|

시장보고서

상품코드

1887990

비뇨기과 의료기기 시장 : 제품별, 용도별, 최종 사용자별, 지역별 - 예측(-2030년)Urology Devices Market by Product (Dialysis, Laser, Lithotripsy, Robotic, Insufflators, Guidewires, Catheters, Stents, Implants), Application (Kidney Diseases, Cancer, Pelvic Organ Prolapse, BPH, Stones), End User and Region - Global Forecast to 2030 |

||||||

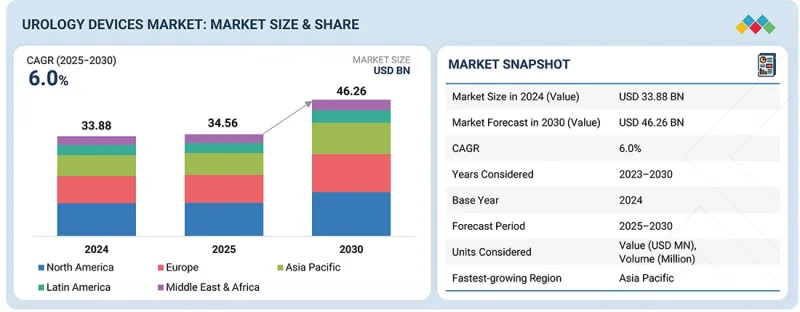

세계의 비뇨기과 의료기기 시장 규모는 2025년에 345억 6,000만 달러에 달할 것으로 추정되고, 예측 기간 동안 CAGR 6.0%로 성장을 지속할 것으로 예측되며, 2030년까지 462억 6,000만 달러에 이를 것으로 전망되고 있습니다.

당뇨병과 고혈압을 포함한 만성 대사성 질환 및 심혈관 질환의 유병률이 증가함에 따라 신속한 진단 평가 및 수술 개입이 필요한 비뇨기과 질환의 발생률이 현저하게 증가하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 제품별, 용도별, 최종 사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

질병 진행을 예방하고 환자의 치료 성과를 최적화하기 위해서는 즉각적이고 증거 기반 임상 관리가 필수적입니다. 동시에, 로봇 지원 수술, 내시경적 개입, 경피적 치료법을 포함한 저침습 비뇨기과 기술의 채용이 가속화됨에 따라, 수술의 안전성, 진단 정밀도, 치료 효과를 보증하는 정밀한 비뇨기과 의료기기에 대한 수요가 대폭 증가하고 있습니다.

제품 카테고리별로는 예측 기간에 소모품 및 부속품 부문이 비뇨기과 의료기기 시장에서 가장 높은 성장률을 나타낼 것으로 전망되고 있습니다.

비뇨기과 의료기기 시장은 제품에 따라 기구와 소모품 및 부속품으로 이분됩니다. 소모품 및 부속품 부문은 높은 CAGR로 확대될 것으로 예측됩니다. 이 부문의 높은 성장률은 증가하는 만성 비뇨기 질환의 유병률을 관리하기 위한 혁신적인 솔루션 개발에 초점을 맞춘 연구개발 활동 증가 때문입니다. 또한, 재사용 가능한 소모품, 장비의 표준화 및 치료 효율성에 대한 중시가 고조됨에 따라 세계 병원, 수술센터 및 외래 시설에서 소모품에 대한 수요가 증가하고 있습니다.

최종 사용자별로 비뇨기과 의료기기 시장은 병원, 외래수술센터(ASCs), 클리닉, 투석 센터, 재택 치료 시설로 구분됩니다. 투석 센터가 가장 높은 성장률을 보이고 있으며, 이러한 가속 성장은 말기 신부전(ESRD) 관리에 필요한 고급 투석 장비 및 전문 시설에 대한 수요가 크게 증가했기 때문입니다. 세계적으로 만성 신장병의 유병률이 증가하고 있는 것 외에, 당뇨병 및 고혈압의 이환율 상승이 신부전 증례를 증가시키고 있기 때문에 보다 많은 투석 센터 및 시설 인프라의 확충이 급무가 되고 있습니다. 게다가 투석 기술의 진보, 치료 프로토콜의 개선, 환자 의식의 높아짐과 더불어 새로운 투석 시설과 최신 기기에 대한 투자를 촉진하고 있어, 투석 센터 부문은 세계의 비뇨기과 의료기기 시장에서 가장 성장이 빠른 최종 사용자 카테고리로서 대두해 왔습니다.

예측 기간 동안 아시아태평양은 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 이러한 가속적인 지역 성장은 고도의 비뇨기과적 개입을 필요로 하는 노인 인구의 상당한 증가, 신장 질환의 유병률 증가, 지역 전체에서 수백만 명에 영향을 미치는 만성 신장 질환(CKD)에 의한 심각한 질병 부담, 의료비 지출과 1인당 소득 수준의 급격한 신속한 증가, 치료 기술에 대한 소비자 수요 증가, 아시아태평양 국가의 의료 서비스가 부족한 농촌 지역으로의 민간 병원 네트워크의 전략적 확대, 미개척 가능성을 지닌 신흥 고성장 시장의 존재 등이 있습니다. 또한 의료 접근 개선, 의료 인프라 정비를 지원하는 정부 시책, 첨단 비뇨기 치료 옵션에 대한 환자 의식이 높아짐에 따라 아시아태평양은 세계적으로 가장 역동적이고 급성장하는 비뇨기 장비 시장으로서의 지위를 확립하고 있습니다.

공급측의 1차 인터뷰 내역(기업 유형, 직위, 지역별 :

- * 기업 규모별 : Tier 1(40%), Tier 2(30%), Tier 3(20%)

- * 직책별 : 경영 간부(27%), 부장급(18%), 기타(55%)

- 지역별 : 북미(51%), 유럽(21%), 아시아태평양(18%), 라틴아메리카(6%), 중동 및 아프리카(4%)

이 보고서에서 다룬 기업 목록

- Fresenius Medical Care AG & Co. KGaA(Germany)

- Boston Scientific Corporation(US)

- Becton, Dickinson and Company(US)

- B. Braun Melsungen AG(Germany)

- Cardinal Health(US)

- Olympus Corporation(Japan)

- Intuitive Surgical(US)

- Coloplast A/S(Denmark)

- Stryker Corporation(US)

- Teleflex Incorporated(US)

- Convatec Group PLC(UK)

- Medtronic PLC(Ireland)

- Karl Storz(Germany)

- Cook Medical(US)

- Richard Wolf GmbH(Germany)

- CompactCath(US)

- Dornier MedTech(Germany)

- Well Lead Medical(China)

- ROCAMED(Germany)

- Amniso International, Inc.(US)

- Medispec(US)

- Vimex Sp. z oo(Poland)

- Balton Sp. z oo(Poland)

- Hunter Urology(UK)

- Ribbel International Ltd.(India)

조사 범위

본 조사 보고서에서는 비뇨기과 의료기기 시장을 제품별(기구, 소모품 및 부속품), 용도별(신장 질환, 비뇨기암, 골반장기탈, 전립선 비대증, 요실금, 발기 부전, 요로 결석, 기타 용도), 최종 사용자별(병원, 외래수술센터 및 클리닉, 투석 센터, 재택 의료), 지역별(북미, 유럽, 아시아태평양, 중남미, 중동 및 아프리카)로 분류하고 있습니다. 이 보고서의 범위는 비뇨기과 의료기기 시장의 성장에 영향을 미치는 주요 요인(추진 요인, 시장 성장 억제요인, 성장 기회, 과제 등)에 대한 자세한 정보를 다룹니다. 주요 업계 진출기업의 상세한 분석을 실시해, 각사의 사업 개요, 솔루션 서비스, 주요 전략, 인수, 계약에 관한 인사이트를 제공합니다. 비뇨기과용 의료기기 시장과 관련된 신제품 출시와 최근의 동향에 대해서도 기재하고 있습니다. 본 보고서에서는 비뇨기과용 의료기기 시장 생태계에서의 신흥 스타트업 기업의 경쟁 분석도 다루고 있습니다.

이 보고서 구매의 주요 이점

이 보고서는 시장 리더 및 신규 진출 기업에게 비뇨기과 의료기기 시장 전체 및 하위 부문의 수익 규모에 대한 가장 정확한 추정치를 제공합니다. 이를 통해 이해관계자는 경쟁 구도를 이해하고 자사의 포지셔닝 강화 및 적절한 시장 진출 전략의 입안을 위한 인사이트를 얻을 수 있습니다. 또한 시장 동향을 파악하고 주요 시장 성장 촉진요인, 제약, 과제 및 기회에 대한 정보를 제공합니다.

이 보고서는 다음 포인트에 대한 인사이트를 제공합니다.

- 비뇨기과 의료기기 시장의 성장에 영향을 미치는 주요 시장 성장 촉진요인(비뇨기 질환의 발생률 상승, 저침습 수술에 대한 선호 증가, 기술 진보 및 연구개발 투자 증가, 병원 및 외과 센터 증가), 성장 억제요인(주요 기업 간 고도의 통합), 시장 기회(신흥경제국에서의 잠재적인 성장 기회), 시장 과제(주요 기업별 제품 리콜 증가, 비뇨기과의 및 훈련을 받은 전문가 부족)의 분석

- 제품 개발 및 이노베이션 : 비뇨기과 의료기기 시장에서 향후 기술 동향, 연구개발, 신제품 출시에 대한 상세한 분석을 제공합니다.

- 시장 개발 : 수익성이 높은 시장에 대한 종합적인 정보-이 보고서는 다양한 지역의 비뇨기과 의료기기 시장을 분석합니다.

- 시장 다양화 : 비뇨기과 의료기기 시장의 신제품, 미개척 지역, 최근 동향, 투자에 대한 종합적인 정보.

- 경쟁 평가 : 시장 점유율, 성장 전략 및 제품 제공에 관한 주요 기업(Fresenius Medical Care AG & Co. KGaA(Germany), Cardinal Health(US), Boston Scientific Corporation(US), Becton, Dickinson and Company(US), B. Braun Melsungen AG(Germany) 등)에 대한 자세한 평가.

자주 묻는 질문

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 시장 역학

- 고객의 비즈니스에 영향을 미치는 동향 및 혼란

- 가격 분석

- 밸류체인 분석

- 공급망 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 기술 분석

- 특허 분석

- 무역 분석

- 주된 회의 및 이벤트(2025-2026년)

- 규제 분석

- Porter's Five Forces 분석

- 주요 이해관계자 및 구매 기준

- AI 및 생성형 AI가 비뇨기과 의료기기 시장에 미치는 영향

- 미국 관세가 비뇨기과 의료기기 시장에 미치는 영향(2025년)

제6장 비뇨기과 의료기기 시장 : 제품별

- 장치

- 소모품 및 부속품

제7장 비뇨기과 의료기기 시장 : 용도별

- 신장 질환

- 비뇨기 암

- 골반장기 탈

- 양성 전립선 비대증(BPH)

- 요실금(UI)

- 발기 부전

- 요로 결석

- 기타

제8장 비뇨기과 의료기기 시장 역학 및 유병률 분석(2023-2030년)(증례 수 및 유병률)

제9장 비뇨기과 의료기기 시장 : 최종 사용자별

- 병원

- 외래수술센터(ASC)

- 클리닉

- 투석 센터

- 재택 케어

제10장 비뇨기과 의료기기 시장 : 지역별

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 거시경제 전망

- 중국

- 일본

- 인도

- 기타

- 라틴아메리카

- 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

제11장 경쟁 구도

- 개요

- 주요 참가 기업의 전략 및 강점(2022-2025년)

- 수익 분석(2022-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 및 재무지표

- 브랜드 및 제품 비교

- 기업 평가 매트릭스 : 주요 진입기업(2024년)

- 기업 평가 매트릭스 : 스타트업 및 중소기업(2024년)

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 진출기업

- FRESENIUS MEDICAL CARE AG & CO. KGAA

- BOSTON SCIENTIFIC CORPORATION

- B. BRAUN MELSUNGEN AG

- BECTON, DICKINSON AND COMPANY

- OLYMPUS CORPORATION

- CARDINAL HEALTH

- INTUITIVE SURGICAL

- COLOPLAST A/S

- STRYKER

- TELEFLEX INCORPORATED

- CONVATEC GROUP PLC

- MEDTRONIC PLC

- 기타 기업

- KARL STORZ

- COOK MEDICAL

- RICHARD WOLF GMBH

- COMPACTCATH

- DORNIER MEDTECH

- NIKKISO CO., LTD.

- DIALIFE SA

- ERBE VISION

- WELL LEAD MEDICAL CO., LTD.

- ROCAMED

- ENDOMED SYSTEMS GMBH

- AMSINO INTERNATIONAL, INC.

- MEDISPEC

- VIMEX SP. Z OO

- BALTON SP. Z OO

- HUNTER UROLOGY

- RIBBEL INTERNATIONAL LIMITED

제13장 부록

AJY 25.12.24The global urology devices market is valued at an estimated USD 34.56 billion in 2025 and is projected to reach USD 46.26 billion by 2030, at a CAGR of 6.0% during the forecast period. The rising prevalence of chronic metabolic and cardiovascular diseases, including diabetes mellitus and hypertension, has significantly escalated the incidence of urological pathologies that necessitate prompt diagnostic assessment and surgical intervention.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East & Africa |

Immediate and evidence-based clinical management is essential to prevent disease progression and optimize patient outcomes. Concurrently, the accelerating adoption of minimally invasive urological techniques, encompassing robotic-assisted procedures, endoscopic interventions, and percutaneous therapies, has substantially increased the demand for precision urology devices that ensure procedural safety, diagnostic accuracy, and therapeutic efficacy.

The consumables & accessories segment is projected to register the fastest growth rate in the urology devices market, by product category, during the forecast period.

The urology devices market is bifurcated into instruments and consumables & accessories based on product. The consumables & accessories segment is expected to expand at a higher compound annual growth rate. The high growth rate of the consumables & accessories segment is due to increased research and development initiatives focused on developing innovative solutions for managing the rising prevalence of chronic urological diseases. Additionally, the growing emphasis on reusable consumables, device standardization, and procedural efficiency has increased demand for consumables across hospitals, surgical centers, and outpatient facilities globally.

The dialysis centers segment is projected to register the highest growth rate in the urology devices market.

Based on end users, the urology devices market is segmented into hospitals, ASCs, clinics, dialysis centers, and home care settings. Dialysis centers are experiencing the highest growth rate. This accelerated growth can be attributed to the substantially increased demand for advanced dialysis equipment and specialized facilities required for managing end-stage renal disease (ESRD). The rising prevalence of chronic kidney disease globally, coupled with the escalating incidence of diabetes and hypertension driving renal failure cases, has created urgent demand for more dialysis centers and upgraded facility infrastructure. Additionally, technological advancements in dialysis technology, improved treatment protocols, and growing patient awareness are collectively driving investment in new dialysis facilities and modern equipment, thereby propelling the dialysis centers segment to emerge as the fastest-growing end-user category in the global urology devices market.

Asia Pacific is expected to be the fastest-growing region in the global urology devices market.

The Asia Pacific region is projected to register the highest CAGR during the forecast period. This accelerated regional growth is propelled by multiple interconnected factors, including the substantially rising geriatric population requiring advanced urological interventions, escalating prevalence of kidney disease, significant disease burden from chronic kidney disease (CKD) affecting millions across the region, rapidly increasing healthcare spending and per capita income levels, growing consumer demand for therapeutic technologies, strategic expansion of private-sector hospital networks into underserved rural areas across Asia Pacific countries, and the presence of emerging high-growth markets with untapped potential. Additionally, improvements in healthcare accessibility, government initiatives supporting the development of healthcare infrastructure, and rising patient awareness of advanced urological treatment options are collectively positioning the Asia Pacific region as the most dynamic and fastest-growing market for urology devices globally.

Breakdown of supply-side primary interviews, by company type, designation, and region:

- * By Company Type: Tier 1 (40%), Tier 2 (30%), and Tier 3 (20%)

- * By Designation: C Level (27%), Director Level (18%), and Others (55%)

- * By Region: North America (51%), Europe (21%), Asia Pacific (18%), Latin America (6%), and Middle East & Africa (4%)

List of Companies Profiled in the Report

- Fresenius Medical Care AG & Co. KGaA (Germany)

- Boston Scientific Corporation (US)

- Becton, Dickinson and Company (US)

- B. Braun Melsungen AG (Germany)

- Cardinal Health (US)

- Olympus Corporation (Japan)

- Intuitive Surgical (US)

- Coloplast A/S (Denmark)

- Stryker Corporation (US)

- Teleflex Incorporated (US)

- Convatec Group PLC (UK)

- Medtronic PLC (Ireland)

- Karl Storz (Germany)

- Cook Medical (US)

- Richard Wolf GmbH (Germany)

- CompactCath (US)

- Dornier MedTech (Germany)

- Well Lead Medical Co., Ltd. (China)

- ROCAMED (Germany)

- Amniso International, Inc. (US)

- Medispec (US)

- Vimex Sp. z o.o. (Poland)

- Balton Sp. z o.o. (Poland)

- Hunter Urology (UK)

- Ribbel International Ltd. (India)

Research Coverage

This research report categorizes the urology devices market by product (instruments and consumables & accessories), application (kidney diseases, urological cancer, pelvic organ prolapse, benign prostatic hyperplasia, urinary incontinence, erectile dysfunction, urinary stones and other applications), end user (hospitals, ASCS & clinics, dialysis centers and home care settings), and region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the urology devices market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions and services, key strategies, acquisitions, and agreements. New product launches and recent developments associated with the urology devices market. Competitive analysis of upcoming startups in the urology devices market ecosystem is covered in this report.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall urology devices market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Rising incidence of urological diseases, Growing preference for minimally invasive procedures, Technological advancements and increased R&D investments, Increasing number of hospitals and surgical centers) restraints (High degree of consolidation among key players), opportunities (Potential growth opportunities in emerging economies) and challenges (Increasing number of product recalls by key players, Shortage of urologists and trained professionals) influencing the growth of the urology devices market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and new product launches in the urology devices market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the urology devices market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the urology devices market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players, such as Fresenius Medical Care AG & Co. KGaA (Germany), Cardinal Health (US), Boston Scientific Corporation (US), Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany), among others in the urology devices market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 List of key secondary sources

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key objectives of primary research

- 2.1.2.2 List of primary sources

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primary interviews

- 2.1.2.5 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Revenue estimation of key players

- 2.2.1.2 Annual reports and investor presentations

- 2.2.1.3 Primary interviews

- 2.2.1.4 Growth forecast

- 2.2.1.5 CAGR projections

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.4.1 PARAMETRIC ASSUMPTIONS

- 2.4.2 GROWTH RATE ASSUMPTIONS

- 2.4.3 SCOPE-RELATED ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN UROLOGY DEVICES MARKET

- 4.2 ASIA PACIFIC UROLOGY DEVICES MARKET, BY END USER AND COUNTRY

- 4.3 UROLOGY DEVICES MARKET, BY COUNTRY

- 4.4 UROLOGY DEVICES MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising incidence of urological diseases

- 5.2.1.2 Growing preference for minimally invasive procedures

- 5.2.1.3 Technological advancements and increased R&D investments

- 5.2.1.4 Increasing number of hospitals and surgical centers

- 5.2.2 RESTRAINTS

- 5.2.2.1 High degree of consolidation among key players

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Potential growth opportunities in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing number of product recalls by key players

- 5.2.4.2 Shortage of urologists and trained professionals

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY TYPE

- 5.4.2 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.4.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Antimicrobial-coated catheters

- 5.9.1.2 Portable hemodialysis

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Smart catheters

- 5.9.2.2 Connected health & remote sensors

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Wearable artificial kidney

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA FOR HS CODE 841920

- 5.11.2 EXPORT DATA FOR HS CODE 841920

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 REGULATORY ANALYSIS

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 REGULATORY FRAMEWORK

- 5.13.2.1 North America

- 5.13.2.1.1 US

- 5.13.2.1.2 Canada

- 5.13.2.2 Europe

- 5.13.2.3 Asia Pacific

- 5.13.2.3.1 China

- 5.13.2.3.2 Japan

- 5.13.2.3.3 India

- 5.13.2.4 Latin America

- 5.13.2.4.1 Brazil

- 5.13.2.4.2 Mexico

- 5.13.2.5 Middle East

- 5.13.2.6 Africa

- 5.13.2.1 North America

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 BARGAINING POWER OF SUPPLIERS

- 5.14.2 BARGAINING POWER OF BUYERS

- 5.14.3 THREAT OF NEW ENTRANTS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 KEY BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON UROLOGY DEVICES MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 POTENTIAL OF AI

- 5.16.3 IMPACT OF AI

- 5.16.4 KEY COMPANIES IMPLEMENTING AI

- 5.16.5 FUTURE OF AI

- 5.17 IMPACT OF 2025 US TARIFF ON UROLOGY DEVICES MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 North America

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

- 5.17.5.1 Hospitals

- 5.17.5.2 Clinics

- 5.17.5.3 Ambulatory Surgical Centers (ASCs)

- 5.17.5.4 Dialysis centers

- 5.17.5.5 Home care settings

6 UROLOGY DEVICES MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 INSTRUMENTS

- 6.2.1 DIALYSIS DEVICES

- 6.2.1.1 Hemodialysis devices

- 6.2.1.1.1 Increasing use of dialysis machines to spur growth

- 6.2.1.2 Peritoneal dialysis devices

- 6.2.1.2.1 Rising technological advancements and increasing product approvals to propel market

- 6.2.1.1 Hemodialysis devices

- 6.2.2 ENDOSCOPES

- 6.2.2.1 Laparoscopes

- 6.2.2.1.1 Lower surgical site infections to support growth

- 6.2.2.2 Ureteroscopes

- 6.2.2.2.1 Increased usage of ureteroscopy for kidney stones to drive market

- 6.2.2.3 Nephroscopes

- 6.2.2.3.1 High cost of maintenance to restrain market growth

- 6.2.2.4 Resectoscopes

- 6.2.2.4.1 High prevalence of prostate, kidney, and bladder cancers to fuel market

- 6.2.2.5 Cystoscopes

- 6.2.2.5.1 Growing incidence of urological cancers to boost market

- 6.2.2.1 Laparoscopes

- 6.2.3 LASER & LITHOTRIPSY DEVICES

- 6.2.3.1 Associated benefits of lithotripsy devices to support growth

- 6.2.4 ENDOVISION & IMAGING SYSTEMS

- 6.2.4.1 Need for high-resolution images to aid growth

- 6.2.5 ROBOTIC SYSTEMS

- 6.2.5.1 Growing industry-academia collaborations to fuel market

- 6.2.6 INSUFFLATORS

- 6.2.6.1 Increasing volume of laparoscopic procedures to boost market

- 6.2.7 ENDOSCOPY FLUID MANAGEMENT SYSTEMS

- 6.2.7.1 Growing incidence of chronic diseases to drive market

- 6.2.8 URODYNAMIC SYSTEMS

- 6.2.8.1 Rising patient pool to support growth

- 6.2.9 OTHER INSTRUMENTS

- 6.2.1 DIALYSIS DEVICES

- 6.3 CONSUMABLES & ACCESSORIES

- 6.3.1 DIALYSIS CONSUMABLES

- 6.3.1.1 Growing number of dialysis procedures to fuel market

- 6.3.2 CATHETERS

- 6.3.2.1 Intermittent catheters

- 6.3.2.1.1 Rising clinical adoption of intermittent catheters to support growth

- 6.3.2.2 Indwelling catheters

- 6.3.2.2.1 Increased use in hospitals and home care settings to facilitate growth

- 6.3.2.3 External catheters

- 6.3.2.3.1 Growing preference for home-based management of chronic urinary conditions to drive market

- 6.3.2.1 Intermittent catheters

- 6.3.3 GUIDEWIRES

- 6.3.3.1 Increasing number of surgeries and development of next-generation hybrid guidewires to drive market

- 6.3.4 RETRIEVAL DEVICES & EXTRACTORS

- 6.3.4.1 Growing number of kidney stone removal surgeries to fuel market

- 6.3.5 SURGICAL DISSECTORS, FORCEPS & NEEDLE HOLDERS

- 6.3.5.1 Rise in urology procedures to support growth

- 6.3.6 DILATOR SETS & URETHRAL ACCESS SHEATHS

- 6.3.6.1 Increasing demand for effective endoscopic management of ureteral and renal calculi to aid growth

- 6.3.7 STENTS & IMPLANTS

- 6.3.7.1 Growing prevalence of urological, kidney-related disorders, and erectile dysfunction to propel market

- 6.3.8 BIOPSY DEVICES

- 6.3.8.1 High incidence of prostate cancer to contribute to growth

- 6.3.9 TUBES & DISTAL ATTACHMENTS

- 6.3.9.1 Increasing demand for endoscopy to boost market

- 6.3.10 DRAINAGE BAGS

- 6.3.10.1 Increasing prevalence of urinary incontinence and chronic kidney disease to foster growth

- 6.3.11 OTHER CONSUMABLES & ACCESSORIES

- 6.3.1 DIALYSIS CONSUMABLES

7 UROLOGY DEVICE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 KIDNEY DISEASES

- 7.2.1 GROWING PREVALENCE OF DIABETES AND HYPERTENSION TO DRIVE MARKET

- 7.3 UROLOGICAL CANCER

- 7.3.1 RISING PREVALENCE OF UROLOGICAL CANCER TO CONTRIBUTE TO GROWTH

- 7.4 PELVIC ORGAN PROLAPSE

- 7.4.1 HIGH COSTS INVOLVED IN SURGERIES & HIGH REOCCURRENCE RATES TO RESTRAIN GROWTH

- 7.5 BENIGN PROSTATIC HYPERPLASIA (BPH)

- 7.5.1 INCREASING ELDERLY POPULATION TO AID GROWTH

- 7.6 URINARY INCONTINENCE (UI)

- 7.6.1 NEED FOR PROPER DIAGNOSIS AND TREATMENT TO SUPPORT GROWTH

- 7.7 ERECTILE DYSFUNCTION

- 7.7.1 INCREASING PREVALENCE OF PROSTATE CANCER TO AID GROWTH

- 7.8 URINARY STONES

- 7.8.1 GROWING PREFERENCE FOR MINIMALLY INVASIVE PROCEDURES TO FUEL MARKET

- 7.9 OTHER APPLICATIONS

8 UROLOGY DEVICES MARKET - EPIDEMIOLOGY AND PREVALENCE ANALYSIS, 2023-2030 (NO. OF CASES/PREVALENCE)

9 UROLOGY DEVICES MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS

- 9.2.1 INCREASING NUMBER OF HOSPITALS IN EMERGING ECONOMIES TO EXPEDITE GROWTH

- 9.3 AMBULATORY SURGERY CENTERS

- 9.3.1 LOWER COST AND SHORTER PATIENT STAYS TO PROMOTE GROWTH

- 9.4 CLINICS

- 9.4.1 GROWING INTEGRATION OF ADVANCED TECHNOLOGY IN UROLOGY CLINICS TO PROPEL MARKET

- 9.5 DIALYSIS CENTERS

- 9.5.1 RISING DEMAND FOR ADVANCED DIALYSIS AND END-STAGE RENAL DISEASE TREATMENTS TO AID GROWTH

- 9.6 HOME CARE SETTINGS

- 9.6.1 LOWER COST AND SHORTER HOSPITAL STAYS TO BOOST MARKET

10 UROLOGY DEVICES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Presence of large dialysis patient base and robust infrastructure to promote growth

- 10.2.3 CANADA

- 10.2.3.1 Increasing focus on preventing target diseases to expedite growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Presence of major urology device manufacturers to contribute to growth

- 10.3.3 UK

- 10.3.3.1 Rising incidence of kidney conditions to bolster growth

- 10.3.4 FRANCE

- 10.3.4.1 Favorable government initiatives and shifting demographic trends to aid growth

- 10.3.5 ITALY

- 10.3.5.1 Increasing cases of chronic diseases to spur growth

- 10.3.6 SPAIN

- 10.3.6.1 Rising geriatric population to accelerate growth

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK

- 10.4.2 CHINA

- 10.4.2.1 Rising incidence of target health conditions and decreasing mortality rate to facilitate growth

- 10.4.3 JAPAN

- 10.4.3.1 Large geriatric population and established healthcare system to support growth

- 10.4.4 INDIA

- 10.4.4.1 Large patient pool and rapidly growing healthcare sector to drive market

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK

- 10.5.2 BRAZIL

- 10.5.2.1 Rising cases of metabolic diseases to support growth

- 10.5.3 MEXICO

- 10.5.3.1 Increasing prevalence of diabetes and kidney disorders to expedite growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Product footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES AND APPROVALS

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 FRESENIUS MEDICAL CARE AG & CO. KGAA

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 BOSTON SCIENTIFIC CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches and approvals

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 B. BRAUN MELSUNGEN AG

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 BECTON, DICKINSON AND COMPANY

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Key strengths

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 OLYMPUS CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches and approvals

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Expansions

- 12.1.6 CARDINAL HEALTH

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 INTUITIVE SURGICAL

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches and approvals

- 12.1.8 COLOPLAST A/S

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches and approvals

- 12.1.9 STRYKER

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches and approvals

- 12.1.10 TELEFLEX INCORPORATED

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches and approvals

- 12.1.11 CONVATEC GROUP PLC

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.12 MEDTRONIC PLC

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Expansions

- 12.1.1 FRESENIUS MEDICAL CARE AG & CO. KGAA

- 12.2 OTHER PLAYERS

- 12.2.1 KARL STORZ

- 12.2.2 COOK MEDICAL

- 12.2.3 RICHARD WOLF GMBH

- 12.2.4 COMPACTCATH

- 12.2.5 DORNIER MEDTECH

- 12.2.6 NIKKISO CO., LTD.

- 12.2.7 DIALIFE SA

- 12.2.8 ERBE VISION

- 12.2.9 WELL LEAD MEDICAL CO., LTD.

- 12.2.10 ROCAMED

- 12.2.11 ENDOMED SYSTEMS GMBH

- 12.2.12 AMSINO INTERNATIONAL, INC.

- 12.2.13 MEDISPEC

- 12.2.14 VIMEX SP. Z O. O.

- 12.2.15 BALTON SP. Z O.O.

- 12.2.16 HUNTER UROLOGY

- 12.2.17 RIBBEL INTERNATIONAL LIMITED

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS