|

시장보고서

상품코드

1881286

동물 표준 실험실 시장 : 서비스별, 용도별, 동물 유형별, 최종 사용자별, 지역별, 예측(-2030년)Veterinary Reference Laboratory Market by Service (Microbiology, Immunodiagnostics, Molecular Diagnostics, PCR, ELISA, Hematology, Urinalysis), Animal (Companion, Livestock), Application (Clinical Pathology, Toxicology), Region - Global Forecast to 2030 |

||||||

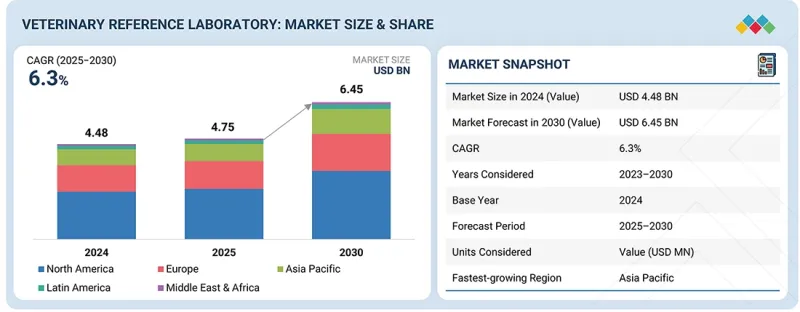

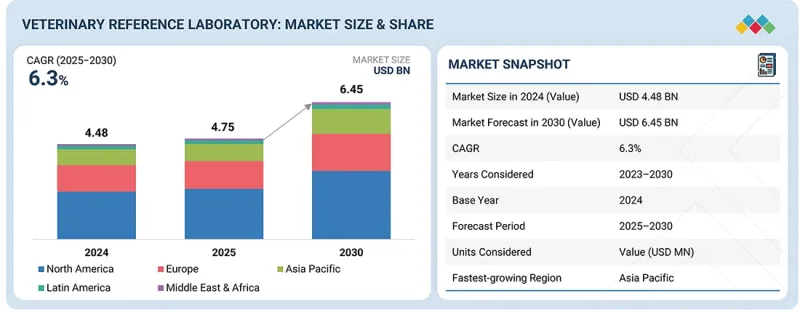

동물 표준 실험실 시장 규모는 2025년 475만 달러, 2030년까지 646만 달러에 이르고, CAGR은 6.3%를 보일 것으로 예측됩니다.

인수 공통 감염과 만성 동물 질환 증가, 동반 동물의 사육률의 상승, 예방 의료에 대한 중시 증가가 주로 시장 확대를 견인하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 기간 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 서비스별, 용도별, 동물 유형별, 최종 사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

분자진단, 면역진단, 임상화학검사 등 고도의 진단검사에 대한 수요가 높아짐에 따라 선진국 및 신흥지역 모두에서 높은 처리량 기준검사기관의 설립이 가속화되고 있습니다. 또한 자동화, AI 기반 영상 분석, 분자 검사의 기술적 진보로 검사 결과의 신속한 제공과 진단 정밀도의 향상이 가능해짐에 따라 수의사와 반려동물 소유자 간의 신뢰 관계가 더욱 깊어지고 있습니다.

동시에 진단 서비스와 디지털 플랫폼과 실험실 정보 관리 시스템(LIMS)의 통합이 진행됨에 따라 워크플로우의 효율화, 시료의 추적성 향상, 검사 결과에 대한 원격 액세스가 가능해지고 있습니다. 질병의 조기 발견과 동반 동물의 건강 관리 프로그램에 대한 관심 증가가 검사 도입을 더욱 뒷받침하는 한편, 수의학의 기업화나 진료소와 기준 검사 기관과의 제휴 확대가, 안정된 검체 유입을 촉진하고 있습니다. 그러나 시장은 높은 운영 비용과 검사 비용, 숙련된 검사 기사 부족, 수의 진단을 규제하는 엄격한 기준 등 과제에 직면하고 있습니다. 게다가 다양한 지역에서의 품질보증 유지, 바이오 보안 대책 및 시료 운송의 과제에 대한 대응은 정확성, 신뢰성, 성장의 지속을 목표로 하는 검사기관에 있어서 중요한 우선사항이 되고 있습니다.

용도별로 볼 때 동물 표준 실험실 시장은 임상 병리학, 세균학, 바이러스학, 기생충학 및 기타 용도로 분류됩니다. 2024년에는 임상병리학이 시장에서 가장 큰 점유율을 차지했습니다. 이 이점은 혈액학, 세포학 및 임상 화학 검사를 통해 상세한 진단 지식을 제공하는 동일한 부문의 중요한 역할에 기인합니다. 이러한 분석을 통해 수의사는 전신 질환의 정확한 진단, 치료 경과 추적, 복잡한 병리학의 효과적인 관리가 가능합니다. 반려동물 증가와 수의사 진료의 빈도 상승이 일상적인 병리 검사 서비스 수요를 뒷받침하고 있습니다. 또한, 자동 분석기와 디지털 병리 시스템의 기술 진보로 진단 정확도, 효율성, 결과 보고까지의 시간이 크게 개선되어 이 분야 시장 성장을 더욱 촉진하고 있습니다.

최종 사용자별로, 동물 표준 실험실 시장은 동물 병원 및 진료소, 연구 기관·대학, 포인트 오브 케어/원내 검사실, 기타 최종 사용자로 분류됩니다. 2024년 기준에서 수의사 클리닉 병원 부문은 세계 시장에서 가장 큰 점유율을 차지했습니다. 이 우위성은 주로 진단 정밀도와 효율 향상을 위해 분자진단, 면역 진단, 임상 화학 검사 등의 고도이고 전문적인 검사를 외부 위탁하는 클리닉이 증가하고, 집중형 검사 기관과의 제휴에 의한 진단 검사량이 증가하고 있는 것에 기인합니다.

반려동물 증가, 반려동물 의료비의 확대, 소규모·대규모 동물 병원 네트워크의 확충도, 진료소·병원으로부터의 검체 유입 증가에 기여하고 있습니다. 이러한 시설에서는 원내에서는 효율적으로 실시할 수 없는 확정 진단이나 복잡한 검사를 참고 검사 기관에 의존하는 것으로, 치료 성과와 업무 흐름의 개선을 도모하고 있습니다. 또한, 진료소와 참고검사기관 간의 디지털 검체 관리 시스템과 자동 결과 보고 시스템의 통합으로 검사 결과의 반환 시간이 단축되어 근거 기반의 수의학이 지원됩니다.

동물 표준 실험실 시장은 북미, 유럽, 아시아태평양, 중동 및 아프리카로 구분됩니다. 2024년 현재 북미는 세계 시장에서 가장 큰 점유율을 차지했습니다. 이러한 이점은 반려동물 사육률의 높이, 예방수의료에 대한 강한 의식, 지역 전체에서 반려동물을 위한 의료비 지출의 많음 등 몇 가지 주요 요인에 기인하고 있습니다. IDEXX Laboratories, Zoetis Services LLC, Mars, Incorporated와 같은 주요 기업의 존재 외에도 확립 된 동물 병원 및 진단센터 네트워크가이 지역의 주도적 지위를 더욱 강화하고 있습니다. 북미 내에서 미국은 가장 큰 시장 점유율을 차지합니다. 이는 일본의 첨단 수의학 인프라, 전문 및 분자진단 검사에 대한 수요 증가, 자동화 및 디지털 병리 솔루션의 급속한 도입을 지원합니다. 또한 미국 시장은 반려동물 보험의 보급률이 높고 수의학 서비스 제공업체의 견고한 생태계, 반려동물 및 가축 진단 기술 혁신을위한 연구 개발에 적극적인 투자 등의 이점을 누리고 있습니다.

본 보고서에서는 세계의 동물 표준 실험실 시장에 대해 조사했으며, 서비스별, 용도별, 동물 유형별, 최종 사용자별, 지역별 동향, 시장 진출기업프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 시장 역학

- 업계 동향

- 기술 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 규제 분석

- 특허 분석

- 가격 분석

- 상환 분석

- 반려동물 보호자 행동

- 2025년-2026년의 주된 회의와 이벤트

- 최종 사용자의 시점과 충족되지 않은 요구

- AI/GEN AI가 동물 표준 실험실 시장에 미치는 영향

- 에코시스템 맵

- 생태계에서의 역할

- 밸류체인 분석

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 2025년 미국 관세가 동물 표준 실험실 시장에 미치는 영향

제6장 동물 표준 실험실 시장(서비스별)

- 소개

- 임상 화학

- 면역진단

- 분자진단

- 혈액학

- 소변 검사

- 조직병리학 및 세포학

- 미생물학

- 기타

제7장 동물 표준 실험실 시장(용도별)

- 소개

- 임상병리학

- 세균학

- 바이러스학

- 기생충학

- 생산성 테스트

- 임신 검사

- 독성시험

- 기타

제8장 동물 표준 실험실 시장(동물 유형별)

- 소개

- 반려동물

- 가축

제9장 동물 표준 실험실 시장(최종사용자별)

- 소개

- 동물병원 및 클리닉

- 포인트 오브 케어/사내 검사

- 수의학 조사 기관 및 대학

- 기타

제10장 동물 표준 실험실 시장(지역별)

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 기타

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 인도

- 호주

- 한국

- 태국

- 뉴질랜드

- 기타

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 아르헨티나

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 기타

제11장 경쟁 구도

- 소개

- 주요 진입기업의 전략/강점

- 수익 분석, 2020년-2024년

- 시장 점유율 분석, 2024년

- 기업평가 매트릭스: 주요 진입기업, 2024년

- 기업평가 매트릭스: 스타트업/중소기업, 2024년

- 브랜드/제품 비교

- 주요 기업의 연구 개발비

- 기업평가와 재무지표

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 진출기업

- IDEXX LABORATORIES, INC.

- MARS, INCORPORATED

- ZOETIS SERVICES LLC

- GD(ROYAL GD ANIMAL HEALTH)

- LABOKLIN GMBH & CO. KG

- CVS(UK) LIMITED

- NATIONAL VETERINARY SERVICES LABORATORY USDA-APHIS

- ANIMAL AND PLANT HEALTH AGENCY

- ICAR-NIVEDI(NATIONAL INSTITUTE OF VETERINARY EPIDEMIOLOGY AND DISEASE INFORMATICS)

- NATIONAL VETERINARY SERVICES

- TEXAS A&M VETERINARY MEDICAL DIAGNOSTIC LABORATORY(TVMDL)

- ANIMAL HEALTH DIAGNOSTIC CENTER, CORNELL UNIVERSITY

- COLORADO STATE UNIVERSITY(VETERINARY DIAGNOSTIC LABORATORY)

- BIOBEST LABORATORIES LTD.

- PRIVATE VETERINARY CLINIC SAN MARCO SRL UNIPERSONALE

- 기타 기업

- ROYAL VETERINARY COLLEGE, UNIVERSITY OF LONDON

- UNIVERSITY OF GUELPH, ANIMAL HEALTH LABORATORY

- VAXXINOVA

- MIRA VISTA LABS

- ELLIE DIAGNOSTICS

- PROTATEK INTERNATIONAL, INC.

- THE PIRBRIGHT INSTITUTE

- CVR LABORATORY(CVRL)

- VETERINARY PATHOLOGY GROUP

- FRIEDRICH-LOEFFLER-INSTITUT(FLI)

제13장 부록

SHW 25.12.11The veterinary reference laboratory market is forecasted to grow from USD 4.75 million in 2025 to USD 6.46 million by 2030, recording a CAGR of 6.3%. The increasing prevalence of zoonotic and chronic animal diseases, rising companion animal ownership, and the growing emphasis on preventive healthcare primarily drive market expansion.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | By Service, Application, Animal type, End User, Region |

| Regions covered | North America, Europe, APAC, RoW |

The rising demand for advanced diagnostic testing, including molecular diagnostics, immunodiagnostics, and clinical chemistry, has accelerated the establishment of high-throughput reference laboratories in both developed and emerging regions. Moreover, technological advancements in automation, AI-based image analysis, and molecular testing are enabling faster turnaround times and improved diagnostic accuracy, fostering greater trust among veterinarians and pet owners.

At the same time, the increasing integration of diagnostic services with digital platforms and laboratory information management systems (LIMS) is streamlining workflows, enhancing sample traceability, and enabling remote access to test results. The rising focus on early disease detection and companion animal wellness programs further supports test adoption, while expanding veterinary corporatization and partnerships between clinics and reference labs are driving consistent sample inflows. However, the market faces challenges such as high operational and testing costs, a shortage of skilled laboratory professionals, and stringent regulatory standards governing veterinary diagnostics. Additionally, maintaining quality assurance across diverse geographies and addressing biosecurity and sample transport challenges remain key priorities for laboratories aiming to sustain accuracy, reliability, and growth momentum.

The clinical pathology segment accounted for the largest share of the market, by application, in 2024.

Based on application, the veterinary reference laboratory market is segmented into clinical pathology, bacteriology, virology, parasitology, and other applications. In 2024, clinical pathology accounted for the largest share of the market. This dominance is attributed to the segment's critical role in delivering detailed diagnostic insights through hematology, cytology, and clinical chemistry testing. These analyses enable veterinarians to accurately diagnose systemic disorders, track therapeutic progress, and effectively manage complex disease conditions. The rising companion animal population and increasing frequency of veterinary consultations have fueled the demand for routine pathology services. Moreover, technological advancements in automated analyzers and digital pathology systems have significantly improved diagnostic precision, efficiency, and turnaround time, further driving market growth in this segment.

The veterinary clinics & hospitals segment is expected to dominate the market, by end user, during the forecast period.

Based on end user, the veterinary reference laboratory market is segmented into veterinary clinics and hospitals, research institutes and universities, point-of-care/in-house labs, and other end users. In 2024, veterinary clinics and hospitals accounted for the largest share of the global market. This dominance is primarily driven by the rising volume of diagnostic testing conducted through referral partnerships with centralized laboratories, as clinics increasingly outsource advanced and specialized tests such as molecular diagnostics, immunodiagnostics, and clinical chemistry to improve diagnostic accuracy and efficiency.

The growing companion animal population, higher pet healthcare expenditure, and expanding network of small and large veterinary practices have further contributed to the rising sample inflow from clinics and hospitals. These facilities rely on reference laboratories for confirmatory and complex testing that cannot be efficiently performed in-house, thereby enhancing treatment outcomes and operational workflows. Additionally, the integration of digital sample management systems and automated result reporting between clinics and reference labs is improving turnaround times and supporting evidence-based veterinary care.

In 2024, North America dominated the veterinary reference laboratory market.

The veterinary reference laboratory market is segmented into North America, Europe, Asia Pacific, and the Middle East & Africa. In 2024, North America accounted for the largest share of the global market. This dominance can be attributed to several key factors, including the high prevalence of companion animal ownership, strong awareness of preventive veterinary care, and significant healthcare expenditure on pets across the region. The presence of leading industry players such as IDEXX Laboratories, Zoetis Services LLC, and Mars, Incorporated, coupled with a well-established network of veterinary hospitals and diagnostic centers, has further reinforced the region's leadership. Within North America, the United States held the largest market share, supported by the country's advanced veterinary infrastructure, growing demand for specialized and molecular diagnostic testing, and rapid adoption of automation and digital pathology solutions. Additionally, the U.S. market benefits from favorable pet insurance penetration, a robust ecosystem of veterinary service providers, and strong investment in R&D for companion and livestock diagnostic innovations.

Breakdown of supply-side primary interviews:

- By Company Type: Tier 1 (45%), Tier 2 (20%), and Tier 3 (35%)

- By Designation: C-level Executives (35%), Directors (25%), and Other Designations (40%)

- By Region: North America (40%), Europe (25%), Asia Pacific (20%), Latin America (10%), and Middle East & Africa (5%)

Breakdown of demand-side primary interviews:

- By Company Type: Veterinary Clinics & Hospitals (70%), POC/In-house labs (15%), Research Institutions and Universities (10%), and Other End Users (5%)

- By Designation: Veterinary Healthcare Professionals (35%), Department Heads (27%), Procurement Heads (22%), and Other Designations (16%)

- By Region: North America (40%), Europe (25%), Asia Pacific (20%), Latin America (10%), and Middle East & Africa (5%)

Research Coverage

This report studies the veterinary reference laboratory market based on service, application, animal type, end user, and region. It also studies factors affecting market growth (drivers, restraints, opportunities, and challenges). It analyzes the market's opportunities and challenges and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to six main regions and respective countries.

Reasons to Buy the Report

The report can help established companies and new or smaller firms understand market trends, which will help them capture a larger market share. Firms that purchase the report can utilize one or more of the five strategies mentioned below.

This report provides insights into the following points:

- Analysis of key drivers, opportunities, restraints, and challenges influencing the growth of the veterinary reference laboratory market.

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and service launches in the veterinary reference laboratory market

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of veterinary reference laboratory services across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the veterinary reference laboratory market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the veterinary reference laboratory market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 MARKET STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH METHODOLOGY DESIGN

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key sources of secondary research

- 2.2.1.2 Key objectives of secondary research

- 2.2.1.3 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key primary sources

- 2.2.2.2 Key objectives of primary research

- 2.2.2.3 Key data from primary sources

- 2.2.2.4 Key industry insights

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 REVENUE SHARE ANALYSIS

- 2.3.2 COMPANY PRESENTATIONS AND PRIMARY INTERVIEWS

- 2.3.3 DEMAND-SIDE ANALYSIS

- 2.3.4 TOP-DOWN APPROACH

- 2.3.5 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 MARKET SHARE ANALYSIS

- 2.6 STUDY ASSUMPTIONS

- 2.6.1 MARKET ASSUMPTIONS

- 2.6.2 GROWTH RATE ASSUMPTIONS

- 2.7 RISK ANALYSIS

- 2.8 RESEARCH LIMITATIONS

- 2.8.1 METHODOLOGY-RELATED LIMITATIONS

- 2.8.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 VETERINARY REFERENCE LABORATORY MARKET OVERVIEW

- 4.2 ASIA PACIFIC: VETERINARY REFERENCE LABORATORY MARKET, BY PRODUCT AND COUNTRY (2024)

- 4.3 VETERINARY REFERENCE LABORATORY MARKET: REGIONAL MIX

- 4.4 VETERINARY REFERENCE LABORATORY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.5 VETERINARY REFERENCE LABORATORY MARKET: DEVELOPED VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- 5.1.1 DRIVERS

- 5.1.1.1 Growing routine wellness and oncology screening in companion animals

- 5.1.1.2 Rapid adoption of digital pathology and telepathology

- 5.1.1.3 Increasing prevalence/awareness of zoonotic and emerging diseases

- 5.1.1.4 Growth in companion animal population

- 5.1.1.5 Rising demand for animal-derived food products

- 5.1.1.6 Increasing demand for pet insurance and growing animal health expenditure

- 5.1.2 RESTRAINTS

- 5.1.2.1 Competition from in-clinic and point-of-care testing

- 5.1.2.2 High capital investment and fixed cost burden in veterinary reference laboratories

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Potential growth opportunities in emerging economies

- 5.1.3.2 Investment in advanced technologies in veterinary reference laboratories

- 5.1.4 CHALLENGES

- 5.1.4.1 Competitive pressure and margin pressure in veterinary reference laboratories

- 5.1.4.2 Data privacy, biosecurity, and sample ownership in veterinary reference laboratories

- 5.1.1 DRIVERS

- 5.2 INDUSTRY TRENDS

- 5.2.1 DIGITAL PATHOLOGY, TELECYTOLOGY, AND AI FROM PILOT TO COMMERCIAL SERVICES

- 5.2.2 CONTINUED CONSOLIDATION AND VERTICAL INTEGRATION ACROSS ANIMAL-HEALTH ECOSYSTEM

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 Real-time PCR/Quantitative PCR (qPCR) and digital PCR (dPCR)

- 5.3.1.2 Next-generation/Metagenomic sequencing (NGS/mNGS)

- 5.3.1.3 CRISPR-based diagnostics

- 5.3.2 ADJACENT TECHNOLOGIES

- 5.3.2.1 Integrated LIMS and one health surveillance platforms

- 5.3.2.2 AI-driven diagnostic tools

- 5.3.3 COMPLEMENTARY TECHNOLOGIES

- 5.3.3.1 Telepathology

- 5.3.3.2 Breath and saliva-based diagnostic tools

- 5.3.1 KEY TECHNOLOGIES

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF NEW ENTRANTS

- 5.4.2 THREAT OF SUBSTITUTES

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 BARGAINING POWER OF BUYERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.5.2 KEY BUYING CRITERIA

- 5.6 REGULATORY ANALYSIS

- 5.6.1 REGULATORY LANDSCAPE

- 5.6.1.1 North America

- 5.6.1.1.1 US

- 5.6.1.2 Europe

- 5.6.1.1 North America

- 5.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.1 REGULATORY LANDSCAPE

- 5.7 PATENT ANALYSIS

- 5.7.1 PATENT PUBLICATION TRENDS FOR VETERINARY REFERENCE LABORATORY

- 5.7.2 JURISDICTION & TOP APPLICANT ANALYSIS

- 5.7.3 MAJOR PATENTS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND OF VETERINARY REFERENCE LABORATORY SERVICES, BY KEY PLAYER, 2022-2024

- 5.8.2 AVERAGE SELLING PRICE TREND OF CLINICAL CHEMISTRY AND IMMUNODIAGNOSTIC SERVICES, BY REGION, 2022-2024

- 5.9 REIMBURSEMENT ANALYSIS

- 5.10 PET PARENT BEHAVIOUR

- 5.11 KEY CONFERENCES & EVENTS, 2025-2026

- 5.12 END-USER PERSPECTIVE & UNMET NEEDS

- 5.13 IMPACT OF AI/GEN AI ON VETERINARY REFERENCE LABORATORY MARKET

- 5.13.1 INTRODUCTION

- 5.13.2 MARKET POTENTIAL IN VETERINARY REFERENCE LABORATORY ECOSYSTEM

- 5.13.3 AI-USE CASES

- 5.13.4 KEY COMPANIES IMPLEMENTING AI

- 5.14 ECOSYSTEM MAP

- 5.15 ROLE IN ECOSYSTEM

- 5.16 VALUE CHAIN ANALYSIS

- 5.17 INVESTMENT & FUNDING SCENARIO

- 5.18 CASE STUDY ANALYSIS

- 5.18.1 DIGITAL CYTOLOGY WORKFLOW ACCELERATION TO ENHANCE DIAGNOSTIC TURNAROUND IN VETERINARY PRACTICES

- 5.18.2 IDEXX-CANCERDX (LYMPHOMA DIAGNOSTIC SERVICE) TO ADVANCE ONCOLOGY DETECTION THROUGH BLOOD-BASED TESTING

- 5.18.3 VIRTUAL LABORATORY INTEGRATION TO ENHANCE CYTOLOGY TURNAROUND AND CLINICAL WORKFLOW

- 5.19 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.20 IMPACT OF 2025 US TARIFF ON VETERINARY REFERENCE LABORATORY MARKET

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.4.1 North America

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.4.4 Latin America

- 5.20.5 IMPACT ON END-USE INDUSTRIES

- 5.20.5.1 Veterinary hospitals & clinics

- 5.20.5.2 Point-of-care (POC) and in-house testing setups

- 5.20.5.3 Veterinary research institutes & universities

- 5.20.5.4 Other end users

6 VETERINARY REFERENCE LABORATORY MARKET, BY SERVICE

- 6.1 INTRODUCTION

- 6.2 CLINICAL CHEMISTRY

- 6.2.1 VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE

- 6.2.1.1 Companion animals

- 6.2.1.1.1 Rising pet ownership and preventive health trends to drive segment growth

- 6.2.1.2 Livestock animals

- 6.2.1.2.1 Rising focus on herd health, food safety, and export compliance to strengthen segment growth

- 6.2.1.1 Companion animals

- 6.2.1 VETERINARY REFERENCE LABORATORY MARKET FOR CLINICAL CHEMISTRY, BY ANIMAL TYPE

- 6.3 IMMUNODIAGNOSTICS

- 6.3.1 VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE

- 6.3.1.1 ELISA

- 6.3.1.1.1 ELISA tests to dominate immunodiagnostics segment owing to widespread use in infectious disease detection

- 6.3.1.1 ELISA

- 6.3.2 LATERAL FLOW ASSAYS

- 6.3.2.1 Technological advancements and cost-effectiveness to aid market growth

- 6.3.3 ALLERGEN-SPECIFIC IMMUNODIAGNOSTIC TESTS

- 6.3.3.1 Rising prevalence of atopic disorders and adoption of precision allergy testing to augment market growth

- 6.3.4 OTHER IMMUNODIAGNOSTIC SERVICES

- 6.3.5 VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY ANIMAL TYPE

- 6.3.5.1 Companion animals

- 6.3.5.1.1 High pet care spending and preventive diagnostics to propel market growth

- 6.3.5.2 Livestock animals

- 6.3.5.2.1 Regulatory compliance, food safety, and disease surveillance to sustain steady demand

- 6.3.5.1 Companion animals

- 6.3.1 VETERINARY REFERENCE LABORATORY MARKET FOR IMMUNODIAGNOSTICS, BY SERVICE

- 6.4 MOLECULAR DIAGNOSTICS

- 6.4.1 VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY SERVICE

- 6.4.2 PCR TESTS

- 6.4.2.1 High sensitivity and diagnostic accuracy to drive dominance of PCR tests

- 6.4.3 MICROARRAYS

- 6.4.3.1 Advancements in genetic profiling and pharmacogenomics to expand microarray applications

- 6.4.4 NUCLEIC ACID SEQUENCING

- 6.4.4.1 Rising adoption of next-generation sequencing and precision genomics to fuel market growth

- 6.4.5 OTHER MOLECULAR DIAGNOSTIC SERVICES

- 6.4.6 VETERINARY REFERENCE LABORATORY MARKET FOR MOLECULAR DIAGNOSTICS, BY ANIMAL TYPE

- 6.4.6.1 Companion animals

- 6.4.6.1.1 High pet-owner spending, precision diagnostics, and rapid turnaround to drive dominance

- 6.4.6.2 Livestock animals

- 6.4.6.2.1 Regulatory mandates, disease surveillance, and one health initiatives to strengthen market presence

- 6.4.6.1 Companion animals

- 6.5 HEMATOLOGY

- 6.5.1 VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE

- 6.5.1.1 Companion animals

- 6.5.1.1.1 High diagnostic frequency and technological advancements TO sustain segment growth

- 6.5.1.2 Livestock animals

- 6.5.1.2.1 Rising focus on herd health, biosecurity, and productivity optimization to drive steady market growth

- 6.5.1.1 Companion animals

- 6.5.1 VETERINARY REFERENCE LABORATORY MARKET FOR HEMATOLOGY, BY ANIMAL TYPE

- 6.6 URINALYSIS

- 6.6.1 VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE

- 6.6.1.1 Companion animals

- 6.6.1.1.1 Rising incidences of renal diseases in companion animals to drive market

- 6.6.1.2 Livestock animals

- 6.6.1.2.1 Growing emphasis on metabolic profiling and precision herd management to strengthen livestock urinalysis segment

- 6.6.1.1 Companion animals

- 6.6.1 VETERINARY REFERENCE LABORATORY MARKET FOR URINALYSIS, BY ANIMAL TYPE

- 6.7 HISTOPATHOLOGY & CYTOLOGY

- 6.7.1 VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE

- 6.7.1.1 Companion animals

- 6.7.1.1.1 Clinical reliance on laboratory-based tissue and cellular diagnostics for definitive case management to drive market

- 6.7.1.2 Livestock animals

- 6.7.1.2.1 Biosecurity investments and disease surveillance programs to drive steady demand

- 6.7.1.1 Companion animals

- 6.7.1 VETERINARY REFERENCE LABORATORY MARKET FOR HISTOPATHOLOGY & CYTOLOGY, BY ANIMAL TYPE

- 6.8 MICROBIOLOGY

- 6.8.1 VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE

- 6.8.1.1 Companion animals

- 6.8.1.1.1 Rising AMR awareness and shift toward rapid and automated testing to spur market growth

- 6.8.1.2 Livestock animals

- 6.8.1.2.1 Antimicrobial resistance monitoring and food safety compliance to sustain demand

- 6.8.1.1 Companion animals

- 6.8.1 VETERINARY REFERENCE LABORATORY MARKET FOR MICROBIOLOGY, BY ANIMAL TYPE

- 6.9 OTHER SERVICES

- 6.9.1 VETERINARY REFERENCE LABORATORY MARKET FOR OTHER SERVICES, BY ANIMAL TYPE

- 6.9.1.1 Companion animals

- 6.9.1.2 Livestock animals

- 6.9.1 VETERINARY REFERENCE LABORATORY MARKET FOR OTHER SERVICES, BY ANIMAL TYPE

7 VETERINARY REFERENCE LABORATORY MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 CLINICAL PATHOLOGY

- 7.2.1 INCREASING AWARENESS OF ANIMAL HEALTH TO DRIVE MARKET

- 7.3 BACTERIOLOGY

- 7.3.1 GROWTH IN VETERINARY HEALTHCARE EXPENDITURE TO DRIVE MARKET

- 7.4 VIROLOGY

- 7.4.1 EMERGING INFECTIOUS DISEASES IN ANIMALS TO PROPEL MARKET GROWTH

- 7.5 PARASITOLOGY

- 7.5.1 RISING PREVALENCE OF ZOONOTIC DISEASES TO AUGMENT MARKET GROWTH

- 7.6 PRODUCTIVITY TESTING

- 7.6.1 EXPANSION OF LIVESTOCK INDUSTRIES TO SUPPORT MARKET GROWTH

- 7.7 PREGNANCY TESTING

- 7.7.1 ADVANCED BREEDING TECHNIQUES AND RESPONSIBLE PET OWNERSHIP TO DRIVE MARKET GROWTH

- 7.8 TOXICOLOGY TESTING

- 7.8.1 GLOBALIZATION OF FOOD SUPPLY CHAINS TO PROPEL MARKET GROWTH

- 7.9 OTHER APPLICATIONS

8 VETERINARY REFERENCE LABORATORY MARKET, BY ANIMAL TYPE

- 8.1 INTRODUCTION

- 8.2 COMPANION ANIMALS

- 8.2.1 DOGS

- 8.2.1.1 High insurance coverage and availability of reimbursements to drive market

- 8.2.2 CATS

- 8.2.2.1 Increasing pet cat population to support market uptake

- 8.2.3 HORSES

- 8.2.3.1 Growing awareness regarding equine health to fuel market growth

- 8.2.4 OTHER COMPANION ANIMALS

- 8.2.1 DOGS

- 8.3 LIVESTOCK ANIMALS

- 8.3.1 CATTLE

- 8.3.1.1 Growing consumption of dairy products to drive market growth

- 8.3.2 SWINE

- 8.3.2.1 Increasing incidence of infectious diseases to fuel market growth

- 8.3.3 POULTRY

- 8.3.3.1 Increasing demand for poultry meat to spur market growth

- 8.3.4 SHEEP & GOATS

- 8.3.4.1 International trade and strict health regulations to drive market

- 8.3.5 OTHER LIVESTOCK ANIMALS

- 8.3.1 CATTLE

9 VETERINARY REFERENCE LABORATORY MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 VETERINARY HOSPITALS & CLINICS

- 9.2.1 RISING PET OWNERSHIP AND GROWING DIAGNOSTIC AWARENESS TO DRIVE DEMAND FOR VETERINARY REFERENCE LABS

- 9.3 POINT-OF-CARE/IN-HOUSE TESTING

- 9.3.1 INCREASING COLLABORATIONS BETWEEN IN-HOUSE DIAGNOSTIC SETUPS AND REFERENCE LABORATORIES TO AID MARKET GROWTH

- 9.4 VETERINARY RESEARCH INSTITUTES & UNIVERSITIES

- 9.4.1 INCREASING ACADEMIC COLLABORATIONS AND FUNDING TO DRIVE UTILIZATION OF REFERENCE LABORATORY SERVICES

- 9.5 OTHER END USERS

10 VETERINARY REFERENCE LABORATORY MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 US to dominate Norths American veterinary reference laboratory market during forecast period

- 10.2.3 CANADA

- 10.2.3.1 Growing pet adoption, rising animal healthcare expenditure, and increasing number of veterinary practices to drive market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Increasing pet healthcare expenditure and rising demand for animal-derived food products to aid market growth

- 10.3.3 UK

- 10.3.3.1 Increased pet ownership and availability of animal health insurance policies to augment market growth

- 10.3.4 FRANCE

- 10.3.4.1 Growth of livestock industry and high companion animal population to support market growth

- 10.3.5 ITALY

- 10.3.5.1 Rising awareness about pet healthcare to drive market

- 10.3.6 SPAIN

- 10.3.6.1 Growing demand for pig and poultry products to drive market

- 10.3.7 NETHERLANDS

- 10.3.7.1 Increasing animal healthcare expenditure to drive market growth

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Large pool of food-producing animals to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Awareness about zoonotic diseases and increased pet expenditure to propel market growth

- 10.4.4 INDIA

- 10.4.4.1 Growing demand for livestock products and increasing awareness about animal health to support market growth

- 10.4.5 AUSTRALIA

- 10.4.5.1 Increasing investments in pet services and products to aid market growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Increasing pet population in urban households to drive market

- 10.4.7 THAILAND

- 10.4.7.1 Rapidly expanding companion animal population to create higher demand for advanced diagnostic testing

- 10.4.8 NEW ZEALAND

- 10.4.8.1 Increased demand for preventive care and high aging pet population to drive market growth

- 10.4.9 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Increasing use of reproductive technologies in livestock industry to propel market growth

- 10.5.3 MEXICO

- 10.5.3.1 Increasing adoption of advanced diagnostic technologies to propel market growth

- 10.5.4 ARGENTINA

- 10.5.4.1 Focus on advanced healthcare and regular disease monitoring among companion animals to drive market

- 10.5.5 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Kingdom of Saudi Arabia

- 10.6.2.1.1 Technology advancements in veterinary diagnostics to boost market growth

- 10.6.2.2 UAE

- 10.6.2.2.1 Government support and favorable initiatives to fuel market growth

- 10.6.2.3 Rest of GCC Countries

- 10.6.2.1 Kingdom of Saudi Arabia

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN VETERINARY REFERENCE LABORATORY MARKET

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 RANKING OF KEY MARKET PLAYERS

- 11.4.2 GLOBAL MARKET SHARE ANALYSIS

- 11.4.3 US MARKET SHARE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Service footprint

- 11.5.5.4 Animal type footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SME PLAYERS, 2024

- 11.6.5.1 Detailed list of key startups/SME players

- 11.6.5.2 Competitive benchmarking of key emerging players/startups

- 11.7 BRAND/PRODUCT COMPARISON

- 11.8 R&D EXPENDITURE OF KEY PLAYERS

- 11.9 COMPANY VALUATION & FINANCIAL METRICS

- 11.9.1 FINANCIAL METRICS

- 11.9.2 COMPANY VALUATION

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 SERVICE LAUNCHES & ENHANCEMENTS

- 11.10.2 DEALS

- 11.10.3 EXPANSIONS

- 11.10.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 IDEXX LABORATORIES, INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Service launches and enhancements

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 MARS, INCORPORATED

- 12.1.2.1 Business overview

- 12.1.2.2 Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Service launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 ZOETIS SERVICES LLC

- 12.1.3.1 Business overview

- 12.1.3.2 Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 GD (ROYAL GD ANIMAL HEALTH)

- 12.1.4.1 Business overview

- 12.1.4.2 Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Service launches

- 12.1.4.3.2 Deals

- 12.1.4.3.3 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 LABOKLIN GMBH & CO. KG

- 12.1.5.1 Business overview

- 12.1.5.2 Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Service launches

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 CVS (UK) LIMITED

- 12.1.6.1 Business overview

- 12.1.6.2 Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Service launches

- 12.1.7 NATIONAL VETERINARY SERVICES LABORATORY USDA-APHIS

- 12.1.7.1 Business overview

- 12.1.7.2 Services offered

- 12.1.8 ANIMAL AND PLANT HEALTH AGENCY

- 12.1.8.1 Business overview

- 12.1.8.2 Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Other developments

- 12.1.9 ICAR-NIVEDI (NATIONAL INSTITUTE OF VETERINARY EPIDEMIOLOGY AND DISEASE INFORMATICS)

- 12.1.9.1 Business overview

- 12.1.9.2 Services offered

- 12.1.10 NATIONAL VETERINARY SERVICES

- 12.1.10.1 Business overview

- 12.1.10.2 Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Expansions

- 12.1.10.3.2 Other developments

- 12.1.11 TEXAS A&M VETERINARY MEDICAL DIAGNOSTIC LABORATORY (TVMDL)

- 12.1.11.1 Business overview

- 12.1.11.2 Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Service launches and enhancements

- 12.1.12 ANIMAL HEALTH DIAGNOSTIC CENTER, CORNELL UNIVERSITY

- 12.1.12.1 Business overview

- 12.1.12.2 Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Service launches

- 12.1.12.3.2 Expansions

- 12.1.13 COLORADO STATE UNIVERSITY (VETERINARY DIAGNOSTIC LABORATORY)

- 12.1.13.1 Business overview

- 12.1.13.2 Services offered

- 12.1.14 BIOBEST LABORATORIES LTD.

- 12.1.14.1 Business overview

- 12.1.14.2 Services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Expansions

- 12.1.15 PRIVATE VETERINARY CLINIC SAN MARCO SRL UNIPERSONALE

- 12.1.15.1 Business overview

- 12.1.15.2 Services offered

- 12.1.1 IDEXX LABORATORIES, INC.

- 12.2 OTHER PLAYERS

- 12.2.1 ROYAL VETERINARY COLLEGE, UNIVERSITY OF LONDON

- 12.2.2 UNIVERSITY OF GUELPH, ANIMAL HEALTH LABORATORY

- 12.2.3 VAXXINOVA

- 12.2.4 MIRA VISTA LABS

- 12.2.5 ELLIE DIAGNOSTICS

- 12.2.6 PROTATEK INTERNATIONAL, INC.

- 12.2.7 THE PIRBRIGHT INSTITUTE

- 12.2.8 CVR LABORATORY (CVRL)

- 12.2.9 VETERINARY PATHOLOGY GROUP

- 12.2.10 FRIEDRICH-LOEFFLER-INSTITUT (FLI)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.3.1 SERVICE ANALYSIS

- 13.3.2 COMPANY INFORMATION

- 13.3.3 GEOGRAPHIC ANALYSIS

- 13.3.4 REGIONAL/COUNTRY-LEVEL MARKET SHARE ANALYSIS

- 13.3.5 COUNTRY-LEVEL VOLUME ANALYSIS BY PRODUCT

- 13.3.6 BY SERVICE MARKET SHARE ANALYSIS (TOP 5 PLAYERS)

- 13.3.7 ANY CONSULT/CUSTOM REQUIREMENTS AS PER CLIENT REQUESTS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS