|

시장보고서

상품코드

1883067

후방 산란 X선 기기 시장 : 유형별, 컴포넌트별, 이미징 방식별, 용도별, 최종 사용자별, 지역별 - 예측(-2032년)Backscatter X-ray Device Market by Type, Component, Imaging Mode, Application and Enduser and Region -Global Forecast To 2032 |

||||||

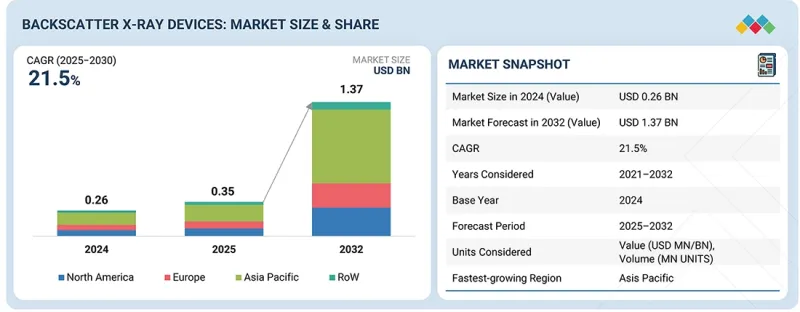

세계의 후방 산란 X선 기기 시장 규모는 2025년 3억 5,000만 달러로 평가되었고 2032년에는 13억 7,000만 달러에 이를 것으로 예측되며, 예측 기간에 CAGR은 21.5%를 나타낼 전망입니다.

국경 보안, 세관 집행, 교통 허브 및 핵심 인프라 전반에 걸쳐 신속하고 정확하며 비침습적인 검사에 대한 수요 증가로 시장이 강력한 성장을 보이고 있습니다. 밀수 활동 증가, 국경 간 무역 확대, 강화된 보안 규정, 그리고 고처리량 검사에 대한 강조가 더욱 높아지면서 첨단 후방 산란 시스템에 대한 수요가 더욱 촉진되고 있습니다. 검출기 감도, 저선량 X선 생성, 영상 알고리즘, 그리고 AI 기반 위협 식별 기술의 발전은 탐지 정확도, 처리 효율성, 그리고 운영 신뢰성을 향상시키고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 기간 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 단위 | 10억 달러 |

| 부문 | 유형, 모빌리티, 이미징 방식, 컴포넌트, 용도, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

또한 공항, 항만, 육상 국경, 군사 시설 및 법 집행 기관 전반에 걸친 확대된 배치는 상당한 성장 기회를 창출하고 있습니다. 이러한 시스템은 유기적 위협, 은닉된 밀수품, 폭발물 및 무기 탐지에 핵심적인 역할을 수행하며, 국가 안보 작전을 지원하고 검사 워크플로우를 가속화하며 전 세계 현대 보안 인프라 전반에 걸쳐 안전하고 효율적이며 확장 가능한 검사를 가능하게 합니다.

"출력 범위별로는 저출력 범위가 예측 기간에 최대 시장 규모를 차지할 전망"

저출력 후방 산란 엑스레이 시스템은 예측 기간 동안 가장 큰 시장 점유율을 유지할 것으로 예상되며, 이는 주로 시장에서 가장 빠르게 성장하는 부문인 휴대용, 핸드헬드 및 모바일 검사 애플리케이션에 널리 채택되기 때문입니다. 이 장치들은 100keV 미만의 에너지로 작동하여 세관, 법 집행 기관 및 보안 기관의 현장 사용에 적합한 안전하고 저선량 검사를 가능하게 합니다. 컴팩트한 설계, 낮은 운영 위험, 완화된 규제 제한 및 낮은 소유 비용으로 신속한 현장 배치에 이상적입니다. 또한 저전력 시스템은 유기물 위협에 대한 비침습적 고대비 검출이 필수적인 인체, 수하물, 차량 및 소형 화물 스캐닝에 선호됩니다.

"용도별로 법 집행 기관이 예측 기간에 가장 높은 CAGR을 나타낼 것으로 예측"

법 집행 기관은 일상적인 치안 유지 및 작전 수행 시 무기, 폭발물, 마약 및 은닉된 유기적 위협 요소에 대한 신속하고 비침습적인 탐지 수요가 증가함에 따라 후방 산란 X선 장치 시장에서 가장 높은 연평균 복합 성장률(CAGR)을 기록할 것으로 예상됩니다. 도시 보안 문제 증가, 마약 밀매 확대, 이동형 및 휴대용 후방 산란 시스템의 보급 확대로 도입이 가속화되고 있습니다. 기관들은 교통 단속, 급습, 검문소, 공공 행사 보안 시 실시간 검사를 지원하는 소형 현장용 장비를 점점 더 우선시하고 있습니다. 또한 경찰 인프라 현대화에 대한 투자 증가와 첨단 검사 기술에 대한 정부 자금 지원이 이 부문에서 강력한 성장 동력을 이끌고 있습니다.

“북미가 예측기간에 최대 시장 규모를 차지할 전망”

북미는 기술의 조기 도입, Rapiscan Systems, Tek84, Viken Detection, Videray 등 선도적 제조업체의 강력한 입지, 국경 보안 및 국토 보호에 대한 정부의 지속적인 투자로 인해 후방 산란 X선 장치 시장에서 가장 큰 시장 점유율을 차지하고 있습니다. 국토안보부(DHS), 세관국경보호청(CBP), 이민세관집행국(ICE), 지방 법집행기관 등은 마약 차단, 화물 검사, 전술 현장 검사를 위해 휴대용, 차량 장착형, 이동식 후방 산란 장비를 대규모로 배치하고 있습니다. 해당 지역의 엄격한 보안 기준, 높은 조달 예산, 지속적인 시스템 업그레이드, 첨단 탐지 능력에 대한 수요가 종합적으로 작용하여 북미는 예측 기간 내내 지배적인 시장 지위를 유지할 것으로 예상됩니다.

본 보고서에서는 세계의 후방 산란 X선 기기 시장에 대해 조사 분석하여 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요한 지견

- 후방 산란 X선 기기 시장의 기업에게 매력적인 기회

- 후방 산란 X선 기기 시장 : 유형별

- 후방 산란 X선 기기 시장 : 모빌리티별

- 후방 산란 X선 기기 시장 : 컴포넌트별

- 후방 산란 X선 기기 시장 : 용도별

- 후방 산란 X선 기기 시장 : 지역별

- 후방 산란 X선 기기 시장 : 국가별

제4장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 후방 산란 X선 기기 시장의 미충족 요구

- 화이트 스페이스의 기회

- 상호연결된 시장과 부문 크로스섹터 기회

- 상호연결된 시장

- 부문 크로스섹터 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- 소개

- Porter's Five Forces 분석

- 거시경제지표

- 소개

- GDP의 동향과 예측

- 세계의 공항 및 항산업계 동향

- 세계의 세관과 국경 경비의 동향

- 밸류체인 분석

- 생태계 분석

- 가격 설정 분석

- 평균 판매 가격 동향 : 지역별(2021-2024년)

- 후방 산란 X선 기기의 평균 판매 가격 동향 : 주요 제조업체별

- 무역 분석

- 수입 시나리오(HS 코드 9022)

- 수출 데이터(HS 코드 9022)

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 고객사업에 영향을 주는 동향/혼란

- 투자와 자금 조달 시나리오(2021-2025년)

- 사례 연구 분석

- 미국 관세의 영향(2025년)

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 미치는 영향

- 용도에 대한 영향

제6장 기술의 진보, AI 영향, 특허, 혁신 및 미래 응용 분야

- 주요 신기술

- 보완 기술

- 인접 기술

- 기술/제품 로드맵

- 단기(2025-2027년) : 시스템 최적화와 AI 통합

- 중기(2027-2030년) : 하이브리드 이미징과 플랫폼 확장성

- 장기(2030-2035년 이후) : 범용 재구성 가능 컴퓨팅 및 시스템 수준 융합

- 특허 분석

- 후방 산란 X선 기기에 대한 AI 영향

- 주요 이용 사례와 시장의 장래성

- 후방 산란 X선 기기 시장의 모범 사례

- 후방 산란 X선 기기 시장에서 AI 도입의 사례 연구

- 상호연결된 인접 생태계와 시장 기업에 미치는 영향

- 후방 산란 X선 기기 시장의 AI 채택에 대한 고객 준비 상황

제7장 규제 상황

- 소개

- 규제기관, 정부기관, 기타 조직

- 표준

- 정부 규제

제8장 고객정세와 구매행동

- 의사결정 프로세스

- 주요 이해관계자와 구매 기준

- 채택 장벽과 내부 과제

- 다양한 용도에서 미충족 요구

제9장 후방 산란 X선 기기 시장 : 용도별

- 소개

- 세관 및 국경 경비

- 법 집행

- 공항/항공

- 군사 및 방위

- 산업 및 중요 용도

- 기타 용도

제10장 후방 산란 X선 기기 시장 : 컴포넌트별

- 소개

- 하드웨어

- 소프트웨어

- 서비스

제11장 후방 산란 X선 기기 시장 : 검출 방식별

- 소개

- 펜슬빔 래스터 스캔 시스템

- Z-후방 산란/플라잉 스팟 운용

- 대면적 검출기 패널

제12장 후방 산란 X선 기기 시장 : 이미징 방식별

- 소개

- 싱글 뷰 후방 산란 이미징

- 듀얼 뷰 후방 산란 이미징

- 멀티 뷰 후방 산란 이미징

- 하이브리드 이미징

제13장 후방 산란 X선 기기 시장 : 모빌리티별

- 소개

- 고정식

- 모바일/자동차

- 휴대용/핸드헬드

제14장 후방 산란 X선 기기 시장 : 출력 범위별

- 소개

- 저출력 후방 산란 시스템

- 중출력 후방 산란 시스템

- 고출력 후방 산란 시스템

제15장 후방 산란 X선 기기 시장 : 유형별

- 소개

- 휴대용/핸드헬드 기기

- 차재기기

- 차량/포터 스캐너 기기

- 수하물 검사 기기

- 갠트리/화물 기기

- 하이브리드 멀티 센서 기기

제16장 후방 산란 X선 기기 시장 : 전개 환경별

- 소개

- 실외/현장

- 실내/시설

제17장 후방 산란 X선 기기 시장 : 판매 채널별

- 소개

- 정부 직접/입찰

- 통합업체/OEM 파트너

- 판매자/리셀러

제18장 후방 산란 X선 기기 시장 : 해상도/화질별

- 소개

- 표준(1MM 미만)

- 고해상도(0.5MM)

- 초고해상도(0.25MM 미만)

제19장 후방 산란 X선 기기 시장 : 소유 모델별

- 소개

- 정부 소유 조달

- 임대/서비스 계약

- 민간 상업 소유

제20장 후방 산란 X선 기기 시장 : 지역별

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 네덜란드

- 벨기에

- 북유럽 국가

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 호주

- 일본

- 인도

- 한국

- 동남아시아

- 기타 아시아태평양

- 기타 지역

- 기타 지역의 거시 경제 전망

- 중동

제21장 경쟁 구도

- 개요

- 주요 참가 기업의 전략/강점(2021-2024년)

- 시장 점유율 분석(2024년)

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제22장 기업 프로파일

- 소개

- 주요 기업

- RAPISCAN SYSTEMS

- NUCTECH COMPANY LIMITED

- VIKEN DETECTION

- SCANNA MSC LTD.

- TEK84, INC

- VIDERAY TECHNOLOGIES

- AUTOCLEAR

- BEIJING HEWEIYONGTAI

- SMITHS DETECTION GROUP LTD.

- MICRO-X LIMITED

- 기타 주요 기업

- ANALYTICON INSTRUMENTS GMBH

- HAMAMATSU PHOTONICS KK

- DONGGUAN JUZHENG ELECTRONIC TECHNOLOGY CO., LTD.

- INSTECH NETHERLANDS

- MS SPEKTRAL

- CGN BEGOOD TECHNOLOGY CO., LTD.

- SHANGHAI FOCUS INTELLIGENT TECHNOLOGY CO., LTD.

- XIA RUI INTELLIGENT TECHNOLOGY CO., LTD.

- RAYSCAN TECHNOLOGIES PVT. LTD.

- MEKONG TECHNOLOGIES CO., LTD.

- NORDION INC.

- CHENGDU LIYANG ELECTRONICS TECHNOLOGY CO., LTD.

- JME LTD.

- X-TEK SYSTEMS

제23장 조사 방법

제24장 부록

HBR 25.12.15The backscatter X-ray Devices market is expected to reach USD 1.37 billion by 2032 from USD 0.35 billion in 2025, at a CAGR of 21.5% during the forecast period. The market is witnessing strong growth driven by the increasing need for rapid, accurate, and non-intrusive inspection across border security, customs enforcement, transportation hubs, and critical infrastructure. Rising smuggling activities, expanding cross-border trade, stricter security regulations, and the growing emphasis on high-throughput screening are further boosting demand for advanced backscatter systems. Technological advancements in detector sensitivity, low-dose X-ray generation, imaging algorithms, and AI-enabled threat identification are enhancing detection accuracy, throughput efficiency, and operational reliability.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Mobility, Imaging Mode, Component, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

Additionally, expanding deployment across airports, seaports, land borders, military facilities, and law enforcement agencies is creating significant growth opportunities. These systems play a vital role in detecting organic threats, hidden contraband, explosives, and weapons, supporting national security operations, accelerating inspection workflows, and enabling safe, efficient, and scalable screening across modern security infrastructures worldwide.

"Based on power range, the low power range will account for the largest market size during the forecast period"

Low-power backscatter X-ray systems are expected to hold the largest market share during the forecast period, primarily due to their widespread adoption in portable, handheld, and mobile screening applications, which represent the fastest-growing segments of the market. These devices operate at energies below 100 keV, enabling safe, low-dose inspections suitable for frontline use by customs, law enforcement, and security agencies. Their compact design, lower operational risks, reduced regulatory restrictions, and lower cost of ownership make them ideal for rapid field deployment. Additionally, low-power systems are favored for scanning people, baggage, vehicles, and small cargo, where non-intrusive, high-contrast detection of organic threats is essential.

"Based on application, law enforcement is projected to register the highest CAGR during the forecast period"

Law enforcement is projected to register the highest CAGR in the Backscatter X-ray Devices Market due to the increasing need for rapid, non-intrusive detection of weapons, explosives, narcotics, and concealed organic threats in routine policing and tactical operations. Rising urban security challenges, growth in drug trafficking, and expanding deployment of mobile and handheld backscatter systems are accelerating adoption. Agencies are increasingly prioritizing compact, field-ready devices that support real-time inspections during traffic stops, raids, checkpoints, and public event security. Additionally, growing investments in modernizing policing infrastructure, combined with government funding for advanced screening technologies, are driving strong growth momentum in this segment.

"North America holds the largest market size during the forecast period"

North America holds the largest market share in the backscatter X-ray Devices market due to its early adoption of technology, the strong presence of leading manufacturers such as Rapiscan Systems, Tek84, Viken Detection, and Videray, and sustained government investments in border security and homeland protection. Agencies such as DHS, CBP, ICE, and local law enforcement deploy large fleets of handheld, vehicle-mounted, and mobile backscatter units for narcotics interdiction, cargo screening, and tactical field inspections. The region's strict security standards, high procurement budgets, continuous system upgrades, and demand for advanced detection capabilities collectively ensure North America maintains the dominant market position throughout the forecast period.

Extensive primary interviews were conducted with key industry experts in the backscatter X-ray devices market to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study draws insights from a range of industry experts, including component suppliers, Tier 1 companies, and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation - Directors - 50%, Managers - 30%, and Others - 20%

- By Region - North America - 45%, Europe - 30%, Asia Pacific - 20%, and RoW - 5%

The backscatter X-ray devices market is dominated by a few globally established players, such as Rapiscan Systems (US), Nuctech Company Limited (China), Viken Detection Corp. (US), Tek84, Inc. (US), Videray Technologies Inc. (US), Autoclear LLC (US), Smiths Detection Group Ltd. (UK), Scanna MSC Ltd. (UK).

The study includes an in-depth competitive analysis of these key players in the backscatter X-ray devices market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

The report segments the backscatter X-ray devices market. It forecasts its size by type (portable/handheld devices, vehicle mounted devices, vehicle/porter scanner devices, baggage scanner devices, gantry/cargo devices, hybrid multisensor devices), by application (customs & border protection, law enforcement, airport/aviation, military & defense, industrial & critical, other applications), by imaging mode (single-view backscatter imaging, dual-view backscatter imaging, multi-view backscatter imaging, hybrid imaging), by mobility (fixed/stationary, mobile/vehicle mounted, portable/handheld), by detection mode (pencil-beam raster-scan systems, z-backscatter/flying-spot implementations, large-area detector panels), by component (hardware, software, services), by power range (low, medium, high). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four central regions (North America, Europe, Asia Pacific, and RoW). The report includes a value chain analysis of the key players and their competitive analysis in the backscatter X-ray devices ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (increasing deployment of security solutions at public gathering spaces, rising number of terrorist attacks, illegal immigration), restraints (high installation & maintenance costs, privacy concerns), opportunities (technological advancements in X-ray screening systems, development of low-cost products), and challenges (rapid technological advancements)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the backscatter x-ray devices market

- Market Development: Comprehensive information about lucrative markets - the report analyses the backscatter X-ray devices market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the backscatter x-ray devices market

- Competitive Assessment: In-depth assessment of market shares and growth strategies of leading players, such as Rapiscan Systems (US), Nuctech Company Limited (China), Viken Detection Corp. (US), Tek84, Inc. (US), Videray Technologies Inc. (US), Autoclear LLC (US), Smiths Detection Group Ltd. (UK), Scanna MSC Ltd. (UK), ADANI Systems, Inc. (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BACKSCATTER X-RAY DEVICES MARKET

- 3.2 BACKSCATTER X-RAY DEVICES MARKET, BY TYPE

- 3.3 BACKSCATTER X-RAY DEVICES MARKET, BY MOBILITY

- 3.4 BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT

- 3.5 BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION

- 3.6 BACKSCATTER X-RAY DEVICES MARKET, BY REGION

- 3.7 BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Increasing deployment of security solutions in public spaces

- 4.2.1.2 Increase in terrorist attacks and illegal immigration

- 4.2.2 RESTRAINT

- 4.2.2.1 High installation and maintenance costs

- 4.2.2.2 Privacy concerns associated with backscatter X-ray devices

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Technological advancements in X-ray screening systems

- 4.2.3.2 Development of low-cost products

- 4.2.4 CHALLENGES

- 4.2.4.1 Rapid technological advancements

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN THE BACKSCATTER X-RAY DEVICES MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- 4.5.1 MARKET DYNAMICS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 THREAT OF SUBSTITUTES

- 5.2.3 BARGAINING POWER OF SUPPLIERS

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 MACROECONOMIC INDICATORS

- 5.3.1 INTRODUCTION

- 5.3.2 GDP TRENDS AND FORECAST

- 5.3.3 TRENDS IN GLOBAL AIRPORT/AVIATION INDUSTRY

- 5.3.4 TRENDS IN GLOBAL CUSTOMS & BORDER PROTECTION

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF BACKSCATTER X-RAY DEVICES, BY KEY PLAYER

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 9022)

- 5.7.2 EXPORT DATA (HS CODE 9022)

- 5.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 BACKSCATTER X-RAY SECURITY SYSTEM DEPLOYED AT A NATIONAL BORDER CHECKPOINT

- 5.11.2 BACKSCATTER X-RAY SYSTEM INTEGRATED IN AIRPORT SECURITY FOR RAPID PERSONNEL SCREENING

- 5.11.3 MOBILE BACKSCATTER X-RAY UNITS DEPLOYED FOR URBAN LAW ENFORCEMENT OPERATIONS

- 5.11.4 BACKSCATTER X-RAY CARGO INSPECTION SOLUTION IMPLEMENTED AT A MAJOR SEAPORT

- 5.12 IMPACT OF 2025 US TARIFFS

- 5.12.1 KEY TARIFF RATES

- 5.12.2 PRICE IMPACT ANALYSIS

- 5.12.3 IMPACT ON VARIOUS COUNTRIES/REGIONS

- 5.12.3.1 US

- 5.12.3.2 Europe

- 5.12.3.3 Asia Pacific

- 5.12.4 IMPACT ON APPLICATIONS

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACTS, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 MULTI-ENERGY BACKSCATTER X-RAY

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 IMAGE RECONSTRUCTION ALGORITHM

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 TERAHERTZ IMAGING SYSTEM

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.4.1 SHORT-TERM (2025-2027): SYSTEM OPTIMIZATION AND AI INTEGRATION

- 6.4.2 MID-TERM (2027-2030): HYBRID IMAGING & PLATFORM SCALABILITY

- 6.4.3 LONG-TERM (2030-2035+): UNIVERSAL RECONFIGURABLE COMPUTING AND SYSTEM-LEVEL CONVERGENCE

- 6.5 PATENT ANALYSIS

- 6.6 IMPACT OF AI ON BACKSCATTER X-RAY DEVICES

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES IN BACKSCATTER X-RAY DEVICES MARKET

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN BACKSCATTER X-RAY DEVICES MARKET

- 6.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT AI IN BACKSCATTER X-RAY DEVICES MARKET

7 REGULATORY LANDSCAPE

- 7.1 INTRODUCTION

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 STANDARDS

- 7.1.2.1 IEC 61010 - Safety Requirements for Electrical Equipment

- 7.1.2.2 IEC/ISO 2919 - Sealed Radioactive Source Classification

- 7.1.3 GOVERNMENT REGULATIONS

- 7.1.3.1 US

- 7.1.3.2 Europe

- 7.1.3.3 China

- 7.1.3.4 Japan

- 7.1.3.5 India

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS APPLICATIONS

9 BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 CUSTOMS & BORDER PROTECTION

- 9.2.1 RISING CROSS-BORDER SECURITY DEMANDS TO DRIVE ADOPTION

- 9.3 LAW ENFORCEMENT

- 9.3.1 INCREASING ADOPTION FOR TACTICAL THREAT DETECTION IN LAW ENFORCEMENT

- 9.4 AIRPORTS/AVIATION

- 9.4.1 RISING SECURITY REQUIREMENTS IN AIRPORT AND AVIATION INFRASTRUCTURE TO FUEL MARKET

- 9.5 MILITARY & DEFENSE

- 9.5.1 GROWING USE FOR FORCE PROTECTION AND TACTICAL INTELLIGENCE TO BOOST GROWTH

- 9.6 INDUSTRIAL & CRITICAL

- 9.6.1 INCREASING DEPLOYMENT IN INDUSTRIAL AND CRITICAL INFRASTRUCTURE PROTECTION

- 9.7 OTHER APPLICATIONS

10 BACKSCATTER X-RAY DEVICES MARKET, BY COMPONENT

- 10.1 INTRODUCTION

- 10.2 HARDWARE

- 10.2.1 ADVANCEMENTS IN HIGH-PERFORMANCE HARDWARE TO ACCELERATE MARKET GROWTH

- 10.2.2 X-RAY SOURCE/TUBE ASSEMBLIES

- 10.2.3 DETECTORS

- 10.2.4 CONTROL & POWER ELECTRONICS

- 10.2.5 SENSOR MODULES

- 10.2.6 SHIELDING AND CABINETS

- 10.2.7 MECHANICAL & MOBILITY STRUCTURES

- 10.2.8 OTHER HARDWARE

- 10.3 SOFTWARE

- 10.3.1 AI-DRIVEN IMAGING AND AUTOMATED THREAT DETECTION TO ACCELERATE SOFTWARE GROWTH

- 10.3.2 IMAGE PROCESSING AND ANALYSIS

- 10.3.3 AI/ML-BASED IMAGE ENHANCEMENT

- 10.3.4 AUTOMATIC THREAT RECOGNITION

- 10.4 SERVICES

- 10.4.1 RISING DEMAND FOR TRAINING, CALIBRATION, AND MAINTENANCE SERVICES TO DRIVE MARKET

11 BACKSCATTER X-RAY DEVICES MARKET, BY DETECTION MODE

- 11.1 INTRODUCTION

- 11.2 PENCIL-BEAM RASTER-SCAN SYSTEMS

- 11.2.1 SEGMENT TO GROW AS AGENCIES PRIORITIZE PORTABLE, HIGH-ACCURACY INSPECTION TOOLS

- 11.3 Z-BACKSCATTER/FLYING-SPOT IMPLEMENTATIONS

- 11.3.1 RISING NEED FOR HIGH-SPEED VEHICLE SCREENING TO DRIVE SEGMENT

- 11.4 LARGE-AREA DETECTOR PANELS

- 11.4.1 RISING NEED FOR HIGH-THROUGHPUT CARGO SCREENING TO DRIVE GROWTH

12 BACKSCATTER X-RAY DEVICES MARKET, BY IMAGING MODE

- 12.1 INTRODUCTION

- 12.2 SINGLE-VIEW BACKSCATTER IMAGING

- 12.2.1 RISING DEMAND FOR RAPID FRONTLINE SCREENING TO PROPEL GROWTH

- 12.3 DUAL-VIEW BACKSCATTER IMAGING

- 12.3.1 RISING NEED FOR ENHANCED DETECTION ACCURACY TO DRIVE GROWTH

- 12.4 MULTI-VIEW BACKSCATTER IMAGING

- 12.4.1 EXPANSION OF BORDER AND CARGO MODERNIZATION PROGRAMS TO BOOST GROWTH

- 12.5 HYBRID IMAGING

- 12.5.1 RISING DEMAND FOR ADVANCED MULTI-MODAL DETECTION TO DRIVE SEGMENT

13 BACKSCATTER X-RAY DEVICES MARKET, BY MOBILITY

- 13.1 INTRODUCTION

- 13.2 FIXED/STATIONARY

- 13.2.1 RISING DEMAND FOR HIGH-THROUGHPUT SECURITY TO DRIVE GROWTH

- 13.3 MOBILE/VEHICLE MOUNTED

- 13.3.1 INCREASED SMUGGLING AND TACTICAL SECURITY DEMANDS DRIVE ADOPTION OF VEHICLE-MOUNTED BACKSCATTER SCANNERS

- 13.4 PORTABLE/HANDHELD

- 13.4.1 INCREASED SMUGGLING AND TACTICAL SECURITY DEMANDS DRIVE ADOPTION

14 BACKSCATTER X-RAY DEVICES MARKET, BY POWER RANGE

- 14.1 INTRODUCTION

- 14.2 LOW-ENERGY BACKSCATTER SYSTEMS

- 14.2.1 DEMAND FOR SAFE, PORTABLE SCREENING TO DRIVE SEGMENT

- 14.3 MEDIUM-ENERGY BACKSCATTER SYSTEMS

- 14.3.1 RISING DEMAND FOR DEEPER, MID-LEVEL SCREENING TO BOOST SEGMENT

- 14.4 HIGH-ENERGY BACKSCATTER SYSTEMS

- 14.4.1 RISING NEED FOR DEEP, HIGH-THROUGHPUT CARGO SCREENING TO DRIVE GROWTH

15 BACKSCATTER X-RAY DEVICES MARKET, BY TYPE

- 15.1 INTRODUCTION

- 15.2 PORTABLE/HANDHELD DEVICES

- 15.2.1 GROWING DEMAND FOR RAPID FIELD SCREENING TO DRIVE SEGMENT

- 15.3 VEHICLE-MOUNTED DEVICES

- 15.3.1 INCREASING USE OF MOBILE SCREENING PLATFORMS TO PROPEL SEGMENT

- 15.4 VEHICLE/PORTER SCANNER DEVICES

- 15.4.1 GROWING NEED FOR CHECKPOINT FLEXIBILITY TO SUPPORT SEGMENT GROWTH

- 15.5 BAGGAGE SCANNER DEVICES

- 15.5.1 RISING PASSENGER AND PARCEL SCREENING REQUIREMENTS TO DRIVE SEGMENT

- 15.6 GANTRY/CARGO DEVICES

- 15.6.1 INCREASING CARGO INSPECTION NEEDS TO ACCELERATE DEMAND

- 15.7 HYBRID MULTISENSOR DEVICES

- 15.7.1 INCREASING DEMAND FOR INTEGRATED THREAT DETECTION TO DRIVE SEGMENT

16 BACKSCATTER X-RAY DEVICES MARKET, BY DEPLOYMENT ENVIRONMENT

- 16.1 INTRODUCTION

- 16.2 OUTDOOR/FIELD

- 16.2.1 DEMAND FOR MOBILE, FLEXIBLE, AND RAPID INSPECTION CAPABILITIES ACROSS BORDER SECURITY TO DRIVE SEGMENT

- 16.3 INDOOR/FACILITY

- 16.3.1 INCREASING ADOPTION IN AIRPORTS, SEAPORTS, LOGISTICS HUBS, AND SECURE GOVERNMENT FACILITIES TO BOOST MARKET GROWTH

17 BACKSCATTER X-RAY DEVICES MARKET, BY SALES CHANNEL

- 17.1 INTRODUCTION

- 17.2 DIRECT TO GOVERNMENT/TENDERS

- 17.2.1 GOVERNMENT PROCUREMENT AND TENDER-DRIVEN EXPANSION TO STRENGTHEN MARKET GROWTH

- 17.3 INTEGRATORS/OEM PARTNERS

- 17.3.1 SYSTEM INTEGRATION AND OEM PARTNERSHIP GROWTH TO ENABLE HIGH-VALUE SOLUTIONS

- 17.4 DISTRIBUTORS/RESELLERS

- 17.4.1 DISTRIBUTOR AND RESELLER NETWORK EXPANSION TO BROADEN MARKET PENETRATION

18 BACKSCATTER X-RAY DEVICES MARKET, BY RESOLUTION/IMAGE QUALITY

- 18.1 INTRODUCTION

- 18.2 STANDARD (<1 MM SPATIAL)

- 18.2.1 NEED FOR HIGH THROUGHPUT SCREENING AND RAPID OPERATIONAL READINESS TO DRIVE MARKET GROWTH

- 18.3 HIGH (=0.5 MM)

- 18.3.1 RISING NEED FOR FINER DETECTION SENSITIVITY TO BOOST GROWTH

- 18.4 ULTRA-HIGH (<0.25 MM)

- 18.4.1 SEGMENT TO GAIN MOMENTUM THROUGH PRECISION SCREENING IN HIGH-SECURITY ZONES

19 BACKSCATTER X-RAY DEVICES MARKET, BY OWNERSHIP MODEL

- 19.1 INTRODUCTION

- 19.2 GOVERNMENT-OWNED PROCUREMENT

- 19.2.1 DRIVES LONG-TERM STABILITY IN BACKSCATTER X-RAY DEVICES MARKET

- 19.3 LEASED/SERVICE CONTRACTS

- 19.3.1 LEASED & SERVICE CONTRACT MODELS TO GAIN TRACTION THROUGH FLEXIBLE DEPLOYMENT AND LOWER CAPITAL BURDEN

- 19.4 PRIVATE COMMERCIAL OWNERSHIP

- 19.4.1 SEGMENT SET TO EXPAND WITH RISING INDUSTRIAL SECURITY NEEDS AND AUTONOMOUS SCREENING OPERATIONS

20 BACKSCATTER X-RAY DEVICES MARKET, BY REGION

- 20.1 INTRODUCTION

- 20.2 NORTH AMERICA

- 20.2.1 MACROECONOMIC OUTLOOK IN NORTH AMERICA

- 20.2.2 US

- 20.2.2.1 Growing investments in border security and mobile scanning fleets to boost market

- 20.2.3 CANADA

- 20.2.3.1 Growing focus on airport security and critical infrastructure protection to drive market

- 20.2.4 MEXICO

- 20.2.4.1 Growing need for anti-smuggling surveillance across trade corridors - key driver

- 20.3 EUROPE

- 20.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 20.3.2 GERMANY

- 20.3.2.1 Growing demand for advanced cargo and automotive security screening to fuel market

- 20.3.3 UK

- 20.3.3.1 Market to be driven by upgrades in airport and urban security modernization

- 20.3.4 FRANCE

- 20.3.4.1 Growing emphasis on counterterrorism and transportation security to lead to growth

- 20.3.5 SPAIN

- 20.3.5.1 Growing modernization of ports and maritime cargo screening - key driver

- 20.3.6 ITALY

- 20.3.6.1 Increase in security needs across ports, logistics, and urban policing to drive market

- 20.3.7 NETHERLANDS

- 20.3.7.1 Growing security enhancements across high volume logistics hubs to boost growth

- 20.3.8 BELGIUM

- 20.3.8.1 Growing customs modernization and cross border inspection needs to propel market

- 20.3.9 NORDIC COUNTRIES

- 20.3.9.1 Growing adoption for infrastructure security and high technology integration

- 20.3.10 REST OF EUROPE

- 20.4 ASIA PACIFIC

- 20.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 20.4.2 CHINA

- 20.4.2.1 Growing border modernization and high-volume cargo screening demand to fuel market growth

- 20.4.3 AUSTRALIA

- 20.4.3.1 Market drive by increasing emphasis on border protection and biosecurity screening

- 20.4.4 JAPAN

- 20.4.4.1 Growing adoption in airport security and technology infrastructure to lead to market growth

- 20.4.5 INDIA

- 20.4.5.1 Growing security infrastructure upgrades across borders and airports to serve as key driver

- 20.4.6 SOUTH KOREA

- 20.4.6.1 Growing deployment in high security facilities and trade gateways to boost market

- 20.4.7 SOUTHEAST ASIA

- 20.4.7.1 Demand from cross-border trade and port expansion sectors to drive market

- 20.4.8 REST OF ASIA PACIFIC

- 20.5 ROW

- 20.5.1 ROW: MACROECONOMIC OUTLOOK

- 20.5.2 MIDDLE EAST

- 20.5.2.1 Bahrain

- 20.5.2.1.1 Growing border security modernization to drive backscatter adoption

- 20.5.2.2 Kuwait

- 20.5.2.2.1 Expanding port and oil sector security to boost backscatter deployment

- 20.5.2.3 Oman

- 20.5.2.3.1 Rising trade and infrastructure expansion supporting advanced screening systems to boost growth

- 20.5.2.4 Qatar

- 20.5.2.4.1 Growing aviation and critical infrastructure investments to fuel market growth

- 20.5.2.5 Saudi Arabia

- 20.5.2.5.1 Large-scale security modernization to drive high demand for backscatter X-ray devices

- 20.5.2.6 UAE

- 20.5.2.6.1 Strong customs excellence and airport innovation to boost adoption

- 20.5.2.7 Rest of Middle East

- 20.5.2.8 Africa

- 20.5.2.8.1 Growing customs modernization and trade security to strengthen adoption

- 20.5.2.9 South America

- 20.5.2.1 Bahrain

21 COMPETITIVE LANDSCAPE

- 21.1 OVERVIEW

- 21.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 21.3 MARKET SHARE ANALYSIS, 2024

- 21.4 BRAND/PRODUCT COMPARISON

- 21.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 21.5.1 STARS

- 21.5.2 EMERGING LEADERS

- 21.5.3 PERVASIVE PLAYERS

- 21.5.4 PARTICIPANTS

- 21.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 21.5.5.1 Company footprint

- 21.5.5.2 Region footprint

- 21.5.5.3 Type footprint

- 21.5.5.4 Mobility footprint

- 21.5.5.5 Imaging mode footprint

- 21.5.5.6 Component footprint

- 21.5.5.7 Application footprint

- 21.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 21.6.1 PROGRESSIVE COMPANIES

- 21.6.2 RESPONSIVE COMPANIES

- 21.6.3 DYNAMIC COMPANIES

- 21.6.4 STARTING BLOCKS

- 21.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 21.6.5.1 List of startups/SMEs

- 21.6.5.2 Competitive benchmarking of startups/SMEs

- 21.7 COMPETITIVE SCENARIO

- 21.7.1 PRODUCT LAUNCHES

- 21.7.2 DEALS

22 COMPANY PROFILES

- 22.1 INTRODUCTION

- 22.2 KEY PLAYERS

- 22.2.1 RAPISCAN SYSTEMS

- 22.2.1.1 Business overview

- 22.2.1.2 Products/Solutions/Services offered

- 22.2.1.3 Recent developments

- 22.2.1.3.1 Deals

- 22.2.1.4 MnM view

- 22.2.1.4.1 Right to win

- 22.2.1.4.2 Strategic choices

- 22.2.1.4.3 Weaknesses and competitive threats

- 22.2.2 NUCTECH COMPANY LIMITED

- 22.2.2.1 Business overview

- 22.2.2.2 Products/Solutions/Services offered

- 22.2.2.3 Recent developments

- 22.2.2.3.1 Deals

- 22.2.2.4 MnM view

- 22.2.2.4.1 Right to win

- 22.2.2.4.2 Strategic choices

- 22.2.2.4.3 Weaknesses and competitive threats

- 22.2.3 VIKEN DETECTION

- 22.2.3.1 Business overview

- 22.2.3.2 Products/Solutions/Services offered

- 22.2.3.3 Recent developments

- 22.2.3.3.1 Product launches

- 22.2.3.3.2 Deals

- 22.2.3.4 MnM view

- 22.2.3.4.1 Right to win

- 22.2.3.4.2 Strategic choices

- 22.2.3.4.3 Weaknesses and competitive threats

- 22.2.4 SCANNA MSC LTD.

- 22.2.4.1 Business overview

- 22.2.4.2 Products/Solutions/Services offered

- 22.2.4.3 MnM view

- 22.2.4.3.1 Right to win

- 22.2.4.3.2 Strategic choices

- 22.2.4.3.3 Weaknesses and competitive threats

- 22.2.5 TEK84, INC

- 22.2.5.1 Business overview

- 22.2.5.2 Products/Solutions/Services offered

- 22.2.5.3 Recent developments

- 22.2.5.3.1 Deals

- 22.2.5.4 MnM view

- 22.2.5.4.1 Right to win

- 22.2.5.4.2 Strategic choices

- 22.2.5.4.3 Weaknesses and competitive threats

- 22.2.6 VIDERAY TECHNOLOGIES

- 22.2.6.1 Business overview

- 22.2.6.2 Products/Solutions/Services offered

- 22.2.6.3 Recent developments

- 22.2.6.3.1 Product launches

- 22.2.7 AUTOCLEAR

- 22.2.7.1 Business overview

- 22.2.7.2 Products/Solutions/Services offered

- 22.2.8 BEIJING HEWEIYONGTAI

- 22.2.8.1 Business overview

- 22.2.8.2 Products/Solutions/Services offered

- 22.2.9 SMITHS DETECTION GROUP LTD.

- 22.2.9.1 Business overview

- 22.2.9.2 Products/Solutions/Services offered

- 22.2.10 MICRO-X LIMITED

- 22.2.10.1 Business overview

- 22.2.10.2 Products/Solutions/Services offered

- 22.2.1 RAPISCAN SYSTEMS

- 22.3 OTHER KEY PLAYERS

- 22.3.1 ANALYTICON INSTRUMENTS GMBH

- 22.3.2 HAMAMATSU PHOTONICS K.K.

- 22.3.3 DONGGUAN JUZHENG ELECTRONIC TECHNOLOGY CO., LTD.

- 22.3.4 INSTECH NETHERLANDS

- 22.3.5 MS SPEKTRAL

- 22.3.6 CGN BEGOOD TECHNOLOGY CO., LTD.

- 22.3.7 SHANGHAI FOCUS INTELLIGENT TECHNOLOGY CO., LTD.

- 22.3.8 XIA RUI INTELLIGENT TECHNOLOGY CO., LTD.

- 22.3.9 RAYSCAN TECHNOLOGIES PVT. LTD.

- 22.3.10 MEKONG TECHNOLOGIES CO., LTD.

- 22.3.11 NORDION INC.

- 22.3.12 CHENGDU LIYANG ELECTRONICS TECHNOLOGY CO., LTD.

- 22.3.13 JME LTD.

- 22.3.14 X-TEK SYSTEMS

23 RESEARCH METHODOLOGY

- 23.1 RESEARCH DATA

- 23.1.1 SECONDARY DATA

- 23.1.1.1 List of key secondary sources

- 23.1.1.2 Key data from secondary sources

- 23.1.2 PRIMARY DATA

- 23.1.2.1 List of primary interview participants

- 23.1.2.2 Breakdown of primary interviews

- 23.1.2.3 Key data from primary sources

- 23.1.2.4 Key industry insights

- 23.1.3 SECONDARY AND PRIMARY RESEARCH

- 23.1.1 SECONDARY DATA

- 23.2 MARKET SIZE ESTIMATION

- 23.2.1 BOTTOM-UP APPROACH

- 23.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 23.2.2 TOP-DOWN APPROACH

- 23.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 23.2.1 BOTTOM-UP APPROACH

- 23.3 FACTOR ANALYSIS

- 23.3.1 DEMAND-SIDE ANALYSIS

- 23.3.2 SUPPLY-SIDE ANALYSIS

- 23.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 23.5 RESEARCH ASSUMPTIONS

- 23.6 RISK ASSESSMENT

- 23.7 RESEARCH LIMITATIONS

24 APPENDIX

- 24.1 INSIGHTS FROM INDUSTRY EXPERTS

- 24.2 DISCUSSION GUIDE

- 24.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 24.4 CUSTOMIZATION OPTIONS

- 24.5 RELATED REPORTS

- 24.6 AUTHOR DETAILS