|

시장보고서

상품코드

1859661

애플리케이션 현대화 서비스 시장(-2031년) : 서비스 유형별(클라우드 애플리케이션 전환, 애플리케이션 재플랫폼화, 포스트 현대화), 애플리케이션 유형별(레거시, 클라우드 호스트, 클라우드 네이티브)Application Modernization Services Market by Service Type (Cloud Application Migration, Application Re-Platforming, Post Modernization), Application Type (Legacy, Cloud-hosted, Cloud-native) - Global Forecast to 2031 |

||||||

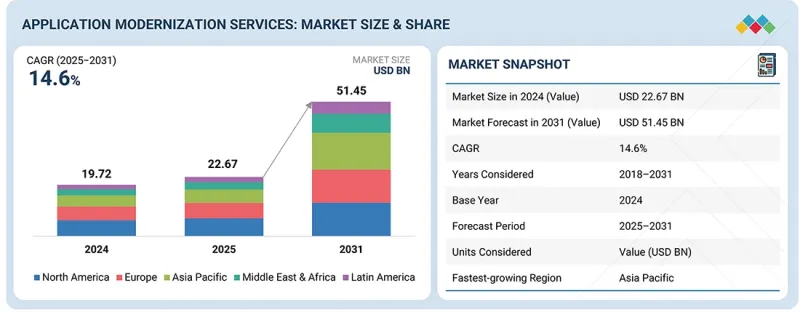

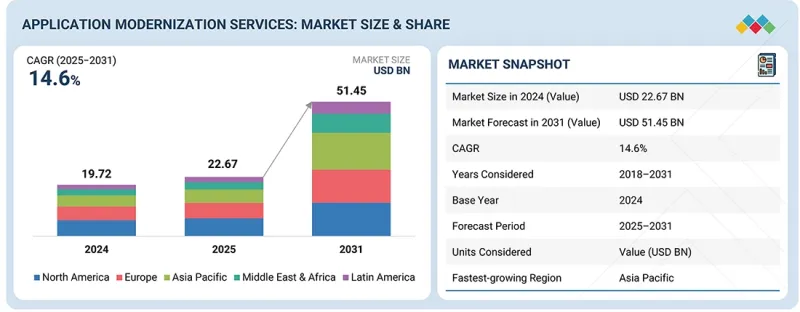

애플리케이션 현대화 서비스 시장 규모는 2025년 226억 7,000만 달러에서 CAGR 14.6%로 추정되며, 2031년에는 514억 5,000만 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2018-2031년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2031년 |

| 단위 | 금액(달러) |

| 부문 | 서비스 유형·애플리케이션 유형·산업·지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

애플리케이션 현대화 서비스 시장은 몇 가지 요인에 의해 성장하고 있습니다. 급격한 기술 혁신의 시대에 기업은 경쟁력을 유지하고 효율성을 높이기 위해 오래된 애플리케이션을 업데이트할 필요성을 무시할 수 없습니다. 기업이 사업 규모나 네트워크, 커버리지가 확대되면 기존 레거시 시스템으로는 현재의 비즈니스 수요를 감당할 수 없는 경우가 많습니다. 이는 규모의 제약, 유연성 부족, 새로운 기술과의 통합이 어렵기 때문입니다.

클라우드 기술의 이용 확대도 또 다른 중요한 성장 요인입니다. 많은 기업들이 운영의 확장성과 비용 효율을 위해 클라우드 제공업체를 활용하고 있습니다. 이러한 디지털 혁신의 결과로 기업들은 애플리케이션의 혁신을 요구받고 있습니다. AI, 머신러닝(ML), IoT와 같은 첨단 기술과 원활하게 통합될 수 있는 애플리케이션이 필수적이기 때문입니다.

또한, 데이터 보안과 컴플라이언스에 대한 관심이 높아지면서 기업들은 사이버 보안 문제에 대한 규제 요건의 변화에 따라 새로운 버전의 애플리케이션으로 적극적으로 전환하고 있습니다. 또한, 애플리케이션의 성능 향상과 사용자 경험 개선도 현대화의 흐름을 가속화하는 이유입니다. 기업들은 고객이 디지털 상에서 자신과 소통하는 방식을 개선하기 위해 끊임없이 노력하고 있습니다. 또한, 운영 비용을 줄이면서 민첩성과 시장 출시 속도를 높이고자 하는 니즈도 큰 요인으로 작용하고 있습니다. 애플리케이션 현대화는 새로운 기능이나 서비스를 단기간에 배포할 수 있도록 하기 위함입니다. 이러한 이유로 애플리케이션 현대화 서비스에 대한 수요가 증가하고 있으며, 기업들은 전략적 목표와 업무 효율성에 따라 자사의 기술 기반을 재구축하고자 합니다.

"클라우드 네이티브 애플리케이션 부문이 예측 기간 동안 가장 높은 성장률을 보일 것으로 전망"

이 부문은 확장성, 유연성, 효율성 측면에서 높은 성장 잠재력을 가지고 있어 예측 기간 동안 가장 높은 성장률을 보일 것으로 예상됩니다. 레거시 애플리케이션은 대부분 단일 단위로 제공되며, 서버나 데이터센터와 같은 물리적 인프라에 의존하는 경우가 많습니다. 이에 반해 클라우드 네이티브 애플리케이션은 클라우드를 중심으로 구축되며, 마이크로서비스, 컨테이너화 부팅, 스케줄링 관리 시스템 등 고도의 아키텍처 설계를 채택하고 있습니다. 이를 통해 기업은 비즈니스 환경 변화에 유연하게 대응하고 필요에 따라 리소스를 확장하며 불필요한 운영 비용을 최소화할 수 있습니다. 또한, 클라우드 기반 솔루션의 보급과 클라우드 기술의 성숙은 클라우드 네이티브 애플리케이션에 대한 수요를 증가시키고 있습니다. 이러한 솔루션은 시장 과제를 극복하고 더 빠르고 고품질의 결과물과 최적화된 사용자 경험을 제공합니다. 비즈니스 프로세스의 디지털화를 통해 효율성을 높이는 지속적인 움직임도 중요한 기술 트렌드입니다. 따라서 현대의 클라우드 기반 요구에 부응하는 고성능, 고응답성 시스템 솔루션의 개발이 진행되어 클라우드 네이티브 애플리케이션으로의 전환이 가속화되고 있으며, 이는 이 부문이 높은 성장률을 보이는 이유입니다.

"아시아태평양이 예측 기간 동안 가장 높은 성장률을 기록할 것으로 전망"

이를 뒷받침하는 요인 중 하나는 이 지역에서 진행되고 있는 디지털 전환입니다. 클라우드 컴퓨팅 및 기타 신흥 기술 도입 확대, 업무 효율성 추구가 성장을 견인하고 있습니다. 중국, 인도 등의 국가에서는 IT 지출과 디지털 활동이 증가하면서 노후화된 관리 시스템 현대화 및 신기술 도입 서비스에 대한 수요가 증가하고 있습니다. 또한, 세계 기술 제공업체의 진출과 지역 기업의 부상도 시장 경쟁을 활성화하고 성장을 가속화하고 있습니다. 또한, 소득 수준 상승과 기술 지향적인 인구 구성의 변화도 이 지역의 고기능, 대용량 애플리케이션 현대화 서비스 수요를 증가시키는 주요 요인으로 작용하고 있습니다.

세계의 애플리케이션 현대화 서비스 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술·특허 동향, 법·규제 환경, 사례 분석, 시장 규모 추정 및 예측, 각종 부문별·지역별·주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요와 업계 동향

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 애플리케이션 현대화 서비스의 진화

- 애플리케이션 현대화 서비스 : 생태계 분석

- 사례 연구 분석

- 공급망 분석

- 규제 상황

- 가격 분석

- Porter's Five Forces 분석

- 기술 분석

- 특허 분석

- 고객의 사업에 영향을 미치는 동향/디스럽션

- 주요 이해관계자와 구입 기준

- 2025-2026년의 주요 회의와 이벤트

- 애플리케이션 현대화 서비스 시장용 기술 로드맵

- 애플리케이션 현대화 서비스 시장의 베스트 프랙티스

- 현재 비즈니스 모델과 신흥 비즈니스 모델

- 투자와 자금 조달 시나리오

- 생성형 AI가 애플리케이션 현대화 서비스 시장에 미치는 영향

- 2025년 미국 관세의 영향 - 개요

- 주요 관세율

- 가격 영향 분석

- 국가/지역에 대한 영향

- 산업

- 애플리케이션 현대화의 7 'R'

제6장 애플리케이션 현대화 서비스 시장 : 서비스 유형별

- 시장 성장 촉진요인

- 용도 포트폴리오 평가

- 클라우드 애플리케이션 전환

- 애플리케이션 재플랫폼화

- 애플리케이션 통합

- UI/UX 현대화

- 포스트모더니제이션 서비스

제7장 애플리케이션 현대화 서비스 시장 : 애플리케이션 유형별

- 시장 성장 촉진요인

- 레거시 애플리케이션

- 클라우드 호스트 애플리케이션

- 클라우드 네이티브 애플리케이션

제8장 애플리케이션 현대화 서비스 시장 : 산업별

- 시장 성장 촉진요인

- BFSI

- IT·ITES

- 헬스케어 및 생명과학

- 제조

- 통신

- 운송·물류

- 미디어 및 엔터테인먼트

- 소매·E-Commerce

- 정부

- 기타

제9장 애플리케이션 현대화 서비스 시장 : 지역별

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 유럽

- 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 거시경제 전망

- 중국

- 일본

- 인도

- 기타

- 중동 및 아프리카

- 거시경제 전망

- 아랍에미리트

- 사우디아라비아

- 아프리카

- 기타

- 라틴아메리카

- 거시경제 전망

- 브라질

- 멕시코

- 기타

제10장 경쟁 구도

- 주요 진출 기업의 전략/강점

- 시장 점유율 분석

- 매출 분석

- 브랜드/제품 비교

- 기업 평가와 재무 지표

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 경쟁 시나리오

제11장 기업 개요

- 주요 기업

- IBM

- MICROSOFT

- HCL TECHNOLOGIES

- ACCENTURE

- AWS

- ATOS

- CAPGEMINI

- ORACLE

- COGNIZANT

- TCS

- INNOVA SOLUTIONS

- EPAM SYSTEMS

- ASPIRE SYSTEMS

- NTT DATA

- DELL TECHNOLOGIES

- DXC TECHNOLOGY

- LTIMINDTREE

- INFOSYS

- WIPRO

- ROCKET SOFTWARE, INC.

- FUJITSU

- HEXAWARE TECHNOLOGIES

- VIRTUSA

- MONGODB

- SCIENCESOFT

- SIMFORM

- UTTHUNGA

- RISHABH SOFTWARE

- 스타트업/SME

- SOFTURA

- CLOUDHEDGE TECHNOLOGIES PVT. LTD.

- D3V TECHNOLOGY

- BAYSHORE INTELLIGENCE SOLUTIONS

- OPINOV8

- ICREON

- SYMPHONY SOLUTIONS

- CLEVEROAD

- TECHAHEAD

- GEOMOTIV

- SOFT SUAVE

- PALMDIGITALZ

- AVERISOURCE

- VERITIS

제12장 인접 시장과 관련 시장

제13장 부록

KSM 25.11.17The Application modernization services market was estimated to be USD 22.67 billion in 2025 and is expected to reach USD 51.45 billion by 2031 at a compound annual growth rate (CAGR) of 14.6%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2031 |

| Base Year | 2024 |

| Forecast Period | 2025-2031 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By Service Type, Application Type, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

There are a few factors owing to which the application modernization services market is experiencing growth. In the era of rapid technological advancements, a business cannot afford to overlook the need to update its outdated applications in order to stay competitive and improve its efficiency. Often, when a business has grown sufficiently in scope, coverage, and network, the legacy systems in place can hardly meet current business demands because they are constrained by scale, flexibility, and integration with new-age technologies.

The increased use of cloud technology is another key driver, with many organizations aiming to utilize cloud providers due to the scalability and cost-effectiveness of their operations. As a result of this digital evolution, companies have been compelled to undergo application transformation, as it is essential that such applications integrate seamlessly with advanced technologies such as Artificial Intelligence, machine learning, and the Internet of Things.

Moreover, with the increasing focus on securing data and compliance, organizations are also actively migrating their deployments to newer versions of applications developed to meet the changing needs of regulations aimed at addressing cybersecurity issues. Additionally, better performance of applications and improving user experience with such applications are other reasons for enhanced modernization trends, since every business strives to improve how its customers interact with the business digitally. The need to reduce operating costs while increasing agility and speed to market is also a major factor, as application modernization enables the rollout of new features and services in a shorter period. Overall, these are the reasons for the high demand for services related to application modernization, as organizations seek to redesign their technological frameworks in response to their strategic objectives and operational effectiveness.

"The healthcare & life sciences vertical is expected to have the second-largest market size during the forecast period."

The healthcare sector is expected to capture a significant share of the application modernization services market, second only to the telecom industry, during the forecast period. This growth is driven by the rising demand for advanced digital solutions. The sector is undergoing a major transformation fueled by the increasing adoption of electronic health records, telemedicine, and AI-driven diagnostics. To support these advancements, healthcare providers require more efficient IT systems that enhance operational efficiency, improve patient care, and ensure compliance with regulatory standards. Additionally, the growing demand for cloud-based solutions that offer both security and scalability, along with seamless integration of new technologies into existing systems, continues to accelerate growth in this space.

"The cloud-native applications segment will witness the highest growth rate during the forecast period."

In the application modernization services, owing to their vast potential for growth in aspects such as scalability, flexibility, and efficiency over and above the others, cloud-native applications are projected to have a greater increase within the forecasted period. On the other hand, while legacy applications offer services as a single unit and often rely on underlying physical structures, such as servers and data centers, cloud-native applications are cloud-centric and are constructed using enhanced architectural designs, including those of microservices, containerized booting, and scheduling management systems. This allows players in the industry to adapt to changes in the business environment, increase resources when needed, and minimize unnecessary operational costs. Additionally, the increased use of cloud-based solutions and the maturation of cloud technologies are driving the need for cloud-native applications, as such solutions have overcome market challenges to deliver faster, better results, and an optimized user experience. The most important technological trend has also been the continuous and sustained drive towards digitalizing businesses' processes for improved efficiency, which therefore means the development of able and responsive system solutions to the modern need for cloud based solutions will make transition to the more use of cloud-native applications faster hence this explains the expected higher growth rate of such applications in the application modernization services market.

"Asia Pacific to register the highest growth rate during the forecast period."

The application modernization services market in the forecast period is expected to grow at a higher pace in the Asia-Pacific region, driven by several underlying factors. One of the reasons is the digital transformation of the region, which has been facilitated by the growing adoption of cloud computing and other emerging technologies, as well as the pursuit of efficiency in business operations. There is an increase in IT spending and digital activities in countries like China and India, creating a need for services to modernize aging management systems and incorporate new technologies. The growth of the sector is also enhanced by the efforts of global technology providers and the influx of local enterprises, which are enhancing competition. The increasing affluence of the population, along with the trend towards a more technologically inclined population, is another major factor driving the need for sophisticated and high-capacity application modernization services within the region.

Breakdown of primaries

The study offers insights from a range of industry experts, including solution vendors and Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 62%, Tier 2 - 23%, and Tier 3 - 15%

- By Designation: C-level -50%, D-level - 30%, and Others - 20%

- By Region: North America - 38%, Europe - 15%, Asia Pacific - 35%, Middle East & Africa - 7%, and Latin America - 5%.

The major players in the Application modernization services market include Oracle (US), IBM (US), Microsoft (US), AWS (US), HCL Technologies (India), Accenture (Ireland), ATOS (France), Capgemini (France), Cognizant (US), TCS (India), Aspire Systems (India), NTT Data Group Corporation (Japan), Infosys (India), Dell Technologies (US), Innova Solutions (US), EPAM Systems (US), DXC Technology (US), MongoDB (US), LTIMindtree (India), Wipro (India), Rocket Software (US), Fujitsu (Japan), Hexaware Technologies (India), Virtusa (US), Softura (US), CloudHedge (US), D3V Technology (US), Bayshore Intelligence (US), Opinov8 (UK), Icreon (US), Symphony Solutions (Netherlands), Cleveroad (Ukraine), Soft Suave (India), TechAhead (US), Geomotiv (US), PalmDigitalz (India), AveriSource (US), ScienceSoft (US), Simform (US), Utthunga (India), Rishabh Software (India), and Veritis (US). These players have adopted various growth strategies, including partnerships, agreements, collaborations, product launches, enhancements, and acquisitions, to expand their footprint in the application modernization services market.

Research Coverage

The market study covers the size of the application modernization services market across various segments. It aims to estimate the market size and growth potential across different segments, including service types, application types, verticals, and regions. The service type includes application portfolio assessment, cloud application migration, application re-platforming, application integration, UI/UX modernization, and post-modernization. Further, the application types include legacy applications, cloud-hosted applications, and cloud-native applications. The verticals include BFSI, healthcare & life sciences, telecom, IT & ITeS, retail & e-commerce, government, energy & utilities, transportation & logistics, media & entertainment, and manufacturing. The regional analysis of the Application modernization services market covers North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders/new entrants with information on the closest approximations of the global Application Modernization Services market's revenue numbers and subsegments. This report will help stakeholders understand the competitive landscape and gain valuable insights to better position their businesses and plan suitable go-to-market strategies. Moreover, the report will provide stakeholders with insights into the market's pulse, as well as information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

1. Analysis of key drivers (rising digital transformation initiatives, demand for flexibility and scalability through cloud computing, rapid technological advancements), restraints (high costs and complexity, legacy system dependencies), opportunities (emerging markets and SMEs, evolution of open standards for software development), and challenges (vendor lock-in and platform dependencies, managing technical debt) influencing the growth of the application modernization services market.

2. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the application modernization services market.

3. Market Development: Comprehensive information about lucrative markets - the report analyses the application modernization services market across various regions.

4. Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the application modernization services market.

5. Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as Oracle (US), IBM (US), Microsoft (US), AWS (US), HCL Technologies (India), Accenture (Ireland), ATOS SE (France), Capgemini (France), Cognizant (US), Tata Consultancy Services (India), Aspire Systems (India), NTT Data Group Corporation (Japan), Infosys (India), Dell Technologies (US), Innova Solutions (US), EPAM Systems (US), DXC Technology (US), MongoDB (US), LTIMindtree (India), Wipro (India), Rocket Software (US), Fujitsu (Japan), Hexaware Technologies (India), Virtusa (US), Softura (US), CloudHedge (US), D3V Technology (US), Bayshore Intelligence (US), Opinov8 (UK), Icreon (US), Symphony Solutions (Netherlands), Cleveroad (Ukraine), Soft Suave (India), TechAhead (US), Geomotiv (US), PalmDigitalz (India), AveriSource (US), ScienceSoft (US), Simform (US), Utthunga (India), Rishabh Software (India), and Veritis (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 LIMITATIONS AND RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN APPLICATION MODERNIZATION SERVICES MARKET

- 4.2 APPLICATION MODERNIZATION SERVICES MARKET, BY SERVICE TYPE

- 4.3 APPLICATION MODERNIZATION SERVICES MARKET, BY APPLICATION TYPE

- 4.4 APPLICATION MODERNIZATION SERVICES MARKET, BY VERTICAL

- 4.5 NORTH AMERICA: APPLICATION MODERNIZATION SERVICES MARKET, BY SERVICE TYPE AND APPLICATION TYPE

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in digital transformation initiatives

- 5.2.1.2 Demand for flexibility and scalability through cloud computing

- 5.2.1.3 Rapid technological advancements

- 5.2.1.4 Shift toward modernization by cloud-native technologies

- 5.2.1.5 Stringent regulatory compliance and security

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs and complexity

- 5.2.2.2 Legacy system dependencies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Proliferation of Kubernetes and containerization

- 5.2.3.2 Evolution of open standards for software development

- 5.2.3.3 Emerging markets and SMEs

- 5.2.3.4 Existence of large number of legacy applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Vendor lock-in and platform dependencies

- 5.2.4.2 Managing technical debt

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF APPLICATION MODERNIZATION SERVICES

- 5.4 APPLICATION MODERNIZATION SERVICES: ECOSYSTEM ANALYSIS

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 AIRBNB MODERNIZED RUBY ON RAILS MONOLITH USING KUBERNETES TO REDUCE TECH DEBT

- 5.5.2 MODERNIZATION OF ATRUVIA AG'S BANKING APPLICATION

- 5.5.3 LEGACY SYSTEMS' MODERNIZATION FOR BIOPHARMA BY HCL ON AWS

- 5.5.4 APPLICATION MODERNIZATION FOR LEADING MEDICAL LABORATORY RESULTING IN BETTER ROI

- 5.5.5 UNIPER ENERGY'S UK TRADING SOLUTIONS MODERNIZED BY INFOSYS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.2 REGULATIONS

- 5.7.2.1 North America

- 5.7.2.1.1 US

- 5.7.2.1.2 Canada

- 5.7.2.2 Europe

- 5.7.2.2.1 UK

- 5.7.2.2.2 Germany

- 5.7.2.3 Asia Pacific

- 5.7.2.3.1 South Korea

- 5.7.2.3.2 China

- 5.7.2.3.3 Japan

- 5.7.2.3.4 India

- 5.7.2.4 Middle East & Africa

- 5.7.2.4.1 UAE

- 5.7.2.4.2 KSA

- 5.7.2.5 Latin America

- 5.7.2.5.1 Brazil

- 5.7.2.5.2 Mexico

- 5.7.2.1 North America

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY SERVICE TYPE, 2024

- 5.8.2 INDICATIVE PRICING ANALYSIS, BY SERVICE FEATURE, 2024

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Cloud platforms

- 5.10.1.2 Containerization

- 5.10.1.3 DevOps tools and CI/CD pipelines

- 5.10.1.4 Microservices architecture

- 5.10.1.5 API management platforms

- 5.10.1.6 Low-code/No-code platforms

- 5.10.2 ADJACENT TECHNOLOGIES

- 5.10.2.1 Edge computing

- 5.10.2.2 5G and next-generation networks

- 5.10.2.3 Blockchain

- 5.10.2.4 Quantum computing

- 5.10.2.5 Augmented reality (AR) and virtual reality (VR)

- 5.10.3 COMPLEMENTARY TECHNOLOGIES

- 5.10.3.1 AI/ML integration

- 5.10.3.2 Robotic process automation (RPA)

- 5.10.3.3 Identity and access management (IAM)

- 5.10.3.4 Data lakes and data warehousing

- 5.10.3.5 Enterprise service bus (ESB)

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PATENT ANALYSIS

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 TECHNOLOGY ROADMAP FOR APPLICATION MODERNIZATION SERVICES MARKET

- 5.15.1 SHORT-TERM ROADMAP (2026-2027)

- 5.15.2 MID-TERM ROADMAP (2028-2029)

- 5.15.3 LONG-TERM ROADMAP (2030-2031)

- 5.16 BEST PRACTICES IN APPLICATION MODERNIZATION SERVICES MARKET

- 5.16.1 CONDUCT THOROUGH ASSESSMENT

- 5.16.2 DEFINE CLEAR GOALS AND OBJECTIVES

- 5.16.3 DEVELOP MODERNIZATION ROADMAP

- 5.16.4 CHOOSE RIGHT MODERNIZATION APPROACH

- 5.16.5 PRIORITIZE APPLICATIONS FOR MODERNIZATION

- 5.16.6 OPTIMIZE FOR CLOUD

- 5.16.7 ENSURE CONTINUOUS MONITORING AND OPTIMIZATION

- 5.16.8 ENGAGE STAKEHOLDERS THROUGHOUT PROCESS

- 5.17 CURRENT AND EMERGING BUSINESS MODELS

- 5.17.1 PLATFORM-AS-A-SERVICE (PAAS)

- 5.17.2 CONSULTATIVE SERVICES MODEL

- 5.17.3 OUTCOME-BASED MODELS

- 5.17.4 OPEN-SOURCE MODEL

- 5.17.5 CO-DEVELOPMENT MODEL

- 5.17.6 AUTOMATED MODELS

- 5.18 INVESTMENT AND FUNDING SCENARIO

- 5.19 IMPACT OF GENERATIVE AI ON APPLICATION MODERNIZATION SERVICES MARKET

- 5.19.1 IMPACT OF AI/GENERATIVE AI ON APPLICATION MODERNIZATION SERVICES

- 5.19.2 USE CASES OF GENERATIVE AI IN APPLICATION MODERNIZATION SERVICES

- 5.19.3 BEST PRACTICES

- 5.19.3.1 BFSI Industry

- 5.19.3.2 IT & ITeS Industry

- 5.19.3.3 Telecom Industry

- 5.19.4 CASE STUDIES OF GENERATIVE AI IMPLEMENTATION

- 5.19.4.1 Modernizing a mission critical banking app

- 5.19.4.2 Cloud-first ERP renewal for a manufacturer

- 5.19.4.3 Zero-downtime auction platform scale-out

- 5.19.5 CLIENT READINESS AND IMPACT ASSESSMENT

- 5.19.5.1 Client A: Global retail bank

- 5.19.5.2 Client B: Industrial manufacturer

- 5.19.5.3 Client C: Digital marketplace

- 5.20 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.20.1 INTRODUCTION

- 5.21 KEY TARIFF RATES

- 5.22 PRICE IMPACT ANALYSIS

- 5.23 IMPACT ON COUNTRY/REGION

- 5.23.1 NORTH AMERICA

- 5.23.2 EUROPE

- 5.23.3 APAC

- 5.24 INDUSTRIES

- 5.25 7 'R'S OF APPLICATION MODERNIZATION

- 5.25.1 REHOST

- 5.25.2 RE-PLATFORM

- 5.25.3 REFACTOR

- 5.25.4 REVISE

- 5.25.5 REBUILD

- 5.25.6 REPLACE

- 5.25.7 RETIRE

6 APPLICATION MODERNIZATION SERVICES MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- 6.1.1 SERVICE TYPE: MARKET DRIVERS

- 6.1.2 APPLICATION PORTFOLIO ASSESSMENT

- 6.1.2.1 Need for strategic evaluation to streamline modernization paths to drive initial adoption of portfolio assessments

- 6.1.3 CLOUD APPLICATION MIGRATION

- 6.1.3.1 Rapid adoption of cloud infrastructure to support these services as businesses seek scalability and cost-efficiency

- 6.1.4 APPLICATION RE-PLATFORMING

- 6.1.4.1 Demand for performance optimization without complete rewrites

- 6.1.5 APPLICATION INTEGRATION

- 6.1.5.1 Increase in complexity of hybrid environments to drive need for seamless application integration across cloud and legacy systems

- 6.1.6 UI/UX MODERNIZATION

- 6.1.6.1 Growth in emphasis on user-centric digital experiences to sustain demand for UI/UX modernization

- 6.1.7 POST-MODERNIZATION SERVICES

- 6.1.7.1 Ongoing need for support in maintaining modernized applications to ensure steady, albeit slower, growth of post-modernization services

7 APPLICATION MODERNIZATION SERVICES MARKET, BY APPLICATION TYPE

- 7.1 INTRODUCTION

- 7.1.1 APPLICATION TYPE: MARKET DRIVERS

- 7.1.2 LEGACY APPLICATIONS

- 7.1.2.1 Need to reduce operational costs of legacy applications and integrate with modern technologies

- 7.1.3 CLOUD-HOSTED APPLICATIONS

- 7.1.3.1 Growth in demand for scalable and cost-efficient IT infrastructure to fuel adoption of cloud-hosted application modernization

- 7.1.4 CLOUD-NATIVE APPLICATIONS

- 7.1.4.1 Push for innovation, scalability, and speed in digital transformation to drive rapid adoption of cloud-native applications

8 APPLICATION MODERNIZATION SERVICES MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.1.1 VERTICAL: MARKET DRIVERS

- 8.2 BFSI

- 8.2.1 NEED FOR SECURE, SCALABLE, AND EFFICIENT FINANCIAL SERVICES

- 8.2.2 BFSI: APPLICATION MODERNIZATION SERVICE USE CASES

- 8.2.2.1 Core banking system modernization

- 8.2.2.2 Claims processing overhaul

- 8.2.2.3 Digital customer portals

- 8.2.2.4 Real-time risk management

- 8.2.2.5 Payment gateway integration

- 8.3 IT & ITES

- 8.3.1 NEED FOR AGILE SERVICE DELIVERY AND TECHNOLOGICAL INTEGRATION

- 8.3.2 IT & ITES: APPLICATION MODERNIZATION SERVICE USE CASES

- 8.3.2.1 ERP cloud migration

- 8.3.2.2 Unified IT management systems

- 8.3.2.3 Customer support systems modernization

- 8.3.2.4 Cloud-native software optimization

- 8.3.2.5 Hybrid cloud management systems

- 8.4 HEALTHCARE & LIFE SCIENCES

- 8.4.1 NEED FOR IMPROVED PATIENT CARE, DIGITAL HEALTH SOLUTIONS, AND EFFICIENT DATA MANAGEMENT

- 8.4.2 HEALTHCARE & LIFE SCIENCES: APPLICATION MODERNIZATION SERVICE USE CASES

- 8.4.2.1 EHR cloud migration

- 8.4.2.2 Pharmaceutical research modernization

- 8.4.2.3 Health insurance claims

- 8.4.2.4 Telemedicine platforms

- 8.4.2.5 Medical device connectivity

- 8.5 MANUFACTURING

- 8.5.1 DRIVE TOWARD SMART FACTORIES AND REAL-TIME SUPPLY CHAIN OPTIMIZATION

- 8.5.2 MANUFACTURING: APPLICATION MODERNIZATION SERVICE USE CASES

- 8.5.2.1 Smart factory implementations

- 8.5.2.2 Predictive maintenance solutions

- 8.5.2.3 Integrated supply chain management

- 8.5.2.4 Quality control enhancements

- 8.5.2.5 Collaborative robotics integration

- 8.6 TELECOM

- 8.6.1 RAPID GROWTH OF 5G NETWORKS AND DEMAND FOR ENHANCED SERVICE DELIVERY

- 8.6.2 TELECOM: APPLICATION MODERNIZATION SERVICE USE CASES

- 8.6.2.1 5G network management modernization

- 8.6.2.2 Cloud-based CRM systems

- 8.6.2.3 Billing system integration

- 8.6.2.4 Network automation

- 8.6.2.5 Self-service portal modernization

- 8.7 TRANSPORTATION & LOGISTICS

- 8.7.1 DEMAND FOR REAL-TIME VISIBILITY AND OPERATIONAL EFFICIENCY

- 8.7.2 TRANSPORTATION & LOGISTICS: APPLICATION MODERNIZATION SERVICE USE CASES

- 8.7.2.1 Cloud-based fleet management systems

- 8.7.2.2 Integrated warehouse management

- 8.7.2.3 Enhanced shipping portals

- 8.7.2.4 Visibility and responsiveness improvements

- 8.7.2.5 Predictive analytics for demand forecasting

- 8.8 MEDIA & ENTERTAINMENT

- 8.8.1 NEED FOR INNOVATIVE CONTENT DELIVERY AND PERSONALIZED VIEWER EXPERIENCES

- 8.8.2 MEDIA & ENTERTAINMENT: APPLICATION MODERNIZATION SERVICE USE CASES

- 8.8.2.1 Cloud-based content delivery networks

- 8.8.2.2 Personalized user experiences

- 8.8.2.3 Digital asset management systems

- 8.8.2.4 Enhanced audience analytics

- 8.8.2.5 Integrated marketing solutions

- 8.9 RETAIL & E-COMMERCE

- 8.9.1 ADOPTION OF PERSONALIZED CUSTOMER EXPERIENCES AND STREAMLINED OPERATIONS

- 8.9.2 RETAIL & E-COMMERCE: APPLICATION MODERNIZATION SERVICE USE CASES

- 8.9.2.1 Cloud-based inventory management

- 8.9.2.2 Customer loyalty program modernization

- 8.9.2.3 POS and e-commerce integration

- 8.9.2.4 Demand forecasting modernization

- 8.9.2.5 Scalable e-commerce platforms

- 8.10 GOVERNMENT

- 8.10.1 NEED FOR ENHANCED CITIZEN ENGAGEMENT AND EFFICIENT SERVICE DELIVERY

- 8.10.2 GOVERNMENT: APPLICATION MODERNIZATION SERVICE USE CASES

- 8.10.2.1 Citizen services cloud migration

- 8.10.2.2 Document management system overhaul

- 8.10.2.3 Inter-agency communication integration

- 8.10.2.4 User-friendly public service apps

- 8.10.2.5 Disaster recovery planning

- 8.11 OTHER VERTICALS

- 8.11.1 OTHER VERTICALS: APPLICATION MODERNIZATION SERVICE USE CASES

- 8.11.1.1 Cloud-based booking systems

- 8.11.1.2 Personalized travel recommendations

- 8.11.1.3 Cloud-based student information systems

- 8.11.1.4 Interactive virtual classrooms

- 8.11.1.5 Adaptive learning platforms

- 8.11.1 OTHER VERTICALS: APPLICATION MODERNIZATION SERVICE USE CASES

9 APPLICATION MODERNIZATION SERVICES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Rise in prevalence of AI advancements, automation, and next-gen network technologies

- 9.2.3 CANADA

- 9.2.3.1 Government-backed digital initiatives and cloud adoption to fuel modernization across public and private sectors

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 UK

- 9.3.2.1 Stringent regulations support adoption of application modernization services in UK

- 9.3.3 GERMANY

- 9.3.3.1 Strong focus on Industry 4.0 and smart manufacturing, and need for advanced networking solutions

- 9.3.4 FRANCE

- 9.3.4.1 Increased demand for digital services and automation to boost modernization across sectors

- 9.3.5 ITALY

- 9.3.5.1 Transformation of legacy infrastructure, particularly in finance and telecom

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Significant investments by key players and need for rapid development and adoption of new technologies

- 9.4.3 JAPAN

- 9.4.3.1 Increase in adoption of advanced technologies and integration with AI and automation

- 9.4.4 INDIA

- 9.4.4.1 Growing focus on cloud and network connectivity powered by AI technology

- 9.4.5 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 UAE

- 9.5.2.1 Economic Vision 2030's focus on digital transformation to key driver for modernization in public and private sectors

- 9.5.3 KSA

- 9.5.3.1 Saudi's need for digital transformation driven by Vision 2030 agenda

- 9.5.4 AFRICA

- 9.5.4.1 Growing need for digital infrastructure and modernized telecom and financial systems

- 9.5.5 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Ongoing investments in telecom infrastructure and modernization projects

- 9.6.3 MEXICO

- 9.6.3.1 Shift toward cloud modernization in public and financial sectors

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 10.3 MARKET SHARE ANALYSIS

- 10.3.1 MARKET RANKING ANALYSIS

- 10.4 REVENUE ANALYSIS, 2020-2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.6 COMPANY VALUATION AND FINANCIAL METRICS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Service type footprint

- 10.7.5.3 Application type footprint

- 10.7.5.4 Vertical footprint

- 10.7.5.5 Regional footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 IBM

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 MICROSOFT

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 HCL TECHNOLOGIES

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 ACCENTURE

- 11.1.4.1 Business overview

- 11.1.4.2 Platforms/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 AWS

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 ATOS

- 11.1.6.1 Business overview

- 11.1.6.2 Platforms/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.6.4 MnM view

- 11.1.6.4.1 Key strengths

- 11.1.6.4.2 Strategic choices

- 11.1.6.4.3 Weaknesses and competitive threats

- 11.1.7 CAPGEMINI

- 11.1.7.1 Business overview

- 11.1.7.2 Platforms/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Deals

- 11.1.7.4 MnM view

- 11.1.7.4.1 Key strengths

- 11.1.7.4.2 Strategic choices

- 11.1.7.4.3 Weaknesses and competitive threats

- 11.1.8 ORACLE

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches

- 11.1.8.3.2 Deals

- 11.1.8.4 MnM view

- 11.1.8.4.1 Key strengths

- 11.1.8.4.2 Strategic choices

- 11.1.8.4.3 Weaknesses and competitive threats

- 11.1.9 COGNIZANT

- 11.1.9.1 Business overview

- 11.1.9.2 Platforms/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.10 TCS

- 11.1.10.1 Business overview

- 11.1.10.2 Platforms/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.3.2 Deals

- 11.1.11 INNOVA SOLUTIONS

- 11.1.12 EPAM SYSTEMS

- 11.1.13 ASPIRE SYSTEMS

- 11.1.14 NTT DATA

- 11.1.15 DELL TECHNOLOGIES

- 11.1.16 DXC TECHNOLOGY

- 11.1.17 LTIMINDTREE

- 11.1.18 INFOSYS

- 11.1.19 WIPRO

- 11.1.20 ROCKET SOFTWARE, INC.

- 11.1.21 FUJITSU

- 11.1.22 HEXAWARE TECHNOLOGIES

- 11.1.23 VIRTUSA

- 11.1.24 MONGODB

- 11.1.25 SCIENCESOFT

- 11.1.26 SIMFORM

- 11.1.27 UTTHUNGA

- 11.1.28 RISHABH SOFTWARE

- 11.1.1 IBM

- 11.2 STARTUPS/SMES

- 11.2.1 SOFTURA

- 11.2.2 CLOUDHEDGE TECHNOLOGIES PVT. LTD.

- 11.2.3 D3V TECHNOLOGY

- 11.2.4 BAYSHORE INTELLIGENCE SOLUTIONS

- 11.2.5 OPINOV8

- 11.2.6 ICREON

- 11.2.7 SYMPHONY SOLUTIONS

- 11.2.8 CLEVEROAD

- 11.2.9 TECHAHEAD

- 11.2.10 GEOMOTIV

- 11.2.11 SOFT SUAVE

- 11.2.12 PALMDIGITALZ

- 11.2.13 AVERISOURCE

- 11.2.14 VERITIS

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 DIGITAL TRANSFORMATION MARKET

- 12.2.1 MARKET DEFINITION

- 12.3 MAINFRAME MODERNIZATION MARKET

- 12.3.1 MARKET DEFINITION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS