|

시장보고서

상품코드

1880372

데이터센터 절연재 시장 : 데이터센터 유형별, 설치 방법별, 제품 유형별, 소재별, 용도별, 절연 유형별, 지역별 - 예측(-2032년)Data Center Insulation Market by Material (Mineral Wool, PU Foam, PE Foam, Polystyrene Foam, Flexible Elastomeric Foam), Insulation Type (Thermal & Acoustic), Application (Wall & Roof, Raised Floors, Pipes & Ducts) and Region - Global Forecast to 2032 |

||||||

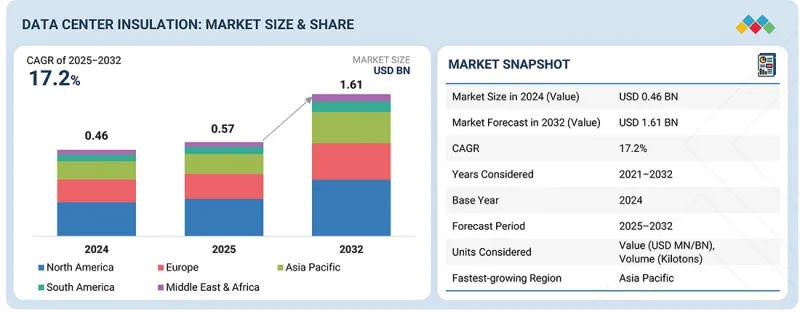

데이터센터 절연재 시장 규모는 2025년 5억 7,000만 달러에서 2032년까지 16억 1,000만 달러되어, CAGR17.2%를 보일 것으로 예측되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 대상 단위 | 가치(100만/10억 달러) |

| 부문 | 데이터센터 유형별, 설치 방법별, 제품 유형별, 소재별, 용도별, 절연 유형별, 지역별 |

| 대상 지역 | 아시아태평양, 유럽, 북미, 중동 및 아프리카, 남미 |

데이터센터 시장은 단열재 시장의 주요 촉진요인입니다. 데이터센터 단열재는 성능 향상, 열획득 감소, 온도변화에 따른 손실 억제를 목적으로 벽, 천장, 고상형 바닥, 배관 및 덕트, 기타 영역에 폭넓게 적용되고 있습니다.

폴리에틸렌 폼은 우수한 단열성, 내습성, 시공 용이성으로 인해 예측 기간 동안 데이터센터 단열재 시장에서 가장 높은 CAGR을 보일 것으로 예측됩니다. 이러한 특성은 정밀한 온도 제어와 에너지 효율을 필요로 하는 차세대 데이터센터에 이상적입니다. 가볍고 유연한 폴리에틸렌 폼은 배관, 덕트, 벽, 바닥의 열 및 음향 단열재로 사용됩니다. 독립 기포 구조는 열교를 줄이고 높은 방습성을 제공하여 고밀도 데이터센터의 시스템 신뢰성을 향상시킵니다. 현대적인 모듈식 구조와 환경 친화적인 배합과의 호환성 또한 그 매력을 더하고 있습니다. 하이퍼스케일 데이터센터와 엣지 시설 증가는 경제적이고 수명이 긴 단열재에 대한 수요를 촉진하며 성장을 견인하고 있습니다. 에너지 손실을 효과적으로 줄이고 HVAC 시스템의 수명을 연장하여 장기적인 운영 지속가능성을 지원합니다.

단열재 부문은 고성능 환경에서의 에너지 효율과 온도 관리의 필요성 때문에 예측 기간 동안 데이터센터 단열재 시장에서 가장 높은 CAGR을 보일 것으로 예측됩니다. 데이터센터의 규모 확대와 고밀도화에 따라 과열 방지, 에너지 손실 감소, 서버의 지속적인 가동 보장을 위해 적절한 열 환경의 유지가 매우 중요합니다. 폴리우레탄 폼, 유리섬유, 엘라스토머 코팅과 같은 단열재는 우수한 내열성을 제공하여 HVAC 부하와 운영 비용을 줄이고 에너지 효율을 향상시킵니다. 또한, 탄소 배출량 감소 및 국제 에너지 기준 준수를 통해 환경 목표 달성에 기여하고 있습니다. 신흥국에서의 하이퍼스케일 및 엣지 데이터센터 증가는 열 관리 솔루션에 대한 수요를 더욱 증가시키고 있으며, 단열재는 현대 데이터센터의 성능, 안전성, 비용 최적화를 위해 필수적인 요소입니다.

배관 및 덕트 부문은 고밀도 시설의 냉각 성능 향상과 열 손실 감소의 필요성으로 인해 예측 기간 동안 데이터센터 단열재 시장에서 가장 높은 성장률을 보일 것으로 예측됩니다. 단열 처리된 배관 및 덕트는 온도 유지, 공조 냉각 부하 감소, 에너지 효율 향상에 기여합니다. 폴리에틸렌, 엘라스토머 폼, 유리섬유 등의 첨단 소재는 내열성, 결로 제어, 내구성을 향상시킵니다. 데이터센터가 전 세계적으로 확장됨에 따라 운영자들은 공기 흐름 조절, 비용 절감, 지속가능성 목표 달성을 위해 단열 배관 및 덕트를 점점 더 많이 활용하고 있습니다. 이러한 에너지 효율에 대한 관심은 배관 및 덕트 부문을 데이터센터의 성능과 신뢰성에 있어 중요한 요소로 인식하고 있습니다.

아시아태평양은 급속한 인프라 개발, 디지털화 가속화, 클라우드 컴퓨팅에 대한 투자 증가로 인해 예측 기간 동안 데이터센터 절연재 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 중국, 인도, 일본, 싱가포르 등의 국가에서는 하이퍼스케일 데이터센터 건설이 급증하고 있으며, 에너지 효율을 높이고 운영 비용을 절감할 수 있는 혁신적인 단열재에 대한 수요가 급증하고 있습니다. 에너지 소비 증가와 엄격한 환경 규제 강화로 인해 효율적인 열 관리를 위한 지속 가능하고 고성능의 단열 솔루션 도입이 사업자들에게 요구되고 있습니다. 그린 데이터센터 추진을 위한 정부 정책과 재생에너지의 통합은 단열 기술의 채택을 더욱 촉진할 것입니다. 데이터센터를 최적의 가동 온도로 유지하기 위한 냉각 효율 향상과 탄소 배출량 감소에 대한 관심은 아시아태평양을 세계 데이터센터 단열재 시장 성장의 거점으로 자리매김하고 있습니다.

세계의 데이터센터용 절연재 시장에 대해 조사했으며, 데이터센터 유형별, 설치 방법별, 제품 유형별, 재료별, 용도별, 절연 유형별, 지역별 동향, 시장 진출 기업 프로파일 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 미충족 요구와 공백

- 상호 접속된 시장과 분야의 횡단적인 기회

- Tier1/2/3 기업의 전략적 움직임

제6장 업계 동향

- Porter의 Five Forces 분석

- 밸류체인 분석

- 데이터센터 절연재 시장 생태계

- 가격 분석

- 무역 분석

- 2025-2026년 주요 컨퍼런스 및 이벤트

- 고객의 비즈니스에 영향을 미치는 동향/파괴적 변화

- 투자, 자금조달 시나리오(2024년-2025년)

- 사례 연구 분석

- 2025년 미국 관세의 영향 - 데이터센터 절연재 시장

- 주요 관세율

제7장 기술, 특허, 디지털, AI 도입에 의한 전략적 파괴

- 주요 신기술

- 보완적 기술

- 기술/제품 로드맵

- 특허 분석

- 향후 응용

- 데이터센터 절연재 시장에 대한 인공지능(AI)의 영향

- 성공 사례와 실세계에의 응용

제8장 지속가능성과 규제 상황

- 지역 규제와 컴플라이언스

- 데이터센터 단열에 관한 ASHRAE 가이드라인

- 지속가능성 이니셔티브

- 지속가능성에 대한 영향과 규제 정책 대처

- 인증, 라벨, 환경기준

제9장 고객 상황과 구매 행동

- 의사결정 프로세스

- 주요 이해관계자와 구입 기준

- 채택 장벽과 내부 과제

- 다양한 최종사용자의 미충족 요구

- 시장 수익성

제10장 데이터센터 절연재 시장(데이터센터 유형별)

- 서론

- 하이퍼스케일 데이터센터

- 코로케이션 데이터센터

- 기업 데이터센터

제11장 데이터센터 절연재 시장(설치 방법별)

- 서론

- 신축

- 개보수 및 개축

제12장 데이터센터 절연재 시장(제품 유형별)

- 서론

- 시트 및 롤

- 패널

- 파이프 섹션

- 타일

- 보드 및 슬라브

- wired 매트

- 기타

제13장 데이터센터 절연재 시장(소재별)

- 서론

- 미네랄 울

- 폴리우레탄 폼

- 폴리에틸렌 폼

- 폴리스티렌 폼

- 플렉서블 엘라스토머 폼

- 기타

제14장 데이터센터 절연재 시장(용도별)

- 서론

- 벽 및 천장

- RAISED FLOOR

- 파이프 및 덕트

- 기타

제15장 데이터센터 절연재 시장(절연 유형별)

- 서론

- 단열

- 방음

제16장 데이터센터 절연재 시장(지역별)

- 서론

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 스페인

- 영국

- 이탈리아

- 러시아

- 기타

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타

- 중동 및 아프리카

- GCC 국가

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

제17장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점

- 매출 분석

- 시장 점유율 분석, 2024년

- 브랜드 비교

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

- 기업 평가와 재무 지표

제18장 기업 개요

- 주요 시장 진출기업

- ARMACELL

- KINGSPAN GROUP

- JOHNS MANVILLE(BERKSHIRE HATHAWAY INC.)

- OWENS CORNING.

- KAIMANN(SAINT-GOBAIN)

- SIKA AG

- VENTAC

- THE SUPREME INDUSTRIES LTD.

- IAC ACOUSTICS UK LTD

- BOYD.

- THERMAFLEX

- PROSYNEFFEX

- ROCKWOOL A/S

- INSULTECH, LLC.

- TROCELLEN(FURUKAWA ELECTRIC CO., LTD.)

- METL-SPAN(NUCOR)

- ITW FORMEX(ILLINOIS TOOL WORKS INC)

- 기타 기업

- CLARK PACIFIC

- ORANGE COUNTY THERMAL INDUSTRIES, INC.

- FIRWIN CORPORATION

- SHANDONG AOHUAN NEW MATERIAL TECHNOLOGY CO., LTD.

- SUZHOU HANMING ELECTRONIC MATERIALS CO., LTD.

- AUBURN MANUFACTURING, INC.

- ENGINEERED MATERIALS

- SOUTHLAND INSULATORS

제19장 인접 시장과 관련 시장

제20장 부록

LSH 25.12.10The data center insulation market is projected to grow from USD 0.57 billion in 2025 to USD 1.61 billion at a CAGR of 17.2% from 2025 to 2032.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Insulation, Material, Application, And Region |

| Regions covered | Asia Pacific, Europe, North America, the Middle East & Africa, and South America |

The data center market is a key driver of the insulation market. Data center insulation is commonly employed in walls and ceilings, raised floors, pipes & ducts, and other areas in data centers to improve performance, reduce heat gain, and losses caused by temperature fluctuations.

"By material, the polyethylene foam segment is estimated to be the fastest growing segment of the data center insulation market during the forecast period."

Polyethylene foam is projected to have the highest CAGR in the data center insulation market during the forecast, due to its excellent insulation, moisture resistance, and ease of installation. These qualities make it ideal for next-generation data centers needing precise temperature control and energy efficiency. Lightweight and flexible, polyethylene foam is used in pipes, ducts, walls, and flooring for thermal and acoustic insulation. Its closed-cell structure reduces thermal bridging and offers high vapor resistance, enhancing system reliability in high-density data centers. Its compatibility with modern modular construction and green formulations makes it more attractive. The rise in hyperscale data centers and edge facilities boosts demand for economical, long-lasting insulation materials, which drives growth. It effectively reduces energy losses and prolongs HVAC system lifespan, supporting long-term operational sustainability.

"By insulation type, thermal insulation is estimated to be the fastest growing segment of the data center insulation market during the forecast period."

The thermal insulation segment is expected to have the highest CAGR in the data center insulation market during the forecast period, driven by the need for energy efficiency and temperature control in high-performance environments. As data centers grow larger and denser, maintaining proper thermal conditions is critical to prevent overheating, reduce energy loss, and ensure continuous server operation. Thermal insulation materials, such as polyurethane foams, fiberglass, and elastomeric coatings, provide superior heat resistance, lowering HVAC loads, operational costs, and boosting energy efficiency. They also support environmental goals by reducing carbon footprints and meeting global energy standards. The rise of hyperscale and edge data centers in emerging economies further increases demand for thermal management solutions, making insulation essential for performance, safety, and cost optimization in modern data centers.

"By application, by application, pipes & ducts are estimated to be the fastest growing segment of the data center insulation market during the forecast period."

The pipes and ducts segment is expected to grow at the fastest rate in the data center insulation market during the forecast period, driven by the need to improve cooling and reduce thermal losses in high-density facilities. Insulated pipes and ducts help maintain temperatures, reduce HVAC cooling loads, and enhance energy efficiency. Advanced materials, such as polyethylene, elastomeric foam, and fiberglass, enhance thermal resistance, condensation control, and durability. As data centers expand globally, operators are increasingly using insulated piping and ducting to regulate airflow, reduce costs, and meet sustainability goals. This focus on energy efficiency makes the pipes and ducts segment a key factor for data center performance and reliability.

"The Asia Pacific region's data center insulation market is projected to be the fastest-growing region in the data center insulation market during the forecast period."

The Asia Pacific region is projected to register the highest CAGR in the data center insulation market during the forecast period, driven by rapid infrastructure development, accelerating digitalization, and increasing investments in cloud computing. Countries such as China, India, Japan, and Singapore are witnessing a surge in hyperscale data center construction, thereby creating a huge demand for innovative insulation materials that can enhance energy efficiency and reduce operational costs. Increasing energy consumption, coupled with stringent environmental regulations, will require operators to adopt sustainable, high-performance insulation solutions for efficient thermal management. Government initiatives for green data centers and the integration of renewable energy will further promote the adoption of insulation technologies. The focus on reducing carbon emissions while enhancing cooling efficiency to keep the data center at optimum operating temperatures positions the Asia Pacific region as the hub for the global data center insulation market growth.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 45%, Tier 2 - 22%, and Tier 3 - 33%

- By Designation: C-Level Executives- 50%, Directors- 10%, and Others - 40%

- By Region: North America - 17%, Asia Pacific - 17%, Europe - 33%, Middle East & Africa - 25%, and South America - 8%

ARMACELL (Luxembourg), Kingspan Group (Ireland), Johns Manville (US), Kaimann (Germany), Owens Corning. (US), Boyd. (US), The Supreme Industries Ltd. (India), Sika AG (Switzerland), Ventac (Ireland), IAC Acoustics UK Ltd (UK), Thermaflex (Netherlands), ROCKWOOL A/S (Denmark), Prosyneffex (US), InsulTech, LLC. (US), Trocellen (Germany), Metl-Span (US), ITW Formex (US), and others are the key players in the data center insulation market. These players have adopted various strategies, including agreements, joint ventures, and expansions, to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the data center insulation market size based on product, process, end-use, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as expansions, agreements, and acquisitions undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the data center insulation market and its segments. This report is also expected to help stakeholders gain a deeper understanding of the market's competitive landscape, acquire valuable insights to enhance their business positions, and develop effective go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of critical drivers (advancements in thermal management and acoustic optimization in high-density and liquid-cooled data centers, rising global data center construction, stringent environmental & building regulations accelerating adoption of advanced insulation materials), restraints (high initial installation and material costs, lack of standardization and regulatory push), opportunities (increasing installation of GenAI-based mega centers, retrofitting & modernization of legacy data centers) and challenges (alternative materials, such as mineral fiber ceilings, roof coatings, and reflective panels, substitution with other technologies such as direct-to-chip and immersion cooling) influencing the growth of the data center insulation market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the data center insulation market.

- Market Development: Comprehensive information about lucrative markets-the report analyzes the data center insulation market across various regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the data center insulation market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as ARMACELL (Luxembourg), Kingspan Group (Ireland), Johns Manville (US), Kaimann (Germany), and Owens Corning (US) are the key players in the data center insulation market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.3.4 UNITS CONSIDERED

- 1.3.5 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MATRIX CONSIDERED FOR DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 CALCULATION FOR SUPPLY-SIDE ANALYSIS

- 2.5 GROWTH FORECAST

- 2.6 DATA TRIANGULATION

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN DATA CENTER INSULATION MARKET

- 4.2 NORTH AMERICA: DATA CENTER INSULATION MARKET, BY SOURCE AND COUNTRY

- 4.3 DATA CENTER INSULATION MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Advancements in thermal management and acoustic optimization in high-density and liquid-cooled data centers

- 5.2.1.2 Rising global data center construction

- 5.2.1.3 Stringent environmental & building regulations accelerating adoption of advanced insulation materials

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial installation and material costs

- 5.2.2.2 Lack of standardization and regulatory push

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing installation of GenAI-based mega centers

- 5.2.3.2 Retrofitting & modernization of legacy data centers

- 5.2.4 CHALLENGES

- 5.2.4.1 Alternative materials, such as mineral fiber ceilings, roof coatings, and reflective panels

- 5.2.4.2 Substitution with other technologies, such as direct-to-chip and immersion cooling

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS AND WHITE SPACES

- 5.3.1 UNMET NEEDS IN DATA CENTER INSULATION MARKET

- 5.3.2 WHITE SPACE OPPORTUNITIES

- 5.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 BARGAINING POWER OF SUPPLIERS

- 6.1.2 BARGAINING POWER OF BUYERS

- 6.1.3 THREAT OF SUBSTITUTES

- 6.1.4 THREAT OF NEW ENTRANTS

- 6.1.5 DEGREE OF COMPETITION

- 6.2 VALUE CHAIN ANALYSIS

- 6.3 ECOSYSTEM FOR DATA CENTER INSULATION MARKET

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE, BY REGION

- 6.4.2 AVERAGE SELLING PRICE OF DATA CENTER INSULATION, BY MATERIAL

- 6.5 TRADE ANALYSIS

- 6.5.1 IMPORT SCENARIO

- 6.5.2 EXPORT SCENARIO

- 6.6 KEY CONFERENCES & EVENTS IN 2025-2026

- 6.7 TRENDS/DISRUPTION IMPACTING CUSTOMER BUSINESS

- 6.8 INVESTMENT & FUNDING SCENARIO, (2024-2025)

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 DATA CENTER 2.0 (THERMAFLEX)

- 6.9.1.1 Objective

- 6.9.1.2 Challenge

- 6.9.1.3 Solution statement

- 6.9.1.4 Result

- 6.9.2 INNOVATION IN ENERGY EFFICIENCY: INFOSYS-BANGALORE DATA CENTER

- 6.9.2.1 Objective

- 6.9.2.2 Challenge

- 6.9.2.3 Solution statement

- 6.9.2.4 Result

- 6.9.3 DATA CENTRE INSULATION

- 6.9.3.1 Objective

- 6.9.3.2 Challenge

- 6.9.3.3 Solution statement

- 6.9.3.4 Result

- 6.9.1 DATA CENTER 2.0 (THERMAFLEX)

- 6.10 IMPACT OF 2025 US TARIFF - DATA CENTER INSULATION MARKET

- 6.10.1 KEY TARIFF RATES

- 6.11 KEY TARIFF RATES

- 6.11.1 PRICE IMPACT ANALYSIS

- 6.11.2 IMPACT ON COUNTRY/REGION

- 6.11.2.1 US

- 6.11.2.2 Europe

- 6.11.2.3 Asia Pacific

- 6.11.3 IMPACT ON APPLICATIONS

- 6.11.3.1 Walls & Ceilings

- 6.11.3.2 Raised Floors

- 6.11.3.3 Pipes & Ducts

- 6.11.3.4 Other Applications

7 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 7.1 KEY EMERGING TECHNOLOGIES

- 7.1.1 AEROGEL

- 7.1.2 PHASE CHANGE MATERIALS

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 HOT AISLE CONTAINMENT AND COLD AISLE CONTAINMENT

- 7.2.2 HIGH-EFFICIENCY COOLING SYSTEMS

- 7.3 TECHNOLOGY/PRODUCT ROADMAP

- 7.3.1 SHORT-TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 7.3.2 MID-TERM (2027-2030) | EXPANSION & STANDARDIZATION

- 7.3.3 LONG-TERM (2030-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 7.4 PATENT ANALYSIS

- 7.4.1 INTRODUCTION

- 7.4.2 METHODOLOGY

- 7.4.3 DOCUMENT TYPE

- 7.4.4 INSIGHTS

- 7.4.5 LEGAL STATUS OF PATENTS

- 7.4.6 JURISDICTION ANALYSIS

- 7.4.7 TOP APPLICANTS

- 7.4.7.1 List of major patents

- 7.5 FUTURE APPLICATIONS

- 7.5.1 HIGH-DENSITY AND AI-OPTIMIZED DATA CENTERS

- 7.5.2 IMMERSION AND LIQUID-COOLED DATA CENTERS

- 7.5.3 SMART AND ADAPTIVE INSULATION SYSTEMS

- 7.5.4 ACOUSTIC OPTIMIZATION FOR URBAN DATA CENTERS

- 7.5.5 FIRE AND SAFETY ENHANCEMENT APPLICATIONS

- 7.6 IMPACT OF ARTIFICIAL INTELLIGENCE (AI) IN DATA CENTER INSULATION MARKET

- 7.6.1 TOP USE CASES AND MARKET POTENTIAL

- 7.6.2 BEST PRACTICES IN INSULATION IN DATA CENTERS

- 7.6.3 CASE STUDY ANALYSIS

- 7.6.3.1 Data Center 2.0 (Thermaflex)

- 7.6.3.1.1 Objective

- 7.6.3.1.2 Challenge

- 7.6.3.1.3 Solution statement

- 7.6.3.1.4 Result

- 7.6.3.2 Innovation in energy efficiency: Infosys-Bangalore data center

- 7.6.3.2.1 Objective

- 7.6.3.2.2 Challenge

- 7.6.3.2.3 Solution statement

- 7.6.3.2.4 Result

- 7.6.3.3 Data center insulation

- 7.6.3.3.1 Objective

- 7.6.3.3.2 Challenge

- 7.6.3.3.3 Solution statement

- 7.6.3.3.4 Result

- 7.6.3.1 Data Center 2.0 (Thermaflex)

- 7.6.4 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- 7.6.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN DATA CENTER INSULATION MARKET

- 7.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 7.7.1 THERMAFLEX: DATA CENTER 2.0

- 7.7.2 INSULTECH, LLC: DATA CENTER THERMAL INSULATION

- 7.7.3 ROCKWOOL: STONE WOOL INSULATION FOR DATA CENTRES

8 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.1.1 INTRODUCTION

- 8.1.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.3 INDUSTRY STANDARDS

- 8.2 ASHRAE GUIDELINES FOR DATA CENTER INSULATION

- 8.2.1 ASHRAE GUIDELINES FOR DATA CENTER INSULATION - TECHNICAL REGULATORY SUMMARY (BASED ON ASHRAE 90.1-2022 & ASHRAE TC9.9)

- 8.2.1.1 Roof insulation requirements relevant to data centers

- 8.2.1.1.1 Attic roofs (wood-framed) - overall u-factors

- 8.2.1.1.2 Wood joist roof with continuous insulation

- 8.2.1.1.3 Steel-joist roof assemblies

- 8.2.1.1.4 Roof edge & parapet insulation requirements

- 8.2.1.2 Exterior wall insulation requirements

- 8.2.1.2.1 Steel-framed walls (typical for data centers)

- 8.2.1.2.2 Thermal bridge mitigation at wall edges

- 8.2.1.3 Floor & slab insulation requirements

- 8.2.1.3.1 Mass floors (concrete slabs) - assembly u-factors

- 8.2.1.4 Mechanical system insulation for data centers

- 8.2.1.4.1 Steel-joist floors with spray-applied insulation

- 8.2.1.5 Insulation material performance values

- 8.2.1.5.1 Fiberglass batt (effective R-values in real cavities)

- 8.2.1.5.2 Material R-values (table A9.4.4-1)

- 8.2.1.6 Installation & quality compliance requirements

- 8.2.1.7 ASHRAE TC9.9 thermal stability guidance (influencing insulation design)

- 8.2.1.1 Roof insulation requirements relevant to data centers

- 8.2.1 ASHRAE GUIDELINES FOR DATA CENTER INSULATION - TECHNICAL REGULATORY SUMMARY (BASED ON ASHRAE 90.1-2022 & ASHRAE TC9.9)

- 8.3 SUSTAINABILITY INITIATIVES

- 8.3.1 CARBON IMPACT AND ECO-APPLICATIONS OF DATA CENTER INSULATION

- 8.3.1.1 Carbon impact reduction

- 8.3.1.2 Eco-applications

- 8.3.1 CARBON IMPACT AND ECO-APPLICATIONS OF DATA CENTER INSULATION

- 8.4 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 8.4.1 KEY SUSTAINABILITY AND REGULATORY DEVELOPMENTS

- 8.5 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

9 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 9.1 DECISION-MAKING PROCESS

- 9.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 9.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.2.2 BUYING CRITERIA

- 9.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 9.4 UNMET NEEDS FOR VARIOUS END USERS

- 9.5 MARKET PROFITIBILITY

- 9.5.1 REVENUE POTENTIAL

- 9.5.2 COST DYNAMICS

- 9.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS

10 DATA CENTER INSULATION MARKET, BY DATA CENTER TYPE

- 10.1 INTRODUCTION

- 10.2 HYPERSCALE DATA CENTER

- 10.2.1 SURGE IN CLOUD COMPUTING AND AI WORKLOADS TO DRIVE MARKET

- 10.3 COLOCATION DATA CENTER

- 10.3.1 EXPANSION OF EDGE AND REGIONAL COLOCATION FACILITIES TO DRIVE MARKET

- 10.4 ENTERPRISE DATA CENTER

- 10.4.1 FOCUS ON ENERGY EFFICIENCY AND COST OPTIMIZATION TO DRIVE MARKET

11 DATA CENTER INSULATION MARKET, BY INSTALLATION METHOD

- 11.1 INTRODUCTION

- 11.2 NEW CONSTRUCTION

- 11.2.1 RAPID EXPANSION OF GLOBAL DATA CENTER INFRASTRUCTURE

- 11.3 RETROFIT/RENOVATION

- 11.3.1 MODERNIZATION OF AGING DATA CENTER INFRASTRUCTURE TO DRIVE MARKET

12 DATA CENTER INSULATION MARKET, BY PRODUCT TYPE

- 12.1 INTRODUCTION

- 12.2 SHEETS & ROLLS

- 12.2.1 EASE OF INSTALLATION & ADAPTABILITY TO DRIVE MARKET

- 12.3 PANELS

- 12.3.1 PREFABRICATED AND MODULAR DESIGN FOR SPEEDY INSTALLATION TO DRIVE MARKET

- 12.4 PIPE SECTION

- 12.4.1 GROWING ADOPTION OF LIQUID COOLING AND ADVANCED HVAC SYSTEMS TO DRIVE MARKET

- 12.5 TILES

- 12.5.1 THERMAL REGULATION AND ENERGY EFFICIENCY TO DRIVE MARKET

- 12.6 BOARDS & SLABS

- 12.6.1 COMPATIBILITY WITH SUSTAINABLE CONSTRUCTION GOALS TO DRIVE MARKET

- 12.7 WIRED MAT

- 12.7.1 SUPERIOR MECHANICAL STRENGTH AND DURABILITY TO DRIVE MARKET

- 12.8 OTHERS

13 DATA CENTER INSULATION MARKET, BY MATERIAL

- 13.1 INTRODUCTION

- 13.2 MINERAL WOOL

- 13.2.1 SUPERIOR THERMAL AND ACOUSTIC PERFORMANCE TO DRIVE MARKET

- 13.2.2 FIBERGLASS

- 13.2.3 STONE WOOL

- 13.3 POLYURETHANE FOAM

- 13.3.1 LIGHTWEIGHT AND SPACE-SAVING DESIGN FLEXIBILITY TO DRIVE MARKET

- 13.4 POLYETHYLENE FOAM

- 13.4.1 VIBRATION DAMPENING AND ACOUSTIC CONTROL FOR EQUIPMENT PROTECTION

- 13.5 POLYSTYRENE FOAM

- 13.5.1 HIGH COMPRESSIVE STRENGTH FOR RAISED FLOOR AND STRUCTURAL APPLICATIONS TO DRIVE MARKET

- 13.6 FLEXIBLE ELASTOMERIC FOAM

- 13.6.1 EASY INSTALLATION AND ADAPTABILITY TO DRIVE MARKET

- 13.7 OTHER MATERIALS

14 DATA CENTER INSULATION MARKET, BY APPLICATION

- 14.1 INTRODUCTION

- 14.2 WALLS & CEILINGS

- 14.2.1 MINIMIZING HEAT TRANSFER THROUGH BUILDING ENVELOPE TO DRIVE MARKET

- 14.3 RAISED FLOORS

- 14.3.1 ENHANCING AIRFLOW MANAGEMENT AND COOLING EFFICIENCY TO DRIVE MARKET

- 14.4 PIPES & DUCTS

- 14.4.1 SUPPORTING ADVANCED COOLING TECHNOLOGIES TO DRIVE MARKET

- 14.5 OTHER APPLICATIONS

15 DATA CENTER INSULATION MARKET, BY INSULATION

- 15.1 INTRODUCTION

- 15.2 THERMAL INSULATION

- 15.2.1 REDUCING HEAT LOAD FROM DENSELY PACKED EQUIPMENT TO DRIVE MARKET

- 15.2.2 DIFFERENT MATERIALS USED IN THERMAL INSULATION

- 15.2.2.1 Mineral wool (rock wool/stone wool)

- 15.2.2.1 Fiberglass insulation

- 15.2.2.2 Rigid foam boards (polyisocyanurate, EPS, XPS)

- 15.2.2.3 Spray polyurethane foam (SPF)

- 15.2.2.4 Vacuum insulation panels (VIPs)

- 15.2.2.5 Aerogel blankets

- 15.2.2.6 Phase change materials (PCMs)

- 15.3 ACOUSTIC INSULATION

- 15.3.1 RISING NOISE LEVELS FROM HIGH-DENSITY EQUIPMENT TO DRIVE MARKET

- 15.3.2 DIFFERENT MATERIALS USED IN ACOUSTIC INSULATION

- 15.3.2.1 Acoustic foam panels (polyurethane/melamine)

- 15.3.2.2 Mineral wool/rock wool

- 15.3.2.3 Mass Loaded Vinyl (MLV)

- 15.3.2.4 Acoustic barriers & curtains

- 15.3.2.5 Sound-absorbing ceiling tiles

- 15.3.2.6 Perforated metal panels with acoustic backing

16 DATA CENTER INSULATION MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 US

- 16.2.1.1 Rising IoT and AI integration driving growth

- 16.2.2 CANADA

- 16.2.2.1 Expansion of cloud and colocation facilities accelerating growth

- 16.2.3 MEXICO

- 16.2.3.1 Surge in hyperscale investment and digital infrastructure projects to drive market

- 16.2.1 US

- 16.3 EUROPE

- 16.3.1 GERMANY

- 16.3.1.1 Expansion of cloud infrastructure and energy efficiency regulations accelerating growth

- 16.3.2 FRANCE

- 16.3.2.1 Expansion of colocation facilities and renewable energy integration driving market growth

- 16.3.3 SPAIN

- 16.3.3.1 Expansion of renewable-powered infrastructure and sustainable regulations driving market

- 16.3.4 UK

- 16.3.4.1 Rising AI infrastructure development and policy support driving demand

- 16.3.5 ITALY

- 16.3.5.1 Expanding digital infrastructure driving growth

- 16.3.6 RUSSIA

- 16.3.6.1 Expansion of digital infrastructure and cold climate efficiency demands driving growth

- 16.3.7 REST OF EUROPE

- 16.3.1 GERMANY

- 16.4 ASIA PACIFIC

- 16.4.1 CHINA

- 16.4.1.1 Expansion of computational infrastructure and energy efficiency goals driving growth

- 16.4.2 INDIA

- 16.4.2.1 Rising digital capacity and thermal efficiency demands to drive growth

- 16.4.3 JAPAN

- 16.4.3.1 Infrastructure growth and sustainability to drive market

- 16.4.4 SOUTH KOREA

- 16.4.4.1 Infrastructure growth and safety concerns to drive market

- 16.4.5 REST OF ASIA PACIFIC

- 16.4.1 CHINA

- 16.5 MIDDLE EAST & AFRICA

- 16.5.1 GCC COUNTRIES

- 16.5.1.1 UAE

- 16.5.1.1.1 AI infrastructure expansion and sustainable cooling advancing market

- 16.5.1.2 Saudi Arabia

- 16.5.1.2.1 Large-scale digital investments and Vision 2030 to drive market

- 16.5.1.3 Rest of GCC countries

- 16.5.1.1 UAE

- 16.5.2 REST OF MIDDLE EAST & AFRICA

- 16.5.1 GCC COUNTRIES

- 16.6 SOUTH AMERICA

- 16.6.1 BRAZIL

- 16.6.1.1 Expanding data center infrastructure and growing renewable energy emphasis to drive market

- 16.6.2 ARGENTINA

- 16.6.2.1 Large-scale AI infrastructure investment and renewable energy expansion to accelerate demand

- 16.6.3 REST OF SOUTH AMERICA

- 16.6.1 BRAZIL

17 COMPETITIVE LANDSCAPE

- 17.1 INTRODUCTION

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 17.3 REVENUE ANALYSIS

- 17.3.1 TOP 5 PLAYERS' REVENUE ANALYSIS

- 17.4 MARKET SHARE ANALYSIS, 2024

- 17.4.1 RANKING OF KEY MARKET PLAYERS, 2024

- 17.4.2 MARKET SHARE ANALYSIS

- 17.5 BRAND COMPARISON

- 17.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.6.1 STARS

- 17.6.2 EMERGING LEADERS

- 17.6.3 PERVASIVE PLAYERS

- 17.6.4 PARTICIPANTS

- 17.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 17.6.5.1 Company footprint

- 17.6.5.2 Region footprint

- 17.6.5.3 Insulation footprint

- 17.6.5.4 Material type footprint

- 17.6.5.5 Application footprint

- 17.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 17.7.1 PROGRESSIVE COMPANIES

- 17.7.2 RESPONSIVE COMPANIES

- 17.7.3 DYNAMIC COMPANIES

- 17.7.4 STARTING BLOCKS

- 17.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 17.7.5.1 Detailed list of key startups/SMES

- 17.7.5.2 Competitive benchmarking of key startups/SMEs

- 17.8 COMPETITIVE SCENARIO

- 17.8.1 DEALS

- 17.8.2 EXPANSIONS

- 17.9 COMPANY VALUATION AND FINANCIAL METRICS

18 COMPANY PROFILES

- 18.1 MAJOR PLAYERS

- 18.1.1 ARMACELL

- 18.1.1.1 Business overview

- 18.1.1.2 Products/Solutions/Services offered

- 18.1.1.3 Recent developments

- 18.1.1.3.1 Deals

- 18.1.1.3.2 Others

- 18.1.1.4 MnM view

- 18.1.1.4.1 Right to win

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses and competitive threats

- 18.1.2 KINGSPAN GROUP

- 18.1.2.1 Business overview

- 18.1.2.2 Products offered

- 18.1.2.3 Recent developments

- 18.1.2.3.1 Deals

- 18.1.2.3.2 Expansions

- 18.1.2.4 MnM view

- 18.1.2.4.1 Right to win

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses and competitive threats

- 18.1.3 JOHNS MANVILLE (BERKSHIRE HATHAWAY INC.)

- 18.1.3.1 Business overview

- 18.1.3.2 Products/Solutions/Services offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Expansions

- 18.1.3.4 MnM view

- 18.1.3.4.1 Right to win

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses and competitive threats

- 18.1.4 OWENS CORNING.

- 18.1.4.1 Business overview

- 18.1.4.2 Products/Solutions/Services offered

- 18.1.4.3 MnM view

- 18.1.4.3.1 Right to win

- 18.1.4.3.2 Strategic choices

- 18.1.4.3.3 Weaknesses and competitive threats

- 18.1.5 KAIMANN (SAINT-GOBAIN)

- 18.1.5.1 Business overview

- 18.1.5.2 Products/Solutions/Services offered

- 18.1.5.3 MnM view

- 18.1.5.3.1 Right to win

- 18.1.5.3.2 Strategic choices

- 18.1.5.3.3 Weaknesses and competitive threats

- 18.1.6 SIKA AG

- 18.1.6.1 Business overview

- 18.1.6.2 Products offered

- 18.1.6.3 Recent developments

- 18.1.6.3.1 Deals

- 18.1.6.3.2 Expansions

- 18.1.6.4 MnM view

- 18.1.6.4.1 Right to win

- 18.1.6.4.2 Strategic choices

- 18.1.6.4.3 Weaknesses and competitive threats

- 18.1.7 VENTAC

- 18.1.7.1 Business overview

- 18.1.7.2 Products/Solutions/Services offered

- 18.1.7.3 MnM view

- 18.1.7.3.1 Right to win

- 18.1.7.3.2 Strategic choices

- 18.1.7.3.3 Weaknesses and competitive threats

- 18.1.8 THE SUPREME INDUSTRIES LTD.

- 18.1.8.1 Business overview

- 18.1.8.2 Products/Solutions/Services offered

- 18.1.8.3 MnM view

- 18.1.8.3.1 Right to win

- 18.1.8.3.2 Strategic choices

- 18.1.8.3.3 Weaknesses and competitive threats

- 18.1.9 IAC ACOUSTICS UK LTD

- 18.1.9.1 Business overview

- 18.1.9.2 Products/Solutions/Services offered

- 18.1.9.3 MnM view

- 18.1.9.3.1 Right to win

- 18.1.9.3.2 Strategic choices

- 18.1.9.3.3 Weaknesses and competitive threats

- 18.1.10 BOYD.

- 18.1.10.1 Business overview

- 18.1.10.2 Products/Solutions/Services offered

- 18.1.10.3 MnM view

- 18.1.10.3.1 Right to win

- 18.1.10.3.2 Strategic choices

- 18.1.10.3.3 Weaknesses and competitive threats

- 18.1.11 THERMAFLEX

- 18.1.11.1 Business overview

- 18.1.11.2 Products/Solutions/Services offered

- 18.1.11.3 Recent developments

- 18.1.11.3.1 Expansions

- 18.1.11.4 MnM view

- 18.1.11.4.1 Right to win

- 18.1.11.4.2 Strategic choices

- 18.1.11.4.3 Weaknesses and competitive threats

- 18.1.12 PROSYNEFFEX

- 18.1.12.1 Business overview

- 18.1.12.2 Products/Solutions/Services offered

- 18.1.12.3 MnM view

- 18.1.12.3.1 Right to win

- 18.1.12.3.2 Strategic choices

- 18.1.12.3.3 Weaknesses and competitive threats

- 18.1.13 ROCKWOOL A/S

- 18.1.13.1 Business overview

- 18.1.13.2 Products/Solutions/Services offered

- 18.1.13.3 Recent developments

- 18.1.13.3.1 Deals

- 18.1.13.3.2 Expansions

- 18.1.13.4 MnM view

- 18.1.13.4.1 Right to win

- 18.1.13.4.2 Strategic choices

- 18.1.13.4.3 Weaknesses and competitive threats

- 18.1.14 INSULTECH, LLC.

- 18.1.14.1 Business overview

- 18.1.14.2 Products/Solutions/Services offered

- 18.1.14.3 MnM view

- 18.1.14.3.1 Right to win

- 18.1.14.3.2 Strategic choices

- 18.1.14.3.3 Weaknesses and competitive threats

- 18.1.15 TROCELLEN (FURUKAWA ELECTRIC CO., LTD.)

- 18.1.15.1 Business overview

- 18.1.15.2 Products/Solutions/Services offered

- 18.1.15.3 MnM view

- 18.1.15.3.1 Right to win

- 18.1.15.3.2 Strategic choices

- 18.1.15.3.3 Weaknesses and competitive threats

- 18.1.16 METL-SPAN (NUCOR)

- 18.1.16.1 Business overview

- 18.1.16.2 Products/Solutions/Services offered

- 18.1.16.3 MnM view

- 18.1.16.3.1 Right to win

- 18.1.16.3.2 Strategic choices

- 18.1.16.3.3 Weaknesses and competitive threats

- 18.1.17 ITW FORMEX (ILLINOIS TOOL WORKS INC)

- 18.1.17.1 Business overview

- 18.1.17.2 Products/Solutions/Services offered

- 18.1.17.3 Recent developments

- 18.1.17.3.1 Deals

- 18.1.17.4 MnM view

- 18.1.17.4.1 Right to win

- 18.1.17.4.2 Strategic choices

- 18.1.17.4.3 Weaknesses and competitive threats

- 18.1.1 ARMACELL

- 18.2 OTHER PLAYERS

- 18.2.1 CLARK PACIFIC

- 18.2.2 ORANGE COUNTY THERMAL INDUSTRIES, INC.

- 18.2.3 FIRWIN CORPORATION

- 18.2.4 SHANDONG AOHUAN NEW MATERIAL TECHNOLOGY CO., LTD.

- 18.2.5 SUZHOU HANMING ELECTRONIC MATERIALS CO., LTD.

- 18.2.6 AUBURN MANUFACTURING, INC.

- 18.2.7 ENGINEERED MATERIALS

- 18.2.8 SOUTHLAND INSULATORS

19 ADJACENT AND RELATED MARKETS

- 19.1 INTRODUCTION

- 19.2 LIMITATIONS

- 19.3 EPP FOAM MARKET INTERCONNECTED MARKET

- 19.4 DATA CENTER COOLING MARKET - GLOBAL FORECAST TO 2032

- 19.4.1 MARKET DEFINITION

- 19.4.2 MARKET OVERVIEW

- 19.4.3 DATA CENTER COOLING MARKET, BY COMPONENT

- 19.4.3.1 Solutions

- 19.4.3.2 Services

- 19.5 INSULATION PRODUCTS MARKET - GLOBAL FORECAST TO 2029

- 19.5.1 MARKET DEFINITION

- 19.5.2 MARKET OVERVIEW

- 19.5.3 INSULATION PRODUCTS MARKET, BY INSULATION TYPE

- 19.5.3.1 Thermal insulation

- 19.5.3.2 Acoustic & other insulation

20 APPENDIX

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS

- 20.5 AUTHOR DETAILS