|

시장보고서

상품코드

1901401

무인 잠수정(UUV) 시장 : 유형(AUV 및 ROV), 용도, 추진 방식, 시스템, 속도, 형상, 지역별Unmanned Underwater Vehicle Market By Type (AUV, ROV ), Application, Propulsion, System, Speed, Shape, Region - Global Forecast to 2030 |

||||||

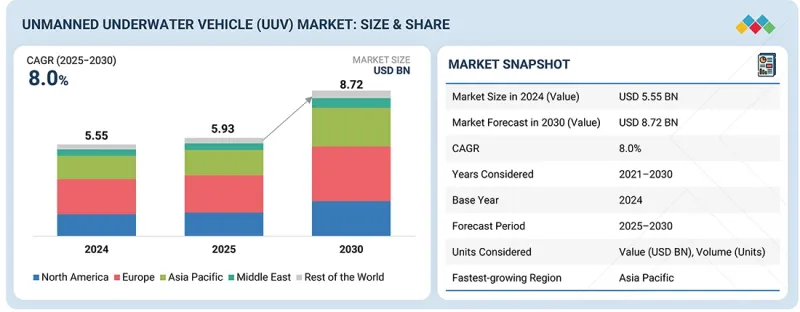

세계의 무인 잠수정(UUV) 시장의 규모는 예측기간 동안 CAGR 8.0%로 성장하여 2025년 59억 3,000만 달러에서 2030년까지 87억 2,000만 달러에 이를 것으로 예측됩니다.

수량 기준(신규 납품 대수)에서는 시장 규모가 2024년 19,092대에서 증가하여 2030년까지 33,603대에 이를 것으로 예측되고 있습니다.

방위기관, 해상에너지 사업자, 해양연구기관이 복잡한 해저 작업을 위한 자율형 및 원격조작 플랫폼의 배치를 확대하면서 UUV 시장은 진전을 계속하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2020-2030년 |

| 기준연도 | 2024년 |

| 예측기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문 | 유형, 형상, 속도, 추진 방식, 용도, 시스템, 비용, 크기, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

시장의 성장은 지속적인 수중 모니터링의 필요성, 심해 인프라의 효율적인 점검, 위험한 환경에서의 인력 배치 최소화로의 전환에 의해 추진되고 있습니다. 또한, 보다 효과적인 방위 임무, 해양 자산 관리, 환경 평가를 지원하기 위한 장거리 항속 능력, 심해 대응 능력, 유연한 페이로드 통합의 요구가 시장을 강화하고 있습니다.

"유형별로 ROV 부문이 예측기간 동안 가장 높은 CAGR로 성장할 것으로 예측됩니다."

원격조작 차량(ROV)은 정밀한 제어, 신뢰할 수 있는 해저 투입 능력, 실시간 운영 감시를 제공하는 플랫폼을 운영자가 우선시하는 가운데 가장 급속한 성장을 기록하고 있습니다. 검사, 수리 및 유지보수 작업에 대한 적합성으로 인해 잠수사의 작업을 위한 효율적인 선택을 요구하는 해양 에너지 기업과 방위 사용자에게 ROV가 선호되는 선택이 되고 있습니다. 심해 자산 개발 증가와 신뢰성이 높고 비용 효율적인 수중 개입의 필요성이 높아지고 있는 것도 ROV 솔루션 수요를 더욱 가속화하고 있습니다.

"용도별로는 군 및 방위 부문이 예측기간 중 가장 큰 점유율을 차지할 것으로 전망됩니다"

해군부대가 우선순위가 높은 수중 작전을 위한 무인 플랫폼의 활용을 확대하는 가운데 군 및 방위 부문은 UUV 시장에서 주도적인 지위를 유지하고 있습니다. 이 성장은 기뢰 대책, 대잠수함 감시, 중요한 해양 자산 보호에 대한 요구 증가에 의해 지원됩니다. 방위기관은 인원에 대한 작전 위험도를 줄이면서 수중 상황 인식을 강화하기 위해 항속시간 연장, 자율성 향상, 적재능력 증강을 갖춘 UUV를 우선적으로 도입하고 있습니다. 주요 해군 함대의 현대화 계획은 복잡한 방위 임무에 적합한 첨단 UUV 시스템의 도입을 더욱 가속화하고 있습니다.

"유럽은 예측기간 중 시장 점유율 2위를 달성할 전망입니다"

이는 지속적인 해군 근대화 노력, 해상보안활동에서 높아지는 무인시스템 수요, 이 지역의 광범위한 해양에너지 활동에 의해 지원되고 있습니다. 유럽 각국의 해군은 대기뢰 작전, 해저 감시, 자율형 모니터링을 위한 UUV의 배치를 확대하고 있습니다. 북해의 방대한 해저 인프라는 신뢰할 수 있는 점검 및 보수 플랫폼에 대한 수요를 뒷받침하고 있습니다. 또한 유럽은 방위 및 상업 사용자 모두에서 선진적인 UUV 기술의 개발과 채용을 가속화하는 견고한 산업 기반과 연구 기반을 가지고 있습니다.

본 보고서에서는 세계의 무인 잠수정(UUV) 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인 분석, 기술 및 특허 동향, 법 규제 환경, 사례 연구, 시장 규모 추이와 예측, 각종 구분, 지역 및 주요 국가별 상세 분석, 경쟁 구도, 주요 기업 프로파일 등을 정리했습니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 중요 인사이트

제4장 시장 개요

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 미충족 요구 및 사업 기회

- 관련 시장 및 이업종과의 횡단적 기회

- Tier 1, 2, 3 기업의 전략적 움직임

제5장 업계 동향

- 생태계 분석

- 밸류체인 분석

- 2025년 미국 관세

- 무역 분석

- 사례 연구 분석

- 주요 회의 및 이벤트

- 부품표

- 총 소유 비용

- 투자 및 자금조달 시나리오

- 운용 데이터

- 볼륨 데이터

- 가격 분석

- 거시경제 전망

- 비즈니스 모델

제6장 기술의 진보, AI에 의한 영향, 특허, 혁신, 미래 응용

- 주요 기술

- 자율성과 AI 기반 내비게이션

- 에너지 밀도가 높은 전력 시스템

- 하이브리드 수중 통신

- 고해상도 인식 및 매핑

- 보완 기술

- 무인 수상선

- 수중 음향 측위

- 위성 링크 지상 게이트웨이

- 기술 로드맵

- 특허 분석

- 미래 응용

- AI 및 생성형 AI의 영향

- 메가 트렌드의 영향

제7장 지속 가능성과 규제 상황

- 지역 규제 및 규정 준수

- 지속 가능성에 대한 노력

- 지속 가능성에 미치는 영향과 규제 정책의 노력

- 인증, 라벨, 환경 기준

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 이해관계자와 구매 평가 기준

- 채용 장벽과 내부 과제

- 최종 사용자 산업의 미충족 요구

제9장 무인 잠수정(UUV) 시장 : 유형별

- 원격조작 차량(ROV)

- 자율형 잠수정(AUV)

제10장 원격조작 차량(ROV) 시장 : 추진 방식별

- 전동식 ROV

- 기계식 ROV

- 하이브리드 ROV

제11장 원격조작 차량(ROV) 시장 : 크기별

- 관찰용(91kg 미만)

- 마이크로(4.5kg 미만)

- 미니(4.5-32kg)

- 대형(32-91kg)

- 소형 및 중형(91-907kg)

- 천해(1,000미터 미만)

- 심해(1,000-2,0000미터)

- 중량 작업 및 경량 작업용(2,000 미터 이상)

- 작업용(907kg 초과)

- 표준(100-200HP)

- 중량(200HP 초과)

제12장 원격조작 차량(ROV) 시장 : 시스템별

- 충돌 회피

- 전방 감시 소나

- 기타

- 커뮤니케이션&네트워킹

- 테더 기반 통신

- 음향 통신

- 지상 및 백홀 통신

- 기타

- 내비게이션 및 유도

- 관성 항법 및 추측 항법

- 음향 항법

- 기타

- 추진 및 모빌리티

- 추력 발생

- 유압 파워 및 액추에이션

- 부력 및 수직 운동

- 기타

- 페이로드&센서

- 음향 이미지 및 매핑 페이로드

- 광학 이미지 페이로드

- 환경 및 해양 센서 페이로드

- 기타

- 섀시

- 금속 합금

- 섬유 강화 복합재료

- 기타

- 전력&에너지

- 에너지 저장

- 전력 관리 및 배전

- 기타

제13장 원격조작 차량(ROV) 시장 : 속도별

- 5노트 미만

- 5노트 이상

제14장 원격조작 차량(ROV) 시장 : 용도별

- 군 및 방위

- 국경 경비와 감시

- 대잠수함 작전

- 인신매매 및 밀수품 감시

- 환경 평가

- 지뢰 식별

- 석유 및 가스

- 파이프라인 조사

- 지구 물리 조사

- 쓰레기 및 정리 조사

- 기선 환경 평가 조사

- 환경보호 및 감시

- 서식지 조사

- 물 샘플 채취

- 어업 연구

- 긴급 대응

- 해양학

- 고고학 및 탐사

- 수색 구조 활동

제15장 자율형 잠수정(AUV) 시장 : 유형별

- 천해(100미터 미만)

- 마이크로 및 소형(20kg 미만)

- 미니(20-100kg)

- 중형(100-1,000미터)

- 대형(1,000미터 초과)

- 심해(1,000-3,000미터)

- 대형(3,000-6,000미터)

- 특대형(6,000미터 초과)

제16장 자율형 잠수정(AUV) 시장 : 형상별

- 어뢰

- 층류체

- 유선형 직사각형

- 다동선

제17장 자율형 잠수정(AUV) 시장 : 추진 방식별

- 전동식 AUV

- 기계식 AUV

- 하이브리드 AUV

제18장 자율형 잠수정(AUV) 시장 : 시스템별

- 충돌 회피

- 전방 감시 소나

- 기타

- 커뮤니케이션&네트워킹

- 수중 음향 통신

- 해저 무선 광통신

- 해면 RF 및 Wi-Fi 통신

- 위성통신

- 기타

- 내비게이션 및 유도

- 관성 항법 및 추측 항법

- 음향 항법

- 기타

- 추진 및 모빌리티

- 추력 발생

- 모션 & 컨트롤 액추에이션

- 부력 및 수직 운동

- 기타

- 페이로드와 센서

- 음향 이미지 및 매핑 페이로드

- 광학 이미지 페이로드

- 환경 및 해양 센서 페이로드

- 기타

- 섀시

- 금속 합금 선체

- 섬유 강화 복합재료

- 기타

- 전력 및 에너지

- 에너지 저장

- 전력 관리 및 배전

- 기타

제19장 자율형 잠수정(AUV) 시장 : 속도별

- 5노트 미만

- 5노트 이상

제20장 자율형 잠수정(AUV) 시장 : 용도별

- 군 및 방위

- 해상 감시 및 위협 탐지 강화

- 국경 경비 및 감시

- 대잠수함 작전

- 인신매매 및 밀수 감시

- 환경 평가

- 지뢰 식별

- 석유 및 가스

- 해저 자산의 건전성과 검사 효율 향상

- 파이프라인 조사

- 지구 물리 조사

- 쓰레기 및 정리 조사

- 기선 환경 평가 조사

- 환경보호 및 감시

- 해양 자원 관리 및 오염 제어 지원

- 서식지 조사

- 물 샘플 채취

- 어업 연구

- 긴급 대응

- 해양학

- 고고학 및 탐사

- 수색 구조 활동

제21장 무인 잠수정(UUV) 시장 : 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 노르웨이

- 기타

- 아시아태평양

- 중국

- 일본

- 호주

- 한국

- 인도

- 기타

- 중동

- GCC

- 이스라엘

- 튀르키예

- 기타

- 기타 지역

- 아프리카

- 라틴아메리카

제22장 경쟁 구도

- 주요 진입기업의 전략 및 강점

- 수익 분석

- 시장 점유율 분석

- 브랜드 및 제품 비교

- 기업 평가와 재무지표

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 신흥 기업 및 중소기업

- 경쟁 시나리오

제23장 기업 프로파일

- 주요 기업

- KONGSBERG

- SAIPEM SPA

- BAE SYSTEMS

- L3HARRIS TECHNOLOGIES, INC.

- OCEANEERING INTERNATIONAL, INC.

- EXAIL TECHNOLOGIES

- SAAB AB

- TELEDYNE TECHNOLOGIES INCORPORATED

- HII

- GENERAL DYNAMICS CORPORATION

- KAWASAKI HEAVY INDUSTRIES, LTD

- LOCKHEED MARTIN CORPORATION

- TKMS

- BOSTON ENGINEERING

- BOEING

- XYLEM INC

- INTERNATIONAL SUBMARINE ENGINEERING LIMITED

- NORTHROP GRUMMAN

- AEROVIRONMENT, INC.

- FORUM ENERGY TECHNOLOGIES, INC.

- 기타 기업

- MSUBS

- FALMOUTH SCIENTIFIC, INC

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- ECOSUB ROBOTICS

- EELUME AS

- HYDROMEA

- GRAAL TECH SRL

- BALTROBOTICS

- OCEANSCAN-MARINE SYSTEMS & TECHNOLOGY

- RTSYS

- BLUEYE ROBOTICS

- EYEROV

제24장 조사 방법

제25장 부록

CSM 26.01.16The global unmanned underwater vehicle (UUV) market is projected to grow from USD 5.93 billion in 2025 to USD 8.72 billion by 2030 at a CAGR of 8.0% during the forecast period. In terms of volume (new deliveries), the market is projected to reach 33,603 units by 2030, rising from 19,092 units in 2024. The UUV market is advancing as defense agencies, offshore energy operators, and marine research organizations increase the deployment of autonomous and remotely operated platforms for complex subsea operations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Shape, Speed, Propulsion, Application, System, Cost, Size and Region |

| Regions covered | North America, Europe, APAC, RoW |

Growth is driven by the need for continuous underwater monitoring, efficient inspection of deep-water infrastructure, and a shift toward minimizing human presence in hazardous environments. The market is further reinforced by requirements for longer-range endurance, greater depth capability, and flexible payload integration to support more effective defense missions, offshore asset management, and environmental assessment.

"By type, the ROV segment is projected to grow at the highest CAGR during the forecast period."

Remotely operated vehicles (ROVs) are registering the fastest growth in the UUV market as operators prioritize platforms that offer precise control, dependable subsea intervention capabilities, and real-time operational oversight. Their suitability for inspection, repair, and maintenance tasks makes them a preferred choice for offshore energy companies and defense users seeking efficient alternatives to diver-based operations. Increasing deep-water asset development and the need for reliable, cost-effective underwater intervention are further accelerating demand for ROV solutions.

"By application, the military & defense segment is projected to be the most dominant during the forecast period."

The military & defense segment maintains a leading position in the unmanned underwater vehicle (UUV) market as naval forces expand the use of unmanned platforms for high-priority underwater operations. Growth is supported by increasing requirements for mine countermeasures, anti-submarine monitoring, and the protection of critical maritime assets. Defense organizations are prioritizing UUVs with extended endurance, enhanced autonomy, and higher payload capacity to strengthen underwater situational awareness while reducing operational risk to personnel. Modernization initiatives across major naval fleets are further accelerating the acquisition of advanced UUV systems suited for complex defense missions.

"Europe is projected to have the second-largest market share during the forecast period."

Europe is projected to have the second-largest share of the UUV market during the forecast period, supported by sustained naval modernization efforts, rising demand for unmanned systems in maritime security operations, and the region's extensive offshore energy activity. European navies are expanding UUV deployment for mine countermeasures, seabed surveillance, and autonomous monitoring. The North Sea's substantial subsea infrastructure reinforces demand for reliable inspection and maintenance platforms. Additionally, Europe benefits from a strong industrial and research base that accelerates the development and adoption of advanced UUV technologies across defense and commercial users.

The breakdown of profiles for primary participants in the UUV market is provided below:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 10%, and Others - 70%

- By Region: North America - 20%, Europe - 20%, Asia Pacific - 40%, Middle East - 10% Rest of the World (RoW) - 10%

Research Coverage:

This market study covers the UUV market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different regions. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their products and business offerings, recent developments, and key market strategies they adopted.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall UUV market. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the market pulse and will provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Market Drivers (Growing adoption of autonomous systems for maritime security tasks, increased subsea inspection needs in offshore energy, advances in underwater navigation and autonomy technologies), Restraints (High acquisition and lifecycle costs, limited underwater communication bandwidth, regulatory and standardization gaps across regions), Opportunities (Expansion of offshore wind and subsea renewable projects, naval modernization programs integrating unmanned systems, increasing scientific and environmental monitoring needs), Challenges (Harsh underwater environments affecting navigation and reliability, battery endurance constraints limiting mission duration, cybersecurity risks in autonomous underwater operations).

- Market Penetration: Comprehensive information on unmanned underwater vehicles offered by the top players in the market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the UUV market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the UUV market

- Competitive Assessment: In-depth assessment of market share, growth strategies, products, and manufacturing capabilities of leading players in the UUV market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN UNMANNED UNDERWATER VEHICLE MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN UNMANNED UNDERWATER VEHICLE MARKET

- 3.2 UNMANNED UNDERWATER VEHICLE MARKET, BY TYPE

- 3.3 REMOTELY OPERATED VEHICLE MARKET, BY APPLICATION

- 3.4 REMOTELY OPERATED VEHICLE MARKET, BY SPEED

- 3.5 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Ongoing naval fleet modernization programs

- 4.2.1.2 Rise in offshore energy exploration and pipeline inspection

- 4.2.1.3 Increasing investments in oceanographic research and environmental monitoring

- 4.2.1.4 Advances in energy storage and navigation systems

- 4.2.2 RESTRAINTS

- 4.2.2.1 Limited bandwidth for underwater communication

- 4.2.2.2 Lack of standardized policies in international waters and exclusive economic zones

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Expansion of dual-use applications across defense, commercial, and research sectors

- 4.2.3.2 Advent of unmanned underwater vehicle-as-a-service and leasing models

- 4.2.3.3 Government investments in autonomous inspection and maintenance systems

- 4.2.4 CHALLENGES

- 4.2.4.1 System reliability and data integrity challenges in high-pressure environments

- 4.2.4.2 Interoperability and standardization constraints across multi-OEM UUV fleets

- 4.2.4.3 Complexity of maintaining navigation accuracy and obstacle avoidance in seafloor terrains

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 PERSISTENT ENERGY SOLUTIONS AND AUTONOMOUS RECHARGING INFRASTRUCTURE

- 4.3.2 REAL-TIME HIGH-BANDWIDTH UNDERWATER COMMUNICATION NETWORKS

- 4.3.3 AI-DRIVEN AUTONOMY AND DECISION-MAKING IN COMPLEX ENVIRONMENTS

- 4.3.4 STANDARDIZATION AND INTEROPERABILITY FRAMEWORKS FOR MULTI-OEM FLEETS

- 4.4 INTERCONNECTED MARKET AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 DEFENSE MODERNIZATION AND CROSS-DOMAIN MISSION INTEGRATION

- 4.4.2 OFFSHORE ENERGY, RENEWABLE INFRASTRUCTURE, AND DEEP-SEA RESOURCE OPERATIONS

- 4.4.3 OCEAN DATA ECONOMY AND ENVIRONMENTAL INTELLIGENCE APPLICATIONS

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 ECOSYSTEM ANALYSIS

- 5.1.1 PROMINENT COMPANIES

- 5.1.2 PRIVATE AND SMALL ENTERPRISES

- 5.1.3 END USERS

- 5.2 VALUE CHAIN ANALYSIS

- 5.2.1 RESEARCH AND DEVELOPMENT

- 5.2.2 RAW MATERIALS

- 5.2.3 COMPONENT/PRODUCT MANUFACTURING

- 5.2.4 ASSEMBLY AND INTEGRATION

- 5.2.5 END USE

- 5.3 2025 US TARIFF

- 5.3.1 INTRODUCTION

- 5.3.2 KEY TARIFF RATES

- 5.3.3 PRICE IMPACT ANALYSIS

- 5.3.4 IMPACT ON COUNTRIES/REGIONS

- 5.3.4.1 US

- 5.3.4.2 Europe

- 5.3.4.3 Asia Pacific

- 5.3.5 IMPACT ON END-USE INDUSTRIES

- 5.3.5.1 Military & defense

- 5.3.5.2 Oil & gas

- 5.3.5.3 Environmental protection & monitoring

- 5.3.5.4 Oceanography

- 5.3.5.5 Archaeology & exploration

- 5.3.5.6 Search & salvage operation

- 5.4 TRADE ANALYSIS

- 5.4.1 IMPORT SCENARIO (HS CODE 901580)

- 5.4.2 EXPORT SCENARIO (HS CODE 901580)

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 CURTISS-WRIGHT'S NETWORK-ATTACHED STORAGE UNIT FOR LONG-ENDURANCE UUV OPERATIONS

- 5.5.2 UUV RAJAAMPAT FOR UNDERWATER INSPECTION AND INFRASTRUCTURE MONITORING

- 5.5.3 UUV FOR MARITIME CRIME DETECTION AND SECURITY OPERATIONS

- 5.6 KEY CONFERENCES AND EVENTS

- 5.7 BILL OF MATERIALS

- 5.8 TOTAL COST OF OWNERSHIP

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 OPERATIONAL DATA

- 5.10.1 REMOTELY OPERATED VEHICLE, BY SIZE

- 5.10.2 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE

- 5.11 VOLUME DATA

- 5.11.1 REMOTELY OPERATED VEHICLE MARKET, BY COUNTRY

- 5.11.2 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY COUNTRY

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE TREND OF UNMANNED UNDERWATER VEHICLES, BY TYPE

- 5.12.1.1 Average selling price trend of remotely operated vehicles, by size

- 5.12.1.1.1 Average selling price trend of observation-class remotely operated vehicles

- 5.12.1.1.2 Average selling price trend of medium/small remotely operated vehicles

- 5.12.1.1.3 Average selling price trend of work-class remotely operated vehicles

- 5.12.1.2 Average selling price trend of autonomous underwater vehicles, by type

- 5.12.1.2.1 Average selling price trend of shallow autonomous underwater vehicles

- 5.12.1.2.2 Average selling price trend of large autonomous underwater vehicles

- 5.12.1.1 Average selling price trend of remotely operated vehicles, by size

- 5.12.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.12.2.1 Average selling price trend of remotely operated vehicles, by region

- 5.12.2.2 Average selling price trend of autonomous underwater vehicles, by region

- 5.12.1 AVERAGE SELLING PRICE TREND OF UNMANNED UNDERWATER VEHICLES, BY TYPE

- 5.13 MACROECONOMIC OUTLOOK

- 5.13.1 INTRODUCTION

- 5.13.2 GDP TRENDS AND FORECAST

- 5.13.3 TRENDS IN GLOBAL UNDERWATER MARITIME VEHICLE INDUSTRY

- 5.13.4 TRENDS IN GLOBAL MARINE INDUSTRY

- 5.14 BUSINESS MODELS

- 5.14.1 UUV SYSTEM MANUFACTURERS

- 5.14.2 UUV PRODUCT MANUFACTURERS AND ASSEMBLERS

- 5.14.3 UUV SERVICE PROVIDERS

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 AUTONOMY AND AI-DRIVEN NAVIGATION

- 6.1.2 ENERGY-DENSE POWER SYSTEMS

- 6.1.3 HYBRID UNDERWATER COMMUNICATION

- 6.1.4 HIGH-RESOLUTION PERCEPTION AND MAPPING

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 UNMANNED SURFACE VESSELS

- 6.2.2 UNDERWATER ACOUSTIC POSITIONING

- 6.2.3 SATELLITE-LINKED SURFACE GATEWAYS

- 6.3 TECHNOLOGY ROADMAP

- 6.3.1 ADVANCED COMMUNICATION ECOSYSTEM

- 6.3.1.1 Architecture overview

- 6.3.1.1.1 Underwater communication layer

- 6.3.1.1.2 Surface relay layer

- 6.3.1.1.3 Satellite and RF connectivity layer

- 6.3.1.1.4 Cloud-AI and digital operations layer

- 6.3.1.2 Performance matrix

- 6.3.1.3 Innovation roadmap

- 6.3.1.4 Challenges and gaps

- 6.3.1.1 Architecture overview

- 6.3.2 ENERGY AND BATTERY TECHNOLOGIES

- 6.3.2.1 Battery chemistry comparison

- 6.3.2.2 Design trade-off matrix

- 6.3.2.3 Innovation roadmap

- 6.3.2.4 Challenges and gaps

- 6.3.3 OTHER EVOLVING TECHNOLOGIES

- 6.3.3.1 Pressure-tolerant electronics and oil-filled modules

- 6.3.3.2 Autonomous docking, recharging, and underwater service nodes

- 6.3.3.3 Distributed swarm and collaborative UUV operations

- 6.3.1 ADVANCED COMMUNICATION ECOSYSTEM

- 6.4 PATENT ANALYSIS

- 6.5 FUTURE APPLICATIONS

- 6.6 IMPACT OF AI/GEN AI

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES

- 6.6.3 CASE STUDIES OF AI/GEN AI IMPLEMENTATION

- 6.6.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.6.5 CLIENTS' READINESS TO ADOPT AI/GEN AI

- 6.7 IMPACT OF MEGATRENDS

- 6.7.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 6.7.2 CLOUD COMPUTING AND DISTRIBUTED ANALYTICS

- 6.7.3 IOT AND EDGE COMPUTING

- 6.7.4 BLOCKCHAIN AND SECURE DISTRIBUTED LEDGERS

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 SUSTAINABILITY INITIATIVES

- 7.2.1 CARBON IMPACT REDUCTION

- 7.2.2 ECO-APPLICATIONS

- 7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.3.1 SUSTAINABILITY IMPACT

- 7.3.2 REGULATORY POLICY INITIATIVES

- 7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM END-USE INDUSTRIES

9 UNMANNED UNDERWATER VEHICLE MARKET, BY TYPE (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION & VOLUME, UNITS)

- 9.1 INTRODUCTION

- 9.2 REMOTELY OPERATED VEHICLE

- 9.2.1 ADVANCES IN TOOLING AND SENSING EXPAND USAGE ACROSS MILITARY AND COMMERCIAL SECTORS

- 9.2.2 USE CASE: SHALLOW WATER PIPELINE INSPECTION CHALLENGES RESOLVED WITH LIGHTWEIGHT INSPECTION-CLASS ROV

- 9.3 AUTONOMOUS UNDERWATER VEHICLE

- 9.3.1 GROWING DEMAND FOR LONG-ENDURANCE OCEAN INTELLIGENCE

- 9.3.2 USE CASE: LONG-RANGE SEAFLOOR MAPPING LIMITATIONS ADDRESSED BY AUV WITH ADVANCED NAVIGATION AND ENERGY SYSTEMS

10 REMOTELY OPERATED VEHICLE MARKET, BY PROPULSION (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 10.1 INTRODUCTION

- 10.2 ELECTRIC ROV

- 10.2.1 COMPACT ELECTRIC POWER SYSTEMS STRENGTHEN ROV PERFORMANCE IN INSPECTION MISSIONS

- 10.2.2 USE CASE: HIGH-CAPACITY BATTERY SYSTEM ENABLES EXTENDED INSPECTION IN REMOTE OFFSHORE FIELDS

- 10.3 MECHANICAL ROV

- 10.3.1 LOW-ENERGY MECHANICAL SYSTEMS SUPPORT EXTENDED ENVIRONMENTAL AND SCIENTIFIC MISSIONS

- 10.3.2 USE CASE: MECHANICAL BUOYANCY-DRIVEN ROV REDUCES POWER CONSUMPTION DURING LONG-TRANSECT HABITAT MAPPING

- 10.4 HYBRID ROV

- 10.4.1 HYBRIDIZED THRUSTER AND BUOYANCY SYSTEMS ENABLE EXTENDED, HIGH-PERFORMANCE ROV MISSIONS

- 10.4.2 USE CASE: HYBRID FUEL-CELL ROV ACHIEVES HIGH-POWER SUBSEA INTERVENTION WITHOUT ELECTRICAL LOAD INSTABILITY

11 REMOTELY OPERATED VEHICLE MARKET, BY SIZE (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION & VOLUME, UNITS)

- 11.1 INTRODUCTION

- 11.2 OBSERVATION CLASS (<91 KG)

- 11.2.1 OCROV ADOPTION RISES AS OPERATORS SHIFT FROM SCHEDULED SURVEYS TO REAL-TIME INSPECTION MODELS

- 11.2.2 MICRO (<4.5 KG)

- 11.2.3 MINI (4.5-32 KG)

- 11.2.4 LARGE (32-91 KG)

- 11.3 MEDIUM/SMALL (91-907 KG)

- 11.3.1 STABLE MID-SIZE ROVS ENABLE ENGINEERING-GRADE DATA COLLECTION FOR COMPLEX SUBSEA TASKS

- 11.3.2 SHALLOW (< 1,000 M)

- 11.3.3 DEEPWATER (1,000-2,0000 M)

- 11.3.4 HEAVY/LIGHT WORK CLASS (>2,000 M)

- 11.4 WORK CLASS (>907 KG)

- 11.4.1 WORK-CLASS ROVS ENABLE HIGH-POWER INTERVENTION AND DEEPWATER CONSTRUCTION OPERATIONS

- 11.4.2 STANDARD (100-200 HP)

- 11.4.3 HEAVY (>200 HP)

12 REMOTELY OPERATED VEHICLE MARKET, BY SYSTEM (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 12.1 INTRODUCTION

- 12.2 COLLISION AVOIDANCE

- 12.2.1 ADVANCED SONAR AND BUOYANCY SAFEGUARDS STRENGTHEN ROV SAFETY IN CLUTTERED SUBSEA ZONES

- 12.2.2 FORWARD-LOOKING SONAR

- 12.2.3 OTHERS

- 12.3 COMMUNICATION & NETWORKING

- 12.3.1 ENHANCED TETHER AND RELAY COMMUNICATION ARCHITECTURES IMPROVE PRECISION CONTROL AND REAL-TIME SUBSEA COORDINATION

- 12.3.2 TETHER-BASED COMMUNICATION

- 12.3.3 ACOUSTIC COMMUNICATION

- 12.3.4 SURFACE & BACKHAUL COMMUNICATION

- 12.3.5 OTHERS

- 12.4 NAVIGATION & GUIDANCE

- 12.4.1 NEXT-GENERATION NAVIGATION SYSTEMS ENABLE SAFER, DRIFT-FREE ROV OPERATIONS IN CHALLENGING ENVIRONMENTS

- 12.4.2 INERTIAL & DEAD-RECKONING

- 12.4.2.1 Inertial navigation

- 12.4.2.2 Compass-based navigation

- 12.4.2.3 Others

- 12.4.3 ACOUSTIC NAVIGATION

- 12.4.4 OTHERS

- 12.5 PROPULSION & MOBILITY

- 12.5.1 ADVANCEMENTS IN MULTI-MODE PROPULSION ARCHITECTURES ENHANCE ROV STABILITY, POWER, AND MISSION AGILITY

- 12.5.2 THRUST GENERATION

- 12.5.2.1 Propulsion motor

- 12.5.2.2 Thruster

- 12.5.2.3 Others

- 12.5.3 HYDRAULIC POWER & ACTUATION

- 12.5.3.1 Hydraulic power unit

- 12.5.3.2 Hydraulic manifold & valve block

- 12.5.3.3 Others

- 12.5.4 BUOYANCY & VERTICAL MOTION

- 12.5.4.1 Pump motor

- 12.5.4.2 Variable buoyancy system

- 12.5.4.3 Others

- 12.5.5 OTHERS

- 12.6 PAYLOAD & SENSOR

- 12.6.1 MODULAR SENSOR AND TOOLING ECOSYSTEMS EXPAND ROV MISSION VERSATILITY ACROSS INSPECTION AND INTERVENTION TASKS

- 12.6.2 ACOUSTIC IMAGING & MAPPING PAYLOAD

- 12.6.2.1 Side-scan sonar imager

- 12.6.2.2 Multibeam echo sounder

- 12.6.2.3 Synthetic aperture sonar

- 12.6.2.4 Sub-bottom profiler

- 12.6.2.5 Others

- 12.6.3 OPTICAL IMAGING PAYLOAD

- 12.6.3.1 High-resolution digital still camera

- 12.6.3.2 Dual-eye camera

- 12.6.3.3 Others

- 12.6.4 ENVIRONMENTAL & OCEANOGRAPHIC SENSOR PAYLOAD

- 12.6.4.1 CTD sensor

- 12.6.4.2 Biogeochemical sensor

- 12.6.4.3 Acoustic Doppler Current Profiler

- 12.6.5 OTHERS

- 12.7 CHASSIS

- 12.7.1 IMPROVING STRUCTURAL RESILIENCE, REDUCING WEIGHT, AND ENABLING SAFER OPERATIONS

- 12.7.2 METAL ALLOY

- 12.7.3 FIBER-REINFORCED COMPOSITE

- 12.7.4 OTHERS

- 12.8 POWER & ENERGY

- 12.8.1 ADVANCES IN SUBSEA POWER MANAGEMENT AND HIGH-EFFICIENCY CONVERSION

- 12.8.2 ENERGY STORAGE

- 12.8.2.1 Battery module

- 12.8.2.2 Pressure-tolerant subsea battery system

- 12.8.2.3 Supercapacitor

- 12.8.3 POWER MANAGEMENT & DISTRIBUTION

- 12.8.3.1 BMS

- 12.8.3.2 DC/DC converter

- 12.8.3.3 Busbar

- 12.8.3.4 Others

- 12.9 OTHER SYSTEMS

13 REMOTELY OPERATED VEHICLE MARKET, BY SPEED (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 13.1 INTRODUCTION

- 13.2 <5 KNOTS

- 13.2.1 OPERATIONAL, ENVIRONMENTAL, AND COST PRIORITIES DRIVE RISING DEMAND FOR LOW-SPEED ROVS

- 13.3 >5 KNOTS

- 13.3.1 EXPANSION OF SUBSEA OPERATIONS INTO DEEPER AND MORE DYNAMIC ENVIRONMENTS

14 REMOTELY OPERATED VEHICLE MARKET, BY APPLICATION (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 14.1 INTRODUCTION

- 14.2 MILITARY & DEFENSE

- 14.2.1 RISING DEFENSE DEMAND FOR HIGH-FIDELITY UNDERWATER SURVEILLANCE AND MISSION-CRITICAL ROV OPERATIONS

- 14.2.2 BORDER SECURITY & SURVEILLANCE

- 14.2.3 ANTI-SUBMARINE WARFARE

- 14.2.4 ANTI-TRAFFICKING & CONTRABAND MONITORING

- 14.2.5 ENVIRONMENTAL ASSESSMENT

- 14.2.6 MINE COUNTERMEASURE IDENTIFICATION

- 14.3 OIL & GAS

- 14.3.1 GROWING RELIANCE ON ROVS FOR SAFE, DATA-DRIVEN INSPECTION AND SURVEY OPERATIONS IN COMPLEX OFFSHORE ENVIRONMENTS

- 14.3.2 PIPELINE SURVEY

- 14.3.3 GEOPHYSICAL SURVEY

- 14.3.4 DEBRIS/CLEARANCE SURVEY

- 14.3.5 BASELINE ENVIRONMENTAL ASSESSMENT SURVEY

- 14.4 ENVIRONMENTAL PROTECTION & MONITORING

- 14.4.1 SHIFT TOWARD STRUCTURED, DATA-DRIVEN MARINE MONITORING ACCELERATES ROV ADOPTION ACROSS RESEARCH AND REGULATORY AGENCIES

- 14.4.2 HABITAT RESEARCH

- 14.4.3 WATER SAMPLING

- 14.4.4 FISHERY STUDY

- 14.4.5 EMERGENCY RESPONSE

- 14.5 OCEANOGRAPHY

- 14.5.1 STRUCTURED, SENSOR-DRIVEN OCEAN OBSERVATIONS DRIVE ROV INTEGRATION INTO MODERN MARINE SCIENCE PROGRAMS

- 14.6 ARCHAEOLOGY & EXPLORATION

- 14.6.1 RISING NEED FOR NON-INTRUSIVE, HIGH-ACCURACY UNDERWATER DOCUMENTATION TO SUPPORT CULTURAL HERITAGE PRESERVATION

- 14.7 SEARCH & SALVAGE OPERATION

- 14.7.1 RISING DEMAND FOR DATA-DRIVEN, LOW-RISK RECOVERY SOLUTIONS ACCELERATES ROV ADOPTION IN SEARCH AND SALVAGE

15 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY TYPE (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION & VOLUME, UNITS)

- 15.1 INTRODUCTION

- 15.2 SHALLOW (<100 M)

- 15.2.1 SUPPORTING COASTAL SURVEILLANCE AND MINE COUNTERMEASURE MISSIONS IN CONFINED WATERS

- 15.2.2 USE CASE: KONGSBERG'S REMUS-100 FOR VERY SHALLOW WATER MINE COUNTERMEASURE MISSIONS

- 15.2.3 MICRO/SMALL (<20 KG)

- 15.2.4 MINI (20-100 KG)

- 15.3 MEDIUM (100-1,000 M)

- 15.3.1 BRIDGING ENDURANCE AND PAYLOAD FOR SCIENTIFIC AND INDUSTRIAL SEAFLOOR MISSIONS

- 15.3.2 USE CASE: MBARI'S SEAFLOOR MAPPING DEEP-RATED SURVEY VEHICLE FOR FULLY AUTONOMOUS MISSIONS

- 15.4 LARGE (>1,000 M)

- 15.4.1 ENABLING LONG-RANGE AND MODULAR MISSIONS WITH HEAVY-PAYLOAD CAPACITY

- 15.4.2 USE CASE: BOEING'S ORCA FOR MODULAR MISSION PACKAGES

- 15.4.3 DEEP WATER (1,000-3,000 M)

- 15.4.4 LARGE DISPLACEMENT (3,000-6,000 M)

- 15.4.5 EXTRA LARGE (>6,000 M)

16 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SHAPE (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION & VOLUME, UNITS)

- 16.1 INTRODUCTION

- 16.2 TORPEDO

- 16.2.1 OPTIMIZING DEEP-SEA ENDURANCE THROUGH HYDRODYNAMIC STABILITY

- 16.3 LAMINAR FLOW BODY

- 16.3.1 IMPROVING ENERGY EFFICIENCY THROUGH FLOW-OPTIMIZED HULL DESIGNS

- 16.4 STREAMLINED RECTANGULAR STYLE

- 16.4.1 BALANCING PAYLOAD MODULARITY WITH OPERATIONAL STABILITY FOR INDUSTRIAL TASKS

- 16.5 MULTI-HULL

- 16.5.1 EXPANDING PAYLOAD FLEXIBILITY AND REDUNDANCY FOR MULTI-SENSOR UNDERWATER MISSIONS

17 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY PROPULSION (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 17.1 INTRODUCTION

- 17.2 ELECTRIC AUV

- 17.2.1 FUELING TRANSITION TO ENERGY-DENSE, LOW-MAINTENANCE AUV OPERATIONS

- 17.2.2 USE CASE: REMUS SERIES LI-ION BATTERY SYSTEMS DEVELOPED BY SAFT/MATHEWS FOR PROLONGED MISSIONS

- 17.3 MECHANICAL AUV

- 17.3.1 ENABLING PERSISTENT OCEAN OBSERVATION THROUGH ENERGY-NEUTRAL PROPULSION

- 17.3.2 USE CASE: TELEDYNE'S SLOCUM G3 GLIDER FOR LONG ENDURANCE WITH BUOYANCY ENGINE AND WINGS FOR COASTAL PROGRAMS

- 17.4 HYBRID AUV

- 17.4.1 EXPANDING DEEP-SEA MISSION ENDURANCE THROUGH HYDROGEN AND FUEL-CELL INTEGRATION

- 17.4.2 USE CASE: EARLY PEM FUEL-CELL AUV PROTOTYPES DELIVER ~4 KW FOR PROPULSION WITH HYDROGEN STORED IN METAL HYDRIDE TANKS

18 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SYSTEM (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 18.1 INTRODUCTION

- 18.2 COLLISION AVOIDANCE

- 18.2.1 INTEGRATION OF ADVANCED SONAR AND BUOYANCY SYSTEMS ENHANCES AUV AUTONOMY AND MISSION SAFETY

- 18.2.2 FORWARD-LOOKING SONAR

- 18.2.3 OTHERS

- 18.3 COMMUNICATION & NETWORKING

- 18.3.1 SHIFT TOWARD HYBRID ACOUSTIC-OPTICAL LINKS STRENGTHENS REAL-TIME UNDERWATER CONNECTIVITY

- 18.3.2 UNDERWATER ACOUSTIC COMMUNICATION

- 18.3.3 SUBSEA WIRELESS OPTICAL COMMUNICATION

- 18.3.4 SURFACE RF & WI-FI COMMUNICATION

- 18.3.5 SATELLITE COMMUNICATION

- 18.3.6 OTHERS

- 18.4 NAVIGATION & GUIDANCE

- 18.4.1 PRECISION NAVIGATION TECHNOLOGIES DRIVE ACCURACY AND AUTONOMY IN DEEP-SEA AUV MISSIONS

- 18.4.2 INERTIAL & DEAD-RECKONING

- 18.4.2.1 Inertial navigation

- 18.4.2.2 Compass-based navigation

- 18.4.2.3 Others

- 18.4.3 ACOUSTIC NAVIGATION

- 18.4.4 OTHERS

- 18.5 PROPULSION & MOBILITY

- 18.5.1 SHIFT TOWARD ELECTRICALLY DRIVEN MODULAR PROPULSION SYSTEMS ENHANCES AUV ENDURANCE AND EFFICIENCY

- 18.5.2 THRUST GENERATION

- 18.5.2.1 Propulsion motor

- 18.5.2.2 Thruster

- 18.5.2.3 Others

- 18.5.3 MOTION & CONTROL ACTUATION

- 18.5.3.1 Fin control actuator

- 18.5.3.2 Servo/Linear electromechanical actuator

- 18.5.4 BUOYANCY & VERTICAL MOTION

- 18.5.4.1 Pump motor

- 18.5.4.2 Variable buoyancy system

- 18.5.4.3 Others

- 18.5.5 OTHERS

- 18.6 PAYLOAD & SENSOR

- 18.6.1 EXPANDING AUV CAPABILITIES FROM DEEP-SEA MAPPING TO CLIMATE MONITORING

- 18.6.2 ACOUSTIC IMAGING & MAPPING PAYLOAD

- 18.6.2.1 Side-scan sonar imager

- 18.6.2.2 Multibeam echo sounder

- 18.6.2.3 Synthetic aperture sonar

- 18.6.2.4 Sub-bottom profiler

- 18.6.2.5 Others

- 18.6.3 OPTICAL IMAGING PAYLOAD

- 18.6.3.1 High-resolution digital still camera

- 18.6.3.2 Dual-eye camera

- 18.6.3.3 Others

- 18.6.4 ENVIRONMENTAL & OCEANOGRAPHIC SENSOR PAYLOAD

- 18.6.4.1 CTD sensor

- 18.6.4.2 Biogeochemical sensor

- 18.6.4.3 Acoustic Doppler Current Profiler

- 18.6.5 OTHERS

- 18.7 CHASSIS

- 18.7.1 INNOVATIONS IN LIGHTWEIGHT AND PRESSURE-RESISTANT CHASSIS MATERIALS ENHANCE STRUCTURAL EFFICIENCY

- 18.7.2 METAL ALLOY HULL

- 18.7.3 FIBER-REINFORCED COMPOSITE

- 18.7.4 OTHERS

- 18.8 POWER & ENERGY

- 18.8.1 ADVANCES IN HIGH-DENSITY ENERGY STORAGE AND EFFICIENT POWER CONVERSION EXTEND AUV MISSION ENDURANCE

- 18.8.2 ENERGY STORAGE

- 18.8.2.1 Battery module

- 18.8.2.2 Pressure-tolerant subsea battery system

- 18.8.2.3 Supercapacitor

- 18.8.3 POWER MANAGEMENT & DISTRIBUTION

- 18.8.3.1 BMS

- 18.8.3.2 DC/DC converter

- 18.8.3.3 Busbar

- 18.8.3.4 Others

- 18.9 OTHER SYSTEMS

19 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY SPEED (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 19.1 INTRODUCTION

- 19.2 <5 KNOTS

- 19.2.1 ENHANCING MISSION DURATION AND DATA STABILITY

- 19.3 >5 KNOTS

- 19.3.1 IMPROVING OPERATIONAL EFFICIENCY AND RAPID UNDERWATER RESPONSE

20 AUTONOMOUS UNDERWATER VEHICLE MARKET, BY APPLICATION (MARKET SIZE & FORECAST TO 2030 - IN VALUE, USD MILLION)

- 20.1 INTRODUCTION

- 20.2 MILITARY & DEFENSE

- 20.2.1 STRENGTHENING MARITIME SURVEILLANCE AND THREAT DETECTION

- 20.2.2 BORDER SECURITY & SURVEILLANCE

- 20.2.3 ANTI-SUBMARINE WARFARE

- 20.2.4 ANTI-TRAFFICKING & CONTRABAND MONITORING

- 20.2.5 ENVIRONMENTAL ASSESSMENT

- 20.2.6 MINE COUNTERMEASURE IDENTIFICATION

- 20.3 OIL & GAS

- 20.3.1 IMPROVING SUBSEA ASSET INTEGRITY AND INSPECTION EFFICIENCY

- 20.3.2 PIPELINE SURVEY

- 20.3.3 GEOPHYSICAL SURVEY

- 20.3.4 DEBRIS/CLEARANCE SURVEY

- 20.3.5 BASELINE ENVIRONMENTAL ASSESSMENT SURVEY

- 20.4 ENVIRONMENTAL PROTECTION & MONITORING

- 20.4.1 SUPPORTING MARINE RESOURCE MANAGEMENT AND POLLUTION CONTROL

- 20.4.2 HABITAT RESEARCH

- 20.4.3 WATER SAMPLING

- 20.4.4 FISHERY STUDY

- 20.4.5 EMERGENCY RESPONSE

- 20.5 OCEANOGRAPHY

- 20.5.1 ADVANCING OCEAN DATA COLLECTION AND CLIMATE OBSERVATION

- 20.6 ARCHAEOLOGY & EXPLORATION

- 20.6.1 ENABLING SUBMERGED SITE IDENTIFICATION AND DOCUMENTATION

- 20.7 SEARCH & SALVAGE OPERATION

- 20.7.1 ENHANCING UNDERWATER OBJECT DETECTION AND RECOVERY PLANNING

21 UNMANNED UNDERWATER VEHICLE MARKET, BY REGION

- 21.1 INTRODUCTION

- 21.2 NORTH AMERICA

- 21.2.1 US

- 21.2.1.1 Domestic defense initiatives to drive market

- 21.2.2 CANADA

- 21.2.2.1 Increased UUV requirements in Arctic surveillance and maritime domain awareness to drive market

- 21.2.1 US

- 21.3 EUROPE

- 21.3.1 UK

- 21.3.1.1 Defense programs and offshore expansion to drive market

- 21.3.2 GERMANY

- 21.3.2.1 Increased use of ROVs for naval operations, offshore energy work, and scientific programs to drive market

- 21.3.3 FRANCE

- 21.3.3.1 Seabed protection efforts to drive market

- 21.3.4 ITALY

- 21.3.4.1 Research and defense partnerships to drive market

- 21.3.5 SPAIN

- 21.3.5.1 Increased reliance on autonomous systems for maritime operations to drive market

- 21.3.6 NORWAY

- 21.3.6.1 Offshore-sector requirements and national ocean-research activities to drive market

- 21.3.7 REST OF EUROPE

- 21.3.1 UK

- 21.4 ASIA PACIFIC

- 21.4.1 CHINA

- 21.4.1.1 National defense programs and industrial initiatives to drive market

- 21.4.2 JAPAN

- 21.4.2.1 Efforts to strengthen maritime domain awareness to drive market

- 21.4.3 AUSTRALIA

- 21.4.3.1 Defense innovation and marine research to drive market

- 21.4.4 SOUTH KOREA

- 21.4.4.1 Defense reform and industrial partnerships to drive market

- 21.4.5 INDIA

- 21.4.5.1 Focus on developing indigenous underwater platforms to drive market

- 21.4.6 REST OF ASIA PACIFIC

- 21.4.1 CHINA

- 21.5 MIDDLE EAST

- 21.5.1 GCC

- 21.5.1.1 Saudi Arabia

- 21.5.1.1.1 Defense modernization efforts and energy operations to drive market

- 21.5.1.2 UAE

- 21.5.1.2.1 Domestic focus on maritime security and offshore energy projects to drive market

- 21.5.1.1 Saudi Arabia

- 21.5.2 ISRAEL

- 21.5.2.1 Expanding maritime security, research, and underwater technology capabilities to drive market

- 21.5.3 TURKEY

- 21.5.3.1 Evolving defense priorities to drive market

- 21.5.4 REST OF MIDDLE EAST

- 21.5.1 GCC

- 21.6 REST OF THE WORLD

- 21.6.1 AFRICA

- 21.6.1.1 Emphasis on coastal management and offshore operations to drive market

- 21.6.2 LATIN AMERICA

- 21.6.2.1 Operational focus on monitoring maritime zones and managing underwater infrastructure to drive market

- 21.6.1 AFRICA

22 COMPETITIVE LANDSCAPE

- 22.1 INTRODUCTION

- 22.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 22.3 REVENUE ANALYSIS, 2021-2024

- 22.4 MARKET SHARE ANALYSIS, 2024

- 22.5 BRAND/PRODUCT COMPARISON

- 22.6 COMPANY VALUATION AND FINANCIAL METRICS

- 22.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 22.7.1 STARS

- 22.7.2 EMERGING LEADERS

- 22.7.3 PERVASIVE PLAYERS

- 22.7.4 PARTICIPANTS

- 22.7.5 COMPANY FOOTPRINT

- 22.7.5.1 Company footprint

- 22.7.5.2 Region footprint

- 22.7.5.3 Application footprint

- 22.7.5.4 Speed footprint

- 22.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 22.8.1 PROGRESSIVE COMPANIES

- 22.8.2 RESPONSIVE COMPANIES

- 22.8.3 DYNAMIC COMPANIES

- 22.8.4 STARTING BLOCKS

- 22.8.5 COMPETITIVE BENCHMARKING

- 22.8.5.1 List of start-ups/SMEs

- 22.8.5.2 Competitive benchmarking of start-ups/SMEs

- 22.9 COMPETITIVE SCENARIO

- 22.9.1 PRODUCT LAUNCHES

- 22.9.2 DEALS

- 22.9.3 OTHER DEVELOPMENTS

23 COMPANY PROFILES

- 23.1 KEY PLAYERS

- 23.1.1 KONGSBERG

- 23.1.1.1 Business overview

- 23.1.1.2 Products offered

- 23.1.1.3 Recent developments

- 23.1.1.3.1 Deals

- 23.1.1.3.2 Other developments

- 23.1.1.4 MnM view

- 23.1.1.4.1 Right to win

- 23.1.1.4.2 Strategic choices

- 23.1.1.4.3 Weaknesses and competitive threats

- 23.1.2 SAIPEM S.P.A.

- 23.1.2.1 Business overview

- 23.1.2.2 Products offered

- 23.1.2.3 Recent developments

- 23.1.2.3.1 Deals

- 23.1.2.3.2 Other developments

- 23.1.2.4 MnM view

- 23.1.2.4.1 Right to win

- 23.1.2.4.2 Strategic choices

- 23.1.2.4.3 Weaknesses and competitive threats

- 23.1.3 BAE SYSTEMS

- 23.1.3.1 Business overview

- 23.1.3.2 Products offered

- 23.1.3.3 Recent developments

- 23.1.3.3.1 Product launches

- 23.1.3.3.2 Deals

- 23.1.3.3.3 Other developments

- 23.1.3.4 MnM view

- 23.1.3.4.1 Right to win

- 23.1.3.4.2 Strategic choices

- 23.1.3.4.3 Weaknesses and competitive threats

- 23.1.4 L3HARRIS TECHNOLOGIES, INC.

- 23.1.4.1 Business overview

- 23.1.4.2 Products offered

- 23.1.4.3 Recent developments

- 23.1.4.3.1 Other developments

- 23.1.4.4 MnM view

- 23.1.4.4.1 Right to win

- 23.1.4.4.2 Strategic choices

- 23.1.4.4.3 Weaknesses and competitive threats

- 23.1.5 OCEANEERING INTERNATIONAL, INC.

- 23.1.5.1 Business overview

- 23.1.5.2 Products offered

- 23.1.5.3 Recent developments

- 23.1.5.3.1 Other developments

- 23.1.5.4 MnM view

- 23.1.5.4.1 Right to win

- 23.1.5.4.2 Strategic choices

- 23.1.5.4.3 Weaknesses and competitive threats

- 23.1.6 EXAIL TECHNOLOGIES

- 23.1.6.1 Business overview

- 23.1.6.2 Products offered

- 23.1.6.3 Recent developments

- 23.1.6.3.1 Product launches

- 23.1.6.3.2 Deals

- 23.1.6.3.3 Other developments

- 23.1.7 SAAB AB

- 23.1.7.1 Business overview

- 23.1.7.2 Products offered

- 23.1.7.3 Recent developments

- 23.1.7.3.1 Deals

- 23.1.7.3.2 Other developments

- 23.1.8 TELEDYNE TECHNOLOGIES INCORPORATED

- 23.1.8.1 Business overview

- 23.1.8.2 Products offered

- 23.1.8.3 Recent developments

- 23.1.8.3.1 Product launches

- 23.1.8.3.2 Deals

- 23.1.8.3.3 Other developments

- 23.1.9 HII

- 23.1.9.1 Business overview

- 23.1.9.2 Products offered

- 23.1.9.3 Recent developments

- 23.1.9.3.1 Deals

- 23.1.9.3.2 Other developments

- 23.1.10 GENERAL DYNAMICS CORPORATION

- 23.1.10.1 Business overview

- 23.1.10.2 Products offered

- 23.1.10.3 Recent developments

- 23.1.10.3.1 Other developments

- 23.1.11 KAWASAKI HEAVY INDUSTRIES, LTD

- 23.1.11.1 Business overview

- 23.1.11.2 Products offered

- 23.1.11.3 Recent developments

- 23.1.11.3.1 Deals

- 23.1.11.3.2 Other developments

- 23.1.12 LOCKHEED MARTIN CORPORATION

- 23.1.12.1 Business overview

- 23.1.12.2 Products offered

- 23.1.13 TKMS

- 23.1.13.1 Business overview

- 23.1.13.2 Products offered

- 23.1.13.3 Recent developments

- 23.1.13.3.1 Other developments

- 23.1.14 BOSTON ENGINEERING

- 23.1.14.1 Business overview

- 23.1.14.2 Products offered

- 23.1.14.3 Recent developments

- 23.1.14.3.1 Other developments

- 23.1.15 BOEING

- 23.1.15.1 Business overview

- 23.1.15.2 Products offered

- 23.1.15.3 Recent developments

- 23.1.15.3.1 Other developments

- 23.1.16 XYLEM INC

- 23.1.16.1 Business overview

- 23.1.16.2 Products offered

- 23.1.16.3 Recent developments

- 23.1.16.3.1 Deals

- 23.1.16.4 Other developments

- 23.1.17 INTERNATIONAL SUBMARINE ENGINEERING LIMITED

- 23.1.17.1 Business overview

- 23.1.17.2 Products offered

- 23.1.17.3 Recent developments

- 23.1.17.3.1 Product launches

- 23.1.17.3.2 Other developments

- 23.1.18 NORTHROP GRUMMAN

- 23.1.18.1 Business overview

- 23.1.18.2 Products offered

- 23.1.18.3 Recent developments

- 23.1.18.3.1 Other developments

- 23.1.19 AEROVIRONMENT, INC.

- 23.1.19.1 Business overview

- 23.1.19.2 Products offered

- 23.1.19.3 Recent developments

- 23.1.19.3.1 Product launches

- 23.1.19.3.2 Deals

- 23.1.19.3.3 Other developments

- 23.1.20 FORUM ENERGY TECHNOLOGIES, INC.

- 23.1.20.1 Business overview

- 23.1.20.2 Products offered

- 23.1.20.3 Recent developments

- 23.1.20.3.1 Product launches

- 23.1.20.3.2 Deals

- 23.1.20.3.3 Other developments

- 23.1.1 KONGSBERG

- 23.2 OTHER PLAYERS

- 23.2.1 MSUBS

- 23.2.2 FALMOUTH SCIENTIFIC, INC

- 23.2.3 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 23.2.4 ECOSUB ROBOTICS

- 23.2.5 EELUME AS

- 23.2.6 HYDROMEA

- 23.2.7 GRAAL TECH SRL

- 23.2.8 BALTROBOTICS

- 23.2.9 OCEANSCAN - MARINE SYSTEMS & TECHNOLOGY

- 23.2.10 RTSYS

- 23.2.11 BLUEYE ROBOTICS

- 23.2.12 EYEROV

24 RESEARCH METHODOLOGY

- 24.1 RESEARCH DATA

- 24.1.1 SECONDARY DATA

- 24.1.1.1 Key data from secondary sources

- 24.1.2 PRIMARY DATA

- 24.1.2.1 Primary interview participants

- 24.1.2.2 Key data from primary sources

- 24.1.2.3 Breakdown of primary interviews

- 24.1.2.4 Key industry insights

- 24.1.1 SECONDARY DATA

- 24.2 FACTOR ANALYSIS

- 24.2.1 SUPPLY-SIDE INDICATORS

- 24.2.2 DEMAND-SIDE INDICATORS

- 24.3 MARKET SIZE ESTIMATION

- 24.3.1 BOTTOM-UP APPROACH

- 24.3.2 TOP-DOWN APPROACH

- 24.3.3 BASE NUMBER CALCULATION

- 24.4 DATA TRIANGULATION

- 24.5 RESEARCH ASSUMPTIONS

- 24.6 RESEARCH LIMITATIONS

- 24.7 RISK ASSESSMENT

25 APPENDIX

- 25.1 DISCUSSION GUIDE

- 25.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 25.3 CUSTOMIZATION OPTIONS

- 25.4 RELATED REPORTS

- 25.5 AUTHOR DETAILS