|

시장보고서

상품코드

1876463

혈관 이미징 시장(-2030년) : 제품 유형, 용도, 최종 사용자별Vascular Imaging Market by Product Type, Application, End User - Global Forecast to 2030 |

||||||

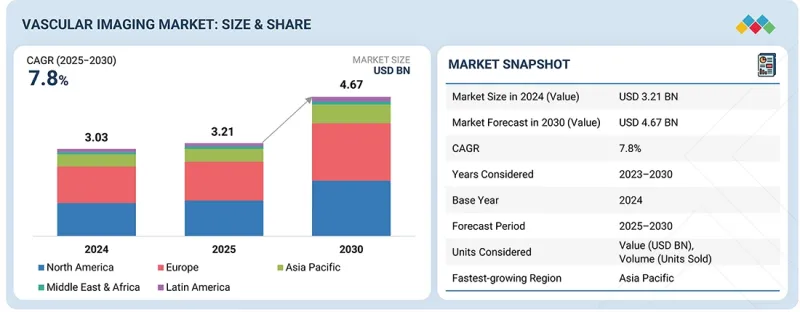

세계의 혈관 이미징 시장 규모는 2025년 31억 9,000만 달러에서 예측 기간 동안 CAGR 7.3%로 추이하고, 2030년에는 45억 4,000만 달러에 이를 것으로 예측됩니다.

심혈관 질환 증가, 조기 및 정밀 진단의 필요성, 혈관 질환의 위험이 높은 노인 인구의 확대가 혈관 이미징 시장의 성장을 뒷받침하고 있습니다. 3D 이미징, AI를 활용한 진단, 비침습 기술 등의 기술 혁신에 의해 진단의 정밀도와 효율이 향상되어 보다 광범위한 도입이 진행되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(달러) |

| 부문 | 제품 유형, 용도, 최종 사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

게다가 특히 신흥경제국에서는 의료투자 증가, 인프라의 개선, 예방의료에 대한 중점적인 대처가 진행되고 있는 것이 시장 확대에 크게 기여하고 있습니다.

"제품 유형별로 시스템 및 콘솔 부문이 예측 기간 동안 최대 CAGR을 기록할 전망"

이는 혈관 내 초음파(IVUS), 광간섭 단층계(OCT), 근적외선 분광법(NIRS) 등의 고급 이미징 양식을 가능하게하는 핵심 플랫폼 역할을 하기 때문입니다. 이 시스템은 정확한 진단 및 가이드 개입에 필수적인 고해상도 실시간 시각화를 제공하여 병원, 외래수술센터(ASC) 및 전문 클리닉 수요를 견인하고 있습니다. AI와의 통합, 강화된 영상 소프트웨어, 하이브리드 이미징 기능 등의 지속적인 기술 혁신은 임상적 유용성과 채용을 촉진하고 있습니다. 또한 호환 가능한 카테터와 액세서리의 지속적인 수익은 시장 성장을 더욱 가속화하고 시스템과 콘솔은 제조업체에게 중요한 투자 대상이되었습니다.

"용도별로는 2024년 혈관염 부문이 가장 높은 CAGR을 기록"

이 배경은 이환율 증가와 혈관 내 염증을 정확하게 진단 및 모니터링하는 중요성이 높아지고 있다는 것을 들 수 있습니다. PET, MRI, CT 혈관조영 등의 영상 진단 기술의 진보에 의해 혈관염의 조기 단계에서의 검출 및 평가 능력이 대폭 향상되어, 시기 적절하고 표적을 좁힌 치료가 가능하게 되었습니다. 게다가, 혈관염 관리에서 혈관 이미징의 중요성에 대한 임상가의 인식 증가와 고급 영상 기술에 대한 투자 증가가 시장 성장을 가속화하고 있습니다. 혈관염의 만성적 성질과 심각한 합병증을 유발할 가능성은 고급 혈관 이미징 솔루션에 대한 수요를 더욱 강조하고 이 분야의 견조한 확대를 뒷받침하고 있습니다.

"예측 기간 중 아시아태평양이 가장 높은 성장률을 기록할 전망"

아시아태평양은 고령화에 따른 심혈관 질환 증가, 앉기 쉬운 생활 습관, 당뇨병 및 고혈압의 유병률 상승을 배경으로 혈관 이미징 시장에서 가장 높은 CAGR을 나타낼 것으로 예측되고 있습니다. 의료 인프라에 대한 대규모 투자, 조기 진단을 촉진하는 정부 프로그램, 첨단 영상 기술의 급속한 보급이 수요를 더욱 강화하고 있습니다. 또한 의료비 지출 증가, 저렴한 영상 진단 솔루션에 대한 수요, 중국과 인도와 같은 주요 경제 지역에서 AI 기반 도구의 통합이 이 지역 시장 성장을 강력하게 추진하고 있습니다.

본 보고서에서는 세계의 혈관 이미징 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인 분석, 기술 및 특허 동향, 법규제 환경, 사례 연구, 시장 규모 추이와 예측, 각종 구분 및 지역/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

- 혈관 이미징 시장 개요

- 북미 : 혈관 이미징 시장(국가 및최종 사용자별)

- 혈관 이미징 시장의 지리적 스냅샷

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 미충족 요구

- 상호접속된 시장과 분야 횡단적인 기회

- Tier 1/2/3 기업의 전략적 움직임

제6장 업계 동향

- Porter's Five Forces 분석

- 거시경제지표

- 공급망 분석

- 밸류체인 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 주요 회의 및 이벤트

- 고객의 사업에 영향을 미치는 동향

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 미국 관세의 영향

제7장 기술, 특허, 디지털, AI 도입을 통한 전략적 혁신

- 주요 신기술

- MRI

- CT

- 초음파 영상 진단

- 보완적 기술

- 특허 분석

- 혈관 영상 시장에서 AI의 영향

- 성공 사례와 실세계에의 응용

제8장 규제 상황

- 규제 및 규정 준수

- 업계 표준

- 고객정세와 구매행동

- 주요 이해관계자와 구매평가기준

- 채용 장벽과 내부 과제

- 다양한 최종 사용자 고객의 미충족 요구

제9장 혈관 이미징 시장 : 제품 유형별

- 시스템 및 콘솔

- 초음파

- MRI

- X선

- 핵 이미징 시스템

- CT 스캐너

- 광 간섭 단층 촬영

- 기타

- 액세서리 및 소모품

- 소프트웨어 및 서비스

- 스트레인 이미징

- 고공간 및 시간 해상도

- 자동 혈관 형태 평가

- 간소화된 워크플로우

- 기타

제10장 혈관 이미징 시장 : 용도별

- 아테롬성 동맥경화증

- 동맥류

- 맥관염

- 심부정맥혈전증

- 동정맥 기형 및 누공

- 기타

제11장 혈관 이미징 시장 : 최종 사용자별

- 병원

- 진단 영상 센터

- 외래수술센터(ASC)

- 기타

제12장 혈관 이미징 시장 : 지역별

- 북미

- 북미 : 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽: 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양: 거시경제 전망

- 일본

- 중국

- 인도

- 한국

- 호주

- 기타

- 라틴아메리카

- 라틴아메리카: 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카 : 거시경제 전망

- GCC 국가

- 기타

제13장 경쟁 구도

- 주요 기업의 전략/유력 기업

- 수익 분석

- 시장 점유율 분석

- 기업평가 및 재무지표

- 브랜드/제품 비교

- 기업평가 매트릭스 : 혈관 이미징 시장

- 기업평가 매트릭스: 스타트업/중소기업

- 경쟁 시나리오

제14장 기업 프로파일

- 주요 기업

- SIEMENS HEALTHINEERS AG

- GE HEALTHCARE

- FUJIFILM CORPORATION

- PHILIPS HEALTHCARE

- SHIMADZU CORPORATION

- UNITED IMAGING HEALTHCARE CO., LTD

- SAMSUNG HEALTHCARE

- SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- CANON MEDICAL SYSTEMS CORPORATION

- KONICA MINOLTA, INC.

- NEUSOFT CORPORATION

- TERUMO CORPORATION

- HOLOGIC, INC.

- BRACCO IMAGING SPA

- BAYER AG

- GUERBET

- NIPRO EUROPE GROUP COMPANIES

- 기타 기업

- ACCUVEIN, INC.

- CHISON MEDICAL TECHNOLOGIES CO., LTD.

- SONOSCAPE MEDICAL CORP.

- PIUR IMAGING

- ARINETA LTD

- HEALCERION CO., LTD.

- ECHONOUS INC.

- BEIJING WEMED MEDICAL EQUIPMENT

- CLARIUS

- ESAOTE SPA

제15장 부록

JHS 25.12.03The global vascular imaging market is projected to reach USD 4.54 billion by 2030 from USD 3.19 billion in 2025, growing at a CAGR of 7.3% during the forecast period. The growth in the vascular imaging market is fueled by the increasing burden of cardiovascular diseases, the need for early and precise diagnosis, and the expanding elderly population vulnerable to vascular conditions. Advances in technology, including 3D imaging, AI-powered diagnostics, and non-invasive techniques, are enhancing accuracy and efficiency, driving wider adoption.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Furthermore, rising healthcare investments, improved infrastructure, and greater emphasis on preventive care, especially across emerging economies, are contributing significantly to the market's expansion.

By product type, the systems & consoles segment is expected to register the highest CAGR during the forecast period.

By product type, the systems & consoles segment is expected to account for the highest CAGR in the vascular imaging market because they serve as the core platforms enabling advanced imaging modalities such as intravascular ultrasound (IVUS), optical coherence tomography (OCT), and near-infrared spectroscopy (NIRS). These systems provide high-resolution, real-time visualization critical for accurate diagnosis and guided interventions, driving demand in hospitals, ambulatory surgery centers, and specialty clinics. Continuous technological innovations-such as integration with AI, enhanced imaging software, and hybrid imaging capabilities-boost their clinical utility and adoption. Additionally, recurring revenue from compatible catheters and accessories further propels market growth, making systems and consoles a key investment focus for manufacturers.

By application, the vasculitis segment accounted for the highest CAGR of the market in 2024.

In the vascular imaging market, the vasculitis segment dominated the market due to its increasing prevalence and the critical need for accurate diagnosis and monitoring of inflammation in blood vessels. Advances in imaging technologies such as PET, MRI, and CT angiography have significantly improved the ability to detect and assess vasculitis at early stages, enabling timely and targeted treatment. Additionally, growing awareness among clinicians about the importance of vascular imaging in managing vasculitis, coupled with rising investment in advanced imaging modalities, is accelerating market growth. The chronic nature of vasculitis and its potential to cause severe complications further underscores the demand for sophisticated vascular imaging solutions, fueling robust expansion in this segment.

Asia Pacific is expected to register the highest growth rate in the market during the forecast period.

The Asia-Pacific region is expected to register the highest CAGR in the vascular imaging market, driven by the growing burden of cardiovascular diseases linked to an aging population, sedentary lifestyles, and the increasing prevalence of diabetes and hypertension. Significant investments in healthcare infrastructure, government programs promoting early diagnosis, and the rapid adoption of advanced imaging technologies are further fueling demand. Additionally, rising healthcare spending, the need for affordable imaging solutions, and the integration of AI-based tools across major economies such as China and India are propelling the region's strong market growth.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (40%), Tier 2 (30%), and Tier 3 (30%)

- By Designation: C-level Executives (55%), Directors (27%), and Others (18%)

By Region: North America (35%), Europe (32%), Asia Pacific (25%), Latin America (6%), and the Middle East & Africa (2%)

The prominent players in this market are Philips Healthcare (Netherlands), GE Healthcare (US), Canon Medical Systems Corporation (Japan), Siemens Healthineers (Germany), Shenzhen Mindray Bio-Medical Electronics (China), FUJIFILM Corporation (Japan), Hologic Inc. (US), Samsung Electronics Co., Ltd. (South Korea), Shimadzu Corporation (Japan), United Imaging Healthcare (China), Konica Minolta (Japan), Neusoft Corporation (China), Bracco Imaging SPA (Italy), Bayer AG (Germany), Guerbet (France), Nipro Europe Group Companies (Belgium).

Research Coverage

The vascular imaging market is segmented by product type, application, end user, and region. Key factors influencing market growth include driving forces, restraints, opportunities, and challenges for stakeholders. The report also reviews the leading companies competing in the Vascular imaging market. A micro-level analysis can be conducted to examine trends, growth opportunities, and contributions to the market. Additionally, it highlights potential revenue growth opportunities across various market segments in five major regions.

Key Benefits of Buying the Report

The report is valuable for new entrants in the vascular imaging market as it provides comprehensive information about the market. This information is essential for understanding various investment opportunities. The report provides insights into both key and smaller players in the market, which can help create a solid basis for risk analysis when making investment decisions. It accurately segments the market by end users and regions, providing focused insights into specific market segments. Additionally, the report highlights key trends, challenges, growth drivers, and opportunities to support strategic decision-making through a thorough analysis.

The report provides insights into the following points:

- Key drivers (rising prevalence of cardiovascular diseases, minimally invasive and personalized interventions, technological advancements in vascular imaging technology, increasing investments, funds, and grants by public-private organizations), restraints (radiation exposure and contrast-related risks, unfavorable reimbursement scenario, high costs and resource requirements), opportunities (expanding economies offer high growth potential, increasing establishment of hospitals and diagnostic imaging centers, increasing adoption of teleradiology), and challenges (hospital budget cuts, increasing adoption of refurbished diagnostic imaging systems, dearth of trained professionals, image quality limitations because of patient and physiological motion) fueling the market growth of vascular imaging market.

- Product Development/Innovation: Emerging technologies in space, R&D, recent product launches & approvals in the vascular imaging market.

- Market Growth: In-depth insights into remunerative markets report analyze the vascular imaging market across varied geographies.

- Market Diversification: Detailed analysis of new products, unexplored geographies, latest trends, and investments in the vascular imaging market

- Competitive Assessment: Detailed assessment of market share, service offerings, leading strategies of key players such as Philips Healthcare (Netherlands), GE Healthcare (US), Canon Medical Systems Corporation (Japan), Siemens Healthineers (Germany), and FUJIFILM Corporation (Japan), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key industry insights

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION APPROACH

- 2.2.1 APPROACH 1: COMPANY REVENUE ESTIMATION APPROACH

- 2.2.2 APPROACH 2: CUSTOMER-BASED MARKET ESTIMATION

- 2.3 MARKET FORECASTING

- 2.4 DATA TRIANGULATION AND MARKET BREAKDOWN

- 2.5 MARKET SHARE ASSESSMENT

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 VASCULAR IMAGING MARKET OVERVIEW

- 4.2 NORTH AMERICA: VASCULAR IMAGING MARKET, BY COUNTRY AND END USER, 2025

- 4.3 GEOGRAPHIC SNAPSHOT OF VASCULAR IMAGING MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising prevalence of cardiovascular diseases

- 5.2.1.2 Growing inclination toward minimally invasive and personalized interventions

- 5.2.1.3 Technological advancements in vascular imaging systems

- 5.2.1.4 Increasing investments, funds, and grants by public-private organizations

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost and resource requirements

- 5.2.2.2 Radiation exposure and contrast-related risks

- 5.2.2.3 Unfavorable reimbursement scenario

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth potential in emerging economies

- 5.2.3.2 Increasing establishment of hospitals and diagnostic imaging centers

- 5.2.3.3 Rising adoption of teleradiology

- 5.2.4 CHALLENGES

- 5.2.4.1 Need to maintain high-quality, artifact-free images

- 5.2.4.2 Hospital budget cuts

- 5.2.4.3 Increasing adoption of refurbished vascular imaging systems

- 5.2.4.4 Dearth of trained professionals

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS

- 5.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 BARGAINING POWER OF BUYERS

- 6.1.2 BARGAINING POWER OF SUPPLIERS

- 6.1.3 THREAT OF NEW ENTRANTS

- 6.1.4 THREAT OF SUBSTITUTES

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 MACROECONOMIC INDICATORS

- 6.2.1 INTRODUCTION

- 6.2.2 GDP TRENDS AND FORECAST

- 6.2.3 TRENDS IN GLOBAL ENVIRONMENTAL INDUSTRY

- 6.2.4 TRENDS IN GLOBAL HEALTHCARE INDUSTRY

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.3.1 PROMINENT COMPANIES

- 6.3.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 6.3.3 END USERS

- 6.4 VALUE CHAIN ANALYSIS

- 6.4.1 RESEARCH & DEVELOPMENT

- 6.4.2 RAW MATERIAL PROCUREMENT

- 6.4.3 MANUFACTURING & ASSEMBLY

- 6.4.4 DISTRIBUTION, MARKETING & SALES, AND POST-SALE SERVICES

- 6.5 ECOSYSTEM ANALYSIS

- 6.6 PRICING ANALYSIS

- 6.7 TRADE ANALYSIS

- 6.7.1 TRADE DATA FOR COMPUTED TOMOGRAPHY SYSTEMS (HS CODE 902212)

- 6.7.1.1 Import data

- 6.7.1.2 Export data

- 6.7.2 TRADE ANALYSIS FOR ULTRASOUND SYSTEMS (HS CODE 901812)

- 6.7.2.1 Import data

- 6.7.2.2 Export data

- 6.7.3 TRADE ANALYSIS FOR MAGNETIC RESONANCE IMAGING SYSTEMS (HS CODE 901813)

- 6.7.3.1 Import data

- 6.7.3.2 Export data

- 6.7.4 TRADE ANALYSIS FOR X-RAY SYSTEMS (HS CODE 902214)

- 6.7.4.1 Import data

- 6.7.4.2 Export data

- 6.7.1 TRADE DATA FOR COMPUTED TOMOGRAPHY SYSTEMS (HS CODE 902212)

- 6.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.9 TRENDS IMPACTING CUSTOMERS' BUSINESSES

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 CASE STUDY ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRY/REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES

7 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 7.1 KEY EMERGING TECHNOLOGIES

- 7.1.1 MAGNETIC RESONANCE IMAGING (MRI)

- 7.1.2 COMPUTED TOMOGRAPHY (CT)

- 7.1.3 ULTRASOUND IMAGING

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 PICTURE ARCHIVING AND COMMUNICATION SYSTEMS (PACS)

- 7.2.2 ARTIFICIAL INTELLIGENCE (AI) FOR IMAGE ANALYSIS

- 7.3 PATENT ANALYSIS

- 7.4 IMPACT OF AI ON VASCULAR IMAGING MARKET

- 7.4.1 INTRODUCTION

- 7.4.2 TOP USE CASES AND MARKET POTENTIAL

- 7.4.3 BEST PRACTICES IN VASCULAR IMAGING MARKET

- 7.4.4 CASE STUDY ON AI IMPLEMENTATION IN VASCULAR IMAGING MARKET

- 7.4.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN THE VASCULAR IMAGING MARKET

- 7.5 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

8 REGULATORY LANDSCAPE

- 8.1 REGULATIONS AND COMPLIANCE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.1.1 North America

- 8.1.1.1.1 US

- 8.1.1.1.2 Canada

- 8.1.1.2 Europe

- 8.1.1.3 Asia Pacific

- 8.1.1.3.1 Japan

- 8.1.1.3.2 China

- 8.1.1.3.3 India

- 8.1.1.1 North America

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.2 INDUSTRY STANDARDS

- 8.3 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.3.1 DECISION-MAKING PROCESS

- 8.4 KEY STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.4.2 BUYING CRITERIA

- 8.5 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.6 UNMET NEEDS FROM VARIOUS END-USE CUSTOMERS

9 VASCULAR IMAGING MARKET, BY PRODUCT TYPE

- 9.1 INTRODUCTION

- 9.2 SYSTEMS & CONSOLES

- 9.2.1 ULTRASOUND

- 9.2.1.1 Duplex ultrasound

- 9.2.1.1.1 Ongoing shift toward non-invasive and radiation-free imaging techniques to drive market

- 9.2.1.2 Doppler ultrasound

- 9.2.1.2.1 Increasing prevalence of lifestyle-related conditions to propel market

- 9.2.1.1 Duplex ultrasound

- 9.2.2 MRI

- 9.2.2.1 Growing adoption of non-invasive diagnostic techniques to fuel market

- 9.2.3 X-RAY

- 9.2.3.1 High spatial resolution and real-time imaging ability to boost market

- 9.2.4 NUCLEAR IMAGING SYSTEMS

- 9.2.4.1 Increasing advancements in hybrid imaging systems to facilitate growth

- 9.2.5 CT SCANNERS

- 9.2.5.1 Wide applicability of CT in diagnosing vascular abnormalities to favor growth

- 9.2.6 OPTICAL COHERENCE TOMOGRAPHY

- 9.2.6.1 Ability to provide micron-level resolution to support growth

- 9.2.7 OTHER SYSTEMS & CONSOLES

- 9.2.1 ULTRASOUND

- 9.3 ACCESSORIES & CONSUMABLES

- 9.3.1 NEED FOR CONSISTENT IMAGE QUALITY AND PATIENT SAFETY TO FOSTER GROWTH

- 9.4 SOFTWARE & SERVICES

- 9.4.1 STRAIN IMAGING

- 9.4.1.1 Rising focus on early detection of vascular diseases to aid growth

- 9.4.2 HIGH SPATIAL AND TEMPORAL RESOLUTION

- 9.4.2.1 Increasing product development to facilitate growth

- 9.4.3 AUTOMATED VESSEL MORPHOLOGY ASSESSMENT

- 9.4.3.1 Need for precise and reproducible analysis to expedite growth

- 9.4.4 STREAMLINED PROCEDURAL WORKFLOW

- 9.4.4.1 Rising patient volume to contribute to growth

- 9.4.5 OTHER SOFTWARE & SERVICES

- 9.4.1 STRAIN IMAGING

10 VASCULAR IMAGING MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 ATHEROSCLEROSIS

- 10.2.1 GROWING GLOBAL BURDEN OF CARDIOVASCULAR DISEASES TO DRIVE MARKET

- 10.3 ANEURYSM

- 10.3.1 EXPANDING ACCESS TO DIAGNOSTIC FACILITIES TO BOOST MARKET

- 10.4 VASCULITIS

- 10.4.1 GROWING INCIDENCE OF AUTOIMMUNE AND INFLAMMATORY DISORDERS TO PROPEL MARKET

- 10.5 DEEP VEIN THROMBOSIS

- 10.5.1 INCREASING FOCUS ON PREVENTIVE HEALTHCARE AND TECHNOLOGICAL INNOVATIONS TO PROMOTE GROWTH

- 10.6 ARTERIOVENOUS MALFORMATIONS & FISTULAS

- 10.6.1 RISING USE OF MINIMALLY INVASIVE ENDOVASCULAR THERAPIES TO EXPEDITE GROWTH

- 10.7 OTHER APPLICATIONS

11 VASCULAR IMAGING MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 HOSPITALS

- 11.2.1 STRONG REIMBURSEMENT FRAMEWORKS AND GOVERNMENT SUPPORT FOR MODERNIZING HEALTHCARE INFRASTRUCTURE TO DRIVE MARKET

- 11.3 DIAGNOSTIC IMAGING CENTERS

- 11.3.1 INCREASING FOCUS ON OUTPATIENT CARE AND PREVENTIVE DIAGNOSTICS TO ENCOURAGE GROWTH

- 11.4 AMBULATORY SURGERY CENTERS

- 11.4.1 GROWING EMPHASIS ON VALUE-BASED CARE TO PROPEL MARKET

- 11.5 OTHER END USERS

12 VASCULAR IMAGING MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 12.2.2 US

- 12.2.2.1 High prevalence of chronic vascular diseases to drive market

- 12.2.3 CANADA

- 12.2.3.1 Rapidly aging population to support growth

- 12.3 EUROPE

- 12.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 12.3.2 GERMANY

- 12.3.2.1 High number of MRI and CT units to fuel market

- 12.3.3 UK

- 12.3.3.1 Increasing investments in imaging infrastructure to drive market

- 12.3.4 FRANCE

- 12.3.4.1 Increasing focus on early detection of vascular disorders and strong technological adoption to boost market

- 12.3.5 ITALY

- 12.3.5.1 Demographic shift toward aging population and increasing focus on non-invasive diagnostic solutions to aid growth

- 12.3.6 SPAIN

- 12.3.6.1 Growing access to advanced cancer vascular to propel market

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 12.4.2 JAPAN

- 12.4.2.1 Presence of universal healthcare coverage to fuel market

- 12.4.3 CHINA

- 12.4.3.1 Favorable government initiatives and demographic shift to aid growth

- 12.4.4 INDIA

- 12.4.4.1 Increasing number of vascular procedures and public & private investments to promote growth

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Growing awareness about diseases and rising applications of ultrasound to boost market

- 12.4.6 AUSTRALIA

- 12.4.6.1 Increasing healthcare spending to propel market

- 12.4.7 REST OF ASIA PACIFIC

- 12.5 LATIN AMERICA

- 12.5.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 12.5.2 BRAZIL

- 12.5.2.1 Favorable demographic conditions and coverage policies to propel market

- 12.5.3 MEXICO

- 12.5.3.1 Growing adoption of advanced diagnostic imaging systems to drive market

- 12.5.4 REST OF LATIN AMERICA

- 12.6 MIDDLE EAST & AFRICA

- 12.6.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 12.6.2 GCC COUNTRIES

- 12.6.2.1 Increasing prevalence of cardiovascular diseases, diabetes, and hypertension to support growth

- 12.6.3 REST OF MIDDLE EAST & AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 13.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN VASCULAR IMAGING MARKET

- 13.3 REVENUE ANALYSIS, 2021-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: VASCULAR IMAGING MARKET, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Product footprint

- 13.7.5.4 Application footprint

- 13.7.5.5 End-user footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES, UPGRADES, AND APPROVALS

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 SIEMENS HEALTHINEERS AG

- 14.1.1.1 Business overview

- 14.1.1.2 Products offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.3.2 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 GE HEALTHCARE

- 14.1.2.1 Business overview

- 14.1.2.2 Products offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches, upgrades, and approvals

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 FUJIFILM CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches, upgrades, and approvals

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats.

- 14.1.4 PHILIPS HEALTHCARE

- 14.1.4.1 Business overview

- 14.1.4.2 Products offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches, upgrades, and approvals

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 SHIMADZU CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.6 UNITED IMAGING HEALTHCARE CO., LTD

- 14.1.6.1 Business overview

- 14.1.6.2 Products offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches, upgrades, and approvals

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Expansions

- 14.1.7 SAMSUNG HEALTHCARE

- 14.1.7.1 Business overview

- 14.1.7.2 Products offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches, upgrades, and approvals

- 14.1.7.3.2 Deals

- 14.1.7.3.3 Other developments

- 14.1.8 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- 14.1.8.1 Business overview

- 14.1.8.2 Products offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches, upgrades, and approvals

- 14.1.8.3.2 Deals

- 14.1.9 CANON MEDICAL SYSTEMS CORPORATION

- 14.1.9.1 Business overview

- 14.1.9.2 Products offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches, upgrades, and approvals

- 14.1.9.3.2 Deals

- 14.1.9.3.3 Expansions

- 14.1.10 KONICA MINOLTA, INC.

- 14.1.10.1 Business overview

- 14.1.10.2 Products offered

- 14.1.11 NEUSOFT CORPORATION

- 14.1.11.1 Business overview

- 14.1.11.2 Products offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Product launches, upgrades, and approvals

- 14.1.12 TERUMO CORPORATION

- 14.1.12.1 Business overview

- 14.1.12.2 Products offered

- 14.1.13 HOLOGIC, INC.

- 14.1.13.1 Business overview

- 14.1.13.2 Products offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.13.3.2 Expansions

- 14.1.14 BRACCO IMAGING S.P.A.

- 14.1.14.1 Business overview

- 14.1.14.2 Products offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Deals

- 14.1.14.3.2 Expansions

- 14.1.15 BAYER AG

- 14.1.15.1 Business overview

- 14.1.15.2 Products offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Deals

- 14.1.15.3.2 Expansions

- 14.1.16 GUERBET

- 14.1.16.1 Business overview

- 14.1.16.2 Products offered

- 14.1.17 NIPRO EUROPE GROUP COMPANIES

- 14.1.17.1 Business overview

- 14.1.17.2 Products offered

- 14.1.1 SIEMENS HEALTHINEERS AG

- 14.2 OTHER PLAYERS

- 14.2.1 ACCUVEIN, INC.

- 14.2.2 CHISON MEDICAL TECHNOLOGIES CO., LTD.

- 14.2.3 SONOSCAPE MEDICAL CORP.

- 14.2.4 PIUR IMAGING

- 14.2.5 ARINETA LTD

- 14.2.6 HEALCERION CO., LTD.

- 14.2.7 ECHONOUS INC.

- 14.2.8 BEIJING WEMED MEDICAL EQUIPMENT

- 14.2.9 CLARIUS

- 14.2.10 ESAOTE SPA

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS