|

시장보고서

상품코드

1873970

적층 세라믹 커패시터 시장 : 유형별, 정격 전압별, 최종 용도별, 용도별, 패키지별, 정전 용량 범위별, 지역별 예측(-2030년)Multilayer Ceramic Capacitor Market by Type (General Capacitor, Array, Serial Construction, Mega Cap, Dielectric Type), Rated Voltage (Low Voltage, Mid Voltage, High Voltage), End Use, Application, Package, Capacitance Range - Global Forecast to 2030 |

||||||

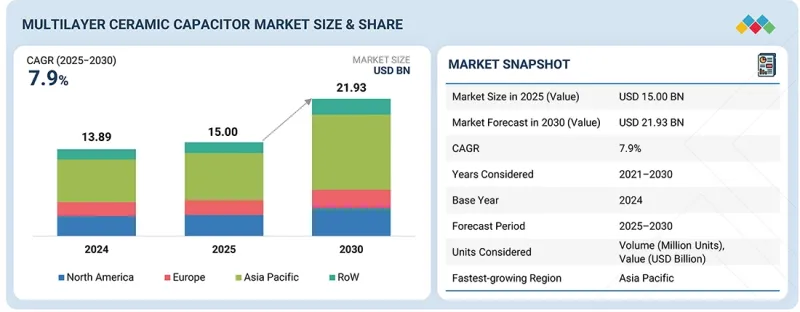

세계의 적층 세라믹 커패시터 시장 규모는 2025년 150억 달러에서 2030년까지 219억 3,000만 달러에 달하고, CAGR 7.9%를 나타낼 것으로 예측됩니다.

5G 네트워크의 급속한 배치는 통신 분야에서 적층 세라믹 커패시터(MLCC) 수요를 크게 견인하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 유형별, 유전체 유형별, 최종 용도별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

5G 인프라(기지국 및 스몰셀 포함)는 안정적이고 효율적인 작동을 실현하기 위해 고주파 신호의 필터링, 디커플링, 에너지 저장을 보장하기 위해 4G LTE 시스템의 몇 배에 달하는 대량의 MLCC가 필요합니다. 이러한 커패시터는 소형화되면서도, 보다 높은 주파수와 고온 환경에 대응할 수 있는 성능이 요구되고, 통신 기기에 있어서의 현대의 고밀도 회로 기판에 불가결한 존재입니다. 예를 들어, Samsung Electronics기계사는 5G 기지국을 위해 특별히 설계된 전용 MLCC를 개발하여 차세대 네트워크의 엄격한 성능 요구 사항을 지원합니다. 5G의 세계 전개가 확대됨에 따라 선진적이고 고성능인 MLCC에 대한 의존도가 더욱 높아져 통신 업계에서 중요한 부품으로서의 지위를 확고하게 할 전망입니다.

NP0(네거티브 포지티브 제로) 또는 C0G(클래스 0, 그룹 G) 커패시터는 탁월한 전기적 특성과 광범위한 적용성으로 2024년 클래스 I MLCC 부문에서 가장 큰 시장 점유율을 차지했습니다. 이러한 커패시터는 온도 계수가 거의 0인 것으로 알려져 있으며, 이는 커패시턴스 값이 -55°C-125°C의 넓은 온도 범위에서 매우 안정하고 변동이 최소임을 의미합니다. 또한 유전 손실이 낮고 절연 저항이 높기 때문에 고주파, 고정밀도, 타이밍 용도에서 매우 효율적입니다.

NP0/C0G 커패시터의 안정성과 신뢰성은 소비자용 전자기기, 자동차 전자기기, 산업용 오토메이션, 항공우주 시스템의 발진기, 필터, RF 모듈, 센서, 디커플링 네트워크 등의 중요한 회로에 최적입니다. 또한 성숙한 제조 공정, 광범위한 공급 시스템 및 업계 표준을 준수함으로써 설계자는 일관된 품질과 예측 가능한 성능을 신뢰할 수 있으며 설계 위험을 줄일 수 있습니다. 높은 신뢰성, 정밀도, 범용성을 겸비한 NP0/C0G 커패시터는 클래스 I MLCC 분야에서 계속 주도적 지위를 유지해, 세계의 엔지니어나 제조업체로부터 선택되고 있습니다.

정격 전압이 보통 16V 이하인 저전압 MLCC는 대량 생산되는 소비자용 전자기기, 자동차, 산업 용도에서의 광범위한 사용으로 2024년 최대 시장 점유율을 차지했습니다. 이러한 커패시터는 스마트폰, 태블릿, 노트북, 웨어러블 디바이스, 자동차 제어 유닛 등의 소형 회로 설계에서 디커플링, 필터링, 에너지 저장에 필수적입니다. 소형 폼 팩터로 고용량을 실현하는 특성은 현대의 전자 기기에 일반적인 소형화·고밀도 실장의 프린트 기판에 최적입니다. 또한 저전압 MLCC 제조 공정은 비용 효율성, 신뢰성 및 성숙도가 우수하며 설계자에게 우선적인 선택이 되었습니다. 이에 따라 수요는 견조하게 추이하고, 적층 세라믹 커패시터 시장에서 우위적인 지위를 유지하고 있습니다.

중국은 대규모 제조 능력, 견고한 공급망 및 전자 부품에 대한 국내 수요 증가로 예측 기간 동안 아시아태평양 시장을 주도할 것으로 전망됩니다. 이 나라에는 기존 기업과 신흥 기업을 포함한 다수의 MLCC 제조업체가 있으며 대량 생산과 비용 우위를 가능하게 합니다. 중국 국내에서의 소비자용 전자기기, 자동차용 전자기기(특히 전기자동차), 통신기기, 산업용 오토메이션의 급속한 성장이 MLCC에 대한 큰 내수를 견인하고 있습니다. 또한, 하이테크 제조업에 대한 정부 지원, 스마트 공장 투자, 5G 인프라 확충은 중국이 지역 시장을 선도하는 능력을 더욱 강화하고 있습니다. 재료 및 제조 공정의 지속적인 기술 발전과 함께 이러한 요인은 중국을 아시아태평양의 MLCC의 주요 성장 기지로 자리 매김하고 있습니다.

주요 관계자와의 인터뷰 내역

적층 세라믹 커패시터 시장에서 사업을 전개하는 주요 조직의 경영 간부(CEO, 마케팅 책임자, 기술 및 혁신 책임자 등)에 대해, 상세한 인터뷰를 실시했습니다.

본 보고서에서는 세계의 적층 세라믹 커패시터 시장에 대해 조사했으며, 유형별, 유전체 유형별, 정격 전압별, 최종 용도별, 용도별, 패키지별, 정전용량 범위별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 고객에 영향을 주는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 생태계 분석

- 기술 분석

- 특허 분석

- 무역 분석

- 주요 컨퍼런스 및 이벤트(2026년)

- 사례 연구 분석

- 투자 및 자금조달 시나리오

- 관세 및 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- AI가 적층 세라믹 커패시터 시장에 미치는 영향

- 미국 관세가 적층 세라믹 커패시터 시장에 미치는 영향(2025년)

제6장 적층 세라믹 커패시터 시장(유형별)

- 서론

- 일반 커패시터

- 어레이

- 직렬 구조

- 메가 커패시터

- 기타

제7장 적층 세라믹 커패시터 시장(유전체 유형별)

- 서론

- 클래스 I

- 클래스 II

- 클래스 III

제8장 적층 세라믹 커패시터 시장(정격 전압별)

- 서론

- 저전압(16V 이하)

- 중전압(25-200V)

- 고전압(200V 초과)

제9장 적층 세라믹 커패시터 시장(최종 용도별)

- 서론

- 가전

- 자동차

- 통신

- 산업

- 헬스케어 및 의료

- 항공우주 및 방위

- 기타

제10장 적층 세라믹 커패시터 시장(용도별)

- 서론

- 분리 커패시터

- 필터링 커패시터

- 바이패스 커패시터

- 공진/타이밍 커패시터

- RF 커플링/디커플링 커패시터

- 파워트레인 HV 커패시터

제11장 적층 세라믹 커패시터 시장(패키지별)

- 서론

- 초소형

- 소형

- 중형

- 대형

제12장 적층 세라믹 커패시터 시장(정전 용량 범위별)

- 서론

- 100PF 미만

- 100 PF-1NF

- 1-100NF

- 0.1-1µF

- 1-100µF

- 100µF 초과

제13장 적층 세라믹 커패시터 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 폴란드

- 북유럽

- 기타

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 한국

- 인도

- 대만

- 호주

- 인도네시아

- 말레이시아

- 태국

- 베트남

- 기타

- 기타 지역

- 기타 지역의 거시 경제 전망

- 중동

- 아프리카

- 남미

제14장 경쟁 구도

- 개요

- 주요 참가 기업의 전략/강점(2022-2025년)

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업평가와 재무지표

- 제품 비교

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제15장 기업 프로파일

- 서론

- 주요 진출기업

- MURATA MANUFACTURING CO., LTD.

- SAMSUNG ELECTRO-MECHANICS

- TDK CORPORATION

- KYOCERA CORPORATION

- TAIYO YUDEN CO., LTD.

- YAGEO GROUP

- VISHAY INTERTECHNOLOGY, INC.

- WALSIN TECHNOLOGIES CORPORATION

- MARUWA CO., LTD.

- HOLY STONE ENTERPRISE CO., LTD.

- 기타 기업

- DARFON

- SAMWHA CAPACITOR GROUP

- FENGHUA

- NIPPON CHEMI-CON CORPORATION

- FUJIAN TORCH ELECTRON TECHNOLOGY CO., LTD.

- SHENZHEN EYANG TECHNOLOGY DEVELOPMENT CO., LTD.

- KNOWLES CAPACITORS

- EXXELIA

- JOHANSON TECHNOLOGY

- WURTH ELEKTRONIK EISOS GMBH & CO. KG

- CHAOZHOU THREE-CIRCLE(GROUP) CO., LTD.

- PROSPERITY DIELECTRICS CO. LTD.(PDC)

- VIKING TECH CORPORATION

- AEM COMPONENTS

- XINGRONG TECHNOLOGIES

제16장 부록

KTH 25.11.27The global multilayer ceramic capacitor market is projected to grow from USD 15.00 billion in 2025 to USD 21.93 billion by 2030, at a CAGR of 7.9%. The rapid deployment of 5G networks is significantly driving the demand for multilayer ceramic capacitors (MLCCs) in the telecommunications sector.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Dielectric Type, End Use and Region |

| Regions covered | North America, Europe, APAC, RoW |

5G infrastructure, including base stations and small cells, requires a substantial number of MLCCs, often several times more than in 4G LTE systems, to ensure high-frequency signal filtering, decoupling, and energy storage for stable and efficient operation. These capacitors must be miniaturized yet capable of handling higher frequencies and elevated temperatures, making them essential for modern high-density circuit boards in telecom equipment. A real-world example is SAMSUNG ELECTRO-MECHANICS, which has developed specialized MLCCs explicitly designed for 5G base stations, supporting the stringent performance requirements of next-generation networks. As 5G deployment continues to expand globally, the reliance on advanced, high-performance MLCCs is expected to grow, solidifying their role as a critical component in the telecommunications industry.

"NP0/C0G Led Class I MLCC Market Share in 2024"

NP0 (Negative-Positive-Zero) or C0G (Class 0, Group G) capacitors held the largest market share within the Class I MLCC segment in 2024, due to their exceptional electrical properties and widespread applicability. These capacitors are known for having a near-zero temperature coefficient, which means their capacitance remains very stable over a wide temperature range, typically from -55°C to +125°C, with minimal variation. They also demonstrate low dielectric loss and high insulation resistance, making them highly efficient for use in high-frequency, precision, and timing applications.

The stability and reliability of NP0/C0G capacitors make them ideal for critical circuits such as oscillators, filters, RF modules, sensors, and decoupling networks in consumer electronics, automotive electronics, industrial automation, and aerospace systems. Additionally, their mature manufacturing processes, wide availability, and compliance with industry standards allow designers to rely on consistent quality and predictable performance, reducing design risks. The combination of high reliability, precision, and versatility ensures that NP0/C0G capacitors continue to dominate the Class I MLCC segment and remain the preferred choice for engineers and manufacturers worldwide.

"Low Voltage (<=16 V) MLCCs Dominated Market in 2024"

Low-voltage MLCCs, typically rated up to 16 volts, held the largest market share in 2024 due to their widespread use across high-volume consumer electronics, automotive, and industrial applications. These capacitors are essential for decoupling, filtering, and energy storage in compact circuit designs of smartphones, tablets, laptops, wearable devices, and automotive control units. Their ability to deliver high capacitance in small form factors makes them ideal for miniaturized and densely packed PCBs, which are common in modern electronic devices. Furthermore, the cost-effectiveness, reliability, and maturity of low-voltage MLCC manufacturing processes make them the preferred choice for designers, sustaining strong demand and maintaining their dominant position within the multilayer ceramic capacitor market.

"China to dominate Asia Pacific Multilayer Ceramic Capacitor Market During Forecast Period"

China is expected to dominate the Asia Pacific market during the forecast period due to its large-scale manufacturing capabilities, robust supply chain, and growing domestic demand for electronic components. The country hosts a significant number of MLCC manufacturers, including both established players and emerging companies, which enables high-volume production and cost advantages. Rapid growth in consumer electronics, automotive electronics (particularly electric vehicles), telecommunications, and industrial automation within China is driving substantial internal demand for MLCCs. Additionally, government support for high-tech manufacturing, investment in smart factories, and expansion of 5G infrastructure further enhance China's capacity to lead the regional market. Combined with ongoing technological advancements in materials and production processes, these factors position China as a key growth hub for MLCCs in the Asia Pacific region.

Breakdown of Primaries

Various executives from key organizations operating in the multilayer ceramic capacitor market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1-40%, Tier 2-30%, and Tier 3-30%

- By Designation: C-level Executives-40%, Directors-40%, and Others-20%

- By Region: North America-25%, Europe-20%, Asia Pacific-45%, and RoW-10%

The multilayer ceramic capacitor market is dominated by globally established players, such as Murata Manufacturing Co., Ltd. (Japan), SAMSUNG ELECTRO-MECHANICS (South Korea), TDK Corporation (Japan), KYOCERA Corporation (Japan), TAIYO YUDEN CO., LTD. (Japan), YAGEO Group (Taiwan), Vishay Intertechnology, Inc. (US), Walsin Technology Corporation (Taiwan), MARUWA Co., Ltd. (Japan), Holy Stone Enterprise Co., Ltd. (Taiwan), Darfon (Taiwan), Samwha Capacitor Group (South Korea), FengHua (China), Nippon Chemi-Con Corporation (Japan), Fujian Torch Electron Technology Co., Ltd. (China), Shenzhen EYANG Technology Development Co., Ltd. (China), Knowles Capacitors (US), Exxelia (France), Johanson Dielectrics (US), Wurth Elektronik eiSos GmbH & Co. KG (Germany), ChaoZhou Three-Circle (Group) Co., Ltd. (China), PROSPERITY DIELECTRICS CO. LTD. (PDC) (China), Viking Tech Corporation (Taiwan), AEM Components (US), and Xingrong Technologies (China). The study includes an in-depth competitive analysis of these key players in the multilayer ceramic capacitor market, with their company profiles, recent developments, and key market strategies.

Study Coverage

The report segments the multilayer ceramic capacitor market and forecasts its size by type, dielectric type, end, application, capacitance range, rated voltage, package, and region. The report also examines the key drivers, restraints, opportunities, and challenges influencing the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. The report includes a value chain analysis of the key players and their competitive analysis of the multilayer ceramic capacitor ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (rising incorporation of MLCCs in smartphones, smart wearables, and other electronic devices), restraints (price volatility in raw materials), opportunities (elevating demand for circular sourcing and recycling services for MLCCs), and challenges (availability of counterfeit and substandard MLCCs) influencing the growth of the multilayer ceramic capacitor market

- Products/Solution/Service Development/Innovation: Detailed insights into upcoming technologies, research, and development activities in the multilayer ceramic capacitor market

- Market Development: Comprehensive information about lucrative markets by analyzing the multilayer ceramic capacitor market across varied regions

- Market Diversification: Exhaustive information about new dielectric type MLCC untapped geographies, recent developments, and investments in the multilayer ceramic capacitor market

- Competitive Assessment: In-depth assessment of market shares and growth strategies and offerings of leading players, such as Murata Manufacturing Co., Ltd. (Japan), SAMSUNG ELECTRO-MECHANICS (South Korea), YAGEO Group (Taiwan), TAIYO YUDEN CO., LTD. (Japan), and TDK Corporation (Japan).

TABLE OF CONTENTS

1 NTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Key data from primary sources

- 2.1.3.2 List of primary interview participants

- 2.1.3.3 Breakdown of primaries

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET SHARE ESTIMATION

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MULTILAYER CERAMIC CAPACITOR MARKET

- 4.2 MULTILAYER CERAMIC CAPACITOR MARKET, BY DIELECTRIC TYPE

- 4.3 MULTILAYER CERAMIC CAPACITOR MARKET, BY RATED VOLTAGE

- 4.4 MULTILAYER CERAMIC CAPACITOR MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand from automotive industry due to advent of EVs

- 5.2.1.2 Increasing requirement from telecommunications sector with rapid deployment of 5G technology

- 5.2.1.3 Rising incorporation of MLCCs in smartphones, smart wearables, and other electronic devices

- 5.2.1.4 Increased circuit complexity in consumer electronics due to miniaturization

- 5.2.2 RESTRAINTS

- 5.2.2.1 Price volatility in raw materials

- 5.2.2.2 Environmental and regulatory compliance costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Elevating demand for circular sourcing and recycling services for MLCCs

- 5.2.3.2 Surging use of medium- and high-voltage MLCCs in industrial, medical, and automotive applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Availability of counterfeit and substandard MLCCs

- 5.2.4.2 High capital expenditure required for capacity expansion

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF NP0/C0G CLASS I DIELECTRIC TYPE MLCC, BY KEY PLAYER, 2021-2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF NP0/C0G CLASS I DIELECTRIC TYPE MLCC, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Layer stacking & lamination technology

- 5.7.1.2 High-precision printing technology for electrodes

- 5.7.1.3 Electroplating/Termination technology

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Surface-mount technology (SMT)

- 5.7.2.2 Circuit simulation & modeling (SPICE, ESR/ESL analysis)

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 On-chip passives in semiconductor fabrication

- 5.7.3.2 Embedded passive technology

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 EXPORT SCENARIO (HS CODE 853224)

- 5.9.2 IMPORT SCENARIO (HS CODE 853224)

- 5.10 KEY CONFERENCES AND EVENTS, 2026

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 MURATA INTRODUCED MULTILAYER CERAMIC CAPACITORS FOR 5G SMARTPHONES

- 5.11.2 TDK DEVELOPED MLCC WITH ZL CHARACTERISTICS FOR ULTRASONIC PARKING ASSIST

- 5.11.3 TDK OFFERS CA AND CN SERIES OF MLCCS TO ESTABLISH STABLE AND INTERFERENCE-FREE AUTOMOTIVE POWER SYSTEMS

- 5.11.4 KEMET MINIATURIZED HIGH-VOLTAGE BME X7R CAPACITORS FOR AUTOMOTIVE APPLICATIONS BY SUPPRESSING SURFACE ARCING

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS (HS CODE 853224)

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 KEY REGULATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 BARGAINING POWER OF SUPPLIERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI ON MULTILAYER CERAMIC CAPACITOR MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON MULTILAYER CERAMIC CAPACITOR MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END USES

6 MULTILAYER CERAMIC CAPACITOR MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 GENERAL CAPACITORS

- 6.2.1 ENHANCED CIRCUIT RELIABILITY AND PERFORMANCE FEATURES TO DRIVE DEMAND

- 6.3 ARRAY

- 6.3.1 SIGNIFICANT FOCUS ON MINIATURIZATION AND INVENTORY REDUCTION TO BOOST DEMAND

- 6.4 SERIAL CONSTRUCTION

- 6.4.1 REQUIREMENT FOR HIGH SAFETY AND RELIABILITY FOR AUTOMOTIVE APPLICATIONS TO FUEL SEGMENTAL GROWTH

- 6.5 MEGA CAP

- 6.5.1 ENHANCED MECHANICAL STRENGTH AND HIGH CAPACITANCE EFFICIENCY TO FACILITATE ADOPTION

- 6.6 OTHER TYPES

7 MULTILAYER CERAMIC CAPACITOR MARKET, BY DIELECTRIC TYPE

- 7.1 INTRODUCTION

- 7.2 CLASS I

- 7.2.1 NP0/COG

- 7.2.1.1 Extremely consistent capacitance and zero-drift traits to spike demand

- 7.2.2 U2J

- 7.2.2.1 Integration into automotive powertrains, EV inverters, and industrial data acquisition modules to propel market

- 7.2.3 X8G

- 7.2.3.1 Long-term reliability and compliance with automotive industry standards to drive market

- 7.2.4 OTHER CLASS I TYPES

- 7.2.1 NP0/COG

- 7.3 CLASS II

- 7.3.1 X7R

- 7.3.1.1 Increasing use in mass production of circuit boards to favor segmental growth

- 7.3.2 X5R

- 7.3.2.1 Competence in balancing capacitance and cost efficiency to boost demand

- 7.3.3 X8R

- 7.3.3.1 Reliable performance in extended temperatures to drive adoption

- 7.3.4 OTHER CLASS II TYPES

- 7.3.1 X7R

- 7.4 CLASS III

- 7.4.1 Y5V

- 7.4.1.1 Industry-leading capacitance density and most economical price point to elevate requirement

- 7.4.2 Z5U

- 7.4.2.1 Competence in offering low-cost manufacturing and simplified logistics to escalate requirement

- 7.4.3 OTHER CLASS III TYPES

- 7.4.1 Y5V

8 MULTILAYER CERAMIC CAPACITOR MARKET, BY RATED VOLTAGE

- 8.1 INTRODUCTION

- 8.2 LOW VOLTAGE (<=16 V)

- 8.2.1 STABLE CAPACITANCE AND FREQUENCY RESPONSE WITH MINIMAL DRIFT TO DRIVE ADOPTION IN ADAS SENSORS

- 8.3 MID VOLTAGE (25-200 V)

- 8.3.1 HIGH CAPACITANCE, ROBUST INSULATION, AND COMPACT SMD CONFIGURATIONS TO BOOST DEMAND

- 8.4 HIGH VOLTAGE (>200 V)

- 8.4.1 ONGOING PUSH TOWARD HIGHER VOLTAGE E-MOBILITY AND GRID MODERNIZATION TO SUPPORT SEGMENTAL GROWTH

9 MULTILAYER CERAMIC CAPACITOR MARKET, BY END USE

- 9.1 INTRODUCTION

- 9.2 CONSUMER ELECTRONICS

- 9.2.1 SURGING DEMAND FOR MINIATURE CONSUMER ELECTRONICS TO FUEL MARKET

- 9.2.1.1 Smartphones

- 9.2.1.2 Tablets

- 9.2.1.3 Laptops

- 9.2.1.4 Wearables

- 9.2.1 SURGING DEMAND FOR MINIATURE CONSUMER ELECTRONICS TO FUEL MARKET

- 9.3 AUTOMOTIVE

- 9.3.1 ELEVATING DEMAND FOR EVS AND ADAS TO FOSTER SEGMENTAL GROWTH

- 9.3.1.1 Advanced driver-assistance systems (ADAS)

- 9.3.1.2 Infotainment systems

- 9.3.1.3 Body electronics

- 9.3.1.4 EV powertrain

- 9.3.1 ELEVATING DEMAND FOR EVS AND ADAS TO FOSTER SEGMENTAL GROWTH

- 9.4 TELECOM

- 9.4.1 NEED FOR STABLE CONNECTIVITY AND LOW LATENCY IN DENSELY POPULATED NETWORKS TO ELEVATE DEMAND

- 9.4.1.1 5G base stations

- 9.4.1.2 Networking gears

- 9.4.1 NEED FOR STABLE CONNECTIVITY AND LOW LATENCY IN DENSELY POPULATED NETWORKS TO ELEVATE DEMAND

- 9.5 INDUSTRIAL

- 9.5.1 INCREASING USE OF INDUSTRIAL AUTOMATION AND ROBOTICS TO ENHANCE OPERATIONAL RELIABILITY TO DRIVE MARKET

- 9.5.1.1 Automation

- 9.5.1.2 Robotics

- 9.5.1.3 Power supplies

- 9.5.1 INCREASING USE OF INDUSTRIAL AUTOMATION AND ROBOTICS TO ENHANCE OPERATIONAL RELIABILITY TO DRIVE MARKET

- 9.6 HEALTHCARE & MEDICAL

- 9.6.1 NEED FOR ACCURATE READINGS AND DEVICE LONGEVITY TO SPUR DEMAND

- 9.6.1.1 Diagnostic imaging systems

- 9.6.1.2 Patient monitoring systems

- 9.6.1.3 Implantable medical devices

- 9.6.1 NEED FOR ACCURATE READINGS AND DEVICE LONGEVITY TO SPUR DEMAND

- 9.7 AEROSPACE & DEFENSE

- 9.7.1 ONGOING MODERNIZATION OF DEFENSE ELECTRONICS AND SATELLITE NETWORKS TO ELEVATE DEMAND

- 9.7.1.1 Avionics

- 9.7.1.2 Radar & communication systems

- 9.7.1.3 Missile & guidance electronics

- 9.7.1 ONGOING MODERNIZATION OF DEFENSE ELECTRONICS AND SATELLITE NETWORKS TO ELEVATE DEMAND

- 9.8 OTHER END USES

- 9.8.1 ENERGY STORAGE SYSTEMS

- 9.8.2 IOT DEVICES

- 9.8.3 SENSORS

10 MULTILAYER CERAMIC CAPACITOR MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 DECOUPLING CAPACITORS

- 10.2.1 PROFICIENCY IN MAINTAINING STABLE ELECTRONIC PERFORMANCE TO FUEL SEGMENTAL GROWTH

- 10.3 FILTERING CAPACITORS

- 10.3.1 ABILITY TO ELIMINATE UNWANTED NOISE FROM ELECTRONIC CIRCUITS TO FOSTER MARKET

- 10.4 BYPASS CAPACITORS

- 10.4.1 EXCELLENCE IN ENHANCING BATTERY EFFICIENCY AND PROCESSOR PERFORMANCE TO ACCELERATE DEMAND

- 10.5 RESONANT/TIMING CAPACITORS

- 10.5.1 WIDE USAGE IN RF TRANSMITTERS, CLOCK GENERATORS, AND GPS SYSTEMS TO FACILITATE MARKET GROWTH

- 10.6 COUPLING/DECOUPLING CAPACITORS IN RF

- 10.6.1 RAPID EXPANSION OF IOT AND 5G INFRASTRUCTURE TO AUGMENT DEMAND

- 10.7 POWERTRAIN HV CAPACITORS

- 10.7.1 INCREASING DEMAND FOR EVS TO CREATE OPPORTUNITIES

11 MULTILAYER CERAMIC CAPACITOR MARKET, BY PACKAGE

- 11.1 INTRODUCTION

- 11.2 ULTRA-MINIATURE

- 11.2.1 RISING USE IN RF MODULES, CAMERA CONTROL SYSTEMS, AND POWER MANAGEMENT CIRCUITS TO FUEL SEGMENTAL GROWTH

- 11.3 SMALL

- 11.3.1 HIGH RELIABILITY AND DURABILITY EVEN UNDER VIBRATION AND TEMPERATURE STRESS TO BOOST SEGMENTAL GROWTH

- 11.4 MEDIUM

- 11.4.1 SHIFT TOWARD ELECTRIFICATION AND INDUSTRIAL AUTOMATION TO CREATE OPPORTUNITIES

- 11.5 LARGE

- 11.5.1 EXCELLENT RELIABILITY UNDER HIGH ELECTRICAL AND THERMAL STRESS TO SPUR DEMAND

12 MULTILAYER CERAMIC CAPACITOR MARKET, BY CAPACITANCE RANGE

- 12.1 INTRODUCTION

- 12.2 <100 PF

- 12.2.1 INCREASING USE IN RF AND MICROWAVE APPLICATIONS TO FUEL SEGMENTAL GROWTH

- 12.3 100 PF-1 NF

- 12.3.1 SUITABILITY FOR HIGH-SPEED DATA LINES, OSCILLATORS, AND NETWORK FILTERS TO STIMULATE SEGMENTAL GROWTH

- 12.4 1-100 NF

- 12.4.1 PROFICIENCY IN REDUCING SIGNAL NOISE IN MICROCONTROLLERS, POWER CONVERTERS, AND COMPUTING SYSTEMS TO DRIVE MARKET

- 12.5 0.1-1 µF

- 12.5.1 NEED TO ENSURE CLEAN SIGNAL TRANSMISSION ACROSS SMARTPHONES AND LAPTOPS TO BOOST DEMAND

- 12.6 1-100 µF

- 12.6.1 INTEGRATION INTO NEXT-GENERATION EV INVERTERS AND AUTONOMOUS DRIVING ELECTRONICS TO SUPPORT MARKET GROWTH

- 12.7 >100 µF

- 12.7.1 SURGING DEMAND FOR ELECTRIC VEHICLES, SOLAR INVERTERS, ROBOTICS, AND AEROSPACE CONTROL SYSTEMS TO DRIVE DEMAND

13 MULTILAYER CERAMIC CAPACITOR MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Technological advancements and industrial expansion to drive market

- 13.2.3 CANADA

- 13.2.3.1 Rapid electrification, 5G deployment, and industrial automation to boost demand

- 13.2.4 MEXICO

- 13.2.4.1 Automotive and consumer electronics industries to contribute to market growth

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 GERMANY

- 13.3.2.1 Accelerating shift toward electrification and digitalization to propel market

- 13.3.3 UK

- 13.3.3.1 Industrial digitization, 5G expansion, and rising consumer electronics demand to foster market growth

- 13.3.4 FRANCE

- 13.3.4.1 Continued investment in telecom and data center infrastructure to stimulate market growth

- 13.3.5 SPAIN

- 13.3.5.1 Fast-track solar PV and grid storage projects to augment market growth

- 13.3.6 ITALY

- 13.3.6.1 Increasing emphasis on integrating solar and wind energy to boost demand

- 13.3.7 POLAND

- 13.3.7.1 Rising demand for automotive electronics to support market growth

- 13.3.8 NORDICS

- 13.3.8.1 Strong emphasis on electric mobility and green energy initiatives to create growth opportunities

- 13.3.9 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 5G development initiatives to drive market

- 13.4.3 JAPAN

- 13.4.3.1 Presence of leading players to support market growth

- 13.4.4 SOUTH KOREA

- 13.4.4.1 Focus on developing MLCCs for AI servers and automotive electronics to stimulate market growth

- 13.4.5 INDIA

- 13.4.5.1 Automotive electrification and smart manufacturing initiatives to spike demand

- 13.4.6 TAIWAN

- 13.4.6.1 Booming market for autonomous vehicles to create opportunities

- 13.4.7 AUSTRALIA

- 13.4.7.1 Emphasis on clean energy expansion to contribute to market growth

- 13.4.8 INDONESIA

- 13.4.8.1 Rapidly growing EV market to create opportunities

- 13.4.9 MALAYSIA

- 13.4.9.1 Government incentives promoting Industry 4.0 adoption to favour market growth

- 13.4.10 THAILAND

- 13.4.10.1 Digital transformation and smart manufacturing initiatives to augment market growth

- 13.4.11 VIETNAM

- 13.4.11.1 Need to enhance telecom infrastructure to elevate demand

- 13.4.12 REST OF ASIA PACIFIC

- 13.5 ROW

- 13.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 13.5.2 MIDDLE EAST

- 13.5.2.1 Bahrain

- 13.5.2.1.1 Growing data center investment to fuel demand

- 13.5.2.2 Kuwait

- 13.5.2.2.1 Coordinated 5G rollouts to create opportunities

- 13.5.2.3 Oman

- 13.5.2.3.1 Broader 5G standalone rollouts to push demand

- 13.5.2.4 Qatar

- 13.5.2.4.1 Rapid expansion of AI infrastructure to support market growth

- 13.5.2.5 Saudi Arabia

- 13.5.2.5.1 Expanding colocation and hyperscale pipeline to stimulate market growth

- 13.5.2.6 UAE

- 13.5.2.6.1 Hyperscale AI campuses and cloud investments to elevate demand

- 13.5.2.7 Rest of Middle East

- 13.5.2.1 Bahrain

- 13.5.3 AFRICA

- 13.5.3.1 South Africa

- 13.5.3.1.1 Growing penetration of wearable devices and consumer electronic devices to stimulate demand

- 13.5.3.2 Rest of Africa

- 13.5.3.1 South Africa

- 13.5.4 SOUTH AMERICA

- 13.5.4.1 Industrial automation and consumer electronics expansion to support market growth

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Dielectric type footprint

- 14.7.5.4 Rated voltage footprint

- 14.7.5.5 End use footprint

- 14.7.5.6 Application footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 14.9.2 DEALS

15 COMPANY PROFILES

- 15.1 INTRODUCTION

- 15.2 KEY PLAYERS

- 15.2.1 MURATA MANUFACTURING CO., LTD.

- 15.2.1.1 Business overview

- 15.2.1.2 Products/Solutions/Services offered

- 15.2.1.3 Recent developments

- 15.2.1.3.1 Product launches and enhancements

- 15.2.1.3.2 Deals

- 15.2.1.4 MnM view

- 15.2.1.4.1 Key strengths/Right to win

- 15.2.1.4.2 Strategic choices

- 15.2.1.4.3 Weaknesses/Competitive threats

- 15.2.2 SAMSUNG ELECTRO-MECHANICS

- 15.2.2.1 Business overview

- 15.2.2.2 Products/Solutions/Services offered

- 15.2.2.3 Recent developments

- 15.2.2.3.1 Product launches and enhancements

- 15.2.2.3.2 Other developments

- 15.2.2.4 MnM view

- 15.2.2.4.1 Key strengths/Right to win

- 15.2.2.4.2 Strategic choices

- 15.2.2.4.3 Weaknesses/Competitive threats

- 15.2.3 TDK CORPORATION

- 15.2.3.1 Business overview

- 15.2.3.2 Products/Solutions/Services offered

- 15.2.3.3 Recent developments

- 15.2.3.3.1 Product launches and enhancements

- 15.2.3.3.2 Deals

- 15.2.3.4 MnM view

- 15.2.3.4.1 Key strengths/Right to win

- 15.2.3.4.2 Strategic choices

- 15.2.3.4.3 Weaknesses/Competitive threats

- 15.2.4 KYOCERA CORPORATION

- 15.2.4.1 Business overview

- 15.2.4.2 Products/Solutions/Services offered

- 15.2.4.3 Recent developments

- 15.2.4.3.1 Product launches and enhancements

- 15.2.4.4 MnM view

- 15.2.4.4.1 Key strengths/Right to win

- 15.2.4.4.2 Strategic choices

- 15.2.4.4.3 Weaknesses/Competitive threats

- 15.2.5 TAIYO YUDEN CO., LTD.

- 15.2.5.1 Business overview

- 15.2.5.2 Products/Solutions/Services offered

- 15.2.5.3 MnM view

- 15.2.5.3.1 Key strengths/Right to win

- 15.2.5.3.2 Strategic choices

- 15.2.5.3.3 Weaknesses/Competitive threats

- 15.2.6 YAGEO GROUP

- 15.2.6.1 Business overview

- 15.2.6.2 Products/Solutions/Services offered

- 15.2.6.3 Recent developments

- 15.2.6.3.1 Product launches and enhancements

- 15.2.7 VISHAY INTERTECHNOLOGY, INC.

- 15.2.7.1 Business overview

- 15.2.7.2 Products/Solutions/Services offered

- 15.2.7.3 Recent developments

- 15.2.7.3.1 Product launches and enhancements

- 15.2.7.3.2 Deals

- 15.2.8 WALSIN TECHNOLOGIES CORPORATION

- 15.2.8.1 Business overview

- 15.2.8.2 Products/Solutions/Services offered

- 15.2.9 MARUWA CO., LTD.

- 15.2.9.1 Business overview

- 15.2.9.2 Products/Solutions/Services offered

- 15.2.10 HOLY STONE ENTERPRISE CO., LTD.

- 15.2.10.1 Business overview

- 15.2.10.2 Products/Solutions/Services offered

- 15.2.1 MURATA MANUFACTURING CO., LTD.

- 15.3 OTHER PLAYERS

- 15.3.1 DARFON

- 15.3.2 SAMWHA CAPACITOR GROUP

- 15.3.3 FENGHUA

- 15.3.4 NIPPON CHEMI-CON CORPORATION

- 15.3.5 FUJIAN TORCH ELECTRON TECHNOLOGY CO., LTD.

- 15.3.6 SHENZHEN EYANG TECHNOLOGY DEVELOPMENT CO., LTD.

- 15.3.7 KNOWLES CAPACITORS

- 15.3.8 EXXELIA

- 15.3.9 JOHANSON TECHNOLOGY

- 15.3.10 WURTH ELEKTRONIK EISOS GMBH & CO. KG

- 15.3.11 CHAOZHOU THREE-CIRCLE (GROUP) CO., LTD.

- 15.3.12 PROSPERITY DIELECTRICS CO. LTD. (PDC)

- 15.3.13 VIKING TECH CORPORATION

- 15.3.14 AEM COMPONENTS

- 15.3.15 XINGRONG TECHNOLOGIES

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS