|

시장보고서

상품코드

1893730

폴리하이드록시알카노에이트(PHA) 시장 : 유형별, 제조 방법별, 용도별, 지역별(-2030년)Polyhydroxyalkanoate (PHA) Market by Type (Short Chain Length, Medium Chain Length), Production Method (Sugar Fermentation, Vegetable Oil Fermentation), Application (Packaging & Food Services, Biomedical), and Region - Global Forecasts to 2030 |

||||||

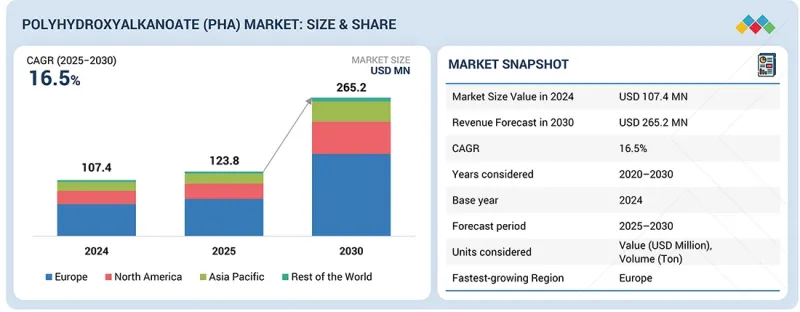

폴리하이드록시알카노에이트(PHA) 시장 규모는 2025년 1억 2,380만 달러, 2030년에는 2억 6,520만 달러에 이를 것으로 예측됩니다.

2025년부터 2030년까지의 CAGR은 16.5%를 나타낼 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) 및 톤 |

| 부문 | 유형, 제조 방법, 용도, 지역 |

| 대상 지역 | 유럽, 북미, 아시아태평양 및 기타 지역 |

"규제 압력과 지속가능성에 대한 요청이 PHA 시장 성장을 가속화"

플라스틱 폐기물과 화석 유래 물질의 사용에 대한 엄격한 세계 정책이 PHA 시장의 주요 촉진요인이 되었습니다. 정부는 일회용 플라스틱의 금지, 바이오 폴리머의 촉진, 퇴비화 가능성의 의무화 등의 조치를 강구하고 있으며, 이들이 PHA에 대한 규제적인 뒷받침이 되고 있습니다. 이러한 정책은 환경·안전 기준의 준수가 전제조건이 되고 있는 포장, 소비재, 농업, 바이오메디컬 용도 등의 분야에서 특히 중요해지고 있습니다. 브랜드 기업은 지속가능성 활동을 강화하고 있으며 기업의 ESG 목표 달성을 위해 PHA의 도입이 요구되고 있습니다. 이러한 규제 및 기업의 지속가능성 요구 사항은 산업에서 PHA 기반 솔루션으로의 전환을 뒷받침합니다.

"유형별로, 단쇄 길이 부문이 예측 기간 동안 가장 빠르게 성장할 것으로 예상된다"

단쇄 길이 PHA는 기계적 강도가 높고 결정성이 뛰어나 포장, 농업, 의료기기 등 폭넓은 제품에 응용이 가능합니다. 그 성능 특성은 기존의 플라스틱과 유사하기 때문에 생분해성 제품으로의 전환이 급속히 진행되는 산업에서 적절한 대체품이 되고 있습니다. 화석 유래 플라스틱의 소비 삭감을 요구하는 엄격한 규제 압력도 단쇄 PHA 수요를 더욱 뒷받침하고 있습니다. 게다가 생산 능력의 확대와 비용 구조의 개선이 상업 이용의 확대를 촉진하고 있습니다.

"지역별로는 아시아태평양이 2024년 기준에서 3위 점유율을 차지했다"

아시아태평양은 2024년 기준에서 세계 3위의 PHA 시장입니다. 이 지역 시장은 포장, 농업 및 소비재 용도에서 생분해성 재료 수요 증가에 견인하고 있습니다. 중국, 일본, 인도, 한국에서 일회용 플라스틱에 대한 규제 강화가 PHA 기반 제품으로의 전환을 촉진하는 원동력이 되고 있습니다. 이 지역 시장은 확대되는 바이오폴리머 생산 기반과 순환 경제에 대한 정부의 높은 참여에 의해 지원되고 있습니다. 지속가능한 소재에 대한 소비자 관심 증가, 전자상거래용 포장의 급성장이 시장 확대를 더욱 뒷받침하고 있습니다.

본 보고서에서는 세계의 폴리하이드록시알카노에이트(PHA) 시장을 조사했으며, 시장 개요, 시장 성장 영향요인 분석, 기술·특허 동향, 법규제 환경, 사례연구, 시장 규모 추이와 예측, 각종 구분·지역/주요 국가별 상세 분석, 경쟁 구도, 주요기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 인사이트

제4장 시장 개요

- 시장 역학

- 성장 촉진 요인

- 억제 요인

- 기회

- 과제

- 상호 연결된 시장과 산업 간 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제지표

- 공급망 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 2025-2026년의 주된 회의와 이벤트

- 고객의 비즈니스에 영향을 미치는 동향/혁신

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세의 영향 - PHA 시장

제6장 기술의 진보, AI에 의한 영향, 특허

- 주요 신기술

- 합성 생물학 및 균주 개량 기술

- 연속식 고밀도 바이오리액터

- PHA 블렌드 및 공중합체

- 보완 기술

- 하류 정제 기술

- 퇴비화와 생분해 기술

- 기술/제품 로드맵

- 특허 분석

- AI/생성형 AI가 PHA 시장에 미치는 영향

제7장 지속가능성과 규제상황

- 지역 규제 및 규정 준수

- 지속가능성에 미치는 영향과 규제 정책의 노력

- 인증, 라벨, 환경 기준

제8장 고객정세와 구매행동

- 의사결정 프로세스

- 주요 이해관계자와 구매 기준

- 채택 장벽과 내부 과제

- 다양한 용도에서의 미충족 요구

제9장 PHA공급원과 생산 공정

- 일반적인 생산 공정

- 식물 유래의 당 기질 또는 탄수화물

- 트리아실글리세롤

- 탄화수소

- 균주 선별

- 바이오프로세스와 다운스트림 프로세스

- 발효 공정

- 추출 프로세스

제10장 생산 능력 분석

제11장 PHA 시장 : 유형별

- 단쇄 길이

- 폴리하이드록시발레레이트(PHV)

- P(4HB-CO-3HB)

- P(3HB-CO-3HV)

- 기타

- 중쇄 길이

- P(HYDROXYBUTYRATE-CO-HYDROXYOCTANOATE)

- P(3HB-CO-3HV-CO-4HB)

- 기타

제12장 PHA 시장 : 제조방법별

- 당 발효

- 식물성 기름 발효

- 메탄 발효

제13장 PHA 시장 : 용도별

- 포장 및 푸드서비스

- 포장

- 푸드서비스

- 바이오메디컬

- 봉합사

- 약제 방출

- 기타

- 농업

- 멀티 필름

- 화분

- 기타

- 기타 용도

- 폐수 처리

- 화장품

- 화학첨가물

- 3D 프린팅

제14장 PHA 시장 : 지역별

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 북미

- 미국

- 캐나다

- 멕시코

- 아시아태평양

- 중국

- 인도

- 일본

- 말레이시아

- 한국

- 기타 지역

- 남미

- 중동 및 아프리카

제15장 경쟁 구도

- 주요 진입기업의 전략/강점

- 시장 점유율 분석

- 수익 분석

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 브랜드 비교 분석

- 기업평가와 재무지표

- 경쟁 시나리오

- 주요 기업

- TEKNOR APEX

- KANEKA CORPORATION

- ECOMANN BIOTECHNOLOGY CO. LTD

- RWDC INDUSTRIES

- BLUEPHA CO, LTD.

- NEWLIGHT TECHNOLOGIES, INC.

- NINGBO TIANAN BIOMATERIALS CO., LTD.

- BIOMER

- BEIJING PHABUILDER BIOTECHNOLOGY CO., LTD

- TERRAVERDAE BIOWORKS INC.

- 다른 기업

- CJ CHEILJEDANG CORP.

- GENECIS BIOINDUSTRIES INC.

- MANGO MATERIALS

- COFCO

- MEDPHA BIOSCIENCE CO., LTD.

- PAQUES BIOMATERIALS BV

- PRAJ INDUSTRIES

- PHAXTEC, INC.

- UNILONG INDUSTRY CO., LTD.

- MAIP SRL

제17장 조사 방법

제18장 인접 시장과 관련 시장

제19장 부록

SHW 26.01.06The polyhydroxyalkanoate (PHA) market size was USD 123.8 million in 2025 and is projected to reach USD 265.2 million by 2030, at a CAGR of 16.5% between 2025 and 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Ton) |

| Segments | Type, Production Method, Application, and Region |

| Regions covered | Europe, North America, Asia Pacific, and Rest of the World |

"Regulatory pressure and sustainability mandates to accelerate PHA market growth"

Strict global policies against plastic waste and the use of fossil-based substances are a major driver of the PHA market. Governments are also taking actions such as banning single-use plastic, encouraging bio-based polymers, and making compostability mandatory, which provide a regulatory push towards PHAs. Such policies have been especially significant in areas like packaging, consumer goods, agriculture, and biomedical applications, where adherence to environmental and safety standards is becoming a prerequisite. Brands are being pressurized to enhance sustainability activities and are compelled to implement PHAs to achieve corporate ESG goals. These regulatory and corporate sustainability requirements are providing a boost to the transition to PHA-based solutions in industries.

"Agriculture sector to account for third-largest market share during forecast period"

In 2024, the agriculture sector accounted for the third-largest share in the overall PHA market. The increase in demand for biodegradable and soil-safe materials in agricultural activities is driving the market in this application. As there is an ongoing shift toward sustainability and regulatory standards, PHA is being implemented in mulch films, plant pots, seed coatings, and controlled-release fertilizers by manufacturers who are avoiding the use of conventional plastics. Its biodegradation in soil saves waste-management expense and reduces environmental impact. Moreover, government incentives for the use of environmentally friendly farm inputs also speed up adoption.

"Short chain length segment projected to be fastest-growing type of PHA during forecast period"

The short chain length PHA segment is estimated to be the fastest-growing type, in terms of value, during the forecast period. Short chain length PHA is more mechanically strong, more crystalline, and applicable in a wide range of packaging, agriculture, and biomedical products. Its performance properties resemble traditional plastics and, hence, is a suitable alternative in industries that are rapidly moving towards biodegradable products. The intense regulatory pressure to minimize the consumption of fossil-based plastics further boosts the demand for short chain length PHA. Moreover, the expansion of production capacities and enhancement of cost structures are facilitating increased commercial usage.

"Asia Pacific accounted for third-largest share of global PHA market, in terms of value, in 2024"

Asia Pacific is the third-largest PHA market in 2024. The market in the region is driven by the increase in demand for biodegradable materials in the packaging, agriculture, and consumer goods applications. Increasing regulatory intervention with single-use plastics in China, Japan, India, and South Korea is creating a motivating push towards PHA-based products. The region's market is also supported by a growing biopolymer production base and a high level of government attention toward the circular economy. The growing consumer interest in sustainable materials, as well as the booming development of e-commerce packaging, further supports the market growth.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, RoW- 5%

The key players profiled in the report include Teknor Apex (US), Kaneka Corporation (Japan), Ecomann Biotechnology Co., Ltd. (China), RWDC Industries (Singapore), Bluepha Co., Ltd. (China), Newlight Technologies, Inc. (US), Ningbo Tianan Biologic Materials Co., Ltd. (China), Biomer (Germany), Beijing PhaBuilder Biotechnology Co., Ltd. (China), and TerraVerdae Bioworks Inc. (Canada).

Study Coverage

This report segments the market for PHA based on type, production method, application, and region, and provides estimations of value (in USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies associated with the PHA market.

Reasons to Buy this Report

This research report is focused on various levels of analysis-industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the PHA market, high-growth regions, and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on PHA offered by top players in the global market

- Analysis of key drivers: (Green procurement policies, High availability of renewable and cost-effective raw materials, Biodegradability driving consumption, Increasing concerns about human health and safety), restraints (High price compared to conventional polymers and Performance issues), opportunities (Increasing scope in end-use segments, Emergence of new raw materials, Cyanobacteria enabling cost reduction, and Growth opportunities in Asia Pacific) and challenges (Manufacturing technology in initial phase and Expensive and complex production process) influencing the growth of PHA market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the PHA market

- Market Development: Comprehensive information about lucrative emerging markets-the report analyzes the market for PHA across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global PHA market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the PHA market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.3.3 MARKET DEFINITION AND INCLUSIONS, BY TYPE

- 1.3.4 MARKET DEFINITION AND INCLUSIONS, BY PRODUCTION METHOD

- 1.3.5 MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.3.6 YEARS CONSIDERED

- 1.3.7 CURRENCY CONSIDERED

- 1.3.8 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: EUROPE MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PHA MARKET

- 3.2 PHA MARKET, BY APPLICATION AND REGION

- 3.3 PHA MARKET, BY TYPE

- 3.4 PHA MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Green procurement policies

- 4.2.1.2 High availability of renewable and cost-effective raw materials

- 4.2.1.3 Biodegradability driving consumption

- 4.2.1.4 Increasing concerns about human health and safety

- 4.2.2 RESTRAINTS

- 4.2.2.1 Higher price of PHA than conventional polymers

- 4.2.2.2 Performance issues

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Increasing scope in end-use segments

- 4.2.3.2 Emergence of new raw materials

- 4.2.3.3 Cyanobacteria enabling cost reduction

- 4.2.3.4 Growth opportunities in Asia Pacific

- 4.2.4 CHALLENGES

- 4.2.4.1 Manufacturing technology in initial phase

- 4.2.4.2 Expensive and complex production process

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.3.1 INTERCONNECTED MARKETS

- 4.3.2 CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.4.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF SUBSTITUTES

- 5.1.2 THREAT OF NEW ENTRANTS

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

- 5.2.3 TRENDS IN GLOBAL PACKAGING INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF PHA OFFERED BY KEY PLAYERS, BY APPLICATION, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF PHA, BY REGION, 2022-2025

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT SCENARIO (HS CODE 391190)

- 5.6.2 EXPORT SCENARIO (HS CODE 391190)

- 5.7 KEY CONFERENCES & EVENTS IN 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 BACARDI TRANSITIONS FROM PET TO DANIMER SCIENTIFIC'S BIODEGRADABLE PHA BOTTLES FOR SUSTAINABLE PACKAGING

- 5.10.2 SHISEIDO COMPANY LTD. ADOPTS PHBH BIOPOLYMER FOR COSMETICS PACKAGING

- 5.11 IMPACT OF 2025 US TARIFF - PHA MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRY/REGION

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON APPLICATIONS

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, AND PATENTS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 SYNTHETIC BIOLOGY AND STRAIN ENGINEERING

- 6.1.2 CONTINUOUS AND HIGH-DENSITY BIOREACTORS

- 6.1.3 PHA BLENDS AND COPOLYMERS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 DOWNSTREAM PURIFICATION TECHNOLOGIES

- 6.2.2 COMPOSTING & BIODEGRADATION TECHNOLOGIES

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.3.1 SHORT-TERM (2025-2027) | PRODUCTION SCALE-UP & COST REDUCTION

- 6.3.2 MID-TERM (2027-2030) | PERFORMANCE ENHANCEMENT & APPLICATION EXPANSION

- 6.3.3 LONG-TERM (2030-2035+) | SUSTAINABILITY & CIRCULARITY

- 6.4 PATENT ANALYSIS

- 6.4.1 APPROACH

- 6.4.2 DOCUMENT TYPE

- 6.4.3 TOP APPLICANTS

- 6.4.4 JURISDICTION ANALYSIS

- 6.5 IMPACT OF AI/GEN AI ON PHA MARKET

- 6.5.1 ACCELERATED R&D AND FORMULATION INNOVATION

- 6.5.2 ENHANCED PRODUCTION EFFICIENCY AND PROCESS CONTROL

- 6.5.3 PREDICTIVE MAINTENANCE AND OPERATIONAL CONTINUITY

- 6.5.4 OPTIMIZED SUPPLY CHAIN AND COST MANAGEMENT

- 6.5.5 SUSTAINABILITY MODELING AND LIFE CYCLE OPTIMIZATION

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.2.1 SAFETY PROTOCOLS

- 7.2.2 SUSTAINABLE DEVELOPMENT

- 7.2.3 STANDARDIZATION

- 7.2.4 CIRCULAR ECONOMY

- 7.3 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS IN VARIOUS APPLICATIONS

9 SOURCES AND PROCESSES OF PHA PRODUCTION

- 9.1 GENERAL PRODUCTION PROCESS

- 9.2 SUGAR SUBSTRATE OR CARBOHYDRATES FROM PLANTS

- 9.3 TRIACYLGLYCEROLS

- 9.4 HYDROCARBONS

- 9.5 STRAIN SELECTION

- 9.6 BIOPROCESS AND DOWNSTREAM PROCESS

- 9.6.1 FERMENTATION PROCESS

- 9.6.1.1 Discontinuous process

- 9.6.1.1.1 Batch process

- 9.6.1.1.2 Fed-batch process

- 9.6.1.1.3 Fed-batch process with cell recycling

- 9.6.1.1.4 Repeated fed-batch

- 9.6.1.2 Continuous process

- 9.6.1.2.1 Continuous fed-batch process

- 9.6.1.2.2 One-stage chemostat

- 9.6.1.2.3 Two-stage chemostat

- 9.6.1.2.4 Multi-stage chemostat

- 9.6.1.1 Discontinuous process

- 9.6.2 EXTRACTION PROCESS

- 9.6.1 FERMENTATION PROCESS

10 PRODUCTION CAPACITY ANALYSIS

11 PHA MARKET, BY TYPE

- 11.1 INTRODUCTION

- 11.2 SHORT CHAIN LENGTH

- 11.2.1 EXCELLENT PHYSICAL AND MECHANICAL PROPERTIES TO DRIVE MARKET

- 11.2.2 POLYHYDROXYVALERATE (PHV)

- 11.2.3 P (4HB-CO-3HB)

- 11.2.4 P (3HB-CO-3HV)

- 11.2.5 OTHERS

- 11.3 MEDIUM CHAIN LENGTH

- 11.3.1 EXPANDING APPLICATION NEEDS IN BIOMEDICAL AND PACKAGING SECTORS PROPEL MARKET GROWTH

- 11.3.2 P (HYDROXYBUTYRATE-CO-HYDROXYOCTANOATE)

- 11.3.3 P (3HB-CO-3HV-CO-4HB)

- 11.3.4 OTHERS

12 PHA MARKET, BY PRODUCTION METHOD

- 12.1 INTRODUCTION

- 12.2 SUGAR FERMENTATION

- 12.2.1 AVAILABILITY OF LOW-COST CARBOHYDRATE FEEDSTOCKS TO BOOST DEMAND

- 12.3 VEGETABLE OIL FERMENTATION

- 12.3.1 STRENGTHENING CIRCULAR ECONOMY POLICIES ACCELERATING MARKET ADOPTION

- 12.4 METHANE FERMENTATION

- 12.4.1 EXPANDING WASTE-GAS UTILIZATION AND CARBON-REDUCTION MANDATES ACCELERATING MARKET GROWTH

13 PHA MARKET, BY APPLICATION

- 13.1 INTRODUCTION

- 13.2 PACKAGING & FOOD SERVICES

- 13.2.1 PACKAGING

- 13.2.1.1 Rigid packaging

- 13.2.1.1.1 High durability, tamper-resistance, lightweight, and low cost, to drive market

- 13.2.1.2 Flexible packaging

- 13.2.1.2.1 Replacement for petroleum-based plastics to drive market

- 13.2.1.3 Other packaging

- 13.2.1.1 Rigid packaging

- 13.2.2 FOOD SERVICES

- 13.2.2.1 Cups

- 13.2.2.1.1 Increasing use of biodegradable disposable products to drive market

- 13.2.2.2 Trays

- 13.2.2.2.1 Increasing demand for sustainable trays to drive market

- 13.2.2.3 Other food services

- 13.2.2.1 Cups

- 13.2.1 PACKAGING

- 13.3 BIOMEDICAL

- 13.3.1 SUTURES

- 13.3.1.1 High tensile strength to drive market

- 13.3.2 DRUG RELEASE

- 13.3.2.1 Biocompatibility for drug carrier applications to drive market

- 13.3.3 OTHER BIOMEDICAL APPLICATIONS

- 13.3.1 SUTURES

- 13.4 AGRICULTURE

- 13.4.1 MULCH FILMS

- 13.4.1.1 Extensive use by farmers to drive market

- 13.4.2 PLANT POTS

- 13.4.2.1 Plant pots help during stages of plant growth

- 13.4.3 OTHER AGRICULTURAL APPLICATIONS

- 13.4.1 MULCH FILMS

- 13.5 OTHER APPLICATIONS

- 13.5.1 WASTEWATER TREATMENT

- 13.5.2 COSMETICS

- 13.5.3 CHEMICAL ADDITIVES

- 13.5.4 3D PRINTING

14 PHA MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 EUROPE

- 14.2.1 GERMANY

- 14.2.1.1 Advanced infrastructure for solid waste management to drive market

- 14.2.2 UK

- 14.2.2.1 Government's aim to achieve zero-waste economy to drive market

- 14.2.3 FRANCE

- 14.2.3.1 Government's initiatives for bio-based economy to drive market

- 14.2.4 ITALY

- 14.2.4.1 Demand for eco-friendly packaging solutions to drive market

- 14.2.1 GERMANY

- 14.3 NORTH AMERICA

- 14.3.1 US

- 14.3.1.1 Stringent guidelines regarding production, use, and disposal of plastics to drive market

- 14.3.2 CANADA

- 14.3.2.1 Proposed ban on single-use plastics to drive market

- 14.3.3 MEXICO

- 14.3.3.1 Government initiatives and international investments to drive market

- 14.3.1 US

- 14.4 ASIA PACIFIC

- 14.4.1 CHINA

- 14.4.1.1 Global and local PHA manufacturers to drive market

- 14.4.2 INDIA

- 14.4.2.1 Ban on non-biodegradable plastics to drive market

- 14.4.3 JAPAN

- 14.4.3.1 Biomass-based and biodegradable plastics to drive market

- 14.4.4 MALAYSIA

- 14.4.4.1 Fully automated biodegradable plastic from palm oil to drive market

- 14.4.5 SOUTH KOREA

- 14.4.5.1 High number of R&D establishments to drive market

- 14.4.1 CHINA

- 14.5 REST OF THE WORLD

- 14.5.1 SOUTH AMERICA

- 14.5.1.1 Awareness of green economy to drive market

- 14.5.2 MIDDLE EAST & AFRICA

- 14.5.2.1 Growing biomedical industry to drive market

- 14.5.1 SOUTH AMERICA

15 COMPETITIVE LANDSCAPE

- 15.1 INTRODUCTION

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 15.3 MARKET SHARE ANALYSIS, 2024

- 15.4 REVENUE ANALYSIS, 2020-2024

- 15.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.5.1 STARS

- 15.5.2 EMERGING LEADERS

- 15.5.3 PERVASIVE PLAYERS

- 15.5.4 PARTICIPANTS

- 15.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.5.5.1 Company footprint

- 15.5.5.2 Region footprint

- 15.5.5.3 Type footprint

- 15.5.5.4 Application footprint

- 15.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.6.1 PROGRESSIVE COMPANIES

- 15.6.2 RESPONSIVE COMPANIES

- 15.6.3 DYNAMIC COMPANIES

- 15.6.4 STARTING BLOCKS

- 15.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 15.6.5.1 Detailed list of key startups/SMEs

- 15.6.5.2 Competitive benchmarking of key startups/SMEs

- 15.7 BRAND COMPARISON ANALYSIS

- 15.8 COMPANY VALUATION AND FINANCIAL METRICS

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

- 15.9.4 OTHER DEVELOPMENTS

16 'COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 TEKNOR APEX

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Deals

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 KANEKA CORPORATION

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Deals

- 16.1.2.3.2 Expansions

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 ECOMANN BIOTECHNOLOGY CO. LTD

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 MnM view

- 16.1.3.3.1 Right to win

- 16.1.3.3.2 Strategic choices

- 16.1.3.3.3 Weaknesses and competitive threats

- 16.1.4 RWDC INDUSTRIES

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Deals

- 16.1.4.3.2 Other developments

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 BLUEPHA CO, LTD.

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Product launches

- 16.1.5.3.2 Deals

- 16.1.5.3.3 Expansions

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 NEWLIGHT TECHNOLOGIES, INC.

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Deals

- 16.1.6.3.2 Expansions

- 16.1.6.4 MnM view

- 16.1.6.4.1 Key strengths

- 16.1.6.4.2 Strategic choices

- 16.1.6.4.3 Weaknesses and competitive threats

- 16.1.7 NINGBO TIANAN BIOMATERIALS CO., LTD.

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.8 BIOMER

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.9 BEIJING PHABUILDER BIOTECHNOLOGY CO., LTD

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Deals

- 16.1.10 TERRAVERDAE BIOWORKS INC.

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product launches

- 16.1.10.3.2 Deals

- 16.1.10.3.3 Other developments

- 16.1.1 TEKNOR APEX

- 16.2 OTHER PLAYERS

- 16.2.1 CJ CHEILJEDANG CORP.

- 16.2.2 GENECIS BIOINDUSTRIES INC.

- 16.2.3 MANGO MATERIALS

- 16.2.4 COFCO

- 16.2.5 MEDPHA BIOSCIENCE CO., LTD.

- 16.2.6 PAQUES BIOMATERIALS B.V.

- 16.2.7 PRAJ INDUSTRIES

- 16.2.8 PHAXTEC, INC.

- 16.2.9 UNILONG INDUSTRY CO., LTD.

- 16.2.10 MAIP SRL

17 RESEARCH METHODOLOGY

- 17.1 RESEARCH DATA

- 17.1.1 SECONDARY DATA

- 17.1.1.1 Key data from secondary sources

- 17.1.2 PRIMARY DATA

- 17.1.2.1 Key data from primary sources

- 17.1.2.2 Key primary participants

- 17.1.2.3 Breakdown of primary interviews

- 17.1.2.4 Key industry insights

- 17.1.1 SECONDARY DATA

- 17.2 MARKET SIZE ESTIMATION

- 17.2.1 BOTTOM-UP APPROACH

- 17.2.2 TOP-DOWN APPROACH

- 17.3 GROWTH FORECAST

- 17.3.1 SUPPLY-SIDE ANALYSIS

- 17.3.2 DEMAND-SIDE ANALYSIS

- 17.4 DATA TRIANGULATION

- 17.5 FACTOR ANALYSIS

- 17.6 RESEARCH ASSUMPTIONS

- 17.7 RESEARCH LIMITATIONS

- 17.8 RISK ASSESSMENT

18 ADJACENT & RELATED MARKETS

- 18.1 INTRODUCTION

- 18.2 LIMITATION

- 18.3 BIOPLASTICS & BIOPOLYMERS MARKET

- 18.3.1 MARKET DEFINITION

- 18.3.2 MARKET OVERVIEW

- 18.4 BIOPLASTICS & BIOPOLYMERS MARKET, BY REGION

- 18.4.1 EUROPE

- 18.4.2 NORTH AMERICA

- 18.4.3 ASIA PACIFIC

- 18.4.4 MIDDLE EAST & AFRICA

- 18.4.5 SOUTH AMERICA

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.3 CUSTOMIZATION OPTIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS