|

시장보고서

상품코드

1873967

구미 보충제 시장 : 유형별, 최종 용도별, 기능별, 유통 경로별, 지역별 예측(-2030년)Gummy Supplements Market by Type (Vitamin & Minerals, Omega-3 Fatty Acid, Collagen), End-use Demographics (Adults, Children), Functionality Distribution Channel (Hypermarkets & Supermarkets, Pharmacies & Drugstores), and Region - Global Forecast to 2030 |

||||||

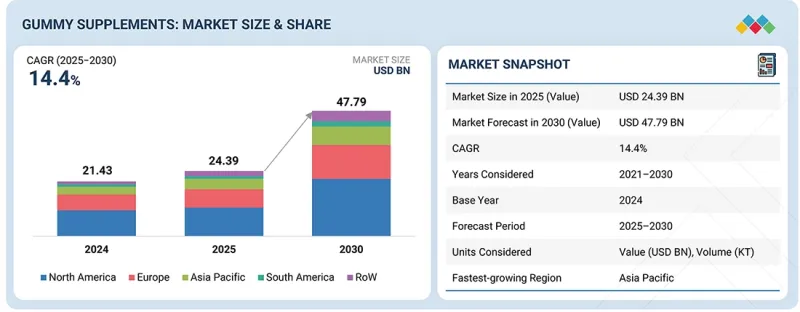

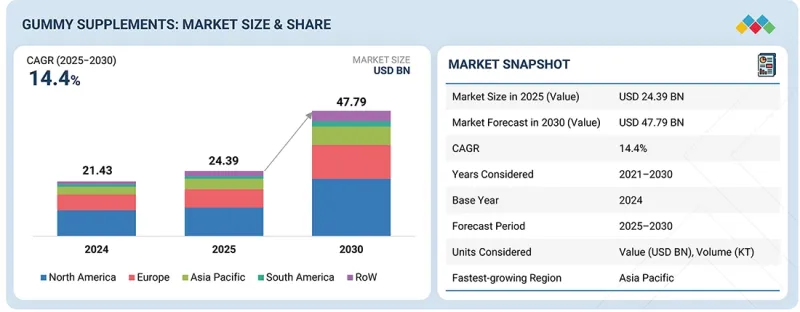

세계의 구미 보충제 시장 규모는 2025년에 243억 9,000만 달러, 2030년까지 약 477억 9,000만 달러에 이를 것으로 예측되며, CAGR로 14.4%를 나타낼 것으로 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2025-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 달러, 1,000톤 |

| 부문 | 유형, 최종 용도, 기능성, 유통 채널, 전분 성분, 유래, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미 및 기타 지역 |

이 시장은 현대 건강 및 웰니스 중심의 라이프 스타일에 부응하는 편리하고 맛있고 효과적인 영양 보충 옵션으로 소비자 선호의 변화에 의해 견인되고 있습니다. 건강 의식의 높아짐과 예방 의료에 대한 주목이 주된 촉진요인이 되어, 소비자는 섭취하기 쉽고 일상 생활에 임베디드하기 쉬운 보충제를 요구하게 되어 있습니다. 무당, 식물 유래, 비건, 클린 라벨 성분 등 제품의 제법의 혁신이 자연스럽고 투명한 웰빙 솔루션을 요구하는 소비자의 진화하는 요구에 부응하고 있습니다.

또한 노년 인구 증가와 영양 부족의 유행이 시장 성장을 더욱 촉진하고 있습니다. 이러한 레이어는 얻기 쉽고 기능적인 보충제를 선호하기 때문입니다.

구미 보충제 시장은 특히 프리미엄 및 클린 라벨 제품에서 높은 생산 비용과 배합 비용으로 인한 제약에 직면하고 있습니다. 게다가 식감, 유효성분의 열화, 온도감도와 관련된 안정성과 보존기간의 과제가 생산규모의 확대와 장기보존을 제한하고 있습니다.

"CBD 구미 부문이 예측 기간에 가장 큰 점유율을 차지할 것으로 예측됩니다."

CBD 구미는 자연스럽고 종합적인 건강 솔루션에 대한 소비자의 관심이 증가함에 따라 구미 보충제 시장에서 유형별로 가장 빠르게 성장하는 부문입니다. 급속한 보급은 헴프 유래 CBD 제품의 합법화 확대, 불안·통증·수면장애에 대한 CBD의 치료 효과의 인지도의 향상, 편리하고 맛있고 눈에 띄지 않는 섭취 방법의 매력에 의해 촉진되고 있습니다. 소비자는 기존의 정제와 팅크를 대체하는 옵션을 요구하고 있으며, CBD 구미는 정확한 투여와 안정적인 효과를 제공하기 때문에 인기를 더욱 높이고 있습니다.

또한, 고농도의 배합, 클린 라벨 성분, 풍미의 다양성에 있어서의 지속적인 혁신이 소비자의 신뢰를 높이고, 밀레니얼 세대로부터 고령층에 이르는 다양한 층에의 소구력을 확대하고 있습니다. 소매·EC채널의 지속적인 확대에 더해, 웰니스 인플루언서에 의한 추천이나 제휴도 시장 침투를 가속시키고 있습니다. 이러한 요인은 CBD 구미의 견조한 성장 궤도를 촉진하고 이 부문을 향후 10년간 크게 확대할 것으로 예측됩니다.

"식물 유래 구미가 예측 기간에 가장 빠른 성장을 기록할 전망입니다."

식물 유래 구미는 깨끗한 라벨 천연 비건 대응 제품에 대한 소비자 수요가 증가함에 따라 구미 보충제 시장의 유래 부문 내에서 가장 빠르게 성장하는 카테고리입니다. 건강, 지속가능성, 윤리적 소비에 관한 의식의 향상에 의해 펙틴이나 식물 엑기스 등의 식물 유래 성분에의 이행이 진행되어, 종래의 젤라틴 베이스의 제법에 대체해 가고 있습니다. 모든 연령층, 특히 밀레니얼 세대와 Z세대 소비자는 환경 의식과 동물 복지 등 자신의 가치관에 맞는 제품을 적극적으로 요구하고 있으며, 이것이 채용을 가속화하고 있습니다.

또한, 풍미 프로파일, 기능성 효과, 무당 옵션의 지속적인 혁신은 식물 유래 구미의 매력을 높여줍니다. 전자상거래 및 건강식품 전문점을 포함한 유통 채널의 확대, 투명성과 지속가능성을 강조한 마케팅 활동의 강화가 시장 성장을 더욱 가속화하고 있습니다. 이 추세는 더 건강하고 지속 가능한 영양 솔루션으로 향하는 소비자 선호의 광범위한 변화를 반영하여 식물 유래 구미는 미래 시장 확대의 중요한 성장 촉진요인이되었습니다.

"아시아태평양이 예측 기간에 가장 높은 CAGR을 나타낼 전망입니다."

아시아태평양은 건강 의식 증가, 가처분 소득 증가, 소매 및 EC 유통 채널 확대로 구미 보충제 시장에서 가장 빠르게 성장하는 부문입니다. 중국, 인도, 일본은 대규모 인구, 확대되는 중산층 소비자층, 편리하고 기능적인 건강 제품에 대한 선호도가 높아짐에 따라 중요한 성장 거점으로 부상하고 있습니다. 클린 라벨 제품, 식물 유래 제품, 면역력 향상 효과가 있는 구미 등 제품의 혁신이 이러한 제품의 보급을 더욱 가속화하고 있습니다.

이 보고서는 세계의 구미 보충제 시장에 대한 조사 분석을 통해 주요 성장 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

- 구미 보충제 시장의 기업에게 매력적인 성장 기회

- 북미의 구미 보충제 시장 : 인구 통계별, 국가별

- 구미 보충제 시장 : 지역의 서브 마켓

- 구미 보충제 시장 : 제품 유형별, 지역별

- 구미 보충제 시장 : 유통 채널별, 지역별

- 구미 보충제 시장 : 인구 통계별, 지역별

제5장 시장 개요

- 서론

- 거시지표

- 미·중 무역 관세의 변동이 구미 보충제 시장을 재형성

- 인플레이션과 원재료비의 상승이 구미 보충제 시장을 형성

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 구미 보충제 시장에 대한 생성형 AI의 영향

- 서론

- 구미 보충제 시장에서 생성형 AI 활용

- 사례 연구 분석

- 생성형 AI에 임하는 인접 에코시스템

제6장 업계 동향

- 서론

- 고객사업에 영향을 주는 동향/혼란

- 밸류체인 분석

- 연구 및 제품 개발

- 원재료 조달

- 생산과 가공

- 품질과 안전관리자

- 마케팅과 유통

- 최종 사용자

- 무역 분석

- 수입 분석 : 프로비타민과 비타민

- 수출 분석 : 프로비타민과 비타민

- 생태계/시장지도 분석

- 수요측

- 공급사이드

- 가격 설정 분석

- 구미 보충제의 평균 판매 가격(ASP)의 동향

- 구미 보충제의 평균 판매 가격(ASP)의 동향 : 지역별(2021-2024년)

- 구미 보충제의 평균 판매 가격(ASP) : 주요 기업별(2023년)

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 기술 분석

- 주요 기술

- 보완 분석

- 인접 기술

- 사례 연구

- 특허 분석

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 북미

- 유럽연합(EU)

- 아시아태평양

- 기타 지역

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 미국 관세의 영향(2025년) - 구미 보충제 시장

- 서론

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 미치는 영향

- 최종 이용 산업에 대한 영향

- 투자 및 자금조달 시나리오

제7장 구미 보충제 시장 : 제품 유형별

- 서론

- 비타민 및 미네랄 구미

- 오메가 지방산 구미

- 콜라겐 구미

- CBD 구미

- 기타 제품 유형

제8장 구미 보충제 시장 : 기능별

- 서론

- 면역

- 건강 및 웰니스

- 뼈 및 관절 건강

- 체중 관리

- 미용 및 피부 건강

- 기타 기능

제9장 구미 보충제 시장 : 인구 통계별

- 서론

- 어린이

- 성인

제10장 구미 보충제 시장 : 유통 채널별

- 서론

- 하이퍼마켓 및 슈퍼마켓

- 약국 및 드럭스토어

- 편의점

- 온라인 소매점

- 직접 판매 및 MLM

제11장 구미 보충제 시장 : 유래별

- 서론

- 동물 유래

- 식물 유래

제12장 구미 보충제 시장 : 지역별

- 서론

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주 및 뉴질랜드

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 기타 지역

- 중동

- 아프리카

제13장 경쟁 구도

- 개요

- 주요 진입기업의 전략/강점

- 수익 분석(2022-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 및 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제14장 기업 프로파일

- 주요 기업

- CHURCH & DWIGHT CO., INC.

- H&H GROUP

- AMWAY

- BAYER AG

- HALEON GROUP OF COMPANIES

- NESTLE

- UNILEVER

- OTSUKA HOLDINGS CO., LTD.

- PHARMACARE LABORATORIES AUSTRALIA

- SWANSON

- GLOBAL WIDGET, LLC

- IM HEALTHCARE

- SMP NUTRA

- NATURE'S TRUTH

- HERBALAND NATURALS INC.

- BOSCOGEN, INC.

- ERNEST JACKSON

- NATURE'S WAY BRANDS

- MEDTERRA

- PURE HEMP BOTANICALS

- 기타 기업

- HERO NUTRITIONALS

- VITAKEM NUTRACEUTICAL INC.

- THE TROST

- MAKERS NUTRITION, LLC

- CBDISTILLERY

제15장 인접 시장과 관련 시장

- 서론

- 제한 사항

- 영양 보조 식품 성분 시장

- 시장의 정의

- 시장 개요

- 다이어트 보충제 시장

- 시장의 정의

- 시장 개요

제16장 부록

KTH 25.11.27The gummy supplements market is valued at USD 24.39 billion in 2025 and is projected to reach about USD 47.79 billion by 2030, at a CAGR of 14.4%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD), Volume (KT) |

| Segments | By type, end-use demographics, functionality, distribution channel, starch ingredients, ingredients source, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

The market is driven by an increasing shift in consumer preferences toward convenient, palatable, and effective nutritional options that cater to modern health and wellness lifestyles. Rising health awareness and focus on preventive healthcare are key drivers, encouraging consumers to seek supplements that are easy to consume and integrate into daily routines. Innovations in product formulations, including sugar-free, plant-based, vegan, and clean-label ingredients, are meeting the evolving demands of consumers for natural and transparent wellness solutions.

Additionally, the growing aging population and increased prevalence of nutritional deficiencies further fuel market growth, as these demographics prioritize accessible, functional supplementation.

The gummy supplements market faces restraints due to high production and formulation costs, particularly for premium and clean-label products. Additionally, stability and shelf-life challenges related to texture, active ingredient degradation, and temperature sensitivity limit scalability and long-term storage.

"CBD gummies segment is projected to hold the largest share during the forecast period"

CBD gummies represent the fastest-growing segment by type within the gummy supplement market, driven by increasing consumer interest in natural and holistic wellness solutions. Their rapid adoption is fueled by expanding legalization of hemp-derived CBD products, growing awareness of CBD's therapeutic benefits for anxiety, pain, and sleep disorders, and the appeal of a convenient, tasty, and discreet delivery format. Consumers seek alternatives to traditional pills and tinctures, and CBD gummies offer precise dosing and consistent effects, which further drives their popularity.

Additionally, ongoing innovations in high-potency formulations, clean-label ingredients, and flavor variety enhance consumer trust and broaden the appeal across diverse demographics ranging from millennials to aging populations. The continued expansion of retail and e-commerce channels, along with collaborations and endorsements by wellness influencers, also accelerates market penetration. These factors are expected to foster a strong growth trajectory for CBD gummies, positioning the segment for substantial expansion over the next decade.

"Plant-based gummies are expected to record the fastest growth during the forecast period"

Plant-based gummies are the fastest-growing category within the by source segment in the gummy supplements market, driven by the rising consumer demand for clean-label, natural, and vegan-friendly products. Increasing awareness about health, sustainability, and ethical consumption has driven a shift toward plant-derived ingredients, such as pectin and botanical extracts, which are replacing traditional gelatin-based formulations. Consumers across all age groups, particularly millennials and Gen Z, are actively seeking products that align with their values of environmental consciousness and animal welfare, which has accelerated their adoption.

Furthermore, ongoing innovation in flavor profiles, functional benefits, and sugar-free options enhances the appeal of plant-based gummies. Expanding distribution channels, including e-commerce and specialty health food stores, along with increased marketing efforts around transparency and sustainability, are further accelerating market growth. This trend reflects broader shifts in consumer preferences toward healthier and more sustainable nutrition solutions, positioning plant-based gummies as a key driver of future market expansion.

"Asia Pacific is expected to record the highest CAGR during the forecast period"

The Asia Pacific is the fastest-growing segment in the gummy supplements market, driven by increasing health awareness, rising disposable incomes, and expanding retail and e-commerce distribution channels. China, India, and Japan are emerging as key growth hubs, driven by large populations, a growing middle-class consumer base, and a rising preference for convenient and functional wellness products. Innovation in product offerings, including clean-label, plant-based, and immunity-boosting gummies, further accelerates the adoption of these products.

Additionally, local companies, alongside global brands, are actively marketing tailored gummy supplements to meet the diverse needs of various demographics across the region. The favorable socio-economic factors and evolving consumer preferences are propelling Asia Pacific to become the largest growth engine for the global gummy supplements market in the coming years.

In-depth interviews were conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the gummy supplements market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 50%, Executives - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World - 10%

The key players providing gummy supplements services include Church & Dwight Co., Inc. (US), H&H Group (Hongkong), Amway (US), The Clorox Company (US), Bayer AG (Germany), Haleon Group of Companies (UK), Nestle (Switzerland), Unilever (UK), Otsuka Pharmaceutical Co., Ltd. (Japan), PharmaCare Laboratories Australia (Australia), and Swanson (US).

Research Coverage

This research report categorizes the market by type (vitamin & minerals, omega-3 fatty acid, collagen, CBD, and other product types), end-use demographics (adults, children, and elderly), functionality (immunity support, general health & wellness, bone & joint health, beauty & skin health, and others), distribution channel (hypermarkets & supermarkets, pharmacies & drugstores, convenience stores, online retail stores and direct sales & multi-level marketing (MLM)), starch ingredients (with starch and starchless systems), ingredients source (animal-based and plant-based), and region (North America, Europe, Asia Pacific, South America, and RoW). The report's scope encompasses detailed information on drivers, restraints, challenges, and opportunities that influence the growth of the gummy supplements market.

A detailed analysis of key industry players has been conducted to provide insights into their business overview, services, key strategies, including contracts, partnerships, agreements, service launches, and mergers and acquisitions associated with the gummy supplements market. This report provides a competitive analysis of emerging startups in the gummy supplements market ecosystem. Furthermore, the study also covers industry-specific trends, including technology analysis, ecosystem mapping, and market and regulatory landscapes.

Reasons to Buy this Report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall gummy supplements fungicide and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights into improving their business position, enabling them to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market, providing them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Growing consumer preference for convenient, tasty, and easy-to-consume dietary supplements), restraints (Higher costs of gummy supplements compared to traditional pills), opportunities (Expanding e-commerce platforms and increasing demand for plant-based and clean-label gummy formulations), and challenges (Regulatory complexities and stringent compliance requirements around ingredient transparency and labeling) influencing the growth of the gummy supplements market

- Service Launch/Innovation: Detailed insights into research & development activities and service launches in the gummy supplements market

- Market Development: Comprehensive information about lucrative markets - analysis of the gummy supplements market across varied regions

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the gummy supplements market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, product/service comparison, and product/service footprints of leading players, including gummy supplements services include include Church & Dwight Co., Inc. (US), H&H Group (Hongkong), Amway (US), The Clorox Company (US), Bayer AG (Germany), Haleon Group of Companies (UK), Nestle (Switzerland), Unilever (UK), Otsuka Pharmaceutical Co., Ltd. (Japan), PharmaCare Laboratories Australia (Australia), and Swanson (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Primary sources

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 GUMMY SUPPLEMENTS MARKET SIZE ESTIMATION: SUPPLY SIDE

- 2.2.2 GUMMY SUPPLEMENTS MARKET SIZE ESTIMATION: DEMAND SIDE

- 2.2.3 GUMMY SUPPLEMENTS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.4 GUMMY SUPPLEMENTS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN GUMMY SUPPLEMENTS MARKET

- 4.2 NORTH AMERICA: GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS AND COUNTRY

- 4.3 GUMMY SUPPLEMENTS MARKET: REGIONAL SUBMARKETS

- 4.4 GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE AND REGION

- 4.5 GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL AND REGION

- 4.6 GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS AND REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACRO INDICATORS

- 5.2.1 US-CHINA TRADE TARIFF FLUCTUATIONS RESHAPE GUMMY SUPPLEMENTS MARKET

- 5.2.2 INFLATION AND RAW MATERIAL COSTS RESHAPE GUMMY SUPPLEMENTS MARKET

- 5.2.2.1 Sweeteners and sugar inputs

- 5.2.2.2 Gelling agents: Gelatin, pectin, and alternatives

- 5.2.2.3 Vitamins, actives, flavors, and specialty additives

- 5.2.2.4 Energy, transportation, and packaging inflation

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Rising rate of vitamin-deficiency diseases and undernutrition

- 5.3.1.2 Soaring burden of metabolic diseases

- 5.3.1.3 Growing focus on preventive health and wellness

- 5.3.1.4 Rising consumer interest in beauty and wellness

- 5.3.1.5 Expanding e-commerce and DTC channels

- 5.3.1.6 Innovation in functional formulations

- 5.3.2 RESTRAINTS

- 5.3.2.1 High production costs and ingredient stability issues

- 5.3.2.2 Regulatory complexities across regions

- 5.3.2.3 Sugar content and health concerns

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Growth of plant-based and sugar-free gummies

- 5.3.3.2 Expansion into personalized and AI-driven nutrition

- 5.3.4 CHALLENGES

- 5.3.4.1 Risks associated with overconsumption

- 5.3.4.2 Limited bioavailability and nutrient degradation

- 5.3.4.3 Intense market competition and brand differentiation

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GENERATIVE AI ON GUMMY SUPPLEMENTS MARKET

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GENERATIVE AI ON GUMMY SUPPLEMENTS MARKET

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 Nestle Health Science's robotic technology in gummy production

- 5.4.3.2 Nourished's AI-driven personalized gummy supplements

- 5.4.4 ADJACENT ECOSYSTEM WORKING ON GENERATIVE AI

- 5.4.4.1 Nutraceuticals and dietary supplements

- 5.4.4.2 Functional foods and beverages

- 5.4.4.3 Personalized nutrition and wellness platforms

- 5.4.4.4 Ingredient innovation and supply chain optimization

- 5.4.4.5 Government and regulatory initiatives

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.3.2 RAW MATERIAL SOURCING

- 6.3.3 PRODUCTION AND PROCESSING

- 6.3.4 QUALITY AND SAFETY CONTROLLERS

- 6.3.5 MARKETING AND DISTRIBUTION

- 6.3.6 END USERS

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT ANALYSIS: PROVITAMINS AND VITAMINS

- 6.4.2 EXPORT ANALYSIS: PROVITAMINS AND VITAMINS

- 6.5 ECOSYSTEM/MARKET MAP ANALYSES

- 6.5.1 DEMAND SIDE

- 6.5.2 SUPPLY SIDE

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE (ASP) TREND OF GUMMY SUPPLEMENTS, BY TYPE, 2021-2024 (USD/KG)

- 6.6.2 AVERAGE SELLING PRICE (ASP) TREND OF GUMMY SUPPLEMENTS, BY REGION, 2021-2024 (USD/KG)

- 6.6.3 AVERAGE SELLING PRICE (ASP) OF GUMMY SUPPLEMENTS, BY KEY PLAYER, 2023 (USD/UNIT)

- 6.7 PORTER'S FIVE FORCES ANALYSIS

- 6.7.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.7.2 BARGAINING POWER OF SUPPLIERS

- 6.7.3 BARGAINING POWER OF BUYERS

- 6.7.4 THREAT OF SUBSTITUTES

- 6.7.5 THREAT OF NEW ENTRANTS

- 6.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.8.2 BUYING CRITERIA

- 6.9 TECHNOLOGY ANALYSIS

- 6.9.1 KEY TECHNOLOGIES

- 6.9.1.1 Incorporation of heat-sensitive vitamins in gummy supplements

- 6.9.1.2 Taste masking & flavor microencapsulation

- 6.9.2 COMPLEMENTARY ANALYSIS

- 6.9.2.1 Incorporation of heat-sensitive vitamins in gummy supplements

- 6.9.2.2 Pectin gummy supplements

- 6.9.3 ADJACENT TECHNOLOGIES

- 6.9.3.1 3D-printing & personalized dosing platforms

- 6.9.3.2 Plant-based and clean-label ingredient technologies

- 6.9.1 KEY TECHNOLOGIES

- 6.10 CASE STUDY

- 6.11 PATENT ANALYSIS

- 6.12 REGULATORY LANDSCAPE

- 6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.2 NORTH AMERICA

- 6.12.2.1 Canada

- 6.12.2.2 US

- 6.12.2.3 Mexico

- 6.12.3 EUROPEAN UNION (EU)

- 6.12.3.1 France

- 6.12.3.2 Spain

- 6.12.4 ASIA PACIFIC

- 6.12.4.1 Japan

- 6.12.4.2 China

- 6.12.4.3 India

- 6.12.4.4 Australia & New Zealand

- 6.12.5 REST OF THE WORLD (ROW)

- 6.12.5.1 Brazil

- 6.12.5.2 Argentina

- 6.12.5.3 Israel

- 6.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.14 IMPACT OF 2025 US TARIFF - GUMMY SUPPLEMENTS MARKET

- 6.14.1 INTRODUCTION

- 6.14.2 KEY TARIFF RATES

- 6.14.3 PRICE IMPACT ANALYSIS

- 6.14.4 IMPACT ON COUNTRIES/REGIONS

- 6.14.4.1 US

- 6.14.4.2 Europe

- 6.14.4.3 Asia Pacific

- 6.14.5 IMPACT ON END-USE INDUSTRIES

- 6.15 INVESTMENT AND FUNDING SCENARIO

7 GUMMY SUPPLEMENTS MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 VITAMIN & MINERAL GUMMIES

- 7.2.1 RISING INSTANCES OF VITAMIN DEFICIENCIES TO DRIVE SEGMENT

- 7.3 OMEGA FATTY ACID GUMMIES

- 7.3.1 SOARING CASES OF CVD AND BENEFITS OF OMEGA-3 FATTY ACIDS TO DRIVE SEGMENT

- 7.4 COLLAGEN GUMMIES

- 7.4.1 INCREASED INTEREST IN SKIN CARE AMONG CONSUMERS TO BOOST SEGMENT

- 7.5 CBD GUMMIES

- 7.5.1 RISING CASES OF INSOMNIA COUPLED WITH STRESS AND ANXIETY TO CONTRIBUTE TO SEGMENT GROWTH

- 7.6 OTHER PRODUCT TYPES

8 GUMMY SUPPLEMENTS MARKET, BY FUNCTIONALITY

- 8.1 INTRODUCTION

- 8.2 IMMUNITY

- 8.2.1 INCREASING FOCUS ON IMPROVING IMMUNITY TO DRIVE MARKET

- 8.3 GENERAL HEALTH & WELLNESS [VITAMINS (A, B-COMPLEX, D, E) AND MINERALS (MAGNESIUM, IRON)]

- 8.3.1 GROWING AWARENESS OF ESSENTIAL NUTRIENTS FOR OVERALL WELLNESS AND PREVENTIVE HEALTH TO DRIVE MARKET

- 8.4 BONE & JOINT HEALTH

- 8.4.1 RISING CASES OF OSTEOPOROSIS TO PROPEL MARKET GROWTH

- 8.5 WEIGHT MANAGEMENT

- 8.5.1 CLINICALLY BACKED INGREDIENTS IN GUMMY FORM TO AID WEIGHT MANAGEMENT AND METABOLIC HEALTH

- 8.6 BEAUTY & SKIN HEALTH

- 8.6.1 CLINICALLY SUPPORTED GUMMY SUPPLEMENTS FOR ENHANCED SKIN HEALTH AND RADIANCE.

- 8.7 OTHER FUNCTIONALITIES

9 GUMMY SUPPLEMENTS MARKET, BY DEMOGRAPHICS

- 9.1 INTRODUCTION

- 9.2 CHILDREN

- 9.2.1 INCREASING NEED FOR NUTRIENTS IN CHILDREN TO DRIVE DEMAND FOR GUMMY SUPPLEMENTS

- 9.3 ADULTS

- 9.3.1 RISING RATES OF NUTRIENT DEFICIENCY IN ADULTS TO BOOST CONSUMPTION OF GUMMY SUPPLEMENTS

10 GUMMY SUPPLEMENTS MARKET, BY DISTRIBUTION CHANNEL

- 10.1 INTRODUCTION

- 10.2 HYPERMARKETS & SUPERMARKETS

- 10.2.1 PREFERRED PURCHASING DESTINATION AND AVAILABILITY OF VARIANTS TO DRIVE GROWTH

- 10.3 PHARMACIES & DRUGSTORES

- 10.3.1 WIDE PRESENCE AND AROUND-THE-CLOCK SERVICES TO DRIVE GROWTH

- 10.4 CONVENIENCE STORES

- 10.4.1 RISING PREFERENCE FOR SPECIALIZED HEALTHCARE PRODUCTS TO FUEL GROWTH

- 10.5 ONLINE RETAIL STORES

- 10.5.1 INCREASING RELIANCE ON ONLINE STORES FOR BUYING HEALTH-RELATED PRODUCTS TO DRIVE MARKET

- 10.6 DIRECT SALES & MLM

- 10.6.1 EXPANDING REACH THROUGH NETWORKS - DRIVING GROWTH VIA DIRECT ENGAGEMENT AND MULTI-LEVEL MARKETING CHANNELS

11 GUMMY SUPPLEMENTS MARKET, BY INGREDIENT SOURCE

- 11.1 INTRODUCTION

- 11.2 ANIMAL-BASED

- 11.2.1 BLENDING MARINE NUTRITION WITH CLASSIC FORMULATION - DELIVERING OMEGA-3 WELLNESS IN EVERY CHEW

- 11.3 PLANT-BASED

- 11.3.1 NATURALLY DERIVED AND NUTRITIONALLY BALANCED - SHAPING THE FUTURE OF CLEAN NUTRITION

12 GUMMY SUPPLEMENTS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Presence of key players and various health trends to boost market

- 12.2.2 CANADA

- 12.2.2.1 Convenience, taste, and health benefits of gummy supplements to drive market

- 12.2.3 MEXICO

- 12.2.3.1 Rising health-conscious and vegan population to drive market

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Growing interest in health & wellness to drive market

- 12.3.2 UK

- 12.3.2.1 Rising prevalence of diseases to drive market

- 12.3.3 FRANCE

- 12.3.3.1 High healthcare costs and increased demand for dietary supplements to drive market

- 12.3.4 SPAIN

- 12.3.4.1 Adoption of healthy lifestyles to drive market

- 12.3.5 ITALY

- 12.3.5.1 Strong e-commerce system and geriatric population to drive market

- 12.3.6 NETHERLANDS

- 12.3.6.1 Rising awareness about health benefits of gummy supplements to drive market

- 12.3.7 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 Large population and increasing prevalence of diseases to drive market

- 12.4.2 JAPAN

- 12.4.2.1 Rising awareness and shifting preferences toward dietary supplements to drive market

- 12.4.3 INDIA

- 12.4.3.1 Vitamin deficiency among consumers to drive market

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Increase in health consciousness and attractive marketing campaigns to drive market

- 12.4.5 AUSTRALIA & NEW ZEALAND

- 12.4.5.1 High demand for dietary supplements, particularly in new formats, to drive market

- 12.4.6 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.5.1.1 Increasing consumer preference for convenient and palatable formats in nutrient intake to drive market

- 12.5.2 ARGENTINA

- 12.5.2.1 Growing focus on prevention of micronutrient deficiencies and cardiometabolic risks in children and adults to drive market

- 12.5.3 REST OF SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.6 REST OF THE WORLD

- 12.6.1 MIDDLE EAST

- 12.6.1.1 Rising disposable incomes and healthcare costs to drive market

- 12.6.2 AFRICA

- 12.6.2.1 Increase in vitamin deficiency and consumer awareness about health supplements to fuel market

- 12.6.1 MIDDLE EAST

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS, 2022-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Regional footprint

- 13.7.5.3 Product type footprint

- 13.7.5.4 Demographics footprint

- 13.7.5.5 Functionality footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 CHURCH & DWIGHT CO., INC.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 H&H GROUP

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Expansions

- 14.1.2.3.3 Other developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 AMWAY

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 BAYER AG

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 HALEON GROUP OF COMPANIES

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 NESTLE

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Other developments

- 14.1.6.4 MnM view

- 14.1.6.4.1 Key strengths

- 14.1.6.4.2 Strategic choices

- 14.1.6.4.3 Weaknesses and competitive threats

- 14.1.7 UNILEVER

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.7.3.3 Expansions

- 14.1.7.4 MnM view

- 14.1.7.4.1 Key strengths

- 14.1.7.4.2 Strategic choices

- 14.1.7.4.3 Weaknesses and competitive threats

- 14.1.8 OTSUKA HOLDINGS CO., LTD.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.3.2 Expansions

- 14.1.8.4 MnM view

- 14.1.8.4.1 Key strengths

- 14.1.8.4.2 Strategic choices

- 14.1.8.4.3 Weaknesses and competitive threats

- 14.1.9 PHARMACARE LABORATORIES AUSTRALIA

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Expansions

- 14.1.9.4 MnM view

- 14.1.10 SWANSON

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.4 MnM view

- 14.1.11 GLOBAL WIDGET, LLC

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Product launches

- 14.1.11.3.2 Expansions

- 14.1.11.4 MnM view

- 14.1.12 IM HEALTHCARE

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.4 MnM view

- 14.1.13 SMP NUTRA

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.4 MnM view

- 14.1.14 NATURE'S TRUTH

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Other developments

- 14.1.14.4 MnM view

- 14.1.15 HERBALAND NATURALS INC.

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.15.3 Recent developments

- 14.1.15.4 MnM view

- 14.1.16 BOSCOGEN, INC.

- 14.1.16.1 Business overview

- 14.1.16.2 Products/Solutions/Services offered

- 14.1.16.3 Recent developments

- 14.1.16.4 MnM view

- 14.1.17 ERNEST JACKSON

- 14.1.17.1 Business overview

- 14.1.17.2 Products/Solutions/Services offered

- 14.1.17.3 Recent developments

- 14.1.17.4 MnM view

- 14.1.18 NATURE'S WAY BRANDS

- 14.1.18.1 Business overview

- 14.1.18.2 Products/Solutions/Services offered

- 14.1.18.3 Recent developments

- 14.1.18.3.1 Product launches

- 14.1.18.4 MnM view

- 14.1.19 MEDTERRA

- 14.1.19.1 Business overview

- 14.1.19.2 Products/Solutions/Services offered

- 14.1.19.3 Recent developments

- 14.1.19.4 MnM view

- 14.1.20 PURE HEMP BOTANICALS

- 14.1.20.1 Business overview

- 14.1.20.2 Products/Solutions/Services offered

- 14.1.20.3 Recent developments

- 14.1.20.4 MnM view

- 14.1.1 CHURCH & DWIGHT CO., INC.

- 14.2 OTHER PLAYERS

- 14.2.1 HERO NUTRITIONALS

- 14.2.2 VITAKEM NUTRACEUTICAL INC.

- 14.2.3 THE TROST

- 14.2.4 MAKERS NUTRITION, LLC

- 14.2.5 CBDISTILLERY

15 ADJACENT & RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 NUTRACEUTICAL INGREDIENTS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 DIETARY SUPPLEMENTS MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS