|

시장보고서

상품코드

1901406

유기산 시장 : 유래별, 유형별, 형태별, 용도별, 기능별, 지역별 - 예측(-2030년)Organic Acids Market by Type (Acetic Acid, Citric Acid, Formic Acid, Lactic Acid, Propionic Acid), Application (Food & Beverages, Feed, Industrial, Pharmaceutical, Agriculture), Source, Form, Function, and Region - Global Forecast to 2030 |

||||||

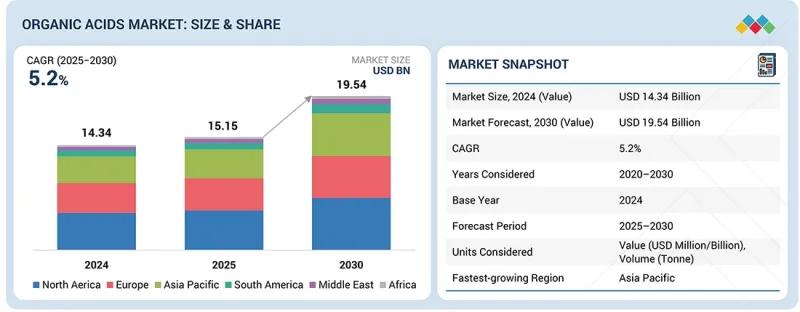

유기산 시장 규모는 2025년에 151억 5,000만 달러 규모와 추정되어 예측 기간 중에 CAGR 5.2%로 성장하여 2030년까지 195억 4,000만 달러에 이를 전망입니다. 시장 확대는 특히 식품, 음료, 동물 영양 분야에서 천연 유래, 바이오, 클린 라벨 원료에 수요 증가에 의해서 촉진 되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 기간 | 2025-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 대상 단위 | 금액(달러) 및 1,000톤 |

| 부문 | 유래별, 유형별, 형태별, 용도별, 기능별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미, 기타 지역 |

건강과 지속가능성에 대한 소비자의 인식이 높아지면서 친환경 제조 공정으로의 전환과 함께 전 세계적으로 확산되고 있습니다. 또한, 바이오 발효 및 순환형 생산 모델과 같은 기술 혁신과 더불어 유럽, 북미 등의 지역에서의 지원적인 규제 프레임워크가 시장 성장을 가속하고 있습니다. 기업들이 저탄소 및 재생 가능한 생산 방식에 대한 투자를 늘리면서 유기산 산업은 광범위한 바이오 화학 분야에서 지속 가능한 성장과 혁신의 핵심 동력으로 부상하고 있습니다.

축산 부문은 사료용 산성화제, 방부제, 동물 영양의 성능 향상제로 광범위하게 사용됨에 따라 세계 유기산 시장에서 중요한 점유율을 차지할 것으로 예측됩니다. 포름산, 젖산, 구연산, 프로피온산 등의 유기산은 최적의 장내 환경 유지, 영양 흡수 개선, 사료 내 미생물 오염 방지에 중요한 역할을 합니다. 시장에서는 항생제를 사용하지 않고 지속 가능한 축산을 지원하기 위한 전략적 발전과 제품 혁신이 이루어지고 있습니다. 2025년 1월, 카길은 아시아태평양에서 가금류의 장 건강과 사료 효율을 향상시키는 새로운 유기산 기반 사료 첨가제를 출시했습니다. 마찬가지로, 2024년 6월 Kemin Industries는 캡슐화된 포름산 칼슘과 구연산을 결합한 첨단 산성화제 'Formyl(TM)'을 도입하여 돼지의 병원체 부하를 감소시켰습니다. 이러한 개발은 유기산이 동물의 생산성, 사료 품질 및 전체 축산업 생산성을 향상시키는 데 중요한 역할을 한다는 것을 강조하고 있습니다.

유기산의 건조 형태는 보존 기간 연장, 취급 용이성, 자동화 제조 및 공급 시스템과의 우수한 호환성으로 인해 식품, 사료, 농업 분야에서 강력한 지지를 받고 있습니다. 고체 상태에서의 안정성은 오염 위험을 최소화하고 스마트한 폐쇄 루프 생산 환경에 통합하기에 적합합니다. 특히 제빵, 제과, 가공식품 산업에서 수요가 높으며, 건조 유기산은 합성 방부제 없이도 제품의 신선도 유지, 풍미 개선, 미생물학적 안정성 확보에 기여합니다. 또한, 건조 형태는 비용 효율적인 보관 및 운송을 가능하게 하고, 특수 콜드체인의 필요성을 제거하여 물류 효율성을 향상시킵니다. 전 세계적으로 천연 유래, 클린 라벨, 지속 가능한 원료로의 전환이 가속화됨에 따라 건조 유기산 부문은 꾸준한 성장이 예상됩니다. 캡슐화 기술 및 서방형 제제의 발전으로 그 효능이 더욱 높아져 식품 보존 및 사료 개선을 위한 효율적이고 안정적이며 친환경적인 솔루션을 찾는 다양한 분야에서 채택을 촉진하고 있습니다.

유럽은 예측 기간 동안 세계 유기산 시장에서 두 번째로 높은 CAGR로 성장할 것으로 추정 및 예측됩니다. 이는 산업적 용도의 확대, 지속가능성에 대한 강한 관심, 바이오 화학제품 생산에 대한 투자 증가에 의해 주도되고 있습니다. BASF SE, Corbion N.V. 등 유럽의 주요 기업들은 저탄소 및 순환형 제조 혁신을 통해 이러한 변화를 주도하고 있습니다. BASF가 2022년 9월에 발표한 프로피온산 'ZeroPCF'는 원료 조달부터 제조 공정까지 탄소 발자국이 제로인 것이 특징이며, 재생 가능한 원료와 에너지에 초점을 맞추고 있다는 것을 보여줍니다. 마찬가지로, 네덜란드에 본사를 둔 콜비온이 태국에 건설을 발표한 순환형 젖산 공장은 저배출 생산 모델 개발에서 유럽의 기술 리더십을 반영하고 있습니다. 식품, 사료, 제약 산업에서 유기산에 대한 수요 증가와 유럽 그린딜에 기반한 지원 정책이 결합되어 이 지역의 지속가능한 생산으로의 전환을 촉진하고 있습니다. 또한, 석유화학 공정에서 발효 기반 공정으로의 전환을 통해 유럽은 친환경 유기산 생산의 거점으로서 입지를 굳건히 하고, 세계 시장 확대의 주요 기여자로서의 역할을 확고히 하고 있습니다.

주요 기업으로는 BASF SE(독일), Cargill, Incorporated(미국), Archer Daniels Midland Company(미국), Celanese Corporation(미국), Eastman Chemical Company(미국), Tate & Lyle PLC(영국), Koninklijke DSM N.V.(네덜란드), Henan Jindan L.V.(네덜란드), Corbion(네덜란드), Tate & Lyle PLC(영국) 미국), Corbion(네덜란드), Tate & Lyle PLC(영국), Koninklijke DSM N.V.(네덜란드), Henan Jindan Lactic Acid Technology(중국), Myriant Corporation(미국), Jungbunzlauer Suisse, Inc. Jungbunzlauer Suisse AG(스위스), The Dow Chemical Company(미국) 등이 있습니다.

조사 범위

유기산 시장을 유형별(아세트산, 구연산, 포름산, 젖산, 프로피온산, 아스코르브산, 글루콘산, 푸마르산, 말산, 사과산, 기타), 용도별(식음료, 사료, 제약, 공업, 농업), 원료원(바이오 및 합성), 형태별(건조 및 액체), 기능별(산미료, 향미증진제, 보존제, 향미증진제, 항산화제, pH 조절제), 지역별로 분석하였습니다. 방부제, 향미증진제, 항산화제, pH조절제), 지역별로 분석했습니다. 이 보고서의 조사 범위에는 유기산 시장의 성장에 영향을 미치는 주요 요인(시장 성장 촉진요인, 저해요인, 과제, 성장 기회 등)에 대한 자세한 정보가 포함되어 있습니다. 주요 산업 기업에 대한 상세한 분석을 통해 사업 개요, 솔루션 서비스, 주요 전략, 계약, 제휴 및 합의에 대한 통찰력을 제공합니다. 본 조사에서는 유기산 시장과 관련된 신제품 및 서비스 출시, 인수합병, 최근 동향에 대해서도 조사하였습니다. 또한, 유기산 시장 생태계의 신생 스타트업 기업의 경쟁 분석도 포함되어 있습니다.

본 보고서 구매의 장점

이 보고서는 시장 리더와 신규 시장 진출기업에게 전체 유기산 시장 및 하위 부문의 수익 규모에 대한 가장 정확한 추정치를 제공합니다. 또한, 이해관계자들이 경쟁 구도를 이해하고, 사업 포지셔닝을 최적화하고 적절한 시장 진출 전략을 수립하는 데 도움이 되는 통찰력을 얻을 수 있도록 돕습니다. 또한, 시장 동향을 파악하고 주요 시장 성장 촉진요인, 시장 성장 억제요인, 과제, 기회에 대한 정보를 제공합니다.

이 보고서는 다음 사항에 대한 통찰력을 제공합니다.

1. 유형별, 원료별, 용도별 상세 세분화 - 본 보고서는 유기산 시장을 유형별(아세트산, 구연산, 포름산, 젖산, 프로피온산, 아스코르브산, 글루콘산, 푸마르산, 말산, 말산, 기타), 용도(식음료, 사료, 제약, 산업, 농업), 원료(바이오), 형태(건조 및 합성), 기능(산미증진제, 향미증진제, 항산화제, pH 조절제) 및 합성), 형태(건조 및 액체), 기능(산미료, 방부제, 향미증진제, 항산화제, pH 조절제)으로 분류합니다. 이러한 세분화를 통해 이해관계자들은 고성장 분야를 파악하고, 제품 개발을 최적화하며, 공급망에 따라 전략적으로 제품을 포지셔닝할 수 있습니다.

2. 신흥 시장에 초점을 맞춘 지역별 인사이트 - 이 보고서는 아시아태평양, 남미 등 급성장하는 시장에서의 성장 기회를 강조하고 지역별, 국가별 상세 분석을 제공합니다. 다양한 산업분야에서 유기산 도입에 영향을 미치는 지역 정책, 규제 프레임워크, 수요 동향을 살펴봅니다. 또한, 바이오 화학제품 생산을 촉진하는 투자 동향과 정부 정책을 개괄하고, 이들 고성장 지역에서의 사업 확장, 제조 현지화, 시장 입지 강화를 목표로 하는 기업들에게 귀중한 정보를 제공합니다.

3. 경쟁 정보 및 혁신 동향 - BASF SE, Corbion N.V., Cargill Incorporated, Kemin Industries 등 주요 기업의 종합적인 프로파일을 수록하고, 전략적 동향과 기술 혁신에 대한 상세한 분석을 제공합니다. 신제품 출시, 생산능력 확장, 인수합병, R&D 이니셔티브 등 주요 동향을 추적하고, 이해관계자들이 성과를 벤치마킹하고, 유기산 시장을 형성하는 새로운 혁신 트렌드를 파악할 수 있도록 지원합니다.

4. 데이터 기반 수요 예측 - 2030년까지 시장 규모 추정치 및 성장 예측은 강력한 하향식 및 상향식 분석 기법을 통해 도출되었으며, 전문가와의 협의 및 공식 무역 데이터를 통해 검증되었습니다. 이러한 예측은 세계 유기산 산업의 전략적 투자 계획, 생산 확대 및 장기적인 기회 평가에 대한 신뢰할 수 있는 통찰력을 제공합니다.

자주 묻는 질문

목차

제1장 서론

제2장 주요 요약

제3장 프리미엄 인사이트

제4장 시장 개요

- 시장 역학

- 미충족 요구와 공백

- 연결된 시장과 분야간 기회

- Tier1/2/3 기업의 전략적 움직임

제5장 업계 동향

- Porter의 Five Forces 분석

- 거시경제 지표

- 공급망 분석

- 밸류체인 분석

- 생태계 분석

- 가격 분석

- 무역 분석

- 2026년 주요 컨퍼런스 및 이벤트

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 2025년 미국 관세의 영향-유기산 시장

제6장 기술 진보, AI에 의한 영향, 특허, 혁신, 향후 응용

- 주요 신기술

- 보완적 기술

- 기술/제품 로드맵

- 특허 분석

- 향후 응용

- AI/생성형 AI가 유기산 시장에 미치는 영향

- 성공 사례와 실세계에의 응용

제7장 지속가능성과 규제 상황

- 지역 규제와 컴플라이언스

- 지속가능성 이니셔티브

- 규제 정책이 지속가능성 구상에 미치는 영향

- 인증, 라벨, 환경기준

제8장 고객 상황과 구매 행동

- 의사결정 프로세스

- 구매 프로세스에 관여하는 주요 이해관계자와 평가 기준

- 채택 장벽과 내부 과제

- 다양한 최종 이용 산업에서의 미충족 요구

- 시장 수익성

제9장 유기산 시장(유래별)

- 바이오

- 합성

제10장 유기산 시장(유형별)

- 아세트산

- 구연산

- 포름산

- 젖산

- 프로피온산

- 아스코르브산

- 글루콘산

- 푸마르산

- 사과산

- 기타

제11장 유기산 시장(형태별)

- 건조

- 액체

제12장 유기산 시장(용도별)

- 식품 및 음료

- 의약품

- 산업용

- 기타

제13장 유기산 시장(기능별)

- 산미료

- 방부제

- 풍미 증강제

- 항산화물질

- pH 조절제

제14장 유기산 시장(지역별)

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 이탈리아

- 프랑스

- 스페인

- 영국

- 기타

- 아시아태평양

- 중국

- 인도

- 일본

- 호주 및 뉴질랜드

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

- 기타 지역

- 중동

- 아프리카

제15장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점, 2021년-2024년

- 매출 분석, 2022년-2024년

- 시장 점유율 분석, 2024년

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제16장 기업 개요

- 주요 시장 진출기업

- BASF SE

- ADM

- CARGILL, INCORPORATED

- CORBION

- JUNGBUNZLAUER SUISSE AG

- THE DOW CHEMICAL COMPANY

- EASTMAN CHEMICAL COMPANY

- DSM-FIRMENICH

- POLYNT S.P.A.

- CELANESE CORPORATION

- TATE & LYLE

- HENAN JINDAN LACTIC ACID TECHNOLOGY CO., LTD.

- SHANDONG ENSIGN INDUSTRY CO., LTD.

- FOODCHEM INTERNATIONAL CORPORATION

- AFYREN

- GALACTIC

- 기타 기업

- HAWKINS

- BBCA BIOCHEMICAL

- RZBC GROUP CO., LTD.

- BARTEK INGREDIENTS INC.

- FUSO CHEMICAL CO., LTD.

- VINIPUL CHEMICALS PRIVATE LIMITED

- GEOCON PRODUCTS

- LOBA CHEMIE PVT. LTD.

- CITNVBEL NV

- PEER CHEMICAL INDUSTRIES

- SHANDONG ACID TECHNOLOGY CO., LTD.

제17장 조사 방법

제18장 인접 시장과 관련 시장

제19장 부록

LSH 26.01.15The organic acids market is estimated to be valued at USD 15.15 billion in 2025 and is projected to reach USD 19.54 billion by 2030, growing at a CAGR of 5.2% during the forecast period. The market's expansion is driven by rising demand for natural, bio-based, and clean-label ingredients, particularly in the food, beverage, and animal nutrition sectors.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) and Volume (KT) |

| Segments | Type, Source, Application, Form, Function, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, RoW |

Growing consumer awareness of health and sustainability, coupled with the shift toward eco-friendly manufacturing processes, is propelling adoption globally. Moreover, technological innovations, such as bio-fermentation and circular production models, along with supportive regulatory frameworks in regions like Europe and North America, are enhancing market growth. As companies increasingly invest in low-carbon and renewable production methods, the organic acids industry is emerging as a key enabler of sustainable growth and innovation within the broader bio-based chemicals landscape.

"The livestock application segment is estimated to witness a significant share during the forecast period."

The livestock segment is projected to have a significant share in the global organic acids market, driven by their extensive use as feed acidifiers, preservatives, and performance enhancers in animal nutrition. Organic acids such as formic, lactic, citric, and propionic acids play a crucial role in maintaining optimal gut health, improving nutrient absorption, and preventing microbial contamination in feed. The market is witnessing strategic advancements and product innovations aimed at supporting antibiotic-free and sustainable animal production. In January 2025, Cargill Incorporated launched a new organic-acid-based feed additive in the Asia Pacific region to enhance poultry gut health and feed efficiency. Similarly, in June 2024, Kemin Industries introduced FORMYL(TM), an advanced acidifier combining encapsulated calcium formate and citric acid to reduce pathogen load in swine. These developments highlight the pivotal role of organic acids in promoting animal performance, feed quality, and overall livestock productivity.

"The dry formulation segment is estimated to maintain robust growth."

Dry forms of organic acids are gaining strong preference across food, feed, and agriculture applications due to their extended shelf life, ease of handling, and excellent compatibility with automated manufacturing and feeding systems. Their solid-state stability minimizes contamination risks, making them well-suited for integration into smart and closed-loop production environments. This demand is particularly high in the bakery, confectionery, and processed food industries, where dry organic acids help maintain product freshness, enhance flavor, and ensure microbial stability without the need for synthetic preservatives. Additionally, the dry form supports cost-effective storage and transportation, eliminating the need for specialized cold chains and improving logistical efficiency. As the global shift toward natural, clean-label, and sustainable ingredients accelerates, the dry organic acids segment is poised for steady growth. Technological advancements in encapsulation and controlled-release formulations are further enhancing their effectiveness, driving adoption across diverse sectors seeking efficient, stable, and eco-friendly solutions for food preservation and feed enhancement.

"Europe is estimated to grow at the second-highest CAGR in the organic acids market."

Europe is estimated to grow at the second-highest CAGR in the global organic acids market during the forecast period, driven by expanding industrial applications, a strong focus on sustainability, and increased investments in bio-based chemical production. Major European players, such as BASF SE and Corbion N.V., are leading this transformation through innovations in low-carbon and circular manufacturing. BASF's launch of Propionic Acid ZeroPCF in September 2022, featuring a cradle-to-gate carbon footprint of zero, underscores the region's commitment to renewable raw materials and energy. Similarly, Corbion's circular lactic acid plant in Thailand, announced by its Netherlands-based parent company, reflects Europe's technological leadership in developing low-emission production models. The growing demand for organic acids in food, feed, and pharmaceutical industries, coupled with supportive policies under the European Green Deal, is propelling the region's transition toward sustainable production. Additionally, the shift from petrochemical to fermentation-based processes positions Europe as a hub for eco-efficient organic acid manufacturing, solidifying its role as a key contributor to the market's global expansion.

In-depth interviews were conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the organic acids market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors - 20%, Managers - 50%, Executives - 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World (Middle East and Africa) - 10%

Prominent companies in the market include BASF SE (Germany), Cargill, Incorporated (US), Archer Daniels Midland Company (US), Celanese Corporation (US), Eastman Chemical Company (US), Corbion (Netherlands), Tate & Lyle PLC (UK), Koninklijke DSM N.V. (Netherlands), Henan Jindan Lactic Acid Technology Co., Ltd. (China), Myriant Corporation (US), Jungbunzlauer Suisse AG (Switzerland), and The Dow Chemical Company (US).

Research Coverage

This research report categorizes the organic acids market by type (acetic acid, citric acid, formic acid, lactic acid, propionic acid, ascorbic acid, gluconic acid, fumaric acid, malic acid, and others), application (food & beverages, feed, pharmaceutical, industrial, and agriculture), source (bio-based and synthetic), form (dry and liquid), function (acidulant, preservative, flavor enhancer, antioxidants, and pH control agents), and region. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the organic acids market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, and agreements. The study includes new product & service launches, mergers & acquisitions, and recent developments associated with the organic acids market. This report also includes a competitive analysis of emerging startups in the organic acids market ecosystem.

Reasons to buy this report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall organic acids and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

1. In-depth Segmentation across Type, Source, and Application: This report offers an in-depth analysis of the organic acids market, categorizing it by type (acetic acid, citric acid, formic acid, lactic acid, propionic acid, ascorbic acid, gluconic acid, fumaric acid, malic acid, and others), application (food & beverages, feed, pharmaceutical, industrial, agriculture), source (bio-based and synthetic), form (dry and liquid), function (acidulant, preservative, flavor enhancer, antioxidants, and pH control agents). Such detailed segmentation enables stakeholders to pinpoint high-growth areas, optimize product development, and strategically position offerings along the supply chain.

2. Region-specific Insights with Focus on Emerging Markets: The report delivers in-depth regional and country-level analysis, highlighting growth opportunities in fast-expanding markets such as the Asia Pacific and South America. It examines regional policies, regulatory frameworks, and demand dynamics influencing the adoption of organic acids across various industries. Additionally, the study outlines investment trends and government initiatives promoting bio-based chemical production, offering valuable insights for companies aiming to expand, localize manufacturing, or strengthen their market presence in these high-potential regions.

3. Competitive Intelligence and Innovation Landscape: Comprehensive profiles of key players such as BASF SE, Corbion N.V., Cargill Incorporated, and Kemin Industries are included, detailing their strategic moves and technological innovations. The report tracks major developments, including new product launches, capacity expansions, mergers & acquisitions, and R&D initiatives, enabling stakeholders to benchmark performance and identify emerging innovation trends shaping the organic acids market.

4. Demand Forecasts Backed by Data-driven Methodologies: Market size estimations and growth projections up to 2030 are derived using robust top-down and bottom-up analytical approaches, validated through expert consultations and official trade data. These forecasts offer reliable insights for strategic investment planning, production expansion, and long-term opportunity assessment within the global organic acids industry.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNITS CONSIDERED

- 1.4.1 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ORGANIC ACIDS MARKET

- 3.2 ORGANIC ACIDS MARKET: SHARE OF MAJOR REGIONAL SUBMARKETS

- 3.3 ASIA PACIFIC: ORGANIC ACIDS MARKET, BY APPLICATION AND COUNTRY

- 3.4 ORGANIC ACIDS MARKET, BY APPLICATION AND REGION

- 3.5 ORGANIC ACIDS MARKET, BY FORM

- 3.6 ORGANIC ACIDS MARKET, BY SOURCE

- 3.7 ORGANIC ACIDS MARKET, BY TYPE

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Multifunctional roles and applications of organic acids in food safety and quality

- 4.2.1.2 Rising health consciousness

- 4.2.1.3 Growing use of sustainable formic acid in animal feed preservation

- 4.2.2 RESTRAINTS

- 4.2.2.1 Regulatory compliance and labeling requirements

- 4.2.2.2 Increased transportation and logistics expenses

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Emergence of organic acids in personal care and cosmetic formulations

- 4.2.3.2 Innovations in technologies and wide industry scope

- 4.2.4 CHALLENGES

- 4.2.4.1 Maintaining consistent product quality due to fermentation variability

- 4.2.4.2 Intense competition from large-scale chemical manufacturers offering low-cost synthetic acids

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 INTRODUCTION

- 4.3.2 EMERGING GAPS AND INNOVATION WHITE SPACES

- 4.3.2.1 Inconsistent fermentation performance at commercial scale

- 4.3.2.2 Overdependence on food-grade feedstocks and limited alternative inputs

- 4.3.2.3 High cost and energy intensity of downstream purification

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 AGRICULTURE AND FOOD PROCESSING

- 4.4.2 PHARMACEUTICALS AND HEALTHCARE

- 4.4.3 INDUSTRIAL CHEMICALS AND MATERIALS

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.5.1 STRATEGIC MOVES BY KEY PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.2.2 BARGAINING POWER OF SUPPLIERS

- 5.2.3 BARGAINING POWER OF BUYERS

- 5.2.4 THREAT OF SUBSTITUTES

- 5.2.5 THREAT OF NEW ENTRANTS

- 5.3 MACROECONOMIC INDICATORS

- 5.3.1 GROWTH IN GLOBAL POPULATION AND FOOD DEMAND

- 5.3.2 STABLE GLOBAL GDP GROWTH AND MACRO PROJECTIONS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 DEMAND SIDE

- 5.6.2 SUPPLY SIDE

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF ORGANIC ACIDS, BY TYPE

- 5.7.2 AVERAGE SELLING PRICE TREND OF ORGANIC ACIDS, BY REGION

- 5.8 TRADE ANALYSIS

- 5.8.1 TRADE ANALYSIS OF ORGANIC ACIDS

- 5.8.1.1 Export trends of acetic acids under HS code 291521 (2020-2024)

- 5.8.1.2 Import trends of acetic acids under HS code 291521 (2020-2024)

- 5.8.1.3 Export trends of formic acids under HS code 291511 (2020-2024)

- 5.8.1.4 Import trends of formic acids under HS code 291511 (2020-2024)

- 5.8.1 TRADE ANALYSIS OF ORGANIC ACIDS

- 5.9 KEY CONFERENCES AND EVENTS, 2026

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 INVESTMENT AND FUNDING SCENARIO

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 JUNGBUNZLAUER INSTALLED LARGE-SCALE INDUSTRIAL HEAT PUMPS THAT CAPTURE EXCESS HEAT FROM FERMENTATION

- 5.12.2 DOW PARTNERED WITH KEMIN INDUSTRIES AND ADESCO NUTRICINES TO CONDUCT GATE-TO-GATE LIFE CYCLE ASSESSMENT

- 5.13 IMPACT OF 2025 US TARIFF - ORGANIC ACIDS MARKET

- 5.13.1 INTRODUCTION

- 5.13.2 KEY TARIFF RATES

- 5.13.3 PRICE IMPACT ANALYSIS

- 5.13.4 IMPACT ON COUNTRY/REGION

- 5.13.4.1 US

- 5.13.4.2 European Union

- 5.13.4.3 China

- 5.13.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS

- 6.1 INTRODUCTION

- 6.2 KEY EMERGING TECHNOLOGIES

- 6.3 COMPLEMENTARY TECHNOLOGIES

- 6.4 TECHNOLOGY/PRODUCT ROADMAP

- 6.5 PATENT ANALYSIS

- 6.5.1 LIST OF MAJOR PATENTS

- 6.6 FUTURE APPLICATIONS

- 6.7 IMPACT OF AI/GEN AI ON ORGANIC ACIDS MARKET

- 6.7.1 TOP USE CASES AND MARKET POTENTIAL

- 6.7.2 CASE STUDIES ON AI IMPLEMENTATION IN ORGANIC ACIDS MARKET

- 6.7.2.1 Using Gen AI to enable proper extraction conditions

- 6.7.2.2 AI transforms bioreactor sensor data into dynamic videos showing microbial growth

- 6.7.3 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.7.4 CLIENTS' READINESS TO ADOPT GENERATIVE AI IN ORGANIC ACIDS MARKET

- 6.8 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 INTRODUCTION

- 7.2 REGIONAL REGULATIONS AND COMPLIANCE

- 7.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.2.2 INDUSTRY STANDARDS

- 7.3 SUSTAINABILITY INITIATIVES

- 7.3.1 CORBION'S BIO-BASED LACTIC ACID & CIRCULAR FERMENTATION MODEL

- 7.4 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES

- 7.5 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 INTRODUCTION

- 8.2 DECISION-MAKING PROCESS

- 8.3 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA

- 8.3.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.3.2 BUYING CRITERIA

- 8.4 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.5 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES

- 8.6 MARKET PROFITABILITY

9 ORGANIC ACIDS MARKET, BY SOURCE

- 9.1 INTRODUCTION

- 9.2 BIO-BASED

- 9.2.1 COST-EFFECTIVENESS AND HIGH STABILITY PROPERTIES TO PROPEL DEMAND

- 9.3 SYNTHETIC

- 9.3.1 EASY AVAILABILITY AND CONSISTENT QUALITY TO DRIVE MARKET

10 ORGANIC ACIDS MARKET, BY TYPE

- 10.1 INTRODUCTION

- 10.2 ACETIC ACID

- 10.2.1 EXTENSIVE APPLICATIONS IN VARIOUS INDUSTRIES TO BOOST MARKET

- 10.3 CITRIC ACID

- 10.3.1 INCREASING ROLE IN FEED FORMULATIONS AND FEED PRESERVATION TO DRIVE MARKET

- 10.4 FORMIC ACID

- 10.4.1 INNOVATIONS BY MARKET PLAYERS TO DRIVE DEMAND

- 10.5 LACTIC ACID

- 10.5.1 BIODEGRADABILITY AND VERSATILITY TO DRIVE DEMAND

- 10.6 PROPIONIC ACID

- 10.6.1 GROWING USE IN VARIOUS INDUSTRIES TO DRIVE DEMAND

- 10.7 ASCORBIC ACID

- 10.7.1 RISING AWARENESS ABOUT NUTRITIONAL VALUE AND IMMUNE-BOOSTING PROPERTIES TO DRIVE MARKET

- 10.8 GLUCONIC ACID

- 10.8.1 GROWING RELEVANCE IN PROMOTING ENVIRONMENTAL SUSTAINABILITY AND PRODUCT INNOVATION TO DRIVE DEMAND

- 10.9 FUMARIC ACID

- 10.9.1 RISING DEMAND FOR PROCESSED FOOD AND FUNCTIONAL INGREDIENTS TO FUEL MARKET

- 10.10 MALIC ACID

- 10.10.1 MULTIFUNCTIONAL PROPERTIES TO DRIVE DEMAND

- 10.11 OTHER TYPES

11 ORGANIC ACIDS MARKET, BY FORM

- 11.1 INTRODUCTION

- 11.2 DRY

- 11.2.1 CONVENIENCE IN STORAGE, HANDLING, AND TRANSPORTATION TO DRIVE DEMAND

- 11.3 LIQUID

- 11.3.1 UNIFORM MIXING AND PRECISE DOSING OF LIQUID ORGANIC ACIDS TO PROPEL DEMAND

12 ORGANIC ACIDS MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 FOOD & BEVERAGES

- 12.2.1 DEMAND FOR CLEAN-LABEL AND NATURAL INGREDIENTS TO DRIVE MARKET

- 12.2.1.1 Beverages

- 12.2.1.2 Dairy products

- 12.2.1.3 Bakery and confectionery

- 12.2.1.4 Meat and processed meat

- 12.2.1.5 Canned and processed foods

- 12.2.1.6 Nutritional and dietary supplements

- 12.2.1.7 Others

- 12.2.1 DEMAND FOR CLEAN-LABEL AND NATURAL INGREDIENTS TO DRIVE MARKET

- 12.3 PHARMACEUTICALS

- 12.3.1 GROWING NEED FOR FORMULATION STABILITY AND FUNCTIONAL EXCIPIENTS TO DRIVE MARKET

- 12.4 INDUSTRIAL

- 12.4.1 INCREASING USE OF BIO-BASED INTERMEDIATES AND PROCESS CHEMICALS TO DRIVE MARKET

- 12.5 OTHERS

13 ORGANIC ACIDS MARKET, BY FUNCTION

- 13.1 INTRODUCTION

- 13.2 ACIDULANTS

- 13.2.1 IMPROVING FLAVOR PROFILE OF BEVERAGES, CONFECTIONERY, AND BAKERY PRODUCTS

- 13.3 PRESERVATIVES

- 13.3.1 PREVENTING SPOILAGE AND EXTENDING SHELF LIFE IN BAKERY ITEMS, BEVERAGES, AND DAIRY PRODUCTS

- 13.4 FLAVOR ENHANCERS

- 13.4.1 ENHANCING TASTE, STABILITY, AND CONSUMER APPEAL IN NATURAL AND PROCESSED FOODS

- 13.5 ANTIOXIDANTS

- 13.5.1 EFFECTIVE ROLE IN SUPPORTING BETTER FOOD PRODUCTIVITY

- 13.6 PH CONTROL AGENTS

- 13.6.1 REGULATING ACIDITY, STABILIZING FORMULATIONS, AND MAINTAINING PRODUCT QUALITY

14 ORGANIC ACIDS MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 NORTH AMERICA

- 14.2.1 US

- 14.2.1.1 Increasing demand for organic acid products to boost market

- 14.2.2 CANADA

- 14.2.2.1 Increased production of poultry products to boost market

- 14.2.3 MEXICO

- 14.2.3.1 Expanding food processing industry to drive market

- 14.2.1 US

- 14.3 EUROPE

- 14.3.1 GERMANY

- 14.3.1.1 Growing use in biodegradable materials, preservatives, and specialty chemicals to drive demand for organic acids

- 14.3.2 ITALY

- 14.3.2.1 Growing industry demand for renewable organic acid solutions with high purity and lower environmental impact to drive market

- 14.3.3 FRANCE

- 14.3.3.1 Partnerships among key players and increasing focus on sustainability to drive market

- 14.3.4 SPAIN

- 14.3.4.1 Expanding application areas to drive market

- 14.3.5 UK

- 14.3.5.1 Rising demand for high-performance acids to drive market

- 14.3.6 REST OF EUROPE

- 14.3.1 GERMANY

- 14.4 ASIA PACIFIC

- 14.4.1 CHINA

- 14.4.1.1 Robust food, beverage, and biotechnology sectors to drive demand for organic acids

- 14.4.2 INDIA

- 14.4.2.1 Increasing industrial demand and government initiatives to strengthen domestic production to drive market

- 14.4.3 JAPAN

- 14.4.3.1 Increasing industrial demand and advancements in bio-based production technologies to drive market

- 14.4.4 AUSTRALIA & NEW ZEALAND

- 14.4.4.1 Increasing demand for sustainable chemicals to drive market

- 14.4.5 REST OF ASIA PACIFIC

- 14.4.1 CHINA

- 14.5 SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.5.1.1 Growing import of organic acids to create opportunities for domestic producers and international manufacturers

- 14.5.2 ARGENTINA

- 14.5.2.1 Rising agricultural and industrial needs to drive market

- 14.5.3 REST OF SOUTH AMERICA

- 14.5.1 BRAZIL

- 14.6 REST OF THE WORLD

- 14.6.1 MIDDLE EAST

- 14.6.1.1 Increasing demand for bio-based acids to fuel market

- 14.6.2 AFRICA

- 14.6.2.1 Growing use of organic acids in food applications to propel market

- 14.6.1 MIDDLE EAST

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 15.3 REVENUE ANALYSIS, 2022-2024

- 15.4 MARKET SHARE ANALYSIS, 2024

- 15.5 BRAND/PRODUCT COMPARISON

- 15.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 15.6.1 STARS

- 15.6.2 EMERGING LEADERS

- 15.6.3 PERVASIVE PLAYERS

- 15.6.4 PARTICIPANTS

- 15.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 15.6.5.1 Company footprint

- 15.6.5.2 Regional footprint

- 15.6.5.3 Type footprint

- 15.6.5.4 Application footprint

- 15.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 15.7.1 PROGRESSIVE COMPANIES

- 15.7.2 RESPONSIVE COMPANIES

- 15.7.3 DYNAMIC COMPANIES

- 15.7.4 STARTING BLOCKS

- 15.7.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2024

- 15.7.5.1 Detailed list of key startups/SMEs

- 15.7.5.2 Competitive benchmarking of key startups/SMEs

- 15.8 COMPETITIVE SCENARIO

- 15.8.1 PRODUCT LAUNCHES

- 15.8.2 DEALS

- 15.8.3 EXPANSIONS

16 COMPANY PROFILES

- 16.1 KEY PLAYERS

- 16.1.1 BASF SE

- 16.1.1.1 Business overview

- 16.1.1.2 Products/Solutions/Services offered

- 16.1.1.3 Recent developments

- 16.1.1.3.1 Product launches

- 16.1.1.4 MnM view

- 16.1.1.4.1 Key strengths

- 16.1.1.4.2 Strategic choices

- 16.1.1.4.3 Weaknesses and competitive threats

- 16.1.2 ADM

- 16.1.2.1 Business overview

- 16.1.2.2 Products/Solutions/Services offered

- 16.1.2.3 Recent developments

- 16.1.2.3.1 Deals

- 16.1.2.4 MnM view

- 16.1.2.4.1 Key strengths

- 16.1.2.4.2 Strategic choices

- 16.1.2.4.3 Weaknesses and competitive threats

- 16.1.3 CARGILL, INCORPORATED

- 16.1.3.1 Business overview

- 16.1.3.2 Products/Solutions/Services offered

- 16.1.3.3 MnM view

- 16.1.3.3.1 Key strengths

- 16.1.3.3.2 Strategic choices

- 16.1.3.3.3 Weaknesses and competitive threats

- 16.1.4 CORBION

- 16.1.4.1 Business overview

- 16.1.4.2 Products/Solutions/Services offered

- 16.1.4.3 Recent developments

- 16.1.4.3.1 Expansions

- 16.1.4.4 MnM view

- 16.1.4.4.1 Key strengths

- 16.1.4.4.2 Strategic choices

- 16.1.4.4.3 Weaknesses and competitive threats

- 16.1.5 JUNGBUNZLAUER SUISSE AG

- 16.1.5.1 Business overview

- 16.1.5.2 Products/Solutions/Services offered

- 16.1.5.3 MnM view

- 16.1.5.3.1 Key strengths

- 16.1.5.3.2 Strategic choices

- 16.1.5.3.3 Weaknesses and competitive threats

- 16.1.6 THE DOW CHEMICAL COMPANY

- 16.1.6.1 Business overview

- 16.1.6.2 Products/Solutions/Services offered

- 16.1.6.3 MnM view

- 16.1.6.3.1 Key strengths

- 16.1.6.3.2 Strategic choices

- 16.1.6.3.3 Weaknesses and competitive threats

- 16.1.7 EASTMAN CHEMICAL COMPANY

- 16.1.7.1 Business overview

- 16.1.7.2 Products/Solutions/Services offered

- 16.1.7.3 MnM view

- 16.1.7.3.1 Key strengths

- 16.1.7.3.2 Strategic choices

- 16.1.7.3.3 Weaknesses and competitive threats

- 16.1.8 DSM-FIRMENICH

- 16.1.8.1 Business overview

- 16.1.8.2 Products/Solutions/Services offered

- 16.1.8.3 MnM view

- 16.1.8.3.1 Key strengths

- 16.1.8.3.2 Strategic choices

- 16.1.8.3.3 Weaknesses and competitive threats

- 16.1.9 POLYNT S.P.A.

- 16.1.9.1 Business overview

- 16.1.9.2 Products/Solutions/Services offered

- 16.1.9.3 MnM view

- 16.1.9.3.1 Key strengths

- 16.1.9.3.2 Strategic choices

- 16.1.9.3.3 Weaknesses and competitive threats

- 16.1.10 CELANESE CORPORATION

- 16.1.10.1 Business overview

- 16.1.10.2 Products/Solutions/Services offered

- 16.1.10.3 MnM view

- 16.1.10.3.1 Key strengths

- 16.1.10.3.2 Strategic choices

- 16.1.10.3.3 Weaknesses and competitive threats

- 16.1.11 TATE & LYLE

- 16.1.11.1 Business overview

- 16.1.11.2 Products/Solutions/Services offered

- 16.1.11.3 MnM view

- 16.1.11.3.1 Key strengths

- 16.1.11.3.2 Strategic choices

- 16.1.11.3.3 Weaknesses and competitive threats

- 16.1.12 HENAN JINDAN LACTIC ACID TECHNOLOGY CO., LTD.

- 16.1.12.1 Business overview

- 16.1.12.2 Products/Solutions/Services offered

- 16.1.12.3 MnM view

- 16.1.12.3.1 Key strengths

- 16.1.12.3.2 Strategic choices

- 16.1.12.3.3 Weaknesses and competitive threats

- 16.1.13 SHANDONG ENSIGN INDUSTRY CO., LTD.

- 16.1.13.1 Business overview

- 16.1.13.2 Products/Solutions/Services offered

- 16.1.13.3 MnM view

- 16.1.13.3.1 Key strengths

- 16.1.13.3.2 Strategic choices

- 16.1.13.3.3 Weaknesses and competitive threats

- 16.1.14 FOODCHEM INTERNATIONAL CORPORATION

- 16.1.14.1 Business overview

- 16.1.14.2 Products/Solutions/Services offered

- 16.1.14.3 MnM view

- 16.1.14.3.1 Key strengths

- 16.1.14.3.2 Strategic choices

- 16.1.14.3.3 Weaknesses and competitive threats

- 16.1.15 AFYREN

- 16.1.15.1 Business overview

- 16.1.15.2 Products/Solutions/Services offered

- 16.1.15.3 MnM view

- 16.1.15.3.1 Key strengths

- 16.1.15.3.2 Strategic choices

- 16.1.15.3.3 Weaknesses and competitive threats

- 16.1.16 GALACTIC

- 16.1.16.1 Business overview

- 16.1.16.2 Products/Solutions/Services offered

- 16.1.16.3 MnM view

- 16.1.16.3.1 Key strengths

- 16.1.16.3.2 Strategic choices

- 16.1.16.3.3 Weaknesses and competitive threats

- 16.1.1 BASF SE

- 16.2 OTHER PLAYERS

- 16.2.1 HAWKINS

- 16.2.1.1 Business overview

- 16.2.1.2 Products/Solutions/Services offered

- 16.2.1.3 MnM view

- 16.2.1.3.1 Key strengths

- 16.2.1.3.2 Strategic choices

- 16.2.1.3.3 Weaknesses and competitive threats

- 16.2.2 BBCA BIOCHEMICAL

- 16.2.2.1 Business overview

- 16.2.2.2 Products/Solutions/Services offered

- 16.2.2.3 MnM view

- 16.2.2.3.1 Key strengths

- 16.2.2.3.2 Strategic choices

- 16.2.2.3.3 Weaknesses and competitive threats

- 16.2.3 RZBC GROUP CO., LTD.

- 16.2.3.1 Business overview

- 16.2.3.2 Products/Solutions/Services offered

- 16.2.3.3 MnM view

- 16.2.3.3.1 Key strengths

- 16.2.3.3.2 Strategic choices

- 16.2.3.3.3 Weaknesses and competitive threats

- 16.2.4 BARTEK INGREDIENTS INC.

- 16.2.4.1 Business overview

- 16.2.4.2 Products/Solutions/Services offered

- 16.2.4.3 MnM view

- 16.2.4.3.1 Key strengths

- 16.2.4.3.2 Strategic choices

- 16.2.4.3.3 Weaknesses and competitive threats

- 16.2.5 FUSO CHEMICAL CO., LTD.

- 16.2.5.1 Business overview

- 16.2.5.2 Products/Solutions/Services offered

- 16.2.5.3 MnM view

- 16.2.5.3.1 Key strengths

- 16.2.5.3.2 Strategic choices

- 16.2.5.3.3 Weaknesses and competitive threats

- 16.2.6 VINIPUL CHEMICALS PRIVATE LIMITED

- 16.2.6.1 Business overview

- 16.2.6.2 Products/Solutions/Services offered

- 16.2.6.3 MnM view

- 16.2.6.3.1 Key strengths

- 16.2.6.3.2 Strategic choices

- 16.2.6.3.3 Weaknesses and competitive threats

- 16.2.7 GEOCON PRODUCTS

- 16.2.8 LOBA CHEMIE PVT. LTD.

- 16.2.9 CITNVBEL NV

- 16.2.10 PEER CHEMICAL INDUSTRIES

- 16.2.11 SHANDONG ACID TECHNOLOGY CO., LTD.

- 16.2.1 HAWKINS

17 RESEARCH METHODOLOGY

- 17.1 RESEARCH DATA

- 17.1.1 SECONDARY DATA

- 17.1.1.1 Key data from secondary sources

- 17.1.2 PRIMARY DATA

- 17.1.2.1 Key data from primary sources

- 17.1.2.2 Key primary participants

- 17.1.2.3 Breakdown of primary interviews

- 17.1.2.4 Key industry insights

- 17.1.1 SECONDARY DATA

- 17.2 MARKET SIZE ESTIMATION

- 17.2.1 BOTTOM-UP APPROACH

- 17.2.2 TOP-DOWN APPROACH

- 17.2.3 BASE NUMBER CALCULATION

- 17.3 MARKET SIZE ESTIMATION

- 17.3.1 BOTTOM-UP APPROACH

- 17.3.2 APPROACH TWO (TOP-DOWN APPROACH)

- 17.4 MARKET FORECAST APPROACH

- 17.4.1 SUPPLY SIDE

- 17.4.2 DEMAND SIDE

- 17.5 DATA TRIANGULATION

- 17.6 FACTOR ANALYSIS

- 17.7 RESEARCH ASSUMPTIONS

- 17.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

18 ADJACENT AND RELATED MARKETS

- 18.1 INTRODUCTION

- 18.2 LIMITATIONS

- 18.3 LACTIC ACID AND POLYLACTIC ACID MARKET

- 18.3.1 MARKET DEFINITION

- 18.3.2 MARKET OVERVIEW

19 APPENDIX

- 19.1 DISCUSSION GUIDE

- 19.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.3 CUSTOMIZATION OPTIONS

- 19.4 RELATED REPORTS

- 19.5 AUTHOR DETAILS