|

시장보고서

상품코드

1877355

HVAC 라인세트 시장 : 유통 채널별, 재질별, 최종 이용 산업별, 실장별, 지역별 예측(-2030년)HVAC Lineset Market by Material Type (Copper, Low Carbon, Other Material Types), Implementation (New Construction, Retrofit), End-use Industry (Commercial, Industrial, Residential), and Region - Global Forecast to 2030 |

||||||

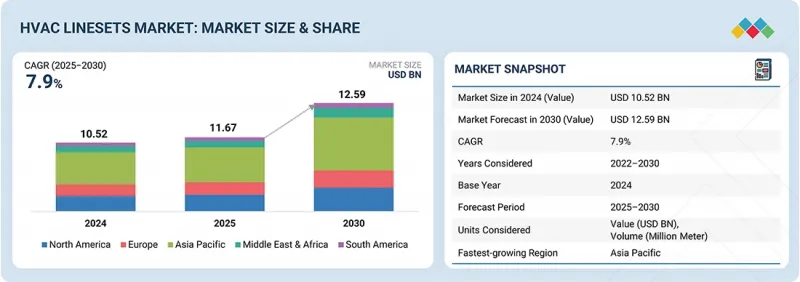

세계의 HVAC 라인세트 시장 규모는 2025년 116억 7,000만 달러에서 예측 기간 동안 CAGR 7.9%로 성장하여 2030년에는 125억 9,000만 달러에 이를 것으로 전망됩니다.

에너지 효율이 뛰어나고 환경 친화적인 HVAC 시스템에 대한 수요 증가는 건축물의 에너지 효율과 지속가능성에 관한 규제의 강화에 의해 추진되고 있습니다. 급속한 도시화와 새로운 주택 및 상업 빌딩의 건설이 계속되고 있는 것으로, HVAC 유닛의 설치가 증가하고 있어 이것이 라인세트 수요 증가로 이어지고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2022-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025년-2030년 |

| 대상 단위 | 가치(100만 달러)/수량(100만 미터) |

| 부문 | 유통 채널별, 재질별, 최종 이용 산업별, 실장별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미, 중동 및 아프리카 |

또한 스마트하고 IoT 호환 고성능 HVAC 시스템의 개발로 누설 방지 라인세트에 대한 수요가 증가하고 있습니다. 미국 EPA의 AIM법 및 F가스 규제에 준거한 지구온난화계수(GWP)가 낮은 냉매로의 이행에 따라 성능과 안전성 향상을 위한 라인세트의 재설계가 진행되고 있습니다. 또한 HVAC의 리노베이션 및 교환 시장은 라인세트 애프터마켓 수요를 계속 지원할 것입니다.

저탄소 구리는 성능, 지속가능성, 규제 적합성이 뛰어난 균형으로 HVAC 라인세트 시장에서 가장 빠르게 성장하는 재료 유형으로 부상하고 있습니다. 이 재료는 전통적인 구리와 동등한 우수한 열전도성, 내식성 및 납땜성을 제공하면서 탄소 발자국을 크게 줄이고 업계 전반의 탈탄소화 목표를 준수합니다. HVAC 제조업체와 시공업체는 미국 환경보호청의 AIM법 요건과 HVAC 부품 전체의 함유 배출량 감축을 요구하는 기업의 지속가능성 목표를 달성하기 위해 저탄소 구리 라인세트를 점점 선호하고 있습니다. 또한 저탄소 구리는 R-32 및 R-454B와 같은 차세대 저 GWP 냉매와의 호환성을 지원합니다. 이 냉매는 높은 신뢰성과 누설 저항이 있는 튜브가 필요합니다. Wieland Group과 KME SE와 같은 주요 구리 생산 기업은 폐쇄 루프 재활용 및 저배출 제련 기술에 많은 투자를 하고 있으며, 이로써 재료공급 안정성과 비용 효율성이 더욱 향상되고 있습니다. 에너지 절약형 HVAC의 보급, LEED나 ENERGY STAR 등의 그린 빌딩 인증, 그리고 최종 사용자에 의한 환경 라벨 부착 기기에 대한 수요가 더해져, 저탄소 동제 라인세트로 시장 시프트가 가속하고 있습니다. 이 전환은 제조업체의 ESG 실적을 강화할 뿐만 아니라 성능 기준과 지속가능성 요청 모두에 견인되는 시장에서 장기적인 경쟁력을 확보할 수 있습니다.

신축 건설은 급속히 도시화가 진행되는 지역에서 주택 및 상업 및 공공건축 프로젝트의 급증을 배경으로 HVAC 라인세트 시장에서 성장률이 두 번째로 높은 도입 부문입니다. 스마트 시티의 지속적인 확대와 에너지 절약형 인프라 투자 증가와 함께 고성능 라인세트를 갖춘 첨단 HVAC 시스템에 대한 지속적인 수요를 뒷받침하고 있습니다. 신축 건물에서는 현대적인 냉매와 고효율 히트펌프 기술의 채용이 증가하고 있어 최적의 열성능과 누설 방지를 확보하기 위해 내구성이 뛰어나 정밀하게 설계된 라인세트가 요구되고 있습니다. 미국 에너지부의 건축 기술 프로그램과 캐나다의 넷 제로 배출 건축 전략 등 지속 가능한 건축 기준을 추진하는 정부의 이니셔티브는 새로운 HVAC 시스템에서 환경 친화적인 구리 및 알루미늄 라인세트의 설치를 더욱 촉진하고 있습니다. 개발자는 공장 단열 및 프리 플레어 가공 라인세트를 선호합니다. 이것은 설치 시간의 단축, 인건비의 삭감, 시스템 신뢰성 향상이라는 이점이 있어, 대규모 주택 개발이나 상업시설 개발에 있어서 높게 평가되고 있는 특징입니다. 게다가 유행 후 건설 지출 회복과 교외 주택의 급성장으로 인해 보수 공사보다 신규 HVAC 설치 수요가 가속화되고 있습니다. 성숙시장에서는 리노베이션 용도가 여전히 주류이지만, 북미 및 아시아태평양에서 에너지 절약 건축 프로젝트의 견조한 파이프라인에 의해 2030년까지 HVAC 라인세트 시장에서 신축 분야가 2위 성장 부문이 될 전망입니다.

중동 및 아프리카은 급속한 도시화, 건설 활동 확대, 에너지 절약형 냉각 솔루션에 대한 관심 증가를 바탕으로 HVAC 라인세트 시장에서 2위 성장률을 보여줍니다. 고온 환경 온도를 특징으로 하는 이 지역의 가혹한 기후 조건은 특히 주택, 상업 및 접객 분야에서 첨단 HVAC 시스템에 대한 지속적인 수요를 창출하고 있습니다. 사우디아라비아의 NEOM 시티, UAE의 스마트 시티 구상, 카타르, 이집트, 남아프리카의 대규모 개발 프로젝트 등 주요 인프라 사업은 신뢰성과 내구성을 갖춘 라인세트를 필요로 하는 현대적인 HVAC 시스템의 도입을 촉진하고 있습니다. 또한 각국 정부가 그린빌딩 규제와 지속가능성 프레임워크의 도입을 가속화하고 있기 때문에 환경친화적인 재료나 저GWP 냉매의 사용이 추천되어, 고품질의 구리 및 알루미늄 라인세트 수요를 견인하고 있습니다. 가처분소득 증가, 인구 증가, 도시의 주택 및 상업시설 확장이 공조설비 도입을 더욱 촉진하고 있습니다. 또한 LG Electronics, Daikin, Johnson Controls 등 국제적인 공조 제조업체가 현지 사업 확대를 진행함으로써 지역 공급 체인과 기술 보급이 강화되고 있습니다. 데이터센터, 의료시설, 공항 확장에 대한 투자 증가와 함께 이러한 요인에 의해 중동 및 아프리카은 2030년까지 에어컨 배관 세트 시장에서 세계에서 두 번째로 성장률이 높은 지역 시장이 될 전망입니다.

본 보고서에서는 세계의 HVAC 라인세트 시장에 대해 조사했으며, 유통 채널별, 재질별, 최종 이용 산업별, 실장별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 거시경제지표

- 밸류체인 분석

- 규제 상황

- 무역 분석

- 생태계 분석

- 고객사업에 영향을 주는 동향과 혼란

- 사례 연구 분석

- 기술 분석

- 가격 분석

- 주요 회의 및 이벤트

- 특허 분석

- AI/생성형 AI의 영향

- 투자 및 자금조달 시나리오

- 2025년 미국 관세

제6장 HVAC 라인세트 시장(유통 채널별)

- 소개

- 직접 판매

- 소매

- 온라인 판매

- 기타

제7장 HVAC 라인세트 시장(재질별)

- 소개

- 배관

- 절연

제8장 HVAC 라인세트 시장(최종 이용 산업별)

- 소개

- 주택

- 상업

- 공업

제9장 HVAC 라인세트 시장(실장별)

- 소개

- 신축

- 개조

제10장 HVAC 라인세트 시장(지역별)

- 소개

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

제11장 경쟁 구도

- 소개

- 주요 참가 기업의 전략/강점, 2021-2025년

- 수익 분석, 2022-2024년

- 시장 점유율 분석, 2024년

- 기업평가 및 재무지표

- 브랜드/제품 비교

- 기업평가 매트릭스: 주요 진입기업, 2024년

- 기업평가 매트릭스: 스타트업/중소기업, 2024년

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 진출기업

- HALCOR

- NORSK HYDRO ASA

- KME GERMANY GMBH

- MUELLER STREAMLINE CO.(MUELLER INDUSTRIES, INC.)

- CERRO FLOW PRODUCTS LLC

- PDM CORPORATION

- LINESETS INC.(MUELLER INDUSTRIES, INC.)

- ZHEJIANG HAILIANG CO., LTD.

- DIVERSITECH CORPORATION

- PTUBES, INC.(FEINROHREN SPA)

- 기타 기업

- INABA DENKO AMERICA

- GREAT LAKES COPPER LTD.(MUELLER INDUSTRIES, INC.)

- HMAX

- ICOOL USA, INC.

- CAMBRIDGE-LEE INDUSTRIES LLC

- MM KEMBLA

- MANDEV TUBES

- UNIFLOW COPPER TUBES

- KMCT CORPORATION

- MEHTA TUBES LTD.

- JMF COMPANY

- KLIMA INDUSTRIES

- UNITED PIPE & STEEL

- THERMADUCT

제13장 부록

JHS 25.12.03The HVAC linesets market is projected to reach USD 12.59 billion by 2030 from USD 11.67 billion in 2025, at a CAGR of 7.9% during the forecast period. The growing demand for energy-efficient and environmentally friendly HVAC systems is driven by stricter building energy and sustainability codes. Rapid urbanization and the ongoing construction of new residential and commercial buildings are increasing the installation of HVAC units, which in turn boosts the demand for linesets.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) / Volume (Million Meter) |

| Segments | Material Type, Implementation, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

Additionally, the development of smart, IoT-enabled, and high-performance HVAC systems has led to a higher need for leak-resistant linesets. The transition to refrigerants with lower global warming potential (GWP), in accordance with the US EPA AIM Act and F-Gas regulations, is prompting redesigns of linesets for improved performance and safety. Furthermore, the HVAC retrofit and replacement market will continue to support demand in the lineset aftermarket.

"Low carbon is the fastest-growing material type in the HVAC linesets market during the forecast period."

Low-carbon copper is emerging as the fastest-growing material type in the HVAC linesets market due to its superior balance of performance, sustainability, and regulatory compliance. The material offers excellent thermal conductivity, corrosion resistance, and brazing capability similar to traditional copper but with a significantly reduced carbon footprint, aligning with industry-wide decarbonization goals. HVAC manufacturers and contractors increasingly prefer low-carbon copper linesets to meet the US Environmental Protection Agency's AIM Act requirements and corporate sustainability targets that demand lower embodied emissions across HVAC components. Additionally, low-carbon copper supports compatibility with next-generation, low-GWP refrigerants such as R-32 and R-454B, which require high-integrity and leak-resistant tubing. Major copper producers like Wieland Group and KME SE are investing heavily in closed-loop recycling and low-emission smelting technologies, further enhancing material availability and cost efficiency. The combination of energy-efficient HVAC adoption, green building certifications such as LEED and ENERGY STAR, and end-user demand for eco-labeled equipment is accelerating the market shift toward low-carbon copper linesets. This transition not only strengthens manufacturers' ESG credentials but also ensures long-term competitiveness in a market driven by both performance standards and sustainability imperatives.

"New construction is the second-fastest-growing implementation segment in the HVAC linesets market during the forecast period."

New construction is the second fastest-growing implementation segment in the HVAC linesets market, driven by a surge in residential, commercial, and institutional building projects across rapidly urbanizing regions. The ongoing expansion of smart cities, coupled with rising investments in energy-efficient infrastructure, has fueled sustained demand for advanced HVAC systems equipped with high-performance linesets. New constructions increasingly integrate modern refrigerants and high-efficiency heat pump technologies, requiring durable and precisely engineered linesets to ensure optimal thermal performance and leak prevention. Government initiatives promoting sustainable building standards, such as the US Department of Energy's Building Technologies Program and Canada's Net-Zero Emissions Building Strategy, further stimulate installations of eco-friendly copper and aluminum linesets in new HVAC systems. Developers also favor factory-insulated and pre-flared linesets for faster installation, reduced labor costs, and enhanced system reliability-features highly valued in large-scale housing and commercial developments. Moreover, post-pandemic recovery in construction spending and the rapid growth of suburban housing are accelerating the demand for new HVAC installations rather than retrofits. While retrofit applications remain dominant in mature markets, the robust pipeline of energy-efficient building projects across North America and the Asia Pacific is positioning new construction as the second fastest-growing segment in the HVAC linesets market through 2030.

"The Middle East & Africa is the second-fastest growing region in the HVAC linesets market during the forecast period."

The Middle East & Africa is the second-fastest growing market in the HVAC linesets market, driven by rapid urbanization, expanding construction activity, and a growing focus on energy-efficient cooling solutions. The region's extreme climatic conditions, characterized by high ambient temperatures, create a continuous demand for advanced HVAC systems, particularly in residential, commercial, and hospitality sectors. Major infrastructure projects such as Saudi Arabia's NEOM City, the UAE's smart city initiatives, and large-scale developments across Qatar, Egypt, and South Africa are fueling installations of modern HVAC systems that require reliable and durable linesets. Additionally, governments are increasingly adopting green building regulations and sustainability frameworks, encouraging the use of eco-friendly materials and low-GWP refrigerants, which in turn drives demand for high-quality copper and aluminum linesets. Rising disposable incomes, population growth, and the expansion of urban housing and retail complexes further stimulate HVAC adoption. Moreover, the presence of international HVAC manufacturers expanding local operations, such as LG Electronics, Daikin, and Johnson Controls, enhances regional supply chains and technology penetration. Combined with growing investment in data centers, healthcare facilities, and airport expansions, these factors position the Middle East & Africa as the second-fastest-growing regional market for HVAC linesets through 2030.

Extensive primary interviews were conducted to determine and verify the market size for several segments and subsegments and the information gathered through secondary research.

The breakdown of primary interviews is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 45%, Asia Pacific: 20%, South America: 5%, and Middle East & Africa 5%

Mueller Streamline Co. (US), Cerro Flow Products LLC (US), JMF Company (US), Zhejiang ICE Loong Environmental Sci-Tech Co. Ltd. (China), Feinrohren S.p.A (Italy), Halcor (Greece), Hydro (Norway), KME SE (Germany), Diversitech Corporation (US), Inaba Denko (Japan), and Zhejiang Hailiang Co., Ltd (China), among others, are some of the key players in the HVAC linesets market. The study includes an in-depth competitive analysis of these key players in the HVAC linesets market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the HVAC linesets market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on material type, implementation, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the HVAC linesets market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall HVAC linesets market and its segments and subsegments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provide them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (urbanization and increase in residential construction, growing trend of smart homes, rising demand for air conditioners, and increasing requirement for replacement and retrofitting HVAC systems), restraints (local cooling solutions, high installation and maintenance costs of HVAC systems, and rising environmental concerns), opportunities (rising global temperatures and heat islands and a combination of climate and income dynamics), challenges (passive cooling and free cooling solutions and adoption of new refrigerants).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the HVAC linesets market

- Market Development: Comprehensive information about lucrative markets - the report analyses the HVAC linesets market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the HVAC linesets market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Mueller Streamline Co. (US), Cerro Flow Products LLC (US), JMF Company (US), Zhejiang ICE Loong Environmental Sci-Tech Co. Ltd. (China), Fein Rohren S.p.A (Italy), Halcor (Greece), Hydro (Norway), KME SE (Germany), Diversitech Corporation (US), Inaba Denko (Japan), and Zhejiang Hailiang Co., Ltd (China), among others, are the top manufacturers covered in the HVAC linesets market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants: demand and supply side

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HVAC LINESET MARKET

- 4.2 HVAC LINESET MARKET, BY MATERIAL TYPE

- 4.3 HVAC LINESET MARKET, BY IMPLEMENTATION

- 4.4 HVAC LINESET MARKET, BY END-USE INDUSTRY

- 4.5 HVAC LINESET MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for energy-efficient HVAC systems

- 5.2.1.2 Increasing urbanization and ongoing residential construction

- 5.2.1.3 Heightened global demand for air conditioners

- 5.2.1.4 Replacement and retrofitting of HVAC systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 High installation and maintenance costs of HVAC systems

- 5.2.2.2 Skilled labor shortages and installation complexities

- 5.2.2.3 Growing environmental concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High demand for cooling solutions amid increasing global warming

- 5.2.3.2 Surge in demand for low-GWP and environmentally friendly refrigerants

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain disruptions

- 5.2.4.2 Rapid evolution of regulatory and refrigerant landscape

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 NORTH AMERICA

- 5.7.1.1 US

- 5.7.1.2 Canada

- 5.7.2 ASIA PACIFIC

- 5.7.3 EUROPE

- 5.7.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.1 NORTH AMERICA

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 7411)

- 5.8.2 EXPORT SCENARIO (HS CODE 7411)

- 5.9 ECOSYSTEM ANALYSIS

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 VRF SOLUTIONS ELEVATES NYC ELECTRIFICATION RETROFIT WITH INABA DENKO'S SLIMDUCT RD ROOFTOP LINESET PROTECTION

- 5.11.2 THERMADUCT STREAMLINES DETROIT MULTIFAMILY HVAC INSTALLATION WITH INSULATED LINESET PORTAL SYSTEM

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Pre-insulated linesets

- 5.12.1.2 Corrosion-resistant coatings

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 AI-enabled HVAC control systems

- 5.12.2.2 Heat pumps and VRF systems

- 5.12.1 KEY TECHNOLOGIES

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.13.2 AVERAGE SELLING PRICE OF HVAC LINESETS OFFERED BY KEY PLAYERS

- 5.14 KEY CONFERENCES AND EVENTS

- 5.15 PATENT ANALYSIS

- 5.16 IMPACT OF AI/GEN AI

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 2025 US TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON KEY REGIONS

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 HVAC LINESET MARKET, BY DISTRIBUTION CHANNEL

- 6.1 INTRODUCTION

- 6.2 DIRECT SALES

- 6.3 RETAIL

- 6.4 ONLINE SALES

- 6.5 OTHERS

7 HVAC LINESET MARKET, BY MATERIAL TYPE

- 7.1 INTRODUCTION

- 7.2 TUBING

- 7.2.1 RISING DEMAND FOR ENERGY-EFFICIENT AIR CONDITIONING SYSTEMS AND RETROFITTING OF OLDER BUILDINGS TO DRIVE MARKET

- 7.2.2 COPPER

- 7.2.2.1 Advantages

- 7.2.2.1.1 Malleability

- 7.2.2.1.2 Easy to join

- 7.2.2.1.3 Durable

- 7.2.2.1.4 100% recyclable

- 7.2.2.2 Applications

- 7.2.2.1 Advantages

- 7.2.3 OTHERS

- 7.2.4 COPPER VS. LOW-CARBON LINESETS

- 7.3 INSULATION

- 7.3.1 ONGOING DEVELOPMENT OF ECO-FRIENDLY AND HALOGEN-FREE MATERIALS TO DRIVE MARKET

8 HVAC LINESET MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 RESIDENTIAL

- 8.2.1 ELEVATED DEMAND FOR AIR CONDITIONING SYSTEMS DUE TO EXPANDING GLOBAL POPULATION TO DRIVE MARKET

- 8.3 COMMERCIAL

- 8.3.1 IMPLEMENTATION OF STRINGENT ENERGY EFFICIENCY REGULATIONS TO DRIVE MARKET

- 8.4 INDUSTRIAL

- 8.4.1 EMPHASIS ON ENERGY EFFICIENCY, SUSTAINABILITY, AND COMPLIANCE WITH REGULATIONS TO DRIVE MARKET

9 HVAC LINESET MARKET, BY IMPLEMENTATION

- 9.1 INTRODUCTION

- 9.2 NEW CONSTRUCTION

- 9.2.1 RAPID URBANIZATION AND ROBUST ECONOMIC GROWTH TO DRIVE MARKET

- 9.3 RETROFIT

- 9.3.1 PUSH FOR SUSTAINABILITY TO DRIVE MARKET

10 HVAC LINESET MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Rapid urbanization and economic development to drive market

- 10.2.2 INDIA

- 10.2.2.1 Favorable government initiatives to drive market

- 10.2.3 JAPAN

- 10.2.3.1 Presence of leading HVAC system manufacturers to drive market

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Rising demand for smart home integration to drive market

- 10.2.5 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 NORTH AMERICA

- 10.3.1 US

- 10.3.1.1 Surge in construction activities to drive market

- 10.3.2 CANADA

- 10.3.2.1 Rise of new housing projects to drive market

- 10.3.3 MEXICO

- 10.3.3.1 Heightened installations of HVAC systems to drive market

- 10.3.1 US

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Surge in construction of residential infrastructure to drive market

- 10.4.2 UK

- 10.4.2.1 Government subsidies for HVAC systems to drive market

- 10.4.3 FRANCE

- 10.4.3.1 Policy and financial incentives for building renovation and low-carbon heating to drive market

- 10.4.4 ITALY

- 10.4.4.1 Investments in residential buildings and renovation activities to drive market

- 10.4.5 SPAIN

- 10.4.5.1 High demand for commercial air conditioning units to drive market

- 10.4.6 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 SAUDI ARABIA

- 10.5.1.1 Trend of small and affordable housing units to drive market

- 10.5.2 UAE

- 10.5.2.1 Projects aimed at promoting economic development to drive market

- 10.5.3 SOUTH AFRICA

- 10.5.3.1 Regional copper trade expansion to drive market

- 10.5.4 REST OF MIDDLE EAST & AFRICA

- 10.5.1 SAUDI ARABIA

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Rapid industrial growth to drive market

- 10.6.2 ARGENTINA

- 10.6.2.1 Economic stabilization to drive market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 HALCOR

- 11.4.2 NORSK HYDRO ASA

- 11.4.3 KME GERMANY GMBH

- 11.4.4 MUELLER STREAMLINE CO.

- 11.4.5 ZHEJIANG HAILIANG CO., LTD.

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Material type footprint

- 11.7.5.4 Implementation footprint

- 11.7.5.5 End-use industry footprint

- 11.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2024

- 11.8.5.1 List of start-ups/SMEs

- 11.8.5.2 Competitive benchmarking of start-ups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 DEALS

- 11.9.2 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 HALCOR

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 MnM view

- 12.1.1.3.1 Right to win

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses and competitive threats

- 12.1.2 NORSK HYDRO ASA

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 KME GERMANY GMBH

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses and competitive threats

- 12.1.4 MUELLER STREAMLINE CO. (MUELLER INDUSTRIES, INC.)

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 CERRO FLOW PRODUCTS LLC

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threats

- 12.1.6 PDM CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Expansions

- 12.1.6.4 MnM view

- 12.1.7 LINESETS INC. (MUELLER INDUSTRIES, INC.)

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 MnM view

- 12.1.8 ZHEJIANG HAILIANG CO., LTD.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.4 MnM view

- 12.1.9 DIVERSITECH CORPORATION

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.4 MnM view

- 12.1.10 PTUBES, INC. (FEINROHREN S.P.A.)

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 MnM view

- 12.1.1 HALCOR

- 12.2 OTHER PLAYERS

- 12.2.1 INABA DENKO AMERICA

- 12.2.2 GREAT LAKES COPPER LTD. (MUELLER INDUSTRIES, INC.)

- 12.2.3 HMAX

- 12.2.4 ICOOL USA, INC.

- 12.2.5 CAMBRIDGE-LEE INDUSTRIES LLC

- 12.2.6 MM KEMBLA

- 12.2.7 MANDEV TUBES

- 12.2.8 UNIFLOW COPPER TUBES

- 12.2.9 KMCT CORPORATION

- 12.2.10 MEHTA TUBES LTD.

- 12.2.11 JMF COMPANY

- 12.2.12 KLIMA INDUSTRIES

- 12.2.13 UNITED PIPE & STEEL

- 12.2.14 THERMADUCT

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS