|

시장보고서

상품코드

1877347

농업용 로봇 시장 : 로봇 유형별, 용도별, 제공별, 최종 용도별, 농업 환경별, 농장 규모별, 지역별 예측(-2030년)Agricultural Robots Market by Robot Type, Application, Offering, End Use, Farming Environment, Farm Size, and Region - Global Forecast to 2030 |

||||||

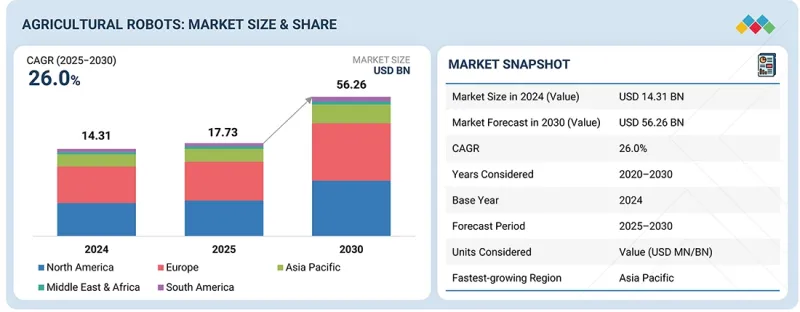

세계의 농업용 로봇 시장 규모는 2025년에 177억 3,000만 달러 규모에 달할 것으로 예측됩니다.

예측 기간 중 CAGR은 26.0%로 2030년까지 562억 6,000만 달러에 달할 것으로 전망됩니다. 농업용 로봇에 대한 인공지능(AI)의 채용은 데이터 구동형으로 효율적인 농업 운영으로의 전환을 가속화하고 있습니다. AI를 통해 로봇은 씨앗, 작물 감시, 제초, 수확 등의 복잡한 작업을 인간의 개입을 최소화하면서 정밀하게 수행할 수 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2025-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(100만 달러) |

| 부문 | 로봇 유형별, 용도별, 최종 용도별, 농업 환경별, 제공별, 농장 규모별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미 및 기타 지역 |

머신러닝과 컴퓨터 비전을 활용함으로써 이러한 시스템은 자원 활용 최적화, 수확량 예측 정확도 향상 및 운영 비용 절감을 실현합니다. 자율주행 트랙터와 무인 항공기에 대한 AI 통합은 대규모 농장에서 의사결정과 확장성을 강화합니다. 기술 비용이 낮아짐에 따라 AI 구동형 농업용 로봇은 지속가능하고 생산성이 높고 탄력적인 농업 비즈니스 운영을 위한 전략적 추진력이 되고 있습니다.

무인 항공기(UAV) 부문은 현대 농업의 범용성과 효율성으로 인해 농업용 로봇 시장에서 점유율을 차지하고 있습니다. 드론이라고도 불리는 UAV는 작물 모니터링, 농장 매핑, 정밀 살포, 토양 분석에 널리 활용되고 있습니다. 고해상도 카메라, 멀티스펙트럼 센서, AI 탑재 분석 기능을 장비하여 작물의 건강 상태, 해충 피해, 관개 요구에 대한 실시간 지식을 제공합니다. 광범위한 신속하고 비용 효율적인 커버리지 능력을 통해 노동력 수요를 줄이면서 생산성을 향상시킵니다. 정밀농업, 데이터구동형 의사결정, 지속가능한 농업기술에 대한 수요 증가가 세계적인 농업운영에 있어서 UAV의 급속한 보급을 추진하고 있습니다.

농업용 로봇 시장에서의 필드 농업 분야는 자동화와 정밀 농업 실천의 보급 확대를 배경으로 예측 기간 동안 현저한 성장률을 나타낼 것으로 예측됩니다. 대규모 농장에서는 파종, 심기, 제초, 관개, 수확 등의 작업에 로봇과 자율 기계가 점점 도입되고 있습니다. 이러한 기술은 작업 효율 향상, 노동력 의존도 저감, 물·비료·농약을 포함한 자원 이용 최적화를 실현합니다. AI, 머신러닝, IoT 대응 센서의 발전으로 정확성과 의사 결정 능력이 더욱 향상되었습니다. 보다 높은 수확량과 지속가능한 농업 기법에 대한 수요 증가는 이 분야의 세계적인 견조한 성장을 이끌 것으로 예측됩니다.

북미는 선진기술의 조기 도입과 확립된 정밀농업의 실천에 의해 농업용 로봇 시장에서 큰 점유율을 차지할 것으로 예측됩니다. 이 지역은 농업 자동화에 대한 강력한 투자, 정부의 지원책, AI 및 로봇 기술을 활용한 솔루션에 대한 높은 인지도 등의 이점을 가지고 있습니다. 생산성 향상, 자원 이용 최적화, 노동력 의존도 저감을 위해 자율주행 트랙터, 드론, AI 탑재 로봇을 농가가 활용하는 경우가 증가하고 있습니다. 또한 주요 시장 기업의 존재와 로보틱스 및 IoT 기술의 지속적인 혁신이 결합되어 스마트하고 지속 가능한 농업 솔루션의 도입에 있어 북미가 주도적인 지역으로서의 지위를 더욱 강화하고 있습니다.

본 보고서에서는 세계의 농업용 로봇 시장에 대해 조사했으며 로봇 유형별, 용도별, 제공별, 농업 환경별, 농장 규모별, 최종 용도별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 서론

- 거시경제지표

- 시장 역학

- 미충족 수요(Unmet Needs)와 백스페이스

- 연결된 시장과 부문 간 기회

- 새로운 비즈니스 모델과 생태계의 변화

- Tier 1/2/3 기업의 전략적 움직임

제6장 업계 동향

- Porter's Five Forces 분석

- 밸류체인 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 주된 회의와 이벤트(2024-2026년)

- 고객사업에 영향을 주는 동향/혼란

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 미국 관세의 영향 - 농업용 로봇 시장(2025년)

제7장 기술, 특허, 디지털, AI 도입으로 파괴적 혁신

- 주요 신기술

- AI 탑재 컴퓨터 비전과 딥러닝

- 공중 지상 협조 시스템(UAV-UGV 통합)

- 스웜 로봇

- RTK GPS와 고정밀 측위

- 보완적 기술

- IoT 센서와 스마트 필드 감시 시스템

- 5G 연결 및 엣지 컴퓨팅

- 클라우드 기반 농장 관리 플랫폼

- 기술/제품 로드맵

- 단기(2025-2027년) | 기반 구축과 조기 상업화

- 중기(2027-2030년)|확장과 표준화

- 장기적(2030-2035년 이후) | 대규모 상업화와 파괴적 변화

- 특허 분석

- 미래의 응용

- AI/생성형 AI가 농업용 로봇 시장에 미치는 영향

- 성공 사례와 실세계에의 응용

제8장 규제 상황

- 지역 규제 및 규정 준수

- 농업기계의 세계기준

- 북미

- 유럽연합(EU)

- 아시아태평양

- 기타 지역

- 업계 표준

제9장 고객정세와 구매행동

- 의사결정 프로세스

- 구매자의 이해관계자와 구매평가기준

- 채용 장벽과 내부 과제

- 시장 수익성

제10장 농업용 로봇 시장(로봇 유형별)

- 서론

- 무인 항공기

- 착유 로봇

- 무인 트랙터

- 자동화 수확 시스템

- 기타

제11장 농업용 로봇 시장(용도별)

- 서론

- 수확 관리

- 밭농사 및 작물 관리

- 낙농 및 가축 관리

- 토양 및 관개 관리

- 재고 및 공급망 관리

- 기타

제12장 농업용 로봇 시장(제공별)

- 서론

- 하드웨어

- 소프트웨어

- 서비스

제13장 농업용 로봇 시장(농업 환경별)

- 서론

- 실외

- 실내

제14장 농업용 로봇 시장(농장 규모별)

- 서론

- 소규모 농장(100헥타르 미만)

- 중규모 농장(100헥타르 이상 500헥타르 미만)

- 대규모 농장(500헥타르 이상)

제15장 농업용 로봇 시장(최종 용도별)

- 서론

- 농산물

- 유제품 및 축산

제16장 농업용 로봇 시장(지역별)

- 서론

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 프랑스

- 독일

- 이탈리아

- 네덜란드

- 영국

- 기타

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

- 기타 지역

- 중동

- 아프리카

제17장 경쟁 구도

- 개요

- 주요 진입기업의 전략/강점

- 연간 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업평가와 재무지표

- 제품 비교

- 경쟁 시나리오와 동향

제18장 기업 프로파일

- 주요 진출기업

- DEERE & COMPANY

- CNH INDUSTRIAL NV

- AGCO CORPORATION

- TRIMBLE INC.

- DJI

- BOUMATIC

- LELY INTERNATIONAL

- EAGLENXT

- KUBOTA CORPORATION

- DELAVAL

- HARVEST CROO ROBOTICS

- NAIO TECHNOLOGIES

- ECOROBOTIX

- AGROBOTS

- ROBOTICS PLUS

- 기타 기업

- AUTONOMOUS TRACTOR CORPORATION

- FFROBOTICS

- DRONEDEPLOY

- YANMAR CO.

- CLEARPATH ROBOTICS, INC.

- BONSAI ROBOTICS INC.

- AIGEN

- TEVEL AEROBOTICS TECHNOLOGIES LTD.

- SWARMFARM

- MONARCH TRACTOR

제19장 인접 시장과 관련 시장

제20장 부록

KTH 25.11.28The global market for agricultural robots is estimated to be valued at USD 17.73 billion in 2025. It is projected to reach USD 56.26 billion by 2030, at a CAGR of 26.0% during the forecast period. The adoption of artificial intelligence (AI) in agricultural robots is accelerating the shift toward data-driven and efficient farming operations. AI enables robots to perform complex tasks such as seeding, crop monitoring, weeding, and harvesting with precision and minimal human intervention.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Robot Type, Application, End Use, Farming Environment, Offering, Farm Size, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

By leveraging machine learning and computer vision, these systems optimize resource utilization, improve yield prediction, and reduce operational costs. The integration of AI with autonomous tractors and drones enhances decision-making and scalability across large farms. As technology costs decline, AI-driven agricultural robots are becoming a strategic enabler for sustainable, productive, and resilient agri-business operations.

"The unmanned aerial vehicles segment holds the highest market share in the robot type segment of the agricultural robots market."

The unmanned aerial vehicle (UAV) segment leads the agricultural robots market in terms of market share due to its versatility and efficiency in modern farming. UAVs, also known as drones, are widely used for crop monitoring, field mapping, precision spraying, and soil analysis. Equipped with high-resolution cameras, multispectral sensors, and AI-enabled analytics, they provide real-time insights into crop health, pest infestations, and irrigation needs. Their ability to cover large areas quickly and cost-effectively reduces labor requirements while enhancing productivity. The growing demand for precision agriculture, data-driven decision-making, and sustainable farming practices is driving the rapid adoption of UAVs across global agricultural operations.

"The field farming application segment is projected to grow at a significant rate during the forecast period."

The field farming application segment in the agricultural robots market is projected to grow at a significant rate during the forecast period, driven by increasing adoption of automation and precision agriculture practices. Robots and autonomous machinery are increasingly deployed for activities such as seeding, planting, weeding, irrigation, and harvesting across large-scale farms. These technologies improve operational efficiency, reduce labor dependency, and optimize resource utilization, including water, fertilizers, and pesticides. Advances in AI, machine learning, and IoT-enabled sensors further enhance accuracy and decision-making. The growing demand for higher crop yields and sustainable farming practices is expected to drive robust growth in this segment globally.

North America is expected to hold a significant share of the agricultural robots market.

North America is expected to hold a significant share in the agricultural robots market due to early adoption of advanced technologies and well-established precision farming practices. The region benefits from strong investment in agrarian automation, supportive government initiatives, and high awareness of AI- and robotics-driven solutions. Farmers are increasingly using autonomous tractors, drones, and AI-enabled robots to enhance productivity, optimize resource utilization, and reduce labor dependency. Additionally, the presence of key market players and continuous innovation in robotics and IoT technologies further strengthen North America's position as a leading region in the adoption of smart and sustainable agricultural solutions.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the agricultural robots market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors- 20%, Managers - 50%, Executives- 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15% and Rest of the World -10%

Prominent companies in the market include Deere & Company (US), DJI (China), CNH Industrial NV (Netherlands), AGCO Corporation (US), Delaval (Sweden), Trimble Inc. (US), Boumatic Robotic (Netherlands), Lely (Netherlands), AgJunction (US), AgEagle Aerial Systems (US), Yanmar Co. (Japan), Deepfield Robotics (Germany), Ecorobotix (Switzerland), Harvest Automation (US), and Naio Technologies (France).

Other players include Robotics Plus (Zealand), Kubota Corporation (Japan), Harvest Cro Robotics (US), Autonomous Tractor Corporation (US), Clearpath Robotics (Canada), Dronedeploy (US), Agrobots (Spain), FFRobotics (Israel), Fullwood Joz (UK), and Monarch Tractors (US).

Research Coverage:

This research report categorizes the agricultural robots market by robot type (unmanned aerial vehicles/drones, milking robotics, driverless tractor, automated harvesting robots), (harvest management, field & crop management, dairy & livestock management, inventory & supply chain management, soil & irrigation management, weather tracking & forecasting), end use (farm produce, dairy & livestock), farming environment (indoor, outdoor), offering (hardware, software, services), farm size (small-sized farm, mid-sized farms, large sized farms) and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report encompasses detailed information regarding the major factors, including drivers, restraints, challenges, and opportunities, that influence the growth of the agricultural robots market. A detailed analysis of key industry players has been conducted to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments related to the agricultural robots market. This report provides a competitive analysis of emerging startups in the agricultural robots market ecosystem. Furthermore, the study also covers industry-specific trends, including technology analysis, ecosystem and market mapping, patent analysis, and regulatory landscape, among others.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall agricultural robots and the subsegments. This report will help stakeholders understand the competitive landscape and gain valuable insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market, providing them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (increasing demand for food), restraints (supply chain disruption), opportunities (technological innovations), and challenges (regulatory barriers) influencing the growth of the agricultural robots market.

- New product launch/Innovation: Detailed insights on research & development activities and new product launches in the agricultural robots market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the agricultural robots market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the agricultural robots market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players such as Deere & Company (US), DJI (China), CNH Industrial NV (Netherlands), AGCO Corporation (US), Delaval (Sweden), and other players in the agricultural robots market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE AND SEGMENTATION

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.3.6 STAKEHOLDERS

- 1.4 SUMMARY OF STRATEGIC CHANGES IN MARKET

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 BASE NUMBER CALCULATION

- 2.3 MARKET FORECAST APPROACH

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 3.3 DISRUPTIVE TRENDS SHAPING MARKET

- 3.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 3.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AGRICULTURAL ROBOTS MARKET

- 4.2 AGRICULTURAL ROBOTS MARKET, BY OFFERING AND REGION

- 4.3 AGRICULTURAL ROBOTS MARKET, BY FARM SIZE

- 4.4 AGRICULTURAL ROBOTS MARKET, BY APPLICATION

- 4.5 AGRICULTURAL ROBOTS MARKET, BY END USE

- 4.6 AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT

- 4.7 AGRICULTURAL ROBOTS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 REDUCTION IN ARABLE LAND

- 5.2.2 RAPID DIGITALIZATION

- 5.2.3 LIVESTOCK POPULATION TRENDS

- 5.3 MARKET DYNAMICS

- 5.3.1 INTRODUCTION

- 5.3.2 DRIVERS

- 5.3.2.1 Advancement in technologies

- 5.3.2.2 Sustainability goals accelerate adoption of agricultural robots

- 5.3.2.3 Surging labor costs and labor shortages

- 5.3.2.4 Increasing number of dairy, poultry, and swine farms

- 5.3.3 RESTRAINTS

- 5.3.3.1 High initial cost of automation for small farms

- 5.3.3.2 Technological barriers pertaining to fully autonomous robots

- 5.3.3.3 Complex and unstructured farm environments

- 5.3.3.4 Lack of training activities in operating agricultural robots

- 5.3.4 OPPORTUNITIES

- 5.3.4.1 Untapped market potential and scope for automation in agriculture

- 5.3.4.2 Controlled Environment Agriculture (CEA) to drive adoption of agricultural robots

- 5.3.4.3 High adoption of aerial data collection tools in agriculture

- 5.3.4.4 Adoption of software, data, and service-based business models

- 5.3.5 CHALLENGES

- 5.3.5.1 Lack of standardization and regulation of agricultural robot technologies globally

- 5.3.5.2 High cost and complexity of fully autonomous robots

- 5.3.5.3 Integration challenges with existing farm equipment

- 5.3.5.4 Lack of technical knowledge among farmers

- 5.4 UNMET NEEDS AND WHITE SPACES

- 5.4.1 UNMET NEEDS IN AGRICULTURAL ROBOTS MARKET

- 5.4.2 WHITE SPACE OPPORTUNITIES

- 5.5 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.5.1 INTERCONNECTED MARKETS

- 5.5.2 CROSS-SECTOR OPPORTUNITIES

- 5.6 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 5.6.1 EMERGING BUSINESS MODELS

- 5.6.2 ECOSYSTEM SHIFTS

- 5.7 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 5.7.1 KEY MOVES AND STRATEGIC FOCUS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF NEW ENTRANTS

- 6.1.2 THREAT OF SUBSTITUTES

- 6.1.3 BARGAINING POWER OF SUPPLIERS

- 6.1.4 BARGAINING POWER OF BUYERS

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.2.2 DEVICE AND COMPONENT MANUFACTURERS

- 6.2.3 SYSTEM INTEGRATORS

- 6.2.4 SERVICE PROVIDERS

- 6.2.5 END USERS

- 6.2.6 POST-SALES SERVICES

- 6.3 ECOSYSTEM ANALYSIS

- 6.3.1 DEMAND SIDE

- 6.3.2 SUPPLY SIDE

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE, BY KEY PLAYER

- 6.4.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.5 TRADE ANALYSIS

- 6.5.1 EXPORT SCENARIO OF HS CODE 8433

- 6.5.2 IMPORT SCENARIO OF HS CODE 8433

- 6.6 KEY CONFERENCES AND EVENTS, 2024-2026

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.8 INVESTMENT AND FUNDING SCENARIO

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 KUBOTA-KILTER COLLABORATION ON AX-1 ULTRA-PRECISE WEEDING ROBOT

- 6.9.2 ENHANCING SOFT-FRUIT HARVESTING THROUGH PLATFORM-AGNOSTIC ROBOTICS INTEGRATION

- 6.9.3 AIGEN'S ELEMENT GEN2 ROBOTIC CREW FOR WEED CONTROL

- 6.10 IMPACT OF 2025 US TARIFF - AGRICULTURAL ROBOTS MARKET

- 6.10.1 INTRODUCTION

- 6.10.2 KEY TARIFF RATES

- 6.10.3 PRICE IMPACT ANALYSIS

- 6.10.4 IMPACT ON COUNTRY/REGION

- 6.10.4.1 US

- 6.10.4.2 Europe

- 6.10.4.3 Asia Pacific

- 6.10.5 IMPACT ON END-USE INDUSTRIES

7 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 7.1 KEY EMERGING TECHNOLOGIES

- 7.1.1 AI-POWERED COMPUTER VISION & DEEP LEARNING

- 7.1.2 AERIAL-GROUND COLLABORATIVE SYSTEMS (UAV-UGV INTEGRATION)

- 7.1.3 SWARM ROBOTICS

- 7.1.4 RTK GPS & HIGH-PRECISION POSITIONING

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 IOT SENSORS AND SMART FIELD MONITORING SYSTEMS

- 7.2.2 5G CONNECTIVITY AND EDGE COMPUTING

- 7.2.3 CLOUD-BASED FARM MANAGEMENT PLATFORMS

- 7.3 TECHNOLOGY/PRODUCT ROADMAP

- 7.3.1 SHORT-TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 7.3.2 MID-TERM (2027-2030) | EXPANSION & STANDARDIZATION

- 7.3.3 LONG-TERM (2030-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 7.4 PATENT ANALYSIS

- 7.4.1 INTRODUCTION

- 7.4.2 METHODOLOGY

- 7.4.3 DOCUMENT TYPE

- 7.4.4 INSIGHTS

- 7.4.5 LEGAL STATUS OF PATENTS

- 7.4.6 JURISDICTION ANALYSIS

- 7.4.7 TOP APPLICANTS

- 7.4.8 LIST OF PATENTS BY DEERE & CO

- 7.5 FUTURE APPLICATIONS

- 7.5.1 AUTONOMOUS SWARM ROBOTICS: SCALABLE FIELD OPTIMIZATION

- 7.5.2 AI-INTEGRATED HARVESTING ROBOTS: PRECISION YIELD OPTIMIZATION

- 7.5.3 SENSOR-EMBEDDED SOIL MONITORING ROBOTS: REAL-TIME FARM DIAGNOSTICS

- 7.5.4 BIODEGRADABLE FIELD ROBOTS: CIRCULAR AGRICULTURE ENHANCEMENT

- 7.5.5 HYBRID AGRO-ROBOTIC SYSTEMS: UAV-UGV INTEGRATION FOR ADVANCED OPERATIONS

- 7.6 IMPACT OF AI/GEN AI ON AGRICULTURAL ROBOTS MARKET

- 7.6.1 TOP USE CASES AND MARKET POTENTIAL

- 7.6.2 BEST PRACTICES IN AGRICULTURAL ROBOT MANUFACTURING

- 7.6.3 CASE STUDIES OF AI IMPLEMENTATION IN AGRICULTURAL ROBOTS MARKET

- 7.6.4 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- 7.6.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN AGRICULTURAL ROBOTS MARKET

- 7.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 7.7.1 DEERE & COMPANY - AUTONOMOUS TRACTORS & AI SPRAYING

- 7.7.2 AGCO CORPORATION - AUTONOMOUS FIELD ROBOTS

- 7.7.3 CNH INDUSTRIAL N.V. - SPECIALTY CROP ROBOTS & AUTONOMOUS TRACTORS

8 REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.1.1 GLOBAL STANDARDS FOR AGRICULTURAL MACHINERY

- 8.1.2 NORTH AMERICA

- 8.1.2.1 United States (US)

- 8.1.2.2 Canada

- 8.1.2.3 Mexico

- 8.1.3 EUROPEAN UNION (EU)

- 8.1.4 ASIA PACIFIC

- 8.1.4.1 India

- 8.1.4.2 China

- 8.1.4.3 Australia

- 8.1.5 REST OF THE WORLD

- 8.1.6 INDUSTRY STANDARDS

9 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 9.1 DECISION-MAKING PROCESS

- 9.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 9.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.2.2 BUYING CRITERIA

- 9.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 9.4 MARKET PROFITABILITY

- 9.4.1 REVENUE POTENTIAL

- 9.4.2 COST DYNAMICS

- 9.4.3 MARGIN OPPORTUNITIES BY APPLICATION

10 AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE

- 10.1 INTRODUCTION

- 10.2 UNMANNED AERIAL VEHICLES

- 10.2.1 INCREASING DEMAND FOR REAL-TIME CROP MONITORING AND PRECISION SPRAYING TO ENHANCE YIELD TO FUEL MARKET GROWTH

- 10.2.1.1 Fixed-wing drones

- 10.2.1.2 Multi-rotor drones

- 10.2.1.3 Hybrid drones

- 10.2.1 INCREASING DEMAND FOR REAL-TIME CROP MONITORING AND PRECISION SPRAYING TO ENHANCE YIELD TO FUEL MARKET GROWTH

- 10.3 MILKING ROBOTS

- 10.3.1 LABOR SHORTAGE AND NEED FOR CONSISTENT, HIGH-EFFICIENCY DAIRY OPERATIONS TO DRIVE DEMAND

- 10.3.1.1 Automated Milking Rotary Systems

- 10.3.1.2 Box/Stall Milking Systems

- 10.3.1 LABOR SHORTAGE AND NEED FOR CONSISTENT, HIGH-EFFICIENCY DAIRY OPERATIONS TO DRIVE DEMAND

- 10.4 DRIVERLESS TRACTORS

- 10.4.1 DRIVERLESS TRACTORS TO LEAD TO LESS DAMAGE TO SOIL DUE TO AUTOMATED SOFTWARE AND LESS HUMAN ERROR

- 10.4.1.1 Fully Autonomous Tractors

- 10.4.1.2 Semi-autonomous Tractors

- 10.4.1 DRIVERLESS TRACTORS TO LEAD TO LESS DAMAGE TO SOIL DUE TO AUTOMATED SOFTWARE AND LESS HUMAN ERROR

- 10.5 AUTOMATED HARVESTING SYSTEMS

- 10.5.1 REDUCTION OF NEED FOR MANUAL LABOR AND INCREASING OPERATIONAL EFFICIENCY TO DRIVE SEGMENT

- 10.5.1.1 Fruit-picking Robots

- 10.5.1.2 Vegetable Harvesting Robots

- 10.5.1 REDUCTION OF NEED FOR MANUAL LABOR AND INCREASING OPERATIONAL EFFICIENCY TO DRIVE SEGMENT

- 10.6 OTHERS

- 10.6.1 MATERIAL MANAGEMENT ROBOTS

- 10.6.2 SOIL MANAGEMENT ROBOTS

- 10.6.3 CROP MONITORING AND SCOUTING ROBOTS

- 10.6.4 WEEDING AND THINNING ROBOTS

- 10.6.5 PRUNING ROBOTS

- 10.6.6 SPRAYING & IRRIGATION ROBOTS

- 10.6.7 OTHER SPECIALIZED AGRICULTURAL ROBOTS

11 AGRICULTURAL ROBOTS MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 HARVEST MANAGEMENT

- 11.2.1 HARVEST MANAGEMENT APPLICATIONS TO DRIVE UTILIZATION OF UAV AND AUTOMATED HARVESTING SYSTEMS

- 11.3 FIELD FARMING & CROP MANAGEMENT

- 11.3.1 USAGE OF ROBOTS IN PLOWING AND SEEDING TO YIELD BETTER PRODUCTIVITY

- 11.3.2 PLANTING AND SEEDING

- 11.3.3 MONITORING & SCOUTING

- 11.3.4 FERTILIZATION & NUTRIENT MANAGEMENT

- 11.4 DAIRY & LIVESTOCK MANAGEMENT

- 11.4.1 MILKING ROBOTS TO AUTOMATE MANUAL PROCESSES IN DAIRY FARMS

- 11.5 SOIL & IRRIGATION MANAGEMENT

- 11.5.1 USAGE OF DRONES IN SOIL & IRRIGATION MANAGEMENT TO DRIVE MARKET

- 11.6 INVENTORY & SUPPLY CHAIN MANAGEMENT

- 11.6.1 INVENTORY MANAGEMENT TO STREAMLINE TRACKING AND ORGANIZING OF AGRICULTURAL PRODUCTS AND RESOURCES

- 11.6.2 WEATHER TRACKING & MONITORING

- 11.6.2.1 Demand for real-time weather data to drive robotic field optimization

- 11.7 OTHERS

12 AGRICULTURAL ROBOTS MARKET, BY OFFERING

- 12.1 INTRODUCTION

- 12.2 HARDWARE

- 12.2.1 ADOPTION OF PRECISION EQUIPMENT AND REAL-TIME DATA TOOLS TO DRIVE MARKET GROWTH

- 12.2.2 AUTOMATION & CONTROL

- 12.2.3 SENSING & MONITORING

- 12.3 SOFTWARE

- 12.3.1 RISE IN FARM MANAGEMENT, ANALYTICS, AND AI-BASED DECISION TOOLS TO BOOST MARKET GROWTH

- 12.3.2 ON-CLOUD

- 12.3.3 ON-PREMISE

- 12.3.4 AI AND DATA ANALYTICS

- 12.4 SERVICES

- 12.4.1 INCREASING DEPLOYMENT OF LIVESTOCK FARMING DEVICES AND EQUIPMENT

- 12.4.2 SYSTEM INTEGRATION & CONSULTING

- 12.4.3 MANAGED SERVICES

13 AGRICULTURAL ROBOTS MARKET, BY FARMING ENVIRONMENT

- 13.1 INTRODUCTION

- 13.2 OUTDOOR

- 13.2.1 ADOPTION OF AGRICULTURAL ROBOTS FOR LIVESTOCK MONITORING AND VARIABLE RATE APPLICATION TO DRIVE MARKET GROWTH

- 13.3 INDOOR

- 13.3.1 USAGE OF ROBOTS IN OPTIMIZING RESOURCE USAGE IN HYDROPONICS TO DRIVE MARKET GROWTH

14 AGRICULTURAL ROBOTS MARKET, BY FARM SIZE

- 14.1 INTRODUCTION

- 14.2 SMALL-SIZED FARMS (LESS THAN 100 HECTARES)

- 14.2.1 ADOPTION DRIVEN BY LABOR COST REDUCTION AND PRODUCTIVITY IMPROVEMENT

- 14.3 MID-SIZED FARMS (MORE THAN 100 HECTARES AND LESS THAN 500 HECTARES)

- 14.3.1 ADOPTION DRIVEN BY EFFICIENT RESOURCE MANAGEMENT AND PRECISION FARMING BENEFITS

- 14.4 LARGE-SIZED FARMS (MORE THAN 500 HECTARES)

- 14.4.1 SCALABILITY AND OPERATIONAL EFFICIENCY TO DRIVE MARKET

15 AGRICULTURAL ROBOTS MARKET, BY END USE

- 15.1 INTRODUCTION

- 15.2 FARM PRODUCE

- 15.2.1 CEREALS & GRAINS

- 15.2.1.1 Promotion of innovative and technological advancements in cereals & grains to boost market

- 15.2.1.2 Corn

- 15.2.1.3 Wheat

- 15.2.1.4 Rice

- 15.2.1.5 Other Cereals & Grains

- 15.2.2 OILSEEDS & PULSES

- 15.2.2.1 Assistance of robots in post-harvest operations for oilseeds & pulses to drive market

- 15.2.2.2 Soyabeans

- 15.2.2.3 Sunflowers

- 15.2.2.4 Other oilseeds & pulses

- 15.2.3 FRUITS & VEGETABLES

- 15.2.3.1 Revolutionizing traditional farming practices in fruits & vegetables to propel market growth

- 15.2.3.2 Pome fruits

- 15.2.3.3 Citrus fruits

- 15.2.3.4 Berries

- 15.2.3.5 Root & tuber vegetables

- 15.2.3.6 Leafy vegetables

- 15.2.3.7 Other fruits & vegetables

- 15.2.4 OTHERS

- 15.2.1 CEREALS & GRAINS

- 15.3 DAIRY & LIVESTOCK

- 15.3.1 USAGE OF MILKING ROBOTS IN DAIRY & LIVESTOCK PRODUCE SEGMENT TO DRIVE MARKET

16 AGRICULTURAL ROBOTS MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 US

- 16.2.1.1 Leveraging unmanned aerial vehicles for improved farming practices to bolster market growth

- 16.2.2 CANADA

- 16.2.2.1 Constant enhancements and developments in precision farming practices to drive market growth

- 16.2.3 MEXICO

- 16.2.3.1 Adoption of drones and other smart technologies through government's financial support to drive market

- 16.2.1 US

- 16.3 EUROPE

- 16.3.1 FRANCE

- 16.3.1.1 Increasing robotic startups in France for agricultural applications to lead to market growth

- 16.3.2 GERMANY

- 16.3.2.1 Government incentives and ongoing collaborative research projects to propel market growth

- 16.3.3 ITALY

- 16.3.3.1 Usage of latest agricultural sensor technologies in Italy to drive market

- 16.3.4 NETHERLANDS

- 16.3.4.1 Technology-driven economy and focus on sustainable agriculture to boost market

- 16.3.5 UK

- 16.3.5.1 Adopting advanced digital technologies to enhance farming practices in UK

- 16.3.6 REST OF EUROPE

- 16.3.1 FRANCE

- 16.4 ASIA PACIFIC

- 16.4.1 CHINA

- 16.4.1.1 Increasing government incentives and investments to boost market

- 16.4.2 INDIA

- 16.4.2.1 Increasing government incentives and investments to boost market

- 16.4.3 JAPAN

- 16.4.3.1 Rising adoption of advanced technology in Japan to drive market growth

- 16.4.4 SOUTH KOREA

- 16.4.4.1 Agriculture drones to be used for surveying farms and assessing crop losses

- 16.4.5 AUSTRALIA

- 16.4.5.1 Usage of agricultural drones in different applications to boost demand in Australia

- 16.4.6 REST OF ASIA PACIFIC

- 16.4.1 CHINA

- 16.5 SOUTH AMERICA

- 16.5.1 BRAZIL

- 16.5.1.1 Rise in digital agriculture activities to drive market

- 16.5.2 ARGENTINA

- 16.5.2.1 Increase in public-private partnerships for agriculture innovations in Argentina to drive market growth

- 16.5.3 REST OF SOUTH AMERICA

- 16.5.1 BRAZIL

- 16.6 REST OF THE WORLD

- 16.6.1 MIDDLE EAST

- 16.6.1.1 Growth in agriculture monitoring activities in Middle East to boost market

- 16.6.2 AFRICA

- 16.6.2.1 Increase in investments for agriculture innovations in Africa to drive market growth

- 16.6.1 MIDDLE EAST

17 COMPETITIVE LANDSCAPE

- 17.1 OVERVIEW

- 17.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 17.3 ANNUAL REVENUE ANALYSIS, 2020-2024

- 17.4 MARKET SHARE ANALYSIS, 2024

- 17.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.5.1 STARS

- 17.5.2 EMERGING LEADERS

- 17.5.3 PERVASIVE PLAYERS

- 17.5.4 PARTICIPANTS

- 17.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 17.5.5.1 Company footprint

- 17.5.5.2 Region footprint

- 17.5.5.3 Robot type footprint

- 17.5.5.4 Offering footprint

- 17.5.5.5 End use footprint

- 17.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 17.6.1 PROGRESSIVE COMPANIES

- 17.6.2 RESPONSIVE COMPANIES

- 17.6.3 DYNAMIC COMPANIES

- 17.6.4 STARTING BLOCKS

- 17.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 17.6.5.1 Detailed list of key startups/SMEs

- 17.6.5.2 Competitive benchmarking of key startups/SMEs

- 17.7 COMPANY VALUATION AND FINANCIAL METRICS

- 17.8 PRODUCT COMPARISON

- 17.9 COMPETITIVE SCENARIO AND TRENDS

- 17.9.1 PRODUCT LAUNCHES

- 17.9.2 DEALS

- 17.9.3 EXPANSIONS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 DEERE & COMPANY

- 18.1.1.1 Business overview

- 18.1.1.2 Products offered

- 18.1.1.3 Recent developments

- 18.1.1.3.1 Product launches

- 18.1.1.3.2 Deals

- 18.1.1.4 MnM view

- 18.1.1.4.1 Right to win

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses and competitive threats

- 18.1.2 CNH INDUSTRIAL NV

- 18.1.2.1 Business overview

- 18.1.2.2 Products offered

- 18.1.2.3 Recent developments

- 18.1.2.3.1 Deals

- 18.1.2.4 MnM view

- 18.1.2.4.1 Right to win

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses and competitive threats

- 18.1.3 AGCO CORPORATION

- 18.1.3.1 Business overview

- 18.1.3.2 Products offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Product launches

- 18.1.3.3.2 Deals

- 18.1.3.3.3 Expansions

- 18.1.3.4 MnM view

- 18.1.3.4.1 Right to win

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses and competitive threats

- 18.1.4 TRIMBLE INC.

- 18.1.4.1 Business overview

- 18.1.4.2 Products offered

- 18.1.4.3 Recent developments

- 18.1.4.3.1 Product launches

- 18.1.4.3.2 Deals

- 18.1.4.4 MnM view

- 18.1.4.4.1 Key strengths

- 18.1.4.4.2 Strategic choices

- 18.1.4.4.3 Weaknesses and competitive threats

- 18.1.5 DJI

- 18.1.5.1 Business overview

- 18.1.5.2 Products offered

- 18.1.5.3 Recent developments

- 18.1.5.3.1 Product launches

- 18.1.5.4 MnM view

- 18.1.5.4.1 Right to win

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses and competitive threats

- 18.1.6 BOUMATIC

- 18.1.6.1 Business overview

- 18.1.6.2 Products offered

- 18.1.6.3 Recent developments

- 18.1.6.3.1 Product launches

- 18.1.6.3.2 Deals

- 18.1.6.4 MnM view

- 18.1.7 LELY INTERNATIONAL

- 18.1.7.1 Business overview

- 18.1.7.2 Products offered

- 18.1.7.3 Recent developments

- 18.1.7.3.1 Products offered

- 18.1.7.3.2 Deals

- 18.1.7.4 MnM view

- 18.1.8 EAGLENXT

- 18.1.8.1 Business overview

- 18.1.8.2 Products offered

- 18.1.8.3 Recent developments

- 18.1.8.3.1 Product launches

- 18.1.8.3.2 Deals

- 18.1.8.3.3 Other developments

- 18.1.8.4 MnM view

- 18.1.9 KUBOTA CORPORATION

- 18.1.9.1 Business overview

- 18.1.9.2 Products offered

- 18.1.9.3 Recent developments

- 18.1.9.3.1 Product launches

- 18.1.9.3.2 Deals

- 18.1.9.4 MnM view

- 18.1.10 DELAVAL

- 18.1.10.1 Business overview

- 18.1.10.2 Products offered

- 18.1.10.3 Recent developments

- 18.1.10.3.1 Product launches

- 18.1.10.3.2 Deals

- 18.1.10.3.3 Expansions

- 18.1.10.4 MnM view

- 18.1.10.4.1 Right to win

- 18.1.11 HARVEST CROO ROBOTICS

- 18.1.11.1 Business overview

- 18.1.11.2 Products offered

- 18.1.11.3 Recent developments

- 18.1.11.3.1 Product launches

- 18.1.11.4 MnM view

- 18.1.12 NAIO TECHNOLOGIES

- 18.1.12.1 Business overview

- 18.1.12.2 Products offered

- 18.1.12.3 Recent developments

- 18.1.12.3.1 Product launches

- 18.1.12.3.2 Deals

- 18.1.12.4 MnM view

- 18.1.13 ECOROBOTIX

- 18.1.13.1 Business overview

- 18.1.13.2 Products offered

- 18.1.13.3 MnM view

- 18.1.14 AGROBOTS

- 18.1.14.1 Business overview

- 18.1.14.2 Products offered

- 18.1.14.3 MnM view

- 18.1.15 ROBOTICS PLUS

- 18.1.15.1 Business overview

- 18.1.15.2 Products offered

- 18.1.15.3 Recent developments

- 18.1.15.3.1 Product launches

- 18.1.15.3.2 Deals

- 18.1.15.4 MnM view

- 18.1.1 DEERE & COMPANY

- 18.2 OTHER PLAYERS

- 18.2.1 AUTONOMOUS TRACTOR CORPORATION

- 18.2.1.1 Business overview

- 18.2.1.2 Products offered

- 18.2.1.3 Recent developments

- 18.2.1.3.1 Product launches

- 18.2.1.4 MnM view

- 18.2.2 FFROBOTICS

- 18.2.2.1 Business overview

- 18.2.2.2 Products offered

- 18.2.2.3 MnM view

- 18.2.3 DRONEDEPLOY

- 18.2.3.1 Business overview

- 18.2.3.2 Products offered

- 18.2.3.3 Recent developments

- 18.2.3.3.1 Deals

- 18.2.3.4 MnM view

- 18.2.4 YANMAR CO.

- 18.2.4.1 Business overview

- 18.2.4.2 Products offered

- 18.2.4.3 Recent developments

- 18.2.4.3.1 Product launches

- 18.2.4.4 MnM view

- 18.2.5 CLEARPATH ROBOTICS, INC.

- 18.2.5.1 Business overview

- 18.2.5.2 Products offered

- 18.2.5.3 Recent developments

- 18.2.5.3.1 Product launches

- 18.2.5.3.2 Deals

- 18.2.5.4 MnM view

- 18.2.6 BONSAI ROBOTICS INC.

- 18.2.7 AIGEN

- 18.2.8 TEVEL AEROBOTICS TECHNOLOGIES LTD.

- 18.2.9 SWARMFARM

- 18.2.10 MONARCH TRACTOR

- 18.2.1 AUTONOMOUS TRACTOR CORPORATION

19 ADJACENT AND RELATED MARKETS

- 19.1 INTRODUCTION

- 19.2 LIMITATIONS

- 19.3 PRECISION LIVESTOCK FARMING MARKET

- 19.3.1 MARKET DEFINITION

- 19.3.2 MARKET OVERVIEW

- 19.4 MILKING ROBOTS MARKET

- 19.4.1 MARKET DEFINITION

- 19.4.2 MARKET OVERVIEW

20 APPENDIX

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS

- 20.5 AUTHOR DETAILS