|

시장보고서

상품코드

1859662

시스템 통합 서비스 시장 : 서비스 유형별, 조직 규모별, 업계별, 지역별 - 예측(-2030년)System Integration Services Market by Service Type (Infrastructure Integration Services, Enterprise Application Integration Services, Consulting Services, and Managed Integration Services) - Global Forecast to 2030 |

||||||

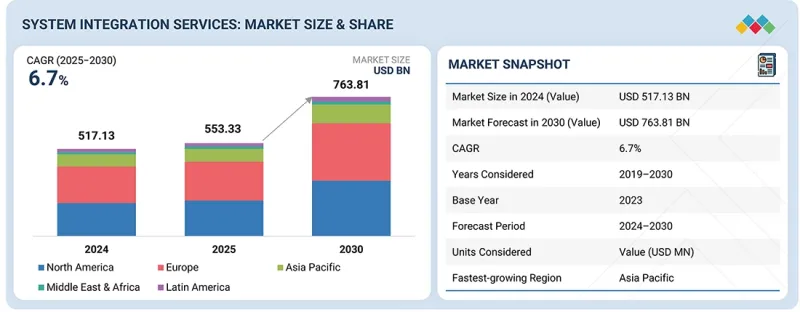

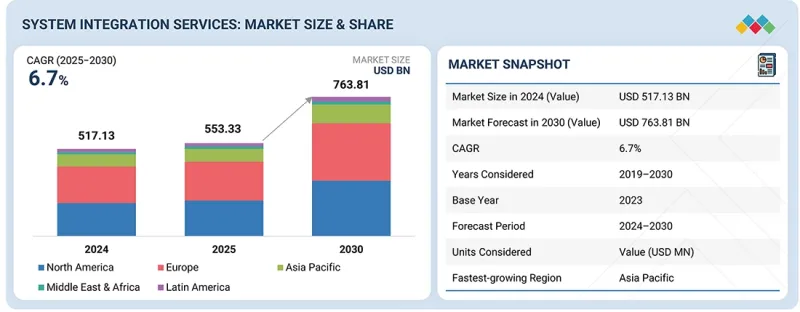

시스템 통합 서비스 시장 규모는 2025년 5,533억 3,000만 달러에서 2030년에는 7,638억 1,000만 달러로 성장할 것으로 예측되며, 예측 기간 동안 CAGR은 6.7%를 기록할 것으로 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러/10억 달러) |

| 부문 | 서비스 유형별, 조직 규모별, 업계별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

북미는 대기업, 클라우드 사업자, AI 인프라에 대한 대규모 투자 집중으로 인해 시스템 통합 서비스의 최대 시장으로 부상하고 있습니다. 미국과 캐나다에서는 강력한 규제 프레임워크와 강력한 기술 생태계를 바탕으로 통합 IT 및 OT 시스템, 고도의 자동화, 기업 규모의 디지털 혁신 이니셔티브의 도입이 두드러지게 나타나고 있습니다. AI, 클라우드, 산업 자동화에 대한 대규모 투자는 이 분야의 리더십을 더욱 강화하고 있습니다.

아시아태평양은 중국, 인도, 일본, 한국 등의 국가에서 스마트 제조, 로봇 공학, 산업 자동화가 빠르게 도입되면서 시스템 통합 서비스 시장으로 가장 빠르게 성장하고 있습니다. 디지털 전환 개념의 확대, ERP, MES, 산업용 AI 솔루션에 대한 수요 증가, 정부 지원 기술 프로그램이 통합 프로젝트를 가속화하고 있습니다. IT와 OT 시스템의 융합은 세계 기업 및 지역 기업의 투자 확대와 함께 아시아태평양을 시스템 통합 서비스의 고성장 허브로 자리매김하고 있으며, 업무 효율성, 실시간 모니터링, 확장 가능한 기업 솔루션을 지원하고 있습니다.

BFSI 분야는 은행 업무, 보험 프로세스, 금융 거래를 안전하고 효율적으로 관리하기 위해 통합 IT 시스템에 크게 의존하고 있습니다. 시스템 통합 서비스는 코어 뱅킹 플랫폼, 고객관계관리(CRM) 시스템, 결제 게이트웨이, 규제 보고 도구 간의 원활한 연결을 통해 실시간 데이터 흐름과 업무 연속성을 보장합니다. 디지털 뱅킹, AI 기반 분석, 클라우드 기반 플랫폼이 도입되면서 보안, 컴플라이언스, 고객 경험을 유지하기 위해서는 통합이 필수적입니다. 서비스 제공업체는 레거시 시스템과 최신 애플리케이션을 통합하고, 워크플로우를 자동화하며, 분산된 환경 전반의 사이버 보안을 강화하는 엔드투엔드 솔루션을 제공합니다. 확장 가능한 통합 프레임워크는 새로운 서비스의 신속한 배포를 지원하고, 트랜잭션 처리 속도를 높이며, 운영의 탄력성을 향상시킵니다. 시스템 통합 서비스는 이종 시스템을 연결하고 프로세스를 최적화함으로써 BFSI 조직이 다운타임을 최소화하고, 오류를 줄이며, 효율성을 개선하고, 안정적이고 민첩하며 디지털로 전환된 금융 생태계의 중추를 형성할 수 있도록 지원합니다.

시스템 통합 시장의 컨설팅 서비스는 조직이 복잡한 IT 및 OT 통합 이니셔티브를 설계, 계획 및 구현할 수 있도록 최고 수준의 전략적 지침을 제공합니다. 이러한 서비스는 기업 시스템, 클라우드 플랫폼, AI 애플리케이션, 레거시 인프라가 원활하게 연동되어 미션 크리티컬한 업무를 지원할 수 있도록 보장합니다. 아키텍처 설계, 워크플로우 최적화, 사이버 보안, 컴플라이언스에 대한 엔드투엔드 자문을 제공하여 기업이 리스크를 최소화하고 다운타임을 줄이며 디지털 전환을 가속화할 수 있도록 돕습니다. 컨설팅에는 종종 타당성 평가, 기술 로드맵, 프로세스 표준화, 통합 이니셔티브의 확장성, 미래성, 비즈니스 목표와의 정합성을 보장하기 위한 기술 로드맵, 프로세스 표준화가 포함됩니다. 기술 전문성과 전략적 인사이트를 결합한 컨설팅 서비스를 통해 기업은 운영 탄력성, 원활한 상호운용성, 효율적인 시스템 성능을 달성할 수 있습니다. 이러한 서비스를 제공하는 벤더는 대규모 통합 프로젝트에서 신뢰할 수 있는 파트너로 자리매김하여 기업이 ROI를 극대화하고 민첩성을 높이며 디지털화된 생태계에서 경쟁력을 유지할 수 있도록 돕습니다.

북미는 대기업, 클라우드 사업자, AI 인프라 투자 집중으로 인해 시스템 통합 서비스의 최대 시장으로 부상하고 있습니다. 미국과 캐나다에서는 강력한 규제 프레임워크와 확립된 기술 생태계를 바탕으로 통합 IT 및 OT 시스템, 고도의 자동화, 기업 규모의 디지털 전환 이니셔티브가 광범위하게 전개되고 있습니다. AI, 클라우드, 산업 자동화에 대한 대규모 투자는 이 분야의 리더십을 더욱 강화할 것입니다.

아시아태평양은 중국, 인도, 일본, 한국 등의 국가에서 스마트 제조, 로봇 공학, 산업 자동화가 빠르게 도입되고 있어 시스템 통합 서비스 시장으로 급성장할 것으로 예상됩니다. 디지털 전환 이니셔티브의 확대, ERP, MES, 산업용 AI 솔루션에 대한 수요 증가, 정부 지원 기술 프로그램이 통합 프로젝트를 가속화하고 있습니다. IT와 OT 시스템의 융합은 세계 기업 및 지역 기업의 투자 증가와 함께 이 지역을 시스템 통합 서비스의 고성장 허브로 자리매김하고 있으며, 업무 효율성, 실시간 모니터링, 확장 가능한 기업 솔루션을 지원하고 있습니다.

세계의 시스템 통합 서비스 시장에 대해 조사했으며, 서비스 종류별, 조직 규모별, 산업별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 소개

제2장 주요 요약

제3장 주요 인사이트

제4장 시장 개요

- 소개

- 시장 역학

- 미충족 수요와 공백

- 상호 접속된 시장과 분야 횡단적인 기회

- 새로운 비즈니스 모델과 생태계의 변화

- 티어1/2/3기업 전략적 활동

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제 지표

- 공급망 분석

- 생태계 분석

- 가격 분석

- 2025-2026년의 주요 회의와 이벤트

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 투자와 자금 조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세의 영향 - 시스템 통합 서비스 시장

제6장 기술, 특허, 디지털, AI의 도입별 전략적 파괴

- 주요 신기술

- 보완적 기술

- 기술/제품 로드맵

- 특허 분석

- AI/생성형 AI가 시스템 통합 서비스 시장에 미치는 영향

제7장 규제 상황

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 구매자 이해관계자와 구입 평가 기준

- 구입 기준

- 채용 장벽과 내부 과제

- 다양한 최종 이용 산업의 미충족 수요

- 시장 수익성

제9장 시스템 통합 서비스 시장(서비스 유형별)

- 소개

- 인프라 통합 서비스

- 기업 애플리케이션 통합 서비스

- 컨설팅 서비스

- 매니지드 통합 서비스

제10장 시스템 통합 서비스 시장(조직 규모별)

- 소개

- 대기업

- 중소기업

제11장 시스템 통합 서비스 시장(업계별)

- 소개

- BFSI

- 소매·E-Commerce

- IT·통신

- 헬스케어·생명과학

- 정부·방위

- 제조

- 미디어·엔터테인먼트

- 운송·물류

- 기타

제12장 시스템 통합 서비스 시장(지역별)

- 소개

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 중국

- 일본

- 인도

- 기타

- 중동 및 아프리카

- 걸프협력회의(GCC)

- 남아프리카공화국

- 기타

- 라틴아메리카

- 브라질

- 멕시코

- 기타

제13장 경쟁 구도

- 소개

- 주요 진출 기업의 전략/강점, 2023-2025년

- 매출 분석, 2020-2024년

- 시장 점유율 분석, 2024년

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 경쟁 시나리오

제14장 기업 개요

- 소개

- 주요 진출 기업

- ACCENTURE

- TCS

- COGNIZANT

- DELOITTE

- IBM

- CAPGEMINI

- WIPRO

- DXC TECHNOLOGY

- HCLTECH

- INFOSYS

- 기타 기업

- ATOS

- ORACLE

- HPE

- DELL TECHNOLOGIES

- MICROSOFT

- FUJITSU

- ASPIRE SYSTEMS

- CGI

- ITRANSITION

- CELIGO

- 3INSYS

- WORK HORSE INTEGRATIONS

- DOC INFUSION

- FLOWGEAR

- JITTERBIT

- SAMLINK

- STEFANINI IT SOLUTIONS

- HEXAWARE

- LTIMINDTREE

- CISCO

제15장 조사 방법

제16장 인접 시장/관련 시장

제17장 부록

KSM 25.11.17The system integration services market is projected to grow from USD 553.33 billion in 2025 to USD 763.81 billion by 2030 at a compounded annual growth rate (CAGR) of 6.7% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Service Type, Organization Size, Vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

North America is the largest market for system integration services, driven by the concentration of large enterprises, cloud providers, and significant investments in AI infrastructure. The US and Canada are witnessing significant deployments of integrated IT and OT systems, advanced automation, and enterprise-wide digital transformation initiatives, supported by robust regulatory frameworks and strong technology ecosystems. Major investments in AI, cloud, and industrial automation further strengthen the region's leadership.

The Asia Pacific region is the fastest-growing market for system integration services, with rapid adoption of smart manufacturing, robotics, and industrial automation in countries like China, India, Japan, and South Korea. Expanding digital transformation initiatives, rising demand for ERP, MES, and industrial AI solutions, and government-backed technology programs are accelerating integration projects. The convergence of IT and OT systems, along with growing investments by global and regional enterprises, positions the Asia Pacific region as a high-growth hub for system integration services, supporting operational efficiency, real-time monitoring, and scalable enterprise solutions.

"Based on vertical, the BFSI segment is estimated to lead the market during the forecast period."

The BFSI sector relies heavily on integrated IT systems to manage banking operations, insurance processes, and financial transactions securely and efficiently. System integration services enable seamless connectivity between core banking platforms, customer relationship management (CRM) systems, payment gateways, and regulatory reporting tools, ensuring real-time data flow and operational continuity. With growing adoption of digital banking, AI-driven analytics, and cloud-based platforms, integration is critical to maintaining security, compliance, and customer experience. Service providers deliver end-to-end solutions that unify legacy systems with modern applications, automate workflows, and strengthen cybersecurity across distributed environments. Scalable integration frameworks support rapid deployment of new services, enable faster transaction processing, and improve operational resilience. By connecting disparate systems and optimizing processes, system integration services help BFSI organizations minimize downtime, reduce errors, and enhance efficiency, forming the backbone of a reliable, agile, and digitally transformed financial ecosystem.

"Based on service type, the consulting services segment is projected to register the highest CAGR during the forecast period."

Consulting services in the system integration market offer the highest level of strategic guidance, enabling organizations to design, plan, and implement complex IT and OT integration initiatives. These services ensure that enterprise systems, cloud platforms, AI applications, and legacy infrastructure work together seamlessly to support mission-critical operations. Providers deliver end-to-end advisory on architecture design, workflow optimization, cybersecurity, and compliance, enabling organizations to minimize risks, reduce downtime, and accelerate digital transformation. Consulting engagements often include feasibility assessments, technology roadmaps, and process standardization, ensuring that integration initiatives are scalable, future-ready, and aligned with business objectives. By combining technical expertise with strategic insights, consulting services enable enterprises to achieve operational resilience, seamless interoperability, and efficient system performance. Vendors offering these services position themselves as trusted partners for large-scale integration projects, helping organizations maximize ROI, enhance agility, and maintain a competitive edge in an increasingly digital ecosystem.

"North America is estimated to lead the market while Asia Pacific is expected to emerge as the fastest-growing market during the forecast period."

North America is the largest market for system integration services, driven by the concentration of large enterprises, cloud providers, and AI infrastructure investments. The US and Canada are witnessing significant deployments of integrated IT and OT systems, advanced automation, and enterprise-wide digital transformation initiatives, supported by robust regulatory frameworks and well-established technology ecosystems. Major investments in AI, cloud, and industrial automation further strengthen the region's leadership.

The Asia Pacific region is projected to be the fastest-growing market for system integration services, with rapid adoption of smart manufacturing, robotics, and industrial automation in countries like China, India, Japan, and South Korea. Expanding digital transformation initiatives, rising demand for ERP, MES, and industrial AI solutions, and government-backed technology programs are accelerating integration projects. The convergence of IT and OT systems, along with growing investments by global and regional enterprises, positions the region as a high-growth hub for system integration services, supporting operational efficiency, real-time monitoring, and scalable enterprise solutions.

Breakdown of primaries

Chief executive officers (CEOs), directors of innovation and technology, system integrators, and executives from several significant system integration services market companies were interviewed to gain insights into this market.

- By Company: Tier I: 40%, Tier II: 25%, and Tier III: 35%

- By Designation: C-Level Executives: 45%, Director Level: 30%, and Others: 25%

- By Region: North America: 30%, Europe: 20%, Asia Pacific: 25%, Rest of the World: 15%

Some of the key system integration services market vendors are Accenture (Ireland), TCS (India), Cognizant (US), Deloitte (UK), IBM (US), Capgemini (France), Wipro (India), DXC Technology (US), HCLTech (India), Infosys (India), HPE (US), Atos (France), Oracle (US), Dell Technologies (US), Microsoft (US), Fujitsu (Japan), Aspire Systems (India), CGI (Canada), Itransition (US), Celigo (US), 3Insys (US), Work Horse Integrations (US), DOCInfusion (US), Flowgear (South Africa), Jitterbit (US), Samlink (Finland), Stefanini (Brazil), Hexaware (India), LTIMindtree (India), and Cisco (US).

Research Coverage

The market report covers the system integration services market across segments. The market size and growth potential for many segments were estimated based on service type, organization size, vertical, and region. It contains a thorough competition analysis of the major market participants, information about their businesses, essential observations about their product and service offerings, current trends, and critical market strategies.

Reasons to Buy This Report:

This research provides the most accurate revenue estimates for the entire system integration services industry and its subsegments, benefiting both established leaders and new entrants. Stakeholders will gain valuable insights into the competitive landscape, enabling them to better position their companies and develop effective go-to-market strategies. The report outlines key market drivers, constraints, opportunities, and challenges, helping industry players understand the current state of the market.

The report provides insights on the following pointers:

- Analysis of key drivers (API fragmentation driving middleware integration), restraints (budget overrun and extended deployment timelines impacting ROI), opportunities (AI/ML operationalization requiring legacy system integration), and challenges (continuous maintenance and support burden) influencing the growth of the system integration services market

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and new service and product introductions in the system integration service market

- Market Development: In-depth details regarding profitable markets, examining the global system integration services market

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, and new solutions and services

- Competitive Assessment: Thorough analysis of the market shares, expansion plans, and offerings of the top competitors in the system integration services industry, such as Accenture (Ireland), TCS (India), Cognizant (US), Deloitte (UK), IBM (US), Capgemini (France), Wipro (India), DXC Technology (US), HCLTech (India), Infosys (India), HPE (US), Atos (France), Oracle (US), Dell Technologies (US), Microsoft (US), Fujitsu (Japan), Aspire Systems (India), CGI (Canada), Itransition (US), Celigo (US), 3Insys (US), Work Horse Integrations (US), DOCInfusion (US), Flowgear (South Africa), Jitterbit (US), Samlink (Finland), Stefanini (Brazil), Hexaware (India), LTIMindtree (India), and Cisco (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 STAKEHOLDERS

- 1.4 SUMMARY OF STRATEGIC CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SYSTEM INTEGRATION SERVICES MARKET

- 3.2 SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE

- 3.3 SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE

- 3.4 SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL

- 3.5 SYSTEM INTEGRATION SERVICES MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 IT and OT system integration strengthening industrial operations

- 4.2.1.2 Legacy system migration to cloud

- 4.2.1.3 API fragmentation driving middleware integration

- 4.2.2 RESTRAINTS

- 4.2.2.1 Budget overrun and extended deployment timelines impacting ROI

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rise of cloud-native integration platforms

- 4.2.3.2 Cybersecurity integration services for distributed enterprises

- 4.2.3.3 AI/ML operationalization requiring legacy system integration

- 4.2.4 CHALLENGES

- 4.2.4.1 Complex integration requirements and skill shortages

- 4.2.4.2 Continuous maintenance and support burden

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN SYSTEM INTEGRATION SERVICES

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.5.1 EMERGING BUSINESS MODELS

- 4.5.2 ECOSYSTEM SHIFTS

- 4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMICS INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL ICT INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF SYSTEM INTEGRATION SERVICES, BY REGION, 2022-2024

- 5.5.2 INDICATIVE PRICING OF KEY PLAYERS, BY SERVICE, 2025

- 5.6 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 VORWERK: TRANSFORMING PERSON-TO-PERSON SALES EXPERIENCE BY DIGITALIZING DIRECT SELLING PROCESSES

- 5.9.2 BUCHI'S CUSTOMER-CENTRIC VISION ACCELERATES INNOVATION USING AZURE INTEGRATION SERVICES

- 5.9.3 MOVING MOUNTAINS WITH CLOUD INTEGRATION

- 5.9.4 VEDANTA PURSUES CENTRALIZED PERSPECTIVE TO BETTER CONTROL MINING-RELATED ACTIVITIES

- 5.10 IMPACT OF 2025 US TARIFF - SYSTEM INTEGRATION SERVICES MARKET

- 5.10.1 INTRODUCTION

- 5.10.2 KEY TARIFF RATES

- 5.10.3 PRICE IMPACT ANALYSIS

- 5.10.4 IMPACT ON COUNTRY/REGION

- 5.10.4.1 North America

- 5.10.4.1.1 US

- 5.10.4.1.2 Canada

- 5.10.4.1.3 Mexico

- 5.10.4.2 Europe

- 5.10.4.2.1 Germany

- 5.10.4.2.2 France

- 5.10.4.2.3 UK

- 5.10.4.3 Asia Pacific

- 5.10.4.3.1 China

- 5.10.4.3.2 India

- 5.10.4.1 North America

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 ARTIFICIAL INTELLIGENCE & MACHINE LEARNING (AI/ML)

- 6.1.2 ROBOTIC PROCESS AUTOMATION (RPA)

- 6.1.3 LOW-CODE/NO-CODE PLATFORMS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 CLOUD COMPUTING & HYBRID CLOUD PLATFORMS

- 6.2.2 API MANAGEMENT & MICROSERVICES

- 6.2.3 DATA ANALYTICS & BUSINESS INTELLIGENCE TOOLS

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.3.1 SHORT-TERM (2025-2027) | FOUNDATION & HYBRID ADOPTION

- 6.3.2 MID-TERM (2027-2030) | AUTOMATION & STANDARDIZATION

- 6.3.3 LONG-TERM (2030-2035+) | AI-NATIVE & QUANTUM-ENABLED INTEGRATION

- 6.4 PATENT ANALYSIS

- 6.4.1 LIST OF MAJOR PATENTS

- 6.5 IMPACT OF AI/GEN AI ON SYSTEM INTEGRATION SERVICES MARKET

- 6.5.1 CASE STUDY

- 6.5.1.1 Keeping patients front and center in establishing a new company

- 6.5.2 VENDOR INITIATIVES

- 6.5.2.1 Transforming enterprise workflows through IBM's AI integration services

- 6.5.2.2 Accelerating AI-driven financial transformation through TCS-Google Cloud collaboration

- 6.5.3 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.5.1 CASE STUDY

7 REGULATORY LANDSCAPE

- 7.1 INTRODUCTION

- 7.2 REGIONAL REGULATIONS AND COMPLIANCE

- 7.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.2.2 REGULATIONS BASED ON REGION

- 7.2.2.1 North America

- 7.2.2.2 Europe

- 7.2.2.3 Asia Pacific

- 7.2.2.4 Middle East & Africa

- 7.2.2.5 Latin America

- 7.2.3 INDUSTRY STANDARDS

- 7.2.3.1 General Data Protection Regulation

- 7.2.3.2 SEC Rule 17a-4

- 7.2.3.3 ISO/IEC 27001

- 7.2.3.4 COBIT (Control Objectives for Information and Related Technologies)

- 7.2.3.5 ISA (International Society of Automation)

- 7.2.3.6 System and Organization Controls 2 Type II

- 7.2.3.7 Financial Industry Regulatory Authority

- 7.2.3.8 Freedom of Information Act

- 7.2.3.9 Health Insurance Portability and Accountability Act

8 CUSTOMER LANDSCAPE AND BUYING BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.3 BUYING CRITERIA

- 8.4 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.5 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES

- 8.6 MARKET PROFITABILITY

- 8.6.1 REVENUE POTENTIAL

- 8.6.2 COST DYNAMICS

- 8.6.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS

9 SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE

- 9.1 INTRODUCTION

- 9.2 INFRASTRUCTURE INTEGRATION SERVICES

- 9.2.1 BUILDING CONNECTED AND SCALABLE IT FOUNDATIONS

- 9.2.2 ERP AND CRM INTEGRATION

- 9.2.3 API & MIDDLEWARE INTEGRATION

- 9.2.4 LEGACY SYSTEM MODERNIZATION

- 9.3 ENTERPRISE APPLICATIONS INTEGRATION SERVICES

- 9.3.1 ENABLING SEAMLESS DATA AND WORKFLOW CONNECTIVITY

- 9.3.2 CLOUD & HYBRID INTEGRATION SERVICES

- 9.3.3 API MANAGEMENT AND INTEGRATION

- 9.3.4 DATA SYNCHRONIZATION AND MASTER DATA MANAGEMENT

- 9.4 CONSULTING SERVICES

- 9.4.1 DESIGNING STRATEGIC INTEGRATION ROADMAPS FOR DIGITAL TRANSFORMATION

- 9.4.2 IT AND INTEGRATION STRATEGY CONSULTING

- 9.4.3 DIGITAL TRANSFORMATION CONSULTING

- 9.4.4 ARCHITECTURE DESIGN AND GOVERNANCE CONSULTING

- 9.5 MANAGED INTEGRATION SERVICES

- 9.5.1 OPTIMIZING AND SUSTAINING INTEGRATED IT ECOSYSTEMS

- 9.5.2 SLA-BASED INTEGRATION SUPPORT

- 9.5.3 INCIDENT AND CHANGE MANAGEMENT FOR INTEGRATION WORKFLOWS

10 SYSTEM INTEGRATION SERVICES MARKET, BY ORGANIZATION SIZE

- 10.1 INTRODUCTION

- 10.2 LARGE ENTERPRISES

- 10.2.1 DIGITAL TRANSFORMATION THROUGH UNIFIED, SCALABLE INTEGRATION FRAMEWORKS

- 10.3 SMES

- 10.3.1 ENABLING AGILITY AND COST-EFFECTIVE INNOVATION THROUGH SIMPLIFIED SYSTEM INTEGRATION

11 SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.2 BFSI

- 11.2.1 ENHANCING OPERATIONAL RESILIENCE AND CUSTOMER EXPERIENCE THROUGH SECURE SYSTEM INTEGRATION

- 11.2.2 BFSI: USE CASES

- 11.2.2.1 Core banking integration

- 11.2.2.2 Payment system integration

- 11.2.2.3 Other use cases

- 11.3 RETAIL & E-COMMERCE

- 11.3.1 POWERING OMNICHANNEL EXPERIENCES THROUGH SEAMLESS PLATFORM INTEGRATION

- 11.3.2 RETAIL & E-COMMERCE: USE CASES

- 11.3.2.1 Supply chain & warehouse integration

- 11.3.2.2 Payment gateway integration

- 11.3.2.3 Other use cases

- 11.4 IT & TELECOM

- 11.4.1 ENABLING NETWORK MODERNIZATION AND CLOUD-DRIVEN INNOVATION THROUGH INTEGRATED IT SYSTEMS

- 11.4.2 IT & TELECOM: USE CASES

- 11.4.2.1 5G core integration

- 11.4.2.2 IOT & edge integration

- 11.4.2.3 Other use cases

- 11.5 HEALTHCARE & LIFE SCIENCES

- 11.5.1 ADVANCING PATIENT CARE AND DATA INTEROPERABILITY WITH UNIFIED HEALTH SYSTEMS

- 11.5.2 HEALTHCARE & LIFE SCIENCES: USE CASES

- 11.5.2.1 Electronic health records integration

- 11.5.2.2 Pharma R&D integration

- 11.5.2.3 Other use cases

- 11.6 GOVERNMENT & DEFENSE

- 11.6.1 STRENGTHENING DIGITAL GOVERNANCE AND SECURITY THROUGH INTEGRATED INFRASTRUCTURE

- 11.6.2 GOVERNMENT & DEFENSE: USE CASES

- 11.6.2.1 National ID & e-governance

- 11.6.2.2 Defense command & control system

- 11.6.2.3 Other use cases

- 11.7 MANUFACTURING

- 11.7.1 DRIVING SMART FACTORY EVOLUTION WITH CONNECTED AND AUTOMATED SYSTEMS

- 11.7.2 MANUFACTURING: USE CASES

- 11.7.2.1 Smart factory integration

- 11.7.2.2 IoT & industrial automation

- 11.7.2.3 Other use cases

- 11.8 MEDIA & ENTERTAINMENT

- 11.8.1 TRANSFORMING CONTENT DELIVERY AND ENGAGEMENT THROUGH INTEGRATED DIGITAL ECOSYSTEMS

- 11.8.2 MEDIA & ENTERTAINMENT: USE CASES

- 11.8.2.1 Content distribution platforms

- 11.8.2.2 Audience analytics

- 11.8.2.3 Other use cases

- 11.9 TRANSPORTATION & LOGISTICS

- 11.9.1 OPTIMIZING SUPPLY CHAINS WITH REAL-TIME, CONNECTED INTEGRATION SOLUTIONS

- 11.9.2 TRANSPORTATION & LOGISTICS: USE CASES

- 11.9.2.1 Fleet management integration

- 11.9.2.2 Warehouse automation

- 11.9.2.3 Other use cases

- 11.10 OTHERS

12 SYSTEM INTEGRATION SERVICES MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Multi-year investment by Jabil in AI and cloud data center infrastructure to boost market

- 12.2.2 CANADA

- 12.2.2.1 AI and cloud investments to fuel demand for system integration services

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 UK

- 12.3.1.1 Rising demand for EAM solutions across asset-intensive industries to drive market

- 12.3.2 GERMANY

- 12.3.2.1 Demand for automation and compliance to drive market

- 12.3.3 FRANCE

- 12.3.3.1 Strategic investments and policy initiatives to fuel demand for system integration services

- 12.3.4 ITALY

- 12.3.4.1 Government investments to fuel demand for system integration services

- 12.3.5 SPAIN

- 12.3.5.1 Strategic investments to boost demand for system integration services

- 12.3.6 REST OF EUROPE

- 12.3.1 UK

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 Increasing digital transformation initiatives to drive demand for system integration services

- 12.4.2 JAPAN

- 12.4.2.1 Growing focus on digitalization through system integration to drive market

- 12.4.3 INDIA

- 12.4.3.1 AWS investment to strengthen demand for system integration services

- 12.4.4 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GULF COOPERATION COUNCIL (GCC)

- 12.5.1.1 UAE

- 12.5.1.1.1 Increasing ATS adoption through policy-driven hiring and AI-enabled recruitment systems to drive market

- 12.5.1.2 Saudi Arabia

- 12.5.1.2.1 Development of AI, fintech, and smart city applications through integration services to drive market

- 12.5.1.3 Rest of GCC

- 12.5.1.1 UAE

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Global cloud investments to fuel demand for system integration services

- 12.5.3 REST OF MIDDLE EAST & AFRICA

- 12.5.1 GULF COOPERATION COUNCIL (GCC)

- 12.6 LATIN AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Rise of industrial and digital ecosystem through system integration to drive market

- 12.6.2 MEXICO

- 12.6.2.1 Rising demand for system integration in digital transformation to drive market

- 12.6.3 REST OF LATIN AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 BRAND/PRODUCT COMPARISON

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Service type footprint

- 13.6.5.4 Vertical footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUP/SMES, 2024

- 13.7.5.1 Detailed list of key startups/SMEs

- 13.7.5.2 Competitive benchmarking of key startups/SMEs

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS

- 13.8.1 COMPANY VALUATION OF KEY VENDORS

- 13.8.2 FINANCIAL METRICS OF KEY VENDORS

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 MAJOR PLAYERS

- 14.2.1 ACCENTURE

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Solutions/Services offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Product launches

- 14.2.1.3.2 Deals

- 14.2.1.4 MnM view

- 14.2.1.4.1 Right to win

- 14.2.1.4.2 Strategic choices

- 14.2.1.4.3 Weaknesses and competitive threats

- 14.2.2 TCS

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Solutions/Services offered

- 14.2.2.3 Recent developments

- 14.2.2.3.1 Deals

- 14.2.2.4 MnM view

- 14.2.2.4.1 Right to win

- 14.2.2.4.2 Strategic choices

- 14.2.2.4.3 Weaknesses and competitive threats

- 14.2.3 COGNIZANT

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Solutions/Services offered

- 14.2.3.3 Recent developments

- 14.2.3.3.1 Product launches

- 14.2.3.3.2 Deals

- 14.2.3.4 MnM view

- 14.2.3.4.1 Right to win

- 14.2.3.4.2 Strategic choices

- 14.2.3.4.3 Weaknesses and competitive threats

- 14.2.4 DELOITTE

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Solutions/Services offered

- 14.2.4.3 Recent developments

- 14.2.4.3.1 Product launches

- 14.2.4.3.2 Deals

- 14.2.4.4 MnM view

- 14.2.4.4.1 Right to win

- 14.2.4.4.2 Strategic choices

- 14.2.4.4.3 Weaknesses and competitive threats

- 14.2.5 IBM

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Solutions/Services offered

- 14.2.5.3 Recent developments

- 14.2.5.3.1 Product launches

- 14.2.5.3.2 Deals

- 14.2.5.4 MnM view

- 14.2.5.4.1 Right to win

- 14.2.5.4.2 Strategic choices

- 14.2.5.4.3 Weaknesses and competitive threats

- 14.2.6 CAPGEMINI

- 14.2.6.1 Business overview

- 14.2.6.2 Products/Solutions/Services offered

- 14.2.6.3 Recent developments

- 14.2.6.3.1 Product launches

- 14.2.6.3.2 Deals

- 14.2.7 WIPRO

- 14.2.7.1 Business overview

- 14.2.7.2 Products/Solutions/Services offered

- 14.2.7.3 Recent developments

- 14.2.7.3.1 Deals

- 14.2.8 DXC TECHNOLOGY

- 14.2.8.1 Business overview

- 14.2.8.2 Products/Solutions/Services offered

- 14.2.8.3 Recent developments

- 14.2.8.3.1 Deals

- 14.2.9 HCLTECH

- 14.2.9.1 Business overview

- 14.2.9.2 Products/Solutions/Services offered

- 14.2.9.3 Recent developments

- 14.2.9.3.1 Deals

- 14.2.10 INFOSYS

- 14.2.10.1 Business overview

- 14.2.10.2 Products/Solutions/Services offered

- 14.2.10.3 Recent developments

- 14.2.10.3.1 Product launches

- 14.2.10.3.2 Deals

- 14.2.1 ACCENTURE

- 14.3 OTHER PLAYERS

- 14.3.1 ATOS

- 14.3.2 ORACLE

- 14.3.3 HPE

- 14.3.4 DELL TECHNOLOGIES

- 14.3.5 MICROSOFT

- 14.3.6 FUJITSU

- 14.3.7 ASPIRE SYSTEMS

- 14.3.8 CGI

- 14.3.9 ITRANSITION

- 14.3.10 CELIGO

- 14.3.11 3INSYS

- 14.3.12 WORK HORSE INTEGRATIONS

- 14.3.13 DOC INFUSION

- 14.3.14 FLOWGEAR

- 14.3.15 JITTERBIT

- 14.3.16 SAMLINK

- 14.3.17 STEFANINI IT SOLUTIONS

- 14.3.18 HEXAWARE

- 14.3.19 LTIMINDTREE

- 14.3.20 CISCO

15 RESEARCH METHODOLOGY

- 15.1 RESEARCH APPROACH

- 15.1.1 SECONDARY DATA

- 15.1.2 PRIMARY DATA

- 15.1.2.1 Key data from primary sources

- 15.1.2.2 Breakup of primary profiles

- 15.1.2.3 Key industry insights

- 15.2 MARKET BREAKUP AND DATA TRIANGULATION

- 15.3 MARKET SIZE ESTIMATION

- 15.3.1 TOP-DOWN APPROACH

- 15.3.2 BOTTOM-UP APPROACH

- 15.3.3 MARKET ESTIMATION APPROACHES

- 15.4 MARKET FORECAST

- 15.5 RESEARCH ASSUMPTIONS

- 15.6 RESEARCH LIMITATIONS

16 ADJACENT/RELATED MARKET

- 16.1 INTRODUCTION

- 16.1.1 RELATED MARKETS

- 16.1.2 LIMITATIONS

- 16.2 CLOUD PROFESSIONAL SERVICES MARKET

- 16.3 NORTH AMERICA IT SERVICES MARKET

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS