|

시장보고서

상품코드

1891773

AI 음성 생성기 시장 : 제공별, 기술별, 음성 유형별, 용도별, 최종사용자별, 지역별 - 예측(-2031년)AI Voice Generator Market By Voice Generation Platform, Technology (Neural Text-to-Speech (TTS) Engine & Speech Synthesis, Real-Time Speech-to-Speech (S2S)), Application (Narration, Voiceovers, Dubbing, Localization) - Global Forecast to 2031 |

||||||

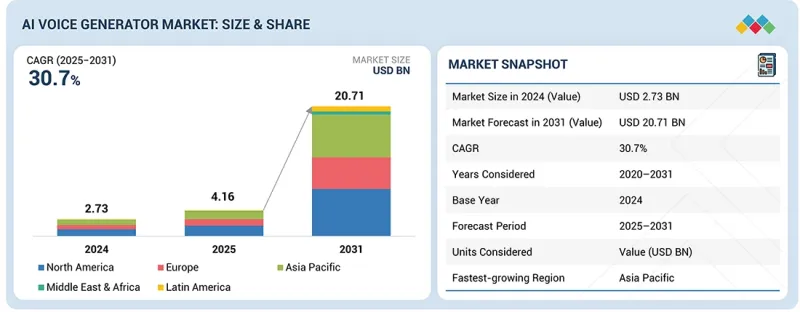

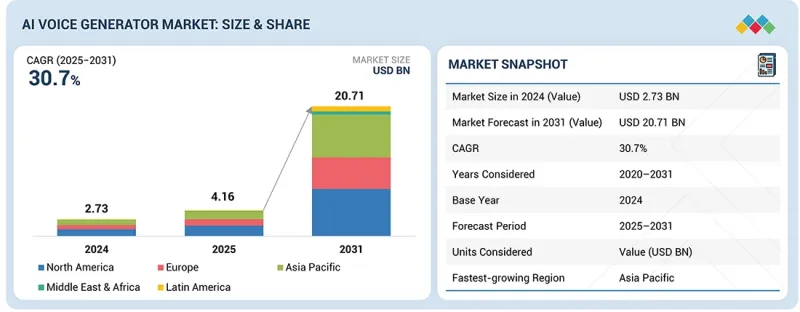

AI 음성 생성기 시장 규모는 예측 기간 동안 CAGR 30.7%로 성장하여 2025년 추정 41억 6,000만 달러에서 2031년까지 207억 1,000만 달러에 달할 것으로 전망됩니다.

기업에서 컨텐츠 유형에 따라 말투, 속도, 강조를 자동으로 조정하는 동적 프로시저 제어 모델을 채택하여 교육, 소매, 미디어 워크플로우에서 사용자 참여도를 향상시키고 시장을 가속화하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2020-2031년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2031년 |

| 대상 단위 | 금액(10억 달러) |

| 부문 | 제공별, 기술별, 음성 유형별, 용도별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카 및 라틴아메리카 |

또한, 자동화된 컴플라이언스에 대한 수요 증가도 성장을 견인하고 있습니다. 조직은 AI 보이스를 활용하여 금융 및 의료 프로세스 전반에 걸쳐 일관된 공시 정보를 제공하고 있습니다. 그러나 특히 기술, 의료, 법률 용어와 같은 분야별 음향 데이터세트의 가용성이 제한적이기 때문에 전문 기업용 애플리케이션의 정확도 향상이 지연되고 있습니다.

API, SDK, 개발자 도구는 산업 전반에 걸쳐 확장 가능한 AI 음성 도입의 핵심 원동력이 되고 있으며, 이에 따라 상당한 수요가 예상됩니다. 개발자들은 현재 전체 플랫폼의 마이그레이션 없이 컨택센터, 크리에이터 플랫폼, 모바일 앱, 기업용 소프트웨어에 직접 통합할 수 있는 모듈식 음성 컴포넌트를 선호하고 있습니다. API 우선 아키텍처로의 전환을 통해 기업은 최소한의 엔지니어링 작업으로 음성 합성, 음성 복제, 실시간 S2S 기능을 기존 워크플로우에 통합할 수 있습니다. SDK는 또한 Android, iOS, Unity, Unreal Engine, 웹 환경용 사전 구축된 라이브러리를 제공하여 통합을 가속화하고, 게임 스튜디오, AR/VR 개발자, 기업 제품팀도 음성 기능에 접근할 수 있도록 지원합니다. 벤더들이 API를 통해 저지연 엔드포인트, 감정 제어, 다국어 기능을 제공함에 따라 기업들은 종량제 모델을 점점 더 많이 채택하고 있으며, 이는 공급자에게 지속적인 수익원을 창출하고 있습니다. 이러한 도구는 빠른 실험이 가능하며, 기업은 본격적인 도입 전에 음성 기능을 테스트할 수 있습니다. 개인화된 양방향 및 다국어 오디오 경험에 대한 수요가 증가함에 따라 API 및 SDK 생태계는 가장 빠르게 성장하는 분야로, 벤더의 도달 범위를 확장하고 개발자가 음성 지원 제품을 빠르고 비용 효율적으로 구축할 수 있도록 지원하고 있습니다.

컨텐츠 제작 분야는 미디어, 광고, E-Learning, 크리에이터 플랫폼에서 AI 음성 도구의 급속한 보급을 배경으로 2025년 가장 큰 시장 점유율을 차지할 것으로 예측됩니다. 기업 및 크리에이터들은 대량 및 단납기 컨텐츠 수요에 대응하기 위해 합성 나레이션, 자동 음성 더빙, 다국어 더빙에 대한 의존도를 높이고 있습니다. AI 음성 생성기 툴을 통해 제작팀은 기존 녹음에 따른 지연과 비용 없이 일관되고 자연스러운 음성을 대규모로 생성할 수 있습니다. 짧은 동영상, 팟캐스트, 온라인 강의, 세계 스트리밍 플랫폼의 성장은 다양한 포맷, 톤, 언어에 대응할 수 있는 유연하고 표현력 있는 음성의 필요성을 더욱 가속화시키고 있습니다. 현재 40-100개 이상의 언어에서 사실적인 감정 표현, 역동적인 속도감, 정확한 발음을 지원하는 고도화된 음성 모델을 통해 AI 생성 음성은 현지화된 캠페인과 전 세계 시청자 참여에 적합합니다. 조직이 속도, 개인화, 효율적인 컨텐츠 파이프라인을 우선시하는 가운데, AI 기반 컨텐츠 제작은 기본 사용 사례로 자리 잡았으며, 2025년 시장 성장에 가장 큰 기여를 할 것으로 예상됩니다.

북미는 2025년에 가장 큰 시장 점유율을 차지할 것으로 예상됩니다. 이는 신경 음성 기술 및 실시간 음성 기술 기업의 조기 도입, 주요 AI 제공업체의 강력한 존재감, 미디어, 엔터테인먼트, 통신 및 고객 참여 플랫폼에 합성 음성의 빠른 통합에 힘입은 바 큽니다. OTT 현지화, 자동화 콜센터, 프로그래매틱 오디오, 기업 교육 컨텐츠의 대규모 도입은 이 지역의 우위를 더욱 강화하고 있습니다. 한편, 아시아태평양은 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예상됩니다. 인도, 동남아시아, 일본의 다국어 및 방언 특화 음성 생성에 대한 수요 증가가 그 배경입니다. 빠르게 성장하는 OTT 생태계, 급성장하는 크리에이터 경제, 통신, BFSI, E-Learning 기업들의 적극적인 디지털 투자가 AI 음성 도구의 도입을 가속화하고 있습니다. 낮은 생산 비용, 모바일 우선의 디지털 소비, 빠른 컨텐츠 현지화의 필요성이 아시아태평양의 높은 성장 궤도를 더욱 뒷받침하고 있습니다. 이러한 추세에 따라 북미는 현재 가장 큰 시장으로 자리매김하고 있으며, 아시아태평양은 AI 음성 생성기 솔루션의 가장 강력한 장기 성장 동력으로 부상하고 있습니다.

주요 조사 대상 내역

- 기업별 : Tier I - 31%, Tier II - 42%, Tier III - 27%

- 직급별 : 이사 - 29%, 관리자 - 44%, 기타 - 27%

- 지역별 : 북미 - 40%, 유럽 - 22%, 아시아태평양 - 26%, 중동 및 아프리카 - 5%, 중남미 - 7%

본 보고서는 AI 음성 생성기 솔루션 및 서비스를 제공하는 주요 기업을 조사 대상으로 합니다. AI 음성 생성기 시장의 주요 진입 기업으로는 Google (US), Microsoft (US), IBM (US), AWS (US), Adobe (US), NVIDIA (US), Meta (US), OpenAI (US), ElevenLabs (US), Cisco (US), SoundHound (UK), AssemblyAI (UK), Freepik (US), Adobe (US), Deepdub (Israel), Voicemod (Spain), Murf AI (US), Speechify (US), Musico (Netherlands), Stability AI (UK), Descript (US), Runway (US), WellSaid Labs (US), Podcastle (US), Respeecher (Ukraine), Synthesia (UK), Soundful (US), AMAI (US), Camb.ai (UAE), PlayHT (US), Resemble AI (US), Lovo AI (US), AI Studios (US), Beatoven.AI (US), Aiva Technologies (Luxembourg), Beyondwords (UK), Picovoice (Canada), Soundraw (Japan), Dubverse (India), Listnr (US), and Simplified (US) 등이 있습니다.

조사 범위

본 조사 보고서는 제공 형태, 음성 유형, 기술, 용도, 최종사용자별로 분류한 AI 음성 생성기 시장을 대상으로 합니다. 제공 형태 부문은 소프트웨어와 서비스로 나뉩니다. 소프트웨어 부문은 다시 음성 생성 플랫폼과 API, SDK, 개발자 도구로 세분화됩니다. 기술 부문은 신경 텍스트 음성변환(TTS) 및 음성합성, 실시간 음성 인식(S2S), 생성형 확산 모델, 에지 최적화 및 하이브리드 엔진으로 나뉩니다. 음성 유형 부문에는 자연음성과 합성 음성이 포함됩니다. 애플리케이션 부문은 컨텐츠 제작, 음성 변경, 인터랙티브 애플리케이션으로 세분화됩니다. 최종사용자 부문에는 컨텐츠 제작자 및 개인 사용자, 기업(미디어/엔터테인먼트, BFSI, 헬스케어/생명과학, 소매/E-Commerce, 교육/E-Learning, 에너지/공공, 정부/국방, 기술/소프트웨어, 통신, 기타 기업)이 포함됩니다. 기타 기업)이 포함됩니다. AI 음성 생성기 시장의 지역별 분석은 북미, 유럽, 아시아태평양, 중동 및 아프리카(MEA), 라틴아메리카를 대상으로 합니다.

본 보고서 구매의 주요 이점

이 보고서는 AI 음성 생성기 시장 전체와 그 하위 부문의 수익 수치에 대한 가장 정확한 근사치를 이 시장의 리더와 신규 진입자에게 제공합니다. 이를 통해 이해관계자들은 경쟁 상황을 이해하고, 자사의 포지셔닝과 적절한 시장 진입 전략을 수립하기 위한 추가 인사이트를 얻을 수 있습니다. 또한, 시장 동향을 파악하고 주요 시장 촉진요인, 시장 억제요인, 과제, 기회에 대한 정보를 제공합니다.

이 보고서는 다음 사항에 대한 인사이트를 제공합니다:

주요 촉진요인 분석(음성 지원 기기 및 가상 비서 수요 증가, NLP 및 머신러닝 기술 발전으로 인한 음성 생성형 AI 능력 향상, 디지털 컨텐츠의 접근성 솔루션 수요 증가), 억제요인(음성 생성형 AI 의사결정 과정의 설명 가능성 부족, 고급 생성형 AI 솔루션 개발 및 도입 비용 증가로 시장 성장 저해, AI 생성형 AI 사용에 대한 윤리적 우려로 인한 모니터링 강화) AI 의사결정 과정의 설명 가능성 부족, 고도의 생성형 AI 솔루션 개발 및 도입 비용 증가로 시장 성장 저해, AI 생성 음성 사용에 대한 윤리적 우려로 감시 강화), 기회 요인(생성형 AI와 5G, 엣지 컴퓨팅 등 신기술의 통합을 통한 실시간 음성 생성의 실현 가능성, 세계 시장에서의 현지화 컨텐츠 및 다국어 지원 수요 증가로 AI 번역 및 더빙 서비스의 성장 가능성 제시, 개인화된 감성지능을 갖춘 AI 비서 시장의 확대는 고급 생성형 AI 음성 기술에 기회), 도전과제(음성 및 음성용 대규모 생성형 AI 모델의 계산 요구 사항과 에너지 소비량 관리가 점점 더 어려워지고 있습니다. 생성형 AI 음성 기술의 부정 사용(사기, 허위 정보, 기타 악의적인 활동), AI 생성 음성의 인간과 같은 자연스러움과 감정 표현의 실현은 여전히 중요한 기술적 과제입니다).

제품 개발/혁신 : AI 음성 생성기 시장의 향후 기술 동향, 연구개발, 신제품 및 서비스 출시에 대한 상세한 분석.

시장 개발 : 수익성 높은 시장에 대한 종합적인 정보 - 이 보고서는 다양한 지역의 AI 음성 생성기 시장을 분석합니다.

시장 다각화 : AI 음성 생성기 시장의 신제품 및 서비스, 미개척 지역, 최근 동향, 투자에 대한 종합적인 정보.

자주 묻는 질문

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

- AI 음성 생성기의 대두

- AI 음성 생성기 시장의 진출 기업에서 매력적인 기회

- 의사결정자에 대한 전략적 원칙

- 전망과 향후 전망

제5장 시장 개요

- 시장 역학

- 미충족 수요와 공백

- 상호 접속된 시장과 분야 횡단적인 기회

- 티어1/2/3 진출 기업의 전략적 활동

제6장 업계 동향

- Porter's Five Forces 분석

- 공급망 분석

- AI 음성 생성기의 진화

- 거시경제 전망

- 생태계 분석

- 가격 분석

- 투자와 자금 조달 시나리오

- 사례 연구 분석

- 2025-2026년의 주요 회의와 이벤트

- 고객 비즈니스에 영향을 미치는 동향/혼란

제7장 전략적 파괴 : 특허, 디지털, AI의 도입

- 주요 기술

- 보완적 기술

- 인접 기술

- 특허 분석

- 향후 응용

제8장 규제 상황

- 지역 규제와 컴플라이언스

- 규제기관, 정부기관, 기타 조직

- 규칙

제9장 고객 상황과 구매 행동

- 의사결정 프로세스

- 구매자 이해관계자와 구입 평가 기준

- 채용 장벽과 내부 과제

- 다양한 최종사용자 미충족 수요

- 시장 수익성

제10장 AI 음성 생성기 시장(제공별)

- 소프트웨어

- 서비스

제11장 AI 음성 생성기 시장(기술별)

- 뉴럴 문자 음성 변환(TTS) 엔진과 음성 합성

- 실시간 음성 합성(S2S)

- 생성 확산 모델

- 엣지 최적화와 하이브리드 엔진

제12장 AI 음성 생성기 시장(음성 유형별)

- 자연스러운 음성

- 합성 음성

제13장 AI 음성 생성기 시장(용도별)

- 컨텐츠 제작

- 음성 수정

- 인터랙티브 애플리케이션

제14장 AI 음성 생성기 시장(최종사용자별)

- 컨텐츠 크리에이터와 개인 사용자

- 기업

제15장 AI 음성 생성기 시장(지역별)

- 북미

- 북미 : AI 음성 생성기 시장 성장 촉진요인

- 미국

- 캐나다

- 유럽

- 유럽 : AI 음성 생성기 시장 성장 촉진요인

- 영국

- 독일

- 프랑스

- 기타

- 아시아태평양

- 아시아태평양 : AI 음성 생성기 시장 성장 촉진요인

- 중국

- 인도

- 일본

- 기타

- 중동 및 아프리카

- 중동 및 아프리카 : AI 음성 생성기 시장 성장 촉진요인

- 사우디아라비아

- 아랍에미리트

- 남아프리카공화국

- 기타

- 라틴아메리카

- 라틴아메리카 : AI 음성 생성기 시장 성장 촉진요인

- 브라질

- 멕시코

- 기타

제16장 경쟁 구도

- 개요

- 주요 진출 기업의 전략, 2020-2025년

- 매출 분석, 2020-2024년

- 시장 점유율 분석, 2024년

- 제품 비교 분석

- 기업 평가 매트릭스 : 주요 진출 기업

- 기업 평가 매트릭스 : 스타트업 기업/중소기업

- 기업 평가와 재무 지표

- 경쟁 시나리오

제17장 기업 개요

- 주요 진출 기업

- IBM

- NVIDIA

- META

- MICROSOFT

- OPENAI

- AWS

- CISCO

- SOUNDHOUND AI

- ELEVENLABS

- WELLSAID

- SPEECHIFY

- SYNTHESIA

- STABILITY AI

- RUNWAY

- MUSICO

- DESCRIPT

- DEEPDUB

- ADOBE

- 스타트업 기업/중소기업

- PLAYHT

- RESEMBLE AI

- AMAI

- AIVA TECHNOLOGIES

- DUBVERSE

- RESPEECHER

- BEYONDWORDS

- VOICEMOD

- REPLICA STUDIOS

- SIMPLIFIED

- MURF AI

- LISTNR AI

- DEEPBRAIN AI

- CAMB.AI

- PODCASTLE

- LOVO AI

- SOUNDFUL

- SOUNDRAW

- BEATOVEN.AI

- ASSEMBLYAI

- PICOVOICE

- FREEPIK

제18장 인접 시장과 관련 시장

제19장 부록

KSM 26.01.05The AI voice generator market is anticipated to witness a compound annual growth rate (CAGR) of 30.7% over the forecast period, reaching USD 20.71 billion by 2031 from an estimated USD 4.16 billion in 2025. The market is accelerating as enterprises adopt dynamic prosody-control models that adjust speaking style, pacing, and emphasis automatically based on content type, improving user engagement in training, retail, and media workflows.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2031 |

| Base Year | 2024 |

| Forecast Period | 2025-2031 |

| Units Considered | Value (USD Billion) |

| Segments | Offering, Technology, Voice Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Growth is also driven by rising demand for automated compliance narration, where organizations use AI voices to deliver consistent disclosures across financial and healthcare processes. However, the limited availability of domain-specific acoustic datasets, especially for technical, medical, and legal vocabulary, slows accuracy improvements for specialized enterprise applications.

"API and developer tooling gain momentum as core growth engine in AI voice generator market"

APIs, SDKs, and developer tools are expected to witness significant demand because they have become the core enablers of scalable AI voice adoption across industries. Developers now prefer modular voice components that can be embedded directly into contact centers, creator platforms, mobile apps, and enterprise software without requiring full platform migration. This shift toward API-first architectures allows companies to plug voice synthesis, voice cloning, or real-time S2S features into existing workflows with minimal engineering effort. SDKs further accelerate integration by providing prebuilt libraries for Android, iOS, Unity, Unreal Engine, and web environments-making voice functionality accessible to gaming studios, AR/VR developers, and enterprise product teams. As vendors release low-latency endpoints, emotion controls, and multilingual capabilities through APIs, enterprises increasingly adopt usage-based models, creating recurring revenue streams for providers. These tools also enable rapid experimentation, letting businesses test voice features before committing to full-scale deployment. With demand rising for personalized, interactive, and multilingual audio experiences, API and SDK ecosystems are becoming the fastest-growing segment, helping vendors expand reach and developers build voice-enabled products quickly and cost-effectively.

"Rising demand for scalable audio automation drives content creation leadership in 2025"

The content creation segment is estimated to hold the largest market share in 2025, driven by the rapid adoption of AI voice tools across media, advertising, e-learning, and creator platforms. Enterprises and creators increasingly rely on synthetic narration, automated voiceovers, and multilingual dubbing to meet the rising demand for high-volume, fast-turnaround content. AI voice generators enable production teams to create consistent, natural-sounding audio at scale without the delays and costs associated with traditional recording. The growth of short-form video, podcasts, online courses, and global streaming platforms has further accelerated the need for flexible, expressive voices that can adapt to different formats, tones, and languages. Advanced speech models now support lifelike emotion, dynamic pacing, and accurate pronunciation across 40-100+ languages, making AI-generated audio suitable for localized campaigns and global audience engagement. As organizations prioritize speed, personalization, and efficient content pipelines, AI-driven content creation has become a foundational use case-positioning it as the strongest contributor to market growth in 2025.

"Asia Pacific to witness rapid AI voice generator demand fueled by innovation and evolving strategies, while North America leads in market size"

North America is estimated to hold the largest market share in 2025, supported by early enterprise adoption of neural and real-time voice technologies, a strong presence of leading AI providers, and the rapid integration of synthetic voices across media, entertainment, telecom, and customer engagement platforms. Large-scale deployments in OTT localization, automated call centers, programmatic audio, and enterprise training content continue to strengthen the region's dominance. Meanwhile, Asia Pacific is projected to grow at the highest CAGR during the forecast period as demand rises for multilingual and dialect-specific voice generation across India, Southeast Asia, and Japan. The region's fast-expanding OTT ecosystem, booming creator economy, and aggressive digital investments by telecom, BFSI, and e-learning companies are accelerating the adoption of AI voice tools. Lower production costs, mobile-first digital consumption, and the need for rapid content localization further support Asia Pacific's high growth trajectory. Together, these dynamics position North America as today's largest market while Asia Pacific emerges as the strongest long-term growth engine for AI voice generator solutions.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the AI voice generator market.

- By Company: Tier I - 31%, Tier II - 42%, and Tier III - 27%

- By Designation: Directors - 29%, Managers - 44%, and others - 27%

- By Region: North America - 40%, Europe - 22%, Asia Pacific - 26%, Middle East & Africa - 5%, and Latin America - 7%

The report includes the study of key players offering AI voice generator solutions and services. The major players in the AI voice generator market include Google (US), Microsoft (US), IBM (US), AWS (US), Adobe (US), NVIDIA (US), Meta (US), OpenAI (US), ElevenLabs (US), Cisco (US), SoundHound (UK), AssemblyAI (UK), Freepik (US), Adobe (US), Deepdub (Israel), Voicemod (Spain), Murf AI (US), Speechify (US), Musico (Netherlands), Stability AI (UK), Descript (US), Runway (US), WellSaid Labs (US), Podcastle (US), Respeecher (Ukraine), Synthesia (UK), Soundful (US), AMAI (US), Camb.ai (UAE), PlayHT (US), Resemble AI (US), Lovo AI (US), AI Studios (US), Beatoven.AI (US), Aiva Technologies (Luxembourg), Beyondwords (UK), Picovoice (Canada), Soundraw (Japan), Dubverse (India), Listnr (US), and Simplified (US).

Research coverage

This research report covers the AI voice generator market, segmented by offering, voice type, technology, application, and end user. The offering segment is split into software and services. The software segment is further split into voice generator platforms and APIs, SDKs, & developer tools. The technology segment is split into neural text-to-speech (TTS) & speech synthesis, real-time speech-to-speech (S2S), generative diffusion models, edge-optimized & hybrid engines. The voice type segment includes natural voice and synthetic voice. The application segment is further split into content creation, voice modification, and interactive applications. The end user segment includes content creators & individual users, and enterprises (media & entertainment, BFSI, healthcare & life sciences, retail & e-commerce, education & e-learning, energy & utilities, government & defense, technology & software, telecommunications, and other enterprises). The regional analysis of the AI voice generator market covers North America, Europe, Asia Pacific, the Middle East & Africa (MEA), and Latin America.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall AI voice generator market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (The increasing demand for voice-enabled devices and virtual assistants, Advancements in NLP and machine learning technologies are enhancing the capabilities of gen AI in audio and speech, Growing need for accessibility solutions in digital content), restraints (Lack of explainability in AI decision-making processes for audio generation, The high cost of developing and implementing advanced generative AI solutions is hindering market growth, Ethical concerns surrounding the use of AI-generated voices are leading to increased scrutiny), opportunities (The integration of gen AI with emerging technologies like 5G and edge computing can enable real-time audio and speech generation, The increasing demand for localized content and multilingual support in global markets offers growth potential for AI-powered translation and dubbing services, The growing market for personalized and emotionally intelligent AI assistants presents opportunities for advanced generative AI speech technologies), and challenges (Managing the computational requirements and energy consumption of large-scale generative AI models for audio & speech is becoming increasingly challenging, Misuse of generative AI audio technologies for fraud, misinformation, and other malicious activities, Achieving human-like naturalness and emotional expressiveness in AI-generated speech remains a significant technical challenge).

Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the AI voice generator market.

Market Development: Comprehensive information about lucrative markets - the report analyses the AI voice generator market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the AI voice generator market.

Competitive Assessment: In-depth assessment of market shares, growth strategies and offerings of leading players like Google (US), Microsoft (US), IBM (US), AWS (US), Adobe (US), NVIDIA (US), Meta (US), OpenAI (US), ElevenLabs (US), Cisco (US), SoundHound (UK), AssemblyAI (UK), Freepik (US), Adobe (US), Deepdub (Israel), Voicemod (Spain), Murf AI (US), Speechify (US), Musico (Netherlands), Stability AI (UK), Descript (US), Runway (US), WellSaid Labs (US), Podcastle (US), Respeecher (Ukraine), Synthesia (UK), Soundful (US), AMAI (US), Camb.ai (UAE), PlayHT (US), Resemble AI (US), Lovo AI (US), AI Studios (US), Beatoven.AI (US), Aiva Technologies (Luxembourg), Beyondwords (UK), Picovoice (Canada), Soundraw (Japan), Dubverse (India), Listnr (US), and Simplified (US), among others, in the AI voice generator market. The report also helps stakeholders understand the pulse of the AI voice generator market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS

- 3.3 DISRUPTIVE TRENDS SHAPING MARKET

- 3.4 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS

- 3.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 RISE OF AI VOICE GENERATORS

- 4.2 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AI VOICE GENERATOR MARKET

- 4.2.1 EMERGING ENTERPRISE-CENTRIC OPPORTUNITIES: VERTICALIZED VOICE MODELS, COMPLIANCE TOOLS, AND DOMAIN INTELLIGENCE

- 4.2.2 HIGH-GROWTH CREATIVE AND MEDIA OPPORTUNITIES: REAL-TIME LOCALIZATION, CHARACTER UNIVERSES, AND DYNAMIC AUDIO-AS-A-SERVICE

- 4.2.3 INFRASTRUCTURE AND DEVELOPER ECOSYSTEM OPPORTUNITIES: PLUG-IN ECONOMIES, LOW-LATENCY EDGE MODELS, AND VOICE AGENTS WITH AUTONOMY

- 4.3 STRATEGIC IMPERATIVES FOR DECISION-MAKERS

- 4.3.1 PRIORITIZING TRUSTED, TRACEABLE, AND RIGHTS-SAFE VOICE DEPLOYMENTS

- 4.3.2 DESIGNING MULTILINGUAL, MULTI-PERSONA VOICE SYSTEMS FOR GLOBAL EXPERIENCE DELIVERY

- 4.3.3 ORCHESTRATING VOICE AI WITH ENTERPRISE AUTOMATION, GEN AI, AND CUSTOMER-EXPERIENCE STACKS

- 4.4 OUTLOOK AND NEXT HORIZONS

- 4.4.1 EXPANDING FROM TEXT-BOUND VOICES TO REAL-TIME, MULTIMODAL SPEECH EXPERIENCES

- 4.4.2 MOVING TOWARD RESPONSIBLE VOICE ECOSYSTEMS WITH AUDITABILITY AND CONSENT INFRASTRUCTURE

- 4.4.3 SHIFTING FROM STANDALONE VOICE MODELS TO INDUSTRY-TUNED VOICE INTELLIGENCE NETWORKS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for voice-enabled devices and virtual assistants

- 5.2.1.2 Advancements in NLP and machine learning technologies to enhance capabilities of gen AI in audio and speech

- 5.2.1.3 Growing need for accessibility solutions in digital content

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of explainability in AI decision-making processes for audio generation

- 5.2.2.2 High cost of developing and implementing advanced generative AI solutions to hinder market growth

- 5.2.2.3 Ethical concerns surrounding use of AI-generated voices to lead to increased scrutiny

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of gen AI with emerging technologies like 5G and edge computing to enable real-time audio and speech generation

- 5.2.3.2 Increasing demand for localized content and multilingual support in global markets to offer growth potential for AI-powered translation and dubbing services

- 5.2.3.3 Growing market for personalized and emotionally intelligent AI assistants to present opportunities for advanced generative AI speech technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Managing computational requirements and energy consumption of large-scale generative AI models for audio and speech becoming increasingly challenging

- 5.2.4.2 Misuse of generative AI audio technologies for fraud, misinformation, and other malicious activities

- 5.2.4.3 Achieving human-like naturalness and emotional expressiveness in AI-generated speech to remain significant technical challenge

- 5.2.1 DRIVERS

- 5.3 UNMET NEEDS AND WHITE SPACES

- 5.3.1 UNMET NEEDS IN AI VOICE GENERATOR MARKET

- 5.3.2 WHITE-SPACE OPPORTUNITIES IN AI VOICE GENERATOR MARKET

- 5.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 5.4.1 INTERCONNECTED MARKETS

- 5.4.2 CROSS-SECTOR OPPORTUNITIES

- 5.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 5.5.1 KEY MOVES AND STRATEGIC FOCUS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF NEW ENTRANTS

- 6.1.2 THREAT OF SUBSTITUTES

- 6.1.3 BARGAINING POWER OF SUPPLIERS

- 6.1.4 BARGAINING POWER OF BUYERS

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 EVOLUTION OF AI VOICE GENERATORS

- 6.4 MACROECONOMIC OUTLOOK

- 6.4.1 INTRODUCTION

- 6.4.2 GDP TRENDS AND FORECAST

- 6.4.3 TRENDS IN GLOBAL AI INDUSTRY

- 6.4.4 TRENDS IN GLOBAL BIG DATA & ANALYTICS INDUSTRY

- 6.5 ECOSYSTEM ANALYSIS

- 6.5.1 VOICE GENERATION PLATFORM PROVIDERS

- 6.5.2 API, SDKS & DEVELOPER TOOL PROVIDERS

- 6.5.3 TECHNOLOGY PROVIDERS

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE OF OFFERINGS, BY KEY PLAYER, 2025

- 6.6.2 AVERAGE SELLING PRICE OF APPLICATION, 2025

- 6.7 INVESTMENT AND FUNDING SCENARIO

- 6.8 CASE STUDY ANALYSIS

- 6.8.1 VOXPOPME INTEGRATED ELEVENLABS AGENTS PLATFORM TO POWER HUMAN-LIKE AI MODERATORS

- 6.8.2 CHARISMA.AI PARTNERED WITH RESEMBLE AI TO USE SYNTHETIC VOICE GENERATION TECHNOLOGY FOR CREATING EMOTIONALLY RICH, SCALABLE CHARACTER VOICES

- 6.8.3 TRIPP COLLABORATED WITH WELLSAID LABS TO AUTOMATE MEDITATION CONTENT CREATION

- 6.8.4 ALINEA IMPLEMENTED SPEECHIFY'S TEXT-TO-SPEECH API TO DELIVER PERSONALIZED, CONVERSATIONAL FINANCIAL LEARNING EXPERIENCES

- 6.8.5 HUBSPOT ADOPTED DESCRIPT'S TEXT-BASED AUDIO EDITING PLATFORM TO STREAMLINE PODCAST PRODUCTION, ENABLING FASTER COLLABORATION, EDITING, AND PUBLISHING

- 6.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

7 STRATEGIC DISRUPTION: PATENTS, DIGITAL, AND AI ADOPTION

- 7.1 KEY TECHNOLOGIES

- 7.1.1 NEURAL VOCODERS

- 7.1.2 TEXT-TO-SPEECH (TTS) ARCHITECTURES

- 7.1.3 ATTENTION MECHANISMS

- 7.1.4 NATURAL LANGUAGE PROCESSING (NLP)

- 7.2 COMPLEMENTARY TECHNOLOGIES

- 7.2.1 AUTOMATIC SPEECH RECOGNITION (ASR)

- 7.2.2 EMOTION AI AND PROSODY MODELING

- 7.2.3 CLOUD AND EDGE AI INFRASTRUCTURE

- 7.2.4 VOICE CONVERSION AND ADAPTATION MODELS

- 7.3 ADJACENT TECHNOLOGIES

- 7.3.1 SPEAKER DIARIZATION AND VOICE EMBEDDINGS

- 7.3.2 BIOMETRIC VOICE AUTHENTICATION

- 7.3.3 SPATIAL AND IMMERSIVE AUDIO (AR/VR)

- 7.4 PATENT ANALYSIS

- 7.4.1 METHODOLOGY

- 7.4.2 PATENTS FILED, BY DOCUMENT TYPE, 2016-2025

- 7.4.3 INNOVATION AND PATENT APPLICATIONS

- 7.5 FUTURE APPLICATIONS

8 REGULATORY LANDSCAPE

- 8.1 REGIONAL REGULATIONS AND COMPLIANCE

- 8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 8.1.2 REGULATIONS

- 8.1.2.1 North America

- 8.1.2.1.1 Executive Order 14110 on Safe, Secure, and Trustworthy AI (US)

- 8.1.2.1.2 Artificial Intelligence and Data Act-AIDA (Canada)

- 8.1.2.2 Europe

- 8.1.2.2.1 Europe Artificial Intelligence Act (European Union)

- 8.1.2.2.2 General Data Protection Regulation (European Union)

- 8.1.2.2.3 Data Protection Act 2018 (UK)

- 8.1.2.2.4 Federal Data Protection Act (Germany)

- 8.1.2.2.5 French Data Protection Act (France)

- 8.1.2.2.6 Personal Data Protection Code-Legislative Decree 196/2003 (Italy)

- 8.1.2.2.7 Organic Law 3/2018 (Spain)

- 8.1.2.2.8 UAVG and Public-Sector Algorithm Transparency (Netherlands)

- 8.1.2.3 Asia Pacific

- 8.1.2.3.1 Interim Measures for the Management of Generative AI Services (China)

- 8.1.2.3.2 Digital Personal Data Protection Act, 2023 (India)

- 8.1.2.3.3 Act on the Protection of Personal Information (Japan)

- 8.1.2.3.4 Basic Act on Artificial Intelligence (South Korea)

- 8.1.2.3.5 Personal Data Protection Act (Singapore)

- 8.1.2.4 Middle East & Africa

- 8.1.2.4.1 Federal Decree-Law No. 45 of 2021 on the Protection of Personal Data (UAE)

- 8.1.2.4.2 Personal Data Protection Law (KSA)

- 8.1.2.4.3 Protection of Personal Information Act (South Africa)

- 8.1.2.4.4 Personal Data Privacy Protection Law (Qatar)

- 8.1.2.4.5 Law on the Protection of Personal Data No. 6698 (Turkey)

- 8.1.2.5 Latin America

- 8.1.2.5.1 General Data Protection Law - LGPD (Brazil)

- 8.1.2.5.2 Federal Law on Protection of Personal Data Held by Private Parties (Mexico)

- 8.1.2.5.3 Personal Data Protection Law No. 25,326 (Argentina)

- 8.1.2.1 North America

9 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 9.1 DECISION-MAKING PROCESS

- 9.1.1 NEED IDENTIFICATION AND USE-CASE DEFINITION

- 9.1.2 TECHNICAL FEASIBILITY AND COMPLIANCE ASSESSMENT

- 9.1.3 VENDOR SHORTLISTING AND CAPABILITY COMPARISON

- 9.1.4 COST-BENEFIT AND ROI EVALUATION

- 9.1.5 PILOT IMPLEMENTATION AND PERFORMANCE VALIDATION

- 9.1.6 FULL-SCALE DEPLOYMENT AND CHANGE MANAGEMENT

- 9.1.7 CONTINUOUS OPTIMIZATION AND INNOVATION EXPANSION

- 9.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 9.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 9.2.2 BUYING CRITERIA

- 9.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 9.4 UNMET NEEDS AMONG VARIOUS END USERS

- 9.5 MARKET PROFITABILITY

10 AI VOICE GENERATOR MARKET, BY OFFERING

- 10.1 INTRODUCTION

- 10.1.1 OFFERING: AI VOICE GENERATOR MARKET DRIVERS

- 10.2 SOFTWARE

- 10.2.1 VOICE GENERATOR PLATFORMS

- 10.2.1.1 Voice generation platforms deliver end-to-end systems that standardize and scale enterprise-grade AI voice creation

- 10.2.2 APIS, SDKS, AND DEVELOPER TOOLS

- 10.2.2.1 APIs and developer tools extend AI voice capabilities into applications, enabling programmable, real-time, and scalable integrations

- 10.2.1 VOICE GENERATOR PLATFORMS

- 10.3 SERVICES

- 10.3.1 PROFESSIONAL SERVICES

- 10.3.1.1 Professional services guide enterprises in designing, deploying, and optimizing AI voice workflows for maximum value

- 10.3.1.2 Training & consulting services

- 10.3.1.3 System integration & implementation services

- 10.3.1.4 Support & maintenance services

- 10.3.2 MANAGED SERVICES

- 10.3.2.1 Managed services provide complete lifecycle oversight for enterprises seeking scalable, low-risk AI voice operations

- 10.3.1 PROFESSIONAL SERVICES

11 AI VOICE GENERATOR MARKET, BY TECHNOLOGY

- 11.1 INTRODUCTION

- 11.1.1 TECHNOLOGY: AI VOICE GENERATOR MARKET DRIVERS

- 11.2 NEURAL TEXT-TO-SPEECH (TTS) ENGINES & SPEECH SYNTHESIS

- 11.2.1 NEURAL TTS TO DRIVE ENTERPRISE ADOPTION BY DELIVERING NATURAL, EXPRESSIVE, AND SECURE SYNTHETIC SPEECH AT SCALE

- 11.3 REAL-TIME SPEECH-TO-SPEECH (S2S)

- 11.3.1 REAL-TIME S2S TO UNLOCK INSTANT MULTILINGUAL AND IDENTITY-CONTROLLED COMMUNICATION FOR HIGH-PERFORMANCE ENTERPRISE USE CASES

- 11.4 GENERATIVE DIFFUSION MODELS

- 11.4.1 DIFFUSION MODELS REDEFINE CREATIVE VOICE GENERATION THROUGH HIGHLY EXPRESSIVE, LONG-FORM, AND EMOTION-RICH SPEECH SYNTHESIS

- 11.5 EDGE-OPTIMIZED & HYBRID ENGINES

- 11.5.1 EDGE AND HYBRID ENGINES ENABLE ULTRA-LOW-LATENCY, PRIVACY-FIRST VOICE AI DEPLOYMENTS ACROSS REGULATED AND REAL-TIME ENVIRONMENTS

12 AI VOICE GENERATOR MARKET, BY VOICE TYPE

- 12.1 INTRODUCTION

- 12.1.1 VOICE TYPE: AI VOICE GENERATOR MARKET DRIVERS

- 12.2 NATURAL VOICE

- 12.2.1 NATURAL VOICE STRENGTHENS TRUST AND EMOTIONAL AUTHENTICITY IN APPLICATIONS WHERE HUMAN CREDIBILITY IS ESSENTIAL

- 12.3 SYNTHETIC VOICE

- 12.3.1 SYNTHETIC VOICE TO DRIVE SCALABLE, CUSTOMIZABLE, AND REAL-TIME VOICE AUTOMATION ACROSS HIGH-VOLUME ENTERPRISE APPLICATIONS

13 AI VOICE GENERATOR MARKET, BY APPLICATION

- 13.1 INTRODUCTION

- 13.1.1 APPLICATION: AI VOICE GENERATOR MARKET DRIVERS

- 13.2 CONTENT CREATION

- 13.2.1 NARRATION & VOICEOVERS

- 13.2.1.1 AI-powered narration to accelerate content production by enabling fast, expressive, and scalable voiceover workflow

- 13.2.2 AUDIO/SPEECH SYNTHESIS

- 13.2.2.1 Speech synthesis to drive efficient, high-quality audio production

- 13.2.3 AUDIOBOOKS

- 13.2.3.1 AI-generated audiobooks to accelerate long-form content production by delivering consistent, expressive, and multilingual narration

- 13.2.4 MARKETING/AD CREATION

- 13.2.4.1 AI-driven voiceovers to enable rapid, personalized, and globally scalable marketing content creation

- 13.2.5 OTHER CONTENT CREATION APPLICATIONS

- 13.2.1 NARRATION & VOICEOVERS

- 13.3 VOICE MODIFICATION

- 13.3.1 VOICE CLONING

- 13.3.1.1 Voice cloning to enable personalized, brand-owned voice identities while advancing secure and consent-driven voice replication

- 13.3.2 DUBBING & LOCALIZATION

- 13.3.2.1 AI-powered dubbing to accelerate global content reach

- 13.3.3 ACCENT & TONE ENHANCEMENT

- 13.3.3.1 Accent and tone enhancement to strengthen communication clarity by delivering neutral, audience-optimized voice quality

- 13.3.4 SOUND EFFECTS INTEGRATION

- 13.3.4.1 AI-driven sound effects integration to enhance engagement by creating immersive, context-aware audio

- 13.3.5 OTHER VOICE MODIFICATION APPLICATIONS

- 13.3.1 VOICE CLONING

- 13.4 INTERACTIVE APPLICATIONS

- 13.4.1 VIRTUAL ASSISTANTS & IVR

- 13.4.1.1 AI-generated voices to elevate virtual assistants by delivering natural, context-aware, and emotionally adaptive user interactions

- 13.4.2 CUSTOMER SERVICE AGENTS & CALL CENTERS

- 13.4.2.1 AI voice agents to streamline customer service by delivering consistent, empathetic, and multilingual call experiences

- 13.4.3 GAMING NPCS & IN-GAME VOICES

- 13.4.3.1 AI-generated NPC voices to enhance gameplay immersion through scalable, expressive, and adaptive character dialog

- 13.4.4 AR/VR EXPERIENCES

- 13.4.4.1 AI-powered speech to enhances AR/VR immersion by delivering adaptive, lifelike, and context-aware voice interactions

- 13.4.5 OTHER INTERACTIVE APPLICATIONS

- 13.4.1 VIRTUAL ASSISTANTS & IVR

14 AI VOICE GENERATOR MARKET, BY END USER

- 14.1 INTRODUCTION

- 14.1.1 END USER: AI VOICE GENERATOR MARKET DRIVERS

- 14.2 CONTENT CREATORS & INDIVIDUAL USERS

- 14.3 ENTERPRISES

- 14.3.1 MEDIA & ENTERTAINMENT

- 14.3.1.1 Media scales global content through high-fidelity voice localization and rapid, studio-integrated production

- 14.3.2 BFSI

- 14.3.2.1 BFSI modernizes customer engagement through secure, compliance-ready voice automation and traceable delivery

- 14.3.3 HEALTHCARE & LIFE SCIENCES

- 14.3.3.1 Healthcare improves patient engagement through HIPAA-aligned, empathetic voice automation and clinical documentation support

- 14.3.4 RETAIL & E-COMMERCE

- 14.3.4.1 Retail drives personalization and conversion through context-aware voice assistants and scalable promotional voice generation

- 14.3.5 ENERGY & UTILITIES

- 14.3.5.1 Energy utilities enhance operations and customer outreach via resilient, low-latency voice notifications and field guidance

- 14.3.6 GOVERNMENT & DEFENSE

- 14.3.6.1 Governments improve citizen services through secure, sovereign, and multilingual voice automation

- 14.3.7 TECHNOLOGY & SOFTWARE

- 14.3.7.1 Tech firms accelerate product value through developer-friendly voice APIs, composable SDKs, and white-label integration

- 14.3.8 TELECOMMUNICATIONS

- 14.3.8.1 Telcos enable scalable, low-latency voice services via edge distribution and integrated enterprise bundles

- 14.3.9 OTHER ENTERPRISES

- 14.3.1 MEDIA & ENTERTAINMENT

15 AI VOICE GENERATOR MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 NORTH AMERICA: AI VOICE GENERATOR MARKET DRIVERS

- 15.2.2 US

- 15.2.2.1 Tech-giant innovations, compliance-focused regulations, and high enterprise automation demand to drive market

- 15.2.3 CANADA

- 15.2.3.1 Bilingual content needs, ethical AI regulation, and government-backed digital transformation to increase AI voice generator deployment

- 15.3 EUROPE

- 15.3.1 EUROPE: AI VOICE GENERATOR MARKET DRIVERS

- 15.3.2 UK

- 15.3.2.1 Regulated innovation, sector-wide automation, and strong investment in public sector digital services to drive market

- 15.3.3 GERMANY

- 15.3.3.1 Industrial digitization, privacy-centric regulation, and multilingual content automation to boost market

- 15.3.4 FRANCE

- 15.3.4.1 Strong cultural localization needs, sovereign AI investment, and media-driven demand to drive market

- 15.3.5 REST OF EUROPE

- 15.4 ASIA PACIFIC

- 15.4.1 ASIA PACIFIC: AI VOICE GENERATOR MARKET DRIVERS

- 15.4.2 CHINA

- 15.4.2.1 Domestic cloud integration, dialect coverage, and sovereign deployment mandates to drive market

- 15.4.3 INDIA

- 15.4.3.1 Vernacular scale, low-resource modeling, and public-sector localization programs to drive market

- 15.4.4 JAPAN

- 15.4.4.1 Focus on premium, low-latency voice AI integration into consumer electronics, automotive, and creative industries to drive market

- 15.4.5 REST OF ASIA PACIFIC

- 15.5 MIDDLE EAST & AFRICA

- 15.5.1 MIDDLE EAST & AFRICA: AI VOICE GENERATOR MARKET DRIVERS

- 15.5.2 SAUDI ARABIA

- 15.5.2.1 Digital modernization efforts and public-sector transformation programs to drive market

- 15.5.3 UAE

- 15.5.3.1 Multilingual services, telecom partnerships, and smart-city integrations to boost market

- 15.5.4 SOUTH AFRICA

- 15.5.4.1 Multilingual outreach, BFSI modernization, and social-impact deployments to drive market

- 15.5.5 REST OF MIDDLE EAST & AFRICA

- 15.6 LATIN AMERICA

- 15.6.1 LATIN AMERICA: AI VOICE GENERATOR MARKET DRIVERS

- 15.6.2 BRAZIL

- 15.6.2.1 Portuguese localization, LGPD-driven compliance, and media-sector demand to drive market

- 15.6.3 MEXICO

- 15.6.3.1 Nearshore integration, Spanish dialect fidelity, and contact-center modernization to drive market

- 15.6.4 REST OF LATIN AMERICA

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES, 2020-2025

- 16.3 REVENUE ANALYSIS, 2020-2024

- 16.4 MARKET SHARE ANALYSIS, 2024

- 16.4.1 MARKET RANKING ANALYSIS, 2024

- 16.5 PRODUCT COMPARATIVE ANALYSIS

- 16.5.1 PRODUCT COMPARATIVE ANALYSIS, BY SPEECH SYNTHESIS

- 16.5.1.1 AWS (Amazon Polly)

- 16.5.1.2 Microsoft (Azure Speech)

- 16.5.1.3 NVIDIA (Riva)

- 16.5.1.4 Google (Text-to-Speech)

- 16.5.1.5 OpenAI (GPT)

- 16.5.2 PRODUCT COMPARATIVE ANALYSIS, BY VOICE MODIFICATION

- 16.5.2.1 Respeecher (Platform)

- 16.5.2.2 Speechify (Speechify API)

- 16.5.2.3 ElevenLabs (ElevenLabs API)

- 16.5.2.4 WellSaid Labs (WellSaid API)

- 16.5.2.5 Play.AI (Play.ht)

- 16.5.3 PRODUCT COMPARATIVE ANALYSIS, BY CONTENT CREATION

- 16.5.3.1 Soundful (Soundful API)

- 16.5.3.2 Soundraw (API)

- 16.5.3.3 Loudly

- 16.5.3.4 Aiva Technologies (Aiva)

- 16.5.3.5 Mubert (API)

- 16.5.1 PRODUCT COMPARATIVE ANALYSIS, BY SPEECH SYNTHESIS

- 16.6 COMPANY EVALUATION MATRIX: KEY PLAYERS

- 16.6.1 STARS

- 16.6.2 EMERGING LEADERS

- 16.6.3 PERVASIVE PLAYERS

- 16.6.4 PARTICIPANTS

- 16.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.6.5.1 Company footprint

- 16.6.5.2 Regional footprint

- 16.6.5.3 Offering footprint

- 16.6.5.4 Application footprint

- 16.6.5.5 Technology footprint

- 16.6.5.6 End User footprint

- 16.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES

- 16.7.1 PROGRESSIVE COMPANIES

- 16.7.2 RESPONSIVE COMPANIES

- 16.7.3 DYNAMIC COMPANIES

- 16.7.4 STARTING BLOCKS

- 16.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.7.5.1 Detailed list of key startups/SMEs

- 16.7.5.2 Competitive Benchmarking of Key Startups/SMEs

- 16.8 COMPANY VALUATION AND FINANCIAL METRICS

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 16.9.2 DEALS

17 COMPANY PROFILES

- 17.1 INTRODUCTION

- 17.2 KEY PLAYERS

- 17.2.1 IBM

- 17.2.1.1 Business overview

- 17.2.1.2 Products/Solutions/Services offered

- 17.2.1.3 Recent developments

- 17.2.1.3.1 Product launches and enhancements

- 17.2.1.3.2 Deals

- 17.2.1.4 MnM view

- 17.2.1.4.1 Key strengths

- 17.2.1.4.2 Strategic choices

- 17.2.1.4.3 Weaknesses and competitive threats

- 17.2.2 NVIDIA

- 17.2.2.1 Business overview

- 17.2.2.2 Products/Solutions/Services offered

- 17.2.2.3 Recent developments

- 17.2.2.3.1 Product launches and enhancements

- 17.2.2.3.2 Deals

- 17.2.2.4 MnM view

- 17.2.2.4.1 Key strengths

- 17.2.2.4.2 Strategic choices

- 17.2.2.4.3 Weaknesses and competitive threats

- 17.2.3 META

- 17.2.3.1 Business overview

- 17.2.3.2 Products/Solutions/Services offered

- 17.2.3.3 Recent developments

- 17.2.3.3.1 Product launches and enhancements

- 17.2.3.3.2 Deals

- 17.2.3.4 MnM view

- 17.2.3.4.1 Key strengths

- 17.2.3.4.2 Strategic choices

- 17.2.3.4.3 Weaknesses and competitive threats

- 17.2.4 MICROSOFT

- 17.2.4.1 Business overview

- 17.2.4.2 Products/Solutions/Services offered

- 17.2.4.3 Recent developments

- 17.2.4.3.1 Product launches and enhancements

- 17.2.4.3.2 Deals

- 17.2.4.4 MnM view

- 17.2.4.4.1 Key strengths

- 17.2.4.4.2 Strategic choices

- 17.2.4.4.3 Weaknesses and competitive threats

- 17.2.5 GOOGLE

- 17.2.5.1 Business overview

- 17.2.5.2 Products/Solutions/Services offered

- 17.2.5.3 Recent developments

- 17.2.5.3.1 Product launches and enhancements

- 17.2.5.3.2 Deals

- 17.2.5.4 MnM view

- 17.2.5.4.1 Key strengths

- 17.2.5.4.2 Strategic choices

- 17.2.5.4.3 Weaknesses and competitive threats

- 17.2.6 OPENAI

- 17.2.6.1 Business overview

- 17.2.6.2 Products/Solutions/Services offered

- 17.2.6.3 Recent developments

- 17.2.6.3.1 Product launches and enhancements

- 17.2.6.3.2 Deals

- 17.2.7 AWS

- 17.2.7.1 Business overview

- 17.2.7.2 Products/Solutions/Services offered

- 17.2.7.3 Recent developments

- 17.2.7.3.1 Product launches and enhancements

- 17.2.7.3.2 Deals

- 17.2.8 CISCO

- 17.2.8.1 Business overview

- 17.2.8.2 Products/Solutions/Services offered

- 17.2.8.3 Recent developments

- 17.2.8.3.1 Product launches and enhancements

- 17.2.8.3.2 Deals

- 17.2.9 SOUNDHOUND AI

- 17.2.9.1 Business overview

- 17.2.9.2 Products/Solutions/Services offered

- 17.2.9.3 Recent developments

- 17.2.9.3.1 Product launches and enhancements

- 17.2.9.3.2 Deals

- 17.2.10 ELEVENLABS

- 17.2.10.1 Business overview

- 17.2.10.2 Products/Solutions/Services offered

- 17.2.10.3 Recent developments

- 17.2.10.3.1 Product launches and enhancements

- 17.2.10.3.2 Deals

- 17.2.11 WELLSAID

- 17.2.11.1 Business overview

- 17.2.11.2 Products/Solutions/Services offered

- 17.2.11.3 Recent developments

- 17.2.11.3.1 Product launches and enhancements

- 17.2.11.3.2 Deals

- 17.2.12 SPEECHIFY

- 17.2.13 SYNTHESIA

- 17.2.14 STABILITY AI

- 17.2.15 RUNWAY

- 17.2.16 MUSICO

- 17.2.17 DESCRIPT

- 17.2.18 DEEPDUB

- 17.2.19 ADOBE

- 17.2.1 IBM

- 17.3 STARTUP/SME PROFILES

- 17.3.1 PLAYHT

- 17.3.2 RESEMBLE AI

- 17.3.3 AMAI

- 17.3.4 AIVA TECHNOLOGIES

- 17.3.5 DUBVERSE

- 17.3.6 RESPEECHER

- 17.3.7 BEYONDWORDS

- 17.3.8 VOICEMOD

- 17.3.9 REPLICA STUDIOS

- 17.3.10 SIMPLIFIED

- 17.3.11 MURF AI

- 17.3.12 LISTNR AI

- 17.3.13 DEEPBRAIN AI

- 17.3.14 CAMB.AI

- 17.3.15 PODCASTLE

- 17.3.16 LOVO AI

- 17.3.17 SOUNDFUL

- 17.3.18 SOUNDRAW

- 17.3.19 BEATOVEN.AI

- 17.3.20 ASSEMBLYAI

- 17.3.21 PICOVOICE

- 17.3.22 FREEPIK

18 ADJACENT AND RELATED MARKETS

- 18.1 INTRODUCTION

- 18.2 GENERATIVE AI MARKET - GLOBAL FORECAST TO 2032

- 18.2.1 MARKET DEFINITION

- 18.2.2 MARKET OVERVIEW

- 18.2.2.1 Generative AI market, by offering

- 18.2.2.2 Generative AI market, by data modality

- 18.2.2.3 Generative AI market, by application

- 18.2.2.4 Generative AI market, by end user

- 18.2.2.5 Generative AI market, by region

- 18.3 DEEPFAKE AI MARKET - GLOBAL FORECAST TO 2031

- 18.3.1 MARKET DEFINITION

- 18.3.2 MARKET OVERVIEW

- 18.3.2.1 Deepfake AI market, by offering

- 18.3.2.2 Deepfake AI market, by technology

- 18.3.2.3 Deepfake AI market, by vertical

- 18.3.2.4 Deepfake AI market, by region

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.3 CUSTOMIZATION OPTIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS