|

시장보고서

상품코드

1876443

임상 분석 시장 : 제공별, 이용 사례별, 최종 사용자별, 지역별 예측(-2030년)Clinical Analytics Market by Offering, Source, Use Case, End User, Region - Global Forecast to 2030 |

||||||

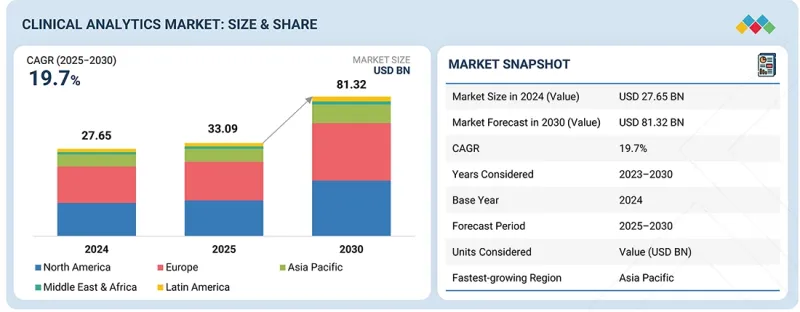

임상 분석 시장 규모는 2025년 330억 9,000만 달러로 평가되고, 2030년까지 813억 2,000만 달러에 이를 것으로 예상되며, 예측 기간 동안 CAGR 19.7%를 나타낼 전망입니다.

시장 성장은 전자건강기록(EHR), 연결형 의료기기, 원격 모니터링 솔루션의 보급에 추진된 임상 데이터의 폭발적인 증가에 의해 견인되고 있으며, 고급 분석 능력에 대한 임박한 요구를 창출하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2024-2033년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 제공별, 데이터 소스별, 이용 사례별, 최종 사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

인공지능(AI), 머신러닝(ML) 및 고성능 컴퓨팅의 발전으로 보다 빠르고 정확한 데이터 처리가 가능해지고 복잡한 데이터세트에서 실용적인 지식을 끌어낼 수 있습니다. 실세계 데이터(RWE)에 대한 규제 완화가 진행되고 있는 가운데, 의료기관이 임상시험, 치료계획, 가치 기반의 의료모델을 지원하기 위해 분석기술을 점점 활용함에 따라 도입이 더욱 가속화되고 있습니다. 또한 개인화 및 정밀의료로의 전환은 진단, 치료 선택 및 치료 결과를 최적화하기 위해 환자별 분석에 대한 수요를 증가시키고 있습니다. 실시간 임상 의사결정에 대한 요구 증가는 환자의 안전성 향상, 에러 감소, 의료 제공의 전반적인 효율화를 도모하는데 중요한 도구로서 임상 분석의 역할을 강화하고 있습니다.

임상 분석 시장에서 EHR 부문의 현저한 성장의 주요 요인은 고급 분석 및 의사 결정 지원에 사용되는 구조화 및 비구조화 환자 데이터의 1차 정보로서 전자 건강 기록(EHR)의 도입이 확대되고 있다는 것입니다. EHR 시스템은 환자 인구통계, 병력, 진단 결과, 치료 계획, 치료 성과 등 광범위한 임상 정보를 수집하기 위해 실시간 인사이트 및 예측 모델링의 중요한 기반이 되고 있습니다. 미국 '21세기 치료법'과 세계적인 디지털 건강 개념과 같은 규제에 뒷받침되는 상호 운용성과 표준화된 데이터 교환에 대한 중점 증가는 EHR 데이터의 임상 분석 플랫폼으로의 통합을 더욱 가속화하고 있습니다. 의료 제공업체와 지불 기관이 의료의 질과 업무 효율성을 향상시키기 위해 데이터 중심 전략에 대한 의존도를 높이는 가운데, EHR 시스템은 보다 정확한 위험 계층화, 질병의 조기 발견, 맞춤 치료 계획을 가능하게 하고, 강력한 시장 성장을 가속하고 있습니다.

정확한 인사이트 및 예측 분석을 지원하는 종합적이고 고품질의 데이터에 대한 수요가 증가함에 따라, 원시 데이터 부문은 2024년 임상 분석 시장에서 큰 점유율을 차지했습니다. EHR, 검사 시스템, 영상 진단 장치, 환자 모니터링 도구 등의 출처에서 얻은 원시 임상 데이터는 고급 분석의 기반을 형성하고, 의료 기관이 동향을 확인하고, 집단의 건강 상태를 평가하며, 정보를 기반으로 의사 결정을 내릴 수 있습니다. 다양한 의료 데이터 세트를 표준화 및 통합하기 위한 데이터 구동 전략과 노력의 도입이 증가하고 있는 것도 분석 플랫폼의 중요한 입력 요소로서 원시 데이터 수요를 더욱 뒷받침하고 있습니다.

아시아태평양의 임상 분석 시장이 급속히 성장하고 있는 주요 요인은 환자의 치료 성과와 업무 효율 향상을 목표로 하는 의료 제공업체에 의한 EHR, 원격 의료, AI를 활용한 분석 솔루션 등 디지털 건강 기술의 채용이 증가하고 있다는 점입니다. 이 지역에서는 의료비 증가, 스마트 병원 및 의료 디지털화를 촉진하는 정부 주도의 대처의 확대, 특히 중국, 인도, 일본 등의 국가에서의 의료 IT 인프라에 대한 투자 확대가 보입니다. 게다가 만성질환의 유병률 상승, 노화, 가치에 근거한 의료에 대한 주목 증가가 데이터 중심의 인사이트, 예측 분석, 집단 건강 관리 솔루션에 대한 수요를 견인하고 있으며, 아시아태평양 시장 성장을 더욱 가속화하고 있습니다.

본 보고서에서는 세계의 임상 분석 시장에 대해 조사했으며 제공별, 데이터 소스별, 이용 사례별, 최종 사용자별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 고객의 비즈니스에 영향을 미치는 동향/혁신

- 업계 동향

- 가격 분석

- 공급망 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 기술 분석

- 특허 분석

- 주된 회의와 이벤트(2025-2026년)

- 사례 연구 분석

- 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 최종 사용자 분석

- 비즈니스 모델 분석

- AI/생성형 AI가 임상 분석 시장에 미치는 영향

- 미국 관세가 임상 분석 시장에 미치는 영향(2025년)

제6장 임상 분석 시장(제공별)

- 서론

- 원시 데이터

- 소프트웨어

- 플랫폼

제7장 임상 분석 시장(데이터 소스별)

- 서론

- 임상 시험 데이터

- 청구 데이터

- 전자건강기록

- 레지스트리 및 RWE

- 영상 및 진단

- 실험실 및 병리학

- 멀티오믹스 데이터

- 기타

제8장 임상 분석 시장(이용 사례별)

- 서론

- 헬스케어

- 생명과학

제9장 임상 분석 시장(최종 사용자별)

- 서론

- 의료 제공업체

- 의료 지불 기관

- 생명과학

- 기타

제10장 임상 분석 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 한국

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 남아프리카

- 기타

제11장 경쟁 구도

- 개요

- 주요 진출기업이 채용한 전략

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 시장 랭킹 분석

- 기업평가와 재무지표

- 브랜드/제품 비교

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 진출기업

- IQVIA

- OPTUM, INC.

- MERATIVE

- EPIC SYSTEMS CORPORATION

- GE HEALTHCARE

- SIEMENS HEALTHINEERS AG

- ORACLE

- MCKESSON CORPORATION

- VERADIGM LLC

- INOVALON

- WNS(HOLDINGS) LTD.

- SOPHIA GENETICS

- COTIVITI, INC.

- HEALTH CATALYST

- COGNIZANT

- F. HOFFMANN-LA ROCHE LTD

- KONINKLIJKE PHILIPS NV

- DASSAULT SYSTEMES(MEDIDATA)

- ATHENAHEALTH, INC.

- VEEVA SYSTEMS

- ICON PLC

- ECLINICALWORKS

- ACCENTURE

- CVS HEALTH

- SAS INSTITUTE INC.

- 기타 기업

- APRIQOT

- OLER HEALTH

- PERCIPIO HEALTH

- FERRUM HEALTH

- AMPLIFY HEALTH

제13장 부록

KTH 25.11.28The clinical analytics market was valued at USD 33.09 billion in 2025 and is estimated to reach USD 81.32 billion by 2030, registering a CAGR of 19.7% during the forecast period. Market growth is driven by the explosion of clinical data, fueled by the widespread adoption of EHRs, connected medical devices, and remote monitoring solutions, creating a pressing need for advanced analytics capabilities.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Offering, Data Source, Use Case, End User, Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

Advances in AI, machine learning (ML), and high-performance computing are enabling faster and more accurate data processing, unlocking actionable insights from complex datasets. Growing regulatory openness to real-world evidence (RWE) is further accelerating adoption, as healthcare organizations increasingly leverage analytics to support clinical trials, treatment planning, and value-based care models. Additionally, the shift toward personalized and precision medicine is driving demand for patient-specific analytics to optimize diagnostics, treatment selection, and outcomes. The increasing need for real-time clinical decision-making is reinforcing the role of clinical analytics as a critical tool for improving patient safety, reducing errors, and enhancing the overall efficiency of care delivery.

Based on the data source, the EHR segment is expected to record significant growth in the clinical analytics market during the forecast period.

A key driver for the significant growth of the EHR segment in the clinical analytics market is the increasing adoption of electronic health records as the primary source of structured and unstructured patient data used for advanced analytics and decision support. EHR systems capture a wide range of clinical information including patient demographics, medical history, diagnostics, treatment plans, and outcomes-making them a critical foundation for real-time insights and predictive modeling. The rising emphasis on interoperability and standardized data exchange, supported by regulations such as the US 21st Century Cures Act and global digital health initiatives, further accelerates the integration of EHR data into clinical analytics platforms. As healthcare providers and payers increasingly rely on data-driven strategies to improve care quality and operational performance, EHR systems enable more accurate risk stratification, early disease detection, and personalized treatment planning, fueling their strong market growth.

Based on the offering, the raw data segment is expected to hold a significant share in the clinical analytics market for 2024.

Driven by the growing need for comprehensive, high-quality data to support accurate insights and predictive analytics, the raw data segment is expected to hold a significant share in the clinical analytics market for 2024. Raw clinical data from sources such as EHRs, laboratory systems, imaging devices, and patient monitoring tools form the foundation for advanced analytics, enabling healthcare organizations to identify trends, assess population health, and make informed decisions. The increasing adoption of data-driven strategies and initiatives to standardize and integrate diverse healthcare datasets further fuels the demand for raw data as a critical input for analytics platforms.

The Asia Pacific market accounted for the fastest growth in the clinical analytics market for the forecast period.

A key driver for the rapid growth of the Asia Pacific clinical analytics market is the increasing adoption of digital health technologies, including EHRs, telemedicine, and AI-powered analytics solutions, by healthcare providers seeking to improve patient outcomes and operational efficiency. The region is witnessing rising healthcare expenditure, growing government initiatives to promote smart hospitals and healthcare digitization, and expanding investments in health IT infrastructure, particularly in countries like China, India, and Japan. Additionally, the rising prevalence of chronic diseases, aging populations, and a growing focus on value-based care are driving demand for data-driven insights, predictive analytics, and population health management solutions, further accelerating market growth in the Asia Pacific region.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the clinical analytics market.

The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1 (41%), Tier 2 (31%), and Tier 3 (28%)

- By Designation - C Level (44%), Directors (31%), and Others (25%)

- By Region - North America (45%), Europe (28%), Asia Pacific (20%), Latin America (4%), Middle East & Africa (3%)

Key Players in the Clinical Analytics Market

Prominent players in the clinical analytics market include Optum, Inc. (UnitedHealth Group) (US), Epic Systems Corporation (US), GE HealthCare (US), Siemens Healthineers (Germany), Oracle Health Sciences (US), McKesson Corporation (US), Veradigm LLC (US), IQVIA (US), Cotiviti Inc. (US), Health Catalyst (US), Cognizant (US), Koninklijke Philips N.V. (Netherlands), Dassault Systemes (France), Athenahealth, Inc. (US), Veeva Systems (US), ICON plc (Ireland), eClinicalWorks (US), Accenture (Ireland), CVS Health (US), Inovalon (US), WNS (Holdings) Ltd. (UK), Merative (US), SOPHiA GENETICS (Switzerland), F. Hoffmann-La Roche Ltd (Roche)(FLATIRON HEALTH) (US), SAS Institute, Inc. (US).

Market players are focusing on organic as well as inorganic growth strategies such as product launches and enhancements, investments, partnerships, collaborations, joint ventures, funding, acquisitions, expansions, agreements, contracts, and alliances to broaden their offerings, cater to the unmet needs of customers, increase profitability, and expand their presence in the global market.

The study includes an in-depth competitive analysis of these key players in the clinical analytics market, with their company profiles, recent developments, and key market strategies.

Research Coverage

- The report studies the clinical analytics market based on offering, data source, use case, end user, and region.

- The report analyzes factors (such as drivers, restraints, opportunities, and challenges) affecting market growth.

- The report evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders.

- The report studies micro-markets with respect to their growth trends, prospects, and contributions to the global clinical analytics market.

- The report forecasts the revenue of market segments with respect to five major regions.

Reasons to Buy the Report

The report can help established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share. Firms purchasing the report could use one or a combination of the following five strategies.

This report provides insights into the following pointers:

- Analysis of key drivers (healthcare data from diverse sources fuels advanced analytics and deeper insights, Payers and providers use outcome metrics to enhance population health and care quality, value-based care & reimbursement pressure, explosion of clinic macro dynamic industry and compute, adoption of cloud & modern data platforms, regulatory openness to RWE, shift toward personalized and precision medicine, increasing need for real-time clinical decision-making), restraints (data privacy & regulatory constraints, data quality & standardization issues, high implementation cost & unclear ROI), opportunities (analytics for decentralized & hybrid clinical trials, edge & on-device analytics for remote monitoring), and challenges (model validation & clinical evidence, biased training data, vendor lock in & migration risk.) influencing the industry macro dynamics of clinical analytics market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the clinical analytics market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes clinical analytics across varied regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the clinical analytics market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the clinical analytics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Insights from primary experts

- 2.1.1 SECONDARY RESEARCH

- 2.2 RESEARCH METHODOLOGY

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 MARKET SHARE ESTIMATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 CLINICAL ANALYTICS MARKET OVERVIEW

- 4.2 CLINICAL ANALYTICS MARKET, BY USE CASE AND REGION

- 4.3 CLINICAL ANALYTICS MARKET: GEOGRAPHIC SNAPSHOT

- 4.4 CLINICAL ANALYTICS MARKET: DEVELOPED VS. EMERGING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid growth of clinical data

- 5.2.1.2 Ongoing transition from fee-for-service models to value-based care

- 5.2.1.3 Rising advancements in AI/ML and computing capabilities

- 5.2.1.4 Increasing acceptance of real-world evidence

- 5.2.1.5 Growing recognition of social determinants of health

- 5.2.1.6 Rising volume of clinical trials

- 5.2.1.7 Expanding healthcare data

- 5.2.1.8 Increasing use of outcome metrics

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data privacy and regulatory constraints

- 5.2.2.2 Data quality and standardization issues

- 5.2.2.3 High implementation cost and unclear return on investment

- 5.2.2.4 Interoperability gaps and prevalence of legacy IT systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of decentralized and hybrid clinical trial models

- 5.2.3.2 Increasing adoption of edge computing and on-device analytics

- 5.2.3.3 Increasing use of embedded workflow analytics

- 5.2.4 CHALLENGES

- 5.2.4.1 Presence of biased or unrepresentative training data

- 5.2.4.2 Vendor lock-in and migration risk

- 5.2.4.3 Pricing and contracting complexities

- 5.2.4.4 Data governance and provenance issues

- 5.2.4.5 Model validation and clinical evidence challenges

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 INDUSTRY TRENDS

- 5.4.1 GENERATIVE AI FOR CLINICAL REASONING

- 5.4.2 REAL-WORLD EVIDENCE AND DECENTRALIZED TRIALS

- 5.4.3 VALUE-BASED CARE AND POPULATION HEALTH ANALYTICS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING ANALYSIS, BY KEY PLAYER

- 5.5.2 INDICATIVE PRICING ANALYSIS, BY REGION

- 5.5.3 QUALITATIVE PRICING MODELS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Predictive analytics and risk stratification

- 5.9.1.2 Health Information Exchange (HIE) platforms

- 5.9.1.3 Clinical Decision Support Systems (CDSS)

- 5.9.1.4 Machine Learning (ML) and Deep Learning (DL)

- 5.9.1.5 Natural Language Processing (NLP)

- 5.9.1.6 Data visualization & business intelligence tools

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Blockchain

- 5.9.2.2 Internet of Medical Things (IoMT)

- 5.9.2.3 Robotic Process Automation (RPA)

- 5.9.2.4 FHIR/HL7 Interoperability Standards

- 5.9.2.5 Digital twin technology

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Virtual clinical trial platforms

- 5.9.3.2 Digital Therapeutics (DTx)

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.10.1 PATENT PUBLICATION TRENDS

- 5.10.2 JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 ENHANCED PATIENT FLOW AND REDUCED EMERGENCY DEPARTMENT CONGESTION USING REAL-TIME OPERATIONAL ANALYTICS

- 5.12.2 IMPROVED GENOMIC DATA INTERPRETATION THROUGH AI-POWERED GENOMIC ANALYTICS

- 5.12.3 ENHANCED PROVIDER PERFORMANCE USING ADVANCED CLINICAL ANALYTICS

- 5.12.4 OPTIMIZING CARE DELIVERY THROUGH PREDICTIVE MODEL INTEGRATION

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 BARGAINING POWER OF SUPPLIERS

- 5.14.2 BARGAINING POWER OF BUYERS

- 5.14.3 THREAT OF NEW ENTRANTS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 END-USER ANALYSIS

- 5.16.1 UNMET NEEDS

- 5.16.2 END-USER EXPECTATIONS

- 5.17 BUSINESS MODEL ANALYSIS

- 5.17.1 LICENSE-BASED BUSINESS MODEL

- 5.17.2 SUBSCRIPTION-BASED BUSINESS MODEL

- 5.17.3 SOFTWARE-AS-A-SERVICE (SAAS) BUSINESS MODEL

- 5.17.4 PAY-PER-USE BUSINESS MODEL

- 5.17.5 FREEMIUM BUSINESS MODEL

- 5.17.6 INTEGRATED SERVICE AND SOFTWARE BUNDLE BUSINESS MODEL

- 5.17.7 OUTCOME-BASED OR VALUE-BASED BUSINESS MODEL

- 5.17.8 SOFTWARE AS A MEDICAL DEVICE (SAMD) BUSINESS MODEL

- 5.18 IMPACT OF AI/GEN AI ON CLINICAL ANALYTICS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 MARKET POTENTIAL OF AI IN CLINICAL ANALYTICS ECOSYSTEM

- 5.18.3 KEY USE CASES

- 5.18.4 AI CASE STUDY

- 5.18.4.1 Case Study 1: AI-powered analytics platform for patient satisfaction

- 5.18.4.2 Case Study 2: Next-generation predictive modelling solution for operational efficiency

- 5.18.5 IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.18.5.1 AI in patient engagement & support platforms

- 5.18.5.2 AI in healthcare operations & management tools

- 5.18.5.3 AI in personalized health & wellness coaching

- 5.18.6 USER READINESS AND IMPACT ASSESSMENT

- 5.18.6.1 User readiness

- 5.18.6.1.1 User A: Healthcare providers

- 5.18.6.1.2 User B: Healthcare payers

- 5.18.6.1.3 User C: Life science companies

- 5.18.6.2 Impact assessment

- 5.18.6.2.1 User A: Healthcare providers

- 5.18.6.2.1.1 Implementation

- 5.18.6.2.1.2 Impact

- 5.18.6.2.2 User B: Healthcare payers

- 5.18.6.2.2.1 Implementation

- 5.18.6.2.2.2 Impact

- 5.18.6.2.3 User C: Life sciences

- 5.18.6.2.3.1 Implementation

- 5.18.6.2.3.2 Impact

- 5.18.6.2.1 User A: Healthcare providers

- 5.18.6.1 User readiness

- 5.19 IMPACT OF 2025 US TARIFFS ON CLINICAL ANALYTICS MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.4.1 US

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END-USE INDUSTRIES

6 CLINICAL ANALYTICS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 RAW DATA

- 6.2.1 NEED FOR REAL-WORLD EVIDENCE, OUTCOMES, AND RESEARCH TO DRIVE MARKET

- 6.3 SOFTWARE

- 6.3.1 IMPROVED CLINICAL, OPERATIONAL, AND FINANCIAL INTELLIGENCE TO BOOST MARKET

- 6.4 PLATFORM

- 6.4.1 INCREASING DIGITIZATION OF HEALTHCARE SYSTEMS TO FUEL MARKET

7 CLINICAL ANALYTICS MARKET, BY DATA SOURCE

- 7.1 INTRODUCTION

- 7.2 CLINICAL TRIALS DATA

- 7.2.1 ABILITY TO PROVIDE ROBUST, STRUCTURED, AND HIGH-QUALITY INFORMATION TO CONTRIBUTE TO GROWTH

- 7.3 CLAIMS DATA

- 7.3.1 INCREASING USE OF CLAIMS DATA BY HEALTHCARE INSTITUTIONS AND PAYERS TO EXPEDITE GROWTH

- 7.4 ELECTRONIC HEALTH RECORDS

- 7.4.1 RISING FOCUS ON PATIENT OUTCOMES, RISK STRATIFICATION, AND EARLY DETECTION OF CLINICAL DETERIORATION TO AID GROWTH

- 7.5 REGISTRIES & RWE

- 7.5.1 GROWING EMPHASIS VALUE-BASED CARE, PERSONALIZED TREATMENT, AND REGULATORY COMPLIANCE TO DRIVE MARKET

- 7.6 IMAGING & DIAGNOSTICS

- 7.6.1 RISING DEMAND FOR PRECISION DIAGNOSTICS AND EVIDENCE-BASED TREATMENT PLANNING TO PROMOTE GROWTH

- 7.7 LAB & PATHOLOGY

- 7.7.1 INCREASING USE OF HIGH-THROUGHPUT TECHNOLOGIES TO SPUR GROWTH

- 7.8 MULTIOMICS DATA

- 7.8.1 RAPID ADVANCEMENT OF NEXT-GENERATION SEQUENCING, MASS SPECTROMETRY, AND SINGLE-CELL TECHNOLOGIES TO FAVOR GROWTH

- 7.9 OTHER DATA SOURCES

8 CLINICAL ANALYTICS MARKET, BY USE CASE

- 8.1 INTRODUCTION

- 8.2 HEALTHCARE USE CASES

- 8.2.1 CLINICAL DECISION SUPPORT

- 8.2.1.1 Growing complexity of patient care and rising prevalence of chronic diseases to drive market

- 8.2.2 POPULATION HEALTH & RISK STRATIFICATION

- 8.2.2.1 Ability to drive proactive, preventive care to facilitate growth

- 8.2.3 QUALITY COMPLIANCE & REPORTING

- 8.2.3.1 Rising focus on enhancing integrity, transparency, and regulatory adherence to support growth

- 8.2.4 OPERATIONAL & CAPACITY ANALYTICS

- 8.2.4.1 Growing focus on optimized healthcare services to fuel market

- 8.2.5 REMOTE PATIENT MONITORING

- 8.2.5.1 Need for continuous data-driven patient care to spur growth

- 8.2.6 OTHER HEALTHCARE USE CASES

- 8.2.1 CLINICAL DECISION SUPPORT

- 8.3 LIFE SCIENCE USE CASES

- 8.3.1 R&D & CLINICAL DEVELOPMENT

- 8.3.1.1 Increasing adoption of predictive modeling and simulation tools to aid growth

- 8.3.2 SAFETY & PHARMACOVIGILANCE

- 8.3.2.1 Enhanced drug safety to contribute to growth

- 8.3.3 PRECISION & TRANSLATIONAL CLINICAL ANALYTICS

- 8.3.3.1 Ability to drive precision medicine through data-driven translational insights to favor growth

- 8.3.4 REGULATORY EVIDENCE ANALYTICS

- 8.3.4.1 Evolving regulatory landscape to bolster growth

- 8.3.5 HEOR & RWE ANALYTICS

- 8.3.5.1 Increasing strategic collaborations and technological innovations to boost market

- 8.3.6 OTHER LIFE SCIENCE USE CASES

- 8.3.1 R&D & CLINICAL DEVELOPMENT

9 CLINICAL ANALYTICS MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HEALTHCARE PROVIDERS

- 9.2.1 HOSPITALS & CLINICS

- 9.2.1.1 Increasing adoption of clinical analytics in hospitals and clinics to support growth

- 9.2.2 AMBULATORY CARE SERVICES

- 9.2.2.1 Need to improve quality outcomes and reduce avoidable hospital admissions to foster growth

- 9.2.3 DIAGNOSTIC CENTERS

- 9.2.3.1 Rising shift toward precision medicine and value-based care models to stimulate growth

- 9.2.4 SPECIALTY PRACTICE PROVIDERS

- 9.2.4.1 Growing prevalence of chronic and complex diseases care to boost market

- 9.2.5 OTHER HEALTHCARE PROVIDERS

- 9.2.1 HOSPITALS & CLINICS

- 9.3 HEALTHCARE PAYERS

- 9.3.1 NEED TO IMPROVE RETURN ON INVESTMENT TO ENCOURAGE GROWTH

- 9.4 LIFE SCIENCES

- 9.4.1 PHARMACEUTICALS & BIOTECH COMPANIES

- 9.4.1.1 Increasing complexity of therapeutic development to augment growth

- 9.4.2 MEDTECH COMPANIES

- 9.4.2.1 Need to accelerate product development cycles and economic value to propel market

- 9.4.3 OTHER LIFE SCIENCE END USERS

- 9.4.1 PHARMACEUTICALS & BIOTECH COMPANIES

- 9.5 OTHER END USERS

10 CLINICAL ANALYTICS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Growing advancements in machine learning, predictive modeling, and natural language processing to drive market

- 10.2.3 CANADA

- 10.2.3.1 Increasing prevalence of chronic diseases and accelerated digital transformation in healthcare to fuel market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Comprehensive digital health policy framework and significant federal investment in healthcare modernization to aid growth

- 10.3.3 FRANCE

- 10.3.3.1 Strong commitment to digital health transformation and robust institutional research ecosystem to foster growth

- 10.3.4 UK

- 10.3.4.1 Favorable investments and digital health strategy to contribute to growth

- 10.3.5 ITALY

- 10.3.5.1 Increasing emphasis on digital health record systems and healthcare research to stimulate growth

- 10.3.6 SPAIN

- 10.3.6.1 Growing public investment in data-driven healthcare and national mental health strategies to boost market

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Rising focus on modernizing healthcare delivery and enhancing patient outcomes to expedite growth

- 10.4.3 JAPAN

- 10.4.3.1 Booming geriatric population and advanced technological ecosystem to amplify growth

- 10.4.4 INDIA

- 10.4.4.1 Rapid adoption of electronic health records to accelerate growth

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Increasing prevalence of chronic and lifestyle-related conditions to aid growth

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Rising integration of AI-driven analytics in healthcare systems to encourage growth

- 10.5.3 MEXICO

- 10.5.3.1 Rising burden of non-communicable diseases to facilitate growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Saudi Arabia

- 10.6.2.1.1 Growing adoption of electronic health records and centralized digital platforms to fuel market

- 10.6.2.2 UAE

- 10.6.2.2.1 Favorable policy and regulatory environment to promote growth

- 10.6.2.3 Rest of GCC Countries

- 10.6.2.1 Saudi Arabia

- 10.6.3 SOUTH AFRICA

- 10.6.3.1 Robust public and private health systems to facilitate growth

- 10.6.4 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN CLINICAL ANALYTICS MARKET

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 MARKET RANKING ANALYSIS

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 BRAND/PRODUCT COMPARISON

- 11.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.8.1 STARS

- 11.8.2 EMERGING LEADERS

- 11.8.3 PERVASIVE PLAYERS

- 11.8.4 PARTICIPANTS

- 11.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.8.5.1 Company footprint

- 11.8.5.2 Region footprint

- 11.8.5.3 Offering footprint

- 11.8.5.4 Data source footprint

- 11.8.5.5 Use case footprint

- 11.8.5.6 End-user footprint

- 11.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- 11.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.9.5.1 Detailed list of key startups/SMEs

- 11.9.5.2 Competitive benchmarking of startups/SMEs

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES AND APPROVALS

- 11.10.2 DEALS

- 11.10.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 IQVIA

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches and approvals

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 OPTUM, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches and approvals

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 MERATIVE

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 EPIC SYSTEMS CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches and approvals

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 GE HEALTHCARE

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches and approvals

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 SIEMENS HEALTHINEERS AG

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches and approvals

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Other developments

- 12.1.6.4 MnM view

- 12.1.6.4.1 Right to win

- 12.1.6.4.2 Strategic choices

- 12.1.7 ORACLE

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches and approvals

- 12.1.7.3.2 Deals

- 12.1.7.4 MnM view

- 12.1.7.4.1 Right to win

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses and competitive threats

- 12.1.8 MCKESSON CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches and approvals

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Other developments

- 12.1.9 VERADIGM LLC

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches and approvals

- 12.1.9.3.2 Deals

- 12.1.9.3.3 Other developments

- 12.1.10 INOVALON

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches and approvals

- 12.1.10.3.2 Deals

- 12.1.11 WNS (HOLDINGS) LTD.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.11.3.2 Other developments

- 12.1.12 SOPHIA GENETICS

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches and approvals

- 12.1.12.3.2 Deals

- 12.1.13 COTIVITI, INC.

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches and approvals

- 12.1.13.3.2 Deals

- 12.1.14 HEALTH CATALYST

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches and approvals

- 12.1.14.3.2 Deals

- 12.1.15 COGNIZANT

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Product launches and approvals

- 12.1.15.3.2 Deals

- 12.1.16 F. HOFFMANN-LA ROCHE LTD

- 12.1.16.1 Business overview

- 12.1.16.2 Products offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Product launches and approvals

- 12.1.16.3.2 Deals

- 12.1.17 KONINKLIJKE PHILIPS N.V.

- 12.1.17.1 Business overview

- 12.1.17.2 Products offered

- 12.1.17.3 Recent developments

- 12.1.17.3.1 Product launches and approvals

- 12.1.17.3.2 Deals

- 12.1.18 DASSAULT SYSTEMES (MEDIDATA)

- 12.1.18.1 Business overview

- 12.1.18.2 Products offered

- 12.1.18.3 Recent developments

- 12.1.18.3.1 Product launches and approvals

- 12.1.18.3.2 Deals

- 12.1.19 ATHENAHEALTH, INC.

- 12.1.19.1 Business overview

- 12.1.19.2 Products offered

- 12.1.19.3 Recent developments

- 12.1.19.3.1 Product launches and approvals

- 12.1.19.3.2 Deals

- 12.1.20 VEEVA SYSTEMS

- 12.1.20.1 Business overview

- 12.1.20.2 Products offered

- 12.1.20.3 Recent developments

- 12.1.20.3.1 Product launches and approvals

- 12.1.20.3.2 Deals

- 12.1.21 ICON PLC

- 12.1.21.1 Business overview

- 12.1.21.2 Products offered

- 12.1.21.3 Recent developments

- 12.1.21.3.1 Product launches and approvals

- 12.1.21.3.2 Deals

- 12.1.22 ECLINICALWORKS

- 12.1.22.1 Business overview

- 12.1.22.2 Products offered

- 12.1.22.3 Recent developments

- 12.1.22.3.1 Product launches and approvals

- 12.1.22.3.2 Deals

- 12.1.23 ACCENTURE

- 12.1.23.1 Business overview

- 12.1.23.2 Products offered

- 12.1.23.3 Recent developments

- 12.1.23.3.1 Deals

- 12.1.24 CVS HEALTH

- 12.1.24.1 Business overview

- 12.1.24.2 Products offered

- 12.1.24.3 Recent developments

- 12.1.24.3.1 Product launches and approvals

- 12.1.24.3.2 Deals

- 12.1.25 SAS INSTITUTE INC.

- 12.1.25.1 Business overview

- 12.1.25.2 Products offered

- 12.1.25.3 Recent developments

- 12.1.25.3.1 Product launches and approvals

- 12.1.25.3.2 Deals

- 12.1.1 IQVIA

- 12.2 OTHER PLAYERS

- 12.2.1 APRIQOT

- 12.2.2 OLER HEALTH

- 12.2.3 PERCIPIO HEALTH

- 12.2.4 FERRUM HEALTH

- 12.2.5 AMPLIFY HEALTH

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS