|

시장보고서

상품코드

1881284

자동차 서스펜션 시장 : 작동 방식별, 컴포넌트별, 구조별, 시스템별, 차량 유형별, 용도별, 지역별 예측(-2032년)Automotive Suspension Market by Architecture, System, Actuation, Component, Vehicle, Aftermarket, & Region - Global Forecast to 2032 |

||||||

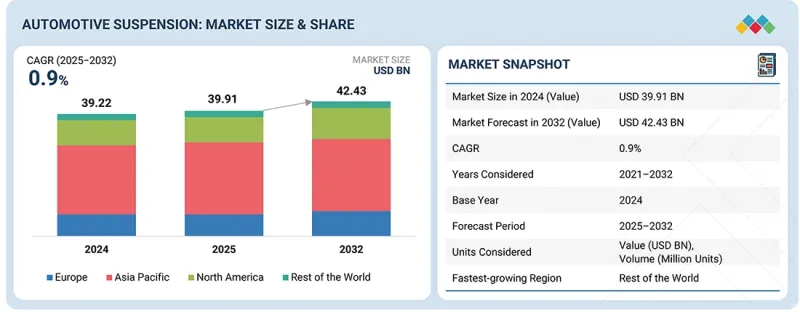

자동차 서스펜션 시장 규모는 예측 기간 동안 CAGR 0.9%로 성장하고 2025년 399억 1,000만 달러, 2032년까지 424억 3,000만 달러에 이를 것으로 전망됩니다.

세계 SUV, 전기차, 고급차의 판매 증가가 서스펜션 시장의 성장을 견인하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 기간 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2035년 |

| 대상 단위 | 금액(100만 달러) |

| 부문 | 작동 방식별, 컴포넌트별, 구조별, 시스템별, 차량 유형별, 용도별, 지역별 |

| 대상 지역 | 아시아태평양, 유럽, 북미 및 세계 기타 지역 |

또한 버스 및 트럭에서의 에어 서스펜션 시스템의 채택 증가가 첨단 서스펜션 시스템 시장의 성장을 이끌고 있습니다.

에어 서스펜션 시장은 2025년까지 확대를 계속할 전망입니다. 이러한 성장은 특히 북미 및 유럽에서 다임러, 볼보, 스카니아와 같은 OEM 제조업체들이 장거리 운행에서의 승차감, 안전성, 적재 적응 안정성을 우선하는 고급 버스, 프리미엄 코치, 대형 트럭, 전기 버스의 채택 증가에 의해 견인되고 있습니다. 볼보 FH 및 프레이트 라이너 카스카디아와 같은 대형 트럭은 취약한 화물을 보호하고 핸들링을 최적화하기 위해 전자 제어식 에어 서스펜션의 통합이 진행되고 있습니다. 아시아태평양에서는 비용면에서의 배려로부터 도입률은 현재 낮은 것, 중국이나 인도에서는 소비자의 쾌적성에 대한 기대나 도시에서의 화물 수송 수요를 배경으로 고급 도시간 버스나 선진적인 물류 차량에 있어서 이러한 시스템의 채택이 급속히 진행되고 있습니다. 경량 소재, 모듈식 에어 스프링, 전자식 안정성 제어 시스템과의 통합과 같은 기술 혁신으로 성능과 내구성이 지속적으로 향상되고 있으며, 에어 서스펜션은 세계적으로 승용차 및 상용차 부문 모두에서 중요한 차별화 요소로 확립되고 있습니다.

승용차 부문은 높은 생산량, SUV 및 고급 차량의 인기, 승차감과 취급에 대한 수요 증가를 배경으로 세계 자동차 서스펜션 시장에서 가장 큰 점유율을 유지하고 있습니다. 해치백, 세단 및 중형 SUV의 대부분은 단순한 디자인, 컴팩트하고 가벼운 구조, 비용 효율성, 모듈형 플랫폼에 대한 통합의 용이성으로 맥퍼슨 스트럿 프론트 서스펜션을 채택하고 있습니다. 한편, 고급 SUV와 쿠페는 뛰어난 조종성과 안정성을 실현하기 위해 더블 위시 본식을 채택하고 있습니다. 이 더블 위시본식 서스펜션은 BMW, Lexus, Mercedes-Benz 등 브랜드의 고성능 자동차 및 고급 자동차 부문에서 널리 볼 수 있습니다.

후륜 서스펜션에서는 토션 빔이 컴팩트 카나 미드레인지 차량 유형으로 주류를 차지하고 있습니다. 특히 아시아, 유럽 및 기타 지역 시장에서 공간 효율성과 비용 성능이 우수하기 때문입니다. 한편, 북미, 유럽, 아시아의 고급차 시장에서는 프리미엄 SUV나 고성능 SUV에 멀티링크 서스펜션이 널리 채택되어 보다 뛰어난 쾌적성과 제어 성능을 제공합니다. 에어 서스펜션은 여전히 초고급 차량으로 제한되지만 BMW, Mercedes-Benz, Toyota, 현대 등의 브랜드가 플래그십 모델에 세미 액티브 및 액티브 댐핑을 통합하여 NVH 성능과 적응 형 핸들링을 향상 시켰습니다. 전반적으로 맥퍼슨 및 토션 빔 시스템은 양산 차량 부문을 선도하고 더블 위시 본, 멀티 링크 및 에어 서스펜션이 프리미엄 카테고리를 정의합니다. 이 추세는 향후 몇 년 동안 지속될 것으로 예측됩니다.

2025년 EV 부문은 자동차 서스펜션 시스템 시장에서 가장 빠르게 성장하는 분야 중 하나로 부상하고 있습니다. 이는 세계 EV 보급 가속화, 정부 보조금 정책, 배출가스 규제 강화에 의해 견인되고 있습니다. 대체 파워트레인 차량 유형 중에서 전기 승용차가 가장 높은 수요를 차지합니다. 전기자동차 부문에서는 콤팩트 및 중형 EV가 주로 맥퍼슨 스트럿식 프론트 서스펜션과 토션 빔 또는 멀티링크식 리어 서스펜션을 채택하고 있으며, 이는 내연 기관(ICE) 차량 유형에서 채택된 기술과 유사합니다. 한편, BMW i5, 포르쉐 타이칸 크로스 투리스모, 루시드 에어, 테슬라 모델 S/X 등의 프리미엄 EV나 고성능 모델에서는 배터리 중량 관리와 승차감 최적화를 목적으로 멀티링크 서스펜션의 채택이 증가하고 있습니다.전기 승용차의 주요 서스펜션 기술에는 복합제제 컨트롤 암을 통합한 경량 멀티링크 구조와 승차감과 핸들링을 최적화하면서 에너지 소비를 최소화하는 전자 제어 댐퍼가 포함됩니다. 테슬라 모델 S나 포르쉐 타이칸과 같은 모델에 탑재되는 전자기 액추에이터나 예측 서스펜션 제어 등 혁신 기술은 동적 응답성과 배터리 항속 거리의 향상에 의해 차별화를 도모하고 있습니다. 전기 버스에서는 승객의 쾌적성과 적재 적응성이 뛰어난 에어 서스펜션이 주류(90% 이상)이며, 전자식 차량 높이 제어를 갖춘 모듈식 에어 스프링 시스템의 통합에 의해 달성되고 있습니다. 전기 트럭은 볼보의 전기 FH 시리즈로 대표되는 바와 같이 기존의 견고한 포물선형 리프 스프링과 신흥 전기 유압식 및 세미 액티브 댐핑 시스템을 결합하여 무거운 적재 요구와 균형을 맞추고 구동 시스템의 효율을 향상시킵니다. 세계적인 EV로의 전환과 승차감과 프리미엄 운전 체험에 대한 소비자의 기대가 높아짐에 따라 EV 시장 전체에서 선진적이고 중량 최적화된 서스펜션 구조에 대한 견고한 수요를 견인하고 있습니다.

북미에서는 승용차가 주로 프런트에 맥퍼슨 스트럿, 리어에 멀티 링크 서스펜션을 채택하여 승차감과 핸들링 성능을 향상시키고 있습니다. 이 디자인은 테슬라 모델 3 및 캐딜락 CT4와 같은 모델에서 두드러집니다. 픽업 트럭과 소형 상용차(LCV)는 하중 관리 능력 향상과 오프로드 성능 향상을 위해 프런트에 더블 위시본과 멀티링크 서스펜션을 선호합니다. 반면 리어에는 일반적으로 토션 빔과 리프 스프링이 채택됩니다. 대형 트럭에서는 주로 포물선형 및 반 타원형 리프 스프링이 채택됩니다. 마찬가지로 도시 간 버스는 이러한 견고한 기계식 서스펜션을 채택하지만, 에어 서스펜션은 일반적으로 고급 모델로 제한됩니다. 다양한 부문의 전기자동차(EV)에서는 경량 멀티링크와 복합재료 부품, 전자제어 댐핑 시스템의 채택이 중시되고 있어 배터리 중량과의 밸런스를 효과적으로 취하면서 효율을 최적화하고 있습니다. 북미 시장에서는 적응형·통합형 서스펜션 기술이 급속히 진전하고 있으며, OEM 제조업체나 애프터마켓 제공업체에게 전동화 차량 및 상용차 플랫폼에 특화된 스마트하고 내구성 있는 솔루션을 개발할 기회가 탄생하고 있습니다.

본 보고서에서는 세계의 자동차 서스펜션 시장에 대해 조사했으며, 작동 방식별, 컴포넌트별, 구조별, 시스템별, 차량 유형별, 용도별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 언멧 요구와 공백

- 상호접속된 시장과 분야 횡단적인 기회

- Tier 1/2/3 기업의 전략적 움직임

제6장 고객정세와 구매행동

- 의사결정 프로세스

- 주요 이해관계자와 구매평가기준

- 구매 과정에서 주요 이해관계자

- 구입 기준

- 채택 장벽과 내부 과제

- 시장 수익성

- 수익 가능성

- 코스트 다이내믹스

제7장 규제 상황

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 세계 안전 규제

제8장 기술, 특허, 디지털, AI 도입별 전략적 파괴

- 특허 분석

- 기술 분석

- 기술/제품 로드맵

- 미래의 응용

- AI/생성형 AI가 자동차 서스펜션 시장에 미치는 영향

- 성공 사례와 실세계에 응용

- 지역별 자동차 서스펜션의 핫스팟과 현지화의 다이나믹스

- 자동차 서스펜션 부품공급 체인 위험

- 정책이 서스펜션 조달 형성

- 차세대 서스펜션 시스템의 비용 추이

- 전기자동차(EV)의 부품표에 있어서의 자동차용 서스펜션 시스템의 점유율(2025년 대 2032년)

- 서스펜션 조달 모델 : 멀티 공급업체 vs. 캡티브 디자인

- 향후 자동차 출시와 서스펜션 시스템의 미래 수요

제9장 업계 동향

- 거시경제지표

- 생태계 분석

- 공급망 분석

- 가격 분석

- 고객사업에 영향을 주는 동향과 혼란

- 투자 및 자금조달 시나리오

- 2025년-2026년의 주된 회의와 이벤트

- 무역 분석

- 사례 연구 분석

- 미국 관세의 영향

제10장 액티브 서스펜션 시장(작동 방식별)

- 소개

- 유압 작동식 액티브 서스펜션

- 전자제어 액티브 서스펜션

- 주요 산업 인사이트

제11장 자동차 서스펜션 애프터마켓(컴포넌트별)

- 소개

- 쇼크 업소버

- 스트럿

- 볼 조인트

- 리프 스프링

- 컨트롤 암

- 코일 스프링

- 주요 산업 인사이트

제12장 자동차 서스펜션 시장(구조별)

- 소개

- 맥퍼슨 스트럿

- 더블 위시본

- 멀티링크

- 트위스트 빔/토션 빔

- 리프 스프링

- 에어 서스펜션

- 주요 산업 인사이트

제13장 자동차 서스펜션 시장(시스템별)

- 소개

- 패시브

- 세미 액티브

- 액티브

- 주요 산업 인사이트

제14장 자동차 서스펜션 시장(차량 유형별)

- 소개

- 승용차

- LCVS

- 트럭

- 버스

- 주요 산업 인사이트

제15장 자동차 서스펜션 OE 시장(컴포넌트별)

- 소개

- 코일 스프링

- 에어 스프링

- 쇼크 업소버

- 스트럿

- 컨트롤 암

- 러버 부싱

- 리프 스프링

- 링크 스태빌라이저/스태빌라이저 바

- 볼 조인트

- 주요 산업 인사이트

제16장 전기자동차 및 하이브리드 자동차 서스펜션 시장(구조 및 지역별)

- 소개

- 전기자동차(BEV), 플러그인 하이브리드 자동차(PHEV), 연료전지 자동차(FCEV)용 전동·하이브리드 서스펜션 시장(아키텍처별)

- 지역별 전동·하이브리드 서스펜션 시장(추진 방식별)

제17장 전기자동차 및 하이브리드 HCV 서스펜션 시장(차량 유형별)

- 소개

- 지역별 전기자동차 및 하이브리드 HCV 서스펜션 시장(차량 유형별)

- 전기자동차 및 하이브리드 HCV 서스펜션 시장(구조별)

- 주요 산업 인사이트

제18장 오프 하이웨이 차량용 서스펜션 시장(용도별)

- 소개

- 건설기계

- 농업용 트랙터

- 주요 산업 인사이트

제19장 전지형 대응 차량용 서스펜션 시장(지역별)

- 소개

- 전지형 대응차 서스펜션 시장에 있어서의 아키텍쳐 유형(지역별)

제20장 자동차 서스펜션 시장(지역별)

- 소개

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타

- 북미

- 미국

- 멕시코

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 러시아

- 기타

- 기타 지역

- 브라질

- 남아프리카

- 이란

제21장 경쟁 구도

- 소개

- 주요 진입기업의 전략/강점

- 시장 점유율 분석, 2024년

- 수익 분석, 2020년-2024년

- 기업평가와 재무지표

- 브랜드/제품 비교

- 기업평가 매트릭스 : 주요 진입기업, 2024년

- 기업평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제22장 기업 프로파일

- 주요 진출기업

- ZF FRIEDRICHSHAFEN AG

- HYUNDAI MOBIS

- TENNECO INC.

- THYSSENKRUPP AG

- DANA LIMITED

- MAGNA INTERNATIONAL INC.

- CONTINENTAL AG

- BWI GROUP

- KYB CORPORATION

- HL MANDO CORPORATION

- MERITOR, INC.

- HENDRICKSON USA, LLC

- 기타 기업

- ASTEMO, LTD

- SOGEFI

- EIBACH

- GESTAMP

- SIDEM

- PEDDERS SUSPENSION & BRAKES

- RTS

- YSS SUSPENSION

- BELLTECH

- SKYJACKER SUSPENSIONS

- MULTIMATIC INC

- KING SHOCKS

- FOX FACTORY, INC.

- RANCHO SUSPENSION

- TEIN USA.

- AIR LIFT COMPANY

- MOOG INC.

제23장 시장에 대한 제안

제24장 부록

SHW 25.12.11The automotive suspension market is expected to grow from USD 39.91 billion in 2025 to USD 42.43 billion by 2032, at a CAGR of 0.9% during the forecast period. Rising global sales of SUVs, electric vehicles, and luxury cars are driving the suspension market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Units Considered | Value (USD Million) |

| Segments | Vehicle Type, Electric Vehicle, System, Architecture, Active Suspension Market, by Actuation, OE Market, by Component, Aftermarket, by Component, Off-highway Market, by Application, ATV Market, by Region, and Region |

| Regions covered | Asia Pacific, Europe, North America, and the Rest of the World |

Additionally, the increasing adoption of air suspension systems in buses and trucks is driving the growth of the advanced suspension systems market.

The air suspension market is expected to continue expanding in 2025. The growth is driven by the increased adoption of luxury buses, premium coaches, heavy-duty trucks, and electric buses, particularly in North America and Europe, where OEMs like Daimler, Volvo, and Scania prioritize ride quality, safety, and load adaptive stability for long-haul operations. Heavy-duty trucks, such as the Volvo FH and Freightliner Cascadia, increasingly integrate electronically controlled air suspensions to protect fragile cargo and optimize handling. Although Asia Pacific adoption is currently lower due to cost sensitivity, premium intercity buses and advanced logistics vehicles in China and India are rapidly adopting these systems, fueled by consumer expectations for comfort and urban freight demands. Innovations in lightweight materials, modular air springs, and integration with electronic stability systems continue to enhance performance and durability, establishing air suspension as a key differentiator in both the passenger and commercial segments globally.

"Passenger cars is the largest market for automotive suspension during the forecast period."

The passenger cars segment remains the largest in the global automotive suspension market, driven by high production volumes, the popularity of SUVs and premium vehicles, and growing demand for ride comfort and handling. Most hatchbacks, sedans, and mid-size SUVs utilize MacPherson strut front suspensions due to their simple design, compact & lightweight structure, cost efficiency, and ease of integration into modular platforms. Whereas high-end SUVs and coupes adopt double wishbone systems for superior handling and stability. The double wishbone suspension is commonly found in high-performance and luxury vehicle segments from brands like BMW, Lexus, and Mercedes-Benz, among others.

At the rear, torsion beams dominate compact and mid-range cars, offering space efficiency and affordability, especially in Asia, Europe, and the RoW markets. In contrast, multilink suspensions are common in premium and performance SUVs in North America, Europe, and luxury Asian markets, providing better comfort and control. Air suspensions, still limited to ultra-premium vehicles, enhance NVH and adaptive handling, with brands like BMW, Mercedes-Benz, Toyota, and Hyundai integrating semi-active and active damping in flagship models. Overall, MacPherson and torsion beam systems lead the mass-market segment, while double wishbone, multilink, and air suspensions define the premium category; this trend is expected to continue in the coming years.

"Growth in electric vehicle sales to drive the demand for suspension systems."

The EV segment is emerging as one of the fastest-growing markets for automotive suspension systems in 2025, driven by accelerating global EV adoption, government incentives, and stricter emissions regulations. Electric passenger vehicles account for the highest demand among alternative powertrain vehicles. For the electric cars segment, compact and mid-size EVs predominantly use MacPherson strut front suspensions with torsion beam or multilink rear setups, similar to the technologies adopted for ICE counterparts. Alternatively, premium EVs and performance models such as the BMW i5, Porsche Taycan Cross Turismo, Lucid Air, and Tesla Model S/X increasingly deploy multilink suspensions to manage battery weight and optimize ride comfort. In electric passenger cars, key suspension technologies include lightweight multilink setups with integrated composite control arms and electronically controlled dampers that optimize ride comfort and handling while minimizing energy consumption. Innovations such as electromagnetic actuators and predictive suspension control, featured in models like the Tesla Model S and Porsche Taycan, differentiate by enhancing dynamic response and battery range. For electric buses, air suspension dominates (>90%) due to its superior passenger comfort and load adaptability, which is achieved by integrating modular air spring systems with electronic height control. Electric trucks combine traditional robust parabolic leaf springs with emerging electrohydraulic and semi-active damping systems to balance heavy payload demands and improve drivetrain efficiency, as exemplified by Volvo's electric FH series. The global shift toward EVs, combined with rising consumer expectations for ride quality and premium driving experiences, is driving robust demand for advanced, weight-optimized suspension architectures across the EV market.

"North America is expected to be the second-largest market during the forecast period."

In North America, passenger cars primarily utilize MacPherson struts at the front and multilink suspensions at the rear to enhance ride quality and handling. This design is evident in models such as the Tesla Model 3 and Cadillac CT4. For pickups and light commercial vehicles (LCVs), double wishbone and multilink front suspensions are preferred for enhanced load management and improved off-road performance, while rear setups typically feature torsion beams and leaf springs. Heavy-duty trucks mainly depend on parabolic and semi-elliptical leaf springs. Similarly, intercity buses also employ these robust mechanical suspensions, although air suspension is typically reserved for premium models. EVs across various segments emphasize the use of lightweight multilink and composite components, along with electronic damping systems, to effectively balance battery weight and optimize efficiency. The North American market is rapidly advancing in adaptive and integrated suspension technologies, presenting opportunities for OEMs and aftermarket providers to develop smart, durable solutions specifically tailored for electrified and commercial vehicle platforms.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 30% and Automotive Suspension Manufacturers - 70%

- By Designation: C-level - 35%, Director Level - 55%, and Others - 10%

- By Region: North America - 20%, Europe - 45%, Asia Pacific - 30%, and the Rest of the World - 5%

The automotive suspension market is dominated by established players, including Continental AG (Germany), ZF Friedrichshafen AG (Germany), ThyssenKrupp AG (Germany), KYB Corporation (Japan), and Tenneco Inc. (US). These companies actively manufacture and develop new and advanced rubber seals. They have set up R&D facilities and offer best-in-class products to their customers.

Research Coverage

The study segments the automotive suspension market and forecasts the market size based on system (passive suspension, semi-active suspension, and active suspension), active suspension market, actuation (hydraulically actuated and electronically actuated), architecture (MacPherson strut, double wishbone, multilink, twist beam/torsion beam, leaf spring suspension, air suspension), OE market, component (coil spring, air spring, shock dampener, strut, control arm, ball joint, rubber bushing, leaf spring, and sway bar/link stabilizer), aftermarket, component (shock absorber, strut, ball joint, leaf spring, control arm, coil spring), vehicle type (passenger cars, light commercial vehicles, trucks, and buses), electric & hybrid passenger car suspension, architecture (leaf spring suspension, air suspension, double wishbone, MacPherson strut, multilink, twist beam/torsion beam), electric & hybrid trucks and buses suspension, vehicle type (trucks and buses), off-highway application (construction & mining and agricultural tractors), all-terrain vehicles, and region (Asia Pacific, North America, Europe, and the Rest of the World).

Key Benefits of Purchasing this Report

The study provides a comprehensive competitive analysis of key market players, including their company profiles, key insights into product and business offerings, recent developments, and primary market strategies. The report will assist market leaders and new entrants with estimates of revenue figures for the overall automotive suspension market and its subsegments. It helps stakeholders understand the competitive landscape and gain additional insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report provides information on key market drivers, restraints, challenges, and opportunities, enabling stakeholders to stay informed about market dynamics.

The report provides insights into the following points:

- Analysis of key drivers (strong premium SUV & pickup demand and regulatory pressure on vehicle & passenger safety & curb emissions), restraints (high system cost vs. ROI in non-premium segments), opportunities (integration of smart/connected suspensions with ADAS & SDVs and local manufacturing & supply chain opportunities), and challenges (balancing suspension weight and range efficiency in electric vehicles) influencing the growth of the automotive suspension market.

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and product launches in the automotive suspension market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the automotive suspension across various regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the automotive suspension market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Continental AG (Germany), ZF Friedrichshafen AG (Germany), ThyssenKrupp AG (Germany), KYB Corporation (Japan), and Tenneco Inc. (US) in the market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources referred to for estimating vehicle production

- 2.1.1.2 List of key secondary sources referred to for estimating automotive suspension market

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews: Demand and supply sides

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.4.1 DEMAND- AND SUPPLY-SIDE FACTOR ANALYSIS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RESEARCH ASSUMPTIONS & RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 3.3 DISRUPTIVE TRENDS IN THE AUTOMOTIVE SUSPENSION MARKET

- 3.4 HIGH-GROWTH SEGMENTS

- 3.5 SNAPSHOT: REGIONAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE SUSPENSION MARKET

- 4.2 AUTOMOTIVE SUSPENSION MARKET, BY SYSTEM

- 4.3 AUTOMOTIVE SUSPENSION MARKET, BY ARCHITECTURE

- 4.4 AUTOMOTIVE SUSPENSION MARKET, BY VEHICLE TYPE

- 4.5 AUTOMOTIVE SUSPENSION OE MARKET, BY COMPONENT

- 4.6 AUTOMOTIVE SUSPENSION AFTERMARKET, BY COMPONENT

- 4.7 ELECTRIC & HYBRID PASSENGER CAR SUSPENSION MARKET, BY ARCHITECTURE

- 4.8 ELECTRIC & HYBRID HCV SUSPENSION MARKET, BY VEHICLE TYPE

- 4.9 ACTIVE SUSPENSION MARKET, BY ACTUATION

- 4.10 OFF-HIGHWAY SUSPENSION MARKET, BY APPLICATION

- 4.11 ALL-TERRAIN VEHICLE SUSPENSION MARKET, BY REGION

- 4.12 AUTOMOTIVE SUSPENSION MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for premium SUVs and pickup trucks

- 5.2.1.2 Regulatory pressure on vehicle and passenger safety and emissions

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of suspension systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of smart/connected suspension systems with ADAS and SDVs

- 5.2.3.2 Local manufacturing and supply chain opportunities

- 5.2.4 CHALLENGES

- 5.2.4.1 Balancing suspension weight and range efficiency in electric vehicles

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS AND WHITE SPACES

- 5.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

6 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 6.1 DECISION-MAKING PROCESS

- 6.2 KEY STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.2.2 BUYING CRITERIA

- 6.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 6.4 MARKET PROFITABILITY

- 6.4.1 REVENUE POTENTIAL

- 6.4.2 COST DYNAMICS

7 REGULATORY LANDSCAPE

- 7.1 REGULATORY LANDSCAPE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 GLOBAL SAFETY REGULATIONS

8 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 8.1 PATENT ANALYSIS

- 8.1.1 INTRODUCTION

- 8.1.1.1 Methodology

- 8.1.1.2 Document type

- 8.1.1.3 Insights

- 8.1.1.4 Legal status of patents

- 8.1.1.5 Jurisdiction analysis

- 8.1.1.6 Top applicants

- 8.1.1.7 List of patents

- 8.1.1 INTRODUCTION

- 8.2 TECHNOLOGY ANALYSIS

- 8.2.1 KEY TECHNOLOGIES

- 8.2.1.1 Active and semi-active suspension systems

- 8.2.1.2 In-wheel suspension technology

- 8.2.2 COMPLEMENTARY TECHNOLOGIES

- 8.2.2.1 ADAS & sensor fusion integration

- 8.2.3 ADJACENT TECHNOLOGIES

- 8.2.3.1 Lightweight materials and additive manufacturing

- 8.2.3.2 Regenerative suspension systems

- 8.2.1 KEY TECHNOLOGIES

- 8.3 TECHNOLOGY/PRODUCT ROADMAP

- 8.4 FUTURE APPLICATIONS

- 8.5 IMPACT OF AI/GEN AI ON AUTOMOTIVE SUSPENSION MARKET

- 8.5.1 TOP USE CASES OF AI IMPLEMENTATION AND MARKET POTENTIAL

- 8.5.2 BEST PRACTICES IN AUTOMOTIVE SUSPENSION DEVELOPMENT

- 8.5.3 AUTOMOTIVE SUSPENSION MARKET: CASE STUDIES RELATED TO IMPLEMENTATION OF GEN AI

- 8.5.4 INTERCONNECTED ADJACENT MARKET ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 8.5.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN AUTOMOTIVE SUSPENSION MARKET

- 8.6 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 8.6.1 ZF FRIEDRICHSHAFEN: AI-DRIVEN ADAPTIVE DAMPER CALIBRATION

- 8.6.2 KYB CORPORATION: PREDICTIVE MAINTENANCE FOR ELECTRONIC DAMPERS

- 8.6.3 HITACHI ASTEMO: ELECTROHYDRAULIC ACTUATOR OPTIMIZATION

- 8.6.4 CONTINENTAL: SMART AIR SPRING WITH SENSOR INTEGRATION

- 8.7 REGIONAL AUTOMOTIVE SUSPENSION HOTSPOTS AND LOCALIZATION DYNAMICS

- 8.8 SUPPLY CHAIN RISKS IN AUTOMOTIVE SUSPENSION COMPONENTS

- 8.9 POLICY DRIVES SHAPING SUSPENSION SOURCING

- 8.10 COST TRAJECTORY FOR NEXT-GEN SUSPENSION SYSTEMS

- 8.11 SHARE OF AUTOMOTIVE SUSPENSION SYSTEMS IN BILL OF MATERIALS FOR EVS, 2025 VS. 2032

- 8.12 SUSPENSION SOURCING MODELS: MULTI-SUPPLIER VS. CAPTIVE DESIGN

- 8.13 UPCOMING VEHICLE LAUNCHES AND FUTURE DEMAND FOR SUSPENSION SYSTEMS

9 INDUSTRY TRENDS

- 9.1 MACROECONOMIC INDICATORS

- 9.1.1 INTRODUCTION

- 9.1.2 GDP TRENDS AND FORECAST

- 9.1.3 TRENDS IN GLOBAL ELECTRIC VEHICLE INDUSTRY

- 9.1.4 TRENDS IN GLOBAL AUTOMOTIVE & TRANSPORTATION INDUSTRY

- 9.2 ECOSYSTEM ANALYSIS

- 9.2.1 RAW MATERIAL SUPPLIERS

- 9.2.2 COMPONENT MANUFACTURERS

- 9.2.3 SYSTEM INTEGRATORS/SUSPENSION MANUFACTURERS

- 9.2.4 OEM ASSEMBLY

- 9.2.5 AFTERMARKET AND REPLACEMENT PART PROVIDERS

- 9.3 SUPPLY CHAIN ANALYSIS

- 9.4 PRICING ANALYSIS

- 9.4.1 AVERAGE SELLING PRICE OF LIGHT-DUTY VEHICLE SUSPENSION SYSTEMS, BY REGION

- 9.4.2 AVERAGE SELLING PRICE OF TRUCK SUSPENSION ARCHITECTURE TYPES, BY REGION

- 9.4.3 AVERAGE SELLING PRICE OF AUTOMOTIVE SUSPENSION OE COMPONENTS, BY REGION

- 9.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 9.6 INVESTMENT AND FUNDING SCENARIO

- 9.7 KEY CONFERENCES & EVENTS, 2025-2026

- 9.8 TRADE ANALYSIS

- 9.8.1 EXPORT SCENARIO

- 9.8.2 IMPORT SCENARIO

- 9.8.3 TRADE RESTRICTIONS

- 9.8.4 US-CHINA EXPORT BANS

- 9.8.5 EU SUBSIDY RACE

- 9.8.6 IMPACT OF LOCALIZATION POLICIES ON SOURCING

- 9.8.7 CXO PRIORITIES

- 9.9 CASE STUDY ANALYSIS

- 9.9.1 LINK AND VOLVO ENGINEERING TEAMS COLLABORATED TO DEVELOP PROPRIETARY APPLICATION AND VALIDATE FUEL SAVINGS

- 9.9.2 EMPLOYEES OF HENDRICKSON USA, L.L.C. IMPORTED CREO CAD GEOMETRY OF SUSPENSION SYSTEM

- 9.9.3 CONTINENTAL AG DEVELOPED HITEMP AIR SPRINGS, CAPABLE OF WITHSTANDING TEMPERATURES

- 9.10 IMPACT OF US TARIFF

- 9.10.1 INTRODUCTION

- 9.10.2 KEY TARIFF RATES

- 9.10.3 PRICE IMPACT ANALYSIS

- 9.10.4 IMPACT ON REGION/COUNTRY

- 9.10.5 IMPACT ON END-USE INDUSTRIES

10 ACTIVE SUSPENSION MARKET, BY ACTUATION

- 10.1 INTRODUCTION

- 10.2 HYDRAULICALLY ACTUATED ACTIVE SUSPENSION

- 10.2.1 HYDRAULIC SUSPENSION SYSTEMS REPLACE CONVENTIONAL COIL SPRINGS WITH AIR SPRINGS

- 10.3 ELECTRONICALLY ACTUATED ACTIVE SUSPENSION

- 10.3.1 TECHNOLOGICAL ADVANCEMENTS DRIVING NEED FOR ELECTRONICALLY ACTUATED ACTIVE SUSPENSION SYSTEM

- 10.4 KEY INDUSTRY INSIGHTS

11 AUTOMOTIVE SUSPENSION AFTERMARKET, BY COMPONENT

- 11.1 INTRODUCTION

- 11.2 SHOCK ABSORBERS

- 11.2.1 SHOCK ABSORBERS ARE AMONG MOST FREQUENTLY REPLACED SUSPENSION COMPONENTS DUE TO NATURAL WEAR FROM CONTINUOUS DAMPING CYCLES

- 11.3 STRUTS

- 11.3.1 GROWING VEHICLE SALES TO BOOST DEMAND FOR STRUTS

- 11.4 BALL JOINTS

- 11.4.1 BALL JOINTS ARE UNIVERSALLY USED IN FRONT SUSPENSION

- 11.5 LEAF SPRINGS

- 11.5.1 ABILITY OF LEAF SPRINGS TO HANDLE HEAVY LOAD TO DRIVE THEIR DEMAND

- 11.6 CONTROL ARMS

- 11.6.1 ALUMINUM AND HYBRID COMPOSITE CONTROL ARMS TO GAIN POPULARITY AS LIGHTWEIGHT REPLACEMENTS COMPATIBLE WITH OE SPECIFICATIONS

- 11.7 COIL SPRINGS

- 11.7.1 COIL SPRINGS ALLOW MAXIMUM RANGE OF MOVEMENT IN SUSPENSION SYSTEM

- 11.8 KEY INDUSTRY INSIGHTS

12 AUTOMOTIVE SUSPENSION MARKET, BY ARCHITECTURE

- 12.1 INTRODUCTION

- 12.2 MACPHERSON STRUT

- 12.2.1 COST-EFFECTIVENESS AND SIMPLE DESIGN MAKE MACPHERSON STRUT SUITABLE FOR PASSENGER CARS

- 12.3 DOUBLE WISHBONE

- 12.3.1 COMPLEX DESIGN AND HIGH COST MAKE DOUBLE WISHBONE SUITABLE FOR PREMIUM VEHICLES

- 12.4 MULTILINK

- 12.4.1 MULTILINK SUSPENSION PROVIDES BETTER RIDE QUALITY AND HANDLING

- 12.5 TWIST BEAM/TORSION BEAM

- 12.5.1 DEMAND FOR TWIST BEAM/TORSION BEAM SUSPENSION IS LIMITED TO ECONOMIC CARS

- 12.6 LEAF SPRING

- 12.6.1 LEAF SPRINGS ARE PREFERRED IN HEAVY TRUCKS DUE TO THEIR HIGH LOAD-CARRYING CAPACITY

- 12.7 AIR SUSPENSION

- 12.7.1 INCREASED DEMAND FOR CABIN COMFORT, BETTER CONTROL, AND STABILITY TO DRIVE MARKET

- 12.8 KEY INDUSTRY INSIGHTS

13 AUTOMOTIVE SUSPENSION MARKET, BY SYSTEM

- 13.1 INTRODUCTION

- 13.2 PASSIVE

- 13.2.1 MACPHERSON STRUT AND DOUBLE WISHBONE ARE MOST COMMONLY USED PASSIVE SYSTEMS IN PASSENGER CARS

- 13.3 SEMI-ACTIVE

- 13.3.1 INCREASING DEMAND FOR HIGH-PERFORMANCE CARS TO DRIVE MARKET FOR SEMI-ACTIVE SYSTEMS

- 13.4 ACTIVE

- 13.4.1 INCREASING DEMAND FOR ACTIVE AIR SUSPENSION SYSTEM IN BUSES TO DRIVE MARKET

- 13.5 KEY INDUSTRY INSIGHTS

14 AUTOMOTIVE SUSPENSION MARKET, BY VEHICLE TYPE

- 14.1 INTRODUCTION

- 14.2 PASSENGER CARS

- 14.2.1 USE OF MACPHERSON STRUT IN PASSENGER CARS TO DRIVE MARKET

- 14.3 LCVS

- 14.3.1 DEMAND FOR MULTILINK ARCHITECTURE TO DRIVE MARKET FOR LCV SUSPENSION

- 14.4 TRUCKS

- 14.4.1 INCREASED USE OF TRUCKS IN MAJOR REGIONS TO DRIVE NEED FOR LEAF SPRING SUSPENSION

- 14.5 BUSES

- 14.5.1 AIR SUSPENSION OFFERS MAXIMUM COMFORT TO PASSENGERS

- 14.6 KEY INDUSTRY INSIGHTS

15 AUTOMOTIVE SUSPENSION OE MARKET, BY COMPONENT

- 15.1 INTRODUCTION

- 15.2 COIL SPRINGS

- 15.3 AIR SPRINGS

- 15.4 SHOCK ABSORBERS

- 15.5 STRUTS

- 15.6 CONTROL ARMS

- 15.7 RUBBER BUSHINGS

- 15.8 LEAF SPRINGS

- 15.9 LINK STABILIZERS/SWAY BARS

- 15.10 BALL JOINTS

- 15.11 KEY INDUSTRY INSIGHTS

16 ELECTRIC & HYBRID PASSENGER CAR SUSPENSION MARKET, BY ARCHITECTURE & REGION

- 16.1 INTRODUCTION

- 16.2 ELECTRIC & HYBRID SUSPENSION MARKET FOR BEVS, PHEVS, AND FCEVS, BY ARCHITECTURE

- 16.2.1 BATTERY ELECTRIC VEHICLES (BEVS), BY ARCHITECTURE

- 16.2.1.1 Active suspension systems to enhance driving performance of BEVs

- 16.2.2 PLUG-IN HYBRID ELECTRIC VEHICLES (PHEVS), BY ARCHITECTURE

- 16.2.2.1 Demand for maximum comfort and safety in PHEVs to drive market for advanced suspension systems

- 16.2.3 FUEL CELL ELECTRIC VEHICLES (FCEVS), BY ARCHITECTURE

- 16.2.3.1 Limited demand for FCEVs due to infrastructure challenges

- 16.2.1 BATTERY ELECTRIC VEHICLES (BEVS), BY ARCHITECTURE

- 16.3 REGIONAL ELECTRIC & HYBRID SUSPENSION MARKET, BY PROPULSION

- 16.3.1 ASIA PACIFIC, BY PROPULSION

- 16.3.1.1 Advancements in battery technology and government support to drive BEV sales

- 16.3.2 EUROPE, BY PROPULSION

- 16.3.2.1 Demand for emission-free vehicles to drive electric & hybrid vehicle suspension market

- 16.3.3 NORTH AMERICA, BY PROPULSION

- 16.3.3.1 Technological advancements to fuel demand for advanced suspension systems

- 16.3.4 INDUSTRY INSIGHTS

- 16.3.1 ASIA PACIFIC, BY PROPULSION

17 ELECTRIC & HYBRID HCV SUSPENSION MARKET, BY VEHICLE TYPE

- 17.1 INTRODUCTION

- 17.2 REGIONAL ELECTRIC & HYBRID HCV SUSPENSION MARKET, BY VEHICLE TYPE

- 17.2.1 ASIA PACIFIC, BY VEHICLE TYPE

- 17.2.1.1 Need to scale zero-emission bus deployment in urban mega-cities through policy and charging integration to drive market

- 17.2.2 EUROPE, BY VEHICLE TYPE

- 17.2.2.1 Need to expand zero-emission urban freight and public transit zones to drive fleet conversion

- 17.2.3 NORTH AMERICA, BY VEHICLE TYPE

- 17.2.3.1 Need for leveraging federal incentives to scale zero-emission freight corridors and transit fleets to drive market

- 17.2.1 ASIA PACIFIC, BY VEHICLE TYPE

- 17.3 ELECTRIC & HYBRID HCV SUSPENSION MARKET, BY ARCHITECTURE

- 17.3.1 ELECTRIC & HYBRID TRUCKS

- 17.3.2 ELECTRIC & HYBRID BUSES

- 17.4 KEY INDUSTRY INSIGHTS

18 OFF-HIGHWAY VEHICLE SUSPENSION MARKET, BY APPLICATION

- 18.1 INTRODUCTION

- 18.2 CONSTRUCTION EQUIPMENT

- 18.2.1 INCREASED DEMAND FOR OPERATOR COMFORT AND EQUIPMENT STABILITY TO DRIVE MARKET

- 18.3 AGRICULTURAL TRACTORS

- 18.3.1 RISING FARM MECHANIZATION ACTIVITIES TO DRIVE DEMAND FOR SUSPENSION IN TRACTORS

- 18.4 KEY INDUSTRY INSIGHTS

19 ALL-TERRAIN VEHICLE SUSPENSION MARKET, BY REGION

- 19.1 INTRODUCTION

- 19.2 ALL-TERRAIN VEHICLE SUSPENSION MARKET ARCHITECTURE TYPES, BY REGION

- 19.2.1 MACPHERSON STRUT

- 19.2.1.1 Growing penetration of ATVs in agricultural practices and sports activities to drive market

- 19.2.2 DOUBLE WISHBONE

- 19.2.2.1 Double wishbone suspension systems offer maximum comfort while traveling

- 19.2.3 KEY INDUSTRY INSIGHTS

- 19.2.1 MACPHERSON STRUT

20 AUTOMOTIVE SUSPENSION MARKET, BY REGION

- 20.1 INTRODUCTION

- 20.2 ASIA PACIFIC

- 20.2.1 CHINA

- 20.2.1.1 Demand for MacPherson strut architecture to drive growth

- 20.2.2 INDIA

- 20.2.2.1 Growing vehicle production and expanding domestic demand for comfort and safety to drive market

- 20.2.3 JAPAN

- 20.2.3.1 Need for electrification and premium vehicle development to drive market

- 20.2.4 SOUTH KOREA

- 20.2.4.1 Strong push toward independent suspension architecture to drive market

- 20.2.5 REST OF ASIA PACIFIC

- 20.2.1 CHINA

- 20.3 NORTH AMERICA

- 20.3.1 US

- 20.3.1.1 Preference for SUVs and light trucks to boost growth

- 20.3.2 MEXICO

- 20.3.2.1 Strong vehicle production and export base to lead market

- 20.3.3 CANADA

- 20.3.3.1 Increasing adoption of advanced suspension technologies to boost growth

- 20.3.1 US

- 20.4 EUROPE

- 20.4.1 GERMANY

- 20.4.1.1 Rapid technological advancements to drive market

- 20.4.2 UK

- 20.4.2.1 Strong base of premium and performance vehicle manufacturers to boost market

- 20.4.3 FRANCE

- 20.4.3.1 Notable transition toward electrified and comfort-oriented vehicle platforms to boost growth

- 20.4.4 SPAIN

- 20.4.4.1 Increasing production of compact cars, SUVs, and light commercial vehicles to drive market

- 20.4.5 ITALY

- 20.4.5.1 Increased demand for air suspension architecture in special application trucks to drive market

- 20.4.6 RUSSIA

- 20.4.6.1 Rise in production of SUVs, LCVs, and off-road vehicles to boost market

- 20.4.7 REST OF EUROPE

- 20.4.1 GERMANY

- 20.5 REST OF THE WORLD (ROW)

- 20.5.1 BRAZIL

- 20.5.1.1 Well-established automotive manufacturing base and strong domestic demand to drive market

- 20.5.2 SOUTH AFRICA

- 20.5.2.1 Country's expanding and aging vehicle fleet to drive market

- 20.5.3 IRAN

- 20.5.1 BRAZIL

21 COMPETITIVE LANDSCAPE

- 21.1 INTRODUCTION

- 21.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 21.3 MARKET SHARE ANALYSIS, 2024

- 21.4 REVENUE ANALYSIS, 2020-2024

- 21.5 COMPANY VALUATION AND FINANCIAL METRICS

- 21.6 BRAND/PRODUCT COMPARISON

- 21.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 21.7.1 STARS

- 21.7.2 EMERGING LEADERS

- 21.7.3 PERVASIVE PLAYERS

- 21.7.4 PARTICIPANTS

- 21.7.5 COMPANY FOOTPRINT

- 21.7.5.1 Company footprint

- 21.7.5.2 Region footprint

- 21.7.5.3 System footprint

- 21.7.5.4 Actuation footprint

- 21.7.5.5 Vehicle type footprint

- 21.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 21.8.1 PROGRESSIVE COMPANIES

- 21.8.2 RESPONSIVE COMPANIES

- 21.8.3 DYNAMIC COMPANIES

- 21.8.4 STARTING BLOCKS

- 21.8.5 COMPETITIVE BENCHMARKING

- 21.8.5.1 List of startups/SMEs

- 21.8.5.2 Competitive benchmarking of SMEs

- 21.9 COMPETITIVE SCENARIO

- 21.9.1 PRODUCT LAUNCHES

- 21.9.2 DEALS

- 21.9.3 EXPANSIONS

- 21.9.4 OTHER DEVELOPMENTS

22 COMPANY PROFILES

- 22.1 KEY PLAYERS

- 22.1.1 ZF FRIEDRICHSHAFEN AG

- 22.1.1.1 Business overview

- 22.1.1.2 Products offered

- 22.1.1.3 Recent developments

- 22.1.1.3.1 Product launches/developments

- 22.1.1.3.2 Expansions

- 22.1.1.4 MnM view

- 22.1.1.4.1 Key strengths

- 22.1.1.4.2 Strategic choices

- 22.1.1.4.3 Weaknesses and competitive threats

- 22.1.2 HYUNDAI MOBIS

- 22.1.2.1 Business overview

- 22.1.2.2 Products offered

- 22.1.2.3 Recent developments

- 22.1.2.3.1 Product launches/developments

- 22.1.2.4 MnM view

- 22.1.2.4.1 Key strengths

- 22.1.2.4.2 Weaknesses and competitive threats

- 22.1.2.4.3 Strategic choices

- 22.1.3 TENNECO INC.

- 22.1.3.1 Business overview

- 22.1.3.2 Products offered

- 22.1.3.3 Recent developments

- 22.1.3.3.1 Product launches/developments

- 22.1.3.4 MnM view

- 22.1.3.4.1 Key strengths

- 22.1.3.4.2 Weaknesses and competitive threats

- 22.1.3.4.3 Strategic choices

- 22.1.4 THYSSENKRUPP AG

- 22.1.4.1 Business overview

- 22.1.4.2 Products offered

- 22.1.4.3 Recent developments

- 22.1.4.3.1 Deals

- 22.1.4.4 MnM view

- 22.1.4.4.1 Key strengths

- 22.1.4.4.2 Weaknesses and competitive threats

- 22.1.4.4.3 Strategic choices

- 22.1.5 DANA LIMITED

- 22.1.5.1 Business overview

- 22.1.5.2 Products offered

- 22.1.5.3 Recent developments

- 22.1.5.3.1 Product launches/developments

- 22.1.5.4 MnM view

- 22.1.5.4.1 Key strengths

- 22.1.5.4.2 Weaknesses and competitive threats

- 22.1.5.4.3 Strategic choices

- 22.1.6 MAGNA INTERNATIONAL INC.

- 22.1.6.1 Business overview

- 22.1.6.2 Products offered

- 22.1.6.3 MnM view

- 22.1.6.3.1 Key strengths

- 22.1.6.3.2 Strategic choices

- 22.1.6.3.3 Weaknesses and competitive threats

- 22.1.7 CONTINENTAL AG

- 22.1.7.1 Business overview

- 22.1.7.2 Products offered

- 22.1.8 BWI GROUP

- 22.1.8.1 Business overview

- 22.1.8.2 Products offered

- 22.1.8.3 Recent developments

- 22.1.8.3.1 Expansions

- 22.1.8.3.2 Deals

- 22.1.9 KYB CORPORATION

- 22.1.9.1 Business overview

- 22.1.9.2 Products offered

- 22.1.9.3 MnM view

- 22.1.9.3.1 Key strengths

- 22.1.9.3.2 Strategic choices

- 22.1.9.3.3 Weaknesses and competitive threats

- 22.1.10 HL MANDO CORPORATION

- 22.1.10.1 Business overview

- 22.1.10.2 Products offered

- 22.1.11 MERITOR, INC.

- 22.1.11.1 Business overview

- 22.1.11.2 Products offered

- 22.1.12 HENDRICKSON USA, L.L.C.

- 22.1.12.1 Business overview

- 22.1.12.2 Products offered

- 22.1.12.3 Recent developments

- 22.1.12.3.1 Product launches/developments

- 22.1.12.3.2 Deals

- 22.1.1 ZF FRIEDRICHSHAFEN AG

- 22.2 OTHER KEY PLAYERS

- 22.2.1 ASTEMO, LTD

- 22.2.2 SOGEFI

- 22.2.3 EIBACH

- 22.2.4 GESTAMP

- 22.2.5 SIDEM

- 22.2.6 PEDDERS SUSPENSION & BRAKES

- 22.2.7 RTS

- 22.2.8 YSS SUSPENSION

- 22.2.9 BELLTECH

- 22.2.10 SKYJACKER SUSPENSIONS

- 22.2.11 MULTIMATIC INC

- 22.2.12 KING SHOCKS

- 22.2.13 FOX FACTORY, INC.

- 22.2.14 RANCHO SUSPENSION

- 22.2.15 TEIN USA.

- 22.2.16 AIR LIFT COMPANY

- 22.2.17 MOOG INC.

23 RECOMMENDATIONS BY MARKETSANDMARKETS

- 23.1 ASIA PACIFIC TO LEAD AUTOMOTIVE SUSPENSION MARKET

- 23.2 GROWING DEMAND FOR AIR SUSPENSION SYSTEMS: KEY FOCUS AREAS

- 23.3 CONCLUSION

24 APPENDIX

- 24.1 INSIGHTS FROM INDUSTRY EXPERTS

- 24.2 DISCUSSION GUIDE

- 24.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 24.4 CUSTOMIZATION OPTIONS

- 24.4.1 AUTOMOTIVE SUSPENSION MARKET, BY ICE VEHICLE TYPE (COUNTRY LEVEL)

- 24.4.1.1 Passenger cars

- 24.4.1.1.1 Front suspension, by architecture

- 24.4.1.1.1.1 Macpherson strut

- 24.4.1.1.1.2 Double wishbone

- 24.4.1.1.1.3 Multilink

- 24.4.1.1.1.4 Twist beam/torsion beam

- 24.4.1.1.1.5 Air suspension

- 24.4.1.1.2 Rear suspension, by architecture

- 24.4.1.1.2.1 Macpherson strut

- 24.4.1.1.2.2 Double wishbone

- 24.4.1.1.2.3 Multilink

- 24.4.1.1.2.4 Twist beam/torsion beam

- 24.4.1.1.2.5 Air suspension

- 24.4.1.1.1 Front suspension, by architecture

- 24.4.1.2 LCVs

- 24.4.1.2.1 Front suspension, by architecture

- 24.4.1.2.1.1 Macpherson strut

- 24.4.1.2.1.2 Double wishbone

- 24.4.1.2.1.3 Multilink

- 24.4.1.2.1.4 Twist beam/torsion beam

- 24.4.1.2.1.5 Leaf spring

- 24.4.1.2.1.6 Air suspension

- 24.4.1.2.2 Rear suspension, by architecture

- 24.4.1.2.2.1 Macpherson strut

- 24.4.1.2.2.2 Double wishbone

- 24.4.1.2.2.3 Multilink

- 24.4.1.2.2.4 Twist beam/torsion beam

- 24.4.1.2.2.5 Leaf spring

- 24.4.1.2.2.6 Air suspension

- 24.4.1.2.1 Front suspension, by architecture

- 24.4.1.3 HCVs

- 24.4.1.1 Passenger cars

- 24.4.2 PASSIVE, SEMI-ACTIVE, AND ACTIVE SUSPENSION MARKET, BY ARCHITECTURE (COUNTRY LEVEL)

- 24.4.2.1 Macpherson strut

- 24.4.2.2 Double wishbone

- 24.4.2.3 Multilink

- 24.4.2.4 Twist beam/torsion beam

- 24.4.2.5 Leaf spring suspension

- 24.4.2.6 Air suspension

- 24.4.3 AUTOMOTIVE SUSPENSION MARKET, ELECTRIC & HYBRID VEHICLE (REGIONAL LEVEL), BY PROPULSION

- 24.4.3.1 BEV

- 24.4.3.1.1 Front suspension, by architecture

- 24.4.3.1.2 Rear suspension, by architecture

- 24.4.3.2 PHEV

- 24.4.3.2.1 Front suspension, by architecture

- 24.4.3.2.2 Rear suspension, by architecture

- 24.4.3.3 FCEV

- 24.4.3.3.1 Front suspension, by architecture

- 24.4.3.3.2 Rear suspension, by architecture

- 24.4.3.1 BEV

- 24.4.4 OFF-HIGHWAY SUSPENSION MARKET, BY APPLICATION (REGIONAL LEVEL)

- 24.4.4.1 Construction equipment

- 24.4.4.1.1 Mechanical

- 24.4.4.1.2 Pneumatic

- 24.4.4.1.3 Hydropneumatics

- 24.4.4.2 Agricultural tractors

- 24.4.4.2.1 Mechanical

- 24.4.4.2.2 Pneumatic

- 24.4.4.2.3 Hydropneumatics

- 24.4.4.1 Construction equipment

- 24.4.1 AUTOMOTIVE SUSPENSION MARKET, BY ICE VEHICLE TYPE (COUNTRY LEVEL)

- 24.5 RELATED REPORTS

- 24.6 AUTHOR DETAILS