|

시장보고서

상품코드

1858528

첨가제 마스터배치 시장 예측(-2030년) : 유형별, 캐리어 수지별, 용도별, 지역별Additive Masterbatch Market by Type (Antimicrobial, Antioxidant, Flame Retardants), Carrier Resin (PE, PP, PS), Application (Packaging, Building & Construction, Consumer Goods, Automotive, Agriculture), and Region - Global Forecasts to 2030 |

||||||

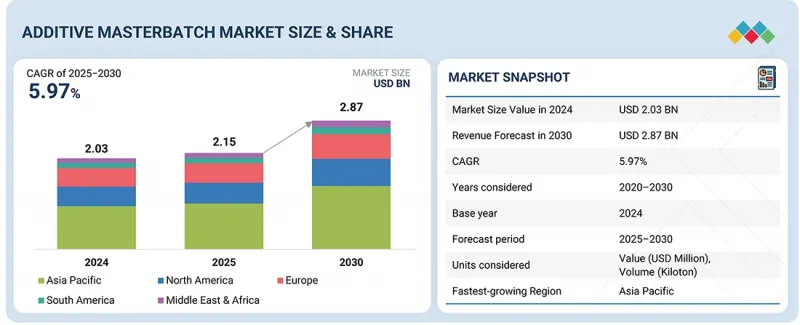

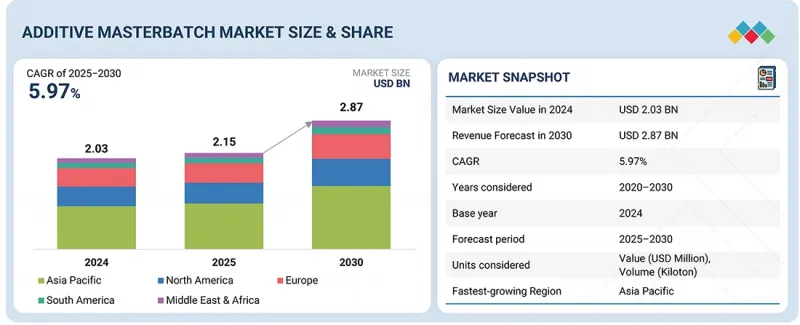

첨가제 마스터배치 시장 규모는 2025년에 21억 5,000만 달러에 달하며, 2025-2030년에 5.97%의 CAGR로 확대하며, 2030년에는 28억 7,000만 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(100만 달러) 및 킬로톤 |

| 부문 | 유형별, 캐리어 수지별, 용도별, 지역별 |

| 대상 지역 | 아시아태평양, 서유럽, 중유럽·동유럽, 북미, 중동 아프리카, 남미 |

첨가제 마스터배치 시장을 촉진하는 가장 중요한 요인 중 하나는 플라스틱 제조 기업에 대한 엄격한 규제와 안전 조치에 대한 전 세계적인 부과로, 내화성,내 자외선, 항균성을 가진 플라스틱의 제조를 강제하고 있습니다. 첨가제 마스터배치는 제품의 디자인이나 기능에 영향을 주지 않으면서 컴플라이언스 요건을 충족할 수 있으며, 건설, 자동차, 전자, 포장 등 규제가 엄격한 시장에서 매우 중요합니다. 제품의 안전성과 내구성에 대한 소비자의 민감도가 높아짐에 따라 생산자들은 환경 및 안전 규제에 저촉되지 않으면서도 재료의 성능을 향상시키기 위해 더 복잡한 첨가제를 사용하게 되었고, 이에 대한 수요는 더욱 증가하고 있습니다.

자동차 부문은 예측 기간 중 세계 첨가제 마스터배치 시장에서 금액 기준으로 두 번째로 빠르게 성장하는 용도가 될 것으로 예측됩니다.

자동차 분야는 예측 기간 중 세계 첨가제 마스터배치 시장에서 금액 기준으로 두 번째로 빠르게 성장하는 시장이 될 것으로 예측됩니다. 이는 연비를 개선하고, 배기가스를 줄이고, 엄격한 안전 및 규제 요건을 충족하며, 경량화 및 고성능 플라스틱의 사용이 증가하고 있기 때문입니다. 난연성, UV 안정화, 항균성 등의 첨가제 마스터배치는 성능과 내구성을 높이기 위해 내장 부품, Under-The-Hood 부품, 외장 부품에 적용이 확대되고 있습니다. 특히 신흥 시장에서의 자동차 제조 증가와 지속가능성 및 첨단 폴리머 솔루션도 이 부문의 성장에 기여하고 있습니다.

2024년 첨가제 마스터배치 시장에서 항산화제 부문은 금액 기준으로 두 번째 점유율을 차지할 것으로 예측됩니다.

2024년, 항산화제 부문은 첨가제 마스터배치 시장에서 두 번째로 큰 금액 점유율을 차지했는데, 이는 폴리머의 열 및 산화 성능 향상과 관련이 있기 때문입니다. 이러한 첨가제는 공정 중 열화를 억제하고 플라스틱 제품의 수명을 연장하는 데 도움이 되므로 포장, 자동차, 전기 및 전자 산업 등의 용도에 사용할 수 있습니다. 고성능 및 내구성 플라스틱의 추세, 높은 품질 기준과 안전 기준, 항산화 마스터배치의 사용이 강화되고 있습니다. 가열 및 환경적 요인에 의한 재료 파괴에 저항하는 능력은 시장 개발에 크게 기여하고 있습니다.

2024년 유럽은 세계 첨가제 마스터배치 시장에서 금액 기준으로 3번째로 큰 지역으로, 이 지역의 기존 플라스틱 산업과 제조업이 주도하고 있습니다. 안전성, 지속가능성, 재활용성을 중시하는 엄격한 규제 프레임워크는 난연성, 자외선 안정화, 항균성 마스터배치를 포함한 특수 마스터배치의 보급에 기여하고 성장을 가속합니다. 또한 자동차, 건설, 포장 산업의 지속적인 성장과 고분자 가공 및 첨가제 통합 기술의 발전이 시장을 주도하고 있습니다. 성숙한 인프라, 소비자 의식, 환경적으로 지속가능한 솔루션에 대한 강조는 세계 시장에서 유럽의 확고한 입지를 보여주는 또 다른 지표입니다.

세계의 첨가제 마스터배치 시장에 대해 조사했으며, 유형별, 캐리어 수지별, 용도별, 지역별 동향 및 시장에 참여하는 기업의 개요 등을 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 거시경제 지표

제6장 업계 동향

- 공급망 분석

- 원재료 공급업체

- 제조업체

- 유통 네트워크

- 최종 용도 산업

- 가격 분석

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 에코시스템 분석

- 기술 분석

- 사례 연구 분석

- 무역 분석

- 규제 상황

- 2025-2026년의 주요 컨퍼런스와 이벤트

- 투자와 자금조달 시나리오

- 특허 분석

- 2025년 미국 관세의 영향 - 첨가제 마스터배치 시장

- AI/생성형 AI가 첨가제 마스터배치 시장에 미치는 영향

제7장 첨가제 마스터배치 시장(유형별)

- 서론

- 항균 첨가제

- 산화방지제 첨가제

- 난연성

- UV 안정제

- 발포제

- 형광증백제

- 핵제

- 기타

제8장 첨가제 마스터배치 시장(캐리어 수지별)

- 서론

- 폴리프로필렌(PP)

- 저밀도 폴리에틸렌 및 선형 저밀도 폴리에틸렌(LDPE 및 LLDPE)

- 고밀도 폴리에틸렌(HDPE)

- 폴리염화비닐(PVC)

- 폴리우레탄(PU)

- 폴리스티렌(PS)

- 기타

제9장 첨가제 마스터배치 시장(용도별)

- 서론

- 포장

- 건축·건설

- 소비재

- 자동차

- 섬유

- 농업

- 기타

제10장 첨가제 마스터배치 시장(지역별)

- 서론

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 영국

- 스페인

- 이탈리아

- 튀르키예

- 중동 및 아프리카

- 이란

- 사우디아라비아

- 남아프리카공화국

- 남미

- 브라질

- 아르헨티나

제11장 경쟁 구도

- 서론

- 주요 참여 기업의 전략/강점

- 시장 점유율 분석, 2024년

- 매출 분석

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 브랜드/제품 비교 분석

- 기업 평가와 재무 지표

- 경쟁 시나리오

제12장 기업 개요

- 주요 참여 기업

- AVIENT CORPORATION

- AMPACET CORPORATION

- LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- TOSAF COMPOUNDS LTD.

- PLASTIKA KRITIS S.A.

- PLASTIBLENDS

- RTP COMPANY

- SUKANO AG

- FRILVAM SPA

- AMERICHEM

- 기타 기업

- PRIMEX PLASTICS CORPORATION

- REPIN MASTERBATCHES

- UNIVERSAL MASTERBATCH LLP

- VANETTI S.P.A.

- SURYA COMPOUNDS & MASTERBATCHES PRIVATE LIMITED

- GRANULA

- GABRIEL-CHEMIE GMBH

- AF-COLOR

- HIGH TECHNOLOGY MASTERBATCHES S.L.

- PRAYAG POLYTECH

- ASTRA POLYMERS

- JIANGSU PULAIKE HONGMEI MASTERBATCH CO., LTD.

- ALOK MASTERBATCHES PVT. LTD.

- COSMO SPECIALITY CHEMICALS

- RAJIV PLASTIC INDUSTRIES

제13장 인접 시장과 관련 시장

제14장 부록

KSA 25.11.14The additive masterbatch market size was USD 2.15 billion in 2025 and is projected to reach USD 2.87 billion by 2030, at a CAGR of 5.97%, between 2025 and 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Type, Carrier Resin, Application, and Region |

| Regions covered | Asia Pacific, Western Europe, Central & Eastern Europe, North America, Middle East & Africa, and South America |

"Regulatory Compliance and Safety Standards to Drive Additive Masterbatch Market"

One of the most important factors driving the additive masterbatch market is the global imposition of tight regulations and safety measures on plastic manufacturing companies, compelling them to produce plastics with fire-resistant, UV-resistant, and antimicrobial properties. Additive masterbatch enables the fulfillment of compliance requirements without affecting product design or functionality, and it is crucial in highly regulated markets, such as construction, automotive, electronics, and packaging. The demand is further intensified by growing consumer sensitivity to the safety and durability of products, which prompts producers to use more complex additives to improve material performance without breaching environmental and safety regulations.

The automotive sector is estimated to be the second-fastest-growing application of the global additive masterbatch market, in terms of value, during the forecast period.

The automotive sector is expected to be the second-fastest-growing market in the global additive masterbatch market in terms of value during the forecast period. This is due to the increasing use of lightweight and high-performance plastics, which enhance fuel efficiency, reduce emissions, and meet stringent safety and regulatory requirements. Additive masterbatches, such as flame-retardant, UV-stabilized, and antimicrobial versions, are finding more applications in interior parts, under-the-hood parts, and exterior parts to enhance performance and durability. An increase in vehicle manufacturing, particularly in emerging markets, as well as sustainability and advanced polymer solutions, are also contributing to the growth of the segment.

The antioxidant additive segment accounted for the second-largest share in the additive masterbatch market, in terms of value, in 2024.

In 2024, the antioxidant additive segment held the second largest value share of the additive masterbatch market, as it is relevant when it comes to improving the thermal and oxidative performance of polymers. These additives help in inhibiting degradation during the process and increase the life service of plastic products and therefore it can be used in application packaging, automobile, and electrical and electronics industries. The trend of high-performance and durable plastics, high quality standards and safety standards have strengthened the use of antioxidant masterbatches. Their capacity to resist the material destruction during heating and under the influence of environmental factors makes them a major contributor to the development of the markets.

"Europe was the third largest region of the global additive masterbatch market, in terms of value, in 2024."

In 2024, Europe was the third-largest region in the global additive masterbatch market in terms of value, driven by the well-established plastics and manufacturing industries in the region. Stringent regulatory frameworks that focus on safety, sustainability, and recyclability promote growth by contributing to the greater uptake of special masterbatches, including flame-retardant, UV-stabilized, and antimicrobial masterbatches. Additionally, the market is driven by the continuous growth of the automotive, construction, and packaging industries, coupled with advancements in technology for polymer processing and additive integration. The strong presence of mature infrastructure, consumer awareness, and an emphasis on environmentally sustainable solutions are additional indicators of Europe's strong position in the global market.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, RoW- 5%

The key players profiled in the report include Avient Corporation (US), Ampacet Corporation (US), LyondellBasell Industries Holdings B.V. (US), Tosaf Compounds Ltd. (Israel), Sukano AG (Switzerland), Frilvam SPA (Italy), Plastika Kritis S.A. (Greece), Plastiblends (India), RTP Company (US), and Americhem (US).

Study Coverage

This report segments the market for additive masterbatch based on type, carrier resin, application, and region, and provides estimations of value (in USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies associated with the additive masterbatch market.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the additive masterbatch market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on additive masterbatch offered by top players in the global market

- Analysis of key drivers: (Advancement in packaging solutions, growing priority on quality retention and extended shelf life, rising demand for durable & high-performance plastics, and expanding plastic usage in emerging market), restraints (Stringent environmental and compliance regulations and high cost of advanced additives), opportunities (Rising demand for sustainable & eco-friendly solutions, growth in emerging economies, and growth in agriculture films & greenhouse applications) and challenges (Recyclability concerns in additive use ) influencing the growth of additive masterbatch market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the additive masterbatch market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for additive masterbatch across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global additive masterbatch market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the additive masterbatch market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 ADDITIVE MASTERBATCH MARKET: DEFINITION AND INCLUSIONS, BY TYPE

- 1.3.4 ADDITIVE MASTERBATCH MARKET: DEFINITION AND INCLUSIONS, BY CARRIER RESIN

- 1.3.5 ADDITIVE MASTERBATCH MARKET: DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.3.6 YEARS CONSIDERED

- 1.3.7 CURRENCY CONSIDERED

- 1.3.8 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Data from key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Data from key primary sources

- 2.1.2.2 Primary interviews - demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ADDITIVE MASTERBATCH MARKET

- 4.2 ADDITIVE MASTERBATCH MARKET, BY REGION

- 4.3 ASIA PACIFIC: ADDITIVE MASTERBATCH MARKET, BY APPLICATION AND COUNTRY

- 4.4 REGIONAL ANALYSIS: ADDITIVE MASTERBATCH MARKET, BY CARRIER RESIN

- 4.5 ADDITIVE MASTERBATCH MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Advancements in packaging solutions

- 5.2.1.2 Growing focus on quality retention and extended shelf life

- 5.2.1.3 Rising demand for durable & high-performance plastics

- 5.2.1.4 Expanding plastic usage in emerging markets

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent environmental and compliance regulations

- 5.2.2.2 High cost of advanced additives

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for sustainable & eco-friendly solutions

- 5.2.3.2 Growth in emerging economies

- 5.2.3.3 Growth in agriculture films & greenhouse applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Recyclability concerns in additive use

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.1.1 RAW MATERIALS SUPPLIERS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTION NETWORK

- 6.1.4 END-USE INDUSTRIES

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF ADDITIVE MASTERBATCH, BY APPLICATION, 2024

- 6.2.2 AVERAGE SELLING PRICE TREND OF ADDITIVE MASTERBATCH, BY REGION, 2023-2030

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Advanced polymer dispersion & compounding technology

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Nanotechnology-enabled additives

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Digital formulation & simulation tools

- 6.5.1 KEY TECHNOLOGIES

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 CASE STUDY ON SUPERFEET INSOLES

- 6.6.2 CASE STUDY ON ADDITIVE MASTERBATCH USED IN AUTOMOTIVE NONWOVEN FIBERS

- 6.6.3 CASE STUDY ON ADDITIVE MASTERBATCH USED IN CLOSURES FOR CONSUMER SOFT DRINKS

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 320649)

- 6.7.2 EXPORT SCENARIO (HS CODE 320649)

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 International Organization for Standardization (ISO)

- 6.9 KEY CONFERENCES & EVENTS IN 2025-2026

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF - ADDITIVE MASTERBATCH MARKET

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRY/REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES

- 6.13 IMPACT OF AI/GEN AI ON ADDITIVE MASTERBATCH MARKET

7 ADDITIVE MASTERBATCH MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 ANTIMICROBIAL ADDITIVE

- 7.2.1 HELPS MAINTAIN PRODUCT SAFETY, REDUCES RISK OF CONTAMINATION, AND IMPROVES OVERALL DURABILITY- KEY FACTORS DRIVING GROWTH

- 7.3 ANTIOXIDANT ADDITIVE

- 7.3.1 USE OF ANTIOXIDANT ADDITIVE MASTERBATCH FOR MATERIAL DURABILITY AND STABILITY TO DRIVE MARKET

- 7.4 FLAME RETARDANT

- 7.4.1 SUSTAINABLE MANUFACTURING PRACTICES AND LONG-TERM PROTECTION AGAINST THERMAL & FIRE-RELATED DEGRADATION TO PROPEL MARKET

- 7.5 UV STABILIZER

- 7.5.1 IMPROVED PLASTIC LONGEVITY TO DRIVE GROWTH

- 7.6 FOAMING/BLOWING AGENT

- 7.6.1 PROCESS EFFICIENCY ENHANCEMENT TO SUPPORT MARKET GROWTH

- 7.7 OPTICAL BRIGHTENER

- 7.7.1 HELP IN IMPROVING WHITENESS AND OVERALL VISUAL APPEAL- KEY FACTOR DRIVING ADOPTION

- 7.8 NUCLEATING AGENT

- 7.8.1 PROMOTES FASTER AND MORE UNIFORM CRYSTALLIZATION DURING COOLING

- 7.9 OTHER TYPES

8 ADDITIVE MASTERBATCH MARKET, BY CARRIER RESIN

- 8.1 INTRODUCTION

- 8.2 POLYPROPYLENE (PP)

- 8.2.1 GREATER EFFICIENCY, SMOOTHNESS, AND DISPERSION ABILITY TO PROPEL MARKET

- 8.3 LOW-DENSITY POLYETHYLENE & LINEAR LOW-DENSITY POLYETHYLENE (LDPE & LLDPE)

- 8.3.1 HIGHER COMPATIBILITY WITH ADDITIVE MASTERBATCH TO PRODUCE WIDE RANGE OF PLASTIC PRODUCTS TO DRIVE MARKET

- 8.4 HIGH-DENSITY POLYETHYLENE (HDPE)

- 8.4.1 HIGH STRENGTH-TO-DENSITY RATIO TO DRIVE MARKET

- 8.5 POLYVINYL CHLORIDE (PVC)

- 8.5.1 EASY AVAILABILITY AND LOW PRICE OF PVC TO PROPEL MARKET GROWTH

- 8.6 POLYURETHANE (PU)

- 8.6.1 INCREASING DEMAND IN AUTOMOTIVE, FURNITURE, CONSTRUCTION, AND FOOTWEAR APPLICATIONS TO DRIVE MARKET

- 8.7 POLYSTYRENE (PS)

- 8.7.1 EXCELLENT THERMAL & DIMENSIONAL STABILITY TO SUPPORT MARKET GROWTH

- 8.8 OTHER CARRIER RESINS

- 8.8.1 POLYCARBONATE (PC)

- 8.8.2 ACRYLONITRILE BUTADIENE STYRENE (ABS)

- 8.8.3 POLYAMIDE (PA)

9 ADDITIVE MASTERBATCH MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 PACKAGING

- 9.2.1 GROWING FOCUS ON RETAINING AROMA AND PROVIDING BARRIER AGAINST MOISTURE TO DRIVE MARKET

- 9.2.2 RIGID PACKAGING

- 9.2.3 FLEXIBLE PACKAGING

- 9.3 BUILDING & CONSTRUCTION

- 9.3.1 INCREASING DEMAND TO IMPROVE PRODUCT DURABILITY AND CONSISTENCY TO FUEL DEMAND

- 9.3.2 PIPES & FITTINGS

- 9.3.3 DOORS & WINDOWS

- 9.3.4 FENCES & FENESTRATIONS

- 9.3.5 SIDING

- 9.4 CONSUMER GOODS

- 9.4.1 INCREASING DEMAND FOR THERMOPLASTIC MATERIALS IN FOOTWEAR TO DRIVE MARKET

- 9.4.2 ELECTRONICS

- 9.4.3 FURNITURE

- 9.4.4 FOOTWEAR

- 9.5 AUTOMOTIVE

- 9.5.1 IMPLEMENTATION OF STRINGENT REGULATIONS AND WEIGHT REDUCTION OF VEHICLES TO FUEL MARKET

- 9.5.2 EXTERIOR

- 9.5.3 INTERIOR

- 9.6 TEXTILE

- 9.6.1 GROWING DEMAND FOR ADDITIVE MASTERBATCH IN TEXTILES TO DRIVE MARKET

- 9.7 AGRICULTURE

- 9.7.1 TECHNOLOGICAL ADVANCEMENTS IN AGRICULTURE INDUSTRY TO DRIVE MARKET

- 9.8 OTHER APPLICATIONS

10 ADDITIVE MASTERBATCH MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Presence of major manufacturing industries to increase demand

- 10.2.2 JAPAN

- 10.2.2.1 Advanced industrialization and innovation to propel market

- 10.2.3 INDIA

- 10.2.3.1 Rapid industrialization and infrastructure development to boost market growth

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Export-oriented industrial growth to increase demand

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Advanced manufacturing and regulatory compliance to propel market growth

- 10.3.2 CANADA

- 10.3.2.1 Sustainability initiatives and regulatory focus to drive market

- 10.3.3 MEXICO

- 10.3.3.1 Industrial expansion and supply chain integration to fuel market growth

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Advanced regulatory compliance and innovation in additive masterbatch to drive market

- 10.4.2 FRANCE

- 10.4.2.1 Increasing demand from packaging and automotive industries to drive market

- 10.4.3 UK

- 10.4.3.1 Expansion of e-commerce and consumer-centric packaging to drive market

- 10.4.4 SPAIN

- 10.4.4.1 Increasing demand from food packaging industry to drive market

- 10.4.5 ITALY

- 10.4.5.1 Enhanced food safety regulations and supply chain transparency to boost market growth

- 10.4.6 TURKEY

- 10.4.6.1 Demand from automotive industry to propel market

- 10.4.1 GERMANY

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 IRAN

- 10.5.1.1 Expanding petrochemical sector to drive market

- 10.5.2 SAUDI ARABIA

- 10.5.2.1 Rising demand for plastics in building & construction industry to drive market

- 10.5.3 SOUTH AFRICA

- 10.5.3.1 Industrial modernization and increase in exports to drive market growth

- 10.5.1 IRAN

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Economic growth and industrial expansion to drive market

- 10.6.2 ARGENTINA

- 10.6.2.1 Rising demand from packaging industry to support market growth

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Type footprint

- 11.5.5.4 Carrier resin footprint

- 11.5.5.5 Application footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 BRAND/PRODUCT COMPARISON ANALYSIS

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 AVIENT CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 AMPACET CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 TOSAF COMPOUNDS LTD.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 PLASTIKA KRITIS S.A.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses & competitive threats

- 12.1.6 PLASTIBLENDS

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.7 RTP COMPANY

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Expansions

- 12.1.8 SUKANO AG

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 FRILVAM SPA

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 AMERICHEM

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.1 AVIENT CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 PRIMEX PLASTICS CORPORATION

- 12.2.2 REPIN MASTERBATCHES

- 12.2.3 UNIVERSAL MASTERBATCH LLP

- 12.2.4 VANETTI S.P.A.

- 12.2.5 SURYA COMPOUNDS & MASTERBATCHES PRIVATE LIMITED

- 12.2.6 GRANULA

- 12.2.7 GABRIEL-CHEMIE GMBH

- 12.2.8 AF-COLOR

- 12.2.9 HIGH TECHNOLOGY MASTERBATCHES S.L.

- 12.2.10 PRAYAG POLYTECH

- 12.2.11 ASTRA POLYMERS

- 12.2.12 JIANGSU PULAIKE HONGMEI MASTERBATCH CO., LTD.

- 12.2.13 ALOK MASTERBATCHES PVT. LTD.

- 12.2.14 COSMO SPECIALITY CHEMICALS

- 12.2.15 RAJIV PLASTIC INDUSTRIES

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 MASTERBATCH MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.3 MASTERBATCH MARKET, BY REGION

- 13.3.3.1 ASIA PACIFIC

- 13.3.3.2 NORTH AMERICA

- 13.3.3.3 EUROPE

- 13.3.3.4 MIDDLE EAST & AFRICA

- 13.3.3.5 SOUTH AMERICA

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS