|

시장보고서

상품코드

1883937

의료기기용 플라스틱 시장 : 재질별, 원료별, 제조 공정별, 용도별, 지역별(-2030년)Medical Device Plastics Market by Material, Source, Manufacturing Process, Application, & Region - Global Forecast to 2030 |

||||||

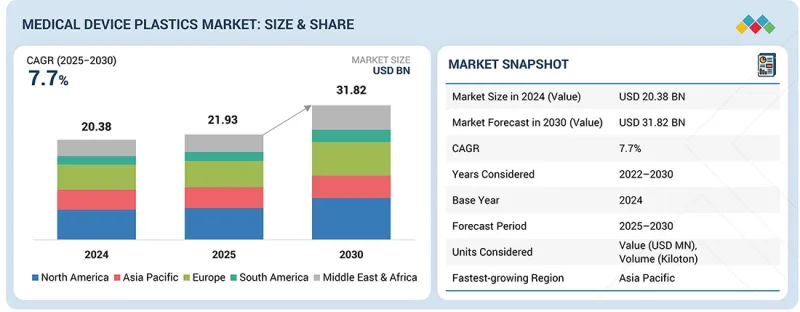

의료기기용 플라스틱 시장 규모는 2025년 219억 3,000만 달러에서 2030년까지 318억 2,000만 달러에 이를 것으로 예측됩니다.

2025-2030년까지 연평균 복합 성장률(CAGR) 7.7%로 성장할 전망입니다. 재료 유형별로, 엔지니어링 플라스틱 부문은 의료기기용 플라스틱 시장에서 두 번째 점유율을 차지합니다. 이것은 우수한 기계적 강도, 내열성, 화학적 안정성에 의해 지원된 결과입니다. 이 플라스틱은 뛰어난 치수 안정성 및 멸균 호환성을 제공하므로 내구성과 수명이 길어지는 용도에 이상적입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2022-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러), 킬로톤 |

| 부문 | 재질, 원료, 제조 공정, 용도, 지역 |

| 대상 지역 | 유럽, 북미, 아시아태평양, 중동 및 아프리카, 남미 |

게다가, 특히 진단이나 환자 모니터링 분야에 있어서, 소형화 및 고성능화된 의료기기의 채용이 진행되고 있는 것도, 엔지니어링 플라스틱 수요 증가를 뒷받침하고 있습니다. OEM이 금속을 대체하는 가볍고 비용 효율적이며 규제를 준수하는 대체 재료를 찾는 동안, 이 분야는 현대 의료기기 제조의 혁신 및 신뢰성을 지원하는 중요한 요소가 되고 있습니다.

'용도별로는 약물 전달 시스템의 부문이 가장 큰 점유율로'

용도별로는 약물 전달 시스템 부서가 최대 규모의 수익 점유율을 차지하고 시장을 선도하고 있습니다. 이러한 이점은 주사기, 카테터, 주입 시스템, 흡입기, 프리필드 약물 전달 장치 등에서 플라스틱 부품의 광범위한 사용으로 인해 발생합니다. 자기 투여형 및 저침습형 약물 전달 시스템의 보급 확대에 더하여, 지속적인 투약을 필요로 하는 만성 질환 증가 경향이 이 동향을 뒷받침하고 있습니다. 또한 마이크로 성형 및 복합재료 사출 성형 기술의 진보로 고도로 통합된 일회용 환자 친화적인 전달 장치의 제조가 가능해져, 이 분야의 의료기기 플라스틱 시장에서 주도적 지위를 더욱 확고하게 하고 있습니다.

'북미가 예측 기간 동안 최대 시장 점유율을 차지할 전망'

이것은 주로 견고한 의료 인프라, 높은 의료기기 소비, 고급 제조 생태계 때문입니다. 이 지역의 주도적 지위는 비침습성 및 약물 전달 용도를 위한 정밀 성형 플라스틱 부품에 특화된 주요 OEM 및 전문 수탁 제조업체의 존재에 의해 더욱 지원됩니다. Jabil Inc., SMC Ltd., Phillips-Medisize(Molex 산하)와 같은 주요 기업은 고급 의료 등급 사출 성형, 클린 룸 제조 및 조립 서비스를 제공하며이 시장의 최전선에 서 있습니다.

본 보고서에서는 세계의 의료기기용 플라스틱 시장을 조사했으며, 시장 개요, 시장 성장 영향요인 분석, 기술 및 특허 동향, 법 규제 환경, 사례 연구, 시장 규모 추이 및 예측, 각종 구분, 지역 및 주요 국가별 상세 분석, 경쟁 구도, 주요기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- Porter's Five Forces 분석

- 주요 이해관계자 및 구매 기준

- 거시경제지표

- 밸류체인 분석

- 생태계 분석

- 사례 연구 분석

- 규제 상황

- 기술 분석

- 고객의 사업에 영향을 주는 동향 및 혁신

- 무역 분석

- 주요 회의 및 이벤트(2025-2026년)

- 가격 분석

- 투자 및 자금 조달 시나리오

- 특허 분석

- 미국 관세가 의료기기 플라스틱 시장에 미치는 영향(2025년)

제6장 의료기기용 플라스틱 시장 : 재질별

- 표준 플라스틱

- 엔지니어링 플라스틱

- 특수 플라스틱

제7장 의료기기용 플라스틱 시장 : 원료별

- 화석연료 베이스

- 바이오 베이스

제8장 의료기기용 플라스틱 시장 : 제조 공정별

- 압출

- CNC 가공

- 사출 성형

- 진공 주조

- 열 성형

- 블로우 성형

- 기타

제9장 의료기기용 플라스틱 시장 : 용도별

- 진단 기기

- 수술 기구

- 전달 시스템

- 포인트 오브 케어 디바이스

- 웨어러블 의료기기

- 의료기기 하우징

- 기타

제10장 의료기기용 플라스틱 시장 : 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 이탈리아

- 영국

- 스페인

- 기타

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

- 중동 및 아프리카

- 사우디아라비아

- 기타 GCC 국가

- 남아프리카

- 기타

제11장 경쟁 구도

- 개요

- 주요 기업의 전략 및 유력 기업

- 수익 분석

- 시장 점유율 분석

- 브랜드 및 제품 비교

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업 및 중소기업

- 기업 평가 및 재무지표

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 기업

- JABIL INC.

- PHILLIPS MEDISIZE

- DONATELLE PLASTICS, LLC.

- FLEX LTD.

- BEMIS MANUFACTURING COMPANY

- NOLATO AB

- TRELLEBORG AB

- FREUDENBERG GROUP

- VIANT

- SMC LTD

- 기타 기업

- ACCU-MOLD

- APL MANUFACTURING INC.

- C&J INDUSTRIES

- EUROPLAZ

- GE SHEN CORPORATION

- HOCHUEN MEDICAL

- HOFFER PLASTICS

- KAYSUN CORPORATION

- MACK MOLDING CO.

- PUTNAM PLASTICS

- THE RODON GROUP

- ROSTI GROUP AB

- SEASKYMEDICAL

- TECHNIMARK LLC.

- TESSY PLASTICS

제13장 부록

AJY 25.12.17The medical device plastics market is estimated to be worth USD 21.93 billion in 2025 and is projected to reach USD 31.82 billion by 2030, growing at a CAGR of 7.7% from 2025 to 2030. The engineering plastics segment holds the second-largest share in the medical device plastics market based on material type, driven by its superior mechanical strength, heat resistance, and chemical stability. These plastics offer excellent dimensional stability and sterilization compatibility, making them ideal for applications requiring durability and long service life.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Material, Source, Manufacturing Process, Application, and Region |

| Regions covered | Europe, North America, Asia Pacific, the Middle East & Africa, and South America |

Furthermore, the growing adoption of miniaturized and high-performance medical devices, especially in diagnostics and patient monitoring, continues to boost demand for engineering plastics. As OEMs seek lightweight, cost-effective, and regulatory-compliant alternatives to metals, this segment remains a critical enabler of innovation and reliability in modern medical device manufacturing.

''In terms of value, the drug delivery systems segment accounted for the largest share of the overall medical device plastic market.''

The drug delivery systems segment leads the medical device plastics market in terms of application, accounting for the largest revenue share. This dominance is driven by the widespread use of plastic-based components in syringes, catheters, infusion systems, inhalers, and prefilled drug delivery devices. The increasing adoption of self-administrative and minimally invasive drug delivery systems, along with the rising prevalence of chronic diseases requiring continuous medication, is driving this trend. Additionally, advances in micro-molding and multi-material injection technologies are enabling the production of highly integrated, disposable, and patient-friendly delivery devices, further solidifying this segment's leadership in the medical device plastics market.

"North America is projected to account for the largest market share during the forecast period".

North America dominates the medical device plastics market, holding the largest regional share, primarily due to its strong healthcare infrastructure, high medical device consumption, and advanced manufacturing ecosystem. The region's leadership is further supported by the presence of major OEMs and specialized contract manufacturers that focus on precision-molded plastic components for noninvasive and drug delivery applications. Key players such as Jabil Inc., SMC Ltd., and Phillips-Medisize (a Molex company) are at the forefront of this market, offering advanced medical-grade injection molding, cleanroom manufacturing, and assembly services.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type: Tier 1 - 60%, Tier 2 - 20%, and Tier 3 - 20%

- By Designation: C Level - 33%, Director Level - 33%, and Managers - 34%

- By Region: North America - 20%, Europe - 25%, Asia Pacific - 25%, Middle East & Africa - 15%, and Latin America - 15%

The report provides a comprehensive analysis of company profiles:

Prominent companies in this market include Jabil Inc. (US), Phillips Medisize (US), Donatelle Plastics, LLC (US), Spectrum Plastics Group (US), Bemis Manufacturing Company (US), Nolato (Sweden), Trelleborg AB (Sweden), Freudenberg Medical (US), Viant (US), and SMC Ltd. (US).

Study Coverage

This research report categorizes the medical device plastics market by material type (standard plastics, engineering plastics, and other specialty types), source (fossil-based and bio-based), manufacturing process (extrusion, CNC machining, injection molding, vacuum casting, thermoforming, blow molding, and other manufacturing processes), application (diagnostics equipment, surgical instruments, delivery systems, point-of-care devices, wearable medical devices, medical device housings, and other applications), an region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The scope of the report includes detailed information about the major factors influencing the growth of the medical device plastics market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted in order to provide insights into their business overview, solutions, and services, key strategies, contracts, partnerships, and agreements. Product launches, mergers and acquisitions, and recent developments in the medical device plastics market are all covered. This report includes a competitive analysis of upcoming startups in the medical device plastics market ecosystem.

Reasons to Buy this Report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall medical device plastics market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (continuous investment in the healthcare segment, growing aging population, and chronic diseases), restraints (volatility in raw material prices), opportunities (contract manufacturing boom), and challenges (quality and biocompatibility testing, skilled workforce, and technology gaps).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and service launches in the medical device plastics market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the medical device plastics market across varied regions.

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the medical device plastics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Jabil Inc. (US), Phillips Medisize (US), Donatelle Plastics, LLC (US), Spectrum Plastics Group (US), Bemis Manufacturing Company (US), Nolato (Sweden), Trelleborg AB (Sweden), Freudenberg Medical (US), Viant (US), and SMC Ltd. (US) in the medical device plastics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 UNITS CONSIDERED

- 1.3.4.1 Currency/Value unit

- 1.3.4.2 Volume unit

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MEDICAL DEVICE PLASTICS MARKET

- 4.2 MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL

- 4.3 MEDICAL DEVICE PLASTICS MARKET, BY SOURCE

- 4.4 MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS

- 4.5 MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION

- 4.6 MEDICAL DEVICE PLASTICS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for single-use and disposable medical devices due to infection-control protocols and preparedness

- 5.2.1.2 Rising investments in healthcare infrastructure globally

- 5.2.1.3 Industrialization and infrastructure growth in emerging economies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Environmental concerns and growing pressure to reduce plastic waste and adopt sustainable alternatives

- 5.2.2.2 Stringent regulatory and quality standards mandating extensive biocompatibility and sterilization testing

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of plastics into smart devices, microfluidics, and wearable health monitors

- 5.2.3.2 Customization via 3D printing/additive manufacturing and advanced molding for patient-specific solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Balancing between cost-efficiency, device safety, and recyclability to meet healthcare needs

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 MEDICAL DEVICE PROTOTYPING WITH MANTLE 3D METAL TOOLING

- 5.8.2 REDESIGNING CELLULAR OXYGEN SENSORS FOR HOSPITAL USE

- 5.8.3 LEVERAGING PLASTIC THERMOFORMING FOR ADVANCED MEDICAL DIAGNOSTIC ENCLOSURES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATIONS

- 5.9.1.1 Europe

- 5.9.1.2 Asia Pacific

- 5.9.1.3 North America

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.1 REGULATIONS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Over molding and micro molding

- 5.10.1.2 3D printing (Additive manufacturing)

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Microfluidics and lab-on-a-chip technology

- 5.10.2.2 Embedded electronics and smart sensors

- 5.10.1 KEY TECHNOLOGIES

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.12 TRADE ANALYSIS

- 5.12.1 EXPORT SCENARIO

- 5.12.2 IMPORT SCENARIO

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 PRICING ANALYSIS

- 5.14.1 AVERAGE SELLING PRICE TREND OF MEDICAL DEVICE PLASTICS, BY REGION, 2022-2024

- 5.14.2 AVERAGE SELLING PRICE TREND OF MEDICAL DEVICE PLASTICS, BY APPLICATION, 2022-2024

- 5.14.3 AVERAGE SELLING PRICES OF MEDICAL DEVICE PLASTICS OFFERED BY KEY PLAYERS, BY APPLICATION, 2024

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 PATENT ANALYSIS

- 5.16.1 APPROACH

- 5.16.2 DOCUMENT TYPES

- 5.16.3 PUBLICATION TRENDS, 2014-2024

- 5.16.4 INSIGHTS

- 5.16.5 LEGAL STATUS OF PATENTS

- 5.16.6 JURISDICTION ANALYSIS, 2014-2024

- 5.16.7 TOP COMPANIES/APPLICANTS

- 5.16.8 TOP 10 PATENT OWNERS (US), 2014-2024

- 5.17 IMPACT OF 2025 US TARIFF ON MEDICAL DEVICE PLASTICS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON KEY COUNTRIES/REGIONS

- 5.17.4.1 North America

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 MEDICAL DEVICE PLASTICS MARKET, BY MATERIAL

- 6.1 INTRODUCTION

- 6.2 STANDARD PLASTICS

- 6.2.1 INCREASE IN USE OF STANDARD PLASTICS IN GLOBAL MEDICAL DEVICE MARKET

- 6.3 ENGINEERING PLASTICS

- 6.3.1 CRITICAL PERFORMANCE AND ECONOMIC DRIVERS TO INCREASE DEMAND

- 6.4 SPECIALTY PLASTICS

- 6.4.1 RISE OF BIORESORBABLE POLYMERS IN NEXT-GENERATION MEDICAL APPLICATIONS

7 MEDICAL DEVICE PLASTICS MARKET, BY SOURCE

- 7.1 INTRODUCTION

- 7.2 FOSSIL-BASED

- 7.2.1 PROVEN PERFORMANCE TO SUSTAIN DEMAND

- 7.3 BIO-BASED

- 7.3.1 GREEN CHEMISTRY ACCELERATES ADOPTION OF BIO-ORIGIN POLYMERS IN HEALTHCARE

8 MEDICAL DEVICE PLASTICS MARKET, BY MANUFACTURING PROCESS

- 8.1 INTRODUCTION

- 8.2 EXTRUSION

- 8.2.1 HIGH-PERFORMANCE EXTRUSION ENSURES CONSISTENCY IN MEDICAL-GRADE DEVICE PLASTICS

- 8.3 CNC MACHINING

- 8.3.1 HIGH-PERFORMANCE CNC SYSTEMS ENHANCE PRODUCT INTEGRITY FOR IMPLANTABLE AND DIAGNOSTIC PARTS

- 8.4 INJECTION MOLDING

- 8.4.1 INJECTION MOLDING REMAINS BACKBONE OF COST-EFFECTIVE DEVICE MANUFACTURING

- 8.5 VACUUM CASTING

- 8.5.1 VACUUM-ASSISTED FORMING ENSURES PRECISE DETAIL AND SMOOTH FINISHES IN LARGE MEDICAL COMPONENTS

- 8.6 THERMOFORMING

- 8.6.1 VERSATILITY OF THERMOFORMING SUPPORTS QUICK CUSTOMIZATION IN HEALTHCARE EQUIPMENT

- 8.7 BLOW MOLDING

- 8.7.1 ENSURES SEAMLESS, LEAK-PROOF MEDICAL BOTTLES AND IV CONTAINERS

- 8.8 OTHER MANUFACTURING PROCESSES

9 MEDICAL DEVICE PLASTICS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 DIAGNOSTIC EQUIPMENT

- 9.2.1 TRANSPARENT POLYMERS ENHANCE ACCURACY AND MINIATURIZATION IN DIAGNOSTIC DEVICES

- 9.3 SURGICAL INSTRUMENTS

- 9.3.1 STERILIZABLE PLASTICS ENHANCE PERFORMANCE IN REUSABLE AND SINGLE-USE INSTRUMENTS

- 9.4 DELIVERY SYSTEMS

- 9.4.1 SMART DELIVERY DEVICES RELY ON HIGH-PERFORMANCE AND FLEXIBLE PLASTIC DESIGNS

- 9.5 POINT-OF-CARE DEVICES

- 9.5.1 SMART POLYMER HOUSINGS ENABLE REAL-TIME DATA TRANSMISSION IN POC DEVICES

- 9.6 WEARABLE MEDICAL DEVICES

- 9.6.1 CONDUCTIVE PLASTICS INTEGRATE ELECTRONICS INTO SEAMLESS WEARABLE DESIGNS

- 9.7 MEDICAL DEVICE HOUSINGS

- 9.7.1 MECHANICAL STRENGTH, STERILIZATION RESISTANCE, AND AESTHETIC DESIGN FLEXIBILITY TO DRIVE DEMAND

- 9.8 OTHER APPLICATIONS

10 MEDICAL DEVICE PLASTICS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Growing aging population and strong manufacturing base to drive market

- 10.2.2 CANADA

- 10.2.2.1 High demand from aging population for chronic care and surgical procedures to boost market

- 10.2.3 MEXICO

- 10.2.3.1 Rising healthcare expenditure to drive market

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 High expenditure in medical infrastructure to fuel market growth

- 10.3.2 FRANCE

- 10.3.2.1 Growing demand for high-quality medical devices to boost market growth

- 10.3.3 ITALY

- 10.3.3.1 Government support and initiatives to drive demand

- 10.3.4 UK

- 10.3.4.1 Need for advancements in medical injection molding, rapid prototyping, and additive manufacturing to drive market

- 10.3.5 SPAIN

- 10.3.5.1 Government-financed healthcare spending to drive market for medical device plastics

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Advanced manufacturing and healthcare expansion to create new opportunities

- 10.4.2 JAPAN

- 10.4.2.1 Aging population to drive demand for advanced medical plastics

- 10.4.3 INDIA

- 10.4.3.1 Rising domestic manufacturing and policy support to drive demand

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Technological innovation and government support to drive growth

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Rising healthcare modernization to drive demand

- 10.5.2 ARGENTINA

- 10.5.2.1 Local manufacturing capacity to drive demand

- 10.5.3 REST OF SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 SAUDI ARABIA

- 10.6.1.1 Healthcare expansion and localization under vision 2030 to drive demand

- 10.6.2 REST OF GCC COUNTRIES

- 10.6.3 SOUTH AFRICA

- 10.6.4 REST OF MIDDLE EAST & AFRICA

- 10.6.1 SAUDI ARABIA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Material footprint

- 11.6.5.4 Source footprint

- 11.6.5.5 Manufacturing process footprint

- 11.6.5.6 Application footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 JABIL INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 PHILLIPS MEDISIZE

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 DONATELLE PLASTICS, LLC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses and competitive threats

- 12.1.4 FLEX LTD.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Right to win

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 BEMIS MANUFACTURING COMPANY

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threat

- 12.1.6 NOLATO AB

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.4 MnM view

- 12.1.6.4.1 Key strengths

- 12.1.6.4.2 Strategic choices

- 12.1.6.4.3 Weaknesses and competitive threat

- 12.1.7 TRELLEBORG AB

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Expansions

- 12.1.7.4 MnM view

- 12.1.7.4.1 Key strengths

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses and competitive threats

- 12.1.8 FREUDENBERG GROUP

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 MnM view

- 12.1.8.3.1 Right to win

- 12.1.8.3.2 Strategic choices

- 12.1.8.3.3 Weaknesses and competitive threats

- 12.1.9 VIANT

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 MnM view

- 12.1.9.3.1 Right to win

- 12.1.9.3.2 Strategic choices

- 12.1.9.3.3 Weaknesses and competitive threats

- 12.1.10 SMC LTD

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 MnM view

- 12.1.10.3.1 Right to win

- 12.1.10.3.2 Strategic choices

- 12.1.10.3.3 Weaknesses and competitive threats

- 12.1.1 JABIL INC.

- 12.2 OTHER PLAYERS

- 12.2.1 ACCU-MOLD

- 12.2.2 APL MANUFACTURING INC.

- 12.2.3 C&J INDUSTRIES

- 12.2.4 EUROPLAZ

- 12.2.5 GE SHEN CORPORATION

- 12.2.6 HOCHUEN MEDICAL

- 12.2.7 HOFFER PLASTICS

- 12.2.8 KAYSUN CORPORATION

- 12.2.9 MACK MOLDING CO.

- 12.2.10 PUTNAM PLASTICS

- 12.2.11 THE RODON GROUP

- 12.2.12 ROSTI GROUP AB

- 12.2.13 SEASKYMEDICAL

- 12.2.14 TECHNIMARK LLC.

- 12.2.15 TESSY PLASTICS

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS