|

시장보고서

상품코드

1891772

착상전 유전자 검사 시장 : 제품 및 서비스별, 기술별, 시술별, 용도별, 주기 유형별 - 예측(-2030년)Preimplantation Genetic Testing Market by Product & Service (Reagents, Consumables, Instruments, Software), Technology (NGS, PCR, SNP, CGH), Procedure (Screening, Diagnosis), Application (Aneuploidy, HLA Typing), Type of cycle - Global Forecast to 2030 |

||||||

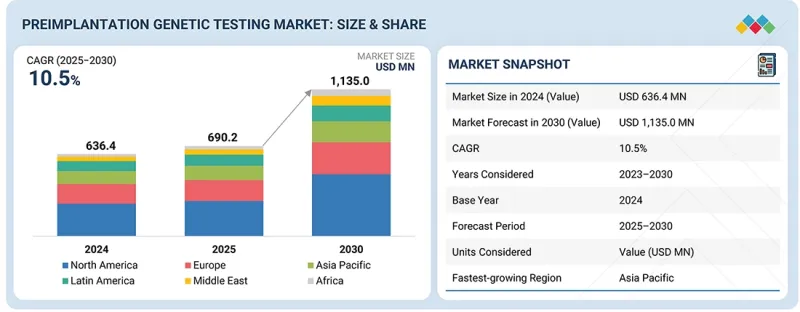

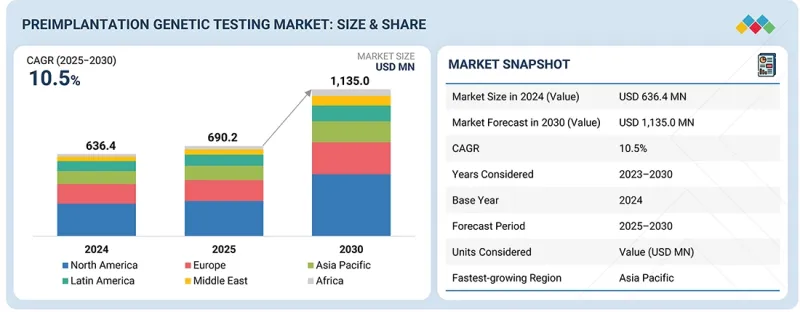

세계의 착상전 유전자 검사 시장 규모는 2025년 6억 9,020만 달러에서 2030년까지 11억 3,500만 달러에 달할 것으로 예측되며, 예측 기간 동안 CAGR 10.5%의 성장이 전망됩니다.

시장 성장의 주요 촉진요인으로는 유전성 질환의 유병률 증가, 조기 유전자 진단에 대한 인식 증가, 전 세계적으로 체외수정(IVF) 시술의 보급이 꼽힙니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2024-2033년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러 |

| 부문 | 시술 유형, 기술, 제품 서비스, 용도, 주기 유형, 최종사용자 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

착상전 유전자 검사에 대한 수요는 검사의 정확성과 효율성을 높이는 차세대 시퀀싱(NGS) 및 중합효소 연쇄 반응(PCR) 기술의 발전으로 뒷받침되고 있습니다. 또한, 임신 후기화 추세의 증가와 배아의 염색체 이상 위험 증가가 시장 확대에 기여하고 있습니다. 그러나 체외수정(IVF)과 유전자 검사 시술에 따른 고가의 비용, 그리고 윤리적, 규제적 문제들이 여전히 보급의 걸림돌로 작용하고 있습니다.

"이형성 검사 응용 분야는 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예상됩니다."

이러한 성장은 특히 고령 출산 여성의 염색체 이상 발병률 증가와 체외수정 시술에서 정확한 배아 선별 검사에 대한 수요 증가에 의해 촉진되고 있습니다. 이수성 검사는 비정상적인 염색체 수를 검출할 수 있어 착상률 향상과 유산 위험 감소에 기여합니다. 차세대 염기서열 분석(NGS)과 어레이 비교 유전체 하이브리드화(aCGH)와 같은 첨단 유전체 검사법의 통합으로 검사의 정확성과 효율성이 더욱 향상되고 있습니다. 또한, 유전자 검사의 이점에 대한 인식이 높아지고 보조생식술의 보급이 확대되면서 전 세계적으로 난임 검사 부문의 강력한 성장세를 견인하고 있습니다.

"시약 및 소모품 부문이 가장 큰 시장 점유율을 차지하고 있습니다."

이러한 장점은 샘플 조제, 증폭, 분석을 포함한 검사 프로세스의 모든 단계에서 반복적으로 사용되기 때문입니다. 체외수정(IVF) 시술과 유전자 검사가 증가함에 따라 정확성, 재현성, 일관된 결과를 제공하는 고품질 시약, 어세이 키트, 소모품에 대한 수요가 크게 증가하고 있습니다. 또한, 차세대 염기서열분석(NGS), 중합효소 연쇄 반응(PCR), 어레이 기반 플랫폼의 발전으로 고처리량, 정밀한 배아 분석에 사용되는 특수 시약의 개발이 가능해졌습니다. 주요 시장 기업들의 지속적인 제품 혁신과 더불어 불임 클리닉 및 연구 기관에서 유전자 검사 보급이 확산되면서 이 부문의 성장을 더욱 촉진하고 있습니다. 이 제품들은 필수적이고 반복적으로 사용되는 특성으로 인해 전 세계 착상전 유전자 검사 시장에서 선도적인 위치를 확고히 하고 있습니다.

"미국이 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예상됩니다."

여러 요인으로 인해 미국이 착상전 유전자 검사 시장에서 가장 높은 성장률을 보일 것으로 예상됩니다. 주요 체외수정(IVF) 클리닉의 강력한 존재감, 선진화된 유전체 연구소 및 확립된 의료 시스템 등이 시장 성장에 크게 기여하고 있습니다. 또한, 불임율 증가, 평균 산모 연령의 증가, 유전자 검사 옵션에 대한 인식이 높아지면서 미국 내 착상전 유전자 검사에 대한 수요가 증가하고 있습니다. 유리한 상환 정책, 생식 의료에 대한 정부의 지원책, 그리고 유전체 연구에 대한 지속적인 투자가 시장 확대를 더욱 촉진하고 있습니다.

또한 체외수정(IVF) 시술에서 차세대 염기서열분석(NGS) 기술과 중합효소 연쇄 반응(PCR) 기술의 통합이 진행되면서 검사의 정확도와 효율성이 향상되고 있습니다. 보조생식술에 대한 접근성 확대와 맞춤형 생식 의료에 대한 선호도가 높아짐에 따라 이 지역 전체에서 착상전 유전자 검사의 채택이 지속적으로 증가하고 있습니다. 미국의 강력한 규제 프레임워크는 검사의 신뢰성과 임상적 타당성을 보장하고, 착상전 유전자 검사 솔루션에 대한 신뢰를 높이며, 북미가 세계 시장에서 선도적인 위치를 유지하는 데 일조하고 있습니다.

세계의 착상전 유전자 검사 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 상황, 향후 동향 등의 정보를 전해드립니다.

자주 묻는 질문

목차

제1장 소개

제2장 주요 요약

제3장 중요한 인사이트

- 북미의 착상전 유전자 검사 시장 : 제품 및 서비스별, 국가별

- 착상전 유전자 검사 시장 : 지리적 성장 기회

- 착상전 유전자 검사 시장 점유율 : 제품 및 서비스별(2025년·2030년)

- 착상전 유전자 검사 시장 점유율 : 최종사용자별(2024년)

제4장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 미충족 수요와 화이트 스페이스

- 상호 접속된 시장과 부문 횡단적인 기회

- Tier 1/2/3 기업에 의한 전략적인 활동

제5장 업계 동향

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 거시경제 전망

- GDP 동향과 예측

- 세계 의료 업계의 동향

- 세계 제약 업계의 연구 동향

- 사례 연구 분석

- 가격 책정 분석

- 착상전 유전자 검사 제품 평균판매가격 동향 : 최종사용자별(2022-2024년)

- 착상전 유전자 검사 제품 평균판매가격 동향 : 주요 기업별(2022-2024년)

- 착상전 유전자 검사 제품 평균판매가격 동향 : 시술 유형별(2022-2024년)

- 착상전 유전자 검사 기기와 소모품 평균판매가격 동향 : 지역별(2022-2024년)

- 무역 분석

- HS 코드 3822 수입 데이터(2020-2024년)

- HS 코드 3822 수출 데이터(2020-2024년)

- HS 코드 9018 수입 데이터(2020-2024년)

- HS 코드 9018 수출 데이터(2020-2024년)

- 밸류체인 분석

- 생태계 분석

- Porter's Five Forces 분석

- 주요 회의와 이벤트(2025-2026년)

- 투자와 자금 조달 시나리오

- 착상전 유전자 검사 시장에 대한 2025년 미국 관세의 영향

- 주요 관세율

- 가격의 영향 분석

- 다양한 지역에의 중요한 영향

- 최종 이용 산업에 대한 영향

제6장 기술의 진보, AI에 의한 영향, 특허, 혁신, 향후 용도

- 기술 분석

- 주요 기술

- 보완 기술

- 테크놀러지 로드맵

- 특허 분석

- 조사 방법

- 특허 출원 건수 : 서류 유형별

- 주요 특허 리스트

- 향후 용도

- 착상전 유전자 검사 시장에 대한 AI/생성형 AI의 영향

- 주요 이용 사례와 시장 전망

- AI를 활용한 배아 선별과 유전자 스크리닝 베스트 프랙티스

- 착상전 유전자 검사 시장의 AI 도입 사례 연구

- 상호 접속된 인접 생태계와 시장 기업에 대한 영향

- 착상전 유전자 검사 시장의 생성형 AI 채용에 대한 고객 준비 상황

제7장 지속가능성과 규제 상황

- 지역 규제와 컴플라이언스

- 규제기관, 정부기관, 기타 조직

- 업계 표준

- 지속가능성에 대한 영향과 규제 정책의 대처

- 인증, 라벨, 환경기준

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 바이어 이해관계자와 구입 평가 기준

- 구매 프로세스의 주요 이해관계자

- 주요 구입 기준

- 채용 장벽과 내부 과제

- 다양한 최종 이용 산업으로부터의 미충족 수요

제9장 착상전 유전자 검사 시장 : 제품 및 서비스별

- 시약·소모품

- 기구

- 소프트웨어·서비스

제10장 착상전 유전자 검사 시장 : 시술 유형별

- 착상전 유전자 스크리닝

- 착상전 유전자 진단

제11장 착상전 유전자 검사 시장 : 기술별

- 차세대 시퀀싱

- 중합효소 연쇄 반응

- FISH(Fluorescent In Situ Hybridization)

- CGH(Comparative Genomic Hybridization)

- 단일염기다형

제12장 착상전 유전자 검사 시장 : 용도별

- 이수성 검사

- 염색체 구조 이상

- 단일 유전질환

- X연쇄 질환

- HLA 타이핑

- 성별 동정

제13장 착상전 유전자 검사 시장 : 주기 유형별

- 신선 비기증

- 동결 비기증

- 신선 기증

- 동결 기증

제14장 착상전 유전자 검사 시장 : 최종사용자별

- 불임 치료 클리닉

- 진단 검사실

- 병원

- 기타 최종사용자

제15장 착상전 유전자 검사 시장 : 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동

- GCC 국가

- 기타 중동

- 아프리카

제16장 경쟁 구도

- 착상전 유전자 검사 시장의 주요 기업이 채용한 전략 개요

- 매출 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가와 재무 지표

- 브랜드/제품의 비교

- ILLUMINA, INC.

- THERMO FISHER SCIENTIFIC INC.

- AGILENT TECHNOLOGIES, INC.

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제17장 기업 개요

- 주요 기업

- ILLUMINA, INC.

- THERMO FISHER SCIENTIFIC INC.

- AGILENT TECHNOLOGIES, INC.

- REVVITY

- COOPERCOMPANIES

- ABBOTT

- TAKARA BIO INC.

- QIAGEN

- VITROLIFE

- OXFORD NANOPORE TECHNOLOGIES PLC

- 기타 기업

- OXFORD GENE TECHNOLOGY IP LIMITED

- YIKON GENOMICS

- SHIVA SCIENTIFIC

- NANJING SUPERYEARS GENE TECHNOLOGY CO., LTD.

- MEDICOVER GENETICS

- MEDGENOME

- FULGENT GENETICS

- INVICTA SP. Z O.O.

- GENEA PTY LIMITED

- SCIGENE CORPORATION

- BIOARRAY S.L.

- UNIMED BIOTECH(SHANGHAI) CO., LTD.

- GENEMIND BIOSCIENCES CO., LTD.

- BERRY GENOMICS

- BANGKOK GENOMICS INNOVATION

제18장 부록

KSM 26.01.05The preimplantation genetic testing market is expected to reach USD 1,135.0 million by 2030, up from USD 690.2 million in 2025, at a CAGR of 10.5% during the forecast period. The market growth is primarily driven by the increasing prevalence of genetic disorders, growing awareness regarding early genetic diagnosis, and the rising adoption of in-vitro fertilization (IVF) procedures worldwide.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million) |

| Segments | Procedure Type, Technology, Product & Service, Application, Type of Cycle, End User |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa |

The demand for preimplantation genetic testing is also supported by advancements in next-generation sequencing (NGS) and polymerase chain reaction (PCR) technologies that enhance testing accuracy and efficiency. Moreover, the growing trend toward delayed pregnancies and the rising risk of chromosomal abnormalities in embryos are contributing to the market expansion. However, the high costs associated with IVF and genetic testing procedures, along with ethical and regulatory challenges, continue to hinder widespread adoption.

"The aneuploidy application segment is expected to grow at the highest CAGR during the forecast period."

The aneuploidy application segment is projected to grow at the highest CAGR in the preimplantation genetic testing market during the forecast period. This growth is primarily driven by the rising incidence of chromosomal abnormalities, particularly among women of advanced maternal age, and the increasing demand for accurate embryo screening in IVF procedures. Aneuploidy enables the detection of abnormal chromosome numbers, helping improve implantation rates and reduce the risk of miscarriage. The integration of advanced genomic tools such as next-generation sequencing (NGS) and array-based comparative genomic hybridization (aCGH) has further enhanced test precision and efficiency. Additionally, growing awareness of genetic screening benefits and the rising adoption of assisted reproductive technologies are contributing to the strong growth of the aneuploidy segment globally.

"The reagents and consumables segment holds the largest share of the market."

The reagents and consumables segment holds the largest share of the preimplantation genetic testing market. This dominance is due to their repeated use at every stage of the testing process, including sample preparation, amplification, and analysis. The increasing number of IVF procedures and genetic tests has greatly boosted the demand for high-quality reagents, assay kits, and consumables that provide accuracy, reproducibility, and consistent results. Additionally, advances in next-generation sequencing (NGS), polymerase chain reaction (PCR), and array-based platforms have enabled the development of specialized reagents for high-throughput and precise embryo analysis. Ongoing product innovations by major market players, along with the growing use of genetic screening in fertility clinics and research labs, further drive segment growth. The essential and recurring nature of these products secures their leading role in the global preimplantation genetic testing market.

"The US is expected to grow at the highest CAGR during the forecast period."

The US is expected to have the highest growth rate in the preimplantation genetic testing market, driven by several key factors. The strong presence of leading IVF clinics, advanced genomic labs, and a well-established healthcare system significantly contributes to market growth in the country. Additionally, the increasing rate of infertility, rising average maternal age, and growing awareness of genetic screening options are boosting demand for preimplantation genetic testing in the US. Favorable reimbursement policies, supportive government initiatives for reproductive health, and ongoing investments in genomic research further drive market expansion.

Furthermore, the growing integration of next-generation sequencing (NGS) and polymerase chain reaction (PCR) technologies in IVF procedures is improving testing accuracy and efficiency. Increasing access to assisted reproductive technologies, along with the rising preference for personalized reproductive care, continues to drive the adoption of preimplantation genetic testing across the region. The US's robust regulatory framework ensures test reliability and clinical validity, bolstering confidence in preimplantation genetic testing solutions and reinforcing North America's leading position in the global market.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Tier 1 - 25%, Tier 2 - 35%, and Tier 3 - 40%

- By Designation: Managers - 45%, CXOs and Directors - 30%, and Executives - 25%

- By Region: North America - 35%, Europe - 25%, Asia Pacific - 15%, Latin America - 10%, the Middle East - 10%, and Africa - 5%

Illumina, Inc. (US), Thermo Fisher Scientific Inc. (US), Agilent Technologies, Inc. (US), Revvity (US), CooperCompanies (US), Abbott (US), Takara Bio Inc. (Japan), QIAGEN (Germany), Vitrolife (Sweden), Oxford Nanopore Technologies plc (UK), Oxford Gene Technology IP Limited (UK), Yikon Genomics (China), Shiva Scientific (India), Nanjing Superyears Gene Technology Co. Ltd. (China), Medicover Genetics (Germany), MedGenome (India), Fulgent Genetics (US), Invicta (Poland), Genea Pty Limited (Australia), SciGene Corporation (US), Bioarray S.L. (Spain), Unimed Biotech (Shanghai) Co., Ltd. (China), GeneMind Biosciences Co. Ltd. (China), Berry Genomics (China), and Bangkok Genomics Innovation (Thailand) are some of the key companies offering preimplantation genetic testing products.

Research Coverage

This research report categorizes the preimplantation genetic testing market by procedure type (preimplantation genetic screening, preimplantation genetic diagnosis), technology (next-generation sequencing, polymerase chain reaction, fluorescence in situ hybridization, comparative genomic hybridization, single-nucleotide polymorphism), product & service (reagents & consumables, instruments, software & services), application (aneuploidy, structural chromosomal abnormalities [translocations, deletions, duplications, inversions], single gene disorders, X-linked disorders, HLA typing, gender identification), type of cycle (fresh non-donor, frozen non-donor, fresh donor, frozen donor), end user (fertility clinics, hospitals, diagnostic laboratories, other end users), and region (North America, Europe, Asia Pacific, Latin America, Middle East, And Africa).

The report's scope encompasses detailed information about the primary factors, including drivers, restraints, challenges, and opportunities, that influence the growth of the preimplantation genetic testing market. A comprehensive analysis of key industry players has been performed to provide insights into their business overview, product portfolio, key strategies, new product launches, acquisitions, and recent developments related to the preimplantation genetic testing market. This report also includes a competitive analysis of emerging startups in the preimplantation genetic testing industry ecosystem.

Key Benefits of Buying the Report

The report will assist market leaders and new entrants by providing revenue estimates for the overall market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to position their businesses effectively and develop suitable go-to-market strategies. This report will enable stakeholders to grasp the market's pulse and offer information on key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (decline in fertility, rise of fertility tourism in emerging economies, increasing number of fertility clinics and IVF centers, increasing public-private investments to develop novel diagnostic techniques, and high risk of chromosomal abnormalities with advancing maternal age), restraints (high procedural cost in preimplantation genetic testing and unfavorable government regulations and healthcare reforms for IVF procedures), opportunities (improving healthcare infrastructure and rising medical tourism in emerging economies and use of fertility treatments by single parents and same-sex couples), and challenges (socio-ethical concerns surrounding preimplantation genetic testing and procedural limitations with advancing age) influencing the market growth

- Product Development/Innovation: Detailed insights into newly launched products and technological assessment of the preimplantation genetic testing market

- Market Development: Comprehensive information about lucrative markets and analysis of the market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the preimplantation genetic testing market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including Illumina, Inc. (US), Thermo Fisher Scientific Inc. (US), and Agilent Technologies, Inc. (US), Revvity (US), CooperCompanies (US), and Abbott (US), among others offering products and services for preimplantation genetic testing market. Other companies include MedGenome (India), Fulgent Genetics (US), Invicta (Poland), Genea Pty Limited (Australia), SciGene Corporation (US), Bioarray S.L. (Spain), Unimed Biotech (Shanghai) Co., Ltd (China), and GeneMind Biosciences Co., Ltd. (China), among others, for the preimplantation genetic testing market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS & MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: INSIGHTS & STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING PREIMPLANTATION GENETIC TESTING MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 GLOBAL PREIMPLANTATION GENETIC TESTING MARKET SNAPSHOT

3 PREMIUM INSIGHTS

- 3.1 NORTH AMERICA: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT & SERVICE AND COUNTRY

- 3.2 PREIMPLANTATION GENETIC TESTING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 3.3 PREIMPLANTATION GENETIC TESTING MARKET SHARE, BY PRODUCT & SERVICE, 2025 VS. 2030 (%)

- 3.4 PREIMPLANTATION GENETIC TESTING MARKET SHARE, BY END USER, 2024 (%)

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Decline in fertility rates

- 4.2.1.2 Expanding network of fertility clinics and IVF centers

- 4.2.1.3 Rising incidence of chromosomal abnormalities associated with advancing maternal age

- 4.2.2 RESTRAINTS

- 4.2.2.1 High procedural cost

- 4.2.2.2 Stringent regulatory frameworks governing IVF and genetic testing procedures

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Expanding acceptance of fertility treatments among single parents and same-sex couples

- 4.2.4 CHALLENGES

- 4.2.4.1 Socio-ethical concerns regarding embryo screening and selection

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS & WHITE SPACES

- 4.4 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVIES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 GDP TRENDS & FORECAST

- 5.2.2 R&D TRENDS IN GLOBAL HEALTHCARE INDUSTRY

- 5.2.3 R&D TRENDS IN GLOBAL PHARMA INDUSTRY

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 PGT-M FOR RPGRIP1L VARIANT-ENABLED BY MINIGENE ASSAY

- 5.3.2 PERSISTENT FETAL MOSAICISM AFTER TRANSFER OF PGT-A MOSAIC EMBRYO

- 5.3.3 CRYPTIC REARRANGEMENTS RESOLVED BY OGM TO GUIDE PGT-SR

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF PREIMPLANTATION GENETIC TESTING PRODUCTS, BY END USER, 2022-2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF PREIMPLANTATION GENETIC TESTING PRODUCTS, BY KEY PLAYER, 2022-2024

- 5.4.3 AVERAGE SELLING PRICE TREND OF PREIMPLANTATION GENETIC TESTING PRODUCTS, BY PROCEDURE TYPE, 2022-2024

- 5.4.4 AVERAGE SELLING PRICE TREND OF PREIMPLANTATION GENETIC TESTING INSTRUMENTS AND CONSUMABLES, BY REGION, 2022-2024

- 5.5 TRADE ANALYSIS

- 5.5.1 IMPORT DATA FOR HS CODE 3822, 2020-2024

- 5.5.2 EXPORT DATA FOR HS CODE 3822, 2020-2024

- 5.5.3 IMPORT DATA FOR HS CODE 9018, 2020-2024

- 5.5.4 EXPORT DATA FOR HS CODE 9018, 2020-2024

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.7.1 ROLE IN ECOSYSTEM

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.8.2 BARGAINING POWER OF SUPPLIERS

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 THREAT OF SUBSTITUTES

- 5.8.5 THREAT OF NEW ENTRANTS

- 5.9 KEY CONFERENCES & EVENTS, 2025-2026

- 5.10 INVESTMENT & FUNDING SCENARIO

- 5.11 IMPACT OF 2025 US TARIFF ON PREIMPLANTATION GENETIC TESTING MARKET

- 5.11.1 KEY TARIFF RATES

- 5.11.2 PRICE IMPACT ANALYSIS

- 5.11.3 KEY IMPACTS ON VARIOUS REGIONS

- 5.11.3.1 US

- 5.11.3.2 Europe

- 5.11.3.3 Asia Pacific

- 5.11.4 END-USE INDUSTRY IMPACT

- 5.11.4.1 Fertility clinics

- 5.11.4.2 Hospitals

- 5.11.4.3 Diagnostic laboratories

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 TECHNOLOGY ANALYSIS

- 6.1.1 KEY TECHNOLOGIES

- 6.1.1.1 Laser-assisted TE biopsy

- 6.1.1.2 Whole genome amplification

- 6.1.2 COMPLEMENTARY TECHNOLOGIES

- 6.1.2.1 Micromanipulation

- 6.1.1 KEY TECHNOLOGIES

- 6.2 TECHNOLOGY ROADMAP

- 6.3 PATENT ANALYSIS

- 6.3.1 METHODOLOGY

- 6.3.2 NUMBER OF PATENTS FILED, BY DOCUMENT TYPE

- 6.3.3 LIST OF KEY PATENTS

- 6.4 FUTURE APPLICATIONS

- 6.5 IMPACT OF AI/GEN AI ON PREIMPLANTATION GENETIC TESTING MARKET

- 6.5.1 TOP USE CASES AND MARKET POTENTIAL

- 6.5.2 BEST PRACTICES IN AI-ENABLED EMBRYO SELECTION AND GENETIC SCREENING

- 6.5.3 CASE STUDIES OF AI IMPLEMENTATION IN PREIMPLANTATION GENETIC TESTING MARKET

- 6.5.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.5.5 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN PREIMPLANTATION GENETIC TESTING MARKET

7 SUSTAINABILITY & REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS & COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.1.2.1 North America

- 7.1.2.1.1 US

- 7.1.2.1.2 Canada

- 7.1.2.2 Europe

- 7.1.2.3 Asia Pacific

- 7.1.2.3.1 Japan

- 7.1.2.3.2 China

- 7.1.2.3.3 India

- 7.1.2.4 Latin America

- 7.1.2.4.1 Brazil

- 7.1.2.1 North America

- 7.2 SUSTAINABILITY IMPACT & REGULATORY POLICY INITIATIVES

- 7.3 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOUR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS & BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 KEY BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

9 PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT & SERVICE

- 9.1 INTRODUCTION

- 9.2 REAGENTS & CONSUMABLES

- 9.2.1 EXPANSION OF ADVANCED GENOMIC TECHNOLOGIES TO PROMOTE MARKET GROWTH

- 9.3 INSTRUMENTS

- 9.3.1 ONGOING TECHNOLOGICAL ADVANCEMENTS AND INCREASING FERTILITY CLINICS TO PROPEL MARKET GROWTH

- 9.4 SOFTWARE & SERVICES

- 9.4.1 RISING AWARENESS ABOUT DATA ANALYSIS TO DRIVE MARKET

10 PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE

- 10.1 INTRODUCTION

- 10.2 PREIMPLANTATION GENETIC SCREENING

- 10.2.1 INCREASING MATERNAL AGE TO AID MARKET GROWTH

- 10.3 PREIMPLANTATION GENETIC DIAGNOSIS

- 10.3.1 RISING AWARENESS ABOUT CHROMOSOMAL ABNORMALITIES IN FETUSES TO SUPPORT MARKET GROWTH

11 PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY

- 11.1 INTRODUCTION

- 11.2 NEXT-GENERATION SEQUENCING

- 11.2.1 IMPROVED TECHNOLOGY FOR DETECTING STRUCTURAL ABNORMALITIES TO FUEL MARKET GROWTH

- 11.3 POLYMERASE CHAIN REACTION

- 11.3.1 INCREASED USAGE IN CLINICAL AND RESEARCH APPLICATIONS AND HIGH PREVALENCE OF GENETIC DISEASES TO SUPPORT MARKET

- 11.4 FLUORESCENCE IN SITU HYBRIDIZATION

- 11.4.1 ADVANCES IN FLUORESCENCE MICROSCOPY AND DIGITAL IMAGING TO AUGMENT MARKET GROWTH

- 11.5 COMPARATIVE GENOMIC HYBRIDIZATION

- 11.5.1 LOW COST, LESS LABOR REQUIREMENT, AND ONGOING TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET

- 11.6 SINGLE-NUCLEOTIDE POLYMORPHISM

- 11.6.1 HIGH-RESOLUTION ACCURACY AND VALIDATED CLINICAL PERFORMANCE TO BOOST MARKET GROWTH

12 PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 ANEUPLOIDY

- 12.2.1 HIGH ANEUPLOIDY INCIDENCE AND RAPID INNOVATION TO ACCELERATE MARKET GROWTH

- 12.3 STRUCTURAL CHROMOSOMAL ABNORMALITIES

- 12.3.1 TRANSLOCATIONS

- 12.3.1.1 Rising incidence of translocation chromosomal abnormalities during IVF treatments to drive segment

- 12.3.2 DELETIONS

- 12.3.2.1 Advancements in genetic testing to boost segment growth

- 12.3.3 DUPLICATIONS

- 12.3.3.1 Rising cases of duplication of chromosomal abnormalities and increasing maternal age to drive segment

- 12.3.4 INVERSIONS

- 12.3.4.1 Risk of unexplained male-factor infertility and multiple miscarriages to limit segment growth

- 12.3.1 TRANSLOCATIONS

- 12.4 SINGLE GENE DISORDERS

- 12.4.1 INCREASING AWARENESS ABOUT GENETIC TESTING TO PROPEL MARKET GROWTH

- 12.5 X-LINKED DISORDERS

- 12.5.1 MEDICAL ADVANCEMENTS AND INCREASED RESEARCH ON GENETIC DISORDERS TO AUGMENT MARKET GROWTH

- 12.6 HLA TYPING

- 12.6.1 RISING NUMBER OF COUPLES WITH CHILDREN AFFECTED BY HEMATOLOGICAL DISEASES TO DRIVE MARKET

- 12.7 GENDER IDENTIFICATION

- 12.7.1 INCREASED FOCUS ON SEX DISCRIMINATION TO LIMIT MARKET GROWTH

13 PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE

- 13.1 INTRODUCTION

- 13.2 FRESH NON-DONOR

- 13.2.1 HIGH RATES OF SUCCESSFUL PREGNANCY AMONG YOUNG WOMEN TO DRIVE MARKET GROWTH

- 13.3 FROZEN NON-DONOR

- 13.3.1 LONG-TERM STORAGE OF FROZEN EGGS AND EASY SCHEDULING TO PROPEL MARKET GROWTH

- 13.4 FRESH DONOR

- 13.4.1 HIGH-QUALITY FRESH DONOR OOCYTES AND EXPANDING PGT-DRIVEN RISK REDUCTION TO PROMOTE MARKET GROWTH

- 13.5 FROZEN DONOR

- 13.5.1 RISING USE OF ADVANCED AND NON-INVASIVE PGT TECHNOLOGIES TO AID MARKET GROWTH

14 PREIMPLANTATION GENETIC TESTING MARKET, BY END USER

- 14.1 INTRODUCTION

- 14.2 FERTILITY CLINICS

- 14.2.1 HIGH SUCCESS RATE OF FERTILITY TREATMENT TO DRIVE MARKET

- 14.3 DIAGNOSTIC LABORATORIES

- 14.3.1 IMPROVED CLINICAL EFFICACY AND INCREASED RESEARCH FUNDING TO FUEL MARKET

- 14.4 HOSPITALS

- 14.4.1 RISING NUMBER OF HOSPITALS AND INCREASING HEALTHCARE AWARENESS TO DRIVE GROWTH

- 14.5 OTHER END USERS

15 PREIMPLANTATION GENETIC TESTING MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 US

- 15.2.1.1 US to dominate North American preimplantation genetic testing market during forecast period

- 15.2.2 CANADA

- 15.2.2.1 Whole-genome embryo testing and public-private R&D investment to propel market growth

- 15.2.1 US

- 15.3 EUROPE

- 15.3.1 GERMANY

- 15.3.1.1 Global clinical adoption of precision medicines to boost market growth

- 15.3.2 UK

- 15.3.2.1 Demographic pressures and evidence-based clinical innovation to support market growth

- 15.3.3 FRANCE

- 15.3.3.1 Ethical regulation and adoption of patient-centered precision medicines to fuel market growth

- 15.3.4 ITALY

- 15.3.4.1 Regulatory reforms and clinical-genetic partnerships to boost market growth

- 15.3.5 SPAIN

- 15.3.5.1 Well-established network of research centers and universities to augment market growth

- 15.3.6 REST OF EUROPE

- 15.3.1 GERMANY

- 15.4 ASIA PACIFIC

- 15.4.1 CHINA

- 15.4.1.1 Advancing next-generation genomic infrastructure and cross-border fertility capacity to propel market growth

- 15.4.2 JAPAN

- 15.4.2.1 Reinforcing global PGT standards and rigorous clinical governance to favor market growth

- 15.4.3 INDIA

- 15.4.3.1 Expanding genetic-diagnostic access to drive market growth

- 15.4.4 AUSTRALIA

- 15.4.4.1 Standardized regulation and expanding clinical adoption to fuel market growth

- 15.4.5 SOUTH KOREA

- 15.4.5.1 Clinically validated PGT-A integration and improved IVF outcomes to support market growth

- 15.4.6 REST OF ASIA PACIFIC

- 15.4.1 CHINA

- 15.5 LATIN AMERICA

- 15.5.1 BRAZIL

- 15.5.1.1 Global genomic innovation and regulatory modernization to boost market growth

- 15.5.2 MEXICO

- 15.5.2.1 Adoption of advanced NGS-based PGT services to support growth

- 15.5.3 REST OF LATIN AMERICA

- 15.5.1 BRAZIL

- 15.6 MIDDLE EAST

- 15.6.1 GCC COUNTRIES

- 15.6.1.1 Kingdom of Saudi Arabia

- 15.6.1.1.1 Rising global emphasis on preventive genomic medicine and advanced embryo-screening technologies to drive market

- 15.6.1.2 UAE

- 15.6.1.2.1 Rising global demand for safer and technologically advanced embryo screening to aid market growth

- 15.6.1.3 Rest of GCC Countries

- 15.6.1.1 Kingdom of Saudi Arabia

- 15.6.2 REST OF MIDDLE EAST

- 15.6.1 GCC COUNTRIES

- 15.7 AFRICA

- 15.7.1 REGIONAL ART REGISTRY EXPANSION AND RISING IVF INFRASTRUCTURE TO PROPEL MARKET GROWTH

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PREIMPLANTATION GENETIC TESTING MARKET

- 16.3 REVENUE ANALYSIS, 2020-2024

- 16.4 MARKET SHARE ANALYSIS, 2024

- 16.5 COMPANY VALUATION & FINANCIAL METRICS

- 16.5.1 FINANCIAL METRICS

- 16.5.2 COMPANY VALUATION

- 16.6 BRAND/PRODUCT COMPARISON

- 16.6.1 ILLUMINA, INC.

- 16.6.2 THERMO FISHER SCIENTIFIC INC.

- 16.6.3 AGILENT TECHNOLOGIES, INC.

- 16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.7.1 STARS

- 16.7.2 EMERGING LEADERS

- 16.7.3 PERVASIVE PLAYERS

- 16.7.4 PARTICIPANTS

- 16.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.7.5.1 Company footprint

- 16.7.5.2 Region footprint

- 16.7.5.3 Product & service footprint

- 16.7.5.4 Technology footprint

- 16.7.5.5 Application footprint

- 16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.8.1 PROGRESSIVE COMPANIES

- 16.8.2 RESPONSIVE COMPANIES

- 16.8.3 DYNAMIC COMPANIES

- 16.8.4 STARTING BLOCKS

- 16.8.5 COMPETITIVE BENCHMARKING

- 16.8.5.1 Detailed list of key startups/SMEs

- 16.8.5.2 Competitive benchmarking of key startups/SMEs

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES

- 16.9.2 DEALS

- 16.9.3 EXPANSIONS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 ILLUMINA, INC.

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Services/Solutions offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Deals

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses & competitive threats

- 17.1.2 THERMO FISHER SCIENTIFIC INC.

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Services/Solutions offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses & competitive threats

- 17.1.3 AGILENT TECHNOLOGIES, INC.

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Services/Solutions offered

- 17.1.3.3 MnM view

- 17.1.3.3.1 Key strengths

- 17.1.3.3.2 Strategic choices

- 17.1.3.3.3 Weaknesses & competitive threats

- 17.1.4 REVVITY

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Services/Solutions offered

- 17.1.4.3 MnM view

- 17.1.4.3.1 Key strengths

- 17.1.4.3.2 Strategic choices

- 17.1.4.3.3 Weaknesses & competitive threats

- 17.1.5 COOPERCOMPANIES

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Services/Solutions offered

- 17.1.5.3 MnM view

- 17.1.5.3.1 Key strengths

- 17.1.5.3.2 Strategic choices

- 17.1.5.3.3 Weaknesses & competitive threats

- 17.1.6 ABBOTT

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Services/Solutions offered

- 17.1.7 TAKARA BIO INC.

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Services/Solutions offered

- 17.1.8 QIAGEN

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Services/Solutions offered

- 17.1.9 VITROLIFE

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Services/Solutions offered

- 17.1.10 OXFORD NANOPORE TECHNOLOGIES PLC

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Services/Solutions offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Expansions

- 17.1.1 ILLUMINA, INC.

- 17.2 OTHER PLAYERS

- 17.2.1 OXFORD GENE TECHNOLOGY IP LIMITED

- 17.2.2 YIKON GENOMICS

- 17.2.3 SHIVA SCIENTIFIC

- 17.2.4 NANJING SUPERYEARS GENE TECHNOLOGY CO., LTD.

- 17.2.5 MEDICOVER GENETICS

- 17.2.6 MEDGENOME

- 17.2.7 FULGENT GENETICS

- 17.2.8 INVICTA SP. Z O.O.

- 17.2.9 GENEA PTY LIMITED

- 17.2.10 SCIGENE CORPORATION

- 17.2.11 BIOARRAY S.L.

- 17.2.12 UNIMED BIOTECH (SHANGHAI) CO., LTD.

- 17.2.13 GENEMIND BIOSCIENCES CO., LTD.

- 17.2.14 BERRY GENOMICS

- 17.2.15 BANGKOK GENOMICS INNOVATION

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS