|

시장보고서

상품코드

1883071

의약품 등급 염화나트륨시장 : 등급별, 용도별, 지역별 예측(-2030년)Pharmaceutical-Grade Sodium Chloride Market by Grade (API-NaCl, HD-NaCl), Application (Injectables /Intravenous Solutions, Dialysis, Oral Rehydration Salts, Hemofiltration Solutions, Mechanical Cleansing Solutions), and Region - Global Forecast to 2030 |

||||||

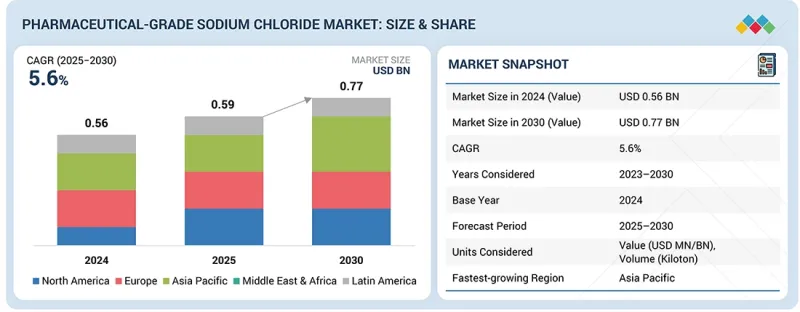

세계의 의약품 등급 염화나트륨 시장 규모는 2025년에 추정 5억 9,000만 달러로 평가되었고, 2030년까지 7억 7,000만 달러에 이를 것으로 예측되며, 2025-2030년에 CAGR은 5.6%를 나타낼 전망입니다. 만성 신장 질환(CKD), 당뇨병, 탈수 장애와 같은 만성 질환의 유병률이 지속적으로 증가함에 따라 정맥 주사액, 주사제 제형 및 투석 용액에 대한 수요 증가로 인해 의약품 등급 염화나트륨 시장이 확대될 것입니다.

| 조사 범위 | |

|---|---|

| 조사 기간 | 2023-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(100만/10억 달러), 킬로톤 |

| 부문 | 등급, 용도, 지역 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 중동, 아프리카, 남미 |

신흥 경제국을 포함한 의약품 및 생물학적 제제의 생산 증가 역시 약전 기준을 충족하는 고순도 염화나트륨 수요에 기여하고 있습니다. 인프라 시설 투자, 중환자 치료에 대한 정부 지출, 공급망 시설 개선 역시 시장 성장을 주도하고 있습니다.

"HD-NaCl 부문이 2025-2030년에 가장 높은 CAGR을 나타낼 것으로 예측"

HD-NaCl은 병원 내 중환자 치료 및 수분 공급 요법에 대한 수요 증가로 인해 예측 기간 동안 의약품 등급 염화나트륨 시장에서 가장 높은 CAGR을 기록할 것으로 예상됩니다. HD 염화나트륨 소비량은 증가 추세에 있습니다. 비용이 저렴하고 대량 생산이 가능하여 대규모 의약품 및 임상 용도에서 API 염화나트륨보다 선호되는 선택지입니다.

"투석 부문이 2030년에 가장 큰 시장 점유율을 획득할 것으로 예측됩니다."

노인, 당뇨병, 고혈압과 관련된 만성 신장 질환(CKD) 발생률이 급증함에 따라, 의약품 등급 염화나트륨 시장에서 가장 큰 응용 분야는 투석입니다. 전 세계적으로 투석 시설의 증가와 가정용 투석 장치의 도입은 시장 수요를 더욱 가속화하고 있습니다. 혈액투석 및 복막투석과 같은 투석 방식은 투석액 조제를 위해 지속적으로 대량의 의약품 등급 염화나트륨 사용을 필요로 합니다.

"아시아태평양의 의약품 등급 염화나트륨 시장이 예측 기간에 가장 높은 CAGR은 성장할 것으로 예측"

아시아태평양 지역은 의약품 및 생물학적 제제 생산 산업의 급속한 발전과 병원 및 투석 인프라에 대한 투자 증가로 인해 의약품 등급 염화나트륨 시장에서 높은 성장을 경험하고 있습니다. 유리한 정부 정책과 낮은 생산 비용은 경쟁력 있는 수입 의약품 등급 염화나트륨 생산을 억제합니다. 인도, 중국 및 동남아시아에서 현대 의료 서비스의 사용 증가가 시장 가속화를 강화하고 있습니다.

이 보고서는 세계의 의약품 등급 염화나트륨 시장에 대한 조사 분석을 통해 주요 촉진요인 및 억제요인, 경쟁 구도, 미래 동향 등에 대한 정보를 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요한 지견

- 의약품 등급 염화나트륨 시장에서 매력적인 기회

- 의약품 등급 염화나트륨 시장 : 등급별, 지역별

- 의약품 등급 염화나트륨 시장 : 제품 형태별

- 의약품 등급 염화나트륨 시장 : 용도별

- 의약품 등급 염화나트륨 시장 : 국가별

제4장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 의약품 등급 염화나트륨 시장의 미충족 요구

- 화이트 스페이스의 기회

- 상호연결된 시장과 부문 크로스섹터 기회

- 상호연결된 시장

- 부문 크로스섹터 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제 분석

- 소개

- GDP의 동향과 예측

- 도시화와 인구동태의 변화

- 무역과 세계공급망의 역학

- 밸류체인 분석

- 원재료의 조달과 취득

- 가공, 정제, 품질 보증

- 유통, 물류, 공급망 관리

- 최종 용도 의약품으로의 전환

- 생태계 분석

- 가격 설정 분석

- 주요 기업의 평균 판매 가격 동향 : 등급별

- 평균 판매 가격 동향 : 지역별

- 무역 분석

- 수입 시나리오

- 수출 시나리오

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 고객사업에 영향을 주는 동향/혼란

- 사례 연구 분석

- 의약품 등급 염화나트륨 시장에 대한 미국 관세의 영향(2025년)

- 소개

- 주요 관세율

- 가격의 영향 분석

- 다양한 지역에 대한 주요 영향

- 용도에 대한 영향

제6장 기술, 특허, 디지털, AI의 채택에 의한 혁신

- 주요 기술

- 진공 염 생산

- 기계식 증기 재압축(MVR) 및 다중 효과 증발(MEE)

- 재결정화

- 냉염수 침출 및 화학 침전

- 보완 기술

- 입자 크기 제어, 체 및 과립화

- 건조 기술(열풍 건조, 유동층 건조)

- PAT 및 공정 자동화 (SCADA, DCS, 인라인 품질 모니터링)

- 인접 기술

- 무균 정맥 주입액, 투석액 및 경구수분보충액(ORS) 생산 시스템

- 클린룸, HVAC 및 GMP 포장 기술

- 기술/제품 로드맵

- 단기(2025-2027년) : 디지털 이행과 생산 최적화 단계

- 중기(2027-2030년) : 지속 가능한 생산과 공급망의 통합

- 장기(2030-2035년 이후) : 바이오프로세스 통합과 현장 의약품 염수 시스템

- 특허 분석

- 소개

- 접근

- 주요 출원인

- 미래의 용도

- 의약품 등급 염화나트륨 시장에 대한 AI/생성형 AI 영향

- 주요 이용 사례와 시장의 장래성

- 상호연결된 인접 생태계와 시장 기업에 미치는 영향

- 의약품 등급 염화나트륨 시장에서 생성형 AI 채택에 대한 고객 준비 상황

- 성공 사례와 실세계에의 응용

제7장 지속가능성과 규제정세

- 지역 규제 및 규정 준수

- 규제기관, 정부기관, 기타 조직

- 업계 표준

- 지속가능성에 대한 노력

- 인증, 라벨, 환경 기준

제8장 고객정세와 구매행동

- 의사결정 프로세스

- 구매자 이해관계자 및 구매 평가 기준

- 구매 프로세스의 주요 이해 관계자

- 구입 기준

- 채택 장벽과 내부 과제

- 다양한 용도에서 미충족 요구

- 시장의 수익성

- 잠재적인 수익

- 비용역학

- 마진 기회 : 용도별

제9장 의약품 등급 염화나트륨 시장 : 등급별

- 소개

- HD-NACL

- API-NACL

제10장 의약품 등급 염화나트륨 시장 : 제품 형태별

- 소개

- 액체

- 고체

제11장 의약품 등급 염화나트륨 시장 : 용도별

- 소개

- 투석

- 주사제

- 경구수분보충액(ORS)

- 혈액 여과액

- 기계 세정액

- 기타 용도

제12장 의약품 등급 염화나트륨 시장 : 지역별

- 소개

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 네덜란드

- 아일랜드

- 튀르키예

- 러시아

- 기타 유럽

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타 중동 및 아프리카

제13장 경쟁 구도

- 개요

- 주요 진입기업의 전략

- 수익 분석

- 시장 점유율 분석

- 기업 평가 및 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제14장 기업 프로파일

- 주요 기업

- KS AKTIENGESELLSCHAFT

- SUDWESTDEUTSCHE SALZWERKE AG

- DOMINION SALT

- MORTON SALT, INC.

- SALINEN AUSTRIA AG

- MERCK KGAA

- GROUPE SALINS

- HUB SALT

- JIANGSU PROVINCE QINFEN PHARMACEUTICAL CO., LTD.

- US SALT

- 기타 기업

- NANDU CHEMICALS

- MACCO ORGANIQUES, SRO

- JJ CHEMICALS

- SALT MINERALS GMBH

- HITECH MINERALS AND CHEMICALS GROUP

- TIANJIN HENGHAIXIN INTERNATIONAL TRADING CO., LTD.

- MARKHOR SALT CO.

- ABHAY AQUA CHEM

- HAWKINS

- RCI LABSCAN LIMITED

- GLENTHAM LIFE SCIENCES LIMITED

- FENGCHEN GROUP CO., LTD

- DHANRAJ SUGAR PVT. LTD.

- SD FINE-CHEM LTD

- VM CHEMICALS

제15장 조사 방법

제16장 부록

HBR 25.12.15The pharmaceutical-grade sodium chloride market size is estimated to be USD 0.59 billion in 2025 and is projected to reach USD 0.77 billion by 2030, at a CAGR of 5.6% from 2025 to 2030. The pharmaceutical-grade sodium chloride market will expand owing to the rise in the demand for intravenous fluids, the injectable formulations, and dialysis solutions as the prevalence of chronic diseases like chronic kidney disease (CKD), diabetes, and dehydration disorders continues to rise.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) and Volume (Kiloton) |

| Segments | Grade, Application, and Region |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

The increased production of pharmaceuticals and biologics, including in the emerging economies, is also contributing to the demand for high-purity sodium chloride that is pharmacopeially acceptable. Investment in infrastructure facilities, government expenditure on critical care, and enhancements to supply chain facilities are also driving the market's growth.

"HD-NaCl segment is projected to exhibit the highest CAGR from 2025 to 2030"

The HD-NaCl is expected to record the highest CAGR in the pharmaceutical-grade sodium chloride market during the forecast period, owing to the rising demand for critical care therapies and hydration therapies provided in hospitals. Consumption of HD sodium chloride is on the rise. It is cheaper and can be produced in large quantities, making it the preferred choice over API sodium chloride for large-scale pharmaceutical and clinical usage.

"Dialysis segment is projected to capture the largest market share in 2030"

The largest application in the pharmaceutical-grade sodium chloride market is dialysis due to the rapidly rising incidences of CKD associated with older people, diabetes, and hypertension. The growth of dialysis facilities and the introduction of home dialysis units worldwide only escalates the market demand. The dialytic modalities of hemodialysis and peritoneal dialysis necessitate constant and high-volume utilization of pharmaceutical-grade sodium chloride to formulate the dialysates.

"Asia Pacific pharmaceutical-grade sodium chloride market is projected to grow at the highest CAGR during the forecast period"

The Asia Pacific is experiencing high growth in the pharmaceutical-grade sodium chloride market due to the rapid development of the pharmaceutical and biologics production industry, as well as increased investment in hospital and dialysis infrastructure. Favorable government policies and low cost of production deter competitive imported pharmaceutical-grade sodium chloride production. The increased use of modern healthcare in India, China, and Southeast Asia is reinforcing market acceleration.

By Company Type: Tier 1 - 25%, Tier 2 - 42%, and Tier 3 - 33%

By Designation: C-level Executives - 20%, Directors - 30%, and Others - 50%

By Region: North America - 20%, Europe - 10%, Asia Pacific - 40%, South America - 10%, and Middle East & Africa - 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: K+S Aktiengesellschaft (Germany), Sudwestdeutsche Salzwerke AG (Germany), Dominion Salt (New Zealand), Morton Salt, Inc. (US), and Salinen Austria AG (Austria), among other companies, are covered in the report.

The study includes an in-depth competitive analysis of these key players in the pharmaceutical-grade sodium chloride market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the pharmaceutical-grade sodium chloride market based on grade (API-NaCl and HD-NaCl), application (injectables/intravenous solutions, dialysis, oral rehydration salts, hemofiltration solutions, mechanical cleansing solutions, and other applications), and region (Asia Pacific, North America, Europe, South America, and the Middle East & Africa). The report's scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, and key strategies, such as partnerships, expansions, and acquisitions, associated with the market. This report also covers a competitive analysis of upcoming startups in the pharmaceutical-grade sodium chloride market ecosystem.

Reasons to Buy the Report

The report will provide market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall pharmaceutical-grade sodium chloride market and its subsegments. This report will help stakeholders understand the competitive landscape, gain deeper insights into positioning their businesses more effectively, and develop suitable go-to-market strategies. The report will help stakeholders understand the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

Analysis of key drivers (Rising dialysis treatments), restraints (Complex regulatory approvals), opportunities (Rising healthcare investment in developing regions), and challenges (Audits and documentation burdens)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the pharmaceutical-grade sodium chloride market

- Market Development: Comprehensive information about profitable markets-the report analyzes the pharmaceutical-grade sodium chloride market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the pharmaceutical-grade sodium chloride market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as K+S Aktiengesellschaft (Germany), Sudwestdeutsche Salzwerke AG (Germany), Dominion Salt (New Zealand), Morton Salt, Inc. (US), Salinen Austria AG (Austria)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF STRATEGIC CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: ASIA PACIFIC MARKET SIZE AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET

- 3.2 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE AND REGION

- 3.3 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY PRODUCT FORM

- 3.4 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION

- 3.5 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising dialysis treatments

- 4.2.1.2 Strong demand for pharmaceutical-grade sodium chloride in North America and Europe

- 4.2.1.3 Emerging markets driving healthcare expansion and increasing demand

- 4.2.2 RESTRAINTS

- 4.2.2.1 Complex regulatory approvals

- 4.2.2.2 Dependence on stable supply of raw salt

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rising healthcare investment in developing regions

- 4.2.3.2 Partnerships with hospitals and pharmaceutical companies

- 4.2.4 CHALLENGES

- 4.2.4.1 Strict audits and documentation burdens

- 4.2.4.2 Competition from local low-cost producers

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET

- 4.3.1.1 Need for higher purity and specialized grades

- 4.3.1.2 Digitalization and supply chain transparency

- 4.3.1.3 Enhanced technical support and quality services

- 4.3.1.4 Flexible and long-term supply models

- 4.3.1.5 Skilled quality teams and regulatory assurance

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.3.2.1 Expansion into emerging and underserved markets

- 4.3.2.2 Development of specialty and high-performance grades

- 4.3.2.3 Digital quality systems and traceability platforms

- 4.3.2.4 Enhanced technical services and regulatory support

- 4.3.2.5 Integrated supply and capacity-reliability solutions

- 4.3.1 UNMET NEEDS IN PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- 4.5.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES' ANALYSIS

- 5.1.1 THREAT OF NEW ENTRANTS

- 5.1.2 THREAT OF SUBSTITUTES

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC ANALYSIS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECASTS

- 5.2.3 URBANIZATION AND DEMOGRAPHIC SHIFTS

- 5.2.4 TRADE AND GLOBAL SUPPLY CHAIN DYNAMICS

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 RAW MATERIAL PROCUREMENT AND ACQUISITION

- 5.3.2 PROCESSING, REFINING, AND QUALITY ASSURANCE

- 5.3.3 DISTRIBUTION, LOGISTICS, AND SUPPLY CHAIN MANAGEMENT

- 5.3.4 CONVERSION TO END-USE PHARMACEUTICAL PRODUCTS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY GRADE

- 5.5.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO

- 5.6.2 EXPORT SCENARIO

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 EFFICIENT PRODUCTION OF PHARMACEUTICAL-GRADE SODIUM CHLORIDE FROM ROCK SALT AT ENASEL, ALGERIA

- 5.9.2 TRANSFORMING LOW-QUALITY SOLAR SALT INTO PHARMACEUTICAL-GRADE SODIUM CHLORIDE IN BANGLADESH

- 5.10 IMPACT OF 2025 US TARIFF ON PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET

- 5.10.1 INTRODUCTION

- 5.10.2 KEY TARIFF RATES

- 5.10.3 PRICE IMPACT ANALYSIS

- 5.10.4 KEY IMPACT ON VARIOUS REGIONS

- 5.10.5 IMPACT ON APPLICATIONS

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 VACUUM SALT PRODUCTION

- 6.1.2 MECHANICAL VAPOR RECOMPRESSION (MVR) & MULTIPLE-EFFECT EVAPORATION (MEE)

- 6.1.3 RECRYSTALLIZATION

- 6.1.4 COLD BRINE LEACHING & CHEMICAL PRECIPITATION

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 PARTICLE SIZE CONTROL, SIEVING, AND GRANULATION

- 6.2.2 DRYING TECHNOLOGY (HOT AIR & FLUID BED DRYING)

- 6.2.3 PAT & PROCESS AUTOMATION (SCADA, DCS, INLINE QUALITY MONITORING)

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 STERILE INTRAVENOUS FLUID, DIALYSIS, AND ORS PRODUCTION SYSTEMS

- 6.3.2 CLEANROOM, HVAC, AND GMP PACKAGING TECHNOLOGIES

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.4.1 SHORT-TERM (2025-2027) | DIGITAL TRANSITION AND PRODUCTION OPTIMIZATION PHASE

- 6.4.2 MID-TERM (2027-2030): SUSTAINABLE PRODUCTION & SUPPLY CHAIN INTEGRATION

- 6.4.3 LONG-TERM (2030-2035+): BIOPROCESS INTEGRATION & ON-SITE PHARMACEUTICAL BRINE SYSTEMS

- 6.5 PATENT ANALYSIS

- 6.5.1 INTRODUCTION

- 6.5.2 APPROACH

- 6.5.3 TOP APPLICANTS

- 6.6 FUTURE APPLICATIONS

- 6.6.1 ADVANCED APPLICATIONS IN INJECTABLES, DIALYSIS, AND BIOPROCESSING SYSTEMS

- 6.7 IMPACT OF AI/GEN AI ON PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET

- 6.7.1 TOP USE CASES AND MARKET POTENTIAL

- 6.7.2 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.7.3 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET

- 6.8 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.8.1 K+S AKTIENGESELLSCHAFT ENABLES CRITICAL PHARMACEUTICAL SUPPLY SUPPORT DURING GLOBAL COVID-19 VACCINATION ROLLOUT

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF PHARMACEUTICAL-GRADE SODIUM CHLORIDE

- 7.2.1.1 Carbon Impact Reduction

- 7.2.1.2 Eco-Applications

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF PHARMACEUTICAL-GRADE SODIUM CHLORIDE

- 7.3 CERTIFICATIONS, LABELING, ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS APPLICATIONS

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES, BY APPLICATION

9 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY GRADE

- 9.1 INTRODUCTION

- 9.2 HD-NACL

- 9.2.1 UNMATCHED STABILITY, HEIGHT, AND LIFTING POWER TO DRIVE DEMAND

- 9.3 API-NACL

- 9.3.1 HIGH REGULATORY COMPLIANCE, PURITY ASSURANCE, AND FUNCTIONAL PERFORMANCE TO AUGMENT DEMAND

10 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY PRODUCT FORM

- 10.1 INTRODUCTION

- 10.2 LIQUID

- 10.2.1 GROWING DEMAND FOR ORAL ELECTROLYTE THERAPIES TO DRIVE DEMAND

- 10.3 SOLID

- 10.3.1 RISING GLOBAL HOSPITALIZATION RATES TO AUGMENT DEMAND

11 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 DIALYSIS

- 11.2.1 GROWING DIALYSIS PATIENT POPULATION TO FUEL MARKET GROWTH

- 11.3 INJECTABLES

- 11.3.1 GROWING USE OF IV THERAPIES AND SURGICAL PROCEDURES TO DRIVE DEMAND

- 11.4 ORAL REHYDRATION SALTS

- 11.4.1 GROWING GLOBAL NEED FOR EFFECTIVE DEHYDRATION MANAGEMENT TO DRIVE DEMAND

- 11.5 HEMOFILTRATION SOLUTIONS

- 11.5.1 ADVANCED RENAL REPLACEMENT REQUIREMENTS TO ACCELERATE DEMAND

- 11.6 MECHANICAL CLEANING SOLUTIONS

- 11.6.1 INCREASING SURGICAL ACTIVITIES AND HOSPITAL HYGIENE STANDARDS TO DRIVE DEMAND

- 11.7 OTHER APPLICATIONS

12 PHARMACEUTICAL-GRADE SODIUM CHLORIDE MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Pharmaceutical industry and shift toward advanced drug development to drive market

- 12.2.2 JAPAN

- 12.2.2.1 Accelerating aging population and rising healthcare demand to drive market

- 12.2.3 INDIA

- 12.2.3.1 Growing generic injectable drug industry to drive market

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Rapidly aging population and rising healthcare demand to propel market

- 12.2.5 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Rising renal replacement therapy demand to boost consumption

- 12.3.2 FRANCE

- 12.3.2.1 Growing adoption of home hemodialysis

- 12.3.3 UK

- 12.3.3.1 CKD prevalence and aging population to accelerate market

- 12.3.4 ITALY

- 12.3.4.1 Expanding healthcare infrastructure to drive demand

- 12.3.5 SPAIN

- 12.3.5.1 Strong organ donation infrastructure and rising dialysis volume to accelerate market growth

- 12.3.6 NETHERLANDS

- 12.3.6.1 Increasing CKD incidence and elderly population expansion to support market growth

- 12.3.7 IRELAND

- 12.3.7.1 Increasing incidence of kidney failure and expanding renal care needs to boost market

- 12.3.8 TURKEY

- 12.3.8.1 High incidence of end-stage kidney disease to boost market

- 12.3.9 RUSSIA

- 12.3.9.1 Expanding dialysis centers and rising CKD burden to propel market

- 12.3.10 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 NORTH AMERICA

- 12.4.1 US

- 12.4.1.1 Aging population increasing hospital and infusion needs to boost market

- 12.4.2 CANADA

- 12.4.2.1 Rising CKD and expanding dialysis needs to boost market

- 12.4.3 MEXICO

- 12.4.3.1 Rapidly aging population to propel the market

- 12.4.1 US

- 12.5 SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.5.1.1 Rising CKD burden and rapid population aging fueling the demand

- 12.5.2 ARGENTINA

- 12.5.2.1 Healthcare modernization and rising chronic disease burden to augment market

- 12.5.3 REST OF SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.6 MIDDLE EAST & AFRICA

- 12.6.1 GCC COUNTRIES

- 12.6.1.1 Saudi Arabia

- 12.6.1.1.1 High CKD and diabetes burden paired with Vision 2030 healthcare expansion to drive market

- 12.6.1.2 UAE

- 12.6.1.2.1 High diabetes and CKD burden to boost market

- 12.6.1.3 Rest of GCC countries

- 12.6.1.1 Saudi Arabia

- 12.6.2 SOUTH AFRICA

- 12.6.2.1 Expanding healthcare & dialysis infrastructure to drive market

- 12.6.3 REST OF MIDDLE EAST & AFRICA

- 12.6.1 GCC COUNTRIES

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES

- 13.3 REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.5.1 COMPANY VALUATION

- 13.5.2 FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Grade footprint

- 13.7.5.4 Product form footprint

- 13.7.5.5 Application footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.6 DETAILED LIST OF KEY STARTUPS/SMES

- 13.8.7 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 DEALS

- 13.9.2 EXPANSIONS

- 13.9.3 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 K+S AKTIENGESELLSCHAFT

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Others

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 SUDWESTDEUTSCHE SALZWERKE AG

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 MnM view

- 14.1.2.3.1 Key strengths

- 14.1.2.3.2 Strategic choices

- 14.1.2.3.3 Weaknesses and competitive threats

- 14.1.3 DOMINION SALT

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 MnM view

- 14.1.3.3.1 Key strengths

- 14.1.3.3.2 Strategic choices

- 14.1.3.3.3 Weaknesses and competitive threats

- 14.1.4 MORTON SALT, INC.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Key strengths

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses and competitive threats

- 14.1.5 SALINEN AUSTRIA AG

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Key strengths

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses and competitive threats

- 14.1.6 MERCK KGAA

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Expansions

- 14.1.6.4 MnM view

- 14.1.7 GROUPE SALINS

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.7.4 MnM view

- 14.1.8 HUB SALT

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 MnM view

- 14.1.9 JIANGSU PROVINCE QINFEN PHARMACEUTICAL CO., LTD.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 MnM view

- 14.1.10 US SALT

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 MnM view

- 14.1.1 K+S AKTIENGESELLSCHAFT

- 14.2 OTHER PLAYERS

- 14.2.1 NANDU CHEMICALS

- 14.2.2 MACCO ORGANIQUES, S.R.O.

- 14.2.3 J J CHEMICALS

- 14.2.4 SALT MINERALS GMBH

- 14.2.5 HITECH MINERALS AND CHEMICALS GROUP

- 14.2.6 TIANJIN HENGHAIXIN INTERNATIONAL TRADING CO., LTD.

- 14.2.7 MARKHOR SALT CO.

- 14.2.8 ABHAY AQUA CHEM

- 14.2.9 HAWKINS

- 14.2.10 RCI LABSCAN LIMITED

- 14.2.11 GLENTHAM LIFE SCIENCES LIMITED

- 14.2.12 FENGCHEN GROUP CO., LTD

- 14.2.13 DHANRAJ SUGAR PVT. LTD.

- 14.2.14 SD FINE-CHEM LTD

- 14.2.15 VM CHEMICALS

15 RESEARCH METHODOLOGY

- 15.1 RESEARCH DATA

- 15.1.1 SECONDARY DATA

- 15.1.1.1 Key data from secondary sources

- 15.1.2 PRIMARY DATA

- 15.1.2.1 Key data from primary sources

- 15.1.2.2 Key industry insights

- 15.1.1 SECONDARY DATA

- 15.2 MARKET SIZE ESTIMATION

- 15.3 BASE NUMBER CALCULATION

- 15.3.1 DEMAND-SIDE APPROACH

- 15.3.2 SUPPLY-SIDE APPROACH

- 15.4 MARKET FORECAST APPROACH

- 15.4.1 SUPPLY SIDE

- 15.4.2 DEMAND SIDE

- 15.5 DATA TRIANGULATION

- 15.6 FACTOR ANALYSIS

- 15.7 RESEARCH ASSUMPTIONS

- 15.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS