|

시장보고서

상품코드

1883072

위성 지상국 시장 : 플랫폼별, 솔루션별, 기능별, 최종 사용자별, 주파수별, 궤도별, 지역별 예측(-2030년)Satellite Ground Station Market by Platform (Fixed, Portable, Vehicle-mounted, Shipborne, Airborne, Container-mounted), Solution (Hardware, Software, Ground Station as a Service), Function, Frequency, Orbit, End User, Region - Global Forecast to 2030 |

||||||

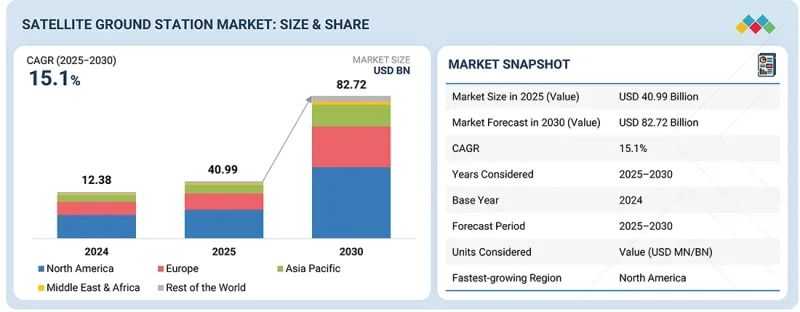

위성 지상국 시장 규모는 2025년 409억 9,000만 달러로 평가되었고 2025-2030년 연평균 복합 성장률(CAGR)은 15.1%를 나타낼것으로 예측되며 2030년까지 827억 2,000만 달러에 이를 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 기간 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 플랫폼별, 솔루션별, 기능별, 최종 사용자별, 주파수별, 궤도별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

위성 지상국 수요 증가는 데이터 전송 및 TT&C(텔레메트리·추적·제어) 운영을 위한 고밀도·고용량 지상 네트워크가 필요한 다중 궤도 위성 군집의 급속한 확장에 의해 주도됩니다.

최종 사용자 기준, 상업 부문은 예측 기간 동안 위성 지상국 시장에서 가장 큰 점유율을 차지할 것으로 예상되며, 이는 주로 민간 위성 군집의 급속한 확장, 텔레포트 확장 및 클라우드 통합 지상 서비스에 의해 주도됩니다. 상업 운영사들은 더 높은 처리량과 낮은 지연 시간 요구 사항을 지원하기 위해 가상화 기저대역, 다중 궤도 안테나 및 자동화된 TT&C 인프라에 대한 투자를 늘리고 있습니다. 항공 및 해상 분야 전반에 걸친 지구 관측 데이터 서비스, 글로벌 광대역 네트워크, 모빌리티 솔루션의 부상은 상업적 수요를 더욱 촉진하고 있습니다. 또한 유연한 용량 임대 모델과 GSaaS 플랫폼은 스타트업 및 비위성 기업들이 물리적 자산을 소유하지 않고도 고품질 지상 인프라에 접근할 수 있도록 지원합니다. 이러한 변화는 시장 성장을 가속화하고 상업적 플레이어들을 전 세계적으로 지배적인 수요 중심지로 공고히 하고 있습니다.

기능별로는 통신 부문이 예측 기간 동안 가장 큰 시장 점유율을 차지할 것으로 전망되며, 이는 상업, 정부, 국방 애플리케이션 전반에 걸친 대용량 위성 연결 수요 증가에 힘입은 바입니다. 다중 궤도 위성 네트워크의 가속화된 구축, 광대역 및 이동성 서비스의 확장, 그리고 탄력적이고 광역적인 통신 인프라에 대한 필요성이 지상 안테나, RF 시스템, 게이트웨이 아키텍처의 상당한 업그레이드를 주도하고 있습니다. 또한 클라우드 통합 지상 시스템의 확산과 비디오, IoT, 보안 임무 통신 등 데이터 집약적 애플리케이션의 급증은 위성 지상 부문 시장에서 통신 부문의 우위를 더욱 공고히 하고 있습니다.

군사 위성통신 현대화 프로그램의 급속한 확대, 상업용 위성군 배치, 탄력적인 지상 인프라에 대한 연방 정부의 투자에 힘입어 북미 지역이 예측 기간 동안 가장 큰 시장 점유율을 차지할 것으로 예상됩니다. 미국은 저궤도(LEO), 중궤도(MEO), 정지궤도(GEO), 심우주 임무를 지원하는 다중 궤도 아키텍처 분야에서 글로벌 리더십을 유지하고 있으며, 스페이스X, 아마존 카이퍼, 크라토스, RTX, 노스롭 그루먼 등 주요 업체들의 적극적인 참여가 이어지고 있습니다. 미국 우주군의 위성통신 지휘통제(SATCOM C2) 현대화, NASA의 근우주 네트워크 업그레이드, NOAA의 지구관측(EO) 지상 부문 프로그램 등 정부 주도 사업이 지역 내 도입을 가속화하고 있습니다. 또한 클라우드 하이퍼스케일러 및 GSaaS(지상 서비스로서의 위성) 공급업체의 진출로 가상화 및 AI 기반 지상 운영으로의 전환이 가능해졌다. 이러한 요소들이 종합적으로 작용하여 북미는 전 세계에서 가장 기술적으로 진보되고 투자 집약적인 위성 지상국 시장으로 자리매김하고 있습니다.

이 보고서는 세계의 위성 지상국 시장을 조사했으며, 플랫폼별, 솔루션별, 기능별, 최종 사용자별, 주파수별, 궤도별, 지역별 동향, 시장 진출기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 인사이트

제4장 시장 개요

- 소개

- 시장 역학

- 미충족 요구와 공백

- 상호연결된 시장과 분야 크로스섹터 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- 소개

- 거시경제지표

- 밸류체인 분석

- 생태계 분석

- 무역 데이터

- 주요 회의 및 이벤트

- 투자 및 자금조달 시나리오

- 가격 분석

- 이용 사례 분석

- 비즈니스 모델

제6장 기술의 진보, AI별 영향, 특허, 혁신, 장래의 응용

- 주요 기술

- 보완적 기술

- 기술 동향

- 특허 분석

- 미래의 응용

- AI/생성형 AI 영향

- 성공 사례와 실세계에의 응용

제7장 고객정세와 구매행동

- 의사결정 프로세스

- 구매자의 이해관계자와 구매평가기준

- 채택 장벽과 내부 과제

제8장 지속가능성과 규제상황

- 지역 규제 및 규정 준수

- 지속가능성에 대한 노력

- 지속가능성에 미치는 영향과 규제 정책의 노력

- 인증, 라벨, 환경 기준

제9장 위성 지상국 시장(플랫폼별)

- 소개

- 고정형

- 휴대용

- 모바일

제10장 위성 지상국 시장(솔루션별)

- 소개

- 하드웨어

- 소프트웨어

- 서비스형 지상국(GSaaS)

제11장 위성 지상국 시장(기능별)

- 소개

- 네비게이션

- 지구 관측

- 통신

- 우주 조사

- 기타 기능

제12장 위성 지상국 시장(최종 사용자별)

- 소개

- 방위

- 정부

- 상업

제13장 위성 지상국 시장(주파수별)

- 소개

- X-밴드

- C-밴드

- S-밴드

- L-밴드

- KU-밴드와 KA-밴드

- UHF/VHF/HF-밴드

- 광학/레이저

- 기타

제14장 위성 지상국 시장(궤도별)

- 소개

- LEO

- MEO

- GEO

- 기타

제15장 위성 지상국 시장(지역별)

- 소개

- 북미

- 미국

- 캐나다

- 유럽

- 러시아

- 영국

- 독일

- 프랑스

- 기타

- 아시아태평양

- 중국

- 인도

- 일본

- 싱가포르

- 호주

- 기타

- 중동

- 아랍에미리트(UAE)

- 사우디아라비아

- 기타

- 기타 지역

- 아프리카

- 라틴아메리카

제16장 경쟁 구도

- 소개

- 주요 참가 기업의 전략/강점(2020-2024년)

- 수익 분석(2021-2024년)

- 시장 점유율 분석(2024년)

- 브랜드/제품 비교

- 기업평가와 재무지표

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 신흥기업/중소기업(2024년)

- 경쟁 시나리오

제17장 기업 프로파일

- 주요 진출기업

- RTX

- GENERAL DYNAMICS CORPORATION

- AIRBUS

- L3HARRIS TECHNOLOGIES, INC.

- LOCKHEED MARTIN CORPORATION

- KONGSBERG

- ELBIT SYSTEMS LTD.

- BOEING

- ASELSAN AS

- NORTHROP GRUMMAN

- BAE SYSTEMS

- MITSUBISHI ELECTRIC CORPORATION

- THALES

- HONEYWELL INTERNATIONAL INC.

- SPACEX

- TERMA

- LEONARDO SPA

- EXAIL TECHNOLOGIES

- INDRA SISTEMAS, SA

- AMAZON

- GMV INNOVATING SOLUTIONS SL

- KRATOS

- VIASAT, INC.

- SAFRAN

- 기타 기업

- DHRUVA SPACE PRIVATE LIMITED

- NORTHWOOD SPACE

- INTELLIAN TECHNOLOGIES, INC.

- LEAF SPACE

- REMOS SPACE SYSTEMS AB

- YORK SPACE SYSTEM

- INFOSTELLAR

- RBC SIGNALS LLC

- ATSRALINTU SPACE TECHNOLOGIES

- CORAC ENGINEERING

제18장 조사 방법

제19장 부록

HBR 25.12.15The satellite ground station market is projected to reach USD 82.72 billion by 2030 from USD 40.99 billion in 2025 at a CAGR of 15.1% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Platform, Solution, Function and Region |

| Regions covered | North America, Europe, APAC, RoW |

The rising demand for satellite ground stations is driven by the rapid expansion of multi-orbit satellite constellations requiring dense, high-capacity ground networks for data transport and TT&C operations.

"By end user, the commercial segment is expected to hold the largest market share."

Based on end user, the commercial segment is expected to hold the largest share of the satellite ground station market during the forecast period, primarily driven by the rapid scale-up of private satellite constellations, teleport expansions, and cloud-integrated ground services. Commercial operators are increasingly investing in virtualized baseband, multi-orbit antennas, and automated TT&C infrastructure to support higher throughput and lower latency requirements. The rise of Earth-observation data services, global broadband networks, and mobility solutions across aviation and maritime sectors is further propelling commercial demand. Additionally, flexible capacity leasing models and GSaaS platforms are enabling startups and non-satellite enterprises to access high-quality ground infrastructure without owning physical assets. This shift is accelerating market growth and solidifying commercial players as the dominant demand center globally.

"By function, the communication segment is projected to hold the largest market share."

Based on function, the communication segment is projected to hold the largest market share during the forecast period, propelled by the rising demand for high-capacity satellite connectivity across commercial, government, and defense applications. The accelerated deployment of multi-orbit satellite networks, expansion of broadband and mobility services, and the need for resilient, wide-area communication infrastructure are driving significant upgrades in ground antennas, RF systems, and gateway architectures. Additionally, the growing adoption of cloud-integrated ground systems and the surge in data-intensive applications, such as video, IoT, and secure mission communications, further reinforce the dominance of the communication segment of the satellite ground segment market.

"North America is projected to hold the largest market share."

North America is expected to acquire the largest market share during the forecast period, driven by the rapid expansion of military SATCOM modernization programs, commercial constellation deployments, and federal investment in resilient ground infrastructure. The US leads globally with multi-orbit architectures supporting LEO, MEO, GEO, and deep space missions, alongside strong participation from key players such as SpaceX, Amazon Kuiper, Kratos, RTX, and Northrop Grumman. Government initiatives, such as the US Space Force's SATCOM C2 modernization, NASA's Near-Space Network upgrades, and NOAA's EO ground segment programs, are further accelerating regional adoption. Additionally, the presence of cloud hyperscalers and GSaaS providers is enabling the shift to virtualized and AI-enabled ground operations. These factors collectively position North America as the most technologically advanced and investment-heavy satellite ground station market worldwide.

The breakup of the profile of primary participants in the satellite ground station market:

- By Company Type: Tier 1 - 40%, Tier 2 - 40%, and Tier 3 - 20%

- By Designation: C-Level Executives- 25%, Managers - 25%, Others - 40%

- By Region: North America - 30%, Europe - 10%, Asia Pacific - 40%, Middle East -15%, Latin America -3%, Africa -2%

RTX (US), General Dynamics Corporation (US), Kongsberg (Norway), Airbus (Netherlands), Elbit System Limited (Israel), Boeing (US), Aselsan A.S. (Turkey), L3Harris Technologies, Inc. (US), Northrop Grumman (US), GMV Innovating Solutions S.L. (Spain), Kratos Defense & Security Solutions (US), and Lockheed Martin Corporation (US) are some of the key market players that have well-equipped and strong distribution networks across North America, Europe, the Asia Pacific, the Middle East, and the Rest of the World.

Research Coverage:

The study covers the satellite ground station market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different segments based on platform, solution, function, frequency, orbit, end user, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

This report segments the satellite ground station market across five key regions: North America, Europe, the Asia Pacific, the Middle East, and the Rest of the World, and their respective key countries. The report's scope includes in-depth information on significant factors, such as drivers, restraints, challenges, and opportunities that influence the growth of the market.

A comprehensive analysis of major industry players has been conducted to provide insights into their business profiles, solutions, and services. This analysis also covers key aspects, including agreements, collaborations, product launches, contracts, expansions, acquisitions, and partnerships, associated with the satellite ground station market.

Reasons to buy this report:

This report serves as a valuable resource for market leaders and newcomers in the satellite ground station market, offering data that closely approximates revenue figures for both the overall market and its subsegments. It equips stakeholders with a comprehensive understanding of the competitive landscape, facilitating informed decisions to enhance their market positioning and formulate effective go-to-market strategies. The report imparts valuable insights into market dynamics, offering information on crucial factors such as drivers, restraints, challenges, and opportunities, enabling stakeholders to gauge the market's pulse.

The report provides insights into the following pointers:

- Analysis of key drivers and factors, such as the rapid growth of satellite constellations, requiring precise navigation and control

- Market Penetration: Comprehensive information on satellite ground station solutions offered by the top players in the market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the satellite ground station market

- Market Development: Comprehensive information about lucrative markets (the report analyzes the Satellite Ground Station market across varied regions)

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the satellite ground station market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the satellite ground station market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 DISRUPTIVE TRENDS SHAPING MARKET

- 2.3 KEY MARKET PARTICIPANTS: SHARED INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 2.5 GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SATELLITE GROUND STATION MARKET

- 3.2 DEFENSE SATELLITE GROUND STATION MARKET, BY END USER

- 3.3 COMMERCIAL SATELLITE GROUND STATION MARKET, BY END USER

- 3.4 SATELLITE GROUND STATION MARKET, BY HARDWARE

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rapid adoption of cloud-integrated and virtualized ground infrastructure

- 4.2.1.2 Surge in satellite deployments

- 4.2.1.3 Elevated demand for satellite-based services

- 4.2.1.4 Need for Earth observation imagery and analytics

- 4.2.2 RESTRAINTS

- 4.2.2.1 Stringent regulatory and certification requirements

- 4.2.2.2 Substantial installation and maintenance costs

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Integration of optical and quantum communication technologies

- 4.2.3.2 AI-driven automation and intelligent network orchestration

- 4.2.4 CHALLENGES

- 4.2.4.1 Increasing network complexity from multi-orbit and multi-constellation operations

- 4.2.4.2 Weather-related signal disruptions and environmental constraints

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTER-CONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL SPACE INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 R&D ENGINEERS

- 5.3.2 RAW MATERIAL SUPPLIERS

- 5.3.3 COMPONENT/PRODUCT MANUFACTURERS

- 5.3.4 ASSEMBLERS, INTEGRATORS, AND SERVICE PROVIDERS

- 5.3.5 END USERS

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 PROMINENT COMPANIES

- 5.4.2 PRIVATE AND SMALL ENTERPRISES

- 5.4.3 END USERS

- 5.5 TRADE DATA

- 5.5.1 IMPORT SCENARIO (HS CODE 880260)

- 5.5.2 EXPORT SCENARIO (HS CODE 880260)

- 5.6 KEY CONFERENCES AND EVENTS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 PRICING ANALYSIS

- 5.8.1 INDICATIVE PRICING ANALYSIS, BY PLATFORM

- 5.8.2 INDICATIVE PRICING ANALYSIS, BY REGION

- 5.9 USE CASE ANALYSIS

- 5.9.1 REAL-TIME EARTH OBSERVATION DATA DOWNLINK FOR CLIMATE AND DISASTER MONITORING

- 5.9.2 MULTI-ORBIT CONNECTIVITY AND GSAAS FOR LEO CONSTELLATIONS

- 5.9.3 SECURE GOVERNMENT AND DEFENSE COMMUNICATIONS NETWORK EXPANSION

- 5.10 BUSINESS MODELS

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 VIRTUALIZED GROUND STATIONS

- 6.1.2 OPTICAL GROUND STATIONS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 EDGE COMPUTING AND CLOUD INTEGRATION

- 6.2.2 PHASED-ARRAY AND ELECTRONICALLY STEERABLE ANTENNAS

- 6.3 TECHNOLOGY TRENDS

- 6.4 PATENT ANALYSIS

- 6.5 FUTURE APPLICATIONS

- 6.6 IMPACT OF AI/GEN AI

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES

- 6.6.3 CASE STUDIES OF AI IMPLEMENTATION

- 6.6.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT GEN AI/GEN AI

- 6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.7.1 AMAZON WEB SERVICES: PIONEERING CLOUD-NATIVE GROUND INFRASTRUCTURE

- 6.7.2 KONGSBERG SATELLITE SERVICES: BUILDING WORLD'S MOST EXTENSIVE GROUND NETWORK

- 6.7.3 MICROSOFT AZURE ORBITAL: INTEGRATING SPACE CONNECTIVITY WITH CLOUD INTELLIGENCE

7 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 7.1 DECISION-MAKING PROCESS

- 7.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 7.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 7.2.2 BUYING CRITERIA

- 7.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

8 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 INDUSTRY STANDARDS

- 8.2 SUSTAINABILITY INITIATIVES

- 8.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 8.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

9 SATELLITE GROUND STATION MARKET, BY PLATFORM

- 9.1 INTRODUCTION

- 9.2 FIXED

- 9.2.1 EXPANSION OF HIGH-THROUGHPUT SATELLITE CONSTELLATIONS AND CLOUD-INTEGRATED GATEWAY NETWORKS

- 9.2.2 USE CASE: NATIONAL SATELLITE COMMUNICATION GATEWAY

- 9.3 PORTABLE 93 9.3.1 HEIGHTENED DEMAND FOR FIELD-DEPLOYABLE, REAL-TIME COMMUNICATION SYSTEMS

- 9.3.2 USE CASE: RAPID-DEPLOYMENT SATCOM FOR DISASTER RESPONSE

- 9.3.3 HAND-HELD

- 9.3.4 BACKPACK/BAG-MOUNTED

- 9.4 MOBILE

- 9.4.1 RAPID ADOPTION OF AGILE AND TACTICAL SATELLITE COMMUNICATION SYSTEMS

- 9.4.2 USE CASE: DEPLOYABLE GROUND INFRASTRUCTURE FOR US SPACE FORCE

- 9.4.3 VEHICLE-MOUNTED

- 9.4.3.1 Groundborne

- 9.4.3.2 Shipborne

- 9.4.3.3 Airborne

- 9.4.4 CONTAINER/TRAILER-MOUNTED

10 SATELLITE GROUND STATION MARKET, BY SOLUTION

- 10.1 INTRODUCTION

- 10.2 HARDWARE

- 10.2.1 INCREASED OPERATIONAL EFFICIENCY IN SCIENTIFIC MISSIONS

- 10.2.2 ANTENNA SYSTEMS

- 10.2.3 RF SYSTEMS

- 10.2.3.1 Transmit RF systems

- 10.2.3.2 Receiver RF systems

- 10.2.3.3 System clocks

- 10.2.4 BASEBAND & RECORDING HARDWARE

- 10.2.5 STORAGE & NETWORKING UNITS

- 10.2.6 POWER & RACKS

- 10.3 SOFTWARE

- 10.3.1 GROWING ADOPTION OF VIRTUALIZED AND SOFTWARE-DEFINED GROUND SYSTEMS

- 10.3.2 MISSION CONTROL & FLIGHT DYNAMICS

- 10.3.3 BASEBAND/VIRTUAL MODEMS & WAVEFORMS

- 10.3.4 CYBERSECURITY & KEY MANAGEMENT

- 10.3.5 NETWORK M&C/ORCHESTRATION

- 10.4 GROUND STATION AS A SERVICE

- 10.4.1 RISING DEMAND FOR ON-DEMAND, CLOUD-INTEGRATED SATELLITE OPERATIONS

- 10.4.2 CONTACT/PASS SERVICES

- 10.4.3 DATA HANDLING & DELIVERY

- 10.4.4 MISSION OPERATIONS & VALUE-ADDED SERVICES

11 SATELLITE GROUND STATION MARKET, BY FUNCTION

- 11.1 INTRODUCTION

- 11.2 NAVIGATION

- 11.2.1 NEED FOR PRECISE PNT SERVICES TO SUPPORT AVIATION, DEFENSE, AND AUTONOMOUS SYSTEMS

- 11.2.2 USE CASE: ENHANCING GNSS INTEGRITY FOR AVIATION SAFETY

- 11.3 EARTH OBSERVATION

- 11.3.1 DEMAND FOR REAL-TIME, HIGH-RESOLUTION GEOSPATIAL INTELLIGENCE FROM COMMERCIAL AND GOVERNMENT SECTORS

- 11.3.2 USE CASE: RAPID DOWNLINK FOR DISASTER MONITORING

- 11.4 COMMUNICATION

- 11.4.1 RISE IN BANDWIDTH DEMAND AND EXPANSION OF MULTI-ORBIT BROADBAND NETWORKS

- 11.4.2 USE CASE: GLOBAL BROADBAND THROUGH MULTI-ORBIT GATEWAYS

- 11.5 SPACE RESEARCH

- 11.5.1 SCIENTIFIC MISSIONS AND DEEP-SPACE EXPLORATION PROGRAMS REQUIRING HIGH-PRECISION TT&C INFRASTRUCTURE

- 11.5.2 USE CASE: DEEP-SPACE TRACKING FOR LUNAR SURFACE MISSIONS

- 11.6 OTHER FUNCTIONS

12 SATELLITE GROUND STATION MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 DEFENSE

- 12.2.1 NEED FOR RESILIENT, MOBILE SATCOM TO SUPPORT BATTLEFIELD CONNECTIVITY AND ISR OPERATIONS

- 12.2.2 USE CASE: TACTICAL SATCOM MODERNIZATION FOR MILITARY OPERATIONS

- 12.2.3 AIR FORCE

- 12.2.4 ARMY

- 12.2.5 NAVY

- 12.3 GOVERNMENT

- 12.3.1 RELIANCE ON SATELLITE CONNECTIVITY FOR DISASTER RESPONSE AND EMERGENCY COMMUNICATION

- 12.3.2 USE CASE: SATELLITE-BASED EARLY WARNING AND PUBLIC SAFETY MONITORING

- 12.3.3 PUBLIC SAFETY & CIVIL AGENCIES

- 12.3.4 SPACE AGENCIES & RESEARCH CENTERS

- 12.4 COMMERCIAL

- 12.4.1 EXPANSION OF MULTI-ORBIT SATELLITE CONSTELLATIONS REQUIRING SCALABLE, HIGH-THROUGHPUT GATEWAY INFRASTRUCTURE

- 12.4.2 USE CASE: EXPANDING GLOBAL BROADBAND THROUGH MULTI-ORBIT GATEWAY DEPLOYMENT

- 12.4.3 SATELLITE & TELEPORT OPERATORS

- 12.4.4 CARRIERS & SERVICE PROVIDERS

- 12.4.5 ENTERPRISES & MOBILITY

13 SATELLITE GROUND STATION MARKET, BY FREQUENCY

- 13.1 INTRODUCTION

- 13.2 X-BAND

- 13.2.1 USE OF SECURE, WEATHER-RESILIENT LINKS IN DEFENSE, GOVERNMENT, AND EARTH OBSERVATION MISSIONS

- 13.3 C-BAND

- 13.3.1 EXPANSION OF HYBRID TERRESTRIAL-SATELLITE NETWORKS BY TELECOM OPERATORS

- 13.4 S-BAND

- 13.4.1 SURGE IN SMALL-SATELLITE DEPLOYMENTS AND COMMERCIAL LAUNCH CADENCE

- 13.5 L-BAND

- 13.5.1 LOW-POWER, HIGH-RELIABILITY CONNECTIVITY FOR NAVIGATION AND MOBILITY SERVICES

- 13.6 KU- AND KA-BAND

- 13.6.1 RISE IN IFC, MARITIME BROADBAND, ENTERPRISE NETWORKS, AND REMOTE-INDUSTRY COMMUNICATION

- 13.7 UHF/VHF/HF-BAND

- 13.7.1 MODERNIZATION OF TACTICAL COMMUNICATION ARCHITECTURES

- 13.8 OPTICAL /LASER

- 13.8.1 CRITICAL ROLE OF ULTRA-HIGH-SPEED, SECURE, AND INTERFERENCE-FREE SATELLITE DATA LINKS

- 13.9 OTHER FREQUENCY BANDS

14 SATELLITE GROUND STATION MARKET, BY ORBIT

- 14.1 INTRODUCTION

- 14.2 LEO

- 14.2.1 LARGE-SCALE DEPLOYMENT IN COMMUNICATIONS SATELLITES

- 14.3 MEO

- 14.3.1 HIGH DEMAND FOR NAVIGATION SATELLITES

- 14.4 GEO

- 14.4.1 EXTENSIVE USE IN BROADCAST, ENTERPRISE CONNECTIVITY, MOBILITY, AND DEFENSE COMMUNICATION

- 14.5 OTHER ORBITS

15 SATELLITE GROUND STATION MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 US

- 15.2.1.1 Rapid transition toward virtualized and cloud-integrated ground infrastructure to drive market

- 15.2.2 CANADA

- 15.2.2.1 High domestic demand for satellite-based services to drive market

- 15.2.1 US

- 15.3 EUROPE

- 15.3.1 RUSSIA

- 15.3.1.1 Sovereign data security and strategic autonomy to drive market

- 15.3.2 UK

- 15.3.2.1 Proliferation of LEO/MEO constellations to drive market

- 15.3.3 GERMANY

- 15.3.3.1 Increased investments by private companies to drive market

- 15.3.4 FRANCE

- 15.3.4.1 Earth observation and science missions by domestic space agencies to drive market

- 15.3.5 REST OF EUROPE

- 15.3.1 RUSSIA

- 15.4 ASIA PACIFIC

- 15.4.1 CHINA

- 15.4.1.1 Dependence on self-made space technology to drive market

- 15.4.2 INDIA

- 15.4.2.1 Lucrative space initiatives to drive market

- 15.4.3 JAPAN

- 15.4.3.1 Growth of multi-orbit constellations to drive market

- 15.4.4 SINGAPORE

- 15.4.4.1 Fewer government restrictions to drive market

- 15.4.5 AUSTRALIA

- 15.4.5.1 Growing focus on sovereign space operations to drive market

- 15.4.6 REST OF ASIA PACIFIC

- 15.4.1 CHINA

- 15.5 MIDDLE EAST

- 15.5.1 UAE

- 15.5.1.1 Expansion of national space infrastructure to drive market

- 15.5.2 SAUDI ARABIA

- 15.5.2.1 Need for secure satellite communications to drive market

- 15.5.3 REST OF MIDDLE EAST

- 15.5.1 UAE

- 15.6 REST OF THE WORLD

- 15.6.1 AFRICA

- 15.6.1.1 Need for surveillance and security to drive market

- 15.6.2 LATIN AMERICA

- 15.6.2.1 Need for cost-effective solutions in space research to drive market

- 15.6.1 AFRICA

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 16.3 REVENUE ANALYSIS, 2021-2024

- 16.4 MARKET SHARE ANALYSIS, 2024

- 16.5 BRAND/PRODUCT COMPARISON

- 16.6 COMPANY VALUATION AND FINANCIAL METRICS

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT

- 16.7.5.1 Company footprint

- 16.7.5.2 Region footprint

- 16.7.5.3 Solution footprint

- 16.7.5.4 Function footprint

- 16.7.5.5 Orbit footprint

- 16.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING

- 16.8.5.1 List of start-ups/SMEs

- 16.8.5.2 Competitive benchmarking of start-ups/SMEs

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 16.9.2 DEALS

- 16.9.3 OTHERS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 RTX

- 17.1.1.1 Business overview

- 17.1.1.2 Products offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Deals

- 17.1.1.3.2 Others

- 17.1.1.4 MnM view

- 17.1.1.4.1 Right to win

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 GENERAL DYNAMICS CORPORATION

- 17.1.2.1 Business overview

- 17.1.2.2 Products offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches/developments

- 17.1.2.3.2 Deals

- 17.1.2.3.3 Others

- 17.1.2.4 MnM view

- 17.1.2.4.1 Right to win

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 AIRBUS

- 17.1.3.1 Business overview

- 17.1.3.2 Products offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches/developments

- 17.1.3.3.2 Deals

- 17.1.3.3.3 Others

- 17.1.3.4 MnM view

- 17.1.3.4.1 Right to win

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses and competitive threats

- 17.1.4 L3HARRIS TECHNOLOGIES, INC.

- 17.1.4.1 Business overview

- 17.1.4.2 Products offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches/developments

- 17.1.4.3.2 Deals

- 17.1.4.3.3 Others

- 17.1.4.4 MnM view

- 17.1.4.4.1 Right to win

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 LOCKHEED MARTIN CORPORATION

- 17.1.5.1 Business overview

- 17.1.5.2 Products offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches/developments

- 17.1.5.3.2 Deals

- 17.1.5.3.3 Others

- 17.1.5.4 MnM view

- 17.1.5.4.1 Right to win

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 KONGSBERG

- 17.1.6.1 Business overview

- 17.1.6.2 Products offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Product launches/developments

- 17.1.6.3.2 Deals

- 17.1.6.3.3 Others

- 17.1.7 ELBIT SYSTEMS LTD.

- 17.1.7.1 Business overview

- 17.1.7.2 Products offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Product launches/developments

- 17.1.7.3.2 Others

- 17.1.8 BOEING

- 17.1.8.1 Business overview

- 17.1.8.2 Products offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product launches/developments

- 17.1.8.3.2 Deals

- 17.1.8.3.3 Others

- 17.1.9 ASELSAN A.S.

- 17.1.9.1 Business overview

- 17.1.9.2 Products offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches/developments

- 17.1.9.3.2 Others

- 17.1.10 NORTHROP GRUMMAN

- 17.1.10.1 Business overview

- 17.1.10.2 Products offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches/developments

- 17.1.10.3.2 Deals

- 17.1.10.3.3 Others

- 17.1.11 BAE SYSTEMS

- 17.1.11.1 Business overview

- 17.1.11.2 Products offered

- 17.1.11.3 Recent developments

- 17.1.11.3.1 Product launches/developments

- 17.1.11.3.2 Deals

- 17.1.11.3.3 Others

- 17.1.12 MITSUBISHI ELECTRIC CORPORATION

- 17.1.12.1 Business overview

- 17.1.12.2 Products offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Product launches/developments

- 17.1.12.3.2 Deals

- 17.1.12.3.3 Others

- 17.1.13 THALES

- 17.1.13.1 Business overview

- 17.1.13.2 Products offered

- 17.1.13.3 Recent developments

- 17.1.13.3.1 Product launches/developments

- 17.1.13.3.2 Deals

- 17.1.13.3.3 Others

- 17.1.14 HONEYWELL INTERNATIONAL INC.

- 17.1.14.1 Business overview

- 17.1.14.2 Products offered

- 17.1.14.3 Recent developments

- 17.1.14.3.1 Product launches/developments

- 17.1.14.3.2 Deals

- 17.1.14.3.3 Others

- 17.1.15 SPACEX

- 17.1.15.1 Business overview

- 17.1.15.2 Products offered

- 17.1.15.3 Recent developments

- 17.1.15.3.1 Product launches/developments

- 17.1.15.3.2 Deals

- 17.1.15.3.3 Others

- 17.1.16 TERMA

- 17.1.16.1 Business overview

- 17.1.16.2 Products offered

- 17.1.16.3 Recent developments

- 17.1.16.3.1 Product launches/developments

- 17.1.16.3.2 Deals

- 17.1.16.3.3 Others

- 17.1.17 LEONARDO S.P.A.

- 17.1.17.1 Business overview

- 17.1.17.2 Products offered

- 17.1.17.3 Recent developments

- 17.1.17.3.1 Product launches/developments

- 17.1.17.3.2 Deals

- 17.1.17.3.3 Others

- 17.1.18 EXAIL TECHNOLOGIES

- 17.1.18.1 Business overview

- 17.1.18.2 Products offered

- 17.1.18.3 Recent developments

- 17.1.18.3.1 Product launches/developments

- 17.1.18.3.2 Deals

- 17.1.18.3.3 Others

- 17.1.19 INDRA SISTEMAS, S.A.

- 17.1.19.1 Business overview

- 17.1.19.2 Products offered

- 17.1.19.3 Recent developments

- 17.1.19.3.1 Product launches/developments

- 17.1.19.3.2 Deals

- 17.1.19.3.3 Others

- 17.1.20 AMAZON

- 17.1.20.1 Business overview

- 17.1.20.2 Products offered

- 17.1.20.3 Recent developments

- 17.1.20.3.1 Product launches/developments

- 17.1.20.3.2 Deals

- 17.1.20.3.3 Others

- 17.1.21 GMV INNOVATING SOLUTIONS S.L.

- 17.1.21.1 Business overview

- 17.1.21.2 Products offered

- 17.1.21.3 Recent developments

- 17.1.21.3.1 Deals

- 17.1.21.3.2 Others

- 17.1.22 KRATOS

- 17.1.22.1 Business overview

- 17.1.22.2 Products offered

- 17.1.22.3 Recent developments

- 17.1.22.3.1 Deals

- 17.1.22.3.2 Others

- 17.1.23 VIASAT, INC.

- 17.1.23.1 Business overview

- 17.1.23.2 Products offered

- 17.1.23.3 Recent developments

- 17.1.23.3.1 Product launches/developments

- 17.1.23.3.2 Deals

- 17.1.23.3.3 Others

- 17.1.24 SAFRAN

- 17.1.24.1 Business overview

- 17.1.24.2 Products offered

- 17.1.24.3 Recent developments

- 17.1.24.3.1 Product launches/developments

- 17.1.24.3.2 Deals

- 17.1.24.3.3 Others

- 17.1.1 RTX

- 17.2 OTHER PLAYERS

- 17.2.1 DHRUVA SPACE PRIVATE LIMITED

- 17.2.2 NORTHWOOD SPACE

- 17.2.3 INTELLIAN TECHNOLOGIES, INC.

- 17.2.4 LEAF SPACE

- 17.2.5 REMOS SPACE SYSTEMS AB

- 17.2.6 YORK SPACE SYSTEM

- 17.2.7 INFOSTELLAR

- 17.2.8 RBC SIGNALS LLC

- 17.2.9 ATSRALINTU SPACE TECHNOLOGIES

- 17.2.10 CORAC ENGINEERING

18 RESEARCH METHODOLOGY

- 18.1 RESEARCH DATA

- 18.1.1 SECONDARY DATA

- 18.1.1.1 Key data from secondary sources

- 18.1.2 PRIMARY DATA

- 18.1.2.1 Primary sources

- 18.1.2.2 Key data from primary sources

- 18.1.2.3 Breakdown of primary interviews

- 18.1.1 SECONDARY DATA

- 18.2 FACTOR ANALYSIS

- 18.2.1 DEMAND-SIDE INDICATORS

- 18.2.2 SUPPLY-SIDE INDICATORS

- 18.3 MARKET SIZE ESTIMATION

- 18.3.1 BOTTOM-UP APPROACH

- 18.3.1.1 Market size estimation methodology for demand side

- 18.3.1.2 Market size estimation methodology for GSaaS market

- 18.3.2 TOP-DOWN APPROACH

- 18.3.1 BOTTOM-UP APPROACH

- 18.4 DATA TRIANGULATION

- 18.5 RESEARCH ASSUMPTIONS

- 18.6 RESEARCH LIMITATIONS

- 18.7 RISK ASSESSMENT

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 COMPANY LONG LIST

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS