|

시장보고서

상품코드

1883066

밀도계 시장 : 유형별, 운용 유형별, 정밀도별, 측정 방법별, 작동 원리별, 컴포넌트별, 용도별, 최종 이용 산업별, 지역별 예측(-2032년)Density Meter Market by Type, Measurement Method and Region - Global Forecast to 2032 |

||||||

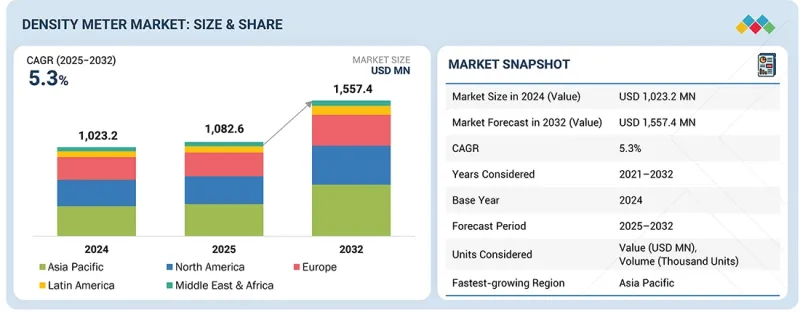

세계의 밀도계 시장 규모는 2025년 10억 8,260만 달러로 평가되었고 2032년까지 15억 5,740만 달러에 이를 것으로 예측되며 CAGR은 5.3%를 나타낼 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 기간 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 대상 단위 | 금액(100만 달러) |

| 부문 | 유형별, 운용 유형별, 정밀도별, 측정 방법별, 작동 원리별, 컴포넌트별, 용도별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

세계의 밀도계 시장은 다양한 산업 사용자, 규제 기관 및 상업 공정 운영자의 채택 증가에 힘입어 예측 기간 동안 꾸준한 성장을 보일 것으로 예상됩니다. 대규모 제조 및 가공 시설은 재료 일관성 개선, 공정 안정성 강화, 연속 작업 전반에 걸친 엄격한 품질 관리 유지를 위해 밀도 측정 시스템을 통합하고 있습니다. 규제 당국은 규정 준수 점검 지원, 안전 기준 시행, 민감한 응용 분야의 유체 특성 검증에 밀도 측정 도구를 점점 더 많이 활용하고 있습니다. 환경 및 모니터링 기관들은 액체 특성 평가, 오염 통제 활동 지원, 지속가능성 프로그램 보고 정확도 향상을 위해 밀도계를 도입하고 있습니다. 동시에 다양한 분야의 상업 운영자들은 제품 검증, 자원 최적화, 운영 효율성을 위해 밀도 측정을 적용하고 있습니다. 이러한 사용자 그룹들은 전 세계 산업 환경에서 정확하고 효율적이며 데이터 기반 의사 결정을 촉진하는 데 밀도계의 중요성이 점점 더 커지고 있음을 보여줍니다.

초음파 밀도계는 현대 산업 요구에 부합하는 비침습적이고 유지보수가 용이한 측정 방식을 제공하기 때문에 예측 기간 동안 가장 높은 CAGR을 기록할 것으로 예상됩니다. 유체와 직접 접촉하지 않고 밀도를 측정할 수 있는 능력은 마모를 줄이고 오염 위험을 최소화하며 기존 센서 설계에 비해 더 긴 운영 수명을 보장합니다. 또한 부식성, 마모성 또는 고온 매체에서도 안정적으로 작동하여 더 넓은 범위의 응용 분야에 적합합니다. 산업계가 더 깨끗하고 안전하며 디지털 호환 기술 채택을 지속함에 따라 초음파 밀도계 수요는 급증할 것으로 전망되며, 이는 글로벌 시장 전반에 걸친 강력한 성장 전망을 뒷받침합니다.

화학 및 석유화학 산업은 제품 일관성 유지, 휘발성 물질의 안전한 취급 보장, 엄격한 국제 품질 기준 충족을 위해 유체 특성에 대한 지속적이고 매우 정확한 모니터링이 필요하므로 2024년 최대 시장 점유율을 유지할 것으로 예상됩니다. 농도 제어, 혼합, 반응 모니터링, 소유권 이전과 같은 응용 분야에는 밀도 측정이 필수적이며, 이 모든 것은 화학 및 석유화학 생산의 핵심입니다. 이들 산업은 또한 광범위한 자동화 시스템을 갖춘 대규모 통합 시설을 운영하므로, 첨단 밀도계는 공정 계측 장비의 핵심 요소입니다. 복잡한 공정 요구사항, 높은 규제 요건, 지속적인 운영 효율성 요구가 결합되어 이 부문에서 밀도계의 강력한 채택을 주도하며, 이를 시장의 주요 최종 사용자로 자리매김하게 합니다.

아시아태평양 지역은 기술 발전 가속화와 수출 지향 산업 확장에 힘입어 예측 기간 동안 가장 높은 연평균 복합 성장률(CAGR)을 기록할 것으로 예상됩니다. 중국의 급속한 산업화, 일본의 스마트 제조 투자, 한국 및 동남아시아의 화학 및 식품 가공 부문 성장이 밀도계 수요를 견인하고 있습니다. 또한 이 지역은 운영 효율성 향상과 글로벌 규정 준수 기준 충족을 위해 통합 디지털 모니터링 시스템 및 자동화 도입이 두드러지게 증가하고 있습니다. 기업들이 데이터 기반 공정 최적화로 계속 전환함에 따라, 소형 지능형 비중 측정 시스템에 대한 수요는 다른 지역보다 빠르게 증가할 것으로 전망됩니다.

본 보고서에서는 세계의 밀도계 시장에 대해 조사했으며, 유형별, 운용유형별, 정밀도별, 측정방법별, 작동원리별, 컴포넌트별, 용도별, 최종용도산업별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 인사이트

제4장 시장 개요

- 소개

- 시장 역학

- 상호연결된 시장과 분야 크로스섹터 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- 소개

- Porter's Five Forces 분석

- 거시경제 전망

- 공급망 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 주된 회의 및 이벤트(2025-2026년)

- 고객사업에 영향을 주는 동향/혼란

- 투자 및 자금조달 시나리오(2021-2025년)

- 사례 연구 분석

- 미국 관세가 밀도계 시장에 미치는 영향(2025년)

제6장 기술의 진보, AI 영향, 특허, 혁신

- 주요 신기술

- 보완적 기술

- 기술 로드맵

- 특허 분석

- AI/생성형 AI가 밀도계 시장에 미치는 영향

제7장 지속가능성과 규제상황

제8장 고객정세와 구매행동

- 의사결정 공정

- 주요 이해관계자와 구매 기준

- 채택 장벽과 내부 과제

- 다양한 최종 이용 산업에서 미충족 요구

제9장 밀도 측정의 원리

- 밀도 측정 방법

- 밀도 측정 물리적 원리

제10장 진동관 밀도계의 동작 원리

- 진동 메커니즘

- 주파수 측정

- 온도 보정

- 신호 처리 및 출력

제11장 다른 계측기기와의 비교

- 밀도계와 굴절계

- 밀도계와 비중계

- 밀도계와 피크노미터

제12장 밀도계 시장(유형별)

- 소개

- 코리올리 밀도계

- 비중계

- 피크노미터

- 진동관

- 방사선

- 초음파

- 마이크로파

- 광학

- 기타

제13장 밀도계 시장(운용 유형별)

- 소개

- 공정

- 실험실

제14장 밀도계 시장(정밀도별)

- 소개

- 프리미엄/고정밀도 계측기

- 중규모 공정 계측기

- 저비용/가치 계측기

제15장 밀도계 시장(측정 방법별)

- 소개

- 인라인/온라인 밀도계

- 실험실/벤치탑 밀도계

- 휴대용/핸드헬드 밀도계

- 패널/OEM 임베디드 밀도계

- 모듈러/멀티센서 플랫폼

제16장 밀도계 시장(작동 원리별)

- 소개

- 디지털

- 아날로그

- 하이브리드

제17장 밀도계 시장(컴포넌트별)

- 소개

- 센서 및 트랜스듀서

- 디스플레이 및 제어 장치

- 샘플 처리 시스템

- 교정 표준 및 장비

제18장 밀도계 시장(용도별)

- 소개

- 공정 제어 및 모니터링

- 품질 관리 및 보증

- 연구개발

- 환경 모니터링

- 순도 시험 및 검증

- 농도 측정

- 혼합 최적화

- 발효 모니터링

- 기타

제19장 밀도계 시장(최종 이용 산업별)

- 소개

- 화학 및 석유화학

- 의약품

- 식품 및 음료

- 석유 및 가스

- 금속 및 광업

- 물 및 폐수 처리

- 펄프 및 종이

- 기타

제20장 밀도계 시장(지역별)

- 소개

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 태국

- 베트남

- 말레이시아

- 인도네시아

- 싱가포르

- 기타

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 네덜란드

- 북유럽

- 기타

- 라틴아메리카

- 브라질

- 아르헨티나

- 멕시코

- 기타

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타

제21장 경쟁 구도

- 소개

- 주요 참가 기업, 전략/강점(2021-2025년)

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업평가와 재무지표

- 브랜드/제품 비교

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제22장 기업 프로파일

- 주요 진출기업

- EMERSON ELECTRIC CO.

- METTLER-TOLEDO INTERNATIONAL INC.

- ANTON PAAR GMBH

- ENDRESS HAUSER GROUP SERVICES AG

- YOKOGAWA ELECTRIC CORPORATION

- THERMO FISHER SCIENTIFIC INC.

- VEGA

- BERTHOLD TECHNOLOGIES GMBH & CO.KG

- TOSHIBA CORPORATION

- VALMET

- 기타 기업

- AMETEK, INC.

- AVENISENSE

- RUDOLPH RESEARCH ANALYTICAL

- SCHMIDT HAENSCH

- A. KRUSS OPTRONIC GMBH

- BOPP & REUTHER MESSTECHNIK GMBH

- SENSOTECH

- INTEGRATED SENSING SYSTEMS, INC.

- RHEONICS

- BRITISH ROTOTHERM GROUP

- FLUID.IO SENSOR CONTROL GMBH & CO. KG

- MICROTRAC RETSCH GMBH

- KOEHLER INSTRUMENT COMPANY, INC.

- KYOTO ELECTRONICS MANUFACTURING CO., LTD.

- DOSCHER MICROWAVE SYSTEMS GMBH

제23장 조사 방법

제24장 부록

HBR 25.12.15The global density meter market is anticipated to grow from USD 1,082.6 million in 2025 to USD 1,557.4 million by 2032, growing at a CAGR of 5.3%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million) |

| Segments | By Type, Implementation Type, Accuracy, Measurement Method, Component and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Extensive use of density measurement across industries to support market growth."

The global density meter market is expected to experience steady expansion during the forecast period, driven by increasing adoption among a wide range of industrial users, regulatory bodies, and commercial process operators. Large manufacturing and processing facilities are integrating density measurement systems to improve material consistency, enhance process stability, and maintain tighter quality control across continuous operations. Regulatory authorities are increasingly using density measurement tools to support compliance checks, enforce safety standards, and validate fluid properties in sensitive applications. Environmental and monitoring organizations are deploying density meters to assess liquid characteristics, support pollution control activities, and improve reporting accuracy for sustainability programs. At the same time, commercial operators across multiple sectors are applying density measurement for product verification, resource optimization, and operational efficiency. Together, these user groups demonstrate the increasing relevance of density meters in facilitating accurate, efficient, and data-driven decision-making across global industrial environments.

"Ultrasonic type segment to record higher CAGR during the forecast period."

Ultrasonic density meters are expected to record the highest CAGR during the forecast period because they offer a non-intrusive and maintenance-friendly measurement method that aligns well with modern industrial needs. Their ability to measure density without direct contact with the fluid reduces wear, minimizes contamination risk, and ensures longer operational life compared to conventional sensor designs. These systems also perform reliably with corrosive, abrasive, or high-temperature media, making them suitable for a wider range of applications. As industries continue to adopt cleaner, safer, and digitally compatible technologies, the demand for ultrasonic density meters is projected to rise rapidly, supporting their strong growth outlook across global markets.

"Chemical and petrochemical industries accounted for the largest market share in 2024."

Chemical and petrochemical industries are expected to hold the largest market share in 2024, as their operations require continuous, highly accurate monitoring of fluid properties to maintain product consistency, ensure the safe handling of volatile materials, and meet stringent international quality standards. Density measurement is essential for applications such as concentration control, blending, reaction monitoring, and custody transfer, all of which are central to chemical and petrochemical production. These industries also operate large, integrated facilities with extensive automation systems, making advanced density meters a critical part of their process instrumentation. The combination of complex processing needs, high regulatory requirements, and constant demand for operational efficiency drives the strong adoption of density meters in this segment, positioning it as the leading end user in the market.

"Asia Pacific to record the highest CAGR during the forecast period."

The Asia Pacific is expected to register the highest CAGR during the forecast period, driven by accelerating technological advancements and the expansion of export-oriented industries. Rapid industrialization in China, investment in smart manufacturing in Japan, and the growth of the chemical and food processing sectors in South Korea and Southeast Asia are driving demand for density meters. The region is also witnessing notable adoption of integrated digital monitoring systems and automation to improve operational efficiency and meet global compliance standards. As companies continue to shift toward data-driven process optimization, demand for compact, intelligent density measurement systems is projected to grow faster than in other regions.

Breakdown of Primaries

A variety of executives from key organizations operating in the density meter market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 - 35%, Tier 2 - 40%, and Tier 3 - 25%

- By Designation: C-level Executives - 30%, Directors - 40%, and Others - 30%

- By Region: North America - 40%, Europe - 32%, Asia Pacific - 23%, and RoW - 5%

Note: Other designations include sales, marketing, and product managers.

Tier 1 companies include market players with revenues exceeding USD 500 million; Tier 2 companies earn revenues between USD 100 million and USD 500 million; and Tier 3 companies earn revenues of up to USD 100 million.

The density meter market is dominated by globally established players, including Anton Paar GmbH (Austria), Mettler-Toledo International Inc. (US), Emerson Electric Co. (US), Endress+Hauser Group Services AG (Switzerland), and Yokogawa Electric Corporation (Japan). The study includes an in-depth competitive analysis of these key players in the density meter market, with their company profiles, recent developments, and key market strategies.

Study Coverage

The report segments the density meter market and forecasts its size by type, implementation type, accuracy, measurement method, operating principle, component, application, end user, and region. It also discusses the market's drivers, restraints, opportunities, and challenges, and gives a detailed view of the market across four main regions: Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa. The report includes a supply chain analysis and the key players and their competitive analysis in the density meter ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (growing demand for process optimization, increasing quality control requirements, and rising R&D in pharmaceutical industries), restraints (high cost of advanced digital density meters and sensitivity to environmental conditions leading to measurement errors), opportunities (development of smart density meters and expansion in emerging economies), and challenges (limited skilled workforce for operation and calibration and complexity in data management) influencing the growth of the density meter market.

- Products/Solution/Service Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and product/solution/service launches in the density meter market.

- Market Development: Comprehensive information about lucrative markets. The report analyzes the density meter market across various regions.

- Market Diversification: Exhaustive information about new products/solutions/services, untapped geographies, recent developments, and investments in the density meter market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Anton Paar GmbH (Austria), Mettler-Toledo International Inc. (US), Emerson Electric Co. (US), Endress+Hauser Group Services AG (Switzerland), and Yokogawa Electric Corporation (Japan), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN DENSITY METER MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 SNAPSHOT: REGIONAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DENSITY METER MARKET

- 3.2 DENSITY METER MARKET, BY TYPE

- 3.3 DENSITY METER MARKET, BY IMPLEMENTATION TYPE

- 3.4 DENSITY METER MARKET, BY ACCURACY

- 3.5 DENSITY METER MARKET, BY MEASUREMENT METHOD

- 3.6 DENSITY METER MARKET, BY OPERATING PRINCIPLE

- 3.7 DENSITY METER MARKET, BY COMPONENT

- 3.8 DENSITY METER MARKET, BY APPLICATION

- 3.9 DENSITY METER MARKET, BY END-USE INDUSTRY

- 3.10 DENSITY METER MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Shift toward automation and smart manufacturing

- 4.2.1.2 Increasing quality control requirements

- 4.2.1.3 Growing R&D in pharmaceutical industry

- 4.2.2 RESTRAINTS

- 4.2.2.1 High purchase and implementation cost of advanced digital density meters

- 4.2.2.2 High sensitivity to environmental conditions

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Development of smart density meters

- 4.2.3.2 Rapid industrialization in developing countries

- 4.2.4 CHALLENGES

- 4.2.4.1 Lack of skilled human resources

- 4.2.4.2 Complexities associated with data management

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.3.1 INTERCONNECTED MARKETS

- 4.3.2 CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 THREAT OF SUBSTITUTES

- 5.2.3 BARGAINING POWER OF SUPPLIERS

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 MACROECONOMIC OUTLOOK

- 5.3.1 INTRODUCTION

- 5.3.2 GDP TRENDS AND FORECAST

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF VIBRATING TUBE DENSITY METERS, BY KEY PLAYER, 2020-2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF DENSITY METERS, BY END-USE INDUSTRY, 2020-2024

- 5.6.3 AVERAGE SELLING PRICE TREND, BY MEASUREMENT METHOD, 2020-2024

- 5.6.4 AVERAGE SELLING PRICE TREND OF DENSITY METERS, BY REGION, 2020-2024

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 9027)

- 5.7.2 EXPORT SCENARIO (HS CODE 9027)

- 5.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 FRENCH HYDRO-ELECTRIC POWER PLANT COLLABORATES WITH RHOSONICS ANALYTICAL TO PREVENT SEDIMENT ACCUMULATION AND TURBINE WEAR

- 5.11.2 SOUTH AFRICAN FERROCHROME SMELTER PARTNERS WITH RHOSONICS TO REMOVE MANUAL SAMPLING AND IMPROVE PROCESS CONTROL

- 5.11.3 ANTON PAAR'S DENSITY MEASUREMENT SOLUTION ENHANCES QUALITY CONTROL AT AVISTA OIL

- 5.12 IMPACT OF 2025 US TARIFF ON DENSITY METER MARKET

- 5.12.1 INTRODUCTION

- 5.12.1.1 Key tariff rates

- 5.12.2 PRICE IMPACT ANALYSIS

- 5.12.3 IMPACT OF COUNTRIES/REGIONS

- 5.12.3.1 US

- 5.12.3.2 Europe

- 5.12.3.3 Asia Pacific

- 5.12.4 IMPACT ON END-USE INDUSTRIES

- 5.12.1 INTRODUCTION

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 VIBRATING ELEMENT

- 6.1.2 CORIOLIS FLOW MEASUREMENT

- 6.1.3 ULTRASONIC DENSITY MEASUREMENT

- 6.1.4 NUCLEAR/RADIATION ABSORPTION TECHNIQUE

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 SCADA

- 6.2.2 SMART TRANSMITTERS AND DIGITAL INTERFACES

- 6.3 TECHNOLOGY ROADMAP

- 6.4 PATENT ANALYSIS

- 6.5 IMPACT OF AI/GEN AI ON DENSITY METER MARKET

- 6.5.1 TOP USE CASES AND MARKET POTENTIAL

- 6.5.2 BEST PRACTICES IN DENSITY METER MARKET

- 6.5.3 CASE STUDIES OF AI IMPLEMENTATION IN DENSITY METER MARKET

- 6.5.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.5.5 CLIENTS' READINESS TO ADOPT AI IN DENSITY METER MARKET

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 INTRODUCTION

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.1.2.1 ASTM D4052

- 7.1.2.2 ASTM D5002

- 7.1.2.3 ISO 12185

- 7.1.2.4 ISO 15212 1

- 7.1.2.5 JIS K2249-1

- 7.1.2.6 USP <841>

- 7.1.2.7 ASTM D1480

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

9 PRINCIPLES OF DENSITY MEASUREMENT

- 9.1 METHODS OF MEASURING DENSITY

- 9.1.1 DIRECT MEASUREMENT METHODS

- 9.1.2 INDIRECT OR INSTRUMENT-BASED METHODS

- 9.1.3 ADVANCED CONTINUOUS AND NON-CONTACT METHODS

- 9.2 PHYSICAL PRINCIPLES BEHIND DENSITY MEASUREMENT

10 OPERATING PRINCIPLES OF VIBRATING TUBE DENSITY METER

- 10.1 OSCILLATION MECHANISM

- 10.2 FREQUENCY MEASUREMENT

- 10.3 TEMPERATURE COMPENSATION

- 10.4 SIGNAL PROCESSING AND OUTPUT

11 COMPARISON WITH OTHER MEASUREMENT INSTRUMENTS

- 11.1 DENSITY METER VS. REFRACTOMETER

- 11.2 DENSITY METER VS. HYDROMETER

- 11.3 DENSITY METER VS. PYCNOMETER

12 DENSITY METER MARKET, BY TYPE

- 12.1 INTRODUCTION

- 12.2 CORIOLIS DENSITY METERS

- 12.2.1 REAL-TIME MEASUREMENT CAPABILITY FOR CONTINUOUS OPERATIONS TO FUEL MARKET GROWTH

- 12.2.2 CHEMICAL DOSING AND BLENDING

- 12.2.3 OIL & GAS CUSTODY TRANSFER

- 12.2.4 FOOD & BEVERAGES FILLING LINES

- 12.2.5 PHARMACEUTICAL INGREDIENT MEASUREMENT

- 12.3 HYDROMETERS

- 12.3.1 NEED TO DETERMINE LIQUID DENSITY USING GRAVITY-BASED MEASUREMENT FOR FOUNDATIONAL ACCURACY TO FOSTER MARKET GROWTH

- 12.3.2 ALCOHOL CONTENT MEASUREMENT IN BREWING AND DISTILLING

- 12.3.3 BATTERY ELECTROLYTE TESTING IN AUTOMOTIVE AND INDUSTRIAL BATTERIES

- 12.3.4 SALINITY MEASUREMENT IN AQUARIUMS AND SEAWATER ANALYSIS

- 12.3.5 PETROLEUM PRODUCT DENSITY TESTING IN OIL REFINERIES

- 12.4 PYCNOMETERS

- 12.4.1 VOLUMETRIC PRECISION USING CALIBRATED GLASS OR METAL VESSELS TO OFFER GROWTH OPPORTUNITIES

- 12.4.2 POWDER AND SOLID MATERIAL DENSITY IN PHARMACEUTICALS

- 12.4.3 SOIL PARTICLE DENSITY ANALYSIS IN GEOTECHNICAL ENGINEERING

- 12.4.4 QUALITY CONTROL IN CERAMICS AND GLASS INDUSTRIES

- 12.4.5 PAINT AND PIGMENT FORMULATION IN COATINGS MANUFACTURING

- 12.5 VIBRATING TUBES

- 12.5.1 SUITABILITY FOR DYNAMIC AND STATIC MEASUREMENT ENVIRONMENTS TO FOSTER MARKET GROWTH

- 12.5.2 FUEL QUALITY AND BLENDING CONTROL IN PETROCHEMICALS

- 12.5.3 GAS AND LIQUID DENSITY MEASUREMENT IN CHEMICAL PLANTS

- 12.5.4 LUBRICANT MONITORING IN AUTOMOTIVE AND INDUSTRIAL APPLICATIONS

- 12.5.5 BEVERAGE CONCENTRATION MEASUREMENT IN FOOD PROCESSING

- 12.5.6 DIGITAL (OSCILLATING U TUBES)

- 12.5.6.1 Pharmaceutical formulation testing

- 12.5.6.2 Quality control in food & beverage production

- 12.5.6.3 Chemical concentration analysis in lab and field environments

- 12.5.6.4 E-liquids and cosmetic fluid density measurement

- 12.6 NUCLEAR

- 12.6.1 COMPLIANCE WITH INDUSTRIAL SAFETY STANDARDS FOR APPROVED DEPLOYMENT IN REGULATED ENVIRONMENTS TO FUEL MARKET GROWTH

- 12.6.2 SOIL COMPACTION TESTING IN CONSTRUCTION AND ROAD BUILDING

- 12.6.3 MINING SLURRY MONITORING FOR PROCESS OPTIMIZATION

- 12.6.4 BULK MATERIAL FLOW MEASUREMENT IN MINERAL PROCESSING

- 12.6.5 PIPELINE MONITORING IN OIL AND GAS OPERATIONS

- 12.7 ULTRASONIC

- 12.7.1 SUITABILITY FOR APPLICATIONS REQUIRING UNINTERRUPTED PROCESS FLUID HANDLING TO SUPPORT MARKET GROWTH

- 12.7.2 CORROSIVE OR HAZARDOUS FLUID MONITORING IN CHEMICAL PROCESSING

- 12.7.3 IN-LINE DENSITY MEASUREMENT IN FOOD PRODUCTION

- 12.7.4 REAL-TIME MONITORING OF SLURRIES AND EMULSIONS

- 12.7.5 HIGH-TEMPERATURE APPLICATIONS LIKE MOLTEN METAL OR GLASS

- 12.8 MICROWAVE

- 12.8.1 REAL-TIME AND FULLY AUTOMATED MEASUREMENT CAPABILITY TO BOOST DEMAND

- 12.8.2 SLURRY MONITORING IN MINING AND MINERALS

- 12.8.3 PULP AND PAPER INDUSTRY

- 12.9 OPTICAL

- 12.9.1 RAPID NON-CONTACT MEASUREMENT FOR CONTINUOUS MONITORING TO FOSTER MARKET GROWTH

- 12.9.2 SUSPENDED SOLID ANALYZER/SLUDGE DENSITY METER

- 12.9.3 REFRACTOMETER

- 12.9.4 OPTICAL CONSISTENCY TRANSMITTER

- 12.10 OTHER TYPES

13 DENSITY METER MARKET, BY IMPLEMENTATION TYPE

- 13.1 INTRODUCTION

- 13.2 PROCESS

- 13.2.1 ABILITY TO OFFER PRECISE CONTROL OVER CHEMICAL REACTIONS TO FUEL MARKET GROWTH

- 13.2.2 LIQUID

- 13.2.2.1 Tanks

- 13.2.2.2 Pipelines

- 13.2.3 GAS

- 13.3 LAB

- 13.3.1 NEED TO ENSURE ACCURACY AND PRECISION IN SMALL-SCALE MEASUREMENTS TO FUEL MARKET GROWTH

- 13.3.2 LIQUID

- 13.3.3 GAS

14 DENSITY METER MARKET, BY ACCURACY

- 14.1 INTRODUCTION

- 14.2 PREMIUM/HIGH-PRECISION INSTRUMENTS

- 14.2.1 INCREASING NEED FOR STRINGENT QUALITY CONTROL IN AUTOMATED PRODUCTION LINES TO FOSTER MARKET GROWTH

- 14.3 MID-RANGE PROCESS INSTRUMENTS

- 14.3.1 SUITABILITY FOR VARIOUS INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- 14.4 LOW-COST/VALUE INSTRUMENTS

- 14.4.1 INCREASING APPLICATION IN ROUTINE QUALITY CHECKS AND SMALL-SCALE PROCESSING OPERATIONS TO SUPPORT MARKET GROWTH

15 DENSITY METER MARKET, BY MEASUREMENT METHOD

- 15.1 INTRODUCTION

- 15.2 INLINE/ONLINE DENSITY METERS

- 15.2.1 CONTINUOUS MONITORING OF LIQUID STREAMS FOR PRODUCT QUALITY TO BOOST DEMAND

- 15.3 LABORATORY/BENCHTOP DENSITY METERS

- 15.3.1 DIGITAL INTERFACES WITH DATA LOGGING AND LIMS EXPORT TO SUPPORT MARKET

- 15.4 PORTABLE/HANDHELD DENSITY METERS

- 15.4.1 MOBILITY AND EASE OF USE FOR REMOTE LOCATIONS TO FUEL MARKET GROWTH

- 15.5 PANEL/OEM EMBEDDED DENSITY METERS

- 15.5.1 ACCURATE MEASUREMENT IN HIGH-PRESSURE AND HIGH-TEMPERATURE ENVIRONMENTS TO DRIVE MARKET

- 15.6 MODULAR/MULTI-SENSOR PLATFORMS

- 15.6.1 REDUCED MATERIAL WASTE THROUGH CONSOLIDATED MULTI-PARAMETER MEASUREMENT TO SUPPORT MARKET GROWTH

16 DENSITY METER MARKET, BY OPERATING PRINCIPLE

- 16.1 INTRODUCTION

- 16.2 DIGITAL

- 16.2.1 HIGH PRECISION AND RELIABILITY FOR CRITICAL PROCESS MONITORING TO BOOST DEMAND

- 16.3 ANALOG

- 16.3.1 DURABILITY AND LOW MAINTENANCE FOR RELIABLE FIELD PERFORMANCE TO SUPPORT MARKET GROWTH

- 16.4 HYBRID

- 16.4.1 INTEGRATION OF OSCILLATION-BASED SENSING WITH ELECTRONIC PROCESSING TO OFFER GROWTH OPPORTUNITIES

17 DENSITY METER MARKET, BY COMPONENT

- 17.1 INTRODUCTION

- 17.2 SENSORS AND TRANSDUCERS

- 17.2.1 DURABILITY AND RESISTANCE TO CORROSION TO BOOST DEMAND

- 17.3 DISPLAY AND CONTROL UNITS

- 17.3.1 DIGITAL SCREENS AND TOUCH INTERFACES FOR CLEARER OPERATIONAL USABILITY TO FUEL MARKET GROWTH

- 17.4 SAMPLE HANDLING SYSTEMS

- 17.4.1 ENHANCED RELIABILITY AND REPEATABILITY FOR LONG-TERM MEASUREMENT PERFORMANCE TO FOSTER MARKET GROWTH

- 17.5 CALIBRATION STANDARDS AND DEVICES

- 17.5.1 COMPLIANCE WITH INTERNATIONAL QUALITY AND SAFETY GUIDELINES FOR ASSURED OPERATION TO SUPPORT MARKET GROWTH

18 DENSITY METER MARKET, BY APPLICATION

- 18.1 INTRODUCTION

- 18.2 PROCESS CONTROL AND MONITORING

- 18.2.1 NEED TO ENSURE REGULATORY COMPLIANCE ACROSS COMPLEX PRODUCTION ENVIRONMENTS TO DRIVE MARKET

- 18.3 QUALITY CONTROL AND ASSURANCE

- 18.3.1 ABILITY TO DELIVER REPEATABLE AND HIGH-ACCURACY MEASUREMENTS TO FUEL MARKET GROWTH

- 18.4 RESEARCH AND DEVELOPMENT

- 18.4.1 INCREASING APPLICATIONS FOR EXPERIMENTAL MODELING AND PROTOTYPE TESTING TO SUPPORT MARKET GROWTH

- 18.5 ENVIRONMENTAL MONITORING

- 18.5.1 NEED TO DELIVER CONSISTENT AND REAL-TIME DATA TO FOSTER MARKET GROWTH

- 18.6 PURITY TESTING AND VERIFICATION

- 18.6.1 RISING CONCERNS OVER ADULTERATION IN HIGH-VALUE PRODUCTS TO DRIVE MARKET

- 18.7 CONCENTRATION MEASUREMENT

- 18.7.1 MINIMIZED RESOURCE WASTE DURING MANUFACTURING AND FORMULATION STAGES TO BOOST DEMAND

- 18.8 BLEND OPTIMIZATION

- 18.8.1 GROWING DEMAND FOR CONSISTENT PRODUCT QUALITY ACROSS GLOBAL SUPPLY CHAINS TO FUEL MARKET GROWTH

- 18.9 FERMENTATION MONITORING

- 18.9.1 GROWING APPLICATIONS IN BREWING, BIOTECHNOLOGY, AND PHARMACEUTICALS TO FOSTER MARKET GROWTH

- 18.10 OTHER APPLICATIONS

19 DENSITY METER MARKET, BY END-USE INDUSTRY

- 19.1 INTRODUCTION

- 19.2 CHEMICALS & PETROCHEMICALS

- 19.2.1 IMPROVED COMPOSITION MONITORING TO BOOST DEMAND

- 19.2.2 PROCESS CHEMICAL MANUFACTURING

- 19.2.3 SPECIALTY CHEMICALS

- 19.2.4 POLYMER AND PLASTICS MANUFACTURING

- 19.2.5 QUALITY ASSURANCE

- 19.2.6 CORROSIVE CHEMICAL MONITORING

- 19.2.7 BULK STORAGE AND TRANSFER

- 19.3 PHARMACEUTICALS

- 19.3.1 HIGH-QUALITY OUTPUT ASSURANCE TO FUEL MARKET GROWTH

- 19.3.2 DRUG MANUFACTURING PROCESS APPLICATIONS

- 19.3.3 BIOPHARMACEUTICAL APPLICATIONS

- 19.3.4 RESEARCH AND DEVELOPMENT

- 19.3.5 REGULATORY COMPLIANCE

- 19.4 FOOD & BEVERAGES

- 19.4.1 PRODUCT UNIFORMITY DRIVEN BY ACCURATE DENSITY READINGS TO FOSTER MARKET GROWTH

- 19.4.2 BREWERY AND DISTILLERY APPLICATIONS

- 19.4.3 SOFT DRINKS AND CARBONATED BEVERAGES

- 19.4.4 DAIRY PROCESSING

- 19.4.5 SYRUPS AND SWEETENERS

- 19.4.6 PROCESSED FOODS AND SAUCES

- 19.4.7 EDIBLE OILS AND FATS

- 19.5 OIL & GAS

- 19.5.1 NEED TO STRENGTHEN SAFETY ASSURANCE ACROSS OIL & GAS OPERATIONS TO STRENGTHEN MARKET

- 19.5.2 DRILLING OPERATIONS

- 19.5.3 PIPELINE MONITORING

- 19.5.4 REFINING AND BLENDING

- 19.5.5 RESERVOIR ANALYSIS

- 19.6 METALS & MINING

- 19.6.1 ABILITY TO OFFER ACCURATE READINGS IN ABRASIVE OR HIGH-TEMPERATURE CONDITIONS TO FOSTER MARKET GROWTH

- 19.6.2 ORE PROCESSING

- 19.6.3 MINERAL CONCENTRATION

- 19.6.4 SMELTING OPERATIONS

- 19.6.5 TAILINGS MANAGEMENT

- 19.7 WATER & WASTEWATER TREATMENT

- 19.7.1 ABILITY TO PERFORM REAL-TIME MEASUREMENTS IN CHALLENGING ENVIRONMENTS TO BOOST DEMAND

- 19.7.2 SLUDGE TREATMENT

- 19.7.3 EFFLUENT MONITORING

- 19.7.4 CHEMICAL DOSING

- 19.7.5 DESALINATION SYSTEMS

- 19.8 PULP & PAPER

- 19.8.1 REDUCED MATERIAL WASTE THROUGH ACCURATE DENSITY MONITORING TO BENEFIT MARKET

- 19.8.2 PULPING PROCESS CONTROL

- 19.8.3 CHEMICAL RECOVERY SYSTEMS

- 19.9 OTHER END-USE INDUSTRIES

20 DENSITY METER MARKET, BY REGION

- 20.1 INTRODUCTION

- 20.2 ASIA PACIFIC

- 20.2.1 CHINA

- 20.2.1.1 Robust local supply and smart automation to fuel market growth

- 20.2.2 JAPAN

- 20.2.2.1 Integration with high-precision industrial processes and advanced automation systems to support market growth

- 20.2.3 INDIA

- 20.2.3.1 Rapid expansion of process-driven sectors to strengthen market

- 20.2.4 SOUTH KOREA

- 20.2.4.1 Advanced manufacturing and technology-driven industries to offer growth opportunities

- 20.2.5 AUSTRALIA

- 20.2.5.1 Growing deployment of digital interfaces and automatic temperature compensation to drive market

- 20.2.6 THAILAND

- 20.2.6.1 Tailored deployment of inline, benchtop, and modular systems to boost demand

- 20.2.7 VIETNAM

- 20.2.7.1 Growing adoption of automation and digital monitoring among chemical plants to foster market growth

- 20.2.8 MALAYSIA

- 20.2.8.1 Growing application in quality verification and control to drive market

- 20.2.9 INDONESIA

- 20.2.9.1 Rising demand from oil & gas sector to fuel market growth

- 20.2.10 SINGAPORE

- 20.2.10.1 Emphasis on environmental stewardship, carbon management, and biodiversity conservation to fuel demand

- 20.2.11 REST OF ASIA PACIFIC

- 20.2.1 CHINA

- 20.3 NORTH AMERICA

- 20.3.1 US

- 20.3.1.1 Integration of density measurement into industrial automation systems to fuel market growth

- 20.3.2 CANADA

- 20.3.2.1 Widespread presence of multiple end-user industries to offer growth opportunities

- 20.3.1 US

- 20.4 EUROPE

- 20.4.1 GERMANY

- 20.4.1.1 Strong preference for oscillating-tube and Coriolis density meters across industrial and laboratory settings to drive market

- 20.4.2 FRANCE

- 20.4.2.1 Increasing demand for sensors and transducers to fuel market growth

- 20.4.3 UK

- 20.4.3.1 Growing demand for precision measurement and quality assurance across various applications to offer growth opportunities

- 20.4.4 ITALY

- 20.4.4.1 Rising demand for flexible and user-friendly instrumentation to drive market

- 20.4.5 SPAIN

- 20.4.5.1 Increasing emphasis on operational precision and regulatory compliance across industrial and laboratory setting to offer growth opportunities

- 20.4.6 NETHERLANDS

- 20.4.6.1 Reliance on accurate measurement for process control and quality assurance to foster market growth

- 20.4.7 NORDICS

- 20.4.7.1 Growing demand for efficient and sustainable processes to drive market

- 20.4.8 REST OF EUROPE

- 20.4.1 GERMANY

- 20.5 LATIN AMERICA

- 20.5.1 BRAZIL

- 20.5.1.1 Reliance of oil & gas on precise density measurement for quality verification to offer growth opportunities

- 20.5.2 ARGENTINA

- 20.5.2.1 Increasing application in food & beverage sector to foster market growth

- 20.5.3 MEXICO

- 20.5.3.1 Growing use of digital and automated instruments for real-time readings to fuel market growth

- 20.5.4 REST OF LATIN AMERICA

- 20.5.1 BRAZIL

- 20.6 MIDDLE EAST & AFRICA

- 20.6.1 GCC

- 20.6.1.1 Saudi Arabia

- 20.6.1.1.1 Need to monitor crude oil quality, refining processes, and pipeline transport to drive market

- 20.6.1.2 UAE

- 20.6.1.2.1 Focus on advanced process control and precision measurement across various applications to support market growth

- 20.6.1.3 Rest of GCC

- 20.6.1.1 Saudi Arabia

- 20.6.2 SOUTH AFRICA

- 20.6.2.1 Increasing demand for robust and easy-to-integrate instruments to fuel market growth

- 20.6.3 REST OF MIDDLE EAST & AFRICA

- 20.6.1 GCC

21 COMPETITIVE LANDSCAPE

- 21.1 INTRODUCTION

- 21.2 KEY PLAYERS, STRATEGIES/RIGHT TO WIN, 2021-2025

- 21.3 REVENUE ANALYSIS, 2020-2024

- 21.4 MARKET SHARE ANALYSIS, 2024

- 21.5 COMPANY VALUATION AND FINANCIAL METRICS

- 21.6 BRAND/PRODUCT COMPARISON

- 21.6.1 ANTON PAAR GMBH

- 21.6.2 EMERSON ELECTRIC CO.

- 21.6.3 METTLER-TOLEDO INTERNATIONAL INC.

- 21.6.4 YOKOGAWA ELECTRIC CORPORATION

- 21.6.5 TOSHIBA CORPORATION

- 21.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 21.7.1 STARS

- 21.7.2 EMERGING LEADERS

- 21.7.3 PERVASIVE PLAYERS

- 21.7.4 PARTICIPANTS

- 21.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 21.7.5.1 Company footprint

- 21.7.5.2 Region footprint

- 21.7.5.3 Type footprint

- 21.7.5.4 Implementation type footprint

- 21.7.5.5 Measurement method footprint

- 21.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 21.8.1 PROGRESSIVE COMPANIES

- 21.8.2 RESPONSIVE COMPANIES

- 21.8.3 DYNAMIC COMPANIES

- 21.8.4 STARTING BLOCKS

- 21.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 21.8.5.1 Detailed list of key startups/SMEs

- 21.9 COMPETITIVE SCENARIO

- 21.9.1 PRODUCT LAUNCHES

- 21.9.2 DEALS

22 COMPANY PROFILES

- 22.1 KEY PLAYERS

- 22.1.1 EMERSON ELECTRIC CO.

- 22.1.1.1 Business overview

- 22.1.1.2 Products/Solutions/Services offered

- 22.1.1.3 Recent developments

- 22.1.1.3.1 Product launches

- 22.1.1.4 MnM view

- 22.1.1.4.1 Key strengths/Right to win

- 22.1.1.4.2 Strategic choices

- 22.1.1.4.3 Weaknesses/Competitive threats

- 22.1.2 METTLER-TOLEDO INTERNATIONAL INC.

- 22.1.2.1 Business overview

- 22.1.2.2 Products/Solutions/Services offered

- 22.1.2.3 MnM view

- 22.1.2.3.1 Key strengths/Right to win

- 22.1.2.3.2 Strategic choices

- 22.1.2.3.3 Weaknesses/Competitive threats

- 22.1.3 ANTON PAAR GMBH

- 22.1.3.1 Business overview

- 22.1.3.2 Products/Solutions/Services offered

- 22.1.3.3 Recent developments

- 22.1.3.3.1 Product launches

- 22.1.3.4 MnM view

- 22.1.3.4.1 Key strengths/Right to win

- 22.1.3.4.2 Strategic choices

- 22.1.3.4.3 Weaknesses/Competitive threats

- 22.1.4 ENDRESS+HAUSER GROUP SERVICES AG

- 22.1.4.1 Business overview

- 22.1.4.2 Products/Solutions/Services offered

- 22.1.4.3 Recent developments

- 22.1.4.3.1 Product launches

- 22.1.4.4 MnM view

- 22.1.4.4.1 Key strengths/Right to win

- 22.1.4.4.2 Strategic choices

- 22.1.4.4.3 Weaknesses/Competitive threats

- 22.1.5 YOKOGAWA ELECTRIC CORPORATION

- 22.1.5.1 Business overview

- 22.1.5.2 Products/Solutions/Services offered

- 22.1.5.3 Recent developments

- 22.1.5.3.1 Deals

- 22.1.5.4 MnM view

- 22.1.5.4.1 Key strengths/Right to win

- 22.1.5.4.2 Strategic choices

- 22.1.5.4.3 Weaknesses/Competitive threats

- 22.1.6 THERMO FISHER SCIENTIFIC INC.

- 22.1.6.1 Business overview

- 22.1.6.2 Products/Solutions/Services offered

- 22.1.7 VEGA

- 22.1.7.1 Business overview

- 22.1.7.2 Products/Solutions/Services offered

- 22.1.8 BERTHOLD TECHNOLOGIES GMBH & CO.KG

- 22.1.8.1 Business overview

- 22.1.8.2 Products/Solutions/Services offered

- 22.1.9 TOSHIBA CORPORATION

- 22.1.9.1 Business overview

- 22.1.9.2 Products/Solutions/Services offered

- 22.1.10 VALMET

- 22.1.10.1 Business overview

- 22.1.10.2 Products/Solutions/Services offered

- 22.1.1 EMERSON ELECTRIC CO.

- 22.2 OTHER PLAYERS

- 22.2.1 AMETEK, INC.

- 22.2.2 AVENISENSE

- 22.2.3 RUDOLPH RESEARCH ANALYTICAL

- 22.2.4 SCHMIDT + HAENSCH

- 22.2.5 A. KRUSS OPTRONIC GMBH

- 22.2.6 BOPP & REUTHER MESSTECHNIK GMBH

- 22.2.7 SENSOTECH

- 22.2.8 INTEGRATED SENSING SYSTEMS, INC.

- 22.2.9 RHEONICS

- 22.2.10 BRITISH ROTOTHERM GROUP

- 22.2.11 FLUID.IO SENSOR + CONTROL GMBH & CO. KG

- 22.2.12 MICROTRAC RETSCH GMBH

- 22.2.13 KOEHLER INSTRUMENT COMPANY, INC.

- 22.2.14 KYOTO ELECTRONICS MANUFACTURING CO., LTD.

- 22.2.15 DOSCHER MICROWAVE SYSTEMS GMBH

23 RESEARCH METHODOLOGY

- 23.1 RESEARCH DATA

- 23.1.1 SECONDARY DATA

- 23.1.1.1 Key data from secondary sources

- 23.1.1.2 List of key secondary sources

- 23.1.2 PRIMARY DATA

- 23.1.2.1 Key data from primary sources

- 23.1.2.2 List of key primary interview participants

- 23.1.2.3 Breakdown of primaries

- 23.1.2.4 Key industry insights

- 23.1.3 SECONDARY AND PRIMARY RESEARCH

- 23.1.1 SECONDARY DATA

- 23.2 MARKET SIZE ESTIMATION

- 23.2.1 BOTTOM-UP APPROACH

- 23.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 23.2.2 TOP-DOWN APPROACH

- 23.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 23.2.1 BOTTOM-UP APPROACH

- 23.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 23.4 RESEARCH ASSUMPTIONS

- 23.5 RISK ASSESSMENT

- 23.6 RESEARCH LIMITATIONS

24 APPENDIX

- 24.1 DISCUSSION GUIDE

- 24.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 24.3 CUSTOMIZATION OPTIONS

- 24.4 RELATED REPORTS

- 24.5 AUTHOR DETAILS