|

시장보고서

상품코드

1895142

의약품 품질관리 소프트웨어(QMS) 시장 예측(-2030년) : 프로세스별, 용도별, 규모별, 최종사용자별, 지역별Pharmaceutical Quality Management Software Market by Process, Application, Size, End User, Region - Global Forecast to 2030 |

||||||

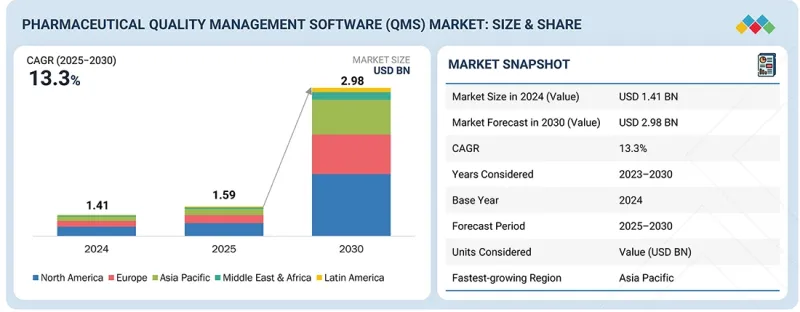

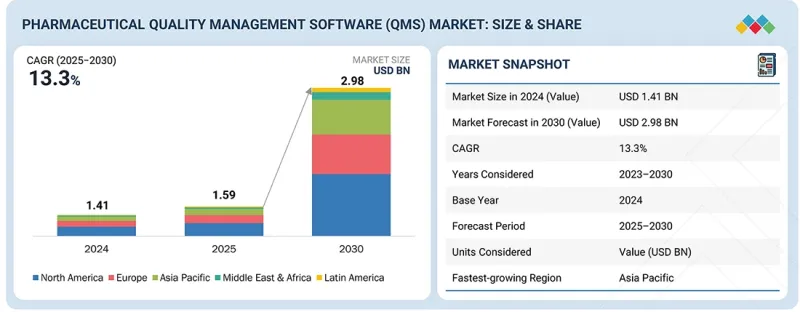

세계의 의약품 QMS 시장 규모는 2025년 15억 9,000만 달러에서 2030년까지 29억 8,000만 달러에 달할 것으로 예측되며, 예측 기간에 CAGR로 13.3%의 성장이 전망됩니다.

규제 요건 강화, 컴플라이언스 프로세스 효율화에 대한 요구, 제약 산업의 디지털 혁신에 대한 수요 증가로 인해 제약 QMS 시장은 꾸준한 성장세를 보이고 있습니다. 기업은 효율성 향상, 오류 최소화, FDA, EMA, ISO 가이드라인 등 국제 표준을 준수하기 위해 QMS 솔루션을 도입하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2024-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 프로세스, 용도, 기업 규모, 최종사용자 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

또한 의약품 개발, 임상시험, 제조 업무가 복잡해지고 있는 점도 채용을 더욱 촉진하고 있습니다. 이러한 추세는 업계 전체가 자동화되고 통합된 데이터베이스 품질관리 시스템으로 전환하여 품질과 환자 안전을 개선하고 시장 출시 속도를 가속화하기 위해 노력하고 있음을 반영합니다.

"프로세스 부문의 규제 준수 부문이 예측 기간 중 가장 높은 성장률을 보일 것으로 예측됩니다. "

프로세스별로는 규제 준수 부문이 의약품 QMS 시장에서 가장 빠르게 성장할 것으로 예측됩니다. 이러한 확장은 전 세계에서 규제 요건이 복잡해지고 FDA, EMA, WHO 등의 기관에서 설정한 엄격한 품질 및 안전 기준을 충족해야 할 필요성이 증가함에 따라 가속화되고 있습니다. QMS는 조직이 감사, 문서화, 보고 업무를 효율적으로 관리하여 컴플라이언스 위반의 위험과 관련 처벌을 줄일 수 있도록 지원합니다. 또한 자동화된 컴플라이언스 추적, 실시간 데이터 가시성, 중앙 집중식 문서 관리에 대한 수요가 증가하면서 업계 전반에 걸쳐 QMS 솔루션의 채택이 증가하고 있습니다.

"용도별로는 CAPA(교정 및 예방 조치) 관리가 예측 기간 중 가장 빠르게 성장할 것으로 예측됩니다. "

용도별로는 CAPA(시정조치 및 예방조치) 관리 부문이 의약품 QMS 시장에서 가장 빠르게 성장하는 분야가 될 것으로 예측됩니다. 이러한 성장은 규제 기준을 충족하기 위해 품질 문제를 적극적으로 식별하고 수정하는 노력에 대한 관심이 높아짐에 따라 성장세를 보이고 있습니다. CAPA 솔루션은 제약회사가 근본 원인을 체계적으로 조사하고, 시정 조치를 취하며, 일탈 및 부적합의 재발을 방지할 수 있도록 도와줍니다. CAPA 프로세스의 자동화, 데이터 분석, 실시간 모니터링의 통합이 진행됨에 따라 효율성과 정확성이 더욱 향상될 것입니다. 기업이 높은 품질 기준을 유지하고 운영 리스크를 줄이기 위해 QMS 플랫폼내 고급 CAPA 기능에 대한 수요가 빠르게 증가하고 있습니다.

"아시아태평양이 예측 기간 중 가장 높은 성장률을 보일 것으로 예측됩니다. "

아시아태평양은 의약품 제조 능력의 급속한 확대, 이 지역에 대한 임상시험 의뢰 건수 증가, 세계 표준과의 규제 정합성 강화로 인해 의약품 QMS 시장에서 가장 빠르게 성장할 것으로 예측됩니다. 또한 디지털화 노력의 진전과 컴플라이언스를 위한 첨단 IT 인프라 및 자동화에 대한 투자로 인해, 복잡한 다중 거점 업무에서 품질 보증을 개선하고 문서화를 간소화하며 규제 준수를 유지하기 위해 통합 QMS 플랫폼이 광범위하게 채택되고 있습니다.

세계의 의약품 품질관리 소프트웨어(QMS) 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 제품 개발과 혁신, 경쟁 구도에 관한 인사이트를 제공하고 있습니다.

자주 묻는 질문

목차

제1장 서론

제2장 개요

제3장 중요 인사이트

- 의약품 품질관리 소프트웨어(QMS) 시장 개요

- 의약품 품질관리 소프트웨어(QMS) 시장 : 기업 규모별, 지역별

- 의약품 품질관리 소프트웨어(QMS) 시장 : 지역적 스냅숏

- 의약품 품질관리 소프트웨어(QMS) 시장 : 선진 시장과 신흥 시장

제4장 시장 개요

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 상호접속된 시장과 부문 횡단적인 기회

- Tier 1/2/3 기업의 전략적 움직임

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제 전망

- GDP의 동향과 예측

- 세계의 의료 IT 업계의 동향

- 밸류체인 분석

- 에코시스템 분석

- 가격결정 분석

- 참고 가격 분석 : 주요 기업별(2024년)

- 참고 가격 분석 : 지역별(2024년)

- 주요 컨퍼런스와 이벤트(2025-2026년)

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 투자와 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세의 영향

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종 용도 산업에 대한 영향

제6장 기술의 진보, AI에 의한 영향, 특허, 혁신, 향후 용도

- 주요 신기술

- 생성형 AI와 기계학습

- 클라우드 컴퓨팅과 SaaS 플랫폼

- 로보틱 프로세스 자동화

- 보완 기술

- 제조 실행 시스템(MES)

- 전사적 자원 관리(ERP) 시스템

- 전자 데이터 관리 시스템(EDMS)

- 기술/제품 로드맵

- 특허 분석

- 관할 분석

- 주요 특허

- 특허 리스트

- 향후 용도

- 감사·검사의 자동화

- AI에 의한 컴플라이언스 모니터링

- 첨단 애널리틱스 대시보드

- 모바일 QMS 애플리케이션

- 공급업체 품질관리 자동화

- 의약품 품질관리 소프트웨어(QMS) 시장에 대한 AI/생성형 AI의 영향

- 의약품 품질관리 소프트웨어(QMS) 시장에서 AI/생성형 AI 시장의 장래성

- AI/생성형 AI 실장에 관한 사례 연구

- 상호접속된 인접 에코시스템에 대한 AI/생성형 AI의 영향

- 사용자 준비 상황과 영향 평가

제7장 규제 상황

- 지역의 규제와 컴플라이언스

- 규제기관, 정부기관, 기타 조직

- 업계표준

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 바이어 이해관계자와 구매 평가 기준

- 구매 프로세스의 주요 이해관계자

- 주요 구입 기준

- 채택 장벽과 내부 과제

- 다양한 최종 용도 산업으로부터의 미충족 요구

제9장 의약품 품질관리 소프트웨어(QMS) 시장 : 프로세스별

- 임상시험

- 규제 준수

- 제조/생산

- 품질 보증/품질관리

- 유통·공급망

- 상업화·마케팅·세일즈

- 시판 후 조사

- 기타 프로세스

제10장 의약품 품질관리 소프트웨어(QMS) 시장 : 용도별

- 문서 관리·ESOP

- CAPA(시정 조치·예방 조치) 관리

- 감사·검사 관리

- 트레이닝 관리

- 규제·컴플라이언스 관리

- 공급업체 품질관리

- 리스크 관리

- 변경 관리

- 기타 용도

제11장 의약품 품질관리 소프트웨어(QMS) 시장 : 기업 규모별

- 대기업

- 중소기업

제12장 의약품 품질관리 소프트웨어(QMS) 시장 : 최종사용자별

- 제약 기업

- 바이오테크놀러지 기업

- CRO

- CDMO

- 기타 최종사용자

제13장 의약품 품질관리 소프트웨어(QMS) 시장 : 지역별

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 남아프리카공화국

- 기타 중동 및 아프리카

제14장 경쟁 구도

- 개요

- 주요 기업의 경쟁 전략/강점

- 매출 분배 분석

- 시장 점유율 분석

- 소프트웨어 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업의 평가와 재무 지표

- 경쟁 시나리오

제15장 기업 개요

- 주요 기업

- HONEYWELL INTERNATIONAL INC.

- IQVIA

- VEEVA SYSTEMS INC.

- MASTERCONTROL SOLUTIONS, INC.

- DASSAULT SYSTEMES

- QUALIO

- HEXAGON AB

- ASSURX, INC.

- QT9 SOFTWARE

- COMPLIANCEQUEST

- IDEAGEN

- SOFTEXPERT

- INSTEM

- INTELEX TECHNOLOGIES

- INTELLECT, INC

- AMPLELOGIC

- 기타 기업

- INSTANTGMP

- SIMPLERQMS

- DOT COMPLIANCE LTD.

- SNIC SOLUTIONS

- QUALITYZE

- SCIGENIQ

- KIVO, INC.

- GMP SOFTWARE INDIA PVT. LTD.

- VMT SOFT SOL PVT. LTD.

제16장 조사 방법

제17장 부록

KSA 26.01.08The global pharmaceutical QMS market is projected to reach USD 2.98 billion by 2030 from USD 1.59 billion in 2025, at a CAGR of 13.3% during the forecast period. The pharmaceutical QMS market is experiencing consistent growth, driven by increasing regulatory requirements, the need for streamlined compliance processes, and rising demand for digital transformation in the pharmaceutical industry. Companies are adopting QMS solutions to improve efficiency, minimize errors, and ensure compliance with global standards such as FDA, EMA, and ISO guidelines.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Process, Application, Enterprise Size, End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

Additionally, the increasing complexity of drug development, clinical trials, and manufacturing operations is further boosting adoption. This trend reflects the industry's move toward integrated, automated, and data-driven quality management systems to enhance overall product quality, patient safety, and accelerate time-to-market efficiency.

"Regulatory compliance under the process segment is expected to register the fastest growth rate during the forecast period."

By process, the regulatory compliance segment is expected to grow the fastest in the pharmaceutical QMS market. This expansion is driven by the growing complexity of global regulatory requirements and the increasing need for pharmaceutical companies to meet stringent quality and safety standards set by agencies such as the FDA, EMA, and WHO. QMS helps organizations efficiently manage audits, documentation, and reporting tasks, thereby reducing the risk of non-compliance and associated penalties. Moreover, the rising demand for automated compliance tracking, real-time data visibility, and centralized document control is boosting the adoption of QMS solutions across the industry.

"CAPA management under the application segment is expected to be the fastest-growing segment during the forecast period."

By application, the CAPA (Corrective and Preventive Action) management segment is expected to be the fastest-growing area in the pharmaceutical QMS market. This growth is fueled by the rising focus on proactively identifying and fixing quality issues to meet regulatory standards. CAPA solutions help pharmaceutical companies systematically investigate root causes, implement corrective actions, and prevent the recurrence of deviations or nonconformities. The increasing integration of automation, data analytics, and real-time monitoring within CAPA processes further boosts efficiency and accuracy. As companies aim to maintain high-quality standards and reduce operational risks, the demand for advanced CAPA capabilities within QMS platforms continues to grow rapidly.

"The Asia Pacific is expected to witness the highest growth rate during the forecast period."

The Asia Pacific is expected to experience the fastest growth in the pharmaceutical QMS market, driven by the rapid expansion of pharmaceutical manufacturing capacities, an increasing number of clinical trials outsourced to the region, and greater regulatory alignment with global standards. Additionally, the rise in digitization efforts, combined with investments in advanced IT infrastructure and automation for compliance, is fueling widespread adoption of integrated QMS platforms to improve quality assurance, simplify documentation, and maintain regulatory compliance across complex, multi-site operations.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the authentication and brand protection marketplace. The breakdown of primary participants is as mentioned below:

- By Company Type - Tier 1: 31%, Tier 2: 28%, and Tier 3: 41%

- By Designation - C-level: 31%, Director-level: 25%, and Others: 44%

- By Region - North America: 32%, Europe: 32%, Asia Pacific: 26%, Middle East & Africa: 5%, Latin America: 5%

Key Players in the Pharmaceutical QMS Market

The key players operating in the Pharmaceutical QMS market include Veeva Systems Inc. (US), MasterControl Solutions, Inc. (US), Honeywell International Inc. (US), IQVIA (US), Qualio, Inc. (US), Hexagon AB (Sweden), AssurX, Inc. (US), QT9 Software (US), Dassault Systemes (France), ComplianceQuest (US), Ideagen (UK), SoftExpert (Brazil), Xybion Digital Inc. (US), Intelex Technologies (Canada), Intellect, Inc. (US), AmpleLogic (India).

Research Coverage:

The report analyzes the pharmaceutical QMS market and aims to estimate its size and future growth potential across various segments based on process, application, enterprise size, end user, and region. It also provides a competitive analysis of the key players in the market, along with their company profiles, product offerings, recent developments, and key market insights strategies.

Reasons to Buy the Report

This report will help both established firms and newer or smaller companies understand the market trends, which can assist them in gaining a larger share of the market. Companies using the report can apply one or a combination of the strategies listed below to strengthen their positions in the market.

This report provides insights into:

- Analysis of key drivers (stringent regulatory compliance pressures are pushing pharma companies to adopt QMS solutions, Globalization of pharmaceutical operations is driving the need for digitalization and automation of QMS systems, cost pressures, reduce errors, and the need for operational efficiency in pharma, Increasing emphasis on risk management and adherence to regulatory standards), restraints (reluctance to adapt to new software solutions, strict data protection laws (GDPR, HIPAA) raise cybersecurity costs and slow software adoption, Concerns regarding data security & privacy), opportunities (increasing demand for specialized cloud-based software solutions in pharma manufacturing, Rising number of small & mid-sized pharma companies to propel market growth, expansion across emerging regions, fuelled by rising pharmaceutical manufacturing activities and evolving regulatory frameworks, adoption of AI and analytics to enable proactive quality management), and challenges (high initial costs of pharma QMS solutions, Variability in regulatory standards across regions, Shortages of skilled R&D and quality professionals with expertise in AI and advanced digital platforms) influencing the growth of the pharmaceutical QMS market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the pharmaceutical QMS market.

- Market Development: Comprehensive information on the lucrative emerging markets, application, process, enterprise size, end user, and region.

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the pharmaceutical QMS market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the pharmaceutical QMS market, like Veeva Systems, Inc. (US), MasterControl Solutions, Inc. (US), Honeywell International Inc. (US), IQVIA (US), and Dassault Systemes (France).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING THE MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMRGING FRONTIERS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET OVERVIEW

- 3.2 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE & REGION

- 3.3 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: GEOGRAPHIC SNAPSHOT

- 3.4 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET: DEVELOPED MARKETS VS. EMERGING MARKETS

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Stringent regulatory compliance

- 4.2.1.2 Globalization of pharmaceutical operations

- 4.2.1.3 Growing demand for operational efficiency and reduce human errors

- 4.2.1.4 Increasing emphasis on risk management and adherence to regulatory standards

- 4.2.2 RESTRAINTS

- 4.2.2.1 Reluctance to adopt new software solutions

- 4.2.2.2 Strict data protection laws

- 4.2.2.3 Data security and privacy concerns

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Increasing demand for specialized cloud-based software solutions

- 4.2.3.2 Rising number of small & mid-sized pharma companies

- 4.2.3.3 Expanding pharmaceutical industry in emerging regions

- 4.2.3.4 Adoption of AI and advanced analytics

- 4.2.4 CHALLENGES

- 4.2.4.1 High initial costs of implementing quality management systems

- 4.2.4.2 Variability in regulatory standards

- 4.2.4.3 Shortage of skilled R&D and quality professionals

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF SUBSTITUTES

- 5.1.2 THREAT OF NEW ENTRANTS

- 5.1.3 BARGAINING POWER OF BUYERS

- 5.1.4 BARGAINING POWER OF SUPPLIERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL HEALTHCARE IT INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING ANALYSIS, BY KEY PLAYER, 2024

- 5.5.2 INDICATIVE PRICING ANALYSIS, BY REGION, 2024

- 5.6 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS BUSINESS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 CASE STUDY ANALYSIS

- 5.10 IMPACT OF 2025 US TARIFF

- 5.10.1 INTRODUCTION

- 5.10.2 KEY TARIFF RATES

- 5.10.3 PRICE IMPACT ANALYSIS

- 5.10.4 IMPACT ON COUNTRY/REGION

- 5.10.4.1 US

- 5.10.4.2 Europe

- 5.10.4.3 Asia Pacific

- 5.10.5 IMPACT ON END-USE INDUSTRIES

- 5.10.5.1 Pharmaceutical companies

- 5.10.5.2 Biotechnology companies

- 5.10.5.3 Contract Research Organizations (CROs)

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 GENERATIVE AI & MACHINE LEARNING

- 6.1.2 CLOUD COMPUTING & SAAS PLATFORMS

- 6.1.3 ROBOTIC PROCESS AUTOMATION

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 MANUFACTURING EXECUTION SYSTEMS (MES)

- 6.2.2 ENTERPRISE RESOURCE PLANNING (ERP) SYSTEMS

- 6.2.3 ELECTRONIC DATA MANAGEMENT SYSTEMS (EDMS)

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.4 PATENT ANALYSIS

- 6.4.1 JURISDICTION ANALYSIS

- 6.4.2 MAJOR PATENTS

- 6.4.3 LIST OF PATENTS

- 6.5 FUTURE APPLICATIONS

- 6.5.1 AUTOMATED AUDIT AND INSPECTION

- 6.5.2 AI-POWERED COMPLIANCE MONITORING

- 6.5.3 ADVANCED ANALYTICS DASHBOARDS

- 6.5.4 MOBILE QMS APPLICATIONS

- 6.5.5 SUPPLIER QUALITY MANAGEMENT AUTOMATION

- 6.6 IMPACT OF AI/GEN AI ON PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE (QMS) MARKET

- 6.6.1 INTRODUCTION

- 6.6.2 MARKET POTENTIAL OF AI/GEN AI IN PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE (QMS) MARKET

- 6.6.3 CASE STUDY RELATED TO AI/GEN AI IMPLEMENTATION

- 6.6.3.1 Use of unified QMS platform for quality documentation

- 6.6.4 IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 6.6.4.1 Automated audit simulation

- 6.6.4.2 Real-time monitoring & alerts

- 6.6.4.3 Regulatory & compliance services

- 6.6.4.4 Research laboratories & contract manufacturers

- 6.6.5 USER READINESS AND IMPACT ASSESSMENT

- 6.6.5.1 User readiness

- 6.6.5.1.1 User A: Pharmaceutical companies

- 6.6.5.1.2 User B: Biotechnology companies

- 6.6.5.2 Impact assessment

- 6.6.5.2.1 User A: Pharmaceutical companies

- 6.6.5.2.1.1 Implementation

- 6.6.5.2.1.2 Impact

- 6.6.5.2.2 User B: Biotechnology companies

- 6.6.5.2.2.1 Implementation

- 6.6.5.2.2.2 Impact

- 6.6.5.2.1 User A: Pharmaceutical companies

- 6.6.5.1 User readiness

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.1.2.1 North America

- 7.1.2.2 Europe

- 7.1.2.3 Asia Pacific

- 7.1.2.4 Middle East & Africa

- 7.1.2.5 Latin America

8 CUSTOMER LANDSCAPE & BUYING BEHAVIOUR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYERS STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 KEY BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

9 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY PROCESS

- 9.1 INTRODUCTION

- 9.2 CLINICAL TRIALS

- 9.2.1 NEED TO ENSURE CLINICAL EXCELLENCE AND REGULATORY INTEGRITY TO EXPEDITE GROWTH

- 9.3 REGULATORY COMPLIANCE

- 9.3.1 INCREASING EMPHASIS ON COMPLYING WITH STRINGENT INTERNATIONAL STANDARDS TO AID GROWTH

- 9.4 MANUFACTURING/PRODUCTION

- 9.4.1 GROWING FOCUS ON CONSISTENT PRODUCT QUALITY TO DRIVE MARKET

- 9.5 QUALITY ASSURANCE/QUALITY CONTROL

- 9.5.1 INCREASING FOCUS ON CONTINUOUS MONITORING, DOCUMENTATION, AND CONTROL IN PHARMA PRODUCTION TO FAVOR GROWTH

- 9.6 DISTRIBUTION & SUPPLY CHAIN

- 9.6.1 COMPLEX GLOBAL SUPPLY NETWORKS TO CONTRIBUTE TO GROWTH

- 9.7 COMMERCIALIZATION, MARKETING, AND SALES

- 9.7.1 RISING INTRODUCTION OF COMPLEX THERAPIES AND EVOLVING REGULATIONS TO SUSTAIN GROWTH

- 9.8 POST-MARKET SURVEILLANCE

- 9.8.1 GROWING FOCUS ON PRODUCT PERFORMANCE AND PATIENT SAFETY TO BOOST MARKET

- 9.9 OTHER PROCESSES

10 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 DOCUMENT CONTROL & ESOP

- 10.2.1 NEED TO MANAGE AND CONTROL CRITICAL QUALITY DOCUMENTS TO FACILITATE GROWTH

- 10.3 CAPA (CORRECTIVE AND PREVENTIVE ACTION) MANAGEMENT

- 10.3.1 ABILITY TO ADDRESS DETECTION, RESOLUTION, AND PREVENTION OF QUALITY AND COMPLIANCE ISSUES TO FUEL MARKET

- 10.4 AUDIT & INSPECTION MANAGEMENT

- 10.4.1 INCREASING FOCUS ON EFFECTIVE AUDIT AND INSPECTION MANAGEMENT TO BOLSTER GROWTH

- 10.5 TRAINING MANAGEMENT

- 10.5.1 RISING AUTOMATION AND STANDARDIZATION IN TRAINING ACTIVITIES TO ADVANCE GROWTH

- 10.6 REGULATORY & COMPLIANCE MANAGEMENT

- 10.6.1 EVOLVING GLOBAL REGULATORY REQUIREMENTS TO ACCELERATE GROWTH

- 10.7 SUPPLIER QUALITY MANAGEMENT

- 10.7.1 NEED TO MAINTAIN SUPPLIER RELIABILITY, MATERIAL INTEGRITY, AND REGULATORY COMPLIANCE TO SPUR GROWTH

- 10.8 RISK MANAGEMENT

- 10.8.1 COMPLEX NATURE OF PHARMACEUTICAL OPERATIONS TO ENCOURAGE GROWTH

- 10.9 CHANGE CONTROL MANAGEMENT

- 10.9.1 RISING TRANSITION TOWARD DIGITAL SYSTEMS TO STIMULATE GROWTH

- 10.10 OTHER APPLICATIONS

11 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY ENTERPRISE SIZE

- 11.1 INTRODUCTION

- 11.2 LARGE ENTERPRISES

- 11.2.1 RISING DIGITAL TRANSFORMATION AND COMPLIANCE MODERNIZATION STRATEGIES TO EXPEDITE GROWTH

- 11.3 SMALL & MEDIUM ENTERPRISES

- 11.3.1 INCREASING ADOPTION OF CLOUD-BASED, MODULAR, AND SCALABLE QMS SOLUTIONS TO AID GROWTH

12 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 PHARMACEUTICAL COMPANIES

- 12.2.1 INCREASING INVESTMENTS IN AI AND ANALYTICS-ENABLED QMS PLATFORMS TO PROPEL MARKET

- 12.3 BIOTECHNOLOGY COMPANIES

- 12.3.1 STRONG FOCUS ON INNOVATION, REGULATORY COMPLIANCE, AND MANUFACTURING PRECISION TO FAVOR GROWTH

- 12.4 CONTRACT RESEARCH ORGANIZATIONS

- 12.4.1 INCREASING CLINICAL RESEARCH, DATA MANAGEMENT, AND REGULATORY SUBMISSION ACTIVITIES TO SUSTAIN GROWTH

- 12.5 CONTRACT DEVELOPMENT & MANUFACTURING ORGANIZATIONS

- 12.5.1 CRUCIAL ROLE IN GLOBAL DRUG PRODUCTION, FORMULATION DEVELOPMENT, AND SUPPLY CHAIN MANAGEMENT TO DRIVE MARKET

- 12.6 OTHER END USERS

13 PHARMACEUTICAL QUALITY MANAGEMENT SOFTWARE MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Growing need for operational excellence in life sciences sector to boost market

- 13.2.3 CANADA

- 13.2.3.1 Increasing digital transformation initiatives and focus on lifecycle quality management to aid growth

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 GERMANY

- 13.3.2.1 Robust pharma infrastructure to propel market

- 13.3.3 UK

- 13.3.3.1 Increasing focus on comprehensive patient safety and risk management solutions to spur growth

- 13.3.4 FRANCE

- 13.3.4.1 Strict regulatory environment to foster growth

- 13.3.5 ITALY

- 13.3.5.1 Rising compliance mandates to contribute to growth

- 13.3.6 SPAIN

- 13.3.6.1 Need for scalable, cost-effective, and regulatory-ready systems to augment growth

- 13.3.7 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Rising clinical & manufacturing volumes and growing number of biotech companies to drive market

- 13.4.3 JAPAN

- 13.4.3.1 Increasing adoption of cloud systems and electronic records to aid growth

- 13.4.4 INDIA

- 13.4.4.1 Expanding pharmaceutical manufacturing base and increasing regulatory scrutiny from global health authorities to drive market

- 13.4.5 AUSTRALIA

- 13.4.5.1 Increasing shift toward electronic integrated quality ecosystems to promote growth

- 13.4.6 SOUTH KOREA

- 13.4.6.1 Growing focus on lifecycle quality management to propel market

- 13.4.7 REST OF ASIA PACIFIC

- 13.5 LATIN AMERICA

- 13.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 13.5.2 BRAZIL

- 13.5.2.1 Growing investments in automated quality systems to drive market

- 13.5.3 MEXICO

- 13.5.3.1 Increasing emphasis on data integrity and electronic documentation to boost market

- 13.5.4 REST OF LATIN AMERICA

- 13.6 MIDDLE EAST & AFRICA

- 13.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 13.6.2 GCC COUNTRIES

- 13.6.2.1 Saudi Arabia

- 13.6.2.1.1 Increasing local manufacturing and enhanced regulatory compliance to promote growth

- 13.6.2.2 UAE

- 13.6.2.2.1 Rising regulatory modernization and national manufacturing initiatives to sustain growth

- 13.6.2.3 Rest of GCC countries

- 13.6.2.1 Saudi Arabia

- 13.6.3 SOUTH AFRICA

- 13.6.3.1 Evolving regulatory expectations and digitalization trends to fuel market

- 13.6.4 REST OF MIDDLE EAST & AFRICA

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER COMPETITIVE STRATEGIES/RIGHT TO WIN

- 14.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 14.3 REVENUE SHARE ANALYSIS

- 14.4 MARKET SHARE ANALYSIS

- 14.5 SOFTWARE COMPARISON

- 14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 PARTICIPANTS

- 14.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.6.5.1 Company footprint

- 14.6.5.2 Region footprint

- 14.6.5.3 Process footprint

- 14.6.5.4 Application footprint

- 14.6.5.5 Enterprise size footprint

- 14.6.5.6 End-user footprint

- 14.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 DYNAMIC COMPANIES

- 14.7.4 STARTING BLOCKS

- 14.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.7.5.1 Detailed list of key startups/SMEs

- 14.7.5.2 Competitive benchmarking of key startups/SMEs

- 14.8 COMPANY VALUATION AND FINANCIAL METRICS

- 14.8.1 COMPANY VALUATION

- 14.8.2 FINANCIAL METRICS

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES AND APPROVALS

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

- 14.9.4 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 HONEYWELL INTERNATIONAL INC.

- 15.1.1.1 Business overview

- 15.1.1.2 Products offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches and approvals

- 15.1.1.3.2 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses/Competitive threats

- 15.1.2 IQVIA

- 15.1.2.1 Business overview

- 15.1.2.2 Products offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Deals

- 15.1.2.3.2 Other developments

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 VEEVA SYSTEMS INC.

- 15.1.3.1 Business overview

- 15.1.3.2 Products offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches and approvals

- 15.1.3.3.2 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths/Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses/Competitive threats

- 15.1.4 MASTERCONTROL SOLUTIONS, INC.

- 15.1.4.1 Business overview

- 15.1.4.2 Products offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 DASSAULT SYSTEMES

- 15.1.5.1 Business overview

- 15.1.5.2 Products offered

- 15.1.5.3 MnM view

- 15.1.5.3.1 Key strengths/Right to win

- 15.1.5.3.2 Strategic choices

- 15.1.5.3.3 Weaknesses/Competitive threats

- 15.1.6 QUALIO

- 15.1.6.1 Business overview

- 15.1.6.2 Products offered

- 15.1.7 HEXAGON AB

- 15.1.7.1 Business overview

- 15.1.7.2 Products offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches and approvals

- 15.1.7.3.2 Deals

- 15.1.8 ASSURX, INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.9 QT9 SOFTWARE

- 15.1.9.1 Business overview

- 15.1.9.2 Products offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches and approvals

- 15.1.9.3.2 Deals

- 15.1.10 COMPLIANCEQUEST

- 15.1.10.1 Business overview

- 15.1.10.2 Products offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Deals

- 15.1.11 IDEAGEN

- 15.1.11.1 Business overview

- 15.1.11.2 Products offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Product launches and approvals

- 15.1.11.3.2 Deals

- 15.1.12 SOFTEXPERT

- 15.1.12.1 Business overview

- 15.1.12.2 Products offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Deals

- 15.1.13 INSTEM

- 15.1.13.1 Business overview

- 15.1.13.2 Products offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Deals

- 15.1.14 INTELEX TECHNOLOGIES

- 15.1.14.1 Business overview

- 15.1.14.2 Products offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Product launches and approvals

- 15.1.14.3.2 Expansions

- 15.1.15 INTELLECT, INC

- 15.1.15.1 Business overview

- 15.1.15.2 Products offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Product launches and approvals

- 15.1.16 AMPLELOGIC

- 15.1.16.1 Business overview

- 15.1.16.2 Products offered

- 15.1.16.3 Recent developments

- 15.1.16.3.1 Deals

- 15.1.1 HONEYWELL INTERNATIONAL INC.

- 15.2 OTHER PLAYERS

- 15.2.1 INSTANTGMP

- 15.2.2 SIMPLERQMS

- 15.2.3 DOT COMPLIANCE LTD.

- 15.2.4 SNIC SOLUTIONS

- 15.2.5 QUALITYZE

- 15.2.6 SCIGENIQ

- 15.2.7 KIVO, INC.

- 15.2.8 GMP SOFTWARE INDIA PVT. LTD.

- 15.2.9 VMT SOFT SOL PVT. LTD.

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.1.1 SECONDARY DATA

- 16.1.1.1 Key data from secondary sources

- 16.1.2 PRIMARY DATA

- 16.1.2.1 Key data from primary sources

- 16.1.2.2 Key primary participants

- 16.1.2.3 Breakdown of primary interviews

- 16.1.2.4 Key industry insights

- 16.1.1 SECONDARY DATA

- 16.2 MARKET SIZE ESTIMATION

- 16.3 DATA TRIANGULATION

- 16.4 FACTOR ANALYSIS

- 16.5 RESEARCH ASSUMPTIONS

- 16.5.1 MARKET SIZING ASSUMPTIONS

- 16.5.2 STUDY ASSUMPTIONS

- 16.6 RESEARCH LIMITATIONS AND RISK ASSESSMENT

- 16.6.1 RESEARCH LIMITATIONS

- 16.6.1.1 Methodology-related limitations

- 16.6.1.2 Scope-related limitations

- 16.6.2 RISK ASSESSMENT

- 16.6.1 RESEARCH LIMITATIONS

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS