|

시장보고서

상품코드

1869554

유기 사료 시장 예측(-2030년) : 원료 유래별, 형태별, 가축별, 농장 규모별, 영양원별, 제조 기술별, 지역별Organic Feed Market by Ingredient Source (Cereals & Grains, Oilseed Meals & Pulses, Fibers & Forage, Additives), Form (Pellets, Crumbles, Mashes), Livestock, Nutrient Source, Farm Size, Manufacturing Technology, and Region - Global Forecast to 2030 |

||||||

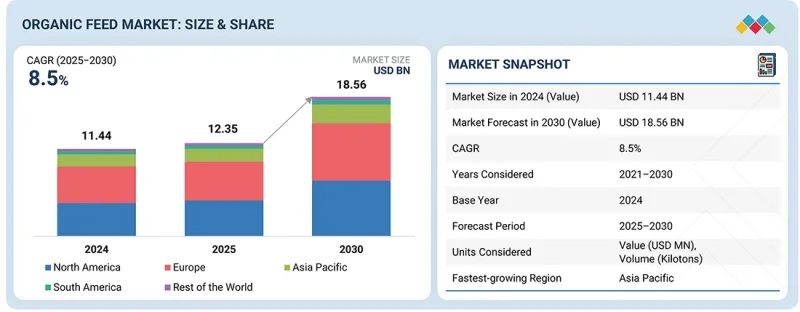

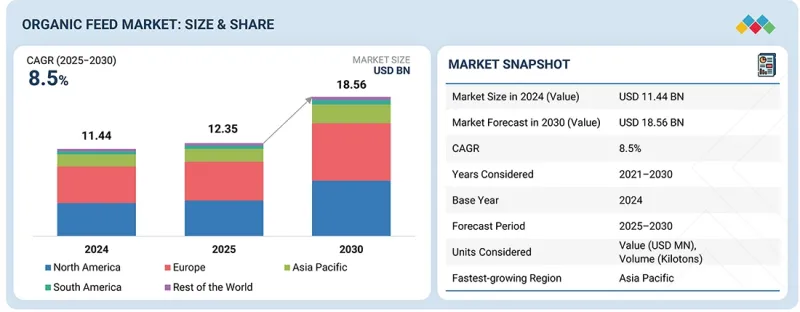

유기 사료 시장 규모는 2025년에 123억 5,000만 달러로 추정되며, 2030년까지 185억 6,000만 달러에 달할 것으로 예측되고 있으며, CAGR은 8.5%로 전망되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(100만 달러) 및 수량(천톤) |

| 부문 | 원료 유래별, 형태별, 가축별, 농장 규모별, 영양원별, 제조 기술별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미, 기타 지역 |

세계 유기농 사료 시장은 유기축산 농법의 보급 확대, 유기농 농지 확대, 사료 배합의 혁신으로 인해 괄목할 만한 성장을 거듭하고 있습니다. 유기농 사료와 유기농 축산물을 제공하는 것은 고품질 사료와 동물성 단백질에 대한 수요 증가에 대응하는 지속가능한 해결책입니다.

전통적 농업과 사료 생산은 농약과 살충제를 많이 사용하고 있으며, 이는 동물과 인간의 건강에 심각한 해를 끼칠 수 있습니다. 이러한 작물 보호 제품은 농산물을 오염시키고, 작물 오염과 그에 따른 손실을 초래할 수 있습니다. 이러한 우려에 대응하기 위해 농업 생산자들은 유기농업으로의 전환을 가속화하고 있습니다. 그러나 유기농 인증 과정에 따른 높은 생산 비용, 가격 책정, 시간적 제약, 복잡성, 그리고 시판되고 승인된 유기농 사료첨가제 및 보조 식품의 부족은 유기농 사료 시장을 억제하는 요인으로 작용하고 있습니다.

펠릿 형태는 유기 사료 중 가장 보편적이고 선호되는 형태이며, 분쇄된 사료에 수분, 열, 압력을 가하여 제조됩니다. 펠릿은 분쇄된 형태의 유기 사료에 비해 바인더의 함량도 높습니다. 펠릿 형태의 유기농 사료는 조기 섭취를 촉진합니다. 또한 사료 급여가 용이하고 보관성이 뛰어나 소규모 양계농가에서도 선호도가 높아 폐기물을 줄이는데도 기여합니다. 펠릿의 크기는 동물의 유형과 나이에 따라 다릅니다. 소형 펠릿은 동물의 성능 향상과 조기 성장률 촉진에 도움이 됩니다. 이러한 요인들이 펠릿화된 배합유기농사료의 사용을 촉진하고 있습니다. 단, 펠릿 형태의 유기 사료는 분쇄된 형태의 사료보다 가격이 비쌉니다.

곡물 및 두류 부문은 동물 사료의 주요 에너지원으로서 성장과 유지에 필요한 탄수화물, 전분, 적당한 단백질을 공급하므로 유기농 사료 시장에서 중요한 비중을 차지하고 있습니다. 유기농 옥수수, 밀, 보리, 귀리, 쌀 등의 원료는 대부분의 사료 배합의 영양적, 경제적 기초를 형성하고 있습니다. 가용성 확대, 확립된 유기농 인증 제도, 가축 종(특히 가금류, 반추동물, 돼지)에 대한 적응성이 그 우위를 더욱 강화시키고 있습니다. 또한 유기농 곡물 재배의 확대와 공급망 통합으로 안정적인 조달과 비용 효율성이 확보되어 이 부문 시장 점유율이 강화되고 있습니다.

미국은 북미의 주요 축산 국가 중 하나입니다. 미국 농무부(USDA)에 따르면 가금육 및 가금류 제품, 돼지고기, 유기농 식품에 대한 수요가 증가할 것으로 예상되어 생산능력 확대를 위한 투자가 이루어지고 있습니다. 또한 고품질 사료에 대한 수요에 힘입은 정밀 사료 기술의 보급 추세는 가축 영양에 대한 지출 증가와 집중을 가져왔고, 그 결과 가축 사료의 유기농 원료에 대한 수요를 증가시켰습니다.

USDA에 따르면 미국에서는 유기농산물에 대한 소비자 수요가 지속적으로 증가하고 있으며, 다양한 제품 분야에서 농가에 기회가 창출되고 있다고 합니다. 이 지역은 옥수수, 콩, 밀 등 유기농 사료 제조에 필요한 주요 원료의 주요 생산지이자 소비지 중 하나입니다. 이에 따라 이 지역의 유기농 사료에 대한 수요는 더욱 증가할 것으로 예측됩니다.

세계의 유기 사료 시장에 대해 조사했으며, 원료 유래별, 형태별, 가축별, 농장 규모별, 영양원별, 제조 기술별, 지역별 동향 및 시장에 참여하는 기업의 개요 등을 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 미충족 요구와 공백

- 상호접속된 시장과 분야 횡단적인 기회

- Tier1/2/3 플레이어의 전략적 움직임

제6장 업계 동향

- Porter's Five Forces 분석

- 거시경제 전망

- 공급망 분석

- 밸류체인 분석

- 에코시스템 분석

- 가격 분석

- 무역 분석

- 2025-2026년의 주요 컨퍼런스와 이벤트

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 투자와 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세의 영향 - 유기 사료 시장

제7장 기술의 진보, AI별 영향, 특허, 혁신, 그리고 향후 응용

- 주요 기술

- 보완적 기술

- 인접 기술

- 특허 분석

- 향후 응용

- AI/생성형 AI가 동물 영양 산업에 미치는 영향

- 성공 사례와 실세계에 대한 응용

제8장 지속가능성과 규제 상황

- 지역의 규제와 컴플라이언스

- 지속가능성 구상

- 지속가능성에 대한 영향과 규제 정책 구상

- 인증, 라벨, 환경기준

제9장 고객 상황과 구매 행동

- 의사결정 프로세스

- 구입자 이해관계자와 구입 평가 기준

- 채택 장벽과 내부 과제

- 다양한 최종 용도 산업으로부터의 미충족 요구

- 시장 수익성

제10장 유기 사료 시장, 원료 유래별(시장 규모와 2030년까지의 예측- 100만 달러)

- 서론

- 곡물

- 지방 종자, 밀, 두류

- 섬유와 사료

- 첨가제

제11장 유기 사료 시장, 형태별(시장 규모와 2030년까지의 예측- 100만 달러)

- 서론

- 펠릿

- 크럼블

- 매시

- 기타

제12장 유기 사료 시장, 가축별(시장 규모와 2030년까지의 예측- 100만 달러 및 킬로톤)

- 서론

- 가금

- 반추동물

- 돼지

- 수생동물

- 반려동물

제13장 유기 사료 시장, 노우죠 규모별(시장 규모와 2030년까지의 예측- 100만 달러)

- 서론

- 대규모 상업 농장(500에이커 이상)

- 중규모 농장(50-500에이커)

- 소규모 농장(50에이커 미만)

제14장 유기 사료 시장, 영양원별(시장 규모와 2030년까지의 예측- 100만 달러)

- 서론

- 에너지원

- 단백질원

- 섬유원

- 미네랄과 비타민 공급원

- 퍼포먼스 첨가제

제15장 유기 사료 시장, 제조 기술별

- 서론

- 한마미링과 연삭

- 펠릿화

- 엑스팬더

- 압출

- 기타

제16장 유기 사료 시장, 지역별(시장 규모와 2030년까지의 예측- 100만 달러 및 킬로톤)

- 서론

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 기타

- 아시아태평양

- 중국

- 인도

- 일본

- 호주와 뉴질랜드

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

- 기타 지역

- 아프리카

- 중동

제17장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 경쟁 시나리오

제18장 기업 개요

- 주요 참여 기업

- CARGILL, INCORPORATED

- PURINA ANIMAL NUTRITION LLC

- FORFARMERS UK

- ADM

- SCRATCH & PECK

- ALLER AQUA A/S

- THE ORGANIC FEED COMPANY

- COUNTRY HERITAGE FEEDS

- GREEN MOUNTAIN FEEDS

- UNIQUE ORGANICS LTD.

- KREAMER FEED

- YORKTOWN ORGANICS, LLC

- MODESTO MILLING INC.

- HINDUSTAN ANIMAL FEEDS

- ARDENT MILLS

- 기타 기업

- CIZERON BIO

- JONES FEED MILLS LTD.

- COYOTE CREEK FARM

- PETERSON ORGANIC FEEDS

- FARMSTEAD ORGANICS

- CANADIAN ORGANIC FEEDS LTD.

- AUS ORGANIC FEEDS

- BIOMUHLE+KRAUTERFUTTER GMBH

- BLUE STEM ORGANIC FEED MILL

- GRAHAM'S ORGANICS

제19장 인접 시장과 관련 시장

제20장 부록

KSA 25.11.25The organic feed market is estimated at USD 12.35 billion in 2025 and is projected to reach USD 18.56 billion by 2030, at a CAGR of 8.5%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (KT) |

| Segments | By Ingredient Source, Form, Nutrient Source, Livestock, Farm Size, Manufacturing Technology, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Rest of the World (RoW) |

The global organic feed market is experiencing significant growth, driven by the increasing adoption of organic livestock farming practices, expansion of organic farmland, and innovation in feed formulations. The provision of organic feed and organic animal products is a sustainable solution to meet the growing demand for high-quality feed and animal protein.

Conventional farming or feed production involves the heavy use of pesticides and insecticides, which poses significant harm to both animals and human health. These crop protection products can contaminate agricultural commodities, resulting in crop contamination and subsequent losses. To address these concerns, agricultural producers are increasingly turning to organic farming. However, high production costs, pricing, time, and complexity associated with the organic certification process, as well as the lack of commercially available and permitted organic feed supplements and additives, are restraining factors for the organic feed market.

"Pellet form of organic feed is expected to hold a significant share during the forecast period"

The pelleted form is the most common and preferred form of organic feed, prepared by applying moisture, heat, and pressure to the mashed form of the feed. Pellets also contain a higher level of binders compared to the mashed form of organic feed. The pelleted form of organic feed encourages early intake of organic feed. Pelleting also reduces wastage, as it is easy to feed to the animals, easy to store, and is also preferred by backyard chicken farmers. The pellet sizes differ based on the animal and their age. Small pellets are beneficial for animals, as they enhance performance and early growth rates. These factors drive the use of pelletized compound organic feed. However, the pelleted organic feed is more expensive than the mashed form.

"Cereals & grains segment is expected to hold a strong market share among the ingredient sources in the organic feed market"

The cereals & grains segment holds a significant share in the organic feed market as they serve as the primary energy source in animal diets, supplying essential carbohydrates, starch, and moderate protein content for growth and maintenance. Ingredients such as organic corn, wheat, barley, oats, and rice form the nutritional and economic foundation of most feed formulations. Wider availability, established organic certification systems, and compatibility across livestock types, particularly poultry, ruminants, and swine, further reinforce their dominance. Additionally, growing organic grain cultivation and integrating the supply chain support consistent sourcing and cost efficiency, thereby strengthening this segment's market share.

"North America is expected to dominate the global organic feed market during the forecast period"

The US is one of the largest livestock-producing countries in North America. According to the United States Department of Agriculture (USDA), the demand for poultry meat & poultry products, swine meat, and organic foods is expected to grow; therefore, investments are made to increase production capacity. Furthermore, the increasing trend of precision feeding techniques in the region, driven by demand for quality feed, has resulted in increased expenditure and a focus on livestock nutrition, which has, in turn, boosted the demand for organic ingredients in livestock feed.

According to the USDA, consumer demand for organically produced goods continues to grow in the US, creating opportunities for farmers in a wide range of products. The region is one of the largest producers and consumers of major ingredients involved in manufacturing organic feed, such as corn, soybean, and wheat. This is projected to further increase the demand for organic feed in the region.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the organic feed market.

- By Company Type: Tier 1 - 30%, Tier 2 - 25%, and Tier 3 - 45%

- By Designation: Directors - 30%, Managers - 25%, Others - 45%

- By Region: North America - 20%, Europe - 30%, Asia Pacific - 40%, and Rest of the World -10%

Prominent companies in the market include Cargill, Incorporated (US), Purina Animal Nutrition LLC (US), ForFarmers Group (Netherlands), Bern Aqua NV (ADM) (Belgium), Aller Aqua A/S (Denmark), The Organic Feed Company (UK), Scratch & Peck (US), Country Heritage Feeds (Australia), Green Mountain Feeds (US), Unique Organics Ltd (India), Kreamer Feed (Nature's Best Organic Feeds) (US), Yorktown Organics, LLC (US), Modesto Milling Inc. (US), Hindustan Animal Feeds (India), Ardent Mills (US), and others.

Research Coverage

This research report categorizes the organic feed market by ingredient source (cereals & grains, oilseeds, meals & pulses, fibers & forage, additives, and other ingredient sources), by form (pellets, crumbles, mashes, and other forms), by nutrient source (energy, protein, fiber, minerals & vitamins, and performance additives), by livestock (poultry, ruminants, swine, aquatic animals, and companion animals), by farm size (large-scale commercial farms (>500 acres), medium-scale farms (50-500 acres), and small-scale farms (<50 acres)), by manufacturing technology (qualitative) (hammer-milling & grinding, pelleting, expander, extrusion, other manufacturing technologies), and region (North America, Europe, Asia Pacific, South America, and Rest of the World).

The report's scope encompasses detailed information on the major factors, including drivers, restraints, challenges, and opportunities, that influence the growth of the organic feed industry. A thorough analysis of the key industry players has been done to provide insights into their business, services, key strategies, contracts, partnerships, agreements, product launches, mergers & acquisitions, and recent developments associated with the organic feed market. This report provides a competitive analysis of emerging startups in the organic feed market ecosystem. Furthermore, the study covers industry-specific trends, including technology analysis, ecosystem & market mapping, and patent & regulatory landscape, among others.

Reasons to Buy This Report

The report provides market leaders/new entrants with information on the closest approximations of revenue numbers for the overall organic feed and its subsegments. It will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (growing organic livestock farming), restraints (high production costs and pricing), opportunities (emergence of plant-based & alternative feed ingredients), and challenges (limited supply of organic feed ingredients) influencing the growth of the organic feed market

- Product Development/Innovation: Detailed insights into research & development activities and new product launches in the organic feed market

- Market Development: Comprehensive information about lucrative markets-analysis of organic feed across varied regions

- Market Diversification: Exhaustive information about new product sources, untapped geographies, recent developments, and investments in the organic feed market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players such as Cargill, Incorporated (US), Purina Animal Nutrition LLC (US), ForFarmers Group (Netherlands), Bern Aqua NV (ADM) (Belgium), Aller Aqua A/S (Denmark), The Organic Feed Company (UK), Scratch & Peck (US), Country Heritage Feeds (Australia), Green Mountain Feeds (US), Unique Organics Ltd (India), Kreamer Feed (Nature's Best Organic Feeds) (US), Yorktown Organics, LLC (US), Modesto Milling Inc. (US), Hindustan Animal Feeds (India), Ardent Mills (US), and other players in the organic feed market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE AND SEGMENTATION

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 BASE NUMBER CALCULATION

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS

- 3.3 DISRUPTIVE TRENDS SHAPING THE MARKET

- 3.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 3.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ORGANIC FEED MARKET

- 4.2 ORGANIC FEED MARKET, BY FORM AND REGION

- 4.3 ORGANIC FEED MARKET, BY INGREDIENT SOURCE

- 4.4 ORGANIC FEED MARKET, BY LIVESTOCK

- 4.5 ORGANIC FEED MARKET, BY NUTRIENT SOURCE

- 4.6 ORGANIC FEED MARKET, BY FARM SIZE

- 4.7 ORGANIC FEED MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Shift from organic certification to brand differentiation

- 5.2.1.2 Feed-to-fork integration by large retailers

- 5.2.1.3 Rise of functional organic feed additives

- 5.2.1.4 Transition to circular bioeconomy models

- 5.2.2 RESTRAINTS

- 5.2.2.1 Certification bottlenecks and bureaucratic delays

- 5.2.2.2 Organic input volatility

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Localized micro-milling and contract farming

- 5.2.3.2 Rising investment in organic protein alternatives

- 5.2.3.3 Convergence with regenerative agriculture

- 5.2.4 CHALLENGES

- 5.2.4.1 Fragmented certification ecosystem

- 5.2.4.2 Scaling organic aquafeed production

- 5.2.4.3 Inconsistent organic seed supply chain

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS AND WHITE SPACES

- 5.3.1 UNMET NEEDS IN ORGANIC FEED MARKET

- 5.3.2 WHITE SPACE OPPORTUNITIES

- 5.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.4.1 INTERCONNECTED MARKETS

- 5.4.2 CROSS-SECTOR OPPORTUNITIES

- 5.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 5.5.1 KEY MOVES AND STRATEGIC FOCUS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF NEW ENTRANTS

- 6.1.2 THREAT OF SUBSTITUTES

- 6.1.3 BARGAINING POWER OF SUPPLIERS

- 6.1.4 BARGAINING POWER OF BUYERS

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 MACROECONOMICS OUTLOOK

- 6.2.1 INTRODUCTION

- 6.2.2 AGRICULTURAL COMMODITY CYCLES

- 6.2.3 SUSTAINABILITY & CARBON-POLICY INCENTIVES

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.3.1 INPUTS & ORGANIC CROP PRODUCTION

- 6.3.2 RAW MATERIAL SOURCING & AGGREGATION

- 6.3.3 ORGANIC FEED MILLING & PROCESSING

- 6.3.4 PACKAGING, LABELING, & ORGANIC CERTIFICATION COMPLIANCE

- 6.3.5 DISTRIBUTION & LOGISTICS

- 6.3.6 END-USE BY ORGANIC LIVESTOCK & POULTRY FARMERS

- 6.4 VALUE CHAIN ANALYSIS

- 6.5 ECOSYSTEM ANALYSIS

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY LIVESTOCK

- 6.6.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 230400)

- 6.7.2 EXPORT SCENARIO (HS CODE 230400)

- 6.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 CIRCULAR INSECT PROTEIN INTEGRATION TO STRENGTHEN ORGANIC FEED SUPPLY RESILIENCE

- 6.11.2 DIGITALIZED LOW-TEMPERATURE FEED PROCESSING FOR ORGANIC QUALITY & COMPLIANCE

- 6.11.3 REGIONAL ORGANIC FEED ECOSYSTEM DEVELOPMENT THROUGH LOCALIZED SOURCING & TRACEABILITY

- 6.12 IMPACT OF 2025 US TARIFF - ORGANIC FEED MARKET

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRIES/REGIONS

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES

7 TECHNOLOGY ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 7.1 KEY TECHNOLOGIES

- 7.1.1 FEED FORMULATION TECHNOLOGIES

- 7.1.2 FEED PRODUCTION TECHNOLOGIES

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 PRECISION FEEDING AND FARM MANAGEMENT SYSTEMS

- 7.2.2 BLOCKCHAIN FOR TRACEABILITY AND TRANSPARENCY

- 7.2.3 IOT AND SENSORS

- 7.3 ADJACENT TECHNOLOGIES

- 7.3.1 ALTERNATIVE PROTEIN SOURCES

- 7.3.2 REGENERATIVE AGRICULTURE

- 7.3.3 GENETIC TECHNOLOGIES

- 7.3.4 AQUAPONICS AND INTEGRATED SYSTEMS

- 7.4 PATENT ANALYSIS

- 7.4.1 INTRODUCTION

- 7.4.2 METHODOLOGY

- 7.4.3 DOCUMENT TYPE

- 7.4.4 JURISDICTION ANALYSIS

- 7.4.5 LIST OF MAJOR PATENTS

- 7.5 FUTURE APPLICATIONS

- 7.5.1 CARBON-NEGATIVE FEED FORMULATIONS

- 7.5.2 BLOCKCHAIN-BASED FEED TRACEABILITY APPS

- 7.5.3 AI-BASED FEED OPTIMIZATION MODELS

- 7.5.4 BIOACTIVE FUNCTIONAL FEEDS

- 7.5.5 SMART-FEED SILOS & SELF-MONITORING SYSTEMS

- 7.6 IMPACT OF AI/GEN AI ON ANIMAL NUTRITION INDUSTRY

- 7.6.1 TOP USE CASES AND MARKET POTENTIAL

- 7.6.2 BEST PRACTICES IN LIVESTOCK FEED PROCESSING

- 7.6.3 CASE STUDIES OF AI IMPLEMENTATION IN ORGANIC FEED MARKET

- 7.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 7.6.5 READINESS TO ADOPT GENERATIVE AI IN ORGANIC FEED MARKET

- 7.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 7.7.1 CARGILL - CIRCULAR PROTEIN INNOVATION THROUGH INSECT-BASED FEED SOLUTIONS

- 7.7.2 INNOVAFEED - UPCYCLING ORGANIC BY-PRODUCTS INTO HIGH-PROTEIN FEED INGREDIENTS

- 7.7.3 BUHLER GROUP - SMART FEED MILLS FOR SUSTAINABLE ORGANIC PRODUCTION

8 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 INDUSTRY STANDARDS

- 8.1.3 LABELING REQUIREMENTS AND CLAIMS

- 8.1.4 ANTICIPATED REGULATORY CHANGES IN NEXT 5-10 YEARS

- 8.1.4.1 Stronger traceability and digital audit requirements

- 8.1.4.2 Harmonization and mutual recognition of organic standards

- 8.1.4.3 Mandatory digital labeling and provenance claims

- 8.1.4.4 Defined pathways for novel/alternative proteins

- 8.2 SUSTAINABILITY INITIATIVES

- 8.2.1 SUSTAINABLE SOURCING

- 8.2.2 CARBON FOOTPRINT REDUCTION INITIATIVES

- 8.2.3 CIRCULAR ECONOMY APPROACHES

- 8.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 8.4 CERTIFICATIONS, LABELING, ECO-STANDARDS

9 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 9.1 DECISION-MAKING PROCESS

- 9.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 9.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.2.2 BUYING CRITERIA

- 9.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 9.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 9.5 MARKET PROFITABILITY

- 9.5.1 REVENUE POTENTIAL

- 9.5.2 COST DYNAMICS

- 9.5.3 MARGIN OPPORTUNITIES, BY INGREDIENT SOURCE

10 ORGANIC FEED MARKET, BY INGREDIENT SOURCE (MARKET SIZE & FORECAST TO 2030 - USD MILLION)

- 10.1 INTRODUCTION

- 10.2 CEREALS & GRAINS

- 10.2.1 PROVIDING ESSENTIAL CARBOHYDRATES FOR ANIMAL GROWTH AND PRODUCTIVITY

- 10.2.2 CORN

- 10.2.3 WHEAT

- 10.2.4 BARLEY

- 10.2.5 OTHER CEREALS & GRAINS (OATS, TRITICALE, RYE, SORGHUM, RICE, MILLET)

- 10.3 OILSEEDS, MEALS, & PULSES

- 10.3.1 POWERING HEALTHY, SUSTAINABLE ANIMAL NUTRITION NATURALLY

- 10.3.2 SOYBEAN

- 10.3.3 RAPESEED

- 10.3.4 PEAS

- 10.3.5 OTHER OILSEEDS, MEALS, & PULSES

- 10.4 FIBERS & FORAGE

- 10.4.1 SUPPORTING OPTIMAL GUT FUNCTION, NUTRIENT ABSORPTION, AND OVERALL WELL-BEING IN LIVESTOCK

- 10.5 ADDITIVES

- 10.5.1 ENRICHING ORGANIC NUTRITION WITH ESSENTIAL BOOSTERS

- 10.5.2 VITAMINS

- 10.5.3 MINERALS

- 10.5.4 FUNCTIONAL ADDITIVES

11 ORGANIC FEED MARKET, BY FORM (MARKET SIZE & FORECAST TO 2030 - USD MILLION)

- 11.1 INTRODUCTION

- 11.2 PELLETS

- 11.2.1 EFFICIENCY MEETS SUSTAINABILITY IN EVERY PELLET

- 11.3 CRUMBLES

- 11.3.1 NUTRIENT-RICH CRUMBLES FOR SUSTAINABLE LIVESTOCK GROWTH

- 11.4 MASHES

- 11.4.1 BLENDED NATURALLY, WIDELY USED IN RUMINANTS AND LAYER POULTRY FOR NATURAL NUTRITION

- 11.5 OTHER FORMS

12 ORGANIC FEED MARKET, BY LIVESTOCK (MARKET SIZE & FORECAST TO 2030 - USD MILLION & KILOTONS)

- 12.1 INTRODUCTION

- 12.2 POULTRY

- 12.2.1 ORGANIC NUTRITION FOR SUSTAINABLE POULTRY PRODUCTION

- 12.2.2 BROILERS

- 12.2.3 LAYERS

- 12.2.4 BREEDERS

- 12.2.5 OTHER POULTRY

- 12.3 RUMINANTS

- 12.3.1 SUPPORTING SUSTAINABLE DAIRY AND MEAT PRODUCTION

- 12.3.2 DAIRY CATTLE

- 12.3.3 BEEF CATTLE

- 12.3.4 CALVES

- 12.3.5 OTHER RUMINANTS (GOATS AND LAMBS)

- 12.4 SWINE

- 12.4.1 ENSURING STRONGER IMMUNITY, EFFICIENT GROWTH, AND GREENER PORK INDUSTRY

- 12.4.2 STARTER

- 12.4.3 GROWER

- 12.4.4 SOW

- 12.5 AQUATIC ANIMALS

- 12.5.1 DRIVING SUSTAINABLE AQUACULTURE WITH NATURAL INGREDIENTS AND RESPONSIBLE FARMING PRACTICES

- 12.5.2 FISH

- 12.5.3 CRUSTACEANS

- 12.5.4 MOLLUSKS

- 12.5.5 OTHER AQUATIC ANIMALS

- 12.6 COMPANION ANIMALS

- 12.6.1 SUPPORTING VITALITY, LONGEVITY, AND OVERALL WELL-BEING IN HOUSEHOLD PETS

13 ORGANIC FEED MARKET, BY FARM SIZE (MARKET SIZE & FORECAST TO 2030 - USD MILLION)

- 13.1 INTRODUCTION

- 13.2 LARGE-SCALE COMMERCIAL FARMS (>500 ACRES)

- 13.2.1 LARGE FARMS LEADING ORGANIC REVOLUTION

- 13.3 MEDIUM-SCALE FARMS (50-500 ACRES)

- 13.3.1 BALANCING PRODUCTIVITY AND SUSTAINABILITY IN ORGANIC FARMING

- 13.4 SMALL-SCALE FARMS (<50 ACRES)

- 13.4.1 NURTURING LOCAL FIELDS TO GLOBAL ORGANIC GROWTH

14 ORGANIC FEED MARKET, BY NUTRIENT SOURCE (MARKET SIZE & FORECAST TO 2030 - USD MILLION)

- 14.1 INTRODUCTION

- 14.2 ENERGY SOURCES

- 14.2.1 POWERING LIVESTOCK METABOLISM WITH CLEAN, SUSTAINABLE ENERGY

- 14.3 PROTEIN SOURCES

- 14.3.1 SUPPORTING GROWTH, REPAIR, AND PRODUCTIVITY

- 14.4 FIBER SOURCES

- 14.4.1 PROMOTING DIGESTIVE WELLNESS AND NUTRIENT EFFICIENCY

- 14.5 MINERAL & VITAMIN SOURCES

- 14.5.1 ENSURING OVERALL HEALTH AND IMMUNITY

- 14.6 PERFORMANCE ADDITIVES

- 14.6.1 BOOSTING EFFICIENCY AND ANIMAL WELL-BEING-NATURALLY

15 ORGANIC FEED MARKET, BY MANUFACTURING TECHNOLOGY

- 15.1 INTRODUCTION

- 15.2 HAMMER-MILLING & GRINDING

- 15.3 PELLETING

- 15.4 EXPANDER

- 15.5 EXTRUSION

- 15.6 OTHER MANUFACTURING TECHNOLOGIES

16 ORGANIC FEED MARKET, BY REGION (MARKET SIZE & FORECAST TO 2030 - USD MILLION & KILOTONS)

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 US

- 16.2.1.1 Growing focus on innovation, sustainability, and certified organic integrity in livestock nutrition to drive market

- 16.2.2 CANADA

- 16.2.2.1 Emphasis on sustainable livestock production through trusted organic feed solutions to drive market

- 16.2.3 MEXICO

- 16.2.1 US

- 16.3 EUROPE

- 16.3.1 GERMANY

- 16.3.1.1 Green transition to boost demand for organic feed

- 16.3.2 UK

- 16.3.2.1 Promotion of sustainable agricultural practices to drive market

- 16.3.3 FRANCE

- 16.3.3.1 Sustainable consumption trends to drive market

- 16.3.4 SPAIN

- 16.3.4.1 Robust agricultural base and growing consumer awareness to drive market

- 16.3.5 ITALY

- 16.3.5.1 Green feed initiatives and livestock system transition to drive market

- 16.3.6 NETHERLANDS

- 16.3.6.1 Increase in organic farming activity to drive market

- 16.3.7 REST OF EUROPE

- 16.3.1 GERMANY

- 16.4 ASIA PACIFIC

- 16.4.1 CHINA

- 16.4.1.1 Green agricultural vision to drive market

- 16.4.2 INDIA

- 16.4.2.1 Shift toward natural nutrition to drive market

- 16.4.3 JAPAN

- 16.4.3.1 Focus on sustainability, animal welfare, and food safety to drive market

- 16.4.4 AUSTRALIA & NEW ZEALAND

- 16.4.4.1 Emphasis on organic production systems and traceable feed ingredients to drive market

- 16.4.5 REST OF ASIA PACIFIC

- 16.4.1 CHINA

- 16.5 SOUTH AMERICA

- 16.5.1 BRAZIL

- 16.5.1.1 Focus on nurturing sustainable livestock with organic nutrition to drive market

- 16.5.2 ARGENTINA

- 16.5.2.1 Strengthening sustainable livestock through clean and traceable feed systems to drive market

- 16.5.3 REST OF SOUTH AMERICA

- 16.5.1 BRAZIL

- 16.6 REST OF THE WORLD

- 16.6.1 AFRICA

- 16.6.1.1 Increasing focus on livestock sustainability through natural and resource-efficient feed innovation to drive market

- 16.6.2 MIDDLE EAST

- 16.6.2.1 Rising concerns over food safety and import dependency to drive market

- 16.6.1 AFRICA

17 COMPETITIVE LANDSCAPE

- 17.1 OVERVIEW

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 17.3 REVENUE ANALYSIS

- 17.4 MARKET SHARE ANALYSIS

- 17.5 BRAND/PRODUCT COMPARISON

- 17.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.6.1 STARS

- 17.6.2 EMERGING LEADERS

- 17.6.3 PERVASIVE PLAYERS

- 17.6.4 PARTICIPANTS

- 17.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 17.6.5.1 Company footprint

- 17.6.5.2 Regional footprint

- 17.6.5.3 Ingredient source footprint

- 17.6.5.4 Form footprint

- 17.6.5.5 Livestock footprint

- 17.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 17.7.1 PROGRESSIVE COMPANIES

- 17.7.2 RESPONSIVE COMPANIES

- 17.7.3 DYNAMIC COMPANIES

- 17.7.4 STARTING BLOCKS

- 17.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 17.7.5.1 Detailed list of key startups/SMEs

- 17.7.5.2 Competitive benchmarking of key startups/SMEs

- 17.8 COMPANY VALUATION AND FINANCIAL METRICS

- 17.9 COMPETITIVE SCENARIO

- 17.9.1 PRODUCT LAUNCHES/ENHANCEMENTS

- 17.9.2 DEALS

- 17.9.3 EXPANSIONS

- 17.9.4 OTHER DEVELOPMENTS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 CARGILL, INCORPORATED

- 18.1.1.1 Business overview

- 18.1.1.2 Products/Services/Solutions offered

- 18.1.1.3 Recent developments

- 18.1.1.3.1 Product launches & enhancements

- 18.1.1.3.2 Deals

- 18.1.1.3.3 Expansions

- 18.1.1.4 MnM view

- 18.1.1.4.1 Key strengths

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses & competitive threats

- 18.1.2 PURINA ANIMAL NUTRITION LLC

- 18.1.2.1 Business overview

- 18.1.2.2 Products/Services/Solutions offered

- 18.1.2.3 Recent developments

- 18.1.2.4 MnM view

- 18.1.2.4.1 Key strengths

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses & competitive threats

- 18.1.3 FORFARMERS UK

- 18.1.3.1 Business overview

- 18.1.3.2 Products/Services/Solutions offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Deals

- 18.1.3.4 MnM view

- 18.1.3.4.1 Key strengths

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses & competitive threats

- 18.1.4 ADM

- 18.1.4.1 Business overview

- 18.1.4.2 Products/Services/Solutions offered

- 18.1.4.3 Recent developments

- 18.1.4.4 MnM view

- 18.1.4.4.1 Key strengths

- 18.1.4.4.2 Strategic choices

- 18.1.4.4.3 Weaknesses & competitive threats

- 18.1.5 SCRATCH & PECK

- 18.1.5.1 Business overview

- 18.1.5.2 Products/Services/Solutions offered

- 18.1.5.3 Recent developments

- 18.1.5.4 MnM view

- 18.1.5.4.1 Key strengths

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses & competitive threats

- 18.1.6 ALLER AQUA A/S

- 18.1.6.1 Business overview

- 18.1.6.2 Products/Services/Solutions offered

- 18.1.6.3 Recent developments

- 18.1.6.3.1 Other developments

- 18.1.6.4 MnM view

- 18.1.7 THE ORGANIC FEED COMPANY

- 18.1.7.1 Business overview

- 18.1.7.2 Products/Services/Solutions offered

- 18.1.7.3 Recent developments

- 18.1.7.4 MnM view

- 18.1.8 COUNTRY HERITAGE FEEDS

- 18.1.8.1 Business overview

- 18.1.8.2 Products/Services/Solutions offered

- 18.1.8.3 Recent developments

- 18.1.8.4 MnM view

- 18.1.9 GREEN MOUNTAIN FEEDS

- 18.1.9.1 Business overview

- 18.1.9.2 Products/Services/Solutions offered

- 18.1.9.3 Recent developments

- 18.1.9.4 MnM view

- 18.1.10 UNIQUE ORGANICS LTD.

- 18.1.10.1 Business overview

- 18.1.10.2 Products/Services/Solutions offered

- 18.1.10.3 Recent developments

- 18.1.10.4 MnM view

- 18.1.11 KREAMER FEED

- 18.1.11.1 Business overview

- 18.1.11.2 Products/Services/Solutions offered

- 18.1.11.3 Recent developments

- 18.1.11.4 MnM view

- 18.1.12 YORKTOWN ORGANICS, LLC

- 18.1.12.1 Business overview

- 18.1.12.2 Products/Services/Solutions offered

- 18.1.12.3 Recent developments

- 18.1.12.4 MnM view

- 18.1.13 MODESTO MILLING INC.

- 18.1.13.1 Business overview

- 18.1.13.2 Products/Services/Solutions offered

- 18.1.13.3 Recent developments

- 18.1.13.4 MnM view

- 18.1.14 HINDUSTAN ANIMAL FEEDS

- 18.1.14.1 Business overview

- 18.1.14.2 Products/Services/Solutions offered

- 18.1.14.3 Recent developments

- 18.1.14.4 MnM view

- 18.1.15 ARDENT MILLS

- 18.1.15.1 Business overview

- 18.1.15.2 Products/Services/Solutions offered

- 18.1.15.3 Recent developments

- 18.1.15.4 MnM view

- 18.1.1 CARGILL, INCORPORATED

- 18.2 OTHER PLAYERS

- 18.2.1 CIZERON BIO

- 18.2.1.1 Business overview

- 18.2.1.2 Products/Services/Solutions offered

- 18.2.1.3 Recent developments

- 18.2.1.4 MnM view

- 18.2.2 JONES FEED MILLS LTD.

- 18.2.2.1 Business overview

- 18.2.2.2 Products/Services/Solutions offered

- 18.2.2.3 Recent developments

- 18.2.2.4 MnM view

- 18.2.3 COYOTE CREEK FARM

- 18.2.3.1 Business overview

- 18.2.3.2 Products/Services/Solutions offered

- 18.2.3.3 Recent developments

- 18.2.3.4 MnM view

- 18.2.4 PETERSON ORGANIC FEEDS

- 18.2.4.1 Business overview

- 18.2.4.2 Products/Services/Solutions offered

- 18.2.4.3 Recent developments

- 18.2.4.4 MnM view

- 18.2.5 FARMSTEAD ORGANICS

- 18.2.5.1 Business overview

- 18.2.5.2 Products/Services/Solutions offered

- 18.2.5.3 Recent developments

- 18.2.5.4 MnM view

- 18.2.6 CANADIAN ORGANIC FEEDS LTD.

- 18.2.7 AUS ORGANIC FEEDS

- 18.2.8 BIOMUHLE + KRAUTERFUTTER GMBH

- 18.2.9 BLUE STEM ORGANIC FEED MILL

- 18.2.10 GRAHAM'S ORGANICS

- 18.2.1 CIZERON BIO

19 ADJACENT & RELATED MARKETS

- 19.1 INTRODUCTION

- 19.2 STUDY LIMITATIONS

- 19.3 FEED ADDITIVES MARKET

- 19.3.1 MARKET DEFINITION

- 19.3.2 MARKET OVERVIEW

- 19.4 COMPOUND FEED MARKET

- 19.4.1 MARKET DEFINITION

- 19.4.2 MARKET OVERVIEW

20 APPENDIX

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS

- 20.5 AUTHOR DETAILS