|

시장보고서

상품코드

1876445

무인항공기 대응 시스템 시장 : 솔루션별, 최종 사용자별, 배포별, 범위별, 기술별, 지역별 예측(-2030년)Counter-UAS Systems Market by Solution (Drone Detection, Tracking & Identification, C2, UAS Mitigation & Neutralization), by End-User (Commercial, Defense, Government & Law Enforcement), Deployment, Range, Technology and Region - Global Forecast to 2030 |

||||||

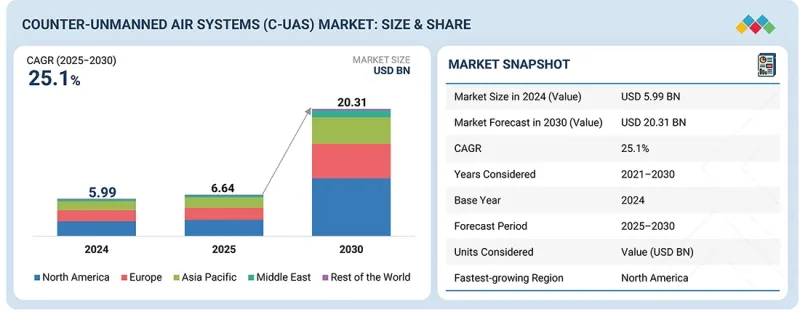

세계의 무인항공기 대응 시스템 시장 규모는 2025년에 66억 4,000만 달러, 2030년까지 203억 1,000만 달러에 이를 것으로 예측되며, CAGR로 25.1%를 나타낼 것으로 전망됩니다.

무인항공기의 위협에 대응하기 위한 레이더 시스템, RF 센서, 지휘 통제 유닛 수요가 시장 성장을 가속화하고 있습니다. 방위 근대화의 노력과 싸움이 심한 공역에 있어서 안전하고 고속의 데이터·전력 전송에 대한 수요가, 계속해서 중요한 성장 촉진요인이 되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 솔루션, 최종 사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

C4ISR 통합, 전자전 시스템, 다층 방어 프레임워크 내 대 드론 솔루션은 컴팩트하고 고성능 시스템의 채택을 더욱 촉진합니다. 세계 방어 예산 증가와 인공지능을 활용한 위협 감지 및 자율 교전 기술에 대한 투자 확대는 다중 도메인 C-UAS 작전 전반에 걸쳐 안정적인 성능을 보장하는 견고하고 소형화된 솔루션에 대한 수요를 강화하고 있습니다.

"기존 부문이 예측 기간에 무인항공기 대응 시스템 시장에서 AI 탑재 부문보다 큰 점유율을 차지할 것으로 예측됩니다."

기술별로는 예측 기간에 있어서, 기존 부문이 AI 탑재 부문보다 무인항공기 대응 시스템 시장에서 큰 점유율을 차지할 것으로 예측됩니다. 이 부문의 성장은 방위 및 정부 부문에서 경계 보호, 기지 경비, 국경 감시를 목적으로 기존의 시스템이 널리 전개되고 있기 때문입니다. 이들은 현장에서 입증된 아키텍처로 레이더, EO/IR 센서, RF 재머를 조합하여 신뢰성과 통합의 용이성을 제공합니다. 방위기관은 비용효과, 확장성, 기존의 지휘통제 인프라와의 호환성으로 기존 C-UAS 유닛을 선호하여 채택하고 있으며 예측 기간을 통해 시장 우위를 유지할 것으로 전망됩니다.

"예측 기간 동안 핸드헬드 부문이 지상 설치형 부문보다 무인항공기 대응 시스템 시장에서 빠르게 성장할 것으로 예측됩니다."

배포별로는 핸드헬드 부문이 예측 기간에 지상 설치형 부문을 상회하는 성장률을 나타낼 전망입니다. 이 예측은 법 집행기관, 국경 경비대, 보안기관으로부터 휴대 가능하고 조작하기 쉬운 대 드론 솔루션에 대한 핸드헬드 시스템에 대한 수요가 증가하고 있는 것으로 예측됩니다. 이러한 가벼운 재밍 건과 휴대용 RF 방해 장치는 도시 및 전술 환경에서 무인항공기 침입시 신속하게 대응할 수 있습니다. 운영상의 유연성, 저비용, 공공 안전 및 이벤트 보호 채택의 확대가 전 세계적으로 그 전개를 가속화하고 있습니다.

"북미가 예측 기간에 무인항공기 대응 시스템 시장에서 가장 빠르게 성장할 시장이 될 전망입니다."

북미는 정부에 의한 대 드론 연구개발 프로그램에 대한 대규모 투자, 부정한 UAV 위협 수준 증가, 미국 방총성과 국토 안보부의 빈번한 시험 운용으로 무인항공기 대응 시스템 시장에서 가장 빠르게 성장할 시장이 될 전망입니다. 이 지역에는 AI를 활용한 감지 기술과 지향성 에너지 솔루션을 개발하는 주요 C-UAS 제조업체와 통합자가 여러 개 존재합니다. 또한 공항, 발전소, 중요 인프라 등에서의 C-UAS 시스템의 민간 채용 확대가 지역 시장 확대를 더욱 강화하고 있습니다.

본 보고서에서는 세계의 무인항공기 대응 시스템 시장에 대해 조사 분석하여 주요 성장 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 주요 인사이트

- 무인항공기 대응 시스템 시장에서의 매력적인 기회

- 무인항공기 대응 시스템 시장 : 범위별

- 무인항공기 대응 시스템 시장 : 기술별

- 무인항공기 대응 시스템 시장 : 군사 및 방위 최종 사용자별

- 무인항공기 대응 시스템 시장 : 배포별

- 무인항공기 대응 시스템 시장 : 솔루션별

제4장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 미충족 수요(Unmet Needs)와 백스페이스

- 성가신 행위 증가

- 정보 수집·경계 감시·정찰(ISR)의 위협

- 페이로드 배송 실패

- 연결된 시장과 부문 간 기회

- 통합 병사 시스템에서 대 드론

- 해안 선박용 대 드론

- 중장갑·차량용 대 드론

- Tier 1/2/3 기업에 의한 전략적 움직임

제5장 기술의 진보, AI에 의한 영향, 특허, 혁신, 향후 응용

- 주요 신기술

- 스털링 어레이를 갖춘 KU/X 밴드 낮은 RCS 3D 레이더

- CRPA 안티잼 프론트엔드, 디시프린드 오실레이터

- 보완 기술

- DEW용 빔 디렉터, 전력 서브 시스템, 서멀 팩

- 센서/DEW용 해양 강화 키트

- MWIR/LWIR 센서 코어, 게르마늄 대체 광학

- 기술 로드맵

- 특허 분석

- 미래의 응용

- 무인항공기 대응 시스템 시장에 대한 AI/생성형 AI의 영향

- 주요 이용 사례와 시장의 장래성

- C-UAS의 모범 사례

- C-UAS에서 생성형 AI 구현의 사례 연구

- 연결된 인접 생태계와 시장 기업에 미치는 영향

- 고객 생성형 AI 채용 준비 상황

- 성공 사례와 실세계에의 응용

- RAFAEL ADVANCED DEFENSE SYSTEMS - IRON BEAM의 C-UAS 통합

- HENSOLDT - XPELLER 대 드론 시스템의 멀티 센서 퓨전

- LITEYE SYSTEMS - 기동부대 방어용 전술적 C-UAS

제6장 업계 동향

- 생태계 분석

- 시스템 통합자 및 프라임 계약자

- C-UAS 전문 기술 공급업체

- 센서, 레이더, 서브 시스템 제조업체

- 밸류체인 분석

- 연구개발

- 센서 및 재료 개발

- 서브시스템/제품 제조

- 시스템 조립 및 통합

- 애프터 서비스

- 공급망 분석

- 구성 요소 공급업체

- 시스템 통합자 및 운영자

- C-UAS 시스템 제조업체

- 최종 사용자

- 미국 관세의 영향(2025년)

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 미치는 영향

- 최종 이용 산업에 대한 영향

- 무역 분석

- 수입 시나리오(HS 코드 852610)

- 수출 시나리오(HS 코드 852610)

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 총소유비용

- 투자 및 자금조달 시나리오

- 운용 데이터

- 가격 설정 분석

- C-UAS의 평균 판매가격 : 주요 기업별(2024년)

- C-UAS의 평균 판매 가격 동향 : 지역별

- 거시경제 전망

- 북미

- 유럽

- 아시아태평양

- 중동

- 기타 지역

- 주요 규제

- 북미

- 유럽

- 아시아태평양

- 중동

- 기타 지역

- 메가 트렌드의 영향

- 5G 및 엣지 대응 C-UAS 네트워크

- 우주 기반 고고도 ISR 통합

- 디지털 트윈과 시뮬레이션 주도의 C-UAS 설계

제7장 규제 상황

- 지역 규제 및 규정 준수

- 규제기관, 정부기관, 기타 조직

- 업계 표준

제8장 고객정세와 구매행동

- 의사결정 프로세스

- 구매 이해관계자와 구입 평가 기준

- 구매 프로세스의 주요 이해 관계자

- 구매평가기준

- 채용 장벽과 내부 과제

- 다양한 최종 이용 산업으로부터의 미충족 수요(Unmet Needs)

- 시장의 수익성

- 수익 가능성

- 비용역학

- 최종 사용자에 대한 마진 기회

제9장 무인항공기 대응 시스템 시장 : 솔루션별

- 서론

- 드론 탐지, 추적 및 식별

- 지휘통제(C2)

- 무인항공기 위협 완화 및 무력화

- 서비스

제10장 무인항공기 대응 시스템 시장 : 최종 사용자별

- 서론

- 상업 및 민간

- 군사 및 방위

- 정부 및 법 집행 기관

제11장 무인항공기 대응 시스템 시장 : 배포별

- 서론

- 지상 설치형

- 핸드헬드

제12장 무인항공기 대응 시스템 시장 : 범위별

- 서론

- 단거리(<1 km)

- 전술 범위(1-5 km)

- 중거리(6-20 km)

- 장거리(21-50 km)

- 확장 범위(>50 km)

제13장 무인항공기 대응 시스템 시장 : 기술별

- 서론

- 기존

- AI 탑재

제14장 무인항공기 대응 시스템 시장 : 지역별

- 서론

- 북미

- PESTLE 분석

- 미국

- 캐나다

- 유럽

- PESTLE 분석

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 폴란드

- 기타 유럽

- 아시아태평양

- PESTLE 분석

- 중국

- 일본

- 호주

- 한국

- 인도

- 기타 아시아태평양

- 중동

- PESTLE 분석

- GCC

- 이스라엘

- 튀르키예

- 기타 중동

- 기타 지역

- PESTLE 분석

- 아프리카

- 라틴아메리카

제15장 경쟁 구도

- 서론

- 주요 참가 기업의 전략/강점(2021-2025년)

- 수익 분석(2021-2024년)

- 시장 점유율 분석(2024년)

- 브랜드 비교

- 기업평가 및 재무 지표

- 기업평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제16장 기업 프로파일

- 주요 기업

- RTX

- LOCKHEED MARTIN CORPORATION

- NORTHROP GRUMMAN

- ELBIT SYSTEMS LTD

- RAFAEL ADVANCED DEFENSE SYSTEMS LTD

- DEDRONE BY AXON

- BHARAT ELECTRONICS LIMITED(BEL)

- DRONESHIELD LTD

- AERODEFENSE

- LEONARDO DRS

- THALES

- HENSOLDT AG

- SAAB AB

- ANDURIL INDUSTRIES

- DIEHL STIFTUNG & CO. KG

- ELECTRO OPTIC SYSTEMS

- HANWHA SYSTEMS CO., LTD

- RHEINMETALL AG

- EDGE GROUP PJSC

- KONGSBERG

- BAE SYSTEMS

- HONEYWELL INTERNATIONAL INC

- ISRAEL AEROSPACE INDUSTRIES LTD

- BLIGHTER SURVEILLANCE SYSTEMS LIMITED

- INDRA

- 기타 기업

- MY DEFENSE A/S

- FORTEM TECHNOLOGIES

- ROBIN RADAR SYSTEMS

- AEROVIRONMENT, INC

- DETECT INC

- OPENWORKS

- AIRBUS

- SKYLOCK LTD

- DZYNE

- SKYSAFE

제17장 조사 방법

제18장 부록

KTH 25.11.28The counter-unmanned air systems (C-UAS) market is estimated to be USD 6.64 billion in 2025. It is projected to reach USD 20.31 billion by 2030, at a CAGR of 25.1%. The need for radar systems, RF sensors, and command-and-control units to counter drone threats accelerates market growth. Defense modernization efforts and the demand for secure, high-speed data and power transmission in contested airspace remain key growth drivers.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Solution, End-User and Region |

| Regions covered | North America, Europe, APAC, RoW |

C4ISR integrations, electronic warfare systems, and counter-drone solutions within multi-layer defense frameworks further advance the adoption of compact, high-performance systems. Increasing global defense budgets and rising investments in AI-enabled threat detection and autonomous engagement technologies reinforce the demand for ruggedized and miniaturized solutions to ensure reliable performance across multi-domain C-UAS operations.

"The conventional segment is projected to account for a larger share than the AI-powered segment in the counter-unmanned air systems (C-UAS) market during the forecast period."

By technology, the conventional segment is projected to account for a larger share than the AI-powered segment in the counter-unmanned air systems (C-UAS) market during the forecast period. The segment's growth is due to conventional systems being widely deployed across the defense and government sectors for perimeter protection, base security, and border surveillance. They combine radar, EO/IR sensors, and RF jammers in field-proven architectures, offering reliability and ease of integration. Defense agencies prefer conventional C-UAS units due to their cost-effectiveness, scalability, and compatibility with existing command-and-control infrastructures, sustaining their market dominance over the forecast period.

"The handheld segment is projected to be the faster-growing segment than the ground-based segment in the counter-unmanned air systems (C-UAS) market during the forecast period."

By deployment, the handheld segment is projected to be the faster-growing segment than the ground-based segment during the forecast period. This projection can be attributed to the increasing demand for handheld systems from law enforcement, border patrol units, and security agencies for portable, easy-to-operate anti-drone solutions. These lightweight jamming guns and portable RF disruptors allow rapid response during drone incursions in urban and tactical environments. Their operational flexibility, low cost, and growing adoption of public safety and event protection are accelerating their deployment worldwide.

"North America is projected to be the fastest-growing market in the counter-unmanned air systems (C-UAS) market during the forecast period."

North America is projected to be the fastest-growing market in the counter-unmanned air systems (C-UAS) market, driven by substantial government investments in counter-drone R&D programs, rising threat levels from unauthorized UAVs, and frequent trials under the US Department of Defense and Department of Homeland Security. The region hosts several leading C-UAS manufacturers and integrators developing AI-enabled detection and directed-energy solutions. Moreover, the growing civil adoption of C-UAS systems across airports, power plants, and critical infrastructure further supports regional market expansion.

Breakdown of Primaries

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%; Tier 2 - 30%; and Tier 3 - 30%

- By Designation: Directors - 20%; Managers - 10%; and Others - 70%

- By Region: Asia Pacific - 40%; Europe - 20%; North America - 20%; Middle East - 10%; and Rest of the World - 10%

RTX (US), Lockheed Martin Corporation (US), Elbit Systems Ltd. (Israel), Northrop Grumman (US), and RAFAEL Advanced Defense Systems Ltd. (Israel) are some of the leading players operating in the counter-unmanned air systems (C-UAS) market.

Research Coverage

The study covers the counter-unmanned air systems (C-UAS) market across various segments and subsegments. It aims to estimate this market's size and growth potential across different segments based on solution, range, deployment, technology, end-user, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key Benefits of Buying this Report

This report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall counter-unmanned air systems (C-UAS) market and its subsegments. The report covers the entire counter-unmanned air systems (C-UAS) market ecosystem. The report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. It will also help stakeholders understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Market Dynamics: Analysis of key growth drivers (Shift to integrated air and missile defense alignment, rising threat from drone swarms and asymmetric warfare, enterprise-grade C2/fusion replacing point solutions), restraints (legal authority and spectrum constraints in civil airspace and critical materials, critical materials and export-control dependencies), opportunities (IAMD-ready adapters and common-architecture compliance, scalable non-kinetic defeat systems), challenges (Proving effectiveness and safety of emerging effectors in-theater, supply chain resilience for EO/IR, power electronics, and lasers)

- Product Development: In-depth analysis of product innovation/development by companies across various regions

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in the counter-unmanned air systems (C-UAS) market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and product offerings of leading players like market RTX (US), Lockheed Martin Corporation (US), Elbit Systems Ltd. (Israel), Northrop Grumman (US), and RAFAEL Advanced Defense Systems Ltd. (Israel) in the counter-unmanned air systems (C-UAS) market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 DISRUPTIVE TRENDS SHAPING MARKET

- 2.3 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 2.4 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COUNTER-UNMANNED AIRCRAFT SYSTEMS (C-UAS) MARKET

- 3.2 COUNTER-UNMANNED AIRCRAFT SYSTEMS (C-UAS) MARKET, BY RANGE

- 3.3 COUNTER-UNMANNED AIRCRAFT SYSTEMS (C-UAS) MARKET, BY TECHNOLOGY

- 3.4 COUNTER-UNMANNED AIRCRAFT SYSTEMS (C-UAS) MARKET, BY MILITARY & DEFENSE END USER

- 3.5 COUNTER-UNMANNED AIRCRAFT SYSTEMS (C-UAS) MARKET, BY DEPLOYMENT

- 3.6 COUNTER-UNMANNED AIRCRAFT SYSTEMS (C-UAS) MARKET, BY SOLUTION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Shift toward integrated air and missile defense alignment

- 4.2.1.2 Enterprise-grade C2/fusion replacing point solutions

- 4.2.1.3 Rising threat density and mixed-domain salvos

- 4.2.1.4 Magazine depth and cost-per-engagement economics

- 4.2.1.5 Maturation of directed energy and protocol-aware defeat

- 4.2.2 RESTRAINTS

- 4.2.2.1 Legal authority and spectrum constraints in civil airspace

- 4.2.2.2 Critical materials and export-control dependencies

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 IAMD-ready adapters and common-architecture compliance

- 4.2.3.2 Scalable non-kinetic defeat systems

- 4.2.3.3 Counter-swarm toolkits and autonomy-resilient sensing

- 4.2.3.4 Maritime and expeditionary C-UAS expansion

- 4.2.3.5 Training, red-team swarms, and managed detection services

- 4.2.3.6 Mission data, analytics, and model sustainment as subscription

- 4.2.4 CHALLENGES

- 4.2.4.1 Proving effectiveness and safety of emerging effectors in-theater

- 4.2.4.2 Supply chain resilience for EO/IR, power electronics, and lasers

- 4.2.4.3 Assured interoperability and cyber hardening across C2 ecosystems

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 RISE OF NUISANCE ACTIVITY

- 4.3.2 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR) THREATS

- 4.3.3 PAYLOAD DELIVERY FAILURES

- 4.4 INTERCONNECTED MARKET AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 COUNTER-DRONES IN INTEGRATED SOLDIER SYSTEMS

- 4.4.2 COUNTER-DRONES FOR LITTORAL VESSELS

- 4.4.3 COUNTER-DRONES FOR HEAVY ARMOR AND VEHICLES

- 4.5 STRATEGIC MOVES BY TIER 1, 2, AND 3 PLAYERS

5 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 5.1 KEY EMERGING TECHNOLOGIES

- 5.1.1 KU/X-BAND LOW-RCS 3D RADARS WITH STARING ARRAYS

- 5.1.2 CRPA ANTI-JAM FRONT ENDS AND DISCIPLINED OSCILLATORS

- 5.2 COMPLEMENTARY TECHNOLOGIES

- 5.2.1 BEAM DIRECTORS, POWER SUBSYSTEMS, AND THERMAL PACKS FOR DEWS

- 5.2.2 MARITIME HARDENING KITS FOR SENSORS AND DEW

- 5.2.3 MWIR/LWIR SENSOR CORES AND GERMANIUM-ALTERNATIVE OPTICS

- 5.3 TECHNOLOGY ROADMAP

- 5.4 PATENT ANALYSIS

- 5.5 FUTURE APPLICATIONS

- 5.6 IMPACT OF AI/GEN AI ON COUNTER-UNMANNED AIRCRAFT SYSTEMS (C-UAS) MARKET

- 5.6.1 TOP USE CASES AND MARKET POTENTIAL

- 5.6.2 BEST PRACTICES IN C-UAS

- 5.6.3 CASE STUDIES OF IMPLEMENTATION OF GEN AI IN C-UAS

- 5.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 5.6.5 CLIENTS' READINESS TO ADOPT GEN AI

- 5.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 5.7.1 RAFAEL ADVANCED DEFENSE SYSTEMS - IRON BEAM C-UAS INTEGRATION

- 5.7.2 HENSOLDT - MULTI-SENSOR FUSION IN XPELLER COUNTER-DRONE SYSTEM

- 5.7.3 LITEYE SYSTEMS - TACTICAL C-UAS FOR MOBILE FORCE PROTECTION

6 INDUSTRY TRENDS

- 6.1 ECOSYSTEM ANALYSIS

- 6.1.1 SYSTEM INTEGRATORS & PRIME CONTRACTORS

- 6.1.2 SPECIALIZED C-UAS TECHNOLOGY PROVIDERS

- 6.1.3 SENSOR, RADAR, AND SUBSYSTEM MANUFACTURERS

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH & DEVELOPMENT

- 6.2.2 SENSOR & MATERIAL DEVELOPMENT

- 6.2.3 SUBSYSTEM/PRODUCT MANUFACTURING

- 6.2.4 SYSTEM ASSEMBLY & INTEGRATION

- 6.2.5 POST-SALES SERVICE

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.3.1 COMPONENT SUPPLIERS

- 6.3.2 SYSTEM INTEGRATORS & OPERATORS

- 6.3.3 C-UAS SYSTEM MANUFACTURERS

- 6.3.4 END USERS

- 6.4 IMPACT OF 2025 US TARIFF

- 6.4.1 KEY TARIFF RATES

- 6.4.2 PRICE IMPACT ANALYSIS

- 6.4.3 IMPACT ON COUNTRY/REGION

- 6.4.3.1 US

- 6.4.3.2 Europe

- 6.4.3.3 Asia Pacific

- 6.4.4 IMPACT ON END-USE INDUSTRIES

- 6.4.4.1 Military & defense

- 6.4.4.2 Commercial & civil

- 6.4.4.3 Government & law enforcement

- 6.5 TRADE ANALYSIS

- 6.5.1 IMPORT SCENARIO (HS CODE 852610)

- 6.5.2 EXPORT SCENARIO (HS CODE 852610)

- 6.6 KEY CONFERENCES & EVENTS, 2025-2026

- 6.7 TOTAL COST OF OWNERSHIP

- 6.8 INVESTMENT AND FUNDING SCENARIO

- 6.9 OPERATIONAL DATA

- 6.10 PRICING ANALYSIS

- 6.10.1 AVERAGE SELLING PRICE OF C-UAS, BY KEY PLAYER, 2024

- 6.10.1.1 Short range (< 1 KM)

- 6.10.1.2 Tactical range (1-5 KM)

- 6.10.1.3 Medium Range (6-20 KM)

- 6.10.1.4 Long Range (21-50 KM)

- 6.10.1.5 Extended Range (> 50 KM)

- 6.10.2 AVERAGE SELLING PRICE TREND OF C-UAS, BY REGION

- 6.10.1 AVERAGE SELLING PRICE OF C-UAS, BY KEY PLAYER, 2024

- 6.11 MACROECONOMIC OUTLOOK

- 6.11.1 NORTH AMERICA

- 6.11.2 EUROPE

- 6.11.3 ASIA PACIFIC

- 6.11.4 MIDDLE EAST

- 6.11.5 REST OF THE WORLD

- 6.12 KEY REGULATIONS

- 6.12.1 NORTH AMERICA

- 6.12.2 EUROPE

- 6.12.3 ASIA PACIFIC

- 6.12.4 MIDDLE EAST

- 6.12.5 REST OF THE WORLD

- 6.13 IMPACT OF MEGATRENDS

- 6.13.1 5G AND EDGE-ENABLED C-UAS NETWORKS

- 6.13.2 SPACE-BASED, HIGH-ALTITUDE ISR INTEGRATION

- 6.13.3 DIGITAL TWIN AND SIMULATION-DRIVEN C-UAS DESIGN

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING EVALUATION CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES FOR END USERS

9 COUNTER-UNMANNED AIRCRAFT SYSTEMS (C-UAS) MARKET, BY SOLUTION (MARKET SIZE & FORECAST TO 2030 - IN USD MILLION)

- 9.1 INTRODUCTION

- 9.2 DRONE DETECTION, TRACKING, AND IDENTIFICATION

- 9.2.1 MULTI-SENSOR FUSION AND AI-BASED ANALYTICS TO TRANSFORM DRONE DETECTION AND IDENTIFICATION ACCURACY

- 9.2.2 DRONE DETECTION RADAR

- 9.2.2.1 Ku-band

- 9.2.2.2 X-band

- 9.2.2.3 C-band

- 9.2.2.4 S-band

- 9.2.2.5 L-band

- 9.2.2.6 Other frequency bands

- 9.2.3 PASSIVE RF ANALYZERS

- 9.2.4 COUNTER-DRONE ACOUSTIC SENSORS

- 9.2.4.1 Arrays

- 9.2.4.2 Microphones

- 9.2.5 ELECTRO-OPTICAL AND INFRARED CAMERAS

- 9.2.5.1 Multispectral

- 9.2.5.2 Hyperspectral

- 9.2.6 MULTI-SENSOR SYSTEMS

- 9.3 COMMAND & CONTROL (C2)

- 9.3.1 EVOLVING C2 ARCHITECTURES TO ENABLE FASTER, CONNECTED, AND MORE RESILIENT COUNTER-DRONE OPERATIONS

- 9.3.2 COUNTER-UAS COMMAND & CONTROL SYSTEM

- 9.3.3 INTEGRATED C2 SYSTEM

- 9.4 UAS MITIGATION & NEUTRALIZATION

- 9.4.1 INTEGRATION OF LAYERED MITIGATION SYSTEMS TO ENHANCE DRONE NEUTRALIZATION EFFICIENCY ACROSS THREAT ENVIRONMENTS

- 9.4.2 HARD KILL

- 9.4.2.1 Anti-drone guns

- 9.4.2.2 Intercept drones

- 9.4.2.3 C-UAS kinetic missiles

- 9.4.2.4 Anti-swarm munition

- 9.4.2.5 High-power microwave anti-drone systems

- 9.4.2.6 High-energy lasers

- 9.4.2.7 Others

- 9.4.3 SOFT KILL/ELECTRONIC COUNTERMEASURES

- 9.4.3.1 Anti-FPV RF jamming technology

- 9.4.3.2 Global navigation satellite system (GNSS) jamming

- 9.4.3.3 Spoofing, protocol manipulation, and cyber-takeover systems

- 9.5 SERVICES

- 9.5.1 LIFECYCLE SERVICE MODELS TO STRENGTHEN RELIABILITY AND SUSTAINMENT

- 9.5.2 SOFTWARE UPGRADE

- 9.5.3 HARDWARE UPGRADE

- 9.5.4 MAINTENANCE & SUPPORT

- 9.5.5 INSTALLATION & INTEGRATION SERVICES

10 COUNTER-UNMANNED AIRCRAFT SYSTEMS (C-UAS) MARKET, BY END USER (MARKET SIZE & FORECAST TO 2030 - IN USD MILLION)

- 10.1 INTRODUCTION

- 10.2 COMMERCIAL & CIVIL

- 10.2.1 RISING DRONE MISUSE ACROSS CIVIL INFRASTRUCTURE TO ACCELERATE DEMAND FOR C-UAS SOLUTIONS IN PRIVATE SECTOR

- 10.2.2 PUBLIC VENUES

- 10.2.3 CRITICAL INFRASTRUCTURE

- 10.2.3.1 Stadiums & arenas

- 10.2.3.2 Airports

- 10.2.3.3 Prisons

- 10.2.3.4 Power plants

- 10.2.3.5 Oil & gas fields

- 10.2.3.6 Transportation hubs

- 10.2.3.7 Data centers

- 10.2.3.8 Research & development centers

- 10.2.3.9 Corporate & industrial facilities

- 10.3 MILITARY & DEFENSE

- 10.3.1 DEFENSE MODERNIZATION AND ASYMMETRIC THREATS TO ACCELERATE C-UAS ADOPTION ACROSS ARMED SERVICES

- 10.3.2 ARMED FORCES

- 10.3.3 AIR FORCE

- 10.3.4 NAVY

- 10.3.5 OTHER SPECIAL FORCES

- 10.4 GOVERNMENT & LAW ENFORCEMENT

- 10.4.1 GROWING CIVIL AIRSPACE INTRUSIONS AND PUBLIC SECURITY RISKS TO DRIVE ADOPTION OF C-UAS

- 10.4.2 NATIONAL/FEDERAL POLICE

- 10.4.3 CIVILIAN INTELLIGENCE & SECURITY AGENCIES

- 10.4.4 PARAMILITARY POLICE

11 COUNTER-UNMANNED AIRCRAFT SYSTEMS (C-UAS) MARKET, BY DEPLOYMENT (MARKET SIZE & FORECAST TO 2030 - IN USD MILLION)

- 11.1 INTRODUCTION

- 11.2 GROUND-BASED

- 11.2.1 NEED TO STRENGTHEN CONTINUOUS PROTECTION OF STRATEGIC AND CIVIL INFRASTRUCTURE TO DRIVE MARKET

- 11.2.2 FIXED

- 11.2.3 MOBILE

- 11.3 HANDHELD

- 11.3.1 FRONTLINE FORCES INCREASINGLY RELY ON PORTABLE COUNTER-DRONE DEVICES FOR RAPID THREAT NEUTRALIZATION

12 COUNTER-UNMANNED AIRCRAFT SYSTEMS (C-UAS) MARKET, BY RANGE (MARKET SIZE & FORECAST TO 2030 - IN USD MILLION)

- 12.1 INTRODUCTION

- 12.2 SHORT RANGE (< 1 KM)

- 12.2.1 URBAN AND CRITICAL SITE SECURITY TO ACCELERATE ADOPTION OF COMPACT SHORT-RANGE COUNTER-DRONE SYSTEMS

- 12.3 TACTICAL RANGE (1-5 KM)

- 12.3.1 MILITARY AND LAW ENFORCEMENT AGENCIES EXPAND TACTICAL-RANGE C-UAS CAPABILITIES FOR MOBILE FIELD OPERATIONS

- 12.4 MEDIUM RANGE (6-20 KM)

- 12.4.1 INCREASE IN BORDER SURVEILLANCE AND MILITARY BASE PROTECTION PROGRAMS TO DRIVE DEMAND

- 12.5 LONG RANGE (21-50 KM)

- 12.5.1 INCREASING CROSS-BORDER DRONE INTRUSIONS TO PROPEL INVESTMENTS IN LONG-RANGE COUNTER-DRONE PLATFORMS

- 12.6 EXTENDED RANGE (> 50 KM)

- 12.6.1 STRATEGIC DEFENSE MODERNIZATION TO SPUR DEVELOPMENT OF EXTENDED-RANGE C-UAS NETWORKS

13 COUNTER-UNMANNED AIRCRAFT SYSTEMS (C-UAS) MARKET, BY TECHNOLOGY (MARKET SIZE & FORECAST TO 2030 - IN USD MILLION)

- 13.1 INTRODUCTION

- 13.2 CONVENTIONAL

- 13.2.1 UPGRADES IN RADAR AND RF TECHNOLOGIES SUSTAIN GROWTH OF CONVENTIONAL COUNTER-DRONE SOLUTIONS

- 13.3 AI-POWERED

- 13.3.1 AI-POWERED C-UAS PLATFORMS TRANSFORM THREAT DETECTION, DECISION-MAKING, AND OPERATIONAL AUTONOMY

14 COUNTER-UNMANNED AIRCRAFT SYSTEMS (C-UAS) MARKET, BY REGION (MARKET SIZE & FORECAST TO 2030 - IN USD MILLION)

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 PESTLE ANALYSIS

- 14.2.2 US

- 14.2.2.1 Increased security incidents to drive investment in defense and homeland security programs

- 14.2.3 CANADA

- 14.2.3.1 Increase in innovation and defense policies to drive expansion of Canadian C-UAS initiatives

- 14.3 EUROPE

- 14.3.1 PESTLE ANALYSIS

- 14.3.2 UK

- 14.3.2.1 Rising airspace security incidents to drive C-UAS expansion

- 14.3.3 GERMANY

- 14.3.3.1 Layered defense deployment to strengthen country's C-UAS posture

- 14.3.4 FRANCE

- 14.3.4.1 Repeated drone incursions to drive country's C-UAS strategy

- 14.3.5 ITALY

- 14.3.5.1 Drone-related incidents to drive Italy's C-UAS reinforcement

- 14.3.6 SPAIN

- 14.3.6.1 Rising drone smuggling incidents to drive market expansion

- 14.3.7 POLAND

- 14.3.7.1 Rising drone activity near Eastern frontier to drive growth

- 14.3.8 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 PESTLE ANALYSIS

- 14.4.2 CHINA

- 14.4.2.1 Rising threats from foreign drones to drive market

- 14.4.3 JAPAN

- 14.4.3.1 National security requirements to boost coordinated counter-drone framework

- 14.4.4 AUSTRALIA

- 14.4.4.1 Rising incidents of drone threats to drive country's C-UAS development

- 14.4.5 SOUTH KOREA

- 14.4.5.1 Repeated drone incursions to create demand for C-UAS expansion

- 14.4.6 INDIA

- 14.4.6.1 Rising cross-border drone operations to strengthen India's C-UAS capabilities

- 14.4.7 REST OF ASIA PACIFIC

- 14.5 MIDDLE EAST

- 14.5.1 PESTLE ANALYSIS

- 14.5.2 GCC

- 14.5.2.1 Saudi Arabia

- 14.5.2.1.1 Rising threat of drones to drive C-UAS modernization

- 14.5.2.2 UAE

- 14.5.2.2.1 Rising drone activity to boost C-UAS expansion

- 14.5.2.1 Saudi Arabia

- 14.5.3 ISRAEL

- 14.5.3.1 Persistent border drone incursions to spur demand for C-UAS

- 14.5.4 TURKEY

- 14.5.4.1 Evolving unmanned threats to drive country's C-UAS framework expansion

- 14.5.5 REST OF MIDDLE EAST

- 14.6 REST OF THE WORLD

- 14.6.1 PESTLE ANALYSIS

- 14.6.2 AFRICA

- 14.6.2.1 Need for national security governance to strengthen C-UAS integration

- 14.6.3 LATIN AMERICA

- 14.6.3.1 Rising border drone activities to boost market

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 15.3 REVENUE ANALYSIS, 2021-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 BRAND COMPARISON

- 15.6 COMPANY VALUATION AND FINANCIAL METRICS

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 Deployment footprint

- 15.7.5.4 End user footprint

- 15.7.5.5 Range footprint

- 15.7.5.6 Technology footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING

- 15.8.5.1 List of startups/SMEs

- 15.8.5.2 Competitive benchmarking of startups/SMEs

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 15.9.2 DEALS

- 15.9.3 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 RTX

- 16.1.1.1 Business overview

- 16.1.1.2 Products offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Other developments

- 16.1.1.4 MnM view

- 16.1.1.4.1 Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 LOCKHEED MARTIN CORPORATION

- 16.1.2.1 Business overview

- 16.1.2.2 Products offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches & enhancements

- 16.1.2.3.2 Deals

- 16.1.2.3.3 Other developments

- 16.1.2.4 MnM view

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 NORTHROP GRUMMAN

- 16.1.3.1 Business overview

- 16.1.3.2 Products offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Other developments

- 16.1.3.4 MnM view

- 16.1.3.4.1 Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 ELBIT SYSTEMS LTD

- 16.1.4.1 Business overview

- 16.1.4.2 Products offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches & enhancements

- 16.1.4.3.2 Other developments

- 16.1.4.4 MnM view

- 16.1.4.4.1 Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 RAFAEL ADVANCED DEFENSE SYSTEMS LTD

- 16.1.5.1 Business overview

- 16.1.5.2 Products offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Deals

- 16.1.5.3.2 Other developments

- 16.1.5.4 MnM view

- 16.1.5.4.1 Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 DEDRONE BY AXON

- 16.1.6.1 Business overview

- 16.1.6.2 Products offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Product launches & enhancements

- 16.1.6.3.2 Deals

- 16.1.7 BHARAT ELECTRONICS LIMITED (BEL)

- 16.1.7.1 Business overview

- 16.1.7.2 Products offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Deals

- 16.1.7.3.2 Other developments

- 16.1.8 DRONESHIELD LTD

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Product launches & enhancements

- 16.1.8.3.2 Deals

- 16.1.8.3.3 Other developments

- 16.1.9 AERODEFENSE

- 16.1.9.1 Business overview

- 16.1.9.2 Products offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Product launches & enhancements

- 16.1.9.3.2 Deals

- 16.1.9.3.3 Other developments

- 16.1.10 LEONARDO DRS

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product launches & enhancements

- 16.1.10.3.2 Other developments

- 16.1.11 THALES

- 16.1.11.1 Business overview

- 16.1.11.2 Products offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Deals

- 16.1.11.3.2 Other developments

- 16.1.12 HENSOLDT AG

- 16.1.12.1 Business overview

- 16.1.12.2 Products offered

- 16.1.12.3 Recent developments

- 16.1.12.3.1 Deals

- 16.1.12.3.2 Other developments

- 16.1.13 SAAB AB

- 16.1.13.1 Business overview

- 16.1.13.2 Products offered

- 16.1.13.3 Recent developments

- 16.1.13.3.1 Product launches & enhancements

- 16.1.13.3.2 Other developments

- 16.1.14 ANDURIL INDUSTRIES

- 16.1.14.1 Business overview

- 16.1.14.2 Products offered

- 16.1.14.3 Recent developments

- 16.1.14.3.1 Other developments

- 16.1.15 DIEHL STIFTUNG & CO. KG

- 16.1.15.1 Business overview

- 16.1.15.2 Products offered

- 16.1.15.3 Other developments

- 16.1.16 ELECTRO OPTIC SYSTEMS

- 16.1.16.1 Business overview

- 16.1.16.2 Products offered

- 16.1.17 HANWHA SYSTEMS CO., LTD

- 16.1.17.1 Business overview

- 16.1.17.2 Products offered

- 16.1.17.3 Recent developments

- 16.1.17.3.1 Deals

- 16.1.17.3.2 Other developments

- 16.1.18 RHEINMETALL AG

- 16.1.18.1 Business overview

- 16.1.18.2 Products offered

- 16.1.18.3 Recent developments

- 16.1.18.3.1 Product launches & enhancements

- 16.1.18.3.2 Other developments

- 16.1.19 EDGE GROUP PJSC

- 16.1.19.1 Business overview

- 16.1.19.2 Products offered

- 16.1.19.3 Recent developments

- 16.1.19.3.1 Product launches & enhancements

- 16.1.19.3.2 Deals

- 16.1.19.3.3 Other developments

- 16.1.20 KONGSBERG

- 16.1.20.1 Business overview

- 16.1.20.2 Products offered

- 16.1.20.3 Recent developments

- 16.1.20.3.1 Product launches & enhancements

- 16.1.20.3.2 Deals

- 16.1.20.3.3 Other developments

- 16.1.21 BAE SYSTEMS

- 16.1.21.1 Business overview

- 16.1.21.2 Products offered

- 16.1.21.3 Recent developments

- 16.1.21.3.1 Deals

- 16.1.21.3.2 Other developments

- 16.1.22 HONEYWELL INTERNATIONAL INC

- 16.1.22.1 Business overview

- 16.1.22.2 Products offered

- 16.1.22.3 Recent developments

- 16.1.22.3.1 Product launches & enhancements

- 16.1.22.3.2 Deals

- 16.1.22.3.3 Other developments

- 16.1.23 ISRAEL AEROSPACE INDUSTRIES LTD

- 16.1.23.1 Business overview

- 16.1.23.2 Products offered

- 16.1.23.3 Recent developments

- 16.1.23.3.1 Product launches & enhancements

- 16.1.23.3.2 Other developments

- 16.1.24 BLIGHTER SURVEILLANCE SYSTEMS LIMITED

- 16.1.24.1 Business overview

- 16.1.24.2 Products offered

- 16.1.24.3 Recent developments

- 16.1.24.3.1 Product launches & enhancements

- 16.1.24.3.2 Other developments

- 16.1.25 INDRA

- 16.1.25.1 Business overview

- 16.1.25.2 Products offered

- 16.1.25.3 Recent developments

- 16.1.25.3.1 Deals

- 16.1.25.3.2 Other developments

- 16.1.1 RTX

- 16.2 OTHER PLAYERS

- 16.2.1 MY DEFENSE A/S

- 16.2.2 FORTEM TECHNOLOGIES

- 16.2.3 ROBIN RADAR SYSTEMS

- 16.2.4 AEROVIRONMENT, INC

- 16.2.5 DETECT INC

- 16.2.6 OPENWORKS

- 16.2.7 AIRBUS

- 16.2.8 SKYLOCK LTD

- 16.2.9 DZYNE

- 16.2.10 SKYSAFE

17 RESEARCH METHODOLOGY

- 17.1 RESEARCH DATA

- 17.1.1 SECONDARY DATA

- 17.1.1.1 Key data from secondary sources

- 17.1.2 PRIMARY DATA

- 17.1.2.1 Primary participants

- 17.1.2.2 Key data from primary sources

- 17.1.2.3 Breakdown of primary interviews

- 17.1.2.4 Insights from industry experts

- 17.1.1 SECONDARY DATA

- 17.2 FACTOR ANALYSIS

- 17.2.1 MACROECONOMIC AND POLICY FACTORS

- 17.2.2 INDUSTRY AND OPERATIONAL FACTORS

- 17.2.3 DEMAND-SIDE AND END USER FACTORS

- 17.2.4 QUANTITATIVE WEIGHTING AND SENSITIVITY

- 17.2.5 FACTOR-DRIVEN FORECAST IMPLICATIONS

- 17.2.6 DEMAND-SIDE INDICATORS

- 17.2.7 SUPPLY-SIDE INDICATORS

- 17.3 MARKET SIZE ESTIMATION

- 17.3.1 BOTTOM-UP APPROACH

- 17.3.1.1 Market size estimation methodology

- 17.3.2 TOP-DOWN APPROACH

- 17.3.1 BOTTOM-UP APPROACH

- 17.4 DATA TRIANGULATION

- 17.5 RESEARCH ASSUMPTIONS

- 17.6 RESEARCH LIMITATIONS

- 17.7 RISK ASSESSMENT

18 APPENDIX

- 18.1 LAUNDRY LIST OF COMPANIES

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS