|

시장보고서

상품코드

1876462

배터리 제조 장비 시장 : 전극 적층기, 캘린더기, 슬리터, 혼합, 코팅·건조, 조립, 형성·시험기, 리튬 이온 배터리 - 예측(-2030년)Battery Manufacturing Equipment Market by Electrode Stacking Machines, Calendering Machines, Slitting Machines, Mixing, Coating & Drying, Assembling, Formation & Testing Machines, Lithium-ion Battery -Global Forecast to 2030 |

||||||

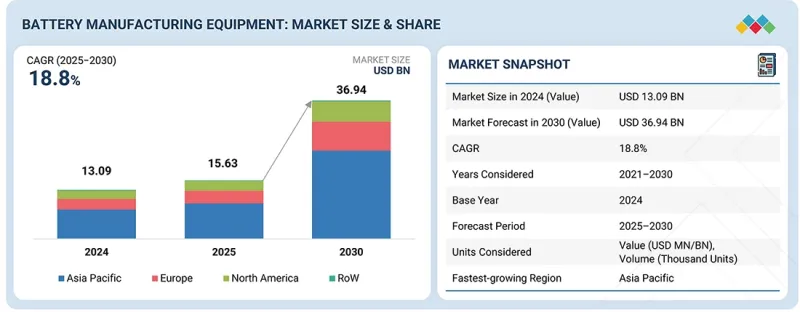

세계의 배터리 제조 장비 시장 규모는 2025년 156억 3,000만 달러에서 2030년에는 369억 4,000만 달러에 이를 것으로 예측되며 CAGR로 18.8%를 나타낼 것으로 전망됩니다.

시장의 확대는 전동 이동성의 급속한 보급, 에너지 저장 시스템에 대한 수요 증가, 자동화·고정밀 제조 기술의 채용 확대에 의한 것입니다. 코팅, 캘린더 가공, 셀 조립, 형성 시스템 등의 장치가 기가팩토리 경영에서 생산 효율, 품질 일관성, 확장성 향상을 목적으로 널리 전개되고 있습니다. AI, 로보틱스, IoT 대응 플랫폼의 통합으로, 예지 보전, 디지털 프로세스 제어, 실시간 성능 최적화가 가능하며, 배터리 생산은 변화의 도상에 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 기계 유형, 배터리 유형, 용도, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

게다가 청정에너지 제조에 대한 강력한 정부 지원책과 주요 지역에서의 배터리 생산의 현지화 추진이 시장 성장을 더욱 추진하고 있습니다. 제조업체가 지속가능성, 비용효율, 생산유연성에 주력하는 가운데, 배터리 제조 장비 시장은 세계전화를 추진하고 첨단 에너지제조의 미래를 형성하는데 있어 매우 중요한 역할을 할 것으로 기대되고 있습니다.

"고정밀 배터리 생산에 대한 주목이 높아짐에 따라 코팅·건조기가 견조한 성장을 기록합니다."

코팅 및 건조기 부문은 높은 정밀도와 에너지 효율적인 전극 제조에 대한 수요가 증가함에 따라 예측 기간 동안 배터리 제조 장비 시장에서 상당한 CAGR로 성장할 것으로 예측됩니다. 이 기계는 균일한 재료 코팅과 일관된 전극 성능을 실현하는 데 필수적이며, 이는 배터리의 용량, 효율 및 전반적인 품질에 직접 영향을 미칩니다. 제조업체 각사는 생산성 향상, 결함 저감, 운영 비용 절감을 목적으로 AI를 탑재하여 에너지가 최적화된 자동식 코팅·건조 시스템에 투자를 추진하고 있습니다. 대규모 배터리 생산에서 공정의 일관성, 확장성 및 재료 최적화에 대한 필요성이 증가함에 따라 장비의 채택을 더욱 촉진하고 있습니다. EV와 에너지 저장 제조 시설의 급속한 확대뿐만 아니라 지속가능하고 고성능의 배터리 기술의 추진에 힘입어, 코팅·건조기 부문은 견조한 성장을 기록해, 세계의 배터리 제조 에코시스템에서 중요한 구성 요소가 될 것으로 예측됩니다.

"자동차 부문은 EV 생산 확대로 최고의 CAGR로 성장할 것"

자동차 부문이 예측 기간에 배터리 제조 장비 시장에서 최고의 CAGR을 나타낼 전망입니다. 이는 세계 전동 이동성으로의 급속한 전환과 EV용 배터리 생산 시설에 대한 투자 증가로 추진되고 있습니다. 자동차 제조업체는 공급망 확보, 비용 절감, 기술적 경쟁력 강화를 목적으로 자사 내 및 현지 배터리 제조에 주력하고 있습니다. 이 트렌드는 정확성, 확장성, 효율성을 보장하는 전극 제조, 셀 조립, 형성 및 테스트 프로세스에 사용되는 첨단 장비에 대한 큰 수요를 촉진합니다. 자동화, 로보틱스, 디지털 모니터링 시스템의 통합은 EV용 배터리 생산을 더욱 변화시켜 생산 증가와 품질 관리의 향상을 실현하고 있습니다. 또한 깨끗한 운송 수단과 지속 가능한 제조를 촉진하는 정부 인센티브는 대규모 기가팩토리 개발을 가속화하고 있습니다. 주요 시장에서의 전기자동차의 보급이 급속히 확대되고 있는 가운데, 자동차 부문은 배터리 제조 장비 시장의 주요 성장 촉진요인이며, 탈탄소화 및 업계의 전기화를 위한 세계적인 노력을 강화하고 있습니다.

"기가팩토리 확대와 강력한 정부 지원으로 아시아태평양이 가장 높은 성장률을 기록할 전망입니다."

아시아태평양은 전기자동차의 급속한 생산 확대, 에너지 저장 투자, 중국, 일본, 한국, 인도 등 국가에서 대규모 배터리 기가팩토리를 설립하여 배터리 제조 장비 시장에서 최고의 CAGR을 나타낼 것으로 예측됩니다. 청정 에너지와 산업 자동화에 대한 정부 지원, 숙련된 노동력, 견고한 공급망이 이 지역의 경쟁 우위를 높이고 있습니다. 자동화와 AI 대응 생산 시스템의 채용이 효율성을 향상시키고 있습니다. 주요 기업은 수요 증가에 대응하기 위해 이 지역에서의 연구개발과 생산을 확대하고 있습니다. 전기와 재생가능 에너지의 성장이 계속되고 있는 가운데 아시아태평양은 배터리 제조 장비 시장에서 계속 주도적인 지위를 유지할 것으로 전망됩니다.

본 보고서에서는 세계의 배터리 제조 장비 시장에 대해 조사 분석했으며, 주요한 성장 촉진요인과 억제요인, 경쟁 구도, 장래의 동향 등의 정보를 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 주요 인사이트

- 배터리 제조 장비 시장의 기업에게 매력적인 기회

- 배터리 제조 장비 시장 : 기계 유형별

- 배터리 제조 장비 시장 : 배터리 유형별

- 배터리 제조 장비 시장 : 용도별

- 아시아태평양 배터리 제조 장비 시장 : 용도별, 국가별

- 배터리 제조 장비 시장 : 국가별

제4장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 연결된 시장과 부문 간 기회

- Tier 1/2/3 기업의 전략적 움직임

- EV 부문의 전략적 제휴

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제지표

- 서론

- GDP의 동향과 예측

- 세계 자동차 업계 동향

- 재생에너지산업 동향

- 밸류체인 분석

- 생태계 분석

- 가격 설정 분석

- 배터리 제조 장비의 참고 가격 분석 : 주요 기업별

- 참고 판매 가격 : 기계 유형별

- 참고 가격 분석 : 지역별

- 무역 분석

- 수입 시나리오(HS 코드 850650)

- 수출 시나리오(HS 코드 850650)

- 고객사업에 영향을 주는 동향/혼란

- 투자 및 자금조달 시나리오

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 사례 연구 분석

- 미국 관세의 영향(2025년) - 배터리 제조 장비 시장

- 서론

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 미치는 영향

- 최종 이용 산업에 대한 영향

제6장 기술의 진보, AI에 의한 영향, 특허, 혁신

- 주요 기술

- 재료 가공 기술

- 레이저 가공 기술

- 인접 기술

- EV 기술

- 에너지 저장 시스템

- 재활용 기술

- 보완 기술

- 품질관리 기술

- 자동화와 디지털 전환

- 기술/제품 로드맵

- 특허 분석

- 배터리 제조 장비 시장에 대한 AI의 영향

- 주요 이용 사례와 시장의 장래성

- 배터리 제조 장비의 모범 사례

- 배터리 제조 장비 시장에서의 AI 도입 사례 연구

- 연결된 인접 생태계와 시장 기업에 미치는 영향

- 배터리 제조 장비 시장에서의 AI 채용에 대한 고객의 준비 상황

제7장 규제 상황

- 지역 규제 및 규정 준수

- 규제기관, 정부기관, 기타 조직

- 규제

- 표준

제8장 고객정세와 구매행동

- 의사결정 프로세스

- 주요 이해관계자와 구매 평가 기준

- 구매 프로세스의 주요 이해 관계자

- 구입 기준

- 채용 장벽과 내부 과제

- 다양한 업계의 미충족 수요(Unmet Needs)

제9장 배터리 제조 장비 시장 : 기계 유형별

- 서론

- 혼합 기계

- 코팅 및 건조 기계

- 캘린더링 기계

- 슬리팅 기계

- 전극 적층 기기

- 조립 및 핸들링 기계

- 형성 및 테스트 기계

제10장 배터리 제조 장비 시장 : 배터리 유형별

- 서론

- NCA

- NMC

- LFP

- LMO

- LCO

- LTO

제11장 배터리 제조 장비 시장 : 용도별

- 서론

- 자동차

- 재생에너지

- 산업

- 소비자 일렉트로닉스

- 기타

제12장 배터리 제조 장비 시장 : 지역별

- 서론

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 헝가리

- 폴란드

- 영국

- 프랑스

- 스웨덴

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 한국

- 호주

- 기타 아시아태평양

- 기타 지역

- 중동

- 남미

- 아프리카

제13장 경쟁 구도

- 개요

- 주요 참가 기업의 전략/강점(2021-2024년)

- 수익 분석(2020-2024년)

- 시장 점유율 분석

- 기업평가 및 재무지표(2024년)

- 브랜드/제품 비교

- 기업의 평가 매트릭스 : 주요 기업(2023년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제14장 기업 프로파일

- 주요 기업

- HITACHI HIGH-TECH CORPORATION

- DURR GROUP

- LEAD INTELLIGENT EQUIPMENT CO., LTD.

- ANDRITZ SCHULER GMBH

- YINGHE TECHNOLOGY CO., LTD.

- BUHLER

- LYRIC

- NORDSON CORPORATION

- ROSENDAHL NEXTROM

- CKD CORPORATION

- DAIICHI JITSUGYO CO., LTD.

- 기타 기업

- CHARLES ROSS & SON COMPANY

- FOSHAN GOLDEN MILKY WAY INTELLIGENT EQUIPMENT CO., LTD.

- HIRANO TECSEED CO., LTD

- KAMPF LSF

- MONDRAGON ASSEMBLY

- NAGANO AUTOMATION

- JIANGSU KATOP AUTOMATION CO., LTD.

- SEMCO INFRATECH

- XIAMEN TMAX BATTERY EQUIPMENT LIMITED

- XIAMEN LITH MACHINE LIMITED

- XIAMEN TOB NEW ENERGY TECHNOLOGY CO., LTD.

- GELON LIB GROUP CO., LTD.

- TARGRAY

- XINGTAI ZHAOYANG MACHINERY MANUFACTURING CO., LTD.

제15장 조사 방법

제16장 부록

KTH 25.11.28With a CAGR of 18.8%, the global battery manufacturing equipment market is projected to grow from USD 15.63 billion in 2025 to USD 36.94 billion by 2030. Market expansion is driven by the rapid rise of electric mobility, growing demand for energy storage systems, and increasing adoption of automated, high-precision manufacturing technologies. Equipment such as coating, calendering, cell assembly, and formation systems is being widely deployed to improve production efficiency, consistency of quality, and scalability in gigafactory operations. The integration of AI, robotics, and IoT-enabled platforms is transforming battery production by enabling predictive maintenance, digital process control, and real-time performance optimization.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Machine Type, Battery Type, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

Additionally, strong government incentives for clean energy manufacturing and the push for localized battery production across major regions are further supporting market growth. As manufacturers focus on sustainability, cost efficiency, and production flexibility, the battery manufacturing equipment market is set to play a pivotal role in driving global electrification and shaping the future of advanced energy manufacturing.

"Coating & drying machines to record strong growth with rising focus on high-precision battery production"

The coating & drying machines segment is projected to grow at a significant CAGR in the battery manufacturing equipment market during the forecast period, driven by increasing demand for high-precision and energy-efficient electrode manufacturing. These machines are crucial for achieving uniform material coating and consistent electrode performance, which directly impact battery capacity, efficiency, and overall quality. Manufacturers are investing in automated, AI-enabled, and energy-optimized coating and drying systems to enhance throughput, reduce defects, and lower operational costs. The growing need for process consistency, scalability, and material optimization in large-scale battery production is further driving the adoption of equipment. Supported by the rapid expansion of EV and energy storage manufacturing facilities, along with the push for sustainable and high-performance battery technologies, the coating and drying machines segment is expected to register strong growth, becoming a vital component of the global battery manufacturing ecosystem.

"Automotive segment to grow with the highest CAGR driven by expanding EV production"

The automotive segment is projected to grow at the highest CAGR in the battery manufacturing equipment market during the forecast period, fueled by the rapid global shift toward electric mobility and rising investments in EV battery production facilities. Automakers are increasingly focusing on in-house and localized battery manufacturing to secure supply chains, reduce costs, and enhance technological competitiveness. This trend is driving significant demand for advanced equipment used in electrode manufacturing, cell assembly, formation, and testing processes that ensure precision, scalability, and efficiency. The integration of automation, robotics, and digital monitoring systems is further transforming EV battery production, enabling higher output and improved quality control. Additionally, government incentives promoting clean transportation and sustainable manufacturing are accelerating the deployment of large-scale gigafactories. As electric vehicle adoption continues to surge across major markets, the automotive segment will remain the primary driver of growth for the battery manufacturing equipment market, reinforcing global efforts toward decarbonization and industrial electrification.

"Asia Pacific to witness the highest growth driven by expanding gigafactories and strong government support"

The Asia Pacific region is expected to achieve the highest CAGR in the battery manufacturing equipment market, driven by rapid electric vehicle production, investments in energy storage, and the establishment of large-scale battery gigafactories in countries such as China, Japan, South Korea, and India. Government support for clean energy and industrial automation, along with a skilled labor force and strong supply chain, enhances the region's competitive advantage. The adoption of automated and AI-enabled production systems is boosting efficiency. Major industry players are expanding R&D and production in the region to meet rising demand. As electrification and renewable energy continue to grow, the Asia Pacific is expected to remain the leading region in the battery manufacturing equipment market.

Breakdown of primaries

A variety of executives from key organizations operating in the battery manufacturing equipment market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1-40%, Tier 2-35%, and Tier 3-25%

- By Designation: Directors-40%, C-level-45%, and Others-15%

- By Region: Asia Pacific-41%, North America-26%, Europe-28%, and RoW-5%

Note: The RoW region includes the Middle East, Africa, and South America. Other designations include product, sales, and marketing managers. Three tiers of companies have been defined based on their total revenue as of 2024: Tier 3, with revenue less than USD 300 million; Tier 2, with revenue between USD 300 million and USD 1 billion; and Tier 1, with revenue exceeding USD 1 billion.

Major players profiled in this report: Hitachi High-Tech Corporation (Japan), Durr Group (Germany), ANDRITZ Schuler GmbH (Germany), Nordson Corporation (US), Lead Intelligent Equipment Co., Ltd. (China), Yinghe Technology Co., Ltd. (China), Lyric (China), Buhler (Switzerland), ROSENDAHL NEXTROM (Austria), HIRANO TECSEED Co., Ltd. (Japan), CKD Corporation (Japan), Mondragon Assembly (Spain), Semco Infratech (India), DAIICHI JITSUGYO CO., LTD. (Japan), Charles Ross & Son Company (US), Nagano Automation (Japan), Foshan Golden Milky Way Intelligent Equipment Co., Ltd. (China), Kampf LSF (Germany), Jiangsu KATOP Automation Co., Ltd. (China), Targray (Canada), Xiamen Tmax Battery Equipments Limited (China), Xiamen Lith Machine Limited (China), XIAMEN TOB NEW ENERGY TECHNOLOGY Co., LTD. (China), Gelon LIB Group Co., Ltd. (China), and Xingtai Zhaoyang Machinery Manufacturing Co., Ltd. (China). These leading companies offer a wide range of advanced equipment solutions, spanning electrode manufacturing, coating, calendering, cell assembly, and testing, and have a strong global presence across established and emerging battery production markets.

Research Coverage

This report on the battery manufacturing equipment market offers a comprehensive analysis, categorized by battery type, machine type, application, and region. By battery type, the market is segmented into NCA, NMC, LFP, LMO, LCO, and LTO. By machine type, it covers mixing machines, coating and drying machines, calendering machines, slitting machines, electrode stacking machines, assembling and handling machines, and formation and testing machines. By application, the market is categorized into automotive, renewable energy, industrial, consumer electronics, and others. The regional analysis includes North America, Europe, Asia Pacific, and the Rest of the World (RoW). This segmentation provides detailed insights into emerging growth opportunities, key trends, and technological advancements that are shaping the global battery manufacturing equipment industry.

Reasons to buy the report

The report will assist leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall market and its sub-segments. This report will help stakeholders understand the competitive landscape and gain valuable insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the battery manufacturing equipment market and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (rising EV adoption driving demand for next-gen manufacturing technologies, global gigafactory expansion initiatives, advancements in battery technology, policy-driven electrification mandates), restraints (capital-intensive plant setups limiting scalability), opportunities (renewable energy integration fueling demand for advanced equipment, customization in production systems, industrial automation & electrification of material handling equipment, AI-powered smart manufacturing), and challenges (rapid technological shifts, evolving consumer demands & market volatility) influencing the growth of the battery manufacturing equipment market

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the battery manufacturing equipment market

- Market Development: Comprehensive information about lucrative markets-the report analyzes the battery manufacturing equipment market across varied regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the battery manufacturing equipment market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Hitachi High-Tech Corporation (Japan), Durr Group (Germany), Lead Intelligent Equipment Co., Ltd. (China), ANDRITZ Schuler GmbH (Germany), Yinghe Technology Co., Ltd. (China), etc.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BATTERY MANUFACTURING EQUIPMENT MARKET

- 3.2 BATTERY MANUFACTURING EQUIPMENT MARKET, BY MACHINE TYPE

- 3.3 BATTERY MANUFACTURING EQUIPMENT MARKET, BY BATTERY TYPE

- 3.4 BATTERY MANUFACTURING EQUIPMENT MARKET, BY APPLICATION

- 3.5 BATTERY MANUFACTURING EQUIPMENT MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

- 3.6 BATTERY MANUFACTURING EQUIPMENT MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising EV adoption drives demand for next-gen manufacturing technologies

- 4.2.1.2 Global gigafactory expansion initiatives

- 4.2.1.3 Advancements in battery technology

- 4.2.1.4 Policy-driven electrification mandates

- 4.2.2 RESTRAINTS

- 4.2.2.1 Capital-intensive plant setups limit scalability

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Renewable energy integration fuels demand for advanced equipment

- 4.2.3.2 Customization in production systems unlocks scalability and efficiency

- 4.2.3.3 Industrial automation and electrification of material-handling equipment

- 4.2.3.4 AI-powered smart manufacturing unlocks next-level efficiency

- 4.2.4 CHALLENGES

- 4.2.4.1 Keeping pace with rapid technological shifts

- 4.2.4.2 Evolving consumer demands and market volatility

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.5 STRATEGIC ALLIANCES IN EV SECTOR

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 BARGAINING POWER OF SUPPLIERS

- 5.1.2 BARGAINING POWER OF BUYERS

- 5.1.3 THREAT OF NEW ENTRANTS

- 5.1.4 THREAT OF SUBSTITUTES

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- 5.2.4 TRENDS IN RENEWABLE ENERGY INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING ANALYSIS OF BATTERY MANUFACTURING EQUIPMENT, BY KEY PLAYER

- 5.5.2 INDICATIVE SELLING PRICE, BY MACHINE TYPE

- 5.5.3 INDICATIVE PRICING ANALYSIS, BY REGION

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 850650)

- 5.6.2 EXPORT SCENARIO (HS CODE 850650)

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 BUHLER HELPED BRITISHVOLT WITH LOW-CARBON BATTERY MIXING TECHNOLOGY THAT STREAMLINED PRODUCTION PROCESS AND ENHANCED BATTERY PERFORMANCE

- 5.10.2 DURR ASSISTED CELLFORCE WITH ADVANCED COATING ELECTRODE TECHNOLOGY THAT IMPROVED OPERATIONAL CAPABILITIES

- 5.10.3 WUXI HELPED INOBAT INSTALL BATTERY PRODUCTION TURNKEY SOLUTIONS TO MANUFACTURE PREMIUM ELECTRIC BATTERIES

- 5.10.4 DURR PROVIDED CATL WITH INNOVATIVE TECHNOLOGY FOR ELECTRODE PRODUCTION THAT ENHANCED PRODUCTION EFFECTIVENESS

- 5.11 IMPACT OF 2025 US TARIFFS-BATTERY MANUFACTURING EQUIPMENT MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, AND INNOVATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 MATERIAL PROCESSING TECHNOLOGIES

- 6.1.2 LASER PROCESSING TECHNOLOGIES

- 6.2 ADJACENT TECHNOLOGIES

- 6.2.1 EV TECHNOLOGIES

- 6.2.2 ENERGY STORAGE SYSTEMS

- 6.2.3 RECYCLING TECHNOLOGIES

- 6.3 COMPLEMENTARY TECHNOLOGIES

- 6.3.1 QUALITY CONTROL TECHNOLOGIES

- 6.3.2 AUTOMATION AND DIGITAL TRANSFORMATION

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.5 PATENT ANALYSIS

- 6.6 IMPACT OF AI ON BATTERY MANUFACTURING EQUIPMENT MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES IN BATTERY MANUFACTURING EQUIPMENT

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN BATTERY MANUFACTURING EQUIPMENT MARKET

- 6.6.4 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT AI IN BATTERY MANUFACTURING EQUIPMENT MARKET

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 REGULATIONS

- 7.1.3 STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS VERTICALS

9 BATTERY MANUFACTURING EQUIPMENT MARKET, BY MACHINE TYPE

- 9.1 INTRODUCTION

- 9.2 MIXING MACHINES

- 9.2.1 ADVANCED SLURRY PREPARATION TECHNOLOGIES ENABLING HIGH-YIELD BATTERY PRODUCTION

- 9.3 COATING & DRYING MACHINES

- 9.3.1 UNIFORMITY AND PROCESS CONTROL ENHANCING BATTERY PERFORMANCE

- 9.4 CALENDERING MACHINES

- 9.4.1 PRECISION SOLUTIONS DRIVING ENERGY DENSITY AND ELECTRODE UNIFORMITY

- 9.5 SLITTING MACHINES

- 9.5.1 ADVANCED SLITTING TECHNOLOGIES ENSURING SAFETY, PRECISION, AND YIELD OPTIMIZATION

- 9.6 ELECTRODE STACKING MACHINES

- 9.6.1 ADVANCED STACKING MACHINES IMPROVING ALIGNMENT QUALITY AND SCALABILITY FOR EV AND ESS APPLICATIONS

- 9.7 ASSEMBLING & HANDLING MACHINES

- 9.7.1 PRECISION ASSEMBLY AND HANDLING SOLUTIONS DRIVING CELL CONSISTENCY AND PRODUCTION SCALABILITY

- 9.8 FORMATION & TESTING MACHINES

- 9.8.1 GROWING EMPHASIS ON QUALITY ASSURANCE AND PERFORMANCE RELIABILITY DRIVING DEMAND FOR FORMATION AND TESTING EQUIPMENT

10 BATTERY MANUFACTURING EQUIPMENT MARKET, BY BATTERY TYPE

- 10.1 INTRODUCTION

- 10.2 NCA

- 10.2.1 INCREASING ADOPTION OF HIGH NICKEL CATHODES SUPPORTING DEMAND FOR SPECIALIZED MANUFACTURING EQUIPMENT

- 10.3 NMC

- 10.3.1 RISING DEMAND FOR BALANCED ENERGY DENSITY AND SAFETY CHARACTERISTICS DRIVING EQUIPMENT INVESTMENTS IN NMC BATTERY PRODUCTION

- 10.4 LFP

- 10.4.1 SURGING ADOPTION OF LFP IN EVS AND ESS TO DRIVE DEMAND FOR HIGH-VOLUME, COST-EFFICIENT MANUFACTURING EQUIPMENT

- 10.5 LMO

- 10.5.1 FOCUS ON COST-EFFECTIVE AND HIGH-POWER SOLUTIONS SUPPORTING LMO DEPLOYMENT

- 10.6 LCO

- 10.6.1 HIGH ENERGY DENSITY REQUIREMENTS IN PORTABLE ELECTRONICS DRIVING LCO DEMAND

- 10.7 LTO

- 10.7.1 HIGH CYCLE AND FAST CHARGING CAPABILITIES OF LTO BATTERIES DRIVING ADVANCED EQUIPMENT ADOPTION

11 BATTERY MANUFACTURING EQUIPMENT MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 AUTOMOTIVE

- 11.2.1 RISING EV PENETRATION DRIVING DEMAND FOR ADVANCED BATTERY MANUFACTURING EQUIPMENT

- 11.3 RENEWABLE ENERGY

- 11.3.1 SURGING RENEWABLE INSTALLATIONS ACCELERATING NEED FOR ADVANCED ENERGY STORAGE PRODUCTION SYSTEMS

- 11.4 INDUSTRIAL

- 11.4.1 RISING DEMAND FOR LITHIUM-ION BATTERIES IN MATERIAL HANDLING AND AUTOMATION DRIVING EQUIPMENT ADOPTION

- 11.5 CONSUMER ELECTRONICS

- 11.5.1 HIGH-VOLUME DEMAND FOR ENERGY-DENSE AND RAPID-CHARGING CELLS TO ACCELERATE CONSUMER ELECTRONICS BATTERY PRODUCTION

- 11.6 OTHERS

12 BATTERY MANUFACTURING EQUIPMENT MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Rising battery demand accelerates investments in advanced manufacturing equipment

- 12.2.2 CANADA

- 12.2.2.1 Growing battery demand and gigafactory investments drive market

- 12.2.3 MEXICO

- 12.2.3.1 Expanding EV exports and rising local production drive equipment market growth

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Clean energy transition and EV expansion driving demand for advanced manufacturing equipment in Germany

- 12.3.2 HUNGARY

- 12.3.2.1 Expanding gigafactory investments and foreign partnerships drive equipment market growth in Hungary

- 12.3.3 POLAND

- 12.3.3.1 Poland's leadership in battery manufacturing to drive market growth

- 12.3.4 UK

- 12.3.4.1 Accelerating gigafactory expansion and strategic investments to drive battery equipment demand

- 12.3.5 FRANCE

- 12.3.5.1 Government-backed expansion of lithium and EV battery production to drive equipment market growth

- 12.3.6 SWEDEN

- 12.3.6.1 Sustainability-driven industrial expansion to drive battery equipment demand

- 12.3.7 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 China's strategic leadership in battery manufacturing to drive equipment demand

- 12.4.2 JAPAN

- 12.4.2.1 Rising gigafactory investments and EV transition to drive equipment demand

- 12.4.3 SOUTH KOREA

- 12.4.3.1 Rising government investments and strategic alliances to drive growth in South Korea

- 12.4.4 AUSTRALIA

- 12.4.4.1 Rising EV adoption and renewable energy expansion to boost battery manufacturing landscape

- 12.4.5 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 ROW

- 12.5.1 MIDDLE EAST

- 12.5.1.1 Renewable investments and industrial diversification are accelerating battery manufacturing growth

- 12.5.2 SOUTH AMERICA

- 12.5.2.1 Strategic lithium reserves and rising EV adoption strengthening battery manufacturing growth

- 12.5.3 AFRICA

- 12.5.3.1 Expansion of electric mobility ecosystem to drive market

- 12.5.1 MIDDLE EAST

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 13.5.1 COMPANY VALUATION

- 13.5.2 FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Machine type footprint

- 13.7.5.4 Application footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2025

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 HITACHI HIGH-TECH CORPORATION

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 DURR GROUP

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Other developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 LEAD INTELLIGENT EQUIPMENT CO., LTD.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Other developments

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses/Competitive threats

- 14.1.4 ANDRITZ SCHULER GMBH

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Other developments

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses/Competitive threats

- 14.1.5 YINGHE TECHNOLOGY CO., LTD.

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Other developments

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses/Competitive threats

- 14.1.6 BUHLER

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Other developments

- 14.1.7 LYRIC

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Other developments

- 14.1.8 NORDSON CORPORATION

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.9 ROSENDAHL NEXTROM

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.10 CKD CORPORATION

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.11 DAIICHI JITSUGYO CO., LTD.

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.1 HITACHI HIGH-TECH CORPORATION

- 14.2 OTHER PLAYERS

- 14.2.1 CHARLES ROSS & SON COMPANY

- 14.2.2 FOSHAN GOLDEN MILKY WAY INTELLIGENT EQUIPMENT CO., LTD.

- 14.2.3 HIRANO TECSEED CO., LTD

- 14.2.4 KAMPF LSF

- 14.2.5 MONDRAGON ASSEMBLY

- 14.2.6 NAGANO AUTOMATION

- 14.2.7 JIANGSU KATOP AUTOMATION CO., LTD.

- 14.2.8 SEMCO INFRATECH

- 14.2.9 XIAMEN TMAX BATTERY EQUIPMENT LIMITED

- 14.2.10 XIAMEN LITH MACHINE LIMITED

- 14.2.11 XIAMEN TOB NEW ENERGY TECHNOLOGY CO., LTD.

- 14.2.12 GELON LIB GROUP CO., LTD.

- 14.2.13 TARGRAY

- 14.2.14 XINGTAI ZHAOYANG MACHINERY MANUFACTURING CO., LTD.

15 RESEARCH METHODOLOGY

- 15.1 RESEARCH DATA

- 15.1.1 SECONDARY AND PRIMARY RESEARCH

- 15.1.2 SECONDARY DATA

- 15.1.2.1 List of major secondary sources

- 15.1.2.2 Key data from secondary sources

- 15.1.3 PRIMARY DATA

- 15.1.3.1 Primary interviews with experts

- 15.1.3.2 Key data from primary sources

- 15.1.3.3 Key industry insights

- 15.1.3.4 Breakdown of primaries

- 15.2 MARKET SIZE ESTIMATION

- 15.2.1 TOP-DOWN APPROACH

- 15.2.2 BOTTOM-UP APPROACH

- 15.2.3 BASE NUMBER CALCULATION

- 15.3 MARKET FORECAST APPROACH

- 15.3.1 SUPPLY SIDE

- 15.3.2 DEMAND SIDE

- 15.4 DATA TRIANGULATION

- 15.5 RESEARCH ASSUMPTIONS

- 15.6 RESEARCH LIMITATIONS

- 15.7 RISK ASSESSMENT

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS