|

시장보고서

상품코드

1883069

카프노그래피 장비 시장 : 제품별, 기술별, 용도별, 최종 사용자별, 지역별 예측(-2030년)Capnography Equipment Market by Product, Technology, Application, End User, Region - Global Forecast to 2030 |

||||||

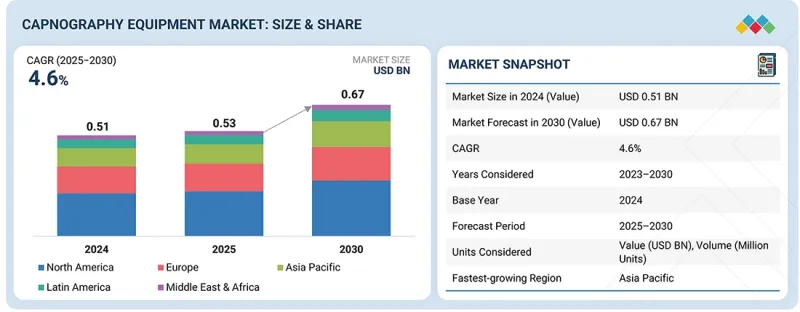

세계의 카프노그래피 장비 시장 규모는 2025년 5억 3,000만 달러로 평가되었고 2030년 6억 7,000만 달러에 이를 것으로 예측되며, 예측 기간 동안 CAGR은 4.6%를 나타낼 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 기간 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러 |

| 부문 | 제품, 기술, 용도, 최종 사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중남미, 중동, 아프리카 |

카프노그래피 장비 시장은 COPD, 천식, 수면무호흡증과 같은 호흡기 질환의 증가와 지속적인 환자 모니터링이 필요한 수술 건수 증가에 힘입어 상당한 성장을 경험하고 있습니다. 호흡기 문제의 조기 발견 중요성에 대한 인식 제고, 센서 기술 및 휴대용 모니터링 장치의 발전, 중환자 치료 및 응급 환경에서의 카프노그래피 적용 확대 등이 수요를 더욱 촉진하고 있습니다.

또한 시술적 진정 시 카프노그래피 사용 증가, 비침습적 모니터링 방식으로의 전환, 병원 및 외래 진료 센터의 환자 안전 기준을 지원하는 정부 정책 등이 시장 확장의 주요 요인으로 작용하고 있습니다.

"제품별로는 카푸노그래피 액세서리 및 소모품 부문이 2024년 최대 시장 점유율을 차지했습니다."

카프노그래피 장비 시장에서 카푸노그래피 액세서리 및 소모품 부문이 가장 큰 부문입니다. 이는 주로 다양한 임상 환경에서 정확하고 신뢰할 수 있는 CO2 모니터링을 보장하는 데 있어 이러한 제품이 중요한 역할을 하기 때문입니다. 이는 다양한 임상 환경에서 정확하고 신뢰할 수 있는 이산화탄소 모니터링을 보장하는 데 있어 핵심적인 역할을 하기 때문입니다. 이 범주에는 비강 및 구강 이산화탄소 캐뉼라, 기도 어댑터, 샘플링 라인, 필터 등이 포함되며, 이들은 모두 메인스트림 및 사이드스트림 카프노그래피 시스템에 필수적입니다. 높은 소비율, 교차 오염 방지를 위한 환자별 전용 사용 필요성, 빈번한 교체 요구사항이 시장 수요를 크게 견인합니다. 또한 증가하는 수술 건수, 마취 및 진정 중 환자 안전에 대한 강조 증가, 중환자실 및 응급실에서 카프노그래피의 광범위한 도입이 전체 시장에서 액세서리 및 소모품의 우위를 더욱 공고히 합니다.

"용도별로 심장 치료 부문이 2024년 최대 시장 점유율을 차지했습니다."

카프노그래피 장비 시장에서 응용 분야별로 심장 치료 부문이 가장 큰 점유율을 차지합니다. 이는 주로 심혈관 질환 환자의 호흡 기능에 대한 지속적인 모니터링이 필수적이기 때문입니다. 카프노그래피는 심장 수술 중, 중환자실, 그리고 마취나 진정이 필요한 시술을 받는 환자에게 널리 사용됩니다. 이는 환자의 환기, 관류, 전반적인 안정성에 대한 실시간 통찰력을 제공합니다. 심장 치료 환경에서 카프노그래피에 대한 강력한 수요는 여러 요인에 기인합니다. 여기에는 심혈관 질환의 증가하는 유병률, 심장 시술 건수의 증가, 환자 안전 및 호흡기 문제 조기 발견에 대한 관심 고조 등이 포함됩니다. 그 결과, 심장 치료는 카프노그래피 시장에서 선도적인 응용 분야가 되었습니다.

"미국이 예측 기간에 가장 높은 CAGR을 나타낼 전망입니다."

미국은 여러 주요 요인으로 인해 북미의 카프노그래피 장비 시장에서 가장 높은 CAGR을 경험할 것으로 전망됩니다. 미국은 병원, 외래 수술 센터, 중환자실에서 첨단 환자 모니터링 기술의 광범위한 도입을 지원하는 잘 구축된 의료 인프라를 보유하고 있습니다. 호흡기 및 심혈관 질환의 증가와 함께 마취 및 진정이 필요한 수술 건수의 증가는 이산화탄소(CO2) 수치의 정확하고 지속적인 모니터링에 대한 수요를 촉진합니다. 또한 정부의 지원 정책, 엄격한 환자 안전 규정, 의료 기술 혁신에 대한 상당한 투자가 시장 성장에 기여하고 있습니다. 주요 카프노그래피 장비 제조업체의 입지, 탄탄한 유통망, 지속적인 제품 개발이 더해져 미국은 해당 지역에서 가장 빠르게 성장하는 시장으로 자리매김하고 있습니다.

이 보고서는 세계의 카푸노그래피 장비 시장에 대한 조사 분석을 통해 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 카프노그래피 장비 시장 개요

- 카프노그래피 장비 시장

- 북미의 카프노그래피 장비 시장 : 최종 사용자별, 국가별(2024년)

- 카프노그래피 장비 시장의 지리적 스냅샷

- 카프노그래피 장비 시장 : 개발 도상 시장과 선진 시장

제5장 시장 개요

- 소개

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 카프노그래피 장비 시장의 미충족 요구

- 화이트 스페이스의 기회

- 상호연결된 시장과 부문 크로스섹터 기회

- 상호연결된 시장

- 부문 크로스섹터 기회

- Tier 1/2/3 기업의 전략적 움직임

제6장 업계 동향

- Porter's Five Forces 분석

- 거시경제 전망

- 소개

- GDP의 동향과 예측

- 세계의 호흡 케어 장비 업계 동향

- 세계의 환자 모니터링 장비 업계 동향

- 공급망 분석

- 저명 기업

- 중소기업

- 최종 사용자

- 생태계 분석

- 가격 설정 분석

- 상위 3개 용도의 참고 판매 가격 : 주요 기업별(2024년)

- 카프노그래피 장비의 평균 판매 가격 동향 : 유형별(2022-2024년)

- 카프노그래피 장비의 평균 판매 가격 동향 : 지역별(2022-2024년)

- 무역 분석

- HS코드 9018의 수입 데이터

- HS코드 9018의 수출 데이터

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 고객사업에 영향을 주는 동향/혁신

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 카프노그래피 장비 시장에 대한 미국 관세의 영향(2025년)

- 소개

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 미치는 영향

- 최종 이용 산업에 대한 영향

제7장 기술의 진보, AI 영향, 특허, 혁신 및 미래 응용 분야

- 주요 신기술

- 메인스트림 카프노그래피

- 사이드스트림 카프노그래피

- 파형 카프노그래피

- 보완 기술

- 기술/제품 로드맵

- 단기(2025-2027년) : 기반 구축과 조기 상업화

- 중기(2027-2030년):확장과 표준화

- 장기(2030-2035년 이후) : 대규모 상업화와 혁신

- 특허 분석

- 카프노그래피 장비의 미래 용도

- 카프노그래피 장비 시장에 대한 AI/생성형 AI 영향

- 주요 이용 사례와 시장의 장래성

- 카프노그래피 장비 처리에 대한 모범 사례

- 카프노그래피 장비 시장에서 AI 도입의 사례 연구

- 상호연결된 인접 생태계와 시장 기업에 미치는 영향

- 카프노그래피 장비 시장의 생성형 AI 채택에 대한 고객의 준비 상황

제8장 규제 상황

- 지역 규제 및 규정 준수

- 규제기관, 정부기관, 기타 조직

- 규제 프레임워크

- 업계 표준

- 인증, 라벨, 환경 기준

제9장 고객정세와 구매행동

- 의사결정 프로세스

- 구매자 이해관계자 및 구매 평가 기준

- 구매 프로세스의 주요 이해 관계자

- 주요 구매 기준

- 채택 장벽과 내부 과제

- 다양한 최종 이용 산업에서 미충족 요구

- 시장의 수익성

- 잠재적인 수익

- 비용역학

- 주요 용도의 마진 기회

제10장 카프노그래피 장비 시장 : 제품별

- 소개

- 장비

- 멀티파라미터 카프노미터

- 독립형 카프노미터

- 소프트웨어

- 카프노그래피 액세서리 및 소모품

제11장 카프노그래피 장비 시장 : 기술별

- 소개

- 메인스트림 카프노그래피

- 사이드스트림 카프노그래피

- 마이크로스트림 카프노그래피

제12장 카푸노그래피 장비 시장 : 용도별

- 소개

- 심장 치료

- 외상 및 구급 치료

- 호흡 모니터링

- 기타 용도

제13장 카푸노그래피 장비 시장 : 최종 사용자별

- 소개

- 병원

- 외래수술센터(ASC) 및 재택 케어 환경

- 기타 최종 사용자

제14장 카프노그래피 장비 시장 : 지역별

- 소개

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 일본

- 중국

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- GCC 국가

- 기타 중동 및 아프리카

제15장 경쟁 구도

- 소개

- 주요 진입기업의 전략/강점

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업 평가 및 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제16장 기업 프로파일

- 주요 기업

- MEDTRONIC PLC

- KONINKLIJKE PHILIPS NV

- MASIMO CORPORATION

- GE HEALTHCARE

- BECTON, DICKINSON AND COMPANY

- DRAGERWERK AG & CO. KGAA

- NIHON KOHDEN CORPORATION

- ICU MEDICAL, INC.

- SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- ZOLL MEDICAL CORPORATION

- EDAN INSTRUMENTS, INC.

- HAMILTON MEDICAL

- NONIN

- SCHILLER

- RESMED INC.

- 기타 기업

- BIONICS CO., LTD.

- BPL MEDICAL TECHNOLOGIES

- BURTONS MEDICAL EQUIPMENT, LTD.

- CRITICARE TECHNOLOGIES, INC.

- DIAMEDICA(UK) LIMITED

- INFINIUM MEDICAL

- SPACELABS HEALTHCARE

- NIDEK MEDICAL INDIA

- RECORDERS & MEDICARE SYSTEMS PVT. LTD.

- ZOE MEDICAL, INCORPORATED

제17장 부록

HBR 25.12.15The global capnography equipment market is projected to reach USD 0.67 billion by 2030 from USD 0.53 billion in 2025, at a CAGR of 4.6% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million) |

| Segments | Product, Technology, Application, End User, and Region |

| Regions covered | North America, Europe, APAC, LATAM, MEA |

The capnography equipment market is experiencing significant growth, driven by the increasing prevalence of respiratory conditions such as COPD, asthma, and sleep apnea, along with a rising number of surgeries that require continuous patient monitoring. There is heightened awareness of the importance of early detection of respiratory issues, advancements in sensor technology and portable monitoring devices, and a broader application of capnography in critical care and emergency settings, all of which are further boosting demand.

Additionally, the growing use of capnography for procedural sedation, the shift toward noninvasive monitoring methods, and government initiatives that support patient safety standards in hospitals and outpatient care centers are key factors contributing to market expansion.

"By product, the capnography accessories & disposables segment accounted for the largest market share in 2024."

Capnography accessories & disposables represent the largest segment of the capnography equipment market, primarily due to their crucial role in ensuring accurate and reliable CO2 monitoring in various clinical settings. This category includes nasal and oral CO2 cannulas, airway adapters, sampling lines, and filters, all of which are essential for both mainstream and sidestream capnography systems. The high consumption rate, the need for single-patient usage to prevent cross-contamination, and frequent replacement requirements significantly drive market demand. Moreover, the increasing number of surgical procedures, a growing emphasis on patient safety during anesthesia and sedation, and the widespread adoption of capnography in critical care and emergency departments further reinforce the dominance of accessories and disposables in the overall market.

"By application, the cardiac care segment accounted for the largest market share in 2024."

The cardiac care segment represents the largest share of the capnography equipment market by application. This is primarily due to the critical need for continuous monitoring of respiratory function in patients with cardiovascular conditions. Capnography is widely used during cardiac surgeries, in intensive care units, and for patients undergoing procedures that require anesthesia or sedation. It provides real-time insights into ventilation, perfusion, and overall patient stability. Several factors contribute to the strong demand for capnography in cardiac care settings. These include the increasing prevalence of cardiovascular diseases, the growing number of cardiac procedures, and a heightened focus on patient safety and the early detection of respiratory issues. As a result, cardiac care has become the leading application segment in the capnography market.

"The US is expected to grow at the highest CAGR during the forecast period."

The US is projected to experience the highest CAGR in the North American capnography equipment market due to several key factors. The country has a well-established healthcare infrastructure that supports the widespread adoption of advanced patient monitoring technologies in hospitals, ambulatory surgical centers, and critical care units. The increasing prevalence of respiratory and cardiovascular disorders, along with a rising number of surgical procedures requiring anesthesia and sedation, drives the demand for accurate and continuous monitoring of carbon dioxide (CO2) levels. Additionally, supportive government initiatives, stringent patient safety regulations, and significant investments in healthcare technology innovation are contributing to market growth. The presence of major capnography equipment manufacturers, complemented by robust distribution networks and ongoing product development, further establishes the US as the fastest-growing market in the region.

A summary of the key participants (supply side) in the capnography equipment market referenced in this report is provided below:

- By Company Type: Tier 1 (35%), Tier 2 (40%), and Tier 3 (25%)

- By Designation: C-level Executives (45%), Director-level Executives (35%), and Others (20%)

- By Region: North America (27%), Europe (25%), Asia Pacific (30%), Latin America (8%), and the Middle East & Africa (10%)

The prominent players in the capnography equipment market are Medtronic (Ireland), Koninklijke Philips N.V. (Netherlands), Masimo (US), GE Healthcare (US), Becton, Dickinson and Company (US), Dragerwerk AG & Co. KGaA (Germany), Nihon Kohden Corporation (Japan), ICU Medical, Inc. (US), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), ZOLL Medical Corporation (US), EDAN Instruments, Inc. (China), Hamilton Medical (Switzerland), Nonin (US), SCHILLER (Switzerland), and ResMed Inc. (US).

Research Coverage:

The report analyzes the capnography equipment market and estimates its size and future growth potential based on various segments such as product, application, end user, and region. It also includes a competitive analysis of the key players in this market, along with their company profiles, service offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will help market leaders and new entrants in this market with information on the closest approximations of the revenue numbers for the overall capnography equipment market. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

- Analysis of key drivers (increasing prevalence of respiratory diseases, clinical benefits of capnography over pulse oximetry, rising number of surgeries and target diseases requiring CO2 monitoring, and technological advancements), restraints (complex regulatory framework for approval of capnography equipment and high equipment and maintenance costs), opportunities (increased availability of clinical research evidence, growth opportunities for healthcare industry in emerging economies, and AI and data analytics integration), and challenges (lack of skilled technicians & specialized training to operate capnometers).

- Market Penetration: It provides detailed information about the products offered by the major players in the global capnography equipment market. The report is segmented by product, application, end user, and region.

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global capnography equipment market.

- Market Development: Comprehensive understanding and analysis of profitable emerging markets by product, technology, application, end user, and region.

- Market Diversification: Detailed information on newly launched products, market expansion, current advancements, and investments in the global capnography equipment market.

- Competitive Assessment: Comprehensive assessment of market shares, growth strategies, product offerings, and capabilities of major competitors in the global capnography equipment market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 BASE NUMBER ESTIMATION

- 2.3 MARKET FORECAST APPROACH

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 ASSUMPTIONS

- 2.5.1 MARKET SHARE ASSUMPTIONS

- 2.5.2 RESEARCH ASSUMPTIONS

- 2.6 FACTOR ANALYSIS

- 2.7 RISK ASSESSMENT

- 2.8 METHODOLOGY-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS & MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: INSIGHTS & DEVELOPMENTS

- 3.3 DISRUPTIVE TRENDS SHAPING MARKET GROWTH

- 3.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 3.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 CAPNOGRAPHY EQUIPMENT MARKET OVERVIEW

- 4.2 CAPNOGRAPHY EQUIPMENT MARKET, BY REGION, 2025 VS. 2030 (USD MILLION)

- 4.3 NORTH AMERICA: CAPNOGRAPHY EQUIPMENT MARKET, BY END USER AND COUNTRY, 2024 (USD MILLION)

- 4.4 GEOGRAPHIC SNAPSHOT OF CAPNOGRAPHY EQUIPMENT MARKET

- 4.5 CAPNOGRAPHY EQUIPMENT MARKET: DEVELOPING VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.1.1 DRIVERS

- 5.1.1.1 Increasing prevalence of respiratory diseases

- 5.1.1.2 Clinical benefits of capnography over pulse oximetry

- 5.1.1.3 Rising number of surgeries and target diseases requiring CO2 monitoring

- 5.1.1.4 Technological advancements

- 5.1.2 RESTRAINTS

- 5.1.2.1 Complex regulatory framework for approval of capnography equipment

- 5.1.2.2 High equipment and maintenance costs

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Increased availability of clinical research evidence

- 5.1.3.2 Growth opportunities for healthcare industry in emerging economies

- 5.1.3.3 AI and data analytics integration

- 5.1.4 CHALLENGES

- 5.1.4.1 Lack of skilled technicians and need for specialized training for operating capnometers

- 5.1.1 DRIVERS

- 5.2 UNMET NEEDS & WHITE SPACES

- 5.2.1 UNMET NEEDS IN CAPNOGRAPHY EQUIPMENT MARKET

- 5.2.2 WHITE SPACE OPPORTUNITIES

- 5.3 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES

- 5.3.1 INTERCONNECTED MARKETS

- 5.3.2 CROSS-SECTOR OPPORTUNITIES

- 5.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF NEW ENTRANTS

- 6.1.2 BARGAINING POWER OF SUPPLIERS

- 6.1.3 BARGAINING POWER OF BUYERS

- 6.1.4 THREAT OF SUBSTITUTES

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 MACROECONOMIC OUTLOOK

- 6.2.1 INTRODUCTION

- 6.2.2 GDP TRENDS AND FORECAST

- 6.2.3 TRENDS IN GLOBAL RESPIRATORY CARE DEVICES INDUSTRY

- 6.2.4 TRENDS IN GLOBAL PATIENT MONITORING DEVICES INDUSTRY

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.3.1 PROMINENT COMPANIES

- 6.3.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 6.3.3 END USERS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 PRICING ANALYSIS

- 6.5.1 INDICATIVE SELLING PRICE OF TOP THREE APPLICATIONS, BY KEY PLAYER (2024)

- 6.5.2 AVERAGE SELLING PRICE TREND OF CAPNOGRAPHY EQUIPMENT, BY TYPE (2022-2024)

- 6.5.3 AVERAGE SELLING PRICE TREND OF CAPNOGRAPHY EQUIPMENT, BY REGION (2022-2024)

- 6.6 TRADE ANALYSIS

- 6.6.1 IMPORT DATA FOR HS CODE 9018

- 6.6.2 EXPORT DATA FOR HS CODE 9018

- 6.7 KEY CONFERENCES & EVENTS, 2025-2026

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.9 INVESTMENT & FUNDING SCENARIO

- 6.10 CASE STUDY ANALYSIS

- 6.10.1 CASE STUDY 1: INCORPORATING CAPNOGRAPHY MONITORING IN PATIENT-CONTROLLED ANALGESIA (PCA) POST-OPERATIVE CARE

- 6.10.2 CASE STUDY 2: AVAILABILITY AND USEFULNESS OF PORTABLE CAPNOMETERS IN CHILDREN WITH TRACHEOSTOMY

- 6.10.3 CASE STUDY 3: RANDOMIZED CONTROLLED TRIAL OF CAPNOGRAPHY IN CORRECTION OF SIMULATED ET DISLODGEMENT

- 6.11 IMPACT OF 2025 US TARIFFS ON CAPNOGRAPHY EQUIPMENT MARKET

- 6.11.1 INTRODUCTION

- 6.11.2 KEY TARIFF RATES

- 6.11.3 PRICE IMPACT ANALYSIS

- 6.11.4 IMPACT ON COUNTRY/REGION

- 6.11.4.1 US

- 6.11.4.2 Europe

- 6.11.4.3 Asia Pacific

- 6.11.5 IMPACT ON END-USER INDUSTRIES

7 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 7.1 KEY EMERGING TECHNOLOGIES

- 7.1.1 MAINSTREAM CAPNOGRAPHY

- 7.1.2 SIDE-STREAM CAPNOGRAPHY

- 7.1.3 WAVEFORM CAPNOGRAPHY

- 7.1.4 COMPLEMENTARY TECHNOLOGIES

- 7.1.4.1 Pulse oximetry

- 7.1.4.2 Ventilators

- 7.2 TECHNOLOGY/PRODUCT ROADMAP

- 7.2.1 SHORT TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 7.2.2 MID TERM (2027-2030) | EXPANSION & STANDARDIZATION

- 7.2.3 LONG TERM (2030-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 7.3 PATENT ANALYSIS

- 7.4 FUTURE APPLICATIONS OF CAPNOGRAPHY EQUIPMENT

- 7.5 IMPACT OF AI/GEN AI ON CAPNOGRAPHY EQUIPMENT MARKET

- 7.5.1 TOP USE CASES AND MARKET POTENTIAL

- 7.5.2 BEST PRACTICES IN CAPNOGRAPHY EQUIPMENT PROCESSING

- 7.5.3 CASE STUDIES OF AI IMPLEMENTATION IN CAPNOGRAPHY EQUIPMENT MARKET

- 7.5.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 7.5.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN CAPNOGRAPHY EQUIPMENT MARKET

8 REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 REGULATORY FRAMEWORK

- 8.1.2.1 North America

- 8.1.2.1.1 US

- 8.1.2.2 Europe

- 8.1.2.3 Asia Pacific

- 8.1.2.3.1 Japan

- 8.1.2.3.2 India

- 8.1.2.3.3 China

- 8.1.2.1 North America

- 8.1.3 INDUSTRY STANDARDS

- 8.2 CERTIFICATIONS, LABELING, ECO-STANDARDS

9 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 9.1 DECISION-MAKING PROCESS

- 9.2 BUYER STAKEHOLDERS & BUYING EVALUATION CRITERIA

- 9.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.2.2 KEY BUYING CRITERIA

- 9.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 9.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 9.5 MARKET PROFITABILITY

- 9.5.1 REVENUE POTENTIAL

- 9.5.2 COST DYNAMICS

- 9.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS

10 CAPNOGRAPHY EQUIPMENT MARKET, BY PRODUCT

- 10.1 INTRODUCTION

- 10.2 EQUIPMENT

- 10.2.1 MULTIPARAMETER CAPNOMETERS

- 10.2.1.1 Handheld multiparameter capnometers

- 10.2.1.1.1 Improved patient safety, portability, and inbuilt audible and visual alarms to aid adoption

- 10.2.1.2 Conventional multiparameter capnometers

- 10.2.1.2.1 Increasing number of complex surgeries involving anesthesia to support segmental growth

- 10.2.1.1 Handheld multiparameter capnometers

- 10.2.2 STANDALONE CAPNOMETERS

- 10.2.2.1 Handheld standalone capnometers

- 10.2.2.1.1 Increasing number of emergency care visits and complex surgeries to propel market growth

- 10.2.2.2 Conventional standalone capnometers

- 10.2.2.2.1 Easy portability and use in critical care settings to boost segmental growth

- 10.2.2.1 Handheld standalone capnometers

- 10.2.1 MULTIPARAMETER CAPNOMETERS

- 10.3 SOFTWARE

- 10.3.1 BETTER CLINICAL DECISION-MAKING AND PATIENT MANAGEMENT TO FUEL MARKET GROWTH

- 10.4 CAPNOGRAPHY ACCESSORIES & DISPOSABLES

- 10.4.1 FAVORABLE REIMBURSEMENT SCENARIO TO SUPPORT MARKET GROWTH

11 CAPNOGRAPHY EQUIPMENT MARKET, BY TECHNOLOGY

- 11.1 INTRODUCTION

- 11.2 MAINSTREAM CAPNOGRAPHY

- 11.2.1 HIGH ACCURACY, FAST RESPONSE TIME, AND IMPROVED SUITABILITY FOR NEONATES TO AID MARKET GROWTH

- 11.3 SIDESTREAM CAPNOGRAPHY

- 11.3.1 RELIABLE MEASUREMENT OF END-TIDAL CO2 LEVELS TO PROPEL ADOPTION IN CLINICAL SETTINGS

- 11.4 MICROSTREAM CAPNOGRAPHY

- 11.4.1 LIMITATIONS IN BLACK-BODY INFRARED TECHNOLOGY TO LIMIT USAGE IN OPERATING ROOMS

12 CAPNOGRAPHY EQUIPMENT MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 CARDIAC CARE

- 12.2.1 INCREASING NUMBER OF CARDIOPULMONARY SURGERIES TO DRIVE MARKET GROWTH

- 12.3 TRAUMA & EMERGENCY CARE

- 12.3.1 INCREASING NUMBER OF ROAD ACCIDENTS TO SPUR MARKET GROWTH

- 12.4 RESPIRATORY MONITORING

- 12.4.1 RISING PREVALENCE OF TARGET RESPIRATORY CONDITIONS TO SUPPORT MARKET GROWTH

- 12.5 OTHER APPLICATIONS

13 CAPNOGRAPHY EQUIPMENT MARKET, BY END USER

- 13.1 INTRODUCTION

- 13.2 HOSPITALS

- 13.2.1 FOCUS ON REDUCING AIRWAY-RELATED DEATHS IN ICU PATIENTS TO ACCELERATE MARKET GROWTH

- 13.3 AMBULATORY SURGERY CENTERS & HOME CARE SETTINGS

- 13.3.1 INCREASING NUMBER OF REIMBURSEMENT-APPROVED MEDICAL PROCEDURES UNDER ASC PAYMENT SYSTEM TO DRIVE MARKET

- 13.4 OTHER END USERS

14 CAPNOGRAPHY EQUIPMENT MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 US

- 14.2.1.1 US to dominate North American capnography equipment market during forecast period

- 14.2.2 CANADA

- 14.2.2.1 Rising prevalence of target respiratory diseases to support market growth

- 14.2.1 US

- 14.3 EUROPE

- 14.3.1 GERMANY

- 14.3.1.1 Developed healthcare infrastructure and high government investments to spur market growth

- 14.3.2 UK

- 14.3.2.1 Increasing target patient population and rising healthcare expenditure to propel market growth

- 14.3.3 FRANCE

- 14.3.3.1 Growing awareness of capnography monitoring procedures and increasing number of trauma cases to augment market growth

- 14.3.4 ITALY

- 14.3.4.1 Rise in diabetes cases and high geriatric population to boost market growth

- 14.3.5 SPAIN

- 14.3.5.1 Increasing prevalence of lifestyle diseases to drive demand for capnography equipment

- 14.3.6 REST OF EUROPE

- 14.3.1 GERMANY

- 14.4 ASIA PACIFIC

- 14.4.1 JAPAN

- 14.4.1.1 Rising geriatric population and growing prevalence of obesity to augment market growth

- 14.4.2 CHINA

- 14.4.2.1 High target patient population and improved inpatient service availability to support market growth

- 14.4.3 INDIA

- 14.4.3.1 Favorable regulatory policies and high public healthcare expenditure to aid market growth

- 14.4.4 AUSTRALIA

- 14.4.4.1 Growing patient population and rising availability of grants to fuel market growth

- 14.4.5 SOUTH KOREA

- 14.4.5.1 Increased focus on R&D activities and high penetration of health insurance to propel market growth

- 14.4.6 REST OF ASIA PACIFIC

- 14.4.1 JAPAN

- 14.5 LATIN AMERICA

- 14.5.1 BRAZIL

- 14.5.1.1 Improved healthcare sector and increased private-public investments to drive market

- 14.5.2 MEXICO

- 14.5.2.1 Favorable trade environment and easy entry of foreign players to fuel market growth

- 14.5.3 REST OF LATIN AMERICA

- 14.5.1 BRAZIL

- 14.6 MIDDLE EAST & AFRICA

- 14.6.1 GCC COUNTRIES

- 14.6.1.1 Healthcare infrastructural developments and increased focus on patient safety to drive market

- 14.6.2 REST OF MIDDLE EAST & AFRICA

- 14.6.1 GCC COUNTRIES

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 15.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN CAPNOGRAPHY EQUIPMENT MARKET

- 15.3 REVENUE ANALYSIS, 2020-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.4.1 RANKING OF KEY MARKET PLAYERS

- 15.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.5.1 STARS

- 15.5.2 EMERGING LEADERS

- 15.5.3 PERVASIVE PLAYERS

- 15.5.4 PARTICIPANTS

- 15.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.5.5.1 Company footprint

- 15.5.5.2 Region footprint

- 15.5.5.3 Product footprint

- 15.5.5.4 Technology footprint

- 15.5.5.5 Application footprint

- 15.5.5.6 End-user footprint

- 15.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.6.1 PROGRESSIVE COMPANIES

- 15.6.2 RESPONSIVE COMPANIES

- 15.6.3 DYNAMIC COMPANIES

- 15.6.4 STARTING BLOCKS

- 15.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.6.5.1 Detailed list of key startups/SMEs

- 15.6.5.2 Competitive benchmarking of key startups/SMEs

- 15.7 COMPANY VALUATION & FINANCIAL METRICS

- 15.7.1 FINANCIAL METRICS

- 15.7.2 COMPANY VALUATION

- 15.8 BRAND/PRODUCT COMPARISON

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT APPROVALS

- 15.9.2 DEALS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 MEDTRONIC PLC

- 16.1.1.1 Business overview

- 16.1.1.2 Products offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product approvals

- 16.1.1.3.2 Deals

- 16.1.1.4 MnM view

- 16.1.1.4.1 Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses & competitive threats

- 16.1.2 KONINKLIJKE PHILIPS N.V.

- 16.1.2.1 Business overview

- 16.1.2.2 Products offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product approvals

- 16.1.2.3.2 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses & competitive threats

- 16.1.3 MASIMO CORPORATION

- 16.1.3.1 Business overview

- 16.1.3.2 Products offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Product approvals

- 16.1.3.3.2 Deals

- 16.1.3.4 MnM view

- 16.1.3.4.1 Right to win

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses & competitive threats

- 16.1.4 GE HEALTHCARE

- 16.1.4.1 Business overview

- 16.1.4.2 Products offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Product approvals

- 16.1.4.3.2 Deals

- 16.1.4.4 MnM view

- 16.1.4.4.1 Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses & competitive threats

- 16.1.5 BECTON, DICKINSON AND COMPANY

- 16.1.5.1 Business overview

- 16.1.5.2 Products offered

- 16.1.5.3 MnM view

- 16.1.5.3.1 Right to win

- 16.1.5.3.2 Strategic choices

- 16.1.5.3.3 Weaknesses & competitive threats

- 16.1.6 DRAGERWERK AG & CO. KGAA

- 16.1.6.1 Business overview

- 16.1.6.2 Products offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Product approvals

- 16.1.7 NIHON KOHDEN CORPORATION

- 16.1.7.1 Business overview

- 16.1.7.2 Products offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Deals

- 16.1.8 ICU MEDICAL, INC.

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Deals

- 16.1.9 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- 16.1.9.1 Business overview

- 16.1.9.2 Products offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Product launches

- 16.1.9.3.2 Deals

- 16.1.10 ZOLL MEDICAL CORPORATION

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Deals

- 16.1.11 EDAN INSTRUMENTS, INC.

- 16.1.11.1 Business overview

- 16.1.11.2 Products offered

- 16.1.12 HAMILTON MEDICAL

- 16.1.12.1 Business overview

- 16.1.12.2 Products offered

- 16.1.12.3 Recent developments

- 16.1.12.3.1 Product launches

- 16.1.13 NONIN

- 16.1.13.1 Business overview

- 16.1.13.2 Products offered

- 16.1.13.3 Recent developments

- 16.1.13.3.1 Product launches

- 16.1.13.3.2 Deals

- 16.1.14 SCHILLER

- 16.1.14.1 Business overview

- 16.1.14.2 Products offered

- 16.1.15 RESMED INC.

- 16.1.15.1 Business overview

- 16.1.15.2 Products offered

- 16.1.1 MEDTRONIC PLC

- 16.2 OTHER PLAYERS

- 16.2.1 BIONICS CO., LTD.

- 16.2.2 BPL MEDICAL TECHNOLOGIES

- 16.2.3 BURTONS MEDICAL EQUIPMENT, LTD.

- 16.2.4 CRITICARE TECHNOLOGIES, INC.

- 16.2.5 DIAMEDICA (UK) LIMITED

- 16.2.6 INFINIUM MEDICAL

- 16.2.7 SPACELABS HEALTHCARE

- 16.2.8 NIDEK MEDICAL INDIA

- 16.2.9 RECORDERS & MEDICARE SYSTEMS PVT. LTD.

- 16.2.10 ZOE MEDICAL, INCORPORATED

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS