|

시장보고서

상품코드

1883070

고정익 VTOL 무인항공기(UAV) 시장 : 용도별, 항속 시간별, MTOW별, 조작 모드별, 추진 방식별, 후속 거리별, 판매 지점별, 지역별 예측(-2030년)Fixed-Wing VTOL UAV Market by Range (VLOS, EVLOS, BVLOS), MTOW (<25 Kg, 25-170 Kg, >170 Kg), Application (Military, Government & Law Enforcement, Commercial), Endurance, Mode of Operation, Propulsion, Point of Sale, and Region - Global Forecast to 2030 |

||||||

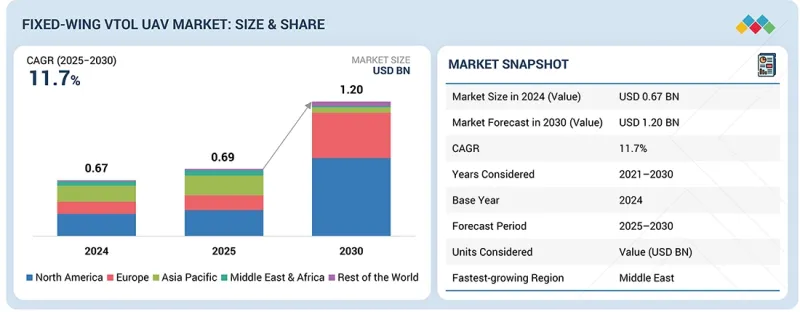

고정익 VTOL 무인항공기(UAV) 시장 규모는 2025년 6억9,000만 달러로 평가되었고 2030년까지 12억 달러에 이를 것으로 예측되며, 예측기간 중 CAGR은 11.7%를 나타낼 전망입니다. 시장 확대는 국방, 법 집행 및 상업 운영 전반에 걸쳐 장시간 비행이 가능하고 높은 신뢰성을 갖춘 무인항공기에 대한 수요 증가에 의해 주도되고 있습니다. 무인 ISR 임무에 대한 투자 증가와 하이브리드 전기 추진 및 자율 비행 기술의 급속한 도입이 운영 유연성과 범위를 향상시키고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 기간 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 용도별, 항속 시간별, MTOW별, 조작 모드별, 추진 방식별, 후속 거리별, 판매 지점별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

또한 신흥 경제국에서의 무인 항공 시스템에 대한 규제 지원 및 함대 인프라 현대화가 시장 성장을 가속화하고 있습니다.

군사 용도 부문은 정보, 감시, 표적 획득 및 정찰 작전에 대한 강조가 증가함에 따라 고정익 VTOL 무인기 시장의 주요 기여자로 남을 것으로 예상됩니다. 국방 기관들은 수직 이착륙 능력, 높은 탑재량 내구성 및 장거리 작전 범위가 요구되는 전술 임무에 이러한 무인기를 점점 더 많이 배치하고 있습니다. 전기 광학, 적외선 및 합성 개구 레이더 탑재체의 통합은 임무 정밀도와 상황 인식을 향상시키고 있습니다.

또한 하이브리드 전기 추진 시스템과 인공지능 기반 자율 항법 기술의 도입으로 군용 UAV 함대의 전력 관리 및 항속 시간이 최적화되고 있습니다. 지속적 ISR, 국경 보안, 전장 지원에 중점을 둔 프로그램들이 계속해서 구매를 주도하고 있습니다. 각국이 함대 현대화와 차세대 전술 UAV 프로그램에 투자함에 따라, 지속적인 국방 지출과 수직 이륙 및 고정익 하이브리드 아키텍처의 급속한 발전으로 군사 부문의 점유율이 강화되고 있습니다.

170kg 초과 부문은 2025년부터 2030년 사이 고정익 수직 이착륙(VTOL) 무인기 시장에서 가장 빠른 성장을 보일 것으로 예상되며, 이는 장시간 임무를 수행할 수 있는 중량 페이로드 탑재 대형 무인기 플랫폼의 증가하는 배치에 힘입은 것입니다. 이러한 시스템은 내구성, 항속 거리 및 다중 센서 능력이 중요한 정보, 감시 및 물류 작전에 통합되고 있습니다. 하이브리드 전기 추진 및 첨단 공기역학적 설계의 채택으로 이러한 무인항공기는 진화하는 군사 및 상업적 요구 사항을 충족하면서 우수한 비행 효율성을 달성할 수 있습니다. 또한 주요 방위 기관 및 항공우주 제조사들은 지속적인 ISR(정보·감시·정찰), 화물 수송, 해양 응용을 위한 확장 가능한 중량 수송 수직이착륙 시스템에 투자하고 있어, 해당 부문이 글로벌 고정익 수직이착륙 무인항공기 시장의 핵심 성장 동력으로서의 위치를 공고히 하고 있습니다.

중동 지역은 국방 현대화 가속화, 국경 감시 수요 증가, 정찰·감시·정찰(ISR) 작전을 위한 무인 시스템 채택 확대에 힘입어 2030년까지 고정익 수직이착륙 무인기 시장에서 가장 높은 성장률을 기록할 것으로 전망됩니다. 해당 지역 다수 국가 정부는 전술적·장거리 항공 역량 강화를 위해 자국 무인기 생산 프로그램 및 국제 제조사와의 협력 사업에 적극적으로 투자하고 있습니다.

이 시장의 급속한 확장은 해당 지역의 진화하는 대테러 대책, 국경 간 보안 감시, 정찰 및 물류용 자율 항공 시스템 투자에 의해 더욱 뒷받침됩니다. 아랍에미리트(UAE), 사우디아라비아, 이스라엘과 같은 국가들은 하이브리드 전기 추진 기술과 다목적 사용을 위한 내구성 최적화 무인 항공기를 활용하여 이 성장의 선두에 서 있습니다.

상업 분야에서는 무인항공기가 인프라 점검, 파이프라인 감시, 환경 평가 프로젝트에 통합되면서 지역적 적용 기반이 확대되고 있습니다. 이러한 요소들이 결합되어 중동은 방위 주도 조달, 다분야 운영적 도입, 무인 능력 개발에 대한 정부의 강력한 강조에 힘입어 고정익 수직이착륙(VTOL) 무인항공기 시장에서 가장 빠르게 성장하는 지역으로 자리매김하고 있습니다.

본 보고서에서는 세계의 고정익 VTOL 무인항공기(UAV) 시장에 대해 조사했으며, 용도별, 항속시간별, MTOW별, 조작모드별, 추진방식별, 후속거리별, 판매지점별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 인사이트

제4장 고객정세와 구매행동

- 의사결정 프로세스

- 구매자의 이해관계자와 구매평가기준

- 채택 장벽과 내부 과제

- 주요 신기술

- 보완적 기술

- 인접 기술

- 기술 로드맵

- 신기술의 동향

- 특허 분석

- 고정익 VTOL 무인항공기 시장의 AI/생성형 AI 영향

제5장 시장 개요

- 소개

- 시장 역학

- 생태계 분석

- 밸류체인 분석

- 관세 및 규제 상황

- 지표 가격 분석

- 무역 분석

- 이용 사례 분석

- 볼륨 데이터

- 주된 회의 및 이벤트(2025-2026년)

- 투자 및 자금조달 시나리오

- 거시경제 전망

- 고객사업에 영향을 주는 동향과 혼란

- 미국 관세의 영향(2025년)

제6장 고정익 VTOL 무인항공기(UAV) 시장(용도별)

- 소개

- 군사

- 상업

- 정부와 법 집행 기관

제7장 고정익 VTOL 무인항공기(UAV) 시장(항속 시간별)

- 소개

- 5시간 미만

- 5-10시간

- 10시간 초과

제8장 고정익 VTOL 무인항공기(UAV) 시장(MTOW별)

- 소개

- 25kg 미만

- 25-170kg

- 170kg 초과

제9장 고정익 VTOL 무인 항공기(UAV) 시장(조작 모드별)

- 소개

- 원격 조종

- 선택 조종

- 완전 자율

제10장 고정익 VTOL 무인항공기(UAV) 시장(추진 방식별)

- 소개

- 전기

- 하이브리드

- 가솔린

제11장 고정익 VTOL 무인항공기(UAV) 시장(항속 거리별)

- 소개

- VLOS

- EVLOS

- BVLOS

제12장 고정익 VTOL 무인항공기(UAV) 시장(판매 지점별)

- 소개

- OEM

- 애프터마켓

제13장 고정익 VTOL 무인항공기(UAV) 시장(지역별)

- 소개

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 프랑스

- 독일

- 이탈리아

- 러시아

- 스웨덴

- 기타

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 기타

- 중동

- 아랍에미리트(UAE)

- 사우디아라비아

- 이스라엘

- 튀르키예

- 기타

- 기타 지역

- 라틴아메리카

- 아프리카

제14장 경쟁 구도

- 소개

- 주요 참가 기업의 전략/강점(2020-2025년)

- 수익 분석

- 시장 점유율 분석

- 브랜드/제품 비교

- 기업평가와 재무지표

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제15장 기업 프로파일

- 주요 진출기업

- ALTI UNMANNED

- UKRSPECSYSTEMS

- AEROVIRONMENT, INC.

- LOCKHEED MARTIN CORPORATION

- TEXTRON SYSTEMS

- VERTICAL TECHNOLOGIES

- CARBONIX

- IDEAFORGE TECHNOLOGY INC.

- QUANTUM-SYSTEMS GMBH

- BLUEBIRD AERO SYSTEMS

- AUTEL ROBOTICS

- THREOD SYSTEMS AS

- JOUAV

- GARUDA ROBOTICS PTE. LTD.

- ASTERIA AEROSPACE LIMITED

- 기타 기업

- A-TECHSYN

- AVY BY

- ELROY AIR

- WINGTRA AG

- FLIGHTWAVE AEROSPACE SYSTEMS

- ELEVONX

- FIXAR-AERO LLC

- CENSYS TECHNOLOGIES

- SKYETON

- VTOL AVIATION INDIA PVT. LTD.

제16장 조사 방법

제17장 부록

HBR 25.12.15The fixed-wing VTOL UAV market is projected to reach USD 1.20 billion by 2030 from USD 0.69 billion in 2025, registering a CAGR of 11.7% during the forecast period. Market expansion is driven by the rising demand for long-endurance and high-reliability UAVs across defense, law enforcement, and commercial operations. Increasing investments in unmanned ISR missions, coupled with the rapid adoption of hybrid-electric propulsion and autonomous flight technologies, are enhancing operational flexibility and range.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Application, Range, Mode of Operation, Endurance and Region |

| Regions covered | North America, Europe, APAC, RoW |

Additionally, regulatory support for unmanned aerial systems and modernization of fleet infrastructure across emerging economies is accelerating market growth.

"By application, the military segment is projected to account for the largest market share during the forecast period."

The military application segment is expected to remain the dominant contributor to the fixed-wing VTOL UAV market, driven by the growing emphasis on intelligence, surveillance, target acquisition, and reconnaissance operations. Defense organizations are increasingly deploying these UAVs for tactical missions that demand vertical take-off and landing capability, high payload endurance, and long operational range. The integration of electro-optical, infrared, and synthetic aperture radar payloads is enhancing mission precision and situational awareness.

Furthermore, the introduction of hybrid-electric propulsion systems and AI-enabled autonomous navigation is optimizing power management and endurance in military UAV fleets. Programs emphasizing persistent ISR, border security, and battlefield support continue to drive procurement. As countries invest in fleet modernization and next-generation tactical UAV programs, the military segment's share is reinforced by sustained defense spending and rapid advancements in vertical-lift and fixed-wing hybrid architectures.

"By MTOW, the >170 kilograms segment is projected to grow at the highest CAGR during the forecast period."

The >170 kilograms segment is projected to register the fastest growth in the fixed-wing VTOL UAV market between 2025 and 2030, driven by the increasing deployment of large UAV platforms capable of carrying heavier payloads for extended missions. These systems are being integrated into intelligence, surveillance, and logistics operations where endurance, range, and multi-sensor capabilities are critical. The adoption of hybrid-electric propulsion and advanced aerodynamic designs allows these UAVs to achieve superior flight efficiency while meeting evolving military and commercial requirements. Additionally, major defense organizations and aerospace manufacturers are investing in scalable heavy-lift VTOL systems for persistent ISR, cargo delivery, and maritime applications, reinforcing the segment's position as the key growth driver in the global fixed-wing VTOL UAV market.

"The Middle East is projected to grow at the highest rate during the forecast period."

The Middle East is projected to register the highest growth rate in the fixed-wing VTOL UAV market through 2030, driven by accelerating defense modernization, heightened border surveillance needs, and the growing adoption of unmanned systems for ISR operations. Governments of many countries in the region are actively investing in indigenous UAV production programs and collaborative ventures with international manufacturers to strengthen tactical and long-range aerial capabilities.

The market's rapid expansion is further supported by the region's evolving counter-terrorism initiatives, cross-border security monitoring, and investments in autonomous aerial systems for reconnaissance and logistics. Countries such as the UAE, Saudi Arabia, and Israel are at the forefront of this growth, leveraging hybrid-electric propulsion technologies and endurance-optimized UAVs for multi-mission use.

On the commercial front, the integration of UAVs into infrastructure inspection, pipeline monitoring, and environmental assessment projects is broadening the regional application base. Combined, these factors position the Middle East as the fastest-growing market for fixed-wing VTOL UAVs, supported by defense-led procurement, cross-sector operational adoption, and strong government emphasis on unmanned capability development.

The breakdown of profiles for primary participants in the fixed-wing VTOL UAV market is provided below:

- By Company Type: Tier 1 - 55%, Tier 2 - 20%, and Tier 3 - 25%

- By Designation: C Level - 75%, Manager Level - 75%

- By Region: North America - 20%, Europe - 25%, Asia Pacific - 30%, Middle East - 10%, Latin America - 10%, Africa - 5%

Research Coverage:

This market study covers the fixed-wing VTOL UAV market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different parts and regions. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their products and business offerings, recent developments, and key market strategies they adopted.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall fixed-wing VTOL UAV market. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the market pulse and will provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Market drivers (Increasing use in military and security applications, expansion of BVLOS and autonomous flight regulations, advancements in hybrid electric and distributed propulsion systems, rising demand for advanced aerial inspection and monitoring, growing commercial and dual use applications), restraints (fragmented regulatory frameworks and certification delays, energy density and power limitations of electric systems, high development and maintenance costs, dependence on skilled technicians and operational expertise), opportunities (advancements in hybrid electric and hydrogen propulsion technologies, growth of defense modernization programs, integration of cloud-based analytics and AI-driven mission systems), challenges (complex airworthiness certification for VTOL configurations, market fragmentation across competing platform architecture, supply chain dependence on advanced components, public acceptance and airspace integration constraints)

- Market Penetration: Comprehensive information on fixed-wing VTOL UAVs offered by the top players in the market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the fixed-wing VTOL UAV market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the fixed-wing VTOL UAV market

- Competitive Assessment: In-depth assessment of market share, growth strategies, products, and manufacturing capabilities of leading players in the fixed-wing VTOL UAV market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.3 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 BUSINESS MODELS

- 3.2 TOTAL COST OF OWNERSHIP

- 3.3 BILL OF MATERIALS

4 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 4.1 DECISION-MAKING PROCESS

- 4.2 BUYERS STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 4.2.1 BUYING EVALUATION CRITERIA

- 4.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 4.4 KEY EMERGING TECHNOLOGIES

- 4.4.1 ARTIFICIAL INTELLIGENCE IN UNMANNED AERIAL VEHICLE (UAV)

- 4.4.2 MID-AIR REFUELING OF DRONES

- 4.4.3 UAV WITH LIDAR SYSTEM

- 4.5 COMPLEMENTARY TECHNOLOGIES

- 4.5.1 BEYOND VISUAL LINE OF SIGHT (BVLOS) OPERATIONS

- 4.5.2 INCREASED AUTONOMY IN TRAFFIC MANAGEMENT

- 4.5.3 ENERGY HARVESTING

- 4.6 ADJACENT TECHNOLOGIES

- 4.6.1 SATELLITE COMMUNICATION (SATCOM) SYSTEMS

- 4.6.2 ELECTRO-OPTICAL/INFRARED (EO/IR) SENSOR PAYLOADS

- 4.7 TECHNOLOGY ROADMAP

- 4.8 EMERGING TECHNOLOGY TRENDS

- 4.9 PATENT ANALYSIS

- 4.10 IMPACT OF AI/ GENERATIVE AI ON FIXED-WING VTOL UAV MARKET

- 4.10.1 USE CASES AND MARKET POTENTIAL

- 4.10.2 BEST PRACTICES IN FIXED-WING VTOL UAV DEVELOPMENT

- 4.10.3 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use in military and security applications

- 5.2.1.2 Expansion of beyond visual line of sight and autonomous flight regulations

- 5.2.1.3 Advancements in hybrid-electric and distributed propulsion systems

- 5.2.1.4 Rising demand for advanced aerial inspection and monitoring

- 5.2.1.5 Growing commercial and dual-use applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fragmented regulatory frameworks and certification delays

- 5.2.2.2 Energy density and power limitations of electric systems

- 5.2.2.3 High development and maintenance costs

- 5.2.2.4 Shortage of trained personnel and operational expertise

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of fixed-wing VTOL leasing and service-based business model

- 5.2.3.2 Integration with national digital infrastructure and emerging aerospace ecosystems

- 5.2.3.3 Integration of cloud-based analytics and AI-driven mission systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex airworthiness certification for VTOL configurations

- 5.2.4.2 Market fragmentation across competing platform architectures

- 5.2.4.3 Supply chain dependence on advanced components

- 5.2.4.4 Public acceptance and airspace integration issues

- 5.2.1 DRIVERS

- 5.3 ECOSYSTEM ANALYSIS

- 5.3.1 PROMINENT COMPANIES

- 5.3.2 PRIVATE AND SMALL ENTERPRISES

- 5.3.3 END USERS

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 RAW MATERIALS

- 5.4.2 RESEARCH & DEVELOPMENT (R&D)

- 5.4.3 COMPONENT MANUFACTURING

- 5.4.4 OEMS

- 5.4.5 END USERS

- 5.4.6 AFTER-SALES SERVICES

- 5.5 TARIFF AND REGULATORY LANDSCAPE

- 5.5.1 TARIFF DATA

- 5.5.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5.3 REGULATORY FRAMEWORK

- 5.6 INDICATIVE PRICING ANALYSIS

- 5.6.1 INDICATIVE PRICING ANALYSIS, BY MTOW

- 5.6.2 INDICATIVE PRICING ANALYSIS BY ENDURANCE

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 8806)

- 5.7.2 EXPORT SCENARIO (HS CODE 8806)

- 5.8 USE CASE ANALYSIS

- 5.8.1 QUANTUM SYSTEMS' TRINITY PRO FOR LONG-ENDURANCE MAPPING MISSIONS

- 5.8.2 WINGTRAONE GEN II FOR ENVIRONMENTAL MONITORING AND FORESTRY OPERATIONS

- 5.8.3 TEXTRON SYSTEMS' AEROSONDE HYBRID VTOL FOR MARITIME INTELLIGENCE MISSIONS

- 5.8.4 ALTI TRANSITION FOR BORDER SURVEILLANCE AND RAPID RESPONSE MISSIONS

- 5.9 VOLUME DATA

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 INVESTMENT AND FUNDING SCENARIO

- 5.12 MACROECONOMIC OUTLOOK

- 5.12.1 INTRODUCTION

- 5.12.2 NORTH AMERICA

- 5.12.3 EUROPE

- 5.12.4 ASIA PACIFIC

- 5.12.5 MIDDLE EAST

- 5.12.6 REST OF THE WORLD

- 5.13 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 IMPACT OF 2025 US TARIFFS

- 5.14.1 INTRODUCTION

- 5.14.2 KEY TARIFF RATES

- 5.14.3 PRICE IMPACT ANALYSIS

- 5.14.4 IMPACT ON COUNTRY/REGION

- 5.14.4.1 US

- 5.14.4.2 Europe

- 5.14.4.3 Asia Pacific

- 5.14.5 IMPACT ON END-USE INDUSTRIES

- 5.14.5.1 Commercial

- 5.14.5.2 Government and military

6 FIXED-WING VTOL UAV MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 MILITARY

- 6.2.1 USE CASE- JUMP 20 BY AEROVIRONMENT INC.

- 6.2.2 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)

- 6.2.2.1 Increasing defense investments in long-endurance ISR assets to drive growth

- 6.2.3 COMBAT OPERATIONS

- 6.2.3.1 Ongoing military modernization programs emphasizing autonomous strike capability to drive growth

- 6.2.4 DELIVERY

- 6.2.4.1 Defense initiatives aimed at reducing human involvement in supply chain operations to drive growth

- 6.3 COMMERCIAL

- 6.3.1 USE CASE: CW-007 BY JOUAV

- 6.3.2 REMOTE SENSING

- 6.3.2.1 Enables repeatable flight paths with reduced operational fatigue compared to rotary systems

- 6.3.3 INSPECTION & MONITORING

- 6.3.3.1 Enhances accuracy and reduces inspection downtime

- 6.3.4 PRODUCT DELIVERY

- 6.3.4.1 Transition toward automated and sustainable supply chain systems to drive growth

- 6.3.5 SURVEYING & MAPPING

- 6.3.5.1 Hybrid configuration supports high-efficiency flight paths

- 6.3.6 AERIAL IMAGING

- 6.3.6.1 Combination of endurance, stability, and image accuracy to drive growth

- 6.3.7 INDUSTRIAL WAREHOUSING

- 6.3.7.1 Hybrid mobility enables efficient navigation between indoor and outdoor zones

- 6.3.8 PASSENGER & PUBLIC TRANSPORTATION

- 6.3.8.1 Exploring advanced air mobility solutions for sustainable urban transport

- 6.3.9 OTHERS

- 6.4 GOVERNMENT & LAW ENFORCEMENT

- 6.4.1 USE CASE: PD-2 UAS BY UKRSPECSYSTEMS

- 6.4.2 BORDER MANAGEMENT

- 6.4.2.1 Advancements in encrypted communication links and all-weather endurance technologies to drive growth

- 6.4.3 TRAFFIC MONITORING

- 6.4.3.1 Growing urban surveillance demand supporting UAV integration in smart mobility programs to drive growth

- 6.4.4 FIREFIGHTING & DISASTER MANAGEMENT

- 6.4.4.1 Hybrid configuration supports extended surveillance of affected zones

- 6.4.5 SEARCH & RESCUE

- 6.4.5.1 Technological advances in AI-assisted detection and autonomous navigation to drive growth

- 6.4.6 POLICE OPERATIONS & INVESTIGATION

- 6.4.6.1 Growing deployment of fixed-wing VTOL UAVs enhancing investigative efficiency and urban policing capabilities

- 6.4.7 MARITIME SECURITY

- 6.4.7.1 Expanding maritime domain awareness initiatives to drive UAV procurement across coastal regions

7 FIXED-WING VTOL UAV MARKET, BY ENDURANCE

- 7.1 INTRODUCTION

- 7.2 <5 HOURS

- 7.2.1 GOVERNMENT INITIATIVES PROMOTING UAV-BASED URBAN OPERATIONS TO DRIVE GROWTH

- 7.3 5-10 HOURS

- 7.3.1 RISING DEMAND FOR MID-ENDURANCE UAVS SUPPORTING DIVERSE SURVEILLANCE AND MAPPING APPLICATIONS TO DRIVE GROWTH

- 7.4 >10 HOURS

- 7.4.1 INCREASING FOCUS ON LONG-ENDURANCE UAVS TO DRIVE MARKET PENETRATION IN DEFENSE AND STRATEGIC APPLICATIONS

8 FIXED-WING VTOL UAV MARKET, BY MTOW

- 8.1 INTRODUCTION

- 8.2 <25 KILOGRAMS

- 8.2.1 RISING ADOPTION OF LIGHTWEIGHT UAVS IN AGRICULTURE, SURVEYING, AND EMERGENCY RESPONSE TO DRIVE SEGMENTAL GROWTH

- 8.3 25-170 KILOGRAMS

- 8.3.1 RISING DEFENSE PROCUREMENT, INFRASTRUCTURE MONITORING, AND COMMERCIAL INSPECTION CONTRACTS TO DRIVE DEMAND FOR MEDIUM-WEIGHT UAVS

- 8.4 >170 KILOGRAMS

- 8.4.1 EMERGING DEMAND FOR UNMANNED CARGO DELIVERY IN REMOTE REGIONS TO DRIVE DEMAND FOR HEAVY-LIFT UAVS

9 FIXED-WING VTOL UAV MARKET, BY MODE OF OPERATION

- 9.1 INTRODUCTION

- 9.2 REMOTELY PILOTED

- 9.2.1 INDUSTRIAL OPERATORS PRIORITIZING REAL-TIME SITUATIONAL CONTROL AND ACCOUNTABILITY TO DRIVE GROWTH

- 9.3 OPTIONALLY PILOTED

- 9.3.1 INCREASING USE IN RESEARCH, DEFENSE TESTING, AND LONG-DURATION SURVEILLANCE APPLICATIONS TO DRIVE GROWTH

- 9.4 FULLY AUTONOMOUS

- 9.4.1 ADVANCEMENTS IN ONBOARD PROCESSING, AI, AND AUTONOMOUS DECISION-MAKING TO DRIVE GROWTH

10 FIXED-WING VTOL UAV MARKET, BY PROPULSION

- 10.1 INTRODUCTION

- 10.2 ELECTRIC

- 10.2.1 EXPANDING USE OF ELECTRIC PROPULSION SYSTEMS SUPPORTING LOW-EMISSION AND SHORT-RANGE UAV OPERATIONS

- 10.3 HYBRID

- 10.3.1 DEFENSE AND INDUSTRIAL USERS SEEKING RELIABILITY UNDER VARIABLE MISSION PROFILES TO DRIVE GROWTH

- 10.4 GASOLINE

- 10.4.1 WIDE UTILIZATION IN DEFENSE SURVEILLANCE, BORDER PATROL, AND LONG-RANGE RECONNAISSANCE TO DRIVE GROWTH

11 FIXED-WING VTOL UAV MARKET, BY RANGE

- 11.1 INTRODUCTION

- 11.2 VISUAL LINE OF SIGHT (VLOS)

- 11.2.1 WIDESPREAD OPERATOR TRAINING PROGRAMS AND INCREASING GOVERNMENT PERMISSIONS FOR LOW-ALTITUDE UAV ACTIVITY TO DRIVE GROWTH

- 11.3 EXTENDED VISUAL LINE OF SIGHT (EVLOS)

- 11.3.1 GROWING REGULATORY ACCEPTANCE OF EVLOS FRAMEWORKS FOR INSPECTION, MAPPING, AND INFRASTRUCTURE MONITORING TASKS TO DRIVE GROWTH

- 11.4 BEYOND VISUAL LINE OF SIGHT (BVLOS)

- 11.4.1 SUITABLE FOR LONG-RANGE SURVEILLANCE, LOGISTICS, AND DEFENSE OPERATIONS

12 FIXED-WING VTOL UAV MARKET, BY POINT OF SALE

- 12.1 INTRODUCTION

- 12.2 OEM

- 12.2.1 COLLABORATIONS BETWEEN AEROSPACE FIRMS AND TECHNOLOGY PROVIDERS TO ENHANCE VERTICAL TAKE-OFF EFFICIENCY AND AUTOMATION TO DRIVE GROWTH

- 12.3 AFTERMARKET

- 12.3.1 INTRODUCTION OF PREDICTIVE MAINTENANCE PROGRAMS USING AI-BASED DIAGNOSTICS AND CONDITION-MONITORING SYSTEMS TO DRIVE GROWTH

13 FIXED-WING VTOL UAV MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 US

- 13.2.1.1 Defense modernization and commercial integration to drive market

- 13.2.2 CANADA

- 13.2.2.1 Expanding commercial UAV use and government-led innovation to drive market

- 13.2.1 US

- 13.3 EUROPE

- 13.3.1 UK

- 13.3.1.1 Investments in electric and hybrid propulsion technologies to drive market

- 13.3.2 FRANCE

- 13.3.2.1 Defense-led development and strong industrial ecosystem to drive market

- 13.3.3 GERMANY

- 13.3.3.1 Industrial strength and defense collaboration to reinforce UAV advancement

- 13.3.4 ITALY

- 13.3.4.1 Expanding defense programs and technology partnerships to strengthen national UAV capability

- 13.3.5 RUSSIA

- 13.3.5.1 Indigenous development and defense procurement to shape national UAV landscape

- 13.3.6 SWEDEN

- 13.3.6.1 Need for defense innovation and cross-border collaboration to drive UAV development

- 13.3.7 REST OF EUROPE

- 13.3.1 UK

- 13.4 ASIA PACIFIC

- 13.4.1 CHINA

- 13.4.1.1 Rapid indigenous scaling and export-oriented production to drive market

- 13.4.2 INDIA

- 13.4.2.1 Expanding defense procurement and indigenous manufacturing to drive market

- 13.4.3 JAPAN

- 13.4.3.1 Technological advancements and regulatory clarity to accelerate UAV integration

- 13.4.4 SOUTH KOREA

- 13.4.4.1 Defense modernization and innovation-led industry to shape UAV ecosystem's growth

- 13.4.5 AUSTRALIA

- 13.4.5.1 Expanding defense programs and commercial integration to advance UAV capability

- 13.4.6 REST OF ASIA PACIFIC

- 13.4.1 CHINA

- 13.5 MIDDLE EAST

- 13.5.1 UAE

- 13.5.1.1 Indigenous manufacturing and defense partnerships to advance UAV capability

- 13.5.2 SAUDI ARABIA

- 13.5.2.1 Defense diversification and local production initiatives to strengthen UAV ecosystem

- 13.5.3 ISRAEL

- 13.5.3.1 Advanced R&D and global exports to reinforce UAV leadership

- 13.5.4 TURKEY

- 13.5.4.1 Indigenous development and defense export to drive UAV prominence

- 13.5.5 REST OF MIDDLE EAST

- 13.5.1 UAE

- 13.6 REST OF THE WORLD

- 13.6.1 LATIN AMERICA

- 13.6.1.1 Focus on defense modernization and industrial collaboration to support growth

- 13.6.2 AFRICA

- 13.6.2.1 Emphasis on security modernization and regional cooperation to foster UAV adoption

- 13.6.1 LATIN AMERICA

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 14.3 REVENUE ANALYSIS

- 14.4 MARKET SHARE ANALYSIS

- 14.5 BRAND/PRODUCT COMPARISON

- 14.6 COMPANY VALUATION AND FINANCIAL METRICS

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Application footprint

- 14.7.5.4 Propulsion footprint

- 14.7.5.5 Point of sale footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING

- 14.8.5.1 List of startups/SMEs

- 14.8.5.2 Competitive benchmarking of startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 DEALS

- 14.9.2 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 ALTI UNMANNED

- 15.1.1.1 Business overview

- 15.1.1.2 Products offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 UKRSPECSYSTEMS

- 15.1.2.1 Business overview

- 15.1.2.2 Products offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 AEROVIRONMENT, INC.

- 15.1.3.1 Business overview

- 15.1.3.2 Products offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Deals

- 15.1.3.3.2 Others

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 LOCKHEED MARTIN CORPORATION

- 15.1.4.1 Business overview

- 15.1.4.2 Products offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product Launches

- 15.1.4.3.2 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 TEXTRON SYSTEMS

- 15.1.5.1 Business overview

- 15.1.5.2 Products offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Others

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 VERTICAL TECHNOLOGIES

- 15.1.6.1 Business overview

- 15.1.6.2 Products offered

- 15.1.7 CARBONIX

- 15.1.7.1 Business overview

- 15.1.7.2 Products offered

- 15.1.8 IDEAFORGE TECHNOLOGY INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Others

- 15.1.9 QUANTUM-SYSTEMS GMBH

- 15.1.9.1 Business overview

- 15.1.9.2 Products offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.9.3.2 Others

- 15.1.10 BLUEBIRD AERO SYSTEMS

- 15.1.10.1 Business overview

- 15.1.10.2 Products offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Deals

- 15.1.11 AUTEL ROBOTICS

- 15.1.11.1 Business overview

- 15.1.11.2 Products offered

- 15.1.12 THREOD SYSTEMS AS

- 15.1.12.1 Business overview

- 15.1.12.2 Products offered

- 15.1.13 JOUAV

- 15.1.13.1 Business overview

- 15.1.13.2 Products offered

- 15.1.14 GARUDA ROBOTICS PTE. LTD.

- 15.1.14.1 Business overview

- 15.1.14.2 Products offered

- 15.1.15 ASTERIA AEROSPACE LIMITED

- 15.1.15.1 Business overview

- 15.1.15.2 Products offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Others

- 15.1.1 ALTI UNMANNED

- 15.2 OTHER PLAYERS

- 15.2.1 A-TECHSYN

- 15.2.2 AVY BY

- 15.2.3 ELROY AIR

- 15.2.4 WINGTRA AG

- 15.2.5 FLIGHTWAVE AEROSPACE SYSTEMS

- 15.2.6 ELEVONX

- 15.2.7 FIXAR-AERO LLC

- 15.2.8 CENSYS TECHNOLOGIES

- 15.2.9 SKYETON

- 15.2.10 VTOL AVIATION INDIA PVT. LTD.

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.1.1 SECONDARY DATA

- 16.1.1.1 Key data from secondary sources

- 16.1.2 PRIMARY DATA

- 16.1.2.1 Key data from primary sources

- 16.1.2.2 Breakdown of primaries

- 16.1.1 SECONDARY DATA

- 16.2 FACTOR ANALYSIS

- 16.2.1 INTRODUCTION

- 16.2.2 DEMAND-SIDE INDICATORS

- 16.2.3 SUPPLY-SIDE INDICATORS

- 16.3 MARKET SIZE ESTIMATION

- 16.3.1 BOTTOM-UP APPROACH

- 16.3.2 TOP-DOWN APPROACH

- 16.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 16.5 RISK ANALYSIS

- 16.6 RESEARCH LIMITATIONS

- 16.7 RESEARCH ASSUMPTIONS

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS