|

시장보고서

상품코드

1876467

AIoT 시장 : 플랫폼, 기술별 예측(-2030년)AIoT Market by Platform (IoT Device Management, IoT Application Enablement Platforms, IoT Connectivity Management, IoT Cloud, IoT Advanced Analytics), Technology (Machine Learning, NLP, Computer Vision, Context Aware AI) - Global Forecast to 2030 |

||||||

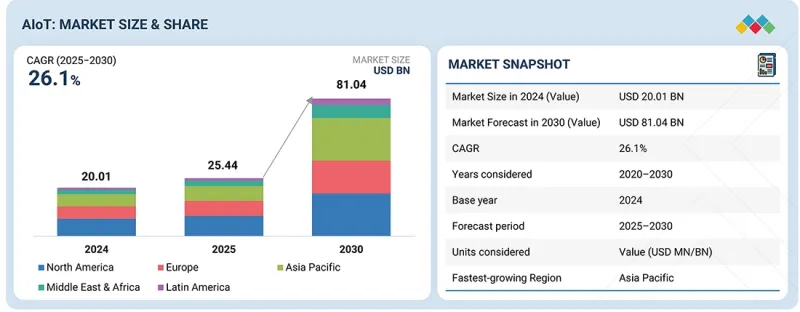

세계의 AIoT 시장 규모는 2025년에 254억 4,000만 달러 규모에 이를 것으로 예측됩니다.

예측 기간 동안 CAGR 26.1%를 나타내 2030년까지 810억 4,000만 달러에 달할 것으로 전망되고 있습니다. AIoT 시장의 성장은 주로 인공지능과 사물인터넷의 융합이 진행되어 업계를 가로지르는 실시간 데이터 분석, 예측적 인사이트, 자율적 의사결정이 가능하기 때문입니다. 5G 네트워크 배포, 엣지 컴퓨팅 발전, 저비용 센서의 보급으로 속도, 연결성, 비용 효율성이 향상되고 AIoT 도입이 가속화되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 제공별, 기술별, 배포 유형별, 업계별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동, 아프리카, 라틴아메리카 |

스마트 시티 개념의 확대, 인더스트리 4.0 기반 산업 자동화, 원격 모니터링 및 예측 진단을 포함한 의료 용도는 시장 성장을 더욱 촉진하고 있습니다. 또한 확장 가능한 클라우드 인프라는 엄청난 데이터 처리와 AI 기반 분석을 지원하여 AIoT 생태계를 강화하고 있습니다. 그러나 데이터 보안 및 개인 정보 보호에 대한 우려, 높은 도입 및 통합 비용 및 IoT 장치 간의 표준화 부족과 같은 주요 제약 요인도 존재합니다. 개발 도상 지역에서의 숙련 전문가의 부족, 규제의 복잡성, 인프라의 제약도 대규모 도입의 추가 장벽이 되고 있습니다. 이러한 과제에도 불구하고 기술 진보와 섹터 횡단적인 통합으로 AIoT는 세계의 지능적으로 연결된 생태계를 변화시키는 기반 기술로서의 지위를 확립하고 있습니다.

제공되는 전문 서비스는 배포, 통합 서비스, 지원, 유지 보수 서비스, 교육 및 컨설팅 서비스로 분류됩니다. 많은 최종 사용자 조직은 능력 부족으로 인해 필요한 안전과 보호 수준을 달성하기 위해 전문 기업을 고용하고 있습니다. AloT 시스템을 도입하기 위해서는 특별히 프로세스와 배포 후에 전문 서비스가 필수적입니다. 주요 서비스에는 계획, 설계, 컨설팅, 업그레이드 등이 포함됩니다. 이러한 서비스를 제공하는 조직에는 컨설턴트, IoT 전문가, AI 전문가 및 미션 크리티컬한 의사결정 지원 시스템, 도구, 서비스, 지식 개발 및 도입을 전문으로 하는 독립적인 프로그램 관리 팀이 포함됩니다.

아시아태평양 시장에는 중국, 일본, 인도 및 기타 국가가 포함됩니다. 이 나라들은 혁신적인 AloT 기술 개발에 중점을 두고 있습니다. 예측 기간 동안 이 지역에서 높은 CAGR 전망은 신기술 솔루션의 진보적이고 역동적인 도입으로 인한 것입니다. IoT 기술의 상용화를 향한 움직임에 더하여, 최대한 활용하고 AloT 플랫폼 솔루션으로 부터 더 큰 이점을 얻기 위한 추가 개발의 필요성은 이 지역에서 AloT 도입을 촉진할 것으로 예상됩니다. 중국과 같은 대규모 경제권을 가진 아시아태평양은 AloT 시장에서 중요한 점유율을 차지할 것으로 예측됩니다. AloT 솔루션, 소프트웨어, 서비스의 도입 가능성이 가장 높은 산업 분야로는 이동성, 운송, 에너지, 유틸리티, 의료, 생명 과학 등이 있습니다.

본 보고서에서는 세계의 AIoT 시장에 대해 조사했으며 제공별, 기술별, 배포 유형별, 업계별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요와 업계 동향

- 서론

- 시장 역학

- 연결된 시장과 부문 간 기회

- Tier 1/2/3 기업의 전략적 움직임

- 업계 동향

제6장 파괴적 혁신 : 특허, 디지털, AI 도입

- 주요 기술

- 보완적 기술

- AIoT 시장 기술/제품 로드맵

- 특허 분석

- AIoT 시장 전망 응용

- AI/생성형 AI가 AIoT 시장에 미치는 영향

제7장 규제 상황

- 지역 규제 및 규정 준수

- 규제기관, 정부기관, 기타 조직

- 업계 표준

제8장 고객정세와 구매행동

- 의사결정 프로세스

- 주요 이해관계자와 구매 기준

- 채용 장벽과 내부 과제

- 다양한 최종 용도 분야에서의 미충족 수요(Unmet Needs)

제9장 AIoT 시장(제공별)

- 서론

- 플랫폼

- 솔루션

- 서비스

제10장 AIoT 시장(기술별)

- 서론

- 머신러닝

- 자연언어처리

- 컴퓨터 비전

- 컨텍스트 인식형 인공지능

제11장 AIoT 시장(배포 유형별)

- 서론

- 클라우드 기반 AIoT

- 엣지 기반 AIoT

제12장 AIoT 시장(업계별)

- 서론

- 가전

- 제조

- BFSI

- 운송 및 물류

- 정부 및 방위

- 에너지 및 유틸리티

- 소매

- 건강 관리

- 기타

제13장 AIoT 시장(지역별)

- 서론

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 러시아

- 프랑스

- 기타

- 아시아태평양

- 중국

- 일본

- 인도

- 기타

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 남아프리카

- 기타

- 라틴아메리카

- 시장 성장 촉진요인과 기회

- 기업 프로파일

- 브라질

- 멕시코

- 기타

제14장 경쟁 구도

- 서론

- 주요 참가 기업의 전략/강점(2021-2025년)

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업평가와 재무지표(2024년)

- 경쟁 시나리오

제15장 기업 프로파일

- 주요 진출기업

- IBM

- CISCO

- AWS

- MICROSOFT

- ORACLE

- HPE

- INTEL

- HITACHI

- SAP

- 기타 기업

- TENCENT CLOUD

- SHARP GLOBAL

- PTC

- SAS

- TELIT CINTERION

- ROBERT BOSCH

- 스타트업/중소기업

- AXIOMTEK

- SOFTWEB SOLUTIONS

- WILIOT

- RELAYR

- TERMINUS GROUP

- C3 IOT

- CLEARBLADE

- SEMIFIVE

- FALKONRY

- UPTAKE

- BUTLR

제16장 인접 시장과 관련 시장

제17장 부록

KTH 25.11.28The global AIoT market is estimated to be worth USD 25.44 billion in 2025. It is projected to reach USD 81.04 billion by 2030, growing at a Compound Annual Growth Rate (CAGR) of 26.1% during the forecast period. The AIoT market is primarily driven by the growing convergence of artificial intelligence and the Internet of Things, enabling real-time data analytics, predictive insights, and autonomous decision-making across industries. The rollout of 5G networks, advancements in edge computing, and the availability of low-cost sensors are accelerating AIoT adoption by enhancing speed, connectivity, and cost efficiency.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | Offering, Technology, Deployment Type, Vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The expansion of smart city initiatives, industrial automation under Industry 4.0, and healthcare applications, including remote monitoring and predictive diagnostics, are further fueling market growth. Additionally, scalable cloud infrastructure supports the handling of massive data and AI-driven analytics, thereby strengthening the AIoT ecosystem. However, the market faces key restraints, including data security and privacy concerns, high implementation and integration costs, and a lack of standardization across IoT devices. The shortage of skilled professionals, regulatory complexities, and infrastructure limitations in developing regions further hinder large-scale deployment. Despite these challenges, technological advancements and cross-sector integration continue to position AIoT as a transformative enabler of intelligent, connected ecosystems worldwide.

"By service, the professional services segment is expected to hold the largest market size during the forecast period."

The professional services offered have been categorized into deployment and integration, support and maintenance, and training and consulting services. Several end-use organizations lack the capacity, and therefore, they hire other specialized firms to achieve the needed level of safety and/or protection. The implementation of AloT systems demands professional services, especially during and after the process. Some of the services are planning, designing, consulting, and upgrades. Organizations delivering these services include consultants, IoT specialists, AI specialists, and separate program management teams committed to developing and implementing mission-critical decision support systems, tools, services, and knowledge.

"By region, Asia Pacific is expected to have the highest growth rate during the forecast period."

The Asia Pacific market includes China, Japan, India, and other countries. These nations have focused heavily on developing innovative AloT technology. The region's expected high CAGR during the forecast period is due to its progressive and dynamic adoption of new technology solutions. The move toward commercializing IoT technology, along with the need for further developments to fully utilize it and to gain greater benefits from AloT platform solutions, is likely to boost their adoption in the region. Asia Pacific, with large economies like China, is expected to hold a significant share of the AloT market. The industries with the greatest potential for adopting AloT solutions, software, and services include mobility and transportation, energy and utilities, and healthcare and life sciences.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the AIoT market.

- By Company Type: Tier 1 - 70%, Tier 2 - 20%, and Tier 3 - 10%

- By Designation: C-level Executives - 73%, Managers - 18%, and Others - 9%

- By Region: North America - 30%, Europe - 25%, Asia Pacific - 35%, RoW - 10%

The major players in the AIoT market include IBM (US), Cisco (US), AWS (US), Google (US), Microsoft (US), Oracle (US), HPE (US), Intel (US), Hitachi (Japan), and SAP (Germany).

Research Coverage

The market report covered the AIoT market across segments. We estimated the market size and growth potential for many segments based on offering, technology, deployment type, vertical, and region. It contains a thorough competition analysis of the major market participants, information about their businesses, essential observations about their product offerings, current trends, and critical market strategies.

Reasons to buy this report:

With information on the most accurate revenue estimates for the whole AIoT industry and its subsegments, the research will benefit market leaders and recent newcomers. Stakeholders will benefit from this report's enhanced understanding of the competitive environment, which will enable them to better position their companies and develop effective go-to-market strategies. The research provides insights into the primary market drivers, constraints, opportunities, and challenges, enabling players to grasp the industry's pulse.

The report provides insights into the following pointers:

- Analysis of key drivers (exponential growth of data from IoT devices, demand for automation and enhanced operational efficiency, rising need to provide improved customer experiences and personalization), restraints (high costs of implementation, limited interoperability and fragmented standards), opportunities (rising investments in the Internet of Things (IoT), growing need for advanced security solutions), and challenges (lack of skills and awareness related to AIoT technologies, data privacy and security concerns)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the AIoT market

- Market Development: The report provides comprehensive information about lucrative markets and analyzes the AIoT market across various regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the AIoT market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading include include IBM (US), Cisco (US), AWS (US), Google (US), Microsoft (US), Oracle (US), HPE (US), Intel (US), Hitachi (Japan), SAP (Germany), Tencent Cloud (China), Sharp Global (Japan), SAS (US), PTC (US), Telit Cinterion (UK), Robert Bosch (Germany), Axiomtek (Taiwan), Softweb Solutions (US), Wiliot (Israel), Relayr (US), Terminus Group (China), C3 IoT (US), Clearblade (US), Semifive (South Korea), Falkonry (US), Uptake (US), Butlr (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Primary sources

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 GROWTH FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 3.3 DISRUPTIVE TRENDS SHAPING MARKET

- 3.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 3.5 SNAPSHOT: ASIA PACIFIC MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 GROWTH OPPORTUNITIES FOR PLAYERS IN AIOT MARKET

- 4.2 NORTH AMERICA: AIOT MARKET, BY OFFERING AND COUNTRY

- 4.3 ASIA PACIFIC: AIOT MARKET, BY OFFERING AND COUNTRY

- 4.4 AIOT MARKET, BY TECHNOLOGY

- 4.5 AIOT MARKET, BY DEPLOYMENT TYPE

- 4.6 AIOT MARKET, BY VERTICAL

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Exponential growth of data from IoT devices

- 5.2.1.2 Demand for automation and enhanced operational efficiency

- 5.2.1.3 Rising need to provide improved user experiences and personalization

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs of implementation

- 5.2.2.2 Limited interoperability and fragmented standards

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing investments in Internet of Things

- 5.2.3.2 Growing need for advanced security solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of skills and awareness related to AIoT technologies

- 5.2.4.2 Data privacy and security concerns

- 5.2.1 DRIVERS

- 5.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.3.1 INTERCONNECTED MARKETS

- 5.3.2 CROSS-SECTOR OPPORTUNITIES

- 5.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 5.5 INDUSTRY TRENDS

- 5.5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1.1 Threat of new entrants

- 5.5.1.2 Threat of substitutes

- 5.5.1.3 Bargaining power of suppliers

- 5.5.1.4 Bargaining power of buyers

- 5.5.1.5 Intensity of competitive rivalry

- 5.5.2 MACROECONOMIC OUTLOOK

- 5.5.2.1 Introduction

- 5.5.2.2 GDP trends and forecast

- 5.5.2.3 Trends in global AI industry

- 5.5.2.4 Trends in global IoT industry

- 5.5.3 SUPPLY CHAIN ANALYSIS

- 5.5.3.1 Data collection

- 5.5.3.2 Data processing

- 5.5.3.3 Data integration

- 5.5.3.4 Data presentation

- 5.5.4 ECOSYSTEM ANALYSIS

- 5.5.5 PRICING ANALYSIS

- 5.5.5.1 Average selling prices offered by key players, by offering, 2024

- 5.5.5.2 Indicative pricing analysis of AIoT, 2024

- 5.5.6 KEY CONFERENCES & EVENTS, 2025-2026

- 5.5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5.8 INVESTMENT AND FUNDING SCENARIO, 2024

- 5.5.9 CASE STUDY ANALYSIS

- 5.5.9.1 SUEZ improved its production quality control with Microsoft's AI and IoT solutions

- 5.5.9.2 US-based global manufacturer of professional factory grade systems used Orion's AIoT solutions to track system anomalies

- 5.5.9.3 Alibaba Cloud's ET City Brain solution helped city administrators in Hangzhou analyze traffic data

- 5.5.10 IMPACT OF 2025 US TARIFFS-AIOT MARKET

- 5.5.10.1 INTRODUCTION

- 5.5.10.2 Key tariff rates

- 5.5.10.3 Price impact analysis

- 5.5.10.4 Impact on countries/regions

- 5.5.10.4.1 US

- 5.5.10.4.2 Europe

- 5.5.10.4.3 Asia Pacific

- 5.5.10.5 Impact on AIoT end users

- 5.5.1 PORTER'S FIVE FORCES ANALYSIS

6 STRATEGIC DISRUPTION: PATENTS, DIGITAL, AND AI ADOPTIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 MACHINE LEARNING

- 6.1.2 NATURAL LANGUAGE PROCESSING

- 6.1.3 COMPUTER VISION

- 6.1.4 EDGE COMPUTING

- 6.1.5 CLOUD COMPUTING

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 5G

- 6.2.2 BLOCKCHAIN

- 6.2.3 DIGITAL TWIN

- 6.3 TECHNOLOGY/PRODUCT ROADMAP OF AIOT MARKET

- 6.3.1 AIOT TECHNOLOGY ROADMAP TILL 2030

- 6.3.1.1 Short-term roadmap (2025-2026)

- 6.3.1.2 Mid-term roadmap (2027-2028)

- 6.3.1.3 Long-term roadmap (2029-2030)

- 6.3.1 AIOT TECHNOLOGY ROADMAP TILL 2030

- 6.4 PATENT ANALYSIS

- 6.4.1 METHODOLOGY

- 6.5 FUTURE APPLICATIONS OF AIOT MARKET

- 6.6 IMPACT OF AI/GENERATIVE AI ON AIOT MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL OF GENERATIVE AI IN AIOT

- 6.6.2 BEST PRACTICES OF AIOT MARKET

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN AIOT MARKET

- 6.6.3.1 Siemens used predictive maintenance platform by Mindsphere to connect industrial assets

- 6.6.3.2 Industrial asset health and reduced downtime with help of GE

- 6.6.3.3 OpenBlue smart-building platform (AI for energy & operations)

- 6.6.3.4 Bosch/Industrial OEMs, maintenance 4.0 & factory optimization

- 6.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN AIOT

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.1.2.1 North America

- 7.1.2.1.1 US

- 7.1.2.1.2 Canada

- 7.1.2.2 Europe

- 7.1.2.3 Asia Pacific

- 7.1.2.3.1 China

- 7.1.2.3.2 Japan

- 7.1.2.3.3 India

- 7.1.2.4 Middle East & Africa

- 7.1.2.4.1 GCC countries

- 7.1.2.4.2 South Africa

- 7.1.2.5 Latin America

- 7.1.2.5.1 Brazil

- 7.1.2.1 North America

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS IN VARIOUS END-USE VERTICALS

9 AIOT MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.1.1 OFFERING: AIOT MARKET DRIVERS

- 9.2 PLATFORMS

- 9.2.1 NEED FOR SCALABILITY AND FLEXIBILITY IN MANAGING LARGE IOT ECOSYSTEMS TO DRIVE MARKET

- 9.2.2 IOT DEVICE MANAGEMENT

- 9.2.3 IOT APPLICATION ENABLEMENT PLATFORMS

- 9.2.4 IOT CONNECTIVITY MANAGEMENT

- 9.2.5 IOT CLOUD

- 9.2.6 IOT ADVANCED ANALYTICS

- 9.3 SOLUTIONS

- 9.3.1 RISING DEMAND FOR REAL-TIME DATA ANALYTICS TO ENABLE PREDICTIVE INSIGHTS TO DRIVE MARKET

- 9.3.2 DATA MANAGEMENT

- 9.3.3 REMOTE MONITORING

- 9.3.4 SECURITY SOLUTIONS

- 9.3.5 NETWORK MANAGEMENT

- 9.3.6 OTHER SOLUTIONS

- 9.4 SERVICES

- 9.4.1 NECESSITY FOR SEAMLESS INTEGRATION AND CUSTOMIZATION OF AIOT SOLUTIONS TO DRIVE MARKET

- 9.4.2 PROFESSIONAL SERVICES

- 9.4.2.1 Enabling seamless AIoT integration through expert consulting training and support to drive market

- 9.4.2.2 Deployment & integration

- 9.4.2.3 Support & maintenance

- 9.4.2.4 Training & consulting

- 9.4.3 MANAGED SERVICES

- 9.4.3.1 Driving continuous AIoT optimization through proactive management and support to drive market

10 AIOT MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.1.1 TECHNOLOGY: AIOT MARKET DRIVERS

- 10.2 MACHINE LEARNING

- 10.2.1 ROLE OF ALGORITHMS IN ENHANCING ACCURACY AND EFFICIENCY TO DRIVE MARKET

- 10.3 NATURAL LANGUAGE PROCESSING

- 10.3.1 ENABLING DEVICES TO UNDERSTAND CONTEXT, PERFORM TASKS, AND PROVIDE REAL-TIME FEEDBACK TO BOOST DEMAND

- 10.4 COMPUTER VISION

- 10.4.1 ROLE OF MACHINES IN INTERPRETING AND UNDERSTANDING VISUAL DATA TO DRIVE MARKET

- 10.5 CONTEXT-AWARE ARTIFICIAL INTELLIGENCE

- 10.5.1 ENHANCED DECISION-MAKING PROCESSES AND IMPROVED ABILITY TO INTERACT TO DRIVE MARKET

11 AIOT MARKET, BY DEPLOYMENT TYPE

- 11.1 INTRODUCTION

- 11.1.1 DEPLOYMENT TYPE: AIOT MARKET DRIVERS

- 11.2 CLOUD-BASED AIOT

- 11.2.1 INTEGRATION OF DATA COLLECTION AND PROCESSING FROM IOT DEVICES TO DRIVE MARKET

- 11.3 EDGE-BASED AIOT

- 11.3.1 DATA PROCESSING CLOSER TO IOT DEVICES OR AT EDGE TO DRIVE MARKET

12 AIOT MARKET, BY VERTICAL

- 12.1 INTRODUCTION

- 12.1.1 VERTICAL: AIOT MARKET DRIVERS

- 12.2 CONSUMER ELECTRONICS

- 12.2.1 ABILITY TO MEASURE AND CONTROL ENERGY USE TO BOOST DEMAND

- 12.3 MANUFACTURING

- 12.3.1 ADOPTION OF INDUSTRY 4.0 AND 5.0 PRINCIPLES TO DRIVE MARKET

- 12.4 BFSI

- 12.4.1 INCREASING DEPLOYMENT OF AIOT WITH RISING COMPETITION IN FINTECH SECTOR TO DRIVE MARKET

- 12.5 TRANSPORTATION & LOGISTICS

- 12.5.1 INCREASED ADOPTION OF CONNECTED VEHICLES AND FLEET MANAGEMENT REQUIREMENTS TO DRIVE MARKET

- 12.6 GOVERNMENT & DEFENSE

- 12.6.1 FOCUS ON DIGITALIZATION AND VARIOUS GOVERNMENT INITIATIVES TO DRIVE GROWTH

- 12.7 ENERGY & UTILITIES

- 12.7.1 REAL-TIME MONITORING OF ENERGY CONSUMPTION AND EFFICIENCY TO DRIVE MARKET

- 12.8 RETAIL

- 12.8.1 GROWING POPULARITY OF DIGITAL SIGNAGE AND INTELLIGENT VENDING MACHINES TO FUEL MARKET GROWTH

- 12.9 HEALTHCARE

- 12.9.1 ABILITY TO ENABLE REAL-TIME PATIENT MONITORING AND DATA-DRIVEN DIAGNOSTICS TO DRIVE MARKET

- 12.10 OTHER VERTICALS

13 AIOT MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 US

- 13.2.1.1 Rising inclination toward innovation and state-of-the-art infrastructure to drive market

- 13.2.2 CANADA

- 13.2.2.1 Active government funding in R&D to drive adoption of AIoT

- 13.2.1 US

- 13.3 EUROPE

- 13.3.1 UK

- 13.3.1.1 Increasing adoption of AI-powered solutions in healthcare sector to drive market

- 13.3.2 GERMANY

- 13.3.2.1 Increased use of AIoT solutions for optimizing industrial systems to drive market

- 13.3.3 RUSSIA

- 13.3.3.1 Growth in initiatives to drive innovations in AIoT

- 13.3.3.2 Market segmentation data

- 13.3.3.3 Market drivers and opportunities

- 13.3.3.3.1 Drivers

- 13.3.3.3.1.1 Increasing adoption of advanced technologies

- 13.3.3.3.1.2 Growing government initiatives and policies

- 13.3.3.3.2 Opportunities

- 13.3.3.3.2.1 Increased government focus and collaborations with companies accelerating AIoT development

- 13.3.3.3.2.2 Significant investments in AI

- 13.3.3.3.1 Drivers

- 13.3.3.4 Company profiles

- 13.3.3.4.1 SberMobile

- 13.3.3.4.2 AtomPark Software

- 13.3.3.4.3 e-legion

- 13.3.3.5 Strategic recommendations

- 13.3.3.6 Vertical trends

- 13.3.4 FRANCE

- 13.3.4.1 Rise in global investments to boost country's technological sector

- 13.3.5 REST OF EUROPE

- 13.3.1 UK

- 13.4 ASIA PACIFIC

- 13.4.1 CHINA

- 13.4.1.1 Active involvement of global players in promoting use of AIoT to boost demand

- 13.4.2 JAPAN

- 13.4.2.1 Enterprises to realize opportunities in sensor-to-edge and edge-to-core AIoT

- 13.4.3 INDIA

- 13.4.3.1 Extensive deployment of AIoT solutions in farming sector to drive market

- 13.4.3.2 Market segmentation data

- 13.4.3.3 Market drivers and opportunities

- 13.4.3.3.1 Drivers

- 13.4.3.3.1.1 Growing talent expansion and sustained investment in AIoT

- 13.4.3.3.1.2 Proactive government approach toward promoting AIoT adoption

- 13.4.3.3.1.3 Increasing adoption of IoT devices

- 13.4.3.3.2 Opportunities

- 13.4.3.3.2.1 Increasing initiatives for smart cities in India

- 13.4.3.3.2.2 Increasing government initiatives and investments in R&D

- 13.4.3.3.1 Drivers

- 13.4.3.4 Company profiles

- 13.4.3.4.1 Autoplant Systems India Pvt. Ltd.

- 13.4.3.4.2 Wipro

- 13.4.3.4.3 TCS

- 13.4.3.4.4 Tech Mahindra

- 13.4.3.4.5 HCL Technologies

- 13.4.3.5 Strategic recommendations

- 13.4.3.6 Vertical Trends

- 13.4.4 REST OF ASIA PACIFIC

- 13.4.1 CHINA

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 KSA

- 13.5.1.1 Increasing investments in data center infrastructures and growth in number of startups to drive market

- 13.5.2 UAE

- 13.5.2.1 Growing digital transformations to boost market

- 13.5.3 TURKIYE

- 13.5.3.1 Rapid adoption of AIoT solutions to drive market expansion

- 13.5.3.2 Market drivers and opportunities

- 13.5.3.2.1 Drivers

- 13.5.3.2.1.1 Increased government investments and initiatives aimed at developing AIoT

- 13.5.3.2.1.2 Continuous advancements in technology

- 13.5.3.2.2 Opportunities

- 13.5.3.2.2.1 Rising need for development of smart cities

- 13.5.3.2.2.2 Increasing investments in AIoT technologies and strategic initiatives to bolster AIoT startups

- 13.5.3.2.1 Drivers

- 13.5.3.3 Company profiles

- 13.5.3.3.1 Volsoft

- 13.5.3.3.2 Teknopar

- 13.5.3.3.3 Ardic

- 13.5.3.3.4 Iot Teknoloji

- 13.5.3.3.5 Forfarming

- 13.5.3.4 Strategic recommendations

- 13.5.3.5 Vertical trends

- 13.5.4 SOUTH AFRICA

- 13.5.4.1 Increasing collaborations between startups and key players to promote use of AIoT solutions

- 13.5.5 REST OF MIDDLE EAST & AFRICA

- 13.5.1 KSA

- 13.6 LATIN AMERICA

- 13.6.1 MARKET DRIVERS AND OPPORTUNITIES

- 13.6.1.1 Drivers

- 13.6.1.1.1 Technological advancements in agriculture are expected to drive market

- 13.6.1.1.2 Increased government projects and public-private partnerships are expected to drive market

- 13.6.1.2 Opportunities

- 13.6.1.2.1 Smart city initiatives expected to create great opportunity for AIoT market to grow

- 13.6.1.2.2 Increased demand for smart energy solutions

- 13.6.1.1 Drivers

- 13.6.2 COMPANY PROFILES

- 13.6.2.1 Jump Corp

- 13.6.2.2 Smartdots

- 13.6.2.3 Softrack

- 13.6.2.4 Iot technologies

- 13.6.2.5 Strategic recommendations

- 13.6.2.6 Vertical trends

- 13.6.3 BRAZIL

- 13.6.3.1 Government initiatives to support growth of AIoT

- 13.6.4 MEXICO

- 13.6.4.1 Rising need for enhanced connectivity in business processes to drive market

- 13.6.4.2 Market drivers and opportunities

- 13.6.4.2.1 Drivers

- 13.6.4.2.1.1 Increased demand for smart solutions

- 13.6.4.2.1.2 Government initiatives and investments

- 13.6.4.2.2 Opportunities

- 13.6.4.2.2.1 Increased focus on development of smart cities

- 13.6.4.2.2.2 Innovation and sustainability in agriculture

- 13.6.4.2.1 Drivers

- 13.6.4.3 Company profiles

- 13.6.4.3.1 Softtek

- 13.6.4.3.2 Kio Networks

- 13.6.4.3.3 Xertica.ai

- 13.6.4.3.4 NDS Cognitive Labs

- 13.6.4.4 Strategic recommendations

- 13.6.4.5 Vertical trends

- 13.6.5 REST OF LATIN AMERICA

- 13.6.1 MARKET DRIVERS AND OPPORTUNITIES

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 14.3 REVENUE ANALYSIS, 2020-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.5.5.1 Company footprint

- 14.5.5.2 Region footprint

- 14.5.5.3 Offering footprint

- 14.5.5.4 Deployment type footprint

- 14.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.6.5.1 Detailed list of key startups/SMEs

- 14.6.5.2 Competitive benchmarking of key startups/SMEs

- 14.7 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 14.8 COMPETITIVE SCENARIO

- 14.8.1 PRODUCT LAUNCHES

- 14.8.2 DEALS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 IBM

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 CISCO

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 AWS

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches

- 15.1.3.3.2 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 GOOGLE

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 MICROSOFT

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches

- 15.1.5.3.2 Deals

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 ORACLE

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.7 HPE

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches

- 15.1.7.3.2 Deals

- 15.1.8 INTEL

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches

- 15.1.8.3.2 Deals

- 15.1.9 HITACHI

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches

- 15.1.9.3.2 Deals

- 15.1.10 SAP

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Deals

- 15.1.1 IBM

- 15.2 OTHER PLAYERS

- 15.2.1 TENCENT CLOUD

- 15.2.2 SHARP GLOBAL

- 15.2.3 PTC

- 15.2.4 SAS

- 15.2.5 TELIT CINTERION

- 15.2.6 ROBERT BOSCH

- 15.3 SMES/STARTUPS

- 15.3.1 AXIOMTEK

- 15.3.2 SOFTWEB SOLUTIONS

- 15.3.3 WILIOT

- 15.3.4 RELAYR

- 15.3.5 TERMINUS GROUP

- 15.3.6 C3 IOT

- 15.3.7 CLEARBLADE

- 15.3.8 SEMIFIVE

- 15.3.9 FALKONRY

- 15.3.10 UPTAKE

- 15.3.11 BUTLR

16 ADJACENT AND RELATED MARKETS

- 16.1 INTRODUCTION TO ADJACENT MARKETS

- 16.2 LIMITATIONS

- 16.3 ARTIFICIAL INTELLIGENCE MARKET

- 16.3.1 MARKET DEFINITION

- 16.4 IOT MARKET

- 16.4.1 MARKET DEFINITION

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS