|

시장보고서

상품코드

1881223

커넥티드 워커 시장 : 제공 제품별, 접속성별, 용도별, 기술별, 업계별, 지역별 - 예측(-2030년)Connected Worker Market by Offering, Technology, Application and Vertical - Global Forecast to 2030 |

||||||

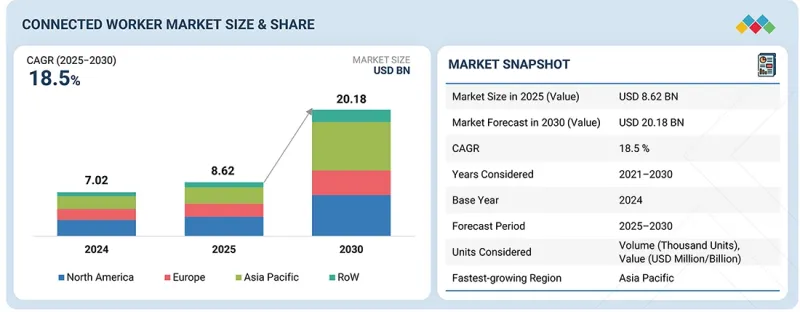

세계의 커넥티드 워커 시장 규모는 예측 기간 중에 CAGR 18.5%로 성장하여 2025년 86억 2,000만 달러에서 2030년까지 201억 8,000만 달러에 이를 것으로 예측됩니다.

원격 근무와 하이브리드 근무 모델의 확대는 현장 작업자와 일선 직원들의 업무 협업 및 업무 관리 방식을 변화시켰습니다. 이러한 모델은 사무실 근무, 원격 근무, 이동 중 근무를 통합하여 직원들이 하나의 물리적 작업 공간에 국한되지 않고 다양한 장소에서 생산성을 발휘할 수 있도록 합니다. 이러한 변화에 따라 분산된 팀 간의 원활한 커뮤니케이션을 실현하고, 직원들이 어디에서 일하든 연결 상태를 유지할 수 있는 고도의 협업 디지털 도구의 사용이 필수적입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 제공 제품별, 접속성별, 용도별, 기술별, 업계별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

현장 작업자나 외근 직원에게 이러한 도구는 대면 대화에 의존하던 실시간 정보 공유, 원격 문제 해결 및 작업 조정을 용이하게 해줍니다. 하이브리드 업무에는 다양한 일정과 환경에 적응할 수 있는 유연한 업무 관리 시스템이 필요하며, 단독 원격 근무와 직장 내 팀 협업을 모두 지원할 수 있는 유연한 업무 관리 시스템이 필요합니다. 이러한 기술은 소통의 격차를 해소하고, 원격으로 전문가 지원을 제공하며, 동적 스케줄링과 보고를 가능하게 함으로써 생산성을 유지하고, 직원들의 참여도를 높이며, 업무 연속성을 보장합니다. 그 결과, 커넥티드 워커 플랫폼은 강력한 협업과 안전 기준을 유지하면서 현장 직원들이 효율적으로 일할 수 있게 함으로써 하이브리드 인력 전략을 뒷받침하는 데 있어 매우 중요한 역할을 하고 있습니다.

2024년 산업용 사물인터넷(IIoT)은 산업 전반의 업무 효율성, 안전 및 생산성 향상에 핵심적인 역할을 수행하면서 커넥티드 워커 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. IIoT 지원 솔루션은 웨어러블 기기, 센서, 견고한 모바일 기기, 헤드 마운트 디스플레이를 통합하여 현장 직원들에게 실시간 데이터와 연결성을 제공합니다. IIoT 용도는 특히 제조업에서 중요한데, 예측 유지보수를 가능하게 하고 다운타임을 최소화할 수 있기 때문입니다. 건설 분야에서는 안전 기준 준수와 작업 효율성 향상에 기여하고, 에너지 및 유틸리티 분야에서는 설비 모니터링과 지속가능성 실천을 지원합니다. 산업 분야의 디지털 전환이 진행됨에 따라 IIoT 기반의 커넥티드 워커 솔루션은 앞으로도 시장을 주도하며 혁신을 촉진하고, 노동력의 생산성과 안전성을 향상시키는 데 기여할 것으로 기대됩니다.

커넥티드 워커 시장의 소프트웨어 부문은 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 소프트웨어 솔루션은 작업자의 안전, 생산성, 운영 효율성 향상에 필수적인 실시간 모니터링, 분석, 웨어러블 기기 및 IoT 센서와의 연계를 실현하는 데 있어 매우 중요합니다. 인공지능(AI), 머신러닝, 빅데이터 분석과 같은 기술의 발전은 커넥티드 워커 소프트웨어의 기능을 더욱 강화하여 작업자의 성과와 안전에 대한 실행 가능한 인사이트를 제공합니다. 이러한 추세는 디지털 전환과 스마트 인력 솔루션에 대한 수요가 가속화되고 있는 제조업, 건설업, 에너지 산업 등에서 특히 두드러지게 나타나고 있습니다. 조직들이 확장성과 비용 효율성을 추구하며 클라우드 기반 플랫폼을 채택하는 움직임이 강화되는 가운데, 소프트웨어 분야는 큰 폭의 성장이 예상되며, 커넥티드 워커 시장 확대에 크게 기여할 것으로 전망됩니다.

중국은 급속한 산업 자동화, '중국 제조 2025'를 포함한 강력한 정부 주도 정책, 산업용 IoT 및 디지털 인프라에 대한 막대한 투자로 인해 2025년부터 2030년까지 아시아태평양의 커넥티드 워커 시장을 주도할 것으로 예측됩니다. 대규모 제조거점, 인건비 상승, 기술 격차가 생산성, 효율성, 안전성 향상을 위한 커넥티드 워커 솔루션의 도입을 촉진하고 있습니다. 또한, 현지 기술 업체들의 기술 발전과 규제 준수에 대한 집중은 웨어러블 기기, 소프트웨어 플랫폼, 실시간 모니터링 시스템의 도입을 더욱 가속화하여 이 지역의 주요 촉진요인으로 작용하고 있습니다.

세계의 커넥티드 워커(Connected Worker) 시장을 조사했으며, 제공 제품별/연결 유형별/용도별/기술별/산업별/지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 고객의 비즈니스에 영향을 미치는 동향과 혼란

- 가격 분석

- 공급망 분석

- 생태계 분석

- 기술 분석

- 특허 분석

- 무역 분석

- 주요 컨퍼런스 및 이벤트

- 사례 연구 분석

- 투자 및 자금조달 시나리오

- 관세 및 규제 상황

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 인공지능이 커넥티드 워커 시장에 미치는 영향

- 2025년 미국 관세의 영향 - 커넥티드 워커 시장

제6장 커넥티드 워커 시장(제공 제품별)

- 서론

- 하드웨어

- 소프트웨어

- 서비스

제7장 커넥티드 워커 시장(접속성별)

- 서론

- WI-FI

- 5G

- LPWAN

- BLUETOOTH

- RFID와 NFC

- 기타

제8장 커넥티드 워커 시장(용도별)

- 서론

- 원격 지원 및 협업

- 작업자 안전 및 규정 준수

- 교육 및 스킬 개발

- 작업 관리 및 생산성 최적화

- 예측 유지보수

- 재고 및 자산 관리

- 기타

제9장 커넥티드 워커 시장(기술별)

- 서론

- 증강현실(AR) 및 가상현실(VR)

- 인공지능(AI)과 머신러닝

- 산업용 IoT

- 엣지 컴퓨팅

- 기타

제10장 커넥티드 워커 시장(업계별)

- 서론

- 제조

- 석유 및 가스

- 건설

- 헬스케어 및 의약품

- 자동차

- 항공우주 및 방위

- 광업

- 소매 및 창고업

- 운송 및 물류

- 유틸리티 및 에너지

- 기타

제11장 커넥티드 워커 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 폴란드

- 북유럽 국가

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 한국

- 인도

- 호주

- 인도네시아

- 말레이시아

- 태국

- 베트남

- 기타

- 기타 지역

- 기타 지역 거시경제 전망

- 중동

- 아프리카

- 남미

제12장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점, 2021년-2025년

- 매출 분석, 2022년-2024년

- 시장 점유율 분석, 2024년

- 기업 평가와 재무 지표

- 제품 비교

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제13장 기업 개요

- 서론

- 주요 시장 진출기업

- HONEYWELL INTERNATIONAL INC.

- MICROSOFT

- SIEMENS

- SCHNEIDER ELECTRIC

- PTC

- ZEBRA TECHNOLOGIES CORP.

- SYMPHONYAI

- HEXAGON AB

- INNOVAPPTIVE

- REALWEAR INC.

- 기타 기업

- PROGLOVE

- REDZONE

- TULIP INTERFACES, INC.

- POKA INC.

- LIBRESTREAM TECHNOLOGIES

- TAQTILE, INC.

- PLUTOMEN

- AATMUNN

- AUGMENTIR, INC.

- VSIGHT UAB

- VUZIX CORPORATION

- THIRDEYE GEN, INC.

- KOPIN

- ATHEER, INC.

- TREEDIS

제14장 부록

LSH 25.12.10The global connected worker market is expected to grow from USD 8.62 billion in 2025 to USD 20.18 billion by 2030, at a CAGR of 18.5% during the forecast period. The expansion of remote and hybrid work models has transformed how field and frontline workers collaborate and manage their tasks. These models blend in-office, remote, and on-the-go work, allowing employees to be productive from various locations rather than confined to a single physical workspace. This shift necessitates the use of advanced collaborative digital tools that enable seamless communication across distributed teams, ensuring that workers remain connected regardless of where they are working.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Technology, Connectivity, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

For frontline and field workers, such tools facilitate real-time information sharing, remote troubleshooting, and task coordination that would otherwise rely on face-to-face interactions. Hybrid work also requires flexible task management systems that adapt to different schedules and environments, supporting solitary remote work and coordinated team efforts at the workplace. These technologies help maintain productivity, enhance worker engagement, and ensure operational continuity by bridging communication gaps, providing remote expert support, and enabling dynamic scheduling and reporting. As a result, connected worker platforms have become critical in supporting hybrid workforce strategies, empowering frontline employees to work efficiently while maintaining strong collaboration and safety standards.

"Industrial Internet of Things (IIoT) segment accounted for the largest market share in 2024"

In 2024, the Industrial Internet of Things (IIoT) held the largest share of the connected worker market due to its pivotal role in enhancing operational efficiency, safety, and productivity across industries. IIoT-enabled solutions integrate wearable devices, sensors, rugged mobile equipment, and head-mounted displays to provide real-time data and connectivity for workers in the field. IIoT applications are particularly significant in manufacturing, enabling predictive maintenance and minimizing downtime. In construction, it improves safety compliance and workflow efficiency, while in energy and utilities, it supports equipment monitoring and sustainable practices. With industries increasingly embracing digital transformation, IIoT-driven connected worker solutions are expected to continue shaping the market, fostering innovation, and enhancing workforce productivity and safety.

"Software offering segment is projected to register the highest CAGR from 2025 to 2030"

The software segment within the connected worker market is projected to experience the highest CAGR during the forecast period. Software solutions are pivotal in enabling real-time monitoring, analytics, and integration with wearable devices and IoT sensors, which are essential for enhancing workforce safety, productivity, and operational efficiency. Advancements in technologies such as artificial intelligence (AI), machine learning, and big data analytics further enhance the capabilities of connected worker software, providing actionable insights into worker performance and safety. This trend is particularly evident in industries such as manufacturing, construction, and energy, where the demand for digital transformation and smart workforce solutions is accelerating. As organizations increasingly adopt cloud-based platforms for scalability and cost-effectiveness, the software segment is poised for significant growth, contributing substantially to the overall expansion of the connected worker market.

"China is likely to dominate the Asia Pacific connected worker market during the forecast period"

China is expected to dominate the Asia Pacific connected worker market from 2025 to 2030 due to its rapid industrial automation, strong government initiatives, including "Made in China 2025," and heavy investment in industrial IoT and digital infrastructure. The large manufacturing base, rising labor costs, and skills gap drive the adoption of connected worker solutions to improve productivity, efficiency, and safety. Additionally, advancements by local technology providers and a focus on regulatory compliance further accelerate the deployment of wearable devices, software platforms, and real-time monitoring systems, positioning them as the primary driver in the region.

Breakdown of Primaries

Various executives from key organizations operating in the connected worker market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1-45%, Tier 2-30%, and Tier 3-25%

- By Designation: C-level Executives-25%, Directors-35%, and Others-40%

- By Region: North America-35%, Europe-30%, Asia Pacific-25%, and RoW-10%

The connected worker market is dominated by globally established players, such as Zebra Technologies Corp. (US), Honeywell International Inc (US), Microsoft (US), Hexagon AB (Sweden), PTC (US), SymphonyAI (US), Innovapptive (US), ProGlove (Germany), Siemens (Germany), RealWear (US), Redzone (US), Schneider Electric (France), Tulip Interfaces, Inc. (US), POKA Inc. (Canada), Librestream Technologies (Canada), Taqtile, Inc. (US), Plutomen (India), Aatmunn (US), Augmentir, Inc. (US), VSight UAB (Lithuania), Vuzix Corporation (US), ThirdEye Gen, Inc. (US), Kopin (US), Atheer, Inc. (US), and Treedis (Israel). The study includes an in-depth competitive analysis of these key players in the connected worker market, with their company profiles, recent developments, and key market strategies.

Study Coverage

The report segments the connected worker market and forecasts its size by offering, technology, connectivity, application, vertical, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. The report includes a value chain analysis of the key players and their competitive analysis of the connected worker ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (Integration of IoT, AI, AR/VR, and 5G), restraints (High initial costs, complexity in integrating connected worker solutions with legacy systems), opportunities (Collaborative robotics and exoskeleton integration), and challenges (Lack of user adoption and workforce resistance) influencing the growth of the connected worker market

- Products/Solution/Service Development/Innovation: Detailed insights into upcoming technologies, research, and development activities in the connected worker market

- Market Development: Comprehensive information about lucrative markets-the report analyses the connected worker market across varied regions.

- Market Diversification: Exhaustive information about new hardware, software, services, untapped geographies, recent developments, and investments in the connected worker market

- Competitive Assessment: In-depth assessment of market shares and growth strategies and offerings of leading players, such as Honeywell International Inc (US), Microsoft (US), Siemens (Germany), Schneider Electric (France), PTC (US), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.2.2 INCLUSIONS AND EXCLUSIONS

- 1.2.3 YEARS CONSIDERED

- 1.2.4 CURRENCY CONSIDERED

- 1.2.5 UNIT CONSIDERED

- 1.3 LIMITATIONS

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Key data from primary sources

- 2.1.3.2 List of primary interview participants

- 2.1.3.3 Breakdown of primaries

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET SHARE ESTIMATION

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CONNECTED WORKER MARKET

- 4.2 CONNECTED WORKER MARKET, BY APPLICATION

- 4.3 CONNECTED WORKER MARKET, BY CONNECTIVITY

- 4.4 CONNECTED WORKER MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Integration of IoT, AI, AR/VR, and 5G

- 5.2.1.2 Growing regulatory requirements for data traceability, safety standards, and digital documentation in manufacturing and logistics

- 5.2.1.3 Increasing demand for operational efficiency through real-time task management and remote assistance

- 5.2.1.4 Expansion of cloud infrastructure supporting scalable, secure connected worker platforms

- 5.2.1.5 Growing emphasis on sustainability and ESG compliance

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial costs and complexity in integrating connected worker solutions with legacy systems

- 5.2.2.2 Data security and privacy concerns related to extensive workforce monitoring

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of connected worker platforms with collaborative robotics and exoskeleton technologies

- 5.2.3.2 Next-generation bio-sensing wearables

- 5.2.3.3 Integration of quantum-enhanced analytics for workforce optimization

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of user adoption and workforce resistance

- 5.2.4.2 Battery life limitations and device reliability in harsh environments

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF HANDHELD MOBILE COMPUTERS, BY REGION

- 5.4.2 AVERAGE SELLING PRICE TREND OF CONNECTED WORKER HARDWARE DEVICES, BY KEY PLAYER

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Wearable devices & smart PPE

- 5.7.1.2 Industrial internet of things (IIoT) & sensors

- 5.7.1.3 Mobile applications & digital workflows

- 5.7.1.4 Artificial intelligence & predictive analytics

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Blockchain

- 5.7.2.2 Cybersecurity solutions

- 5.7.2.3 Human-machine interfaces

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Industrial automation & robotics

- 5.7.3.2 Enterprise resource planning & workforce management software

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 EXPORT SCENARIO

- 5.9.2 IMPORT SCENARIO

- 5.10 KEY CONFERENCES AND EVENTS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 ELECTROLUX DRIVES OPERATIONAL EXCELLENCE THROUGH STANDARDIZED INDUSTRIAL CONNECTIVITY WITH PTC

- 5.11.2 VOLKSWAGEN TRANSFORMED VEHICLE MAINTENANCE EFFICIENCY AND SUSTAINABILITY WITH REALWEAR AND ATHEER CONNECTED WORKER SOLUTIONS

- 5.11.3 COLGATE-PALMOLIVE ENHANCED MANUFACTURING EFFICIENCY AND REDUCED TRAVEL COSTS WITH REALWEAR CONNECTED WORKER TECHNOLOGY

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 KEY REGULATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF ARTIFICIAL INTELLIGENCE ON CONNECTED WORKER MARKET

- 5.17 IMPACT OF 2025 US TARIFF - CONNECTED WORKER MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT OF COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON VERTICAL

6 CONNECTED WORKER MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 HARDWARE

- 6.2.1 WEARABLE DEVICES

- 6.2.1.1 Smart glasses & AR headsets

- 6.2.1.1.1 Need to enhance industrial efficiency and safety to drive market

- 6.2.1.2 Wristbands

- 6.2.1.2.1 Growing adoption of smart wristbands to drive market

- 6.2.1.3 Helmets and body sensors

- 6.2.1.3.1 Real-time monitoring of environmental hazards and biometric parameters to propel demand

- 6.2.1.4 Smart gloves

- 6.2.1.4.1 Reduced errors and faster inventory management cycles to drive adoption

- 6.2.1.5 Other wearable devices

- 6.2.1.1 Smart glasses & AR headsets

- 6.2.2 HANDHELD DEVICES

- 6.2.2.1 Handheld mobile computers

- 6.2.2.1.1 Support real-time workflow management, asset tracking, and seamless data exchange with enterprise systems

- 6.2.2.2 Other handheld mobile computers

- 6.2.2.1 Handheld mobile computers

- 6.2.3 INDUSTRIAL IOT SENSORS & EDGE DEVICES

- 6.2.3.1 Enable real-time safety, predictive maintenance, and Industry 4.0 workflows

- 6.2.4 COMMUNICATION & CONNECTIVITY DEVICES

- 6.2.4.1 Empower real-time collaboration and safety in connected worker ecosystem

- 6.2.5 ROBOTICS & AUTOMATION HARDWARE

- 6.2.5.1 AI-driven robotics and automation hardware augment human capabilities for digitally connected workforce

- 6.2.1 WEARABLE DEVICES

- 6.3 SOFTWARE

- 6.3.1 CLOUD-BASED SOFTWARE

- 6.3.1.1 Enable enterprises to centralize data and streamline digital workflows

- 6.3.2 ON-PREMISES SOFTWARE

- 6.3.2.1 Provide comprehensive digital workflow management, audit trail maintenance, and real-time process monitoring

- 6.3.1 CLOUD-BASED SOFTWARE

- 6.4 SERVICES

- 6.4.1 CONSULTING & ADVISORY SERVICES

- 6.4.1.1 Enable smooth digital workforce transformation

- 6.4.2 TRAINING & SUPPORT SERVICES

- 6.4.2.1 Accelerate adoption and maximize workforce efficiency in connected workplaces

- 6.4.3 MAINTENANCE & UPGRADES

- 6.4.3.1 Ensure reliability, continuity, and long-term performance of connected worker systems

- 6.4.4 OTHER SERVICES

- 6.4.1 CONSULTING & ADVISORY SERVICES

7 CONNECTED WORKER MARKET, BY CONNECTIVITY

- 7.1 INTRODUCTION

- 7.2 WI-FI

- 7.2.1 SUPPORTS DIGITAL WORKFLOWS, DATA STREAMING, AND COLLABORATION TOOLS FOR CONNECTED WORKER SOLUTIONS

- 7.3 5G

- 7.3.1 ULTRA-FAST DATA TRANSFER AND SUPPORT FOR HIGH DEVICE DENSITY TO DRIVE MARKET

- 7.4 LPWAN

- 7.4.1 EXTENSIVE RANGE AND EFFICIENCY TO PROPEL MARKET

- 7.5 BLUETOOTH

- 7.5.1 ENABLES PROXIMITY SERVICES AND WEARABLE INTEGRATION

- 7.6 RFID & NFC

- 7.6.1 NEED TO IMPROVE SAFETY COMPLIANCE AND PREVENT EQUIPMENT LOSS TO DRIVE MARKET

- 7.7 OTHER CONNECTIVITIES

8 CONNECTED WORKER MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 REMOTE ASSISTANCE & COLLABORATION

- 8.2.1 ENHANCED FIELD EFFICIENCY AND EQUIPMENT UPTIME TO DRIVE MARKET

- 8.3 WORKFORCE SAFETY & COMPLIANCE

- 8.3.1 FOCUS ON REDUCING RISKS AND ENSURING ADHERENCE TO REGULATORY STANDARDS IN INDUSTRIES TO PROPEL MARKET

- 8.4 TRAINING & SKILL DEVELOPMENT

- 8.4.1 NEED TO REDUCE ONBOARDING COSTS TO SUPPORT MARKET GROWTH

- 8.5 TASK MANAGEMENT & PRODUCTIVITY OPTIMIZATION

- 8.5.1 HIGHER THROUGHPUT AND OPERATIONAL EXCELLENCE TO PROPEL MARKET

- 8.6 PREDICTIVE MAINTENANCE

- 8.6.1 PREVENTING FAILURES AND OPTIMIZING ASSET LIFE CYCLES- KEY FACTORS DRIVING MARKET

- 8.7 INVENTORY & ASSET MANAGEMENT

- 8.7.1 ENHANCEMENT OF OPERATIONAL EFFICIENCY AND COST CONTROL TO DRIVE MARKET

- 8.8 OTHER APPLICATIONS

9 CONNECTED WORKER MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 AUGMENTED REALITY & VIRTUAL REALITY

- 9.2.1 IMMERSIVE AR AND VR TECHNOLOGIES TRANSFORM CONNECTED WORKER TRAINING AND SUPPORT

- 9.3 ARTIFICIAL INTELLIGENCE & MACHINE LEARNING

- 9.3.1 DRIVE PREDICTIVE INSIGHTS AND PERSONALIZED WORKFLOWS FOR CONNECTED WORKERS

- 9.4 INDUSTRIAL INTERNET OF THINGS

- 9.4.1 REAL-TIME DATA AND SAFETY INTELLIGENCE TO DRIVE MARKET

- 9.5 EDGE COMPUTING

- 9.5.1 DECENTRALIZED ANALYTICS ENHANCE WORKER SAFETY AND EFFICIENCY

- 9.6 OTHER TECHNOLOGIES

10 CONNECTED WORKER MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.2 MANUFACTURING

- 10.2.1 ENSURES EFFICIENCY, PRECISION, AND SAFETY ACROSS FACTORY FLOORS AND ASSEMBLY LINES

- 10.3 OIL & GAS

- 10.3.1 NEED FOR WORKFORCE SAFETY WHILE MAINTAINING OPERATIONAL CONTINUITY TO DRIVE MARKET

- 10.4 CONSTRUCTION

- 10.4.1 NEED TO IMPROVE SITE SAFETY, ENHANCE COLLABORATION, AND DELIVER PROJECTS ON SCHEDULE TO PROPEL MARKET

- 10.5 HEALTHCARE & PHARMACEUTICAL

- 10.5.1 INSTANT ALERTS IN EMERGENCIES TO PROPEL ADOPTION

- 10.6 AUTOMOTIVE

- 10.6.1 NEED TO ENHANCE ASSEMBLY LINE EFFICIENCY, IMPROVE WORKFORCE SAFETY, AND INCREASE OPERATIONAL AGILITY TO DRIVE MARKET

- 10.7 AEROSPACE & DEFENSE

- 10.7.1 ENHANCED MISSION-CRITICAL WORKFORCE PERFORMANCE IN DEFENSE TO PROPEL ADOPTION

- 10.8 MINING

- 10.8.1 CONNECTED WORKER PLATFORMS REVOLUTIONIZING HAZARD MANAGEMENT IN MINING

- 10.9 RETAIL & WAREHOUSING

- 10.9.1 GROWTH IN GLOBAL E-COMMERCE TO DRIVE MARKET

- 10.10 TRANSPORTATION & LOGISTICS

- 10.10.1 GROWTH OF GLOBAL TRADE AND E-COMMERCE TO DRIVE ADOPTION

- 10.11 UTILITIES & ENERGY

- 10.11.1 INTEGRATING DIGITAL WORKER PLATFORMS FOR SAFER ENERGY AND UTILITY SERVICES TO DRIVE MARKET

- 10.12 OTHER VERTICALS

11 CONNECTED WORKER MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Rapid commercialization of AR remote assistance to drive market

- 11.2.3 CANADA

- 11.2.3.1 Expansion of telecom infrastructure and industry digitalization programs to drive market

- 11.2.4 MEXICO

- 11.2.4.1 Advancing workforce digitization and safety innovation to propel market

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Adoption of Industry 4.0 and Industry 5.0 initiatives to support market growth

- 11.3.3 UK

- 11.3.3.1 Increasing digitalization in manufacturing, pharmaceutical, and logistics sectors to propel market

- 11.3.4 FRANCE

- 11.3.4.1 Government regulations to support market growth

- 11.3.5 SPAIN

- 11.3.5.1 Advanced wearable diagnostics and geofencing technologies to drive market

- 11.3.6 ITALY

- 11.3.6.1 Aging workforce and need to bridge skill gaps in high-value industries to support market growth

- 11.3.7 POLAND

- 11.3.7.1 AI-driven automation and IoT in manufacturing and logistics to drive market

- 11.3.8 NORDIC COUNTRIES

- 11.3.8.1 Integration of private 5G networks with bio-integrated wearables to propel market growth

- 11.3.9 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 AI-driven industrial upgrades in high-tech manufacturing hubs to propel market

- 11.4.3 JAPAN

- 11.4.3.1 Aging manufacturing workforce to drive adoption

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Accelerating smart worker adoption via 5G and AI innovation to drive market

- 11.4.5 INDIA

- 11.4.5.1 Workforce augmentation in diverse manufacturing sectors to propel market

- 11.4.6 AUSTRALIA

- 11.4.6.1 Rising deployment of IoT sensors and satellite-integrated wearable technologies to drive market

- 11.4.7 INDONESIA

- 11.4.7.1 Digital transformation in ICT and e-commerce sectors to propel market

- 11.4.8 MALAYSIA

- 11.4.8.1 Integrating connected worker platforms with multicultural workforce dynamics to drive growth

- 11.4.9 THAILAND

- 11.4.9.1 Integration of AR and biometrics via Bio-Circular-Green Model to drive market

- 11.4.10 VIETNAM

- 11.4.10.1 Workforce digitalization to accelerate industrial transition

- 11.4.11 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 MIDDLE EAST

- 11.5.2.1 Bahrain

- 11.5.2.1.1 Emerging hub for smart worker solutions amid digital transformation

- 11.5.2.2 Kuwait

- 11.5.2.2.1 Rise in industrial digitization to drive market

- 11.5.2.3 Oman

- 11.5.2.3.1 Increasing investments in digital workforce solutions to drive growth

- 11.5.2.4 Qatar

- 11.5.2.4.1 Government policies aimed at scaling digital workforce technologies to propel market

- 11.5.2.5 Saudi Arabia

- 11.5.2.5.1 Focus on industrial automation and workforce digitalization to propel market

- 11.5.2.6 United Arab Emirates

- 11.5.2.6.1 Robust digital infrastructure and policies prioritizing workforce connectivity and safety to drive market

- 11.5.2.7 Rest of Middle East

- 11.5.2.1 Bahrain

- 11.5.3 AFRICA

- 11.5.3.1 South Africa

- 11.5.3.1.1 Digitizing workforce safety in mining and manufacturing to drive growth

- 11.5.3.2 Rest of Africa

- 11.5.3.1 South Africa

- 11.5.4 SOUTH AMERICA

- 11.5.4.1 Industrial growth, regulatory support, and technological innovation to drive market

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 REVENUE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.5.1 COMPANY VALUATION

- 12.5.2 FINANCIAL METRICS

- 12.6 PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Regional footprint

- 12.7.5.3 Offering footprint

- 12.7.5.4 Technology footprint

- 12.7.5.5 Connectivity footprint

- 12.7.5.6 Application footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 HONEYWELL INTERNATIONAL INC.

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches

- 13.2.1.3.2 Deals

- 13.2.1.3.3 Others

- 13.2.1.4 MnM view

- 13.2.1.4.1 Key strengths/Right to win

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses/Competitive threats

- 13.2.2 MICROSOFT

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.4 MnM view

- 13.2.2.4.1 Key strengths/Right to win

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses/Competitive threats

- 13.2.3 SIEMENS

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.4 MnM view

- 13.2.3.4.1 Key strengths/Right to win

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses/Competitive threats

- 13.2.4 SCHNEIDER ELECTRIC

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches

- 13.2.4.3.2 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Key strengths/Right to win

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses/Competitive threats

- 13.2.5 PTC

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.4 MnM view

- 13.2.5.4.1 Key strengths/Right to win

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses/Competitive threats

- 13.2.6 ZEBRA TECHNOLOGIES CORP.

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services Offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Product launches

- 13.2.6.3.2 Deals

- 13.2.7 SYMPHONYAI

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.8 HEXAGON AB

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.3 Recent developments

- 13.2.9 INNOVAPPTIVE

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Deals

- 13.2.10 REALWEAR INC.

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.10.3 Recent developments

- 13.2.10.3.1 Product launches

- 13.2.10.3.2 Deals

- 13.2.1 HONEYWELL INTERNATIONAL INC.

- 13.3 OTHER PLAYERS

- 13.3.1 PROGLOVE

- 13.3.2 REDZONE

- 13.3.3 TULIP INTERFACES, INC.

- 13.3.4 POKA INC.

- 13.3.5 LIBRESTREAM TECHNOLOGIES

- 13.3.6 TAQTILE, INC.

- 13.3.7 PLUTOMEN

- 13.3.8 AATMUNN

- 13.3.9 AUGMENTIR, INC.

- 13.3.10 VSIGHT UAB

- 13.3.11 VUZIX CORPORATION

- 13.3.12 THIRDEYE GEN, INC.

- 13.3.13 KOPIN

- 13.3.14 ATHEER, INC.

- 13.3.15 TREEDIS

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS