|

시장보고서

상품코드

1880368

바이오테크놀러지 분야 AI 시장(-2035년) : 기능 및 최종사용자별AI in Biotechnology Market by Function and End User - Global Forecast to 2035 |

||||||

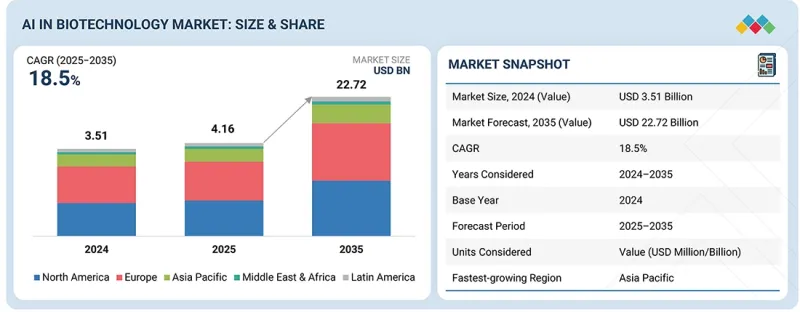

세계의 바이오테크놀러지 분야 AI 시장 규모는 2025년 41억 5,690만 달러에서 예측 기간 중 18.5%의 연평균 복합 성장률(CAGR)로 확대되어 2035년에는 227억 1,650만 달러에 이를 것으로 예측됩니다.

이 시장은 의약품의 안전성 및 유효성 예측 분석에 대한 AI 도입 확대, 실험실 프로세스에서 AI를 통한 자동화 활용 증가, 비용 효율성 및 연구 파이프라인 가속화에 대한 수요 증가를 배경으로 꾸준히 성장하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2024-2035년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2035년 |

| 단위 | 금액(달러) |

| 부문 | 제공 구분, 기능, 도입 구분, 최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

또한, 대규모 생물학적 데이터 세트의 가용성 확대, 클라우드 컴퓨팅 인프라의 발전, 생명과학 분야의 AI 도입을 촉진하기 위한 정부 지원책 등도 시장 성장을 더욱 촉진하고 있습니다. AI와 신흥 바이오테크놀러지의 융합은 더 빠른 혁신, 더 나은 의사결정, 더 개인화된 의료 솔루션을 가능하게 하고 있습니다.

"기능별로는 R&D 부문이 예측 기간 동안 가장 큰 점유율을 차지할 것으로 예측됩니다."

기능별로는 연구개발 부문이 가장 큰 점유율을 차지하고 있으며, 향후 몇 년 동안 그 우위를 유지할 것으로 예측됩니다. 이러한 우위는 신약 개발 가속화, 분자 설계 최적화, 화합물의 효능 및 안전성 예측을 위한 AI 활용 증가로 인해 더욱 가속화되고 있습니다. AI를 활용한 툴을 통해 연구자들은 대규모 유전체, 프로테옴, 임상 데이터 세트를 보다 효율적으로 분석할 수 있으며, 실험 기간과 비용을 절감할 수 있습니다. 또한, 머신러닝 알고리즘과 하이스루풋 스크리닝, 자동화 실험 플랫폼의 통합으로 연구개발 프로세스의 정확성과 확장성을 향상시키고 있습니다. 생명공학 기업들이 새로운 치료제 시장 출시를 가속화하는 가운데, R&D 분야에서의 AI 도입은 계속해서 주요 성장 동력이 될 것입니다.

"최종 사용자별로는 제약 회사 부문이 예측 기간 동안 가장 큰 점유율을 차지할 것으로 예측됩니다."

이러한 성장은 신약 개발 가속화, 임상시험 설계 최적화, 약효 및 안전성 프로파일 예측을 위한 AI 도입 증가에 의해 촉진되고 있습니다. 제약사들은 AI를 활용해 대규모 생물학적 임상 데이터 세트 분석, 신약 타겟 발굴, R&D 워크플로우의 효율화를 통해 시간과 비용을 절감하고 있습니다. 또한, AI를 활용한 예측 모델링과 가상 스크리닝 도구는 데이터에 기반한 의사결정 지원, 성공률 향상, 새로운 치료법의 효율적인 시장 출시에 기여하고 있습니다. 개인 맞춤형 의료에 대한 수요 증가와 빠른 혁신에 대한 압박도 제약 분야의 AI 도입을 더욱 촉진하고 있습니다.

"아시아태평양이 예측 기간 동안 가장 높은 성장률을 보일 것으로 예상"

이러한 급속한 확장은 기술 발전과 연구 우수성에 대한 강한 집중에 의해 추진되고 있습니다. 역내 각국은 인프라 강화, 산학협력, 국경을 초월한 협력관계를 통해 혁신 생태계를 강화해 나가고 있습니다. 정밀의료, 데이터 기반 의료, 지속 가능한 바이오 제조에 대한 관심이 높아지면서 시장 발전의 새로운 기회를 창출하고 있습니다. 또한, 지원적인 규제 프레임워크와 민관 협력 증가로 아시아태평양은 차세대 생명공학 발전의 세계 허브로서 입지를 다지고 있습니다.

세계의 바이오테크놀러지 분야 AI 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술 및 특허 동향, 법 및 규제 환경, 사례 분석, 시장 규모 추이 및 예측, 각종 부문별/지역별/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 관련 시장 및 타업종과의 분야의 횡단적 기회

- Tier1/2/3 기업의 전략적 움직임

제6장 산업 동향

- 바이오테크놀러지 분야에서 AI의 진화

- Porter의 Five Forces 분석

- 거시경제 지표

- 밸류체인 분석

- 생태계 분석

- 가격 분석

- 주요 컨퍼런스 및 이벤트

- 고객 사업에 영향을 미치는 동향과 혼란

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 미국 관세가 시장에 미치는 영향

제7장 기술, 특허, 디지털, AI 도입에 의한 전략적 파괴적 변화

- 주요 신기술

- 자연언어처리(NLP)

- 예측 분석

- 보완적 기술

- 클라우드 컴퓨팅

- 빅데이터 애널리틱스

- 기술/제품 로드맵

- 특허 분석

- 바이오테크놀러지 부문 AI 특허 공개 동향

- 특허 출원 지역 및 주요 출원자 분석

- 향후 응용

- AI를 활용한 정밀 발견과 멀티 오믹스 통합

- 생성 생물학과 분자, 단백질, 유전자 시스템 자동 설계

- 바이오테크놀러지 시장 AI/생성형 AI의 영향

- 주요 이용 사례와 시장 가능성

- 인접 에코시스템과의 제휴 및 참여 기업에 대한 영향

- 바이오테크놀러지 분야 생성형 AI 도입에 대한 고객 준비 상황

- AI/생성형 AI 도입 사례 : 사례 연구

제8장 규제 상황

- 지역 규제와 컴플라이언스

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 규제기관, 정부기관, 기타 조직

- 업계표준

제9장 고객 상황과 구매 행동

- 의사결정 프로세스

- 이해관계자 영향과 구매 기준

- 채택 장벽과 내부 과제

- 각종 최종사용자 산업의 미충족 요구

- 최종사용자 기대

제10장 바이오테크놀러지 분야 AI 시장 : 제공 구분별

- 엔드 투 엔드 솔루션

- 니치 솔루션

- 기술

- 서비스

- 컨설팅 서비스

- 구현 서비스 및 지속적 IT 지원

- 연수 및 교육 서비스

- 애프터서비스 및 유지관리 서비스

제11장 바이오테크놀러지 분야 AI 시장 : 기능별

- 연구개발

- Drug Discovery

- 임상 개발

- 규제 준수

- 제조 및 공급망

- 공급망 계획

- 재고 관리

- 물류 최적화

- 수요 예측

- 예측 유지관리

- 기타

- 발매 및 상업화

- 론치 조정

- 환자 참여

- 마케팅 오퍼레이션

- 예측 가격 결정

- 시판 후 조사 및 환자 지원

- 복약 준수

- 유해사례 보고

- 환자 모니터링

- 컴플라이언스 모니터링

- 환자 지원 프로그램

- 코퍼레이트 기능

- 리스크 관리

- 컴플라이언스 모니터링

- 영업 부문 최적화

- 기타

제12장 바이오테크놀러지 분야 AI 시장 : 도입 구분별

- 클라우드 기반 솔루션

- 퍼블릭 클라우드

- 프라이빗 클라우드

- 멀티클라우드

- 하이브리드 클라우드

- On-Premise 솔루션

제13장 바이오테크놀러지 분야 AI 시장 : 최종사용자별

- 제약회사

- 바이오테크놀러지 기업

- 연구기관 및 연구소

- 의료 제공업체

- CRO

제14장 바이오테크놀러지 분야 AI 시장 : 지역별

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 유럽

- 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 거시경제 전망

- 일본

- 중국

- 인도

- 한국

- 호주

- 기타

- 라틴아메리카

- 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 기타

제15장 경쟁 구도

- 주요 기업의 전략/유력 기업

- 매출 분석

- 시장 점유율 분석

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제16장 기업 개요

- 주요 기업

- NVIDIA CORPORATION

- ILLUMINA, INC.

- RECURSION

- SCHRODINGER, INC.

- BENEVOLENTAI

- DATA4CURE, INC.

- QIAGEN

- INSILICO MEDICINE

- DNANEXUS, INC.

- TEMPUS

- SOPHIA GENETICS

- PREDICTIVE ONCOLOGY

- DEEP GENOMICS

- NUMEDII, INC.

- XTALPI INC.

- IKTOS

- BPGBIO, INC.

- EUROFINS DISCOVERY

- 기타 기업

- VERISIM LIFE

- LIFEBIT BIOTECH INC.

- VALO HEALTH

- VERGE GENOMICS

- LOGICA

- AMERICAN CHEMICAL SOCIETY

- AGANITHA AI INC.

제17장 부록

LSH 25.12.10The global AI in biotechnology market is projected to reach USD 22,716.5 million by 2035 from USD 4,156.9 million in 2025, at a high CAGR of 18.5% during the forecast period. The market is progressing steadily, driven by the growing adoption of AI for predictive analytics in drug safety and efficacy, the increasing use of AI-powered automation in laboratory processes, and the rising demand for cost-efficient and accelerated research pipelines.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2035 |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Units Considered | Value (USD million) |

| Segments | Offering, Function, Deployment Mode, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Moreover, the expanding availability of large-scale biological datasets, advancements in cloud computing infrastructure, and supportive government initiatives promoting AI in life sciences further propel market growth. The convergence of AI with emerging biotechnologies is enabling faster innovation, improved decision-making, and more personalized healthcare solutions.

"The research & development segment of the AI in biotechnology market is the largest segment during the forecast period."

Based on function, the research & development (R&D) segment accounted for the largest share of the AI in biotechnology market and is projected to maintain its lead in the coming years. This dominance is driven by the increasing use of AI to accelerate drug discovery, optimize molecular design, and predict compound efficacy and safety. AI-powered tools enable researchers to analyze large-scale genomic, proteomic, and clinical datasets more efficiently, reducing experimental timelines and costs. Additionally, the integration of machine learning algorithms with high-throughput screening and automated laboratory platforms is enhancing the precision and scalability of R&D processes. As biotech companies strive to bring novel therapeutics to market faster, the adoption of AI in R&D continues to be a key growth driver.

"Based on the end user, the pharmaceutical companies segment accounted for the largest share of AI in biotechnology market during the forecast period."

The pharmaceutical companies segment accounted for the largest share of the AI in biotechnology market during the forecast period. This growth is driven by the increasing adoption of AI for accelerating drug discovery, optimizing clinical trial design, and predicting drug efficacy and safety profiles. Pharmaceutical firms are leveraging AI to analyze large-scale biological and clinical datasets, identify novel drug targets, and streamline R&D workflows, reducing time and cost. Additionally, AI-enabled predictive modeling and virtual screening tools help companies make data-driven decisions, enhance success rates, and bring new therapies to market more efficiently. The rising demand for personalized medicine and the pressure to innovate rapidly further reinforce the adoption of AI within the pharmaceutical sector.

"Asia Pacific is projected to witness the highest growth rate during the forecast period."

The Asia Pacific region is projected to witness the highest growth rate in the AI in biotechnology market during the forecast period. This rapid expansion is driven by a strong focus on technological advancement and research excellence. Countries across the region are strengthening their innovation ecosystems through enhanced infrastructure, academic-industry partnerships, and cross-border collaborations. The growing emphasis on precision medicine, data-driven healthcare, and sustainable biomanufacturing is also creating new opportunities for market development. Moreover, supportive regulatory frameworks and increasing public-private initiatives position Asia Pacific as a global hub for next-generation biotechnological progress.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the AI in biotechnology marketplace. The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1: 34%, Tier 2: 46%, and Tier 3: 20%

- By Designation - C-Level: 35%, Director Level: 25%, and Others: 40%

- By Region - North America: 30%, Europe: 45%, Asia Pacific: 20%, Latin America: 3%, Middle East & Africa: 2%

Key Players in the AI in Biotechnology Market

The key players operating in the AI in biotechnology market include NVIDIA (US), Illumina, Inc. (US), Recursion (US), Schrodinger, Inc. (US), BenevolentAI (UK), Data4Cure, Inc. (US), Qiagen (Germany), Insilico Medicine (US), DNAnexus, Inc. (US), Tempus (US), SOPHiA GENETIC (Switzerland), Predictive Oncology (US), Deep Genomics (Canada), NuMedii, Inc. (US), XtalPi Inc. (China), Iktos (France), BPGbio, Inc. (US), Eurofins Discovery (US), VeriSIM Life (US), Lifebit (UK), Verge Genomics (US), Logica (US), American Chemical Society (US), and Aganitha AI Inc. (India).

Research Coverage

The report analyzes the AI in biotechnology market and aims to estimate the market size and future growth potential of various market segments, based on offering, function, deployment mode, end user, and region. The report also provides a competitive analysis of the key players operating in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will benefit established firms as well as new entrants and smaller firms in gauging the market pulse, which in turn will help them capture a greater share of the market. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their positions in the market.

This report provides insights into the following:

- Analysis of key drivers (growing cross-industry collaborations and partnerships, growing need to reduce time and cost of drug discovery and development, rising adoption of AI in precision medicine, improving computing power and declining hardware cost), restraints (high implementation costs of AI limit adoption in biotechnology, especially for SMEs and emerging economies, data privacy risks and compliance challenges for AI in biotechnology), opportunities (integrating AI and big data in precision medicine for biotechnology advancement, surge in biotechnology investments enhances opportunities for AI to accelerate drug discovery innovations, innovation across healthcare, agriculture, and environmental science for global growth) challenges (data quality and interpretability issues that hinder AI integration and trustworthiness, AI deployment in biotechnology hindered by talent shortages and evolving regulatory challenges) influencing the growth of the AI in biotechnology market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the AI in biotechnology market

- Market Development: Comprehensive information on the lucrative emerging markets, offering, function, deployment mode, end user, and region

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the AI in biotechnology market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the AI in biotechnology market, like NVIDIA (US), Illumina, Inc. (US), Recursion (US), Schrodinger Inc. (US), and BenevolentAI (UK)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 RESEARCH LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Insights from primary experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 AI IN BIOTECHNOLOGY MARKET OVERVIEW

- 4.2 AI IN BIOTECHNOLOGY MARKET, BY REGION

- 4.3 NORTH AMERICA: AI IN BIOTECHNOLOGY MARKET, BY OFFERING AND COUNTRY

- 4.4 AI IN BIOTECHNOLOGY MARKET: GEOGRAPHIC SNAPSHOT

- 4.5 AI IN BIOTECHNOLOGY MARKET: DEVELOPED VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing cross-industry collaborations and partnerships

- 5.2.1.2 Increasing need to reduce time and cost of drug discovery & development

- 5.2.1.3 Rising adoption of AI in precision medicine

- 5.2.1.4 Increasing investments in semiconductor chipsets

- 5.2.2 RESTRAINTS

- 5.2.2.1 High implementation costs

- 5.2.2.2 Data privacy risks and compliance challenges

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise of advanced analytics and predictive modeling

- 5.2.3.2 Surge in biotechnology investments

- 5.2.3.3 Innovations across healthcare, agriculture, and environmental science

- 5.2.4 CHALLENGES

- 5.2.4.1 Data quality and interpretability issues

- 5.2.4.2 Shortage of qualified experts and evolving regulatory challenges

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS AND WHITE SPACES

- 5.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

6 INDUSTRY TRENDS

- 6.1 EVOLUTION OF AI IN BIOTECHNOLOGY

- 6.2 PORTER'S FIVE FORCES ANALYSIS

- 6.2.1 BARGAINING POWER OF SUPPLIERS

- 6.2.2 BARGAINING POWER OF BUYERS

- 6.2.3 THREAT OF SUBSTITUTES

- 6.2.4 THREAT OF NEW ENTRANTS

- 6.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.3 MACROECONOMICS INDICATORS

- 6.3.1 INTRODUCTION

- 6.3.2 GDP TRENDS AND FORECAST

- 6.3.3 TRENDS IN GLOBAL HEALTHCARE IT INDUSTRY

- 6.4 VALUE CHAIN ANALYSIS

- 6.5 ECOSYSTEM ANALYSIS

- 6.6 PRICING ANALYSIS

- 6.6.1 INDICATIVE PRICING ANALYSIS FOR AI IN BIOTECHNOLOGY, BY OFFERING, BY KEY PLAYERS (2024)

- 6.6.2 INDICATIVE PRICING OF AI IN BIOTECHNOLOGY, BY REGION

- 6.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.8 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.9 INVESTMENT AND FUNDING SCENARIO

- 6.10 CASE STUDY ANALYSIS

- 6.10.1 CASE STUDY 1: RAPID TRAINING OF PROTEIN MODELS USING NVIDIA DGX CLOUD

- 6.10.2 CASE STUDY 2: IMPROVED END-TO-END NGS WORKFLOW FOR EFFICIENT GENETIC VARIANT DETECTION

- 6.10.3 CASE STUDY 3: ACCELERATED DRUG DISCOVERY WITH GENERATIVE AI AND STREAMLINED WORKFLOWS

- 6.11 IMPACT OF 2025 US TARIFF ON AI IN BIOTECHNOLOGY MARKET

- 6.11.1 INTRODUCTION

- 6.11.2 KEY TARIFF RATES

- 6.11.3 PRICE IMPACT ANALYSIS

- 6.11.4 IMPACT ON COUNTRIES/REGIONS

- 6.11.4.1 North America

- 6.11.4.2 Europe

- 6.11.4.3 Asia Pacific

- 6.11.5 IMPACT ON END-USE INDUSTRIES

- 6.11.5.1 Pharmaceutical companies

- 6.11.5.2 Biotechnology companies

- 6.11.5.3 Research institutes and labs

- 6.11.5.4 Healthcare providers

- 6.11.5.5 Contract Research Organizations (CROs)

7 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 7.1 KEY EMERGING TECHNOLOGIES

- 7.1.1 NATURAL LANGUAGE PROCESSING (NLP)

- 7.1.2 PREDICTIVE ANALYTICS

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 CLOUD COMPUTING

- 7.2.2 BIG DATA ANALYTICS

- 7.3 TECHNOLOGY/PRODUCT ROADMAP

- 7.4 PATENT ANALYSIS

- 7.4.1 PATENT PUBLICATION TRENDS FOR AI IN BIOTECHNOLOGY

- 7.4.2 JURISDICTION AND TOP APPLICANT ANALYSIS

- 7.5 FUTURE APPLICATIONS

- 7.5.1 AI-ENABLED PRECISION DISCOVERY AND MULTI-OMICS INTEGRATION

- 7.5.2 GENERATIVE BIOLOGY AND AUTOMATED DESIGN OF MOLECULES, PROTEINS, AND GENETIC SYSTEMS

- 7.6 IMPACT OF AI/GEN AI ON AI IN BIOTECHNOLOGY MARKET

- 7.6.1 INTRODUCTION

- 7.6.2 TOP USE CASES AND MARKET POTENTIAL

- 7.6.3 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 7.6.3.1 Drug discovery and development market

- 7.6.3.2 Genomics and bioinformatics market

- 7.6.3.3 Medical imaging & diagnostics market

- 7.6.4 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN AI IN BIOTECHNOLOGY MARKET

- 7.6.4.1 User readiness

- 7.6.4.1.1 Pharmaceutical companies

- 7.6.4.1.2 Biotechnology companies

- 7.6.4.2 Impact assessment

- 7.6.4.2.1 User A: Pharmaceutical companies

- 7.6.4.2.1.1 Implementation

- 7.6.4.2.1.2 Impact

- 7.6.4.2.2 User B: Biotechnology companies

- 7.6.4.2.2.1 Implementation

- 7.6.4.2.2.2 Impact

- 7.6.4.2.1 User A: Pharmaceutical companies

- 7.6.4.1 User readiness

- 7.6.5 CASE STUDY ON AI/GENERATIVE AI IMPLEMENTATION

- 7.6.5.1 Case Study 1: Enhanced operations and revenue using AI-driven real-world data analytics

- 7.6.5.2 Case study 2: Advance AI-powered target discovery with proprietary AI platform

8 REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.1.1 NORTH AMERICA

- 8.1.2 EUROPE

- 8.1.3 ASIA PACIFIC

- 8.1.4 LATIN AMERICA

- 8.1.5 MIDDLE EAST & AFRICA

- 8.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.3 INDUSTRY STANDARDS

9 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 9.1 DECISION-MAKING PROCESS

- 9.2 INFLUENCE OF STAKEHOLDERS AND BUYING CRITERIA

- 9.2.1 BUYING CRITERIA

- 9.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 9.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 9.5 END-USER EXPECTATIONS

10 AI IN BIOTECHNOLOGY MARKET, BY OFFERING

- 10.1 INTRODUCTION

- 10.2 END-TO-END SOLUTIONS

- 10.2.1 GROWING USE OF ADVANCED ALGORITHMS FOR BETTER PRECISION AND EFFICIENCY TO BOOST MARKET GROWTH

- 10.3 NICHE SOLUTIONS

- 10.3.1 ABILITY OF NICHE SOLUTIONS TO ADDRESS SPECIFIC CHALLENGES WITHIN DRUG DISCOVERY TO SUPPORT ADOPTION

- 10.4 TECHNOLOGIES

- 10.4.1 ADOPTION OF ADVANCED TECHNOLOGIES FOR DRUG DISCOVERY, PERSONALIZED MEDICINE, AND DATA ANALYTICS TO FUEL GROWTH

- 10.5 SERVICES

- 10.5.1 CONSULTING SERVICES

- 10.5.1.1 Increasing efficiency of research processes and cost savings to boost adoption

- 10.5.2 IMPLEMENTATION SERVICES & ONGOING IT SUPPORT

- 10.5.2.1 Increasing precision and efficiency in IT support services to boost demand

- 10.5.3 TRAINING & EDUCATION SERVICES

- 10.5.3.1 Need for skilled talent for better training & education services to drive market

- 10.5.4 POST-SALES & MAINTENANCE SERVICES

- 10.5.4.1 Complexity of AI systems and need for improvement in AI algorithms to boost market

- 10.5.1 CONSULTING SERVICES

11 AI IN BIOTECHNOLOGY MARKET, BY FUNCTION

- 11.1 INTRODUCTION

- 11.2 RESEARCH & DEVELOPMENT

- 11.2.1 DRUG DISCOVERY

- 11.2.1.1 Molecular design & optimization

- 11.2.1.1.1 Increased efficiency in drug discovery with molecular design & optimization to drive market

- 11.2.1.2 Biomarker discovery

- 11.2.1.2.1 Ability to analyze large data sets with AI-enabled biomarker discovery to boost demand

- 11.2.1.3 Structure-activity relationship (SAR) modeling

- 11.2.1.3.1 Improved data analysis, predictive modeling, and compound optimization for drug candidates with SAR to fuel growth

- 11.2.1.1 Molecular design & optimization

- 11.2.2 CLINICAL DEVELOPMENT

- 11.2.2.1 Trial design

- 11.2.2.1.1 Ability of AI to improve trial design through simulations and patient stratification to favor market

- 11.2.2.2 Site selection

- 11.2.2.2.1 Optimized process of selecting clinical trial sites to fuel growth

- 11.2.2.3 Recruitment

- 11.2.2.3.1 Enhanced process of selecting and enrolling participants for clinical trials to drive demand

- 11.2.2.4 Clinical data assessment

- 11.2.2.4.1 Ability of clinical data assessment for efficient and accurate of data interpretation to propel market

- 11.2.2.5 Predictive toxicity & risk monitoring

- 11.2.2.5.1 Ability of data integration and predictive modeling to create comprehensive risk profiles for drug candidates

- 11.2.2.6 Monitoring & drug adherence

- 11.2.2.6.1 Enhanced patient compliance with monitoring and drug adherence to drive market

- 11.2.2.7 Real-world evidence (RWE) analysis

- 11.2.2.7.1 Enhanced safety monitoring and economic evaluation with RWE analysis to propel growth

- 11.2.2.1 Trial design

- 11.2.1 DRUG DISCOVERY

- 11.3 REGULATORY COMPLIANCE

- 11.3.1 ABILITY OF AI TO ENSURE REGULATORY COMPLIANCE IN CLINICAL TRIALS TO SUPPORT GROWTH

- 11.4 MANUFACTURING & SUPPLY CHAIN

- 11.4.1 SUPPLY CHAIN PLANNING

- 11.4.1.1 Increasing demand for real-time data analytics to accelerate market growth

- 11.4.2 INVENTORY MANAGEMENT

- 11.4.2.1 Automating stock tracking and replenishment with advanced analytics to fuel market growth

- 11.4.3 LOGISTICS OPTIMIZATION

- 11.4.3.1 Ability of AI for increased collaboration and transparency in biotechnology logistics to aid growth

- 11.4.4 DEMAND FORECASTING

- 11.4.4.1 Ability to integrate data for a reliable demand forecast to fuel market growth

- 11.4.5 PREDICTIVE MAINTENANCE

- 11.4.5.1 Boosting equipment reliability with AI-powered predictive maintenance to drive demand

- 11.4.6 OTHER MANUFACTURING & SUPPLY CHAIN FUNCTIONS

- 11.4.1 SUPPLY CHAIN PLANNING

- 11.5 LAUNCH & COMMERCIAL

- 11.5.1 LAUNCH COORDINATION

- 11.5.1.1 Increasing product launch success rates through predictive analytics to boost adoption

- 11.5.2 PATIENT ENGAGEMENT

- 11.5.2.1 Real-time patient feedback for better health outcomes to support growth

- 11.5.3 MARKETING OPERATIONS

- 11.5.3.1 Enhanced marketing performance with AI to boost market growth

- 11.5.4 PREDICTIVE PRICING

- 11.5.4.1 Ability of AI to enhance pricing accuracy to drive adoption

- 11.5.1 LAUNCH COORDINATION

- 11.6 POST-MARKETING SURVEILLANCE & PATIENT SUPPORT

- 11.6.1 MEDICATION ADHERENCE

- 11.6.1.1 Growing demand for personalized treatment plans to drive market

- 11.6.2 ADVERSE EVENT REPORTING

- 11.6.2.1 Faster post-market surveillance and enhanced drug safety to drive demand

- 11.6.3 PATIENT MONITORING

- 11.6.3.1 Rise of remote healthcare solutions to boost market demand

- 11.6.4 COMPLIANCE MONITORING

- 11.6.4.1 Increasing complexity of regulatory requirements to drive adoption

- 11.6.5 PATIENT SUPPORT PROGRAMS

- 11.6.5.1 Growing interest in patient-centered care to support market growth

- 11.6.1 MEDICATION ADHERENCE

- 11.7 CORPORATE

- 11.7.1 RISK MANAGEMENT

- 11.7.1.1 Rising expenditure for drug development to support growth

- 11.7.2 COMPLIANCE MONITORING

- 11.7.2.1 Strict guidelines for complex regulatory landscapes to aid market growth

- 11.7.3 SALES FORCE OPTIMIZATION

- 11.7.3.1 Need for data-driven decision-making to boost adoption of sales force optimization

- 11.7.4 OTHER CORPORATE FUNCTIONS

- 11.7.1 RISK MANAGEMENT

12 AI IN BIOTECHNOLOGY MARKET, BY DEPLOYMENT MODE

- 12.1 INTRODUCTION

- 12.2 CLOUD-BASED SOLUTIONS

- 12.2.1 PUBLIC CLOUD

- 12.2.1.1 Need to reduce dependency on expensive on-premises infrastructure to boost demand

- 12.2.2 PRIVATE CLOUD

- 12.2.2.1 Need for enhanced security and data protection to propel market growth

- 12.2.3 MULTI-CLOUD

- 12.2.3.1 Enhanced flexibility and cost optimization to support market growth

- 12.2.4 HYBRID CLOUD

- 12.2.4.1 Cost efficiency and flexibility of hybrid cloud models to fuel market growth

- 12.2.1 PUBLIC CLOUD

- 12.3 ON-PREMISES SOLUTIONS

- 12.3.1 BETTER DATA SECURITY, PRIVACY, AND COMPLIANCE WITH REGULATIONS TO FAVOR GROWTH

13 AI IN BIOTECHNOLOGY MARKET, BY END USER

- 13.1 INTRODUCTION

- 13.2 PHARMACEUTICAL COMPANIES

- 13.2.1 INNOVATION AND EFFICIENCY WITH AI INTEGRATION IN DRUG DISCOVERY & DEVELOPMENT TO BOOST ADOPTION

- 13.3 BIOTECHNOLOGY COMPANIES

- 13.3.1 ABILITY OF AI-DRIVEN INNOVATIONS FOR BETTER PERSONALIZED MEDICINE AND DRUG DISCOVERY TO SUPPORT MARKET GROWTH

- 13.4 RESEARCH INSTITUTES & LABS

- 13.4.1 STRATEGIC INVESTMENTS AND COLLABORATIONS TO PROPEL AI ADVANCEMENTS IN RESEARCH INSTITUTES AND LABS

- 13.5 HEALTHCARE PROVIDERS

- 13.5.1 IMPROVED PATIENT OUTCOMES TO SUPPORT ADOPTION

- 13.6 CONTRACT RESEARCH ORGANIZATIONS

- 13.6.1 ABILITY OF AI TECHNOLOGIES TO ACCELERATE CLINICAL TRIALS AND IMPROVE PATIENT RECRUITMENT TO FUEL GROWTH

14 AI IN BIOTECHNOLOGY MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 14.2.2 US

- 14.2.2.1 US to dominate North American AI in biotechnology market during study period

- 14.2.3 CANADA

- 14.2.3.1 Availability of advanced facilities and shorter approval times for drug candidates to drive market

- 14.3 EUROPE

- 14.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 14.3.2 GERMANY

- 14.3.2.1 Increased funding in startups to drive uptake of AI in biotechnology

- 14.3.3 UK

- 14.3.3.1 Increasing investments and government fund allocations to drive market

- 14.3.4 FRANCE

- 14.3.4.1 Government initiatives in France to support market growth

- 14.3.5 ITALY

- 14.3.5.1 Growing investments to create opportunities for market growth

- 14.3.6 SPAIN

- 14.3.6.1 Increasing need for personalized medicine and data-driven healthcare to increase adoption rate in market

- 14.3.7 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 14.4.2 JAPAN

- 14.4.2.1 Accelerating AI-driven drug discovery and biotechnology innovation to drive Japanese market

- 14.4.3 CHINA

- 14.4.3.1 Rising foreign investments in biotechnology and biopharmaceuticals to propel market growth

- 14.4.4 INDIA

- 14.4.4.1 Increasing number of startups and growing support from government to propel market growth

- 14.4.5 SOUTH KOREA

- 14.4.5.1 Significant advances in AI integration for R&D to fuel growth

- 14.4.6 AUSTRALIA

- 14.4.6.1 Accelerating AI adoption in Australia's biotech sector to augment market growth

- 14.4.7 REST OF ASIA PACIFIC

- 14.5 LATIN AMERICA

- 14.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 14.5.2 BRAZIL

- 14.5.2.1 Funding of biotech companies to drive Brazilian market growth

- 14.5.3 MEXICO

- 14.5.3.1 Investment inflows and strengthening AI-related education to spur market growth

- 14.5.4 REST OF LATIN AMERICA

- 14.6 MIDDLE EAST & AFRICA

- 14.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 14.6.2 GCC COUNTRIES

- 14.6.2.1 Increase in healthcare investments to support market growth

- 14.6.3 REST OF MIDDLE EAST & AFRICA

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 15.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN AI IN BIOTECHNOLOGY MARKET

- 15.3 REVENUE ANALYSIS, 2020-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.4.1 RANKING OF KEY MARKET PLAYERS

- 15.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.5.1 STARS

- 15.5.2 EMERGING LEADERS

- 15.5.3 PERVASIVE PLAYERS

- 15.5.4 PARTICIPANTS

- 15.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.5.5.1 Company footprint

- 15.5.5.2 Region footprint

- 15.5.5.3 Component footprint

- 15.5.5.4 Function footprint

- 15.5.5.5 End-user footprint

- 15.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 15.6.1 PROGRESSIVE COMPANIES

- 15.6.2 RESPONSIVE COMPANIES

- 15.6.3 DYNAMIC COMPANIES

- 15.6.4 STARTING BLOCKS

- 15.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.6.5.1 Detailed list of key startups/SMEs

- 15.6.5.2 Competitive benchmarking of key startups/SME players

- 15.7 COMPANY VALUATION & FINANCIAL METRICS

- 15.7.1 FINANCIAL METRICS

- 15.7.2 COMPANY VALUATION

- 15.8 BRAND/PRODUCT COMPARISON

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES & UPGRADES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 NVIDIA CORPORATION

- 16.1.1.1 Business overview

- 16.1.1.2 Products offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.3.2 Deals

- 16.1.1.4 MnM view

- 16.1.1.4.1 Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses & competitive threats

- 16.1.2 ILLUMINA, INC.

- 16.1.2.1 Business overview

- 16.1.2.2 Products offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches

- 16.1.2.3.2 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses & competitive threats

- 16.1.3 RECURSION

- 16.1.3.1 Business overview

- 16.1.3.2 Products offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Product launches

- 16.1.3.3.2 Deals

- 16.1.3.3.3 Expansions

- 16.1.3.3.4 Other developments

- 16.1.3.4 MnM view

- 16.1.3.4.1 Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses & competitive threats

- 16.1.4 SCHRODINGER, INC.

- 16.1.4.1 Business overview

- 16.1.4.2 Products offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product upgrades

- 16.1.4.3.2 Deals

- 16.1.4.3.3 Other developments

- 16.1.4.4 MnM view

- 16.1.4.4.1 Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses & competitive threats

- 16.1.5 BENEVOLENTAI

- 16.1.5.1 Business overview

- 16.1.5.2 Products offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Deals

- 16.1.5.3.2 Other developments

- 16.1.5.4 MnM view

- 16.1.5.4.1 Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses & competitive threats

- 16.1.6 DATA4CURE, INC.

- 16.1.6.1 Business overview

- 16.1.6.2 Products offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Deals

- 16.1.7 QIAGEN

- 16.1.7.1 Business overview

- 16.1.7.2 Products offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product launches and enhancements

- 16.1.7.3.2 Deals

- 16.1.8 INSILICO MEDICINE

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Product launches, approvals, and enhancements

- 16.1.8.3.2 Deals

- 16.1.8.3.3 Other developments

- 16.1.9 DNANEXUS, INC.

- 16.1.9.1 Business overview

- 16.1.9.2 Products offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Deals

- 16.1.9.3.2 Other developments

- 16.1.10 TEMPUS

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product approvals

- 16.1.10.3.2 Deals

- 16.1.10.3.3 Other developments

- 16.1.11 SOPHIA GENETICS

- 16.1.11.1 Business overview

- 16.1.11.2 Products offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Product launches

- 16.1.11.3.2 Deals

- 16.1.11.3.3 Other developments

- 16.1.12 PREDICTIVE ONCOLOGY

- 16.1.12.1 Business overview

- 16.1.12.2 Products offered

- 16.1.12.3 Recent developments

- 16.1.12.3.1 Product launches

- 16.1.12.3.2 Deals

- 16.1.12.3.3 Expansions

- 16.1.13 DEEP GENOMICS

- 16.1.13.1 Business overview

- 16.1.13.2 Products offered

- 16.1.13.3 Recent developments

- 16.1.13.3.1 Product launches

- 16.1.14 NUMEDII, INC.

- 16.1.14.1 Business overview

- 16.1.14.2 Products offered

- 16.1.15 XTALPI INC.

- 16.1.15.1 Business overview

- 16.1.15.2 Products offered

- 16.1.15.3 Recent developments

- 16.1.15.3.1 Deals

- 16.1.16 IKTOS

- 16.1.16.1 Business overview

- 16.1.16.2 Products offered

- 16.1.16.3 Recent developments

- 16.1.16.3.1 Product launches

- 16.1.16.3.2 Deals

- 16.1.16.3.3 Other developments

- 16.1.17 BPGBIO, INC.

- 16.1.17.1 Business overview

- 16.1.17.2 Products offered

- 16.1.17.3 Recent developments

- 16.1.17.3.1 Product launches

- 16.1.17.3.2 Deals

- 16.1.17.3.3 Other developments

- 16.1.18 EUROFINS DISCOVERY

- 16.1.18.1 Business overview

- 16.1.18.2 Products offered

- 16.1.18.3 Recent developments

- 16.1.18.3.1 Product launches

- 16.1.18.3.2 Deals

- 16.1.18.3.3 Expansions

- 16.1.1 NVIDIA CORPORATION

- 16.2 OTHER PLAYERS

- 16.2.1 VERISIM LIFE

- 16.2.2 LIFEBIT BIOTECH INC.

- 16.2.3 VALO HEALTH

- 16.2.4 VERGE GENOMICS

- 16.2.5 LOGICA

- 16.2.6 AMERICAN CHEMICAL SOCIETY

- 16.2.7 AGANITHA AI INC.

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS