|

시장보고서

상품코드

1895140

유도 가열 시장 예측(-2030년) : 전력별, 주파수별, 용도별, 최종 용도 산업별, 지역별Induction Heating Market by Power By Frequency By Application By End-User, Region - Forecast to 2030 |

||||||

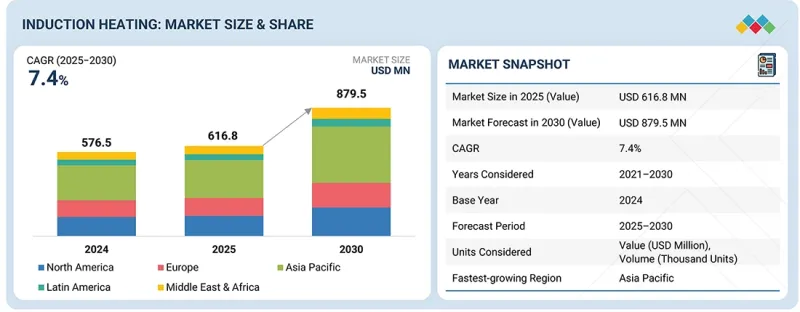

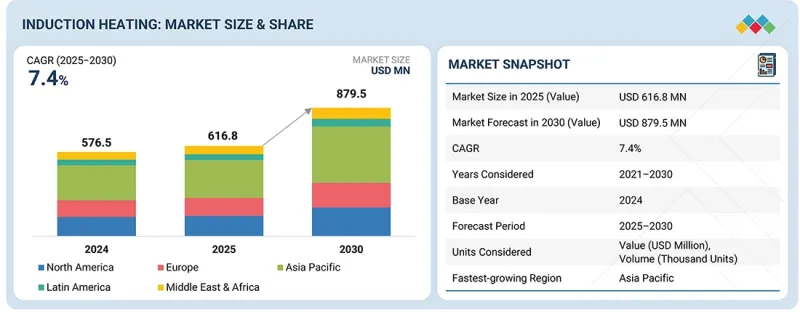

세계의 유도 가열 시장 규모는 예측 기간 중 CAGR 7.4%로 성장하며, 2025년 6억 1,680만 달러에서 2030년까지 8억 7,950만 달러에 달할 것으로 추정되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(100만 달러), 수량(1,000단위) |

| 부문 | 전력별, 주파수별, 용도별, 최종 용도 산업별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

주요 경제권에서 산업 및 제조 인프라의 급속한 확장은 유도 가열 시스템에 대한 강력한 수요를 견인하고 있습니다. 인도에서는 국가 인프라 정비 계획과 금속, 자동차, 화학, 전자기기 분야 투자 확대로 인해 생산성과 에너지 효율을 향상시키는 효율적인 난방 기술의 필요성이 높아지고 있습니다.

미국에서는 인프라 투자 및 일자리 창출법 등 연방정부 프로그램과 청정에너지 산업 확대에 따라 철강 및 반도체 분야의 설비 교체가 추진되고 있으며, 이를 위해 신뢰할 수 있는 고효율 유도가열 솔루션이 요구되고 있습니다. 이러한 꾸준한 현대화 및 생산 능력 증가는 처리 속도 향상, 에너지 사용량 감소, 운영 안정성 향상을 위한 첨단 난방 시스템의 도입을 직접적으로 촉진하고 있습니다.

주파수별 유도가열 시장에서는 10-50kHz 대역이 주요 부문을 차지하고 있습니다. 이는 주로 이 주파수 대역이 가열 깊이와 공정 효율의 이상적인 균형을 제공하여 담금질, 브레이징, 어닐링, 단조 등 다양한 산업 응용 분야에 적합하기 때문입니다. 10-50kHz 대역에서 작동하는 시스템은 빠르고 균일한 가열과 높은 에너지 효율을 실현하여 정밀한 온도 제어와 야금학적 결과물을 향상시킬 수 있습니다.

이 주파수 대역은 전도성 공작물과 중간 두께의 공작물 모두에 광범위하게 적용되므로 산업계는 다양한 생산 요구 사항에 활용할 수 있습니다. 또한 이 대역의 장비는 비용 효율적이고, 유지보수가 용이하며, 기존 제조 설비와 현대식 제조 설비 모두에 적용할 수 있습니다. 이러한 장점으로 인해 10-50 kHz 부문은 금속 가공, 자동차 및 일반 제조 산업에서 빠르게 채택되고 있으며, 시장에서 가장 선호되고 널리 도입된 주파수 범주가 되었습니다.

용도별 유도 가열 시장은 열처리 부문이 주도하고 있습니다. 이러한 장점은 자동차, 기계 제조, 금속 가공 등 핵심 산업에서 담금질, 템퍼링, 어닐링, 응력 제거와 같은 열처리 공정이 광범위하게 채택되고 있기 때문입니다. 열처리는 정밀하고 일관된 에너지 절약형 열 제어가 필요하며, 고급 유도 가열 시스템은 원하는 재료 특성을 달성하고 부품의 내구성을 향상시키는 데 매우 적합합니다.

열처리에 사용되는 유도 가열 기술은 빠른 가열 속도, 깨끗한 작동, 우수한 금속학적 정밀도를 제공하므로 기존 가스 기반 시스템보다 선호되는 선택이 되었습니다. 또한 고성능 금속, 경량 자동차 부품, 정밀 설계 부품에 대한 수요가 증가함에 따라 현대식 열처리 시스템에 대한 의존도가 높아지고 있습니다. 이러한 요인들이 결합되어 열처리는 유도가열 시장에서 가장 크고 중요한 응용 분야가 되었습니다.

지역별로는 유럽이 3번째로 높은 성장률을 보이는 시장으로 유도가열 시장을 꼽을 수 있습니다. 이러한 성장은 이 지역의 탄탄한 제조업 기반, 에너지 효율이 높은 산업 기술에 대한 투자 가속화, 보다 깨끗하고 지속가능한 난방 솔루션을 촉진하는 엄격한 규제 프레임워크에 의해 주도되고 있습니다. 유럽 산업, 특히 자동차, 중장비, 첨단 야금 분야는 탈탄소화 목표를 달성하고 운영시 배출량을 줄이기 위해 고효율 전기 및 유도 가열 시스템으로 빠르게 전환하고 있습니다.

또한 EU 차원의 디지털화 및 녹색 전환을 위한 노력에 힘입어 산업 인프라의 지속적인 현대화가 정밀하고 자동화되고 유지보수가 적은 난방 기술의 채택을 촉진하고 있습니다. 주요 산업 장비 제조업체의 존재, 강력한 연구개발 능력, 고품질 가공 재료에 대한 수요 증가와 함께 유럽은 꾸준히 성장하는 시장으로서의 지위를 더욱 확고히 하여 유도가열 분야에서 세 번째로 높은 성장률을 보이는 지역이 되었습니다.

주요 업계 관계자, 전문 지식을 보유한 전문가, 주요 시장 진출기업의 경영진, 업계 컨설턴트 등 다양한 전문가를 대상으로 심층 인터뷰를 실시하여 중요한 정성적, 정량적 정보를 수집 및 검증하고 향후 시장 전망을 평가했습니다. 1차 인터뷰의 내용은 다음과 같습니다.

조사 범위:

이 보고서는 전력, 애플리케이션, 최종사용자 및 지역별로 세계 유도 가열 시장을 정의, 설명 및 예측합니다. 또한 시장의 상세한 정성적, 정량적 분석을 제공합니다. 주요 시장 성장 촉진요인, 제약요인, 기회, 과제를 종합적으로 검토합니다. 또한 시장의 다양한 중요한 측면을 다룹니다. 여기에는 경쟁 구도 분석, 시장 역학, 가치 기반 시장 추정 및 예측, 유도 가열 시장 전망 동향이 포함됩니다.

이 보고서 구매의 주요 이점

- 유도 가열 시장의 성장에 영향을 미치는 주요 시장 성장 촉진요인, 제약 조건, 기회 및 과제에 대한 분석을 제공합니다.

- 시장 개발: 수익성 높은 시장에 대한 종합적인 정보 - 이 보고서는 다양한 지역의 유도 가열 시장을 분석합니다.

- 시장 다각화 : 유도가열 시장의 신제품 및 서비스, 미개발 지역, 최근 동향, 투자 동향에 대한 상세한 정보를 수록했습니다.

- 경쟁 평가 : 주요 기업 - Interpower Induction(미국), Thermo International(미국), inTEST Corporation(미국), Radyne Corporation(미국), Hammond Power Solutions(캐나다), SPC Electronics Corporation(일본), Park-Ohio Holdings Corp(미국), Induction Innovations(미국), ENRX(독일), RDO Induction, Inc.(미국), UltraFlex Power Technologies(미국), Eldec Induction GmbH(독일), TRUMPF(독일), MagneForce Inc.(미국), Dai-Ichi Kiden(일본), Shenzhen Double-Power Technology(중국), Nippon Avionics(일본) 등 유도 가열 시장에서 주요 기업의 시장 점유율, 성장 전략, 서비스 제공에 대해 상세한 평가를 시행합니다. 유도 가열 시장의 기타 기업.

자주 묻는 질문

목차

제1장 서론

제2장 개요

제3장 주요 인사이트

제4장 시장 개요

- 시장 역학

- 미충족 요구와 공백

- 상호접속된 시장과 분야 횡단적인 기회

- Tier1/2/3 참여 기업의 전략적 움직임

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제 전망

- 밸류체인 분석

- 에코시스템 분석

- 가격 분석

- 무역 분석

- 2025-2026년의 주요 컨퍼런스와 이벤트

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 투자와 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세가 유도 가열 시장에 미치는 영향

제6장 기술의 진보, AI 드리븐 영향, 특허, 혁신, 향후 응용

- 주요 기술

- 보완적 기술

- 기술 로드맵

- 특허 분석

- 향후 응용

- 유도 가열 시장에 대한 AI/생성형 AI의 영향

제7장 규제 상황과 지속가능성에 관한 구상

- 지역의 규제와 컴플라이언스

- 지속가능성 구상

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 구매 프로세스에 관여하는 주요 이해관계자와 평가 기준

- 채택 장벽과 내부 과제

- 다양한 최종 용도 산업의 미충족 요구

- 시장 수익성

제9장 유도 가열 시장(전력별)

- 10kW 미만

- 10-100kW

- 100kW 이상

제10장 유도 가열 시장(주파수별)

- 저

- 중

- 고

제11장 유도 가열 시장(용도별)

- 금속 용해

- 어닐링

- 열처리

- 브레이징 및 솔더링

- 표면 경화

제12장 유도 가열 시장(최종 용도 산업별)

- 금속

- 산업 제조업

- 자동차

- 플라스틱 가공

- 일렉트로닉스 및 반도체

- 가전제품

- 의료기기

제13장 유도 가열 시장(지역별)

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 이탈리아

- 스페인

- 영국

- 프랑스

- 기타

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 기타

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타

- 라틴아메리카

- 브라질

- 아르헨티나

- 멕시코

- 기타

제14장 경쟁 구도

- 개요

- 주요 기업 경쟁 전략/유력 기업, 2021-2025년

- 시장 점유율 분석, 2024년

- 매출 분석, 2020-2024년

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제15장 기업 개요

- 주요 참여 기업

- INTERPOWER INDUCTION

- ENRX

- INTEST CORPORATION

- INDUCTOTHERM GROUP

- PARK-OHIO HOLDINGS CORP.

- THERMO INTERNATIONAL

- HAMMOND POWER SOLUTIONS

- SPC ELECTRONICS CORPORATION

- INDUCTION INNOVATIONS

- RDO INDUCTION, INC.

- ULTRAFLEX POWER TECHNOLOGIES

- ELDEC INDUCTION GMBH

- DAI-ICHI KIDEN CO., LTD.

- DAOBRIGHT

- TRUMPF

- 기타 기업

- MAGNEFORCE INC.

- SHENZHEN DOUBLE-POWER TECHNOLOGY CO., LTD.

- NIPPON AVIONICS CO., LTD.

- ELECTROTHERM

- CHENGDU JINKEZHI ELECTRONIC CO., LTD.

- HF ENERGY AB

- UCHINO CO., LTD.

- AGNI INDUCTION TECHNOLOGIES

- ELECTROHEAT INDUCTION

- SUZHOU HONGCHUANG HIGH FREQUENCY HEATING EQUIPMENT CO., LTD.

제16장 조사 방법

제17장 부록

KSA 26.01.06The global Induction heating market is estimated to grow from USD 616.8 million in 2025 to USD 879.5 million by 2030, at a CAGR of 7.4% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Thousand Units) |

| Segments | Frequency, Power, Application, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Rapid expansion of industrial and manufacturing infrastructure across major economies is driving strong demand for Induction Heating systems. In India, initiatives such as the National Infrastructure Pipeline and growing investments in metals, automotive, chemicals, and electronics are driving the need for efficient heating technologies that enhance productivity and energy performance.

In the United States, federal programs such as the Infrastructure Investment and Jobs Act and clean-energy industrial expansion are pushing upgrades in steel, semiconductors, all of which require reliable, high-efficiency Induction Heating solutions. This steady modernization and capacity building directly increase the adoption of advanced heating systems for faster processing, reduced energy use, and improved operational reliability.

"By frequency, the 10-50 kHz segment is expected to dominate the Induction heating market during the forecast period."

The Induction heating market by frequency has the 10-50 kHz range as its leading segment. This is primarily because this frequency band offers an ideal balance between heating depth and process efficiency, making it suitable for a wide variety of industrial applications such as hardening, brazing, annealing, and forging. Systems operating in the 10-50 kHz range deliver fast, uniform heating with high energy efficiency, enabling precise temperature control and improved metallurgical results.

This frequency range is widely compatible with both conductive and moderately thin workpieces, allowing industries to utilize it for diverse production requirements. Additionally, equipment in this band is cost-effective, easier to maintain, and adaptable to both legacy and modern manufacturing setups. Owing to these advantages, the 10-50 kHz segment is being rapidly adopted across metal processing, automotive, and general manufacturing, making it the most preferred and extensively deployed frequency category in the market.

"By application, the heat-treating segment is expected to dominate the Induction heating market during the forecast period."

The Induction heating market by application is led by the heat-treating segment. This dominance is driven by the widespread use of heat-treating processes-such as hardening, tempering, annealing, and stress relieving across core industries, including automotive, machinery manufacturing, and metalworking. Heat-treating requires precise, consistent, and energy-efficient thermal control, which makes advanced Induction Heating systems highly suited for achieving desired material properties and improving component durability.

Induction Heating technologies used for heat treating provide rapid heating rates, clean operation, and superior metallurgical accuracy, making them a preferred choice over conventional gas-based systems. Furthermore, growing demand for high-performance metals, lightweight automotive components, and precision-engineered parts is increasing reliance on modern heat-treating systems. These factors collectively make heat-treating the largest and most critical application segment in the Induction Heating market.

"By region, Europe is estimated to be the third fastest-growing market during the forecast period."

The Induction Heating market, by region, identifies Europe as the third-fastest-growing market. This growth is driven by the region's strong manufacturing base, accelerating investments in energy-efficient industrial technologies, and stringent regulatory frameworks that promote cleaner and more sustainable heating solutions. European industries, especially automotive, heavy machinery, and advanced metallurgy, are rapidly upgrading to high-efficiency electric and induction-based heating systems to meet decarbonization targets and reduce operational emissions.

Additionally, the ongoing modernization of industrial infrastructure, supported by EU-level initiatives for digitalization and the green transition, is driving industries to adopt precise, automated, and low-maintenance heating technologies. The presence of leading industrial equipment manufacturers, combined with strong R&D capabilities and a rising demand for premium-quality processed materials, further positions Europe as a steadily expanding market, making it the third-fastest-growing region in the Induction Heating Landscape.

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 30%, Tier 2- 45%, and Tier 3 - 25%

By Designation: C-level Executives - 30%, Directors - 20%, and Others - 50%

By Region: North America - 18%, Europe - 8%, Asia Pacific - 60%, Middle East & Africa - 10%, and South America - 4%

Notes: The tiers of the companies are defined based on their total revenues as of 2024. Tier 1: > USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: < USD 500 million.

Other designations include sales managers, engineers, and regional managers.

Research Coverage:

The report defines, describes, and forecasts the global Induction heating market by power, application, end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the Induction Heating market.

Key Benefits of Buying the Report

- It provides an analysis of key drivers, restraints, opportunities, and challenges influencing the growth of the Induction Heating market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Induction heating market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the Induction Heating market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Interpower Induction (US), Thermo International (US), inTEST Corporation (US), Radyne Corporation (US), Hammond Power Solutions (Canada), SPC Electronics Corporation (Japan), Park-Ohio Holdings Corp (US), Induction Innovations (US), ENRX (Germany), RDO Induction, Inc. (US), UltraFlex Power Technologies (US), Eldec Induction GmbH (Germany), TRUMPF (Germany), MagneForce Inc. (US), Dai-Ichi Kiden Co., Ltd. (Japan), Shenzhen Double-Power Technology Co., Ltd. (China), Nippon Avionics Co., Ltd. (Japan). among others in the Induction Heatingmarket.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN INDUCTION HEATING MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDUCTION HEATING MARKET

- 3.2 INDUCTION HEATING MARKET, BY POWER RATING

- 3.3 INDUCTION HEATING MARKET, BY END-USE INDUSTRY

- 3.4 INDUCTION HEATING MARKET, BY FREQUENCY

- 3.5 INDUCTION HEATING MARKET IN ASIA PACIFIC, BY END-USE INDUSTRY AND COUNTRY

- 3.6 INDUCTION HEATING MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Increasing precision-driven manufacturing requirements and trade-driven industrial growth

- 4.2.1.2 Global focus on energy efficiency and decarbonization

- 4.2.2 RESTRAINTS

- 4.2.2.1 High upfront CAPEX associated with larger induction heating systems

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Surging demand for electric vehicles

- 4.2.3.2 Expanding induction heating applications in semiconductor and precision electronics

- 4.2.4 CHALLENGES

- 4.2.4.1 Preference for low-cost conventional resistance heating solutions

- 4.2.4.2 Sustaining competitive edge amid technology commoditization

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN INDUCTION HEATING MARKET

- 4.3.2 WHITE SPACE OPPORTUNITIES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.5.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 BARGAINING POWER OF SUPPLIERS

- 5.1.2 BARGAINING POWER OF BUYERS

- 5.1.3 THREAT OF NEW ENTRANTS

- 5.1.4 THREAT OF SUBSTITUTES

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 INFLATION RATE ACROSS VARIOUS REGIONS, 2024

- 5.2.4 MANUFACTURING VALUE ADDED (% OF GDP)

- 5.2.5 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- 5.2.6 TRENDS IN GLOBAL TRANSPORTATION INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF INDUCTION HEATING SYSTEMS, BY POWER RATING, 2022-2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF INDUCTION HEATING SYSTEMS, BY REGION, 2022-2024

- 5.6 TRADE ANALYSIS

- 5.6.1 EXPORT SCENARIO (HS CODE 851440)

- 5.6.2 IMPORT SCENARIO (HS CODE 851440)

- 5.7 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 USE OF INDUCTION HEATING SOLUTION TO IMPROVE OPERATIONAL EFFICIENCY

- 5.10.2 ADOPTION OF HIGH-POWER INDUCTION DRYER TO ENHANCE COATING LINE SPEED AND UNIFORMITY

- 5.10.3 DEPLOYMENT OF HIGH-THROUGHPUT INDUCTION SYSTEMS TO IMPROVE METALLURGICAL PERFORMANCE AND PRODUCTIVITY

- 5.11 IMPACT OF 2025 US TARIFF ON INDUCTION HEATING MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 SILICON CARBIDE AND GALLIUM NITRIDE SEMICONDUCTORS

- 6.1.2 DIGITAL TWIN AND PREDICTIVE CONTROL SYSTEMS

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 SYSTEMS SMART FACTORY AND INDUSTRIAL IOT INTEGRATION

- 6.3 TECHNOLOGY ROADMAP

- 6.4 PATENT ANALYSIS

- 6.5 FUTURE APPLICATIONS

- 6.6 IMPACT OF AI/GEN AI ON INDUCTION HEATING MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES FOLLOWED BY MANUFACTURERS IN INDUCTION HEATING MARKET

- 6.6.3 IMPACT OF AI/GEN AI ON END-USE INDUSTRIES

- 6.6.4 IMPACT OF AI ON INDUCTION HEATING MARKET, BY REGION

- 6.6.5 CASE STUDIES OF AI IMPLEMENTATION IN INDUSTRIAL HEATING MARKET

- 6.6.6 INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.7 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN INDUSTRIAL HEATING MARKET

7 REGULATORY LANDSCAPE AND SUSTAINABILITY INITIATIVES

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.1.2.1 CODES AND REGULATIONS related to induction heating

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 INTRODUCTION

- 7.2.2 SUSTAINABILITY INITIATIVES

- 7.2.3 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 INTRODUCTION

- 8.2 DECISION-MAKING PROCESS

- 8.3 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.3.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.3.2 BUYING CRITERIA

- 8.4 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.5 UNMET NEEDS OF VARIOUS END-USE INDUSTRIES

- 8.6 MARKET PROFITABILITY

9 INDUCTION HEATING MARKET, BY POWER RATING

- 9.1 INTRODUCTION

- 9.2 LESS THAN 10 KW

- 9.2.1 STRINGENT WORKPLACE SAFETY GUIDELINES TO BOOST DEMAND

- 9.3 10-100 KW

- 9.3.1 GOVERNMENT-BACKED INDUSTRIAL MODERNIZATION PROGRAMS TO ACCELERATE ADOPTION

- 9.4 ABOVE 100 KW

- 9.4.1 RISING GOVERNMENT ENVIRONMENTAL REGULATIONS TO DRIVE MARKET

10 INDUCTION HEATING MARKET, BY FREQUENCY

- 10.1 INTRODUCTION

- 10.2 LOW

- 10.2.1 TRANSITION TO CLEAN, EFFICIENT ELECTRIC HEATING TECHNOLOGIES TO FUEL SEGMENTAL GROWTH

- 10.3 MEDIUM

- 10.3.1 GOVERNMENT-BACKED INDUSTRIAL ELECTRIFICATION INITIATIVES TO STIMULATE DEMAND

- 10.4 HIGH

- 10.4.1 SMART MANUFACTURING INITIATIVES TO CONTRIBUTE TO MARKET GROWTH

11 INDUCTION HEATING MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 METAL MELTING

- 11.2.1 GOVERNMENT-BACKED INDUSTRIAL DECARBONIZATION EFFORTS TO ACCELERATE DEMAND

- 11.3 ANNEALING

- 11.3.1 FOCUS OF INDUSTRIES ON ENERGY-EFFICIENT, LOW-EMISSION, AND PRECISION-CONTROLLED THERMAL PROCESSING TO FUEL DEMAND

- 11.4 HEAT TREATING

- 11.4.1 STRINGENT EMISSION REGULATIONS AND TRANSITION TO ELECTRIFIED INDUSTRIAL HEATING TO PROPEL MARKET

- 11.5 BRAZING AND SOLDERING

- 11.5.1 RISING DEMAND FOR SPECIALTY ALLOY COMPONENTS WITH SUPERIOR JOINT INTEGRITY TO SUPPORT MARKET GROWTH

- 11.6 SURFACE HARDENING

- 11.6.1 PRESSING NEED TO CUT PARTICULATE AND NOX EMISSIONS IN LARGE MANUFACTURING FACILITIES TO DRIVE MARKET

12 INDUCTION HEATING MARKET, BY END-USE INDUSTRY

- 12.1 INTRODUCTION

- 12.2 METALS

- 12.2.1 STRATEGIC SHIFT TOWARD ENERGY-EFFICIENT AND LOW-EMISSION PROCESSES TO FUEL DEMAND

- 12.3 INDUSTRIAL MANUFACTURING

- 12.3.1 GOVERNMENT INCENTIVES TO REDUCE CARBON EMISSIONS DURING INDUSTRIAL PROCESSES TO ACCELERATE ADOPTION

- 12.4 AUTOMOTIVE

- 12.4.1 GROWING FOCUS ON EXPANDING EV INFRASTRUCTURE TO DRIVE MARKET

- 12.5 PLASTIC PROCESSING

- 12.5.1 RISING PUSH TOWARD ELECTRIFICATION AND PRECISION IN THERMAL MANAGEMENT TO FUEL MARKET GROWTH

- 12.6 ELECTRONICS & SEMICONDUCTORS

- 12.6.1 INTEGRATION OF HIGH-PRECISION THERMAL PROCESSES INTO HIGH-TECH MANUFACTURING TO FOSTER MARKET GROWTH

- 12.7 CONSUMER APPLIANCES

- 12.7.1 RISING SHIFT TOWARD EFFICIENT, SAFE, AND SMART TECHNOLOGIES TO FUEL MARKET GROWTH

- 12.8 MEDICAL DEVICES

- 12.8.1 SHIFT TOWARD ENERGY-EFFICIENT THERMAL PROCESSING WHILE MANUFACTURING MEDICAL DEVICES TO DRIVE MARKET

13 INDUCTION HEATING MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 US

- 13.2.1.1 Strict energy efficiency and emission regulations to boost demand

- 13.2.2 CANADA

- 13.2.2.1 High investments in green supply chains and smart factories to support market growth

- 13.2.1 US

- 13.3 EUROPE

- 13.3.1 GERMANY

- 13.3.1.1 Growing reliance on renewable energy sources to fuel market growth

- 13.3.2 ITALY

- 13.3.2.1 Green Deal and REPowerEU initiatives to contribute to market growth

- 13.3.3 SPAIN

- 13.3.3.1 Rapid transition from gas-based furnaces to high-efficiency induction systems to propel market

- 13.3.4 UK

- 13.3.4.1 Concentration of high-performance industrial hubs to create growth opportunities

- 13.3.5 FRANCE

- 13.3.5.1 Industrial decarbonization grants and R&D incentives to stimulate demand

- 13.3.6 REST OF EUROPE

- 13.3.1 GERMANY

- 13.4 ASIA PACIFIC

- 13.4.1 CHINA

- 13.4.1.1 Booming steel industry to fuel market growth

- 13.4.2 JAPAN

- 13.4.2.1 Strong industrial base and greater emphasis on precision manufacturing to fuel market growth

- 13.4.3 INDIA

- 13.4.3.1 Large-scale rail infrastructure modernization projects to create lucrative opportunities

- 13.4.4 AUSTRALIA

- 13.4.4.1 Investment in mining, renewable energy, and infrastructure modernization programs to foster market growth

- 13.4.5 REST OF ASIA PACIFIC

- 13.4.1 CHINA

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 GCC

- 13.5.1.1 Saudi Arabia

- 13.5.1.1.1 Growing number of infrastructure megaprojects to fuel market growth

- 13.5.1.2 UAE

- 13.5.1.2.1 Large-scale infrastructure, renewable energy, and logistics projects to boost demand

- 13.5.1.3 Rest of GCC

- 13.5.1.1 Saudi Arabia

- 13.5.2 SOUTH AFRICA

- 13.5.2.1 Rising need to reduce operating costs and energy consumption to fuel market growth

- 13.5.3 REST OF MIDDLE EAST & AFRICA

- 13.5.1 GCC

- 13.6 LATIN AMERICA

- 13.6.1 BRAZIL

- 13.6.1.1 Emphasis on modernizing fabrication workflows to boost demand

- 13.6.2 ARGENTINA

- 13.6.2.1 Expanding metalworking and manufacturing base to drive market

- 13.6.3 MEXICO

- 13.6.3.1 Automotive sector to contribute to market growth

- 13.6.4 REST OF LATIN AMERICA

- 13.6.1 BRAZIL

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER COMPETITIVE STRATEGIES/RIGHT TO WIN, 2021-2025

- 14.3 MARKET SHARE ANALYSIS, 2024

- 14.4 REVENUE ANALYSIS, 2020-2024

- 14.5 BRAND/PRODUCT COMPARISON

- 14.5.1 INDUCTOTHERM GROUP (US)

- 14.5.2 PARK-OHIO HOLDINGS CORP. (US)

- 14.5.3 ENRX (NORWAY)

- 14.5.4 INTERPOWER INDUCTION (US)

- 14.5.5 INTEST CORPORATION (US)

- 14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 PARTICIPANTS

- 14.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.6.5.1 Company footprint

- 14.6.5.2 Region footprint

- 14.6.5.3 Power rating footprint

- 14.6.5.4 Frequency footprint

- 14.6.5.5 End-use industry footprint

- 14.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 DYNAMIC COMPANIES

- 14.7.4 STARTING BLOCKS

- 14.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.7.5.1 Detailed list of key startups/SMEs

- 14.7.5.2 Competitive benchmarking of key startups/SMEs

- 14.8 COMPETITIVE SCENARIO

- 14.8.1 PRODUCT LAUNCHES

- 14.8.2 DEALS

- 14.8.3 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 INTERPOWER INDUCTION

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 MnM view

- 15.1.1.3.1 Key strategies/Right to win

- 15.1.1.3.2 Strategic choices

- 15.1.1.3.3 Weaknesses/Competitive threats

- 15.1.2 ENRX

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strategies/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 INTEST CORPORATION

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches

- 15.1.3.3.2 Expansions

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strategies/Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses/Competitive threats

- 15.1.4 INDUCTOTHERM GROUP

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Expansions

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strategies/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 PARK-OHIO HOLDINGS CORP.

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 MnM view

- 15.1.5.3.1 Key strategies/Right to win

- 15.1.5.3.2 Strategic choices

- 15.1.5.3.3 Weaknesses/Competitive threats

- 15.1.6 THERMO INTERNATIONAL

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches

- 15.1.7 HAMMOND POWER SOLUTIONS

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Deals

- 15.1.8 SPC ELECTRONICS CORPORATION

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.9 INDUCTION INNOVATIONS

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.10 RDO INDUCTION, INC.

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.11 ULTRAFLEX POWER TECHNOLOGIES

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.12 ELDEC INDUCTION GMBH

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.13 DAI-ICHI KIDEN CO., LTD.

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.14 DAOBRIGHT

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.15 TRUMPF

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.1 INTERPOWER INDUCTION

- 15.2 OTHER PLAYERS

- 15.2.1 MAGNEFORCE INC.

- 15.2.2 SHENZHEN DOUBLE-POWER TECHNOLOGY CO., LTD.

- 15.2.3 NIPPON AVIONICS CO., LTD.

- 15.2.4 ELECTROTHERM

- 15.2.5 CHENGDU JINKEZHI ELECTRONIC CO., LTD.

- 15.2.6 HF ENERGY AB

- 15.2.7 UCHINO CO., LTD.

- 15.2.8 AGNI INDUCTION TECHNOLOGIES

- 15.2.9 ELECTROHEAT INDUCTION

- 15.2.10 SUZHOU HONGCHUANG HIGH FREQUENCY HEATING EQUIPMENT CO., LTD.

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.2 SECONDARY AND PRIMARY RESEARCH

- 16.2.1 SECONDARY DATA

- 16.2.1.1 List of key secondary sources

- 16.2.1.2 Key data from secondary sources

- 16.2.2 PRIMARY DATA

- 16.2.2.1 List of primary interview participants

- 16.2.2.2 Key industry insights

- 16.2.2.3 Breakdown of primaries

- 16.2.2.4 Key data from primary sources

- 16.2.1 SECONDARY DATA

- 16.3 MARKET SIZE ESTIMATION METHODOLOGY

- 16.3.1 BOTTOM-UP APPROACH

- 16.3.2 TOP-DOWN APPROACH

- 16.3.3 DEMAND-SIDE ANALYSIS

- 16.3.3.1 Demand-side assumptions

- 16.3.3.2 Demand-side calculations

- 16.3.4 SUPPLY-SIDE ANALYSIS

- 16.3.4.1 Supply-side assumptions

- 16.3.4.2 Supply-side calculations

- 16.4 GROWTH FORECAST

- 16.5 DATA TRIANGULATION

- 16.6 RESEARCH LIMITATIONS

- 16.7 RISK ANALYSIS

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS