|

시장보고서

상품코드

1881227

희토류 자석 시장 : 유형별, 제조 공정별, 최종 이용 산업별, 지역별 - 예측(-2030년)Rare Earth Magnets Market by Type (NdFeB, SmCo), Manufacturing Process (Sintered, Bonded), End-use Industry (Automotive, Consumer Electronics, Aerospace & Defense, Energy, Industrial, Other End-use Industries), and Region - Global Forecast to 2030 |

||||||

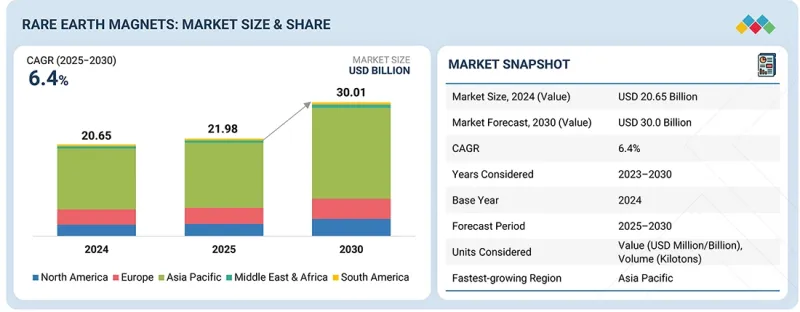

희토류 자석 시장 규모는 예측 기간 중에 CAGR 6.4%로 성장하여 2025년 219억 8,000만 달러에서 2030년까지 300억 1,000만 달러에 이를 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2023-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 가치(100만/10억 달러)/킬로톤 |

| 부문 | 유형별, 제조 공정별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 중동 및 아프리카, 남미 |

본 시장은 주로 소비자용 전자기기, 풍력 터빈, 전기자동차(EV) 등의 분야에서 수요 증가를 주요 요인으로 하여 빠른 성장이 예상됩니다. 이 자석은 뛰어난 강도와 에너지 효율로 유명하며, 현대 기술에 필수적인 가볍고 컴팩트한 디자인을 가능하게 합니다.

가전제품 분야에서는 디바이스의 소형화를 지원하고, 재생에너지 분야에서는 풍력 터빈의 효율 향상에 기여하고 있습니다. 또한, 전기자동차 산업에서 이러한 자석은 모터와 배터리의 성능 향상에 필수적입니다. 산업이 더 높은 에너지 효율과 지속가능성을 추구하는 가운데 희토류 자석은 그린 테크놀러지을 추진하는 데 중요한 역할을 할 것입니다.

향후 몇 년 동안 네오디뮴 자석(NdFeB)이 희토류 자석 시장에서 가장 큰 비중을 차지할 것으로 예측됩니다. 이는 주로 뛰어난 자기 강도와 고성능의 응용 효율성 때문입니다. 이러한 산업 확대는 가전제품, 로봇, 풍력 터빈, 전기자동차에 동자석을 사용했기 때문입니다. 그 결과, 전 세계적인 청정에너지와 전기화로의 전환을 배경으로 NdFeB와 같이 내구성과 경량성을 겸비한 자석이 모터 및 발전기 분야에서 큰 점유율을 차지하고 있습니다.

희토류 자석의 소결 제조 공정은 결합 자석보다 강하고 고온에서 안정성이 높으며 더 균일한 구조의 자석을 생산할 수 있기 때문에 널리 채택되고 있습니다. 이 방법을 통해 제조업체는 자석 내 결정립의 배열을 제어할 수 있으며, 우수한 자기 성능을 얻을 수 있습니다. 소결법은 전기자동차, 풍력 터빈, 산업용 모터 등 고성능 용도에 적합하며, 전 세계적으로 최우선 선택이 되고 있습니다.

희토류 자석의 자동차 최종 이용 산업에서의 적용은 빠르게 확대되고 있습니다. 전기자동차 및 하이브리드 자동차로의 급속한 전환에 따라 자동차 분야에서 희토류 자석의 채택이 증가하고 있습니다. 특히 네오디뮴 자석(NdFeB)은 고성능 전기 모터의 주요 구성 요소로 출력 밀도, 효율, 체적 효율의 향상을 실현합니다. 이를 통해 경량 설계가 가능해져 에너지 효율이 향상되고, 회생 제동, 파워 스티어링 등의 기능 도입을 촉진하여 새로운 모빌리티 시스템에 필수적인 존재가 되고 있습니다.

아시아태평양은 생산기지와 최종 사용 산업이 모두 위치한 중국, 일본, 한국의 제조기반으로 인해 세계 희토류 자석 시장을 선도할 것으로 추정됩니다. 이 지역, 특히 중국의 급속한 산업화와 전기자동차(EV) 혁명은 희토류 자석에 대한 엄청난 수요를 창출하고 있습니다. 이러한 소비는 급성장하는 전자기기 및 재생에너지 분야에 의해 더욱 가속화되고 있습니다. 이러한 성장은 청정에너지와 전기 모빌리티를 지향하는 정부 정책에 의해 뒷받침되고 있습니다. 또한, 중국의 풍부한 희토류 자원과 강력한 정제 능력은 이 지역을 세계적으로 매우 경쟁력 있는 지역으로 만들고 있습니다.

대상 기업: Proterial, Ltd(일본),Shin-Etsu Chemical(일본),TDK Corporation(일본),VACUUMSCHMELZE(독일),JL MAG Rare-Earth(중국),Beijing Zhong Ke San Huan High-tech(중국),Arnold Magnetic Technologies(미국),Neo Performance Materials(캐나다),Ningbo Yunsheng(중국),Adams Magnetic Products(미국) 등 Tech(중국), Arnold Magnetic Technologies(미국), Neo Performance Materials(캐나다), Ningbo Yunsheng(중국), Adams Magnetic Products(미국) 등이 본 보고서의 대상입니다.

희토류 자석 시장의 주요 기업에 대해 조사했으며, 기업 개요, 최근 동향, 주요 시장 전략 등 상세한 경쟁 분석을 실시했습니다.

조사 범위

본 조사 보고서는 희토류 자석 시장을 유형별(NdFeB, SmCo), 제조 공정별(소결, 본드), 최종 이용 산업별(자동차, 가전, 에너지, 산업, 항공우주 및 방위, 기타), 지역별(아시아태평양, 북미, 유럽, 남미, 중동/아프리카) 등으로 분류하여 조사했습니다. 분류하고 있습니다. 이 보고서의 조사 범위는 희토류 자석 시장의 성장에 영향을 미치는 촉진요인, 제약 요인, 과제 및 기회에 대한 자세한 정보를 다룹니다. 주요 산업 기업에 대한 상세한 분석을 통해 사업 개요, 제공 제품 및 희토류 자석 시장과 관련된 제휴 및 협력, 제품 출시, 사업 확장, 인수 등의 주요 전략에 대한 통찰력을 제공합니다. 본 보고서는 희토류 자석 시장 생태계에서 신생 스타트업 기업의 경쟁 분석도 다루고 있습니다.

본 보고서 구매의 장점

이 보고서는 시장 리더와 신규 시장 진출기업에게 전체 희토류 자석 시장 및 하위 부문의 수익 수치에 대한 가장 정확한 추정치를 제공합니다. 이해관계자들이 경쟁 구도를 이해하고, 자사의 포지셔닝을 강화하기 위한 통찰력을 키우고, 적절한 시장 진출 전략을 수립하는 데 도움이 될 수 있습니다. 시장 동향을 파악하고 주요 시장 성장 촉진요인, 제약요인, 과제, 기회요인에 대한 정보를 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 미충족 요구와 공백

- 연결된 시장과 분야간 기회

- Tier1/2/3 기업의 전략적 움직임

제6장 업계 동향

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 생태계 분석

- 무역 분석

- 2025년 주요 컨퍼런스 및 이벤트

- Porter의 Five Forces 분석

- 사례 연구 분석

- 거시경제 분석

- 투자 및 자금조달 시나리오

- 2025년 미국 관세가 희토류 자석 시장에 미치는 영향

- 기술, 특허, 디지털 및 인공지능 도입을 통한 전략적 파괴

- 기술/제품 로드맵

- 특허 분석

- 향후 응용

- AI/생성형 AI가 희토류 자석 시장에 미치는 영향

- 성공 사례와 실세계에의 응용

제7장 지속가능성과 규제 상황

- 지역 규제와 컴플라이언스

- 지속가능성 이니셔티브

- 인증, 라벨 및 환경기준

- 고객 상황과 구매 행동

- 의사결정 프로세스

- 구입자 이해관계자와 구입 평가 기준

- 채택 장벽과 내부 과제

- 다양한 최종 이용 산업의 미충족 요구

- 시장 수익성

제8장 희토류 자석 시장(유형별)

- 서론

- 네오디뮴, 철 및 붕소 자석

- 사마륨 코발트 자석

제9장 희토류 자석 시장(제조 공정별)

- 서론

- 소결

- 접합

제10장 희토류 자석 시장(최종 이용 산업별)

- 서론

- 자동차

- 가전

- 항공우주 및 방위

- 산업

- 에너지

- 기타

제11장 희토류 자석 시장(지역별)

- 서론

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 인도네시아

- 기타

- 유럽

- 독일

- 프랑스

- 이탈리아

- 영국

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

제12장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제13장 기업 개요

- 주요 시장 진출기업

- PROTERIAL, LTD.

- SHIN-ETSU CHEMICAL CO., LTD.

- TDK CORPORATION

- VACUUMSCHMELZE

- JL MAG RARE-EARTH CO., LTD.

- BEIJING ZHONG KE SAN HUAN HI-TECH CO., LTD.

- ARNOLD MAGNETIC TECHNOLOGIES

- NEO PERFORMANCE MATERIALS

- NINGBO YUNSHENG CO., LTD.

- ADAMS MAGNETIC PRODUCTS

- YANTAI ZHENGHAI MAGNETIC MATERIAL CO., LTD.

- 기타 기업

- NOVEON MAGNETICS INC.

- STANFORD MAGNETS

- PERMAG

- GOUDSMIT MAGNETICS

- BAKKER MAGNETICS BV

- RAREARTH S.R.L.

- BAOTOU TIANHE MAGNETICS TECHNOLOGY CO., LTD.

- BELOH MAGNETSYSTEME GMBH & CO. KG

- EARTH-PANDA ADVANCED MAGNETIC MATERIAL CO., LTD.

- VULCAN ELEMENTS

- DAIDO ELECTRONICS CO., LTD.

- ABM MAGNETICS CO., LTD.

- DURA MAGNETS PVT. LTD.

- MAGSUPER(DONGGUAN) CORP.

- HANGZHOU PERMANENT MAGNET GROUP, LTD.

제14장 부록

LSH 25.12.10The rare earth magnets market is projected to grow from USD 21.98 billion in 2025 to USD 30.01 billion by 2030, at a CAGR of 6.4% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) / Volume (Kiloton) |

| Segments | Type, Manufacturing Process, End-use Industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

This market is set for rapid growth, primarily driven by rising demand in sectors like consumer electronics, wind turbines, and electric vehicles (EVs). These magnets are renowned for their exceptional strength and energy efficiency, enabling lightweight and compact designs essential for modern technology.

In consumer electronics, they support the miniaturization of devices, while in renewable energy, they enhance the efficiency of wind turbines. Additionally, the electric vehicle industry relies on these magnets for improved motor and battery performance. As industries move toward greater energy efficiency and sustainability, rare earth magnets will play a crucial role in advancing green technology.

"The NdFeB segment projected to be the faster-growing market during the forecast period."

In the next years, it is estimated that neodymium-iron-boron (NdFeB) magnets will account for the largest percentage of the increase of the rare earth magnets market. This is basically due to their exceptionally strong magnetic power and high-performance application efficiency. The industry expansion is attributed to the usage of such magnets in consumer electronic devices, robots, wind turbines, and electric vehicles. Consequently, driven by the worldwide shift to clean energy and electrification, durable and light magnets such as NdFeB are gaining a significant share in the motors and generators.

"The sintered segment is projected to be the larger segment during the forecast period."

The sintered manufacturing process for rare earth magnets is widely used because it produces magnets that are stronger, more stable at higher temperatures, and have a more uniform structure than bonded magnets. This method lets manufacturers control the alignment of grains in the magnets, resulting in better magnetic performance. Sintering works well for high-performance uses like electric vehicles, wind turbines, and industrial motors, making it the top choice worldwide.

"The automotive segment market is projected to have the fastest growth during the forecast period."

The rare earth magnets have an increasingly rapid application in the automotive end-use industry. The employment of rare earth magnets in the automobile sector is increasing as a result of the fast change to electric and hybrid vehicles. Such magnets, particularly the NdFeB kinds, are the main source of the high-performance electric motors. They offer improved power density, efficiency, and volume. These enable lighter designs, enhance energy efficiency, and facilitate the use of features such as regenerative braking and power steering, thus, they become indispensable for the new mobility systems.

"In terms of value, the Asia Pacific rare earth magnets market is projected to grow at the highest CAGR during the forecast period."

Asia Pacific is estimated to lead the global market of rare earth magnets because of its manufacturing base mainly in China, Japan, and South Korea, where both producers and end-use industries are located. The fast industrialization and electric vehicle (EV) revolution in the area, particularly in China, creates an enormous demand for rare earth magnets. The consumption is further intensified by the booming electronics and renewable energy sectors. The growth is backed by government policies aimed at clean energy and electric mobility. Besides, China's plentiful rare earth resources and its strong refining capabilities make the region very competitive worldwide.

By Company Type: Tier 1: 55%, Tier 2: 30%, and Tier 3: 15%

By Designation: C-level Executives: 30%, Directors: 25%, and Other Designations: 45%

By Region: North America: 27%, Europe: 20%, Asia Pacific: 33%, South America: 12%, and Middle East & Africa 8%

Notes: Other designations include sales, marketing, and product managers

Tier 1: Greater than USD 1 billion; Tier 2: Between USD 500 million and USD 1 billion; and Tier 3: Lesser than USD 500 million

Companies Covered: Proterial, Ltd. (Japan), Shin-Etsu Chemical Co., Ltd. (Japan), TDK Corporation (Japan), VACUUMSCHMELZE (Germany), JL MAG Rare-Earth Co., Ltd. (China), Beijing Zhong Ke San Huan High-Tech Co., Ltd. (China), Arnold Magnetic Technologies (US), Neo Performance Materials (Canada), Ningbo Yunsheng Co., Ltd. (China), and Adams Magnetic Products (US), among others, are covered in the report.

The study includes an in-depth competitive analysis of these key players in the rare earth magnets market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the rare earth magnets market based on type (NdFeB, SmCo), manufacturing process (sintered, bonded), end-use industry (automotive, consumer electronics, energy, industrial, aerospace & defense, others), and region (Asia Pacific, North America, Europe, South America, and the Middle East & Africa). The report's scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the rare earth magnets market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, and key strategies, such as partnerships, collaborations, product launches, expansions, and acquisitions, associated with the rare earth magnets market. This report covers a competitive analysis of upcoming startups in the rare earth magnets market ecosystem.

Reasons to Buy the Report

The report will offer the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall rare earth magnets market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (electric mobility growth, expansion of wind energy, push for supply chain security), restraints (raw material price volatility, environmental effects of rare earth magnets), opportunities (diversification in rare earth magnets production, recycled rare earth magnets, growing demand in emerging applications), and challenges (regulatory and trade obstacles, scaling, infrastructure & capital costs).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the rare earth magnets market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the rare earth magnets market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the rare earth magnets market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Proterial, Ltd. (Japan), Shin-Etsu Chemical Co., Ltd. (Japan), TDK Corporation (Japan), VACUUMSCHMELZE (Germany), JL MAG Rare-Earth Co., Ltd. (China), Beijing Zhong Ke San Huan High-Tech Co., Ltd. (China), Arnold Magnetic Technologies (US), Neo Performance Materials (Canada), Ningbo Yunsheng Co., Ltd. (China), and Adams Magnetic Products (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 RARE EARTH MAGNETS MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 SUPPLY-SIDE APPROACH

- 2.4 GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RARE EARTH MAGNETS MARKET

- 4.2 RARE EARTH MAGNETS MARKET, BY TYPE

- 4.3 RARE EARTH MAGNETS MARKET, BY MANUFACTURING PROCESS

- 4.4 RARE EARTH MAGNETS MARKET, BY END-USE INDUSTRY

- 4.5 ASIA PACIFIC: RARE EARTH MAGNETS MARKET, BY END-USE INDUSTRY & COUNTRY

- 4.6 RARE EARTH MAGNETS MARKET, BY KEY COUNTRIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.1.1 DRIVERS

- 5.1.1.1 Electric mobility growth

- 5.1.1.1.1 Expansion of wind energy

- 5.1.1.2 Push for supply chain security

- 5.1.1.1 Electric mobility growth

- 5.1.2 RESTRAINTS

- 5.1.2.1 Raw material price volatility

- 5.1.2.2 Environmental effects of rare earth magnets

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Diversification in rare earth magnets production

- 5.1.3.2 Recycled rare earth magnets

- 5.1.3.3 Growing demand in emerging applications

- 5.1.4 CHALLENGES

- 5.1.4.1 Regulatory and trade obstacles

- 5.1.4.2 Scaling, infrastructure & capital costs

- 5.1.1 DRIVERS

- 5.2 UNMET NEEDS AND WHITE SPACES

- 5.2.1 SUPPLY CHAIN DIVERSIFICATION AND SECURITY

- 5.2.2 HEAVY RARE EARTH ELEMENT AVAILABILITY

- 5.2.3 MINIATURIZATION AND PERFORMANCE OPTIMIZATION

- 5.2.4 SUSTAINABILITY AND RESOURCE ALTERNATIVES

- 5.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.3.1 INTERCONNECTED MARKETS

- 5.3.2 CROSS-SECTOR OPPORTUNITIES

- 5.4 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- 5.4.1 TIER 1 PLAYERS: GLOBAL LEADERS DRIVING EXPANSION AND INNOVATION

- 5.4.1.1 Proterial, Ltd.'s product innovation

- 5.4.1.2 TDK Corporation invests in closed-loop metal extraction process

- 5.4.2 TIER 2 PLAYERS: REGIONAL INNOVATORS AND NICHE LEADERS

- 5.4.2.1 JL MAG Rare-Earth Co., Ltd.'s potential expansion

- 5.4.2.2 Neo Performance Materials' expansion of manufacturing facility in Europe

- 5.4.3 TIER 3 PLAYERS: AGILE INNOVATORS AND RECYCLING TECHNOLOGIES

- 5.4.3.1 M2M Magnet-to-Magnet recycling process of Noveon Magnetics Inc.

- 5.4.3.2 Circular process of recycling by Rarearth S.r.l

- 5.4.1 TIER 1 PLAYERS: GLOBAL LEADERS DRIVING EXPANSION AND INNOVATION

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPE

- 6.2.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TRADE ANALYSIS

- 6.5.1 IMPORT DATA (HS CODE 850519)

- 6.5.2 EXPORT DATA (HS CODE 850519)

- 6.6 KEY CONFERENCES AND EVENTS, 2025

- 6.7 PORTER'S FIVE FORCES' ANALYSIS

- 6.7.1 THREAT OF NEW ENTRANTS

- 6.7.2 THREAT OF SUBSTITUTES

- 6.7.3 BARGAINING POWER OF SUPPLIERS

- 6.7.4 BARGAINING POWER OF BUYERS

- 6.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.8 CASE STUDY ANALYSIS

- 6.8.1 ENHANCING ELECTRIC MOTOR EFFICIENCY WITH VAC'S ADVANCED MAGNETIC MATERIALS

- 6.8.2 HEAVY RARE EARTH-FREE MAGNETS FOR EVS: PROTERIAL'S NMX SERIES

- 6.8.3 SUSTAINABLE RARE EARTH MAGNETS THROUGH NOVEON'S ECOFLUX MAGNETS

- 6.9 MACROECONOMIC ANALYSIS

- 6.9.1 INTRODUCTION

- 6.9.2 GDP TRENDS AND FORECASTS

- 6.9.3 EXPANSION OF RENEWABLE ENERGY INFRASTRUCTURE

- 6.9.4 ELECTRIFICATION OF GLOBAL VEHICLE FLEET

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 IMPACT OF 2025 US TARIFF ON RARE EARTH MAGNETS MARKET

- 6.11.1 INTRODUCTION

- 6.11.2 KEY TARIFF RATES

- 6.11.3 PRICE IMPACT ANALYSIS

- 6.11.4 KEY IMPACT ON COUNTRIES/REGIONS

- 6.11.4.1 US

- 6.11.4.2 Europe

- 6.11.4.3 Asia Pacific

- 6.11.5 IMPACT ON END-USE SECTORS

- 6.12 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 6.12.1 KEY TECHNOLOGIES

- 6.12.1.1 Laser powder bed fusion (LPBF) technology

- 6.12.1.2 Hydrogenation disproportionation desorption and recombination (HDDR)

- 6.12.2 COMPLEMENTARY TECHNOLOGIES

- 6.12.2.1 Grain boundary diffusion technology

- 6.12.1 KEY TECHNOLOGIES

- 6.13 TECHNOLOGY/PRODUCT ROADMAP

- 6.13.1 SHORT-TERM (2025-2027) | INITIAL GROWTH AND DIGITAL INTEGRATION PHASE

- 6.13.2 MID-TERM (2027-2030): MATERIAL INNOVATION AND SUSTAINABILITY EXPANSION PHASE

- 6.13.3 LONG-TERM (2030-2035+): INTEGRATED ECOSYSTEM AND NEXT-GENERATION MATERIALS PHASE

- 6.14 PATENT ANALYSIS

- 6.14.1 INTRODUCTION

- 6.14.2 APPROACH

- 6.14.3 DOCUMENT TYPE

- 6.14.4 JURISDICTION ANALYSIS

- 6.14.5 TOP APPLICANTS

- 6.15 FUTURE APPLICATIONS

- 6.15.1 ADVANCED HIGH-EFFICIENCY MOTORS AND GENERATORS (ELECTRIC VEHICLES & WIND TURBINES)

- 6.15.2 MINIATURIZED MAGNETIC ACTUATORS & SENSORS (CONSUMER ELECTRONICS, IOT, MEDICAL DEVICES)

- 6.15.3 WIRELESS POWER TRANSFER & MAGNETIC LEVITATION SYSTEMS (AUTONOMOUS VEHICLES, URBAN MOBILITY)

- 6.15.4 DATA STORAGE AND COMPUTATIONAL MAGNETICS (SPINTRONICS & MAGNETIC MEMORY)

- 6.16 IMPACT OF AI/GEN AI ON RARE EARTH MAGNETS MARKET

- 6.16.1 TOP USE CASES AND MARKET POTENTIAL

- 6.16.2 BEST PRACTICES IN RARE EARTH MAGNETS PROCESSING

- 6.16.3 CASE STUDIES OF AI IMPLEMENTATION IN RARE EARTH MAGNETS MARKET

- 6.16.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.16.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN RARE EARTH MAGNETS MARKET

- 6.17 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.17.1 PROTERIAL HIGH-PERFORMANCE HEAVY-RARE-EARTH-FREE NEODYMIUM SINTERED MAGNETS

- 6.17.2 HEAVY RARE EARTH-FREE MAGNETS DEVELOPMENT

- 6.17.3 VERSATILE NDFEB MAGNET GRADES FOR BROAD INDUSTRIAL APPLICATION

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CIRCULAR ECONOMY AND RECYCLING INITIATIVES

- 7.2.1.1 Magnet-to-magnet recycling technologies

- 7.2.1.2 Circular supply chains and industrial implementation

- 7.2.1.3 Closed-loop magnet lifecycle projects

- 7.2.1 CIRCULAR ECONOMY AND RECYCLING INITIATIVES

- 7.3 CERTIFICATIONS, LABELING, ECO-STANDARDS

- 7.4 CUSTOMER LANDSCAPE AND BUYER BEHAVIOUR

- 7.5 DECISION-MAKING PROCESS

- 7.6 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 7.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.6.2 BUYING CRITERIA

- 7.7 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 7.8 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 7.9 MARKET PROFITABILITY

- 7.9.1 REVENUE POTENTIAL

- 7.9.2 COST DYNAMICS

- 7.9.3 MARGIN OPPORTUNITIES, BY END-USE INDUSTRIES

8 RARE EARTH MAGNETS MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 NEODYMIUM-IRON-BORON MAGNET

- 8.2.1 RISING ELECTRIFICATION AND CLEAN ENERGY TRANSITION DRIVING ADOPTION

- 8.3 SAMARIUM-COBALT MAGNET

- 8.3.1 STRATEGIC MATERIAL POLICIES AND DEMAND IN HIGH-TEMPERATURE APPLICATIONS TO PROPEL MARKET GROWTH

9 RARE EARTH MAGNETS MARKET, BY MANUFACTURING PROCESS

- 9.1 INTRODUCTION

- 9.2 SINTERED

- 9.2.1 DEMAND FOR HIGH PERFORMANCE AND DURABILITY FUELING ADOPTION

- 9.3 BONDED

- 9.3.1 GROWING DEMAND IN EVOLVING END-USE APPLICATIONS TO SUPPORT MARKET GROWTH

10 RARE EARTH MAGNETS MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 AUTOMOTIVE

- 10.2.1 GROWTH IN ELECTRIC VEHICLES TO DRIVE MARKET GROWTH

- 10.3 CONSUMER ELECTRONICS

- 10.3.1 INCREASING DEMAND FOR CONSUMER ELECTRONICS TO DRIVE MARKET GROWTH

- 10.4 AEROSPACE & DEFENSE

- 10.4.1 EXPANSION OF AEROSPACE & DEFENSE SECTOR INCREASING ADOPTION OF HIGH-POWER RARE EARTH MAGNETS

- 10.5 INDUSTRIAL

- 10.5.1 GROWING AUTOMATION IN MANUFACTURING TO DRIVE MARKET GROWTH

- 10.6 ENERGY

- 10.6.1 INCREASE IN OFFSHORE WIND ENERGY TO DRIVE MARKET GROWTH

- 10.7 OTHER END-USE INDUSTRIES

11 RARE EARTH MAGNETS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Availability of vast rare earth deposits to drive market

- 11.2.2 JAPAN

- 11.2.2.1 Government-supported initiatives for domestic production to drive market

- 11.2.3 INDIA

- 11.2.3.1 Rapid expansion of EVs and government incentives to drive market

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Expansion of automotive industry to support market growth

- 11.2.5 INDONESIA

- 11.2.5.1 Government push toward electric vehicle adoption and carbon reduction to drive market

- 11.2.6 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Expansion of wind energy and increase in EVs to drive market growth

- 11.3.2 FRANCE

- 11.3.2.1 Rare earth magnets recycling initiatives to support market growth

- 11.3.3 ITALY

- 11.3.3.1 Growth in wind energy sector to increase demand

- 11.3.4 UK

- 11.3.4.1 Expansion of automotive and energy industries to boost market growth

- 11.3.5 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 NORTH AMERICA

- 11.4.1 US

- 11.4.1.1 Government initiatives to propel market growth

- 11.4.2 CANADA

- 11.4.2.1 Investments in offshore wind energy development to drive market

- 11.4.3 MEXICO

- 11.4.3.1 Expanding automotive and EV manufacturing base to drive growth

- 11.4.1 US

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Growth in wind energy and EV manufacturing to drive market growth

- 11.5.1.2 UAE

- 11.5.1.2.1 "Make it in the Emirates" initiative to support market growth

- 11.5.1.3 Rest of GCC Countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Rising adoption of EVs to drive market growth

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Initiatives to develop rare earth elements industry to support market growth

- 11.6.2 ARGENTINA

- 11.6.2.1 Government's focus on expansion of automotive industry to drive growth

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.5.1 COMPANY VALUATION

- 12.5.2 FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Type footprint

- 12.7.5.4 Manufacturing process footprint

- 12.7.5.5 End-use industry footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 PROTERIAL, LTD.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 SHIN-ETSU CHEMICAL CO., LTD.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 TDK CORPORATION

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 VACUUMSCHMELZE

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 JL MAG RARE-EARTH CO., LTD.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 BEIJING ZHONG KE SAN HUAN HI-TECH CO., LTD.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Expansions

- 13.1.6.4 MnM view

- 13.1.6.4.1 Right to win

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses and competitive threats

- 13.1.7 ARNOLD MAGNETIC TECHNOLOGIES

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.3.2 Expansions

- 13.1.7.4 MnM view

- 13.1.8 NEO PERFORMANCE MATERIALS

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Expansions

- 13.1.8.3.3 Others

- 13.1.8.4 MnM view

- 13.1.9 NINGBO YUNSHENG CO., LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Expansions

- 13.1.9.4 MnM view

- 13.1.10 ADAMS MAGNETIC PRODUCTS

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Others

- 13.1.10.4 MnM view

- 13.1.11 YANTAI ZHENGHAI MAGNETIC MATERIAL CO., LTD.

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.3.2 Expansions

- 13.1.11.4 MnM view

- 13.1.1 PROTERIAL, LTD.

- 13.2 OTHER PLAYERS

- 13.2.1 NOVEON MAGNETICS INC.

- 13.2.2 STANFORD MAGNETS

- 13.2.3 PERMAG

- 13.2.4 GOUDSMIT MAGNETICS

- 13.2.5 BAKKER MAGNETICS BV

- 13.2.6 RAREARTH S.R.L.

- 13.2.7 BAOTOU TIANHE MAGNETICS TECHNOLOGY CO., LTD.

- 13.2.8 BELOH MAGNETSYSTEME GMBH & CO. KG

- 13.2.9 EARTH-PANDA ADVANCED MAGNETIC MATERIAL CO., LTD.

- 13.2.10 VULCAN ELEMENTS

- 13.2.11 DAIDO ELECTRONICS CO., LTD.

- 13.2.12 ABM MAGNETICS CO., LTD.

- 13.2.13 DURA MAGNETS PVT. LTD.

- 13.2.14 MAGSUPER(DONGGUAN)CORP.

- 13.2.15 HANGZHOU PERMANENT MAGNET GROUP, LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 CUSTOMIZATION OPTIONS

- 14.3 RELATED REPORTS

- 14.4 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.5 AUTHOR DETAILS