|

시장보고서

상품코드

1881290

자율 무인 잠수정(AUV) 시장 : 유형별, 형상별, 추진 방식별, 시스템별, 속도별, 비용별, 용도별, 지역별 , 예측(-2030년)Autonomous Underwater Vehicle Market by Shape (Torpedo, Laminar Flow Body, Streamlined Rectangular Style, Multi-Hull Vehicle), Type (Shallow, Medium, Large), System, Speed, Propulsion, Application, Cost and Region - Global Forecast to 2030 |

||||||

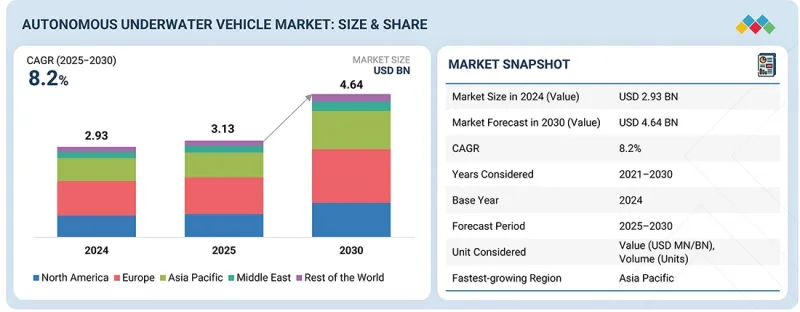

자율 무인 잠수정(AUV) 시장 규모는 2025년 31억 3,000만 달러, 2030년까지 46억 4,000만 달러에 이를 것으로 예상되며, CAGR은 8.2%를 나타낼 전망입니다.

수량 기준으로는 2025년 997대에서 2030년까지 1,424대로 증가할 전망입니다. 세계의 방위기관, 해양에너지사업자, 해양연구기관이 심해 미션, 장기간 감시, 해저자산 점검을 위한 자율시스템 도입을 가속화하고 있기 때문에 AUV 시장은 꾸준히 확대되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 기간 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 유형별, 형상별, 추진 방식별, 시스템별, 속도별, 비용별, 용도별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

수요는 주로 무인 해양 능력에 대한 투자 증가, 해양 탐사 및 유지 보수 활동의 확대, 위험한 수중 환경에서 인적 위험 감소로의 지속적인 전환으로 뒷받침됩니다.

저비용 AUV는 해안 감시, 환경 데이터 수집, 항만 보안, 얕은 해역 조사 임무 등 빈번한 전개와 비용 효율이 중요한 분야에서의 이용 확대에 따라 급속히 보급이 진행되고 있습니다. 합리적인 가격의 센서, 컴팩트한 추진 시스템, 모듈 설계의 보급에 의해 특히 학술, 상업, 정부의 조사 프로그램에 있어서, 유저는 상당액의 설비 투자 없이 운용 규모를 확대할 수 있게 되었습니다.

군 및 방위 분야의 우위성은 자율형 대기뢰 작전 프로그램, 대잠수함전 이니셔티브, 항만 보호 요건, 기밀 취급의 심해 감시 임무의 급속한 확대에 의해 추진되고 있습니다. 방위기관은 상황인식능력 향상, 해군승무원의 리스크 경감, 다영역 해상작전 지원을 목적으로 하는 장항속형 AUV에 대한 투자를 강화하고 있습니다. 미국, 유럽, 아시아의 현대화 노력은 군사 등급 AUV 플랫폼의 조달을 더욱 가속화하고 있습니다.

북미의 자율 무인 잠수정(AUV) 시장은 주로 미국 해군으로부터의 엄청난 자금 제공, 확대되는 해양 에너지 탐사 및 연방 연구 기관에 의한 심해 과학 및 환경 모니터링에 적극적으로 참여함으로써 견인되고 있습니다. 이 지역의 성숙한 산업 기반과 주요 AUV 제조업체와 방어 계약자의 존재가 결합되어 차세대 시스템을 신속하게 배포 할 수 있습니다. 북극권 감시, 해저 인프라 점검, 무인 해상 작전에 대한 주목의 고조가 북미 시장의 지위를 더욱 강화하고 있습니다.

본 보고서에서는 세계의 자율 무인 잠수정(AUV) 시장에 대해 조사했으며, 유형별, 형상별, 추진 방식별, 시스템별, 속도별, 비용별, 용도별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 인사이트

제4장 시장 개요

- 소개

- 시장 역학

- 언멧 요구와 공백

- 연계 시장 및 교차 산업 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- 생태계 분석

- 밸류체인 분석

- 2025년 미국 관세

- 무역 분석

- 사례 연구 분석

- 주요 회의 및 이벤트

- 총소유비용

- 투자 및 자금조달 시나리오

- 가격 분석

- 볼륨 데이터

- 운용 데이터

- 부품표

- 거시경제 전망

- 비즈니스 모델

제6장 기술의 진보, AI별 영향, 특허, 혁신 및 미래의 응용

- 주요 기술

- 보완적 기술

- 기술 로드맵

- 특허 분석

- 미래의 응용

- AI/생성형 AI의 영향

- 메가 트렌드의 영향

제7장 지속가능성과 규제상황

- 지역 규제 및 규정 준수

- 지속가능성에 대한 노력

- 인증, 라벨, 환경 기준

제8장 고객정세와 구매행동

- 의사결정 프로세스

- 구매자의 이해관계자와 구매평가기준

- 채택 장벽과 내부 과제

- 다양한 최종 이용 산업의 미충족 요구

제9장 자율 무인 잠수정(AUV) 시장, 유형별(시장 규모와 2030년까지의 예측- 금액, 100만 달러, 수량, 대수)

- 소개

- 소형(100미터 미만)

- 중형(100-1,000미터)

- 대형(1,000미터 초과)

제10장 자율 무인 잠수정(AUV) 시장, 형상별(시장 규모와 2030년까지의 예측- 금액, 100만 달러, 수량, 대수)

- 소개

- 어뢰

- 층류 유동 차체

- 유선형 직사각형 스타일

- 다중 선체

제11장 자율 무인 잠수정(AUV) 시장, 추진방식별(시장 규모와 2030년까지 예측- 금액, 100만 달러)

- 소개

- 전기

- 기계

- 하이브리드

제12장 자율 무인 잠수정(AUV) 시장, 시스템별(시장 규모와 2030년까지의 예측- 금액, 100만 달러)

- 소개

- 충돌 회피

- 커뮤니케이션과 네트워킹

- 네비게이션과 안내

- 추진력과 이동성

- 페이로드와 센서

- 섀시

- 전력 및 에너지

- 기타

제13장 자율 무인 잠수정(AUV) 시장, 속도별(시장 규모와 2030년까지의 예측- 금액, 100만 달러)

- 소개

- 5노트 미만

- 5노트 이상

제14장 자율 무인 잠수정(AUV) 시장, 비용별(시장 규모와 2030년까지의 예측- 금액, 100만 달러)

- 소개

- 저비용

- 표준

- 하이엔드

제15장 자율 무인 잠수정(AUV) 시장, 용도별(시장 규모와 2030년까지의 예측- 금액, 100만 달러)

- 소개

- 군 및 방위

- 석유 및 가스

- 환경보호 및 감시

- 해양학

- 고고학과 탐험

- 수색 구조 활동

제16장 자율 무인 잠수정(AUV) 시장, 지역별

- 소개

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 노르웨이

- 기타

- 아시아태평양

- 중국

- 일본

- 호주

- 한국

- 인도

- 기타

- 중동

- GCC

- 이스라엘

- 튀르키예

- 기타

- 기타 지역

- 아프리카

- 라틴아메리카

제17장 경쟁 구도

- 소개

- 주요 참가 기업의 전략/강점, 2021년-2024년

- 수익 분석, 2021년-2024년

- 시장 점유율 분석, 2024년

- 브랜드/제품 비교

- 기업평가와 재무지표

- 기업평가 매트릭스 : 주요 진입기업, 2024년

- 기업평가 매트릭스 : 신흥기업/중소기업, 2024년

- 경쟁 시나리오

제18장 기업 프로파일

- 주요 진출기업

- KONGSBERG

- SAIPEM SPA

- EXAIL TECHNOLOGIES

- BAE SYSTEMS

- SAAB AB

- TELEDYNE TECHNOLOGIES INCORPORATED

- HII

- GENERAL DYNAMICS CORPORATION

- KAWASAKI HEAVY INDUSTRIES, LTD

- LOCKHEED MARTIN CORPORATION

- TKMS

- L3HARRIS TECHNOLOGIES, INC.

- BOSTON ENGINEERING

- BOEING

- XYLEM INC

- INTERNATIONAL SUBMARINE ENGINEERING LIMITED

- NORTHROP GRUMMAN

- 기타 기업

- MSUBS

- FALMOUTH SCIENTIFIC, INC

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- ECOSUB ROBOTICS

- EELUME AS

- HYDROMEA

- GRAAL TECH SRL

- BALTROBOTICS

- OCEANSCAN-MARINE SYSTEMS & TECHNOLOGY

- RTSYS

제19장 조사 방법

제20장 부록

SHW 25.12.11The autonomous underwater vehicle market is expected to reach USD 4.64 billion by 2030, from USD 3.13 billion in 2025, with a CAGR of 8.2%. In terms of volume, it is likely to grow from 997 units in 2025 to 1,424 units by 2030. The market for AUVs is expanding steadily, as global defense agencies, offshore energy operators, and ocean research institutions accelerate the adoption of autonomous systems for deep-water missions, long-endurance surveillance, and subsea asset inspection.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Propulsion, System, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

Demand is primarily supported by rising investments in unmanned maritime capabilities, increasing offshore exploration and maintenance activities, and the ongoing shift toward reducing human exposure in hazardous underwater environments.

"The low cost segment is expected to exhibit the fastest growth during the forecast period."

Low-cost AUVs are experiencing rapid adoption due to their increasing use in coastal monitoring, environmental data collection, port security, and shallow-water survey missions, where frequent deployment and cost efficiency are crucial. The availability of affordable sensors, compact propulsion systems, and modular designs enables users to scale operations without incurring high capital expenditures, particularly in academic, commercial, and government research programs.

"The military & defense segment is expected to surpass other applications during the forecast period."

The prevalence of the military & defense segment is driven by rapid growth in autonomous mine countermeasure programs, anti-submarine warfare initiatives, harbor protection requirements, and classified deep-sea surveillance missions. Defense agencies are investing heavily in long-endurance AUVs that enhance situational awareness, reduce risks to naval crews, and support multi-domain maritime operations. Modernization efforts in the US, Europe, and Asia are further accelerating procurement of military-grade AUV platforms.

"North America is expected to rank second in the autonomous underwater vehicle market during the forecast period."

North America's autonomous underwater vehicle market is primarily driven by substantial funding from the US Navy, expanding offshore energy exploration, and the strong involvement of federal research institutions in deep-ocean science and environmental monitoring. The region's mature industrial base, combined with the presence of leading AUV manufacturers and defense contractors, enables the rapid deployment of next-generation systems. Growing emphasis on Arctic surveillance, subsea infrastructure inspection, and unmanned maritime operations further strengthens North America's position in the market.

The breakdown of profiles for primary participants in the autonomous underwater vehicle market is provided below:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 10%, and Others - 70%

- By Region: North America - 40%, Europe - 20%, Asia Pacific - 20%, Middle East - 10% Rest of the World - 10%

Research Coverage:

This market study covers the autonomous underwater vehicle market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different parts and regions. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their products and business offerings, recent developments, and key market strategies they adopted.

Reasons to buy this report:

This report is designed to assist both established market leaders and new entrants by providing accurate revenue estimates for the autonomous underwater vehicle market. It will also help stakeholders grasp the competitive landscape and offer valuable insights for positioning their businesses and developing effective go-to-market strategies. Additionally, the report will highlight key market trends, including essential drivers, constraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Indepth Analysis of Drivers (Rising offshore oil and gas investments, increasing use of AUVs for border and maritime security, growing shift toward renewable energy operations, advancements in AUV autonomy and sensors), Restraints (High development and operational costs, limitations in endurance and mission range), Opportunities (Integration of next-generation batteries, wider use of AUVs for cable protection and seabed monitoring, expansion of offshore energy exploration), and Challenges (Slow underwater communication speeds and signal issues, data-loss risks due to harsh marine conditions, legal and ethical concerns in autonomous underwater operations)

- Market Penetration: Comprehensive information on AUVs offered by the top market players

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and product launches in the autonomous underwater vehicle market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the autonomous underwater vehicle market

- Competitive Assessment: In-depth assessment of market share, growth strategies, products, and manufacturing capabilities of leading players in the autonomous underwater vehicle market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENT AND EMERGING FRONTIERS

- 2.5 GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTONOMOUS UNDERWATER VEHICLE MARKET

- 3.2 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION

- 3.3 SHALLOW AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE

- 3.4 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM

- 3.5 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COMMUNICATION & NETWORKING SYSTEM

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rise of offshore oil and gas exploration

- 4.2.1.2 Emphasis on maritime security

- 4.2.1.3 Shift toward renewable energy sources

- 4.2.1.4 Technological innovations in AUVs

- 4.2.2 RESTRAINTS

- 4.2.2.1 High development, operational, and maintenance costs

- 4.2.2.2 Limited endurance and range

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Integration of NiMH batteries into medium- and high-speed AUVs

- 4.2.3.2 Focus on protecting subsea cables and energy pipelines

- 4.2.3.3 Push for energy diversification

- 4.2.4 CHALLENGES

- 4.2.4.1 Harsh underwater conditions

- 4.2.4.2 Risk of data loss and prolonged research timelines

- 4.2.4.3 Legal and ethical concerns

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 REAL-TIME UNDERWATER COMMUNICATION AND DATA TRANSMISSION

- 4.3.2 LACK OF STANDARDIZATION AND INTEROPERABILITY FRAMEWORKS

- 4.3.3 ENERGY LIMITATIONS AND ENDURANCE CONSTRAINTS

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 OFFSHORE RENEWABLE ENERGY

- 4.4.2 MARITIME SECURITY AND BORDER SURVEILLANCE

- 4.4.3 OCEAN DATA AND CLIMATE RESEARCH

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 ECOSYSTEM ANALYSIS

- 5.1.1 PROMINENT COMPANIES

- 5.1.2 PRIVATE AND SMALL ENTERPRISES

- 5.1.3 END USERS

- 5.2 VALUE CHAIN ANALYSIS

- 5.2.1 CONCEPT AND RESEARCH

- 5.2.2 COMPONENT AND MATERIAL DEVELOPMENT

- 5.2.3 AUV MANUFACTURING

- 5.2.4 SYSTEM INTEGRATION AND VALIDATION

- 5.2.5 POST-DEPLOYMENT SERVICE

- 5.3 2025 US TARIFF

- 5.3.1 INTRODUCTION

- 5.3.2 KEY TARIFF RATES

- 5.3.3 PRICE IMPACT ANALYSIS

- 5.3.4 IMPACT ON COUNTRY/REGION

- 5.3.4.1 US

- 5.3.4.2 Europe

- 5.3.4.3 Asia Pacific

- 5.3.5 IMPACT ON END-USE INDUSTRIES

- 5.3.5.1 Military & defense

- 5.3.5.2 Oil & gas

- 5.3.5.3 Environment protection & monitoring

- 5.3.5.4 Oceanography

- 5.3.5.5 Archaeology & exploration

- 5.3.5.6 Search & salvage operation

- 5.4 TRADE ANALYSIS

- 5.4.1 IMPORT SCENARIO (HS CODE 900630)

- 5.4.2 EXPORT SCENARIO (HS CODE 900630)

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 CELLULA ROBOTICS: GUARDIAN AUV FOR DEFENSE MISSIONS

- 5.5.2 FUJITSU AND NATIONAL MARITIME RESEARCH INSTITUTE: DIGITAL TWIN UNDERWATER MONITORING

- 5.5.3 AUSTRALIAN ECONOMIC ACCELERATOR AND UNIVERSITY OF SYDNEY: SOVEREIGN AUV FOR OFFSHORE INFRASTRUCTURE ASSESSMENT

- 5.6 KEY CONFERENCES AND EVENTS

- 5.7 TOTAL COST OF OWNERSHIP

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE TREND, BY TYPE

- 5.9.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.10 VOLUME DATA

- 5.11 OPERATIONAL DATA

- 5.12 BILL OF MATERIALS

- 5.13 MACROECONOMIC OUTLOOK

- 5.13.1 INTRODUCTION

- 5.13.2 GDP TRENDS AND FORECAST

- 5.13.3 TRENDS IN GLOBAL UNDERWATER VEHICLE INDUSTRY

- 5.13.4 TRENDS IN GLOBAL MARINE INDUSTRY

- 5.14 BUSINESS MODELS

- 5.14.1 DIRECT SALES MODEL

- 5.14.2 LEASING/AUV-AS-A-SERVICE MODEL

- 5.14.3 DATA-AS-A-SERVICE (DAAS) MODEL

- 5.14.4 BUILD-OPERATE-TRANSFER (BOT) MODEL

- 5.14.5 COLLABORATIVE R&D/CO-DEVELOPMENT MODEL

- 5.14.6 SUBSCRIPTION/SOFTWARE LICENSING MODEL

- 5.14.7 TURNKEY INTEGRATED SOLUTION MODEL

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 DOPPLER VELOCITY LOG

- 6.1.2 FIBER-OPTIC GYROSCOPE-BASED INERTIAL NAVIGATION SYSTEM

- 6.1.3 ULTRA-SHORT BASELINE ACOUSTIC POSITIONING

- 6.1.4 LONG-BASELINE ACOUSTIC POSITIONING

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 UNDERWATER ACOUSTIC BEACON NETWORK

- 6.2.2 FIBER-OPTIC DATA LINKS FOR SURFACE-TO-SHORE TRANSFER

- 6.2.3 HIGH-CAPACITY DATA STORAGE MODULE

- 6.3 TECHNOLOGY ROADMAP

- 6.4 PATENT ANALYSIS

- 6.5 FUTURE APPLICATIONS

- 6.6 IMPACT OF AI/GEN AI

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION

- 6.6.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT AI/GEN AI

- 6.7 IMPACT OF MEGATRENDS

- 6.7.1 BIG DATA AND OCEAN INTELLIGENCE PLATFORMS

- 6.7.2 CLOUD AND EDGE COMPUTING INTEGRATION

- 6.7.3 GEN AI AND DIGITAL TWIN ECOSYSTEMS

- 6.7.4 IOT-ENABLED MARITIME CONNECTIVITY

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT REDUCTION

- 7.2.2 ECO-APPLICATIONS

- 7.3 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS OF VARIOUS END-USE INDUSTRIES

9 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION & VOLUME, UNITS)

- 9.1 INTRODUCTION

- 9.2 SHALLOW (<100 M)

- 9.2.1 SUPPORTING COASTAL SURVEILLANCE AND MINE COUNTERMEASURE MISSIONS IN CONFINED WATERS

- 9.2.2 USE CASE: KONGSBERG'S REMUS-100 FOR VERY SHALLOW WATER MINE COUNTERMEASURE MISSIONS

- 9.2.3 MICRO/SMALL

- 9.2.4 MINI

- 9.3 MEDIUM (100-1,000 M)

- 9.3.1 BRIDGING ENDURANCE AND PAYLOAD FOR SCIENTIFIC AND INDUSTRIAL SEAFLOOR MISSIONS

- 9.3.2 USE CASE: MBARI'S SEAFLOOR MAPPING DEEP-RATED SURVEY VEHICLE FOR FULLY AUTONOMOUS MISSIONS

- 9.4 LARGE (>1,000 M)

- 9.4.1 ENABLING LONG-RANGE AND MODULAR MISSIONS WITH HEAVY-PAYLOAD CAPACITY

- 9.4.2 USE CASE: BOEING'S ORCA FOR MODULAR MISSION PACKAGES

- 9.4.3 DEEP WATER

- 9.4.4 LARGE DISPLACEMENT

- 9.4.5 EXTRA LARGE

10 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION & VOLUME, UNITS)

- 10.1 INTRODUCTION

- 10.2 TORPEDO

- 10.2.1 OPTIMIZING DEEP-SEA ENDURANCE THROUGH HYDRODYNAMIC STABILITY

- 10.3 LAMINAR FLOW BODY

- 10.3.1 IMPROVING ENERGY EFFICIENCY THROUGH FLOW-OPTIMIZED HULL DESIGNS

- 10.4 STREAMLINED RECTANGULAR STYLE

- 10.4.1 BALANCING PAYLOAD MODULARITY WITH OPERATIONAL STABILITY FOR INDUSTRIAL TASKS

- 10.5 MULTI-HULL

- 10.5.1 EXPANDING PAYLOAD FLEXIBILITY AND REDUNDANCY FOR MULTI-SENSOR UNDERWATER MISSIONS

11 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 11.1 INTRODUCTION

- 11.2 ELECTRIC

- 11.2.1 FUELING TRANSITION TO ENERGY-DENSE, LOW-MAINTENANCE AUV OPERATIONS

- 11.2.2 USE CASE: REMUS SERIES LI-ION BATTERY SYSTEMS DEVELOPED BY SAFT/MATHEWS FOR PROLONGED MISSIONS

- 11.3 MECHANICAL

- 11.3.1 ENABLING PERSISTENT OCEAN OBSERVATION THROUGH ENERGY-NEUTRAL PROPULSION

- 11.3.2 USE CASE: TELEDYNE'S SLOCUM G3 GLIDER FOR LONG ENDURANCE WITH BUOYANCY ENGINE AND WINGS FOR COASTAL PROGRAMS

- 11.4 HYBRID

- 11.4.1 EXPANDING DEEP-SEA MISSION ENDURANCE THROUGH HYDROGEN AND FUEL-CELL INTEGRATION

- 11.4.2 USE CASE: EARLY PEM FUEL-CELL AUV PROTOTYPES DELIVER ~4 KW FOR PROPULSION WITH HYDROGEN STORED IN METAL HYDRIDE TANKS

12 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 12.1 INTRODUCTION

- 12.2 COLLISION AVOIDANCE

- 12.2.1 INTEGRATION OF ADVANCED SONAR AND BUOYANCY SYSTEMS ENHANCES AUV AUTONOMY AND MISSION SAFETY

- 12.2.2 FORWARD-LOOKING SONAR

- 12.2.3 OTHERS

- 12.3 COMMUNICATION & NETWORKING

- 12.3.1 SHIFT TOWARD HYBRID ACOUSTIC-OPTICAL LINKS STRENGTHENS REAL-TIME UNDERWATER CONNECTIVITY

- 12.3.2 UNDERWATER ACOUSTIC COMMUNICATION

- 12.3.3 SUBSEA WIRELESS OPTICAL COMMUNICATION

- 12.3.4 SURFACE RF & WI-FI COMMUNICATION

- 12.3.5 SATELLITE COMMUNICATION

- 12.3.6 OTHERS

- 12.4 NAVIGATION & GUIDANCE

- 12.4.1 PRECISION NAVIGATION TECHNOLOGIES DRIVE ACCURACY AND AUTONOMY IN DEEP-SEA AUV MISSIONS

- 12.4.2 INERTIAL & DEAD-RECKONING

- 12.4.2.1 Inertial navigation

- 12.4.2.2 Compass-based navigation

- 12.4.2.3 Others

- 12.4.3 ACOUSTIC NAVIGATION

- 12.4.4 OTHERS

- 12.5 PROPULSION & MOBILITY

- 12.5.1 SHIFT TOWARD ELECTRICALLY DRIVEN MODULAR PROPULSION SYSTEMS ENHANCES AUV ENDURANCE AND EFFICIENCY

- 12.5.2 THRUST GENERATION

- 12.5.2.1 Propulsion motor

- 12.5.2.2 Thruster

- 12.5.2.3 Others

- 12.5.3 MOTION & CONTROL ACTUATION

- 12.5.3.1 Fin control actuator

- 12.5.3.2 Servo/Linear electromechanical actuator

- 12.5.4 BUOYANCY & VERTICAL MOTION

- 12.5.4.1 Pump motor

- 12.5.4.2 Variable buoyancy system

- 12.5.4.3 Others

- 12.5.5 OTHERS

- 12.6 PAYLOAD & SENSOR

- 12.6.1 EXPANDING AUV CAPABILITIES FROM DEEP-SEA MAPPING TO CLIMATE MONITORING

- 12.6.2 ACOUSTIC IMAGING & MAPPING PAYLOAD

- 12.6.2.1 Side-scan sonar imager

- 12.6.2.2 Multibeam echo sounder

- 12.6.2.3 Synthetic aperture sonar

- 12.6.2.4 Sub-bottom profiler

- 12.6.2.5 Others

- 12.6.3 OPTICAL IMAGING PAYLOAD

- 12.6.3.1 High-resolution digital still camera

- 12.6.3.2 Dual-eye camera

- 12.6.3.3 Others

- 12.6.4 ENVIRONMENTAL & OCEANOGRAPHIC SENSOR PAYLOAD

- 12.6.4.1 CTD sensor

- 12.6.4.2 Biogeochemical sensor

- 12.6.4.3 Acoustic Doppler Current Profiler

- 12.6.5 OTHERS

- 12.7 CHASSIS

- 12.7.1 INNOVATIONS IN LIGHTWEIGHT AND PRESSURE-RESISTANT CHASSIS MATERIALS ENHANCE STRUCTURAL EFFICIENCY

- 12.7.2 METAL ALLOY HULL

- 12.7.3 FIBER-REINFORCED COMPOSITE

- 12.7.4 OTHERS

- 12.8 POWER & ENERGY

- 12.8.1 ADVANCES IN HIGH-DENSITY ENERGY STORAGE AND EFFICIENT POWER CONVERSION EXTEND AUV MISSION ENDURANCE

- 12.8.2 ENERGY STORAGE

- 12.8.2.1 Battery module

- 12.8.2.2 Pressure-tolerant subsea battery system

- 12.8.2.3 Supercapacitor

- 12.8.3 POWER MANAGEMENT & DISTRIBUTION

- 12.8.3.1 BMS

- 12.8.3.2 DC/DC converter

- 12.8.3.3 Busbar

- 12.8.3.4 Others

- 12.8.4 OTHERS

- 12.9 OTHER SYSTEMS

13 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SPEED (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 13.1 INTRODUCTION

- 13.2 <5 KNOTS

- 13.2.1 ENHANCING MISSION DURATION AND DATA STABILITY

- 13.3 >5 KNOTS

- 13.3.1 IMPROVING OPERATIONAL EFFICIENCY AND RAPID UNDERWATER RESPONSE

14 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COST (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 14.1 INTRODUCTION

- 14.2 LOW-COST

- 14.2.1 ENABLING ACCESSIBLE SURVEY OPERATIONS AND WIDENING UNDERWATER PARTICIPATION

- 14.3 STANDARD

- 14.3.1 BALANCING PERFORMANCE AND COST FOR RELIABLE SUBSEA MISSIONS

- 14.4 HIGH-END

- 14.4.1 ADVANCING DEEP-SEA CAPABILITIES AND SUPPORT COMPLEX UNDERWATER OPERATIONS

15 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 15.1 INTRODUCTION

- 15.2 MILITARY & DEFENSE

- 15.2.1 STRENGTHENING MARITIME SURVEILLANCE AND THREAT DETECTION

- 15.2.2 BORDER SECURITY & SURVEILLANCE

- 15.2.3 ANTISUBMARINE WARFARE

- 15.2.4 ANTI-TRAFFICKING & CONTRABAND MONITORING

- 15.2.5 ENVIRONMENTAL ASSESSMENT

- 15.2.6 MINE COUNTERMEASURE IDENTIFICATION

- 15.3 OIL & GAS

- 15.3.1 IMPROVING SUBSEA ASSET INTEGRITY AND INSPECTION EFFICIENCY

- 15.3.2 PIPELINE SURVEY

- 15.3.3 GEOPHYSICAL SURVEY

- 15.3.4 DEBRIS/CLEARANCE SURVEY

- 15.3.5 BASELINE ENVIRONMENTAL ASSESSMENT SURVEY

- 15.4 ENVIRONMENTAL PROTECTION & MONITORING

- 15.4.1 SUPPORTING MARINE RESOURCE MANAGEMENT AND POLLUTION CONTROL

- 15.4.2 HABITAT RESEARCH

- 15.4.3 WATER SAMPLING

- 15.4.4 FISHERY STUDY

- 15.4.5 EMERGENCY RESPONSE

- 15.5 OCEANOGRAPHY

- 15.5.1 ADVANCING OCEAN DATA COLLECTION AND CLIMATE OBSERVATION

- 15.6 ARCHAEOLOGY & EXPLORATION

- 15.6.1 ENABLING SUBMERGED SITE IDENTIFICATION AND DOCUMENTATION

- 15.7 SEARCH & SALVAGE OPERATION

- 15.7.1 ENHANCING UNDERWATER OBJECT DETECTION AND RECOVERY PLANNING

16 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY REGION

- 16.1 INTRODUCTION

- 16.2 NORTH AMERICA

- 16.2.1 US

- 16.2.1.1 Sustained defense programs and expansion of offshore industries to drive market

- 16.2.2 CANADA

- 16.2.2.1 Arctic operations and cross-agency initiatives to drive market

- 16.2.1 US

- 16.3 EUROPE

- 16.3.1 UK

- 16.3.1.1 Increased adoption of unmanned maritime systems to drive market

- 16.3.2 GERMANY

- 16.3.2.1 Baltic security requirements to drive market

- 16.3.3 FRANCE

- 16.3.3.1 Seabed protection efforts to drive market

- 16.3.4 ITALY

- 16.3.4.1 Mediterranean surveillance programs to drive market

- 16.3.5 SPAIN

- 16.3.5.1 National research and coastal monitoring to drive market

- 16.3.6 NORWAY

- 16.3.6.1 Cold-water operations to drive market

- 16.3.7 REST OF EUROPE

- 16.3.1 UK

- 16.4 ASIA PACIFIC

- 16.4.1 CHINA

- 16.4.1.1 National R&D programs to drive market

- 16.4.2 JAPAN

- 16.4.2.1 Government research initiatives to drive market

- 16.4.3 AUSTRALIA

- 16.4.3.1 Defense procurement and domestic capability growth to drive market

- 16.4.4 SOUTH KOREA

- 16.4.4.1 Deep-sea engineering and industrial specialization to drive market

- 16.4.5 INDIA

- 16.4.5.1 Indigenous development and expanding subsea requirements to drive market

- 16.4.6 REST OF ASIA PACIFIC

- 16.4.1 CHINA

- 16.5 MIDDLE EAST

- 16.5.1 GCC

- 16.5.1.1 Saudi Arabia

- 16.5.1.1.1 Environmental research and heritage exploration to drive market

- 16.5.1.2 UAE

- 16.5.1.2.1 Security programs and local technology development to drive market

- 16.5.1.1 Saudi Arabia

- 16.5.2 ISRAEL

- 16.5.2.1 Advanced defense platforms and sensor innovation to drive market

- 16.5.3 TURKEY

- 16.5.3.1 Multi-role underwater missions to drive market

- 16.5.4 REST OF MIDDLE EAST

- 16.5.1 GCC

- 16.6 REST OF THE WORLD

- 16.6.1 AFRICA

- 16.6.1.1 Maritime enforcement pressures and offshore inspection needs to drive market

- 16.6.2 LATIN AMERICA

- 16.6.2.1 Defense modernization and deepwater survey requirements to drive market

- 16.6.1 AFRICA

17 COMPETITIVE LANDSCAPE

- 17.1 INTRODUCTION

- 17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 17.3 REVENUE ANALYSIS, 2021-2024

- 17.4 MARKET SHARE ANALYSIS, 2024

- 17.5 BRAND/PRODUCT COMPARISON

- 17.6 COMPANY VALUATION AND FINANCIAL METRICS

- 17.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 17.7.1 STARS

- 17.7.2 EMERGING LEADERS

- 17.7.3 PERVASIVE PLAYERS

- 17.7.4 PARTICIPANTS

- 17.7.5 COMPANY FOOTPRINT

- 17.7.5.1 Company footprint

- 17.7.5.2 Region footprint

- 17.7.5.3 Application footprint

- 17.7.5.4 Type footprint

- 17.7.5.5 Speed footprint

- 17.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 17.8.1 PROGRESSIVE COMPANIES

- 17.8.2 RESPONSIVE COMPANIES

- 17.8.3 DYNAMIC COMPANIES

- 17.8.4 STARTING BLOCKS

- 17.8.5 COMPETITIVE BENCHMARKING

- 17.8.5.1 List of start-ups/SMEs

- 17.8.5.2 Competitive benchmarking of start-ups/SMEs

- 17.9 COMPETITIVE SCENARIO

- 17.9.1 PRODUCT LAUNCHES

- 17.9.2 DEALS

- 17.9.3 OTHER DEVELOPMENTS

18 COMPANY PROFILES

- 18.1 KEY PLAYERS

- 18.1.1 KONGSBERG

- 18.1.1.1 Business overview

- 18.1.1.2 Products offered

- 18.1.1.3 Recent developments

- 18.1.1.3.1 Deals

- 18.1.1.3.2 Other developments

- 18.1.1.4 MnM view

- 18.1.1.4.1 Right to win

- 18.1.1.4.2 Strategic choices

- 18.1.1.4.3 Weaknesses and competitive threats

- 18.1.2 SAIPEM S.P.A.

- 18.1.2.1 Business overview

- 18.1.2.2 Products offered

- 18.1.2.3 Recent developments

- 18.1.2.3.1 Other developments

- 18.1.2.4 MnM view

- 18.1.2.4.1 Right to win

- 18.1.2.4.2 Strategic choices

- 18.1.2.4.3 Weaknesses and competitive threats

- 18.1.3 EXAIL TECHNOLOGIES

- 18.1.3.1 Business overview

- 18.1.3.2 Products offered

- 18.1.3.3 Recent developments

- 18.1.3.3.1 Product launches

- 18.1.3.3.2 Deals

- 18.1.3.3.3 Other developments

- 18.1.3.4 MnM view

- 18.1.3.4.1 Right to win

- 18.1.3.4.2 Strategic choices

- 18.1.3.4.3 Weaknesses and competitive threats

- 18.1.4 BAE SYSTEMS

- 18.1.4.1 Business overview

- 18.1.4.2 Products offered

- 18.1.4.3 Recent developments

- 18.1.4.3.1 Product launches

- 18.1.4.3.2 Deals

- 18.1.4.3.3 Other developments

- 18.1.4.4 MnM view

- 18.1.4.4.1 Right to win

- 18.1.4.4.2 Strategic choices

- 18.1.4.4.3 Weaknesses and competitive threats

- 18.1.5 SAAB AB

- 18.1.5.1 Business overview

- 18.1.5.2 Products offered

- 18.1.5.3 Recent developments

- 18.1.5.3.1 Deals

- 18.1.5.3.2 Other developments

- 18.1.5.4 MnM view

- 18.1.5.4.1 Right to win

- 18.1.5.4.2 Strategic choices

- 18.1.5.4.3 Weaknesses and competitive threats

- 18.1.6 TELEDYNE TECHNOLOGIES INCORPORATED

- 18.1.6.1 Business overview

- 18.1.6.2 Products offered

- 18.1.6.3 Recent developments

- 18.1.6.3.1 Product launches

- 18.1.6.3.2 Deals

- 18.1.6.3.3 Other developments

- 18.1.7 HII

- 18.1.7.1 Business overview

- 18.1.7.2 Products offered

- 18.1.7.3 Recent developments

- 18.1.7.3.1 Deals

- 18.1.7.3.2 Other developments

- 18.1.8 GENERAL DYNAMICS CORPORATION

- 18.1.8.1 Business overview

- 18.1.8.2 Products offered

- 18.1.8.3 Recent developments

- 18.1.8.3.1 Other developments

- 18.1.9 KAWASAKI HEAVY INDUSTRIES, LTD

- 18.1.9.1 Business overview

- 18.1.9.2 Products offered

- 18.1.9.3 Recent developments

- 18.1.9.3.1 Deals

- 18.1.9.3.2 Other developments

- 18.1.10 LOCKHEED MARTIN CORPORATION

- 18.1.10.1 Business overview

- 18.1.10.2 Products offered

- 18.1.11 TKMS

- 18.1.11.1 Business overview

- 18.1.11.2 Products offered

- 18.1.11.3 Recent developments

- 18.1.11.3.1 Other developments

- 18.1.12 L3HARRIS TECHNOLOGIES, INC.

- 18.1.12.1 Business overview

- 18.1.12.2 Products offered

- 18.1.12.3 Recent developments

- 18.1.12.3.1 Deals

- 18.1.12.3.2 Other developments

- 18.1.13 BOSTON ENGINEERING

- 18.1.13.1 Business overview

- 18.1.13.2 Products offered

- 18.1.13.3 Recent developments

- 18.1.13.3.1 Other developments

- 18.1.14 BOEING

- 18.1.14.1 Business overview

- 18.1.14.2 Products offered

- 18.1.14.3 Recent developments

- 18.1.14.3.1 Other developments

- 18.1.15 XYLEM INC

- 18.1.15.1 Business overview

- 18.1.15.2 Products offered

- 18.1.15.3 Recent developments

- 18.1.15.3.1 Deals

- 18.1.15.4 Other developments

- 18.1.16 INTERNATIONAL SUBMARINE ENGINEERING LIMITED

- 18.1.16.1 Business overview

- 18.1.16.2 Products offered

- 18.1.16.3 Recent developments

- 18.1.16.3.1 Product launches

- 18.1.16.4 Other developments

- 18.1.17 NORTHROP GRUMMAN

- 18.1.17.1 Business overview

- 18.1.17.2 Products offered

- 18.1.17.3 Recent developments

- 18.1.17.3.1 Other developments

- 18.1.1 KONGSBERG

- 18.2 OTHER PLAYERS

- 18.2.1 MSUBS

- 18.2.2 FALMOUTH SCIENTIFIC, INC

- 18.2.3 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 18.2.4 ECOSUB ROBOTICS

- 18.2.5 EELUME AS

- 18.2.6 HYDROMEA

- 18.2.7 GRAAL TECH SRL

- 18.2.8 BALTROBOTICS

- 18.2.9 OCEANSCAN - MARINE SYSTEMS & TECHNOLOGY

- 18.2.10 RTSYS

19 RESEARCH METHODOLOGY

- 19.1 RESEARCH DATA

- 19.1.1 SECONDARY DATA

- 19.1.1.1 Key data from secondary sources

- 19.1.2 PRIMARY DATA

- 19.1.2.1 Primary interview participants

- 19.1.2.2 Key data from primary sources

- 19.1.2.3 Breakdown of primary interviews

- 19.1.1 SECONDARY DATA

- 19.2 MARKET SIZE ESTIMATION

- 19.2.1 BOTTOM-UP APPROACH

- 19.2.2 TOP-DOWN APPROACH

- 19.2.3 BASE NUMBER CALCULATION

- 19.3 DATA TRIANGULATION

- 19.4 FACTOR ANALYSIS

- 19.4.1 SUPPLY-SIDE INDICATORS

- 19.4.2 DEMAND-SIDE INDICATORS

- 19.5 RESEARCH ASSUMPTIONS

- 19.6 RESEARCH LIMITATIONS

- 19.7 RISK ASSESSMENT

20 APPENDIX

- 20.1 DISCUSSION GUIDE

- 20.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 20.3 CUSTOMIZATION OPTIONS

- 20.4 RELATED REPORTS

- 20.5 AUTHOR DETAILS