|

시장보고서

상품코드

1881288

바이오칩 시장 : 제품 및 서비스별, 유형별, 제조 기술별, 최종 사용자별, 지역별, 예측(-2030년)Biochips Market by Products & Services (Instruments, Software), Type (DNA Chips, Protein Chips, Lab-on-a-Chip), Application (High-throughput Screening, IVD, POC), Fabrication Technology (Microarrays, Microfluidics), & Region - Global Forecast to 2030 |

||||||

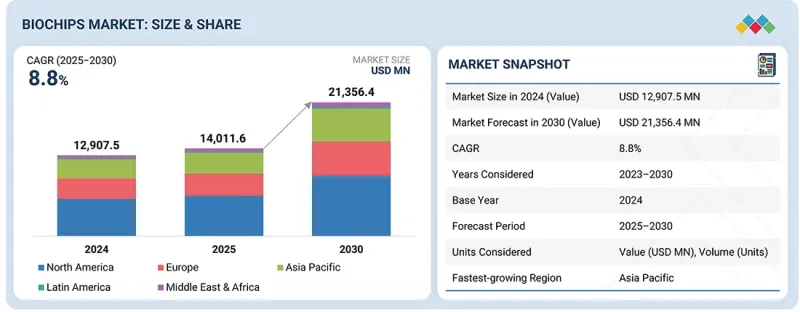

바이오칩 시장 규모는 2025년 140억 1,000만 달러, 2030년까지 213억 6,000만 달러에 달하고, CAGR은 8.8%를 보일 것으로 예측됩니다.

이 성장은 진단 기술, 유전체학, 맞춤형 의료의 미래를 형성하는 몇 가지 주요 요인에 의해 추진되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 기간 | 2023-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 제품 및 서비스별, 유형별, 제조 기술별, 최종 사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

이 성장의 주요 촉진요인은 유전체학의 진보와 맞춤형 의료에 대한 관심 증가로 정밀 진단과 개인화 치료에 대한 수요가 증가하고 있다는 것입니다. 의료 산업이 보다 맞춤 치료 계획으로 이동함에 따라, 유전자 검사, 질병 검출, 의약품 개발 등의 용도에 있어서의 바이오칩의 채용이 급속히 확대되고 있습니다.

또한, 보다 빠르고 효율적인 진단에 대한 수요가 증가함에 따라 높은 처리량으로 포인트 오브 케어 검사 솔루션의 필요성이 가속화되고 있습니다. 바이오칩, 특히 DNA 칩과 실험실 칩 시스템은 빠르고 비용 효율적이고 확장 가능한 진단 솔루션을 제공함으로써 이러한 수요에 부응하는 데 중요한 역할을 합니다. 의료 분산화의 동향, 즉 진단 검사나 치료가 중앙 집권적인 연구소에서 보다 접근하기 쉬운 환경으로 이행하고 있는 것도 바이오칩의 채용을 더욱 뒷받침하고 있습니다.

데이터 분석을 위한 인공지능 통합 및 마이크로플루이딕스 플랫폼 개발과 같은 기술적 진보도 시장 성장을 가속화하고 있습니다. 이러한 혁신은 바이오칩 시스템의 정확성, 속도 및 사용 편의성을 향상시키고 조사에서 임상 진단에 이르기까지 다양한 분야에서의 응용 범위를 확대하고 있습니다.

전체적으로 의료 수요가 높아지고, 기술 혁신, 그리고 개별화·분산형 의료로의 이행이 진행되고 있는 것이 함께, 바이오칩 시장의 견조한 성장을 견인하고 있습니다.

소프트웨어 및 서비스 분야는 바이오칩 응용에 있어서의 고도의 데이터 분석, AI를 활용한 지견, 클라우드 통합의 필요성이 높아지고 있는 것을 배경으로 바이오칩 시장에서 가장 높은 성장이 전망됩니다. 바이오칩은 대량의 복잡한 생물학적 데이터를 생성하므로 결과 처리, 해석 및 시각화를 위한 고급 소프트웨어 솔루션이 필수적입니다. 게다가, 맞춤형 의료나 정밀 진단의 대두에 의해 유전자 데이터, 단백질체학 데이터, 유전체 데이터를 처리·분석하기 위한 바이오인포매틱스 서비스가 요구되고 있습니다. 이러한 동향과 더불어 데이터 공유 및 원격 진단을 위한 클라우드 기반 플랫폼의 도입 확대와 함께 바이오칩 시장에서 소프트웨어 및 서비스의 급속한 성장을 이끌고 있습니다.

2024년에는 바이오칩이 약물발견, 유전체 연구, 맞춤형 의료에서 중요한 역할을 했기 때문에 동물 병원 부문이 바이오칩 시장을 견인했습니다. 이러한 기업들은 신규 치료법의 개발과 치료 정밀도 향상에 필수적인 고처리량 스크리닝, 바이오마커 발견, 유전자 프로파일링에 바이오칩을 활용하고 있습니다. 보다 신속하고 정확하며 비용 효율적인 진단 및 R&D 툴에 대한 요구가 증가함에 따라 이러한 업계에서 바이오칩의 강한 수요가 이어지고 있습니다. 또한, 바이오칩은 제약 기업이 의약품 개발 프로세스를 효율화할 수 있게 해주며, 생명공학 및 제약 분야에서 필수적인 기술이 되었습니다.

아시아태평양은 의료 인프라의 급속한 진전, 생명공학 분야에 대한 정부 투자 증가, 개인화된 의료에 대한 관심 증가를 배경으로 바이오칩 시장에서 가장 높은 성장을 이룰 것으로 전망됩니다. 이 지역에서 계속 확대되는 제약 및 바이오테크놀러지 산업이 의약품 개발, 진단, 유전체 연구에 있어서의 바이오칩 수요를 견인하고 있습니다. 게다가 중국과 인도 등 국가에서의 의료 의식의 향상, 의료 접근의 개선, 중산 계급의 확대가 바이오칩을 포함한 첨단 진단 기술의 채택을 가속화하고 있습니다. 경제 성장, 기술진보, 의료이노베이션이 결합되어 이 지역 시장 확대를 급속히 추진하고 있습니다.

본 보고서에서는 세계의 바이오칩 시장에 대해 조사했으며, 제품 및 서비스별, 유형별, 제조기술별, 최종 사용자별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 업계 동향

- 기술 분석

- Porter's Five Forces 분석

- 규제 상황

- 특허 분석

- 무역 분석

- 가격 분석

- 2025년-2026년의 주된 회의와 이벤트

- 주요 이해관계자와 구매 기준

- 최종 사용자 분석 및 언멧 요구

- AI/생성형 AI가 바이오칩 시장에 미치는 영향

- 생태계 분석

- 사례 연구 분석

- 밸류체인 분석

- 공급망 분석

- 고객의 비즈니스에 영향을 미치는 동향/혁신

- 투자 및 자금조달 시나리오

- 미국 관세가 바이오칩 시장에 미치는 영향

제6장 바이오칩 시장(제품 및 서비스별)

- 소개

- 소모품

- 장치

- 소프트웨어 및 서비스

제7장 바이오칩 시장(유형별)

- 소개

- DNA 칩

- LAB-ON-A-CHIP

- 단백질 칩

- 조직 배열

- 세포 배열

제8장 바이오칩 시장(제조 기술별)

- 소개

- 마이크로어레이

- 마이크로플루이딕스

제9장 바이오칩 시장(최종사용자별)

- 소개

- 생명공학 및 제약회사

- 병원과 진단센터

- 학술연구기관

- CRO

- 기타

제10장 바이오칩 시장(지역별)

- 소개

- 북미

- 북미의 거시경제 전망

- 북미 : 유형별 수량 분석, 2023년-2030년(1,000대)

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 유럽 : 유형별 수량 분석, 2023년-2030년(1,000대)

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 기타

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 아시아태평양 : 유형별 수량 분석, 2023년-2030년(1,000대)

- 중국

- 일본

- 인도

- 호주

- 한국

- 태국

- 뉴질랜드

- 기타

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 라틴아메리카 : 유형별 수량 분석, 2023년-2030년(1,000대)

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- 중동 및 아프리카 : 유형별 수량 분석, 2023년-2030년(1,000대)

- GCC 국가

- 기타

제11장 경쟁 구도

- 개요

- 주요 진입기업의 전략/강점

- 수익 점유율 분석, 2020년-2024년

- 시장 점유율 분석, 2024년

- 기업평가와 재무지표

- 브랜드/제품 비교 분석

- 주요 기업의 연구 개발비

- 기업평가 매트릭스: 주요 진입기업, 2024년

- 기업평가 매트릭스: 스타트업/중소기업, 2024년

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 진출기업

- THERMO FISHER SCIENTIFIC INC.

- ILLUMINA, INC.

- AGILENT TECHNOLOGIES, INC.

- F. HOFFMANN-LA ROCHE LTD

- QIAGEN

- BIO-RAD LABORATORIES, INC.

- ABBOTT

- STANDARD BIOTOOLS

- 10X GENOMICS

- CEPHEID

- BIOMERIEUX

- REVVITY

- DIASORIN SPA

- RANDOX LABORATORIES LTD.

- OXFORD GENE TECHNOLOGY IP LIMITED

- 기타 기업

- MICRONIT BV

- RAYBIOTECH, INC.

- PHALANX BIOTECH GROUP

- ARRAYIT CORPORATION

- 3DHISTECH LTD.

- CREATIVE BIOARRAY

- TISSUEARRAY.COM

- IBIOCHIPS

- CAPITALBIOTECH CO., LTD.

- PEPPERPRINT GMBH

제13장 부록

SHW 25.12.11The biochips market is expected to grow from USD 14.01 billion in 2025 to USD 21.36 billion by 2030, at a CAGR of 8.8%. This growth is driven by several key factors shaping the future of diagnostics, genomics, and personalized medicine.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | By Product & Service, By Type, By Fabrication Technology, By End User, By Region |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa |

A major driver of this growth is the increasing demand for precision diagnostics and personalized treatments, fueled by advancements in genomics and the growing focus on individualized healthcare. As the healthcare industry shifts toward more tailored treatment plans, the adoption of biochips for applications like genetic testing, disease detection, and drug development is rapidly expanding.

Additionally, the growing demand for faster and more efficient diagnostics is driving the need for high-throughput, point-of-care testing solutions. Biochips, particularly DNA chips and lab-on-a-chip systems, play a crucial role in meeting this demand by providing rapid, cost-effective, and scalable diagnostic solutions. The ongoing trend toward decentralization in healthcare, where diagnostic tests and treatments are moving from centralized laboratories to more accessible settings, further boosts the adoption of biochips.

Technological advancements, such as the integration of artificial intelligence for data analysis and the development of microfluidic platforms, are also accelerating market growth. These innovations enhance the accuracy, speed, and ease of use of biochip systems, expanding their applications across various sectors, from research to clinical diagnostics.

Overall, the combination of rising healthcare demands, technological innovations, and the increasing shift toward personalized and decentralized healthcare is driving robust growth in the biochips market.

By product & service, the software & services segment is projected to grow at the highest CAGR during the forecast period.

The software & services segment is expected to see the highest growth in the biochips market, driven by the increasing need for advanced data analysis, AI-driven insights, and cloud integration in biochip applications. As biochips generate large volumes of complex biological data, sophisticated software solutions are essential for processing, interpreting, and visualizing results. Additionally, the rise in personalized medicine and precision diagnostics requires bioinformatics services to handle and analyze genetic, proteomic, and genomic data. These trends, coupled with the growing adoption of cloud-based platforms for data sharing and remote diagnostics, are driving the rapid growth of software and services in the biochips market.

By end user, the biotechnology and pharmaceutical companies segment accounted for the largest market share in 2024.

In 2024, the veterinary clinics segment dominated the biochips market due to the critical role biochips play in drug discovery, genomic research, and personalized medicine. These companies use biochips for high-throughput screening, biomarker discovery, and genetic profiling, which are essential for developing new therapies and improving treatment precision. The need for faster, more accurate, and cost-effective diagnostics and research tools drives strong demand for biochips in these industries. Additionally, biochips enable pharmaceutical companies to streamline drug development processes, making them an indispensable technology in the biotech and pharmaceutical sectors.

The Asia Pacific region is expected to witness the highest growth during the forecast period.

The Asia Pacific is poised to experience the highest growth in the biochips market, driven by rapid advancements in healthcare infrastructure, increasing government investments in biotechnology, and a growing focus on personalized medicine. The region's expanding pharmaceutical and biotechnology industries are driving demand for biochips in drug development, diagnostics, and genomic research. Additionally, rising healthcare awareness, improved healthcare access, and a growing middle class in countries such as China and India are accelerating the adoption of advanced diagnostic technologies, including biochips. This combination of economic growth, technological advancements, and healthcare innovations is driving the region's rapid market expansion.

Breakdown of supply-side primary interviews:

- By Company Type: Tier 1 (45%), Tier 2 (20%), and Tier 3 (35%)

- By Designation: C-level Executives (35%), Directors (25%), and Other Designations (40%)

- By Region: North America (40%), Europe (25%), Asia Pacific (20%), Latin America (10%), and Middle East & Africa (5%)

Breakdown of demand-side primary interviews:

- By End User: Biotechnology and Pharmaceutical Companies (40%), Hospitals and Diagnostic Centers (25%), Academic & Research Institutes (20%), Contract Research Organizations (CROs) (10%), and Other End Users (5%)

By Designation: Laboratory Managers / Heads (47%), Clinical Diagnostics Managers (22%), Genomics / Research Scientists (15%), and Others (16%)

- By Region: North America (25%), Europe (24%), Asia Pacific (25%), Latin America (11%), and the Middle East & Africa (15%)

Research Coverage

The market study covers the biochips market in various segments. It aims to estimate the market size and growth potential of this market by products & services, type, fabrication technology, end user, and region. The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their products and business offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report can assist established companies and newer or smaller firms in understanding market trends, enabling them to capture a larger market share. Firms that acquire the report can implement one or more of the five strategies outlined below.

This report provides insights into the following points:

- Analysis of key drivers (Growing demand for personalized medicines, Technological advancements in microfluidics and AI integration), restraints (High cost of biochip development and fabrication, Data management and standardization issues), opportunities (Expanding applications in point-of-care and decentralized diagnostics, Increasing government and private investments in genomics research), and challenges (Technical complexity and integration of multidisciplinary technologies, Regulatory and validation hurdles for clinical use) influencing the growth of the biochips market.

- Product Development/Innovation: Detailed insights on upcoming technologies and product launches in the biochips market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of biochips across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the biochips market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the biochips market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH METHODOLOGY

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Key industry insights

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 MARKET SHARE ANALYSIS

- 2.5.1 RESEARCH ASSUMPTIONS

- 2.5.2 GROWTH RATE ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 BIOCHIPS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: BIOCHIPS MARKET, BY PRODUCTS & SERVICES & COUNTRY (2024)

- 4.3 BIOCHIPS MARKET: REGIONAL MIX

- 4.4 BIOCHIPS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.5 BIOCHIPS MARKET: DEVELOPED MARKETS VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising adoption of personalized medicine

- 5.2.1.2 Technological advancements in microarray and microfluidics fabrication

- 5.2.1.3 Increasing R&D investments in genomics and proteomics

- 5.2.1.4 Advancements in point-of-care diagnostics and lab-on-a-chip technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of instruments and fabrication

- 5.2.2.2 Complex data interpretation and standardization

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of AI and bioinformatics in biochip data analysis

- 5.2.3.2 Expansion into emerging markets and new applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical complexity and integration of multidisciplinary technologies

- 5.2.4.2 Regulatory and validation hurdles for clinical use

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 MINIATURIZATION, PORTABILITY, AND DECENTRALIZED DIAGNOSTICS

- 5.3.2 SHIFT TOWARD MICROFLUIDICS AND LAB-ON-A-CHIP FORMATS

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Digital microfluidic biochips

- 5.4.1.2 Plasmonic and nanoplasmonic biochips

- 5.4.1.3 Wearable and implantable biochips

- 5.4.2 ADJACENT TECHNOLOGIES

- 5.4.2.1 AI/Machine learning for biochip data & design

- 5.4.2.2 Optical genome mapping chips

- 5.4.3 COMPLEMENTARY TECHNOLOGIES

- 5.4.3.1 Advanced microfabrication and 3D printing

- 5.4.3.2 Biochip integration in biosensors

- 5.4.1 KEY TECHNOLOGIES

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF SUPPLIERS

- 5.5.4 BARGAINING POWER OF BUYERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY ANALYSIS

- 5.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7 PATENT ANALYSIS

- 5.7.1 PATENT PUBLICATION TRENDS FOR BIOCHIPS

- 5.7.2 JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT DATA FOR HS CODE 9027

- 5.8.2 EXPORT DATA FOR HS CODE 9027

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.9.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.9.2.1 Average selling price of DNA chips and lab-on-a-chip, by region

- 5.9.2.2 Average selling price trend of DNA chips, by region

- 5.9.2.3 Average selling price trend of lab-on-a-chip, by region

- 5.9.2.4 Average selling price trend of protein chips, by region

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 END-USER ANALYSIS AND UNMET NEEDS

- 5.13 IMPACT OF AI/GENERATIVE AI ON BIOCHIPS MARKET

- 5.13.1 INTRODUCTION

- 5.13.2 MARKET POTENTIAL IN BIOCHIPS ECOSYSTEM

- 5.13.3 AI-USE CASES

- 5.13.4 KEY COMPANIES IMPLEMENTING AI IN BIOCHIPS MARKET

- 5.14 ECOSYSTEM ANALYSIS

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 MICROFLUIDIC BIOCHIP-BASED MULTIPLEXED PROFILING FOR EARLY CANCER DETECTION

- 5.15.2 POINT-OF-CARE TUMOR MARKER DETECTION BIOCHIP

- 5.15.3 GRAPHENE QUANTUM DOT-BASED BIOCHIP FOR CHILDHOOD LEUKEMIA DETECTION

- 5.16 VALUE CHAIN ANALYSIS

- 5.17 SUPPLY CHAIN ANALYSIS

- 5.18 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.19 INVESTMENT AND FUNDING SCENARIO

- 5.20 US TARIFF IMPACT ON BIOCHIPS MARKET

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.5 IMPACT ON END-USE INDUSTRIES

- 5.20.5.1 Biotechnology and pharmaceutical companies

- 5.20.5.2 Hospitals and diagnostic centers

- 5.20.5.3 Academic & research institutes

- 5.20.5.4 Contract Research Organizations (CROs)

- 5.20.5.5 Other end users

6 BIOCHIPS MARKET, BY PRODUCTS & SERVICES

- 6.1 INTRODUCTION

- 6.2 CONSUMABLES

- 6.2.1 SURGE IN APPLICATIONS ACROSS PERSONALIZED MEDICINE AND PRECISION DIAGNOSTICS TO AID GROWTH

- 6.3 INSTRUMENTS

- 6.3.1 RISING DEMAND FOR ADVANCED INSTRUMENTS TO ENHANCE PRECISION AND EFFICIENCY TO DRIVE MARKET

- 6.4 SOFTWARE & SERVICES

- 6.4.1 INCREASING NEED FOR ADVANCED DATA ANALYSIS AND BIOINFORMATICS TO SUPPORT GROWTH

7 BIOCHIPS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 DNA CHIPS

- 7.2.1 GLOBAL VOLUME ANALYSIS OF DNA CHIPS, 2023-2030 (THOUSAND UNITS)

- 7.2.2 DNA CHIPS MARKET, BY APPLICATION

- 7.2.2.1 Gene expression

- 7.2.2.1.1 Increasing cancer incidence and rising funding for genomic research to foster growth

- 7.2.2.2 SNP genotyping

- 7.2.2.2.1 Growing adoption of genetic screening programs and direct-to-consumer genomics services to fuel market

- 7.2.2.3 Cancer diagnostics & treatment

- 7.2.2.3.1 Rising global cancer burden and expanding reimbursement coverage to spur growth

- 7.2.2.4 Genomics

- 7.2.2.4.1 Rise of personalized medicine and increasing need for non-invasive diagnostics to facilitate growth

- 7.2.2.5 Drug discovery

- 7.2.2.5.1 Increasing application of DNA chips in drug discovery to identify targets and optimize therapeutics to boost market

- 7.2.2.6 Agricultural biotechnology

- 7.2.2.6.1 Growing use of DNA chips for crop improvement and trait analysis to propel market

- 7.2.2.7 Other DNA chip applications

- 7.2.2.1 Gene expression

- 7.3 LAB-ON-A-CHIP

- 7.3.1 GLOBAL VOLUME ANALYSIS OF LAB-ON-A-CHIP, 2023-2030 (THOUSAND UNITS)

- 7.3.2 LAB-ON-A-CHIP MARKET, BY APPLICATION

- 7.3.2.1 Clinical diagnostics

- 7.3.2.1.1 Rising burden of chronic and infectious diseases to accelerate growth

- 7.3.2.2 Genomics

- 7.3.2.2.1 Increasing proliferation of genomic testing programs to stimulate growth

- 7.3.2.3 IVD & POC

- 7.3.2.3.1 Growing emphasis on early disease detection, chronic disease monitoring, and home-based testing to fuel market

- 7.3.2.4 Proteomics

- 7.3.2.4.1 Rise in biologic and biosimilar development to contribute to growth

- 7.3.2.5 Drug discovery

- 7.3.2.5.1 Increasing demand for high-throughput screening to augment growth

- 7.3.2.6 Other LOAC applications

- 7.3.2.1 Clinical diagnostics

- 7.4 PROTEIN CHIPS

- 7.4.1 GLOBAL VOLUME ANALYSIS OF PROTEIN CHIPS, 2023-2030 (THOUSAND UNITS)

- 7.4.2 PROTEIN CHIPS MARKET, BY APPLICATION

- 7.4.2.1 Proteomics

- 7.4.2.1.1 Increasing focus on large-scale protein profiling to aid growth

- 7.4.2.2 Expression profiling

- 7.4.2.2.1 Surge in demand for systems-level understanding of cellular processes to support growth

- 7.4.2.3 Diagnostics

- 7.4.2.3.1 Increasing integration of protein-chip technology into clinical diagnostic workflows to encourage growth

- 7.4.2.4 High-throughput screening

- 7.4.2.4.1 Rising demand for rapid target validation and growing complexity of biologic therapeutics to drive market

- 7.4.2.5 Drug discovery

- 7.4.2.5.1 Need for efficient target identification and screening to favor growth

- 7.4.2.6 Other protein chip applications

- 7.4.2.1 Proteomics

- 7.5 TISSUE ARRAYS

- 7.5.1 INCREASING DEMAND FOR LARGE-SCALE VALIDATION OF BIOMARKERS TO SPUR GROWTH

- 7.5.2 GLOBAL VOLUME ANALYSIS OF TISSUE ARRAYS, 2023-2030 (THOUSAND UNITS)

- 7.6 CELL ARRAYS

- 7.6.1 EXPANDING USE OF CELL ARRAYS FOR HIGH-THROUGHPUT CELLULAR ANALYSIS AND DRUG SCREENING TO AID GROWTH

- 7.6.2 GLOBAL VOLUME ANALYSIS OF CELL ARRAYS, 2023-2030 (THOUSAND UNITS)

8 BIOCHIPS MARKET, BY FABRICATION TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 MICROARRAYS

- 8.2.1 WIDESPREAD ADOPTION OF MICROARRAYS IN GENOMIC AND PROTEOMIC RESEARCH TO FUEL MARKET

- 8.3 MICROFLUIDICS

- 8.3.1 GROWING DEMAND FOR DECENTRALIZED, POINT-OF-CARE DIAGNOSTICS, AND HIGH-THROUGHPUT SCREENING TOOLS TO DRIVE MARKET

9 BIOCHIPS MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES

- 9.2.1 RISING TREND OF PERSONALIZED AND PRECISION THERAPEUTICS TO EXPEDITE GROWTH

- 9.3 HOSPITALS & DIAGNOSTIC CENTERS

- 9.3.1 INCREASING HOSPITAL INVESTMENTS IN MOLECULAR PATHOLOGY TO EXPEDITE GROWTH

- 9.4 ACADEMIC & RESEARCH INSTITUTES

- 9.4.1 GROWING USE OF BIOCHIPS IN GENE-FUNCTION RELATIONSHIPS, PROTEIN NETWORKS, AND DISEASE MECHANISMS TO BOOST MARKET

- 9.5 CONTRACT RESEARCH ORGANIZATIONS (CROS)

- 9.5.1 INCREASING TREND OF OUTSOURCING RESEARCH AND DEVELOPMENT ACTIVITIES TO PROMOTE GROWTH

- 9.6 OTHER END USERS

10 BIOCHIPS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 NORTH AMERICA: VOLUME ANALYSIS, BY TYPE, 2023-2030 (THOUSAND UNITS)

- 10.2.3 US

- 10.2.3.1 Presence of prominent companies and high cancer prevalence to expedite growth

- 10.2.4 CANADA

- 10.2.4.1 Expanding genomics and precision medicine initiatives to drive market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 EUROPE: VOLUME ANALYSIS, BY TYPE, 2023-2030 (THOUSAND UNITS)

- 10.3.3 GERMANY

- 10.3.3.1 Robust ecosystem of biotech startups and multinational corporations to promote growth

- 10.3.4 UK

- 10.3.4.1 Increasing healthcare investments and genomic advancements to drive market

- 10.3.5 FRANCE

- 10.3.5.1 Strong government initiatives in biotechnology, precision medicine, and healthcare innovations to boost market

- 10.3.6 ITALY

- 10.3.6.1 Growing demand for precision medicine to spur growth

- 10.3.7 SPAIN

- 10.3.7.1 Increasing demand for personalized medicine and strong governmental & institutional support to propel market

- 10.3.8 NETHERLANDS

- 10.3.8.1 Increasing emphasis on genomics and personalized medicine to favor growth

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 ASIA PACIFIC: VOLUME ANALYSIS, BY TYPE, 2023-2030 (THOUSAND UNITS)

- 10.4.3 CHINA

- 10.4.3.1 Rising healthcare demand to support growth

- 10.4.4 JAPAN

- 10.4.4.1 Increasing geriatric population to drive market

- 10.4.5 INDIA

- 10.4.5.1 Strong government support for domestic biotech manufacturing to facilitate growth

- 10.4.6 AUSTRALIA

- 10.4.6.1 Increasing advancements in biotechnology to spur growth

- 10.4.7 SOUTH KOREA

- 10.4.7.1 Increasing healthcare expenditure to expedite growth

- 10.4.8 THAILAND

- 10.4.8.1 Rising healthcare investments to accelerate growth

- 10.4.9 NEW ZEALAND

- 10.4.9.1 Increasing focus on early detection and improving survival rates to drive market

- 10.4.10 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 LATIN AMERICA: VOLUME ANALYSIS, BY TYPE, 2023-2030 (THOUSAND UNITS)

- 10.5.3 BRAZIL

- 10.5.3.1 Increasing demand for precision medicine and advancements in genomics to foster growth

- 10.5.4 MEXICO

- 10.5.4.1 Rising prevalence of chronic and infectious conditions to contribute to growth

- 10.5.5 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 MIDDLE EAST & AFRICA: VOLUME ANALYSIS, BY TYPE, 2023-2030 (THOUSAND UNITS)

- 10.6.3 GCC COUNTRIES

- 10.6.3.1 Kingdom of Saudi Arabia (KSA)

- 10.6.3.1.1 Strong public healthcare funding and rapid expansion of hospital infrastructure to aid growth

- 10.6.3.2 United Arab Emirates (UAE)

- 10.6.3.2.1 Growing integration of advanced diagnostic technologies to fuel market

- 10.6.3.3 Rest of GCC Countries

- 10.6.3.1 Kingdom of Saudi Arabia (KSA)

- 10.6.4 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE SHARE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 GLOBAL MARKET SHARE ANALYSIS, 2024

- 11.4.2 US MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.5.1 COMPANY VALUATION

- 11.5.2 FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 11.7 R&D EXPENDITURE OF KEY PLAYERS

- 11.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.8.1 STARS

- 11.8.2 EMERGING LEADERS

- 11.8.3 PERVASIVE PLAYERS

- 11.8.4 PARTICIPANTS

- 11.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.8.5.1 Company footprint

- 11.8.5.2 Region footprint

- 11.8.5.3 Product & service footprint

- 11.8.5.4 Type footprint

- 11.8.5.5 Fabrication technology footprint

- 11.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- 11.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.9.5.1 Detailed list of key startups/SMEs

- 11.9.5.2 Competitive benchmarking of key startups/SMEs

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT/SERVICE LAUNCHES, ENHANCEMENTS, AND APPROVALS

- 11.10.2 DEALS

- 11.10.3 EXPANSIONS

- 11.10.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 THERMO FISHER SCIENTIFIC INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product/Service launches, enhancements, and approvals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 ILLUMINA, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product/Service launches, enhancements, and approvals

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 AGILENT TECHNOLOGIES, INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.3.3 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 F. HOFFMANN-LA ROCHE LTD

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product/Service launches, enhancements, and approvals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 QIAGEN

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product/Service launches, enhancements, and approvals

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Expansions

- 12.1.5.3.4 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 BIO-RAD LABORATORIES, INC.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Services offered

- 12.1.7 ABBOTT

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product/Service launches, enhancements, and approvals

- 12.1.8 STANDARD BIOTOOLS

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product/Service launches, enhancements, and approvals

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Other developments

- 12.1.9 10X GENOMICS

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product/Service launches, enhancements, and approvals

- 12.1.9.3.2 Deals

- 12.1.9.3.3 Other developments

- 12.1.10 CEPHEID

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product/Service launches, enhancements, and approvals

- 12.1.10.3.2 Deals

- 12.1.10.3.3 Other developments

- 12.1.11 BIOMERIEUX

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Services offered

- 12.1.11.2.1 Product/Service launches, enhancements, and approvals

- 12.1.11.2.2 Deals

- 12.1.12 REVVITY

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.13 DIASORIN S.P.A.

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Services offered

- 12.1.14 RANDOX LABORATORIES LTD.

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product/Service launches, enhancements, and approvals

- 12.1.14.3.2 Deals

- 12.1.14.3.3 Expansions

- 12.1.15 OXFORD GENE TECHNOLOGY IP LIMITED

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Services offered

- 12.1.1 THERMO FISHER SCIENTIFIC INC.

- 12.2 OTHER PLAYERS

- 12.2.1 MICRONIT B.V.

- 12.2.2 RAYBIOTECH, INC.

- 12.2.3 PHALANX BIOTECH GROUP

- 12.2.4 ARRAYIT CORPORATION

- 12.2.5 3DHISTECH LTD.

- 12.2.6 CREATIVE BIOARRAY

- 12.2.7 TISSUEARRAY.COM

- 12.2.8 IBIOCHIPS

- 12.2.9 CAPITALBIOTECH CO., LTD.

- 12.2.10 PEPPERPRINT GMBH

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.3.1 PRODUCT ANALYSIS

- 13.3.2 COMPANY INFORMATION

- 13.3.3 GEOGRAPHIC ANALYSIS

- 13.3.4 REGIONAL/COUNTRY-LEVEL MARKET SHARE ANALYSIS

- 13.3.5 COUNTRY-LEVEL VOLUME ANALYSIS BY PRODUCT

- 13.3.6 BY PRODUCT MARKET SHARE ANALYSIS (TOP 5 PLAYERS)

- 13.3.7 ANY CONSULT/CUSTOM REQUIREMENTS AS PER CLIENT REQUESTS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS