|

시장보고서

상품코드

1876466

기계 안전 시장 : 구성 요소별 예측(-2030년)Machine Safety Market by Component (Safety Light Curtains, Laser Scanners, Safety Controllers/Modules/Relays, Programmable Safety Systems, Safety Interlock Switches, Push Buttons, Pull Rope Buttons, Two-Hand Safety Controls) - Global Forecast to 2030 |

||||||

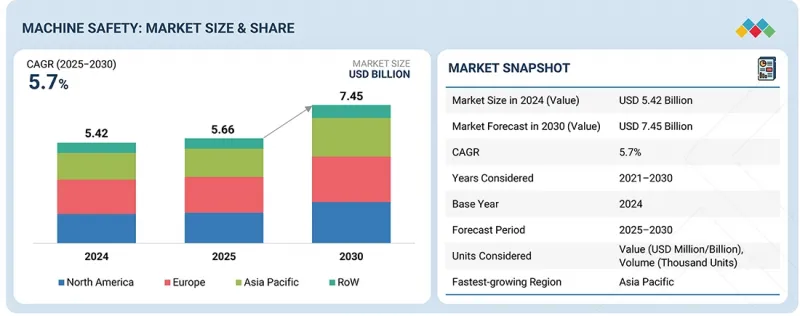

세계의 기계 안전 시장 규모는 2025년 56억 6,000만 달러에서 2030년까지 74억 5,000만 달러에 이를 것으로 예측되며, CAGR로 5.7%를 나타낼 것으로 전망됩니다.

산업화재나 폭발사고는 기업이나 정부에 인적 피해나 물적 손해에 대한 보상으로 수십억 달러의 비용을 부담시키고 있습니다. 설비의 기계적 고장이나 결함은 산업시설이나 제조시설에 있어서 구조화재의 4건에 1건의 발생 원인이 되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 구성 요소, 제공, 구현, 용도, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

따라서 공정 산업에서는 직장에서 사고를 줄이는 데 도움이되는 여러 보안 기술과 장비가 채택되었습니다. 그러므로 사고를 예방하기 위한 예방적 안전 대책의 구현이 점점 더 중요해지고 있으며, 기계 안전 시장의 성장을 가속하고 있습니다.

"개별 부문이 현저한 시장 점유율을 얻습니다."

기계 안전 시스템은 산업 환경에서 직원을 보호하기 위해 여러 구성 요소를 결합하여 구성됩니다. 여기에는 중요 기계, 조립 라인, 포장 라인, 로봇 용도 등이 포함됩니다. 구체적으로는 존재 감지 안전 센서, 비상 정지 장치, 안전 PLC, 안전 컨트롤러/모듈/릴레이, 안전 인터록 스위치 등입니다. 개별 안전 구성 요소는 위험 평가, 잠재적 위험 식별, 기계 보호 필요성 검토, 고급 제어 기능 추가로 설치됩니다. 업계에서는 설치 및 제어가 쉽기 때문에 개별 구성 요소가 선호됩니다. 그러나 개별 안전 구성 요소의 기능은 제한적이며 기본 안전 관련 요구 사항만 충족합니다.

"구성 요소별로 안전 컨트롤러/모듈/릴레이 부문이 2위 시장 점유율을 차지하고 있습니다."

기계 안전 장비는 긴급 상황에서 장비를 정지시키고 위험을 크게 줄이기 위해 안전 컨트롤러/모듈/릴레이가 필요합니다. 이상이 발생하면 이러한 릴레이는 안전하고 안정적인 대응을 시작합니다. 각 안전 릴레이는 특정 기능을 모니터링합니다. 제조 산업은 안전 가드, 라이트 커튼, 안전 매트 등과 같은 추가 안전 장비와 함께 이러한 릴레이를 활용합니다. 이 집합체는 종합적인 안전 시스템을 형성하여 작업자의 보호와 직장에서의 사고 방지를 도모합니다. 기계 안전 장비 제조업체 각 회사는 안전 컨트롤러 제품 포트폴리오를 확장하고 있습니다.

"엄격한 안전기준 채용 확대로 북미가 성장률로 2위 시장이 될 전망입니다."

북미의 기계 안전 시장은 예측 기간에 성장할 전망입니다. 북미 시장은 미국, 캐나다, 멕시코를 대상으로 조사되고 있습니다. 이 지역에서는 엄격한 기계 안전 기준이 적용되어 시장 성장을 가속하고 있습니다. American National Standards Institute(ANSI), National Fire Protection Association(NFPA), Robotic Industries Association(RIA), Occupational Safety & Health Administration(OSHA)과 같은 조직은 지역 내에서 다양한 기계 안전 기준을 수립합니다. OSHA와 ANSI는 또한 고용주가 안전한 노동환경을 확보하기 위해 준수해야 하는 최소한의 요건을 규정하고 있습니다. 기계 안전 규제에 대한 불규칙은 기업에 대한 벌금과 징계처분으로 이어집니다. 북미에서 기계 안전 시스템의 채택은 미국과 캐나다와 같은 주요 석유 및 가스 생산국의 존재에 의해 더욱 촉진되고 있습니다. 또한 많은 공급업체와 안전 시스템 제조업체들이 이 지역에 본사를 두고 있습니다.

본 보고서에서는 세계의 기계 안전 시장에 대해 조사 분석하여 주요 성장 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 주요 인사이트

- 기계 안전 시장의 기업에게 매력적인 기회

- 기계 안전 시장 : 제공별

- 기계 안전 시장 : 산업별

- 북미의 기계 안전 시장 : 산업별, 국가별

- 기계 안전 시장 : 지역별

제4장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 미충족 수요(Unmet Needs)와 백스페이스

- 기계 안전 시장에서의 미충족 수요(Unmet Needs)

- 백스페이스의 기회

- 연결된 시장과 부문 간 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제지표

- 서론

- GDP의 동향과 예측

- 세계 자동차 업계 동향

- 발전 업계 동향

- 밸류체인 분석

- 생태계 분석

- 가격 설정 분석

- 주요 기업이 제공하는 기계 안전 구성 요소의 가격대 : 배포별

- 기계 안전 부품의 평균 판매 가격 동향 : 지역별

- 무역 분석

- 수입 시나리오(HS 코드 8536)

- 수출 시나리오(HS 코드 8536)

- 주요 회의 및 이벤트

- 고객사업에 영향을 주는 동향/혼란

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 미국 관세의 영향 - 개요(2025년)

- 서론

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 미치는 영향

- 미국

- 유럽

- 아시아태평양

- 최종 이용 산업에 대한 영향

제6장 파괴적 혁신, 특허, 디지털, AI 채용

- 주요 신기술

- 컴퓨터 비전

- IoT

- 보완 기술

- 가상현실(VR)

- 자동 머신러닝

- 기술/제품 로드맵

- 특허 분석

- 기계 안전 시장에 대한 AI/생성형 AI의 영향

- 주요 이용 사례와 시장의 장래성

- 기계 안전의 모범 사례

- 기계 안전 시장에서의 AI 도입의 사례 연구

- 연결된 인접 생태계와 시장 기업에 미치는 영향

- 기계 안전 시장에서 생성형 AI 채용에 대한 고객의 준비상황

제7장 규제 상황

제8장 고객정세와 구매행동

- 의사결정 프로세스

- 구매 이해관계자 및 구입 평가 기준

- 구매 프로세스의 주요 이해 관계자

- 구입 기준

- 채용 장벽과 내부 과제

- 다양한 최종 이용 산업으로부터의 미충족 수요(Unmet Needs)

제9장 기계 안전 시장 : 제공별

- 서론

- 시스템

- 센서

제10장 기계 안전 시장 : 구성 요소별

- 서론

- 존재 감지 센서

- 프로그래머블 안전 시스템

- 안전 제어기/모듈/릴레이

- 안전 인터록 스위치

- 비상 정지 제어 장치

- 양손 안전 제어 장치

제11장 기계 안전 시장 : 실장별

- 서론

- 개별

- 내장

제12장 기계 안전 시장 : 접속성별

- 서론

- 유선

- 무선

제13장 기계 안전 시장 : 판매 채널별

- 서론

- 직접

- 간접

제14장 기계 안전 시장 : 용도별

- 서론

- 조립

- 로봇공학

- 포장

- 자재 취급

- 금속 가공

- 용접 및 차폐

제15장 기계 안전 시장 : 산업별

- 서론

- 공정 산업

- 화학

- 식품 및 음료

- 금속 및 광업

- 석유 및 가스

- 제약

- 발전

- 기타 공정 산업

- 이산 산업

- 항공우주

- 자동차

- 반도체 및 전자

- 기타 이산 산업

제16장 기계 안전 시장 : 지역별

- 서론

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 북유럽

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 인도네시아

- 싱가포르

- 기타 아시아태평양

- 기타 지역

- 남미

- 중동

- 아프리카

제17장 경쟁 구도

- 서론

- 주요 참가 기업의 전략/강점(2021-2025년)

- 수익 분석(2020-2024년)

- 상위 5개사의 시장 점유율 분석(2024년)

- 제품 비교

- 기업평가 및 재무 지표

- 기업평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제18장 기업 프로파일

- 주요 기업

- SCHNEIDER ELECTRIC

- KEYENCE CORPORATION

- ROCKWELL AUTOMATION

- SIEMENS

- EMERSON ELECTRIC CO.

- HONEYWELL INTERNATIONAL INC.

- ABB

- OMRON CORPORATION

- YOKOGAWA ELECTRIC CORPORATION

- MITSUBISHI ELECTRIC CORPORATION

- SICK AG

- HIMA

- IDEC CORPORATION

- 기타 기업

- BALLUFF GMBH

- BANNER ENGINEERING CORP.

- BAUMER

- PILZ GMBH & CO. KG

- PEPPERL FUCHS SE

- EUCHNER GMBH CO. KG

- DATALOGIC SPA

- LEUZE ELECTRONIC GMBH CO. KG

- FORTRESS INTERLOCKS

- KA SCHMERSAL GMBH & CO. KG

- STEUTE TECHNOLOGIES GMBH & CO. KG

- CARLO GAVAZZI

- MURRELEKTRONIK GMBH

- EAO AG

제19장 조사 방법

제20장 부록

KTH 25.11.28At a CAGR of 5.7%, the global machine safety market is anticipated to grow from USD 5.66 billion in 2025 to USD 7.45 billion by 2030. Industrial fires and explosions cost companies and governments billions of dollars in compensation for loss of life and property. Mechanical failure or malfunction in equipment is responsible for igniting one in four structure fires in industrial or manufacturing properties.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Component, Offering, Implementation, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

Consequently, process industries are adopting several security technologies and equipment that help reduce workplace accidents. Thus, rising emphasis on implementing proactive safety measures to prevent accidents drives the growth of the machine safety market.

"Individual segment to capture prominent share of machine safety market"

Machine safety systems combine several components to safeguard personnel in an industrial environment, involving critical machinery, assembly lines, packaging lines, and robotic applications. These include presence-sensing safety sensors, emergency stop devices, safety PLCs, safety controllers/modules/relays, and safety interlock switches. Individual safety components are installed by assessing risks, identifying potential hazards, considering machine guarding needs, and adding advanced controls. Industries prefer individual components as they are easy to install and control. The functionalities of individual safety components are limited and fulfill only basic safety-related requirements.

"Safety controllers/modules/relays segment to account for second-largest share of machine safety market, by component"

Machine safety devices require safety controllers/modules/relays to shut down equipment in an emergency, reducing risks significantly. When an error occurs, these relays initiate a safe and reliable response. Each safety relay monitors a specific function. Manufacturing industries utilize these relays with additional safety equipment, including safety guards, light curtains, and safety mats. This collective assembly forms an all-inclusive safety system to safeguard workers and prevent workplace accidents. Machine safety manufacturing companies are expanding their product portfolio of safety controllers.

"Rising adoption of stringent safety standards to position North America as the second-fastest growing market"

The machine safety market in North America is witnessing growth during the forecast period. The North American market has been studied for the US, Canada, and Mexico. The region has stringent machine safety standards, driving the market growth. Various machine safety standards have been established in the region by organizations, such as the American National Standards Institute (ANSI), the National Fire Protection Association (NFPA), the Robotic Industries Association (RIA), and the Occupational Safety & Health Administration (OSHA). OSHA and ANSI have also outlined the minimum requirements that need to be followed by employers to ensure safe working conditions. Failing to comply with machine safety regulations leads to fines and disciplinary actions against companies. The adoption of machine safety systems in North America is further driven by the presence of significant oil- and gas-producing countries such as the US and Canada. Additionally, many suppliers and safety system manufacturers have facilities in this region.

Breakdown of Primaries

Various executives from key organizations operating in the machine safety market, including CEOs, marketing directors, and innovation and technology directors, were interviewed in-depth.

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: Directors - 33%, C-level Executives - 48%, and Others - 19%

- By Region: North America - 35%, Europe - 18%, Asia Pacific - 40%, and RoW - 7%

Note: Three tiers of companies have been defined based on their total revenue as of 2024; Tier 1: Greater than USD 100 million, Tier 2: Between USD 50 million and USD 100 million, and Tier 3: Less than USD 50 million. Other designations include sales managers, marketing managers, and product managers.

Major players profiled in this report are Schneider Electric (France), Honeywell International Inc.(US), ABB (Switzerland), Rockwell Automation (US), Siemens (Germany), OMRON Corporation (Japan), KEYENCE CORPORATION (Japan), Yokogawa Electric Corporation (Japan), Emerson Electric Co. (US), Mitsubishi Electric Corporation (Japan), SICK AG (Germany), HIMA (Germany), IDEC Corporation (Japan), Balluff GmbH (Germany), Banner Engineering Corp. (US), Baumer (Switzerland), Pilz GmbH & Co. KG (Germany), Pepperl+Fuchs SE (Germany), EUCHNER GmbH + Co. KG (Germany), Datalogic S.p.A. (Italy), Leuze electronic GmbH + Co. KG (Germany), Fortress Interlocks (UK), K.A. Schmersal GmbH & Co. KG (Germany), steute Technologies GmbH & Co. KG (Germany), Carlo Gavazzi (Switzerland), Murrelektronik GmbH (Germany), and EAO AG (Switzerland). These leading companies possess a broad portfolio of products and establish a prominent presence in established and emerging markets.

The study provides a detailed competitive analysis of these key market players, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

This report segments the machine safety market based on offering, component, implementation, connectivity, application, industry, and region. The offering segment includes systems and sensors. The component segment comprises presence detection sensors, safety controllers/modules/relays, programmable safety systems, safety interlock switches, emergency stop controls, and two-hand safety controls. The implementation segment includes individual and embedded. The connectivity segment includes wired and wireless. The application segment comprises assembly, robotics, packaging, material handling, metal working, and welding & shielding. The industry segment includes process and discrete industries. The market has been segmented into four regions: North America, Asia Pacific, Europe, and Rest of the World (RoW).

Reasons to Buy the Report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the machine safety market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (Rising personnel and asset protection in the industrial sector, Mandatory safety standards for equipment and machinery, Automation to drive efficiency and productivity gains), restraints (High costs associated with of automated machine safety system implementation, Complexity of machine safety system integration), opportunities (Rising workplace safety awareness in emerging economies, Growing adoption of IIoT to optimize industrial asset performance and lifespan), and challenges (Technological advancements complicate machine safety product design, Failing to assess potential risks in machine configuration) influencing the growth of the machine safety market

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and product launches in the machine safety market

- Market Development: Comprehensive information about lucrative markets, including the analysis of the machine safety market across varied regions

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the machine safety market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, including Siemens (Germany), Schneider Electric (France), KEYENCE CORPORATION (Japan), Rockwell Automation (US), and Emerson Electric Co. (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MACHINE SAFETY MARKET

- 3.2 MACHINE SAFETY MARKET, BY OFFERING

- 3.3 MACHINE SAFETY MARKET, BY INDUSTRY

- 3.4 NORTH AMERICA: MACHINE SAFETY MARKET, BY INDUSTRY AND COUNTRY

- 3.5 MACHINE SAFETY MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rise in personnel and asset protection in industrial sector

- 4.2.1.2 Mandatory safety standards for equipment and machinery

- 4.2.1.3 Automation to drive efficiency and productivity gains

- 4.2.2 RESTRAINTS

- 4.2.2.1 High costs associated with implementation of automated machine safety systems

- 4.2.2.2 Complexity of machine safety system integration

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rising workplace safety awareness in emerging economies

- 4.2.3.2 Growing adoption of IIoT to optimize industrial asset performance and lifespan

- 4.2.4 CHALLENGES

- 4.2.4.1 Technological advancements complicate machine safety product design

- 4.2.4.2 Failing to assess potential risks in machine configuration

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 UNMET NEEDS IN MACHINE SAFETY MARKET

- 4.5 WHITE SPACE OPPORTUNITIES

- 4.6 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.7 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMICS INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- 5.2.4 TRENDS IN POWER GENERATION INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 PRICING RANGE OF MACHINE SAFETY COMPONENTS PROVIDED BY KEY PLAYERS, BY DEPLOYMENT

- 5.5.2 AVERAGE SELLING PRICE TREND OF MACHINE SAFETY COMPONENT, BY REGION

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 8536)

- 5.6.2 EXPORT SCENARIO (HS CODE 8536)

- 5.7 KEY CONFERENCES AND EVENTS

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 ELOPAK INTEGRATED EMERSON'S ROBUST AVENTICS PNEUMATIC COMPONENTS INTO ITS NEW ASEPTIC FILLING MACHINE DESIGNED FOR GABLE TOP PACKAGING APPLICATIONS

- 5.10.2 MP EQUIPMENT PARTNERED WITH ROCKWELL AUTOMATION SAFETY EXPERTS TO ENHANCE DESIGN OF ITS PROTEIN PORTIONING MACHINES

- 5.10.3 MOLLART ENGINEERING CHOSE PROCTER MACHINE SAFETY'S ENCLOSED GUARDS FOR MACHINE TOOL INSTALLATION

- 5.11 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.5 US

- 5.11.6 EUROPE

- 5.11.7 ASIA PACIFIC

- 5.11.8 IMPACT ON END-USE INDUSTRIES

6 STRATEGIC DISRUPTION, PATENT, DIGITAL, AND AI ADOPTIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 COMPUTER VISION

- 6.1.2 IOT

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 VIRTUA REALITY (VR)

- 6.2.2 AUTOMATED MACHINE LEARNING

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.4 PATENT ANALYSIS

- 6.5 IMPACT OF AI/GEN AI ON MACHINE SAFETY MARKET

- 6.5.1 TOP USE CASES AND MARKET POTENTIAL

- 6.5.2 BEST PRACTICES IN MACHINE SAFETY

- 6.5.3 CASE STUDIES OF AI IMPLEMENTATION IN MACHINE SAFETY MARKET

- 6.5.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.5.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN MACHINE SAFETY MARKET

7 REGULATORY LANDSCAPE

- 7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.1 STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

9 MACHINE SAFETY MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.2 SYSTEMS

- 9.2.1 NEED FOR COMPLIANCE WITH STRINGENT SAFETY STANDARDS TO DRIVE GROWTH

- 9.3 SENSORS

- 9.3.1 ADVANCEMENTS IN TECHNOLOGY SUCH AS AI TO HELP EXAMINE SENSOR DATA AND PREDICT SAFETY HAZARDS

10 MACHINE SAFETY MARKET, BY COMPONENT

- 10.1 INTRODUCTION

- 10.2 PRESENCE DETECTION SENSORS

- 10.2.1 INCREASE IN INTEREST IN INDUSTRY 4.0 AND IIOT TO DRIVE GROWTH

- 10.2.2 SAFETY EDGES

- 10.2.2.1 Safety edges help prevent accidents and injuries by providing immediate response to contact

- 10.2.3 LASER SCANNERS

- 10.2.3.1 Escalating demand for automation in manufacturing and requirement for dependable and practical safety solutions to fuel growth

- 10.2.4 SAFETY LIGHT CURTAINS

- 10.2.4.1 Safety light curtains to safeguard workers and prevent external threats to machinery

- 10.2.4.2 Light-emitting diodes (LEDs)

- 10.2.4.3 Photoelectric cells

- 10.2.4.4 Control units

- 10.2.4.5 Displays

- 10.2.4.6 Enclosures

- 10.2.5 SAFETY MATS

- 10.2.5.1 Safety mats help safeguard personnel from entering critical areas

- 10.2.6 OTHER DEVICES

- 10.3 PROGRAMMABLE SAFETY SYSTEMS

- 10.3.1 INCREASING ADOPTION OF PROGRAMMABLE LOGIC CONTROLLERS TO FUEL GROWTH

- 10.4 SAFETY CONTROLLERS/MODULES/RELAYS

- 10.4.1 EXPANDED PRODUCT OFFERINGS TO FUEL GROWTH FOR MANUFACTURING FIRMS

- 10.5 SAFETY INTERLOCK SWITCHES

- 10.5.1 ELECTROMECHANICAL SWITCHES

- 10.5.1.1 Electromechanical switches help lock and unlock gate guards or doors in restricted areas

- 10.5.2 HINGE PIN SWITCHES

- 10.5.2.1 Hinge pin safety switches provide positively operated switching contacts and tamper-resistant actuator mechanism for hinging machine guards

- 10.5.3 LIMIT SWITCHES

- 10.5.3.1 Limit switches protect personnel and equipment by monitoring position of movable components

- 10.5.4 NON-CONTACT INTERLOCK SWITCHES

- 10.5.4.1 Non-contact interlock switches help where precise implementation of safety systems is complex

- 10.5.5 TONGUE INTERLOCK SWITCHES

- 10.5.5.1 Tongue interlock guard switches help in preventing access

- 10.5.6 TRAPPED KEY INTERLOCK SWITCHES

- 10.5.6.1 Trapped key interlock switches help in prescribed sequence to start or shut down

- 10.5.1 ELECTROMECHANICAL SWITCHES

- 10.6 EMERGENCY STOP CONTROLS

- 10.6.1 PUSH BUTTONS

- 10.6.1.1 Push buttons to reduce potential emergency hazards

- 10.6.2 ROPE PULL BUTTONS

- 10.6.2.1 Used as emergency stop devices in areas where simple push buttons cannot be deployed

- 10.6.1 PUSH BUTTONS

- 10.7 TWO-HAND SAFETY CONTROLS

- 10.7.1 EFFECTIVE AS COMPONENT OF MULTI-LAYERED SAFETY APPROACH DESIGNED TO PROTECT OPERATOR AND OTHER INDIVIDUALS

11 MACHINE SAFETY MARKET, BY IMPLEMENTATION

- 11.1 INTRODUCTION

- 11.2 INDIVIDUAL

- 11.2.1 INDIVIDUAL SAFETY COMPONENTS TO OFFER EASY INSTALLATION FOR BASIC MACHINE REQUIREMENTS

- 11.3 EMBEDDED

- 11.3.1 EMBEDDED SAFETY COMPONENTS TO DRIVE MACHINE EFFICIENCY AND FUNCTIONAL SAFETY EVOLUTION

12 MACHINE SAFETY MARKET, BY CONNECTIVITY

- 12.1 INTRODUCTION

- 12.2 WIRED

- 12.2.1 WIRED SAFETY SYSTEMS TO REMAIN RELIABLE FOR HIGH-RISK APPLICATIONS

- 12.3 WIRELESS

- 12.3.1 WIRELESS SAFETY SYSTEMS TO PROVIDE FLEXIBLE ALTERNATIVE FOR MODERN AUTOMATION

13 MACHINE SAFETY MARKET, BY SALES CHANNEL

- 13.1 INTRODUCTION

- 13.2 DIRECT

- 13.2.1 MACHINE SAFETY VENDORS TO UTILIZE DIRECT SALES CHANNELS FOR PRODUCT DISTRIBUTION

- 13.3 INDIRECT

- 13.3.1 INDIRECT SALES CHANNELS TO LEVERAGE TRADITIONAL RETAIL DESPITE DIGITAL AGE CHALLENGES

14 MACHINE SAFETY MARKET, BY APPLICATION

- 14.1 INTRODUCTION

- 14.2 ASSEMBLY

- 14.2.1 MACHINE SAFETY CRUCIAL FOR HIGH-SPEED ASSEMBLY LINE APPLICATIONS

- 14.3 ROBOTICS

- 14.3.1 MACHINE SAFETY IN ROBOTICS TO EVOLVE WITH NEW COLLABORATIVE SPECIFICATIONS

- 14.4 PACKAGING

- 14.4.1 PACKAGING PROCESS TO DRIVE DEMAND FOR ADVANCED MACHINE SAFETY TECHNOLOGIES

- 14.5 MATERIAL HANDLING

- 14.5.1 MACHINE SAFETY SYSTEMS REQUIRED FOR PROTECTING PERSONNEL AND EQUIPMENT IN MATERIAL-HANDLING OPERATIONS

- 14.6 METALWORKING

- 14.6.1 RISE IN NEED FOR MINIMUM MACHINE SAFETY MEASURES FOR HAZARDOUS METALWORKING PROCESSES

- 14.7 WELDING & SHIELDING

- 14.7.1 SPECIALIZED MACHINE SAFETY REQUIRED FOR WELDING AND SHIELDING APPLICATIONS

15 MACHINE SAFETY MARKET, BY INDUSTRY

- 15.1 INTRODUCTION

- 15.2 PROCESS INDUSTRIES

- 15.2.1 CHEMICAL

- 15.2.1.1 Rise in emphasis on implementing more advanced safety measures owing to regulatory requirements and focus to improve operational efficiency

- 15.2.2 FOOD & BEVERAGE

- 15.2.2.1 Implementation of safety systems to reduce risks of accidents to achieve high-quality products at a lower price

- 15.2.3 METAL & MINING

- 15.2.3.1 Rise in adoption of machine safety systems for gas leak prevention

- 15.2.4 OIL & GAS

- 15.2.4.1 Strict enforcement of safety norms and compliance standards to fuel market growth

- 15.2.5 PHARMACEUTICAL

- 15.2.5.1 Adoption of machine safety solutions to boost operational efficiency and innovation

- 15.2.6 POWER GENERATION

- 15.2.6.1 Growing emphasis on workplace safety awareness in highly hazardous environments to propel market growth

- 15.2.7 OTHER PROCESS INDUSTRIES

- 15.2.1 CHEMICAL

- 15.3 DISCRETE INDUSTRIES

- 15.3.1 AEROSPACE

- 15.3.1.1 Cutting-edge advances in aerospace manufacturing facilities to fuel market expansion

- 15.3.2 AUTOMOTIVE

- 15.3.2.1 Automation and machine safety innovations to drive enhanced safety and efficiency in automotive manufacturing

- 15.3.3 SEMICONDUCTOR & ELECTRONICS

- 15.3.3.1 Demand for enhanced precision in manufacturing to fuel market growth

- 15.3.4 OTHER DISCRETE INDUSTRIES

- 15.3.1 AEROSPACE

16 MACHINE SAFETY MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 US

- 16.2.1.1 Increased installation of safety-related systems to drive market growth

- 16.2.2 CANADA

- 16.2.2.1 Strict government regulations for workplace safety to fuel market growth

- 16.2.3 MEXICO

- 16.2.3.1 Rising innovations and significant growth in industrial production to drive market growth

- 16.2.1 US

- 16.3 EUROPE

- 16.3.1 UK

- 16.3.1.1 Strong legal framework for workplace safety to fuel market growth

- 16.3.2 GERMANY

- 16.3.2.1 Acceleration of manufacturing processes through automation to drive market expansion

- 16.3.3 FRANCE

- 16.3.3.1 Mandatory adherence to occupational health and safety policies to drive market growth

- 16.3.4 ITALY

- 16.3.4.1 Strong manufacturing tradition to propel machine safety market growth

- 16.3.5 SPAIN

- 16.3.5.1 Industrial revitalization and automotive sector to boost safety system demand

- 16.3.6 NORDICS

- 16.3.6.1 High automation and strong worker protection laws necessitate premium safety solutions

- 16.3.7 REST OF EUROPE

- 16.3.1 UK

- 16.4 ASIA PACIFIC

- 16.4.1 CHINA

- 16.4.1.1 Increase in adoption of advanced production technologies to fuel growth

- 16.4.2 JAPAN

- 16.4.2.1 Expansion of continuous processing industries to drive market growth

- 16.4.3 INDIA

- 16.4.3.1 National infrastructure and manufacturing initiatives to drive market growth

- 16.4.4 SOUTH KOREA

- 16.4.4.1 Rising investment in machine safety technologies to fuel market growth

- 16.4.5 AUSTRALIA

- 16.4.5.1 Robust safety legislation to propel high-value machine safety investment

- 16.4.6 INDONESIA

- 16.4.6.1 Rapid industrialization and manufacturing expansion to fuel safety demand

- 16.4.7 SINGAPORE

- 16.4.7.1 Focus on high-tech automation to drive demand for intelligent safety solutions

- 16.4.8 REST OF ASIA PACIFIC

- 16.4.1 CHINA

- 16.5 REST OF THE WORLD (ROW)

- 16.5.1 SOUTH AMERICA

- 16.5.1.1 Brazil

- 16.5.1.1.1 Strict local regulations to drive consistent machine safety modernization

- 16.5.1.2 Argentina

- 16.5.1.2.1 Economic stabilization and industrial renewal fuel focused safety investments

- 16.5.1.3 Rest of South America

- 16.5.1.1 Brazil

- 16.5.2 MIDDLE EAST

- 16.5.2.1 Saudi Arabia

- 16.5.2.1.1 Vision 2030 industrialization and compliance to drive largest safety market

- 16.5.2.2 UAE

- 16.5.2.2.1 Logistics, manufacturing, and smart city initiatives to fuel innovation in safety systems

- 16.5.2.3 Oman

- 16.5.2.3.1 Infrastructure development and port expansion to increase safety demand

- 16.5.2.4 Qatar

- 16.5.2.4.1 Energy sector reliability and major industrial projects require sophisticated safety solutions

- 16.5.2.5 Kuwait

- 16.5.2.5.1 Petrochemical and oil sector dominance to mandate premium safety equipment

- 16.5.2.6 Bahrain

- 16.5.2.6.1 Industrial diversification efforts to increase demand for general machine safety

- 16.5.2.7 Rest of the Middle East

- 16.5.2.1 Saudi Arabia

- 16.5.3 AFRICA

- 16.5.3.1 South Africa

- 16.5.3.1.1 Mining and manufacturing compliance to drive machine safety market

- 16.5.3.2 Rest of Africa

- 16.5.3.1 South Africa

- 16.5.1 SOUTH AMERICA

17 COMPETITIVE LANDSCAPE

- 17.1 INTRODUCTION

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 17.3 REVENUE ANALYSIS, 2020-2024

- 17.4 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- 17.5 PRODUCT COMPARISON

- 17.6 COMPANY VALUATION AND FINANCIAL METRICS

- 17.6.1 COMPANY VALUATION

- 17.6.2 FINANCIAL METRICS

- 17.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.7.1 STARS

- 17.7.2 EMERGING LEADERS

- 17.7.3 PERVASIVE PLAYERS

- 17.7.4 PARTICIPANTS

- 17.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 17.7.5.1 Company footprint

- 17.7.5.2 Regional footprint

- 17.7.5.3 Deployment footprint

- 17.7.5.4 Offering footprint

- 17.7.5.5 Industry footprint

- 17.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 17.8.1 PROGRESSIVE COMPANIES

- 17.8.2 RESPONSIVE COMPANIES

- 17.8.3 DYNAMIC COMPANIES

- 17.8.4 STARTING BLOCKS

- 17.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 17.8.5.1 Detailed list of key startups/SMEs

- 17.8.5.2 Competitive benchmarking of key startups/SMEs

- 17.9 COMPETITIVE SCENARIO

- 17.9.1 PRODUCT LAUNCHES

- 17.9.2 DEALS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 SCHNEIDER ELECTRIC

- 18.1.1.1 Business overview

- 18.1.1.2 Products/Solutions/Services offered

- 18.1.1.3 Recent developments

- 18.1.1.3.1 Product launches

- 18.1.1.3.2 Deals

- 18.1.1.4 MnM view

- 18.1.1.4.1 Key strengths

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses and competitive threats

- 18.1.2 KEYENCE CORPORATION

- 18.1.2.1 Business overview

- 18.1.2.2 Products/Solutions/Services offered

- 18.1.2.3 Recent developments

- 18.1.2.3.1 Product launches

- 18.1.2.4 MnM view

- 18.1.2.4.1 Key strengths

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses and competitive threats

- 18.1.3 ROCKWELL AUTOMATION

- 18.1.3.1 Business overview

- 18.1.3.2 Products/Solutions/Services offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Product launches

- 18.1.3.4 MnM view

- 18.1.3.4.1 Key strengths

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses and competitive threats

- 18.1.4 SIEMENS

- 18.1.4.1 Business overview

- 18.1.4.2 Products/Solutions/Services offered

- 18.1.4.3 Recent development

- 18.1.4.3.1 Product launches

- 18.1.4.4 MnM view

- 18.1.4.4.1 Key strengths

- 18.1.4.4.2 Strategic choices

- 18.1.4.4.3 Weaknesses and competitive threats

- 18.1.5 EMERSON ELECTRIC CO.

- 18.1.5.1 Business overview

- 18.1.5.2 Products/Solutions/Services offered

- 18.1.5.3 Recent developments

- 18.1.5.3.1 Product launches

- 18.1.5.3.2 Deals

- 18.1.5.4 MnM view

- 18.1.5.4.1 Key strengths

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses and competitive threats

- 18.1.6 HONEYWELL INTERNATIONAL INC.

- 18.1.6.1 Business overview

- 18.1.6.2 Products/Solutions/Services offered

- 18.1.6.3 Recent developments

- 18.1.6.3.1 Deals

- 18.1.7 ABB

- 18.1.7.1 Business overview

- 18.1.7.2 Products/Solutions/Services offered

- 18.1.7.3 Recent developments

- 18.1.7.3.1 Deals

- 18.1.8 OMRON CORPORATION

- 18.1.8.1 Business overview

- 18.1.8.2 Products/Solutions/Services offered

- 18.1.8.3 Recent developments

- 18.1.8.3.1 Product launches

- 18.1.8.3.2 Deals

- 18.1.9 YOKOGAWA ELECTRIC CORPORATION

- 18.1.9.1 Business overview

- 18.1.9.2 Products/Solutions/Services offered

- 18.1.9.3 Recent developments

- 18.1.9.3.1 Product launches

- 18.1.10 MITSUBISHI ELECTRIC CORPORATION

- 18.1.10.1 Business overview

- 18.1.10.2 Products/Solutions/Services offered

- 18.1.11 SICK AG

- 18.1.11.1 Business overview

- 18.1.11.2 Products/Solutions/Services offered

- 18.1.11.3 Recent developments

- 18.1.11.3.1 Product launches

- 18.1.11.3.2 Deals

- 18.1.12 HIMA

- 18.1.12.1 Business overview

- 18.1.12.2 Products/Solutions/Services offered

- 18.1.13 IDEC CORPORATION

- 18.1.13.1 Business overview

- 18.1.13.2 Products/Solutions/Services offered

- 18.1.13.3 Recent developments

- 18.1.13.3.1 Product launches

- 18.1.1 SCHNEIDER ELECTRIC

- 18.2 OTHER PLAYERS

- 18.2.1 BALLUFF GMBH

- 18.2.2 BANNER ENGINEERING CORP.

- 18.2.3 BAUMER

- 18.2.4 PILZ GMBH & CO. KG

- 18.2.5 PEPPERL+FUCHS SE

- 18.2.6 EUCHNER GMBH + CO. KG

- 18.2.7 DATALOGIC S.P.A.

- 18.2.8 LEUZE ELECTRONIC GMBH + CO. KG

- 18.2.9 FORTRESS INTERLOCKS

- 18.2.10 K.A. SCHMERSAL GMBH & CO. KG

- 18.2.11 STEUTE TECHNOLOGIES GMBH & CO. KG

- 18.2.12 CARLO GAVAZZI

- 18.2.13 MURRELEKTRONIK GMBH

- 18.2.14 EAO AG

19 RESEARCH METHODOLOGY

- 19.1 RESEARCH DATA

- 19.1.1 SECONDARY AND PRIMARY RESEARCH

- 19.1.2 SECONDARY DATA

- 19.1.2.1 List of key secondary sources

- 19.1.2.2 Key data from secondary sources

- 19.1.3 PRIMARY DATA

- 19.1.3.1 List of primary interview participants

- 19.1.3.2 Key data from primary sources

- 19.1.3.3 Key industry insights

- 19.1.3.4 Breakdown of primaries

- 19.2 MARKET SIZE ESTIMATION METHODOLOGY

- 19.2.1 BOTTOM-UP APPROACH

- 19.2.1.1 Approach to derive market size using bottom-up analysis (demand side)

- 19.2.2 TOP-DOWN APPROACH

- 19.2.2.1 Approach to derive market size using top-down analysis (supply side)

- 19.2.1 BOTTOM-UP APPROACH

- 19.3 DATA TRIANGULATION

- 19.4 RESEARCH ASSUMPTIONS

- 19.5 RESEARCH LIMITATIONS

20 APPENDIX

- 20.1 INSIGHTS FROM INDUSTRY EXPERTS

- 20.2 DISCUSSION GUIDE

- 20.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.4 AVAILABLE CUSTOMIZATIONS

- 20.5 RELATED REPORTS

- 20.6 AUTHOR DETAILS