|

시장보고서

상품코드

1893726

상업용 냉장 시장 : 제품 유형별, 냉매 유형별, 용도별, 최종 용도별, 도어 유형별, 지역별 - 예측(-2030년)Commercial Refrigeration Market by Product Type, Refrigerant Type (HCFCs, HFCs, HFO, Isobutane, Propane, Ammonia, Carbon Dioxide), Application, End Use (Supermarkets & Hypermarkets, Hotels & Restaurants), Door Type, and Region - Global Forecast to 2030 |

||||||

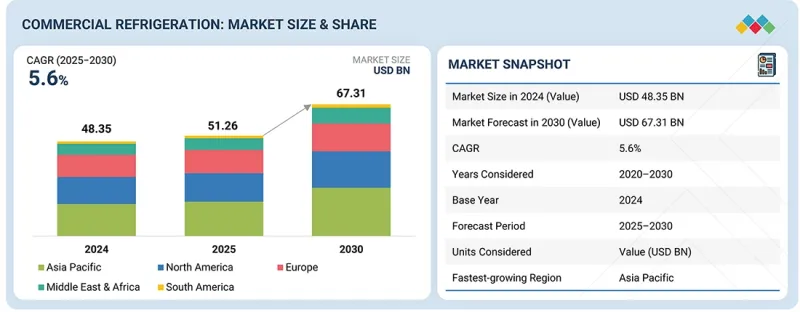

세계의 상업용 냉장 시장 규모는 2025년 512억 6,000만 달러에서 2030년까지 673억 1,000만 달러에 달할 것으로 예측되며, 예측 기간 동안 CAGR 5.6%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러 |

| 부문 | 제품 유형, 냉매 유형, 도어 유형, 최종 용도, 용도 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 중동 및 아프리카, 남미 |

세계 상업용 냉장 시장은 식품 소매업의 확대, 콜드체인에 대한 강력한 수요, 그리고 슈퍼마켓, 편의점, 푸드서비스 등의 부문에서 수요가 증가함에 따라 꾸준히 성장하고 있습니다. 또한, 식품 안전 규제 강화, 에너지 절약 및 친환경 시스템으로의 전환, 스마트하고 디지털로 모니터링되는 냉장 기술의 채택 확대가 성장을 뒷받침하고 있습니다.

"제품 유형별로는 냉장 쇼케이스 부문이 예측 기간 동안 두 번째로 높은 점유율을 차지할 것으로 예상됩니다."

냉장 쇼케이스 부문은 예측 기간 동안 상업용 냉동 시장에서 금액 기준으로 두 번째 점유율을 차지할 것으로 예상됩니다. 이는 슈퍼마켓, 대형마트, 편의점이 전 세계적으로 확대되면서 매력적이고 에너지 절약형 상품 진열에 중점을 두고 있기 때문입니다. 도시화가 진행되고 신선식품과 조리식품에 대한 소비자의 선호도가 변화함에 따라 소매업체들은 상품 진열 효과를 높이기 위해 현대적이고 시각적으로 매력적인 쇼케이스로의 리뉴얼을 추진하고 있습니다. 또한, LED 조명, 단열 성능 향상, 저GWP 냉매 등의 기술 발전은 에너지 비용 절감과 지속가능성 규제에 대응하고자 하는 기업들의 교체 수요를 불러일으키며 이 부문의 성장을 더욱 가속화하고 있습니다.

"냉매 유형별로는 탄화수소 부문이 예측 기간 동안 두 번째로 큰 시장 점유율을 차지할 것으로 예상됩니다."

탄화수소 부문은 예측 기간 동안 상업용 냉동 시장에서 두 번째 점유율을 차지할 것으로 예상됩니다. 소매업체와 외식업체들이 환경 친화적인 시스템과 에너지 효율 향상을 추구함에 따라 이 분야의 시장은 빠르게 성장하고 있습니다. 프로판, 이소부탄 등 탄화수소계 냉매는 높은 냉각 성능을 발휘하면서도 고GWP 가스 감축을 목표로 하는 전 세계 규제에 대응할 수 있어 점점 더 많은 지지를 받고 있습니다. 또한, 제조업체들이 안전성과 효율성을 높이기 위해 시스템 설계를 최적화하면서 현대식 쇼케이스, 리치 인 쿨러, 소형 상업용 장비에 대한 사용도 증가하고 있습니다. 이러한 지속가능하고 규정을 준수하는 냉동 솔루션으로의 전환은 탄화수소 냉매를 시장에서 두 번째로 큰 시장으로 끌어올렸습니다.

"식음료 유통 부문은 예측 기간 동안 두 번째로 큰 응용 분야가 될 것으로 예상됩니다."

식음료 유통 부문은 예측 기간 동안 상업용 냉동 시장에서 두 번째 점유율을 차지할 것으로 추정됩니다. 이 부문의 시장은 세계 공급망과 온도 제어 운송에 대한 수요 증가에 힘입어 성장하고 있습니다. 신선식품, 유제품, 육류, 조리식품의 소비가 증가함에 따라 창고, 물류 허브, 라스트 마일 배송 네트워크 전반에 걸쳐 신뢰할 수 있는 냉장 보관 및 취급이 요구되고 있습니다. 기업들은 또한 제품 손실을 줄이고, 더 엄격한 안전 기준에 대응하고, 급증하는 E-Commerce 식품 배송을 지원하기 위해 현대식 냉장 시스템에 투자하고 있습니다. 이러한 요인들이 복합적으로 작용하여 식음료 유통 부문의 성장세를 견인하고 있습니다.

"최종 용도별로는 호텔 및 레스토랑 부문이 예측 기간 동안 두 번째로 큰 시장 점유율을 차지할 것으로 예상됩니다."

호텔 및 레스토랑 부문은 예측 기간 동안 상업용 냉장 시장에서 금액 기준으로 두 번째 점유율을 차지할 것으로 예상됩니다. 이는 신선하고 질 좋은 음식에 대한 소비자 수요가 높아졌기 때문입니다. 또한, 외식 지향성이 높아짐에 따라 기업들은 보다 효율적이고 신뢰할 수 있는 냉장 시스템으로 주방을 업그레이드하고 있습니다. 호텔이나 레스토랑에서는 식품의 안전성 향상, 경영 비용 절감, 엄격해지는 위생 규제에 대응하기 위해 첨단 공간 절약형 및 에너지 절약형 장비를 채택하고 있습니다. 이러한 추세로 인해 상업용 냉장 보관에 대한 꾸준한 투자가 이루어지고 있습니다.

세계의 상업용 냉장 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 제품 개발 및 혁신, 경쟁 구도 등의 정보를 전해드립니다.

자주 묻는 질문

목차

제1장 소개

제2장 주요 요약

제3장 중요한 인사이트

- 상업용 냉장 시장 기업에서 매력적인 기회

- 상업용 냉장 시장 : 지역별

- 상업용 냉장 시장 : 주요 국가별

제4장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 미충족 수요와 화이트 스페이스

- 상업용 냉장 시장의 미충족 수요

- 화이트 스페이스 기회

- 상호 접속된 시장과 부문 횡단적인 기회

- 상호 접속된 시장

- 부문 횡단적인 기회

- 새로운 비즈니스 모델과 생태계의 변화

- 새로운 비즈니스 모델

- 생태계의 변화

- Tier 1/2/3 기업의 전략적 활동

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제 전망

- GDP 동향과 예측

- 세계의 상업용 냉장 업계 동향

- 밸류체인 분석

- 연구개발

- 원재료

- 제조

- 유통망

- 최종 이용 산업

- 생태계 분석

- 무역 데이터

- 수입 시나리오(HS 코드 8418)

- 수출 시나리오(HS 코드 8418)

- 주요 회의와 이벤트(2025-2026년)

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 투자와 자금 조달 시나리오

- 사례 연구 분석

- 운송업체 사례 연구 : 아이스크림 냉장

- 운송업체 사례 연구 : 바나나 냉장

- VERDE GROUP LIMITED : 냉장 사례 연구

- 상업용 냉장 시장에 대한 미국 관세의 영향

- 주요 관세율

- 가격의 영향 분석

- 주요 국가/지역에 대한 영향

- 상업용 냉장의 최종 이용 산업에 대한 영향

제6장 기술의 진보, AI에 의한 영향, 특허, 혁신, 향후 용도

- 주요 신기술

- 보완 기술

- 기술/제품 로드맵

- 단기|프로세스 최적화와 환경 컴플라이언스(2025-2027년)

- 중기|혁신과 지속가능한 변혁(2027-2030년)

- 장기|순환성, 탈탄소화, 새로운 용도(2030-2035년 이후)

- 특허 분석

- 향후 용도

- 스마트 콜드체인 물류 : 디지털 냉장망

- 저GWP 냉매와 탄소 중립 시스템

- 모듈러 휴대용 냉각장치

- 식품 폐기물 절감 기술

- 의료·바이오의약품 냉장

- 상업용 냉장 시장에 대한 생성형 AI의 영향

- 진단과 트러블슈팅

- 에너지 최적화와 예지보전

- 트레이닝과 재고 관리

- 디자인 혁신과 지속가능성

제7장 지속가능성과 규제 상황

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 업계 표준

- 지속가능성에 대한 대처

- 지속가능성에 대한 영향과 규제 정책의 대처

- 인증, 라벨, 환경기준

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 주요 이해관계자와 구입 기준

- 채용 장벽과 내부 과제

- 다양한 최종 이용 산업의 미충족 수요

- 시장 수익성

- 잠재적 매출

- 비용 역학

- 주요 용도에서의 마진 기회

제9장 상업용 냉장 시장 : 도어 유형별

- 싱글

- 듀얼

- 멀티

제10장 상업용 냉장 시장 : 냉매별

- 불화탄소

- 탄화수소

- 무기물

제11장 상업용 냉장 시장 : 제품 유형별

- 운송 냉장

- 냉장고·냉동고

- 냉장 진열장

- 음료 냉장

- 아이스크림 소매업체

- 냉장 자동판매기

제12장 상업용 냉장 시장 : 용도별

- 푸드서비스

- 식품 및 음료 소매

- 식품 및 음료 유통

- 식품 및 음료 제조

- 기타 용도

제13장 상업용 냉장 시장 : 용도별

- 호텔·레스토랑

- 슈퍼마켓·하이퍼마켓

- 편의점

- 베이커리

제14장 상업용 냉장 시장 : 지역별

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 태국

- 말레이시아

- 싱가포르

- 인도네시아

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 이탈리아

- 프랑스

- 스페인

- 기타 유럽

- 중동 및 아프리카

- GCC 국가

- 이집트

- 튀르키예

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 칠레

- 기타 남미

제15장 경쟁 구도

- 주요 진출 기업의 전략/강점

- 매출 분석

- 시장 점유율 분석(2024년)

- DAIKIN INDUSTRIES LTD.(일본)

- JOHNSON CONTROLS(미국)

- HUSSMANN CORPORATION(미국)

- DANFOSS(덴마크)

- DOVER CORPORATION(미국)

- HAIER INC.(중국)

- EPTA CORPORATE(이탈리아)

- 브랜드/제품의 비교

- MULTIDECKS

- CORAL

- DA420IFTECH

- HR-120A

- VERTICAL FREEZER DISPLAY

- 기업 평가와 재무 지표

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제16장 기업 개요

- 주요 기업

- DAIKIN INDUSTRIES, LTD.

- JOHNSON CONTROLS

- HUSSMANN CORPORATION

- DANFOSS

- DOVER CORPORATION

- HAIER INC.

- EPTA CORPORATE

- BALTIMORE AIRCOIL COMPANY

- TRUE MANUFACTURING CO., INC.

- BLUE STAR LIMITED

- IMBERA

- DE RIGO REFRIGERATION

- FOGEL GROUP

- KUHLMOBELWERK LIMBURG GMBH

- SCM FRIGO S.P.A.

- MAYEKAWA MFG. CO., LTD.

- VIESSMANN KUHLSYSTEME GMBH

- VOLTAS

- ARNEG S.P.A.

- JBG-2

- ISA SPA

- METALFRIO

- HOSHIZAKI CORPORATION

- LIEBHERR

- AUCMA INTERNATIONAL

- ZHEJIANG XINGXING REFRIGERATION CO., LTD.

- SANDEN INTERCOOL(THAILAND) PCL

- BITZER KUHLMASCHINENBAU GMBH

- 기타 기업

- SECOP GMBH

- ELANPRO

- NORLAKE, INC.

- FRIGO BLOCK

- ZERO ZONE, INC.

제17장 조사 방법

제18장 부록

KSM 26.01.06The global commercial refrigeration market is projected to grow from USD 51.26 billion in 2025 to USD 67.31 billion by 2030, at a CAGR of 5.6% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | Product Type, Refrigerant Type, Door Type, End Use, and Application |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

The global commercial refrigeration market is growing steadily, driven by expanding food retail, stronger cold-chain needs, and rising demand from supermarkets, convenience stores, food service, and other sectors. Growth is further supported by stricter food-safety regulations, the shift to energy-efficient and eco-friendly systems, and increasing adoption of smart, digitally monitored refrigeration technologies.

"By product type, refrigerated display case segment to account for second-largest share during forecast period"

The refrigerated display case segment is anticipated to hold the second-largest share in terms of value in the commercial refrigeration market during the forecast period, as supermarkets, hypermarkets, and convenience stores expand globally and prioritize attractive, energy-efficient product presentation. Rising urbanization and shifting consumer preferences toward fresh and ready-to-eat foods are driving retailers to upgrade to modern, visually appealing display cases that enhance merchandising. Additionally, advancements such as LED lighting, improved insulation, and low-GWP refrigerants are prompting replacement demand as businesses seek to reduce energy costs and meet sustainability regulations, further accelerating the segment's growth.

"By refrigerant type, hydrocarbons segment to account for second-largest market share during forecast period"

The hydrocarbons segment is anticipated to hold the second-largest share of the commercial refrigeration market during the forecast period. The market for this segment is expanding rapidly as retailers and foodservice operators move toward systems with lower environmental impact and improved energy efficiency. Hydrocarbon refrigerants like propane and isobutane have become increasingly favored as they offer strong cooling performance while meeting global regulations aimed at reducing high-GWP gases. Their use is also rising in modern display cases, reach-in coolers, and small commercial units as manufacturers optimize system designs for better safety and efficiency. This shift toward sustainable, regulation-compliant refrigeration solutions is making hydrocarbons the second-largest segment in the market.

"Food & beverage distribution segment to be second-largest application during forecast period"

The food & beverage distribution segment is estimated to account for the second-largest share in the commercial refrigeration market during the forecast period. The market in this segment is driven by the expanding global supply chains and the demand for temperature-controlled transport. Rising consumption of fresh produce, dairy, meat, and ready-to-cook items requires reliable cold-storage and handling across warehouses, logistics hubs, and last-mile delivery networks. Companies are also investing in modern refrigeration systems to reduce product loss, meet stricter safety standards, and support the surge in e-commerce grocery deliveries. Together, these factors are pushing the food & beverage distribution segment.

"By end use, hotels & restaurants segment to account for second-largest market share during forecast period"

The hotels & restaurants segment is anticipated to hold the second-largest share in terms of value in the commercial refrigeration market during the forecast period, driven by rising consumer demand for fresh, high-quality meals. Moreover, the growing preference for dining out is prompting businesses to upgrade their kitchens with more efficient and reliable refrigeration systems. Hotels and restaurants are adopting advanced, space-saving, and energy-efficient units to improve food safety, reduce operating costs, and meet tightening health regulations. These trends are driving steady investment in commercial refrigeration.

"North America to account for second-largest market share during forecast period"

The North America region is estimated to account for the second-largest share in terms of value in the commercial refrigeration market during the forecast period, due to ongoing upgrades in food retail infrastructure, a well-established cold-chain network, and rising demand for fresh and frozen foods. Supermarkets, convenience stores, and foodservice operators are investing heavily in modern, energy-efficient refrigeration systems to meet stringent environmental regulations and reduce operating costs. Additionally, the expansion of e-commerce grocery delivery and increased focus on food safety standards are accelerating the adoption of advanced refrigeration solutions.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: Directors- 25%, Managers- 30%, and Others - 45%

- By Region: North America - 30%, Asia Pacific - 40%, Europe - 20%, Middle East & Africa - 7%, and South America - 3%

Daikin (Japan), Johnson Controls (US), Hussmann Corporation (US), Danfoss (Denmark), Dover Corporation (US), Haier Inc. (China), and EPTA Corporate (Italy) are some of the major players operating in the commercial refrigeration market.

Research Coverage:

The report defines segments and projects the commercial refrigeration market based on product type, refrigerant type, door type, application, end use, and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles commercial refrigeration manufacturers, comprehensively analyzing their market shares and core competencies.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the commercial refrigeration market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the market's competitive landscape, gain insights to improve the position of their businesses, and develop suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of critical Drivers (Rapid expansion of cold chain infrastructure driven by e-commerce grocery and pharmaceutical sectors, Growth in retail food and hospitality sectors, and Integration of IoT-enabled, energy-efficient, and smart control systems in commercial refrigeration), Restraints (Stringent regulations against the use of fluorocarbon refrigerants enforced by the United Nations Environment Programme (UNEP) under the Montreal Protocol and Kigali Amendment), Opportunities (High demand for frozen & processed food worldwide and Rising demand for energy-efficient refrigeration systems utilizing natural refrigerants (CO2, ammonia, hydrocarbons)), and Challenges (Growing skilled labor shortage in refrigeration industry) influencing the growth of the commercial refrigeration market

- Product Development/Innovation: Detailed insights on upcoming technologies and research & development activities in the commercial refrigeration market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the commercial refrigeration market across varied regions.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Daikin (Japan), Johnson Controls (US), Hussmann Corporation (US), Danfoss (Denmark), Dover Corporation (US), Haier Inc. (China), and EPTA Corporate (Italy) in the commercial refrigeration market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 RESEARCH LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN COMMERCIAL REFRIGERATION MARKET

- 2.4 HIGH GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COMMERCIAL REFRIGERATION MARKET

- 3.2 COMMERCIAL REFRIGERATION MARKET, BY REGION

- 3.3 COMMERCIAL REFRIGERATION MARKET, BY KEY COUNTRIES

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rapid expansion of cold chain infrastructure driven by e-commerce grocery and pharmaceutical sectors

- 4.2.1.2 Integration of IoT-enabled, energy-efficient, and smart control systems in commercial refrigeration

- 4.2.1.3 Growth in retail food and hospitality sectors

- 4.2.2 RESTRAINTS

- 4.2.2.1 Stringent regulations against use of fluorocarbon refrigerants

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Rising demand for energy-efficient refrigeration systems utilizing natural refrigerants

- 4.2.3.2 High demand for frozen & processed food worldwide

- 4.2.4 CHALLENGES

- 4.2.4.1 Growing skilled labor shortage

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN COMMERCIAL REFRIGERATION MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.5.1 EMERGING BUSINESS MODELS

- 4.5.2 ECOSYSTEM SHIFTS

- 4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.6.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 BARGAINING POWER OF SUPPLIERS

- 5.1.2 BARGAINING POWER OF BUYERS

- 5.1.3 THREAT OF NEW ENTRANTS

- 5.1.4 THREAT OF SUBSTITUTES

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL COMMERCIAL REFRIGERATION INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 RESEARCH & DEVELOPMENT

- 5.3.2 RAW MATERIAL

- 5.3.3 MANUFACTURING

- 5.3.4 DISTRIBUTION NETWORK

- 5.3.5 END-USE INDUSTRIES

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRADE DATA

- 5.5.1 IMPORT SCENARIO (HS CODE 8418)

- 5.5.2 EXPORT SCENARIO (HS CODE 8418)

- 5.6 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 CARRIER CASE STUDY: KEEPING ICE CREAM REFRIGERATED

- 5.9.2 CARRIER CASE STUDY: KEEPING BANANAS REFRIGERATED

- 5.9.3 VERDE GROUP LIMITED: REFRIGERATION CASE STUDIES

- 5.10 US TARIFF IMPACT ON COMMERCIAL REFRIGERATION MARKET

- 5.10.1 KEY TARIFF RATES

- 5.10.2 PRICE IMPACT ANALYSIS

- 5.10.3 IMPACT ON KEY COUNTRIES/REGIONS

- 5.10.3.1 US

- 5.10.3.2 Europe

- 5.10.3.3 Asia Pacific

- 5.10.4 IMPACT ON END-USE INDUSTRIES OF COMMERCIAL REFRIGERATION

- 5.10.4.1 Hotels & restaurants (HoReCa)

- 5.10.4.2 Supermarkets & hypermarkets

- 5.10.4.3 Convenience stores

- 5.10.4.4 Bakeries

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 VAPOR COMPRESSION REFRIGERATION USING INORGANIC REFRIGERANTS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 SMART COMMERCIAL REFRIGERATION TECHNOLOGY (IOT-ENABLED & INTELLIGENT CONTROL SYSTEMS)

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.3.1 SHORT-TERM (2025-2027) | PROCESS OPTIMIZATION & ENVIRONMENTAL COMPLIANCE

- 6.3.2 MID-TERM (2027-2030) | INNOVATION & SUSTAINABLE TRANSFORMATION

- 6.3.3 LONG-TERM (2030-2035+) | CIRCULARITY, DECARBONIZATION & NEW APPLICATIONS

- 6.4 PATENT ANALYSIS

- 6.4.1 METHODOLOGY

- 6.5 FUTURE APPLICATIONS

- 6.5.1 SMART COLD CHAIN LOGISTICS: DIGITAL REFRIGERATION NETWORKS

- 6.5.2 LOW-GWP REFRIGERANTS & CARBON-NEUTRAL SYSTEMS

- 6.5.3 MODULAR & PORTABLE COOLING UNITS

- 6.5.4 FOOD WASTE REDUCTION TECHNOLOGIES

- 6.5.5 HEALTHCARE & BIOPHARMA COLD STORAGE

- 6.6 IMPACT OF GENERATIVE AI ON COMMERCIAL REFRIGERATION MARKET

- 6.6.1 INTRODUCTION

- 6.6.2 DIAGNOSTICS AND TROUBLESHOOTING

- 6.6.3 ENERGY OPTIMIZATION AND PREDICTIVE MAINTENANCE

- 6.6.4 TRAINING AND INVENTORY MANAGEMENT

- 6.6.5 DESIGN INNOVATION AND SUSTAINABILITY

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGULATORY LANDSCAPE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF COMMERCIAL REFRIGERATION

- 7.2.1.1 Carbon impact reduction

- 7.2.1.2 Eco-applications

- 7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF COMMERCIAL REFRIGERATION

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES

- 8.5 MARKET PROFITABILITY

- 8.5.1 REVENUE POTENTIAL

- 8.5.2 COST DYNAMICS

- 8.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS

9 COMMERCIAL REFRIGERATION MARKET, BY DOOR TYPE

- 9.1 INTRODUCTION

- 9.2 SINGLE

- 9.2.1 OFFERS COMPACT AND EFFICIENT SINGLE DOOR SOLUTIONS FOR SMALL-SCALE COMMERCIAL NEEDS

- 9.3 DUAL

- 9.3.1 DEMAND FOR VERSATILE STORAGE SOLUTIONS TO PROPEL MARKET GROWTH

- 9.4 MULTI

- 9.4.1 ADOPTION IN LARGE-SCALE COMMERCIAL APPLICATIONS TO DRIVE MARKET

10 COMMERCIAL REFRIGERATION MARKET, BY REFRIGERANT TYPE

- 10.1 INTRODUCTION

- 10.2 FLUOROCARBONS

- 10.2.1 STRONG COOLING EFFICIENCY AND STABLE THERMODYNAMIC PROPERTIES TO DRIVE ADOPTION

- 10.2.2 HYDROCHLOROFLUOROCARBONS (HCFCS)

- 10.2.3 HYDROFLUOROCARBONS (HFCS)

- 10.2.4 HYDROFLUOROOLEFINS (HFOS)

- 10.3 HYDROCARBONS

- 10.3.1 DEMAND FOR NATURAL AND NON-TOXIC REFRIGERANTS TO DRIVE MARKET

- 10.3.2 ISOBUTANE

- 10.3.3 PROPANE

- 10.3.4 OTHERS

- 10.4 INORGANICS

- 10.4.1 INCREASING ADOPTION OF ENVIRONMENTALLY FRIENDLY SOLUTIONS TO DRIVE MARKET

- 10.4.2 AMMONIA

- 10.4.3 CO2

- 10.4.4 OTHERS

11 COMMERCIAL REFRIGERATION MARKET, BY PRODUCT TYPE

- 11.1 INTRODUCTION

- 11.2 TRANSPORTATION REFRIGERATION

- 11.2.1 INCREASING DEMAND FOR TEMPERATURE-CONTROLLED FOOD SYSTEMS AND CONTAINERS TO DRIVE MARKET

- 11.2.2 TYPES OF TRANSPORTATION REFRIGERATION

- 11.2.2.1 Shipping container

- 11.2.2.2 Trailer

- 11.2.2.3 Truck

- 11.3 REFRIGERATOR & FREEZER

- 11.3.1 INCREASING EMPHASIS ON FOOD SAFETY AND PRODUCT QUALITY TO DRIVE MARKET

- 11.3.2 REFRIGERATOR & FREEZER TYPES

- 11.3.2.1 Walk-in

- 11.3.2.2 Reach-in

- 11.3.2.3 Chest

- 11.4 REFRIGERATED DISPLAY CASE

- 11.4.1 GROWING NUMBER OF SUPERMARKETS, GROCERY STORES, AND OTHER FOOD RETAIL OUTLETS TO DRIVE MARKET

- 11.5 BEVERAGE REFRIGERATION

- 11.5.1 INCREASING DEMAND FOR CHILLED PACKAGED DRINKS TO FUEL ADOPTION

- 11.6 ICE CREAM MERCHANDISER

- 11.6.1 INCREASING CONSUMPTION OF ICE CREAM AND FROZEN DESSERTS TO DRIVE DEMAND

- 11.7 REFRIGERATED VENDING MACHINE

- 11.7.1 LOW OPERATIONAL & FUNCTIONAL COSTS AND GROWING DEMAND FOR HEALTHY FOODS TO SUPPORT MARKET GROWTH

12 COMMERCIAL REFRIGERATION MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 FOOD SERVICE

- 12.2.1 INCREASING DEMAND FOR SAFE STORAGE TO DRIVE MARKET

- 12.3 FOOD & BEVERAGE RETAIL

- 12.3.1 NEED FOR APPEALING PRESENTATION TO FUEL MARKET GROWTH

- 12.4 FOOD & BEVERAGE DISTRIBUTION

- 12.4.1 INCREASING DEMAND FOR MODERN COMMERCIAL REFRIGERATION SYSTEMS TO SUPPORT MARKET GROWTH

- 12.5 FOOD & BEVERAGE PRODUCTION

- 12.5.1 NEED FOR PRODUCT SAFETY AND QUALITY TO DRIVE DEMAND

- 12.6 OTHER APPLICATIONS

13 COMMERCIAL REFRIGERATION MARKET, BY END USE

- 13.1 INTRODUCTION

- 13.2 HOTELS & RESTAURANTS

- 13.2.1 GROWING MIDDLE-CLASS POPULATION IN EMERGING COUNTRIES TO DRIVE MARKET

- 13.3 SUPERMARKETS & HYPERMARKETS

- 13.3.1 NEED FOR INCREASE EFFICIENCY AND REDUCE COSTS TO DRIVE MARKET

- 13.4 CONVENIENCE STORES

- 13.4.1 GROWING TREND OF PACKAGED FOOD CONSUMPTION TO DRIVE DEMAND

- 13.5 BAKERIES

- 13.5.1 REQUIREMENT FOR CONTROLLED TEMPERATURE TO PRESERVE INGREDIENTS AND STORE FINISHED PRODUCTS TO DRIVE MARKET

14 COMMERCIAL REFRIGERATION MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 ASIA PACIFIC

- 14.2.1 CHINA

- 14.2.1.1 Expansion of cold chain logistics to support e-commerce grocery deliveries to boost market growth

- 14.2.2 JAPAN

- 14.2.2.1 Expansion of retail and hospitality sectors to drive market growth

- 14.2.3 INDIA

- 14.2.3.1 Expansion of quick service restaurant chains and cloud kitchens to boost demand

- 14.2.4 SOUTH KOREA

- 14.2.4.1 Growth in frozen food segment to support market growth

- 14.2.5 THAILAND

- 14.2.5.1 Growing penetration of hypermarkets and quick service restaurants to fuel market growth

- 14.2.6 MALAYSIA

- 14.2.6.1 Rising demand for chilled and frozen food products to support market growth

- 14.2.7 SINGAPORE

- 14.2.7.1 Adoption of compact, high-efficiency refrigeration solutions in hospitality and retail sectors to drive demand

- 14.2.8 INDONESIA

- 14.2.8.1 Expansion of food service sector and supermarket chains to boost market growth

- 14.2.9 REST OF ASIA PACIFIC

- 14.2.1 CHINA

- 14.3 NORTH AMERICA

- 14.3.1 US

- 14.3.1.1 Construction of cold storage and ice manufacturing facilities to drive market

- 14.3.2 CANADA

- 14.3.2.1 Expanding quick-service restaurant chains and higher consumption of ready-to-eat foods to fuel demand

- 14.3.3 MEXICO

- 14.3.3.1 Increasing urbanization, young consumer base, and ongoing investment in modern retail infrastructure to drive market

- 14.3.1 US

- 14.4 EUROPE

- 14.4.1 UK

- 14.4.1.1 Growing supermarkets, hypermarkets, and convenience stores to drive market

- 14.4.2 GERMANY

- 14.4.2.1 Regulations to increase adoption of natural refrigerants in commercial refrigeration impacting market growth

- 14.4.3 ITALY

- 14.4.3.1 Increasing adoption of vending machines to drive market

- 14.4.4 FRANCE

- 14.4.4.1 Shift toward natural refrigerants to support market growth

- 14.4.5 SPAIN

- 14.4.5.1 Expansion of food retail, hospitality, and food processing sectors to propel market

- 14.4.6 REST OF EUROPE

- 14.4.1 UK

- 14.5 MIDDLE EAST & AFRICA

- 14.5.1 GCC COUNTRIES

- 14.5.1.1 Saudi Arabia

- 14.5.1.1.1 Expanding cold chain infrastructure to boost adoption

- 14.5.1.2 Rest of GCC Countries

- 14.5.1.2.1 Increasing investments in food retail and logistics infrastructure to support market growth

- 14.5.1.1 Saudi Arabia

- 14.5.2 EGYPT

- 14.5.2.1 Expansion of cold chain and improving agricultural cold storage capacity to drive growth

- 14.5.3 TURKEY

- 14.5.3.1 Expanding food manufacturing base, retail modernization, and vibrant hospitality sector to increase adoption

- 14.5.4 REST OF MIDDLE EAST & AFRICA

- 14.5.1 GCC COUNTRIES

- 14.6 SOUTH AMERICA

- 14.6.1 BRAZIL

- 14.6.1.1 Rising demand for frozen and ready-to-eat foods to fuel adoption

- 14.6.2 ARGENTINA

- 14.6.2.1 Expanding network of supermarkets and restaurant chains to fuel market

- 14.6.3 CHILE

- 14.6.3.1 Investments in logistics and cold storage infrastructure to boost market expansion

- 14.6.4 REST OF SOUTH AMERICA

- 14.6.1 BRAZIL

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 15.3 REVENUE ANALYSIS

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.4.1 DAIKIN INDUSTRIES LTD. (JAPAN)

- 15.4.2 JOHNSON CONTROLS (US)

- 15.4.3 HUSSMANN CORPORATION (US)

- 15.4.4 DANFOSS (DENMARK)

- 15.4.5 DOVER CORPORATION (US)

- 15.4.6 HAIER INC. (CHINA)

- 15.4.7 EPTA CORPORATE (ITALY)

- 15.5 BRAND/PRODUCT COMPARISON

- 15.5.1 MULTIDECKS

- 15.5.2 CORAL

- 15.5.3 DA420IFTECH

- 15.5.4 HR-120A

- 15.5.5 VERTICAL FREEZER DISPLAY

- 15.6 COMPANY VALUATION AND FINANCIAL METRICS

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 Product type footprint

- 15.7.5.4 Door type footprint

- 15.7.5.5 End use footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.8.5.1 Detailed list of key startups/SMES

- 15.8.5.2 Competitive benchmarking of key startups/SMEs

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

16 COMPANY PROFILES

- 16.1 MAJOR PLAYERS

- 16.1.1 DAIKIN INDUSTRIES, LTD.

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.3.2 Expansions

- 16.1.1.4 MnM view

- 16.1.1.4.1 Right to win

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 JOHNSON CONTROLS

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Deals

- 16.1.2.3.2 Expansions

- 16.1.2.4 MnM view

- 16.1.2.4.1 Right to win

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 HUSSMANN CORPORATION

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 MnM view

- 16.1.3.3.1 Right to win

- 16.1.3.3.2 Strategic choices

- 16.1.3.3.3 Weaknesses and competitive threats

- 16.1.4 DANFOSS

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Deals

- 16.1.4.4 MnM view

- 16.1.4.4.1 Right to win

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 DOVER CORPORATION

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product launches

- 16.1.5.3.2 Expansions

- 16.1.5.4 MnM view

- 16.1.5.4.1 Right to win

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 HAIER INC.

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Deals

- 16.1.6.4 MnM view

- 16.1.6.4.1 Right to win

- 16.1.6.4.2 Strategic choices

- 16.1.6.4.3 Weaknesses and competitive threats

- 16.1.7 EPTA CORPORATE

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Deals

- 16.1.7.4 MnM view

- 16.1.7.4.1 Right to win

- 16.1.7.4.2 Strategic choices

- 16.1.7.4.3 Weaknesses and competitive threats

- 16.1.8 BALTIMORE AIRCOIL COMPANY

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.8.3 Recent developments

- 16.1.8.3.1 Product launches

- 16.1.8.3.2 Deals

- 16.1.9 TRUE MANUFACTURING CO., INC.

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.10 BLUE STAR LIMITED

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product launches

- 16.1.10.3.2 Expansions

- 16.1.11 IMBERA

- 16.1.11.1 Business overview

- 16.1.11.2 Products/Solutions/Services offered

- 16.1.12 DE RIGO REFRIGERATION

- 16.1.12.1 Business overview

- 16.1.12.2 Products/Solutions/Services offered

- 16.1.12.3 Recent developments

- 16.1.12.3.1 Product launches

- 16.1.12.3.2 Deals

- 16.1.13 FOGEL GROUP

- 16.1.13.1 Business overview

- 16.1.13.2 Products/Solutions/Services offered

- 16.1.14 KUHLMOBELWERK LIMBURG GMBH

- 16.1.14.1 Business overview

- 16.1.14.2 Products/Solutions/Services offered

- 16.1.15 SCM FRIGO S.P.A.

- 16.1.15.1 Business overview

- 16.1.15.2 Products/Solutions/Services offered

- 16.1.16 MAYEKAWA MFG. CO., LTD.

- 16.1.16.1 Business overview

- 16.1.16.2 Products/Solutions/Services offered

- 16.1.17 VIESSMANN KUHLSYSTEME GMBH

- 16.1.17.1 Business overview

- 16.1.17.2 Products/Solutions/Services offered

- 16.1.17.3 Recent developments

- 16.1.17.3.1 Deals

- 16.1.18 VOLTAS

- 16.1.18.1 Business overview

- 16.1.18.2 Products/Solutions/Services offered

- 16.1.18.3 Recent developments

- 16.1.18.3.1 Product launches

- 16.1.18.3.2 Deals

- 16.1.19 ARNEG S.P.A.

- 16.1.19.1 Business overview

- 16.1.19.2 Products/Solutions/Services offered

- 16.1.19.3 Recent developments

- 16.1.19.3.1 Deals

- 16.1.20 JBG-2

- 16.1.20.1 Business overview

- 16.1.20.2 Products/Solutions/Services offered

- 16.1.21 ISA SPA

- 16.1.21.1 Business overview

- 16.1.21.2 Products/Solutions/Services offered

- 16.1.22 METALFRIO

- 16.1.22.1 Business overview

- 16.1.22.2 Products/Solutions/Services offered

- 16.1.23 HOSHIZAKI CORPORATION

- 16.1.23.1 Business overview

- 16.1.23.2 Products/Solutions/Services offered

- 16.1.23.3 Recent developments

- 16.1.23.3.1 Deals

- 16.1.24 LIEBHERR

- 16.1.24.1 Business overview

- 16.1.24.2 Products/Solutions/Services offered

- 16.1.25 AUCMA INTERNATIONAL

- 16.1.25.1 Business overview

- 16.1.25.2 Products/Solutions/Services offered

- 16.1.26 ZHEJIANG XINGXING REFRIGERATION CO., LTD.

- 16.1.26.1 Business overview

- 16.1.26.2 Products/Solutions/Services offered

- 16.1.27 SANDEN INTERCOOL (THAILAND) PCL

- 16.1.27.1 Business overview

- 16.1.27.2 Products/Solutions/Services offered

- 16.1.28 BITZER KUHLMASCHINENBAU GMBH

- 16.1.28.1 Business overview

- 16.1.28.2 Products/Solutions/Services offered

- 16.1.28.3 Recent developments

- 16.1.28.3.1 Deals

- 16.1.1 DAIKIN INDUSTRIES, LTD.

- 16.2 OTHER PLAYERS

- 16.2.1 SECOP GMBH

- 16.2.2 ELANPRO

- 16.2.3 NORLAKE, INC.

- 16.2.4 FRIGO BLOCK

- 16.2.5 ZERO ZONE, INC.

17 RESEARCH METHODOLOGY

- 17.1 RESEARCH DATA

- 17.1.1 SECONDARY DATA

- 17.1.1.1 List of key secondary sources

- 17.1.1.2 Key data from secondary sources

- 17.1.2 PRIMARY DATA

- 17.1.2.1 Key data from primary sources

- 17.1.2.2 List of primary interview participants (supply side)

- 17.1.2.3 Key industry insights

- 17.1.2.4 Breakdown of interviews with experts

- 17.1.3 DEMAND-SIDE ANALYSIS

- 17.1.1 SECONDARY DATA

- 17.2 MARKET SIZE ESTIMATION

- 17.2.1 BOTTOM-UP APPROACH

- 17.2.2 TOP-DOWN APPROACH

- 17.2.3 SUPPLY-SIDE ANALYSIS

- 17.2.3.1 Calculations for supply-side analysis

- 17.3 GROWTH FORECAST

- 17.4 DATA TRIANGULATION

- 17.5 FACTOR ANALYSIS

- 17.6 RESEARCH ASSUMPTIONS

- 17.7 RESEARCH LIMITATIONS

- 17.8 RISK ASSESSMENT

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS