|

시장보고서

상품코드

1861051

산화 마그네슘(MgO) 시장 : 제품 유형별, 유래별, 등급별, 용도별, 최종 이용 산업별, 지역별 - 예측(-2030년)Magnesium Oxide (MgO) Market by Product Type (CCM, DBM, FM), Purity (High, Medium, Low), Source (Natural, Synthetic), Application (Animal Feed, Steel Making & Cement, Glass & Ceramics, Electronics, Pharmaceuticals, Fertilizers) - Global Forecast to 2030 |

||||||

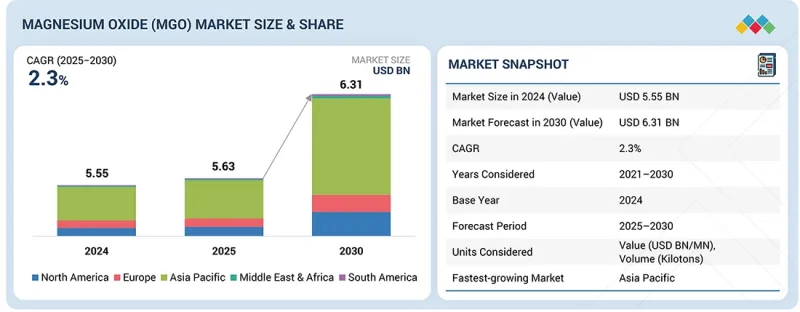

세계의 산화 마그네슘(MgO) 시장 규모는 2025년 56억 3,000만 달러에서 2030년에는 63억 1,000만 달러에 이르고, 2025년부터 2030년까지 연평균 복합 성장률(CAGR)은 2.3%를 보일 것으로 예측됩니다.

세계 시장은 산업, 건설, 환경적 요인으로 인해 강력한 성장세를 보이고 있습니다. 주요 촉진요인 중 하나는 철강 및 내화물 산업의 급속한 확장이며, 산화 마그네슘은 우수한 열 안정성, 낮은 반응성 및 내구성으로 인해 용광로 라이닝, 국자 코팅, 내화 벽돌에 널리 사용되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021년-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러/10억 달러), 킬로톤(KT) |

| 부문 | 제품 유형별, 유래별, 등급별, 용도별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 아시아태평양, 유럽, 북미, 중동 및 아프리카, 남미 |

또 다른 중요한 요인은 특히 아시아태평양 및 신흥 경제권의 인프라 및 건설 활동의 급격한 증가입니다. 시멘트, 보드, 패널을 포함한 산화마그네슘 기반 제품은 내화성, 환경 적합성, 구조적 강도로 인해 점점 더 선호되고 있으며, 지속 가능한 건설 관행에 부합하고 있습니다.

세계 산화마그네슘(MgO) 시장에서 제품 유형별로는 가성 소성 마그네시아 부문이 예측 기간 동안 높은 CAGR을 나타낼 것으로 예측됩니다. 이 제품은 사소 마그네시아보다 낮은 온도에서 마그네사이트를 소성하여 높은 반응성과 수용성을 얻는다. 가성 소성 마그네시아(CCM)의 독특한 화학적 특성으로는 높은 반응성, 우수한 중화 능력, 다양한 산업 응용 분야에 대한 적합성 등이 있습니다. 화학 및 제약 산업은 pH 조절, 폐수 처리, 비료, 의약품 제조에 CCM을 사용하는 주요 사용자 중 하나입니다. 또한, 농업 분야에서는 토양개량제로, 환경 분야에서는 배연 탈황 및 폐수 처리에 사용되고 있습니다. 산을 중화시키는 능력과 pH를 안정화시키는 능력으로 인해 이 모든 공정에서 선호되는 재료가 되었습니다.

합성 산화마그네슘은 2025년 세계 산화마그네슘(MgO) 시장에서 두 번째 점유율을 차지할 것으로 예측됩니다. 합성 산화마그네슘은 수산화마그네슘이나 염화마그네슘과 같은 다양한 마그네슘 화합물을 화학적으로 침전시킨 후, 이를 소성하여 고순도의 제어된 등급의 산화마그네슘을 얻음으로써 제조됩니다. 균일한 조성, 고순도, 맞춤형 반응성으로 인해 천연 자원이 일반적으로 엄격한 사양을 충족하지 못하는 경우 최적의 대체품이 될 수 있습니다. 높은 반응성과 일관된 품질로 인해 합성 산화마그네슘은 화학 처리, 의약품, 첨단 배터리 기술에 적용되고 있습니다. 또한 산성화합물을 중화시켜야 하는 폐수처리, 배연탈황 등 환경관리에도 도움이 됩니다. 합성 산화마그네슘은 전자, 세라믹, 특수 코팅 등 정밀한 성능 특성이 요구되는 산업에서도 각광받고 있습니다.

세계의 산화마그네슘(MgO) 시장에 대해 조사했으며, 제품 유형별, 기원별, 등급별, 용도별, 최종 이용 산업별, 지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- Porter의 Five Forces 분석

- 밸류체인 분석

- 생태계 분석

- 특허 분석

- 가격 분석

- 사례 연구 분석

- 투자 및 자금조달 시나리오

- 무역 분석

- 주요 이해관계자와 구입 기준

- 2025-2026년 주요 컨퍼런스 및 이벤트

- 규제 상황

- 기술 분석

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 세계 거시경제 전망

- 산화 마그네슘 시장 인공지능(AI) 영향

- 2025년 미국 관세가 산화 마그네슘 시장에 미치는 영향

제6장 산화 마그네슘 형태

- 서론

- 분말

- 과립

- 플레이크

제7장 산화 마그네슘 순도 레벨

- 서론

- 고순도

- 중간순도

- 저순도

제8장 산화 마그네슘 시장(제품 유형별)

- 서론

- 가성 소성 마그네시아

- 중소 마그네시아

- 용해 마그네시아

제9장 산화 마그네슘 시장(유래별)

- 서론

- 자연

- 합성

제10장 산화 마그네슘 시장(등급별)

- 서론

- 식품 등급

- 의약품 등급

- 산업용 등급

- 내화 등급

제11장 산화 마그네슘 시장(용도별)

- 서론

- 동물사료

- 제철 및 시멘트

- 유리 및 세라믹

- 일렉트로닉스

- 의약품

- 비료

- 기타

제12장 산화 마그네슘 시장(최종 이용 산업별)

- 서론

- 식품 및 음료

- 건설

- 농업

- 건강 관리

- 환경

- 기타

제13장 산화 마그네슘 시장(지역별)

- 서론

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 남미

- 브라질

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타

제14장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점

- 매출 분석, 2024년

- 시장 점유율 분석, 2024년

- 브랜드/제품 비교

- 기업 평가와 재무 지표

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제15장 기업 개요

- 주요 시장 진출기업

- HAICHENG MAGNESITE GROUP CO., LTD.

- MAGNEZIT GROUP

- RHI MAGNESITA

- MARTIN MARIETTA MAGNESIA SPECIALTIES

- GRECIAN MAGNESITE

- HAICHENG GUANGLING REFRACTORY MANUFACTURING CO. LTD.

- UBE MATERIAL INDUSTRIES, LTD.

- KUMAS A.S.

- ICL

- TATEHO CHEMICAL INDUSTRIES CO., LTD.

- BAYMAG INC.

- NEDMAG B.V.

- INDUSTRIAS PENOLES

- PAUL RAUSCHERT GMBH & CO. KG.

- KONOSHIMA CHEMICAL CO., LTD.

- LEHMANN&VOSS&CO.

- LKAB MINERALS

- OMYA INTERNATIONAL AG

- HAICHENG JIUSHENG REFRACTORY MANUFACTURING CO., LTD.

- HOLY MAGNESIUM INDUSTRY(DASHIQIAO) CO., LTD.

- SINO MEIR INTERNATIONAL CO., LTD.

- HEBEI MEISHEN TECHNOLOGY CO., LTD.

- NANOSHEL LLC

- KYOWA CHEMICAL INDUSTRY CO., LTD.

- IBAR NORDESTE

- TIMAB MAGNESIUM

- YINGKOU MAGNESITE CHEMICAL IND GROUP CO., LTD.

- PRCO AMERICA

- QMAG PTY LIMITED

- HONGYE CHEMICAL

- LIAONING HONGYU REFRACTORY GROUP CO., LTD.

- YINGKOU MAGNESITE MINING CO., LTD.

- 기타 기업

- STAR GRACE MINING CO., LTD.

- AMERICAN ELEMENTS

- LORAD CHEMICAL CORPORATION

- GARRISON MINERALS, LLC

- CHIMAG

- FENGCHEN GROUP CO., LTD.

- LATROBE MAGNESIUM

- DANDONG XINYANG MINERAL CO., LTD.

- YINGKOU SANHUA CHEMICAL CO., LTD.

제16장 인접 시장과 관련 시장

제17장 부록

LSH 25.11.18The global magnesium oxide (MgO) market is projected to reach USD 6.31 billion by 2030 from USD 5.63 billion in 2025, exhibiting a CAGR of 2.3% from 2025 to 2030. The global market is witnessing robust growth, driven by industrial, construction, and environmental factors. One of the primary drivers is the rapid expansion of the steel and refractory industries, where magnesium oxide is extensively used in furnace linings, ladle coatings, and refractory bricks due to its excellent thermal stability, low reactivity, and durability.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Segments | Product Type, Source, Grade, Form, Purity, Application, End-use Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, the Middle East & Africa, and South America |

Another significant factor is the surge in infrastructure and construction activities, particularly in Asia Pacific and emerging economies. Magnesium oxide-based products, including cement, boards, and panels, are increasingly preferred for their fire resistance, eco-friendliness, and structural strength, aligning with sustainable construction practices.

"Caustic calcined magnesia segment is projected to exhibit a significant CAGR between 2025 and 2030"

In the global magnesium oxide (MgO) market, the caustic calcined magnesia segment is estimated to record a significant CAGR during the forecast period under product types. The product obtains high reactivity and water solubility by calcining magnesite at lower temperatures than dead-burned magnesia. The unique chemical properties of caustic calcined magnesia (CCM) include high reactivity, excellent neutralization capabilities, and suitability for various industrial applications. The chemical and pharmaceutical industries are among the key users of CCM for pH regulation, wastewater treatment, fertilizer, and medicinal formulations. It is also used in agriculture as a soil conditioner and environmental management for flue gas desulfurization and effluent treatment. Its acid-neutralizing capabilities and pH stabilization make it the preferred material in all these processes.

"Synthetic segment is likely to hold a commendable share of the magnesium oxide (MgO) market in 2025"

The synthetic magnesium oxide is anticipated to hold the second-largest share of the global magnesium oxide (MgO) market in 2025. Synthetic magnesium oxide is prepared by chemically precipitating various magnesium compounds, such as magnesium hydroxide or magnesium chloride, which is then calcined to obtain high-purity and controlled-grade magnesium oxide. Due to uniform composition, high purity, and tailor-made reactivity, it is the best alternative wherever natural sources do not generally meet the stringent specifications. Due to its high reactivity and consistency in quality, synthetic magnesium oxide finds application in chemical processing, pharmaceuticals, and state-of-the-art battery technologies. It is also beneficial in environmental management, such as treating wastewater and flue gas desulfurization, where acidic compounds must be neutralized. Synthetic magnesium oxide is also gaining prominence in industries such as electronics, ceramics, and specialty coatings, which require exact performance characteristics.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 45%, Tier 2 - 22%, and Tier 3 - 33%

- By Designation: C-level Executives - 50%, Directors - 10%, and Others - 40%

- By Region: North America - 17%, Europe - 33%, Asia Pacific - 17%, Middle East & Africa - 25%, and South America - 8%

Magnezit Group (Russia), RHI Magnesita (Austria), Martin Marietta Magnesia Specialties (US), Grecian Magnesite (Greece), and Haicheng Guangling Refractory Manufacturing Co. LTD (China) are some major players in the magnesium oxide (MgO) market. These players have adopted partnerships and expansions to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the magnesium oxide (MgO) market based on product type, source, grade, form, purity, application, end-use industry, and region. It provides detailed information regarding the major factors influencing the market growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles magnesium oxide manufacturers, comprehensively analyzes their market shares and core competencies, and tracks and analyzes competitive developments they undertake in the market, such as expansions and partnerships.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the magnesium oxide (MgO) market and its segments. This report is also expected to help stakeholders understand the market's competitive landscape better, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Increasing steel production and rising demand for advanced refractory applications, Extensive use in construction and building materials, Growing applications in advanced ceramics and electronic components), restraints (High production costs, Competition from alternatives), opportunities (Rising adoption in wastewater treatment, Emerging role of magnesium oxide in advanced battery technologies, Expanding applications in food & nutrition industry), and challenges (Quality consistency and technological limitations, Environmental and regulatory pressures) influencing the growth of the magnesium oxide (MgO) market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities in the magnesium oxide (MgO) market

- Market Development: Comprehensive information about lucrative markets-the report analyses the magnesium oxide (MgO) market across varied regions

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the industrial market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as Magnezit Group (Russia), RHI Magnesita (Austria), Martin Marietta Magnesia Specialties (US), Grecian Magnesite (Greece), Haicheng Guangling Refractory Manufacturing Co. LTD (China), Ube Material Industries, Ltd. (Japan), KUMAS A.S. (Turkey), ICL (Israel), Tateho Chemical Industries Co., Ltd. (Japan), Baymag Inc. (Canada), Nedmag B.V. (Netherlands), Industrias Penoles (Mexico), Paul Rauschert GmbH & Co. KG. (Germany), Konoshima Chemical Co., Ltd. (Japan), Lehmann&Voss&Co. (Germany), LKAB Minerals (Sweden), Omya International AG (Switzerland), Haicheng Jiusheng Refractory Manufacturing Co., Ltd (China), HOLY MAGNESIUM INDUSTRY (DASHIQIAO) CO., LTD. (China), Sino Meir International Co. Ltd. (China), Hebei Meishen Technology Co., Ltd. (China), Nanoshel LLC (US), and Kyowa Chemical Industry Co., Ltd. (Japan)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 INCLUSIONS & EXCLUSIONS

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY CONSIDERED

- 1.4 UNITS CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 List of participating companies for primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 SUPPLY-SIDE APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.6 ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- 2.7.1 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN MAGNESIUM OXIDE MARKET

- 4.2 ASIA PACIFIC: MAGNESIUM OXIDE MARKET, BY APPLICATION AND COUNTRY

- 4.3 MAGNESIUM OXIDE MARKET: MAJOR COUNTRIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing steel production and rising demand for advanced refractory applications

- 5.2.1.2 Extensive use in construction and building materials

- 5.2.1.3 Growing applications in advanced ceramics and electronic components

- 5.2.2 RESTRAINTS

- 5.2.2.1 High production costs

- 5.2.2.2 Competition from alternatives

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising adoption in wastewater treatment

- 5.2.3.2 Emerging role of magnesium oxide in advanced battery technologies

- 5.2.3.3 Expanding applications in food & nutrition industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Quality consistency and technological limitations

- 5.2.4.2 Environmental and regulatory pressures

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.1.1 Concentrated supply of magnesite reserves

- 5.3.1.2 Limited alternatives for key raw materials

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.2.1 Large volume purchases drive negotiation

- 5.3.2.2 Switching suppliers involves cost and certification

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.3.1 Cheaper minerals can replace magnesium oxide in certain uses

- 5.3.3.2 Few substitutes for high-purity applications

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.4.1 High capital and resource requirements

- 5.3.4.2 Access to raw materials and compliance barriers

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3.5.1 Price pressure is limited in specialty grades

- 5.3.5.2 Differentiation through product quality and reliability

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PATENT ANALYSIS

- 5.6.1 METHODOLOGY

- 5.6.2 PATENT PUBLICATION TRENDS

- 5.6.3 INSIGHTS

- 5.6.4 JURISDICTION ANALYSIS

- 5.6.4.1 List of major patents

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE, BY REGION

- 5.7.2 AVERAGE SELLING PRICE OF MAGNESIUM OXIDE, BY KEY PLAYERS

- 5.7.3 AVERAGE SELLING PRICE TREND, BY APPLICATION

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 SO3 REDUCTION USING HIGHLY-REACTIVE MAGNESIUM OXIDE

- 5.8.1.1 Objective

- 5.8.1.2 Challenge

- 5.8.1.3 Solution statement

- 5.8.1.4 Result

- 5.8.2 SYSTEMATIC KINETIC STUDY OF MAGNESIUM PRODUCTION FROM MAGNESIUM OXIDE USING CARBONIC REDUCTANTS

- 5.8.2.1 Objective

- 5.8.2.2 Challenge

- 5.8.2.3 Solution statement

- 5.8.2.4 Result

- 5.8.3 SYNTHESIS AND CHARACTERIZATION OF MAGNESIUM OXIDE NANOPARTICLES BY PRECIPITATION METHOD

- 5.8.3.1 Objective

- 5.8.3.2 Challenge

- 5.8.3.3 Solution statement

- 5.8.3.4 Result

- 5.8.4 HIGH-RECYCLING CONTAINING MAGNESIA-CARBON BRICKS IN HIGH-PERFORMANCE STEELMAKING APPLICATIONS

- 5.8.4.1 Objective

- 5.8.4.2 Challenge

- 5.8.4.3 Solution statement

- 5.8.4.4 Result

- 5.8.1 SO3 REDUCTION USING HIGHLY-REACTIVE MAGNESIUM OXIDE

- 5.9 INVESTMENT & FUNDING SCENARIO

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO

- 5.10.2 EXPORT SCENARIO

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 INTRODUCTION

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 REGULATORY LANDSCAPE

- 5.13.4 NORTH AMERICA

- 5.13.4.1 Toxic Substances Control Act (TSCA)

- 5.13.4.2 Canadian Environmental Protection Act (CEPA)

- 5.13.5 EUROPE

- 5.13.5.1 REACH Regulation

- 5.13.5.2 Industrial Emissions Directive

- 5.13.6 ASIA PACIFIC

- 5.13.6.1 Measures for the Environmental Management of New Chemical Substances

- 5.13.6.2 Bureau of Indian Standards (BIS) Certification under the Bureau of Indian Standards Act, 2016

- 5.13.6.3 Chemical Substances Control Law

- 5.14 TECHNOLOGY ANALYSIS

- 5.14.1 KEY TECHNOLOGIES

- 5.14.1.1 Calcination of natural magnesite and dolomite

- 5.14.1.2 Seawater and brine precipitation route

- 5.14.2 ADJACENT TECHNOLOGIES

- 5.14.2.1 Sol-gel synthesis of magnesium oxide nanomaterials

- 5.14.2.2 Thermal decomposition and carbonization

- 5.14.3 COMPLEMENTARY TECHNOLOGIES

- 5.14.3.1 Surface modification and doping technologies

- 5.14.3.2 Carbon capture and utilization (CCU)

- 5.14.1 KEY TECHNOLOGIES

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 GLOBAL MACROECONOMIC OUTLOOK

- 5.16.1 GDP

- 5.17 IMPACT OF ARTIFICIAL INTELLIGENCE (AI) ON MAGNESIUM OXIDE MARKET

- 5.17.1 MATERIALS DISCOVERY AND PROCESS OPTIMIZATION

- 5.17.2 SUPPLY CHAIN AND MARKET FORECASTING

- 5.17.3 SUSTAINABILITY AND ENVIRONMENTAL COMPLIANCE

- 5.17.4 PRODUCT INNOVATION AND APPLICATIONS

- 5.17.5 MARKET COMPETITIVENESS AND STRATEGY

- 5.18 IMPACT OF 2025 US TARIFF ON MAGNESIUM OXIDE MARKET

- 5.18.1 KEY TARIFF RATES

- 5.18.2 PRICE IMPACT ANALYSIS

- 5.18.3 IMPACT ON COUNTRIES/REGIONS

- 5.18.3.1 US

- 5.18.3.2 Europe

- 5.18.3.3 Asia Pacific

- 5.18.4 IMPACT ON END-USE INDUSTRIES

- 5.18.4.1 Construction

- 5.18.4.2 Agriculture

- 5.18.4.3 Healthcare

- 5.18.4.4 Food & beverage

- 5.18.4.5 Cosmetics

- 5.18.4.6 Other end-use industries

6 FORMS OF MAGNESIUM OXIDE

- 6.1 INTRODUCTION

- 6.2 POWDER

- 6.2.1 SUPPORTS HIGHER CROP YIELDS TO MEET GROWING GLOBAL FOOD DEMAND

- 6.3 GRANULES

- 6.3.1 HEAT RESISTANCE AND STRUCTURAL INTEGRITY UNDER HIGH TEMPERATURES TO DRIVE MARKET

- 6.4 FLAKES

- 6.4.1 GROWING PREFERENCE FOR ADVANCED MATERIALS WITH BALANCED PERFORMANCE AND LONG SERVICE LIFE TO DRIVE DEMAND

7 PURITY LEVELS OF MAGNESIUM OXIDE

- 7.1 INTRODUCTION

- 7.2 HIGH PURITY

- 7.2.1 RISING DEMAND IN ENVIRONMENTAL AND ENERGY APPLICATIONS TO DRIVE MARKET GROWTH

- 7.3 MEDIUM PURITY

- 7.3.1 ADOPTION AS NEUTRALIZING AGENT IN WASTEWATER TREATMENT AND FLUE GAS DESULFURIZATION TO DRIVE MARKET

- 7.4 LOW PURITY

- 7.4.1 NEED FOR AFFORDABLE MATERIALS FOR ROADS, BUILDINGS, AND STEELMAKING TO DRIVE DEMAND

8 MAGNESIUM OXIDE MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 CAUSTIC CALCINED MAGNESIA

- 8.2.1 RISING DEMAND FOR SUSTAINABLE AGRICULTURE AND HIGHER CROP YIELDS TO FUEL MARKET GROWTH

- 8.3 DEAD BURNED MAGNESIA

- 8.3.1 RISING STEEL PRODUCTION IN ASIA PACIFIC TO FUEL DEMAND

- 8.4 FUSED MAGNESIA

- 8.4.1 GROWTH IN ELECTRONICS AND RENEWABLE ENERGY SYSTEMS DRIVING DEMAND FOR FUSED MAGNESIA

9 MAGNESIUM OXIDE MARKET, BY SOURCE

- 9.1 INTRODUCTION

- 9.2 NATURAL

- 9.2.1 GROWING FOOD DEMAND AND SHIFT TOWARD SUSTAINABLE FARMING PRACTICES TO DRIVE MARKET

- 9.3 SYNTHETIC

- 9.3.1 GROWING DEMAND IN PHARMACEUTICALS, ELECTRONICS, AND SPECIALTY CHEMICALS SECTORS TO DRIVE MARKET

10 MAGNESIUM OXIDE MARKET, BY GRADE

- 10.1 INTRODUCTION

- 10.2 FOOD GRADE

- 10.2.1 GROWING DEMAND FOR DIETARY SUPPLEMENTS TO DRIVE MARKET GROWTH

- 10.3 PHARMACEUTICAL GRADE

- 10.3.1 RISING PREVALENCE OF GASTROINTESTINAL DISORDERS TO INCREASE CONSUMPTION

- 10.4 INDUSTRIAL GRADE

- 10.4.1 RISING DEMAND FOR AUTOMOTIVE TIRES, INDUSTRIAL RUBBER GOODS, AND PLASTICS TO DRIVE MARKET

- 10.5 REFRACTORY GRADE

- 10.5.1 EXCEPTIONAL THERMAL STABILITY AND CHEMICAL RESISTANCE DRIVING ADOPTION IN HIGH-TEMPERATURE INDUSTRIES

11 MAGNESIUM OXIDE MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 ANIMAL FEED

- 11.2.1 EXPANSION OF LIVESTOCK FARMING ACTIVITIES TO DRIVE MARKET

- 11.3 STEEL MAKING & CEMENT

- 11.3.1 RAPID EXPANSION OF GLOBAL CONSTRUCTION AND INFRASTRUCTURE DEVELOPMENT TO DRIVE MARKET

- 11.4 GLASS & CERAMICS

- 11.4.1 DEMAND FOR SUSTAINABILITY AND ECO-FRIENDLY SOLUTIONS TO DRIVE MARKET

- 11.5 ELECTRONICS

- 11.5.1 SURGING DEMAND IN SEMICONDUCTORS & ADVANCED ELECTRONICS TO SUPPORT MARKET GROWTH

- 11.6 PHARMACEUTICALS

- 11.6.1 INCREASE IN AGING POPULATION TO SUPPORT MARKET GROWTH

- 11.7 FERTILIZERS

- 11.7.1 INCREASED FOCUS ON CROP QUALITY AND SPECIALTY CROPS SUPPORTING MARKET GROWTH

- 11.8 OTHER APPLICATIONS

12 MAGNESIUM OXIDE MARKET, BY END-USE INDUSTRY

- 12.1 INTRODUCTION

- 12.2 FOOD & BEVERAGE

- 12.2.1 RISE OF NUTRITIONAL DEFICIENCIES AND HEALTH AWARENESS TO DRIVE MARKET

- 12.3 CONSTRUCTION

- 12.3.1 INCREASED INFRASTRUCTURE SPENDING AND GOVERNMENT INVESTMENT TO FUEL DEMAND

- 12.4 AGRICULTURE

- 12.4.1 PRODUCTIVITY GAINS AND INNOVATION IN AGRICULTURAL INPUTS TO SUPPORT MARKET GROWTH

- 12.5 HEALTHCARE

- 12.5.1 INCREASE IN LIFESTYLE & ENVIRONMENTAL RISK FACTORS TO PROPEL MARKET

- 12.6 ENVIRONMENTAL

- 12.6.1 INCREASING NEED FOR WASTEWATER TREATMENT SOLUTION TO DRIVE GROWTH

- 12.7 OTHER END-USE INDUSTRIES

13 MAGNESIUM OXIDE MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 ASIA PACIFIC

- 13.2.1 CHINA

- 13.2.1.1 Expanding steel & refractory industry to drive demand

- 13.2.2 JAPAN

- 13.2.2.1 Growing demand for pharmaceuticals and dietary supplements to propel market

- 13.2.3 INDIA

- 13.2.3.1 Rising demand from agriculture & animal feed industry to drive market

- 13.2.4 SOUTH KOREA

- 13.2.4.1 Rising need for ultra-high purity magnesium oxide in electronics manufacturing to drive market

- 13.2.5 REST OF ASIA PACIFIC

- 13.2.1 CHINA

- 13.3 NORTH AMERICA

- 13.3.1 US

- 13.3.1.1 Construction sector boom to drive market growth

- 13.3.2 CANADA

- 13.3.2.1 Sustainability and emission-control measures to increase demand in environmental applications

- 13.3.3 MEXICO

- 13.3.3.1 Need for fire-safe building solutions in hurricane and earthquake-prone regions to support market growth

- 13.3.1 US

- 13.4 EUROPE

- 13.4.1 GERMANY

- 13.4.1.1 High demand for use as flame-retardant material to boost market

- 13.4.2 UK

- 13.4.2.1 Growing demand from refractory and metallurgical industries to drive market growth

- 13.4.3 FRANCE

- 13.4.3.1 Technological advancements in production methods to boost market growth

- 13.4.4 ITALY

- 13.4.4.1 Growing emphasis on food security and crop productivity to drive demand

- 13.4.5 SPAIN

- 13.4.5.1 Growth in construction and cement sectors to drive market

- 13.4.6 REST OF EUROPE

- 13.4.1 GERMANY

- 13.5 SOUTH AMERICA

- 13.5.1 BRAZIL

- 13.5.1.1 Expansion of mining and energy sectors to fuel market growth

- 13.5.2 REST OF SOUTH AMERICA

- 13.5.1 BRAZIL

- 13.6 MIDDLE EAST & AFRICA

- 13.6.1 GCC COUNTRIES

- 13.6.1.1 UAE

- 13.6.1.1.1 Rapid construction and infrastructure expansion to drive market growth

- 13.6.1.2 Rest of GCC Countries

- 13.6.1.1 UAE

- 13.6.2 SOUTH AFRICA

- 13.6.2.1 Demand in environmental and waste management applications to drive demand

- 13.6.3 REST OF MIDDLE EAST & AFRICA

- 13.6.1 GCC COUNTRIES

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 14.3 REVENUE ANALYSIS, 2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 BRAND/PRODUCT COMPARISON

- 14.6 COMPANY VALUATION AND FINANCIAL METRICS

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Product type footprint

- 14.7.5.4 Source footprint

- 14.7.5.5 Grade footprint

- 14.7.5.6 Form footprint

- 14.7.5.7 Purity footprint

- 14.7.5.8 Application footprint

- 14.7.5.9 End-use industry footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 DEALS

- 14.9.2 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 MAJOR PLAYERS

- 15.1.1 HAICHENG MAGNESITE GROUP CO., LTD.

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 MnM view

- 15.1.1.3.1 Right to win

- 15.1.1.3.2 Strategic choices

- 15.1.1.3.3 Weaknesses and competitive threats

- 15.1.2 MAGNEZIT GROUP

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Other developments

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 RHI MAGNESITA

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 MARTIN MARIETTA MAGNESIA SPECIALTIES

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 GRECIAN MAGNESITE

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Expansions

- 15.1.5.3.2 Other developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 HAICHENG GUANGLING REFRACTORY MANUFACTURING CO. LTD.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 MnM view

- 15.1.6.3.1 Right to win

- 15.1.6.3.2 Strategic choices

- 15.1.6.3.3 Weaknesses and competitive threats

- 15.1.7 UBE MATERIAL INDUSTRIES, LTD.

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.8 KUMAS A.S.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.9 ICL

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.10 TATEHO CHEMICAL INDUSTRIES CO., LTD.

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Deals

- 15.1.11 BAYMAG INC.

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Deals

- 15.1.12 NEDMAG B.V.

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.13 INDUSTRIAS PENOLES

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.14 PAUL RAUSCHERT GMBH & CO. KG.

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Deals

- 15.1.15 KONOSHIMA CHEMICAL CO., LTD.

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.16 LEHMANN&VOSS&CO.

- 15.1.16.1 Business overview

- 15.1.16.2 Products/Solutions/Services offered

- 15.1.16.3 Recent developments

- 15.1.16.3.1 Expansions

- 15.1.17 LKAB MINERALS

- 15.1.17.1 Business overview

- 15.1.17.2 Products/Solutions/Services offered

- 15.1.18 OMYA INTERNATIONAL AG

- 15.1.18.1 Business overview

- 15.1.18.2 Products/Solutions/Services offered

- 15.1.19 HAICHENG JIUSHENG REFRACTORY MANUFACTURING CO., LTD.

- 15.1.19.1 Business overview

- 15.1.19.2 Products/Solutions/Services offered

- 15.1.20 HOLY MAGNESIUM INDUSTRY (DASHIQIAO) CO., LTD.

- 15.1.20.1 Business overview

- 15.1.20.2 Products/Solutions/Services offered

- 15.1.21 SINO MEIR INTERNATIONAL CO., LTD.

- 15.1.21.1 Business overview

- 15.1.21.2 Products/Solutions/Services offered

- 15.1.22 HEBEI MEISHEN TECHNOLOGY CO., LTD.

- 15.1.22.1 Business overview

- 15.1.22.2 Products/Solutions/Services offered

- 15.1.23 NANOSHEL LLC

- 15.1.23.1 Business overview

- 15.1.23.2 Products/Solutions/Services offered

- 15.1.24 KYOWA CHEMICAL INDUSTRY CO., LTD.

- 15.1.24.1 Business overview

- 15.1.24.2 Products/Solutions/Services offered

- 15.1.25 IBAR NORDESTE

- 15.1.25.1 Business overview

- 15.1.25.2 Products/Solutions/Services offered

- 15.1.26 TIMAB MAGNESIUM

- 15.1.26.1 Business overview

- 15.1.26.2 Products/Solutions/Services offered

- 15.1.26.3 Recent developments

- 15.1.26.3.1 Deals

- 15.1.27 YINGKOU MAGNESITE CHEMICAL IND GROUP CO., LTD.

- 15.1.27.1 Business overview

- 15.1.27.2 Products/Solutions/Services offered

- 15.1.28 PRCO AMERICA

- 15.1.28.1 Business overview

- 15.1.28.2 Products/Solutions/Services offered

- 15.1.28.3 Recent developments

- 15.1.28.3.1 Deals

- 15.1.28.3.2 Expansions

- 15.1.29 QMAG PTY LIMITED

- 15.1.29.1 Business overview

- 15.1.29.2 Products/Solutions/Services offered

- 15.1.29.3 Recent developments

- 15.1.29.3.1 Deals

- 15.1.30 HONGYE CHEMICAL

- 15.1.30.1 Business overview

- 15.1.30.2 Products/Solutions/Services offered

- 15.1.31 LIAONING HONGYU REFRACTORY GROUP CO., LTD.

- 15.1.31.1 Business overview

- 15.1.31.2 Products/Solutions/Services offered

- 15.1.32 YINGKOU MAGNESITE MINING CO., LTD.

- 15.1.32.1 Business overview

- 15.1.32.2 Products/Solutions/Services offered

- 15.1.1 HAICHENG MAGNESITE GROUP CO., LTD.

- 15.2 OTHER PLAYERS

- 15.2.1 STAR GRACE MINING CO., LTD.

- 15.2.2 AMERICAN ELEMENTS

- 15.2.3 LORAD CHEMICAL CORPORATION

- 15.2.4 GARRISON MINERALS, LLC

- 15.2.5 CHIMAG

- 15.2.6 FENGCHEN GROUP CO., LTD.

- 15.2.7 LATROBE MAGNESIUM

- 15.2.8 DANDONG XINYANG MINERAL CO., LTD.

- 15.2.9 YINGKOU SANHUA CHEMICAL CO., LTD.

16 ADJACENT AND RELATED MARKETS

- 16.1 INTRODUCTION

- 16.2 LIMITATIONS

- 16.3 INTERCONNECTED MARKETS

- 16.3.1 REFRACTORIES MARKET

- 16.3.1.1 Market definition

- 16.3.1.2 Market overview

- 16.3.1 REFRACTORIES MARKET

- 16.4 REFRACTORIES MARKET, BY FORM

- 16.4.1 SHAPED REFRACTORIES

- 16.4.1.1 Increasing demand from boilers, nuclear reactors, and cement kilns to drive demand

- 16.4.2 UNSHAPED REFRACTORIES

- 16.4.2.1 Offers ease-of-use and better volume stability

- 16.4.1 SHAPED REFRACTORIES

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS