SINGLE USE SUPPORT

- NEWAGE INDUSTRIES

- BROADLEY-JAMES CORPORATION

- PBS BIOTECH, INC.

- SENTINEL PROCESS SYSTEMS INC.

- MEISSNER FILTRATION PRODUCTS, INC.

- SATAKE MULTIMIX CORPORATION

- HAMILTON COMPANY

- MEMBRANE SOLUTIONS

- ANTYLIA SCIENTIFIC

- DISTEK, INC.

- ESCO LIFESCIENCES GROUP

- TECNIC

제15장 부록

KSA 25.11.14The global single-use bioprocessing market is projected to be valued at USD 18.01 billion in 2025 and USD 33.67 billion by 2030, exhibiting a CAGR of 13.3% from 2025 to 2030. The market growth can be attributed to the growing adoption of single-use technologies among contract development and manufacturing organizations (CDMOs) and contract manufacturing organizations (CMOs), and reduced capital investments required for single-use systems compared to traditional stainless-steel systems. Additionally, the market has been significantly driven by increased productivity & reduced risk of cross-contamination.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Application, Workflow, Molecule Type, End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

Traditional stainless-steel systems often require time-consuming cleaning and validation between batches, leading to significant downtime and resource allocation. In contrast, single-use systems offer a streamlined approach, eliminating the need for extensive cleaning procedures by employing disposable components. This feature enables manufacturers to accelerate product substitutions and process transitions, maximizing equipment utilization and overall production throughput.

"Upstream bioprocessing segment is projected to record the highest CAGR during the forecast period"

Based on workflow, the single-use bioprocessing market is segmented into upstream and downstream bioprocessing. In 2024, the upstream bioprocessing segment held the largest share of the single-use bioprocessing market. It involves a series of preparatory steps for fermenting cell lines, which can be executed through various methods, such as perfusion or fed-batch. This biotechnological process covers multiple stages, including the proper storage of microorganisms, cell isolation, and cultivation until the final harvest. Additionally, the segmental growth can be attributed to the escalating use of single-use bioprocessing for biopharmaceutical formulation.

"Pharmaceutical & biotechnology companies segment accounted for the largest share in 2024"

In 2024, the pharmaceutical & biotechnology companies segment accounted for the largest share by end user in the global single-use bioprocessing market. Single-use equipment decreases cross-product/batch contamination risks, increases product integrity, reduces downtime, lowers cleaning costs, decreases facility setup expenses, provides a smaller manufacturing footprint, and improves facility flexibility and adaptability. These advantages bolster the adoption of single-use bioprocessing products in pharmaceutical & biopharmaceutical companies. The widespread use of single-use bioprocessing equipment and consumables in established and developed markets, such as North America and Europe, has supported market growth.

"US dominated the North American single-use bioprocessing market in 2024"

The US is the world's largest biopharmaceutical market and a leader in biopharmaceutical research/investments. The demand for single-use bioprocessing products is expected to grow over the coming years, driven by the increasing focus on biopharmaceuticals and the need for safe & high-quality products in the healthcare industry. It has a highly advanced market in terms of R&D due to the improved healthcare infrastructure, strong government initiatives supporting biotechnology research and advanced manufacturing, and substantial private funding directed toward innovative bioprocessing technologies. This helps develop innovative and advanced technologies for research. Pharmaceutical companies are actively participating in the development of biologics and biosimilars and increasingly utilizing single-use bioprocessing, which offers less turnaround time, has low installation costs, and is energy-efficient. These factors support the growth of the single-use bioprocessing market across the country.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply-side - 70% and Demand-side - 30%

- By Designation: Managers - 45%, CXOs & Directors - 30%, and Executives - 25%

- By Region: North America - 40%, Europe - 25%, Asia Pacific - 25%, Latin America - 5%, and Middle East & Africa - 5%

Merck KGaA (Germany), Sartorius AG (Germany), Danaher Corporation (US), Thermo Fisher Scientific, Inc. (US), Merck KGaA (Germany), Avantor, Inc. (US), Repligen Corporation (US), Entegris (US), Getinge AB (Sweden), and Parker Hannifin Corporation (US) are some of the key players operating in the single-use bioprocessing market.

Research Coverage:

This research report categorizes the single-use bioprocessing market by product [equipment (single-use bioreactors, single-use mixing systems, single-use filtration systems, single-use chromatography systems, and other single-use equipment) and consumables (single-use bags and containers, single-use filters, single-use chromatography columns, single-use assemblies, single-use sensors, and other single-use consumables)]; application (cell culture, filtration, purification, mixing, storage & transfer, and other applications); workflow (upstream and downstream bioprocessing); molecule type (monoclonal antibodies, vaccines, therapeutic proteins & peptides, and cell & gene therapies); end user (pharmaceutical & biotechnology companies, CMOs & CROs, and other end users); and region (North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa). The report's scope covers detailed information regarding the leading factors, such as drivers, restraints, challenges, and opportunities, influencing the market growth. A thorough analysis of key industry players has provided insights into their business overview, products, solutions, key strategies, collaborations, partnerships, and agreements. New launches, collaborations, and acquisitions are the recent developments associated with the single-use bioprocessing market.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall single-use bioprocessing market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (Growing adoption among CDMOs & CMOs, increased productivity & reduced risk of cross contamination, reduced capital investment, environmental sustainability due to reduced water and energy consumption, growing biologics & biosimilars market), restraints (Issues related to leachables & extractables, regulatory compliance issues, and impact of PFAS restrictions on product development), opportunities (untapped market potential in emerging economies, customization options driving growth and innovation), and challenges (lack of standardization, waste disposal, and potential breakage of SU bags) influencing the growth of the market

- Product Development/Innovation: Detailed insights on newly launched products of the single-use bioprocessing market

- Market Development: Comprehensive information about lucrative markets-the report analyses the market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the single-use bioprocessing market

- Competitive Assessment: Sartorius AG (Germany), Danaher Corporation (US), Thermo Fisher Scientific, Inc. (US), Merck KGaA (Germany), Avantor, Inc. (US), Repligen Corporation (US), Entegris (US), Getinge AB (Sweden), and Parker Hannifin Corporation (US), among others in the market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key objectives of secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 GLOBAL SINGLE-USE BIOPROCESSING MARKET ESTIMATION, 2024

- 2.2.1.1 Company revenue analysis (bottom-up approach)

- 2.2.1.2 Company revenue analysis (bottom-up approach) at product level

- 2.2.1.3 MNM repository analysis

- 2.2.1.4 Secondary analysis

- 2.2.1.5 Primary research

- 2.2.1.5.1 Insights from primary experts

- 2.2.2 SEGMENTAL MARKET SIZE ESTIMATION (TOP-DOWN APPROACH)

- 2.2.1 GLOBAL SINGLE-USE BIOPROCESSING MARKET ESTIMATION, 2024

- 2.3 MARKET GROWTH RATE PROJECTIONS

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS & MARKET HIGHLIGHTS

- 3.2 STRATEGIC IMPERATIVES FOR STAKEHOLDERS IN SINGLE-USE BIOPROCESSING MARKET

- 3.3 DISRUPTIVE TRENDS SHAPING SINGLE-USE BIOPROCESSING MARKET

- 3.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

4 PREMIUM INSIGHTS

- 4.1 GLOBAL SINGLE-USE BIOPROCESSING MARKET SNAPSHOT

- 4.2 NORTH AMERICA: SINGLE-USE BIOPROCESSING MARKET, BY APPLICATION AND COUNTRY, 2024

- 4.3 SINGLE-USE BIOPROCESSING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 UNMET NEEDS & WHITE SPACES

- 4.5 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES

- 4.6 EMERGING BUSINESS MODELS & ECOSYSTEM SHIFTS

- 4.7 STRATEGIC ANALYSIS OF GROWTH OPPORTUNITIES

- 4.8 SUSTAINABILITY IMPACT & REGULATORY POLICY INITIATIVES

- 4.9 VC/PRIVATE EQUITY INVESTMENT TRENDS & STARTUP LANDSCAPE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption among CDMOs & CMOs

- 5.2.1.2 Increased productivity and reduced risk of cross-contamination

- 5.2.1.3 Reduced capital investment compared to traditional stainless-steel systems

- 5.2.1.4 Better environmental sustainability due to reduced water and energy consumption

- 5.2.1.5 Growing biologics & biosimilars market

- 5.2.2 RESTRAINTS

- 5.2.2.1 Issues related to leachables and extractables

- 5.2.2.2 Impact of PFAS restrictions on product development

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Untapped market potential in emerging economies

- 5.2.3.2 Customization options for enhanced growth and innovation

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardization

- 5.2.4.2 Environmental and logistical challenges in single-use bioprocessing waste disposal

- 5.2.4.3 Potential breakage of SU bags

- 5.2.4.4 Regulatory compliance issues

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.2 PORTER'S FIVE FORCES ANALYSIS

- 6.2.1 THREAT OF NEW ENTRANTS

- 6.2.2 THREAT OF SUBSTITUTES

- 6.2.3 BARGAINING POWER OF BUYERS

- 6.2.4 BARGAINING POWER OF SUPPLIERS

- 6.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.3 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.3.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.3.2 KEY BUYING CRITERIA

- 6.3.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 6.4 PRICING ANALYSIS

- 6.4.1 INDICATIVE PRICING ANALYSIS OF SINGLE-USE BIOPROCESSING PRODUCTS, BY KEY PLAYER, 2024

- 6.4.2 INDICATIVE PRICING ANALYSIS OF SINGLE-USE BIOREACTORS, BY REGION, 2024

- 6.5 VALUE CHAIN ANALYSIS

- 6.6 ECOSYSTEM ANALYSIS

- 6.6.1 ROLE IN ECOSYSTEM

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.1.1 Filtration

- 6.7.1.2 Chromatography

- 6.7.1.3 Fermentation

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.2.1 Automation & control systems

- 6.7.2.2 3D cell culture

- 6.7.2.3 Continuous bioprocessing

- 6.7.3 ADJACENT TECHNOLOGIES

- 6.7.3.1 Bioprocess modeling & simulation

- 6.7.3.2 Bioprocess monitoring & data analysis

- 6.7.1 KEY TECHNOLOGIES

- 6.8 PATENT ANALYSIS

- 6.8.1 TOP APPLICANTS/OWNERS (COMPANIES) FOR SINGLE-USE BIOPROCESSING PATENTS, 2014-2024

- 6.8.2 INDICATIVE LIST OF PATENTS

- 6.9 KEY CONFERENCES & EVENTS, 2025-2026

- 6.10 REGULATORY ANALYSIS

- 6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10.2 REGULATORY FRAMEWORK

- 6.10.2.1 North America

- 6.10.2.1.1 US

- 6.10.2.1.2 Canada

- 6.10.2.2 Europe

- 6.10.2.2.1 Germany

- 6.10.2.2.2 UK

- 6.10.2.3 Asia Pacific

- 6.10.2.3.1 Japan

- 6.10.2.3.2 China

- 6.10.2.4 Latin America

- 6.10.2.4.1 Brazil

- 6.10.2.1 North America

- 6.10.3 SUSTAINABILITY INITIATIVES

- 6.11 INVESTMENT & FUNDING SCENARIO

- 6.12 TRADE ANALYSIS

- 6.12.1 IMPORT DATA FOR HS CODE 902720 AND 842129, 2020-2024

- 6.12.2 EXPORT DATA FOR HS CODE 902720 AND 842129, 2020-2024

- 6.13 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.13.1 SARTORIUS: COMMERCIAL BIOMANUFACTURING WITH SINGLE-USE TECHNOLOGIES

- 6.13.2 REVOLUTIONIZING VACCINES WITH THERMO SCIENTIFIC HYPERFORMA SINGLE-USE FERMENTOR

- 6.14 TECHNOLOGY/PRODUCT ROADMAP

- 6.15 FUTURE APPLICATIONS

- 6.15.1 SINGLE-USE SYSTEMS IN CELL & GENE THERAPY MANUFACTURING

- 6.15.2 INTEGRATION WITH CONTINUOUS BIOPROCESSING

- 6.15.3 ADVANCED SINGLE-USE BIOREACTORS FOR PERSONALIZED MEDICINE

- 6.16 CUSTOMER LANDSCAPE

- 6.16.1 STRATEGIC ANALYSIS OF GROWTH OPPORTUNITIES

- 6.16.2 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 6.17 IMPACT OF AI/GENERATIVE AI ON SINGLE-USE BIOPROCESSING MARKET

- 6.17.1 TOP USE CASES AND MARKET POTENTIAL

- 6.17.2 CASE STUDIES OF AI IMPLEMENTATION IN SINGLE-USE BIOPROCESSING MARKET

- 6.17.3 BEST PRACTICES IN SINGLE-USE BIOPROCESSING

- 6.18 IMPACT OF 2025 US TARIFF ON SINGLE-USE BIOPROCESSING MARKET

- 6.18.1 INTRODUCTION

- 6.18.2 KEY TARIFF RATES

- 6.18.3 PRICE IMPACT ANALYSIS

- 6.18.4 IMPACT ON COUNTRY/REGION

- 6.18.4.1 US

- 6.18.4.2 Europe

- 6.18.4.3 Asia Pacific

- 6.18.5 IMPACT ON END-USE INDUSTRIES

- 6.18.5.1 Pharmaceutical & biotechnology companies

- 6.18.5.2 CROs & CMOs

7 SINGLE-USE BIOPROCESSING MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 EQUIPMENT

- 7.2.1 SINGLE-USE BIOREACTORS

- 7.2.1.1 <=10 L bioreactors

- 7.2.1.1.1 Flexibility in early-stage R&D to boost market growth

- 7.2.1.2 11-100 L bioreactors

- 7.2.1.2.1 Scalability for process development in small-scale R&D and larger pilot-scale operations to drive demand

- 7.2.1.3 101-500 L bioreactors

- 7.2.1.3.1 Efficiency in pilot-scale production and clinical trial materials manufacturing to propel demand

- 7.2.1.4 501-1,500 L bioreactors

- 7.2.1.4.1 Growing use in large-scale commercial production to augment market growth

- 7.2.1.5 >1,500L bioreactors

- 7.2.1.5.1 Rising adoption of single-use technologies in high-demand applications to support market growth

- 7.2.1.1 <=10 L bioreactors

- 7.2.2 SINGLE-USE FILTRATION SYSTEMS

- 7.2.2.1 Manufacturing-scale filtration systems

- 7.2.2.1.1 Demand in large-volume operations for biopharmaceutical products to spur market growth

- 7.2.2.2 Pilot-scale filtration systems

- 7.2.2.2.1 Flexibility to drive end-user adoption in virus filtration and buffer preparation

- 7.2.2.3 R&D-scale filtration systems

- 7.2.2.3.1 Rapid hypothesis testing and data generation to support research usage

- 7.2.2.1 Manufacturing-scale filtration systems

- 7.2.3 SINGLE-USE MIXING SYSTEMS

- 7.2.3.1 Manufacturing-scale mixing systems

- 7.2.3.1.1 Need for high-throughput capacity in large-scale production processes to drive market

- 7.2.3.2 Pilot-scale mixing systems

- 7.2.3.2.1 Application flexibility to boost end user adoption in process adjustments and trials

- 7.2.3.3 R&D-scale mixing systems

- 7.2.3.3.1 Growing adoption in small-scale operations to drive market

- 7.2.3.1 Manufacturing-scale mixing systems

- 7.2.4 SINGLE-USE CHROMATOGRAPHY SYSTEMS

- 7.2.4.1 Reduced cost-effectiveness and slow adoption in biopharmaceutical production to restrain market growth

- 7.2.5 OTHER SINGLE-USE EQUIPMENT

- 7.2.1 SINGLE-USE BIOREACTORS

- 7.3 CONSUMABLES

- 7.3.1 SINGLE-USE BAGS & CONTAINERS

- 7.3.1.1 2D bags & containers

- 7.3.1.1.1 High volume use and widespread application of 2D bags in bioproduction applications to drive market

- 7.3.1.2 3D bags & containers

- 7.3.1.2.1 Increasing use in purification processes to drive market

- 7.3.1.1 2D bags & containers

- 7.3.2 SINGLE-USE FILTERS

- 7.3.2.1 Single-use filters to be cost-effective and help in contamination control and operational efficiency

- 7.3.3 SINGLE-USE ASSEMBLIES

- 7.3.3.1 Bag assemblies

- 7.3.3.1.1 High efficiency of disposable filter funnels across biomanufacturing processes to boost market growth

- 7.3.3.2 Filtration assemblies

- 7.3.3.2.1 Advantages of rapid filtration and purification to propel market growth

- 7.3.3.3 Bottle assemblies

- 7.3.3.3.1 Reduced turnaround time and downtime to fuel market growth

- 7.3.3.4 Mixing system assemblies

- 7.3.3.4.1 Flexibility in multiproduct manufacturing to drive demand

- 7.3.3.5 Other assemblies

- 7.3.3.1 Bag assemblies

- 7.3.4 SINGLE-USE CHROMATOGRAPHY COLUMNS

- 7.3.4.1 Reproducibility, scalability, speed, ease of use, and operational safety of chromatography columns to boost demand

- 7.3.5 SINGLE-USE SENSORS

- 7.3.5.1 pH sensors

- 7.3.5.1.1 Need for more sophisticated and precise monitoring to boost market growth

- 7.3.5.2 Oxygen sensors

- 7.3.5.2.1 Need for optimal oxygen levels in bioprocessing to boost market

- 7.3.5.3 Pressure sensors

- 7.3.5.3.1 Wide adoption in filtration to drive market

- 7.3.5.4 Temperature sensors

- 7.3.5.4.1 Need for highly accurate measurement in bioprocessing to drive market growth

- 7.3.5.5 Conductivity sensors

- 7.3.5.5.1 Demand for accurate single-use ionic strength monitoring to support adoption

- 7.3.5.6 Flow sensors

- 7.3.5.6.1 Consistent and reliable fluid delivery to drive usage

- 7.3.5.7 Other sensors

- 7.3.5.1 pH sensors

- 7.3.6 OTHER SINGLE-USE CONSUMABLES

- 7.3.6.1 Tubing

- 7.3.6.2 Connectors

- 7.3.6.3 Disconnectors

- 7.3.6.4 Adaptors

- 7.3.6.5 Valves

- 7.3.6.6 Other consumables

- 7.3.1 SINGLE-USE BAGS & CONTAINERS

8 SINGLE-USE BIOPROCESSING MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 FILTRATION

- 8.2.1 FILTRATION TO BE USEFUL IN CLARIFICATION, STERILIZATION, AND VIRUS-REMOVAL OPERATIONS IN BIOPHARMACEUTICAL SECTOR

- 8.3 CELL CULTURE

- 8.3.1 REDUCED RISK OF CONTAMINATION AND FOCUS ON COST EFFICIENCY TO SUPPORT MARKET GROWTH

- 8.4 MIXING

- 8.4.1 COST-EFFICTIVENESS AND ADVANCEMENTS IN SINGLE-USE MIXER DESIGNS TO DRIVE DEMAND FOR DISPOSABLE MIXING SYSTEMS

- 8.5 PURIFICATION

- 8.5.1 BENEFITS OF ADVANCED SINGLE-USE PURIFICATION TECHNOLOGIES IN MAB AND CELL & GENE THERAPY TO AID MARKET GROWTH

- 8.6 STORAGE & TRANSFER

- 8.6.1 RISING COMPLEXITY AND VOLUME OF CELL & GENE THERAPIES TO INCREASE DEMAND FOR SINGLE-USE CONTAINERS

- 8.7 OTHER APPLICATIONS

9 SINGLE-USE BIOPROCESSING MARKET, BY WORKFLOW

- 9.1 INTRODUCTION

- 9.2 UPSTREAM BIOPROCESSING

- 9.2.1 REDUCED RISK OF CONTAMINATION AND COST EFFICIENCY TO SUPPORT MARKET GROWTH

- 9.3 DOWNSTREAM BIOPROCESSING

- 9.3.1 ADVANCEMENTS IN DISPOSABLE CHROMATOGRAPHY, FILTRATION, AND VIRUS CLEARANCE SYSTEMS TO DRIVE MARKET

10 SINGLE-USE BIOPROCESSING MARKET, BY MOLECULE TYPE

- 10.1 INTRODUCTION

- 10.2 MONOCLONAL ANTIBODIES

- 10.2.1 EXPANDING THERAPEUTIC LANDSCAPE AND GROWING PIPELINE DIVERSIFICATION TO DRIVE MARKET

- 10.2.2 SINGLE-USE BIOPROCESSING MARKET FOR MONOCLONAL ANTIBODIES, BY PRODUCT

- 10.3 VACCINES

- 10.3.1 HIGHER IMMUNIZATION PROGRAMS AND CONTINUED SUCCESS OF MRNA AND VIRAL VECTOR-BASED TECHNOLOGIES TO AID MARKET

- 10.3.2 SINGLE-USE BIOPROCESSING MARKET FOR VACCINES, BY PRODUCT

- 10.4 THERAPEUTIC PROTEINS & PEPTIDES

- 10.4.1 RISING DEMAND FOR COMPLEX BIOLOGICS AND FLEXIBLE MANUFACTURING TO AUGMENT SINGLE-USE ADOPTION

- 10.4.2 SINGLE-USE BIOPROCESSING MARKET FOR THERAPEUTIC PROTEINS & PEPTIDES, BY PRODUCT

- 10.5 CELL & GENE THERAPIES

- 10.5.1 RISING R&D INITIATIVES AND FUNDS FOR CELL & GENE THERAPY DEVELOPMENT TO DRIVE MARKET

- 10.5.2 SINGLE-USE BIOPROCESSING MARKET FOR CELL & GENE THERAPIES, BY PRODUCT

11 SINGLE-USE BIOPROCESSING MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 11.2.1 INCREASE IN R&D EXPENDITURE AND PIPELINE EXPANSION TO SUSTAIN MARKET GROWTH

- 11.3 CROS & CMOS

- 11.3.1 RISING OUTSOURCING OF CLINICAL DEVELOPMENT AND GMP MANUFACTURING TO AUGMENT MARKET GROWTH

- 11.4 OTHER END USERS

12 SINGLE-USE BIOPROCESSING MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 US to dominate North American single-use bioprocessing market during forecast period

- 12.2.3 CANADA

- 12.2.3.1 Increasing demand for biopharmaceuticals & biologics and rising government investments to drive market

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Strong biopharmaceutical manufacturing base and advanced R&D infrastructure to support market growth

- 12.3.3 UK

- 12.3.3.1 Strong government support for biomanufacturing innovation and dynamic biotechnology ecosystem to boost market growth

- 12.3.4 FRANCE

- 12.3.4.1 High biomanufacturing investments and government-backed innovation programs to fuel market growth

- 12.3.5 ITALY

- 12.3.5.1 Increasing government funding for biopharmaceutical research to spur market growth

- 12.3.6 SPAIN

- 12.3.6.1 Rising focus on developing personalized medicines to support market growth

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 CHINA

- 12.4.2.1 Low manufacturing costs and huge demand for personalized medicines to propel market growth

- 12.4.3 SOUTH KOREA

- 12.4.3.1 Increased focus on quality manufacturing practices to support market growth

- 12.4.4 JAPAN

- 12.4.4.1 Rising collaborations among biotechnology companies to drive market

- 12.4.5 INDIA

- 12.4.5.1 Favorable scenario for foreign direct investment to propel market growth

- 12.4.6 AUSTRALIA

- 12.4.6.1 Increasing demand for innovative research solutions to propel market

- 12.4.7 REST OF ASIA PACIFIC

- 12.5 LATIN AMERICA

- 12.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 12.5.2 BRAZIL

- 12.5.2.1 Increased biomanufacturing of biologics and pharmaceutical R&D to foster market growth

- 12.5.3 MEXICO

- 12.5.3.1 Rising demand for chronic disease treatment to support market growth

- 12.5.4 REST OF LATIN AMERICA

- 12.6 MIDDLE EAST

- 12.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST

- 12.6.2 GCC COUNTRIES

- 12.6.2.1 Kingdom of Saudi Arabia

- 12.6.2.1.1 Growing healthcare expenditure in infrastructure, research, and technology to boost market growth

- 12.6.2.2 UAE

- 12.6.2.2.1 Rising demand for biologic therapies and government initiatives for high-quality pharmaceuticals to drive market

- 12.6.2.3 Rest of GCC countries

- 12.6.2.1 Kingdom of Saudi Arabia

- 12.6.3 REST OF MIDDLE EAST

- 12.7 AFRICA

- 12.7.1 GROWING MARKET FOR PHARMACEUTICALS AND INCREASING DEMAND FOR DRUGS TO PROPEL MARKET

- 12.7.2 MACROECONOMIC OUTLOOK FOR AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 13.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SINGLE-USE BIOPROCESSING MARKET

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Product footprint

- 13.5.5.4 Application footprint

- 13.5.5.5 Workflow footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.6.5.1 Detailed list of key startups/SMEs

- 13.6.5.2 Competitive benchmarking of key startups/SMEs

- 13.7 COMPANY VALUATION & FINANCIAL METRICS

- 13.7.1 FINANCIAL METRICS

- 13.7.2 COMPANY VALUATION

- 13.8 BRAND/PRODUCT COMPARISION

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 SARTORIUS AG

- 14.2.1.1 Business overview

- 14.2.1.2 Products offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Product launches

- 14.2.1.3.2 Deals

- 14.2.1.3.3 Expansions

- 14.2.1.4 MnM view

- 14.2.1.4.1 Right to win

- 14.2.1.4.2 Strategic choices

- 14.2.1.4.3 Weaknesses & competitive threats

- 14.2.2 DANAHER CORPORATION

- 14.2.2.1 Business overview

- 14.2.2.2 Products offered

- 14.2.2.3 Recent developments

- 14.2.2.3.1 Product launches

- 14.2.2.3.2 Deals

- 14.2.2.3.3 Expansions

- 14.2.2.4 MnM view

- 14.2.2.4.1 Right to win

- 14.2.2.4.2 Strategic choices

- 14.2.2.4.3 Weaknesses & competitive threats

- 14.2.3 THERMO FISHER SCIENTIFIC INC.

- 14.2.3.1 Business overview

- 14.2.3.2 Products offered

- 14.2.3.3 Recent developments

- 14.2.3.3.1 Product launches

- 14.2.3.3.2 Deals

- 14.2.3.3.3 Expansions

- 14.2.3.4 MnM view

- 14.2.3.4.1 Right to win

- 14.2.3.4.2 Strategic choices

- 14.2.3.4.3 Weaknesses & competitive threats

- 14.2.4 MERCK KGAA

- 14.2.4.1 Business overview

- 14.2.4.2 Products offered

- 14.2.4.3 Recent developments

- 14.2.4.3.1 Product launches

- 14.2.4.3.2 Deals

- 14.2.4.3.3 Expansions

- 14.2.4.4 MnM view

- 14.2.4.4.1 Right to win

- 14.2.4.4.2 Strategic choices

- 14.2.4.4.3 Weaknesses & competitive threats

- 14.2.5 AVANTOR, INC.

- 14.2.5.1 Business overview

- 14.2.5.2 Products offered

- 14.2.5.3 Recent developments

- 14.2.5.3.1 Deals

- 14.2.5.3.2 Expansions

- 14.2.6 SOLVENTUM

- 14.2.6.1 Business overview

- 14.2.6.2 Products offered

- 14.2.7 REPLIGEN CORPORATION

- 14.2.7.1 Business overview

- 14.2.7.2 Products offered

- 14.2.7.3 Recent developments

- 14.2.7.3.1 Product launches

- 14.2.7.3.2 Deals

- 14.2.7.3.3 Expansions

- 14.2.8 ENTEGRIS

- 14.2.8.1 Business overview

- 14.2.8.2 Products offered

- 14.2.8.3 Recent developments

- 14.2.8.3.1 Expansions

- 14.2.9 GETINGE

- 14.2.9.1 Business overview

- 14.2.9.2 Products offered

- 14.2.9.3 Recent developments

- 14.2.9.3.1 Product launches

- 14.2.9.3.2 Deals

- 14.2.10 PARKER HANNIFIN CORP.

- 14.2.10.1 Business overview

- 14.2.10.2 Products offered

- 14.2.11 ALFA LAVAL

- 14.2.11.1 Business overview

- 14.2.11.2 Products offered

- 14.2.11.3 Recent developments

- 14.2.11.3.1 Product launches

- 14.2.12 SAINT-GOBAIN

- 14.2.12.1 Business overview

- 14.2.12.2 Products offered

- 14.2.12.3 Recent developments

- 14.2.12.3.1 Product launches

- 14.2.12.3.2 Expansions

- 14.2.13 EPPENDORF SE

- 14.2.13.1 Business overview

- 14.2.13.2 Products offered

- 14.2.13.3 Recent developments

- 14.2.13.3.1 Deals

- 14.2.13.3.2 Expansions

- 14.2.14 CORNING INCORPORATED

- 14.2.14.1 Business overview

- 14.2.14.2 Products offered

- 14.2.15 EATON

- 14.2.15.1 Business overview

- 14.2.15.2 Products offered

- 14.2.16 METTLER TOLEDO

- 14.2.16.1 Business overview

- 14.2.16.2 Products offered

- 14.2.16.3 Recent developments

- 14.2.16.3.1 Product launches

- 14.2.17 PORVAIR

- 14.2.17.1 Business overview

- 14.2.17.2 Products offered

- 14.2.18 LONZA

- 14.2.18.1 Business overview

- 14.2.18.2 Products offered

- 14.2.1 SARTORIUS AG

- 14.3 OTHER PLAYERS

- 14.3.1 ABEC

- 14.3.2 SINGLE USE SUPPORT

- 14.3.3 NEWAGE INDUSTRIES

- 14.3.4 BROADLEY-JAMES CORPORATION

- 14.3.5 PBS BIOTECH, INC.

- 14.3.6 SENTINEL PROCESS SYSTEMS INC.

- 14.3.7 MEISSNER FILTRATION PRODUCTS, INC.

- 14.3.8 SATAKE MULTIMIX CORPORATION

- 14.3.9 HAMILTON COMPANY

- 14.3.10 MEMBRANE SOLUTIONS

- 14.3.11 ANTYLIA SCIENTIFIC

- 14.3.12 DISTEK, INC.

- 14.3.13 ESCO LIFESCIENCES GROUP

- 14.3.14 TECNIC

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS