|

시장보고서

상품코드

1880374

보안, 취약성 관리(SVM) 시장 : 솔루션별, 표적별, 업계별, 지역별 - 예측(-2030년)Security & Vulnerability Management (SVM) Market by Solution (Vulnerability Assessment and Management, Configuration and Compliance, Asset Discovery and Inventory Management), Target (IT Infrastructure), Vertical, Region - Global Forecast to 2030 |

||||||

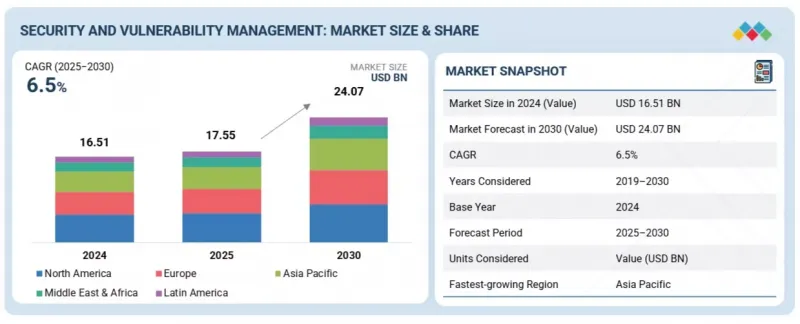

세계의 보안, 취약성 관리 시장 규모는 2025년 175억 5,000만 달러에서 2030년까지 240억 7,000만 달러에 이를 것으로 예측되어 예측 기간에 CAGR 6.5%의 성장이 전망됩니다.

타사 용도의 급속한 확산과 효과적인 취약점 관리 솔루션의 부재로 인한 재정적 손실과 데이터 유출 증가가 시장 성장의 주요 촉진요인으로 작용하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2019-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러/10억 달러 |

| 부문 | 제공, 전개 방식, 보안 유형, 표적, 업계, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

조직이 외부 소프트웨어 및 통합에 대한 의존도가 높아지면서 공격 표면이 확대되고, 새로운 보안 취약점과 컴플라이언스 리스크가 발생하고 있습니다. 적절한 취약점 관리가 이루어지지 않을 경우, 패치 미적용 및 설정이 잘못된 시스템은 사이버 공격의 침입 경로가 되어 심각한 업무적 피해와 금전적 손실을 초래할 수 있습니다. 이러한 잠재적 손실에 대한 인식이 높아지면서 기업들은 상호 연결된 환경을 보호하고 비즈니스 연속성을 보장하기 위해 첨단 취약성 평가, 지속적인 모니터링, 자동 복구 도구의 채택을 추진하고 있습니다.

산업별로는 제조 부문이 예측 기간 동안 가장 높은 CAGR을 보일 것으로 예측됩니다.

제조 부문은 업계가 급속한 디지털 전환과 산업 자동화를 경험하면서 가장 높은 성장률을 보일 것으로 예측됩니다. IoT, OT, IT 시스템의 통합으로 공격 표면이 확대되어 생산 네트워크와 공급망이 잠재적인 사이버 위협에 노출되어 있습니다. 제조업체들은 네트워크에 연결된 기계, 산업 제어 시스템, 클라우드 지원 플랫폼과 관련된 위험을 감지, 평가, 완화하고, 취약점 관리 솔루션을 채택하는 데 박차를 가하고 있습니다. 스마트팩토리, 로봇공학, 데이터 기반 경영에 대한 의존도가 높아지는 가운데, 다운타임을 방지하고 업무의 회복탄력성을 확보하기 위해서는 지속적인 보안 모니터링과 패치 관리가 요구됩니다. 랜섬웨어와 산업 스파이 증가도 예방적 보안 조치의 채택을 촉진하고 있습니다. 제조업이 인더스트리 4.0으로 전환함에 따라, 취약점 평가 및 관리 도구는 생산 환경을 보호하고 안전을 유지하며 진화하는 사이버 보안 컴플라이언스 표준에 대응하는 데 필수적인 요소로 자리 잡았습니다.

"배포 방식별로는 클라우드 부문이 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측됩니다. "

클라우드 구축 부문은 산업 전반에 걸친 클라우드 서비스 및 하이브리드 인프라 도입 증가로 인해 가장 높은 성장률을 보일 것으로 예측됩니다. 기업들은 확장성, 유연성, 비용 효율성을 위해 중요한 워크로드를 클라우드로 전환하고 있지만, 이러한 전환은 새로운 보안 문제를 야기할 수 있습니다. 클라우드 기반 취약점 관리 솔루션은 동적 클라우드 환경 전반에 걸쳐 실시간 가시성, 패치 적용 자동화, 지속적인 컴플라이언스 모니터링을 제공합니다. 이러한 플랫폼을 통해 기업은 가상 머신, 컨테이너, 클라우드 애플리케이션의 취약점을 식별하고 완화할 수 있습니다. SaaS와 멀티 클라우드 전략의 도입이 확대됨에 따라, 데이터 보호와 규제 준수를 보장하기 위해 통합 클라우드 네이티브 보안 솔루션이 필수적입니다. 집중적이고 배포가 용이하며 확장성이 뛰어난 보안 툴에 대한 수요가 증가함에 따라, 효율적이고 비용 효율적인 방식으로 사이버 보안 체계를 강화하고자 하는 중소기업을 중심으로 클라우드 기반 도입이 가속화되고 있습니다.

솔루션별로는 취약점 평가 및 관리 부문이 예측 기간 동안 시장을 주도할 것으로 예측됩니다.

조직이 잠재적인 보안 취약점을 적극적으로 감지하고 수정하는 것을 우선시함에 따라 취약점 평가 및 관리 부문이 가장 큰 시장 규모를 유지할 것으로 예측됩니다. 이러한 솔루션은 전체 IT 자산의 취약점을 지속적으로 스캔, 우선순위 지정 및 관리하여 새로운 위협에 대한 종합적인 보호를 보장합니다. 기업들은 엄격한 데이터 보안 규정과 업계 표준을 준수하기 위해 이러한 도구에 대한 의존도를 높이고 있습니다. 취약점 평가 플랫폼은 분석을 통해 실행 가능한 인사이트를 제공하고, 보안 팀이 중요한 위험에 집중하고 패치 관리 프로세스를 효율화할 수 있도록 도와줍니다. 하이브리드 환경의 복잡성과 시스템 취약성에 대한 실시간 가시성 확보에 대한 필요성이 증가하면서 광범위한 채택을 촉진하고 있습니다. 기업이 디지털 생태계로 전환하는 과정에서 취약점 평가 및 관리 솔루션은 견고한 보안 프레임워크 구축, 업무 연속성 확보, 비용이 많이 드는 사이버 사고 위험 최소화를 위한 기반이 됩니다.

세계의 보안 및 취약점 관리(SVM) 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 지견

- 보안, 취약성 관리 시장 기업에 있어서 매력적인 기회

- 보안, 취약성 관리 시장 : 제공별

- 보안, 취약성 관리 시장 : 솔루션별

- 보안, 취약성 관리 시장 : 취약성 평가 및 관리별

- 보안, 취약성 관리 시장 : 서비스별

- 보안, 취약성 관리 시장 : 전문 서비스별

- 보안, 취약성 관리 시장 : 전개 방식별

- 보안, 취약성 관리 시장 : 보안 유형별

- 보안, 취약성 관리 시장 : 표적별

- 보안, 취약성 관리 시장 : 업계별

- 보안, 취약성 관리 시장 : 지역별

제4장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 상호 접속된 시장과 부문의 횡단적인 기회

- 은행, 금융서비스 및 보험(BFSI)

- 의료

- 정부

- IT 및 ITeS

- 소매 및 E-Commerce

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- Porter의 Five Forces 분석

- 거시경제 지표

- 서론

- GDP 동향과 예측

- 세계의 ICT 업계 동향

- 세계의 사이버 보안 업계 동향

- 밸류체인 분석

- 컴포넌트 프로바이더

- 기술 제공업체

- 보안 솔루션 및 서비스 제공업체

- 시스템 통합사업자

- 판매 및 유통

- 최종사용자 그룹

- 생태계 분석

- 가격 결정 분석

- 소프트웨어 평균 가격 분석(2025년) : 솔루션별

- 소프트웨어 참고 가격 분석(2025년) : 벤더별

- 고객의 비즈니스에 영향을 미치는 동향과 혼란

- 주요 컨퍼런스 및 이벤트(2026년)

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세의 영향 - 보안 및 취약성 관리 시장

- 서론

- 주요 관세율

- 가격 영향 분석

- 국가/지역에 대한 영향

- 최종 이용 산업에 대한 영향

제6장 전략적 파괴 : 특허, 디지털 및 AI 채택

- 주요 신기술

- 취약성 평가와 스캔

- 패치 관리 시스템

- 설정 관리

- 위협 및 취약성 인텔리전스

- 리스크 기반 취약성 관리(RBVM)

- 컨테이너 및 클라우드 취약성 관리

- 애플리케이션 보안(APPSEC), SAST/DAST/IAST

- 엔드포인트 취약성 감지

- 보완 기술

- 보안 정보 및 이벤트 관리(SIEM)

- 보안 오케스트레이션, 자동화 및 대응(SOAR)

- 어셋 감지 및 재고 관리(CMDB)

- 침입 테스트 및 레드 팀 툴

- 익스포져(exposure) 관리 플랫폼

- 수복/티켓 발행 시스템

- DEVSECOPS/CI-CD 통합

- 기술/제품 로드맵

- 단기(2025년-2027년)|기반 구축, 조기 상업화

- 중기(2027년-2030년)|확대와 통합 리스크 관리

- 장기(2030년-2035년 이후)|자율 인텔리전트 익스포져(exposure) 관리

- 특허 분석

- 향후 응용

- AI 기반 리스크 베이스 취약성 관리(RBVM)

- 클라우드와 컨테이너 보안 자동화

- CTEM

- 양자 내성 취약성 관리

- 자율 수복과 보안 오케스트레이션

- 보안, 취약성 관리 시장에 대한 AI/생성형 AI의 영향

- 보안, 취약성 관리 시장 베스트 프랙티스

- 보안, 취약성 관리 시장 AI 도입 사례 연구

- 상호 접속된 인접 에코시스템과 시장 기업에 대한 영향

- 보안, 취약성 관리 시장 생성형 AI 채택에 대한 클라이언트 준비도

제7장 규제 상황

- 지역 규제와 컴플라이언스

- 규제기관, 정부기관 및 기타 조직

- 업계표준

제8장 소비자 상황과 구매 행동

- 의사결정 프로세스

- 바이어 이해관계자와 구입 평가 기준

- 구매 프로세스 주요 이해관계자

- 구입 기준

- 채택 장벽과 내부 과제

- 다양한 최종 이용 산업으로부터 미충족 요구

제9장 보안, 취약성 관리 시장 : 제공별

- 서론

- 솔루션

- 취약성 평가 및 관리

- 패치 및 수복 관리

- 자산 발견 및 재고 관리

- 구성 및 컴플라이언스

- 서비스

- 전문 서비스

- 매니지드 서비스

제10장 보안, 취약성 관리 시장 : 전개 방식별

- 서론

- On-Premise

- 클라우드

제11장 보안, 취약성 관리 시장 : 보안 유형별

- 서론

- 엔드포인트 보안

- 네트워크 보안

- 애플리케이션 보안

- 클라우드 보안

제12장 보안, 취약성 관리 시장 : 표적별

- 서론

- IT 인프라

- 컨텐츠 관리 취약성

- IoT 취약성

- API 취약성

- 기타 표적 취약성

제13장 보안, 취약성 관리 시장 : 업계별

- 서론

- 은행, 금융서비스 및 보험(BFSI)

- 의료

- 정부

- 제조

- 에너지 및 유틸리티

- IT 및 ITeS

- 소매 및 E-Commerce

- 통신

- 여행 및 호스피탈리티

- 기타 업계

제14장 보안, 취약성 관리 시장 : 지역별

- 서론

- 북미

- 북미의 보안 및 취약성 관리 시장 성장 촉진요인

- 미국

- 캐나다

- 유럽

- 유럽의 보안 및 취약성 관리 시장 성장 촉진요인

- 영국

- 독일

- 프랑스

- 이탈리아

- 스웨덴

- 덴마크

- 기타 유럽

- 아시아태평양

- 아시아태평양의 보안 및 취약성 관리 시장 성장 촉진요인

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- 중동 및 아프리카의 보안 및 취약성 관리 시장 성장 촉진요인

- 중동

- GCC

- 기타 중동

- 아프리카

- 남아프리카공화국

- 기타 아프리카

- 라틴아메리카

- 라틴아메리카의 보안 및 취약성 관리 시장 성장 촉진요인

- 브라질

- 멕시코

- 기타 라틴아메리카

제15장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점

- 매출 분석(2020년-2024년)

- 기업 평가와 재무 지표

- 시장 점유율 분석(2024년)

- 브랜드 비교

- MICROSOFT

- TENABLE

- CISCO

- CHECK POINT

- IBM

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제16장 기업 개요

- 주요 기업

- MICROSOFT

- TENABLE

- CISCO

- CHECK POINT

- IBM

- CROWDSTRIKE

- RAPID7

- FORTRA

- QUALYS

- SERVICENOW

- RSI SECURITY

- GFI SOFTWARE

- IVANTI

- TANIUM

- OUTPOST24

- TUFIN

- SECPOD

- BRINQA

- NOPSEC

- HOLM SECURITY

- BALBIX

- INTRUDER

- INVICTI

- NUCLEUS SECURITY

- CYCOGNITO

- BREACHLOCK

제17장 조사 방법

제18장 부록

LSH 25.12.10The security and vulnerability management market is projected to grow from USD 17.55 billion in 2025 to USD 24.07 billion by 2030 at a CAGR of 6.5% during the forecast period. The rapid growth in third-party application deployments and the rising financial and data losses resulting from the absence of effective vulnerability management solutions are key drivers of market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/USD Billion) |

| Segments | Offering, Deployment Mode, Security Type, Target, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

As organizations increasingly depend on external software and integrations, their attack surface expands, introducing new security gaps and compliance risks. Without proper vulnerability management, unpatched or misconfigured systems become entry points for cyberattacks, leading to significant operational and financial damage. This growing awareness of potential losses is pushing enterprises to adopt advanced vulnerability assessment, continuous monitoring, and automated remediation tools to secure interconnected environments and ensure business continuity.

"By vertical, the manufacturing segment is expected to witness the highest CAGR during the forecast period."

The manufacturing segment is expected to grow at the fastest rate as the industry undergoes rapid digital transformation and industrial automation. The integration of IoT, operational technology (OT), and information technology (IT) systems has expanded the attack surface, exposing production networks and supply chains to potential cyber threats. Manufacturers are increasingly adopting vulnerability management solutions to detect, assess, and mitigate risks associated with connected machinery, industrial control systems, and cloud-enabled platforms. The growing reliance on smart factories, robotics, and data-driven operations demands continuous security monitoring and patch management to prevent downtime and ensure operational resilience. Rising incidents of ransomware and industrial espionage are also driving the adoption of proactive security measures. As manufacturing companies move toward Industry 4.0 initiatives, vulnerability assessment and management tools are becoming vital for safeguarding production environments, maintaining safety, and meeting evolving cybersecurity compliance standards.

"By deployment, the cloud segment is projected to register the highest CAGR during the forecast period."

The cloud deployment segment is expected to grow at the fastest rate, driven by the increasing adoption of cloud services and hybrid infrastructures across industries. Organizations are migrating critical workloads to the cloud for scalability, flexibility, and cost efficiency, but this shift also introduces new security challenges. Cloud-based vulnerability management solutions offer real-time visibility, automated patching, and continuous compliance monitoring across dynamic cloud environments. These platforms enable enterprises to identify and mitigate vulnerabilities in virtual machines, containers, and cloud applications. The growing adoption of SaaS and multi-cloud strategies has made integrated cloud-native security solutions essential for ensuring data protection and regulatory compliance. The demand for centralized, easily deployable, and scalable security tools is accelerating cloud-based adoption, particularly among small and medium enterprises seeking efficient and cost-effective ways to enhance their cybersecurity posture.

By solution, the vulnerability assessment and management segment is expected to lead the market during the forecast period.

The vulnerability assessment and management segment is expected to hold the largest market size, as organizations prioritize proactive detection and remediation of potential security weaknesses. These solutions enable continuous scanning, prioritization, and management of vulnerabilities across IT assets, ensuring comprehensive protection against emerging threats. Enterprises increasingly rely on these tools to maintain compliance with stringent data security regulations and industry standards. Vulnerability assessment platforms provide actionable insights through analytics, helping security teams focus on critical risks and streamline patch management processes. The growing complexity of hybrid environments and the need for real-time visibility into system exposures are driving widespread adoption. As businesses transition to digital ecosystems, vulnerability assessment and management solutions serve as the foundation for building strong security frameworks, ensuring operational continuity, and minimizing the risk of costly cyber incidents.

Breakdown of Primaries

The study draws insights from a range of industry experts, including component suppliers, Tier 1 companies, and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: Directors - 35%, Managers - 25%, Others - 40%

- By Region: North America - 45%, Europe - 20%, Asia Pacific - 25%, Middle East & Africa - 5%, Latin America - 5%

Major vendors in the security and vulnerability management market include Microsoft (US), AT&T (US), CrowdStrike (US), IBM (US), Tenable (US), Cisco (US), DXC Technology (US), Qualys (US), Check Point (Israel), Rapid7 (US), ManageEngine (US), RSI Security (US), Fortra (US), Ivanti (US), and Tanium (US), GFI Software (US), Invicti (US), Outpost24 (Sweden), SecPod (India), Balbix (US), Intruder (UK), Brinqa (US), Holm Security (Sweden), Nucleus Security (US), NopSec (US), CyCognito (US), and Breachlock (US).

The study includes an in-depth competitive analysis of the key players in the security and vulnerability management market, their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the security and vulnerability management market and forecasts its size based on offering (solutions and services), deployment mode (on-premises and cloud), security type (endpoint security, network security, cloud security, application security), target (IT infrastructure, content management vulnerabilities, IoT vulnerabilities, API vulnerabilities, and others), and vertical (BFSI, healthcare, government, manufacturing, energy & utilities, IT & ITeS, retail & e-commerce, telecommunications, travel & hospitality, and others).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall security and vulnerability management market and its subsegments. This report will help stakeholders understand the competitive landscape and gain valuable insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increase in vulnerabilities globally, growth in third-party application deployments, high monetary and critical data losses due to the absence of vulnerability management solutions, stringent regulatory standards and data privacy compliances, security breaches due to internal vulnerabilities), restraints (Integration difficulty with existing complex systems), opportunities (need for advanced security solutions due to increasing industrialization, integration of advanced technologies with vulnerability management solutions for vulnerability prioritization and remediation, integration of vulnerability management and patch management solutions), and challenges (High initial installation, maintenance, and deployment costs, lack of appropriate parameters to prioritize risks, regularizing vulnerability management programs of organizations)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the security and vulnerability management market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the security and vulnerability management market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the security and vulnerability management market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the security and vulnerability management market, including Microsoft (US), AT&T (US), CrowdStrike (US), IBM (US), and Tenable (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 STAKEHOLDERS

- 1.3.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS & MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SECURITY AND VULNERABILITY MANAGEMENT MARKET

- 3.2 SECURITY AND VULNERABILITY MANAGEMENT MARKET, BY OFFERING

- 3.3 SECURITY AND VULNERABILITY MANAGEMENT MARKET, BY SOLUTION

- 3.4 SECURITY AND VULNERABILITY MANAGEMENT MARKET, BY VULNERABILITY ASSESSMENT AND MANAGEMENT

- 3.5 SECURITY AND VULNERABILITY MANAGEMENT MARKET, BY SERVICE

- 3.6 SECURITY AND VULNERABILITY MANAGEMENT MARKET, BY PROFESSIONAL SERVICE

- 3.7 SECURITY AND VULNERABILITY MANAGEMENT MARKET, BY DEPLOYMENT MODE

- 3.8 SECURITY AND VULNERABILITY MANAGEMENT MARKET, BY SECURITY TYPE

- 3.9 SECURITY AND VULNERABILITY MANAGEMENT MARKET, BY TARGET

- 3.10 SECURITY AND VULNERABILITY MANAGEMENT MARKET, BY VERTICAL

- 3.11 SECURITY AND VULNERABILITY MANAGEMENT MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Increase in vulnerabilities globally

- 4.2.1.2 Growth in third-party application deployments

- 4.2.1.3 High monetary and critical data losses due to absence of security and vulnerability management solutions

- 4.2.1.4 Stringent regulatory standards and data privacy compliance

- 4.2.1.5 Security breaches due to internal vulnerabilities

- 4.2.2 RESTRAINTS

- 4.2.2.1 Integration difficulty with existing complex systems

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Need for advanced security solutions due to increasing industrialization

- 4.2.3.2 Integration of advanced technologies with vulnerability management solutions for vulnerability prioritization and remediation

- 4.2.3.3 Integration of vulnerability management and patch management solutions

- 4.2.4 CHALLENGES

- 4.2.4.1 High initial installation, maintenance, and deployment costs

- 4.2.4.2 Lack of appropriate parameters to prioritize risks

- 4.2.4.3 Regularizing vulnerability management programs of organizations

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 BFSI

- 4.4.2 HEALTHCARE

- 4.4.3 GOVERNMENT

- 4.4.4 IT & ITES

- 4.4.5 RETAIL & E-COMMERCE

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL ICT INDUSTRY

- 5.2.4 TRENDS IN GLOBAL CYBERSECURITY INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 COMPONENT PROVIDERS

- 5.3.2 TECHNOLOGY PROVIDERS

- 5.3.3 SECURITY SOLUTION AND SERVICE PROVIDERS

- 5.3.4 SYSTEM INTEGRATORS

- 5.3.5 SALES AND DISTRIBUTION

- 5.3.6 END USER GROUPS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE PRICING ANALYSIS OF SOFTWARE, BY SOLUTION, 2025

- 5.5.2 INDICATIVE PRICING ANALYSIS OF SOFTWARE, BY VENDOR, 2025

- 5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 KEY CONFERENCES AND EVENTS IN 2026

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 CASE STUDY 1: INFOSYS RELIES ON QUALYS VMDR FOR BETTER VISIBILITY ACROSS RISKS

- 5.9.2 CASE STUDY 2: SAI GLOBAL USES RAPID7'S INSIGHTIDR TO PROTECT CLIENT'S HIGHLY SECURE AND REGULATED DATA

- 5.9.3 CASE STUDY 3: NETWORK INTELLIGENCE CHOSE TRIPWIRE INDUSTRIAL VISIBILITY TO SECURE ITS CRITICAL INFRASTRUCTURE SITES

- 5.9.4 CASE STUDY 4: QUANTIPHI RELIES ON TENABLE VULNERABILITY MANAGEMENT TO REDUCE CYBER RISK IN CLOUD

- 5.10 IMPACT OF 2025 US TARIFF - SECURITY AND VULNERABILITY MANAGEMENT MARKET

- 5.10.1 INTRODUCTION

- 5.10.2 KEY TARIFF RATES

- 5.10.3 PRICE IMPACT ANALYSIS

- 5.10.4 IMPACT ON COUNTRY/REGION

- 5.10.4.1 North America

- 5.10.4.2 Europe

- 5.10.4.3 Asia Pacific

- 5.10.5 IMPACT ON END-USE INDUSTRIES

6 STRATEGIC DISRUPTIONS: PATENTS, DIGITAL, AND AI ADOPTION

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 VULNERABILITY ASSESSMENT AND SCANNING

- 6.1.2 PATCH MANAGEMENT SYSTEMS

- 6.1.3 CONFIGURATION MANAGEMENT

- 6.1.4 THREAT AND VULNERABILITY INTELLIGENCE

- 6.1.5 RISK-BASED VULNERABILITY MANAGEMENT (RBVM)

- 6.1.6 CONTAINER & CLOUD VULNERABILITY MANAGEMENT

- 6.1.7 APPLICATION SECURITY (APPSEC) & SAST/DAST/IAST

- 6.1.8 ENDPOINT VULNERABILITY DETECTION

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 SECURITY INFORMATION & EVENT MANAGEMENT (SIEM)

- 6.2.2 SECURITY ORCHESTRATION, AUTOMATION & RESPONSE (SOAR)

- 6.2.3 ASSET DISCOVERY & INVENTORY MANAGEMENT (CMDB)

- 6.2.4 PENETRATION TESTING AND RED TEAM TOOLS

- 6.2.5 EXPOSURE MANAGEMENT PLATFORMS

- 6.2.6 REMEDIATION/TICKETING SYSTEMS

- 6.2.7 DEVSECOPS/CI-CD INTEGRATIONS

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.3.1 SHORT-TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 6.3.2 MID-TERM (2027-2030) | EXPANSION & INTEGRATED RISK MANAGEMENT

- 6.3.3 LONG-TERM (2030-2035+) | AUTONOMOUS & INTELLIGENT EXPOSURE MANAGEMENT

- 6.4 PATENT ANALYSIS

- 6.5 FUTURE APPLICATIONS

- 6.5.1 AI-DRIVEN RISK-BASED VULNERABILITY MANAGEMENT (RBVM)

- 6.5.2 CLOUD & CONTAINER SECURITY AUTOMATION

- 6.5.3 CONTINUOUS THREAT EXPOSURE MANAGEMENT (CTEM)

- 6.5.4 QUANTUM-RESILIENT VULNERABILITY MANAGEMENT

- 6.5.5 AUTONOMOUS REMEDIATION & SECURITY ORCHESTRATION

- 6.6 IMPACT OF AI/GEN AI ON SECURITY AND VULNERABILITY MANAGEMENT MARKET

- 6.6.1 BEST PRACTICES IN SECURITY AND VULNERABILITY MANAGEMENT MARKET

- 6.6.2 CASE STUDIES OF AI IMPLEMENTATION IN SECURITY AND VULNERABILITY MANAGEMENT MARKET

- 6.6.3 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS

- 6.6.4 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN SECURITY AND VULNERABILITY MANAGEMENT MARKET

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

8 CONSUMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

9 SECURITY AND VULNERABILITY MANAGEMENT MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.1.1 OFFERING: SECURITY AND VULNERABILITY MANAGEMENT MARKET DRIVERS

- 9.2 SOLUTIONS

- 9.2.1 VULNERABILITY ASSESSMENT AND MANAGEMENT

- 9.2.1.1 Identify, evaluate, prioritize, and remediate security weaknesses across their digital environments

- 9.2.1.2 Vulnerability Assessment and Scanning

- 9.2.1.3 Risk-based Vulnerability Management

- 9.2.1.4 OT/IoT Vulnerability Management

- 9.2.2 PATCH AND REMEDIATION MANAGEMENT

- 9.2.2.1 Tracking software updates and configuration changes across organization's digital assets

- 9.2.3 ASSET DISCOVERY AND INVENTORY MANAGEMENT

- 9.2.3.1 Automatically identify devices, workloads, and applications connected to network and maintain real-time inventory

- 9.2.4 CONFIGURATION AND COMPLIANCE

- 9.2.4.1 Ensuring configuration according to defined security baselines

- 9.2.1 VULNERABILITY ASSESSMENT AND MANAGEMENT

- 9.3 SERVICES

- 9.3.1 PROFESSIONAL SERVICES

- 9.3.1.1 Professional services offer expert team support and dedicated project consultancy for deployment

- 9.3.1.2 Consulting and advisory services

- 9.3.1.3 Integration services

- 9.3.1.4 Support and maintenance

- 9.3.2 MANAGED SERVICES

- 9.3.2.1 Managed services ensure expert technical support for seamless integration and operation of security and vulnerability management

- 9.3.2.2 Managed Vulnerability Scanning

- 9.3.2.3 Managed Patch and Remediation

- 9.3.2.4 Continuous Monitoring & Reporting

- 9.3.1 PROFESSIONAL SERVICES

10 SECURITY AND VULNERABILITY MANAGEMENT MARKET, BY DEPLOYMENT MODE

- 10.1 INTRODUCTION

- 10.1.1 DEPLOYMENT MODE: SECURITY AND VULNERABILITY MANAGEMENT MARKET DRIVERS

- 10.2 ON-PREMISES

- 10.2.1 ON-PREMISE SOLUTIONS PROVIDE ORGANIZATIONS WITH FULL CONTROL OVER ALL PLATFORMS

- 10.3 CLOUD

- 10.3.1 CLOUD DEPLOYMENT BENEFICIAL FOR ORGANIZATIONS WITH LIMITED SECURITY BUDGETS

11 SECURITY AND VULNERABILITY MANAGEMENT MARKET, BY SECURITY TYPE

- 11.1 INTRODUCTION

- 11.1.1 SECURITY TYPE: SECURITY AND VULNERABILITY MANAGEMENT MARKET DRIVERS

- 11.2 ENDPOINT SECURITY

- 11.2.1 INCREASING NEED TO IDENTIFY RISKS ON DEVICES TO PREVENT UNAUTHORIZED ACCESS

- 11.3 NETWORK SECURITY

- 11.3.1 VULNERABILITY MANAGEMENT IMPROVES NETWORK SECURITY BY REDUCING ATTACK SURFACE

- 11.4 APPLICATION SECURITY

- 11.4.1 APPLICATION SECURITY PROTECTS USER PRIVACY, UPHOLDS TRUST, AND ASSURES BUSINESS CONTINUITY

- 11.5 CLOUD SECURITY

- 11.5.1 EFFICIENT VULNERABILITY MANAGEMENT VITAL TO PRESERVE INTEGRITY, AVAILABILITY, AND CONFIDENTIALITY OF CLOUD-BASED ASSETS

12 SECURITY AND VULNERABILITY MANAGEMENT MARKET, BY TARGET

- 12.1 INTRODUCTION

- 12.1.1 TARGET: SECURITY AND VULNERABILITY MANAGEMENT MARKET DRIVERS

- 12.2 IT INFRASTRUCTURE

- 12.2.1 EFFECTIVE VULNERABILITY MANAGEMENT FOR IT INFRASTRUCTURE COMBINES AUTOMATED DISCOVERY, RISK-BASED PRIORITIZATION, AND CONTINUOUS MONITORING

- 12.3 CONTENT MANAGEMENT VULNERABILITIES

- 12.3.1 RISE IN AMOUNT OF CONTENT GENERATED IN INTER- AND INTRA-ORGANIZATIONS DUE TO DIGITALIZATION

- 12.4 IOT VULNERABILITY

- 12.4.1 VULNERABILITY MANAGEMENT HELPS MITIGATE RISKS BY CONTINUOUSLY SCANNING IOT NETWORKS

- 12.5 API VULNERABILITY

- 12.5.1 INCREASING CYBERATTACKS ON APIS TO DRIVE ADOPTION OF SECURITY AND VULNERABILITY MANAGEMENT SOLUTIONS

- 12.6 OTHER TARGET VULNERABILITIES

13 SECURITY AND VULNERABILITY MANAGEMENT MARKET, BY VERTICAL

- 13.1 INTRODUCTION

- 13.1.1 VERTICAL: SECURITY AND VULNERABILITY MANAGEMENT MARKET DRIVERS

- 13.2 BFSI

- 13.2.1 BFSI VERTICAL PRIORITIZES CUSTOMER PRIVACY AND SECURITY, ONLINE TRANSACTIONS, AND SENSITIVE INFORMATION

- 13.3 HEALTHCARE

- 13.3.1 HEALTHCARE SECTOR SECURES PERSONAL HEALTH INFORMATION AND CRITICAL DATA ABOUT PATIENTS

- 13.4 GOVERNMENT

- 13.4.1 VULNERABILITY MANAGEMENT HELPS GOVERNMENT AGENCIES COMPLY WITH STRICT CYBERSECURITY LAWS

- 13.5 MANUFACTURING

- 13.5.1 TECHNOLOGICAL ADVANCEMENTS IN MANUFACTURING VERTICAL TO DRIVE DEMAND FOR VULNERABILITY MANAGEMENT

- 13.6 ENERGY & UTILITIES

- 13.6.1 ENERGY COMPANIES FACE HIGHER RISKS OF CYBERATTACKS DISRUPTING POWER DISTRIBUTION, INCREASING SECURITY DEMAND

- 13.7 IT & ITES

- 13.7.1 IT ORGANIZATIONS HANDLE SIGNIFICANT SENSITIVE DATA AND CRITICAL OPERATIONS FOR GLOBAL CLIENTS, REQUIRING ADVANCED SECURITY SOLUTIONS

- 13.8 RETAIL & E-COMMERCE

- 13.8.1 INCREASING ATTACK SURFACE IN RETAIL SECTOR DUE TO WIDESPREAD USE OF INTERNET AND SMARTPHONES

- 13.9 TELECOMMUNICATIONS

- 13.9.1 VULNERABILITY SOLUTIONS LIKE THREAT INTELLIGENCE INTEGRATION OFFER TELECOM OPERATORS REAL-TIME INSIGHTS INTO EMERGING CYBER THREATS

- 13.10 TRAVEL & HOSPITALITY

- 13.10.1 SECURITY SOLUTIONS SAFEGUARD TRAVEL INDUSTRY NETWORKS, ENSURING CONTINUOUS AND SECURE CLIENT SERVICES

- 13.11 OTHER VERTICALS

14 SECURITY AND VULNERABILITY MANAGEMENT MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 NORTH AMERICA: SECURITY AND VULNERABILITY MANAGEMENT MARKET DRIVERS

- 14.2.2 US

- 14.2.2.1 Strong presence of security and vulnerability management vendors to drive market

- 14.2.3 CANADA

- 14.2.3.1 Increase in online fraud and malicious attacks to drive market

- 14.3 EUROPE

- 14.3.1 EUROPE: SECURITY AND VULNERABILITY MANAGEMENT MARKET DRIVERS

- 14.3.2 UK

- 14.3.2.1 Increase in investments in cyber defense to drive market

- 14.3.3 GERMANY

- 14.3.3.1 Advancement towards digitalization across all business areas to drive market

- 14.3.4 FRANCE

- 14.3.4.1 Increasing government initiatives and support to drive market

- 14.3.5 ITALY

- 14.3.5.1 Increasing cyberattacks due to rapid digitalization to drive market

- 14.3.6 SWEDEN

- 14.3.6.1 Increasing demand for security and vulnerability management solutions due to rising cyber terrorism threats to drive market

- 14.3.7 DENMARK

- 14.3.7.1 Deals and initiatives to enhance security and vulnerability management landscape to drive market

- 14.3.8 REST OF EUROPE

- 14.4 ASIA PACIFIC

- 14.4.1 ASIA PACIFIC: SECURITY AND VULNERABILITY MANAGEMENT MARKET DRIVERS

- 14.4.2 CHINA

- 14.4.2.1 Increasing investments in advanced tools for security and vulnerability management to drive market

- 14.4.3 JAPAN

- 14.4.3.1 Need for advanced security and vulnerability management solutions to minimize attack surfaces to drive market

- 14.4.4 INDIA

- 14.4.4.1 Increasing complexity of cyber threats to drive market

- 14.4.5 AUSTRALIA

- 14.4.5.1 Increasing awareness and demand for security and vulnerability management solutions and services to drive market

- 14.4.6 SOUTH KOREA

- 14.4.6.1 Rising adoption of internet-enabled products to drive market

- 14.4.7 REST OF ASIA PACIFIC

- 14.5 MIDDLE EAST & AFRICA

- 14.5.1 MIDDLE EAST & AFRICA: SECURITY AND VULNERABILITY MANAGEMENT MARKET DRIVERS

- 14.5.2 MIDDLE EAST

- 14.5.2.1 Increase in cyber threats and regulatory demands driving growth of market

- 14.5.3 GCC

- 14.5.3.1 Rise in government initiatives to reduce cybersecurity attacks to drive market

- 14.5.3.2 UAE

- 14.5.3.3 KSA

- 14.5.3.4 Rest of GCC Countries

- 14.5.4 REST OF MIDDLE EAST

- 14.5.5 AFRICA

- 14.5.5.1 Increase in cyberattacks due to growing internet penetration to drive market

- 14.5.6 SOUTH AFRICA

- 14.5.6.1 South Africa's digital revolution transforming its economy at record pace

- 14.5.7 REST OF AFRICA

- 14.6 LATIN AMERICA

- 14.6.1 LATIN AMERICA: SECURITY AND VULNERABILITY MANAGEMENT MARKET DRIVERS

- 14.6.2 BRAZIL

- 14.6.2.1 Increase in hacking incidents due to rise in digital penetration to drive market

- 14.6.3 MEXICO

- 14.6.3.1 Increase in adoption of cloud-based services and broadband to drive market

- 14.6.4 REST OF LATIN AMERICA

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 15.3 REVENUE ANALYSIS, 2020-2024

- 15.4 COMPANY VALUATION AND FINANCIAL METRICS

- 15.4.1 COMPANY VALUATION

- 15.4.2 FINANCIAL METRICS

- 15.5 MARKET SHARE ANALYSIS, 2024

- 15.6 BRAND COMPARISON

- 15.6.1 MICROSOFT

- 15.6.2 TENABLE

- 15.6.3 CISCO

- 15.6.4 CHECK POINT

- 15.6.5 IBM

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 Solution footprint

- 15.7.5.4 Deployment mode footprint

- 15.7.5.5 Vertical footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.8.5.1 Detailed list of key startups/SMEs

- 15.8.5.2 Competitive benchmarking of key startups/SMEs

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 15.9.2 DEALS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 MICROSOFT

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches/enhancements

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 TENABLE

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches/enhancements

- 16.1.2.3.2 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 CISCO

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Deals

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 CHECK POINT

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product launches/enhancements

- 16.1.4.3.2 Deals

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 IBM

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product launches/enhancements

- 16.1.5.3.2 Deals

- 16.1.5.3.3 Other developments

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 CROWDSTRIKE

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Product launches/enhancements

- 16.1.6.3.2 Deals

- 16.1.7 RAPID7

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product launches/enhancements

- 16.1.7.3.2 Deals

- 16.1.8 FORTRA

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Product launches/enhancements

- 16.1.9 QUALYS

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Product launches/enhancements

- 16.1.9.3.2 Deals

- 16.1.10 SERVICENOW

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product launches/enhancements

- 16.1.10.3.2 Deals

- 16.1.11 RSI SECURITY

- 16.1.12 GFI SOFTWARE

- 16.1.13 IVANTI

- 16.1.14 TANIUM

- 16.1.15 OUTPOST24

- 16.1.16 TUFIN

- 16.1.17 SECPOD

- 16.1.18 BRINQA

- 16.1.19 NOPSEC

- 16.1.20 HOLM SECURITY

- 16.1.21 BALBIX

- 16.1.22 INTRUDER

- 16.1.23 INVICTI

- 16.1.24 NUCLEUS SECURITY

- 16.1.25 CYCOGNITO

- 16.1.26 BREACHLOCK

- 16.1.1 MICROSOFT

17 RESEARCH METHODOLOGY

- 17.1 RESEARCH DATA

- 17.1.1 SECONDARY DATA

- 17.1.2 PRIMARY DATA

- 17.1.2.1 Breakup of primary profiles

- 17.1.2.2 Key industry insights

- 17.2 DATA TRIANGULATION

- 17.3 MARKET SIZE ESTIMATION

- 17.3.1 TOP-DOWN APPROACH

- 17.3.2 BOTTOM-UP APPROACH

- 17.4 MARKET FORECAST

- 17.5 RESEARCH ASSUMPTIONS

- 17.6 RESEARCH LIMITATIONS

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS