|

시장보고서

상품코드

1880370

유전체학 시장(-2030년) : 제품(시약 및 키트, 기기), 서비스(유전체 프로파일링, 바이오인포매틱스), 기술(시퀀싱, PCR, ISH, 유세포분석기), 연구 유형(에피유전체학), 용도(Drug Discovery, 진단, 농업)Genomics Market by Product (Reagents, Kits, Instruments), Services (Genome Profiling, Bioinformatics), Technology (Sequencing, PCR, ISH, Flow Cytometry), Study Type (Epigenomics), Application (Drug Discovery, Diagnostics, Agri) - Global Forecast to 2030 |

||||||

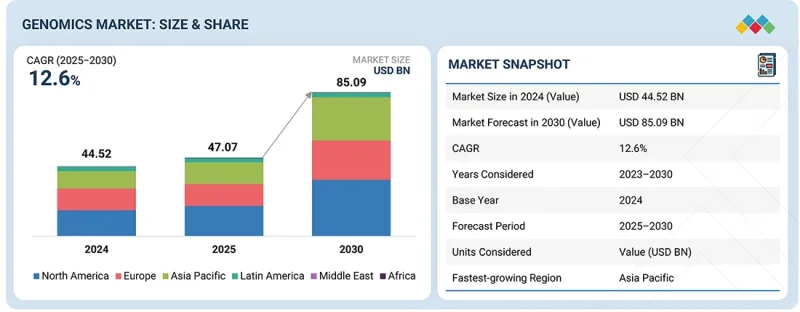

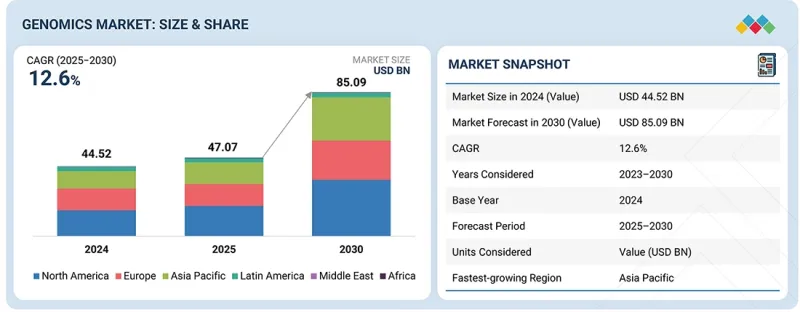

세계의 유전체학 시장 규모는 2025년 470억 7,000만 달러에서 2025-2030년의 예측 기간 중 CAGR 12.6%로 성장하여 2030년에는 850억 9,000만 달러에 이를 것으로 예측됩니다.

유전체학 시장은 정부 자금 증가, 바이러스성 질환 및 유전성 질환의 유병률 증가, 차세대 염기서열 분석(NGS) 기술의 지속적인 발전에 힘입어 강력한 성장세를 보이고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문 | 제공 구분, 제품, 서비스, 기술, 용도, 연구 유형 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

유전체학은 유전성 질환의 규명 및 신약 개발이라는 전통적인 응용 분야 외에도 농업, 수의학, 법의학 분야에서도 주목받고 있습니다. 법의학 분야에서는 차세대 염기서열 분석(NGS)의 도입으로 DNA 분석에 혁신을 가져왔습니다. 기존의 DNA 핑거프린팅 기법은 종합적인 유전체 재구성을 통해 보다 정밀한 신원 확인이 가능해졌습니다. NGS는 현장 분석을 용이하게 하고, 미량 또는 분해된 DNA 샘플에서 상세한 유전 정보를 추출할 수 있게 함으로써 법의학 조사의 정확성과 범위를 향상시키고 있습니다.

"제품 유형별로는 시약, 키트 및 소모품 부문이 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측됩니다."

제품 유형별로는 시약-키트-소모품 부문이 가장 큰 점유율을 차지했습니다. 시약 및 키트는 DNA/RNA 추출, 증폭, 시퀀싱, 분석 등 거의 모든 유전체 워크플로우에 필수적입니다. 이는 연구용과 임상용 모두에서 매우 중요합니다. 진단, 맞춤의료, 신약개발 분야에서의 유전체 실험 증가가 이러한 제품 수요를 견인하고 있습니다. 각 워크플로우에서는 정확하고 신뢰할 수 있는 유전체 데이터 생성을 보장하기 위해 고품질의 시약 및 키트의 안정적인 공급이 요구됩니다.

또한, 차세대 염기서열 분석(NGS), 중합효소 연쇄반응(PCR) 등 첨단 기술의 급속한 보급으로 인해 용도별 시약 및 소모품에 대한 수요는 더욱 증가하고 있습니다. 의료, 연구, 생명공학 등 유전체학 분야의 지속적인 성장으로 소모품 수익이 확대되고 있으며, 해당 시장에서의 선도적 지위를 공고히 하고 있습니다.

"최종 사용자별로는 병원, 진단 실험실, 클리닉 부문이 2024년 가장 큰 점유율을 차지했습니다."

이 최종 사용자 부문의 큰 비중은 시민 과학 이니셔티브를 통해 환자들의 유전체 연구 참여가 확대된 데 기인합니다. 이러한 노력은 데이터 수집의 민주화와 희귀질환 및 맞춤의료 분야에서의 발견을 가속화하기 위한 것입니다. 또한, 최종 사용자별로는 제약 및 생명공학 기업이 두 번째 점유율을 차지하고 있습니다.

"북미 시장에서는 미국이 2024년 시장을 주도할 것"

미국은 세계 최대의 바이오의약품 시장이며, 바이오의약품 연구 및 투자의 선두주자입니다. 선진적인 연구 생태계, 강력한 자금 지원, Illumina, Thermo Fisher Scientific, Agilent Technologies, Danaher와 같은 주요 업계 리더의 존재로 인해 향후 몇 년 동안 유전체 제품 및 서비스에 대한 수요가 증가할 것으로 예측됩니다. 예상되고 있습니다. 미국은 NIH와 All of Us 이니셔티브를 포함한 정밀의료 및 집단 유전체 분석 프로그램에 대한 정부 및 민간의 막대한 투자로 혜택을 누리고 있습니다. 임상 및 연구 환경에서 NGS 및 바이오인포매틱스 플랫폼의 높은 채택률도 시장 선도적 지위를 더욱 뒷받침하고 있습니다. 또한, 확립된 규제 프레임워크, 탄탄한 의료 인프라, 활발한 민관 협력이 미국 내 유전체 기술의 지속적인 혁신과 상용화를 촉진하고 있습니다.

세계의 유전체학(Genomics) 제품 및 서비스 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술 및 특허 동향, 법 및 규제 환경, 사례 분석, 시장 규모 추이 및 예측, 각종 부문별/지역별/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 관련 시장, 타업종과의 분야 횡단적 기회

- Tier1/2/3기업의 전략적 움직임

제6장 업계 동향

- Porter의 Five Forces 분석

- 거시경제 전망

- 밸류체인 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 2026년 주요 컨퍼런스 및 이벤트

- 고객 사업에 영향을 미치는 동향/파괴적 변화

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세의 영향

제7장 기술 진보, AI 별 영향, 특허, 혁신

- 기술 분석

- 주요 신기술

- 보완적 기술

- 인접 기술

- 기술/제품 로드맵

- 특허 분석

- 향후 응용

- AI/생성형 AI가 유전체학 시장에 미치는 영향

제8장 지속가능성과 규제 상황

- 지역 규제와 컴플라이언스

- 지속가능성 이니셔티브

- 지속가능성에 대한 영향과 규제 정책 대처

- 인증, 라벨 및 환경기준

제9장 고객 상황과 구매 행동

- 의사결정 프로세스

- 구입자 이해관계자와 구입 평가 기준

- 채택 장벽과 내부 과제

- 다양한 최종 이용 산업의 충족되지 않은 요구

- 시장 수익성

제10장 유전체학 시장 : 제공 구분별

- 제품

- 서비스

제11장 유전체학 제품 시장 : 유형별

- 시약 및 키트, 소모품

- 기기

- 바이오인포매틱스 툴

제12장 유전체학 제품 시장 : 기술별

- 시퀀싱

- PCR

- 유전자 편집

- 유세포분석기

- 마이크로어레이

- IN SITU HYBRIDIZATION

- 기타

제13장 유전체학 제품 시장 : 최종사용자별

- 병원 및 진단실험실, 진료소

- 학술연구기관

- 제약 기업 및 바이오테크놀러지 기업

- CRO

- 기타

제14장 유전체학 서비스 시장 : 유형별

- 유전체 프로파일링 및 시퀀싱 서비스

- 샘플 조제 및 라이브러리 조제 서비스

- 바이오인포매틱스 서비스

제15장 유전체학 서비스 시장 : 최종사용자별

- 병원 및 진단실험실, 진료소

- 학술연구기관

- 제약 기업 및 바이오테크놀러지 기업

- 기타

제16장 유전체학 시장 : 용도별

- Drug Discovery & Development

- 진단

- 암 진단

- 감염증

- 생식 보건

- 기타

- 농업 및 동물 조사

- 기타

제17장 유전체학 시장 : 연구 유형별

- 기능 유전체학

- 바이오마커 발견

- 경로 분석

- 에피유전체학

- 기타

제18장 유전체학 시장 : 지역별

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 유럽

- 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 거시경제 전망

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타

- 라틴아메리카

- 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동

- 거시경제 전망

- GCC 국가

- 기타

- 아프리카

- 거시경제 전망

제19장 경쟁 구도

- 주요 시장 진출기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 기업 평가와 재무 지표

- 경쟁 시나리오

제20장 기업 개요

- 주요 기업

- THERMO FISHER SCIENTIFIC INC.

- ILLUMINA, INC.

- DANAHER CORPORATION

- F. HOFFMANN-LA ROCHE LTD.

- AGILENT TECHNOLOGIES, INC.

- QIAGEN

- REVVITY

- LABORATORY CORPORATION OF AMERICA HOLDINGS

- IQVIA INC.

- CHARLES RIVER LABORATORIES

- BIO-RAD LABORATORIES, INC.

- EUROFINS SCIENTIFIC

- PACBIO

- OXFORD NANOPORE TECHNOLOGIES PLC.

- TAKARA BIO INC.

- BGI GROUP

- EPPENDORF SE

- MERCK KGAA

- BD

- ABBOTT

- 10X GENOMICS

- NEW ENGLAND BIOLABS

- PROMEGA CORPORATION

- 기타 기업

- CREATIVE BIOGENE

- NOVOGENE CO., LTD.

- HELIX, INC.

- PHALANX BIOTECH GROUP

- POLARIS GENOMICS

제21장 부록

LSH 25.12.10The global genomics market is projected to reach USD 85.09 billion by 2030 from USD 47.07 billion in 2025, exhibiting a CAGR of 12.6% from 2025 to 2030. The genomics market is experiencing strong growth, driven by increasing government funding, the rising prevalence of viral and hereditary diseases, and ongoing advancements in next-generation sequencing (NGS) technologies.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Offering, Products, Services, Technology, Applications and Study type |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa |

Beyond traditional applications in genetic disorder identification and drug discovery, genomics is gaining traction in agriculture, veterinary science, and forensics. In forensics, the adoption of NGS has revolutionized DNA analysis. Traditional DNA fingerprinting methods are being replaced by comprehensive genomic reconstruction, enabling more precise identification. NGS also facilitates on-site analysis, allowing the extraction of detailed genetic information from trace or degraded DNA samples, thereby enhancing the accuracy and scope of forensic investigations.

"The reagents, kits, and consumables segment is projected to record the highest CAGR during the forecast period."

Based on product type, the genomics market is segmented into reagents, kits, and consumables; instruments; and bioinformatics tools. The reagents, kits, and consumables segment accounted for the largest share of the product market. Reagents and kits are essential for nearly all genomic workflows, including DNA and RNA extraction, amplification, sequencing, and analysis. They are vital for both research and clinical applications. The demand for these products is driven by the increasing number of genomic experiments conducted in diagnostics, personalized medicine, and drug development. Each workflow requires a consistent supply of high-quality reagents and kits to ensure the accurate and reliable generation of genomic data.

Moreover, the rapid adoption of advanced technologies such as next-generation sequencing (NGS) and polymerase chain reaction (PCR) further increases the need for application-specific reagents and consumables. The ongoing growth in genomics sectors, such as healthcare, research, and biotechnology, enhances the revenue generated from consumables, solidifying its leading market position.

"The hospitals, diagnostic laboratories, and clinics segment accounted for the largest share in 2024."

In 2024, the hospitals, diagnostic laboratories, and clinics segment accounted for the largest share of the global genomic products market. The large share of this end-user segment can be attributed to increased patient engagement in genomic research, driven by citizen science initiatives. These efforts aim to democratize data collection and accelerate discoveries in rare diseases and personalized medicine. Additionally, pharmaceutical & biotechnology companies hold the second-largest share in this segment.

"The US dominated the North American genomics market in 2024."

The US is the world's largest biopharmaceutical market and a leader in biopharmaceutical research/investments. The demand for genomics products & services is expected to grow over the coming years, driven by its advanced research ecosystem, strong funding support, and presence of major industry leaders such as Illumina, Thermo Fisher Scientific, Agilent Technologies, and Danaher. The country benefits from substantial government and private investments in precision medicine and population genomics programs, including NIH and All of Us initiatives. High adoption of next-generation sequencing (NGS) and bioinformatics platforms across clinical and research settings further supports market leadership. Additionally, a well-established regulatory framework, robust healthcare infrastructure, and active public-private collaborations foster continuous innovation and commercialization of genomic technologies in the US.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side (70%) and Demand Side (30%)

- By Designation: Managers (45%), CXOs & Directors (30%), and Executives (25%)

- By Region: North America (40%), Europe (25%), Asia Pacific (25%), Latin America (5%), and the Middle East & Africa (5%)

Illumina, Inc. (US), Thermo Fisher Scientific Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), Danaher Corporation (US), QIAGEN (Germany), Agilent Technologies, Inc. (US), Revvity (US), Laboratory Corporation of America Holdings (US), and IQVIA Inc. (US) are some of the key players operating in the genomics market.

Research Coverage:

This research report categorizes the genomics market by offering {products [type (reagents, kits, and consumables; instruments; and bioinformatics tools), technology (sequencing, PCR, gene editing, flow cytometry, microarrays, in situ hybridization, and other technologies), and end user (hospitals, diagnostic laboratories, and clinics; academic & research institutes; pharmaceutical & biotechnology companies; CROs; and other end users)] and services [type (genomics profiling and sequencing services, sample preparation and library preparation services, and bioinformatics services) and end user (hospitals, diagnostic laboratories, and clinics; academic & research institutes; pharmaceutical & biotechnology companies; and other end users)]}, application (drug discovery & development, diagnostics, agriculture and animal research, and other applications), study type (functional genomics, biomarker discovery, pathway analysis, epigenomics, and other study types), and region (North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa). The report's scope encompasses detailed information regarding the key factors, including drivers, restraints, challenges, and opportunities, that influence market growth. A thorough analysis of key industry players has provided insights into their business overview, products, solutions, key strategies, collaborations, partnerships, and agreements. New launches, collaborations, and acquisitions are recent developments in the genomics market.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall genomics market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (increasing government funding for genomics projects, increasing prevalence of viral and inherited disorders, advancements in NGS platforms, and growing applications of genomics), restraints (high investment costs), opportunities (increasing use of genomics in precision medicine and technological advancements in genomics), and challenges (handling of large volume of data sets and their analysis and clinical utility of genomics) influencing the growth of the market.

- Product Development/Innovation: Detailed insights on newly launched products/services of the genomics market.

- Market Development: Comprehensive information about lucrative markets; the report analyzes the market across varied regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the genomics market.

- Competitive Assessment: Illumina, Inc. (US), Thermo Fisher Scientific Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), Danaher Corporation (US), QIAGEN (Germany), Agilent Technologies, Inc. (US), Revvity (US), Laboratory Corporation of America Holdings (US), and IQVIA Inc. (US), among others in the market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key objectives of secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 GLOBAL GENOMICS MARKET ESTIMATION, 2024

- 2.2.1.1 Company revenue analysis (bottom-up approach)

- 2.2.1.2 MNM repository analysis

- 2.2.1.3 Primary research

- 2.2.2 SEGMENTAL MARKET SIZE ESTIMATION (TOP-DOWN APPROACH)

- 2.2.1 GLOBAL GENOMICS MARKET ESTIMATION, 2024

- 2.3 MARKET GROWTH RATE PROJECTIONS

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS & MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS

- 3.3 DISRUPTIVE TRENDS SHAPING GENOMICS MARKET

- 3.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

4 PREMIUM INSIGHTS

- 4.1 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

- 4.2 NORTH AMERICA: GENOMICS MARKET, BY APPLICATION AND COUNTRY, 2024

- 4.3 GENOMICS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing government funding for genomics projects

- 5.2.1.2 Increasing prevalence of viral and inherited disorders

- 5.2.1.3 Advancements in NGS platforms

- 5.2.1.4 Growing applications of genomics

- 5.2.2 RESTRAINTS

- 5.2.2.1 High investment costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing use of genomics in precision medicine

- 5.2.3.2 Technological advancements in genomics

- 5.2.4 CHALLENGES

- 5.2.4.1 Handling large volumes of data sets and their analysis

- 5.2.4.2 Clinical utility of genomics

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS AND WHITE SPACES

- 5.4 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES

- 5.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.1.2 BARGAINING POWER OF SUPPLIERS

- 6.1.3 BARGAINING POWER OF BUYERS

- 6.1.4 THREAT OF SUBSTITUTES

- 6.1.5 THREAT OF NEW ENTRANTS

- 6.2 MACROECONOMIC OUTLOOK

- 6.2.1 INTRODUCTION

- 6.2.2 GDP TRENDS AND FORECAST

- 6.2.3 TRENDS IN GLOBAL GENOMICS INDUSTRY

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.4.1 EMERGING BUSINESS MODELS & ECOSYSTEM SHIFTS

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND OF INSTRUMENTS, BY KEY PLAYER, 2022-2024

- 6.5.2 AVERAGE SELLING PRICE TREND OF CONSUMABLES, BY KEY PLAYER, 2022-2024

- 6.5.3 AVERAGE SELLING PRICE OF SERVICES, BY KEY PLAYER, 2024

- 6.5.4 AVERAGE SELLING PRICE TREND OF INSTRUMENTS, BY REGION, 2022-2024

- 6.6 TRADE ANALYSIS

- 6.6.1 IMPORT SCENARIO (HS CODE 3822 & 902789)

- 6.6.2 EXPORT SCENARIO (HS CODE 3822 & 902789)

- 6.7 KEY CONFERENCES AND EVENTS, 2026

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.9 INVESTMENT AND FUNDING SCENARIO

- 6.9.1 VC/PRIVATE EQUITY INVESTMENT TRENDS & STARTUP LANDSCAPE

- 6.10 CASE STUDY ANALYSIS

- 6.11 IMPACT OF 2025 US TARIFFS-GENOMICS MARKET

- 6.11.1 INTRODUCTION

- 6.11.2 KEY TARIFF RATES

- 6.11.3 PRICE IMPACT ANALYSIS

- 6.11.4 IMPACT ON COUNTRIES/REGIONS

- 6.11.4.1 US

- 6.11.4.2 Europe

- 6.11.4.3 Asia Pacific

- 6.11.5 IMPACT ON END-USE INDUSTRIES

- 6.11.5.1 Pharmaceutical & biotechnology companies

- 6.11.5.2 CROs and academic & research institutes

- 6.11.5.3 Hospitals, diagnostic laboratories, and clinics

7 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, AND INNOVATIONS

- 7.1 TECHNOLOGICAL ANALYSIS

- 7.1.1 KEY EMERGING TECHNOLOGIES

- 7.1.1.1 Sequencing by synthesis

- 7.1.1.2 Single-molecule real-time sequencing

- 7.1.1.3 Nanopore sequencing

- 7.1.1.4 qPCR

- 7.1.1.5 dPCR

- 7.1.1.6 Microarray technology

- 7.1.2 COMPLEMENTARY TECHNOLOGIES

- 7.1.2.1 Cytogenetics

- 7.1.2.2 Synthetic biology

- 7.1.2.3 Multiomics

- 7.1.2.4 Single-cell analysis

- 7.1.3 ADJACENT TECHNOLOGIES

- 7.1.3.1 Bioinformatics and computational biology

- 7.1.3.2 Artificial intelligence and machine learning

- 7.1.1 KEY EMERGING TECHNOLOGIES

- 7.2 TECHNOLOGY/PRODUCT ROADMAP

- 7.3 PATENT ANALYSIS

- 7.3.1 TOP APPLICANTS/OWNERS (COMPANIES) FOR GENOMICS PATENTS, 2014-2024

- 7.4 FUTURE APPLICATIONS

- 7.5 IMPACT OF AI/GEN AI ON GENOMICS MARKET

- 7.5.1 BEST PRACTICES IN GENOMICS WORKFLOW

- 7.5.2 CASE STUDIES OF AI IMPLEMENTATION IN GENOMICS MARKET

- 7.5.3 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 7.5.4 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN GENOMICS MARKET

8 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 INDUSTRY STANDARDS

- 8.2 SUSTAINABILITY INITIATIVES

- 8.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 8.4 CERTIFICATIONS, LABELING, ECO-STANDARDS

9 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 9.1 DECISION-MAKING PROCESS

- 9.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 9.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.2.2 KEY BUYING CRITERIA, BY END USER

- 9.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 9.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 9.5 MARKET PROFITABILITY

10 GENOMICS MARKET, BY OFFERING

- 10.1 INTRODUCTION

- 10.2 PRODUCTS

- 10.2.1 ACCELERATION OF HIGH-THROUGHPUT GENOMICS DRIVEN BY PLATFORM INNOVATION AND AUTOMATION IS BOOSTING GROWTH

- 10.3 SERVICES

- 10.3.1 RAPID EXPANSION OF GENOMIC SERVICES FUELED BY CLINICAL ADOPTION AND DATA-DRIVEN DECISION SUPPORT

11 GENOMICS PRODUCTS MARKET, BY TYPE

- 11.1 INTRODUCTION

- 11.2 REAGENTS, KITS, AND CONSUMABLES

- 11.2.1 LARGE NUMBER OF PLAYERS OPERATING IN CONSUMABLES SPACE PROPEL DEMAND FOR REAGENTS, KITS, AND CONSUMABLES

- 11.3 INSTRUMENTS

- 11.3.1 TECHNOLOGICAL ADVANCEMENTS TO SUPPORT MARKET GROWTH

- 11.4 BIOINFORMATICS TOOLS

- 11.4.1 ACCELERATING GENOMIC INSIGHTS THROUGH SCALABLE, AI-ENABLED BIOINFORMATICS PLATFORMS DRIVE MARKET GROWTH

12 GENOMICS PRODUCTS MARKET, BY TECHNOLOGY

- 12.1 INTRODUCTION

- 12.2 SEQUENCING

- 12.2.1 DIRECT DETECTION OF DNA MODIFICATIONS DURING SEQUENCING TO DRIVE MARKET GROWTH

- 12.3 PCR

- 12.3.1 RISING DEMAND FOR BIOMARKER DISCOVERY TO PROPEL MARKET GROWTH

- 12.4 GENE EDITING

- 12.4.1 RISING DEMAND FOR NEWER THERAPEUTIC APPROACHES DRIVING GROWTH

- 12.5 FLOW CYTOMETRY

- 12.5.1 RISING DEMAND FOR FLOW CYTOMETRY IN AGRIGENOMICS TO DRIVE MARKET GROWTH

- 12.6 MICROARRAYS

- 12.6.1 RISING ADOPTION OF HIGH-THROUGHPUT TECHNOLOGIES LIMITING MARKET GROWTH

- 12.7 IN SITU HYBRIDIZATION

- 12.7.1 INCREASING DEMAND FOR PRECISE GENE EXPRESSION ANALYSIS DRIVING GROWTH

- 12.8 OTHER TECHNOLOGIES

13 GENOMICS PRODUCTS MARKET, BY END USER

- 13.1 INTRODUCTION

- 13.2 HOSPITALS, DIAGNOSTIC LABORATORIES, AND CLINICS

- 13.2.1 INCREASED APPLICATION IN DISEASE DIAGNOSTICS AND TREATMENT DRIVING MARKET GROWTH

- 13.3 ACADEMIC & RESEARCH INSTITUTES

- 13.3.1 RISING RESEARCH INTENSITY FOR GENOMICS RESEARCH AMONG INSTITUTES TO SUPPORT MARKET GROWTH

- 13.4 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 13.4.1 RISING DEMAND FOR COMPREHENSIVE GENOMIC DATA IN CLINICAL GENOMICS PROPELS MARKET

- 13.5 CROS

- 13.5.1 RISING COLLABORATION BETWEEN PHARMA COMPANIES AND CROS DRIVING MARKET GROWTH

- 13.6 OTHER END USERS

14 GENOMICS SERVICES MARKET, BY TYPE

- 14.1 INTRODUCTION

- 14.2 GENOMIC PROFILING & SEQUENCING SERVICES

- 14.2.1 INCREASED ADOPTION OF SEQUENCING TECHNOLOGIES IN CLINICAL ADOPTION TO SUPPORT MARKET GROWTH

- 14.3 SAMPLE PREPARATION & LIBRARY PREPARATION SERVICES

- 14.3.1 INCREASED DEMAND FOR ONCOLOGY AND RARE DISEASE DIAGNOSTICS TO DRIVE MARKET GROWTH

- 14.4 BIOINFORMATICS SERVICES

- 14.4.1 RISING DEMAND FOR ADVANCED PERSONALIZED MEDICINE TO SUPPORT MARKET GROWTH

15 GENOMICS SERVICES MARKET, BY END USER

- 15.1 INTRODUCTION

- 15.2 HOSPITALS, DIAGNOSTIC LABORATORIES, AND CLINICS

- 15.2.1 INCREASED APPLICATION IN DISEASE DIAGNOSTICS AND TREATMENT DRIVING MARKET GROWTH

- 15.3 ACADEMIC & RESEARCH INSTITUTES

- 15.3.1 RISING RESEARCH INTENSITY FOR GENOMICS RESEARCH AMONG INSTITUTES TO SUPPORT MARKET GROWTH

- 15.4 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 15.4.1 RISING DEMAND FOR COMPREHENSIVE GENOMIC DATA IN CLINICAL GENOMICS TO DRIVE GROWTH

- 15.5 OTHER END USERS

16 GENOMICS MARKET, BY APPLICATION

- 16.1 INTRODUCTION

- 16.2 DRUG DISCOVERY & DEVELOPMENT

- 16.2.1 DRUG DISCOVERY & DEVELOPMENT TO BE LARGEST APPLICATION IN GENOMICS MARKET

- 16.3 DIAGNOSTICS

- 16.3.1 CANCER DIAGNOSTICS

- 16.3.1.1 Rising demand for targeted therapies to drive market growth

- 16.3.2 INFECTIOUS DISEASES

- 16.3.2.1 Rising demand for comprehensive genomic data in clinical genomics to drive market growth

- 16.3.3 REPRODUCTIVE HEALTH

- 16.3.3.1 Rising focus on genetic diseases to drive market growth

- 16.3.4 OTHER DIAGNOSTIC APPLICATIONS

- 16.3.1 CANCER DIAGNOSTICS

- 16.4 AGRICULTURE & ANIMAL RESEARCH

- 16.4.1 GENOMICS TO HELP IMPROVE CROP PRODUCTIVITY

- 16.5 OTHER APPLICATIONS

17 GENOMICS MARKET, BY STUDY TYPE

- 17.1 INTRODUCTION

- 17.2 FUNCTIONAL GENOMICS

- 17.2.1 INCREASED FOCUS ON FUNCTIONAL GENOME STUDIES TO DRIVE MARKET GROWTH

- 17.3 BIOMARKER DISCOVERY

- 17.3.1 RISING DEMAND FOR PRECISION MEDICINE TO SUPPORT MARKET GROWTH

- 17.4 PATHWAY ANALYSIS

- 17.4.1 RISING PREVALENCE OF COMPLEX DISEASES TO AUGMENT MARKET GROWTH

- 17.5 EPIGENOMICS

- 17.5.1 RISING INVESTMENTS FOR EPIGENETICS RESEARCH TO BOOST MARKET GROWTH

- 17.6 OTHER STUDY TYPES

18 GENOMICS MARKET, BY REGION

- 18.1 INTRODUCTION

- 18.2 NORTH AMERICA

- 18.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 18.2.2 US

- 18.2.2.1 US expected to dominate market in North America

- 18.2.3 CANADA

- 18.2.3.1 Increasing government initiatives in genomics research to boost market growth

- 18.3 EUROPE

- 18.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 18.3.2 GERMANY

- 18.3.2.1 Germany to dominate European genomics market

- 18.3.3 UK

- 18.3.3.1 Strategic initiatives and funding for genomics research to support market growth

- 18.3.4 FRANCE

- 18.3.4.1 Increasing government investment in genomics research to drive growth

- 18.3.5 ITALY

- 18.3.5.1 Favorable funding scenario to drive adoption of advanced sequencing technology

- 18.3.6 SPAIN

- 18.3.6.1 Growing focus on advancements in personalized medicine to support market growth

- 18.3.7 REST OF EUROPE

- 18.4 ASIA PACIFIC

- 18.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 18.4.2 CHINA

- 18.4.2.1 China to dominate Asia Pacific market during forecast period

- 18.4.3 JAPAN

- 18.4.3.1 Rising number of collaborations in genomics to drive market

- 18.4.4 INDIA

- 18.4.4.1 Government and private initiatives for genomics to propel market

- 18.4.5 AUSTRALIA

- 18.4.5.1 Increased genomics research in Australia to support market growth

- 18.4.6 SOUTH KOREA

- 18.4.6.1 Demand for advanced sequencing technologies to support market growth in South Korea

- 18.4.7 REST OF ASIA PACIFIC

- 18.5 LATIN AMERICA

- 18.5.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 18.5.2 BRAZIL

- 18.5.2.1 Increased government investments in genomics advancements to drive market in Brazil

- 18.5.3 MEXICO

- 18.5.3.1 Rising demand for chronic disease treatment to support market growth in Mexico

- 18.5.4 REST OF LATIN AMERICA

- 18.6 MIDDLE EAST

- 18.6.1 MIDDLE EAST: MACROECONOMIC OUTLOOK

- 18.6.2 GCC COUNTRIES

- 18.6.2.1 Saudi Arabia

- 18.6.2.1.1 Growing healthcare expenditure in Saudi Arabia to boost market growth

- 18.6.2.2 United Arab Emirates

- 18.6.2.2.1 Growing collaborations to advance genome sequencing to aid market growth in UAE

- 18.6.2.3 Rest of GCC Countries

- 18.6.2.1 Saudi Arabia

- 18.6.3 REST OF MIDDLE EAST

- 18.7 AFRICA

- 18.7.1 GROWING FOCUS ON PRECISION MEDICINE TO PROPEL MARKET IN AFRICA

- 18.7.2 AFRICA: MACROECONOMIC OUTLOOK

19 COMPETITIVE LANDSCAPE

- 19.1 INTRODUCTION

- 19.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 19.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN GENOMICS MARKET

- 19.3 REVENUE ANALYSIS, 2020-2024

- 19.4 MARKET SHARE ANALYSIS, 2024

- 19.5 BRAND/PRODUCT COMPARISON

- 19.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 19.6.1 STARS

- 19.6.2 EMERGING LEADERS

- 19.6.3 PERVASIVE PLAYERS

- 19.6.4 PARTICIPANTS

- 19.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 19.6.5.1 Company footprint

- 19.6.5.2 Region footprint

- 19.6.5.3 Product footprint

- 19.6.5.4 Application footprint

- 19.6.5.5 Technology footprint

- 19.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 19.7.1 PROGRESSIVE COMPANIES

- 19.7.2 RESPONSIVE COMPANIES

- 19.7.3 DYNAMIC COMPANIES

- 19.7.4 STARTING BLOCKS

- 19.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 19.7.5.1 Detailed list of key startups/SMEs

- 19.7.5.2 Competitive benchmarking of key startups/SMEs

- 19.8 COMPANY VALUATION & FINANCIAL METRICS

- 19.8.1 FINANCIAL METRICS

- 19.8.2 COMPANY VALUATION

- 19.9 COMPETITIVE SCENARIO

- 19.9.1 PRODUCT LAUNCHES

- 19.9.2 DEALS

- 19.9.3 EXPANSIONS

20 COMPANY PROFILES

- 20.1 INTRODUCTION

- 20.2 KEY PLAYERS

- 20.2.1 THERMO FISHER SCIENTIFIC INC.

- 20.2.1.1 Business overview

- 20.2.1.2 Products/Services offered

- 20.2.1.3 Recent developments

- 20.2.1.3.1 Product launches and approvals

- 20.2.1.3.2 Deals

- 20.2.1.3.3 Expansions

- 20.2.1.4 MnM view

- 20.2.1.4.1 Key strengths

- 20.2.1.4.2 Strategic choices

- 20.2.1.4.3 Weaknesses and competitive threats

- 20.2.2 ILLUMINA, INC.

- 20.2.2.1 Business overview

- 20.2.2.2 Products/Services offered

- 20.2.2.3 Recent developments

- 20.2.2.3.1 Product launches and approvals

- 20.2.2.3.2 Deals

- 20.2.2.3.3 Expansions

- 20.2.2.3.4 Other developments

- 20.2.2.4 MnM view

- 20.2.2.4.1 Key strengths

- 20.2.2.4.2 Strategic choices

- 20.2.2.4.3 Weaknesses and competitive threats

- 20.2.3 DANAHER CORPORATION

- 20.2.3.1 Business overview

- 20.2.3.2 Products/Services offered

- 20.2.3.3 Recent developments

- 20.2.3.3.1 Product launches

- 20.2.3.3.2 Deals

- 20.2.3.3.3 Expansions

- 20.2.3.4 MnM view

- 20.2.3.4.1 Key strengths

- 20.2.3.4.2 Strategic choices

- 20.2.3.4.3 Weaknesses and competitive threats

- 20.2.4 F. HOFFMANN-LA ROCHE LTD.

- 20.2.4.1 Business overview

- 20.2.4.2 Products/Services offered

- 20.2.4.2.1 Product launches

- 20.2.4.2.2 Deals

- 20.2.4.2.3 Other developments

- 20.2.4.3 MnM view

- 20.2.4.3.1 Key strengths

- 20.2.4.3.2 Strategic choices

- 20.2.4.3.3 Weaknesses and competitive threats

- 20.2.5 AGILENT TECHNOLOGIES, INC.

- 20.2.5.1 Business overview

- 20.2.5.2 Products/Services offered

- 20.2.5.3 Recent developments

- 20.2.5.3.1 Product launches

- 20.2.5.3.2 Deals

- 20.2.5.3.3 Expansions

- 20.2.5.4 MnM view

- 20.2.5.4.1 Key strengths

- 20.2.5.4.2 Strategic choices

- 20.2.5.4.3 Weaknesses and competitive threats

- 20.2.6 QIAGEN

- 20.2.6.1 Business overview

- 20.2.6.2 Products/Services offered

- 20.2.6.3 Recent developments

- 20.2.6.3.1 Product launches and approvals

- 20.2.6.3.2 Deals

- 20.2.6.3.3 Expansions

- 20.2.7 REVVITY

- 20.2.7.1 Business overview

- 20.2.7.2 Products/Services offered

- 20.2.7.3 Recent developments

- 20.2.7.3.1 Product launches

- 20.2.7.3.2 Deals

- 20.2.7.3.3 Expansions

- 20.2.8 LABORATORY CORPORATION OF AMERICA HOLDINGS

- 20.2.8.1 Business overview

- 20.2.8.2 Services offered

- 20.2.8.3 Recent developments

- 20.2.8.3.1 Service launches

- 20.2.8.3.2 Deals

- 20.2.8.3.3 Expansions

- 20.2.9 IQVIA INC.

- 20.2.9.1 Business overview

- 20.2.9.2 Services offered

- 20.2.9.3 Recent developments

- 20.2.9.3.1 Deals

- 20.2.10 CHARLES RIVER LABORATORIES

- 20.2.10.1 Business overview

- 20.2.10.2 Services offered

- 20.2.11 BIO-RAD LABORATORIES, INC.

- 20.2.11.1 Business overview

- 20.2.11.2 Products/Services offered

- 20.2.11.3 Recent developments

- 20.2.11.3.1 Product launches and approvals

- 20.2.11.3.2 Deals

- 20.2.12 EUROFINS SCIENTIFIC

- 20.2.12.1 Business overview

- 20.2.12.2 Products/Services offered

- 20.2.12.3 Recent developments

- 20.2.12.3.1 Product launches

- 20.2.12.3.2 Deals

- 20.2.13 PACBIO

- 20.2.13.1 Business overview

- 20.2.13.2 Products/Services offered

- 20.2.13.3 Recent developments

- 20.2.13.3.1 Product launches

- 20.2.13.3.2 Deals

- 20.2.13.3.3 Expansions

- 20.2.13.3.4 Other developments

- 20.2.14 OXFORD NANOPORE TECHNOLOGIES PLC.

- 20.2.14.1 Business overview

- 20.2.14.2 Products/Services offered

- 20.2.14.3 Recent developments

- 20.2.14.3.1 Product launches

- 20.2.14.3.2 Deals

- 20.2.14.3.3 Expansions

- 20.2.15 TAKARA BIO INC.

- 20.2.15.1 Business overview

- 20.2.15.2 Products/Services offered

- 20.2.15.3 Recent developments

- 20.2.15.3.1 Product launches

- 20.2.15.3.2 Deals

- 20.2.16 BGI GROUP

- 20.2.16.1 Business overview

- 20.2.16.2 Products/Services offered

- 20.2.16.3 Recent developments

- 20.2.16.3.1 Product & service launches and approvals

- 20.2.16.3.2 Deals

- 20.2.16.3.3 Other developments

- 20.2.17 EPPENDORF SE

- 20.2.17.1 Business overview

- 20.2.17.2 Products/Services offered

- 20.2.17.3 Recent developments

- 20.2.17.3.1 Product launches

- 20.2.18 MERCK KGAA

- 20.2.18.1 Business overview

- 20.2.18.2 Products/Services offered

- 20.2.18.3 Recent developments

- 20.2.18.3.1 Deals

- 20.2.18.3.2 Expansions

- 20.2.19 BD

- 20.2.19.1 Business overview

- 20.2.19.2 Products/Services offered

- 20.2.19.3 Recent developments

- 20.2.19.3.1 Product launches and approvals

- 20.2.19.3.2 Deals

- 20.2.20 ABBOTT

- 20.2.20.1 Business overview

- 20.2.20.2 Products/Services offered

- 20.2.21 10X GENOMICS

- 20.2.21.1 Business overview

- 20.2.21.2 Products/Services offered

- 20.2.21.3 Recent developments

- 20.2.21.3.1 Product launches

- 20.2.22 NEW ENGLAND BIOLABS

- 20.2.22.1 Business overview

- 20.2.22.2 Products/Services offered

- 20.2.22.3 Recent developments

- 20.2.22.3.1 Product launches

- 20.2.22.3.2 Deals

- 20.2.23 PROMEGA CORPORATION

- 20.2.23.1 Business overview

- 20.2.23.2 Products/Services offered

- 20.2.23.3 Recent developments

- 20.2.23.3.1 Product launches

- 20.2.23.3.2 Other developments

- 20.2.1 THERMO FISHER SCIENTIFIC INC.

- 20.3 OTHER PLAYERS

- 20.3.1 CREATIVE BIOGENE

- 20.3.2 NOVOGENE CO., LTD.

- 20.3.3 HELIX, INC.

- 20.3.4 PHALANX BIOTECH GROUP

- 20.3.5 POLARIS GENOMICS

21 APPENDIX

- 21.1 DISCUSSION GUIDE

- 21.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 21.3 CUSTOMIZATION OPTIONS

- 21.4 RELATED REPORTS

- 21.5 AUTHOR DETAILS