|

시장보고서

상품코드

1895144

철도 시험 시장 예측(-2032년) : 용도, 상부 구조 시험 장비, 전기화 시험 장비, 사용 사례, 용도, 지역별Railway Testing Market by End Use, Superstructure Testing Equipment, Electrification Testing Equipment, Use case, Application, and Region - Global Forecast to 2032 |

||||||

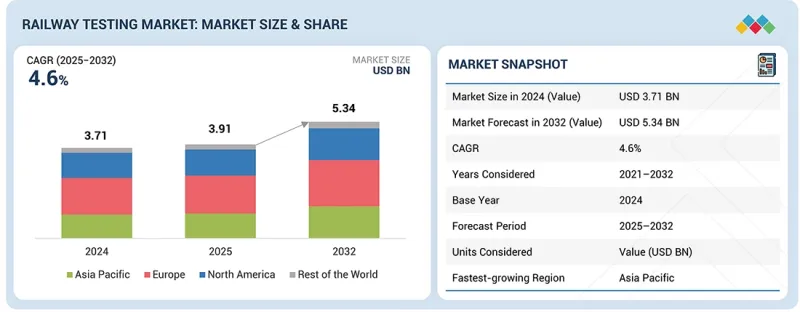

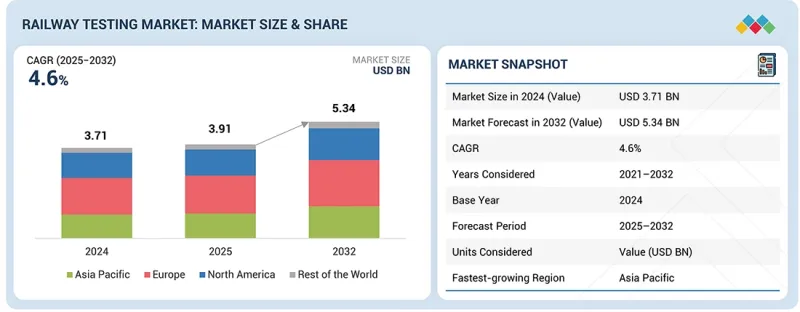

철도 시험 시장 규모는 2025년 39억 1,000만 달러에서 2032년에는 53억 4,000만 달러로, CAGR 4.6%로 성장할 것으로 예측됩니다.

철도 시험 장비는 철도 분야의 운영 효율성, 안전성 확보, 인프라의 장수명화에 있으며, 점점 더 중요한 역할을 담당하고 있습니다. 차량, 신호 시스템, 궤도 네트워크의 복잡성이 증가함에 따라 첨단 계측 및 진단 솔루션에 대한 수요가 증가하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2021-2032년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 단위 | 금액(달러) |

| 부문 | 용도, 상부 구조 시험 장비, 전기화 시험 장비, 사용 사례, 용도, 지역 |

| 대상 지역 | 아시아태평양, 북미, 유럽, 기타 지역 |

또한 데이터 수집(DAQ) 시스템, 차량 탑재형 센서, 휴대용 테스트 장비를 통해 축 중량, 궤도 형상, 제동 성능, 추진 효율 등의 파라미터를 정확하게 모니터링할 수 있습니다.

이 시장의 다른 주요 촉진요인으로는 안전 및 신뢰성 기준의 강화, 예측 유지보수의 필요성, 서비스 중단을 최소화할 필요성 등이 있습니다. 실시간 분석과 테스트 플랫폼의 통합을 통해 사업자는 이상 징후를 조기에 발견하고, 유지보수 일정을 최적화하며, 자산의 수명주기관리를 개선할 수 있습니다.

철도 시험 시장에서는 납품 후 검사 및 지속적인 운영 모니터링을 지원하는 자동화, 고정밀, 모듈식 시험 솔루션으로의 전환이 진행되고 있으며, 철도 시험 장비는 현대 철도 시스템 성능을 지원하는 중요한 기반 기술로 자리매김하고 있습니다.

"철도 전력 공급 테스트 장비 부문이 예측 기간 중 가장 빠르게 성장할 것으로 예측됩니다. "

전기화 시험 장비 중 철도 전력 공급 시험 장비는 예측 기간 중 가장 빠르게 성장하는 부문이 될 것으로 예측됩니다. 이는 철도 사업자가 현대 열차의 높은 전력 수요에 대응하기 위해 견인 변전소 및 가선 전기화 시스템을 업데이트하고 있기 때문입니다. 이러한 업데이트는 전력 품질, 부하 거동, 보호 시스템의 반응성에 대한 보다 엄격한 검증을 요구합니다. 고속철도, 지하철, 중량물 운송 능력을 확대하는 네트워크에서는 안정적인 전압 유지와 신속한 고장 격리에 대한 압력이 증가하고 있으며, 높은 정확도로 고조파, 과도 현상, 변전소 제어 로직을 평가할 수 있는 첨단 테스트 툴의 채택을 촉진하고 있습니다. 이러한 변화는 전략적 의미가 있습니다. 왜냐하면 전력 공급 성능은 가속 능력, 정시 운행, 시스템 안전에 직접적인 영향을 미치기 때문입니다. 따라서 사업자는 시운전 시간 단축과 예지보전 계획을 지원하는 장치를 요구하고 있습니다.

"용도별로 보면 예측 기간 중 사후관리 및 유지보수 부문이 가장 빠르게 성장할 것으로 예측됩니다. "

이는 네트워크 확장, 열차 운행 빈도 증가, 시스템 업그레이드의 복잡성 증가에 따라 사업자가 성능 보증 프로세스를 강화하고 있기 때문입니다. 이러한 운영 환경의 변화로 인해 신규 및 운영 중인 자산에 대한 지속적인 검증의 필요성이 증가하고 있습니다. 선로 형상, 가선 매개변수, 제동 성능 또는 차량 제어 시스템의 일탈은 운행 신뢰성을 손상시키고 수명주기 비용을 증가시킬 수 있기 때문입니다. 그 결과, 운영사들은 자산 수명주기 전반에 걸쳐 일관성 있고 반복 가능한 데이터를 제공하는 자동 측정 차량, 휴대용 진단 장비, 디지털 모니터링 플랫폼으로 지원되는 체계적인 점검 주기를 도입하고 있습니다. 이를 통해 유지보수는 단순한 정기적인 컴플라이언스 활동이 아닌 전략적 기능으로서의 역할을 강화하고 있습니다.

"아시아태평양은 예측 기간 중 가장 빠르게 성장할 것으로 예측됩니다. "

각국 철도 사업자들이 신규 노선, 교외 노선 개선, 현대식 차량에 대한 자본 지출을 확대함에 따라 대량의 건설 및 유지보수 활동을 관리할 수 있는 첨단 계측 기술에 대한 수요가 증가하고 있기 때문입니다. 또한 각국 정부는 고속철도 및 화물 운송 프로젝트 일정을 앞당기고, 운영사는 신뢰성 목표를 더욱 엄격하게 설정하고 있습니다. 이로 인해 자동 궤도 기하학 시스템, 가선 점검 플랫폼, 차량 진단 솔루션으로의 전환이 가속화되고 있습니다. 이 지역에서는 특히 급속한 용량 확장을 추진하는 네트워크에서 수동 점검 시간을 줄이고 자산 가동률을 향상시키는 디지털 상태 모니터링 툴의 도입도 추진되고 있습니다.

세계의 철도 시험 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인의 분석, 기술·특허의 동향, 법규제 환경, 사례 연구, 시장 규모 추이·예측, 각종 구분·지역/주요 국가별 상세 분석, 경쟁 구도, 주요 기업의 개요 등을 정리하여 전해드립니다.

자주 묻는 질문

목차

제1장 서론

제2장 개요

제3장 주요 인사이트

제4장 시장 개요

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 미충족 요구와 화이트 스페이스

- 관련 시장·타업종과의 분야 횡단적 기회

- 철도 시험 시장에서 주요 기업의 전략적 움직임

제5장 업계 동향

- Porter's Five Forces 분석

- 거시경제 지표

- 에코시스템 분석

- 공급망 분석

- 밸류체인 분석

- 가격 분석

- 고객 비즈니스에 영향을 미치는 동향과 파괴적 변화

- 투자와 자금조달 시나리오

- HS 코드

- 2025-2026년의 주요 컨퍼런스와 이벤트

- 사례 연구 분석

- 2025년 미국 관세의 영향

- 철도 시험 서비스 프로바이더의 인사이트

- 철도 시험 시장에서 민관 제휴의 인사이트

- 자율주행 철도용 시험 장비에 관한 인사이트

제6장 고객 상황과 구매 행동

- 의사결정 프로세스

- 이해관계자와 구입 평가 기준

제7장 규제 상황

- 규제 상황

제8장 기술, 특허, 디지털, AI의 도입에 의한 전략적 파괴

- 주요 신규 기술

- AI 기반 진단

- 광섬유 기반 선로 건전성 감시

- 선로·철도 차량 디지털 트윈 기반 시뮬레이션

- 보완적 기술

- 열차 회생 브레이크

- 자율주행 열차

- 트라이 모드 열차

- 경사 열차

- 기술/제품 로드맵

- 특허 분석

- 향후 응용

- AI/생성형 AI가 철도 시험 시장에 미치는 영향

- 성공 사례와 실세계에 대한 응용

제9장 철도 시험 시장 : 상부 구조 시험 장비별

- 레일 기계 시험 장비

- 레일 프로파일 측정 시스템

- 전자기기 및 DAQ 시험 장비

- 초음파탐상 장비

- 와전류 시험기

- 스위치/분기기 시험 장비 시장

- 형상 측정 툴

- 레이저 얼라이먼트 툴

- 스위치 진단 시스템

- 침목(SLEEPERS/CROSSTIES)·패스닝 시험 장비

- 진동 센서

- 토크 측정 툴

- 궤도 측정 장비

- 지표 투과 레이더

- 슬라브 형상 측정 장비

- 기타

- 하중 스트레인 게이지

- 마모 모니터링 시스템

- 주요 인사이트

제10장 철도 시험 시장 : 용도별

- 설계·개발

- 제조·가공

- 납차 전 테스트

- 납차 후·유지 점검

- 주요 인사이트

제11장 철도 시험 시장 : 전기화 시험 장비별

- 차량내 전자기기 시험 장비

- 접촉선 시험 장비

- 트롤리선 높이·스태거 측정기

- 팬터그래프 모니터링 시스템

- 견인 전원 및 변전소 시험 장비

- 파워 애널라이저

- 절연 저항계

- SCADA 진단

- 철도 전력 공급 시험 장비

- 전압 측정 툴

- 열 카메라

- 회로 테스터

- 주요 인사이트

제12장 철도 시험 시장 : 용도별

- 철도 차량 시험 장비

- 선로/인프라 시험 장비

- 기타 시험 장비

- 주요 인사이트

제13장 철도 시험 시장 : 사용 사례별

- 제어 커맨드

- 열차 제어

- 자동 열차 보호

- 자동 열차 제어

- 자동 열차 운전

- 집중 교통 관제

- 운영 텔레매틱스

- 통신 기반 열차 제어

- 열차 제어·모니터링 시스템

- 주요 인사이트

제14장 철도 시험 시장 : 지역별

- 아시아태평양

- 인도

- 일본

- 중국

- 한국

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 북미

- 미국

- 캐나다

- 세계의 기타 지역

- 사우디아라비아

- 아랍에미리트

- 남아프리카공화국

제15장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점

- 시장 점유율 분석

- 상위 5사의 매출 분석

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 경쟁 시나리오

제16장 기업 개요

- KNORR-BREMSE AG

- ZF FRIEDRICHSHAFEN AG

- WABTEC CORPORATION

- HORIBA GROUP

- RENK GROUP AG.

- SPECTRIS

- WAGO

- ADOR TECH INC.

- AMETEK INC.

- KEYSIGHT TECHNOLOGIES

- NATIONAL INSTRUMENTS CORP.

- AKEBONO BRAKE INDUSTRY CO., LTD.

- MTS SYSTEMS

- HEXAGON AB

- TRIMBLE INC.

- INTERTEK PLC

- TUV SUD

- AVL

- DSPACE

- RICARDO

- ROHDE & SCHWARZ

- ILLINOIS TOOL WORKS INC.

- ROBERT BOSCH GMBH

- MB DYNAMICS, INC.

- PANDROL

- KINGSINE ELECTRIC AUTOMATION CO., LTD.

제17장 조사 방법

제18장 부록

KSA 26.01.08The railway testing market is projected to grow from USD 3.91 billion in 2025 to USD 5.34 billion by 2032, at a CAGR of 4.6%. Railway testing equipment is becoming increasingly central to operational efficiency, safety assurance, and infrastructure longevity in the rail sector. Growing complexity in rolling stock, signaling systems, and track networks is driving demand for advanced measurement and diagnostic solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | End Use, Superstructure Testing Equipment, Electrification Testing Equipment, Use case, Application, and Region |

| Regions covered | Asia Pacific, North America, Europe, and Rest of the World |

Additionally, data acquisition (DAQ) systems, on-board sensors, and portable testing devices are enabling precise monitoring of parameters, such as axle loads, track geometry, brake performance, and propulsion efficiency.

Some of the other key drivers of this market include rising safety and reliability standards, the need for predictive maintenance, and pressure to minimize service disruptions. Integration of real-time analytics with testing platforms is allowing operators to identify deviations early, optimize maintenance schedules, and improve lifecycle management of assets.

The railway testing market is witnessing a shift toward automated, high-precision, and modular testing solutions that support post delivery inspection and ongoing operational monitoring, positioning railway testing equipment as a critical enabler of modern rail system performance.

"The railway power supply testing equipment is projected to be the fastest-growing market during the forecast period."

By electrification testing equipment, the railway power supply testing equipment is projected to be the fastest-growing segment during the forecast period, as railway operators are upgrading traction substations and overhead electrification systems to handle higher power demand from modern trains. These upgrades require tighter verification of power quality, load behaviour, and protection system responses. Networks that are adding high-speed, metro, and heavy haul freight capacity are facing greater pressure to maintain stable voltage and rapid fault isolation, which is driving the use of advanced testing tools that can assess harmonics, transient behaviour, and substation control logic with higher accuracy. This shift is strategic because power supply performance directly affects acceleration capability, punctuality, and system safety. Thus, operators seek equipment that reduces commissioning time and supports predictive maintenance planning.

Agencies in India and Japan are validating new traction substation configurations on upgraded corridors using high-precision power analysers and simulation-based load testing units, which confirm performance under peak operational demand and ensure that electrical systems can support the expected service intensity.

"The post-delivery & upkeep inspection segment is projected to be the fastest-growing segment during the forecast period."

By application, the post-delivery & upkeep inspection segment is projected to be the fastest-growing application segment during the forecast period, because operators are tightening their performance assurance processes as networks expand, train frequencies increase, and system upgrades become more complex. This shift in operating conditions is creating the need for continuous validation of new and in-service assets, since any deviation in track geometry, overhead line parameters, braking performance, or on-board control systems can disrupt service reliability and raise lifecycle costs. As a result, operators are adopting structured inspection cycles supported by automated measurement cars, portable diagnostics, and digital monitoring platforms that provide consistent and repeatable data throughout the asset lifecycle. This is strengthening the role of upkeep inspections as a strategic function rather than a routine compliance activity.

Leading metro systems in Asia are applying dedicated post-delivery acceptance tests for new trainsets and conducting high-frequency upkeep inspections on recently upgraded traction, signalling, and electrification assets, using precise measurement tools that verify operational readiness before deployment and maintain performance standards across intensive daily schedules.

"Asia Pacific is projected to be the fastest-growing market during the forecast period."

Asia Pacific is projected to be the fastest-growing market during the forecast period as national rail programs are expanding their capital expenditure on new corridors, suburban upgrades, and modern rolling stock, which is increasing the requirement for advanced measurement technologies that can manage high volumes of construction and maintenance activity. Additionally, governments are accelerating timelines for high-speed and freight projects, and operators are introducing tighter reliability targets, which is pushing the shift toward automated track geometry systems, overhead line inspection platforms, and on-board diagnostic solutions. The region is also adopting digital condition monitoring tools that reduce manual inspection time and improve asset availability, especially on networks that are adding capacity at a rapid pace.

The Indian Railways has rolled out automated track geometry systems, overhead line monitoring units, and real-time measurement platforms across dedicated freight corridors and semi-high-speed routes. This development is creating consistent demand for suppliers that can support broad network scale testing and monitoring requirements.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Test Equipment Manufacturers - 40%, Railway Testing Service Providers - 40%, Track Measurement Equipment Providers & Others - 20%

- By Designation: Directors - 40%, CXOs - 25%, Others - 35%

- By Country: North America - 25%, Europe - 25%, Asia Pacific - 40%, and Rest of the World - 10%

The railway testing market is dominated by a few globally established players, such as Knorr-Bremse AG (Germany), ZF Friedrichshafen AG (Germany), Wabtec Corporation (US), HORIBA Group (Japan), and RENK Group AG (Germany). These companies manufacture and supply railway testing equipment to various countries globally. These companies have set up R&D infrastructure and offer best-in-class solutions to their customers.

Research Coverage:

The report covers the railway testing market, in terms of end use (Rolling stock test equipment, track/infrastructure test equipment, other test equipment), superstructure testing equipment (Rail mechanical testing equipment, electronics and DAQ testing equipment, switches/turnouts testing equipment, sleepers/crossties, fastenings testing equipment, track measurement equipment, other superstructure testing equipment), electrification testing equipment (On-board electronics test equipment, contact lines test equipment, traction power supply & substation testing equipment, railway power supply testing equipment), use case (control command, train control, operational telematics), application (Design & development, manufacturing & fabrication, pre-delivery testing, post-delivery & upkeep inspection), Region (Asia Pacific, Europe, North America, and Rest of the World). It covers the competitive landscape and company profiles of the major players in the railway testing market ecosystem.

The study includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- This report will help market leaders/new entrants in this market with information on the closest approximations of revenue numbers for the overall railway testing ecosystem and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- This report will also help stakeholders understand the market's pulse and provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insight into the following pointers:

- Analysis of key drivers (Global focus on rail modernization, improved rail safety and reliability standards, expansion of high speed urban metro projects and growing demand from heavy-haul and freight corridor development), restraints (Fragmented rail infrastructure and lack of standardization and high cost of testing equipment), challenges (Complex stakeholder ecosystem leads to shifting requirements for testing equipment), and opportunities (Emerging markets rail infrastructure push and Integration of digital technologies to increase demand for testing equipment)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the railway testing market

- Market Development: Comprehensive information about lucrative markets - the report analyses the railway testing market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the railway testing market.

- Competitive Assessment: In-depth assessment of market ranking, growth strategies, and service offerings of leading players like Knorr-Bremse AG (Germany), ZF Friedrichshafen AG (Germany), Wabtec Corporation (US), HORIBA Group (Japan), and RENK Group AG (Germany), among others, in the railway testing market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN RAILWAY TESTING MARKET

- 2.4 HIGH-GROWTH SEGMENTS IN RAILWAY TESTING MARKET

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RAILWAY TESTING MARKET

- 3.2 RAILWAY TESTING MARKET, BY END USE

- 3.3 RAILWAY TESTING MARKET, BY SUPERSTRUCTURE TESTING EQUIPMENT

- 3.4 RAILWAY TESTING MARKET, BY ELECTRIFICATION TESTING EQUIPMENT

- 3.5 RAILWAY TESTING MARKET, BY USE CASE

- 3.6 RAILWAY TESTING MARKET, BY APPLICATION

- 3.7 RAILWAY TESTING MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Global focus on rail modernization

- 4.2.1.2 Need for improved rail safety and reliability standards

- 4.2.1.3 Expansion of high-speed urban metro projects

- 4.2.1.4 Growing demand from heavy-haul and freight corridor development

- 4.2.2 RESTRAINTS

- 4.2.2.1 Fragmented rail infrastructure and lack of standardization

- 4.2.2.2 High cost of railway testing equipment

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Emerging markets in railway infrastructure

- 4.2.3.2 Integration of digital technologies

- 4.2.4 CHALLENGES

- 4.2.4.1 Complex stakeholder ecosystem

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 LIMITED INTEGRATION ACROSS MULTI-MODAL AND CROSS-PLATFORM DATA SYSTEMS

- 4.3.2 INADEQUATE LOW-COST AND MODULAR TESTING SOLUTIONS FOR SECONDARY RAIL LINES

- 4.3.3 LIMITED TESTING INFRASTRUCTURE FOR NEW MATERIALS AND HYBRID TRACK SYSTEMS

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY KEY PLAYERS IN RAILWAY TESTING MARKET

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 INTRODUCTION

- 5.1.2 THREAT FROM NEW ENTRANTS

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 THREAT FROM SUBSTITUTES

- 5.1.6 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL ROLLING STOCK INDUSTRY

- 5.2.4 TRENDS IN GLOBAL AUTOMOTIVE & TRANSPORTATION INDUSTRY

- 5.3 ECOSYSTEM ANALYSIS

- 5.3.1 RAW MATERIAL & COMPONENT SUPPLIERS

- 5.3.2 RAILWAY EQUIPMENT MANUFACTURERS

- 5.3.3 TECHNOLOGY PROVIDERS

- 5.3.4 INFRASTRUCTURE PROVIDERS

- 5.3.5 MAINTENANCE & SERVICE PROVIDERS

- 5.3.6 REGULATORY & POLICY MAKERS

- 5.3.7 RAILWAY OPERATORS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL PROVIDERS AND COMPONENT SUPPLIERS

- 5.5.2 ORIGINAL EQUIPMENT MANUFACTURERS

- 5.5.3 OPERATORS AND END USERS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF RAILWAY SYSTEMS, BY KEY PLAYER

- 5.6.2 AVERAGE SELLING PRICE TREND OF RAILWAY SYSTEMS, BY TYPE

- 5.6.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.7 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 INVESTMENT & FUNDING SCENARIO

- 5.9 HS CODE

- 5.9.1 IMPORT SCENARIO

- 5.9.2 EXPORT SCENARIO

- 5.10 KEY CONFERENCES & EVENTS, 2025-2026

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 NETWORK RAIL DEPLOYED NEW MEASUREMENT TRAIN EQUIPPED WITH LASER GEOMETRY SYSTEMS, INERTIAL SENSORS, AND HIGH-SPEED IMAGING

- 5.11.2 SBB INTRODUCED ULTRASONIC TESTING VEHICLES THAT SCANNED RAILS FOR INTERNAL FATIGUE CRACKS

- 5.11.3 MTR DEPLOYED GROUND-PENETRATING RADAR ON INSPECTION VEHICLES TO MAP BALLAST AND SUBGRADE CONDITION

- 5.12 IMPACT OF 2025 US TARIFF

- 5.12.1 INTRODUCTION

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.4 IMPACT ON COUNTRY/REGION

- 5.12.4.1 US

- 5.12.4.2 Europe

- 5.12.4.3 Asia Pacific

- 5.12.5 IMPACT ON END-USE INDUSTRIES

- 5.13 MNM INSIGHTS INTO RAILWAY TESTING SERVICE PROVIDERS

- 5.14 MNM INSIGHTS INTO PRIVATE-PUBLIC PARTNERSHIPS FOR RAILWAY TESTING MARKET

- 5.15 MNM INSIGHTS INTO TESTING EQUIPMENT FOR AUTONOMOUS RAILWAYS

6 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 6.1 DECISION-MAKING PROCESS

- 6.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.2.2 BUYING CRITERIA

7 REGULATORY LANDSCAPE

- 7.1 REGULATORY LANDSCAPE

- 7.1.1 REGULATORY ANALYSIS, BY KEY COUNTRY/REGION

- 7.1.1.1 US

- 7.1.1.2 Europe

- 7.1.1.3 India

- 7.1.1.4 South Korea

- 7.1.1.5 China

- 7.1.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.1 REGULATORY ANALYSIS, BY KEY COUNTRY/REGION

8 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 8.1 KEY EMERGING TECHNOLOGIES

- 8.1.1 INTRODUCTION

- 8.1.2 AI-BASED DIAGNOSTICS

- 8.1.3 FIBER OPTIC-BASED TRACK HEALTH MONITORING

- 8.1.4 DIGITAL TWIN-BASED SIMULATION FOR TRACK AND ROLLING STOCK

- 8.2 COMPLEMENTARY TECHNOLOGIES

- 8.2.1 REGENERATIVE BRAKING IN TRAINS

- 8.2.2 AUTONOMOUS TRAINS

- 8.2.3 TRI-MODE TRAINS

- 8.2.4 TILTING TRAINS

- 8.3 TECHNOLOGY/PRODUCT ROADMAP

- 8.4 PATENT ANALYSIS

- 8.4.1 INTRODUCTION

- 8.4.1.1 Methodology

- 8.4.1.2 Document type

- 8.4.1.3 Insights

- 8.4.1.4 Legal status of patents

- 8.4.1.5 Jurisdiction analysis

- 8.4.1.6 Top applicants

- 8.4.1 INTRODUCTION

- 8.5 FUTURE APPLICATIONS

- 8.5.1 ADVANCED AUTOMATED MEASUREMENT TO ENABLE PREDICTIVE AND HIGH AVAILABILITY RAILWAY OPERATIONS

- 8.6 IMPACT OF AI/GEN AI ON RAILWAY TESTING MARKET

- 8.6.1 ENHANCEMENT OF DEFECT DETECTION AND PREDICTIVE INSIGHTS

- 8.6.2 ACCELERATION OF FIELD MEASUREMENTS AND REPORTING

- 8.6.3 IMPROVED INTEGRATION WITH DIGITAL ASSET MANAGEMENT PLATFORMS

- 8.6.4 ENHANCEMENT OF AUTONOMOUS AND REMOTE INSPECTION CAPABILITIES

- 8.6.5 REDUCTION OF LIFECYCLE COSTS FOR EQUIPMENT USERS

- 8.6.6 STRENGTHENING OF COMPLIANCE AND QUALITY MANAGEMENT

- 8.6.7 EXPANSION OF REAL-TIME MONITORING AND ALERTS

- 8.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 8.7.1 NEW SOUTH WALES, AUSTRALIA: AUTOMATED TRACK GEOMETRY MONITORING FOR HIGH-DENSITY CORRIDORS

- 8.7.2 NORTH RHINE-WESTPHALIA, GERMANY: WAYSIDE CONDITION MONITORING FOR WHEEL AND BRAKE HEALTH

9 RAILWAY TESTING MARKET, BY SUPERSTRUCTURE TESTING EQUIPMENT

- 9.1 INTRODUCTION

- 9.2 RAIL MECHANICAL TESTING EQUIPMENT

- 9.2.1 NEED FOR DATA-DRIVEN RAIL TESTING SYSTEMS TO BOOST MARKET

- 9.2.2 RAIL PROFILE MEASUREMENT SYSTEMS

- 9.3 ELECTRONICS & DAQ TESTING EQUIPMENT

- 9.3.1 FOCUS ON CONTINUOUS COMMAND EXCHANGE AND PREDICTABLE EXECUTION OF DRIVING FUNCTIONS TO BOOST MARKET

- 9.3.2 ULTRASONIC FLAW DETECTORS

- 9.3.3 EDDY CURRENT TESTERS

- 9.4 SWITCHES/TURNOUTS TESTING EQUIPMENT MARKET

- 9.4.1 FOCUS ON EVALUATING PERFORMANCE OF TURNOUTS, FROGS, POINT BLADES, AND CROSSING COMPONENTS TO DRIVE GROWTH

- 9.4.2 GEOMETRY MEASUREMENT TOOLS

- 9.4.3 LASER ALIGNMENT TOOLS

- 9.4.4 SWITCH DIAGNOSTIC SYSTEMS

- 9.5 SLEEPERS/CROSSTIES, FASTENING TESTING EQUIPMENT

- 9.5.1 EMPHASIS ON STRUCTURAL INTEGRITY, LOAD-BEARING CAPACITY, AND FASTENING PERFORMANCE OF SLEEPERS AND THEIR ASSOCIATED RAIL CLIPS TO BOOST MARKET

- 9.5.2 VIBRATION SENSORS

- 9.5.3 TORQUE MEASUREMENT TOOLS

- 9.6 TRACK MEASUREMENT EQUIPMENT

- 9.6.1 NEED FOR ASSESSING GEOMETRY, STIFFNESS, LOAD DISTRIBUTION, AND LONG-TERM STRUCTURAL INTEGRITY OF SLAB TRACK SYSTEMS TO BOOST GROWTH

- 9.6.2 GROUND-PENETRATING RADARS

- 9.6.3 SLAB GEOMETRY MEASUREMENT DEVICES

- 9.7 OTHER SUPERSTRUCTURE TESTING EQUIPMENT

- 9.7.1 LOAD STRAIN GAUGES

- 9.7.2 WEAR MONITORING SYSTEMS

- 9.8 KEY PRIMARY INSIGHTS

10 RAILWAY TESTING MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 DESIGN & DEVELOPMENT

- 10.2.1 NEED FOR DEPENDABLE RAILWAY SYSTEM TO BOOST GROWTH

- 10.3 MANUFACTURING & FABRICATION

- 10.3.1 FOCUS ON IMPROVING QUALITY AND CONSISTENCY IN RAILWAY MANUFACTURING TO DRIVE MARKET

- 10.4 PRE-DELIVERY TESTING

- 10.4.1 FOCUS ON COMMISSIONING READINESS AND DELIVERY RELIABILITY IN RAILWAY TESTING TO BOOST GROWTH

- 10.5 POST-DELIVERY & UPKEEP INSPECTION

- 10.5.1 NEED FOR ROBUST MAINTENANCE DIAGNOSTICS TO REDUCE SERVICE DISRUPTIONS TO DRIVE MARKET

- 10.6 KEY PRIMARY INSIGHTS

11 RAILWAY TESTING MARKET, BY ELECTRIFICATION TESTING EQUIPMENT

- 11.1 INTRODUCTION

- 11.2 ON-BOARD ELECTRONICS TEST EQUIPMENT

- 11.2.1 NEED FOR ATP SYSTEM COMPLIANCE TO DRIVE GROWTH

- 11.3 CONTACT LINE TEST EQUIPMENT

- 11.3.1 DEMAND FOR HIGH-SPEED, NON-CONTACT LINES TO BOOST MARKET

- 11.3.2 CONTACT WIRE HEIGHT AND STAGGER MEASURING INSTRUMENTS

- 11.3.3 PANTOGRAPH MONITORING SYSTEMS

- 11.4 TRACTION POWER SUPPLY & SUBSTATION TESTING EQUIPMENT

- 11.4.1 EMPHASIS ON SUBSTATION MODERNIZATION TO PROPEL DEMAND

- 11.4.2 POWER ANALYZERS

- 11.4.3 INSULATION RESISTANCE TESTERS

- 11.4.4 SCADA DIAGNOSTICS

- 11.5 RAILWAY POWER SUPPLY TESTING EQUIPMENT

- 11.5.1 GROWING ELECTRIFICATION OF RAILWAY INFRASTRUCTURE TO BOOST DEMAND

- 11.5.2 VOLTAGE MEASUREMENT TOOLS

- 11.5.3 THERMAL CAMERAS

- 11.5.4 CIRCUIT TESTERS

- 11.6 KEY PRIMARY INSIGHTS

12 RAILWAY TESTING MARKET, BY END USE

- 12.1 INTRODUCTION

- 12.2 ROLLING STOCK TEST EQUIPMENT

- 12.2.1 DEMAND FOR ADVANCED DIAGNOSTICS TO DRIVE MARKET

- 12.3 TRACK/INFRASTRUCTURE TEST EQUIPMENT

- 12.3.1 NEED FOR ENABLING STABLE AND PREDICTABLE NETWORK PERFORMANCE TO DRIVE MARKET

- 12.4 OTHER TEST EQUIPMENT

- 12.5 KEY PRIMARY INSIGHTS

13 RAILWAY TESTING MARKET, BY USE CASE

- 13.1 INTRODUCTION

- 13.2 CONTROL COMMAND

- 13.2.1 NEED FOR STRONG COMMAND VALIDATION FOR SAFE AND PREDICTABLE TRAIN OPERATIONS TO DRIVE MARKET

- 13.3 TRAIN CONTROL

- 13.3.1 TRAIN CONTROL SERVES AS OPERATIONAL BACKBONE OF MODERN RAILWAY SYSTEMS

- 13.3.2 AUTOMATIC TRAIN PROTECTION

- 13.3.3 AUTOMATIC TRAIN CONTROL

- 13.3.4 AUTOMATIC TRAIN OPERATION

- 13.3.5 CENTRALIZED TRAFFIC CONTROL

- 13.4 OPERATIONAL TELEMATICS

- 13.4.1 FOCUS ON STRENGTHENING REAL-TIME DECISION SUPPORT IN RAIL OPERATIONS TO BOOST MARKET

- 13.4.2 COMMUNICATION-BASED TRAIN CONTROL

- 13.4.3 TRAIN CONTROL & MONITORING SYSTEM

- 13.5 KEY PRIMARY INSIGHTS

14 RAILWAY TESTING MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 ASIA PACIFIC

- 14.2.1 INDIA

- 14.2.1.1 Need for improving safety standards to drive market

- 14.2.2 JAPAN

- 14.2.2.1 Rising focus on high-speed rail reliability to drive growth

- 14.2.3 CHINA

- 14.2.3.1 Increasing passenger volume to boost market

- 14.2.4 SOUTH KOREA

- 14.2.4.1 Need for upgrading ageing rail infrastructure to drive market

- 14.2.1 INDIA

- 14.3 EUROPE

- 14.3.1 GERMANY

- 14.3.1.1 Focus on prioritizing digital rail operations across national and regional systems to drive market

- 14.3.2 UK

- 14.3.2.1 Emphasis on improving reliability, safety, and capacity across heavily utilized rail network to drive market

- 14.3.3 FRANCE

- 14.3.3.1 Large-scale public investments to boost growth of railways

- 14.3.4 ITALY

- 14.3.4.1 Need for modernization of railway lines to drive investments in railway testing market

- 14.3.5 SPAIN

- 14.3.5.1 Need for enhanced regional rail connectivity to boost growth

- 14.3.1 GERMANY

- 14.4 NORTH AMERICA

- 14.4.1 US

- 14.4.1.1 Rapid increase in railway enhancement projects to boost growth

- 14.4.2 CANADA

- 14.4.2.1 Federal programs to support sustained capital allocation for track renewal and signal upgrades

- 14.4.1 US

- 14.5 REST OF THE WORLD

- 14.5.1 SAUDI ARABIA

- 14.5.1.1 Demand for accelerated rail network expansion to boost market

- 14.5.2 UAE

- 14.5.2.1 Need for increasing scale and technical complexity of rail assets to drive market

- 14.5.3 SOUTH AFRICA

- 14.5.3.1 Focus on renewing metropolitan rail network to drive market

- 14.5.1 SAUDI ARABIA

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 15.3 MARKET SHARE ANALYSIS, 2025

- 15.4 REVENUE ANALYSIS OF TOP FIVE PLAYERS

- 15.5 COMPANY VALUATION AND FINANCIAL METRICS

- 15.5.1 COMPANY VALUATION

- 15.5.2 FINANCIAL METRICS

- 15.6 BRAND/PRODUCT COMPARISON

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2025

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 End use footprint

- 15.7.5.4 Application footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2025

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

- 15.9.3 EXPANSIONS

- 15.9.4 OTHER DEVELOPMENTS

16 COMPANY PROFILES

- 16.1 INTRODUCTION

- 16.1.1 KNORR-BREMSE AG

- 16.1.1.1 Business overview

- 16.1.1.2 Products offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.3.2 Deals

- 16.1.1.3.3 Other developments

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 ZF FRIEDRICHSHAFEN AG

- 16.1.2.1 Business overview

- 16.1.2.2 Products offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Product launches

- 16.1.2.3.2 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 WABTEC CORPORATION

- 16.1.3.1 Business overview

- 16.1.3.2 Products offered

- 16.1.3.3 Recent developments

- 16.1.3.3.1 Deals

- 16.1.3.3.2 Expansions

- 16.1.3.4 MnM view

- 16.1.3.4.1 Key strengths

- 16.1.3.4.2 Strategic choices

- 16.1.3.4.3 Weaknesses and competitive threats

- 16.1.4 HORIBA GROUP

- 16.1.4.1 Business overview

- 16.1.4.2 Products offered

- 16.1.4.3 MnM view

- 16.1.4.3.1 Key strengths

- 16.1.4.3.2 Strategic choices

- 16.1.4.3.3 Weaknesses and competitive threats

- 16.1.5 RENK GROUP AG.

- 16.1.5.1 Business overview

- 16.1.5.2 Products offered

- 16.1.5.3 Recent developments

- 16.1.5.3.1 Deals

- 16.1.5.3.2 Expansions

- 16.1.5.4 MnM view

- 16.1.5.4.1 Key strengths

- 16.1.5.4.2 Strategic choices

- 16.1.5.4.3 Weaknesses and competitive threats

- 16.1.6 SPECTRIS

- 16.1.6.1 Business overview

- 16.1.6.2 Products offered

- 16.1.6.3 Recent developments

- 16.1.6.3.1 Deals

- 16.1.6.3.2 Other developments

- 16.1.7 WAGO

- 16.1.7.1 Business overview

- 16.1.7.2 Products offered

- 16.1.7.3 Recent developments

- 16.1.7.3.1 Product launches

- 16.1.8 ADOR TECH INC.

- 16.1.8.1 Business overview

- 16.1.8.2 Products offered

- 16.1.9 AMETEK INC.

- 16.1.9.1 Business overview

- 16.1.9.2 Products offered

- 16.1.9.3 Recent developments

- 16.1.9.3.1 Deals

- 16.1.10 KEYSIGHT TECHNOLOGIES

- 16.1.10.1 Business overview

- 16.1.10.2 Products offered

- 16.1.10.3 Recent developments

- 16.1.10.3.1 Product launches

- 16.1.10.3.2 Deals

- 16.1.11 NATIONAL INSTRUMENTS CORP.

- 16.1.11.1 Business overview

- 16.1.11.2 Products offered

- 16.1.11.3 Recent developments

- 16.1.11.3.1 Product launches

- 16.1.12 AKEBONO BRAKE INDUSTRY CO., LTD.

- 16.1.12.1 Business overview

- 16.1.12.2 Products offered

- 16.1.1 KNORR-BREMSE AG

- 16.2 OTHER PLAYERS

- 16.2.1 MTS SYSTEMS

- 16.2.2 HEXAGON AB

- 16.2.3 TRIMBLE INC.

- 16.2.4 INTERTEK PLC

- 16.2.5 TUV SUD

- 16.2.6 AVL

- 16.2.7 DSPACE

- 16.2.8 RICARDO

- 16.2.9 ROHDE & SCHWARZ

- 16.2.10 ILLINOIS TOOL WORKS INC.

- 16.2.11 ROBERT BOSCH GMBH

- 16.2.12 MB DYNAMICS, INC.

- 16.2.13 PANDROL

- 16.2.14 KINGSINE ELECTRIC AUTOMATION CO., LTD.

17 RESEARCH METHODOLOGY

- 17.1 RESEARCH DATA

- 17.1.1 SECONDARY DATA

- 17.1.1.1 List of secondary sources

- 17.1.1.2 Key data from secondary sources

- 17.1.2 PRIMARY DATA

- 17.1.2.1 Primary interviews: Demand and supply sides

- 17.1.2.2 Key industry insights and breakdown of primary interviews

- 17.1.2.3 List of primary participants

- 17.1.1 SECONDARY DATA

- 17.2 MARKET SIZE ESTIMATION

- 17.2.1 TOP-DOWN APPROACH

- 17.3 DATA TRIANGULATION

- 17.4 FACTOR ANALYSIS

- 17.5 RESEARCH ASSUMPTIONS

- 17.6 RESEARCH LIMITATIONS

- 17.7 RISK ASSESSMENT

18 APPENDIX

- 18.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.4.1 RAILWAY TESTING MARKET, BY TRACK GEOMETRY EQUIPMENT TYPE, AT REGIONAL LEVEL (FOR REGIONS COVERED IN REPORT)

- 18.4.2 RAILWAY TESTING MARKET, BY RAILWAY HARDWARE TEST EQUIPMENT, AT REGIONAL LEVEL (FOR REGIONS COVERED IN REPORT)

- 18.4.3 COMPANY INFORMATION

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS