|

시장보고서

상품코드

1859658

접합유리 시장 : 용도별, 유리 유형별, 중간층 유형별, 최종 이용 산업별, 지역별 - 예측(-2030년)Laminated Glass Market by Glass Type (Heat-strengthened, Tempered, Triple, Reflective, Others), End-use Industry (Automotive, Electronics, Building & Construction, Energy, Other End-use Industries), and Region - Global Forecast to 2030 |

||||||

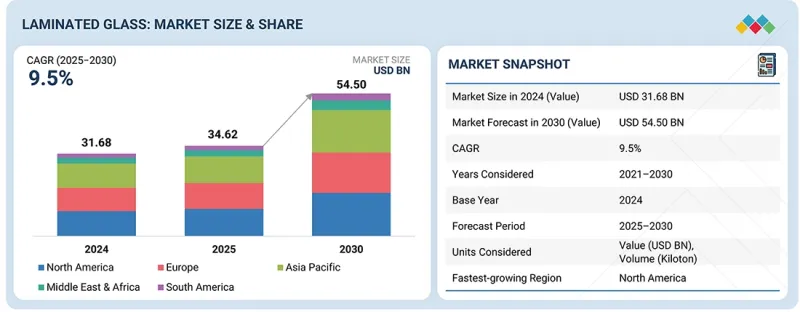

접합유리 시장 규모는 2024년 316억 8,000만 달러에서 2030년에는 545억 달러로 확대될 것으로 예측되며, 예측 기간 동안 CAGR은 9.5%를 기록할 것으로 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러), 킬로톤 |

| 부문별 | 용도별, 유리 유형별, 중간층 유형별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 유럽, 북미, 아시아태평양, 남미, 중동, 아프리카 |

다양한 용도 중 태양전지/BIPV 모듈은 재생에너지 도입, 건축의 발전, 지속가능성에 대한 노력에 힘입어 접합유리의 급성장 분야로 떠오르고 있습니다. 접합유리는 태양전지의 구조적 무결성과 기능적 통합을 제공함으로써 태양전지 패널, 파사드, 채광창 및 기타 에너지 생산 건축 요소에 선택되는 등 이 분야에서 중요한 역할을 하고 있습니다. 이러한 성장을 촉진하는 중요한 요인은 탈탄소화 및 넷 제로 빌딩 개발을 위한 전 세계적인 움직임이며, BIPV 모듈은 지붕 타일, 커튼월, 창문과 같은 전통적인 건축자재를 대체하고 있습니다. 접합유리는 투명성과 반투명도를 유지하면서 내구성과 안전성을 보장하기 때문에 건축가와 디자이너는 미적 요구사항과 기능적 요구사항의 균형을 맞출 수 있습니다.

BIPV 모듈은 재생에너지 발전과 건물 인프라의 에너지 효율 향상이라는 두 가지 이점을 제공하기 때문에 도시화와 스마트 시티 프로젝트 개발로 인해 수요 증가가 더욱 가속화되고 있습니다. 태양에너지 도입에 대한 정부의 우대정책, 건축 규제 강화, 에너지 비용 상승이 BIPV 솔루션의 경제성을 높이고 있습니다. 접합유리는 내충격성, 내후성, 내후성, 자외선 열화 방지가 우수하여 장기적인 성능을 보장하고 태양전지 셀을 보호하여 궁극적으로 유지보수 비용을 절감하고 시스템의 수명을 연장할 수 있습니다.

중간막 유형별 이오노플라스틱 폴리머는 PVB와 같은 기존 소재를 능가하는 성능을 제공하기 때문에 접합유리 시장에서 금액 기준으로 가장 빠르게 성장하고 있습니다. 따라서 프리미엄 가격으로 거래되는 하이엔드급 용도에 사용할 수 있습니다. 강성은 PVB의 최대 100배, 인성은 약 5배로 보고되고 있으며, 이오노플라스틱 라미네이트는 단순한 안전유리가 아닌 진정한 구조적 요소로 작용합니다. 이를 통해 건축가와 엔지니어는 부피가 큰 프레임 없이도 파사드, 난간, 채광창, 오버헤드 글레이징을 위해 더 얇고, 더 가볍고, 더 큰 유리 패널을 만들 수 있으며, 평방미터당 가격은 더 비싸지만 시스템 레벨의 비용 절감으로 이어집니다. 시스템 레벨의 비용 절감으로 이어집니다. 우수한 엣지 안정성과 내습성으로 박리 및 황변의 위험을 줄이고 고급 프로젝트에서 중요한 광학 투명도를 장기간 유지합니다. 특히, 이오노플라스트는 고온에서도 파단 후 내하중성을 유지하기 때문에 온난한 기후나 PVB가 약해지는 안전성이 중요시되는 환경에서는 안전성 측면에서 큰 우위를 발휘합니다. 또한, 이오노플라스틱 필름은 일반적으로 0.89mm 또는 1.52mm와 같은 특정 두께로 제공되며, 매우 낮은 황색도 지수를 특징으로 하여 고급 건축용 유리 및 구조용 유리에 적합하다는 것을 더욱 뒷받침합니다.

삼중 접합유리는 안전성, 내구성, 다기능성 등 현대 인프라 및 특수 용도의 수요 증가에 대응할 수 있어 금액 기준으로 가장 빠르게 성장하고 있습니다. 트리플 접합유리는 일반 이중 접합유리와 달리 3장의 유리를 2장의 중간막으로 접합한 것으로, 보다 견고하고 내구성이 강한 구조로 되어 있습니다. 이 구성은 뛰어난 내충격성을 제공하여 폭발, 탄도 위협, 허리케인, 지진과 같은 가혹한 조건에 직면한 환경에서 최상의 선택이 될 수 있습니다. 예를 들어, 국방, 대사관, 고도의 보안 시설, 공항이나 정부 건물과 같은 중요한 공공 인프라 등 안전과 보안이 우선시되는 장소에서 자주 사용됩니다. 또한, 삼중 접합유리는 차음성과 단열성이 뛰어나 고층 오피스, 고급 주택, 도시개발의 에너지 효율과 방음에 대한 수요 증가에 대응할 수 있습니다. 레이어 추가를 통해 전환 가능한 프라이버시 필름, 태양광 제어 코팅, 광전지 등 고급 기능의 통합이 가능하여 그 가치가 더욱 높아집니다. 트리플 라미네이트 생산은 더 두꺼운 유리, 여분의 중간막, 더 복잡한 오토클레이브 공정으로 인해 더 높은 비용이 들지만 장기적인 위험, 유지보수 필요성, 책임 문제를 줄일 수 있기 때문에 고객은 추가 요금을 지불하기를 원합니다.

"예측 기간 동안 최종 용도인 전자산업용 접합유리 시장이 가장 빠르게 성장할 것으로 예상됩니다.

전자 산업은 첨단 디스플레이 기술과 소비자 및 산업 장비의 내구성 요구가 결합되어 금액 기준으로 가장 빠르게 성장하는 접합유리 최종 용도 시장으로 부상하고 있습니다. 건축이나 자동차 산업과 달리, 전자 최종 용도 분야에서는 강도와 안전성뿐만 아니라 광학 투명성, 내스크래치성, 센서 및 터치 시스템, 플렉서블 부품과의 기능적 통합을 실현하는 접합유리가 요구되고 있습니다. 스마트폰, 태블릿, 노트북, 노트북, 스마트워치, AR/VR 헤드셋 등에서는 고휘도, 고정밀도를 유지하면서 섬세한 디스플레이를 보호하기 위해 접합유리를 사용하는 경우가 늘고 있습니다. 고급 가전 분야에서 접합유리는 엣지 투 엣지 디자인, 초박형 프로파일, 부드러운 터치 반응 등을 실현하여 제품 가치를 직접적으로 높이고 있습니다. 합판유리는 가전제품 외에도 충격, 온도 변화, 환경적 요인에 대한 내성이 중요한 산업용 전자기기, 의료기기, 차량용 스크린 분야에서도 각광받고 있습니다. 이오노플라스틱 층이나 화학적 강화층을 접합유리에 통합함으로써 낙하, 굽힘, 잦은 사용에 대한 내구성을 장기간 유지할 수 있어 보증 클레임을 줄이고 고객의 신뢰를 높일 수 있습니다. 또한, 접합유리는 눈부심 방지, 반사 방지, 자외선 차단, 광전지 코팅 등의 기능성 필름을 내장할 수 있어 디스플레이를 다기능 부품으로 바꿀 수 있습니다.

북미는 견고한 산업 기반, 엄격한 규제 환경, 고부가가치 애플리케이션의 높은 활용도를 바탕으로 합판유리의 주요 지역 시장이 될 것으로 예상됩니다. 특히 플로리다, 멕시코만 연안 등 해안 지역에서는 안전, 방화, 내화, 허리케인 저항 등 엄격한 건축 규정을 준수하기 위해 상업용 건물, 공항, 교육 기관, 주택 개발 등에서 접합유리가 점점 더 의무화되어 건축 산업은 매우 중요한 역할을 하고 있습니다. 친환경 인증 및 에너지 효율이 높은 건축물의 증가로 LEED 및 기타 지속가능성 기준에 따라 태양광 제어 코팅 및 방음 기능을 갖춘 접합유리의 사용이 더욱 확대되고 있습니다. 자동차 분야에서 북미는 높은 자동차 보유율과 충돌 안전과 탑승자 보호를 중시하는 NHTSA(미국 교통부 도로교통안전국) 등 엄격한 규제 감독의 혜택을 누리고 있습니다. 전통적인 앞 유리뿐만 아니라 사이드 윈도우, 파노라마 루프, 첨단 헤드업 디스플레이(HUD) 앞 유리에도 접합유리가 적용되어 안전, 편안함, 프리미엄 디자인에 대한 소비자의 취향을 반영하고 있습니다. 북미에서는 기술적 진보도 두드러져 접합유리는 전자제품, 스마트 유리, BIPV(건물 일체형 태양광발전)에 적용되고 있습니다. 합판유리가 조종석, 캐노피, 방폭유리에 활용되는 항공우주 및 방산분야의 수요는 시장 가치를 더욱 높이고 있습니다. 또한, 미국과 캐나다에는 주요 접합유리 제조업체, R&D 센터, 가공시설이 존재하여 탄력적인 공급능력을 확보하고 새로운 중간막, 코팅, 기능성 라미네이트의 효율적인 상용화가 가능합니다.

세계의 접합유리 시장에 대해 조사했으며, 용도별, 유리 종류별, 중간층 종류별, 최종 이용 산업별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 2024년 가격 분석

- 주요 기업이 제공하는 접합유리 평균판매가격(최종 이용 산업별, 2024년)

- 지역별 평균판매가격 동향(2021-2024년)

- 거시경제 전망

- 공급망 분석

- 밸류체인 분석

- 무역 분석

- 생태계 분석

- 기술 분석

- 특허 분석

- 규제 상황

- 2025-2026년의 주요 회의와 이벤트

- 사례 연구 분석

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 생성형 AI/AI가 접합유리 시장에 미치는 영향

- 투자와 자금 조달 시나리오

- 2025년 미국 관세의 영향 - 접합유리 시장

제6장 접합유리 시장(용도별)

- 소개

- 창호, 파사드

- 자동차용 차폐

- 철도·선박용 유리

- 태양광/BIPV 모듈

- 전자기기와 스마트 디바이스

- 보안 및 방위용 유리

제7장 접합유리 시장(유리 유형별)

- 소개

- 열강화

- 강화

- 트리플 라미네이트

- 반사성

- 기타

제8장 접합유리 시장(중간층 유형별)

- 소개

- 폴리비닐부티랄

- 에틸 비닐 아세테이트

- 이오노플라스트 폴리머

- 열가소성 폴리우레탄

- 기타

제9장 접합유리 시장(최종 이용 산업별)

- 소개

- 건축·건설

- 자동차

- 에너지

- 일렉트로닉스

- 기타

제10장 접합유리 시장(지역별)

- 소개

- 북미

- 유럽

- 아시아태평양

- 남미

- 중동 및 아프리카

제11장 경쟁 구도

- 개요

- 시장 점유율 분석

- 브랜드 비교

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 경쟁 시나리오

제12장 기업 개요

- 주요 진출 기업

- TAIWAN GLASS IND. CORP.

- CSG HOLDING CO. LTD.

- FUYAO GROUP

- NIPPON SHEET GLASS CO., LTD.

- SAINT-GOBAIN

- SISECAM

- CENTRAL GLASS CO., LTD.

- AGC INC.

- TRULITE

- SCHOTT

- VITRO

- FLAT GLASS GROUP CO., LTD.

- XINYI GLASS HOLDINGS LIMITED

- GUARDIAN INDUSTRIES

- CEVITAL

- 기타 기업

- BEHRENBERG GLASS CO.

- APOGEE ENTERPRISES, INC.

- PHOENICIA

- CARDINAL GLASS INDUSTRIES, INC

- UNITED PLATE GLASS COMPANY

- INDEPENDENT GLASS CO.

- GSC GLASS PVT LTD

- FISHFA GROUP

- TECNOGLASS

- SCHEUTEN GLASS

제13장 부록

KSM 25.11.17The laminated glass market is anticipated to expand from USD 31.68 billion in 2024 to USD 54.50 billion by 2030, reflecting a compound annual growth rate (CAGR) of 9.5% over the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | By Interlayer Type, By Glass Type, By Application, By End-use Industry |

| Regions covered | Europe, North America, Asia Pacific, South America, Middle East, and Africa |

Among the various applications, the Solar/BIPV Modules segment represents the fastest-growing sector for laminated glass, propelled by the adoption of renewable energy, architectural advancements, and sustainability initiatives. Laminated glass plays a crucial role in this field by providing both structural integrity and functional integration for photovoltaic cells, thereby making it the preferred choice for solar panels, facades, skylights, and other energy-generating architectural elements. A significant factor driving this growth is the global movement towards decarbonization and the development of net-zero buildings, with BIPV modules increasingly replacing traditional building materials such as roofing tiles, curtain walls, and windows. Laminated glass ensures durability and safety while maintaining transparency or semi-transparency, enabling architects and designers to balance aesthetic appeal with functional requirements.

The rising demand is further supported by urbanization and the development of smart city projects, as BIPV modules offer dual benefits: generating renewable energy and improving energy efficiency in building infrastructures. Government incentives for solar energy implementation, stricter building regulations, and rising energy costs have enhanced the economic viability of BIPV solutions. Laminated glass is renowned for its impact resistance, weather resistance, and UV deterioration protection, ensuring long-term performance and safeguarding photovoltaic cells, which ultimately reduces maintenance costs and prolongs system lifespan.

''In terms of value, ionoplast polymer, by Interlayer type, is projected to be the fastest-growing segment of the overall laminated glass market.''

Ionoplast polymer by interlayer type is the fastest-growing segment in the laminated glass market in terms of value because it offers performance that exceeds traditional materials like PVB. This enables high-end applications that can command premium prices. With stiffness reported to be up to 100 times greater and toughness about five times higher than PVB, ionoplast laminates act as true structural elements rather than just safety glass. This allows architects and engineers to create thinner, lighter, and larger glass panels for facades, balustrades, skylights, and overhead glazing without needing bulky frames, leading to system-level cost savings, though with a higher price per square meter. Their excellent edge stability and resistance to moisture reduce the risk of delamination and yellowing, ensuring long-lasting optical clarity, which is important for upscale projects. Notably, ionoplast maintains its load-bearing capacity after breaking even at high temperatures, offering a significant safety advantage in warm climates or safety-critical settings where PVB weakens. Additionally, ionoplast films are typically available in specific thicknesses such as 0.89 mm and 1.52 mm, and feature a very low yellowness index, further confirming their suitability for high-end architectural and structural glass.

''In terms of value, triple laminated, by glass type is projected to be the fastest-growing segment in the overall laminated glass market.''

Triple-laminated glass is the fastest-growing segment based on value, driven by its ability to meet the increasing demand for enhanced safety, durability, and multifunctionality in modern infrastructure and specialized applications. Unlike standard double laminates, triple laminates feature three layers of glass bonded with two interlayers, creating a much stronger and more durable structure. This configuration offers outstanding impact resistance, making it the top choice for environments that face tough conditions such as blasts, ballistic threats, hurricanes, or earthquakes. For instance, it is frequently used in defense, embassies, high-security facilities, and critical public infrastructure like airports and government buildings, where safety and security are priorities. Besides security benefits, triple laminated glass also provides better acoustic insulation and thermal performance, meeting the rising demand for energy-efficient and soundproof spaces in high-rise offices, luxury homes, and urban developments. The additional layer enables the integration of advanced features such as switchable privacy films, solar control coatings, or photovoltaic cells, further adding to its value. Although manufacturing triple laminates involves higher costs due to the thicker glass, extra interlayers, and more complex autoclave processes, customers are willing to pay the premium because it reduces long-term risks, maintenance needs, and liability issues.

"During the forecast period, the laminated glass market in the electronics end-use industry is projected to be the fastest-growing."

The electronics industry is emerging as the fastest-growing end-use market for laminated glass in terms of value, owing to the confluence of advanced display technologies, and consumer and industrial device durability requirements. Unlike the construction or automotive industry, the electronics end-use sector demands laminated glass that not only provides strength and safety but also optical clarity, scratch resistance, and functional integration with sensors, touch systems, and flexible components. Smartphones, tablets, laptops, smartwatches, and AR/VR headsets are increasingly utilizing laminated glass to safeguard sensitive displays while maintaining high brightness and color accuracy. In the luxury consumer electronics segment, laminated glass facilitates edge-to-edge designs, ultra-thin profiles, and smooth touch response, all of which directly augment product value. Beyond consumer devices, laminated glass is gaining popularity within industrial electronics, medical equipment, and automotive screens, where resistance to impacts, temperature variations, and environmental factors is crucial. The incorporation of ionoplast or chemically strengthened layers within laminates ensures long-lasting durability against drops, bending, or frequent usage, thereby reducing warranty claims and fostering customer confidence. Furthermore, laminated glass can embed functional films such as anti-glare, anti-reflective, UV-blocking, or photovoltaic coatings, transforming displays into multifunctional components.

"During the forecast period, the laminated glass market in North America is projected to be the largest."

North America is anticipated to be the leading regional market for laminated glass, primarily owing to its robust industrial foundation, rigorous regulatory environment, and advanced utilization of high-value applications. The construction industry plays a pivotal role, as laminated glass is increasingly mandated in commercial towers, airports, educational institutions, and residential developments to comply with stringent building regulations pertaining to safety, fire protection, and hurricane impact resistance, particularly in coastal regions such as Florida and the Gulf Coast. The growth of green-certified and energy-efficient buildings has further amplified the use of laminated glass with solar control coatings and sound insulation features, in accordance with LEED and other sustainability standards. In the automotive sector, North America benefits from both high vehicle ownership rates and strict regulatory oversight by agencies such as the National Highway Traffic Safety Administration (NHTSA), which emphasize crash safety and occupant protection. Beyond conventional windshields, laminated glass is being employed for side windows, panoramic roofs, and advanced head-up display (HUD) windshields, reflecting consumer preferences for safety, comfort, and premium design. North America also demonstrates excellence in technological advancements, with laminated glass being increasingly integrated into electronics, smart glass, and building-integrated photovoltaics (BIPV). The demand from aerospace and defense sectors, where laminated glass is utilized in cockpits, canopies, and blast-resistant glazing, further enhances the market value. Additionally, the presence of major laminated glass manufacturers, research & development centers, and processing facilities in the United States and Canada ensures a resilient supply capability and efficient commercialization of new interlayers, coatings, and functional laminates.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type - Tier 1- 45%, Tier 2- 35%, and Tier 3- 20%

- By Designation - Managers- 50%, Directors- 30% and Others - 20%

- By Region - North America- 40%, Europe- 35%, Asia Pacific- 20%, RoW- 5%

The report provides a comprehensive analysis of company profiles:

Prominent companies include TAIWAN GLASS IND. CORP. (Taiwan), CSG HOLDING CO., LTD. (China), Fuyao Group (China), Nippon Sheet Glass Co., Ltd. (Japan), Saint-Gobain (France), Sisecam (Turkey), Central Glass Co., Ltd. (Japan), AGC Inc. (Japan), Trulite (Georgia), SCHOTT (Germany), Vitro (Mexico), and others.

Research Coverage

This research report categorizes the laminated glass market by interlayer type (polyvinyl butyral, ethyl-vinyl acetate, ionoplast polymer, thermoplastic polyurethane, other interlayer types), glass type (heat-strengthened, tempered, triple, reflective, other glass types), application (windows, doors, and facades; automotive shields; railway & marine glazing; solar/BIPV modules; electronics & smart devices; security & defense glazing), end-use industry (automotive, electronics, building & construction, energy, other end-use industries), and region (North America, Europe, Asia Pacific, the Middle East & Africa, and South America).

The scope of the report covers detailed information about the main factors influencing the growth of the laminated glass market, such as drivers, restraints, challenges, and opportunities. A thorough analysis of key industry players has been performed to provide insights into their business overview, solutions, services, key strategies, contracts, partnerships, and agreements. The report also discusses service launches, mergers and acquisitions, and recent developments in the laminated glass market. Additionally, it includes a competitive analysis of upcoming startups within the laminated glass market ecosystem.

Reasons to buy this report:

The report will assist market leaders and new entrants by providing approximate revenue figures for the overall laminated glass market and its subsegments. It will help stakeholders understand the competitive landscape and gather insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report offers stakeholders an understanding of the market's current dynamics and key information on drivers, restraints, challenges, and opportunities.

The report provides insights on the following:

- Analysis of key drivers (rising adoption of laminated glass in construction for safety and energy efficiency), restraints (capital-intensive production processes), opportunities (push for sustainable and green-certified buildings), and challenges (high emission in glass production)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and service launches in the laminated glass market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the laminated glass market across varied regions

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the laminated glass market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players like TAIWAN GLASS IND. CORP. (Taiwan), CSG HOLDING CO., LTD. (China), Fuyao Group (China), Nippon Sheet Glass Co., Ltd (Japan), Saint-Gobain (France), Sisecam (Turkey), Central Glass Co., Ltd. (Japan), AGC Inc. (Japan), Trulite (Georgia), SCHOTT (Germany), Vitro (Mexico), among others in the laminated glass market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.4 MARKET FORECAST APPROACH

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LAMINATED GLASS MARKET

- 4.2 LAMIANTED GLASS MARKET, BY GLASS TYPE

- 4.3 LAMINATED GLASS MARKET, BY APPLICATION

- 4.4 LAMINATED GLASS MARKET, BY INTERLAYER TYPE

- 4.5 LAMINATED GLASS MARKET, BY GLASS TYPE

- 4.6 LAMINATED GLASS MARKET, BY END-USE INDUSTRY

- 4.7 LAMINATED GLASS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising adoption in construction for safety and energy efficiency

- 5.2.1.2 Growing use in automotive windshields and sunroofs

- 5.2.1.3 Advances in acoustic, UV control, and solar-integrated glass

- 5.2.2 RESTRAINTS

- 5.2.2.1 Capital-intensive production processes

- 5.2.2.2 Higher cost of glass bonding adhesives than conventional adhesives

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Push for sustainable & green certified buildings

- 5.2.3.2 Security and defense demand for bullet-resistant glass

- 5.2.4 CHALLENGES

- 5.2.4.1 High emissions in glass production

- 5.2.4.2 Competition from alternative lightweight materials

- 5.2.4.3 Fluctuating price of raw materials

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 PRICING ANALYSIS, 2024

- 5.5.1 AVERAGE SELLING PRICE OF LAMINATED GLASS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.6 AVERAGE SELLING PRICE OF LAMINATED GLASS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.6.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.7 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 5.8 MACROECONOMIC OUTLOOK

- 5.8.1 INTRODUCTION

- 5.8.2 GDP TRENDS AND FORECAST

- 5.8.3 TRENDS IN LAMINATED GLASS MARKET

- 5.9 SUPPLY CHAIN ANALYSIS

- 5.9.1 RAW MATERIAL ANALYSIS

- 5.9.2 FABRICATIORS AND INTERMEDIATES

- 5.9.3 FINAL PRODUCT ANALYSIS

- 5.10 VALUE CHAIN ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 EXPORT SCENARIO FOR HS CODE 700721

- 5.11.2 IMPORT SCENARIO FOR HS CODE 700721

- 5.12 ECOSYSTEM ANALYSIS

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 KEY TECHNOLOGIES

- 5.13.1.1 Autoclave processing

- 5.13.1.2 Vacuum heat processing

- 5.13.2 COMPLEMENTARY TECHNOLOGIES

- 5.13.2.1 Cold press

- 5.13.2.2 Nip-roll processing

- 5.13.1 KEY TECHNOLOGIES

- 5.14 PATENT ANALYSIS

- 5.14.1 INTRODUCTION

- 5.14.2 METHODOLOGY

- 5.14.3 DOCUMENT TYPES

- 5.14.4 INSIGHTS

- 5.14.5 LEGAL STATUS

- 5.14.6 JURISDICTION ANALYSIS

- 5.14.7 TOP APPLICANTS

- 5.14.8 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16 KEY CONFERENCES & EVENTS, 2025-2026

- 5.17 CASE STUDY ANALYSIS

- 5.17.1 USE OF LAMINATED SAFETY GLASS IN HIGH-RISE BUILDINGS BY NIPPON SHEET GLASS

- 5.17.2 DEPLOYMENT OF BULLET-RESISTANT LAMINATED GLASS IN SECURITY INFRASTRUCTURE BY SCHOTT

- 5.17.3 LAMINATED ACOUSTIC GLASS FOR TRANSPORTATION HUBS BY SAINT-GOBAIN

- 5.18 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.19 IMPACT OF GEN AI/AI ON LAMINATED GLASS MARKET

- 5.19.1 TOP USE CASES AND MARKET POTENTIAL

- 5.19.2 CASE STUDIES OF AI IMPLEMENTATION IN LAMINATED GLASS MARKET

- 5.20 INVESTMENT AND FUNDING SCENARIO

- 5.21 IMPACT OF 2025 US TARIFF - LAMINATED GLASS MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON COUNTRY/REGION

- 5.21.4.1 US

- 5.21.4.2 Asia Pacific

- 5.21.5 IMPACT ON END-USE INDUSTRIES

6 LAMINATED GLASS MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 WINDOWS & DOORS, FACADES

- 6.2.1 GROWING DEMAND FOR ENERGY-EFFICIENT AND SAFETY-ENHANCED BUILDING MATERIALS IN MODERN CONSTRUCTION

- 6.3 AUTOMOTIVE SHIELDS

- 6.3.1 GROWING FOCUS ON VEHICLE SAFETY AND COMFORT

- 6.4 RAILWAY & MARINE GLAZING

- 6.4.1 INCREASING DEMAND FOR ENHANCED PASSENGER SAFETY AND DURABILITY IN TRANSPORT INFRASTRUCTURE

- 6.5 SOLAR/BIPV MODULE

- 6.5.1 RAPIDLY GROWING DEMAND FOR SUSTAINABLE AND ENERGY-EFFICIENT BUILDING SOLUTIONS

- 6.6 ELECTRONICS & SMART DEVICES

- 6.6.1 GROWING DEMAND FOR DURABLE, HIGH-PERFORMANCE TOUCHSCREENS AND DISPLAY PANELS

- 6.7 SECURITY & DEFENSE GLAZING

- 6.7.1 INCREASING NEED FOR ENHANCED PROTECTION AGAINST BALLISTIC THREATS, EXPLOSIONS, AND FORCED ENTRY

7 LAMINATED GLASS MARKET, BY GLASS TYPE

- 7.1 INTRODUCTION

- 7.2 HEAT STRENGTHENED

- 7.2.1 GROWING DEMAND FOR ENHANCED SAFETY AND STRUCTURAL PERFORMANCE IN ARCHITECTURAL APPLICATIONS

- 7.3 TEMPERED

- 7.3.1 RISING DEMAND FOR HIGH-SAFETY, HIGH-STRENGTH GLASS SOLUTIONS IN CONSTRUCTION AND AUTOMOTIVE APPLICATIONS

- 7.4 TRIPLE LAMINATED

- 7.4.1 GROWING DEMAND FOR ENHANCED SAFETY, ACOUSTIC INSULATION, AND STRUCTURAL PERFORMANCE

- 7.5 REFLECTIVE

- 7.5.1 INCREASING DEMAND FOR ENERGY-EFFICIENT AND AESTHETICALLY APPEALING BUILDING DESIGNS

- 7.6 OTHER GLASS TYPES

8 LAMINATED GLASS MARKET, BY INTERLAYER TYPE

- 8.1 INTRODUCTION

- 8.2 POLYVINYL BUTYRAL

- 8.2.1 RISING DEMAND FOR COST-EFFECTIVE SAFETY AND ACOUSTIC SOLUTIONS IN AUTOMOTIVE AND CONSTRUCTION APPLICATIONS

- 8.3 ETHYL-VINYL ACETATE

- 8.3.1 RISING ADOPTION IN PHOTOVOLTAICS AND DECORATIVE APPLICATIONS DUE TO SUPERIOR ADHESION AND UV RESISTANCE

- 8.4 IONOPLAST POLYMER

- 8.4.1 GROWING DEMAND FOR HIGH-PERFORMANCE, STRUCTURAL, AND SAFETY GLASS IN PREMIUM ARCHITECTURAL AND SPECIALIZED APPLICATIONS

- 8.5 THERMOPLASTIC POLYURETHANE

- 8.5.1 GROWING ADOPTION IN HIGH-SAFETY AND SPECIALTY APPLICATIONS REQUIRING ENHANCED DURABILITY AND VERSATILITY

- 8.6 OTHER INTERLAYER TYPES

9 LAMINATED GLASS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 BUILDING & CONSTRUCTION

- 9.2.1 RISING DEMAND FOR ENHANCED SECURITY AND ACOUSTIC COMFORT IN URBAN INFRASTRUCTURE

- 9.3 AUTOMOTIVE

- 9.3.1 RISING DEMAND FOR SAFETY, COMFORT, AND ADVANCED GLAZING SOLUTIONS IN VEHICLES

- 9.4 ENERGY

- 9.4.1 GROWING ADOPTION IN SOLAR PHOTOVOLTAICS AND RENEWABLE ENERGY APPLICATIONS

- 9.5 ELECTRONICS

- 9.5.1 RISING INTEGRATION OF LAMINATED GLASS IN SMART DEVICES AND CONSUMER ELECTRONICS

- 9.6 OTHER END-USE INDUSTRIES

10 LAMINATED GLASS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: LAMINATED GLASS MARKET, BY APPLICATION

- 10.2.2 NORTH AMERICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE

- 10.2.3 NORTH AMERICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY

- 10.2.4 NORTH AMERICA: LAMINATED GLASS MARKET, BY GLASS TYPE

- 10.2.5 NORTH AMERICA: LAMINATED GLASS MARKET, BY COUNTRY

- 10.2.5.1 US

- 10.2.5.1.1 Strong demand for energy-efficient and safety-compliant building materials in construction sector

- 10.2.5.2 Canada

- 10.2.5.2.1 Rapid growth of advanced consumer electronics and smart device adoption

- 10.2.5.3 Mexico

- 10.2.5.3.1 Growing construction and infrastructure sector to drive market

- 10.2.5.1 US

- 10.3 EUROPE

- 10.3.1 EUROPE: LAMINATED GLASS MARKET, BY APPLICATION

- 10.3.2 EUROPE: LAMINATED GLASS MARKET, BY INTERLAYER TYPE

- 10.3.3 EUROPE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY

- 10.3.4 EUROPE: LAMINATED GLASS MARKET, BY GLASS TYPE

- 10.3.5 EUROPE: LAMINATED GLASS MARKET, BY COUNTRY

- 10.3.5.1 Germany

- 10.3.5.1.1 Strong emphasis on energy-efficient and sustainable building solutions

- 10.3.5.2 France

- 10.3.5.2.1 Country's strong emphasis on modern urban development and sustainable architecture

- 10.3.5.3 UK

- 10.3.5.3.1 Rising demand for safety and security glazing in modern construction

- 10.3.5.4 Italy

- 10.3.5.4.1 Strong automotive and electronics manufacturing driving demand for advanced laminated glass

- 10.3.5.5 Rest of Europe

- 10.3.5.1 Germany

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: LAMINATED GLASS MARKET, BY APPLICATION

- 10.4.2 ASIA PACIFIC: LAMINATED GLASS MARKET, BY INTERLAYER TYPE

- 10.4.3 ASIA PACIFIC: LAMINATED GLASS MARKET, BY END-USE INDUSTRY

- 10.4.4 ASIA PACIFIC: LAMINATED GLASS MARKET, BY GLASS TYPE

- 10.4.5 ASIA PACIFIC: LAMINATED GLASS MARKET, BY COUNTRY

- 10.4.5.1 China

- 10.4.5.1.1 Rapid urbanization and infrastructure development driving demand for safety, durability, and energy-efficient glazing

- 10.4.5.2 Japan

- 10.4.5.2.1 Technological advancements and strong presence of leading laminated glass manufacturers

- 10.4.5.3 India

- 10.4.5.3.1 Rapid urbanization and growing demand for sustainable and safe construction solutions

- 10.4.5.4 South Korea

- 10.4.5.4.1 Strong automotive and electronics manufacturing driving demand for advanced laminated glass

- 10.4.5.5 Rest of Asia Pacific

- 10.4.5.1 China

- 10.5 SOUTH AMERICA

- 10.5.1 SOUTH AMERICA: LAMINATED GLASS MARKET, BY APPLICATION

- 10.5.2 SOUTH AMERICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE

- 10.5.3 SOUTH AMERICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY

- 10.5.4 SOUTH AMERICA: LAMINATED GLASS MARKET, BY GLASS TYPE

- 10.5.5 SOUTH AMERICA: LAMINATED GLASS MARKET, BY COUNTRY

- 10.5.5.1 Brazil

- 10.5.5.1.1 Rapid growth of the automotive industry to drive market

- 10.5.5.2 Argentina

- 10.5.5.2.1 Expanding construction and infrastructure development

- 10.5.5.3 Rest of South America

- 10.5.5.1 Brazil

- 10.6 MIDDLE EAST AND AFRICA

- 10.6.1 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY APPLICATION

- 10.6.2 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE

- 10.6.3 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY

- 10.6.4 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY GLASS TYPE

- 10.6.5 MIDDLE EAST AND AFRICA: LAMINATED GLASS MARKET, BY COUNTRY

- 10.6.5.1 GCC Countires

- 10.6.5.1.1 UAE

- 10.6.5.1.1.1 Rapid growth of large-scale construction and infrastructure projects

- 10.6.5.1.2 Saudi Arabia

- 10.6.5.1.2.1 Large-scale investment in infrastructure and construction projects under Vision 2030

- 10.6.5.1.3 Rest of GCC countries

- 10.6.5.1.1 UAE

- 10.6.5.1 GCC Countires

- 10.6.6 SOUTH AFRICA

- 10.6.6.1 Expanding automotive industry to drive market

- 10.6.7 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.4 MARKET SHARE ANALYSIS

- 11.5 BRAND COMPARISON

- 11.5.1 NIPPON SHEET GLASS CO., LTD.

- 11.5.2 SAINT-GOBAIN

- 11.5.3 SCHOTT

- 11.5.4 CHINA GLASS HOLDINGS LIMITED

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Glass type footprint

- 11.6.5.4 Interlayer footprint

- 11.6.5.5 End-use industry footprint

- 11.6.5.6 Application footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHERS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 TAIWAN GLASS IND. CORP.

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 MnM view

- 12.1.1.3.1 Key strengths

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses and competitive threats

- 12.1.2 CSG HOLDING CO. LTD.

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 MnM view

- 12.1.2.3.1 Key strengths

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses and competitive threats

- 12.1.3 FUYAO GROUP

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 NIPPON SHEET GLASS CO., LTD.

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.3.3 Others

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 SAINT-GOBAIN

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Expansions

- 12.1.5.3.3 Deals

- 12.1.5.3.4 Others

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 SISECAM

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Expansions

- 12.1.6.3.2 Others

- 12.1.6.4 MnM view

- 12.1.6.4.1 Key strengths

- 12.1.6.4.2 Strategic choices

- 12.1.6.4.3 Weaknesses and competitive threats

- 12.1.7 CENTRAL GLASS CO., LTD.

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 MnM view

- 12.1.7.3.1 Key strengths

- 12.1.7.3.2 Strategic choices

- 12.1.7.3.3 Weaknesses and competitive threats

- 12.1.8 AGC INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Expansions

- 12.1.8.3.2 Product launches

- 12.1.8.3.3 Deals

- 12.1.8.3.4 Others

- 12.1.8.4 MnM view

- 12.1.8.4.1 Key strengths

- 12.1.8.4.2 Strategic choices

- 12.1.8.4.3 Weaknesses and competitive threats

- 12.1.9 TRULITE

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.4 MnM view

- 12.1.9.4.1 Right to win

- 12.1.9.4.2 Strategic choices

- 12.1.9.4.3 Weaknesses and competitive threats

- 12.1.10 SCHOTT

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Expansions

- 12.1.10.4 MnM view

- 12.1.10.4.1 Key strengths

- 12.1.10.4.2 Strategic choices

- 12.1.10.4.3 Weaknesses and competitive threats

- 12.1.11 VITRO

- 12.1.11.1 Business overviews

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Expansions

- 12.1.11.3.2 Deals

- 12.1.11.3.3 Others

- 12.1.11.4 MnM view

- 12.1.11.4.1 Key strengths

- 12.1.11.4.2 Strategic choices

- 12.1.11.4.3 Weaknesses and competitive threats

- 12.1.12 FLAT GLASS GROUP CO., LTD.

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 MnM view

- 12.1.12.3.1 Key strengths

- 12.1.12.3.2 Strategic choices

- 12.1.12.3.3 Weaknesses and competitive threats

- 12.1.13 XINYI GLASS HOLDINGS LIMITED

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Expansions

- 12.1.13.4 MnM view

- 12.1.13.4.1 Key sterngths/Right to win

- 12.1.13.4.2 Strategic choices

- 12.1.13.4.3 Weaknesses and competitive threats

- 12.1.14 GUARDIAN INDUSTRIES

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches

- 12.1.14.3.2 Deals

- 12.1.14.3.3 Expansions

- 12.1.14.3.4 Others

- 12.1.14.4 MnM view

- 12.1.14.4.1 Key strengths

- 12.1.14.4.2 Strategic choices

- 12.1.14.4.3 Weaknesses and competitive threats

- 12.1.15 CEVITAL

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 MnM view

- 12.1.15.3.1 Key strengths

- 12.1.15.3.2 Strategic choices

- 12.1.15.3.3 Weaknesses and competitive threats

- 12.1.1 TAIWAN GLASS IND. CORP.

- 12.2 OTHER PLAYERS

- 12.2.1 BEHRENBERG GLASS CO.

- 12.2.2 APOGEE ENTERPRISES, INC.

- 12.2.3 PHOENICIA

- 12.2.4 CARDINAL GLASS INDUSTRIES, INC

- 12.2.5 UNITED PLATE GLASS COMPANY

- 12.2.6 INDEPENDENT GLASS CO.

- 12.2.7 GSC GLASS PVT LTD

- 12.2.8 FISHFA GROUP

- 12.2.9 TECNOGLASS

- 12.2.10 SCHEUTEN GLASS

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS