|

시장보고서

상품코드

1877353

IoT 시장 : 모듈 유형별, 하드웨어별, 연결성별, 소프트웨어별, 서비스별, 주목 영역별, 지역별 예측(-2030년)IoT Market by Module Type (Hardware, Connectivity, Software, Services), Focus Areas (Smart Manufacturing, Smart Transportation/Mobility, Smart Energy & Utilities, Smart Healthcare, Smart Buildings, Smart Retail) and Region - Global Forecast to 2030 |

||||||

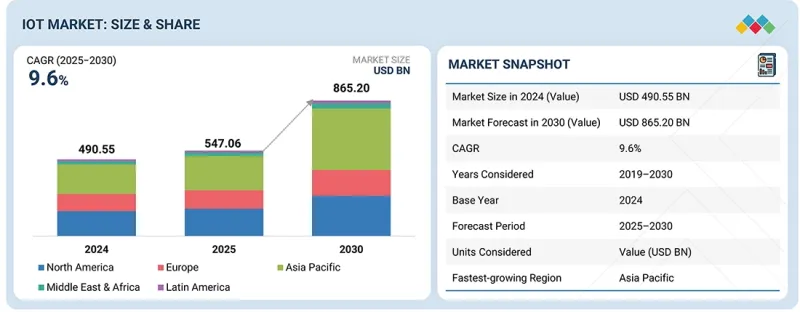

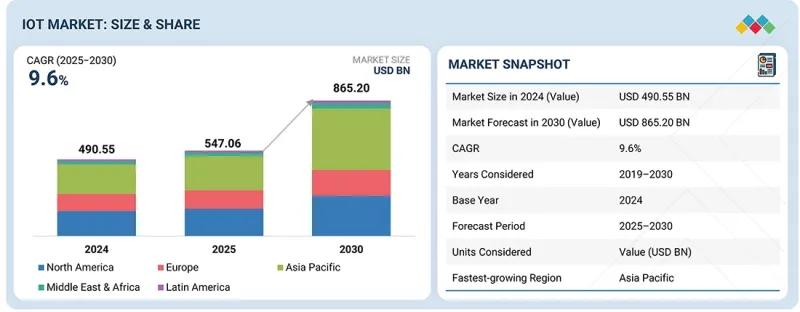

세계의 IoT 시장 규모는 2025년 5,470억 6,000만 달러 규모로 추정되며, 2030년까지 8,652억 달러에 이를 것으로 예측됩니다.

CAGR은 9.6%로 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2019-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025년-2030년 |

| 대상 단위 | 10억 달러 |

| 부문 | 모듈 유형별, 하드웨어별, 연결성별, 소프트웨어별, 서비스별, 주목 영역별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동, 아프리카, 라틴아메리카 |

Cisco, IBM, Microsoft, AWS와 같은 주요 기술 기업은 강력한 플랫폼, 클라우드 에코시스템, AI 통합 솔루션을 통해 IoT 혁신을 추진하고 있습니다. 이러한 기업은 조직이 다양한 환경에서 IoT 용도를 쉽게 배포, 관리 및 확장할 수 있도록 합니다. Cisco의 IoT 제어 센터, Microsoft Azure IoT 허브, IBM Watson IoT는 엔터프라이즈급 솔루션이 연결성을 단순화하고, 보안을 강화하며, 실용적인 인텔리전스를 제공하는 좋은 예입니다.

IoT 데이터를 머신러닝 및 분석 도구와 통합함으로써 이러한 기업은 업계가 더 깊은 통찰력을 얻고 의사 결정을 강화할 수 있습니다. 기술 선도, 통신 사업자, 하드웨어 벤더 간의 전략적 제휴는 상호 운용성과 혁신을 더욱 촉진하고 있습니다. 그 결과 기업은 업무를 최적화하고 사이버 보안을 강화하며 새로운 비즈니스 모델을 개척하는 엔드 투 엔드 IoT 에코시스템을 도입할 수 있게 되었습니다.

위성 IoT는 지상 네트워크를 사용할 수 없거나 신뢰성이 부족한 농업, 해양, 광업, 물류 등의 분야에서 기세를 늘리고 있습니다. 저궤도(LEO) 위성 콘스텔레이션의 출현으로 대역폭, 지연, 합리적인 가격이 크게 개선되어 위성 IoT의 대규모 배포가 가능해졌습니다. 기업은 자산 추적, 환경 모니터링 및 재해 대응 용도에 위성 기반 솔루션을 활용합니다. 위성 네트워크와 5G, 엣지 컴퓨팅의 통합은 실시간 데이터 처리와 세계 연결성을 더욱 강화합니다. 지속적이고 국경을 넘는 통신의 필요성이 높아지는 가운데 위성 IoT는 유비쿼터스 연결의 중요한 기반이 되어 업계나 지역에 관계없이 시장의 급속한 확대를 추진할 것입니다.

모듈과 센서는 스마트 시티, 산업 자동화, 의료, 물류 등 다양한 용도에서 실시간 데이터 수집 및 모니터링을 가능하게 합니다. 저비용 센서의 보급과 MEMS(미소 전기 기계 시스템) 기술의 진보에 의해 소비자용 및 산업용 디바이스 양쪽에서 센서 통합이 가속하고 있습니다. 블루투스, Wi-Fi, 셀룰러 통신 등의 연결 모듈은 분산 네트워크 전체에서 원활한 장치 간 통신을 실현합니다. 센서는 에지 AI와의 통합으로 데이터를 로컬로 분석하고 의사결정 효율성을 높이는 등 점점 고도화되고 있습니다. 또한 스마트 인프라와 자율 시스템에서 환경, 동작, 온도 센서 수요 증가가 시장 성장을 견인하고 있습니다. IoT 배포가 전 세계적으로 확대되는 동안 모듈 및 센서 분야는 상호 연결 시스템 내에서 정확하고 지속적인 데이터 흐름을 실현하는 핵심 역할을 계속하고 있습니다.

아시아태평양의 IoT 시장은 대규모 디지털 전환 구상과 정부 주도의 스마트 인프라 프로젝트를 원동력으로 급속한 확대를 이루고 있습니다. 중국, 일본, 한국, 인도 등 국가들은 강력한 산업 자동화, 스마트 시티 솔루션 도입 확대, 5G 연결 기술의 발전으로 지역 성장을 이끌고 있습니다. 이 지역의 제조 및 운송 부문은 연결된 센서와 데이터 분석을 활용하여 효율성을 높이고 운영 비용을 줄이기 위해 IoT 도입의 최전선에 서 있습니다. 또한, 다양한 산업에서의 예지보전과 실시간 감시에 대한 수요 증가가 IoT 도입의 가속을 추진하고 있습니다. 엣지 컴퓨팅과 AI 통합형 IoT 에코시스템에 대한 지속적인 투자에 힘입어 아시아태평양은 앞으로도 세계에서 가장 빠르게 성장하는 IoT 시장 중 하나가 될 것으로 예측됩니다.

본 보고서에서는 세계의 IoT 시장에 대해 조사했으며, 모듈 유형별, 하드웨어별, 연결성별, 소프트웨어별, 서비스별, 주목 영역별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 인사이트

제4장 시장 개요와 업계 동향

- 소개

- 시장 역학

- 상호접속된 시장과 분야 횡단적인 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- Porter's Five Forces 모델 분석

- 거시경제 전망

- 공급망 분석

- 밸류체인 분석

- 에코시스템

- 가격 분석

- 무역 분석

- 주요 회의 및 이벤트

- 고객사업에 영향을 주는 동향/혼란

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세의 영향 - IoT 시장

제6장 전략적 파괴 : 특허, 디지털, AI 도입

- 주요 신기술

- 보완적 기술

- IoT 시장용 기술 및 제품 로드맵

- 특허 분석

- AI/생성형 AI가 IoT 시장에 미치는 영향

제7장 규제 상황과 규정 준수

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 업계 표준

제8장 고객정세와 구매행동

- 의사결정 프로세스

- 주요 이해관계자와 구매 기준

- 채용 장벽과 내부 과제

- 다양한 최종 용도 분야에서의 미충족 요구

제9장 IoT 시장(모듈 유형별)

- 소개

- 하드웨어

- 커넥티비티

- 소프트웨어

- 서비스

제10장 IoT 시장(하드웨어별)

- 소개

- 모듈 및 센서

- 보안 하드웨어

- 기타

제11장 IoT 시장(접속성별)

- 소개

- 셀룰러

- LP-WAN

- 위성

- 기타

제12장 IoT 시장(소프트웨어별)

- 소개

- IoT 플랫폼

- 응용 소프트웨어

- 분석 소프트웨어

- 보안 및 안전 소프트웨어

- 기타

제13장 IoT 시장(서비스별)

- 소개

- 전문 서비스

- 매니지드 서비스

제14장 IoT 시장(주목 영역별)

- 소개

- 스마트 교통/모빌리티

- 스마트 빌딩

- 스마트 에너지 및 유틸리티

- 스마트 헬스케어

- 스마트 농업

- 스마트 제조

- 스마트 소매

- 기타

제15장 IoT 시장(지역별)

- 소개

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 중국

- 일본

- 인도

- 기타

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

- 라틴아메리카

- 브라질

- 멕시코

- 기타

제16장 경쟁 구도

- 소개

- 주요 참가 기업의 전략/강점, 2023-2025년

- 수익 분석, 2022-2024년

- 시장 점유율 분석, 2024년

- 브랜드/제품 비교

- 기업평가 및 재무지표

- 기업평가 매트릭스: 하드웨어, 2024년

- 기업평가 매트릭스: 소프트웨어, 2024년

- 경쟁 시나리오

제17장 기업 프로파일

- 소개

- 주요 진출기업

- MICROSOFT

- HUAWEI

- AMAZON WEB SERVICES, INC.

- CISCO SYSTEMS, INC.

- INTEL CORPORATION

- QUALCOMM TECHNOLOGIES, INC.

- TEXAS INSTRUMENTS INCORPORATED

- SIEMENS

- ABB

- IBM

- SAP

- HITACHI

- PTC

- STMICROELECTRONICS

- NXP SEMICONDUCTORS

- HPE

- TE CONNECTIVITY

- ADVANTECH

- BOSCH

- TDK CORPORATION

- OMRON CORPORATION

- HONEYWELL

- ORACLE

- SOFTWARE AG

- STC

- SAMSUNG

- ERICSSON

- AVNET

- ALIBABA CLOUD

- 스타트업 기업/중소기업

- HQSOFTWARE

- PARTICLE

- CLEARBLADE

- AYLA NETWORKS

- LOSANT IOT

- EMNIFY

- BLUES

- TELIT CINTERION

제18장 조사 방법

제19장 인접 시장/관련 시장

제20장 부록

JHS 25.12.03MarketsandMarkets: The IoT market is estimated to be worth USD 547.06 billion in 2025 and is projected to reach USD 865.20 billion by 2030, growing at a CAGR of 9.6%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD Billion |

| Segments | By Module Type, Hardware, Connectivity, Software, Service, Focus Area, And Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Major technology companies, including Cisco, IBM, Microsoft, and AWS, are driving IoT innovation through robust platforms, cloud ecosystems, and AI-integrated solutions. These firms are enabling organizations to easily deploy, manage, and scale IoT applications across diverse environments. Cisco's IoT Control Center, Microsoft Azure IoT Hub, and IBM Watson IoT exemplify how enterprise-grade solutions simplify connectivity, enhance security, and deliver actionable intelligence.

By integrating IoT data with machine learning and analytics tools, these companies enable industries to gain deeper insights and enhance decision-making. Strategic partnerships among tech giants, telecom operators, and hardware vendors are further fostering interoperability and innovation. As a result, enterprises are empowered to adopt end-to-end IoT ecosystems that optimize operations, strengthen cybersecurity, and unlock new business models.

"The satellite connectivity segment will witness the highest growth during the forecast period."

Satellite IoT is gaining momentum in sectors such as agriculture, maritime, mining, and logistics, where terrestrial networks are unavailable or unreliable. The emergence of low-Earth orbit (LEO) satellite constellations has significantly improved bandwidth, latency, and affordability, making satellite IoT viable for large-scale deployment. Companies are leveraging satellite-based solutions for asset tracking, environmental monitoring, and disaster response applications. The integration of satellite networks with 5G and edge computing further enhances real-time data processing and global connectivity. As the need for continuous, borderless communication grows, satellite IoT will become an essential enabler of ubiquitous connectivity, driving rapid market expansion across industries and geographies.

"The Modules/Sensors segment is expected to have the largest market size during the forecast period."

Modules and sensors enable real-time data collection and monitoring across various applications, including smart cities, industrial automation, healthcare, and logistics. The proliferation of low-cost sensors and advancements in MEMS (Micro-Electro-Mechanical Systems) technology have accelerated the integration of sensors in both consumer and industrial devices. Connectivity modules, such as Bluetooth, Wi-Fi, and cellular support, enable seamless device communication across distributed networks. Sensors are also becoming increasingly intelligent, integrating with edge AI to analyze data locally and enhance decision-making efficiency. Additionally, the growing demand for environmental, motion, and temperature sensors in smart infrastructure and autonomous systems is fueling market expansion. With IoT deployments scaling globally, the modules and sensors segment remains central to enabling accurate, continuous data flow within interconnected systems.

"Asia Pacific is expected to record the highest growth rate during the forecast period."

The Internet of Things (IoT) market in the Asia Pacific region is witnessing rapid expansion, driven by large-scale digital transformation initiatives and government-backed smart infrastructure projects. Countries such as China, Japan, South Korea, and India are leading the regional growth due to strong industrial automation, increasing adoption of smart city solutions, and advancements in 5G connectivity. The region's manufacturing and transportation sectors are at the forefront of IoT deployment, using connected sensors and data analytics to enhance efficiency and reduce operational costs. Moreover, the growing demand for predictive maintenance and real-time monitoring across various industries is driving the acceleration of IoT adoption. Asia Pacific is projected to remain one of the fastest-growing IoT markets globally, supported by ongoing investments in edge computing and AI-integrated IoT ecosystems.

Breakdown of primaries

The study offers insights from a range of industry experts, including solution vendors and Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level -35%, D-level - 30%, and Others - 35%

- By Region: North America - 40%, Europe - 20%, Asia Pacific - 25%, Middle East & Africa - 9%, Latin America - 6%

The major players in the IoT market include Microsoft (US), Amazon Web Services, Inc. (US), Huawei (China), Cisco (US), Intel (US), Qualcomm (US), Texas Instruments (US), Siemens (US), ABB (Switzerland), IBM (US), SAP (Germany), Hitachi (Japan), PTC (US), STMicroelectronics (ST) (Switzerland), NXP Semiconductors (Netherlands), HP (US), TE Connectivity (Switzerland), Advantech (Taiwan), Bosch (Germany) TDK Corporation (Japan), Omron Corporation (Japan), Honeywell (US), Oracle (US), Software AG (Germany), STC (Saudi Arabia), SAMSUNG (South Korea), Ericsson (Sweden), Avnet (US), Alibaba Cloud (China), HQSoftware (Estonia), Blues (US), Telit Cinterion (US), Particle (US), ClearBlade (Texas), Ayla Networks (US), Losant (Ohio), and emnify (Germany). These players have adopted various growth strategies, including partnerships, agreements, collaborations, new product launches, enhancements, and acquisitions, to expand their footprint in the IoT market.

Research Coverage

The market study encompasses the IoT market size and growth potential across various segments: hardware (modules/sensors, security hardware, other hardware), connectivity (cellular, LP-WAN, satellite, other connectivity), software (IoT platforms, application software, analytics software, security & safety software, other software), and service (professional services, managed services). The focus area segment includes smart transportation/mobility, smart buildings, smart energy & utilities, smart healthcare, smart agriculture, smart manufacturing, smart retail, and other focus areas. The regional analysis covers North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global IoT market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape, gain valuable insights, and develop effective go-to-market strategies. Moreover, the report will provide stakeholders with insights into the market's pulse, offering them information on key market drivers, restraints, challenges, and opportunities.

The report provides the following insights.

- Analysis of key drivers (expansion of 5G and Edge computing for faster and reliable connectivity, broader availability and maturation of LPWAN and cellular IoT that cut connectivity cost and enable new low-power use cases), restraints (rising cybersecurity and data privacy concerns, Interoperability and integration challenges), opportunities (expansion of space-based IoT networks for global connectivity, emergence of emotion-aware IoT devices for personalized experiences), and challenges (cross-border data governance and differing privacy rules that complicate global IoT rollouts, divergent regulations and standards raise compliance costs and deter global scale) influencing the growth of the IoT market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the IoT market

- Market Development: The report provides comprehensive information about lucrative markets, analyzing the IoT market across various regions

- Market Diversification: Comprehensive information about new products and services, untapped geographies, recent developments, and investments in the IoT market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players: Microsoft (US), Amazon Web Services, Inc. (US), Huawei (China), Cisco (US), Intel (US), Qualcomm (US), Texas Instruments (US), Siemens (US), ABB (Switzerland), IBM (US), SAP (Germany), Hitachi (Japan), PTC (US), STMicroelectronics (ST) (Switzerland), NXP Semiconductors (Netherlands), HP (US), TE Connectivity (Switzerland), Advantech (Taiwan), Bosch (Germany) TDK Corporation (Japan), Omron Corporation (Japan), Honeywell (US), Oracle (US), Software AG (Germany), STC (Saudi Arabia), SAMSUNG (South Korea), Ericsson (Sweden), Avnet (US), Alibaba Cloud (China), HQSoftware (Estonia), Blues (US), Telit Cinterion (US), Particle (US), ClearBlade (Texas), Ayla Networks (US), Losant (Ohio), and emnify (Germany)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIONS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN IOT MARKET

- 3.2 IOT MARKET, BY MODULE TYPE AND REGION

- 3.3 IOT MARKET, BY MODULE TYPE

- 3.4 IOT MARKET, BY CONNECTIVITY

- 3.5 IOT MARKET, BY SOFTWARE

- 3.6 IOT MARKET, BY SERVICES

- 3.7 IOT MARKET, BY FOCUS AREA

4 MARKET OVERVIEW AND INDUSTRY TRENDS

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Expansion of 5G and edge computing for faster, reliable connectivity

- 4.2.1.2 Broader availability and maturation of LPWAN and cellular IoT that reduce connectivity costs and enable new low-power use cases

- 4.2.2 RESTRAINTS

- 4.2.2.1 Rising cybersecurity and data privacy concerns

- 4.2.2.2 Interoperability and integration challenges

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Expansion of space-based IoT networks

- 4.2.3.2 Digital twin technology integration across industries

- 4.2.4 CHALLENGES

- 4.2.4.1 Cross-border data governance and differing privacy rules that complicate global IoT rollouts

- 4.2.4.2 Divergent regulations and standards raise compliance costs and deter global scale

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.3.1 INTERCONNECTED MARKETS

- 4.3.2 CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.4.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES MODEL ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL IOT INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE PRICING ANALYSIS, BY HARDWARE

- 5.6.2 INDICATIVE PRICING ANALYSIS, BY SUBSCRIPTION TYPE

- 5.7 TRADE ANALYSIS

- 5.7.1 EXPORT SCENARIO OF MEASURING OR CHECKING INSTRUMENTS, APPLIANCES, AND MACHINES NOT ELSEWHERE SPECIFIED

- 5.7.2 IMPORT SCENARIO OF MEASURING OR CHECKING INSTRUMENTS, APPLIANCES, AND MACHINES NOT ELSEWHERE SPECIFIED

- 5.8 KEY CONFERENCES AND EVENTS

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 NESTLE LEVERAGED AWS TO UNLOCK SCALABILITY AND USE SERVERLESS ARCHITECTURE

- 5.11.2 TITAN INTERNATIONAL ENSURED BUSINESS CONTINUITY WITH ORACLE ERP CLOUD

- 5.11.3 ELECTRIC RACING ACADEMY (ERA) IMPROVED RACING EXPERIENCE AND PROVIDED REAL-TIME DATA BY DEPLOYING SOFTWARE AG'S APPLICATION INTEGRATION SOLUTION

- 5.11.4 EATON ACCELERATED INDUSTRY 4.0 TRANSFORMATION USING PTC'S FACTORY INSIGHTS-AS-A-SERVICE FOR HIGH IMPACT

- 5.11.5 PITNEY BOWES EMBRACED INDUSTRIAL INTERNET USING GE PREDIX TO TRANSFORM ITS PRODUCTION MAIL BUSINESS

- 5.12 IMPACT OF 2025 US TARIFF - IOT MARKET

- 5.12.1 INTRODUCTION

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.4 IMPACT ON COUNTRY/REGION

- 5.12.4.1 US

- 5.12.4.2 Europe

- 5.12.4.3 Asia Pacific

- 5.12.5 IMPACT ON IOT END USERS

6 STRATEGIC DISRUPTION: PATENTS, DIGITAL, AND AI ADOPTIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 SENSORS AND ACTUATORS

- 6.1.2 CONNECTIVITY TECHNOLOGIES

- 6.1.3 EDGE COMPUTING

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 LWM2M (LIGHTWEIGHT MACHINE-TO-MACHINE PROTOCOL)

- 6.2.2 DIGITAL TWIN

- 6.2.3 SECURE OTA/FIRMWARE UPDATE FRAMEWORKS

- 6.3 TECHNOLOGY/PRODUCT ROADMAP FOR IOT MARKET

- 6.3.1 SHORT-TERM ROADMAP (2023-2025)

- 6.3.2 MID-TERM ROADMAP (2026-2028)

- 6.3.3 LONG-TERM ROADMAP (2029-2030)

- 6.4 PATENT ANALYSIS

- 6.4.1 LIST OF MAJOR PATENTS

- 6.5 IMPACT OF AI/GENERATIVE AI ON IOT MARKET

- 6.5.1 TOP USE CASES AND MARKET POTENTIAL OF GENERATIVE AI IN IOT

- 6.5.2 BEST PRACTICES OF IOT MARKET

- 6.5.3 CASE STUDIES OF AI IMPLEMENTATION IN IOT MARKET

- 6.5.3.1 Connected Factory & Predictive Maintenance - Siemens (MindSphere) on AWS

- 6.5.3.2 Asset Management & Predictive Maintenance - DP World (IBM Maximo)

- 6.5.3.3 Audi collaborated with Cisco to build smart factory

- 6.5.3.4 Bosch/Industrial OEMs, maintenance 4.0 & factory optimization

- 6.5.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.5.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN IOT

7 REGULATORY LANDSCAPE AND COMPLIANCE

- 7.1 REGULATORY LANDSCAPE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.1.1 International Telecommunication Union (ITU)

- 7.1.1.2 Internet of Things Consortium (IoTC)

- 7.1.2 INDUSTRY STANDARDS

- 7.1.2.1 North America

- 7.1.2.1.1 US

- 7.1.2.1.2 Canada

- 7.1.2.2 Europe

- 7.1.2.3 Asia Pacific

- 7.1.2.3.1 China

- 7.1.2.3.2 Japan

- 7.1.2.3.3 India

- 7.1.2.4 Middle East & Africa

- 7.1.2.4.1 GCC Countries

- 7.1.2.4.2 South Africa

- 7.1.2.5 Latin America

- 7.1.2.5.1 Brazil

- 7.1.2.1 North America

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS IN VARIOUS END-USE VERTICALS

9 IOT MARKET, BY MODULE TYPE

- 9.1 INTRODUCTION

- 9.1.1 IOT MARKET, BY MODULE TYPE: DRIVERS

- 9.2 HARDWARE

- 9.2.1 DEMAND FOR RELIABLE AND CERTIFIED ENDPOINTS IN INDUSTRIAL AND MEDICAL APPLICATIONS

- 9.3 CONNECTIVITY

- 9.3.1 RISE IN ADOPTION OF MOBILE IOT APPLICATIONS AND NEED FOR LOW-POWER, LONG-RANGE IOT CONNECTIVITY IN INDUSTRIAL AND SMART CITY APPLICATIONS

- 9.4 SOFTWARE

- 9.4.1 REQUIREMENT TO CONVERT TELEMETRY INTO ACTIONABLE INSIGHT THROUGH SCALABLE PLATFORMS, ADVANCED ANALYTICS, AND INTEROPERABLE APIS

- 9.5 SERVICES

- 9.5.1 NEED TO REDUCE IMPLEMENTATION RISK AND OPERATIONAL BURDEN BY USING PROFESSIONAL EXPERTISE AND MANAGED OPERATIONS

10 IOT MARKET, BY HARDWARE

- 10.1 INTRODUCTION

- 10.1.1 IOT HARDWARE: MARKET DRIVERS

- 10.2 MODULES/SENSORS

- 10.2.1 GROWTH IN INDUSTRIAL AUTOMATION, WITH REQUIREMENTS MAINLY IN AGRICULTURE AND AUTOMOTIVE SECTORS

- 10.3 SECURITY HARDWARE

- 10.3.1 INCREASE IN PROCUREMENT MANDATES THAT REQUIRE HARDWARE-BASED SECURITY PRIMITIVES AND CERTIFIED TAMPER RESISTANCE

- 10.4 OTHER HARDWARE

11 IOT MARKET, BY CONNECTIVITY

- 11.1 INTRODUCTION

- 11.1.1 IOT CONNECTIVITY: MARKET DRIVERS

- 11.2 CELLULAR

- 11.2.1 ROLLOUT OF 5G NETWORKS, GROWING ADOPTION OF MOBILE IOT APPLICATIONS, AND ADVANCEMENTS IN CELLULAR PROTOCOLS

- 11.3 LP-WAN

- 11.3.1 NEED FOR LOW-POWER, LONG-RANGE IOT CONNECTIVITY IN INDUSTRIAL AND SMART CITY APPLICATIONS

- 11.4 SATELLITE

- 11.4.1 NEED FOR GLOBAL REACH AND REDUNDANCY LAYER WHERE TERRESTRIAL NETWORKS ARE NOT AVAILABLE

- 11.5 OTHER CONNECTIVITY

12 IOT MARKET, BY SOFTWARE

- 12.1 INTRODUCTION

- 12.1.1 IOT SOFTWARE: MARKET DRIVERS

- 12.2 IOT PLATFORMS

- 12.2.1 ENABLING DEVICE CONNECTIVITY AND INTEGRATION, STREAMLINING DATA MANAGEMENT FOR EFFICIENT OPERATIONS ACROSS INDUSTRIES

- 12.3 APPLICATION SOFTWARE

- 12.3.1 AUTOMATING PROCESSES AND ENHANCING OPERATIONAL EFFICIENCY TO OFFER TAILORED SOLUTIONS FOR VARIOUS SECTORS

- 12.4 ANALYTICS SOFTWARE

- 12.4.1 TRANSFORMING LARGE IOT DATASETS INTO ACTIONABLE INSIGHTS, DRIVING SMARTER DECISION-MAKING AND IMPROVED PERFORMANCE

- 12.5 SECURITY & SAFETY SOFTWARE

- 12.5.1 ENSURING PROTECTION AGAINST CYBER THREATS AND SAFEGUARDING INTEGRITY OF IOT SYSTEMS AND CRITICAL DATA

- 12.6 OTHER SOFTWARE

13 IOT MARKET, BY SERVICE

- 13.1 INTRODUCTION

- 13.1.1 IOT SERVICES: MARKET DRIVERS

- 13.2 PROFESSIONAL SERVICES

- 13.2.1 GROWTH OF HYBRID/REMOTE WORK REQUIRES SUCCESSFUL SYSTEM INTEGRATION AND DEPLOYMENT SUPPORT

- 13.2.2 IMPLEMENTATION SERVICES

- 13.2.3 STRATEGY & SYSTEM DESIGN SERVICES

- 13.3 MANAGED SERVICES

- 13.3.1 DEMAND FOR PREDICTABLE, EXPERT OPERATIONAL MANAGEMENT FOR DEVICE MANAGEMENT, DATA PROCESSING, AND SYSTEM MAINTENANCE

14 IOT MARKET, BY FOCUS AREA

- 14.1 INTRODUCTION

- 14.1.1 IOT FOCUS AREAS: MARKET DRIVERS

- 14.2 SMART TRANSPORTATION/MOBILITY

- 14.2.1 DEMAND FOR EFFICIENT SELF-DRIVING CARS AND IMPROVED TRAFFIC FLOW MANAGEMENT TO DRIVE MARKET

- 14.3 SMART BUILDINGS

- 14.3.1 ENERGY EFFICIENCY AND ENVIRONMENTAL SUSTAINABILITY TO DRIVE SEGMENT

- 14.4 SMART ENERGY & UTILITIES

- 14.4.1 GLOBAL SHIFT TOWARD RENEWABLE AND STABLE POWER SYSTEMS

- 14.5 SMART HEALTHCARE

- 14.5.1 NEED FOR REMOTE CARE AND CONTINUOUS PATIENT MONITORING

- 14.6 SMART AGRICULTURE

- 14.6.1 PRESSURE TO IMPROVE YIELD WHILE REDUCING RESOURCE USE

- 14.7 SMART MANUFACTURING

- 14.7.1 NEED FOR SIMULATING AND PREDICTING EQUIPMENT PERFORMANCE

- 14.8 SMART RETAIL

- 14.8.1 NEED TO COMPETE WITH ECOMMERCE THROUGH AUTOMATION AND PERSONALIZATION

- 14.9 OTHER FOCUS AREAS

15 IOT MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 US

- 15.2.1.1 Government directives and norms to enhance IoT security and compatibility in various sectors to drive market

- 15.2.2 CANADA

- 15.2.2.1 Investment in smart city initiatives to promote adoption of IoT technologies for enhanced city living to drive market

- 15.2.1 US

- 15.3 EUROPE

- 15.3.1 UK

- 15.3.1.1 First country to legally mandate cybersecurity standards for IoT devices under Product Security and Telecommunications Infrastructure (PSTI) regime

- 15.3.2 GERMANY

- 15.3.2.1 IoT technologies adopted by manufacturing sector to create more efficient and flexible production processes to drive demand

- 15.3.3 FRANCE

- 15.3.3.1 Paris aims to become top smart city by 2050 through its 'Paris Smart City 2050' initiative

- 15.3.4 ITALY

- 15.3.4.1 Growth in IoT applications, especially in smart city and energy management projects, to drive market

- 15.3.5 REST OF EUROPE

- 15.3.1 UK

- 15.4 ASIA PACIFIC

- 15.4.1 CHINA

- 15.4.1.1 Investments in 5G networks and IoT infrastructure to drive market

- 15.4.2 JAPAN

- 15.4.2.1 Use of cost-effective IoT platforms in cloud that allow smaller companies to grow operations with improved connectivity options to drive demand

- 15.4.3 INDIA

- 15.4.3.1 Incentives to VC-funded startups focused on IoT technologies to promote growth in sector to drive demand

- 15.4.4 REST OF ASIA PACIFIC

- 15.4.1 CHINA

- 15.5 MIDDLE EAST & AFRICA

- 15.5.1 UAE

- 15.5.1.1 Focus on IoT integration and sustainable urban development due to high internet usage and tech-savvy population to drive demand

- 15.5.2 KSA

- 15.5.2.1 Vision 2030's strategic plan of sustainable initiatives to drive market

- 15.5.3 SOUTH AFRICA

- 15.5.3.1 Adoption of IoT technologies demonstrates deliberate dedication to digital transformation

- 15.5.3.2 Rest of Middle East & Africa

- 15.5.1 UAE

- 15.6 LATIN AMERICA

- 15.6.1 BRAZIL

- 15.6.1.1 Manufacturing companies seek advantages from partnerships to eliminate obstacles to IoT implementation

- 15.6.2 MEXICO

- 15.6.2.1 Supportive regulatory environment and growing fintech ecosystem to drive market

- 15.6.3 REST OF LATIN AMERICA

- 15.6.1 BRAZIL

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 16.3 REVENUE ANALYSIS, 2022-2024

- 16.4 MARKET SHARE ANALYSIS, 2024

- 16.5 BRAND/PRODUCT COMPARISON

- 16.6 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6.1 COMPANY VALUATION

- 16.6.2 FINANCIAL METRICS

- 16.7 COMPANY EVALUATION MATRIX: HARDWARE, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.8 COMPANY EVALUATION MATRIX: SOFTWARE, 2024

- 16.8.1 STARS

- 16.8.2 EMERGING LEADERS

- 16.8.3 PERVASIVE PLAYERS

- 16.8.4 PARTICIPANTS

- 16.8.5 COMPANY FOOTPRINT: KEY PLAYERS (HARDWARE AND SOFTWARE), 2024

- 16.8.5.1 Company footprint

- 16.8.5.2 Regional footprint

- 16.8.5.3 Module type footprint

- 16.8.5.4 Focus area footprint

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 16.9.2 DEALS

17 COMPANY PROFILES

- 17.1 INTRODUCTION

- 17.2 KEY PLAYERS

- 17.2.1 MICROSOFT

- 17.2.1.1 Business overview

- 17.2.1.2 Products/Solutions/Services offered

- 17.2.1.3 Recent developments

- 17.2.1.3.1 Product launches & enhancements

- 17.2.1.3.2 Deals

- 17.2.1.4 MnM view

- 17.2.1.4.1 Right to win

- 17.2.1.4.2 Strategic choices

- 17.2.1.4.3 Weaknesses and competitive threats

- 17.2.2 HUAWEI

- 17.2.2.1 Business overview

- 17.2.2.2 Products offered

- 17.2.2.3 Recent developments

- 17.2.2.3.1 Product launches

- 17.2.2.3.2 Deals

- 17.2.2.4 MnM view

- 17.2.2.4.1 Right to win

- 17.2.2.4.2 Strategic choices

- 17.2.2.4.3 Weaknesses and competitive threats

- 17.2.3 AMAZON WEB SERVICES, INC.

- 17.2.3.1 Business overview

- 17.2.3.2 Products/Solutions/Services offered

- 17.2.3.3 Recent developments

- 17.2.3.3.1 Product launches & enhancements

- 17.2.3.3.2 Deals

- 17.2.3.4 MnM view

- 17.2.3.4.1 Right to win

- 17.2.3.4.2 Strategic choices

- 17.2.3.4.3 Weaknesses and competitive threats

- 17.2.4 CISCO SYSTEMS, INC.

- 17.2.4.1 Business overview

- 17.2.4.2 Products offered

- 17.2.4.3 Recent developments

- 17.2.4.3.1 Product launches

- 17.2.4.3.2 Deals

- 17.2.4.4 MnM view

- 17.2.4.4.1 Right to win

- 17.2.4.4.2 Strategic choices

- 17.2.4.4.3 Weaknesses and competitive threats

- 17.2.5 INTEL CORPORATION

- 17.2.5.1 Business overview

- 17.2.5.2 Products offered

- 17.2.5.3 Recent developments

- 17.2.5.3.1 Product launches

- 17.2.5.3.2 Deals

- 17.2.5.4 MnM view

- 17.2.5.4.1 Right to win

- 17.2.5.4.2 Strategic choices

- 17.2.5.4.3 Weaknesses and competitive threats

- 17.2.6 QUALCOMM TECHNOLOGIES, INC.

- 17.2.6.1 Business overview

- 17.2.6.2 Products offered

- 17.2.6.3 Recent developments

- 17.2.6.3.1 Product launches

- 17.2.6.3.2 Deals

- 17.2.7 TEXAS INSTRUMENTS INCORPORATED

- 17.2.7.1 Business overview

- 17.2.7.2 Products offered

- 17.2.7.3 Recent developments

- 17.2.7.3.1 Product launches

- 17.2.8 SIEMENS

- 17.2.8.1 Business overview

- 17.2.8.2 Products offered

- 17.2.8.3 Recent developments

- 17.2.8.3.1 Product launches

- 17.2.8.3.2 Deals

- 17.2.9 ABB

- 17.2.9.1 Business overview

- 17.2.9.2 Products offered

- 17.2.9.3 Recent developments

- 17.2.9.3.1 Deals

- 17.2.10 IBM

- 17.2.10.1 Business overview

- 17.2.10.2 Products/Solutions/Services offered

- 17.2.10.3 Recent developments

- 17.2.11 SAP

- 17.2.12 HITACHI

- 17.2.13 PTC

- 17.2.14 STMICROELECTRONICS

- 17.2.15 NXP SEMICONDUCTORS

- 17.2.16 HPE

- 17.2.17 TE CONNECTIVITY

- 17.2.18 ADVANTECH

- 17.2.19 BOSCH

- 17.2.20 TDK CORPORATION

- 17.2.21 OMRON CORPORATION

- 17.2.22 HONEYWELL

- 17.2.23 ORACLE

- 17.2.24 SOFTWARE AG

- 17.2.25 STC

- 17.2.26 SAMSUNG

- 17.2.27 ERICSSON

- 17.2.28 AVNET

- 17.2.29 ALIBABA CLOUD

- 17.2.1 MICROSOFT

- 17.3 STARTUPS/SMES

- 17.3.1 HQSOFTWARE

- 17.3.2 PARTICLE

- 17.3.3 CLEARBLADE

- 17.3.4 AYLA NETWORKS

- 17.3.5 LOSANT IOT

- 17.3.6 EMNIFY

- 17.3.7 BLUES

- 17.3.8 TELIT CINTERION

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.1.1 SECONDARY DATA

- 18.1.2 PRIMARY DATA

- 18.1.2.1 Primary interviews with experts

- 18.1.2.2 Breakdown of primary profiles

- 18.1.2.3 Key data from primary sources

- 18.1.2.4 Key industry insights

- 18.2 DATA TRIANGULATION

- 18.3 MARKET SIZE ESTIMATION

- 18.3.1 TOP-DOWN APPROACH

- 18.3.2 BOTTOM-UP APPROACH

- 18.4 MARKET FORECAST

- 18.4.1 FACTOR ANALYSIS

- 18.5 RESEARCH ASSUMPTIONS

- 18.6 LIMITATIONS

19 ADJACENT/RELATED MARKETS

- 19.1 INTRODUCTION

- 19.2 5G IOT MARKET

- 19.2.1 MARKET DEFINITION

- 19.2.2 MARKET OVERVIEW

- 19.2.3 5G IOT MARKET, BY COMPONENT

- 19.2.4 5G IOT MARKET, BY NETWORK TYPE

- 19.2.5 5G IOT MARKET, BY ORGANIZATION SIZE

- 19.2.6 5G IOT MARKET, TYPE

- 19.2.7 5G IOT MARKET, BY END USER

- 19.2.8 5G IOT MARKET, BY REGION

- 19.3 IOT SOLUTIONS AND SERVICES MARKET

- 19.3.1 MARKET DEFINITION

- 19.3.2 MARKET OVERVIEW

- 19.3.3 IOT SOLUTIONS AND SERVICES MARKET, BY COMPONENT

- 19.3.4 IOT SOLUTIONS AND SERVICES MARKET, BY DEPLOYMENT MODE

- 19.3.5 IOT SOLUTIONS AND SERVICES MARKET, BY ORGANIZATION SIZE

- 19.3.6 IOT SOLUTIONS & SERVICES MARKET, BY FOCUS AREA

- 19.3.7 IOT SOLUTIONS & SERVICES MARKET, BY REGION

20 APPENDIX

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS

- 20.5 AUTHOR DETAILS